What is dia coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to dia coin

DIA coin, also known as DIA (Decentralised Information Asset), is an innovative oracle platform that plays a critical role in the cryptocurrency ecosystem. Unlike many digital assets that primarily function as currencies or store of value, DIA is designed to provide reliable and verifiable data feeds for decentralized applications (DApps) and smart contracts. This unique functionality positions DIA as a key player in the growing decentralized finance (DeFi) sector, where accurate and timely data is essential for the operation of various financial products and services.

As a decentralized information oracle, DIA sources data from multiple high-volume markets and provides price feeds, verifiable randomness, and data related to real-world assets. By doing so, DIA aims to bridge the gap between off-chain data (real-world information) and on-chain smart contracts, ensuring that DeFi applications can operate effectively and transparently. This is particularly important given the challenges associated with traditional oracles, which can be non-transparent and vulnerable to manipulation.

This guide is intended to serve as a comprehensive resource for both beginners and intermediate investors interested in DIA coin. It will cover several key aspects of the asset, including:

Technology

We’ll explore how DIA’s oracle technology works, the underlying Ethereum protocol it utilizes, and how it integrates with various blockchain networks. Understanding the technical foundation of DIA is crucial for assessing its functionality and potential applications in the DeFi space.

Tokenomics

DIA’s tokenomics will be examined, including the total supply, circulating supply, and the mechanisms behind its governance token. This section will help investors grasp the economic model of DIA and how it incentivizes participation and data validation.

Investment Potential

We’ll discuss DIA’s market performance, its price history, and current trends. This analysis will provide insights into its investment potential and help investors make informed decisions.

Risks

Investing in cryptocurrencies comes with inherent risks. This guide will outline the specific risks associated with DIA, including market volatility, regulatory challenges, and the technological vulnerabilities of oracle systems.

How to Buy DIA

Lastly, we will provide step-by-step instructions on how to purchase DIA coin, including the exchanges where it is available and the various trading pairs that investors can utilize.

By the end of this guide, readers will have a well-rounded understanding of DIA coin, equipping them with the knowledge needed to navigate the complexities of this unique digital asset and make informed investment decisions.

What is dia coin? A Deep Dive into its Purpose

Understanding DIA Coin

DIA (Decentralized Information Asset) is a cryptocurrency token that serves as the governance and utility asset of a decentralized oracle platform. Founded in 2018, DIA aims to create a transparent and reliable ecosystem for sourcing, supplying, and sharing financial data. The token operates on the Ethereum blockchain as an ERC-20 token and has garnered attention for its unique approach to solving data challenges in the financial sector, particularly in decentralized finance (DeFi).

The Core Problem It Solves

In the rapidly evolving world of blockchain and cryptocurrencies, the need for reliable, real-time data is critical. Traditional financial markets rely on centralized data providers, which can be slow, expensive, and prone to manipulation. This poses significant challenges in the context of smart contracts and DeFi applications, where accurate data feeds are essential for executing transactions and ensuring the integrity of financial operations.

DIA addresses this problem by providing a decentralized platform that aggregates data from multiple sources, allowing users to access verified and trustworthy data streams. The platform’s primary focus is on delivering transparent and real-time price feeds for cryptocurrencies, traditional assets, and other financial instruments. By creating a decentralized network of data providers, DIA aims to mitigate issues such as data inaccuracy, latency, and centralization.

Its Unique Selling Proposition

DIA’s unique selling proposition lies in its ability to create a decentralized and transparent data ecosystem. Here are some key features that set DIA apart:

-

Decentralization: Unlike traditional data providers, DIA leverages a decentralized network of contributors to gather and validate data. This approach reduces the risk of manipulation and ensures that data is sourced from multiple high-volume markets.

-

Open-Source: DIA is an open-source platform, meaning that its code is publicly available for scrutiny and improvement. This transparency fosters trust among users and encourages community involvement in the platform’s development.

-

Incentivized Data Validation: DIA employs a unique incentive structure that encourages users to contribute to data validation. Through the use of its governance token, holders can stake DIA tokens to incentivize the flow of validated data. This mechanism not only enhances data quality but also aligns the interests of all participants in the ecosystem.

-

Multi-Chain Compatibility: DIA is designed to operate across various blockchain networks, including Ethereum, Solana, and Polygon, making it a versatile solution for developers. This compatibility allows for the integration of DIA oracles into a wide range of decentralized applications (dApps) across different ecosystems.

-

Governance: As a governance token, DIA enables its holders to participate in decision-making processes related to the platform’s development and data policies. This democratic approach empowers the community to shape the future of DIA and ensures that the platform remains aligned with user needs.

The Team and Backers

DIA was co-founded by a team of experienced professionals from diverse backgrounds in finance, technology, and blockchain. The leadership team includes:

-

Paul Claudius: Serving as the Chief Business Officer (CBO), Claudius has a strong background in international management and business economics. He is also the CEO of BlockState AG, a company focused on tokenization and asset management.

-

Michael Weber: The founder and association president, Weber has a rich history in financial institutions and has founded several blockchain projects, including Goodcoin and myLucy. His expertise in finance equips DIA with valuable insights into market needs.

-

Samuel Brack: As the Chief Technology Officer (CTO), Brack brings technical expertise to the team, holding a master’s degree in computer science. His role is crucial in ensuring the platform’s technological robustness and scalability.

DIA has also garnered support from various investors and backers, including Outlier Ventures, which played a significant role in the project’s initial funding. The project has a strong community presence and actively engages with its users through governance initiatives, events, and educational resources.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of DIA in the cryptocurrency ecosystem is to serve as a reliable and transparent data oracle. As the DeFi space grows, the demand for accurate and trustworthy data is more critical than ever. DIA aims to fill this gap by providing decentralized data feeds that empower developers to build secure and efficient dApps.

By enabling access to validated data streams, DIA enhances the overall functionality of smart contracts, reduces risks associated with inaccurate data, and fosters innovation in the DeFi sector. Its commitment to decentralization and community governance ensures that it remains aligned with the principles of blockchain technology, providing a trustworthy foundation for future financial applications.

In conclusion, DIA stands out as a pioneering solution in the realm of decentralized data oracles. By addressing the fundamental issues of data reliability, transparency, and community involvement, DIA has positioned itself as a vital player in the evolving landscape of blockchain technology and decentralized finance. As the project continues to grow and innovate, it is likely to play a significant role in shaping the future of financial data access in the crypto ecosystem.

The Technology Behind the Coin: How It Works

Overview of DIA Coin Technology

DIA (Decentralised Information Asset) is a pioneering open-source oracle platform designed to provide reliable financial data for decentralized applications (DApps) and smart contracts. The technology behind DIA aims to bridge the gap between off-chain data sources and on-chain smart contracts, enabling users to access trustable and verified information. This section delves into the core components that define the technology behind DIA Coin, focusing on its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

DIA is built on the Ethereum blockchain, utilizing the ERC-20 token standard. This choice of architecture allows DIA to leverage Ethereum’s robust security and decentralized nature, making it a reliable environment for deploying smart contracts. Here’s a breakdown of its architecture:

-

ERC-20 Standard: As an ERC-20 token, DIA follows a set of predefined rules that govern how the token can be transferred and interacted with within the Ethereum ecosystem. This standardization ensures compatibility with various wallets and exchanges, facilitating broader adoption.

-

Smart Contracts: DIA utilizes smart contracts to automate various processes, such as data validation and governance. Smart contracts execute predefined actions based on certain conditions, ensuring transparency and trust in the data provided.

-

Data Sources: DIA aggregates data from multiple high-volume markets and reliable sources. This decentralized approach ensures that the data is accurate and resistant to manipulation. By sourcing information from various providers, DIA can offer comprehensive price feeds for cryptocurrencies, stocks, and other real-world assets.

Consensus Mechanism

DIA inherits Ethereum’s consensus mechanism, which is currently based on Proof-of-Work (PoW) but is transitioning to Proof-of-Stake (PoS) with Ethereum 2.0. Here’s a closer look at these mechanisms:

-

Proof-of-Work (PoW): Initially, Ethereum used PoW, where miners solve complex mathematical problems to validate transactions and create new blocks. This method ensures that transactions are verified by multiple nodes, contributing to network security. However, PoW is energy-intensive and can lead to congestion and high transaction fees during peak times.

-

Proof-of-Stake (PoS): With Ethereum 2.0, the network is transitioning to PoS, which allows validators to create new blocks and confirm transactions based on the number of coins they hold and are willing to “stake” as collateral. PoS is more energy-efficient and can process transactions faster, reducing fees and improving the overall user experience. DIA will benefit from this upgrade, enhancing its data delivery capabilities.

Key Technological Innovations

DIA’s technology includes several innovative features that distinguish it from other oracle platforms. These innovations aim to enhance data integrity, accessibility, and the overall user experience.

1. Decentralized Oracle Network

DIA operates as a decentralized oracle network, which means it does not rely on a single source of truth for data. Instead, it aggregates information from multiple providers, ensuring that users receive the most accurate and up-to-date data. This decentralization mitigates risks associated with data manipulation and promotes transparency.

2. Financial Incentives for Data Providers

To maintain a steady flow of validated data, DIA employs a system of financial incentives. Users can stake DIA tokens to encourage the provision of new data streams. This mechanism not only incentivizes data providers but also ensures that the data remains current and relevant. Furthermore, users can vote on governance decisions related to data sourcing and validation, promoting community involvement.

3. Proof of Reserve

DIA introduces a unique feature known as “Proof of Reserve,” which provides fair-value price feeds for assets by accounting for the collateral ratio. This ensures that the price data reflects actual market conditions and is not artificially inflated or deflated. By validating the collateral backing the assets, DIA enhances the reliability of its price feeds.

4. Verifiable Randomness Function (VRF)

DIA incorporates a Verifiable Randomness Function (VRF) to provide distributed and verifiable random number generation. This feature is crucial for applications that require randomization, such as lotteries or gaming DApps, ensuring that the randomness is provably fair and transparent.

5. Cross-Chain Compatibility

DIA is designed to be compatible with multiple blockchain networks, including Ethereum, Solana, BNB Chain, and others. This cross-chain capability allows DIA to serve a broader range of DApps and users, enhancing its utility in the decentralized finance (DeFi) space. By integrating with various chains, DIA can provide data feeds for assets across different ecosystems.

Data Aggregation and Delivery

DIA’s data aggregation process involves collecting information from various exchanges and data providers. This multi-source approach is essential for maintaining accuracy and reducing reliance on any single entity. The steps involved in data aggregation and delivery include:

-

Data Collection: DIA continuously pulls data from numerous sources, including high-volume exchanges, traditional financial markets, and other relevant platforms. This data is then processed to ensure accuracy and consistency.

-

Data Validation: Before being fed into the DIA network, the collected data undergoes a validation process. This involves checking for discrepancies and ensuring that the data aligns with expected market conditions.

-

Data Delivery: Once validated, the data is made available to users through APIs and other integration tools. Developers can easily access this data to build DApps and smart contracts, enabling a wide range of financial applications.

Governance and Community Involvement

DIA emphasizes decentralized governance, allowing token holders to have a say in the platform’s future. Governance decisions include proposals for new data sources, changes to the validation process, and adjustments to incentive structures. This participatory model ensures that the community plays an active role in shaping the direction of DIA, fostering a sense of ownership and accountability.

Security Considerations

While DIA leverages the security features of the Ethereum network, it also implements additional measures to protect its data and users:

-

Smart Contract Audits: DIA conducts regular audits of its smart contracts to identify and address vulnerabilities. This proactive approach helps prevent exploits and enhances user confidence in the platform.

-

Decentralization: By decentralizing data sources and governance, DIA reduces the risk of single points of failure. This structure enhances the resilience of the network against attacks and ensures data integrity.

-

Community Oversight: The decentralized governance model allows the community to monitor and assess the performance of the DIA network. This transparency promotes trust and encourages continuous improvement.

Conclusion

DIA Coin represents a significant advancement in the realm of decentralized finance and data provisioning. By combining a robust blockchain architecture with innovative features like decentralized oracles, financial incentives, and cross-chain compatibility, DIA is poised to redefine how data is sourced and utilized in the DeFi ecosystem. As the platform continues to evolve, its commitment to transparency, community involvement, and data integrity will play a crucial role in its long-term success. For both beginners and intermediate investors, understanding the technology behind DIA is essential for grasping its potential impact on the financial landscape.

Understanding dia coin Tokenomics

DIA Coin Tokenomics Overview

DIA (Decentralised Information Asset) operates as a governance token within an open-source oracle platform designed to facilitate the sourcing, supply, and sharing of trustable financial data. Understanding its tokenomics is crucial for both potential investors and users interested in the functionalities and utilities of the DIA token within the broader cryptocurrency ecosystem.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 200,000,000 DIA |

| Max Supply | 200,000,000 DIA |

| Circulating Supply | 119,676,104 DIA |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The DIA token serves multiple pivotal roles within the DIA ecosystem, enhancing its functionality and utility:

-

Governance: DIA token holders can participate in the governance of the platform. This includes voting on proposals related to the development and direction of the DIA protocol. Governance decisions encompass a variety of aspects, such as changes to the protocol, adjustments in the incentive structure, and allocation of resources for data collection and validation.

-

Incentives for Data Providers: DIA aims to create a sustainable ecosystem for data sharing. Token holders can stake their DIA tokens to incentivize the submission of new and validated data onto the platform. This staking mechanism ensures that users are motivated to contribute quality data, thereby enhancing the overall reliability of the information provided.

-

Access to Data Services: While access to historical data is free, DIA tokens may be required for premium data services or advanced functionalities within the platform. This creates a demand for the token as users seek to utilize the full suite of DIA’s offerings.

-

Proof-of-Use and Proof-of-Truth Mechanisms: The DIA protocol utilizes innovative mechanisms where smart contracts that leverage DIA oracles can earn DIA tokens daily. This rewards users for using the oracles and ensures a continuous flow of data, reinforcing the utility of the token.

-

Funding Ecosystem Development: DIA tokens are allocated to fund the ongoing development of the DIA ecosystem. This includes enhancements to the oracle services, integration with new blockchain networks, and the development of tools that facilitate data access and usability.

Token Distribution

The distribution of DIA tokens is carefully structured to promote sustainability and community involvement. Here’s a breakdown of how the total supply is allocated:

-

Initial Sales and Private Offerings:

– Private Sale: 10 million tokens were sold during the private sale.

– Bonding Curve Sale: 30 million tokens were offered in this sale, with 10.2 million sold to the public. The remaining 19.8 million tokens were burned to reduce the overall supply. -

Investor and Advisor Allocations:

– 19.5 million tokens are allocated to early investors and advisors. This allocation includes significant early backers like Outlier Ventures. -

Team and Founders:

– 24 million tokens are designated for the founding team and developers, subject to a 29-month vesting period. This ensures that the team has a long-term incentive aligned with the platform’s success. -

Future Development:

– 25 million tokens are reserved for future development initiatives within the DIA ecosystem. -

Company Reserves:

– A significant portion, 91.5 million tokens, is held in reserve. These tokens are set to be unlocked gradually over ten years, with the first batch released every December. Notably, half of the initially unlocked tokens can be burned based on community voting, ensuring that the supply remains controlled and responsive to community decisions.

Inflationary or Deflationary Dynamics

DIA operates under a deflationary model, primarily driven by the burning of tokens during various phases of its distribution. This includes the initial bonding curve sale where unsold tokens were burned and the potential for additional burns based on governance votes. The controlled supply and strategic burning mechanisms aim to enhance the value of the remaining tokens over time.

Conclusion

Understanding the tokenomics of DIA is vital for anyone interested in engaging with its ecosystem. The governance features, utility as an incentive mechanism, and thoughtful distribution strategy all contribute to the token’s role in fostering a reliable and scalable oracle network. As the DIA platform continues to evolve, its tokenomics will play a crucial role in driving community participation and the overall success of the project.

Price History and Market Performance

Key Historical Price Milestones

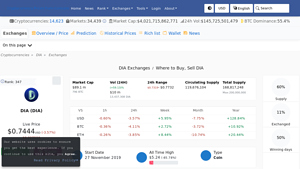

DIA (Decentralized Information Asset) has experienced significant price fluctuations since its inception in 2020. The token was initially made available to the public during a bonding curve sale from August 3 to August 17, 2020, during which 10.2 million tokens were sold. This event marked the beginning of DIA’s journey in the cryptocurrency market.

One of the most notable price milestones for DIA occurred on May 5, 2021, when it reached its all-time high (ATH) of $5.79. This peak was a result of heightened interest in decentralized finance (DeFi) projects, as well as the increasing demand for reliable data oracles, which DIA aims to provide. Following this surge, however, the token experienced a significant downturn, aligning with the broader cryptocurrency market trend of corrections that occurred in mid-2021.

In stark contrast, DIA reached its all-time low (ATL) on September 11, 2023, with a price of $0.2104. This marked a period of extreme volatility and uncertainty in the cryptocurrency market, which was influenced by various external factors, including regulatory scrutiny and macroeconomic conditions.

As of now, the current price of DIA is approximately $0.7442, reflecting a recovery of 253.81% from its all-time low. The token’s market cap stands at around $89.07 million, with a circulating supply of 119.67 million DIA tokens out of a maximum supply of 200 million.

Factors Influencing the Price

Historically, the price of DIA has been influenced by several key factors that are common in the cryptocurrency market:

1. Market Sentiment and Trends

The general sentiment in the cryptocurrency market plays a significant role in DIA’s price movements. Bullish trends in the broader market often lead to increased investment in altcoins, including DIA. Conversely, bearish trends can result in significant sell-offs. For example, during the 2021 bull run, the excitement surrounding DeFi protocols and oracle solutions led to a rapid increase in DIA’s price, culminating in its all-time high.

2. Adoption of Oracle Solutions

DIA’s primary function as a decentralized oracle network means its price is closely tied to the demand for reliable data feeds in the DeFi ecosystem. As more decentralized applications (dApps) adopt DIA’s oracles for price feeds and other data services, the demand for DIA tokens can increase, positively impacting its price. Conversely, a slowdown in the adoption of oracle solutions can lead to stagnation or decline in price.

3. Regulatory Environment

The regulatory landscape surrounding cryptocurrencies and DeFi projects has a profound impact on investor confidence and market activity. Changes in regulations can lead to sudden price fluctuations. For instance, regulatory announcements that are perceived as supportive of DeFi can boost prices, while strict regulations or negative news can have the opposite effect.

4. Technological Developments and Upgrades

Technological advancements and updates within the DIA ecosystem can also influence its price. New features, partnerships, or improvements to the platform can attract more users and investors, thereby increasing demand for the token. For instance, integrations with other blockchain networks or enhancements in the efficiency of DIA’s oracle services can positively impact market perception and price.

5. Market Liquidity and Trading Volume

Market liquidity is a crucial factor in determining DIA’s price stability. Higher trading volumes typically indicate strong interest in the token, which can lead to price appreciation. Conversely, low trading volumes can result in higher volatility and price swings. The 24-hour trading volume for DIA has fluctuated significantly, impacting its price dynamics.

6. Competition in the Oracle Space

DIA operates in a competitive landscape alongside other oracle providers like Chainlink and Tellor. The performance and advancements of these competitors can influence DIA’s market position and price. If a competitor releases a groundbreaking feature or forms a major partnership, it may draw attention away from DIA, potentially impacting its price negatively.

Conclusion

In summary, DIA has experienced a dynamic price history marked by significant highs and lows. The interplay of market sentiment, adoption of its oracle solutions, regulatory developments, technological advancements, market liquidity, and competitive pressures have all played pivotal roles in shaping DIA’s market performance. As the cryptocurrency landscape continues to evolve, DIA’s price will likely remain sensitive to these multifaceted influences, reflecting the broader trends and challenges within the digital asset ecosystem. Understanding these historical factors provides valuable context for both new and experienced investors as they navigate the complexities of the cryptocurrency market.

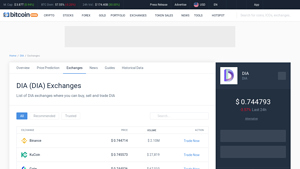

Where to Buy dia coin: Top Exchanges Reviewed

1. DIA Coin – Unlock Great Prices for Easy Trading!

ChangeNOW stands out as a premier platform for exchanging DIA Coin, boasting a high rating of 4.8 from over 2,165 users. The exchange offers competitive rates, allowing users to buy, sell, or swap DIA Crypto instantly without any fees. Additionally, the platform provides real-time pricing in USD, comprehensive charts, and a user-friendly interface, making it an ideal choice for both beginners and seasoned investors looking to optimize their cryptocurrency transactions.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

3. DIA (DIA) – Your Gateway to Decentralized Data!

DIA (DIA) can be traded on over 23 cryptocurrency exchanges, with Binance, Gate, and HTX standing out as the top platforms for purchasing this digital asset. These exchanges offer robust trading volumes, a user-friendly interface, and enhanced security features, making them ideal choices for both novice and experienced investors looking to buy, sell, or trade DIA efficiently.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

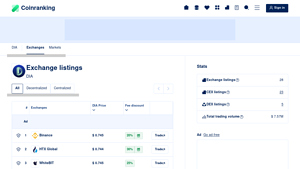

5. DIA – Your Gateway to Diverse Exchange Listings!

DIA stands out in the cryptocurrency market by offering a comprehensive overview of exchange listings, allowing users to easily compare prices, trading volumes, and available discounts. This feature empowers traders to make informed decisions by identifying the most favorable platforms for executing their trades. With its user-friendly interface and detailed market insights, DIA enhances the trading experience for both novice and experienced investors.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Coinbase – Easiest Way to Buy DIA in the U.S.!

Coinbase stands out as a leading centralized exchange for purchasing DIA (DIA) in the United States, renowned for its trustworthiness and user-friendly interface. With robust security measures and a straightforward buying process, it caters to both beginners and experienced investors. Additionally, Coinbase offers comprehensive resources and tools for managing digital assets, making it a go-to platform for anyone looking to invest in DIA.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

3. CoinCodex – Your Ultimate Guide to DIA Trading!

DIA stands out in the cryptocurrency market by being available on 35 exchanges, including prominent platforms like Binance, AscendEX, and Bilaxy. This extensive listing not only enhances its accessibility for traders but also ensures liquidity and competitive pricing. With multiple trading options, including futures on Binance, users can engage with DIA in a versatile manner, catering to both novice and experienced investors looking to buy, sell, or trade this digital asset.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy dia coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing DIA coin is selecting a cryptocurrency exchange where it is listed. DIA is available on several exchanges, including major platforms like Binance, OKEx, and BiKi. Here are some factors to consider when choosing an exchange:

- Reputation: Look for exchanges with good reviews and a solid reputation for security.

- Fees: Different exchanges have varying fee structures, including trading fees, withdrawal fees, and deposit fees. Compare these before making a choice.

- Supported Payment Methods: Ensure the exchange supports your preferred payment method, whether it’s a bank transfer, credit card, or cryptocurrency deposit.

- User Experience: Choose an exchange with an interface that you find user-friendly. Many exchanges offer demo accounts or simplified versions for beginners.

2. Create and Verify Your Account

Once you’ve chosen an exchange, the next step is to create an account. Here’s how:

- Sign Up: Visit the exchange’s website and look for the “Sign Up” or “Register” button. Fill in your email address and create a strong password.

- Email Verification: After signing up, you will receive an email to verify your account. Click on the verification link to activate your account.

- Complete KYC (Know Your Customer): Most exchanges require you to complete KYC for regulatory compliance. This usually involves providing personal information, such as your full name, address, and date of birth, along with identification documents (e.g., a passport or driver’s license).

- Two-Factor Authentication (2FA): Enable 2FA to add an extra layer of security to your account.

3. Deposit Funds

With your account set up and verified, you’ll need to deposit funds to purchase DIA coin. Here’s how to do it:

- Select Deposit Method: Navigate to the “Funds” or “Wallet” section of the exchange and choose the deposit method. You can typically deposit fiat currency (like USD or EUR) or cryptocurrency (like BTC or ETH).

- Deposit Fiat Currency: If depositing fiat, you may need to link your bank account or credit card. Follow the instructions provided by the exchange to complete the transaction.

- Deposit Cryptocurrency: If you already own cryptocurrencies, select the relevant crypto wallet address to send funds from your wallet to the exchange. Make sure to double-check the address to avoid errors.

4. Place an Order to Buy DIA Coin

Now that your account is funded, it’s time to buy DIA coin. Follow these steps:

- Navigate to the Market: Go to the trading section of the exchange and search for the DIA trading pair (for example, DIA/USD, DIA/BTC, or DIA/USDT).

- Select the Type of Order: There are different types of orders you can place:

- Market Order: This order buys DIA at the current market price. It’s the simplest option for beginners.

- Limit Order: This order allows you to set a specific price at which you want to buy DIA. The order will only execute if the market reaches that price.

- Enter the Amount: Specify how much DIA you want to buy. Review the total cost, including any applicable fees.

- Confirm the Order: Review all details and confirm your order. Your purchase will be executed, and you’ll see your DIA coins in your exchange wallet.

5. Secure Your Coins in a Wallet

After buying DIA coin, it’s important to secure your investment. While you can keep your coins on the exchange, it’s generally safer to transfer them to a personal wallet. Here’s how:

- Choose a Wallet: There are several types of wallets to consider:

- Software Wallets: These are apps you can install on your phone or computer. They’re user-friendly and good for everyday transactions.

- Hardware Wallets: These are physical devices that store your coins offline, providing enhanced security against hacks. They are ideal for long-term storage.

- Transfer Your DIA Coins: Go to your wallet and find your DIA wallet address. Then, head back to the exchange, select the withdrawal option, and enter your wallet address and the amount of DIA you wish to transfer.

- Confirm the Transfer: Review the details and confirm the transaction. Wait for the transaction to be processed, and check your wallet to ensure the coins have arrived.

By following these steps, you can successfully buy and secure your DIA coins, making your first venture into this digital asset safe and straightforward. Always remember to stay informed about market trends and practice safe trading habits!

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

DIA (Decentralised Information Asset) aims to bridge the gap between off-chain data and on-chain applications, particularly in the decentralized finance (DeFi) sector. As an open-source oracle platform, DIA provides verified and reliable data feeds that are essential for smart contracts and decentralized applications (dApps). Here are several strengths that could support the investment case for DIA coin:

1. Unique Value Proposition

DIA’s primary function as an oracle network positions it to address a significant problem in the blockchain ecosystem: the lack of reliable, real-time data for smart contracts. By enabling market actors to source, supply, and share trustworthy data, DIA aims to be the go-to solution for financial data in the DeFi space. Its proposition of being the “Wikipedia of financial data” could resonate well with users looking for transparency and accuracy.

2. Expanding Use Cases

DIA supports a variety of data feeds, including market price feeds, verifiable randomness, and real-world asset feeds. This versatility allows DIA to cater to a broad audience, including developers of dApps that require diverse data types. As more projects seek to integrate reliable data sources, the demand for DIA’s services may increase, potentially driving token utility and value.

3. Strong Ecosystem Integration

DIA is integrated across multiple blockchain networks, including Ethereum, Solana, and BNB Chain. This cross-chain functionality enhances its usability and adoption, as developers can utilize DIA’s oracles for applications across various ecosystems. As the DeFi space continues to grow, the ability to provide data feeds across multiple platforms could give DIA a competitive edge.

4. Community Governance

The governance model of DIA is community-driven, allowing holders of the DIA token to participate in decision-making processes. This decentralized governance structure may lead to more robust and adaptable project development, as it can quickly respond to community needs and market changes. A strong, engaged community can also drive awareness and adoption of the DIA platform.

5. Market Position and Growth Potential

As of now, DIA is ranked #394 in terms of market capitalization, with a market cap of approximately $89 million. Although it has experienced significant price fluctuations, it has also shown resilience, recovering from its all-time low. The potential for growth exists, especially if DIA can capture a larger market share within the oracle sector, which is vital for the functioning of DeFi applications.

Potential Risks and Challenges (The Bear Case)

While DIA presents various strengths, potential investors should also consider several risks and challenges that could impact its performance:

1. Market Volatility

The cryptocurrency market is notoriously volatile, and DIA is no exception. The price of DIA has seen considerable fluctuations, including an all-time high of $5.79 in May 2021, followed by a significant drop to its all-time low of $0.21 in September 2023. Such volatility can lead to substantial losses for investors, particularly those with lower risk tolerance. Market sentiment, macroeconomic factors, and overall crypto market trends can significantly influence the price of DIA.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies and blockchain technology is continuously evolving. Regulatory scrutiny could impact DIA’s operations, particularly as it navigates the complexities of providing financial data services. Any unfavorable regulatory decisions could hinder DIA’s growth prospects and lead to increased compliance costs. Investors should remain aware of potential changes in laws and regulations that could affect the overall cryptocurrency market.

3. Competition

DIA operates in a competitive environment where other oracle solutions like Chainlink and Tellor also vie for market share. These competitors have established themselves in the market and may possess greater resources and brand recognition. DIA will need to differentiate itself and continue to innovate to capture and retain users. Failure to do so could result in reduced market demand for DIA’s services.

4. Technological Risks

As an oracle network, DIA’s success is heavily dependent on its technological infrastructure. Any technical failures, security breaches, or vulnerabilities could undermine user trust and lead to a loss of data integrity. Additionally, the reliance on the Ethereum network poses risks, such as high transaction fees and network congestion, which can impact the usability of DIA’s services. Investors should consider the technical robustness of DIA’s platform and its ability to scale effectively.

5. Dependence on Ecosystem Growth

DIA’s success is closely tied to the growth of the DeFi ecosystem. If the DeFi sector experiences stagnation or decline, demand for DIA’s data services may diminish. Moreover, the overall adoption of blockchain technology and smart contracts is still in its early stages, and any setbacks in these areas could impact DIA’s long-term viability. Investors should keep an eye on trends in the broader blockchain and DeFi markets to gauge DIA’s potential for growth.

Conclusion

In summary, DIA coin presents a compelling investment case with its unique value proposition, expanding use cases, and community governance. However, potential investors should remain vigilant regarding the inherent risks, including market volatility, regulatory uncertainty, competition, technological challenges, and dependence on ecosystem growth. A balanced understanding of these factors is crucial for making informed decisions in the dynamic cryptocurrency landscape.

Frequently Asked Questions (FAQs)

1. What is DIA Coin?

DIA Coin (DIA) is the governance token of the DIA (Decentralized Information Asset) platform, which is an open-source oracle network. It enables users to source, supply, and share reliable financial data for decentralized applications (DApps) and smart contracts. DIA’s goal is to become a comprehensive ecosystem for open financial data, addressing the challenges of outdated or unverified data in the finance and DeFi sectors.

2. Who created DIA Coin?

DIA Coin was co-founded by a team of experts including Paul Claudius, Michael Weber, and Samuel Brack. Paul Claudius serves as the lead advocate and has a background in international management and business economics. Michael Weber is the Association President and has experience in banking and financial institutions. Samuel Brack, the Chief Technology Officer (CTO), has a background in computer science and is also working towards a PhD.

3. What makes DIA Coin different from Bitcoin?

DIA Coin differs from Bitcoin in several fundamental ways. Firstly, Bitcoin is primarily a digital currency used for peer-to-peer transactions and a store of value, while DIA focuses on providing reliable data through its oracle network for smart contracts and DApps. Secondly, DIA operates on the Ethereum blockchain as an ERC-20 token, which allows it to integrate with various decentralized applications. In contrast, Bitcoin has its own blockchain. Lastly, DIA is designed to incentivize users to validate and share financial data, whereas Bitcoin relies on miners to secure its network.

4. Is DIA Coin a good investment?

The potential for DIA Coin as a good investment depends on various factors, including market conditions, its adoption in the DeFi space, and the performance of the DIA platform. While DIA has shown significant growth since its all-time low in September 2023, past performance does not guarantee future results. Investors should conduct thorough research and consider their risk tolerance before investing in DIA or any other cryptocurrency.

5. How does DIA Coin work?

DIA Coin functions within the DIA ecosystem as a governance token. It is used to fund data collection, incentivize data validation, and facilitate governance decisions through community voting. Users can stake DIA tokens to encourage the flow of validated data, and they can also access historical data for free. The platform employs mechanisms like “proof-of-use” and “proof-of-truth” to reward smart contracts using DIA oracles.

6. Where can I buy DIA Coin?

DIA Coin is available for trading on several cryptocurrency exchanges. The most prominent exchanges include Binance, OKEx, HBTC, and BiKi. Investors can trade DIA against various pairs such as BTC, ETH, and USDT. It is essential to choose a reputable exchange and ensure proper security measures when purchasing cryptocurrencies.

7. What are the risks associated with investing in DIA Coin?

Investing in DIA Coin, like other cryptocurrencies, carries inherent risks. These include market volatility, regulatory changes, and technological risks associated with smart contracts and oracles. Additionally, since DIA relies on the Ethereum blockchain, any congestion or issues with Ethereum could impact DIA’s performance. Investors should be aware of these risks and consider diversifying their portfolios to mitigate potential losses.

8. How many DIA Coins are in circulation?

The total supply of DIA Coins is capped at 200 million. As of now, there are approximately 119.67 million DIA tokens in circulation. The token distribution includes amounts allocated for early investors, the founding team, and reserves for future development. A portion of the tokens is also set to be unlocked over time, which can impact the token’s market dynamics.

Final Verdict on dia coin

Overview of DIA Coin

DIA Coin (DIA) is the governance token of the DIA platform, a decentralized oracle network designed to provide reliable and verifiable financial data for decentralized applications (dApps). Founded in 2018, DIA aims to tackle the challenges of acquiring trustworthy and timely data in the financial ecosystem, particularly within decentralized finance (DeFi). The platform allows users to source, supply, and share data through an incentivized model that encourages community participation and validation.

Technological Framework

DIA operates on the Ethereum blockchain as an ERC-20 token, benefiting from Ethereum’s extensive security and decentralization. The DIA network supports a variety of chains and integrates with over 50 blockchain networks, providing price feeds, verifiable randomness, and data for real-world assets. This versatility positions DIA as a critical component in the growing DeFi landscape, where accurate data is paramount for decision-making and execution.

Market Performance and Potential

As of now, DIA is trading at approximately $0.7442, with a market capitalization of around $89 million. Despite a notable all-time high of $5.79 in May 2021, the token has faced significant volatility, reflecting the broader market trends typical of cryptocurrencies. With a total supply of 200 million tokens, DIA has a circulating supply of around 119 million, indicating a substantial amount still held in reserves for future use.

Risk and Reward

Investing in DIA Coin presents both opportunities and risks. The potential for high returns exists, especially as demand for reliable financial data in DeFi grows. However, the cryptocurrency market is notoriously volatile, and DIA is no exception. Its price can fluctuate dramatically based on market sentiment, technological developments, and regulatory changes.

Conclusion

In conclusion, DIA Coin represents a promising asset in the evolving landscape of decentralized finance and data provision. However, it is crucial for potential investors to understand that investing in cryptocurrencies is inherently risky and can lead to significant financial loss. Therefore, conducting thorough research (DYOR) and staying informed about market trends, technological advancements, and project developments is essential before making any investment decisions.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.