worldcoin coin Explained: A Deep Dive into the Technology and Token…

An Investor’s Introduction to worldcoin coin

Worldcoin is an innovative cryptocurrency that aims to establish a global identity and financial network, positioning itself as a pioneer in the realm of digital identity verification and decentralized finance. With a mission to create a privacy-preserving ecosystem, Worldcoin enables individuals to prove their humanity online through its unique World ID system. This process leverages advanced technologies like zero-knowledge proofs, allowing users to maintain their privacy while verifying their identities. As a result, Worldcoin has garnered significant attention in the crypto market, attracting over two million users from diverse backgrounds during its pre-launch phase.

The Worldcoin ecosystem revolves around its native utility token, WLD, which serves multiple purposes within the network. As a governance tool, WLD empowers users to participate in decision-making processes regarding the protocol’s future, ensuring that the network evolves in a manner that reflects the community’s needs and values. Additionally, WLD tokens are distributed to users through various mechanisms, including grants for those who verify their identities via World ID. This unique distribution model has the potential to make WLD one of the most widely distributed cryptocurrencies, fostering broad accessibility and inclusion.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in Worldcoin and its associated token, WLD. It will delve into several key areas to enhance your understanding of this digital asset:

Technology Overview

We will explore the underlying technology that powers Worldcoin, including the mechanisms behind the World ID system and the use of Orbs for identity verification.

Tokenomics

A detailed analysis of Worldcoin’s tokenomics will be provided, covering the total supply, allocation, and potential inflation mechanisms, as well as the implications for investors.

Investment Potential

This section will assess the investment potential of WLD, analyzing market trends, historical performance, and factors that could influence its future value.

Risks

Investing in cryptocurrencies carries inherent risks. We will discuss the specific risks associated with Worldcoin, including market volatility, regulatory considerations, and technological challenges.

How to Buy Worldcoin

Finally, we will guide you through the process of purchasing WLD, including the platforms available for trading and tips for securing your investment.

By the end of this guide, readers will have a well-rounded understanding of Worldcoin, its significance in the cryptocurrency landscape, and the essential considerations for investing in this emerging digital asset.

What is worldcoin coin? A Deep Dive into its Purpose

Understanding Worldcoin

Worldcoin is a pioneering cryptocurrency project that aims to create a globally inclusive identity and financial network. Through its innovative use of technology, Worldcoin seeks to empower individuals by giving them the tools to verify their identity while maintaining privacy, thereby addressing some of the most pressing challenges in the digital age.

The Core Problem It Solves

In an increasingly digital world, the need for reliable identity verification has never been more critical. Traditional methods of identity verification often fall short due to concerns about privacy, security, and accessibility. Many existing systems are vulnerable to manipulation, fraud, and data breaches, leaving users exposed and disenfranchised.

Worldcoin addresses these issues through its World ID system, which allows users to prove their identity without compromising their privacy. By leveraging zero-knowledge proofs, Worldcoin enables individuals to verify their humanness online—referred to as “Proof of Personhood”—without revealing sensitive personal information. This capability not only protects users from identity theft but also helps to combat issues such as bot manipulation and sybil attacks in digital environments.

Additionally, Worldcoin aims to democratize access to financial resources. By distributing its native token, WLD, to verified individuals, the project seeks to create a more equitable financial ecosystem where everyone has the opportunity to participate. This could pave the way for innovative solutions such as Universal Basic Income (UBI) funded by AI, enabling a more inclusive economic future.

Its Unique Selling Proposition

Worldcoin’s unique selling proposition lies in its combination of identity verification and financial inclusion. Unlike many cryptocurrencies that primarily serve as speculative investment vehicles or transactional currencies, Worldcoin focuses on building a foundational layer for identity and financial systems that prioritizes user privacy and security.

-

Privacy-Preserving Identity Verification: World ID allows users to verify their identity without exposing their personal data. The use of multispectral imaging technology in the Orb, a device used for verification, ensures that data is collected and processed securely. Images are deleted immediately after verification unless users opt for data custody, reinforcing the project’s commitment to privacy.

-

Global Reach and Accessibility: With plans to deploy thousands of Orbs across multiple countries, Worldcoin aims to provide widespread access to its identity verification system. This approach is designed to reach underserved populations, ensuring that everyone, regardless of their geographical or socio-economic status, can benefit from its services.

-

Community-Centric Tokenomics: The WLD token is designed not only as a utility but also as a governance tool. A significant portion of WLD tokens is allocated to the community, allowing users to have a say in the project’s future direction. This governance model supports a “one-person-one-vote” mechanism, fostering a sense of ownership and community engagement.

-

Innovative Use Cases: Beyond its governance role, WLD may be utilized for various functions within the ecosystem, including payments for services within the World App, participation in airdrops, and incentivizing positive contributions to the community. This flexibility enhances the token’s utility and encourages user participation.

The Team and Backers

Worldcoin was co-founded by Sam Altman, Alex Blania, and Max Novendstern. Sam Altman is a notable figure in the tech industry, known for his role as the CEO of OpenAI and his previous leadership at Y Combinator, a prominent startup accelerator. His experience in the tech space lends credibility to Worldcoin’s mission and vision.

The project has garnered significant financial backing, raising over $250 million from reputable investors such as Andreessen Horowitz (a16z), Khosla Ventures, Bain Capital Crypto, and Tiger Global. This financial support not only highlights the project’s potential but also provides the necessary resources for its ambitious plans.

Fundamental Purpose in the Crypto Ecosystem

Worldcoin’s fundamental purpose is to create a robust infrastructure that integrates identity verification and financial services into the cryptocurrency ecosystem. By establishing a reliable method for individuals to prove their identity while safeguarding their privacy, Worldcoin aims to enhance user trust in digital platforms.

As the cryptocurrency landscape evolves, the importance of identity verification will continue to grow. Worldcoin positions itself as a key player in addressing these challenges, offering solutions that can be integrated into various applications, from social media platforms to government services.

Furthermore, by distributing WLD tokens to verified users, Worldcoin fosters a sense of community ownership and engagement, which is often missing in traditional financial systems. This inclusive approach not only encourages broader participation in the digital economy but also promotes the development of innovative governance models that could redefine how communities interact with technology and resources.

Conclusion

Worldcoin represents a bold step towards a more inclusive and secure digital future. By addressing the dual challenges of identity verification and financial accessibility, the project aims to empower individuals globally. With a strong founding team, substantial backing, and a clear mission, Worldcoin is poised to make a significant impact in the cryptocurrency ecosystem, paving the way for a more equitable digital landscape.

The Technology Behind the Coin: How It Works

Introduction to Worldcoin’s Technology

Worldcoin is a groundbreaking project aiming to build a global identity and financial network. At its core, the technology behind Worldcoin revolves around providing individuals with a unique digital identity while ensuring privacy and security. This guide will explore the key technological components of Worldcoin, including its blockchain architecture, consensus mechanism, and innovative features that set it apart from other cryptocurrencies.

Blockchain Architecture

Worldcoin operates on a multi-layered blockchain architecture, primarily leveraging the Ethereum blockchain and the Optimism layer 2 network.

Ethereum Blockchain

Worldcoin utilizes the Ethereum blockchain for its native token, WLD, which is an ERC-20 token. This choice brings several advantages:

-

Security: Ethereum is one of the most established blockchains, known for its robust security measures. By using Ethereum, Worldcoin benefits from a secure environment for its transactions and smart contracts.

-

Smart Contracts: Worldcoin employs smart contracts to automate various functions within its ecosystem, such as token distribution and governance processes. Smart contracts are self-executing contracts with the terms of the agreement directly written into code, ensuring transparency and reducing the need for intermediaries.

-

Interoperability: Being on the Ethereum network allows Worldcoin to interact with various decentralized applications (dApps) and other tokens, enhancing its utility and accessibility.

Optimism Layer 2

To improve scalability and transaction speed, Worldcoin also operates on the Optimism layer 2 network. This layer enhances the Ethereum blockchain by enabling:

-

Faster Transactions: Optimism uses rollups to bundle multiple transactions into one, significantly increasing the transaction throughput while reducing latency. This results in faster confirmation times, making it more suitable for a global network.

-

Lower Fees: Transactions on the Optimism network generally incur lower fees than those on the Ethereum mainnet. This cost-effectiveness is crucial for widespread adoption, especially in regions where financial transactions can be prohibitively expensive.

Consensus Mechanism

Worldcoin’s architecture relies on the existing consensus mechanisms of the Ethereum blockchain. At present, Ethereum employs a Proof-of-Stake (PoS) mechanism, which has several implications for Worldcoin:

Proof-of-Stake (PoS)

-

Energy Efficiency: Unlike the traditional Proof-of-Work (PoW) model, which requires significant computational power and energy consumption, PoS allows validators to create new blocks based on the number of tokens they hold and are willing to “stake.” This makes the network more environmentally friendly.

-

Security: In PoS, validators are incentivized to act honestly because their staked tokens are at risk of being slashed (partially forfeited) if they behave maliciously. This mechanism promotes security and trust within the network.

-

Decentralization: PoS encourages a more decentralized network because it allows a broader range of participants to become validators, as they do not need expensive hardware to mine blocks. This inclusivity aligns with Worldcoin’s mission of building a globally accessible financial network.

Key Technological Innovations

Worldcoin incorporates several innovative technologies that enhance its functionality and user experience. Here are some of the most notable:

World ID

At the heart of Worldcoin’s ecosystem is the World ID, a digital identity that allows users to prove their humanness without compromising their privacy. The World ID is generated through a process that involves:

-

Orb Verification: Users visit a physical device called the Orb, equipped with multispectral sensors that capture and analyze biometric data to verify an individual’s uniqueness and humanness. This data is processed locally, and images are deleted promptly to safeguard user privacy.

-

Zero-Knowledge Proofs: World ID utilizes advanced cryptographic techniques known as zero-knowledge proofs (ZKPs). ZKPs allow users to prove they possess certain information (like being a unique human) without revealing the actual information itself. This technology ensures that personal data remains confidential while still providing a verifiable identity.

-

Global Accessibility: The design of the World ID system promotes inclusivity by allowing individuals from diverse backgrounds and regions to participate in the digital economy without the barriers often associated with traditional identity verification methods.

Governance Mechanism

Worldcoin introduces a unique governance model that empowers users through decentralized decision-making processes. This model is characterized by:

-

Utility and Governance Token: The WLD token serves as both a utility and governance token. Users holding WLD tokens can participate in voting on important issues regarding the protocol’s future, such as changes to the ecosystem or the allocation of resources.

-

One-Person-One-Vote Mechanism: Unlike traditional governance models where voting power is proportional to the number of tokens held (one-token-one-vote), Worldcoin aims to implement a one-person-one-vote system. This approach enhances fairness and encourages broader participation from the community.

-

Community Involvement: The Worldcoin Foundation actively seeks community proposals and feedback, allowing users to play a pivotal role in shaping the project’s direction. This participatory approach fosters a sense of ownership and collective responsibility among users.

Tokenomics

Worldcoin’s tokenomics is designed to promote widespread distribution and utility of the WLD token. Key aspects include:

-

Token Distribution: Out of a total supply of 10 billion WLD tokens, a significant portion (75%) is allocated to the Worldcoin community. This distribution model ensures that most tokens are accessible to everyday users, aligning with the project’s goal of global inclusivity.

-

Incentives: Users who verify their identity through the Orb are entitled to receive recurring grants of WLD tokens. This incentivizes participation and encourages individuals to join the network.

-

Sustainable Growth: The governance model allows for potential adjustments to the token supply after 15 years, including the possibility of implementing an inflation rate of up to 1.5% per year. This flexibility aims to support the long-term sustainability of the ecosystem.

Security Measures

Worldcoin prioritizes security throughout its ecosystem, leveraging the inherent security features of the Ethereum and Optimism networks. Additionally, it employs several strategies to protect user data and assets:

-

Data Privacy: The design of the Orb ensures that biometric data is processed locally and deleted immediately, minimizing the risk of data breaches.

-

Smart Contract Audits: Regular audits of smart contracts help identify vulnerabilities and ensure the integrity of the platform.

-

Community Vigilance: The decentralized nature of governance allows the community to monitor and address potential security issues, fostering a culture of vigilance and responsiveness.

Conclusion

Worldcoin represents a significant advancement in the intersection of digital identity and cryptocurrency. Through its innovative use of blockchain technology, user-centered design, and a robust governance model, Worldcoin aims to create a truly global and inclusive financial network. By providing individuals with a secure and private way to establish their identities, Worldcoin not only enhances accessibility to the digital economy but also lays the groundwork for a more equitable future. Understanding the technology behind Worldcoin is crucial for anyone looking to participate in this transformative project, whether as an investor, developer, or everyday user.

Understanding worldcoin coin Tokenomics

Worldcoin (WLD) is a digital currency designed to create a global identity and financial network. Its tokenomics is structured to support its mission of fostering a privacy-preserving, inclusive financial ecosystem. Below, we break down the key metrics and components of Worldcoin’s tokenomics.

| Metric | Value |

|---|---|

| Total Supply | 10,000,000,000 WLD |

| Max Supply | 10,000,000,000 WLD |

| Circulating Supply | 2,005,877,584 WLD |

| Inflation/Deflation Model | Fixed supply for 15 years, potential inflation of up to 1.5% per year thereafter |

Token Utility (What is the coin used for?)

The Worldcoin (WLD) token serves multiple critical functions within the Worldcoin ecosystem:

-

Governance: WLD tokens empower holders to participate in the governance of the Worldcoin network. This includes voting on proposals that affect the protocol’s future, ensuring that the community has a voice in decision-making. The governance model is innovative, aiming for a “one-person-one-vote” approach through the integration of the World ID system, which allows for more equitable participation compared to traditional “one-token-one-vote” systems.

-

Incentives: Worldcoin is designed to reward users for verifying their identity and participating in the ecosystem. Individuals can receive WLD tokens simply for being human, as part of the project’s goal to distribute wealth more equitably across the global population. Grants of WLD tokens are given to users who have been verified through the Orb, the physical imaging device used to create World IDs.

-

Transaction Fees and Payments: The WLD token can be used to pay for various services within the Worldcoin ecosystem, including transaction fees in the World App, the primary wallet application for users. This utility can extend to other decentralized applications (dApps) that integrate with the Worldcoin network.

-

Funding Initiatives: Users may also utilize WLD tokens to fund initiatives or projects that are proposed within the community, reflecting the participatory nature of the Worldcoin network.

-

Potential for Future Use Cases: As the ecosystem grows, additional uses for the WLD token may emerge, including applications in decentralized finance (DeFi) or as a medium of exchange in various markets.

Token Distribution

Worldcoin’s token distribution is designed to ensure a fair allocation of tokens to various stakeholders while prioritizing community engagement. The distribution model is as follows:

-

Community Allocation: A substantial 75% of the total supply is allocated to the Worldcoin community. This portion is aimed at user grants and rewards, ensuring that the majority of tokens are distributed to individuals who verify their identity through the World ID system.

-

Development Team: 9.8% of the tokens are allocated to the initial development team. This portion compensates the team responsible for the creation and maintenance of the Worldcoin protocol and infrastructure.

-

Investors: 13.5% of the tokens are allocated to Tools for Humanity (TFH) investors, who provided early funding for the project. This allocation reflects the investment and risk taken by early backers.

-

Reserve Fund: A small percentage, 1.7%, is set aside for the TFH Reserve. This reserve can be utilized for unforeseen expenses or to support the ecosystem’s growth.

The Worldcoin Foundation has set an aspirational goal of allocating at least 60% of all WLD tokens from the community pool to individuals through user grants. This model emphasizes Worldcoin’s commitment to equitable distribution and the empowerment of its users.

Conclusion

Worldcoin’s tokenomics is crafted to support its vision of creating a global identity and financial network that is inclusive and accessible. The combination of a fixed supply model, innovative governance structure, and a strong focus on community engagement positions WLD as a unique asset within the cryptocurrency landscape. By prioritizing the distribution of tokens to individuals and fostering a participatory governance model, Worldcoin aims to redefine the relationship between digital currencies and their users. As the project continues to evolve, the utility and distribution of WLD will likely adapt to meet the needs of its growing community.

Price History and Market Performance

Key Historical Price Milestones

Worldcoin (WLD) has seen a dynamic price history since its inception, reflecting both the broader trends in the cryptocurrency market and its unique position within the digital asset ecosystem.

-

Launch and Initial Trading: Worldcoin was launched in mid-2023, with its native token, WLD, quickly entering the market amid significant interest due to its innovative approach to digital identity and financial inclusion. The initial trading price was relatively modest, setting the stage for its subsequent price movements.

-

All-Time High: The token reached its all-time high of $11.80 on March 10, 2024. This surge can be attributed to a combination of factors, including increased media attention, community engagement, and the successful rollout of the World ID system, which attracted new users and investors to the platform. This peak represented a significant milestone in Worldcoin’s journey, showcasing its potential to disrupt traditional financial systems.

-

Subsequent Declines: Following this peak, the price experienced a notable decline, dropping to around $1.05 by late 2024. This decrease of approximately 91% from its all-time high reflects the volatility often seen in cryptocurrency markets, where speculative trading and market sentiment can lead to sharp price corrections.

-

Recent Performance: As of October 2023, Worldcoin’s price has seen fluctuations, with a current trading price of about $1.05. In the past 24 hours, the price has increased by approximately 15.41%, suggesting a rebound in interest and trading activity. The trading volume over the last day reached around $430 million, indicating strong market participation.

-

Long-Term Trends: Over the past year, Worldcoin has experienced a price decrease of about 25.33%. This trend highlights the challenges faced by cryptocurrencies in maintaining their value post-launch, especially as the market matures and new competitors emerge. Historical data shows that the price has fluctuated between lows of $0.58 to highs of $1.06 in recent months, suggesting that while the price is volatile, it is also responsive to market dynamics.

Factors Influencing the Price

Historically, the price of Worldcoin has been influenced by a variety of factors, ranging from market sentiment and regulatory developments to technological advancements and community engagement.

-

Market Sentiment: The overall sentiment in the cryptocurrency market has a significant impact on Worldcoin’s price. Periods of bullish trends often see heightened interest in cryptocurrencies, resulting in price increases. Conversely, bearish markets can lead to rapid declines. For instance, the massive surge to its all-time high was aligned with a broader market rally, while subsequent downturns were exacerbated by negative sentiment in the crypto space.

-

Technological Developments: Innovations and updates related to the Worldcoin protocol, such as improvements in the World ID system and enhancements to the World App wallet, have also played a crucial role in shaping investor confidence and interest. Successful implementation of technology can lead to increased adoption and, subsequently, higher prices.

-

Regulatory Environment: As with many cryptocurrencies, regulatory developments can significantly impact Worldcoin’s market performance. News regarding government regulations, potential bans, or endorsements of cryptocurrencies can lead to swift changes in price. For example, positive regulatory news in key markets has historically driven prices up, while fears of crackdowns have had the opposite effect.

-

Community Engagement: The strength and activity of the Worldcoin community have also been key drivers of its price. High levels of community participation in governance proposals and user grants can enhance the perceived value of the token, encouraging more investment. The concept of “one-person-one-vote” governance, made possible through the World ID, has fostered a sense of ownership and responsibility among users, which can positively influence market performance.

-

Competitive Landscape: Worldcoin operates in a highly competitive environment, where numerous projects vie for attention and investment. The emergence of new technologies or platforms that offer similar solutions can divert interest and investment away from Worldcoin, impacting its price negatively.

-

Adoption and Use Cases: The practical applications of Worldcoin’s technology also influence its market performance. As more platforms integrate World ID and the utility of WLD tokens becomes clearer, demand for the token may increase, positively affecting its price. Additionally, partnerships with businesses and organizations can enhance the token’s visibility and usability, contributing to price stability or growth.

In summary, the price history and market performance of Worldcoin reflect a complex interplay of various factors, including market sentiment, technological advancements, regulatory developments, community engagement, competition, and practical use cases. Understanding these dynamics can help investors navigate the often volatile landscape of cryptocurrency investing.

Where to Buy worldcoin coin: Top Exchanges Reviewed

3. Coinbase – Easiest Way to Buy Worldcoin (WLD) in the U.S.!

Coinbase stands out as a premier platform for purchasing Worldcoin (WLD) in the United States, renowned for its robust security measures and user-friendly interface. As one of the most trusted exchanges globally, it offers a seamless experience for both beginners and experienced traders, enabling users to easily buy, sell, and manage their Worldcoin holdings with confidence. Its reputation and reliability make it an ideal choice for cryptocurrency transactions.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

3. WorldCoin – Your Quick Guide to Buying WLD Today!

Kraken stands out as a premier exchange for purchasing WorldCoin (WLD) due to its user-friendly interface and diverse payment options, allowing users to buy starting from just $10. With the convenience of credit/debit card transactions, ACH deposits, and support for Apple/Google Pay, Kraken caters to both novice and experienced investors. This accessibility, combined with Kraken’s robust security measures, makes it an attractive platform for acquiring digital assets like WorldCoin.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. Worldcoin – Your Gateway to the Future of Digital Currency!

MoonPay stands out as a user-friendly platform for purchasing Worldcoin (WLD), providing a seamless experience for both newcomers and seasoned investors. With multiple payment options including credit/debit cards, bank transfers, Apple Pay, and Google Pay, users can quickly and conveniently acquire WLD. This versatility in payment methods, combined with MoonPay’s streamlined interface, makes it an appealing choice for those looking to invest in Worldcoin effortlessly.

- Website: moonpay.com

- Platform Age: Approx. 15 years (domain registered in 2010)

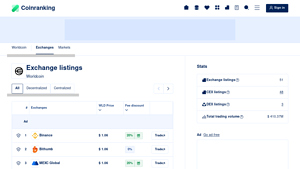

5. Worldcoin (WLD) – A Rising Star in the Crypto Exchange Arena!

The review article on “Exchange Listings of Worldcoin (WLD)” highlights the platform’s comprehensive comparison tools, allowing users to evaluate various exchanges based on prices, trading volumes, and available discounts. This functionality empowers traders to make informed decisions, ensuring they select the most advantageous exchange for their transactions. The emphasis on transparency and accessibility makes it a standout resource for both novice and experienced crypto investors looking to engage with Worldcoin effectively.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy worldcoin coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Worldcoin (WLD) is selecting a cryptocurrency exchange that supports trading for this digital asset. Some popular exchanges where you can buy Worldcoin include:

- Coinbase: Known for its user-friendly interface, Coinbase is a great option for beginners.

- Binance: Offers a wide range of cryptocurrencies and trading pairs, including WLD.

- Kraken: Another reputable exchange that provides a secure trading environment.

- KuCoin: Features a variety of altcoins and competitive trading fees.

When choosing an exchange, consider factors such as transaction fees, supported payment methods, security features, and user reviews.

2. Create and Verify Your Account

Once you have selected an exchange, you will need to create an account:

- Sign Up: Navigate to the exchange’s website and click on the “Sign Up” or “Register” button.

- Provide Information: Fill in the required information, which typically includes your email address and a secure password.

- Verify Your Email: Check your email inbox for a verification link sent by the exchange. Click on it to verify your email address.

- Complete KYC: Many exchanges require you to complete a Know Your Customer (KYC) process to comply with regulations. This usually involves providing personal information such as your full name, date of birth, and address, along with a government-issued ID (e.g., passport or driver’s license).

- Two-Factor Authentication (2FA): Enable 2FA for additional security. This usually involves linking your account to an authenticator app or receiving a code via SMS.

3. Deposit Funds

After successfully creating and verifying your account, the next step is to deposit funds into your exchange account:

- Log In: Access your account on the exchange.

- Navigate to Deposit Section: Look for a “Deposit” or “Funds” section on the exchange’s dashboard.

- Select Deposit Method: Choose your preferred payment method. Most exchanges accept bank transfers, credit/debit cards, and sometimes even PayPal or other e-wallets.

- Enter Deposit Amount: Input the amount you wish to deposit and follow the instructions to complete the transaction. Be aware of any deposit fees that may apply.

- Wait for Confirmation: Depending on the payment method, it may take some time for the funds to reflect in your account. Check your account balance to confirm the deposit.

4. Place an Order to Buy Worldcoin Coin

With your account funded, you can now place an order to buy Worldcoin:

- Go to the Trading Section: Navigate to the trading section of the exchange.

- Select Trading Pair: Look for the WLD trading pair, which may be against fiat currencies (like USD, EUR) or stablecoins (like USDT).

- Choose Order Type: Decide whether you want to place a market order (buying at the current market price) or a limit order (setting a specific price at which you want to buy).

– Market Order: If you want to buy immediately at the current price, select this option and enter the amount of WLD you wish to purchase.

– Limit Order: If you want to wait for a better price, set the price at which you want to buy and enter the amount. - Review and Confirm: Double-check the details of your order, including fees, before confirming the purchase.

5. Secure Your Coins in a Wallet

After successfully purchasing Worldcoin, it is crucial to secure your assets:

- Choose a Wallet: You can choose between a hot wallet (online) or a cold wallet (offline). Hot wallets are more convenient for trading, while cold wallets offer enhanced security.

– Hot Wallets: Options include the World App, MetaMask, or Trust Wallet.

– Cold Wallets: Hardware wallets like Ledger or Trezor provide a secure offline option. - Transfer Your WLD: If you purchased WLD on an exchange, it is advisable to transfer your coins to your personal wallet for added security.

– Get Your Wallet Address: Open your wallet app and copy your WLD wallet address.

– Withdraw from Exchange: Go back to the exchange, navigate to the withdrawal section, and enter your wallet address and the amount of WLD you wish to transfer. - Confirm the Transfer: Check the status of your transfer in the wallet app. It may take a few minutes for the transaction to be confirmed on the blockchain.

By following these steps, you can successfully purchase and secure Worldcoin, allowing you to participate in its unique identity and financial network. Always remember to do thorough research and stay updated on market trends to make informed investment decisions.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Worldcoin (WLD) is designed to address significant challenges in digital identity and financial inclusion, which could position it favorably in the evolving landscape of cryptocurrencies. Below are some of the potential strengths that could contribute to its value and adoption.

1. Unique Value Proposition

Worldcoin aims to create the world’s largest identity and financial network, focusing on providing a privacy-preserving global digital identity through its World ID system. This unique value proposition is significant in an era where digital identity verification is increasingly crucial for online interactions, including financial transactions, social networking, and governance. By enabling users to verify their identity while maintaining privacy through zero-knowledge proofs, Worldcoin addresses the growing concerns surrounding data privacy and security.

2. Broad Token Distribution

One of the standout features of Worldcoin is its approach to token distribution. The project intends to allocate a significant portion of its total supply (75%) to the Worldcoin community, with a substantial portion earmarked for user grants. This approach not only incentivizes participation but also promotes a sense of ownership among users. If successful, this could lead to widespread adoption and engagement, creating a robust ecosystem around the WLD token.

3. Strong Founding Team and Backing

Worldcoin was co-founded by Sam Altman, a prominent figure in the tech industry and the CEO of OpenAI. The project has also attracted substantial funding from reputable investors, including a16z, Khosla Ventures, and Tiger Global. The backing from experienced investors and a visionary founder adds credibility to the project and may enhance its prospects for success.

4. Governance Features

WLD serves not only as a utility token but also as a governance token, allowing holders to participate in decision-making processes regarding the protocol’s future. This participatory governance structure is appealing, particularly in the decentralized finance (DeFi) space, as it empowers users and aligns their interests with the long-term success of the network. The potential for “one-person-one-vote” governance mechanisms could further enhance community engagement.

5. Market Position and Growth Potential

As of now, Worldcoin ranks within the top 50 cryptocurrencies by market capitalization, with a market cap of approximately $2.1 billion. Given its innovative approach to identity and finance, there is significant potential for growth, especially as the demand for secure and privacy-focused identity solutions continues to rise. If the project successfully scales its operations and captures a meaningful market share, the value of WLD could increase substantially.

Potential Risks and Challenges (The Bear Case)

While Worldcoin presents several promising aspects, potential investors should also consider the inherent risks and challenges associated with investing in this digital asset.

1. Market Volatility

Cryptocurrencies, including Worldcoin, are known for their extreme price volatility. WLD has experienced significant price fluctuations, with an all-time high of $11.80 and a subsequent decline of over 90%. Such volatility can lead to substantial losses for investors, particularly those who enter the market without a clear understanding of the risks involved. Price swings can be influenced by market sentiment, macroeconomic factors, and developments within the cryptocurrency space, making it crucial for investors to be prepared for potential downturns.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, and Worldcoin is not immune to potential regulatory scrutiny. Governments around the world are increasingly examining digital assets, focusing on issues such as consumer protection, anti-money laundering (AML) compliance, and tax implications. Regulatory changes could impact the operation and adoption of Worldcoin, and there is a risk that the project could face restrictions or bans in certain jurisdictions. Investors should remain vigilant about regulatory developments that could affect the project’s viability.

3. Competition

The identity and financial services space is becoming increasingly crowded, with numerous projects aiming to address similar challenges. Worldcoin faces competition from established players and emerging projects that offer alternative solutions for digital identity verification and financial services. The ability of Worldcoin to differentiate itself and establish a sustainable competitive advantage will be crucial for its long-term success. If competitors succeed in capturing market share or delivering superior solutions, Worldcoin’s growth potential may be hindered.

4. Technological Risks

Worldcoin’s underlying technology, including its use of zero-knowledge proofs and the Orb for identity verification, introduces potential technological risks. These could include vulnerabilities in smart contracts, security breaches, or failures in the verification process. If any significant technical issues arise, they could undermine user trust and deter participation in the ecosystem. Additionally, the reliance on physical devices (Orbs) for identity verification may pose logistical challenges and operational risks as the network scales.

5. Adoption Challenges

For Worldcoin to realize its vision, widespread adoption of the World ID and WLD token is essential. However, achieving this level of adoption may prove challenging. The success of the project hinges on the willingness of users, businesses, and platforms to integrate with the Worldcoin ecosystem. Factors such as user experience, ease of access, and perceived value will play significant roles in determining whether individuals and organizations choose to participate. A slow adoption rate could limit the growth of the project and, consequently, the value of the WLD token.

Conclusion

Worldcoin presents a compelling proposition with its focus on privacy-preserving digital identity and financial inclusion. Its unique approach to token distribution, strong founding team, and governance features position it favorably in the cryptocurrency landscape. However, investors must also remain aware of the significant risks associated with market volatility, regulatory uncertainty, competition, technological challenges, and adoption hurdles. As with any investment, thorough research and careful consideration of both potential strengths and risks are essential for informed decision-making.

Frequently Asked Questions (FAQs)

1. What is Worldcoin (WLD)?

Worldcoin (WLD) is a digital currency that aims to create a global identity and financial network through its unique World ID system. This network allows users to verify their identity online while protecting their personal information. To participate, individuals must download the World App, which facilitates the creation of a World ID. Verification is completed using a physical device known as the Orb, which confirms users’ uniqueness and humanness. The WLD token serves as both a utility and governance token, enabling holders to participate in the decision-making processes related to the protocol’s future.

2. Who created Worldcoin?

Worldcoin was co-founded by Sam Altman, Alex Blania, and Max Novendstern (who left the project in July 2021). Sam Altman is notably the co-founder and current CEO of OpenAI and was previously the president of Y Combinator, a prominent startup accelerator. The project has received substantial backing, raising over $250 million from various investors, including a16z, Khosla Ventures, and Tiger Global.

3. How does Worldcoin work?

Worldcoin operates by allowing users to create a World ID, which verifies their identity while maintaining privacy through zero-knowledge proofs. Users download the World App to initiate the process and visit an Orb to complete their verification. The Orb uses multispectral sensors to confirm that the individual is a unique human being. Once verified, users can claim recurring grants of WLD tokens, which are distributed as part of the project’s initiative to make digital currency accessible to everyone.

4. What makes Worldcoin different from Bitcoin?

While both Worldcoin and Bitcoin are cryptocurrencies, they serve different purposes. Bitcoin is primarily a decentralized digital currency designed for peer-to-peer transactions without the need for intermediaries. In contrast, Worldcoin focuses on creating a global identity and financial network, emphasizing user verification and privacy. Worldcoin also has a unique governance model that allows for community input on protocol decisions, which is not a feature of Bitcoin.

5. Is Worldcoin a good investment?

As with any investment, the potential of Worldcoin (WLD) depends on various factors, including market conditions, project development, and adoption rates. While the project has ambitious goals and a unique approach to digital identity, it is essential to conduct thorough research and consider your risk tolerance before investing. Additionally, the cryptocurrency market is highly volatile, and past performance is not indicative of future results.

6. How many Worldcoin tokens are there?

The total supply of Worldcoin is capped at 10 billion WLD tokens. As of now, approximately 2 billion WLD tokens are in circulation. The distribution strategy allocates 75% of the tokens to the Worldcoin community, while the remaining tokens are distributed among the development team, investors, and reserves. For the first 15 years, the supply will remain fixed, with governance potentially allowing for a modest inflation rate after that period.

7. How is the Worldcoin protocol secured?

Worldcoin leverages the security features of the Ethereum blockchain, as the WLD token is an ERC-20 token. Additionally, it is bridged to the Optimism network, which enhances scalability and transaction efficiency. This multi-layered approach ensures that the protocol inherits the security properties of both Ethereum and Optimism, making it resilient against common vulnerabilities.

8. Where can I buy Worldcoin?

Worldcoin can be purchased on various cryptocurrency exchanges. It is advisable to check major platforms like Coinbase, Binance, or Kraken for availability. Users will need to create an account on these exchanges, complete any required identity verification processes, and then they can buy WLD using other cryptocurrencies or fiat currencies. Always ensure to use reputable exchanges and consider the security of your investments.

Final Verdict on worldcoin coin

Overview of Worldcoin (WLD)

Worldcoin (WLD) aims to revolutionize digital identity and finance by creating a global, privacy-preserving identity network. The project utilizes a unique mechanism called World ID, which enables individuals to verify their identity as unique humans while maintaining their privacy through zero-knowledge proofs. This innovative approach not only facilitates secure identity verification but also opens doors for decentralized governance and financial inclusivity.

Key Technologies and Features

The core technology behind Worldcoin involves the use of the Orb, a physical imaging device that captures biometric data to establish a World ID. This system ensures that the verification process is secure and efficient, with data privacy being a primary concern. Moreover, the WLD token serves multiple purposes within the ecosystem, acting as both a utility and governance token, allowing users to participate in decision-making processes regarding the protocol’s future.

Market Position and Potential

As of now, Worldcoin has a market capitalization of approximately $2.1 billion and a circulating supply of 2 billion WLD tokens out of a total supply of 10 billion. While the token has seen significant price fluctuations, it reached an all-time high of $11.80 in March 2024, indicating its potential for high returns. However, with such potential comes considerable risk, as the cryptocurrency market is known for its volatility.

Caution and Research

Worldcoin represents a high-risk, high-reward investment opportunity. Its ambitious goals and innovative technology could lead to substantial gains; however, potential investors should remain cautious. It is crucial to conduct thorough research and due diligence (DYOR) before making any investment decisions. Understanding the market dynamics, technological fundamentals, and regulatory landscape is essential for anyone looking to invest in Worldcoin or any other cryptocurrency.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.