What is velo coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to velo coin

Velo Coin, denoted as VELO, is a notable digital asset within the cryptocurrency landscape, recognized for its innovative approach to facilitating secure and efficient value transfers. As part of the broader blockchain ecosystem, Velo operates on a unique federated credit exchange network powered by the Velo Protocol. This protocol enables businesses to issue digital credits backed by collateral, corresponding to various fiat currencies, thus promoting frictionless transactions across borders. With its commitment to enhancing financial operations, Velo is positioned as a significant player in the realm of blockchain-based financial solutions.

The Significance of Velo Coin in the Crypto Market

In a market filled with numerous cryptocurrencies, Velo Coin stands out for its focus on creating a robust infrastructure that allows for seamless value transfers and liquidity. By leveraging advanced blockchain technology, Velo aims to bridge the gap between traditional financial systems and the rapidly evolving digital economy. The integration of smart contracts and the Stellar Consensus Protocol ensures that transactions are processed securely and transparently, which is crucial for building trust among users and partners alike.

Purpose of This Guide

This guide serves as a comprehensive resource for both novice and intermediate investors interested in Velo Coin. It aims to demystify the complexities surrounding this digital asset by covering key aspects such as its underlying technology, tokenomics, investment potential, and associated risks. Additionally, it will provide practical insights on how to acquire VELO tokens, enabling readers to make informed decisions in their investment journeys.

Overview of Content

- Technology: An in-depth look at the Velo Protocol, its features, and how it operates within the blockchain ecosystem.

- Tokenomics: A breakdown of VELO’s supply dynamics, utility, and market performance, including its current price, market cap, and trading volume.

- Investment Potential: Analysis of Velo’s growth prospects, market trends, and potential use cases that could influence its value in the future.

- Risks: Discussion on the inherent risks associated with investing in cryptocurrencies, particularly those specific to Velo.

- How to Buy: Step-by-step guidance on acquiring VELO tokens, including exchanges where they can be traded and tips for securing your investment.

By the end of this guide, readers will have a well-rounded understanding of Velo Coin, equipping them to navigate the complexities of cryptocurrency investment with greater confidence. Whether you are considering adding VELO to your portfolio or simply wish to expand your knowledge of blockchain technology, this guide aims to provide valuable insights and practical information.

What is velo coin? A Deep Dive into its Purpose

Overview of Velo Coin

Velo Coin (VELO) is a cryptocurrency that is integral to the Velo Protocol, a blockchain financial solution designed to facilitate secure and efficient value transfers across various networks. By leveraging blockchain technology, Velo aims to create a seamless environment for digital credit issuance and borderless asset transfers. The VELO token serves as a utility token within this ecosystem, acting as collateral and facilitating transactions, thus playing a crucial role in the overall functionality of the Velo network.

The Core Problem It Solves

In today’s global economy, businesses often face challenges related to cross-border transactions, such as high fees, slow processing times, and a lack of transparency. Traditional banking systems can be cumbersome, with various intermediaries involved, leading to inefficiencies that can hinder business operations. Velo Coin addresses these issues by providing a blockchain-based solution that streamlines the transfer of value between partners, regardless of geographical location.

The Velo Protocol enables the issuance of digital credits that are backed by collateral, corresponding to various fiat currencies. This capability allows businesses to execute transactions more quickly and at a lower cost compared to traditional methods. By using smart contracts and the Stellar Consensus Protocol, Velo ensures that transactions are processed and settled securely, enhancing trust among participants in the network. This approach not only reduces operational friction but also promotes financial inclusion by enabling businesses in developing regions to access global markets more easily.

Its Unique Selling Proposition

Velo’s unique selling proposition lies in its innovative approach to creating a federated credit exchange network. The Velo Protocol allows for the issuance of collateral-backed digital credits, which can be pegged to any fiat currency. This functionality is crucial for businesses looking to conduct cross-border transactions without the typical hurdles associated with traditional banking systems.

One of the standout features of Velo is its mobile application, Orbit, designed for peer-to-peer (P2P) payments. Orbit facilitates user-friendly transactions, allowing individuals and businesses to transfer value securely and efficiently. Additionally, Velo has developed a multi-chain bridge called Warp, which enhances interoperability by enabling seamless movement of assets across different blockchain networks. This flexibility is a significant advantage, as it allows users to engage with multiple blockchain ecosystems without facing barriers.

Moreover, Velo’s commitment to security is evident through its partnerships with reputable organizations in the blockchain space. These collaborations not only enhance the network’s security but also provide insurance mechanisms to protect against unforeseen events. This focus on security, combined with its advanced technology, positions Velo as a reliable option for businesses and users looking for efficient value transfer solutions.

The Team and Backers

The success of Velo Coin can largely be attributed to the expertise and vision of its team. Velo Labs, the entity behind the Velo Protocol, comprises professionals with extensive experience in blockchain technology, finance, and software development. The team is dedicated to creating a robust and scalable ecosystem that caters to the needs of businesses and individuals alike.

Velo has also established strategic partnerships with various organizations to bolster its credibility and expand its reach. For instance, the collaboration with a blockchain-based insurance platform enhances the security and utility of the Velo ecosystem. Additionally, the partnership with the Solana Foundation aims to develop a clearinghouse for digital gold transactions in Laos, demonstrating Velo’s commitment to innovative solutions and its ability to engage with diverse sectors.

The backing of Velo by prominent investors and industry leaders further solidifies its position in the cryptocurrency landscape. This support not only provides the necessary capital for development but also fosters a network of connections that can facilitate growth and adoption. By leveraging the insights and expertise of its backers, Velo is well-positioned to navigate the competitive landscape of blockchain financial solutions.

The Fundamental Purpose in the Crypto Ecosystem

Velo Coin’s fundamental purpose is to enhance the way value is transferred and settled across different networks by offering a comprehensive blockchain solution. By enabling businesses to issue digital credits and facilitating borderless asset transfers, Velo plays a vital role in the evolution of the financial ecosystem. Its technology promotes efficiency, transparency, and security, making it an attractive option for businesses looking to streamline their operations.

As the global economy continues to embrace digital transformation, the need for reliable and efficient value transfer solutions becomes increasingly important. Velo addresses this need by providing a platform that combines the advantages of blockchain technology with the practicality of traditional financial systems. This integration allows for a more inclusive financial environment, where businesses of all sizes can participate in the global economy without facing the traditional barriers that have long existed.

In summary, Velo Coin stands out as a promising cryptocurrency that addresses critical challenges in the realm of value transfer. Its innovative approach, combined with a dedicated team and strategic partnerships, positions it as a key player in the blockchain ecosystem. By facilitating secure and efficient transactions, Velo is paving the way for a more connected and accessible financial future. As with any investment, potential investors should conduct thorough research to understand the risks and opportunities associated with Velo and the broader cryptocurrency market.

The Technology Behind the Coin: How It Works

Overview of Velo Coin Technology

Velo Coin (VELO) is a blockchain-based financial solution designed to facilitate secure and efficient value transfers across different networks. At the core of Velo’s technology is the Velo Protocol, which enables the issuance of digital credits and borderless asset transfers through a smart contract system. This section will explore the various technological components that underpin Velo Coin, including its blockchain architecture, consensus mechanism, and key innovations.

Blockchain Architecture

Velo operates on a federated credit exchange network, which is a unique approach to blockchain architecture. This architecture allows for seamless integration of different financial services and promotes interoperability among various blockchain networks.

-

Smart Contracts: At the heart of Velo’s architecture are smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. Smart contracts automate the process of issuing and settling digital credits, ensuring that transactions are transparent and secure. For example, when a business issues a digital credit backed by collateral, the smart contract automatically enforces the terms and conditions of the transaction.

-

Digital Credits: Velo’s architecture supports the issuance of collateral-backed digital credits that can be pegged to any fiat currency. This feature enables businesses to conduct transactions without the friction typically associated with cross-border payments. The digital credits can be transferred seamlessly within the Velo network, allowing for quick settlements and enhanced liquidity.

-

Multi-Chain Bridge: Velo has developed a multi-chain bridge known as Warp, which facilitates the movement of assets across various blockchain networks. This innovation enhances interoperability and flexibility, allowing users to transfer assets without being confined to a single blockchain. The ability to interact with multiple chains broadens the use cases for Velo and improves overall user experience.

Consensus Mechanism

Velo utilizes the Stellar Consensus Protocol (SCP), which is known for its efficiency and security in processing and settling transactions. Understanding the consensus mechanism is crucial because it determines how transactions are verified and added to the blockchain.

-

Stellar Consensus Protocol: SCP operates on a federated model, which means that it relies on a network of trusted nodes (validators) to reach consensus on the state of the ledger. Unlike traditional consensus mechanisms like Proof-of-Work (PoW) or Proof-of-Stake (PoS), which require significant computational power or staking of tokens, SCP allows for faster transaction processing and lower energy consumption.

-

Transaction Processing: In the Velo network, when a transaction is initiated, it is broadcast to a select group of trusted nodes. These nodes validate the transaction based on their own consensus rules. Once a sufficient number of nodes agree on the validity of the transaction, it is added to the blockchain. This process not only enhances security but also ensures that transactions are settled quickly, making Velo suitable for real-time financial applications.

-

Security Features: The use of the Stellar Consensus Protocol provides several security advantages, including resistance to double-spending and the ability to handle high transaction volumes without compromising speed. Additionally, Velo enhances its security by partnering with organizations specializing in blockchain security, further fortifying its infrastructure against potential threats.

Key Technological Innovations

Velo Coin incorporates several technological innovations that set it apart from other cryptocurrencies. These innovations are designed to address specific challenges in the blockchain and financial sectors.

-

Federated Credit Exchange Network: Velo’s federated credit exchange network allows businesses to issue digital credits securely and efficiently. This network enables participants to transact without the need for traditional banking intermediaries, reducing costs and improving transaction speeds. The ability to issue collateral-backed credits also adds a layer of trust and reliability to the transactions.

-

Orbit Mobile Application: Velo’s mobile application, Orbit, is designed for peer-to-peer (P2P) payments. This user-friendly platform allows individuals and businesses to transfer value easily and securely. The integration of the Velo Protocol within the app ensures that transactions are conducted in a safe and efficient manner, contributing to the overall utility of Velo Coin.

-

Decentralized Settlement Network: Velo is working towards creating a decentralized settlement network that will further enhance its capabilities. This initiative aims to facilitate seamless value transfers across borders while maintaining security and transparency. By leveraging blockchain technology, Velo seeks to create a more inclusive financial system where businesses can easily issue digital credits and conduct transactions globally.

-

Collaboration with Blockchain Communities: Velo actively engages with various blockchain communities to improve the overall security infrastructure of its ecosystem. These collaborations are essential for ensuring the integrity of transactions and protecting digital assets. By working together with other blockchain projects, Velo enhances its technological capabilities and fosters innovation within the space.

Use Cases and Applications

The technology behind Velo Coin enables a wide array of applications, making it a versatile solution for businesses and individuals alike. Some of the notable use cases include:

-

Cross-Border Transactions: Velo’s ability to issue digital credits pegged to fiat currencies makes it an attractive option for businesses engaged in international trade. By utilizing Velo, businesses can conduct transactions without the traditional delays and fees associated with cross-border payments.

-

Digital Gold Trading: Velo has established a significant partnership focused on digital gold transactions in Laos. This initiative illustrates how Velo’s technology can facilitate complex financial operations while ensuring transparency and security in trading valuable assets.

-

Integration with Financial Services: Velo’s federated credit exchange network can be integrated into various financial services, providing a robust infrastructure for issuing digital credits and conducting secure transactions. This capability allows for innovative financial products and services to be developed, expanding the use of Velo Coin in the broader financial ecosystem.

-

Enhanced Security for Digital Assets: By leveraging its partnerships with blockchain security firms, Velo aims to improve the security of digital assets across its platform. This focus on security ensures that users can confidently engage in transactions without fearing potential vulnerabilities.

Conclusion

In summary, the technology behind Velo Coin is a sophisticated blend of blockchain architecture, a unique consensus mechanism, and innovative solutions designed to enhance value transfers across networks. By utilizing the Stellar Consensus Protocol and incorporating smart contracts, Velo provides a secure and efficient platform for issuing digital credits and facilitating transactions. The continuous development of its federated credit exchange network and partnerships within the blockchain community positions Velo as a key player in the evolving landscape of digital finance. As the adoption of Velo Coin grows, it has the potential to redefine how businesses and individuals conduct transactions in the digital age.

Understanding velo coin Tokenomics

Velo Coin Tokenomics Overview

Tokenomics, a portmanteau of “token” and “economics,” refers to the economic model behind a cryptocurrency. Understanding the tokenomics of Velo Coin (VELO) is crucial for investors and users alike, as it provides insights into the supply dynamics, utility, and overall value proposition of the token. In this section, we will explore the key metrics related to VELO, its utility within the Velo ecosystem, and its distribution model.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 23.99 billion VELO |

| Max Supply | 24 billion VELO |

| Circulating Supply | 17.56 billion VELO |

| Inflation/Deflation Model | Controlled Inflation |

Token Utility (What is the coin used for?)

The VELO token is the backbone of the Velo ecosystem, designed to facilitate a variety of financial transactions and services. Here are some of the primary utilities of the VELO token:

-

Collateral for Digital Credits: One of the primary functions of VELO is to serve as collateral for issuing digital credits. These digital credits can correspond to any fiat currency, enabling seamless value transfers across borders without the friction typically associated with traditional banking systems.

-

Transaction Fees: VELO tokens are utilized to pay for transaction fees within the Velo network. This includes fees for issuing digital credits, transferring assets, and other services provided by the Velo Protocol. Using VELO for transaction fees helps to create a self-sustaining ecosystem where the value of the token is directly linked to its utility.

-

Access to Financial Services: Holding VELO tokens provides users access to various financial services offered within the Velo ecosystem. This includes liquidity provision, peer-to-peer (P2P) payments, and other financial applications that rely on the Velo Protocol.

-

Governance Participation: As Velo continues to evolve, VELO token holders may have the opportunity to participate in governance decisions affecting the network. This can include voting on protocol upgrades, changes in fee structures, and other key decisions that shape the future of the Velo ecosystem.

-

Incentives for Network Participants: The Velo ecosystem aims to incentivize various participants, including liquidity providers, developers, and businesses. By utilizing VELO as a reward mechanism, the project encourages active engagement and contributions to the network.

Token Distribution

The distribution of VELO tokens is a critical aspect of its tokenomics, influencing both its market dynamics and long-term sustainability. The following outlines the key components of Velo’s token distribution strategy:

-

Initial Allocation: Upon its launch, VELO tokens were distributed among various stakeholders, including the team, advisors, early investors, and the community. This initial allocation is crucial for establishing a balanced ecosystem where different participants have a vested interest in the project’s success.

-

Token Unlocking Schedule: To prevent market volatility and ensure a gradual introduction of tokens into circulation, Velo has established a token unlocking schedule. This schedule specifies when certain allocations become available for trading, thereby managing supply and demand dynamics effectively.

-

Community Incentives: A portion of the VELO supply is earmarked for community incentives. This includes rewards for participation in community events, educational campaigns, and other initiatives designed to increase user engagement and adoption of the Velo ecosystem.

-

Partnerships and Collaborations: Velo Labs has also reserved tokens for strategic partnerships and collaborations. These tokens can be utilized to foster relationships with other blockchain projects, financial institutions, and technology providers, enhancing the overall utility and reach of the Velo ecosystem.

-

Long-term Vision: The Velo team is committed to maintaining a fair and sustainable token distribution model. This includes ongoing assessments of the tokenomics to adapt to market conditions and user feedback. By ensuring that the interests of all stakeholders are aligned, Velo aims to create a thriving ecosystem that benefits everyone involved.

Conclusion

Understanding the tokenomics of Velo Coin is essential for anyone looking to engage with this digital asset. With a well-defined supply structure, a variety of utilities, and a thoughtful distribution strategy, VELO is positioned to play a significant role in the evolving landscape of blockchain-based financial solutions. As with any investment, potential investors should conduct thorough research and consider the risks associated with cryptocurrency investments.

Price History and Market Performance

Overview of Velo Coin’s Price History

Velo Coin (VELO) has experienced a dynamic price journey since its inception, characterized by significant highs and lows, reflective of the broader cryptocurrency market trends and specific developments within the Velo ecosystem. The following sections delve into key historical price milestones and the factors influencing its market performance.

Key Historical Price Milestones

-

Initial Launch and Early Performance

Velo Coin was launched in late 2020, and during its early days, it demonstrated a modest price range, typically trading under $0.10. The coin’s initial market activity was relatively stable as it sought to establish a presence within the competitive cryptocurrency landscape. -

All-Time High

The peak of Velo Coin’s price occurred on March 8, 2021, when it reached an all-time high of approximately $2.07. This surge can be attributed to a combination of factors, including increased investor interest in decentralized finance (DeFi) projects, the broader bullish sentiment in the cryptocurrency market, and Velo’s innovative financial solutions aimed at facilitating secure value transfers. -

Subsequent Decline

Following its all-time high, Velo Coin experienced a substantial decline, a trend that is common in the cryptocurrency market following peaks. By December 18, 2022, the price had plummeted to an all-time low of $0.001029, representing a staggering decrease of about 99.34% from its peak. This decline can be linked to the general bear market conditions that affected most cryptocurrencies during that period. -

Recent Recovery

As of October 2023, Velo Coin has seen a recovery, with its price stabilizing around $0.01361. This represents a significant increase of approximately 1,222.91% from its all-time low. The recent price action reflects a gradual re-establishment of investor confidence and renewed interest in Velo’s unique value propositions.

Factors Influencing the Price

Historically, the price of Velo Coin has been influenced by a variety of factors, both internal to the Velo ecosystem and external market dynamics.

-

Market Sentiment and Trends

Like many cryptocurrencies, Velo Coin’s price is significantly impacted by overall market sentiment. Bullish trends in the cryptocurrency market often lead to increased investment in altcoins, including Velo. Conversely, bearish market conditions tend to diminish investor interest, resulting in price declines. The speculative nature of cryptocurrency trading means that news, trends, and social media sentiment can quickly sway investor actions, directly impacting Velo’s price. -

Technological Developments and Partnerships

Velo’s price has also been influenced by its technological advancements and strategic partnerships. Collaborations, such as those with the Solana Foundation for the Laos Gold Project, have the potential to enhance the utility and credibility of the Velo Protocol. Announcements regarding technological upgrades or new features within the Velo ecosystem can lead to positive price movements as investors anticipate increased adoption and utility. -

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies can significantly affect market performance. Positive regulatory developments can enhance market confidence and drive prices up, while restrictive regulations can lead to uncertainty and price declines. Velo, being a blockchain-based financial solution, is particularly sensitive to regulatory changes that may affect digital credit issuance and cross-border transactions. -

Adoption and Use Cases

The practical applications of Velo Coin within the financial ecosystem also play a crucial role in influencing its price. As Velo expands its use cases—such as facilitating peer-to-peer payments through its Orbit application or enabling cross-chain asset transfers with its Warp bridge—greater adoption can lead to increased demand for VELO tokens, positively impacting its price. -

Market Capitalization and Trading Volume

Market capitalization and trading volume are critical indicators of a cryptocurrency’s health. Velo Coin has maintained a market cap of around $239.15 million, with a 24-hour trading volume of approximately $14.57 million. Higher trading volumes often correlate with increased investor interest and can lead to price volatility. The relationship between market cap and price is particularly important, as a lower market cap can lead to more pronounced price fluctuations in response to market movements.

Conclusion

In summary, Velo Coin’s price history is marked by significant milestones, from its all-time high to its recent recovery. Various factors, including market sentiment, technological advancements, regulatory changes, and adoption rates, have historically influenced its price dynamics. As Velo continues to develop its ecosystem and expand its use cases, its price performance will likely remain closely tied to these ongoing developments. For investors, understanding this historical context is essential for navigating the complexities of the cryptocurrency market.

Where to Buy velo coin: Top Exchanges Reviewed

5 Steps to Effortlessly Buy VELO on Your Crypto App in the US!

In the review article, we explore the user-friendly features of the Crypto.com app, which simplifies the process of buying Velo tokens for US users. The platform stands out for its intuitive interface, comprehensive research tools, and robust security measures, making it accessible even for beginners. By guiding users through the steps to locate and trade Velo, the article highlights how Crypto.com caters to a diverse audience in the growing cryptocurrency market.

- Website: reddit.com

- Platform Age: Approx. 20 years (domain registered in 2005)

5. Velo – Seamless Trading Experience Awaits!

Velo (VELO) distinguishes itself in the cryptocurrency market by offering comprehensive exchange listings that allow users to compare prices, trading volumes, and available discounts across multiple platforms. This feature empowers traders to make informed decisions by identifying the most favorable conditions for their transactions, ensuring they maximize their investment potential while minimizing costs. With its user-friendly interface, Velo simplifies the trading process for both novice and experienced investors.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

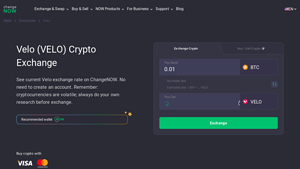

3. ChangeNOW – Best for Instant VELO Swaps!

ChangeNOW stands out as a top platform for exchanging VELO, boasting an impressive rating of 4.8 from over 2,165 users. The exchange offers competitive pricing, ensuring users can buy and sell VELO at the best rates available. Additionally, ChangeNOW provides real-time market data, including live charts and market cap information, making it a user-friendly choice for both novice and experienced traders looking to engage with VELO efficiently.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

7. Velo (VELO) – Your Ultimate Step-by-Step Buying Guide!

In the “How to Buy Velo (VELO) Step-by-Step Guide” by CoinCodex, readers are introduced to several top-tier exchanges, including KuCoin, OKX, Bybit, Gate, and MEXC, which stand out for their user-friendly interfaces, robust security measures, and diverse trading options. The guide simplifies the purchasing process for Velo, making it accessible for both beginners and experienced investors seeking reliable platforms for their cryptocurrency transactions.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy velo coin: A Step-by-Step Guide

Step 1: Choose a Cryptocurrency Exchange

The first step in purchasing Velo Coin (VELO) is selecting a cryptocurrency exchange that supports it. Popular exchanges where you can buy VELO include:

- Binance: A leading global exchange with a wide range of cryptocurrencies available for trading.

- Coinbase: A user-friendly platform ideal for beginners, although it may not always list VELO.

- KuCoin: Known for its diverse selection of altcoins, including VELO.

- Gate.io: Another platform that frequently lists various cryptocurrencies.

Before choosing an exchange, consider the following factors:

- Fees: Different exchanges have varying fee structures, including trading fees, withdrawal fees, and deposit fees.

- User Interface: Ensure that the exchange has an intuitive interface that you feel comfortable navigating.

- Security Features: Look for exchanges with robust security measures, such as two-factor authentication (2FA) and cold storage for assets.

Step 2: Create and Verify Your Account

Once you have chosen an exchange, the next step is to create an account. Here’s how to do that:

- Visit the Exchange’s Website: Go to the official site of the chosen exchange.

- Sign Up: Click on the “Sign Up” or “Register” button. You will need to provide your email address and create a password.

- Email Verification: Most exchanges will send a verification email. Click the link in the email to verify your account.

- Identity Verification: To comply with regulations, you will likely need to verify your identity. This typically involves providing personal information and submitting identification documents (such as a passport or driver’s license).

- Enable Two-Factor Authentication: For added security, enable 2FA on your account. This will require you to enter a code sent to your mobile device each time you log in.

Step 3: Deposit Funds

After verifying your account, you will need to deposit funds to start trading. Here’s how to do it:

- Select Deposit Method: Most exchanges allow you to deposit funds using various methods, including bank transfers, credit/debit cards, or other cryptocurrencies.

- Choose Currency: Decide whether you want to deposit fiat currency (like USD) or another cryptocurrency (like Bitcoin).

- Follow Instructions: If you are depositing fiat, follow the provided instructions for bank transfers or card payments. If depositing cryptocurrency, you will need to send the funds to the exchange’s wallet address.

- Confirm Deposit: Once your deposit is initiated, it may take some time to process. Check your account balance to confirm that the funds have been credited.

Step 4: Place an Order to Buy Velo Coin

Now that you have funds in your exchange account, you can purchase VELO. Here’s how:

- Navigate to the Trading Section: Find the section of the exchange dedicated to trading or markets.

- Select VELO: Search for Velo Coin (VELO) in the list of available cryptocurrencies.

- Choose Order Type: You will typically have options to place a market order (buy at the current market price) or a limit order (set a specific price at which you want to buy).

- Enter Amount: Specify how much VELO you want to purchase. Make sure you have enough funds to cover the transaction.

- Confirm the Order: Review the details and confirm your order. Once the order is executed, the VELO will be credited to your account on the exchange.

Step 5: Secure Your Coins in a Wallet

After buying VELO, it’s crucial to secure your coins. While you can leave them on the exchange, it’s recommended to move them to a personal wallet for better security. Here’s how:

-

Choose a Wallet: Select a wallet that supports VELO. Options include:

– Hardware Wallets: Devices like Ledger or Trezor offer high security by storing your private keys offline.

– Software Wallets: Apps like Trust Wallet or Exodus provide convenient access to your coins while maintaining a decent level of security.

– Web Wallets: Some wallets are available directly through your web browser, but they are generally less secure than hardware or software wallets. -

Transfer VELO: To transfer your VELO to your wallet:

– Open your wallet and locate the receiving address for VELO.

– Go back to the exchange, navigate to the withdrawal section, and enter your wallet address.

– Specify the amount you wish to withdraw and confirm the transaction. -

Confirm Receipt: After a short period, check your wallet to ensure that the VELO has been successfully transferred.

By following these steps, you can securely purchase and store Velo Coin, allowing you to participate in its ecosystem while minimizing risks associated with holding cryptocurrencies.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Unique Value Proposition

Velo Coin (VELO) operates within a unique federated credit exchange network that leverages blockchain technology to facilitate secure and efficient value transfers. By issuing digital credits backed by collateral, Velo aims to streamline transactions across borders, making it an attractive solution for businesses involved in international trade. This capability can reduce transaction times and costs, which are significant barriers in traditional banking.

2. Integration of Blockchain Technology

Velo utilizes the Stellar Consensus Protocol, known for its speed and efficiency in processing transactions. This foundation enhances the reliability of Velo’s services, making it suitable for a range of applications, including peer-to-peer payments and cross-border transactions. The integration of blockchain technology not only improves security but also increases transparency, which can foster trust among users and partners.

3. Growing Market Demand

As the global economy becomes increasingly digital, the demand for efficient and secure payment solutions is expected to rise. Velo’s focus on enabling frictionless value transfers positions it well to capitalize on this trend. Businesses looking to adapt to the digital economy may find Velo’s offerings particularly appealing, creating a potential growth market for the token.

4. Strategic Partnerships

Velo has entered into several strategic partnerships, including collaborations with blockchain security firms and the Solana Foundation for the Laos Gold Project. These alliances can enhance Velo’s credibility and expand its reach within the blockchain ecosystem. By partnering with established organizations, Velo can also leverage their expertise and resources, potentially leading to innovative solutions and increased adoption.

5. Utility Token Functionality

The VELO token serves multiple purposes within the Velo ecosystem, acting as collateral for digital credits and facilitating transactions. This multi-faceted utility can drive demand for the token, as users may need to acquire VELO to participate in various services offered by the platform. A well-structured utility can enhance the token’s value proposition, attracting both users and investors.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies, including Velo Coin, are notoriously volatile. Price fluctuations can be extreme, driven by market sentiment, regulatory news, and macroeconomic factors. This volatility can pose significant risks for investors, as the value of VELO may experience rapid declines, impacting both short-term traders and long-term holders. The potential for loss is a critical consideration for anyone looking to invest in Velo.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain and varies significantly across jurisdictions. Changes in regulations can have profound effects on the operations of blockchain projects. For Velo, any adverse regulatory developments could limit its ability to operate in certain markets or impose additional compliance costs, which may affect its growth and adoption. Investors should remain vigilant about regulatory developments that could impact the cryptocurrency space.

3. Competition

The cryptocurrency and blockchain sectors are highly competitive, with numerous projects vying for market share. Velo faces competition from other blockchain-based financial solutions that offer similar functionalities, including established players and emerging startups. The ability of Velo to differentiate itself and maintain a competitive edge will be crucial for its long-term success. If Velo cannot effectively compete, it may struggle to gain traction in the market.

4. Technological Risks

As a blockchain-based platform, Velo is subject to technological risks that can impact its operations. These risks include potential vulnerabilities in the smart contract code, network security issues, and the scalability of the Velo Protocol. A successful attack or a critical bug could undermine user trust and lead to significant financial losses. Continuous updates and security audits are necessary to mitigate these risks, but they also require ongoing investment and resources.

5. Adoption Challenges

While Velo has a promising technology and value proposition, widespread adoption is not guaranteed. Businesses and users must be willing to integrate Velo’s solutions into their operations, which can be a hurdle, particularly in traditional industries resistant to change. The success of Velo will depend on its ability to demonstrate clear advantages over existing solutions and to build a robust user base. If adoption does not materialize as anticipated, it could hinder the growth of the platform.

Conclusion

Investing in Velo Coin presents both significant potential and considerable risks. On one hand, Velo’s unique value proposition, integration of advanced blockchain technology, and strategic partnerships position it as an innovative player in the cryptocurrency landscape. The growing demand for efficient payment solutions further enhances its prospects.

On the other hand, market volatility, regulatory uncertainty, intense competition, and technological risks pose substantial challenges that could impact Velo’s success. Investors considering VELO should conduct thorough research, weigh these factors carefully, and remain mindful of the rapidly evolving nature of the cryptocurrency market. As with any investment, understanding both the potential rewards and the risks is essential for making informed decisions.

Frequently Asked Questions (FAQs)

1. What is Velo Coin (VELO)?

Velo Coin (VELO) is the native utility token of the Velo Protocol, a blockchain-based financial solution designed to facilitate secure and efficient value transfers across different networks. It serves as collateral for transactions within the Velo ecosystem and is integral to the issuance of digital credits, which can correspond to various fiat currencies. Velo aims to enhance financial transactions through its federated credit exchange network powered by the Stellar Consensus Protocol.

2. Who created Velo Coin?

Velo Coin was developed by Velo Labs, a team focused on creating a blockchain financial protocol that enables digital credit issuance and borderless asset transfers. The project is backed by a group of experienced professionals in the fields of finance, technology, and blockchain, who are committed to building a secure and efficient financial ecosystem.

3. How does Velo Coin work?

Velo Coin operates within the Velo Protocol, which utilizes smart contracts to facilitate digital credit issuance and value transfers. The protocol enables partners to issue collateral-backed digital credits that can be used for seamless transactions. By leveraging the Stellar Consensus Protocol, Velo ensures efficient processing and settlement of transactions, promoting transparency and security.

4. What makes Velo Coin different from Bitcoin?

While both Velo Coin and Bitcoin are cryptocurrencies, they serve different purposes. Bitcoin is primarily a decentralized digital currency aimed at peer-to-peer transactions and store of value, whereas Velo Coin focuses on facilitating financial services and value transfers through the issuance of digital credits. Velo’s unique infrastructure supports various business applications, emphasizing security and efficiency in transactions.

5. Is Velo Coin a good investment?

As with any cryptocurrency, the potential for investment in Velo Coin comes with risks and rewards. Velo’s market cap, current price, and technological advancements are factors to consider. The project’s focus on real-world applications, partnerships, and its innovative use of blockchain technology may present growth opportunities. However, investors should conduct thorough research and consider their risk tolerance before investing.

6. What are the use cases for Velo Coin?

Velo Coin has several use cases within the Velo ecosystem. It facilitates secure and efficient cross-border transactions, serves as collateral for digital credits, and supports various financial applications. Notably, Velo is involved in initiatives such as establishing a clearinghouse for digital gold transactions and enhancing blockchain utility and security through partnerships.

7. How can I buy Velo Coin?

Velo Coin can be purchased on various cryptocurrency exchanges that support its trading. To buy VELO, you typically need to create an account on a supported exchange, complete the necessary KYC (Know Your Customer) verification, deposit funds, and then place an order for VELO. It’s advisable to use secure wallets for storing your VELO after purchase.

8. How is Velo Coin secured?

The security of Velo Coin is ensured through a combination of advanced technology, strategic partnerships, and its foundation on the Stellar Consensus Protocol. Velo collaborates with reputable organizations specializing in blockchain security, enhancing its protective measures against potential threats. Additionally, the use of collateral-backed digital credits adds a layer of trust and reliability to the transactions within the Velo network.

Final Verdict on velo coin

Overview of Velo Coin

Velo Coin (VELO) serves as a utility token within the Velo ecosystem, which aims to revolutionize the way value is transferred across borders. At its core, Velo facilitates the issuance of digital credits that are backed by collateral, allowing businesses to engage in secure and efficient transactions. This is accomplished through the innovative Velo Protocol, which utilizes a smart contract system and the Stellar Consensus Protocol for reliable transaction processing.

Technology and Use Cases

The technology behind Velo focuses on creating a federated credit exchange network that empowers partners to issue digital credits pegged to fiat currencies. Velo’s mobile application, Orbit, and its multi-chain bridge, Warp, enhance its usability by enabling seamless peer-to-peer payments and asset transfers across different blockchain networks. These features position Velo as a versatile solution for various financial applications, including the establishment of clearinghouses for digital transactions, such as the digital gold project in Laos.

Investment Considerations

Investing in Velo Coin presents a high-risk, high-reward opportunity. The coin currently trades at approximately $0.0136, with a market cap of around $239 million. Despite its promising technology and use cases, potential investors should be aware of the inherent volatility and risks associated with cryptocurrency investments. The price of VELO has seen significant fluctuations, with an all-time high of $2.07 and a low of $0.00103, highlighting the speculative nature of the asset.

Final Thoughts

In conclusion, Velo Coin stands out as an innovative digital asset with significant potential to facilitate secure and efficient value transfers in a global economy increasingly reliant on blockchain technology. However, as with any investment in cryptocurrencies, it is crucial to conduct thorough research and consider the risks involved. We encourage you to perform your due diligence (DYOR) before making any investment decisions in Velo Coin or any other cryptocurrency.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.