What is grok coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to grok coin

Grok Coin (GROK) is an intriguing digital asset that has garnered attention in the cryptocurrency market, particularly within the realms of meme coins and AI-driven applications. Inspired by the innovative spirit of tech visionary Elon Musk, Grok Coin is associated with a meme-based ecosystem that thrives on humor and community engagement, leveraging the popularity of AI technologies like ChatGPT. As a relatively new entrant in the crypto space, Grok Coin has quickly carved out a niche, appealing to both casual investors and serious cryptocurrency enthusiasts.

Significance in the Crypto Market

Grok Coin has positioned itself as a notable player within the meme coin category, a segment that has seen explosive growth in recent years. Meme coins, often characterized by their community-driven nature and humorous branding, have the potential to create significant market movements based on social media trends and viral content. Grok Coin stands out due to its connection to AI and big data, tapping into the growing interest in these technologies while maintaining the playful essence of meme culture. As of now, Grok Coin is ranked #1219 on major cryptocurrency tracking platforms, with a market cap of approximately $8.17 million and a circulating supply of over 6.32 billion tokens.

Purpose of This Guide

This guide aims to provide a comprehensive resource for both beginners and intermediate investors interested in Grok Coin. We will delve into various aspects of the cryptocurrency, including:

- Technology: An overview of the underlying blockchain technology and smart contracts that facilitate Grok Coin’s operations.

- Tokenomics: A detailed analysis of Grok Coin’s supply, distribution, and economic model, including its market dynamics and valuation metrics.

- Investment Potential: Insights into the factors that could influence Grok Coin’s price movements and market performance, along with historical price trends.

- Risks: A candid discussion of the risks associated with investing in Grok Coin, including market volatility, regulatory concerns, and the speculative nature of meme coins.

- How to Buy: Step-by-step instructions on acquiring Grok Coin through various exchanges, along with tips for safely storing and managing your investment.

By the end of this guide, readers will have a well-rounded understanding of Grok Coin, enabling them to make informed decisions about their investments in this unique digital asset. Whether you are drawn to its meme-inspired charm or its association with cutting-edge AI technology, Grok Coin presents an exciting opportunity worth exploring.

What is grok coin? A Deep Dive into its Purpose

Overview of Grok Coin

Grok Coin (GROK) is a cryptocurrency that has emerged from the intersection of artificial intelligence and meme culture, drawing inspiration from the tech icon Elon Musk’s products, particularly the xAI and Grok ChatGPT-like systems. Its inception taps into the growing interest in AI-driven solutions and the playful nature of meme coins, offering a novel approach to both technological advancement and community engagement within the cryptocurrency space.

The Core Problem It Solves

At its core, Grok Coin aims to address the challenges associated with the proliferation of AI technologies and their integration into everyday applications. As artificial intelligence becomes more pervasive, there is a need for platforms that can facilitate seamless interactions between users and AI systems. Grok Coin seeks to bridge this gap by providing a decentralized framework where users can engage with AI applications effectively and securely.

-

Accessibility: Many AI tools require substantial investments in infrastructure and expertise, making them inaccessible to the average user. Grok Coin democratizes access to AI by enabling users to interact with AI systems without needing deep technical knowledge or significant financial resources.

-

Community Engagement: Traditional AI solutions often operate in silos, limiting user participation and feedback. Grok Coin fosters a community-centric approach, where users can contribute to the development and evolution of AI applications, ensuring that these technologies align with user needs and preferences.

-

Incentivization: The project incorporates a tokenomics model that rewards users for participating in the ecosystem. This incentivization model encourages users to engage with AI applications and contribute valuable data, thereby enhancing the overall functionality and effectiveness of the systems.

Its Unique Selling Proposition

Grok Coin stands out in the crowded cryptocurrency market due to its unique blend of AI-driven technology and meme culture. Here are some aspects that contribute to its unique selling proposition:

-

Meme Culture Integration: By leveraging the popularity of meme coins, Grok Coin taps into a vibrant community that is often overlooked by more traditional cryptocurrencies. This cultural integration not only broadens its appeal but also fosters a sense of belonging among users.

-

Innovative Use of AI: Grok Coin’s foundation on AI technologies allows it to offer cutting-edge solutions that are not typically found in other meme coins. This positions Grok Coin as a forward-thinking project that is aligned with the technological advancements of the future.

-

Strong Community Focus: The project emphasizes community involvement, allowing users to participate in decision-making processes and the development of the platform. This creates a loyal user base that is invested in the success of the project.

-

Scalability and Versatility: The underlying technology of Grok Coin is designed to be scalable, accommodating a growing number of users and applications. This adaptability ensures that Grok Coin can evolve alongside the rapidly changing landscape of AI technologies.

The Team and Backers

The success of any cryptocurrency project heavily relies on the expertise and vision of its team. Grok Coin is backed by a diverse group of individuals with backgrounds in technology, finance, and marketing, ensuring a well-rounded approach to development and community engagement.

-

Founders and Developers: The team includes AI specialists, software engineers, and blockchain developers who bring a wealth of experience to the project. Their collective expertise enables them to create innovative solutions that integrate AI and blockchain technology seamlessly.

-

Advisory Board: Grok Coin has an advisory board comprising industry veterans who provide strategic guidance and insights. Their experience in navigating the complexities of the tech and crypto landscapes is invaluable in steering the project toward success.

-

Community-Driven Initiatives: The project actively encourages community involvement, allowing users to contribute to the direction of the project. This collaborative approach not only enhances trust but also fosters a sense of ownership among users.

Fundamental Purpose in the Crypto Ecosystem

Grok Coin serves multiple purposes within the cryptocurrency ecosystem:

-

Facilitating AI Adoption: By providing a platform for users to interact with AI applications, Grok Coin contributes to the broader adoption of AI technologies. This aligns with the growing trend of integrating AI into various industries, from healthcare to finance.

-

Creating a Sustainable Economy: The tokenomics model of Grok Coin is designed to create a sustainable economy that rewards users for their contributions. This ensures that the platform remains viable in the long term, fostering continuous growth and innovation.

-

Enhancing User Experience: Grok Coin aims to improve the user experience when engaging with AI systems. By simplifying access and providing incentives for participation, it encourages more users to explore the potential of AI technologies.

-

Building a Community of Innovators: The project fosters a community of individuals who are passionate about AI and cryptocurrency. This collaborative environment encourages innovation and experimentation, driving the development of new applications and use cases for Grok Coin.

Conclusion

In summary, Grok Coin represents a unique fusion of AI technology and meme culture, addressing key challenges in accessibility and community engagement. With a strong foundation built on innovative principles and a dedicated team, Grok Coin aims to carve out a significant niche in the cryptocurrency landscape. Its commitment to democratizing access to AI and fostering community involvement positions it as a forward-thinking project with the potential for long-term success in the evolving crypto ecosystem.

The Technology Behind the Coin: How It Works

Introduction to Grok Coin Technology

Grok Coin (GROK) is a cryptocurrency that operates within the Ethereum ecosystem, leveraging the capabilities of smart contracts and blockchain technology. Understanding the underlying technology of Grok Coin is essential for investors and enthusiasts looking to engage with this digital asset effectively. This guide will walk you through the key technological components that power Grok Coin, including its blockchain architecture, consensus mechanism, and notable innovations.

Blockchain Architecture

Grok Coin is built on the Ethereum blockchain, which is one of the most widely used platforms for decentralized applications (dApps) and smart contracts. The Ethereum blockchain is a public ledger that records all transactions made with the GROK token, ensuring transparency and security.

-

Smart Contracts: At the heart of Grok Coin’s functionality are smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. Smart contracts automate processes and eliminate the need for intermediaries, making transactions faster and more efficient. For Grok Coin, smart contracts facilitate transactions, govern tokenomics, and enable various applications within the Grok ecosystem.

-

Ethereum Virtual Machine (EVM): Grok Coin operates on the Ethereum Virtual Machine, a decentralized computing environment that allows developers to create and deploy dApps. The EVM ensures that all nodes in the Ethereum network execute the same code, which guarantees consistency and security across the network.

-

Token Standards: Grok Coin adheres to Ethereum’s ERC-20 token standard, which defines a common list of rules for all Ethereum tokens. This standardization simplifies the process of creating and managing tokens, making it easier for users to trade GROK on various exchanges and wallets. The ERC-20 standard includes functions for transferring tokens, checking balances, and approving other addresses to spend tokens on behalf of the owner.

Consensus Mechanism

The consensus mechanism is a crucial aspect of any blockchain as it determines how transactions are validated and added to the blockchain. Grok Coin, being part of the Ethereum network, relies on Ethereum’s consensus mechanism.

-

Proof of Stake (PoS): Ethereum transitioned from a Proof of Work (PoW) consensus mechanism to Proof of Stake (PoS) with the Ethereum 2.0 upgrade. In PoS, validators are chosen to create new blocks and confirm transactions based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This shift to PoS enhances the network’s efficiency and reduces energy consumption compared to PoW, where miners solve complex mathematical problems to validate transactions.

-

Validator Nodes: In the PoS system, participants can become validators by staking their ETH. Validators are responsible for confirming transactions and maintaining the integrity of the blockchain. If a validator acts maliciously or fails to perform their duties, they risk losing their staked ETH, which incentivizes honest behavior.

-

Transaction Finality: One of the advantages of PoS is faster transaction finality. In PoW, it can take time for transactions to be confirmed due to the mining process. In contrast, PoS allows for quicker confirmations, enhancing the user experience when transacting with Grok Coin.

Key Technological Innovations

Grok Coin incorporates several innovative features that enhance its usability and appeal within the cryptocurrency market.

-

Generative AI Integration: Grok Coin is inspired by advancements in artificial intelligence, particularly in generative AI. This innovation allows for the development of unique applications and services within the Grok ecosystem, potentially revolutionizing how users interact with AI-driven solutions. For example, Grok Coin may enable AI-based tools for predictive analytics, automated trading, and personalized financial advice.

-

Community-Driven Development: Grok Coin emphasizes community involvement in its development and governance. This decentralized approach allows token holders to propose and vote on changes to the protocol, ensuring that the project evolves in a way that reflects the needs and desires of its users. This model fosters a sense of ownership and engagement among the Grok community.

-

Incentive Mechanisms: The Grok ecosystem includes various incentive mechanisms designed to reward users for participation. For instance, users who stake their GROK tokens can earn rewards in the form of additional tokens or access to exclusive features and services. This encourages active participation and fosters a robust community.

-

Interoperability: Grok Coin aims for interoperability with other blockchain networks and dApps. This feature allows GROK to be integrated into various platforms, enhancing its utility and broadening its user base. Interoperability is essential for the long-term success of any cryptocurrency, as it enables seamless transactions and interactions across different ecosystems.

Security Features

Security is paramount in the cryptocurrency space, and Grok Coin employs several measures to safeguard its users and their assets.

-

Decentralization: The decentralized nature of the Ethereum blockchain means that no single entity controls the network. This minimizes the risk of censorship and fraud, as transactions are validated by a distributed network of nodes rather than a central authority.

-

Cryptographic Security: Grok Coin utilizes advanced cryptographic techniques to secure transactions and protect user data. Each transaction is hashed and linked to the previous transaction, creating an immutable record that is resistant to tampering.

-

Regular Audits: To maintain security and transparency, Grok Coin may undergo regular audits by third-party firms. These audits assess the codebase and overall security of the project, helping to identify and address potential vulnerabilities.

Conclusion

Grok Coin represents a blend of innovative technology and community-driven principles within the Ethereum ecosystem. Its use of smart contracts, Proof of Stake consensus, and integration of generative AI highlights its potential to create a dynamic and user-friendly experience for both beginners and experienced investors. Understanding the technology behind Grok Coin is crucial for anyone looking to navigate the ever-evolving landscape of cryptocurrencies effectively. As the project continues to develop, staying informed about its technological advancements will be essential for maximizing your investment strategy and engagement with the Grok community.

Understanding grok coin Tokenomics

Grok Coin (GROK) has emerged as a unique player in the cryptocurrency market, combining elements of meme culture with advanced AI technology. To understand Grok Coin’s potential and its place in the digital asset landscape, it’s essential to delve into its tokenomics, which encompasses its supply metrics, utility, and distribution mechanisms.

Key Metrics

Below is a summary of the essential metrics that define Grok Coin’s tokenomics:

| Metric | Value |

|---|---|

| Total Supply | 6,590,062,192 GROK |

| Max Supply | 6,900,000,000 GROK |

| Circulating Supply | 6,320,338,192 GROK |

| Inflation/Deflation Model | Deflationary (via token burns) |

Total Supply

The total supply of Grok Coin is capped at 6.9 billion GROK tokens, which is a significant factor for investors to consider. The total supply is the maximum number of tokens that can ever exist, making it a crucial metric in understanding its scarcity and potential value.

Circulating Supply

As of the latest data, the circulating supply stands at approximately 6.32 billion GROK tokens. This figure represents the number of tokens actively available for trading on the market. The difference between the circulating and total supply can impact the token’s price, as a lower circulating supply relative to total supply generally indicates higher scarcity.

Max Supply

The maximum supply is set at 6.9 billion GROK, meaning that no more than this number will ever be issued. This fixed cap can create a sense of scarcity, which may drive demand and value over time.

Inflation/Deflation Model

Grok Coin employs a deflationary model. This means that mechanisms such as token burns are in place to reduce the total supply over time. By decreasing the number of tokens in circulation, Grok Coin aims to increase scarcity, potentially leading to price appreciation. This model is often favored by investors as it can create upward pressure on the token’s value.

Token Utility (What is the coin used for?)

Grok Coin serves multiple purposes within its ecosystem, which can enhance its utility and adoption among users:

-

Access to Services: GROK tokens can be used to access various services provided by the Grok platform, which focuses on AI and meme culture. This includes exclusive features or functionalities that may require token holding.

-

Transaction Fees: Users may need to pay transaction fees in GROK when interacting with the platform, making the token integral to the overall functioning of the ecosystem.

-

Incentives and Rewards: The Grok platform may implement reward mechanisms for users who hold GROK tokens, providing incentives for long-term holding and participation in the ecosystem.

-

Governance: As the community grows, GROK holders may have the opportunity to participate in governance decisions, influencing the future direction of the project. This can include voting on proposals or changes to the platform.

-

Staking: Future plans for the Grok platform may include staking mechanisms, allowing users to lock their tokens in exchange for rewards, further promoting engagement and investment in the ecosystem.

Token Distribution

Understanding how GROK tokens are distributed is crucial for evaluating the project’s fairness and potential for growth:

-

Initial Distribution: The initial distribution of GROK tokens typically involves allocations to the founding team, advisors, early investors, and the community. It is essential that these distributions are transparent to build trust within the community.

-

Community Incentives: A significant portion of the total supply may be allocated to community incentives, including airdrops, rewards for platform usage, and loyalty programs. This approach helps in fostering a vibrant community that actively participates in the ecosystem.

-

Burn Mechanisms: As part of its deflationary model, Grok Coin may implement periodic burns of tokens, reducing the circulating supply and enhancing scarcity. This can be a critical factor in maintaining interest and value in the token over time.

-

Vesting Schedules: To prevent market flooding and ensure stability, tokens allocated to the founding team and early investors often come with vesting schedules. This means that these tokens are released gradually over time, aligning the interests of the team with long-term growth.

-

Community Voting: Future changes to the distribution model or tokenomics may be subject to community voting, allowing GROK holders to have a say in how the token supply is managed and allocated.

In summary, Grok Coin’s tokenomics reflects a thoughtful approach to creating a balanced, sustainable, and engaging ecosystem. With a deflationary model, clear utility, and transparent distribution practices, GROK has the potential to attract both investors and users who are interested in the intersection of cryptocurrency, AI, and meme culture. Understanding these dynamics will be crucial for anyone looking to invest in or utilize Grok Coin within its growing community.

Price History and Market Performance

Key Historical Price Milestones

Grok Coin (GROK) has experienced significant price fluctuations since its inception, with notable milestones that reflect the dynamic nature of the cryptocurrency market.

-

Launch and Initial Trading: Grok Coin was launched in late 2023, and it quickly gained attention due to its meme-oriented branding and association with popular figures in the tech industry, particularly Elon Musk. The coin’s initial trading price was relatively low, aligning with the typical patterns seen in newly launched cryptocurrencies.

-

All-Time High: The price of GROK reached its all-time high of approximately $0.02971 on November 28, 2023. This peak was fueled by a combination of factors, including increased market interest in meme coins and the broader cryptocurrency market’s bullish phase at that time. The surge in price also coincided with heightened social media activity and community engagement, which are common drivers for meme-based tokens.

-

Subsequent Decline: Following its all-time high, GROK experienced a significant decline, losing over 95% of its value by early 2025. The price correction was influenced by a general downturn in the cryptocurrency market, which affected many altcoins, particularly those in the meme category. This decline highlighted the volatility often associated with meme coins, where speculative trading can lead to rapid price changes.

-

Recent Performance: As of October 2023, Grok Coin is trading at around $0.001294, with a market capitalization of approximately $8.17 million. The trading volume over the past 24 hours was about $2.7 million, indicating a moderate level of trading activity. Despite the recent price increase of around 3.9% in the last 24 hours, GROK has struggled to regain its previous highs.

Factors Influencing the Price

Historically, the price of Grok Coin has been influenced by a variety of factors, which include market trends, community engagement, and broader economic conditions.

-

Market Trends: The overall sentiment in the cryptocurrency market plays a critical role in determining the price of GROK. During bullish phases, such as the period leading up to its all-time high, many cryptocurrencies experience upward momentum. Conversely, during bearish phases, GROK, like many other altcoins, tends to suffer greater losses due to its speculative nature.

-

Social Media and Community Engagement: Grok Coin’s identity as a meme coin means that it is heavily reliant on community sentiment and social media trends. The coin’s price often reacts to tweets and announcements from influential figures, particularly Elon Musk, as well as engagement on platforms like Twitter and Reddit. Increased community activity can lead to price spikes, while decreased interest can result in declines.

-

Technological Developments and Partnerships: Announcements regarding technological upgrades or partnerships can significantly impact GROK’s price. For instance, any integrations with popular platforms or new features that enhance the coin’s usability can lead to increased demand, thereby driving the price up. Conversely, delays or failures in development can negatively impact investor confidence and lead to price declines.

-

Market Sentiment Towards Meme Coins: The performance of Grok Coin is also correlated with the broader market sentiment towards meme coins. When the market is enthusiastic about similar projects, GROK can benefit from the increased interest. However, during periods when meme coins fall out of favor, GROK is likely to experience downward pressure on its price.

-

Regulatory Developments: Regulatory news can also influence GROK’s price. As governments around the world continue to refine their stance on cryptocurrencies, any news that suggests increased regulation can lead to market uncertainty, affecting prices negatively. Conversely, positive regulatory developments may bolster confidence in the market, benefiting GROK and other cryptocurrencies.

-

Market Liquidity and Trading Volume: The liquidity of Grok Coin, reflected in its trading volume, is another critical factor that influences its price. Higher trading volumes often lead to more stable prices, while lower volumes can result in increased volatility. For instance, during periods of high trading activity, the price may stabilize, while lower activity can lead to sharper price fluctuations.

In summary, the price history and market performance of Grok Coin have been shaped by a combination of market dynamics, community sentiment, and external factors. Understanding these influences is essential for investors looking to navigate the complexities of this digital asset.

Where to Buy grok coin: Top Exchanges Reviewed

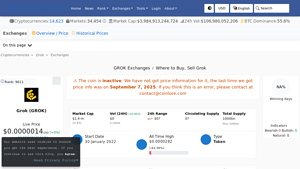

1. Grok (GROK) – Your Go-To for Innovative Trading!

Grok (GROK) is primarily traded on Uniswap V2, distinguishing itself as the sole exchange for this cryptocurrency. With its decentralized platform, Uniswap V2 allows users to seamlessly buy, sell, and trade GROK using the WETH trading pair, providing a unique opportunity for investors to engage with this asset in a secure and efficient manner. The reliance on a single exchange highlights the niche market presence of GROK, appealing to enthusiasts of decentralized finance (DeFi).

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5 Reasons ChangeNOW Offers the Best Prices for GROK!

ChangeNOW stands out as a user-friendly platform for trading GROK, offering competitive pricing and a high customer satisfaction rating of 4.8 based on over 2,100 reviews. With no hidden fees and a seamless exchange process, users can easily buy and sell GROK while accessing real-time market data, including live charts and market cap information. This makes ChangeNOW an appealing choice for both novice and experienced cryptocurrency traders.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

3. Coinbase – Easiest Way to Buy Grok Companions in the U.S.!

Coinbase stands out as a user-friendly platform for purchasing Grok Companions (JARVIS) in the United States, offering a straightforward process that includes creating an account and adding a payment method. The ability to execute a decentralized exchange (DEX) trade directly on the platform enhances accessibility and convenience for both new and experienced investors looking to acquire this unique digital asset.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

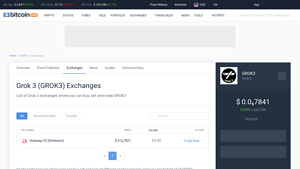

3. Grok 3 Exchanges – Your Gateway to Seamless GROK3 Trading!

Grok 3 exchanges, particularly Uniswap V2 on Ethereum, offer a decentralized platform for trading GROK3 tokens, making it a standout choice for users seeking a secure and user-friendly environment. Despite a current trading volume of $0.00 in the last 24 hours, Uniswap V2’s reputation for facilitating seamless transactions and providing liquidity through automated market-making positions it as a preferred option for both novice and experienced traders looking to buy, sell, or trade GROK3.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy grok coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Grok Coin (GROK) is to select a cryptocurrency exchange that supports the token. Some of the most popular exchanges where GROK is traded include:

- MEXC

- HTX

- LBank

When choosing an exchange, consider factors such as trading fees, user interface, security features, and the availability of customer support. It’s also advisable to check the trading volume of GROK on these exchanges to ensure liquidity, which can affect your buying experience.

2. Create and Verify Your Account

Once you’ve selected an exchange, you’ll need to create an account. Here’s how to do it:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button.

- Provide Information: Fill out the registration form with your email address, password, and any other required information.

- Email Verification: After submitting the form, you will receive a confirmation email. Click the link in the email to verify your account.

- Identity Verification (KYC): Most exchanges require you to complete a Know Your Customer (KYC) process. This typically involves uploading a government-issued ID and possibly a selfie to confirm your identity. Follow the instructions provided by the exchange.

3. Deposit Funds

Now that your account is set up and verified, it’s time to deposit funds:

- Log In: Sign in to your account on the exchange.

- Navigate to the Deposit Section: Look for a “Funds,” “Wallet,” or “Deposit” section in your account dashboard.

- Choose Your Deposit Method: You can typically deposit funds using bank transfers, credit/debit cards, or other cryptocurrencies. Select the method that suits you best.

- Follow the Instructions: If you choose a bank transfer or credit card, enter the required details and the amount you wish to deposit. For cryptocurrency deposits, you will receive a wallet address where you can send your funds.

- Confirm the Deposit: After entering your payment information, confirm the transaction. Depending on the method, the funds may take a few minutes to a few days to appear in your exchange account.

4. Place an Order to Buy Grok Coin

With funds available in your exchange account, you can now purchase GROK:

- Find the GROK Trading Pair: Navigate to the trading section of the exchange and search for the GROK trading pair (e.g., GROK/USDT or GROK/BTC).

- Select the Order Type: You can choose between different types of orders:

– Market Order: Buy GROK at the current market price.

– Limit Order: Set a specific price at which you want to buy GROK. The order will only be executed when the price reaches your specified level. - Enter the Amount: Specify how much GROK you want to buy.

- Review Your Order: Check the details of your order, including the total cost and fees.

- Confirm the Purchase: Click the “Buy” button to complete the transaction. You should see GROK reflected in your account balance shortly after.

5. Secure Your Coins in a Wallet

Once you have purchased GROK, it’s crucial to keep your coins secure:

- Choose a Wallet: You can store your GROK in either a hot wallet (online) or a cold wallet (offline). Hot wallets are more convenient for trading, while cold wallets offer enhanced security.

- Create a Wallet: If you don’t already have a wallet, create one. For a cold wallet, consider hardware wallets like Ledger or Trezor. For a hot wallet, you can use options like MetaMask or Trust Wallet.

- Transfer GROK to Your Wallet:

– If you used a hot wallet, simply withdraw GROK from the exchange by entering your wallet address.

– For cold wallets, follow the instructions provided by the wallet manufacturer to transfer your GROK securely. - Backup Your Wallet: Ensure that you back up your wallet’s recovery phrase or private keys in a safe place. This is crucial for recovering your funds in case of device loss or damage.

Following these steps will help you successfully buy and secure Grok Coin (GROK). Always remember to stay informed about market trends and security practices to protect your investments.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Niche Market Appeal

Grok Coin (GROK) is positioned within the niche of meme coins and AI-related projects, leveraging the popularity of both categories. Its association with Elon Musk’s initiatives, particularly in the realm of generative AI, could enhance its visibility and attract a dedicated community. The combination of humor and cutting-edge technology could resonate well with a younger demographic, making it an attractive investment for those interested in meme culture and AI advancements.

2. Market Performance and Liquidity

As of now, GROK is trading at approximately $0.001294, with a market capitalization of around $8.17 million. The trading volume over the last 24 hours was approximately $2.7 million, indicating a reasonable level of liquidity for investors looking to enter or exit positions. With a fully diluted valuation (FDV) of about $8.92 million, GROK’s current market cap is close to its FDV, suggesting that it may be undervalued if it can successfully increase its user base and application.

3. Community Engagement

Grok Coin boasts a community of over 21,000 holders, which is crucial for the sustainability and growth of any cryptocurrency. Active community engagement can lead to increased adoption, social media buzz, and organic marketing, which are vital for the success of meme coins. A strong community can also provide resilience during market downturns, as committed holders may be less likely to sell during volatility.

4. Potential for Future Use Cases

The ongoing development of AI technologies presents opportunities for GROK to integrate additional functionalities. If Grok Coin can establish partnerships with AI platforms or develop its own AI-based applications, it could significantly enhance its utility and appeal. This adaptability could lead to increased demand for the token, thereby positively impacting its value.

5. Low Entry Price

At a current price of $0.001294, GROK offers an accessible entry point for new investors. This low price point may attract a broad range of investors, especially those who are hesitant to invest large sums in higher-priced cryptocurrencies. The potential for significant percentage gains is more pronounced at lower price levels, making GROK an intriguing option for speculative investment.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies are notoriously volatile, and Grok Coin is no exception. The price of GROK has fluctuated significantly in the past, including a steep decline of approximately 95.64% from its all-time high of $0.02971 in November 2023. Such volatility can lead to substantial losses for investors, especially those who may not be prepared for rapid price swings. The unpredictable nature of the crypto market can deter risk-averse investors and may lead to panic selling during downturns.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain and can vary significantly by jurisdiction. Governments around the world are still developing frameworks to regulate cryptocurrencies, which could impact GROK’s adoption and legality. Potential regulatory actions, such as restrictions on trading or outright bans, could negatively affect GROK’s market value and usability. Investors must remain vigilant about regulatory news that could impact the broader cryptocurrency market.

3. Competition

The cryptocurrency market is highly competitive, with thousands of coins vying for attention and investment. GROK faces competition not only from other meme coins but also from established cryptocurrencies and emerging projects in the AI space. The ability of GROK to differentiate itself and maintain a competitive edge will be crucial for its long-term viability. If it fails to innovate or attract users, it may struggle to gain traction in a crowded market.

4. Technological Risks

As a token built on the Ethereum blockchain, GROK is susceptible to the technological risks associated with the underlying platform. Issues such as network congestion, high transaction fees, and potential vulnerabilities in smart contracts can impact user experience and trust in the coin. Furthermore, if the Ethereum network faces significant challenges, it could adversely affect all tokens operating on it, including GROK.

5. Speculative Nature and Lack of Fundamental Value

Meme coins, including GROK, often lack intrinsic value or a solid business model backing them. Their price movements can be largely driven by speculation, social media trends, and market sentiment rather than fundamental factors. This speculative nature can result in unpredictable price behavior, making it challenging for investors to gauge the true value of their investments. The reliance on community sentiment can also lead to rapid price increases followed by steep declines, further complicating investment strategies.

Conclusion

Grok Coin presents both exciting potential and notable risks for investors. Its unique position within the meme and AI spheres, coupled with a growing community, could provide a strong foundation for future growth. However, the inherent volatility of the cryptocurrency market, coupled with regulatory uncertainties and competitive pressures, poses significant challenges.

Investors should approach GROK with a clear understanding of these dynamics, weighing the potential for high returns against the risks of loss. Conducting thorough research, staying informed about market trends, and maintaining a diversified portfolio can help mitigate some of these risks. As always, it is crucial to exercise caution and only invest what one can afford to lose in the unpredictable world of cryptocurrency.

Frequently Asked Questions (FAQs)

1. What is Grok Coin (GROK)?

Grok Coin (GROK) is a cryptocurrency that operates on the Ethereum blockchain, primarily characterized as a meme coin inspired by the AI technology behind Elon Musk’s Grok chatbot. It aims to leverage the cultural popularity of memes and artificial intelligence to engage users and create a community around its unique branding. As a digital asset, GROK can be traded on various exchanges and has garnered attention for its humorous and innovative approach.

2. Who created Grok Coin?

Grok Coin was developed by a team of enthusiasts and developers who are passionate about memes, AI, and blockchain technology. While specific identities may not be publicly disclosed, the project draws inspiration from Elon Musk’s ventures, particularly in AI, which has led to its meme-centric branding and marketing strategies.

3. Is Grok Coin a good investment?

The potential for Grok Coin as a good investment depends on various factors, including market trends, community engagement, and the overall sentiment towards meme coins. As of now, Grok Coin has experienced significant price fluctuations and has a relatively low market capitalization of approximately $8.17 million. Investors should conduct thorough research, consider the high volatility associated with meme coins, and assess their risk tolerance before investing.

4. What makes Grok Coin different from Bitcoin?

Grok Coin differs from Bitcoin in several key aspects:

- Purpose: Bitcoin was created as a decentralized digital currency and a store of value, while Grok Coin is primarily a meme coin with a focus on community engagement and humor.

- Supply and Demand: Bitcoin has a capped supply of 21 million coins, whereas Grok Coin has a maximum supply of 6.9 billion coins, which can influence its price dynamics.

- Market Position: Bitcoin is the first and most recognized cryptocurrency, while Grok Coin is a newer entrant in the meme coin category, often subject to market trends and community sentiment.

5. Where can I buy Grok Coin?

Grok Coin can be purchased on several centralized exchanges. The most popular platforms for trading GROK include MEXC, HTX, and LBank. Users can typically trade GROK against stablecoins like USDT. It is advisable to use exchanges with high trading volumes to ensure liquidity and better pricing.

6. What is the current price of Grok Coin?

As of the latest data, Grok Coin (GROK) is trading at approximately $0.001294. The price can fluctuate frequently due to market conditions, so it is essential to check live price updates on cryptocurrency tracking platforms like CoinMarketCap or CoinGecko.

7. What is the market capitalization of Grok Coin?

The market capitalization of Grok Coin is around $8.17 million. This figure is calculated by multiplying the current price of GROK by its circulating supply of approximately 6.32 billion coins. Market cap is an important indicator of a cryptocurrency’s size and market presence.

8. How do I store Grok Coin securely?

To store Grok Coin securely, users should consider using a cryptocurrency wallet that supports Ethereum-based tokens. Options include hardware wallets (like Ledger or Trezor) for optimal security and software wallets (like MetaMask) for ease of access. Always ensure to keep your private keys safe and never share them with anyone to prevent unauthorized access to your funds.

Final Verdict on grok coin

Overview of Grok Coin

Grok Coin (GROK) is a cryptocurrency that emerged as a meme-based digital asset, inspired by the popular figure Elon Musk and his AI products, particularly the Grok chat system. Currently ranked around #1219 in the market, GROK has a market capitalization of approximately $8.17 million, with a circulating supply of around 6.32 billion tokens out of a maximum supply of 6.9 billion. Its price has seen significant volatility, with an all-time high of about $0.0297 and a recent trading price around $0.0013.

Purpose and Technology

Grok Coin primarily serves as a playful entry in the cryptocurrency space, leveraging the trends of memes and generative AI. Its underlying technology is based on the Ethereum blockchain, which allows for the use of smart contracts and decentralized applications. This positions GROK within a broader category of AI-related tokens, tapping into the growing intersection of artificial intelligence and blockchain technology. The project aims to create a community-driven platform that facilitates engagement and interaction among users interested in both AI and cryptocurrency.

Investment Potential

As with many cryptocurrencies, investing in Grok Coin carries inherent risks. The digital asset class is known for its high volatility and susceptibility to market sentiment. While GROK has shown some signs of recovery and growth, it is essential to recognize that its price can fluctuate dramatically, influenced by market trends and community interest. The recent trading volume of around $2.7 million indicates active trading, but potential investors should remain cautious.

Conclusion

In conclusion, Grok Coin offers an intriguing opportunity for those interested in meme-based cryptocurrencies and AI applications. However, it is crucial to approach this asset with a clear understanding of the risks involved. As with any investment, particularly in the volatile world of cryptocurrencies, conducting thorough research (DYOR) is essential. Evaluating Grok Coin’s market performance, community engagement, and technological developments will provide valuable insights for making informed investment decisions. Always consider your financial situation and risk tolerance before diving into this high-risk, high-reward asset class.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.