What is cybro coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to cybro coin

Cybro Coin is an innovative digital asset that operates within the rapidly evolving landscape of cryptocurrencies. Positioned as a multichain AI-powered earn marketplace, Cybro Coin facilitates a diverse array of investment opportunities aimed at both novice and experienced investors. The platform stands out by offering a unique suite of investment tools tailored to user preferences, risk tolerance, and desired returns. With a current market cap of approximately $806,000 and a circulating supply of 132 million coins, Cybro Coin is gradually making its mark in the crypto market.

Significance in the Crypto Market

Cybro Coin plays a vital role in the decentralized finance (DeFi) ecosystem, providing users with access to various yield farming strategies and investment vaults. These vaults are designed to simplify the investment process, allowing users to engage in staking, farming, and lending with ease. By leveraging artificial intelligence, Cybro Coin’s platform can recommend optimal investment options based on individual user profiles, enhancing the overall user experience. This combination of advanced technology and user-centric design makes Cybro Coin a noteworthy player in the DeFi space.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for understanding Cybro Coin, encompassing various critical aspects, including its underlying technology, tokenomics, investment potential, associated risks, and how to purchase it. For beginners, this guide will demystify the complexities of cryptocurrency investment, while intermediate investors can benefit from a deeper dive into the nuances of Cybro Coin’s features and market performance.

What You Will Learn

- Technology: An overview of the blockchain technology that powers Cybro Coin, including its multichain capabilities and AI integration.

- Tokenomics: A detailed analysis of Cybro Coin’s supply structure, market performance, and how its tokenomics influence value.

- Investment Potential: Insights into market trends, historical price data, and future growth prospects of Cybro Coin.

- Risks: An evaluation of the potential risks associated with investing in Cybro Coin, including market volatility and regulatory considerations.

- How to Buy: Step-by-step instructions on acquiring Cybro Coin, including exchanges and wallets.

As the cryptocurrency market continues to expand, Cybro Coin presents an intriguing opportunity for investors seeking to diversify their portfolios and explore innovative financial solutions. Whether you are just starting or looking to enhance your investment strategy, this guide will equip you with the knowledge needed to navigate the world of Cybro Coin effectively.

What is cybro coin? A Deep Dive into its Purpose

Overview of Cybro Coin

Cybro Coin (CYBRO) is a digital asset that operates within the growing landscape of decentralized finance (DeFi). It is primarily designed to facilitate investments through an innovative platform known as the Cybro marketplace. This multichain earn marketplace utilizes artificial intelligence (AI) to optimize investment strategies, making it accessible for both novice and experienced investors.

The Core Problem It Solves

In the rapidly evolving world of cryptocurrency and decentralized finance, investors often face challenges such as information overload, high entry barriers, and the complexities associated with yield farming and staking. Traditional investment platforms can be cumbersome, requiring significant expertise and time to navigate various options.

Cybro Coin addresses these issues by offering an intuitive platform that simplifies investment processes. It provides users with diverse investment strategies categorized into different risk levels and expected returns. By utilizing AI, Cybro can recommend optimal investment options tailored to individual preferences, thus lowering the barriers to entry for new investors and enhancing the decision-making process for seasoned ones.

The platform’s main features include:

-

Investment Vaults: Cybro offers a variety of investment vaults that aggregate different protocols for yield farming. These vaults are designed to cater to various investment strategies, allowing users to choose according to their risk appetite and financial goals.

-

One-Click Strategies: For those who prefer simplicity, Cybro provides one-click investment strategies that wrap multiple protocols into an easy-to-use format. This approach enables users to participate in complex financial mechanisms without needing extensive knowledge about each component.

-

Smart Notifications: The platform incorporates smart notifications and portfolio management tools that keep users informed about market changes, enhancing their ability to react swiftly to opportunities or risks.

Its Unique Selling Proposition

Cybro Coin distinguishes itself from other cryptocurrencies and DeFi platforms through its multichain approach and AI-driven features. Here are some of its unique selling propositions:

-

Multichain Compatibility: Cybro is built on multiple blockchain networks, including the Blast, Base, Arbitrum, and BNB Chain ecosystems. This multichain strategy allows for greater flexibility and accessibility, enabling users to engage with various DeFi protocols without being confined to a single blockchain.

-

AI-Powered Investment Tools: The integration of AI technology is a significant advantage. By analyzing user preferences and market trends, the AI broker can suggest the best investment options, reducing the time and effort required for research and decision-making.

-

User-Centric Design: The platform is designed with user experience in mind, emphasizing ease of use and accessibility. This focus on user-friendliness is crucial in attracting a broader audience, particularly those who may be new to the crypto space.

-

Comprehensive Strategy Portfolio: With over 25 vaults and multiple one-click strategies, Cybro offers a diverse range of investment options. This variety allows investors to tailor their portfolios according to their individual risk tolerance and financial objectives.

The Team and Backers

The success of any cryptocurrency project heavily relies on the expertise and vision of its team. While specific details about the founding members and backers of Cybro Coin may not be widely available, the project is backed by a community of developers and investors passionate about revolutionizing the DeFi landscape.

The team has experience in blockchain technology, finance, and AI, which contributes to the robust design of the platform. Their collective expertise helps ensure that Cybro remains relevant and competitive in the fast-paced crypto market.

Moreover, the project is often supported by a community of users who provide feedback and contribute to its development. This community engagement is essential for fostering trust and transparency, which are vital in the cryptocurrency sector.

Fundamental Purpose in the Crypto Ecosystem

Cybro Coin serves a significant purpose within the broader cryptocurrency ecosystem. By bridging the gap between complex DeFi mechanisms and user-friendly investment strategies, it empowers individuals to take control of their financial future.

The fundamental purpose of Cybro is to democratize access to investment opportunities. By simplifying the process of yield farming, staking, and other investment strategies, Cybro aims to attract a diverse range of users, from those just starting their crypto journey to experienced traders looking for optimized strategies.

In conclusion, Cybro Coin represents a promising innovation in the cryptocurrency space, combining advanced technology with a user-centric approach to create a platform that meets the needs of modern investors. As the DeFi landscape continues to evolve, Cybro’s emphasis on accessibility and efficiency positions it as a valuable asset for those seeking to navigate the complexities of digital finance.

The Technology Behind the Coin: How It Works

Introduction to CYBRO Coin Technology

CYBRO Coin is an innovative digital asset designed to power a multichain earn marketplace. As a cryptocurrency, it leverages advanced blockchain technologies to provide users with a diverse range of investment opportunities, including yield farming, staking, and lending. This guide will explore the technology behind CYBRO Coin, breaking down its blockchain architecture, consensus mechanism, and key technological innovations in a beginner-friendly manner.

Blockchain Architecture

The architecture of CYBRO Coin is built on a multichain framework, allowing it to operate across various blockchain networks. Currently, CYBRO supports multiple chains, including Blast, Base, Arbitrum, and BNB Chain. This multichain approach provides several advantages:

-

Interoperability: By being multichain, CYBRO can interact with different blockchain ecosystems. This means that users can access a wider variety of DeFi (Decentralized Finance) products and services without being limited to a single blockchain.

-

Scalability: Operating on multiple chains helps to distribute the transaction load, reducing congestion and enhancing the overall speed and efficiency of transactions. This is particularly important in high-demand periods when a single chain may become overloaded.

-

Flexibility: The ability to switch between chains allows CYBRO to optimize its operations based on the specific strengths of each blockchain, such as lower fees or faster transaction times.

Consensus Mechanism

Proof-of-Stake (PoS)

CYBRO Coin utilizes a Proof-of-Stake (PoS) consensus mechanism. Unlike traditional Proof-of-Work (PoW) systems, which require extensive computational power and energy consumption, PoS allows participants to validate transactions based on the number of coins they hold and are willing to “stake” as collateral. Here’s how it works:

-

Staking: Users can lock up a certain amount of CYBRO coins in the network to participate in the validation process. The more coins they stake, the higher their chances of being selected to validate transactions and earn rewards.

-

Energy Efficiency: PoS is significantly more energy-efficient compared to PoW. It reduces the need for powerful mining rigs, making it a more sustainable option for blockchain operations.

-

Security: In a PoS system, validators have a vested interest in maintaining the integrity of the blockchain. If they act maliciously, they risk losing their staked coins, which incentivizes honest behavior.

Key Technological Innovations

CYBRO Coin incorporates several technological innovations that enhance its functionality and user experience. These innovations are designed to simplify the investment process and provide users with powerful tools for managing their portfolios.

AI-Powered Investment Tools

One of the standout features of CYBRO Coin is its AI-driven investment tools. The platform includes an AI broker that recommends optimal investment strategies based on individual user preferences. Here’s how it works:

-

Personalized Recommendations: The AI analyzes market data, user preferences, and risk tolerance to suggest tailored investment options. This helps users make informed decisions without needing extensive knowledge of the cryptocurrency market.

-

Real-Time Analysis: The AI continuously monitors market conditions, adjusting recommendations as needed. This ensures that users are always equipped with the most current and relevant investment options.

Investment Vaults

CYBRO’s investment structure is built around the concept of “Vaults.” These Vaults are essentially pools that aggregate various investment strategies, allowing users to participate in yield farming, staking, and lending with ease. Here’s how they function:

-

Diverse Strategies: CYBRO offers over 25 different Vaults, each tailored for varying risk levels and investment goals. This diversity allows users to select strategies that align with their financial objectives.

-

One-Click Strategies: For users who may not be familiar with complex investment mechanisms, CYBRO provides One-Click strategies. These simplified options allow users to invest in multiple protocols and strategies with a single action, making the investment process more accessible.

Smart Notifications and Portfolio Management

To enhance the user experience, CYBRO Coin includes smart notifications and portfolio management tools. These features help users stay informed and in control of their investments:

-

Smart Notifications: Users receive alerts about important market changes, investment performance, and other relevant updates. This feature allows users to react promptly to market movements and make timely decisions.

-

Portfolio Management Tools: CYBRO provides tools that help users track their investments, assess performance, and adjust strategies as needed. This comprehensive management capability is crucial for optimizing returns and minimizing risks.

Security Features

Security is a paramount concern in the cryptocurrency space, and CYBRO Coin incorporates several features to ensure user safety:

-

Smart Contract Audits: The smart contracts underlying the CYBRO ecosystem are subject to rigorous audits. This process helps identify and mitigate vulnerabilities, ensuring the integrity of the platform.

-

Decentralization: By leveraging a multichain architecture, CYBRO minimizes the risk of single points of failure. This decentralized approach enhances the overall security and reliability of the platform.

-

User Control: Users retain control over their assets at all times. The platform is designed to empower users with the ability to manage their investments without relying on third parties.

Future Developments

As the cryptocurrency landscape evolves, CYBRO Coin is committed to continuous improvement and innovation. Future developments may include:

-

Expansion to Additional Chains: CYBRO aims to expand its operations to even more blockchain networks, further enhancing interoperability and user choice.

-

Enhanced AI Capabilities: Ongoing advancements in AI technology will likely lead to even more sophisticated investment tools and strategies, further simplifying the investment process for users.

-

Community Engagement: CYBRO plans to foster a strong community around its platform, encouraging user feedback and participation in the development process. This collaborative approach will help shape the future of the CYBRO ecosystem.

Conclusion

In summary, CYBRO Coin combines cutting-edge technology with user-friendly features to create a robust multichain earn marketplace. By leveraging a PoS consensus mechanism, AI-powered tools, and innovative investment strategies, CYBRO aims to empower users to navigate the complex world of cryptocurrency investment with confidence. As the platform continues to evolve, it holds the promise of becoming a significant player in the DeFi space, providing users with a seamless and rewarding investment experience.

Understanding cybro coin Tokenomics

Tokenomics Overview

Cybro Coin (CYBRO) operates within a rapidly evolving ecosystem that focuses on providing users with an AI-powered multichain earn marketplace. Understanding the tokenomics of CYBRO is crucial for investors and enthusiasts looking to navigate its potential benefits and risks. The tokenomics encompasses aspects such as supply, distribution, utility, and the economic model underpinning the asset.

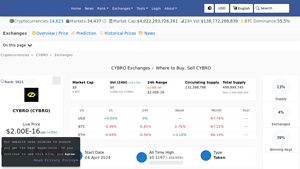

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 499.99 million CYBRO |

| Max Supply | 1 billion CYBRO |

| Circulating Supply | 132.39 million CYBRO |

| Inflation/Deflation Model | Deflationary Model |

Total Supply, Max Supply, and Circulating Supply

The total supply of CYBRO is set at 499.99 million coins, while the maximum supply is capped at 1 billion coins. This indicates that there is still a significant amount of CYBRO that can be released into circulation, which can affect its market dynamics.

As of now, the circulating supply stands at approximately 132.39 million CYBRO. This means that about 13.24% of the total supply is currently available for trading and use within the ecosystem. The remaining tokens are likely held in reserve for future development, strategic partnerships, or other purposes decided by the governance mechanisms of the project.

The inflation/deflation model for CYBRO operates on a deflationary basis. This means that as demand for the token increases, its scarcity may lead to a rise in value. The tokenomics structure encourages a reduction in supply over time, typically through mechanisms such as token burns or buybacks, which can enhance the long-term value proposition for holders.

Token Utility (What is the coin used for?)

Cybro Coin serves multiple purposes within its ecosystem, primarily designed to facilitate participation in various financial activities. The key utilities of CYBRO include:

-

Access to Investment Tools: CYBRO acts as the primary medium through which users can access the platform’s investment tools, including yield farming, staking, and lending services. Users can leverage CYBRO to invest in different strategies based on their risk appetite and financial goals.

-

Participation in Vaults: The core feature of the Cybro platform is its Vaults, which offer users the ability to earn returns on their investments. These Vaults aggregate various investment strategies and protocols, allowing users to choose options that align with their financial objectives. Holding CYBRO tokens is often necessary to participate in these Vaults.

-

Transaction Fees: CYBRO may be used to pay for transaction fees within the ecosystem, providing an incentive for users to hold and utilize the token rather than converting it into other assets.

-

Governance: As the project evolves, CYBRO holders may gain governance rights, allowing them to vote on key decisions related to the platform’s future. This could include proposals for new features, changes in fee structures, or adjustments to the economic model.

-

Incentives and Rewards: Users can earn rewards by staking CYBRO or participating in liquidity pools. This incentivizes users to hold onto their tokens rather than sell them, contributing to a more stable ecosystem.

Token Distribution

Understanding the distribution of CYBRO is essential for assessing its market dynamics and potential for growth. The distribution model generally includes several key components:

-

Initial Distribution: A portion of the tokens is typically allocated to early investors, founders, and team members. This allocation ensures that those who contributed to the project’s development have a stake in its success.

-

Community Incentives: A significant amount of CYBRO tokens may be reserved for community incentives, including rewards for users who participate in the platform’s various features. This can include yield farming rewards, staking bonuses, and liquidity mining incentives.

-

Development and Operations: A portion of the total supply is often allocated to fund ongoing development, marketing initiatives, and operational costs. This ensures that the project has the necessary resources to grow and evolve over time.

-

Reserves: A reserve allocation may be set aside for strategic partnerships, collaborations, or unforeseen expenses. This flexibility allows the project to adapt to changing market conditions and opportunities.

-

Burn Mechanisms: To support the deflationary model, the project may implement token burn mechanisms. This involves permanently removing a portion of the circulating supply from the market, which can help increase scarcity and potentially drive up the value of remaining tokens.

Conclusion

The tokenomics of Cybro Coin is structured to facilitate a vibrant and sustainable ecosystem centered around earning and investment. By understanding the key metrics, utility, and distribution of CYBRO, investors and users can make informed decisions about their engagement with the platform. As the cryptocurrency landscape continues to evolve, the mechanisms embedded in CYBRO’s tokenomics will play a crucial role in determining its long-term viability and success.

Price History and Market Performance

Overview of CYBRO Coin’s Price Journey

CYBRO Coin, a digital asset associated with the multichain AI-powered earn marketplace, has had a notable price trajectory since its inception. Understanding its historical price milestones and the factors that have influenced its market performance can provide investors with valuable insights.

Key Historical Price Milestones

-

Initial Launch and Early Days:

CYBRO Coin was launched in early 2024, entering the market with an initial price point around $0.01. Its debut was met with moderate interest, which is typical for new cryptocurrencies as they seek to establish their presence. -

All-Time High:

The peak price for CYBRO Coin was recorded at approximately $0.0234 on April 6, 2025. This all-time high marked a significant moment for the asset, reflecting increased investor interest and market activity. During this period, CYBRO’s innovative features, such as AI-driven investment strategies and yield farming opportunities, garnered attention, contributing to its price appreciation. -

Recent Price Activity:

Following its all-time high, CYBRO experienced a notable decline, with prices dropping significantly over the ensuing months. By October 2025, the price fell to around $0.0061, indicating a decline of approximately 74% from its peak. This downward trend can be attributed to various market dynamics and investor sentiment. -

Lowest Price Points:

The lowest recorded price for CYBRO Coin was approximately $0.003632, reached on June 27, 2025. This period of low valuation highlighted the volatility often seen in the cryptocurrency market, particularly for newer and less established assets. -

Current Price Performance:

As of the latest data, CYBRO Coin is trading at approximately $0.0061. With a 24-hour trading volume of around $37,205, the market capitalization stands at approximately $806,565. This performance indicates that while CYBRO has faced significant price fluctuations, it maintains a presence in the market.

Factors Influencing the Price

Historically, the price of CYBRO Coin has been influenced by a multitude of factors that are common in the cryptocurrency ecosystem:

-

Market Sentiment:

Investor sentiment plays a crucial role in the price movements of cryptocurrencies. Positive developments, such as partnerships, technological advancements, or successful marketing campaigns, can lead to increased investor confidence and price appreciation. Conversely, negative news, regulatory concerns, or market downturns can lead to sell-offs and price declines. -

Technological Developments:

CYBRO’s unique features, including its AI-driven investment strategies and diverse yield farming options, have attracted interest from both retail and institutional investors. As the platform evolves and introduces new functionalities, it can significantly impact the demand for CYBRO Coin, subsequently influencing its price. -

Overall Market Conditions:

The broader cryptocurrency market conditions have a profound effect on individual assets. Bull markets, characterized by rising prices across multiple cryptocurrencies, often lead to increased interest and investment in assets like CYBRO Coin. Conversely, bear markets can result in decreased trading volumes and lower prices, as seen in the months following CYBRO’s all-time high. -

Liquidity and Trading Volume:

The liquidity of CYBRO Coin, measured by its trading volume, has fluctuated since its launch. Higher trading volumes typically indicate greater investor interest and can lead to more stable price movements. Conversely, low liquidity can result in higher volatility and larger price swings. -

Market Capitalization:

With a current market capitalization of approximately $806,565, CYBRO Coin’s price is affected by its market cap relative to other cryptocurrencies. Lower market cap assets can be more susceptible to price manipulation and volatility, as smaller amounts of capital can lead to larger percentage changes in price. -

Regulatory Developments:

Regulatory news and government policies regarding cryptocurrencies can have immediate effects on market sentiment and price movements. Positive regulatory frameworks can boost investor confidence, while negative regulations may lead to panic selling and price declines.

Conclusion

The price history and market performance of CYBRO Coin illustrate the inherent volatility and complexity of the cryptocurrency market. From its initial launch and subsequent all-time high to its more recent price fluctuations, various factors have influenced its trajectory. Understanding these dynamics is crucial for both novice and intermediate investors as they navigate the evolving landscape of digital assets. By analyzing historical trends and market influences, investors can make more informed decisions regarding their investments in CYBRO Coin.

Where to Buy cybro coin: Top Exchanges Reviewed

5 Steps to Seamlessly Purchase Cybro (CYBRO) Today!

The article “How to Buy Cybro (CYBRO) Step-by-Step Guide – CoinCodex” highlights the advantages of purchasing CYBRO through reputable exchanges like Gate and MEXC. Both platforms stand out for their user-friendly interfaces, robust security measures, and a wide range of trading options, making them ideal choices for both novice and experienced investors. The guide provides clear instructions to facilitate a seamless buying experience for Cybro enthusiasts.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. CYBRO – Your Gateway to Next-Gen Crypto Trading!

Gate.com distinguishes itself as a user-friendly cryptocurrency exchange, particularly for purchasing CYBRO (CYBRO). The platform provides a straightforward four-step guide that simplifies the buying process, making it accessible for both beginners and experienced investors. With a diverse selection of cryptocurrencies available, Gate.com not only facilitates seamless transactions but also enhances user experience through its intuitive interface and robust support resources.

- Website: gate.com

- Platform Age: Approx. 29 years (domain registered in 1996)

5. CYBRO – Your Gateway to Easy Trading!

CYBRO (CYBRO) is available for trading on two prominent exchanges: Gate and Bitmart, making it relatively accessible for investors interested in this digital asset. What sets these exchanges apart is their robust security measures and user-friendly interfaces, which cater to both novice and experienced traders. Additionally, the limited number of platforms offering CYBRO may enhance its appeal for those seeking exclusivity in their investment portfolios.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. CYBRO – Your AI-Powered Gateway to Multichain Earnings!

CYBRO distinguishes itself as an innovative AI-powered multichain earn marketplace, enabling users to tailor their investment strategies according to personal risk tolerance and return expectations. With a diverse range of tools such as staking, farming, and lending, CYBRO simplifies the investment process, allowing both novice and experienced investors to navigate the complex world of digital assets efficiently and effectively. This unique approach positions CYBRO as a versatile platform in the rapidly evolving cryptocurrency landscape.

- Website: cybro.io

- Platform Age: Approx. 1 years (domain registered in 2024)

3. Cybro Crypto – Your Step-by-Step Guide to Smart Investing!

The article “How to Buy Cybro Crypto Step by Step – CoinCarp” provides a comprehensive guide for purchasing Cybro, a lesser-known cryptocurrency often absent from mainstream exchanges. It highlights the unique challenges of investing in such tokens, including potential liquidity issues and the inherent risks involved. By focusing on alternative platforms and offering detailed instructions, CoinCarp empowers investors to navigate the complexities of acquiring Cybro, making it a valuable resource for both novice and experienced traders.

- Website: coincarp.com

- Platform Age: Approx. 4 years (domain registered in 2021)

How to Buy cybro coin: A Step-by-Step Guide

Step 1: Choose a Cryptocurrency Exchange

The first step in purchasing Cybro Coin (CYBRO) is selecting a cryptocurrency exchange that supports this digital asset. Some popular exchanges where you can find CYBRO include:

- Coinbase: Known for its user-friendly interface, Coinbase is an excellent choice for beginners.

- Gate.io: This exchange offers a variety of trading options and supports many altcoins, including CYBRO.

- Uniswap: If you prefer decentralized exchanges, Uniswap allows you to swap tokens directly from your wallet.

Before choosing an exchange, consider factors such as trading fees, security features, and available payment methods. Ensure the exchange is reputable and has a solid track record.

Step 2: Create and Verify Your Account

Once you have selected an exchange, you need to create an account:

-

Sign Up: Navigate to the exchange’s website and click on the ‘Sign Up’ or ‘Register’ button. Fill in the required information, including your email address and a secure password.

-

Email Verification: Check your email inbox for a verification link. Click on it to confirm your email address.

-

Identity Verification: Most exchanges require identity verification to comply with regulations. You may need to upload documents such as a government-issued ID and a proof of address. This process can take a few minutes to several days, depending on the exchange.

Step 3: Deposit Funds

After your account is verified, you need to deposit funds to purchase CYBRO:

-

Choose Deposit Method: Log into your account and navigate to the ‘Deposit’ section. Most exchanges allow deposits via bank transfers, credit/debit cards, or other cryptocurrencies.

-

Select Currency: Choose the currency you wish to deposit (e.g., USD, EUR, or another cryptocurrency).

-

Complete the Deposit: Follow the instructions provided by the exchange to complete your deposit. If using a bank transfer, be aware that it may take a few days to reflect in your account, while card transactions are usually instantaneous.

Step 4: Place an Order to Buy Cybro Coin

Once your funds are available in your exchange account, you can place an order to buy CYBRO:

-

Navigate to CYBRO Trading Page: Use the search function to find CYBRO or locate it in the list of available cryptocurrencies on the exchange.

-

Select Order Type: Decide which type of order you want to place:

– Market Order: This order buys CYBRO at the current market price. It is executed immediately.

– Limit Order: This order allows you to specify a price at which you want to buy CYBRO. It will only be executed if the market reaches your desired price. -

Enter Order Details: If placing a market order, enter the amount of CYBRO you want to buy. If using a limit order, specify the price and amount.

-

Confirm the Order: Review your order details and confirm the transaction. You should receive a confirmation once the order is executed.

Step 5: Secure Your Coins in a Wallet

After purchasing CYBRO, it is essential to store your coins securely:

-

Choose a Wallet: While you can leave your CYBRO on the exchange, it is recommended to transfer it to a personal wallet for better security. You can choose between:

– Software Wallets: These are applications that can be installed on your computer or mobile device (e.g., Trust Wallet, Exodus).

– Hardware Wallets: These are physical devices that store your cryptocurrency offline (e.g., Ledger, Trezor). They offer enhanced security against hacks. -

Transfer Your CYBRO: To transfer your coins, navigate to the ‘Withdraw’ section of your exchange account. Enter your wallet address and the amount of CYBRO you wish to transfer. Double-check the address to avoid mistakes.

-

Confirm the Transfer: Follow any additional security steps required by the exchange, such as two-factor authentication (2FA). Once confirmed, your CYBRO will be sent to your wallet.

By following these steps, you can successfully purchase and secure your Cybro Coin. Always stay informed about the market and practice good security measures to protect your investment.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Innovative Use of AI in Investment Strategies

CYBRO is positioned as a multichain AI-powered earn marketplace, which provides a unique selling proposition in the crowded cryptocurrency market. By leveraging artificial intelligence, CYBRO offers tailored investment strategies that align with user preferences for risk and return. The AI Broker feature recommends optimal investment options, enhancing user experience and potentially improving investment outcomes. This innovation may attract users looking for sophisticated investment solutions without requiring deep financial knowledge.

2. Diverse Investment Options

The platform boasts a range of investment tools, including yield farming, staking, and lending. With over 25 vaults and six one-click strategies deployed across multiple chains, CYBRO caters to various risk appetites and investment goals. This diversity not only makes it appealing to a broad audience but also increases the likelihood of user retention, as investors can find strategies that fit their changing needs over time.

3. Market Demand for Yield Generation

In the current economic climate, many investors are seeking ways to generate passive income. Yield farming and staking have gained popularity as methods to earn returns on cryptocurrency holdings. CYBRO’s focus on these areas aligns well with market demand, positioning it to attract users looking to maximize their returns in a low-interest-rate environment.

4. Growing Ecosystem and Chain Expansion

CYBRO is built on multiple blockchain networks, including Blast, Base, Arbitrum, and BNB. This multichain approach not only enhances its reach and accessibility but also reduces reliance on any single blockchain ecosystem. As the platform continues to expand to additional chains, it could tap into new user bases and liquidity pools, further enhancing its growth potential.

5. Positive Community Sentiment

Community engagement is a crucial factor in the success of cryptocurrencies. CYBRO has shown a favorable sentiment among its users, with a significant percentage of tweets reflecting bullish attitudes. This positive sentiment could lead to increased interest and investment in the token, driving demand and potentially increasing its value over time.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies are notorious for their price volatility. CYBRO’s current price of approximately $0.006091 reflects a significant drop from its all-time high of $0.1579, indicating potential susceptibility to market fluctuations. Such volatility can lead to sharp declines in value, which may deter new investors or cause existing holders to exit the market. Investors should be prepared for the possibility of significant price swings, which could impact their investment strategies.

2. Regulatory Uncertainty

The regulatory environment surrounding cryptocurrencies is evolving and can vary significantly from one jurisdiction to another. Uncertainty regarding regulations can pose risks to the operations of platforms like CYBRO. Stricter regulations may limit the types of services offered or impose additional compliance costs, which could hinder growth and profitability. Investors need to stay informed about regulatory developments that may affect the broader cryptocurrency market and CYBRO specifically.

3. Intense Competition

The decentralized finance (DeFi) space is highly competitive, with numerous platforms offering similar services. CYBRO faces competition from established players as well as new entrants that may offer innovative features or lower fees. This competition could pressure CYBRO to continuously improve its offerings and may impact its market share and profitability. Investors should consider how CYBRO differentiates itself and whether it can maintain a competitive edge in a rapidly evolving landscape.

4. Technological Risks

As a blockchain-based platform, CYBRO is subject to various technological risks, including potential vulnerabilities in smart contracts and security breaches. Any successful attack on the platform could lead to significant financial losses for users and damage the platform’s reputation. Furthermore, the reliance on multiple chains increases complexity and the potential for interoperability issues. Investors should assess the robustness of CYBRO’s technology and its commitment to security measures.

5. Limited Market Capitalization

With a market capitalization of approximately $806.56K, CYBRO is still a relatively small player in the cryptocurrency market. While this can present opportunities for growth, it also implies higher risk. Smaller market cap coins can be more susceptible to manipulation, and lower liquidity may lead to larger price swings. Investors should be cautious of the risks associated with investing in low-cap cryptocurrencies and consider how this aligns with their overall investment strategy.

Conclusion

Investing in CYBRO offers a mix of potential strengths and risks that require careful consideration. Its innovative use of AI, diverse investment strategies, and alignment with market demand for yield generation present compelling reasons for interest. However, investors must also be aware of the inherent volatility of the cryptocurrency market, regulatory uncertainties, and competitive pressures that could impact CYBRO’s success. As with any investment, thorough research and a clear understanding of both the potential and the risks are essential for making informed decisions.

Frequently Asked Questions (FAQs)

1. What is Cybro Coin (CYBRO)?

Cybro Coin (CYBRO) is a digital asset associated with the Cybro platform, which is an AI-powered multichain earn marketplace. It offers various investment tools and strategies, focusing on yield farming through a set of investment vaults. These vaults allow users to engage in staking, lending, and other investment options with different levels of risk and return.

2. Who created Cybro Coin?

Cybro Coin was developed by a team dedicated to creating a user-friendly platform that integrates artificial intelligence to optimize investment strategies. While specific individual names may not be publicly disclosed, the project aims to simplify the investment process in decentralized finance (DeFi).

3. How does Cybro Coin work?

Cybro Coin operates on a multichain ecosystem, utilizing smart contracts to facilitate various financial services such as yield farming, staking, and lending. The platform aggregates investment options across different blockchains, allowing users to choose strategies based on their risk appetite and investment goals.

4. What makes Cybro Coin different from Bitcoin?

Unlike Bitcoin, which primarily serves as a digital currency and a store of value, Cybro Coin is designed specifically for investment and earning strategies within the DeFi space. Cybro Coin focuses on providing users with tools for yield farming and other financial services, leveraging AI to enhance investment decisions.

5. Is Cybro Coin a good investment?

As with any cryptocurrency investment, the potential for profit comes with risks. Cybro Coin has shown significant price volatility, with an all-time high of $0.0234 and a current price around $0.0061. Investors should conduct thorough research, consider market trends, and evaluate their risk tolerance before investing in Cybro Coin.

6. What is the current market cap of Cybro Coin?

As of now, Cybro Coin has a market cap of approximately $807,000. Market capitalization is a crucial indicator of a cryptocurrency’s overall value and market position, calculated by multiplying the current price by the circulating supply of the coin.

7. How can I buy Cybro Coin?

Cybro Coin can be purchased on various cryptocurrency exchanges. To buy Cybro Coin, you typically need to create an account on an exchange that lists CYBRO, deposit funds (such as USD or other cryptocurrencies), and then trade those funds for Cybro Coin. Always ensure you follow safe trading practices and verify the exchange’s credibility.

8. What are the risks associated with investing in Cybro Coin?

Investing in Cybro Coin, like any cryptocurrency, carries inherent risks. These include price volatility, regulatory changes, and potential technological vulnerabilities. Additionally, since Cybro Coin operates in the DeFi space, users should be cautious about smart contract risks and the possibility of losing funds due to hacks or exploits. It’s essential to stay informed and only invest what you can afford to lose.

Final Verdict on cybro coin

Overview of CYBRO Coin

CYBRO Coin operates as a multichain AI-powered earn marketplace, primarily designed to provide users with investment tools tailored to their risk tolerance and desired returns. With a current price of approximately $0.0061 and a market capitalization around $807,000, CYBRO presents itself as an aggregator for various investment options, including staking, farming, and lending. The platform’s unique feature is its investment Vaults, which simplify the process of yield farming through user-friendly strategies.

Technology and Features

Built on multiple blockchain ecosystems, including Ethereum and BNB Chain, CYBRO utilizes advanced technology to streamline the investment process. Its AI Broker recommends optimal investment strategies based on user preferences, while the platform offers over 25 Vaults and multiple one-click strategies. This flexibility allows users to diversify their investments across different protocols, enhancing the overall user experience.

Market Potential and Risks

Despite its innovative approach and the potential for growth, investing in CYBRO Coin is not without risks. The cryptocurrency market is notoriously volatile, and CYBRO’s historical performance reflects this, having reached an all-time high of $0.0234 before experiencing significant declines. Currently, it trades at over 96% below its peak, indicating the potential for both high rewards and substantial losses.

Conclusion

In conclusion, CYBRO Coin is an intriguing asset within the cryptocurrency landscape, offering innovative solutions for investors seeking to maximize returns through automated strategies. However, it is essential to recognize that this asset class carries a high-risk profile, making it crucial for potential investors to conduct thorough research before committing capital. As always, the mantra of “Do Your Own Research” (DYOR) remains paramount in navigating the complexities of digital asset investments.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.