What is dia crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to dia crypto

Introduction to DIA Crypto

DIA (Decentralised Information Asset) is an innovative open-source oracle platform that plays a crucial role in the cryptocurrency ecosystem by providing reliable and verifiable financial data. Launched in 2018, DIA aims to bridge the gap between off-chain data sources and on-chain smart contracts, making it a significant player in the decentralized finance (DeFi) sector. It addresses the pressing issue of accessing trustworthy financial data, which is vital for the functioning of various decentralized applications (DApps) and smart contracts. By enabling market participants to source, supply, and share accurate data, DIA aspires to become the “Wikipedia of financial data.”

The significance of DIA in the crypto market lies in its ability to create transparency and reliability in an environment often plagued by misinformation and data discrepancies. As the DeFi landscape continues to grow, the demand for accurate and timely data feeds increases, positioning DIA as a critical infrastructure component. The platform’s governance token, also named DIA, serves multiple functions, including funding data collection, incentivizing contributions, and facilitating community governance.

Purpose of This Guide

This guide is designed to be a comprehensive resource for both beginners and intermediate investors interested in DIA crypto. It will delve into the various aspects that define DIA, including its underlying technology, tokenomics, investment potential, associated risks, and guidance on how to buy DIA tokens.

In the following sections, we will explore the technological framework that supports DIA’s oracle functionalities, providing insights into how it integrates with various blockchain networks. We will also examine the tokenomics of DIA, detailing its supply structure, distribution, and the mechanisms that govern its value in the market.

Investing in cryptocurrencies can be rewarding but also carries inherent risks. Therefore, we will outline the potential benefits and challenges associated with investing in DIA, helping you to make informed decisions. Lastly, we will provide practical instructions on purchasing DIA tokens, including the exchanges where they are available and the steps required to acquire them.

Whether you are looking to diversify your investment portfolio or seeking a deeper understanding of decentralized data solutions, this guide aims to equip you with the knowledge needed to navigate the world of DIA crypto effectively.

What is dia crypto? A Deep Dive into its Purpose

Introduction to DIA Crypto

DIA (Decentralized Information Asset) is a decentralized oracle platform designed to address the critical issue of accessing reliable and verified financial data in the blockchain ecosystem. Established in 2018, DIA serves as a bridge between off-chain data sources and on-chain smart contracts, enabling a variety of decentralized applications (dApps) to function efficiently and transparently. The platform’s native governance token, DIA, plays a pivotal role in incentivizing participation and ensuring the integrity of the data provided.

The Core Problem It Solves

In the rapidly evolving landscape of decentralized finance (DeFi), the need for accurate and trustworthy data is paramount. Traditional data sources often suffer from issues such as outdated information, lack of verification, and accessibility barriers. This is particularly problematic in the financial sector, where decisions based on erroneous or unverified data can lead to significant losses.

DIA addresses these challenges by providing a transparent and decentralized framework for data sourcing and validation. The platform allows data providers to submit information, which is then verified by the community through a system of incentives. This process ensures that the data fed into smart contracts is both accurate and reliable, thus enhancing the overall integrity of the DeFi ecosystem. By creating a system where users are rewarded for contributing and validating data, DIA effectively crowdsources the maintenance of high-quality information, making it accessible to all market participants.

Its Unique Selling Proposition

DIA’s unique selling proposition lies in its comprehensive approach to data sourcing and validation. Unlike traditional oracle solutions that often rely on a limited number of data providers, DIA employs a decentralized model that leverages multiple sources to aggregate and verify information. This approach not only enhances the reliability of the data but also mitigates the risks associated with centralization, such as data manipulation or single points of failure.

Key features that set DIA apart include:

-

Open-Source Ecosystem: DIA promotes an open-source model, allowing developers and data providers to collaborate and innovate freely. This transparency fosters trust and encourages participation from a diverse range of contributors.

-

Governance through Tokenomics: The DIA token serves as the governance mechanism for the platform. Token holders can vote on important decisions, such as which data feeds to prioritize and how to allocate resources for future development. This democratic approach ensures that the platform evolves in a way that reflects the needs of its users.

-

Diverse Data Feeds: DIA provides a wide array of data feeds, including price feeds for cryptocurrencies, real-world asset data, and verifiable randomness for gaming applications. This versatility allows developers to build a variety of dApps that rely on accurate data, further expanding the use cases for the DIA platform.

-

Integration Across Multiple Blockchains: DIA is designed to operate across various blockchain networks, including Ethereum, Solana, and Polygon. This cross-chain capability enables developers to access DIA’s data services regardless of their chosen blockchain, enhancing the platform’s usability and reach.

-

Incentive Structures: DIA employs a unique incentive structure to encourage data submission and validation. Users can stake DIA tokens to participate in the governance process and earn rewards for their contributions, ensuring a continuous flow of high-quality data.

The Team and Backers Behind the Project

DIA was co-founded by a team of experienced professionals with diverse backgrounds in finance, technology, and blockchain. Key figures include:

-

Paul Claudius: Serving as the face of the project and its lead advocate, Claudius has a master’s degree in international management and extensive experience in business development. He is also a co-founder and CEO of BlockState AG, a company focused on tokenization and digital assets.

-

Michael Weber: As the founder and association president, Weber brings a strong background in management, economics, and physics. His previous roles in banks and financial institutions have equipped him with the necessary insights to address the challenges in data verification and finance.

-

Samuel Brack: Serving as the Chief Technology Officer (CTO), Brack has a master’s degree in computer science and is currently pursuing a PhD. His technical expertise is crucial for the development and maintenance of DIA’s platform and services.

The team is supported by a network of advisors and early investors, including Outlier Ventures, which has played a significant role in the project’s growth and visibility in the market.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of DIA in the crypto ecosystem is to enhance the reliability and accessibility of financial data, which is essential for the functioning of DeFi applications and beyond. By providing a decentralized oracle solution, DIA ensures that smart contracts can access real-time, accurate data from multiple sources, thus enabling more sophisticated and trustworthy financial products.

In a broader context, DIA contributes to the maturation of the blockchain space by fostering transparency, accountability, and innovation. As the demand for decentralized finance continues to grow, the need for reliable data solutions will only become more critical. DIA’s commitment to creating a robust, community-driven data ecosystem positions it as a key player in the ongoing evolution of decentralized finance and the broader blockchain landscape.

In conclusion, DIA represents a significant advancement in how data is sourced, validated, and utilized within the crypto ecosystem. By addressing the core issues of data reliability and accessibility, DIA not only empowers developers and users alike but also lays the groundwork for a more transparent and efficient financial future.

The Technology Behind the Coin: How It Works

Overview of DIA (Decentralized Information Asset)

DIA (Decentralized Information Asset) is a decentralized oracle network designed to provide reliable and verifiable data feeds to decentralized applications (dApps) in the blockchain ecosystem. The technology behind DIA is built to address the challenges of data integrity and accessibility, particularly in the decentralized finance (DeFi) sector. In this section, we will explore the key components that make up the technology behind DIA, including its blockchain architecture, consensus mechanisms, and innovative features.

Blockchain Architecture

DIA operates primarily on the Ethereum blockchain, leveraging the ERC-20 token standard. This choice of architecture provides several advantages:

-

Decentralization: As part of the Ethereum ecosystem, DIA benefits from the robust decentralization of the Ethereum network. This ensures that no single entity controls the data flow, promoting transparency and trust.

-

Interoperability: DIA is designed to integrate seamlessly with various blockchain platforms, including Arbitrum, Optimism, Solana, and others. This flexibility allows DIA to serve a wide range of dApps across different ecosystems.

-

Data Storage and Retrieval: DIA uses smart contracts to automate the process of data collection and distribution. These contracts are self-executing and enforce the rules established within them, ensuring that data is accurately sourced and shared with minimal human intervention.

-

Layered Architecture: DIA employs a layered architecture to separate different functionalities. This design allows for greater scalability and efficiency, as different layers can be optimized for specific tasks, such as data sourcing, validation, and distribution.

Consensus Mechanism

DIA’s consensus mechanism is closely tied to the Ethereum blockchain’s proof-of-work (PoW) protocol. However, with Ethereum’s transition to proof-of-stake (PoS) through Ethereum 2.0, DIA is also expected to adapt to this new consensus model. Here’s how these mechanisms work:

-

Proof of Work (PoW): In the PoW model, miners compete to solve complex mathematical problems to validate transactions and create new blocks. This process consumes significant computational power and energy. Although DIA does not rely on PoW directly, it benefits from the security provided by the Ethereum network.

-

Proof of Stake (PoS): PoS, which Ethereum is transitioning to, allows validators to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. This mechanism is more energy-efficient than PoW and promotes network security by financially incentivizing validators to act honestly.

-

Hybrid Approach: As DIA evolves, it may implement a hybrid consensus mechanism that combines elements of both PoW and PoS. This could enhance security while maintaining efficiency, allowing DIA to adapt to the needs of its users and the broader blockchain environment.

Key Technological Innovations

DIA stands out in the cryptocurrency landscape due to several key innovations that enhance its functionality and user experience:

1. Decentralized Oracle Network

DIA’s decentralized oracle network is its flagship feature. Oracles serve as bridges between on-chain smart contracts and off-chain data sources. DIA’s approach includes:

-

Data Aggregation: DIA sources data from multiple high-volume markets to ensure accuracy and reliability. This reduces the risk of manipulation and single points of failure.

-

Community Involvement: DIA incentivizes users to contribute data, creating a self-sustaining ecosystem. Users can stake DIA tokens to incentivize the provision of high-quality data feeds.

2. Proof of Use and Proof of Truth

DIA employs innovative mechanisms to validate and reward data usage:

-

Proof of Use: Smart contracts utilizing DIA’s data feeds can earn DIA tokens daily. This mechanism encourages the use of reliable data in dApps, promoting a healthy ecosystem.

-

Proof of Truth: This concept allows the community to vote on the accuracy of the data provided. Users can stake tokens to validate data sources, ensuring that only trustworthy information is utilized.

3. Real-World Asset Feeds

DIA is pioneering efforts to integrate real-world asset data into the blockchain. This includes:

-

Price Feeds: DIA provides price feeds for traditional assets, such as stocks and commodities, enabling dApps to access a broader range of financial information.

-

Proof of Reserve: DIA implements mechanisms to verify the collateralization of assets, ensuring that users have access to accurate fair-value price feeds.

4. Verifiable Randomness Function (VRF)

DIA incorporates a Verifiable Randomness Function (VRF) to provide random number generation that is both decentralized and verifiable. This feature is essential for applications that require random inputs, such as gaming or lotteries, ensuring fairness and transparency.

Data Sources and Validation

DIA’s success hinges on its ability to provide accurate and timely data. To achieve this, DIA employs a multi-faceted approach to data sourcing and validation:

-

Integration with Exchanges: DIA connects to numerous cryptocurrency exchanges, pulling data directly from their APIs. This ensures that the data is reflective of real-time market conditions.

-

Community-Driven Validation: The community plays a critical role in validating data. Users can flag inaccurate data, and the system rewards those who consistently provide accurate information.

-

Automated Auditing: DIA employs automated systems to continuously audit data feeds, ensuring they meet quality standards. This process enhances data reliability and reduces the likelihood of errors.

Governance and Community Participation

DIA incorporates a decentralized governance model, allowing token holders to participate in decision-making processes. This includes:

-

Voting on Proposals: DIA token holders can propose and vote on changes to the protocol, data sources, and other critical aspects of the ecosystem.

-

Incentivized Participation: By staking their tokens, community members can earn rewards for their participation in governance, encouraging active involvement in the ecosystem.

Future Developments

As DIA continues to grow, several areas of development are on the horizon:

-

Expansion of Data Feeds: DIA aims to expand its data feeds to include more asset classes and integrate with additional blockchains, enhancing its utility for dApps across various sectors.

-

Enhanced User Interfaces: DIA is committed to improving user experiences through intuitive interfaces and educational resources, making it easier for developers to integrate DIA’s oracles into their projects.

-

Collaboration with Other Projects: DIA is likely to form partnerships with other blockchain projects to enhance its data offerings and expand its ecosystem.

Conclusion

DIA represents a significant advancement in the decentralized data landscape, addressing critical challenges faced by dApps in the blockchain ecosystem. Through its innovative technology, including a decentralized oracle network, community-driven validation, and a robust governance model, DIA is poised to become a leading provider of reliable financial data. As the cryptocurrency space continues to evolve, DIA’s commitment to transparency, accuracy, and community involvement will play a crucial role in its success and adoption.

Understanding dia crypto Tokenomics

DIA (Decentralised Information Asset) is an open-source oracle platform designed to provide reliable and verifiable financial data to smart contracts and decentralized applications (dApps). Understanding the tokenomics of DIA is crucial for investors looking to grasp its value proposition, utility, and the mechanisms that govern its supply and distribution.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 200,000,000 DIA |

| Max Supply | 200,000,000 DIA |

| Circulating Supply | 119,676,104 DIA |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The DIA token plays a multifaceted role within the DIA ecosystem, primarily focusing on governance and incentivization. Here are the key utilities of the DIA token:

-

Governance: DIA token holders can participate in the governance of the DIA platform. This allows users to vote on critical decisions affecting the protocol, such as changes to the data feed mechanisms, partnerships, and development priorities. The decentralized governance structure encourages community involvement and helps ensure that the platform evolves in a way that reflects the interests of its users.

-

Incentivization: The DIA token is used to incentivize data providers and validators. By staking their tokens, users can earn rewards for supplying accurate and timely data to the platform. This staking mechanism encourages community members to contribute valuable information, thereby enhancing the reliability of the data provided by DIA oracles.

-

Funding Data Collection: The funds generated through the sale of DIA tokens are allocated to the development and operational costs of the DIA ecosystem. This includes expenses related to data collection, validation processes, and expanding the network of data providers.

-

Access to Data: While historical data is accessible for free, the DIA token may be required for certain premium features or advanced functionalities on the platform. This creates an additional layer of utility for the token, as users may need to hold DIA tokens to access specific services.

-

Proof of Use and Proof of Truth Mechanisms: DIA employs unique mechanisms where smart contracts utilizing DIA oracles can earn DIA tokens daily. This creates a continuous demand for the token, as it is tied directly to the usage of the oracles.

Token Distribution

The distribution of DIA tokens is structured to promote long-term sustainability and community engagement. Here’s a breakdown of how the tokens are allocated:

-

Private Sale: Initially, 10 million tokens were sold during the private sale phase, allowing early investors to enter the ecosystem.

-

Bonding Curve Sale: In August 2020, 30 million tokens were offered in a bonding curve sale, where 10.2 million tokens were sold to the public. The remaining tokens were burned to reduce the total supply and increase scarcity.

-

Early Investors and Advisors: Approximately 19.5 million tokens are allocated to early investors and advisors. This allocation is aimed at rewarding those who supported the project in its nascent stages.

-

Founders and Team: 24 million tokens are reserved for the founders and team, with a vesting period of 29 months. This ensures that the team is incentivized to remain committed to the project and its long-term success.

-

Ecosystem Development: 25 million tokens are locked for future use in the development of the DIA ecosystem. This allocation is crucial for supporting ongoing projects, partnerships, and enhancements to the platform.

-

Company Reserve: The largest portion, 91.5 million tokens, is kept in the company’s reserve. These tokens are set to be unlocked in equal parts over a period of 10 years, specifically every December. This gradual release allows for controlled inflation and helps maintain the market value of the token.

Conclusion

The tokenomics of DIA are designed to foster a robust ecosystem that not only incentivizes participation but also ensures the long-term viability of the platform. By understanding the utility and distribution of DIA tokens, investors can better appreciate the mechanisms that drive value within the DIA network. As the demand for reliable financial data grows in the decentralized finance (DeFi) space, the relevance and utility of DIA are likely to increase, making it a noteworthy asset in the blockchain landscape.

Price History and Market Performance

Overview of DIA’s Price Performance

DIA (Decentralised Information Asset) is an open-source oracle platform designed to provide reliable and verifiable data for decentralized applications (dApps). The price history of DIA reflects its development, adoption, and the broader trends in the cryptocurrency market. Understanding its price trajectory is essential for both new and experienced investors looking to gauge the asset’s market performance.

Key Historical Price Milestones

DIA’s price history is marked by several significant milestones that illustrate its volatility and the dynamics of the cryptocurrency market.

-

Launch and Initial Trading: DIA was launched in 2018, with its public token sale taking place from August 3 to August 17, 2020. During this period, 10.2 million tokens were sold at a bonding curve price, setting the initial market price. The token began trading on various exchanges, establishing its presence in the market.

-

All-Time High: DIA reached its all-time high of $5.79 on May 5, 2021. This peak was largely driven by the surge in interest in decentralized finance (DeFi) projects and the increasing demand for reliable data feeds in the burgeoning DeFi ecosystem. The high trading volume during this period reflected a strong investor sentiment toward oracles and data solutions.

-

Price Decline: Following its all-time high, DIA experienced a significant price decline, which is a common trend among many cryptocurrencies. By the end of 2021 and into early 2022, the price fell sharply, driven by broader market corrections and the general downturn in the crypto market. The decline culminated in an all-time low of $0.2104 on September 11, 2023. This low point marked a considerable drop of approximately 87.15% from its peak value.

-

Recent Recovery: Since hitting its all-time low, DIA has shown signs of recovery, with the price climbing back to approximately $0.7448 as of October 2023. This recovery phase reflects an increase in trading volume and renewed interest from both retail and institutional investors.

Factors Influencing the Price

Historically, the price of DIA has been influenced by a variety of factors, both internal to the project and external to the broader cryptocurrency market.

Market Sentiment and Speculation

The cryptocurrency market is highly influenced by investor sentiment and speculative trading. Positive news about DIA’s partnerships, technological advancements, or new product features often leads to price surges. Conversely, negative news or market corrections can lead to sharp declines. For instance, the spike in 2021 was partly fueled by the overall bullish sentiment in the DeFi space, whereas the subsequent decline reflected a market-wide correction.

Adoption and Use Case Development

DIA’s utility as a decentralized oracle significantly impacts its price. The more projects and dApps that adopt DIA’s oracle solutions, the higher the demand for its tokens. The integration of DIA oracles into various blockchain ecosystems, including Ethereum, Solana, and others, has contributed to its market relevance. As the demand for reliable data feeds in DeFi and other sectors increases, it positively affects the price.

Technological Developments

Technological advancements and updates to the DIA platform also play a crucial role in price movements. For example, enhancements in the oracle’s functionality, such as improved data validation mechanisms or new integrations with blockchain networks, can attract more users and investors, leading to price appreciation.

Regulatory Environment

The regulatory landscape for cryptocurrencies can also influence DIA’s price. Developments in regulations concerning data privacy, decentralized finance, and cryptocurrency trading can impact investor confidence. Positive regulatory news may boost the price, while unfavorable regulations can lead to declines.

Market Competition

DIA operates in a competitive landscape filled with other oracle solutions like Chainlink and Tellor. The performance of these competitors can impact DIA’s market share and, consequently, its price. If competitors gain significant traction or introduce superior technology, it may lead to a decrease in demand for DIA tokens.

Conclusion

In summary, DIA has experienced a rollercoaster of price movements since its launch, characterized by significant highs and lows. Various factors, including market sentiment, adoption rates, technological developments, regulatory influences, and competition, have shaped its historical price trajectory. As the cryptocurrency market continues to evolve, understanding these dynamics can help investors make informed decisions regarding their investments in DIA.

Where to Buy dia crypto: Top Exchanges Reviewed

5. DIA Coin Exchange – Unlock the Best Prices!

ChangeNOW stands out as a premier platform for exchanging DIA Coin, boasting an impressive rating of 4.8 from over 2,165 users. It offers a seamless experience with instant exchanges at competitive rates, ensuring users get the best value for their DIA transactions. Additionally, the platform provides comprehensive resources, including real-time price charts and guides on how to buy, sell, or swap DIA, making it an ideal choice for both novice and experienced crypto enthusiasts.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

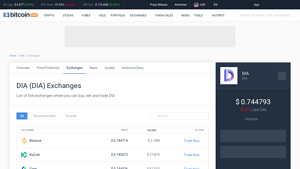

5. DIA on CoinCodex – Your Go-To for Seamless Trading!

DIA stands out in the cryptocurrency market by being available on a wide array of 35 exchanges, including prominent platforms like Binance, AscendEX, and Bilaxy. This extensive accessibility allows users to easily buy, sell, and trade DIA, catering to both novice and experienced investors. Additionally, its presence on major exchanges ensures liquidity and competitive trading options, making it a compelling choice for those looking to engage with this digital asset.

- Website: coincodex.com

5. Coinbase – Easiest Way to Buy DIA in the USA!

Coinbase stands out as a premier platform for purchasing DIA (DIA) in the United States due to its reputation for security and user-friendly interface. As one of the most trusted exchanges, it offers a seamless experience for both individuals and businesses looking to buy, sell, and manage their digital assets. Coinbase’s robust features, educational resources, and regulatory compliance further enhance its appeal to cryptocurrency newcomers and seasoned investors alike.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

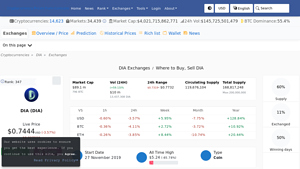

5. DIA (DIA) – Your Gateway to Decentralized Data!

DIA (DIA) can be traded across more than 23 cryptocurrency exchanges, with Binance, Gate, and HTX being the top platforms for purchasing this digital asset. What sets these exchanges apart is their extensive liquidity, diverse trading pairs—including USDT, BUSD, and BTC on Binance—and user-friendly interfaces, making it easier for both novice and experienced traders to buy, sell, and trade DIA efficiently.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

3. DIA Exchange – Swap with Minimal Fees on Changelly!

DIA Exchange, powered by Changelly, stands out for its competitive rates and low transaction fees, making it an attractive option for users looking to swap DIA (DIA) efficiently. With a high rating of 4.7 from over 5,000 reviews, it offers a user-friendly platform accessible via both website and app. Additionally, the exchange supports over 700 cryptocurrencies and provides 24/7 live support, ensuring a seamless trading experience for both beginners and seasoned investors.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

How to Buy dia crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing DIA crypto is selecting a cryptocurrency exchange that supports trading for DIA tokens. Some of the most popular exchanges where you can buy DIA include:

- Binance

- OKEx

- HBTC

- Bidesk

- BiKi

When choosing an exchange, consider the following factors:

- Reputation: Look for exchanges with a solid reputation and positive user reviews.

- Fees: Different exchanges have varying fee structures for trading, deposits, and withdrawals. Compare these fees to find a cost-effective option.

- Security: Ensure that the exchange employs strong security measures, such as two-factor authentication (2FA) and cold storage for funds.

- User Experience: A user-friendly interface can make the buying process smoother, especially for beginners.

2. Create and Verify Your Account

Once you have selected an exchange, the next step is to create an account:

-

Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide your email address and create a password.

-

Verify Your Email: After signing up, you will receive a verification email. Click the link in the email to verify your account.

-

Complete KYC (Know Your Customer): Most exchanges require you to complete KYC verification. This process typically involves submitting a government-issued ID and proof of address. Follow the exchange’s instructions to upload the necessary documents. Verification can take anywhere from a few minutes to a few days.

3. Deposit Funds

After your account is verified, you need to deposit funds to buy DIA:

-

Select Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit card, or other cryptocurrencies. Choose the method that suits you best.

-

Deposit Currency: If you are depositing fiat currency (like USD), follow the exchange’s instructions for making a bank transfer or using a credit/debit card. If you are depositing cryptocurrency, navigate to the “Deposit” section, select the cryptocurrency you want to deposit, and copy the wallet address provided by the exchange.

-

Confirm Deposit: If you deposited fiat, it may take some time for the funds to appear in your account. For cryptocurrency deposits, ensure you wait for the transaction to be confirmed on the blockchain.

4. Place an Order to Buy DIA Crypto

Now that your account is funded, you can place an order to buy DIA:

-

Navigate to the Trading Section: Find the “Markets” or “Trade” section of the exchange and search for DIA. Look for trading pairs like DIA/USD, DIA/BTC, or DIA/USDT.

-

Select Order Type: Most exchanges offer different order types:

- Market Order: This order buys DIA at the current market price. It’s quick and straightforward.

-

Limit Order: This order allows you to set a specific price at which you want to buy DIA. The order will only execute if the price reaches your set amount.

-

Enter Purchase Amount: Specify how much DIA you want to purchase, then review the total cost, including any fees.

-

Place the Order: Click on the “Buy” button to execute your order. You will receive a confirmation once your order is filled.

5. Secure Your Coins in a Wallet

After purchasing DIA, it’s essential to secure your tokens:

- Understand Wallet Types: There are different types of wallets available:

- Hot Wallets: These are online wallets (like those provided by exchanges) that are more convenient for trading but less secure.

-

Cold Wallets: These are offline wallets (like hardware wallets or paper wallets) that provide a higher level of security for long-term storage.

-

Transfer to a Wallet: If you choose to use a wallet outside of the exchange, you will need to transfer your DIA tokens. Go to the “Withdraw” section of the exchange, select DIA, and enter your wallet address.

-

Confirm Transaction: Double-check the wallet address to ensure it is correct, as cryptocurrency transactions are irreversible. Confirm the withdrawal and wait for the transaction to be processed.

-

Backup Your Wallet: If you are using a cold wallet, make sure to back up your wallet information (like seed phrases) securely. This will allow you to recover your funds if needed.

By following these steps, you can successfully buy DIA crypto and take the necessary precautions to secure your investment. Happy trading!

Investment Analysis: Potential and Risks

Understanding DIA Crypto: Investment Analysis

DIA (Decentralised Information Asset) is an open-source oracle platform that aims to provide reliable and verifiable financial data for decentralized applications (dApps) and smart contracts. As with any cryptocurrency investment, potential investors must carefully consider the strengths and weaknesses of DIA. Below, we explore the potential strengths that may make DIA an attractive investment, as well as the risks and challenges that could impact its performance.

Potential Strengths (The Bull Case)

Innovative Use Case

DIA addresses a significant gap in the blockchain ecosystem by providing trustable data through its decentralized oracle network. By sourcing data from multiple high-volume markets, DIA aims to be the go-to platform for reliable financial data, which is crucial for the functioning of decentralized finance (DeFi) applications. This innovative approach could position DIA favorably in a growing market that increasingly relies on accurate and real-time data.

Strong Market Demand

The demand for reliable data oracles in the blockchain space is rising, especially as the DeFi sector expands. As more projects require high-quality data feeds, DIA’s services may become indispensable. The platform’s ability to integrate with various blockchain networks, including Ethereum, Solana, and others, enhances its utility and potential reach within the market.

Governance and Community Involvement

DIA operates on a decentralized governance model, allowing token holders to participate in decision-making processes. This community-oriented approach can foster a sense of ownership and engagement among users, potentially leading to a more robust and dedicated user base. The governance token is used for voting on important issues, funding data collection, and incentivizing platform development.

Historical Performance and Recovery

DIA has experienced significant price fluctuations, with an all-time high of $5.79 in May 2021 and a notable recovery from its all-time low of $0.2104 in September 2023. This recovery indicates market resilience and the potential for future growth. Investors often view historical performance as a factor when assessing the potential of a cryptocurrency, although past performance is not indicative of future results.

Versatility and Integration

The DIA network supports over 20,000 assets and is integrated with more than 55 blockchain networks. This versatility allows DIA to cater to a wide range of applications, from DeFi to traditional financial services. Its ability to provide data feeds for various asset classes—both digital and real-world—positions DIA as a versatile player in the data oracle space.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Cryptocurrencies, including DIA, are notorious for their price volatility. Rapid price swings can lead to significant losses, especially for short-term investors. The current price of DIA is around $0.7448, reflecting a 3.5% decline in the past 24 hours. Such fluctuations can be attributed to market sentiment, broader economic conditions, and changes in investor behavior. For new investors, understanding the inherent volatility in cryptocurrency markets is crucial to managing risk.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain in many jurisdictions. Governments worldwide are still developing frameworks to govern cryptocurrencies and blockchain technologies. Potential regulations could impact the operations of DIA and its ability to provide data services. For instance, stringent regulations on data sharing and privacy could complicate DIA’s data sourcing strategies, leading to operational challenges.

Competition in the Oracle Space

The data oracle market is becoming increasingly competitive, with established players like Chainlink and newer entrants vying for market share. These competitors may offer similar or superior services, which could dilute DIA’s market presence. As the sector evolves, DIA must continually innovate and differentiate itself to maintain its position within the ecosystem.

Technological Risks

DIA relies on the Ethereum network and other blockchain technologies for its functionality. While Ethereum is currently robust, it is not immune to technological challenges such as network congestion, scalability issues, and high transaction fees. For example, during periods of high demand, gas fees on Ethereum can spike, making it costly to execute transactions. Such issues can negatively impact DIA’s operations and user experience.

Dependency on Data Sources

DIA’s value proposition hinges on its ability to provide accurate and reliable data. If the platform fails to maintain high-quality data sources or if those sources become compromised, it could damage DIA’s reputation and utility. Users depend on DIA for trustworthy data, and any lapses in this area could lead to a decline in adoption and use of the platform.

Conclusion

Investing in DIA crypto presents a mix of potential strengths and risks that investors should carefully evaluate. The innovative use case, strong market demand, and community involvement position DIA favorably in the evolving blockchain landscape. However, challenges such as market volatility, regulatory uncertainty, competition, and technological risks cannot be overlooked.

As with any investment, it is essential for potential investors to conduct thorough research and consider their risk tolerance before making decisions. Understanding both the opportunities and challenges associated with DIA will enable investors to make informed choices in the cryptocurrency market.

Frequently Asked Questions (FAQs)

1. What is DIA crypto?

DIA (Decentralised Information Asset) is an open-source oracle platform designed to provide trustworthy financial data to decentralized applications (DApps). It connects off-chain data sources with on-chain smart contracts, enabling users to source, supply, and share reliable data within a decentralized financial ecosystem. DIA aims to create a transparent and scalable system for financial data, particularly for decentralized finance (DeFi) applications.

2. Who created DIA crypto?

DIA was co-founded by a group of individuals, including Paul Claudius, Michael Weber, and Samuel Brack. Paul Claudius serves as the lead advocate and has a background in international management and economics. Michael Weber, the Association President, has experience in banking and finance, while Samuel Brack, the Chief Technology Officer (CTO), holds a master’s degree in computer science.

3. What makes DIA crypto different from Bitcoin?

DIA and Bitcoin serve different purposes within the cryptocurrency ecosystem. While Bitcoin is primarily a digital currency and a store of value, DIA functions as an oracle network that provides reliable data feeds for smart contracts and DApps. DIA focuses on ensuring the accuracy and transparency of financial data, whereas Bitcoin emphasizes decentralization and security as a medium of exchange.

4. Is DIA crypto a good investment?

Like any cryptocurrency, the potential for investment returns depends on various factors, including market conditions, project developments, and broader economic trends. DIA has shown significant price fluctuations, with an all-time high of $5.79 in May 2021 and a recent price around $0.74. Investors should conduct thorough research and consider their risk tolerance before investing in DIA or any other cryptocurrency.

5. How does DIA ensure data reliability?

DIA uses a decentralized approach to data sourcing and validation. It incentivizes users to contribute accurate data through its governance token, DIA. Users can stake DIA tokens to encourage the provision of new data, while historical data is available for free. This model aims to create a sustainable ecosystem for the continuous flow of reliable financial data.

6. Where can I buy DIA crypto?

DIA is available for trading on various cryptocurrency exchanges, including Binance, OKEx, and HBTC. It can be traded against other cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT). To purchase DIA, you would typically need to create an account on a supported exchange, deposit funds, and execute a trade.

7. What is the total supply of DIA tokens?

The total supply of DIA tokens is capped at 200 million. Out of this total, 119.67 million tokens are currently in circulation. The distribution includes tokens sold during initial sales, allocations for founders and team members, and tokens reserved for future development. There is a structured vesting period for these allocations to ensure gradual release into the market.

8. How is the DIA network secured?

DIA operates as an ERC-20 token on the Ethereum blockchain, inheriting its security features. The Ethereum network is known for its decentralization and robust security measures, relying on a proof-of-work consensus mechanism. However, DIA users may experience challenges related to Ethereum’s congestion, which can lead to increased transaction fees and delays.

Final Verdict on dia crypto

Overview of DIA Crypto

DIA (Decentralised Information Asset) is a unique open-source oracle platform designed to bridge the gap between off-chain data sources and on-chain smart contracts. Its primary purpose is to provide reliable, verifiable financial data to decentralized applications (dApps), particularly in the DeFi space. By incentivizing users to contribute to data collection and validation, DIA aims to create a transparent and scalable ecosystem that addresses the prevalent issues of data access and reliability in the financial sector.

Technological Framework

Built on the Ethereum blockchain as an ERC-20 token, DIA employs innovative mechanisms like “proof-of-use” and “proof-of-truth” to reward users for their contributions. The platform supports a wide range of data feeds, including market prices for cryptocurrencies and traditional assets, ensuring that developers can access the necessary information for their dApps. DIA’s integration with over 50 blockchain networks further enhances its versatility and applicability across various platforms, allowing it to serve a growing number of projects and use cases.

Investment Potential and Risks

As of October 2023, DIA’s market cap stands at approximately $89 million, with a circulating supply of 119.67 million tokens. Although it has seen significant price fluctuations, including an all-time high of $5.79 in May 2021, its current valuation reflects the inherent volatility typical of cryptocurrency investments. This high-risk, high-reward asset class demands careful consideration from potential investors.

Final Thoughts

In summary, DIA represents a promising opportunity within the blockchain ecosystem, particularly for those interested in the DeFi sector. However, the volatility and risks associated with cryptocurrency investments are substantial. It is crucial for potential investors to conduct their own thorough research (DYOR) before committing capital to DIA or any other digital asset. Understanding the project’s fundamentals, technology, and market dynamics will empower investors to make informed decisions and navigate the complexities of the cryptocurrency landscape effectively.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.