What is coti coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to coti coin

COTI Coin is an innovative digital asset that serves as the native currency for the COTI platform, a fintech ecosystem designed to facilitate decentralized payment solutions. Positioned as a pioneer in the realm of cryptocurrency, COTI leverages a unique Directed Acyclic Graph (DAG) structure, which allows for rapid transaction processing and scalability, making it an attractive option for businesses and consumers alike. With the capability to handle over 100,000 transactions per second, COTI is built to address the challenges faced by traditional financial systems, such as high fees, latency, and lack of inclusivity.

The significance of COTI Coin in the cryptocurrency market stems from its multifaceted applications. Not only does it enable efficient peer-to-peer transactions, but it also supports the creation of stablecoins and loyalty programs, offering a comprehensive framework for businesses looking to digitize their payment solutions. COTI’s Trustchain protocol ensures security and compliance, making it suitable for both online and offline transactions. This positions COTI as a versatile player in the evolving landscape of decentralized finance (DeFi), attracting interest from developers, merchants, and investors.

This guide aims to be a comprehensive resource for beginners and intermediate investors interested in understanding COTI Coin. It will cover various aspects of the cryptocurrency, including its underlying technology, tokenomics, investment potential, and associated risks. Additionally, we will provide insights on how to buy COTI Coin, ensuring that readers are well-equipped to navigate the complexities of investing in this digital asset.

Understanding COTI’s Technology

COTI operates on an advanced cryptographic framework that enhances privacy and efficiency in transactions. The platform utilizes garbled circuits and multiparty computation (MPC) to ensure confidential transactions, setting a new standard for on-chain privacy. This technological foundation not only enhances the scalability and security of the Ethereum ecosystem but also opens up new possibilities for decentralized applications (dApps).

Tokenomics and Market Performance

COTI Coin has a total supply of 4.91 billion tokens, with approximately 2.34 billion currently in circulation. The current market cap stands at around $115 million, reflecting the asset’s growing adoption and interest. Understanding the tokenomics is crucial for investors looking to gauge the potential for price appreciation and utility within the ecosystem.

Investment Potential and Risks

Investing in COTI Coin comes with its own set of opportunities and challenges. The cryptocurrency market is known for its volatility, and COTI is no exception. Potential investors must consider factors such as market trends, technological developments, and regulatory environments that could impact the asset’s value.

In conclusion, this guide will provide a detailed exploration of COTI Coin, empowering readers with the knowledge needed to make informed investment decisions in this dynamic digital asset landscape. Whether you are looking to diversify your portfolio or explore the potential of decentralized payment solutions, understanding COTI Coin is a step towards navigating the future of finance.

What is coti coin? A Deep Dive into its Purpose

Understanding COTI Coin

COTI (Currency of the Internet) is a cryptocurrency designed to facilitate the creation of decentralized payment networks, focusing on speed, scalability, and security. Built on a Directed Acyclic Graph (DAG) architecture, COTI aims to address various challenges posed by traditional financial systems and enhance the usability of cryptocurrencies in everyday transactions. By leveraging its unique technology, COTI seeks to empower businesses and individuals alike with efficient payment solutions that are both reliable and user-friendly.

The Core Problem It Solves

The primary issue COTI addresses is the inefficiency and limitations of traditional payment systems. Conventional banking and payment platforms often suffer from high fees, slow processing times, and a lack of accessibility, especially in underserved regions. COTI aims to overcome these barriers by offering a decentralized payment solution that is:

-

Fast and Scalable: Utilizing its Trustchain technology, COTI can process over 100,000 transactions per second, significantly surpassing many existing payment networks. This speed is essential for modern commerce, where customers expect instant transactions.

-

Cost-Effective: Traditional payment systems frequently impose hefty transaction fees, which can be particularly burdensome for microtransactions. COTI’s architecture reduces costs, making it a viable option for businesses and consumers looking to save on transaction fees.

-

Inclusive: COTI aims to broaden financial inclusion by providing a platform that can be used globally, regardless of the user’s location. This inclusivity is particularly important in regions where access to banking services is limited.

-

Privacy-Focused: COTI incorporates advanced cryptographic techniques to ensure that transactions remain confidential and secure. This privacy aspect is crucial for users who prioritize data security in their financial dealings.

Its Unique Selling Proposition

COTI’s uniqueness lies in its innovative use of a DAG-based architecture, which differentiates it from traditional blockchain technologies. Here are some key elements that make COTI stand out:

-

Trustchain: COTI’s proprietary Trustchain technology combines the benefits of both blockchain and DAG, allowing for rapid transaction processing while maintaining security and scalability. This dual approach helps to prevent bottlenecks that can occur in traditional blockchain networks.

-

Multi-Use Platform: COTI is designed not just as a cryptocurrency but as a comprehensive fintech platform. It supports various use cases, including online and offline payments, loyalty programs, and the issuance of stablecoins. This versatility allows businesses to tailor solutions to their specific needs.

-

User-Friendly Interface: COTI provides a seamless user experience with its wallet and payment application. The platform is designed for ease of use, making it accessible for both tech-savvy users and those new to cryptocurrencies.

-

Decentralized Governance: COTI incorporates a decentralized governance model, allowing its community to participate in decision-making processes. This feature fosters a sense of ownership and alignment with the interests of its users.

-

EVM Compatibility: As an Ethereum-compatible Layer 2 solution, COTI enables developers to create decentralized applications (dApps) that can leverage its high-speed transactions and low costs. This compatibility enhances the Ethereum ecosystem and broadens the scope for innovation.

The Team and Backers

COTI is supported by a diverse team of professionals with extensive experience in finance, technology, and blockchain. The core team consists of experts in cryptography, software development, and payment processing, which positions COTI to navigate the complexities of building a decentralized payment ecosystem.

The project has also garnered support from notable investors and partners, contributing to its credibility and potential for growth. With a strong community of over 300,000 followers across various social platforms, COTI benefits from a robust network of enthusiasts and advocates who are instrumental in promoting its mission and goals.

Fundamental Purpose in the Crypto Ecosystem

COTI’s fundamental purpose within the cryptocurrency landscape is to bridge the gap between traditional finance and the emerging decentralized finance (DeFi) sector. By providing a scalable and efficient payment infrastructure, COTI aims to enable businesses to create their own payment solutions and digital currencies. This capability is especially valuable for merchants, governments, and organizations looking to leverage blockchain technology for financial transactions.

Moreover, COTI positions itself as a facilitator of a new wave of financial products and services that prioritize speed, cost-effectiveness, and user experience. As the adoption of cryptocurrencies continues to grow, COTI is poised to play a critical role in making digital payments more accessible, secure, and efficient.

In summary, COTI coin represents a significant advancement in the quest for a decentralized payment solution that can compete with traditional financial systems. Its innovative technology, user-centric design, and commitment to inclusivity make it a compelling option for users seeking to navigate the evolving landscape of digital finance. As the project continues to develop and expand its offerings, COTI is well-positioned to influence the future of payments in the crypto ecosystem.

The Technology Behind the Coin: How It Works

Overview of COTI

COTI (Currency of the Internet) is a cryptocurrency designed to facilitate decentralized payment solutions. Its architecture is built on a unique technology known as Directed Acyclic Graph (DAG) and is optimized for creating efficient and scalable payment networks. COTI aims to address the common challenges faced by traditional financial systems, such as high transaction fees, slow processing times, and lack of inclusivity. This guide will explore the core technologies that power COTI, making it a standout player in the cryptocurrency landscape.

Blockchain Architecture

COTI operates on a DAG-based architecture, which significantly differs from traditional blockchain systems like Bitcoin or Ethereum. In a conventional blockchain, transactions are grouped into blocks and added sequentially, which can lead to bottlenecks and scalability issues. Conversely, a Directed Acyclic Graph allows multiple transactions to be processed simultaneously, enabling much higher throughput.

How DAG Works

In a DAG, every transaction is linked to one or more previous transactions, creating a web of interconnections rather than a linear chain. This structure allows COTI to process over 100,000 transactions per second, making it extremely efficient for both online and offline payments. Each new transaction confirms previous transactions, which helps to secure the network and prevents double-spending.

Trustchain

COTI employs a unique ledger technology called Trustchain, which is designed to enhance security and reliability. Trustchain not only records transactions but also verifies them using a consensus mechanism that reduces fraud and errors. As a result, users can trust that their transactions are secure and validated in real time.

Consensus Mechanism

COTI utilizes a unique consensus mechanism that combines aspects of both Proof-of-Work (PoW) and Proof-of-Stake (PoS), along with a proprietary model known as the “Trust Score.” This approach is designed to ensure that transactions are processed efficiently while maintaining high security standards.

Trust Score

The Trust Score is a key innovation in COTI’s consensus mechanism. It evaluates the trustworthiness of participants in the network based on their transaction history and behavior. Users with higher trust scores can process transactions faster and are more likely to be selected to confirm new transactions. This not only incentivizes good behavior but also enhances the overall security of the network by reducing the risk of malicious activity.

Decentralized Sequencer Model

COTI has introduced a decentralized sequencer model to further improve its consensus process. In traditional systems, a centralized sequencer is responsible for ordering transactions, which can create bottlenecks and single points of failure. By decentralizing this function, COTI distributes the responsibility of transaction ordering across multiple participants, enhancing network security and reducing the risks associated with censorship and centralization.

Key Technological Innovations

COTI incorporates several groundbreaking technologies that set it apart from other cryptocurrencies. Below are some of the most notable innovations.

Garbled Circuits and Multi-Party Computation (MPC)

COTI V2 introduces a sophisticated cryptographic framework centered around garbled circuits and multi-party computation (MPC). This technology allows for private transactions that can be executed without revealing the underlying data to any party involved in the transaction. Garbled circuits are approximately 1000 times faster than traditional computation methods, making them highly efficient for on-chain privacy solutions.

Enhanced Security Protocols

COTI employs industry-standard encryption schemes, including AES-CTR for symmetric-key encryption and RSA for asymmetric-key distribution. By using widely adopted and tested encryption methods, COTI mitigates the risks associated with proprietary or unproven security protocols. This approach builds trust among users and encourages broader adoption of the platform.

Interoperability and Compliance

COTI is designed to be interoperable with various blockchain networks, making it a versatile solution for decentralized finance (DeFi) applications. Additionally, COTI’s architecture includes features for Know Your Customer (KYC) compliance, which is essential for businesses and organizations that must adhere to regulatory standards. This focus on compliance helps facilitate the use of COTI in real-world applications, such as payment processing for merchants and businesses.

Scalability and Efficiency

One of the primary goals of COTI is to provide a scalable and efficient payment solution that can handle the demands of a growing user base. The combination of DAG architecture, Trustchain, and the decentralized sequencer model allows COTI to achieve high transaction speeds while maintaining low fees.

High Transaction Throughput

COTI’s architecture enables it to handle thousands of transactions per second, a significant improvement over traditional blockchain networks. This high throughput is crucial for real-time payments, especially in scenarios where speed and reliability are essential, such as retail transactions or online payments.

Low Transaction Fees

In addition to speed, COTI aims to minimize transaction fees. The use of a decentralized network and efficient consensus mechanism allows COTI to keep fees low, making it an attractive option for businesses and consumers alike. Low fees encourage more users to adopt COTI for everyday transactions, further driving its growth and utility.

Use Cases

COTI’s technology opens up a wide array of potential use cases, making it a versatile option for various industries. Here are some notable applications:

Payment Solutions

COTI is designed to facilitate both online and offline payments. Businesses can leverage the platform to create their own payment solutions, whether they want to accept cryptocurrencies, stablecoins, or traditional fiat currencies. The flexibility of COTI’s infrastructure allows for customized payment solutions tailored to specific business needs.

Stablecoins

COTI is optimized for creating stablecoins, which are cryptocurrencies designed to maintain a stable value relative to a fiat currency. This capability allows businesses to issue their own stablecoins, providing them with greater control over their financial assets while benefiting from the advantages of blockchain technology.

Decentralized Finance (DeFi)

COTI’s architecture supports the development of decentralized applications (dApps) in the DeFi space. By enabling confidential transactions and secure data management, COTI can facilitate lending, borrowing, and trading in a decentralized manner, providing users with more options and flexibility in managing their financial activities.

Conclusion

COTI represents a significant advancement in the cryptocurrency space, combining innovative technologies such as DAG architecture, a unique consensus mechanism, and advanced cryptographic techniques. By addressing the challenges faced by traditional financial systems, COTI aims to create a more inclusive and efficient payment ecosystem. With its ability to process high volumes of transactions at low costs, COTI is well-positioned to become a leading player in the growing world of decentralized finance and payment solutions. As the cryptocurrency landscape continues to evolve, COTI’s technology will likely play a crucial role in shaping the future of digital payments.

Understanding coti coin Tokenomics

COTI (Currency of the Internet) is a cryptocurrency that operates on a unique DAG (Directed Acyclic Graph) protocol, designed to facilitate fast and secure transactions. Understanding the tokenomics of COTI is essential for both potential investors and users, as it outlines the supply, distribution, and utility of the token within its ecosystem.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 2,342,562,037 COTI |

| Max Supply | 4,910,000,000 COTI |

| Circulating Supply | 2,342,562,037 COTI |

| Inflation/Deflation Model | Deflationary |

Total Supply

The total supply of COTI is currently set at 2.34 billion tokens, which is also the circulating supply. This means that all COTI tokens that will ever be created are already in circulation, which contributes to its scarcity.

Max Supply

The maximum supply of COTI is capped at 4.91 billion tokens. This cap is significant as it establishes a limit on the total number of tokens that can ever exist, which can potentially drive value as demand increases.

Circulating Supply

The circulating supply also stands at 2.34 billion COTI. This figure represents the number of tokens that are currently available in the market for trading and use. The fact that the circulating supply matches the total supply indicates that there are no tokens locked or reserved, which is a positive sign for liquidity.

Inflation/Deflation Model

COTI follows a deflationary model, meaning that the total supply will not increase beyond the maximum limit. This is a crucial aspect as it implies that as demand for COTI increases, the value may appreciate due to its limited supply.

Token Utility (What is the coin used for?)

COTI tokens serve multiple purposes within the COTI ecosystem, enhancing their utility:

-

Transaction Fees: COTI is primarily used to pay transaction fees on the network. Users need COTI tokens to facilitate transactions, making it essential for anyone looking to engage with the platform.

-

Staking: COTI offers users the ability to stake their tokens, which can provide rewards and incentives. Staking helps secure the network and validates transactions, contributing to the overall stability and reliability of the platform.

-

Loyalty Programs: Businesses that use COTI’s payment solutions can create loyalty programs that reward customers with COTI tokens. This feature encourages user engagement and fosters a more robust ecosystem around the COTI network.

-

Governance: COTI holders may have a say in the development and governance of the platform. This can include voting on proposals, changes to the network, or new features, making the token more than just a medium of exchange but also a participatory asset.

-

Payment Solutions: COTI is designed to enable online and offline payments, including the issuance of stablecoins. This versatility allows businesses to leverage COTI for various financial solutions, enhancing its utility beyond a mere cryptocurrency.

Token Distribution

The distribution of COTI tokens is an important aspect to understand, as it impacts market dynamics and potential price movement. The token distribution is typically allocated as follows:

-

Team and Advisors: A portion of the tokens is allocated to the founding team and advisors. This is often vested over a period to ensure that the team remains incentivized to grow the project sustainably.

-

Partnerships and Collaborations: COTI allocates tokens for strategic partnerships that help expand its ecosystem and reach. These partnerships may involve technology firms, payment processors, and other stakeholders in the financial ecosystem.

-

Community Incentives: Tokens are also distributed to promote community engagement and development. This can include rewards for early adopters, users who participate in staking, or those who contribute to the ecosystem through development and marketing efforts.

-

Reserve Fund: A reserve fund may be held for future development, ensuring that the project has the necessary resources to adapt and grow over time.

-

Public Sale: A significant portion of the total supply may have been made available during public sales or initial coin offerings (ICOs), allowing investors to acquire COTI at an early stage.

Understanding COTI’s tokenomics is vital for anyone looking to engage with this cryptocurrency. Its deflationary nature, combined with various use cases and a well-structured distribution model, positions COTI as a unique player in the digital asset space. By examining these aspects, investors and users can make informed decisions about their involvement with COTI.

Price History and Market Performance

Overview of COTI’s Price History

COTI, a cryptocurrency that powers a decentralized payment network, has exhibited a dynamic price history since its inception. Launched in 2017, COTI has experienced considerable volatility, marked by significant price fluctuations that are common in the cryptocurrency market. Understanding the historical price milestones and the factors influencing COTI’s price can provide valuable insights for potential investors.

Key Historical Price Milestones

COTI’s price journey has been characterized by several key milestones that reflect both market conditions and the project’s development.

-

Initial Launch and Early Trading (2017-2019):

COTI was launched in March 2017, and its price began trading at a modest level. In November 2019, COTI reached its all-time low of approximately $0.006226. This price point represented a significant entry point for early investors, with the market still in its nascent stages and experiencing the effects of broader market sentiment. -

First Major Rally (2020):

In 2020, COTI began to gain traction, driven by developments within its ecosystem and the general recovery of the cryptocurrency market. By the end of the year, COTI’s price had increased significantly, reflecting growing interest and adoption of its payment solutions. -

All-Time High (October 2021):

The peak of COTI’s price occurred on October 31, 2021, when it reached an impressive $0.6826. This surge was influenced by multiple factors, including heightened interest in decentralized finance (DeFi), the overall bullish trend in the cryptocurrency market, and significant partnerships that expanded COTI’s utility. -

Post-Peak Decline (2022-Present):

Following its all-time high, COTI’s price experienced a substantial decline, consistent with the broader market corrections seen across the cryptocurrency space. As of October 2023, COTI’s price was approximately $0.0494, marking a decrease of about 92.75% from its all-time high. This price action reflects the inherent volatility of cryptocurrencies and the impact of market sentiment on asset valuation.

Factors Influencing the Price

Historically, the price of COTI has been influenced by a variety of factors, both internal to the project and external within the broader cryptocurrency market.

-

Market Sentiment:

Like many cryptocurrencies, COTI’s price is heavily influenced by market sentiment. Bullish trends in the cryptocurrency market often lead to increased buying pressure, resulting in price spikes. Conversely, bearish market conditions can result in significant sell-offs, negatively impacting COTI’s price. -

Technological Developments:

COTI’s underlying technology, including its Directed Acyclic Graph (DAG) protocol, has been a significant factor in its valuation. Developments in its technology, such as the introduction of COTI V2, which enhances scalability and security, have historically driven interest and investment in the token. Improvements that address scalability and user experience can lead to increased adoption and, consequently, higher prices. -

Adoption and Use Cases:

The extent to which businesses and consumers adopt COTI’s payment solutions has a direct impact on its price. Partnerships with various organizations to facilitate payments and the creation of stablecoins have positioned COTI as a versatile player in the crypto space. Increased use of COTI in real-world applications can bolster investor confidence and drive demand, leading to price appreciation. -

Regulatory Environment:

Regulatory news and developments can have a profound impact on COTI’s price. As with other cryptocurrencies, any adverse regulations or legal challenges can lead to market apprehension, negatively affecting prices. Conversely, positive regulatory news can enhance investor confidence and contribute to price increases. -

Overall Market Trends:

The performance of Bitcoin and Ethereum, as the leading cryptocurrencies, often sets the tone for the entire market, including altcoins like COTI. When Bitcoin and Ethereum experience significant price movements, it can result in correlated movements in COTI’s price. The overall health of the cryptocurrency market, including investor interest and market capitalization, influences COTI’s price trajectory. -

Trading Volume and Liquidity:

Trading volume is another critical factor influencing COTI’s price. Higher trading volumes typically indicate stronger investor interest and can lead to increased price volatility. The liquidity of COTI on various exchanges also plays a role in its price stability; lower liquidity can result in more significant price swings.

Conclusion

COTI’s price history illustrates the inherent volatility of cryptocurrencies and the multitude of factors that can influence price movements. From its early days with modest trading to its all-time high in 2021, COTI has navigated a complex landscape shaped by technological advancements, market sentiment, and external influences. For investors, understanding these historical price milestones and influencing factors is crucial for making informed decisions in the ever-evolving cryptocurrency market.

Where to Buy coti coin: Top Exchanges Reviewed

5 Reasons to Buy COTI on Kraken Today!

Kraken stands out as a user-friendly exchange for purchasing COTI, allowing investments starting from just $10. With a variety of payment options including credit/debit cards, ACH deposits, and mobile payment methods like Apple and Google Pay, it caters to both beginners and experienced investors. The platform’s robust security features and competitive fees further enhance its appeal, making it a reliable choice for acquiring digital assets.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

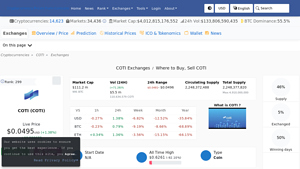

3. Coti Exchanges – Your Gateway to Seamless COTI Trading!

Coti exchanges, including prominent platforms like HTX (Huobi), Binance, KuCoin, and Kraken, offer robust options for buying, selling, and trading COTI. What sets these exchanges apart is their high liquidity, user-friendly interfaces, and a wide range of trading pairs, making it easier for both novice and experienced investors to engage with the Coti ecosystem. Additionally, their strong security measures ensure a safe trading environment for users.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. COTI – Your Gateway to Seamless Transactions

COTI (COTI) is available on more than 33 cryptocurrency exchanges, with Binance, Gate, and HTX being the top platforms for trading. Notably, Binance offers a variety of trading pairs, including USDT, BUSD, TRY, and BTC, enhancing liquidity and accessibility for investors. This diverse trading environment, coupled with the prominence of these exchanges, makes it easier for users to buy, sell, and trade COTI efficiently.

- Website: coinlore.com

5. Gate.com – Your Gateway to Coti (COTI) Investments!

Gate.com distinguishes itself as a user-friendly cryptocurrency exchange, providing a straightforward four-step guide for purchasing Coti (COTI). Its intuitive interface and streamlined process make it accessible for both beginners and experienced investors. Additionally, Gate.com supports a diverse range of cryptocurrencies, enhancing its appeal as a versatile platform for trading and investing in digital assets.

- Website: gate.com

- Platform Age: Approx. 29 years (domain registered in 1996)

7. Top Exchanges to Buy & Sell COTI at Unbeatable Prices!

This exchange stands out for its competitive pricing and user-friendly interface, allowing users to buy and sell COTI (ERC20) effortlessly. With a high rating of 4.8 from over 2,165 reviews, it offers real-time market data, including live charts and comprehensive information on market cap and circulating supply. Additionally, the platform’s commitment to providing a free trading experience enhances its appeal to both novice and experienced investors.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy coti coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to buying COTI coin is to select a cryptocurrency exchange that supports it. Some of the most popular exchanges where you can buy COTI include:

- Binance

- Coinbase

- KuCoin

- Kraken

When choosing an exchange, consider factors such as security, ease of use, trading fees, and available payment methods. If you are a beginner, platforms like Coinbase may be more user-friendly, while more experienced traders might prefer Binance for its range of trading options.

2. Create and Verify Your Account

Once you have selected an exchange, you will need to create an account. Here’s how to do it:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will be prompted to enter your email address and create a password.

- Email Verification: After signing up, you may receive an email asking you to verify your email address. Click on the link in the email to verify your account.

- Complete KYC Process: Most exchanges require you to complete a Know Your Customer (KYC) process to comply with regulations. This usually involves submitting personal information such as your name, address, and date of birth, along with a government-issued ID (like a passport or driver’s license) to verify your identity.

- Enable Two-Factor Authentication (2FA): For added security, enable two-factor authentication (2FA) on your account. This adds an extra layer of protection by requiring a second form of identification, usually through a mobile app like Google Authenticator.

3. Deposit Funds

After your account is verified, you need to deposit funds into your exchange account to purchase COTI. Here’s how:

- Choose a Deposit Method: Most exchanges offer various deposit methods, including bank transfers, credit/debit cards, or even other cryptocurrencies. Choose the method that works best for you.

- Follow the Instructions: Depending on your chosen method, follow the specific instructions provided by the exchange. For bank transfers, you may need to link your bank account; for credit/debit cards, you’ll enter your card details.

- Deposit Amount: Enter the amount you wish to deposit. Keep in mind that some exchanges may have minimum deposit requirements.

- Confirm the Deposit: Review the transaction details and confirm the deposit. Depending on the method, funds may be available instantly or may take a few days to process.

4. Place an Order to Buy COTI Coin

Now that you have funds in your account, you can purchase COTI. Here’s how to place an order:

- Navigate to the COTI Trading Page: Use the search function or navigate through the exchange to find the COTI trading pair you want to use (e.g., COTI/USD or COTI/BTC).

- Select Order Type: Choose the type of order you wish to place. The two most common types are:

– Market Order: Buys COTI at the current market price. This is the simplest option for beginners.

– Limit Order: Sets a specific price at which you want to buy COTI. The order will execute only when the market price reaches your specified price. - Enter the Amount: Specify how much COTI you want to buy or how much of your deposited currency you want to spend on COTI.

- Review and Confirm: Double-check your order details and confirm the transaction. Your order will be executed according to the type of order you placed.

5. Secure Your Coins in a Wallet

Once your purchase is complete, it’s crucial to secure your COTI coins. While you can leave them on the exchange, it’s safer to transfer them to a personal wallet. Here’s how:

-

Choose a Wallet: Decide on the type of wallet you want to use. Options include:

– Software Wallets: These are applications you can download on your computer or mobile device (e.g., Trust Wallet, Exodus).

– Hardware Wallets: Physical devices that store your cryptocurrencies offline for enhanced security (e.g., Ledger, Trezor).

– Paper Wallets: A physical printout of your public and private keys, although this method requires careful handling to avoid loss. -

Set Up Your Wallet: Follow the instructions to set up your chosen wallet. Make sure to securely back up your recovery phrase or private keys.

- Transfer COTI: Go to the exchange, select the option to withdraw, and enter your wallet address. Specify the amount of COTI you want to transfer, review the transaction details, and confirm.

- Confirm the Transfer: Check your wallet to ensure the COTI coins have arrived. This may take a few minutes depending on network conditions.

By following these steps, you can successfully buy and secure your COTI coins, positioning yourself to engage with this innovative cryptocurrency.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

COTI (Currency of the Internet) is positioned as a unique player in the cryptocurrency market, primarily focusing on decentralized payment solutions. Below are several strengths that could contribute to its growth and adoption.

1. Innovative Technology

COTI employs a Directed Acyclic Graph (DAG) protocol, which allows for high transaction throughput and low fees. According to sources, COTI’s Trustchain can process over 100,000 transactions per second. This scalability is particularly attractive for businesses and applications that require fast and efficient payment solutions. The technology is designed to optimize both online and offline payments, making it versatile in various use cases.

2. Strong Use Cases

The COTI ecosystem supports multiple functionalities, including the creation of stablecoins, loyalty programs, and decentralized applications (dApps). This breadth of use cases can potentially attract a wide range of users, from merchants looking to implement payment solutions to developers seeking a platform for their dApps. The ability to issue stablecoins also aligns with the growing demand for price-stable digital assets.

3. Compliance and Security

COTI places a strong emphasis on compliance and security. By utilizing widely adopted encryption standards, it aims to instill trust among users and businesses. The platform’s commitment to regulatory compliance can be a significant advantage as governments worldwide increasingly scrutinize cryptocurrencies. This focus may help COTI gain traction with traditional financial institutions and enterprises looking for secure blockchain solutions.

4. Active Community and Development

COTI has cultivated a robust community, boasting over 300,000 followers across various social platforms. An engaged community can lead to better adoption rates and innovation through user feedback. Additionally, the project benefits from partnerships and development grants, which can support ongoing improvements and expansions of the platform.

5. Market Positioning

COTI’s current market cap of approximately $116 million, with a fully diluted valuation of around $243 million, positions it as a mid-cap cryptocurrency. This can offer a balance of risk and reward for investors. Furthermore, its current price is significantly lower than its all-time high of $0.92, which may entice investors looking for potential recovery opportunities.

Potential Risks and Challenges (The Bear Case)

Despite its strengths, COTI is not without risks. Investors should carefully consider the following challenges that may affect the asset’s performance.

1. Market Volatility

Cryptocurrency markets are known for their extreme volatility. COTI has experienced significant price fluctuations, with its all-time high being approximately 95% higher than its current price. Such volatility can lead to substantial financial losses for investors. Furthermore, the cryptocurrency market is influenced by various external factors, including macroeconomic conditions, market sentiment, and regulatory changes, which can exacerbate price swings.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains ambiguous in many jurisdictions. COTI’s compliance efforts may help mitigate some risks, but ongoing regulatory scrutiny could still pose challenges. For instance, if regulatory bodies classify COTI as a security, it could face additional compliance requirements that may hinder its operational capabilities. Moreover, unfavorable regulations could limit market access and affect user adoption.

3. Competition

The decentralized payment space is highly competitive, with numerous projects vying for market share. COTI competes with established players like Bitcoin, Ethereum, and newer entrants focusing on similar use cases. If competitors introduce superior technology or gain broader adoption, COTI may struggle to capture or retain market interest. Additionally, as more projects emerge, the market could become saturated, making it difficult for any single project to achieve dominance.

4. Technological Risks

COTI’s reliance on innovative technology, while a strength, also introduces potential risks. The complexity of its DAG architecture and cryptographic techniques could lead to unforeseen vulnerabilities. Any security breaches, bugs, or failures in the system could undermine user trust and lead to significant financial repercussions. Furthermore, as the project evolves, the need for constant updates and improvements is paramount to remain competitive and secure.

5. Adoption Challenges

While COTI offers a range of use cases, actual adoption remains uncertain. The success of the platform depends on its ability to attract businesses, developers, and end-users. If it fails to establish a strong foothold in the market or if potential users perceive existing solutions as sufficient, COTI may struggle to achieve its growth objectives. Additionally, the education barrier for both merchants and consumers regarding the benefits of using COTI could hinder widespread acceptance.

Conclusion

Investing in COTI presents both potential rewards and significant risks. Its innovative technology, strong use cases, and focus on compliance and security may attract users and investors alike. However, market volatility, regulatory uncertainties, competition, and technological risks could pose challenges that may hinder its growth and adoption.

As always, potential investors should conduct thorough research and consider their risk tolerance before engaging with any cryptocurrency, including COTI. Understanding the broader market dynamics, regulatory environment, and the project’s ongoing developments will be crucial in making informed investment decisions.

Frequently Asked Questions (FAQs)

1. What is COTI Coin?

COTI Coin (COTI) is the native cryptocurrency of the COTI platform, which aims to provide a decentralized payment solution optimized for various financial applications. Utilizing a Directed Acyclic Graph (DAG) structure, COTI is designed to facilitate fast and scalable transactions, making it suitable for both online and offline payments. The platform’s architecture enables the creation of stablecoins, loyalty programs, and other financial products, all while ensuring data privacy and security.

2. Who created COTI Coin?

COTI was founded in 2017 by a team of professionals with backgrounds in finance, technology, and blockchain development. The project has been developed under the COTI Group, which focuses on creating a robust and scalable payment infrastructure that addresses the challenges faced by traditional financial systems. The team is committed to driving innovation in the cryptocurrency space and expanding the utility of COTI Coin.

3. How does COTI differ from Bitcoin?

COTI and Bitcoin serve different purposes and are built on distinct technological frameworks. While Bitcoin operates on a traditional blockchain and is primarily designed as a store of value and a medium of exchange, COTI utilizes a DAG structure, allowing for faster transaction processing and scalability. COTI is specifically optimized for payment solutions and can support various financial applications, including stablecoins and decentralized finance (DeFi) services, whereas Bitcoin’s primary focus is on being a decentralized digital currency.

4. Is COTI Coin a good investment?

As with any cryptocurrency, the potential of COTI as an investment depends on various factors, including market conditions, technological advancements, and the overall adoption of the platform. COTI has demonstrated significant growth since its inception, but it is essential to conduct thorough research and consider the inherent risks of investing in cryptocurrencies. Investors should assess their financial goals and risk tolerance before making investment decisions.

5. What are the use cases for COTI?

COTI has a wide range of use cases, including:

– Payment Solutions: Enabling merchants to accept various forms of payment, including cryptocurrencies and stablecoins.

– Stablecoins: Facilitating the creation of stablecoins for businesses and governments, allowing for price stability in transactions.

– Loyalty Programs: Implementing loyalty rewards systems that can enhance customer engagement.

– DeFi Applications: Supporting decentralized finance initiatives by providing a secure and scalable infrastructure for financial services.

6. What is the current price of COTI Coin?

As of the latest update, the price of COTI Coin is approximately $0.0495 USD. Prices are subject to fluctuations based on market dynamics, so it’s advisable to check real-time data on cryptocurrency exchanges or financial news platforms for the most current pricing.

7. What is the market cap of COTI Coin?

COTI Coin has a market capitalization of around $115.68 million. Market cap is calculated by multiplying the current price of the coin by its circulating supply. A higher market cap typically indicates greater market confidence and value associated with the asset.

8. Where can I buy COTI Coin?

COTI Coin can be purchased on several centralized exchanges, including Binance, Coinbase, KuCoin, and Kraken. Users can trade COTI for other cryptocurrencies or fiat currencies depending on the exchange’s offerings. It is recommended to use a reputable exchange and ensure that appropriate security measures are taken when trading or storing cryptocurrencies.

Final Verdict on coti coin

Overview of COTI Coin

COTI (Currency of the Internet) aims to revolutionize the payments landscape by offering a decentralized platform that enables users to create their own payment solutions. Built on a Directed Acyclic Graph (DAG) protocol, COTI is designed to facilitate high-speed transactions, processing over 100,000 transactions per second. This unique technology allows for the creation of stablecoins and decentralized applications (dApps), providing users with the ability to manage payments efficiently and securely. The network’s Trustchain algorithm underpins its operations, ensuring that transactions are not only fast but also scalable and private.

Unique Technology and Use Cases

The COTI network employs advanced cryptographic techniques, including garbled circuits and multiparty computation (MPC), to enhance on-chain privacy and security. This makes it particularly suitable for a wide range of applications, from confidential transactions to decentralized identification solutions. COTI’s infrastructure is designed to address the shortcomings of traditional payment systems, such as latency and high fees, while promoting financial inclusion and accessibility.

Investment Considerations

As with many cryptocurrencies, investing in COTI presents both opportunities and risks. With a current market cap of approximately $115 million and a price that has seen significant volatility—reaching an all-time high of $0.92 in late 2021—COTI is categorized as a high-risk, high-reward asset. Potential investors should be aware that while the underlying technology and use cases are promising, the cryptocurrency market is notoriously unpredictable and influenced by a multitude of factors, including regulatory changes and market sentiment.

Final Thoughts

Before making any investment decisions regarding COTI or any other cryptocurrency, it is crucial to conduct thorough research (DYOR). Understanding the technology, market trends, and risks involved will empower you to make informed choices. Always consider your financial situation and investment goals, and consult with financial advisors if necessary. As the digital asset landscape continues to evolve, staying informed will be key to navigating this exciting yet challenging market.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.