What is compound crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to compound crypto

Compound crypto, represented by its native token COMP, is a prominent player in the decentralized finance (DeFi) landscape. Launched in 2018, Compound is a protocol that allows users to lend and borrow cryptocurrencies in a secure, trustless manner through smart contracts on the Ethereum blockchain. As a pioneer in the DeFi space, it has transformed how users engage with their digital assets, providing them with opportunities to earn interest on their holdings or access liquidity by taking out loans. With a market capitalization of approximately $406.65 million and a circulating supply of around 9.45 million COMP tokens, Compound has established itself as a significant contender in the broader cryptocurrency market.

Significance of Compound in the Crypto Market

Compound stands out for its innovative approach to lending and borrowing, distinguishing itself from traditional financial systems. By enabling users to earn interest on their idle cryptocurrencies, Compound addresses a critical gap in the market: the need for accessible, decentralized financial services. The protocol’s governance model, which empowers COMP token holders to propose and vote on changes, further enhances its community-driven ethos, allowing users to actively shape the platform’s future. This unique model has attracted a growing user base and contributed to Compound’s reputation as a trusted DeFi solution.

Purpose of This Guide

This comprehensive guide aims to provide both beginner and intermediate investors with a detailed understanding of Compound crypto. It will cover various aspects of the protocol, including:

- Technology: An overview of how Compound operates, including its smart contract architecture and the mechanics behind lending and borrowing.

- Tokenomics: Insights into the supply and distribution of COMP tokens, as well as their role within the Compound ecosystem.

- Investment Potential: An analysis of Compound’s historical performance, market trends, and factors that could influence its future growth.

- Risks: A balanced discussion of the potential risks associated with investing in Compound, including market volatility and smart contract vulnerabilities.

- How to Buy: Step-by-step instructions on purchasing COMP tokens, including exchanges where they can be traded.

By the end of this guide, readers will have a well-rounded understanding of Compound crypto, enabling them to make informed decisions about their investments in this innovative DeFi platform.

What is compound crypto? A Deep Dive into its Purpose

Understanding Compound Crypto

Compound is a decentralized finance (DeFi) lending protocol that allows users to earn interest on their cryptocurrency holdings or borrow assets against collateral. Launched in 2018, Compound has become one of the prominent players in the DeFi space, enabling users to engage in lending and borrowing through smart contracts on the Ethereum blockchain. It addresses the inefficiencies of traditional finance by offering a platform where users can interact directly without intermediaries, thus creating a more inclusive financial ecosystem.

The Core Problem It Solves

In traditional finance, individuals typically earn minimal interest on their savings accounts, while borrowers often face high interest rates. This disparity creates an environment where capital remains largely inactive, leading to inefficiencies. Compound aims to change this by allowing users to lend their cryptocurrency to others and earn interest in return, thus putting idle assets to work.

The core problems Compound addresses include:

-

Inefficient Capital Utilization: Many cryptocurrencies sit idle on exchanges or in wallets, not generating any return for their holders. Compound allows users to deposit their cryptocurrencies into liquidity pools and earn interest, thus optimizing capital usage.

-

Access to Loans: In traditional finance, obtaining a loan often requires extensive paperwork, credit checks, and the involvement of banks or other financial institutions. Compound simplifies this process by enabling users to take out loans using their crypto assets as collateral, often without the need for credit scores or extensive documentation.

-

Transparency and Trust: Traditional lending and borrowing processes often lack transparency, leading to mistrust among users. Compound operates on a trustless system through smart contracts, ensuring that all transactions are transparent and verifiable on the blockchain.

Its Unique Selling Proposition

Compound’s unique selling proposition lies in its decentralized nature, user-friendly interface, and community governance model. Here are the key elements that set it apart:

-

Decentralization: Compound operates without a central authority, allowing users to lend and borrow directly from one another. This decentralization minimizes the risks associated with centralized financial institutions, such as fraud or mismanagement.

-

Interest Rate Mechanism: Compound employs an algorithmic interest rate model that automatically adjusts rates based on supply and demand. This dynamic approach ensures that interest rates are competitive and reflective of real-time market conditions, providing a fair return for lenders and reasonable rates for borrowers.

-

cTokens: When users deposit assets into Compound, they receive cTokens in return, which represent their stake in the liquidity pool. These cTokens accrue interest over time, allowing users to redeem them for more of the underlying asset than they initially deposited. This innovative mechanism enables users to earn passive income effortlessly.

-

Community Governance: The Compound protocol is governed by its community of users through the COMP token. Holders of COMP can propose changes, vote on protocol upgrades, and influence the future direction of the platform. This governance model fosters a sense of ownership and engagement among users, making Compound a community-driven project.

The Team and Backers

Compound was co-founded by Robert Leshner and Geoffrey Hayes, both of whom have extensive backgrounds in technology and entrepreneurship. Robert Leshner serves as the CEO, while Geoffrey Hayes holds the position of CTO. Before launching Compound, both co-founders worked at Postmates, where they gained valuable experience in building and scaling technology products.

The Compound team has grown over the years and consists of engineers, product managers, and advisors who contribute to the development and expansion of the protocol. The company behind Compound, Compound Labs, Inc., has received backing from prominent venture capital firms, including Andreessen Horowitz and Bain Capital Ventures. These investors provide not only financial support but also strategic guidance, helping Compound navigate the rapidly evolving DeFi landscape.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Compound in the crypto ecosystem is to democratize access to financial services and empower individuals to take control of their assets. By providing a platform for decentralized lending and borrowing, Compound enables users to leverage their cryptocurrency holdings for various financial needs, whether it’s generating passive income or accessing liquidity without selling their assets.

Moreover, Compound plays a crucial role in the broader DeFi movement by:

-

Promoting Financial Inclusion: By lowering the barriers to entry for lending and borrowing, Compound allows individuals from diverse backgrounds to participate in financial markets without the constraints of traditional banking systems.

-

Creating Liquidity: Compound contributes to the liquidity of the cryptocurrency market by facilitating the flow of assets between lenders and borrowers. This liquidity is essential for the overall health and sustainability of the DeFi ecosystem.

-

Encouraging Innovation: As a foundational layer in the DeFi space, Compound encourages other projects and protocols to build on its infrastructure, fostering innovation and creating a vibrant ecosystem of financial products and services.

In conclusion, Compound represents a significant advancement in how individuals can manage and utilize their cryptocurrency assets. By addressing the inefficiencies of traditional finance, offering a decentralized platform for lending and borrowing, and promoting community governance, Compound has established itself as a pivotal player in the evolving landscape of decentralized finance.

The Technology Behind the Coin: How It Works

Introduction to Compound Crypto

Compound (COMP) is a decentralized finance (DeFi) lending protocol built on the Ethereum blockchain. It allows users to lend and borrow cryptocurrencies in a trustless environment, meaning that transactions are executed without the need for intermediaries. Understanding the technology behind Compound is essential for both beginners and intermediate investors, as it sheds light on how the platform operates and why it has gained popularity in the DeFi space.

Blockchain Architecture

At its core, Compound operates on the Ethereum blockchain, which is a decentralized platform that enables the creation of smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This architecture allows Compound to function without a central authority, enabling users to engage in lending and borrowing activities directly.

The Ethereum blockchain is composed of a network of nodes that maintain a copy of the entire blockchain and validate transactions. This decentralized structure ensures that no single entity can control the protocol, making it resilient to censorship and fraud. When users interact with Compound, they do so through a web interface or decentralized applications (dApps) that connect to the Ethereum network.

Smart Contracts in Compound

Smart contracts are crucial to the functionality of Compound. When a user deposits assets into the platform, a smart contract is triggered, creating a representation of the deposited asset in the form of cTokens (e.g., cETH for Ethereum). These cTokens serve as proof of ownership and can be redeemed for the underlying asset at any time.

The exchange rate between cTokens and the underlying cryptocurrency is dynamic and adjusts over time based on the interest accrued. This means that as users deposit funds into the pool, the value of their cTokens increases, allowing them to withdraw more than they initially deposited. This mechanism incentivizes users to provide liquidity to the platform.

Consensus Mechanism

Compound uses the Ethereum blockchain, which primarily operates on a Proof-of-Stake (PoS) consensus mechanism as of Ethereum 2.0. In a PoS system, validators are selected to create new blocks and confirm transactions based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This approach contrasts with the older Proof-of-Work (PoW) mechanism, which relies on computational power to solve complex mathematical problems.

The switch to PoS enhances security and energy efficiency, as it reduces the computational resources required to validate transactions. For Compound, this means that transactions can be processed more quickly and at a lower cost, benefiting users who engage in lending and borrowing activities.

Key Technological Innovations

cTokens

One of the standout features of Compound is its cTokens. When users deposit cryptocurrencies into the protocol, they receive cTokens in return. These tokens not only represent the user’s stake in the liquidity pool but also accrue interest over time. The value of cTokens increases based on the interest generated from borrowers who pay interest on their loans. This innovative approach allows users to earn passive income on their holdings while maintaining liquidity.

Collateralization and Liquidation

To mitigate risks associated with lending, Compound employs a collateralization mechanism. When borrowers take out loans, they must provide collateral that exceeds the value of the loan. The collateralization ratio varies based on the type of asset used as collateral, typically ranging from 50% to 75%. This ensures that the platform remains over-collateralized, protecting lenders from default.

If a borrower’s collateral value falls below a certain threshold, the protocol automatically triggers a liquidation process. Liquidators can purchase the collateral at a discounted rate, allowing the protocol to maintain a healthy balance and protect lenders’ funds. This automated liquidation process is one of the key innovations that enhance the security of the Compound protocol.

Community Governance

Compound also distinguishes itself through its community governance model. Holders of the COMP token can propose changes to the protocol, vote on those proposals, and influence the platform’s direction. This decentralized governance structure empowers users and ensures that decisions are made collectively rather than by a centralized authority.

Proposals can range from adding new cryptocurrencies to the platform, adjusting collateralization factors, or modifying how COMP tokens are distributed. The governance process encourages active participation from the community, fostering a sense of ownership and responsibility among users.

Interest Rate Model

Compound employs a unique interest rate model that adjusts rates dynamically based on supply and demand. When there is high demand for a particular asset, interest rates for borrowing that asset increase, incentivizing users to deposit more into the pool. Conversely, if there is a surplus of assets in the pool, interest rates for borrowing decrease.

This adaptive interest rate mechanism helps maintain equilibrium in the market and ensures that lenders receive fair compensation for their contributions while borrowers face appropriate costs. It also encourages users to make informed decisions based on current market conditions.

Security Features

Security is paramount in DeFi, and Compound has implemented several measures to protect users and their assets. The protocol relies on smart contracts that have undergone extensive audits to identify and mitigate vulnerabilities. Additionally, Compound employs a collateralization strategy that ensures all loans are backed by sufficient collateral.

The protocol’s automated liquidation mechanism acts as a safeguard against defaults, ensuring that lenders’ funds remain secure. Furthermore, the decentralized nature of the Ethereum blockchain adds an extra layer of security, as it is resistant to censorship and manipulation.

Conclusion

Understanding the technology behind Compound is essential for anyone looking to engage with this innovative DeFi lending protocol. From its use of smart contracts to its dynamic interest rates and community governance, Compound offers a unique and secure way for users to earn interest on their cryptocurrencies or borrow against their assets.

As the DeFi landscape continues to evolve, Compound remains at the forefront, leveraging blockchain technology to create a more accessible and efficient financial ecosystem. By grasping these technological concepts, investors can make informed decisions and fully appreciate the potential of Compound and similar platforms in the world of digital assets.

Understanding compound crypto Tokenomics

Compound Tokenomics Overview

Compound (COMP) operates as a decentralized finance (DeFi) protocol that allows users to lend and borrow cryptocurrencies in a trustless environment. Understanding the tokenomics of COMP is essential for anyone looking to engage with this platform, whether for investment purposes or to utilize its services. This section will cover key metrics, the utility of the COMP token, and its distribution model.

| Metric | Value |

|---|---|

| Total Supply | 10,000,000 COMP |

| Max Supply | 10,000,000 COMP |

| Circulating Supply | 9,457,168 COMP |

| Inflation/Deflation Model | Deflationary (limited supply) |

Token Utility (What is the coin used for?)

The COMP token serves multiple purposes within the Compound ecosystem, each enhancing its functionality and utility. Here are the primary uses of COMP:

-

Governance: The most significant role of the COMP token is governance. Holders can propose changes to the protocol, vote on proposals, and influence the platform’s evolution. This decentralized governance model ensures that users have a say in how the platform operates, from adjusting interest rates to deciding on new asset listings.

-

Earning Rewards: Users can earn COMP tokens by participating in the Compound protocol. By supplying assets to liquidity pools or borrowing against their holdings, users accumulate COMP as a reward for their activity. This incentivizes users to engage with the protocol, helping to increase liquidity and participation.

-

Staking: Although Compound does not have a traditional staking model like some other cryptocurrencies, holding COMP can be seen as a form of staking. By holding the token, users contribute to the governance and overall health of the ecosystem.

-

Liquidation Incentives: In case of liquidation events, COMP tokens may be used as incentives for liquidators, rewarding them for maintaining the integrity of the lending pools.

-

Access to Features: As the ecosystem grows, COMP holders may gain access to exclusive features or benefits within the Compound platform, further enhancing its value proposition.

Token Distribution

The distribution of COMP tokens is designed to ensure a fair and equitable allocation while incentivizing early adopters and users of the platform. Below is an overview of the token distribution model:

-

Initial Distribution: The total supply of COMP is capped at 10 million tokens, with approximately 9.45 million tokens currently in circulation. This limited supply is crucial in creating scarcity, which can positively impact the token’s value over time.

-

User Rewards: A significant portion of the total supply—around 4.2 million COMP—is allocated to users who interact with the protocol over a four-year period. This distribution method encourages users to provide liquidity and take loans, ultimately benefiting the entire ecosystem.

-

Founders and Team Allocation: Approximately 2.2 million COMP tokens are designated for the founders and the current team members, with a vesting period of four years. This structure ensures that the team remains committed to the project’s long-term success.

-

Community Governance Incentives: An additional 775,000 COMP tokens are reserved specifically for community governance incentives. This allocation aims to encourage active participation in the governance process, further decentralizing control of the protocol.

-

Shareholders: Nearly 2.4 million COMP tokens are set aside for the shareholders of Compound Labs, Inc., the company behind the protocol. This allocation recognizes the contributions of early investors and stakeholders.

-

Future Team Members: There are also 332,000 tokens reserved for potential future team members, ensuring that the project can attract and retain talent as it grows.

Conclusion

Understanding the tokenomics of Compound (COMP) is vital for anyone looking to participate in the DeFi space. With a capped supply of 10 million tokens, a robust governance model, and incentives designed to reward users, COMP plays a central role in the Compound ecosystem. The thoughtful distribution strategy not only encourages user participation but also fosters a sense of community ownership and governance, making Compound a unique player in the DeFi landscape. As the protocol continues to evolve, the utility and value of COMP may further expand, providing opportunities for both users and investors.

Price History and Market Performance

Key Historical Price Milestones

Compound (COMP) has experienced significant price fluctuations since its inception, reflecting both the broader cryptocurrency market trends and specific developments within the Compound protocol itself.

Launch and Initial Trading

Compound was launched in September 2018, and the COMP token was introduced in June 2020. Initially, the price of COMP started at approximately $0.08. The token saw a gradual increase as the decentralized finance (DeFi) sector gained traction, with Compound becoming one of the leading platforms in this space.

All-Time High

On May 12, 2021, Compound reached its all-time high of $911.20. This surge was part of a broader bull market in cryptocurrencies, driven by increased interest in DeFi protocols and the overall growth of the Ethereum ecosystem. During this period, many investors sought to capitalize on the yield farming opportunities that Compound offered, which contributed to the rapid price appreciation of COMP.

Subsequent Decline

Following its all-time high, Compound’s price saw a steep decline, mirroring the downturn experienced across the cryptocurrency market. By June 10, 2023, the price had dropped to an all-time low of $25.55, marking a staggering 95.5% decrease from its peak. This decline can be attributed to various factors, including regulatory scrutiny, market corrections, and a shift in investor sentiment away from DeFi projects.

Recent Performance

As of October 2023, the price of Compound hovers around $43.00, showing signs of stabilization after the significant volatility of the previous years. Over the past year, COMP has seen a modest increase of approximately 1.18%, although it remains substantially lower than its all-time high.

Factors Influencing the Price

Historically, the price of Compound has been influenced by several key factors that can be categorized into market dynamics, protocol developments, and external economic conditions.

Market Dynamics

The overall cryptocurrency market is known for its volatility, and Compound is no exception. Price movements of Bitcoin and Ethereum often have a ripple effect on altcoins, including COMP. During bull markets, investor enthusiasm tends to drive prices up across the board, while bear markets result in widespread sell-offs. For instance, the impressive rise of COMP in early 2021 coincided with a broader rally in the crypto market, where many tokens reached new all-time highs.

Adoption and Usage

The demand for Compound’s services—such as lending and borrowing—directly impacts the price of COMP. As more users engage with the platform, the total value locked (TVL) in Compound tends to rise, which can create upward pressure on the token’s price. Conversely, a decline in user activity or TVL can lead to decreased demand for COMP, negatively affecting its price. The growth of DeFi and the increasing popularity of yield farming have historically contributed to spikes in user engagement with Compound.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies and DeFi has been another critical factor influencing COMP’s price. Increased scrutiny from regulatory bodies can create uncertainty, leading to sell-offs or a decrease in new investments. For example, discussions around potential regulations for DeFi platforms have occasionally caused market-wide declines, affecting COMP alongside other tokens.

Technological Developments

Updates and changes to the Compound protocol itself can significantly influence COMP’s price. Improvements in the platform’s functionality, such as enhanced security features or new asset integrations, can attract more users and investors, driving up demand for COMP. Conversely, any technical issues or controversies surrounding the protocol can lead to negative sentiment and price declines.

Market Sentiment and Speculation

Investor sentiment plays a crucial role in the price dynamics of cryptocurrencies. The DeFi sector is particularly susceptible to speculation, with price movements often driven by market sentiment rather than fundamental value. Social media trends, news articles, and prominent endorsements can all sway investor opinions, leading to rapid price changes.

Conclusion

In summary, the price history and market performance of Compound (COMP) reflect a complex interplay of various factors. From its initial launch to its all-time high and subsequent decline, COMP’s price trajectory has been shaped by market dynamics, user adoption, regulatory developments, technological enhancements, and overall market sentiment. Understanding these influences can help investors and enthusiasts navigate the evolving landscape of Compound and the broader DeFi ecosystem.

Where to Buy compound crypto: Top Exchanges Reviewed

1. Changelly – Top Choice for Minimal Exchange Fees on Compound (COMP)!

Changelly stands out as a premier platform for exchanging Compound (COMP) due to its competitive rates and minimal fees, earning a commendable rating of 4.7 from over 5,000 users. The exchange offers seamless transactions through both its website and mobile app, allowing users to choose from over 700 cryptocurrencies. With 24/7 live support, Changelly ensures a fast and efficient trading experience for both novice and seasoned investors.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

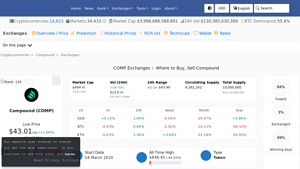

5. Compound (COMP) – Your Gateway to Decentralized Finance!

Compound (COMP) is widely accessible across more than 57 cryptocurrency exchanges, with Binance, Gate, and HTX emerging as the top platforms for trading. What sets these exchanges apart is their extensive support for various trading pairs, including USDT, BUSD, and TUSD on Binance, enhancing liquidity and trading flexibility. This broad availability and robust trading options make it easier for both novice and experienced investors to engage with Compound effectively.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

10. BlockFi – Top Choice for Flexible Loan Terms!

In “10 Best Crypto Loan Providers 2025,” CoinLedger highlights exceptional platforms that cater to diverse borrowing needs. Alchemix stands out with its innovative self-repaying loans, while Arch Lending prioritizes trust and security, ensuring peace of mind for users. Binance appeals to non-US customers with its robust offerings, and Compound attracts borrowers with its no minimum loan requirements, making it accessible for all. Each provider is expert-verified, ensuring reliability in the evolving crypto landscape.

- Website: coinledger.io

- Platform Age: Approx. 11 years (domain registered in 2014)

How to Buy compound crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to buying Compound (COMP) is selecting a reliable cryptocurrency exchange. There are numerous exchanges available, but it’s essential to choose one that supports COMP and is reputable. Popular exchanges for purchasing Compound include:

- Coinbase: User-friendly and great for beginners.

- Binance: Offers a wide variety of trading pairs and features.

- Kraken: Known for its security and comprehensive trading options.

- Huobi Global: Offers competitive trading fees and a variety of digital assets.

When selecting an exchange, consider factors such as fees, security measures, ease of use, and available payment methods. Ensure that the exchange complies with regulatory standards in your region.

2. Create and Verify Your Account

Once you’ve selected an exchange, you’ll need to create an account. Here’s how:

- Visit the exchange’s website and click on the “Sign Up” or “Register” button.

- Provide your information: Enter your email address, create a strong password, and agree to the terms of service.

- Verify your email: Most exchanges will send a verification link to your email. Click on this link to confirm your account.

- Complete KYC (Know Your Customer) verification: This process may vary by exchange but typically involves providing personal information such as your name, address, and date of birth. You may also need to upload a government-issued ID (like a passport or driver’s license) and a selfie for identity verification.

This step is crucial as it helps prevent fraud and ensures compliance with local laws.

3. Deposit Funds

After your account has been verified, you’ll need to deposit funds to buy Compound. Here’s how to do that:

- Log in to your account and navigate to the “Deposit” or “Funds” section.

- Choose your deposit method: Most exchanges allow deposits in various forms, including bank transfers, credit/debit cards, and sometimes even PayPal. Select the method that suits you best.

- Enter the amount you wish to deposit: Be aware of any minimum deposit requirements and transaction fees associated with your chosen method.

- Confirm the deposit: Follow the prompts to complete the transaction. Depending on the method chosen, it may take some time for your funds to appear in your exchange account.

Ensure that you deposit enough funds to cover the cost of the COMP tokens you wish to buy, plus any transaction fees.

4. Place an Order to Buy Compound Crypto

With funds in your exchange account, you’re ready to buy COMP. Follow these steps:

- Navigate to the trading section of the exchange, often labeled as “Markets” or “Trade.”

- Search for Compound (COMP): Use the search bar to find the COMP trading pair you want, such as COMP/USD or COMP/BTC.

- Select the order type: You can place a market order (buying COMP at the current market price) or a limit order (setting a specific price at which you want to buy). For beginners, a market order is usually easier.

- Enter the amount of COMP you wish to purchase: You can typically specify the amount in COMP or the amount of your base currency you want to spend.

- Review your order: Check the details, including the total cost and any fees.

- Submit your order: Click the “Buy” button to execute the trade.

Once your order is filled, the COMP tokens will be credited to your exchange account.

5. Secure Your Coins in a Wallet

After purchasing Compound, it’s crucial to secure your tokens. While you can leave them on the exchange, it’s safer to transfer them to a personal cryptocurrency wallet. Here’s how to do it:

- Choose a wallet: There are several types of wallets to consider:

– Software Wallets: Applications like MetaMask or Trust Wallet that are user-friendly.

– Hardware Wallets: Devices like Ledger or Trezor that offer enhanced security. - Set up your wallet: Follow the instructions provided by the wallet provider to create your wallet and back it up securely.

- Transfer your COMP tokens:

– Log in to your exchange account and navigate to the “Withdraw” or “Send” section.

– Enter your wallet address (double-check it for accuracy) and specify the amount of COMP you want to transfer.

– Confirm the transaction.

By securing your COMP tokens in a wallet, you reduce the risk of loss due to exchange hacks or other vulnerabilities. Always keep your private keys and recovery phrases safe.

Following these steps will help you successfully buy and secure Compound (COMP) tokens, allowing you to participate in the decentralized finance ecosystem.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Innovative DeFi Solution

Compound (COMP) is a pioneering decentralized finance (DeFi) lending protocol that allows users to earn interest on their cryptocurrency holdings or borrow against them. This innovative approach to lending and borrowing is designed to operate without intermediaries, enabling users to access financial services in a trustless environment. As the DeFi sector continues to grow, Compound’s established position may offer significant upside potential.

2. Strong Market Position

As one of the leading platforms in the DeFi space, Compound has garnered significant attention and user adoption. With over $800 million in total locked value (TVL) at various points, it demonstrates robust demand for its lending and borrowing services. This strong market presence can provide a competitive advantage as more users turn to DeFi solutions for their financial needs.

3. Governance and Community Involvement

COMP token holders can participate in the governance of the protocol, allowing them to propose and vote on changes. This decentralized governance structure fosters a sense of community and ownership among users, potentially leading to a more resilient and adaptive protocol. The ability for users to influence protocol changes may also enhance user loyalty and long-term engagement.

4. Diverse Asset Pooling

Compound supports a wide range of ERC-20 tokens, allowing users to deposit various cryptocurrencies to earn interest. This diversification can attract a broader user base, as investors often seek to maximize their returns across different assets. The ability to earn interest on idle assets provides a compelling reason for users to engage with the platform.

5. Established Security Measures

Security is paramount in the DeFi space, and Compound has implemented robust measures to protect user assets. The protocol operates using smart contracts, which are subject to audits and community scrutiny. Additionally, the over-collateralization requirement helps mitigate risks associated with lending, thereby enhancing the platform’s overall security.

6. Potential for Passive Income

For investors seeking passive income, Compound offers an attractive opportunity. By depositing cryptocurrencies into the protocol, users can earn interest on their holdings. This feature can be particularly appealing in a low-interest-rate environment, where traditional savings accounts offer minimal returns.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrency markets are known for their high volatility, which can significantly impact the value of assets held on platforms like Compound. Price fluctuations can lead to rapid changes in collateral values, potentially triggering liquidations for borrowers. Such volatility may deter risk-averse investors and could lead to negative sentiment towards the platform, especially during market downturns.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies and DeFi protocols remains uncertain and varies significantly across jurisdictions. Governments may impose regulations that could affect the operations of Compound and similar platforms. For instance, regulations surrounding lending practices, taxation, or anti-money laundering could complicate user interactions and impact the platform’s growth potential.

3. Competition

The DeFi space is highly competitive, with numerous lending protocols vying for market share. Competitors such as Aave and MakerDAO offer similar services, and new entrants continuously emerge. This competition can drive down interest rates and reduce the attractiveness of Compound’s offerings. If Compound fails to innovate or differentiate itself effectively, it may lose users to rival platforms.

4. Technological Risks

While Compound has established itself as a reputable protocol, it is not immune to technological risks. Smart contracts, despite rigorous auditing, can still contain vulnerabilities that hackers may exploit. Any security breaches or exploits could lead to significant financial losses for users and damage the protocol’s reputation. Moreover, the reliance on Ethereum’s network means that any issues with the Ethereum blockchain, such as congestion or high gas fees, could adversely affect Compound’s performance.

5. Dependence on Ethereum

Compound operates primarily on the Ethereum blockchain, which introduces a dependency on the network’s performance and scalability. As Ethereum continues to transition to a proof-of-stake (PoS) model with Ethereum 2.0, uncertainties surrounding this migration could impact Compound’s functionality. Issues such as network delays or high transaction costs during peak periods may hinder user experience and deter engagement.

6. Economic Sustainability

The sustainability of Compound’s economic model relies heavily on user participation and engagement. If interest rates decline significantly, or if the market sees a reduction in the demand for lending and borrowing services, it could lead to decreased earnings for users and a drop in overall platform activity. This could create a negative feedback loop, resulting in reduced liquidity and a diminished user base.

Conclusion

In summary, Compound presents a compelling investment opportunity within the DeFi sector, with strengths in its innovative solutions, strong market presence, and user governance. However, potential investors must remain aware of the inherent risks, including market volatility, regulatory uncertainty, competition, technological vulnerabilities, dependence on the Ethereum network, and economic sustainability. A balanced understanding of these factors will be crucial for making informed decisions regarding engagement with Compound and similar digital assets.

Frequently Asked Questions (FAQs)

1. What is Compound Crypto?

Compound is a decentralized finance (DeFi) lending protocol that allows users to earn interest on their cryptocurrencies by depositing them into liquidity pools. When users deposit assets, they receive cTokens in return, which represent their stake in the pool. These cTokens can be redeemed for the underlying assets, with the exchange rate increasing over time to reflect the earned interest. Additionally, Compound enables users to borrow assets by providing collateral, allowing for secured loans within the ecosystem.

2. Who created Compound Crypto?

Compound was founded in 2017 by Robert Leshner and Geoffrey Hayes, both of whom previously held significant roles at Postmates, an online food delivery service. Robert Leshner serves as the CEO, while Geoffrey Hayes is the CTO. The development of Compound is managed by Compound Labs, Inc., which comprises a team of engineers and blockchain experts dedicated to enhancing the protocol.

3. How does Compound Crypto work?

Compound operates through smart contracts on the Ethereum blockchain. Users deposit supported cryptocurrencies into various liquidity pools, receiving cTokens in return. The interest earned is automatically credited to users as the cToken exchange rate increases. For borrowers, the protocol allows them to take out loans by depositing collateral, with varying loan-to-value (LTV) ratios depending on the asset. If the collateral value falls below a specified threshold, it can be liquidated to maintain the protocol’s stability.

4. What makes Compound Crypto different from Bitcoin?

While Bitcoin is primarily a digital currency designed for peer-to-peer transactions, Compound serves as a platform for decentralized lending and borrowing. Compound allows users to earn interest on their crypto holdings and facilitates loans, making it a financial service rather than just a store of value. Additionally, Compound uses a governance token, COMP, which enables holders to propose and vote on protocol changes, fostering a decentralized decision-making process.

5. Is Compound Crypto a good investment?

As with any cryptocurrency investment, the decision to invest in Compound (COMP) should be based on thorough research and an understanding of the market dynamics. Factors to consider include the current price, historical performance, market trends, and the overall growth of the DeFi sector. While Compound has demonstrated significant growth and adoption, potential investors should weigh the risks involved and consider their investment goals before proceeding.

6. How can I buy Compound Crypto?

Compound (COMP) can be purchased on various cryptocurrency exchanges, including popular platforms like Coinbase, Binance, and Huobi Global. To buy COMP, users typically need to create an account on an exchange, complete necessary verification processes, deposit funds (either fiat or other cryptocurrencies), and then place an order to buy COMP at the current market price or set a limit order.

7. What is the total supply of Compound Crypto?

The total supply of Compound (COMP) is capped at 10 million tokens. As of now, approximately 9.45 million COMP are in circulation. The distribution of COMP tokens includes allocations for users who participate in the platform, shareholders of Compound Labs, and the founding team, with a portion reserved for community governance incentives.

8. How is Compound Crypto secured?

Compound’s security relies on smart contracts that govern the lending and borrowing process. Each asset deposited into the protocol is subject to a collateralization factor, ensuring that pools remain overcollateralized to protect lenders. In the event that a borrower’s collateral value falls below the maintenance threshold, the collateral can be liquidated at a discount, ensuring the protocol remains solvent and protects users’ funds. Regular audits and community governance also contribute to maintaining security within the Compound ecosystem.

Final Verdict on compound crypto

Overview of Compound Crypto

Compound (COMP) is a decentralized finance (DeFi) lending protocol that empowers users to earn interest on their cryptocurrency holdings by depositing them into liquidity pools. The protocol employs smart contracts on the Ethereum blockchain to facilitate the lending and borrowing of various supported tokens. When users deposit assets, they receive cTokens, which represent their stake in the pool and can be redeemed later for the underlying asset along with accrued interest. This innovative model allows users to generate passive income while maintaining liquidity.

Key Features and Technology

Compound distinguishes itself with its community governance model, where holders of the COMP token can propose and vote on protocol changes. This decentralized approach fosters a sense of ownership among users and encourages active participation in the platform’s evolution. The protocol’s algorithm dynamically adjusts interest rates based on supply and demand, ensuring that both lenders and borrowers have an optimized experience. The current market cap of Compound is approximately $406.65 million, with a circulating supply of around 9.45 million COMP tokens, capped at a total supply of 10 million.

Investment Considerations

Investing in Compound presents significant opportunities, as it is positioned within the rapidly growing DeFi sector. However, it also carries substantial risks. The volatility of cryptocurrency markets, the potential for smart contract vulnerabilities, and regulatory uncertainties are critical factors that could impact the value of COMP tokens. As of now, the price of COMP is significantly lower than its all-time high, reflecting the unpredictable nature of the crypto market.

Final Thoughts

In conclusion, while Compound crypto offers a compelling platform for earning interest and participating in decentralized finance, it is essential to approach this asset class with caution. As with any investment, especially in the high-risk environment of cryptocurrencies, conducting thorough research (DYOR) is crucial. Potential investors should familiarize themselves with the mechanics of the Compound protocol, its market trends, and the broader DeFi landscape before making investment decisions.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.