What is core coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to core coin

Core Coin (CORE) has emerged as a notable player in the cryptocurrency market, particularly since its mainnet launch in January 2023. It operates as an EVM-compatible Layer 1 blockchain, enabling the execution of smart contracts and decentralized applications (dApps). Built upon the innovative Satoshi Plus consensus mechanism, Core Coin combines elements of Bitcoin’s Proof-of-Work (PoW) and Ethereum’s Delegated Proof-of-Stake (DPoS). This unique approach addresses the blockchain trilemma, aiming to achieve a balance between decentralization, scalability, and security.

The significance of Core Coin lies in its ambition to enhance the Web 3.0 landscape by providing a robust infrastructure for developers and users alike. As a utility and governance token, CORE facilitates transaction fees, rewards for staking, and participation in the governance of the Core network via a decentralized autonomous organization (DAO). The growing ecosystem surrounding Core includes various dApps that cater to diverse needs, from DeFi to gaming, positioning it as a comprehensive platform for users looking to engage with blockchain technology.

This guide serves as a comprehensive resource for beginners and intermediate investors seeking to understand Core Coin in depth. It will cover several key areas, including:

Technology

We will delve into the technical aspects of Core Coin, explaining its architecture, the Satoshi Plus consensus mechanism, and how these elements work together to provide a secure and scalable platform for smart contracts and dApps.

Tokenomics

Understanding the economic model of Core Coin is crucial for evaluating its investment potential. This section will explore the total supply, distribution, and the mechanisms that drive value within the Core ecosystem, including the burn model designed to enhance scarcity.

Investment Potential

In this section, we will analyze the current market performance of Core Coin, including its price history, market capitalization, and trading volume. We will also discuss factors that may influence its future growth and adoption.

Risks

Every investment carries risks, and Core Coin is no exception. This part of the guide will highlight potential challenges and market dynamics that investors should be aware of before committing capital.

How to Buy Core Coin

Finally, we will provide practical information on where and how to purchase Core Coin, along with tips for securely storing and managing your assets.

By the end of this guide, readers will have a well-rounded understanding of Core Coin, enabling informed decisions regarding their investments in this innovative digital asset.

What is core coin? A Deep Dive into its Purpose

Understanding Core Coin (CORE)

Core Coin (CORE) is the native utility and governance token of the Core blockchain, which operates as a Layer 1 blockchain compatible with the Ethereum Virtual Machine (EVM). Launched in January 2023, the Core network utilizes the innovative “Satoshi Plus” consensus mechanism, which blends Bitcoin’s mining security with a Delegated Proof-of-Stake (DPoS) framework. This combination aims to address some of the most pressing challenges in the blockchain space while providing a robust foundation for decentralized applications (dApps) and smart contracts.

The Core Problem It Solves

The blockchain industry faces a significant issue known as the “blockchain trilemma,” which refers to the difficulty of achieving a balance among decentralization, scalability, and security. Many existing blockchains excel in one area at the expense of the others. Core aims to solve this problem by combining the strengths of Bitcoin and Ethereum.

-

Decentralization: By employing a DPoS system, Core allows participants to stake their tokens and vote for validators, which helps maintain a decentralized governance model. This is particularly important in the crypto ecosystem, where trust in centralized entities is often low.

-

Scalability: Core’s architecture is designed to handle high transaction throughput, making it suitable for a wide range of applications. The network’s high transactions per second (TPS) capability is a critical advantage in an environment where many existing blockchains struggle with congestion.

-

Security: The Satoshi Plus consensus mechanism reinforces security by integrating Bitcoin’s Proof-of-Work (PoW) mining hash power. This ensures that the Core network benefits from the established security of Bitcoin while also allowing for the efficient block validation provided by DPoS.

Its Unique Selling Proposition

Core’s unique selling proposition lies in its ability to create a seamless bridge between Bitcoin and decentralized finance (DeFi). Unlike traditional DeFi platforms that often operate in isolation, Core enables Bitcoin holders to stake their assets while retaining full custody and control over them. This approach is facilitated through Self-Custodial Bitcoin Staking, which employs Bitcoin’s native CheckLockTimeVerify (CLTV) feature to lock Bitcoin for a specified period.

-

Self-Custodial Staking: This innovative method allows users to stake their Bitcoin without relinquishing control. Participants can timelock their Bitcoin while earning rewards, thus transforming idle assets into productive investments. After the timelock period expires, users regain full access to their Bitcoin.

-

Dual Staking Mechanism: Core offers a Dual Staking feature that allows users to stake both Bitcoin and CORE tokens simultaneously. This synergistic approach not only amplifies the rewards earned but also strengthens the user’s alignment with the Core ecosystem, creating a win-win situation for both the network and its participants.

-

EVM Compatibility: By being EVM-compatible, Core allows developers to easily create and deploy dApps and smart contracts, thereby expanding the ecosystem and attracting a wider range of developers. This feature also facilitates interoperability with existing Ethereum-based applications, enhancing its appeal.

The Team and Backers

Core DAO, the organization behind Core Coin, is a decentralized autonomous organization that is governed by its community members. While the identities of the founders and key contributors remain undisclosed, the project has gained significant traction, boasting a large following on platforms like Twitter and Telegram.

-

Community-Driven Development: The governance structure of Core DAO allows token holders to propose and vote on changes to the network, ensuring that the development is aligned with the interests of the community. This decentralized approach fosters a sense of ownership among users and helps in building a vibrant ecosystem.

-

Support and Collaboration: Core has attracted a diverse range of supporters, including developers, investors, and advocates for a better web 3.0. The network’s commitment to transparency and community involvement has garnered trust and engagement from various stakeholders in the crypto space.

-

Security Audits: To further bolster its credibility, Core undergoes regular audits by recognized firms like CertiK, which specialize in blockchain security. This ensures that the protocol remains robust against vulnerabilities, enhancing the overall trust in the network.

Fundamental Purpose in the Crypto Ecosystem

Core Coin serves multiple roles within the Core ecosystem, functioning as a utility and governance token. Its fundamental purpose can be distilled into several key areas:

-

Transaction Fees: CORE tokens are used to pay for transaction fees on the Core network. This mechanism not only incentivizes validators but also ensures the smooth operation of the network.

-

Governance Participation: Holders of CORE tokens can participate in governance decisions, proposing changes and voting on important matters affecting the ecosystem. This empowers the community and fosters a sense of collective responsibility.

-

Staking and Rewards: CORE is integral to the staking ecosystem, allowing users to earn rewards while contributing to network security and stability. This dual role enhances user engagement and promotes a healthy economic model.

-

Enabling DeFi Applications: By providing a platform where Bitcoin can be utilized in DeFi applications, Core bridges the gap between traditional cryptocurrency holders and the burgeoning DeFi market. This not only enhances the utility of Bitcoin but also opens up new avenues for innovation within the crypto landscape.

In conclusion, Core Coin represents a significant step forward in addressing the challenges faced by the blockchain industry. By leveraging the strengths of both Bitcoin and Ethereum, Core aims to create a secure, scalable, and decentralized platform that empowers users and developers alike. With a community-driven approach and innovative features, Core is poised to play a vital role in the evolving crypto ecosystem.

The Technology Behind the Coin: How It Works

Introduction to Core Coin

Core (CORE) is a cryptocurrency designed to integrate Bitcoin’s security with the scalability and flexibility of Ethereum-compatible smart contracts. By leveraging a unique consensus mechanism and a decentralized governance model, Core aims to tackle the challenges of the blockchain trilemma—scalability, security, and decentralization—while providing a robust platform for decentralized applications (dApps) and financial services.

Blockchain Architecture

At its core, Core operates on a Layer 1 blockchain, which means that it has its own independent blockchain infrastructure. This architecture allows it to handle transactions and smart contracts without relying on other blockchains. Core is designed to be compatible with the Ethereum Virtual Machine (EVM), which means developers can easily port their Ethereum dApps to the Core network without having to rewrite their code.

The Core blockchain is structured to support high throughput and low transaction fees, making it an attractive option for both developers and users. The architecture includes features such as:

- EVM Compatibility: This allows Core to run Ethereum-based smart contracts and dApps, making it easier for developers familiar with Ethereum to transition to or build on Core.

- High Throughput: Core is designed to handle a large number of transactions per second (TPS), which is essential for applications requiring quick execution, such as decentralized finance (DeFi) protocols.

- Low Fees: The network aims to keep transaction fees minimal, making it cost-effective for users to interact with dApps.

Consensus Mechanism: Satoshi Plus

The backbone of the Core network’s security and transaction validation is its unique consensus mechanism known as Satoshi Plus. This mechanism combines elements of both Bitcoin’s Proof-of-Work (PoW) and Ethereum’s Delegated Proof-of-Stake (DPoS) models.

Proof-of-Work (PoW)

In traditional PoW systems like Bitcoin, miners compete to solve complex mathematical problems to validate transactions and create new blocks. This process requires significant computational power and energy consumption. While PoW is highly secure, it can be slow and less scalable.

Delegated Proof-of-Stake (DPoS)

In contrast, DPoS allows token holders to vote for a small number of trusted validators who are responsible for creating new blocks and validating transactions. This model increases efficiency and speed, as fewer participants are involved in the validation process. However, it can lead to centralization if not implemented correctly.

How Satoshi Plus Works

The Satoshi Plus mechanism combines these two approaches:

- Bitcoin Mining Integration: Bitcoin miners can direct their hash power to vote for Core validators, thus integrating Bitcoin’s security into the Core network. This allows miners to earn additional rewards in CORE tokens while still participating in the Bitcoin ecosystem.

- Validator Election: Users can stake CORE tokens to vote for validators, creating a decentralized and democratic process for block validation. This encourages participation and ensures that the network remains decentralized.

- Timelocked Bitcoin Staking: Bitcoin holders can timelock their Bitcoin to participate in the consensus process, allowing them to vote for validators while keeping their Bitcoin secure in their wallets.

This hybrid model aims to provide the best of both worlds: the security of PoW and the efficiency of DPoS.

Key Technological Innovations

Core introduces several innovative features that enhance its functionality and user experience. Here are some of the standout technologies:

Dual Staking

One of the most exciting features of Core is Dual Staking, which allows users to stake both CORE tokens and Bitcoin simultaneously. This mechanism significantly boosts the yield generated from staking:

- Higher Yields: By staking both assets, users can receive enhanced rewards, making it a more attractive option for those looking to generate passive income.

- Alignment with the Ecosystem: Dual staking encourages users to participate actively in the Core ecosystem, as the rewards are proportional to the amount of CORE staked alongside Bitcoin.

Self-Custodial Bitcoin Staking

Core offers a unique self-custodial staking mechanism that utilizes Bitcoin’s native CheckLockTimeVerify (CLTV) feature. This allows users to lock their Bitcoin for a specific period while retaining full control over their assets:

- Security: Users’ Bitcoin never leaves their wallets, which eliminates risks associated with third-party custodians.

- Active Participation: By locking their Bitcoin, users can vote for validators, contributing to the network’s security while earning rewards in CORE tokens.

Decentralized Autonomous Organization (DAO)

Core operates under a Decentralized Autonomous Organization (DAO) model, which empowers the community to participate in governance:

- Community Governance: Token holders can propose and vote on changes to the protocol, ensuring that the network evolves based on the community’s needs and desires.

- Transaction Fee Management: The DAO also manages transaction fees and other economic parameters, promoting transparency and fairness in the ecosystem.

Security Audits and Protocol Integrity

To maintain trust and security, the Core network undergoes regular audits by third-party firms such as CertiK, which specializes in blockchain security. These audits help identify vulnerabilities and ensure that the protocol operates as intended.

- Regular Audits: Continuous auditing and monitoring help maintain a secure environment for users and developers.

- Community Trust: By being transparent about security measures, Core builds trust within its community, encouraging more users to participate in the network.

Conclusion

Core represents a significant advancement in the cryptocurrency landscape, merging the security of Bitcoin with the flexibility of Ethereum-compatible smart contracts. Its innovative Satoshi Plus consensus mechanism, combined with features like Dual Staking and self-custodial Bitcoin staking, positions Core as a versatile platform for developers and users alike.

As the blockchain ecosystem continues to evolve, Core aims to address the inherent challenges of scalability, security, and decentralization, making it a noteworthy player in the growing world of digital assets. Whether you are a developer looking to build dApps or an investor seeking new opportunities, understanding the technology behind Core is crucial for navigating the future of blockchain and cryptocurrency.

Understanding core coin Tokenomics

Core Coin Tokenomics

Understanding the tokenomics of Core Coin (CORE) is essential for both new and intermediate investors looking to grasp how this digital asset functions within the Core ecosystem. Tokenomics encompasses the economic model, utility, distribution, and supply mechanisms of a cryptocurrency, all of which play a crucial role in its long-term viability and value proposition.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 2.1 billion CORE |

| Max Supply | 2.1 billion CORE |

| Circulating Supply | 1.01 billion CORE |

| Inflation/Deflation Model | Deflationary (Burn model similar to Ethereum’s “Ultra Sound Money”) |

Token Utility (What is the coin used for?)

The CORE token serves multiple essential functions within the Core ecosystem:

-

Transaction Fees: CORE tokens are used to pay for transaction fees on the Core blockchain. This is similar to gas fees in Ethereum, where users must hold tokens to interact with smart contracts and decentralized applications (dApps).

-

Governance Participation: CORE holders have the power to participate in the governance of the Core network. They can propose changes, vote on upgrades, and make decisions that affect the future direction of the ecosystem. This decentralized governance structure empowers users and aligns their interests with the health and growth of the network.

-

Staking Rewards: The CORE token is integral to the staking mechanism of the Core network. Users can stake their CORE tokens to help secure the network and, in return, earn rewards. This staking model combines with Bitcoin staking, allowing users to maximize their yields through dual staking, which significantly enhances returns.

-

Burn Mechanism: In a deflationary model similar to Ethereum’s, a portion of transaction fees and rewards will be burnt, reducing the total supply of CORE over time. This creates scarcity, which can potentially increase the value of the remaining tokens. The Core DAO, which governs the network, determines the percentage of tokens to be burned, aligning incentives for token holders and the broader community.

-

Incentives for Developers: Developers who create dApps on the Core network are rewarded with S-Prize tokens (Satoshi Prize) for their contributions. This encourages innovation and growth within the ecosystem, which is vital for its long-term success.

Token Distribution

The distribution of CORE tokens is crucial for understanding the incentives and economic model of the Core network. The total supply of CORE is divided into several categories, each serving distinct purposes:

-

Node Mining (39.995%): This portion is allocated for node operators who help maintain and secure the network. By incentivizing node operators, Core ensures a decentralized and robust network.

-

Core Users (25.029%): A significant share of tokens is reserved for users of the Core platform. This encourages user participation and engagement, helping to create a vibrant community.

-

Contributors (15%): This allocation rewards contributors who play a vital role in the development and growth of the Core ecosystem. This can include developers, marketers, and other supporters.

-

Reserves (10%): A portion of the total supply is held in reserve, providing flexibility for future needs, such as partnerships or unforeseen expenses.

-

Relayer Rewards (0.476%): This small percentage is designated for relayers, which are essential for facilitating transactions and maintaining network efficiency.

-

Treasury (9.5%): The treasury serves as a fund for ongoing development, marketing, and operational expenses, ensuring that the Core ecosystem can grow sustainably.

The careful distribution of CORE tokens aims to balance the incentives for all stakeholders, including users, developers, and node operators. This alignment of interests is vital for fostering a thriving ecosystem where all parties are motivated to contribute positively.

Conclusion

The tokenomics of Core Coin (CORE) reflect a well-thought-out economic model designed to support a decentralized blockchain ecosystem. With a total supply capped at 2.1 billion tokens, the utility of CORE extends beyond mere transactional purposes, encompassing governance, staking rewards, and incentives for both developers and users. The deflationary burn mechanism adds an additional layer of value proposition, potentially increasing the scarcity and value of the token over time. Understanding these dynamics is crucial for investors looking to navigate the evolving landscape of cryptocurrency and blockchain technology.

Price History and Market Performance

Key Historical Price Milestones

Core (CORE) has experienced a notable price trajectory since its inception in January 2023, when its mainnet was launched. The token’s price history can be divided into several key milestones that highlight its market performance and investor sentiment.

-

Launch and Initial Performance (January 2023): Upon the launch of its mainnet, CORE entered the market with an initial price that reflected the excitement surrounding its innovative blockchain technology and the Satoshi Plus consensus mechanism. The price quickly gained traction, reaching a high of approximately $6.47 on February 8, 2023. This all-time high was a result of strong community interest and the novelty of integrating Bitcoin staking with DeFi capabilities.

-

Post-Launch Corrections (February to November 2023): Following its all-time high, CORE experienced a significant price correction, which is typical for many cryptocurrencies after an initial surge. By November 3, 2023, the price had fallen to approximately $0.3432, marking an all-time low. This period of decline was influenced by broader market dynamics, including increased regulatory scrutiny in the cryptocurrency space and a general downturn in market sentiment.

-

Recent Recovery and Current Pricing (Late 2023): As of late October 2023, CORE has shown signs of recovery, with the price stabilizing around $0.4318. This represents a recovery of approximately 25.82% from its all-time low. The market capitalization has also seen improvement, reaching around $436.53 million, with a trading volume of approximately $8.48 million over the last 24 hours.

Factors Influencing the Price

Historically, the price of CORE has been influenced by a variety of factors, both intrinsic to the project itself and extrinsic market conditions.

-

Market Sentiment and Speculation: Like many cryptocurrencies, the price of CORE is heavily influenced by market sentiment. Speculation surrounding new features, partnerships, and technological advancements can lead to rapid price fluctuations. For instance, announcements related to the integration of Bitcoin staking and improvements to the Core network have often resulted in short-term price increases due to heightened investor interest.

-

Technological Developments: The Core network’s unique attributes, such as its EVM compatibility and the Satoshi Plus consensus mechanism, have played a significant role in shaping its price. The ability to stake Bitcoin and earn CORE tokens has attracted a niche audience looking to leverage Bitcoin’s value while participating in DeFi. Any advancements or upgrades to the network can lead to increased demand for the CORE token, thus influencing its price positively.

-

Market Trends and Comparisons: The overall performance of the cryptocurrency market, particularly that of Bitcoin and Ethereum, has a direct impact on CORE’s price. As a project built around Bitcoin’s ecosystem, CORE’s price often moves in correlation with Bitcoin’s price trends. For instance, during periods of bullish sentiment in the crypto market, CORE has benefited from increased visibility and investment flows.

-

Regulatory Environment: Regulatory news and developments can also significantly impact the price of CORE. Increased scrutiny on cryptocurrencies, particularly those that intersect with Bitcoin and DeFi, can lead to uncertainty and volatility. Investors often react to news regarding potential regulations, which can result in price dips or surges depending on the perceived impact on the project.

-

Community Engagement and Governance: The decentralized autonomous organization (DAO) model that governs the Core network has fostered a strong community around the project. The level of community engagement, participation in governance proposals, and the overall sentiment within the community can influence the price. A proactive and engaged community can lead to sustained interest and investment in the token.

-

Liquidity and Exchange Listings: The availability of CORE on various cryptocurrency exchanges has also affected its price. Increased liquidity from being listed on multiple platforms allows for better price discovery and can lead to more stable price movements. Conversely, if trading volume diminishes or if CORE becomes less accessible, it could lead to increased price volatility.

Conclusion

In summary, the price history of Core (CORE) reflects a typical trajectory for a newly launched cryptocurrency, characterized by initial excitement, subsequent corrections, and signs of recovery. Various factors, including market sentiment, technological advancements, regulatory developments, community engagement, and liquidity, have historically influenced the price of CORE. Understanding these dynamics is crucial for investors looking to navigate the evolving landscape of Core and its potential within the broader cryptocurrency ecosystem.

Where to Buy core coin: Top Exchanges Reviewed

5 Steps to Secure Your Core (CORE) Investment Today!

The Bitcompare guide on purchasing Core (CORE) emphasizes the importance of selecting the right cryptocurrency exchange tailored to your location and trading needs. It stands out by offering a comprehensive, step-by-step approach that simplifies the buying process for both novices and seasoned investors. The guide highlights key factors to consider when choosing an exchange, ensuring users make informed decisions in the dynamic cryptocurrency market.

- Website: bitcompare.net

- Platform Age: Approx. 6 years (domain registered in 2019)

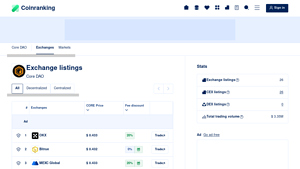

3. Core DAO (CORE) – Exciting New Listings to Watch!

The article on ‘Exchange Listings of Core DAO (CORE)’ from Coinranking offers a comprehensive overview of where to trade CORE tokens, highlighting key factors such as price comparisons, trading volumes, and available discounts across various platforms. What sets this exchange listing apart is its user-friendly interface, which empowers traders to make informed decisions quickly, ensuring they find the most advantageous trading options for their CORE investments.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

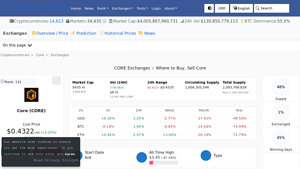

5. Core (CORE) – Your Gateway to Seamless Trading!

Core (CORE) is accessible on over 23 cryptocurrency exchanges, with Gate, OKEX, and Bitget being the top platforms for trading. These exchanges stand out due to their robust security measures, user-friendly interfaces, and a wide range of trading pairs, making it easier for both novice and experienced investors to buy, sell, and trade Core efficiently. Their competitive fee structures further enhance the trading experience for users.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

3. Core Exchange – Your Gateway to Seamless Trading!

Core Exchange on Swapzone offers a standout platform for trading CORE with a high rating of 4.7 based on 153 reviews. It distinguishes itself through competitive pricing, ensuring users get the best rates for their transactions. Additionally, the exchange emphasizes speed and security, making it an appealing choice for both novice and experienced traders looking to swap CORE for other cryptocurrencies efficiently.

- Website: swapzone.io

- Platform Age: Approx. 6 years (domain registered in 2019)

7. Coinbase – Easiest Way to Buy Core (CORECHAIN) in the USA!

Coinbase stands out as a premier platform for purchasing Core (CORECHAIN) in the United States due to its reputation for security and user-friendly interface. As one of the most trusted cryptocurrency exchanges, it offers a seamless experience for both beginners and seasoned investors, facilitating easy transactions and robust asset management tools. Coinbase’s commitment to regulatory compliance further enhances its appeal, making it a reliable choice for digital asset trading.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

How to Buy core coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to buying Core Coin (CORE) is selecting a cryptocurrency exchange where it is listed. Several well-known exchanges support CORE trading, including:

- Huobi

- OKX

- Gate.io

- Bybit

- Poloniex

When choosing an exchange, consider factors such as:

- User Interface: Look for an exchange that is easy to navigate, especially if you are a beginner.

- Fees: Review the trading fees, deposit, and withdrawal fees associated with the exchange.

- Security: Check the exchange’s security features, including two-factor authentication (2FA) and withdrawal whitelists.

- Supported Payment Methods: Ensure the exchange allows you to deposit funds through your preferred payment method (bank transfer, credit card, etc.).

2. Create and Verify Your Account

Once you’ve chosen an exchange, follow these steps to create an account:

- Sign Up: Visit the exchange’s website and click on the ‘Sign Up’ or ‘Register’ button. Fill in the required information, including your email address and password.

- Email Verification: After signing up, you will receive a verification email. Click the link in the email to verify your account.

-

Identity Verification: Most exchanges require identity verification for security and compliance reasons. Prepare to provide personal information, such as:

-

Full name

- Date of birth

- Address

-

Government-issued ID (passport, driver’s license, etc.)

-

Complete Verification: Follow the exchange’s instructions to complete the verification process. This may take a few minutes to a few days, depending on the exchange’s policies.

3. Deposit Funds

After your account is verified, you will need to deposit funds to purchase Core Coin. Here’s how:

- Navigate to the Deposit Section: Log in to your account and find the ‘Deposit’ option, usually located in the account menu.

- Select Your Deposit Method: Choose your preferred payment method. Most exchanges support bank transfers, credit/debit cards, and cryptocurrency deposits.

- Enter Deposit Amount: Specify the amount you wish to deposit. If you are using a bank transfer, you will be provided with the exchange’s bank details to complete the transfer.

- Confirm the Deposit: Follow the instructions provided by the exchange to finalize your deposit. Keep in mind that deposit times may vary depending on the method used.

4. Place an Order to Buy Core Coin

With funds in your account, you can now buy Core Coin. Follow these steps:

- Go to the Trading Section: Navigate to the ‘Markets’ or ‘Trade’ section of the exchange.

- Search for CORE: Use the search bar to find Core Coin (CORE). Select the trading pair that matches the currency you deposited (e.g., CORE/USDT or CORE/BTC).

-

Choose Order Type: Decide on the type of order you want to place. Common options include:

-

Market Order: Buys CORE at the current market price. This is the easiest option for beginners.

-

Limit Order: Sets a specific price at which you want to buy CORE. The order will only execute when the market reaches your specified price.

-

Enter the Amount: Specify how much CORE you wish to purchase.

- Confirm the Order: Review your order details and confirm the purchase. Once your order is executed, you will see your CORE balance reflected in your account.

5. Secure Your Coins in a Wallet

After purchasing Core Coin, it’s important to secure your investment. While you can leave your coins on the exchange, it’s safer to transfer them to a personal wallet. Here’s how to do it:

-

Choose a Wallet: Select a suitable wallet for storing your CORE tokens. You can choose from:

-

Software Wallets: Easy to use and accessible on your computer or smartphone (e.g., MetaMask, Trust Wallet).

-

Hardware Wallets: Physical devices that store your coins offline for enhanced security (e.g., Ledger, Trezor).

-

Create a Wallet: If you don’t already have a wallet, download a software wallet or set up a hardware wallet following the manufacturer’s instructions.

- Transfer CORE to Your Wallet:

- Find your wallet’s CORE address.

- Go to the ‘Withdraw’ section of your exchange account.

- Enter your wallet address and the amount of CORE you wish to transfer.

- Confirm the withdrawal.

Make sure to double-check your wallet address to avoid losing your tokens. After the transfer is complete, you will have successfully secured your Core Coin in your wallet.

Conclusion

Buying Core Coin is a straightforward process when you follow these steps. Always do your research, stay updated on market trends, and ensure the security of your digital assets. Happy investing!

Investment Analysis: Potential and Risks

Overview of Core (CORE)

Core (CORE) is a Layer 1 blockchain designed to leverage the strengths of Bitcoin while providing the capabilities of Ethereum’s smart contracts and decentralized applications (dApps). With a current market cap of approximately $436.53 million, the project aims to address the blockchain trilemma of decentralization, security, and scalability through its unique Satoshi Plus consensus mechanism, which combines elements of Bitcoin’s Proof-of-Work (PoW) and Ethereum’s Delegated Proof-of-Stake (DPoS) frameworks. As the project progresses, potential investors should carefully weigh the strengths and challenges associated with investing in CORE.

Potential Strengths (The Bull Case)

1. Unique Consensus Mechanism

The Satoshi Plus consensus mechanism distinguishes Core from other blockchain projects. By merging Bitcoin’s PoW security with DPoS, Core aims to achieve a balance between decentralization and scalability. This innovative approach could enhance transaction throughput while maintaining a high level of security, making it an attractive option for developers and users alike.

2. EVM Compatibility

Core’s compatibility with the Ethereum Virtual Machine (EVM) allows for the seamless deployment of Ethereum dApps. This feature opens the door for a wide range of applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs), potentially attracting developers who wish to leverage Core’s unique capabilities while benefiting from its security model.

3. Decentralized Governance

Core operates as a decentralized autonomous organization (DAO), giving token holders a voice in governance decisions. This structure can foster community engagement and contribute to the long-term sustainability of the project. By allowing users to participate in proposals and voting, the Core DAO can adapt and evolve based on the needs of its community.

4. Yield Generation Opportunities

Core provides innovative yield generation options, particularly through its Dual Staking feature. Users can stake both Bitcoin and CORE tokens, enhancing their potential returns. This feature not only encourages user engagement but also strengthens the network’s security by tying the value of Bitcoin to the Core ecosystem.

5. Strong Community and Ecosystem

With a growing community of over 1.6 million Twitter followers and 74,000 Telegram members, Core demonstrates substantial interest and support. A vibrant community can contribute to the adoption and growth of the project, driving demand for CORE tokens and its associated services.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

The cryptocurrency market is notoriously volatile, and CORE is no exception. As of now, the token’s price has experienced significant fluctuations, including a peak at $6.47 and a current price of approximately $0.43, reflecting a decline of over 93% from its all-time high. Such volatility can be disconcerting for investors and may deter potential users from adopting the platform. Price fluctuations can also lead to liquidity issues, making it challenging to buy or sell CORE tokens without impacting the market significantly.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is evolving, and Core is not immune to potential changes. Governments worldwide are increasingly scrutinizing digital assets, which could impact the operations of blockchain projects. Regulatory crackdowns or unfavorable legislation could hinder Core’s growth or limit its functionality, leading to a loss of investor confidence.

3. Competition

The blockchain space is highly competitive, with numerous projects vying for attention and market share. Core faces competition from established platforms like Ethereum, Binance Smart Chain, and newer entrants that offer similar functionalities. If Core fails to differentiate itself sufficiently or capture a significant user base, it may struggle to achieve its long-term goals.

4. Technological Risks

Like any blockchain project, Core is susceptible to technological risks, including security vulnerabilities, bugs in the code, and potential attacks on its network. Although the project is audited by CertiK, no system is entirely immune to threats. A successful attack or major technical failure could undermine user trust and lead to significant financial losses for investors.

5. Dependence on Bitcoin’s Performance

Core’s unique proposition hinges on its integration with Bitcoin, which means its success is somewhat tied to the performance and market perception of Bitcoin itself. Any negative developments in the Bitcoin ecosystem, such as decreased interest from miners or regulatory challenges, could adversely affect Core’s value and utility. Additionally, if Bitcoin’s price declines significantly, it may result in reduced staking activity and lower yields, impacting user engagement.

Conclusion

Investing in Core (CORE) presents both opportunities and challenges. Its innovative consensus mechanism, EVM compatibility, and community-driven governance offer significant potential for growth and adoption. However, prospective investors should remain vigilant about market volatility, regulatory uncertainties, and the competitive landscape. As with any investment in the cryptocurrency space, conducting thorough research and understanding the associated risks is crucial before making any financial decisions.

Frequently Asked Questions (FAQs)

1. What is Core Coin (CORE)?

Core Coin (CORE) is the native utility and governance token of the Core blockchain, which operates on a unique consensus mechanism known as Satoshi Plus. This Layer 1 blockchain is designed to be compatible with the Ethereum Virtual Machine (EVM), allowing it to run Ethereum-based smart contracts and decentralized applications (dApps). The Core network aims to solve the blockchain trilemma by combining elements of Bitcoin’s Proof-of-Work (PoW) and Ethereum’s Delegated Proof-of-Stake (DPoS) to achieve decentralization, security, and scalability.

2. Who created Core Coin?

Core Coin was developed by a global team of contributors under the CoreDAO organization, which focuses on advancing the Satoshi Plus ecosystem. The identities of the creators and developers remain undisclosed, but the project has gained significant support, boasting over 1.6 million followers on Twitter and more than 74,000 on Telegram. The community-driven approach is a hallmark of decentralized autonomous organizations (DAOs).

3. What makes Core Coin different from Bitcoin?

Core Coin differs from Bitcoin primarily in its consensus mechanism and functionality. While Bitcoin operates solely on a Proof-of-Work (PoW) model, Core uses the Satoshi Plus consensus, which combines PoW with Delegated Proof-of-Stake (DPoS). This allows for higher transaction throughput and supports the development of dApps. Additionally, Core facilitates Bitcoin staking, enabling users to earn rewards while maintaining control of their Bitcoin assets, which is not possible with Bitcoin alone.

4. Is Core Coin a good investment?

As with any cryptocurrency investment, the potential for profit or loss should be carefully considered. Core Coin has shown a volatile price history, with significant highs and lows since its launch. Investors should conduct thorough research, consider market trends, and evaluate their risk tolerance before investing in CORE. Keep in mind that past performance does not guarantee future results, and the cryptocurrency market is inherently risky.

5. How does staking work with Core Coin?

Staking with Core Coin involves locking up either Bitcoin or CORE tokens to earn rewards. The staking process utilizes Bitcoin’s CheckLockTimeVerify (CLTV) feature, allowing users to timelock their Bitcoin while retaining full custody. Rewards are generated from block rewards and transaction fees on the Core network. Additionally, users can participate in Dual Staking, where staking both Bitcoin and CORE enhances the yield significantly.

6. Where can I buy Core Coin?

Core Coin (CORE) is available for purchase on several cryptocurrency exchanges, including Huobi, OKX, Gate.io, Bybit, and Poloniex. Users can trade CORE against various pairs, including USDT. It is advisable to conduct due diligence on the exchange’s security and reputation before making any transactions.

7. What is the maximum supply of Core Coin?

The total supply of Core Coin is capped at 2.1 billion tokens. This fixed supply is designed to create scarcity and value, similar to Bitcoin’s hard cap. The distribution of CORE tokens is allocated to several categories, including node mining, user incentives, contributor rewards, and reserves, with plans for a burn model to enhance scarcity over time.

8. How is the Core network secured?

The Core network employs the Satoshi Plus consensus mechanism, which integrates Bitcoin’s PoW and a modified PoS model. This unique combination enhances security while enabling higher scalability. Additionally, the network is subject to audits by CertiK, a well-known firm specializing in blockchain security, to ensure that the protocol maintains high standards of safety and reliability.

Final Verdict on core coin

Overview of Core Coin

Core (CORE) is an innovative Layer 1 blockchain project designed to merge the worlds of Bitcoin and decentralized finance (DeFi). It operates using the unique Satoshi Plus consensus mechanism, which combines elements of Bitcoin’s Proof-of-Work with Ethereum’s Delegated Proof-of-Stake. This dual approach aims to achieve scalability, security, and decentralization, addressing the blockchain trilemma effectively. The Core network is compatible with the Ethereum Virtual Machine (EVM), allowing developers to create and manage smart contracts and decentralized applications (dApps) seamlessly.

Purpose and Use Cases

The primary purpose of Core is to transform idle Bitcoin into a productive asset through self-custodial staking. Users can lock their Bitcoin while maintaining full control, thus participating in the network’s governance and earning CORE token rewards. Additionally, the Core ecosystem is positioned to be a hub for various DeFi applications, enabling users to engage with a growing range of financial tools and services. The network’s governance is managed by a decentralized autonomous organization (DAO), allowing token holders to influence key decisions regarding the platform’s future.

Investment Considerations

As with any cryptocurrency investment, Core presents a high-risk, high-reward opportunity. Its innovative technology and unique positioning in the DeFi landscape may offer significant upside potential; however, the volatility of the crypto market and the inherent risks associated with new blockchain projects should not be overlooked. Investors should be aware of the fluctuations in CORE’s price, which has seen dramatic highs and lows since its all-time high of $6.47.

Final Thoughts

Before diving into the world of Core, it is crucial to conduct thorough research (DYOR). Understanding the underlying technology, market dynamics, and potential risks will empower you to make informed investment decisions. While Core has the potential to be a valuable asset in the evolving crypto landscape, caution and due diligence are paramount for navigating this high-stakes environment.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.