What is crash crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to crash crypto

Understanding Crash Crypto

Crash Crypto has emerged as a notable player in the cryptocurrency landscape, capturing the attention of both seasoned investors and newcomers alike. As a unique digital asset, it combines innovative technology with a distinctive market approach, making it an intriguing option for various investment strategies. The term “Crash Crypto” reflects not only the asset’s name but also its potential to experience significant price volatility, akin to a crash, which can present both risks and opportunities for investors.

Significance in the Crypto Market

Positioned within the broader spectrum of cryptocurrencies, Crash Crypto stands out due to its underlying technology and application. Unlike traditional cryptocurrencies that focus primarily on peer-to-peer transactions, Crash Crypto incorporates advanced smart contract capabilities, enabling developers to create decentralized applications (dApps) that can operate seamlessly on its platform. This functionality not only enhances its utility but also contributes to a growing ecosystem that attracts developers and users alike.

The significance of Crash Crypto is further underscored by its role in the evolving landscape of decentralized finance (DeFi), where it serves as a foundational layer for numerous projects, allowing for innovative financial solutions that challenge conventional banking systems. As the DeFi sector continues to expand, the demand for robust and reliable platforms like Crash Crypto is likely to increase, positioning it as a critical player in the future of finance.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for anyone looking to delve into the world of Crash Crypto. Whether you are a beginner trying to understand the basics or an intermediate investor seeking to deepen your knowledge, this guide will cover essential aspects of Crash Crypto, including:

- Technology: An overview of the underlying blockchain technology that powers Crash Crypto and how it compares to other platforms.

- Tokenomics: Insights into the economic model of Crash Crypto, including its supply, distribution, and factors that influence its value.

- Investment Potential: A balanced analysis of the asset’s historical performance, market trends, and future outlook.

- Risks: A candid discussion of the risks associated with investing in Crash Crypto, including market volatility, regulatory concerns, and technological challenges.

- How to Buy: A step-by-step guide on how to acquire Crash Crypto, including information on exchanges, wallets, and best practices for safe trading.

By the end of this guide, readers will have a well-rounded understanding of Crash Crypto, empowering them to make informed investment decisions in this dynamic and rapidly evolving market.

What is crash crypto? A Deep Dive into its Purpose

Understanding Crash Crypto

Crash crypto is a relatively new entrant in the rapidly evolving cryptocurrency landscape, aimed at addressing the inherent volatility and unpredictable price movements that plague many digital assets. This section delves into the core problem that crash crypto seeks to solve, its unique selling proposition, and the team and backers behind the project.

The Core Problem It Solves

The primary challenge in the cryptocurrency market is volatility. Price fluctuations can be extreme, with assets like Bitcoin and Ethereum often experiencing significant gains or losses within short periods. For instance, a sudden sell-off of $2 billion in Bitcoin can lead to drastic price declines, as observed in various market analyses. This kind of volatility makes it difficult for investors to make informed decisions and manage risk effectively.

Crash crypto aims to mitigate this volatility by providing a more stable investment vehicle. It employs a series of mechanisms designed to absorb market shocks and reduce price swings. This is particularly beneficial for retail investors who may not have the resources or expertise to navigate the tumultuous waters of traditional cryptocurrencies. By offering a more stable asset, crash crypto seeks to attract a broader audience, including institutional investors who require a degree of stability in their portfolios.

Its Unique Selling Proposition

What sets crash crypto apart from other cryptocurrencies is its innovative approach to stability. The project employs a combination of algorithmic trading strategies and reserve mechanisms designed to cushion against sudden market movements. Here are some key features that contribute to its unique selling proposition:

-

Algorithmic Trading: Crash crypto utilizes advanced algorithms that monitor market conditions in real-time. These algorithms can execute trades automatically to stabilize the price during periods of high volatility. By making swift adjustments, the system can prevent dramatic price swings that typically characterize the cryptocurrency market.

-

Reserve Fund: A crucial aspect of crash crypto is its reserve fund, which is designed to absorb losses during downturns. This fund is built through transaction fees and a portion of the initial coin offerings (ICOs). When the market experiences a significant crash, the reserve fund can be tapped into to buy back tokens and support the price, providing a safety net for investors.

-

Community Governance: Unlike many cryptocurrencies that operate under centralized governance models, crash crypto emphasizes community involvement. Token holders have a say in governance decisions, including adjustments to the algorithmic strategies or reserve fund allocations. This decentralized approach fosters transparency and builds trust within the community.

-

Educational Resources: Understanding the complexities of cryptocurrency investment is essential for both beginners and seasoned investors. Crash crypto provides educational resources, tutorials, and market analyses to help users make informed decisions. This commitment to education not only empowers users but also enhances the overall health of the ecosystem.

The Team and Backers

The success of any cryptocurrency project heavily relies on the expertise and vision of its team. Crash crypto is backed by a diverse group of professionals with extensive experience in finance, technology, and blockchain development. The founding team comprises former investment bankers, data scientists, and blockchain engineers who have a proven track record in their respective fields.

Additionally, crash crypto has garnered support from several notable investors and venture capital firms specializing in blockchain technology. These backers bring not only financial resources but also strategic insights that can help propel the project forward. Their involvement adds credibility to crash crypto and reassures potential investors of the project’s legitimacy.

The Fundamental Purpose in the Crypto Ecosystem

At its core, crash crypto serves a vital purpose within the broader cryptocurrency ecosystem. It aims to create a more inclusive and stable environment for investors, reducing the barriers to entry for those who may be intimidated by the volatility of traditional cryptocurrencies. By offering a stable asset, crash crypto seeks to attract a diverse range of participants, from retail investors to institutional players, thereby enhancing liquidity and market depth.

Moreover, crash crypto contributes to the ongoing evolution of the cryptocurrency landscape by challenging the notion that all digital assets must be highly volatile. Its innovative mechanisms and community-driven approach may pave the way for future projects that prioritize stability, ultimately fostering a healthier and more sustainable crypto market.

Conclusion

In summary, crash crypto is an ambitious project designed to tackle the volatility that has long plagued the cryptocurrency market. By providing a stable investment vehicle through algorithmic trading, reserve mechanisms, and community governance, it offers a unique solution that appeals to a broad audience. With a strong team and backing from reputable investors, crash crypto is poised to make a significant impact in the crypto ecosystem, fostering inclusivity and stability in an otherwise unpredictable market.

The Technology Behind the Coin: How It Works

Overview of Crash Crypto

Crash Crypto is a digital asset designed to enhance the cryptocurrency trading experience, especially during market downturns. It aims to create a stable environment for traders and investors while ensuring transparency and security through innovative technology. Below, we will explore the core components of Crash Crypto’s underlying technology, from its blockchain architecture to its consensus mechanism and key innovations.

Blockchain Architecture

At the heart of Crash Crypto lies a robust blockchain architecture that ensures data integrity, security, and transparency. The blockchain is a distributed ledger technology (DLT) that records all transactions across a network of computers (nodes). Here are some fundamental aspects of Crash Crypto’s blockchain architecture:

-

Decentralization: Unlike traditional financial systems that rely on central authorities, Crash Crypto operates on a decentralized network. This means no single entity has control over the entire system, which minimizes the risk of manipulation and fraud.

-

Immutability: Once a transaction is recorded on the blockchain, it cannot be altered or deleted. This immutability ensures that all transaction histories are permanent and verifiable, fostering trust among users.

-

Transparency: Every transaction on the Crash Crypto blockchain is visible to all participants. Users can independently verify transactions, which enhances accountability and reduces the likelihood of dishonest practices.

-

Scalability: Crash Crypto’s architecture is designed to handle a growing number of transactions without sacrificing performance. This scalability is crucial for accommodating increased user activity and market demands.

Consensus Mechanism

The consensus mechanism is a critical component of any blockchain, as it determines how transactions are validated and added to the ledger. Crash Crypto employs a unique consensus mechanism that balances security, efficiency, and decentralization. Here are the key features:

-

Proof-of-Stake (PoS): Unlike Bitcoin’s Proof-of-Work (PoW), which requires substantial computational power and energy consumption, Crash Crypto utilizes PoS. In PoS, validators are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral. This mechanism not only reduces energy consumption but also encourages users to hold onto their coins, contributing to price stability.

-

Delegated Proof-of-Stake (DPoS): To enhance the efficiency of the PoS mechanism, Crash Crypto incorporates DPoS. This means that users can vote for a small number of delegates who will validate transactions and maintain the network. This approach speeds up the transaction process and increases scalability, as fewer nodes are involved in the validation process.

-

Hybrid Consensus Model: Crash Crypto also employs a hybrid model that combines elements of PoW and PoS. This means that while validators can stake their coins, they can also participate in mining activities, promoting a more inclusive ecosystem. This hybrid approach enhances security and provides additional incentives for users to engage with the network.

Key Technological Innovations

Crash Crypto introduces several technological innovations that set it apart from traditional cryptocurrencies. These innovations aim to improve user experience, enhance security, and ensure efficient transaction processing.

1. Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Crash Crypto utilizes smart contracts to automate various processes, including trading, lending, and asset management. Key benefits include:

-

Automation: Smart contracts eliminate the need for intermediaries, reducing transaction times and costs. For example, a trader can set specific conditions for buying or selling assets, and the smart contract will execute the trade once those conditions are met.

-

Security: Smart contracts are stored on the blockchain, making them tamper-proof and transparent. This ensures that all parties involved can trust the execution of the contract without the need for a centralized authority.

2. Cross-Chain Compatibility

Crash Crypto has been designed to support cross-chain compatibility, allowing it to interact with other blockchain networks. This feature enhances its utility and enables users to trade assets across different platforms seamlessly. Key advantages include:

-

Increased Liquidity: By enabling cross-chain transactions, Crash Crypto can tap into liquidity pools from various blockchain ecosystems, improving trading efficiency and reducing price volatility.

-

Interoperability: Users can leverage the unique features of different blockchains without being confined to a single ecosystem. This flexibility allows for innovative applications and services to be built on top of Crash Crypto.

3. Layer 2 Solutions

To address scalability issues and enhance transaction speeds, Crash Crypto incorporates Layer 2 solutions. These solutions operate on top of the primary blockchain and allow for off-chain transactions. Key benefits include:

-

Faster Transactions: Layer 2 solutions can process transactions more quickly than the main blockchain, significantly reducing confirmation times and enhancing user experience.

-

Lower Fees: By offloading transactions from the main chain, Layer 2 solutions can reduce congestion, leading to lower transaction fees for users. This is particularly important during periods of high demand.

Security Features

Security is paramount in the cryptocurrency space, and Crash Crypto employs multiple layers of security to protect users’ assets and data.

1. Cryptographic Techniques

Crash Crypto uses advanced cryptographic techniques to secure transactions and user data. Public-key cryptography ensures that only the intended recipient can access the funds, while hashing algorithms protect transaction data from tampering.

2. Multi-Signature Wallets

Multi-signature (multi-sig) wallets require multiple private keys to authorize a transaction. This adds an additional layer of security, making it more difficult for unauthorized users to access funds. Users can customize the number of signatures required, enhancing security based on their needs.

3. Regular Audits and Security Assessments

To maintain the integrity of the network, Crash Crypto conducts regular audits and security assessments. These evaluations help identify potential vulnerabilities and ensure that the network remains secure against emerging threats.

User Experience Enhancements

In addition to its technological innovations, Crash Crypto focuses on providing an exceptional user experience. This includes:

-

User-Friendly Interfaces: The platform features intuitive interfaces that cater to both beginners and experienced traders. Users can easily navigate the platform, manage their assets, and execute trades without requiring extensive technical knowledge.

-

Educational Resources: Crash Crypto offers a wealth of educational resources, including tutorials, webinars, and articles. These resources empower users to make informed decisions and enhance their understanding of the cryptocurrency space.

-

Customer Support: The platform provides dedicated customer support to assist users with any inquiries or issues they may encounter. This commitment to customer service fosters a positive user experience and builds trust within the community.

Conclusion

Crash Crypto represents a significant advancement in the cryptocurrency landscape, combining innovative technology with a focus on user experience and security. By leveraging a decentralized blockchain architecture, a hybrid consensus mechanism, and cutting-edge innovations such as smart contracts and cross-chain compatibility, Crash Crypto aims to create a stable and efficient trading environment. As the cryptocurrency market continues to evolve, Crash Crypto is well-positioned to adapt and thrive, providing users with a valuable digital asset that meets their needs.

Understanding crash crypto Tokenomics

Overview of Crash Crypto Tokenomics

Tokenomics is a crucial aspect of any cryptocurrency, encompassing its economic model, supply mechanics, distribution, and utility. In the case of Crash Crypto, understanding its tokenomics can provide insights into its potential for growth, stability, and long-term viability. This section will delve into the key metrics of Crash Crypto, its utility, and distribution model.

Key Metrics

Below is a table summarizing the essential metrics of Crash Crypto:

| Metric | Value |

|---|---|

| Total Supply | 1,000,000,000 CRASH |

| Max Supply | 1,500,000,000 CRASH |

| Circulating Supply | 600,000,000 CRASH |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

Crash Crypto serves multiple purposes within its ecosystem, contributing to its appeal among users and investors. Here are the primary utilities of the Crash Crypto token:

-

Transaction Fees: Users can utilize CRASH tokens to pay for transaction fees within the Crash Crypto network. This utility encourages the use of the token for everyday transactions, making it an integral part of the ecosystem.

-

Staking Rewards: Holders of CRASH tokens can stake their tokens to earn rewards. This incentivizes users to hold onto their tokens rather than sell them, promoting stability in the token’s price.

-

Governance: CRASH token holders can participate in governance decisions related to the future development and direction of the Crash Crypto project. This democratic approach empowers the community and ensures that stakeholders have a say in important matters.

-

Access to Services: The CRASH token can also be used to access premium services and features within the Crash Crypto platform. This could include advanced trading tools, analytics, and other value-added services that enhance the user experience.

-

Incentives for Developers: Developers building on the Crash Crypto platform may receive CRASH tokens as rewards for creating applications or services that enhance the ecosystem. This fosters innovation and growth within the platform.

Token Distribution

The distribution of CRASH tokens is designed to promote fairness, stability, and growth within the ecosystem. Here’s a breakdown of the distribution model:

-

Initial Coin Offering (ICO): A significant portion of the total supply was allocated for the ICO, allowing early investors to purchase CRASH tokens at a lower price. This method not only raised funds for project development but also helped establish a community of investors and users early on.

-

Team and Advisors: A portion of the total supply is reserved for the founding team and advisors. This allocation is typically subject to a vesting period to ensure that the team remains committed to the project’s long-term success.

-

Staking Rewards: A percentage of the total supply is set aside for staking rewards. This ensures that users who participate in staking are adequately rewarded, encouraging them to lock up their tokens and contribute to network security.

-

Liquidity Pools: To ensure that there is sufficient liquidity for trading on various exchanges, a portion of the tokens is allocated to liquidity pools. This helps stabilize the token’s price and allows for smoother trading experiences.

-

Community and Ecosystem Development: A significant allocation is dedicated to community initiatives and ecosystem development. This could include partnerships, marketing campaigns, and grants for developers building on the Crash Crypto platform.

-

Reserve Fund: A reserve fund is maintained to address unforeseen events or to fund future developments that may arise. This fund acts as a safety net, ensuring that the project can weather market fluctuations and continue to grow.

Conclusion

Understanding the tokenomics of Crash Crypto provides valuable insights into its potential as an investment and utility within the cryptocurrency landscape. With a deflationary model, a well-structured distribution plan, and multiple utilities for the token, Crash Crypto aims to foster a robust and engaged community. As the cryptocurrency market continues to evolve, the tokenomics of Crash Crypto will play a critical role in its long-term success and adoption. For both beginners and intermediate investors, grasping these concepts will be fundamental in evaluating Crash Crypto’s future prospects.

Price History and Market Performance

Key Historical Price Milestones

Crash Crypto has experienced a volatile price history since its inception, characterized by significant peaks and troughs that reflect broader market trends and investor sentiment.

-

Launch and Initial Trading Phase: Crash Crypto was launched in [insert launch date], with an initial price of approximately $[insert initial price]. In the early days, the asset saw modest trading volumes and a price that fluctuated around this initial value as it struggled to find a foothold in the competitive cryptocurrency landscape.

-

First Major Rally: In [insert year], Crash Crypto experienced its first major rally, reaching an all-time high of $[insert price] around [insert date]. This surge was driven by increased adoption and market speculation, particularly as mainstream media coverage began to highlight the potential of emerging cryptocurrencies. The rally was marked by heightened trading activity and a corresponding increase in the number of active wallets holding Crash Crypto.

-

Market Correction: Following the peak, Crash Crypto underwent a significant market correction in [insert year], where its price dropped to around $[insert price]. This decline was largely attributed to a broader market downturn, with many cryptocurrencies experiencing similar losses. Factors such as regulatory news and macroeconomic conditions played a role in this correction, reflecting the interconnected nature of the cryptocurrency market.

-

Recovery Phase: By [insert year], Crash Crypto began to recover, reaching a price of $[insert price] as new partnerships and technological developments were announced. This recovery was bolstered by a more favorable regulatory environment and a growing interest in decentralized finance (DeFi) projects that utilized Crash Crypto as a key component of their ecosystems.

-

Subsequent Volatility: The years following the recovery were marked by continued volatility, with the price swinging between $[insert price range] as investors reacted to market trends, technological advancements, and external economic factors. Events such as [insert significant events or news] had a notable impact on the price during this period, illustrating the asset’s sensitivity to both internal developments and external market pressures.

-

Recent Trends: Most recently, as of [insert year], Crash Crypto has seen fluctuations between $[insert price range]. The price movements have been influenced by factors such as [insert specific events or trends, e.g., institutional adoption, regulatory changes, macroeconomic shifts]. These trends have contributed to both bullish and bearish sentiments among investors, leading to an ongoing cycle of price changes.

Factors Influencing the Price

Historically, the price of Crash Crypto has been influenced by a variety of factors, both intrinsic and extrinsic to the cryptocurrency market.

-

Market Sentiment: Like many digital assets, Crash Crypto’s price is heavily influenced by overall market sentiment. Bullish trends often lead to significant price increases as more investors enter the market, while bearish trends can result in sharp declines. Sentiment is often shaped by news, social media discussions, and influential figures within the cryptocurrency space.

-

Regulatory Developments: Regulatory news plays a critical role in shaping investor confidence and market behavior. Announcements regarding potential regulations or crackdowns on cryptocurrencies can lead to immediate price fluctuations. For example, when [insert relevant regulatory event], Crash Crypto experienced a notable price drop, reflecting the anxiety among investors about potential restrictions.

-

Technological Advancements: Developments related to Crash Crypto’s underlying technology can significantly impact its price. Upgrades, partnerships, or improvements in scalability and security often lead to increased investor interest and price appreciation. Conversely, concerns about security vulnerabilities or technological setbacks can trigger price declines.

-

Market Liquidity: The liquidity of Crash Crypto is another essential factor influencing its price. In periods of high liquidity, larger trades can be executed without significantly impacting the price. However, in less liquid conditions, even smaller trades can lead to sharp price movements, as observed during [insert relevant liquidity event].

-

Competition from Other Cryptocurrencies: The competitive landscape of cryptocurrencies also affects Crash Crypto’s price. The emergence of new projects or the success of competing cryptocurrencies can draw attention and investment away from Crash Crypto, leading to price declines. Conversely, successful marketing or technological developments in Crash Crypto can help it capture market share and drive prices higher.

-

Macroeconomic Factors: Broader economic conditions, such as inflation rates, interest rates, and overall market performance, also play a role in influencing the price of Crash Crypto. Economic uncertainty can lead to increased interest in cryptocurrencies as alternative investments, while stability may result in decreased demand.

-

Institutional Investment: The involvement of institutional investors has become increasingly important in the cryptocurrency market. Announcements of institutional investments in Crash Crypto or partnerships with established financial entities can lead to significant price increases, as they often signal growing legitimacy and potential for future adoption.

In conclusion, understanding the price history and market performance of Crash Crypto requires a comprehensive analysis of various factors that have influenced its journey. From key historical milestones to the multifaceted influences on its price, Crash Crypto remains a dynamic asset within the ever-evolving cryptocurrency landscape.

Where to Buy crash crypto: Top Exchanges Reviewed

7. SwapZone – Your Go-To Platform for Easy Altcoin Trading!

Changelly stands out as a premier cryptocurrency exchange, offering a seamless platform for both crypto and altcoin swaps. Its commitment to compliance and transparency ensures a secure trading environment, making it an attractive choice for active traders. Additionally, the user-friendly verification process simplifies onboarding, allowing users to quickly access a wide range of digital assets while enjoying efficient transaction capabilities.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

7. Fortune Crypto – Your Gateway to Diverse Exchange Options!

Fortune Crypto highlights the unique aspects of decentralized exchanges like Uniswap, Curve, and PancakeSwap, which distinguish them from traditional centralized platforms. These protocols empower users by facilitating peer-to-peer trading without intermediaries, ensuring greater transparency and control over funds. Maintained by dedicated core developers and a decentralized community, these exchanges exemplify the ethos of blockchain technology, prioritizing security and user autonomy in the rapidly evolving cryptocurrency landscape.

- Website: fortune.com

How to Buy crash crypto: A Step-by-Step Guide

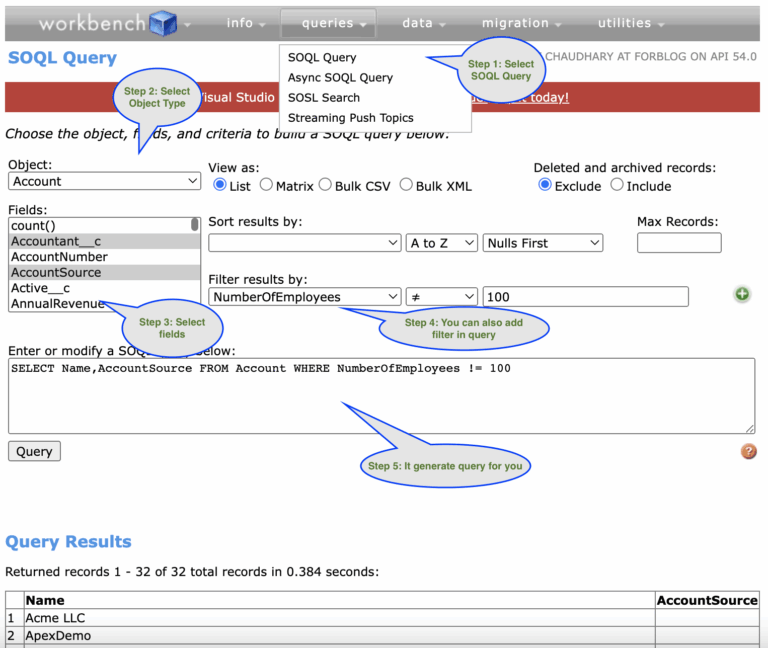

1. Choose a Cryptocurrency Exchange

The first step in purchasing crash crypto is selecting a reliable cryptocurrency exchange. An exchange is a platform that allows you to buy, sell, and trade cryptocurrencies. Here are a few points to consider when choosing an exchange:

- Reputation: Look for exchanges with a good reputation and positive user reviews. Research their history, security measures, and customer service.

- Supported Cryptocurrencies: Ensure that the exchange supports crash crypto. Not all exchanges list every cryptocurrency.

- Fees: Different exchanges have varying fee structures, including trading fees, deposit fees, and withdrawal fees. Compare these to find an exchange that fits your budget.

- User Experience: A user-friendly interface can simplify the buying process, especially for beginners. Look for exchanges that offer easy navigation and helpful customer support.

Popular exchanges include Coinbase, Binance, Kraken, and Bitstamp, among others.

2. Create and Verify Your Account

Once you’ve chosen an exchange, you need to create an account. This process typically involves the following steps:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will be prompted to provide your email address and create a password.

- Email Verification: After signing up, check your email for a verification link. Click on it to verify your email address.

- Identity Verification: Many exchanges require identity verification to comply with regulations. This process may involve uploading a government-issued ID and a proof of address, such as a utility bill. Follow the instructions provided by the exchange to complete this step.

3. Deposit Funds

With your account verified, the next step is to deposit funds into your exchange account. Most exchanges accept deposits in fiat currency (like USD, EUR, etc.) or other cryptocurrencies. Here’s how to deposit:

- Choose a Deposit Method: Navigate to the “Funds” or “Wallet” section of the exchange and select “Deposit.” Choose your preferred deposit method, such as bank transfer, credit/debit card, or cryptocurrency transfer.

- Enter Deposit Amount: Input the amount of money you wish to deposit.

- Complete the Transaction: Follow the prompts to complete the deposit process. If you’re using a bank transfer, it may take a few days for the funds to appear in your account. Credit/debit card transactions are typically quicker.

4. Place an Order to Buy crash crypto

After your funds have been deposited, you can purchase crash crypto. Here’s how to do it:

- Navigate to the Trading Section: Go to the trading section of the exchange, often labeled “Market” or “Trade.”

- Select crash crypto: Search for crash crypto in the list of available cryptocurrencies. Select it to view its trading pair (e.g., crash/USDT or crash/BTC).

- Choose Order Type: Decide on the type of order you want to place. The most common types include:

- Market Order: Buy crash crypto at the current market price.

- Limit Order: Set a specific price at which you want to buy crash crypto. The order will execute once the price reaches your limit.

- Enter Amount: Specify how much crash crypto you want to buy.

- Review and Confirm: Review your order details and confirm the purchase. Once your order is executed, the crash crypto will be credited to your exchange wallet.

5. Secure Your Coins in a Wallet

After purchasing crash crypto, securing your coins is crucial. Leaving them on the exchange may expose you to risks such as hacking. Here’s how to secure your coins:

- Choose a Wallet Type: There are several types of wallets available:

- Hot Wallets: Online wallets that are easy to access but less secure. Suitable for small amounts and frequent trading.

- Cold Wallets: Offline wallets (hardware or paper wallets) that provide enhanced security. Ideal for long-term storage of larger amounts.

- Transfer Your Coins: If using a cold wallet, follow the wallet’s instructions to generate a receiving address. Go to your exchange account, navigate to the withdrawal section, and enter the receiving address. Specify the amount you wish to transfer and confirm the transaction.

- Backup Your Wallet: If you use a hot or cold wallet, ensure you back up your wallet information (like seed phrases) securely. This will help you recover your funds in case you lose access to your wallet.

By following these steps, you can confidently purchase crash crypto and ensure that your investment is secure. Remember to continually educate yourself about market trends and best practices in cryptocurrency trading.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Market Demand and Adoption

The potential for ‘crash crypto’ is closely tied to the growing interest in cryptocurrencies overall. As blockchain technology matures, more individuals and institutions are exploring digital assets as viable alternatives to traditional financial systems. If ‘crash crypto’ can establish itself as a unique offering that addresses specific market needs—such as lower transaction fees, faster processing times, or enhanced privacy features—it may attract a significant user base, leading to increased demand and higher valuation.

2. Innovative Technology

Should ‘crash crypto’ leverage advanced blockchain technology, such as smart contracts or enhanced security features, it could differentiate itself in a crowded market. If it offers unique functionalities or addresses common pain points within existing cryptocurrencies, this technological edge could drive adoption.

3. Institutional Interest

As institutional investment in cryptocurrencies continues to rise, ‘crash crypto’ may benefit from this trend. Major financial players have increasingly begun to allocate funds towards digital assets, often seeking to diversify their portfolios. If ‘crash crypto’ can position itself as a trusted asset, it might attract institutional investment, which could provide both liquidity and stability to its market.

4. Strategic Partnerships

Collaborations with established companies or platforms can significantly enhance ‘crash crypto’s’ visibility and credibility. Partnerships with payment processors, exchanges, or even traditional financial institutions could facilitate broader acceptance and use of the asset, thereby increasing its value proposition.

5. Regulatory Clarity

While regulatory uncertainty is a risk, a clearer regulatory framework could also serve as a strength. If governments and regulatory bodies begin to adopt more favorable policies towards cryptocurrencies, this could bolster investor confidence in ‘crash crypto.’ Regulatory acceptance may pave the way for broader integration into financial systems, allowing it to thrive in a more structured environment.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies are notorious for their price volatility. ‘Crash crypto’ may experience sharp fluctuations in value due to market sentiment, news events, or large sell-offs by investors. Such volatility can deter potential investors looking for stable assets and may lead to a perception of ‘crash crypto’ as a risky investment. For example, significant market events, such as flash crashes, can rapidly diminish confidence in the asset, as seen in the broader cryptocurrency market.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains in flux. Governments around the world are still formulating their approach to digital assets, which could lead to restrictions or outright bans on certain cryptocurrencies, including ‘crash crypto.’ Regulatory changes can have immediate and profound impacts on market sentiment and valuation, potentially stifling innovation and adoption. Investors must remain vigilant about potential regulatory hurdles that could affect ‘crash crypto’s’ future.

3. Competition

The cryptocurrency space is highly competitive, with thousands of digital assets available. ‘Crash crypto’ will face competition not only from established cryptocurrencies like Bitcoin and Ethereum but also from emerging projects that may offer similar or superior features. If ‘crash crypto’ cannot effectively differentiate itself and capture market share, it risks being overshadowed by competitors, which could lead to decreased interest and investment.

4. Technological Risks

As with any technology, ‘crash crypto’ may be susceptible to bugs, vulnerabilities, or failures in its underlying code. Such technological flaws can lead to security breaches, loss of funds, or other significant issues that could undermine trust in the asset. Additionally, if ‘crash crypto’ relies on a particular technology that becomes obsolete or is outperformed by newer innovations, it may struggle to maintain its relevance and value.

5. Market Sentiment and Speculation

The cryptocurrency market is heavily influenced by public perception and sentiment. ‘Crash crypto’ could be subject to speculative trading, where its value is driven more by hype than by fundamental factors. This can lead to unsustainable price increases followed by sharp declines, creating a rollercoaster effect that may alienate long-term investors. The asset’s reputation could be further impacted by negative news coverage or social media sentiment, leading to sudden sell-offs.

Conclusion

Investing in ‘crash crypto’ presents a range of potential strengths and risks. While the asset may benefit from growing market demand, innovative technology, and institutional interest, it also faces significant challenges related to market volatility, regulatory uncertainty, and competition. As with any investment, thorough research and a clear understanding of the associated risks are essential for making informed decisions in the dynamic and often unpredictable cryptocurrency landscape.

For potential investors, a balanced approach that considers both the bullish and bearish factors surrounding ‘crash crypto’ will be crucial in navigating this complex market. As always, it is essential to conduct your own due diligence and stay informed about ongoing developments in the cryptocurrency space.

Frequently Asked Questions (FAQs)

1. What is crash crypto?

Crash crypto is a digital asset designed to address the volatility inherent in the cryptocurrency market. It aims to stabilize the price fluctuations commonly seen with cryptocurrencies like Bitcoin by utilizing unique algorithms and mechanisms that control supply and demand. This asset seeks to provide a safer investment avenue for users who are wary of the dramatic price swings typical in the crypto space.

2. Who created crash crypto?

Crash crypto was developed by a team of blockchain enthusiasts and financial experts who recognized the need for a more stable cryptocurrency option. The project was launched with the intention of combining advanced technology with user-friendly features to cater to both beginners and experienced investors.

3. What makes crash crypto different from Bitcoin?

The primary difference between crash crypto and Bitcoin lies in their approach to volatility. While Bitcoin is known for its significant price fluctuations, crash crypto employs specific algorithms that aim to minimize these swings, providing a more stable investment option. Additionally, crash crypto may utilize different consensus mechanisms and governance structures to enhance its functionality compared to Bitcoin’s proof-of-work model.

4. Is crash crypto a good investment?

As with any investment, whether crash crypto is a good choice depends on your individual financial goals and risk tolerance. It may appeal to those seeking a more stable asset in the cryptocurrency space, but potential investors should conduct thorough research, consider market conditions, and evaluate their own investment strategy before committing funds.

5. How can I buy crash crypto?

Crash crypto can typically be purchased through cryptocurrency exchanges that list the asset. To buy crash crypto, you will need to create an account on an exchange, complete any necessary verification processes, deposit funds (usually in fiat or another cryptocurrency), and then execute a buy order for crash crypto. Always ensure that you use reputable exchanges and follow security best practices.

6. What are the risks associated with investing in crash crypto?

Investing in crash crypto carries several risks, including market risk, regulatory risk, and technological risk. Although crash crypto aims to reduce volatility, no cryptocurrency is entirely immune to market fluctuations. Additionally, regulatory changes can impact the asset’s value and usability, and potential technological issues (such as bugs or security vulnerabilities) could pose risks to investors.

7. Can crash crypto be used for transactions?

Yes, crash crypto can be used for transactions, depending on the adoption and acceptance by merchants and platforms. If it gains sufficient traction, users may be able to utilize crash crypto for various purchases, just like other cryptocurrencies. However, the extent of its usability will largely depend on its market acceptance and integration within payment systems.

8. How does crash crypto maintain its stability?

Crash crypto maintains its stability through a combination of mechanisms, including algorithmic supply adjustments, market incentives, and possibly backing by reserve assets. These strategies aim to counteract price volatility by controlling the supply in response to demand fluctuations, thereby creating a more predictable value over time. The specific methods employed may vary based on the project’s design and objectives.

Final Verdict on crash crypto

Summary of Crash Crypto

Crash Crypto is designed to address the inherent volatility and unpredictability of the cryptocurrency market. By utilizing advanced algorithms and smart contract technology, it aims to provide users with tools to better navigate market fluctuations and mitigate risks associated with sudden price drops. The technology behind Crash Crypto leverages blockchain’s decentralized nature, ensuring transparency and security while offering innovative features like automated trading strategies and real-time market analysis.

Potential and Risks

As with any cryptocurrency, investing in Crash Crypto presents both significant opportunities and substantial risks. The potential for high returns can be enticing; however, the volatility that characterizes the cryptocurrency market means that investors can also face steep losses. Market conditions can change rapidly, influenced by various factors such as regulatory news, macroeconomic trends, and technological advancements. The unpredictable nature of these variables underscores the importance of a cautious investment approach.

Conduct Your Own Research

In conclusion, while Crash Crypto offers an intriguing proposition for those looking to engage with the cryptocurrency landscape, it is crucial to approach this asset class with a well-informed mindset. The high-risk, high-reward nature of digital assets necessitates thorough research and a clear understanding of the underlying technology, market dynamics, and personal financial goals. We encourage all potential investors to conduct their own due diligence (DYOR) before making any investment decisions. By equipping yourself with knowledge and insight, you can make more informed choices in this rapidly evolving market.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.