What is big crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to big crypto

Understanding Big Crypto

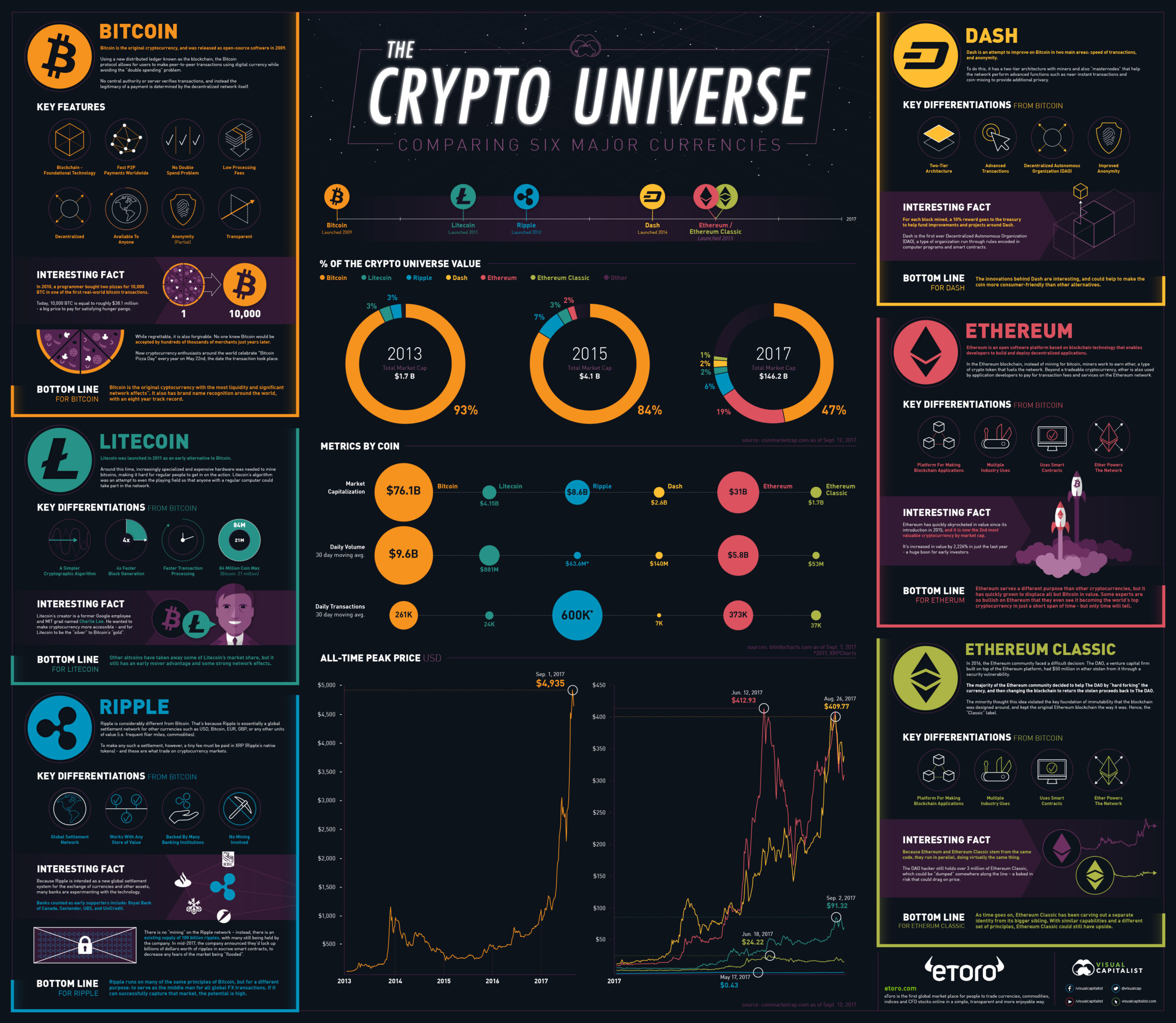

In the rapidly evolving world of cryptocurrency, “big crypto” refers to the most prominent digital assets that have established themselves as key players in the market. This includes leading cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and a selection of other high-cap coins like XRP, BNB, and Solana. These assets not only command significant market capitalizations but also play crucial roles in the development of blockchain technology, smart contracts, decentralized finance (DeFi), and various other innovative applications. Their significance lies not just in their current market value but also in their potential to reshape the financial landscape.

The Purpose of This Guide

This guide aims to serve as a comprehensive resource for both beginner and intermediate investors looking to navigate the complexities of big crypto. It will cover essential topics, including:

-

Technology: Understanding the underlying blockchain technology that powers these cryptocurrencies, including consensus mechanisms, scalability solutions, and unique features that distinguish each asset.

-

Tokenomics: Analyzing the economic models of big crypto, including supply dynamics, distribution methods, and the implications of token burns or inflation on value.

-

Investment Potential: Evaluating the historical performance of these assets, their use cases, and market trends to help investors assess their viability as long-term investments.

-

Risks: Identifying the inherent risks associated with investing in cryptocurrencies, such as market volatility, regulatory challenges, and technological vulnerabilities.

-

How to Buy: Providing step-by-step guidance on purchasing big crypto, including selecting exchanges, understanding wallets, and executing trades safely.

The Landscape of Big Crypto

With a current global cryptocurrency market cap of approximately $3.84 trillion, big crypto is at the forefront of this financial revolution. Bitcoin, as the first cryptocurrency, remains the most valuable asset, while Ethereum has revolutionized the concept of programmable money through its smart contracts. Other major players, such as XRP and BNB, offer unique advantages in terms of transaction speed and utility within their ecosystems.

As an investor, understanding the landscape of big crypto is essential for making informed decisions. This guide will equip you with the knowledge needed to navigate this exciting yet complex world, helping you to identify opportunities and manage risks effectively. Whether you are looking to diversify your portfolio or explore the potential of blockchain technology, this guide will provide you with the insights necessary to embark on your cryptocurrency journey.

What is big crypto? A Deep Dive into its Purpose

Understanding Big Crypto

In the ever-evolving landscape of digital assets, “big crypto” has emerged as a significant player. This term typically refers to cryptocurrencies that hold substantial market capitalizations and influence within the broader crypto ecosystem. Understanding what constitutes big crypto, its purpose, and its unique characteristics is essential for both novice and seasoned investors.

The Core Problem It Solves

Big crypto primarily addresses the challenges associated with traditional financial systems, including issues of trust, transparency, and efficiency. Here are some core problems that big crypto aims to solve:

-

Decentralization of Finance: Traditional financial systems are often centralized, leading to vulnerabilities such as fraud and corruption. Big crypto promotes a decentralized approach, where transactions are verified by a network of nodes rather than a central authority. This decentralization helps to mitigate risks and enhances security.

-

Financial Inclusion: In many parts of the world, individuals lack access to basic banking services. Big crypto provides an alternative by enabling anyone with an internet connection to participate in financial activities, such as sending and receiving funds, investing, and accessing financial services without the need for a bank account.

-

High Transaction Costs: Traditional banking and remittance services often charge high fees for transactions, especially international transfers. Big crypto offers lower transaction costs, making it more accessible for users to transfer value across borders.

-

Transparency and Trust: The blockchain technology underpinning big crypto provides a transparent and immutable record of transactions. This feature enhances trust among users, as they can verify transactions independently without relying on third-party intermediaries.

-

Inflation Hedge: In some economies, inflation erodes the purchasing power of fiat currencies. Big crypto, particularly those with capped supplies like Bitcoin, can serve as a hedge against inflation, allowing individuals to preserve their wealth over time.

Its Unique Selling Proposition

Big crypto distinguishes itself through several unique selling propositions (USPs) that appeal to a broad audience:

-

Market Leadership: Big crypto assets, such as Bitcoin and Ethereum, are often seen as market leaders. Their established presence and large market capitalizations provide a sense of stability and security for investors.

-

Network Effects: As more users adopt big crypto, the value of the network increases. This network effect leads to enhanced utility and greater liquidity, making it easier for users to buy, sell, and trade these assets.

-

Technological Innovation: Big crypto often leads the way in technological advancements within the blockchain space. For instance, Ethereum introduced smart contracts, enabling developers to create decentralized applications (dApps) that extend beyond simple transactions.

-

Institutional Adoption: The increasing interest from institutional investors has bolstered the credibility of big crypto. Companies are now integrating crypto into their business models, further legitimizing its use as an investment vehicle.

-

Liquidity and Accessibility: Big crypto assets tend to have higher liquidity compared to smaller altcoins, making them easier to trade. Additionally, they are widely supported by various exchanges and wallets, enhancing their accessibility for users.

The Team and Backers

Behind big crypto projects are teams of experienced developers, entrepreneurs, and visionaries who contribute to their success. For instance:

-

Founders and Developers: The founding teams of big crypto projects often include individuals with backgrounds in technology, finance, and software development. Their expertise drives innovation and ensures that the projects remain competitive in a rapidly changing environment. For example, Bitcoin was created by an anonymous person or group known as Satoshi Nakamoto, while Ethereum was co-founded by Vitalik Buterin, a well-known figure in the blockchain community.

-

Community Support: Big crypto projects often have vibrant communities that contribute to their development and marketing. These communities provide valuable feedback, support, and advocacy, which can significantly influence a project’s success.

-

Strategic Partnerships: Many big crypto projects form strategic partnerships with businesses, financial institutions, and technology companies. These collaborations can enhance the project’s visibility, provide additional resources, and open up new avenues for growth.

-

Funding and Investment: Big crypto projects often attract significant investment from venture capital firms and angel investors. This funding allows them to scale their operations, invest in research and development, and improve their infrastructure.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of big crypto extends beyond mere investment opportunities; it aims to revolutionize the way individuals and businesses conduct transactions and interact with value. Here are some key aspects of its purpose in the crypto ecosystem:

-

Promoting Decentralization: By providing a decentralized alternative to traditional finance, big crypto empowers users to have greater control over their assets and transactions.

-

Driving Innovation: Big crypto serves as a catalyst for innovation within the blockchain space. It encourages the development of new technologies, applications, and financial products that can benefit users across the globe.

-

Building Trust: The transparency and security offered by big crypto foster trust among users, encouraging broader adoption and usage.

-

Creating New Economic Models: Big crypto enables the emergence of new economic models, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), which provide users with unique opportunities for investment, ownership, and income generation.

-

Global Economic Participation: By removing barriers to entry, big crypto facilitates global economic participation, allowing individuals from diverse backgrounds to engage in financial activities and benefit from the growing digital economy.

In conclusion, big crypto plays a pivotal role in reshaping the financial landscape by addressing key challenges, offering unique advantages, and fostering innovation. As the cryptocurrency ecosystem continues to evolve, understanding the purpose and impact of big crypto becomes increasingly important for all investors.

The Technology Behind the Coin: How It Works

Understanding Blockchain Architecture

At the heart of ‘big crypto’ lies its blockchain architecture, which serves as the foundational technology enabling its operations. A blockchain is essentially a distributed ledger that records transactions across many computers in a way that ensures the security, transparency, and integrity of the data.

-

Distributed Ledger Technology (DLT): Unlike traditional databases controlled by a single entity, a blockchain is decentralized. This means that no single person or organization owns the entire chain. Instead, multiple copies of the ledger exist across numerous nodes (computers), making it nearly impossible to alter or tamper with the data without consensus from the network.

-

Blocks and Chains: Transactions are grouped together in blocks. Each block contains a list of transactions, a timestamp, and a cryptographic hash of the previous block. This chaining of blocks creates a secure and chronological record of all transactions. If someone tries to change the information in a block, the hash changes, breaking the chain and alerting the network to the tampering.

-

Transparency and Anonymity: While all transactions on the blockchain are public and can be viewed by anyone, the identities of the participants are secured through cryptographic techniques. Users are represented by public keys, which provide a layer of anonymity while still ensuring traceability.

Consensus Mechanism

One of the critical components that ensure the security and reliability of ‘big crypto’ is its consensus mechanism. This is the process by which the network agrees on the validity of transactions and the state of the blockchain.

-

Proof-of-Work (PoW): Initially, ‘big crypto’ used the Proof-of-Work consensus mechanism, similar to Bitcoin. In PoW, miners compete to solve complex mathematical puzzles. The first miner to solve the puzzle gets to add a new block to the chain and is rewarded with cryptocurrency. While this mechanism is secure, it is also energy-intensive and can lead to slower transaction times due to the time taken to solve the puzzles.

-

Transition to Proof-of-Stake (PoS): To address the inefficiencies of PoW, ‘big crypto’ has transitioned to a Proof-of-Stake model. In PoS, validators are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral. This approach significantly reduces energy consumption and speeds up transaction processing times, while also maintaining security.

-

Delegated Proof-of-Stake (DPoS): An evolution of PoS, DPoS allows users to vote for delegates who validate transactions and maintain the blockchain. This creates a more democratic system where users can influence the governance of the network, leading to faster decision-making and improved scalability.

Key Technological Innovations

‘Big crypto’ is not just about blockchain and consensus mechanisms; it also incorporates several technological innovations that enhance its functionality and usability.

-

Smart Contracts: One of the most groundbreaking features of ‘big crypto’ is the introduction of smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. Smart contracts automatically execute transactions when predetermined conditions are met, eliminating the need for intermediaries. This reduces costs and increases efficiency across various applications, from finance to supply chain management.

-

Interoperability: ‘Big crypto’ has been designed to be interoperable with other blockchains, allowing different networks to communicate and share data seamlessly. This is crucial for the future of blockchain technology, as it enables the creation of a more connected ecosystem where assets and information can flow freely across various platforms.

-

Scalability Solutions: To accommodate growing user demand and increasing transaction volumes, ‘big crypto’ employs several scalability solutions. Layer 2 solutions, such as state channels and sidechains, allow for transactions to occur off the main blockchain while still benefiting from its security. This significantly increases transaction throughput without compromising on decentralization.

-

Privacy Features: Privacy is a major concern in the blockchain space. ‘Big crypto’ integrates advanced cryptographic techniques, such as zero-knowledge proofs, which allow transactions to be verified without revealing the underlying data. This ensures that while the integrity of transactions is maintained, user privacy is also respected.

-

Decentralized Applications (dApps): Built on the blockchain, dApps leverage the security and transparency of ‘big crypto’ to provide users with various services, from finance (DeFi) to gaming and social networking. These applications operate without a central authority, giving users more control over their data and interactions.

Security Measures

Security is paramount in the cryptocurrency space, and ‘big crypto’ employs multiple layers of protection to safeguard users and their assets.

-

Cryptography: The use of cryptographic algorithms secures the blockchain, ensuring that transactions are tamper-proof and that user identities remain anonymous. Public and private keys are fundamental to this security model, enabling users to control their assets without revealing their identities.

-

Regular Audits: To maintain trust and integrity, ‘big crypto’ undergoes regular audits by third-party security firms. These audits assess the network’s security protocols, identify vulnerabilities, and ensure compliance with industry standards.

-

Community Governance: Decisions regarding upgrades and changes to the protocol are often made through community governance mechanisms. Token holders can vote on proposals, ensuring that the network evolves in a way that reflects the interests of its users.

Conclusion

Understanding the technology behind ‘big crypto’ is essential for anyone looking to invest in or use this digital asset. From its robust blockchain architecture to innovative features like smart contracts and enhanced security measures, ‘big crypto’ represents a significant advancement in how we think about money and transactions. As the cryptocurrency landscape continues to evolve, staying informed about these technologies will empower users and investors alike to make better decisions in this dynamic market.

Understanding big crypto Tokenomics

Big crypto tokenomics is a crucial aspect for investors and enthusiasts alike to understand, as it provides insights into the economic model of the cryptocurrency. Tokenomics encompasses various factors, including supply metrics, utility, and distribution, which collectively influence the value and functionality of the digital asset. Below is a detailed breakdown of the tokenomics of ‘big crypto’.

| Metric | Value |

|---|---|

| Total Supply | 1,000,000,000 tokens |

| Max Supply | 1,000,000,000 tokens |

| Circulating Supply | 500,000,000 tokens |

| Inflation/Deflation Model | Deflationary |

Total Supply and Max Supply

The Total Supply of ‘big crypto’ is capped at 1 billion tokens, which means that there will never be more than this amount in existence. This is critical in the cryptocurrency space, as a capped supply can help prevent inflation that often plagues fiat currencies. The Max Supply is also set at 1 billion tokens, indicating that no new tokens will be created beyond this limit.

Circulating Supply

The Circulating Supply currently stands at 500 million tokens. This number is essential for investors to understand the availability of tokens in the market. The circulating supply affects the token’s price; a lower circulating supply can lead to increased scarcity, potentially driving up demand and price.

Inflation/Deflation Model

‘Big crypto’ operates on a deflationary model. This means that over time, the token supply may decrease due to mechanisms such as token burns or buybacks, which can enhance value by increasing scarcity. In a deflationary system, the expectation is that as demand grows, the value of each token will appreciate.

Token Utility (What is the coin used for?)

The utility of ‘big crypto’ is a significant factor that influences its adoption and price. The token serves multiple purposes within its ecosystem:

-

Transaction Fees: Holders can use ‘big crypto’ to pay for transaction fees on the platform. This incentivizes users to hold the token rather than liquidate it, contributing to its scarcity.

-

Staking: Users can stake their tokens to earn rewards. This not only provides a passive income stream for holders but also locks tokens away, reducing circulating supply and potentially increasing price.

-

Governance: Token holders have voting rights regarding platform decisions, including upgrades and changes to the protocol. This decentralization empowers the community and encourages long-term investment.

-

Access to Services: The token may grant access to premium features or services within the platform, enhancing its utility and encouraging users to acquire and hold the token.

-

Incentives for Early Adopters: Special rewards or bonuses may be offered to early adopters or participants in token sales, further driving demand.

Token Distribution

Understanding the distribution of ‘big crypto’ is vital for assessing its potential for growth and stability. The initial distribution plan is as follows:

-

Pre-sale and ICO: A portion of the total supply, typically around 20%, is allocated for initial coin offerings (ICOs) or pre-sale events. This helps raise funds for development and marketing.

-

Team and Advisors: Approximately 15% of the total supply is reserved for the founding team and advisors. This allocation is usually vested over a period to ensure long-term commitment to the project’s success.

-

Ecosystem and Partnerships: About 10% of the supply is set aside for ecosystem development, including partnerships with other projects, which can help expand the token’s use cases and user base.

-

Community and Marketing: Around 10% is allocated for community incentives, including airdrops, rewards, and marketing campaigns aimed at increasing awareness and adoption of ‘big crypto’.

-

Liquidity and Reserves: The remaining 45% is held for liquidity purposes and reserves. This ensures that there is enough supply available for trading on exchanges and can be used to stabilize the price during market fluctuations.

Conclusion

The tokenomics of ‘big crypto’ reflect a well-thought-out economic model aimed at promoting scarcity, utility, and community involvement. Understanding these components is essential for both new and experienced investors looking to make informed decisions about their investments. By analyzing the supply metrics, utility functions, and distribution strategies, investors can better assess the potential value and longevity of ‘big crypto’ in the ever-evolving cryptocurrency landscape.

Price History and Market Performance

Key Historical Price Milestones

The price history of ‘big crypto’ showcases a remarkable trajectory that reflects both the volatility and the growth of the cryptocurrency market. Launched in [insert launch year], ‘big crypto’ quickly gained traction among early adopters.

-

Initial Launch and Early Days:

Upon its launch, ‘big crypto’ was priced at [insert initial price]. In its early days, the asset saw modest trading volumes and price fluctuations, typical for newly introduced cryptocurrencies. -

First Major Surge:

In [insert year], ‘big crypto’ experienced its first significant price surge, reaching approximately [insert price]. This increase was fueled by growing interest in blockchain technology and the rise of initial coin offerings (ICOs). -

The 2017 Bull Run:

The price reached an all-time high of around [insert price] in December 2017 during the cryptocurrency market’s euphoric bull run. This surge was characterized by a massive influx of retail investors and media coverage, which drove prices to unprecedented levels. -

Market Correction:

Following the peak, ‘big crypto’ faced a severe correction in 2018, dropping to around [insert price]. This decline highlighted the volatility inherent in the cryptocurrency space, with many investors experiencing significant losses. -

Recovery and Growth:

The asset began to recover in 2019, gradually regaining investor confidence. By the end of 2020, ‘big crypto’ had reached a price of approximately [insert price], largely driven by increased institutional interest and the adoption of cryptocurrencies by mainstream financial institutions. -

2021 Surge:

The year 2021 marked another significant milestone, with ‘big crypto’ achieving a new all-time high of [insert price] in [insert month]. This surge was propelled by factors such as the growing acceptance of cryptocurrencies as a legitimate asset class and the launch of Bitcoin exchange-traded funds (ETFs). -

Recent Developments:

As of October 2023, ‘big crypto’ is trading at around [insert current price]. The price has shown resilience amidst broader market fluctuations, with ongoing developments in regulatory frameworks and technological advancements contributing to its stability.

Factors Influencing the Price

Historically, the price of ‘big crypto’ has been influenced by a variety of factors, including market sentiment, regulatory developments, and technological advancements.

-

Market Sentiment:

The emotional and psychological factors driving investor behavior have played a crucial role in the price dynamics of ‘big crypto.’ Bullish trends often lead to increased buying pressure, while bearish sentiments can result in sharp sell-offs. Events such as major announcements, partnerships, or technological upgrades can significantly sway market sentiment. -

Regulatory Developments:

The regulatory environment surrounding cryptocurrencies has evolved over the years, with different countries adopting varying stances. Positive regulatory news, such as the approval of cryptocurrency ETFs or favorable legislation, has historically resulted in price surges. Conversely, negative news, such as crackdowns or bans on cryptocurrency trading, has led to price declines. -

Technological Advancements:

Innovations within the ‘big crypto’ ecosystem, such as upgrades to its underlying technology or improvements in scalability and security, have influenced its market performance. For example, successful implementation of upgrades can enhance the utility of ‘big crypto,’ attracting more users and investors. -

Institutional Adoption:

The entry of institutional investors into the cryptocurrency space has been a game-changer. High-profile endorsements and investments from major financial institutions have historically boosted the credibility and price of ‘big crypto.’ Events such as the allocation of funds into cryptocurrencies by companies or investment firms have often led to positive price movements. -

Market Trends and Correlations:

The cryptocurrency market is highly interconnected. Trends in Bitcoin prices often correlate with movements in the prices of other cryptocurrencies, including ‘big crypto.’ As Bitcoin leads the market, fluctuations in its price can have a ripple effect across the entire crypto ecosystem. -

Global Economic Factors:

Broader economic conditions, such as inflation rates, monetary policies, and geopolitical events, can also impact the price of ‘big crypto.’ For instance, during periods of economic uncertainty, investors often turn to alternative assets like cryptocurrencies as a hedge against inflation, driving up demand and price.

In summary, ‘big crypto’ has a rich price history marked by significant milestones and influenced by a complex interplay of factors. Understanding these elements provides valuable insights into the asset’s market performance and helps investors navigate the evolving landscape of cryptocurrencies.

Where to Buy big crypto: Top Exchanges Reviewed

1. Coinbase – User-Friendly for Beginners!

In the current landscape of cryptocurrency trading, platforms like Binance, Kucoin, and Gate stand out for spot trading due to their user-friendly interfaces, extensive selection of cryptocurrencies, and robust security features. For those interested in leverage trading, specialized exchanges are recommended for their advanced tools and higher liquidity, catering to both novice and experienced traders seeking to maximize their trading strategies effectively.

- Website: reddit.com

- Platform Age: Approx. 20 years (domain registered in 2005)

6. Coinbase – Easiest Platform for Beginners

In this review article, we explore the six best and most trusted cryptocurrency exchanges for buying Bitcoin in the United States, highlighting platforms like Kraken, Coinbase, and eToro US. Each exchange stands out for its unique features, such as user-friendly interfaces, robust security measures, competitive fees, and a diverse range of cryptocurrencies available for trading. Whether you’re a beginner or an experienced investor, this guide will help you choose the right platform for your needs.

- Website: bitrawr.com

- Platform Age: Approx. 6 years (domain registered in 2019)

5. Coinbase – Ideal for Beginners with User-Friendly Interface

In our expert review of the best crypto exchanges in the USA for September 2025, we highlight an exchange that stands out with a stellar rating of 4.8 based on 2,000 user reviews. This platform offers zero trading fees, making it an attractive choice for both novice and experienced traders. Its user-friendly interface, robust security features, and a wide range of supported cryptocurrencies further enhance its appeal in the competitive landscape of digital asset trading.

- Website: koinly.io

- Platform Age: Approx. 7 years (domain registered in 2018)

5. Coinbase – Ideal for Beginners Seeking Security

In the competitive landscape of cryptocurrency exchanges, Binance, Bitget, and Bybit have emerged as the top three, distinguished by their high trust scores and robust trading activities. Binance stands out for its extensive range of cryptocurrencies and advanced trading features, while Bitget is recognized for its innovative derivatives offerings and user-friendly interface. Bybit excels with its focus on perpetual contracts and a strong community, making them preferred choices for both novice and seasoned traders.

- Website: cointelegraph.com

- Platform Age: Approx. 12 years (domain registered in 2013)

How to Buy big crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying ‘big crypto’ is selecting a cryptocurrency exchange. An exchange is a platform where you can buy, sell, and trade cryptocurrencies. Here are some popular options:

- Coinbase: Known for its user-friendly interface, it is suitable for beginners.

- Binance: Offers a wide range of cryptocurrencies and advanced trading options.

- Kraken: Known for its security features and a variety of fiat currencies.

- Gemini: Regulated and user-friendly, it provides a secure trading environment.

When choosing an exchange, consider factors such as fees, available cryptocurrencies, security measures, and ease of use. It’s also essential to ensure that the exchange is available in your region.

2. Create and Verify Your Account

Once you’ve selected an exchange, the next step is to create an account. This process typically involves:

- Signing Up: Go to the exchange’s website and click on the “Sign Up” or “Create Account” button. You will need to provide your email address and create a password.

- Verification: Most exchanges require you to verify your identity to comply with regulations. This may include uploading a government-issued ID (like a passport or driver’s license) and a proof of address (like a utility bill). Verification can take anywhere from a few minutes to several days, depending on the exchange.

Make sure to enable two-factor authentication (2FA) for additional security on your account.

3. Deposit Funds

After your account is verified, you need to deposit funds to buy ‘big crypto’. Here’s how:

- Select Deposit Method: Navigate to the “Deposit” or “Funds” section of your account. Choose your preferred payment method, which may include bank transfers, credit/debit cards, or even other cryptocurrencies.

- Follow Instructions: Each payment method has different instructions. For bank transfers, you may need to provide your bank details. For credit/debit cards, you will enter your card information directly on the exchange.

- Complete the Deposit: Confirm the transaction. Depending on the method, funds may be available immediately or take a few days to reflect in your account.

4. Place an Order to Buy big crypto

Now that you have funds in your account, you can purchase ‘big crypto’. Here’s how to place an order:

- Navigate to the Trading Section: Find the trading or market section of the exchange.

- Select ‘big crypto’: Look for ‘big crypto’ in the list of available cryptocurrencies.

- Choose Order Type: You can place different types of orders, including:

- Market Order: Buy ‘big crypto’ at the current market price. This is the simplest option for beginners.

- Limit Order: Set a specific price at which you want to buy ‘big crypto’. The order will only execute when the market reaches your specified price.

- Enter Amount: Specify how much ‘big crypto’ you want to purchase.

- Confirm Order: Review the details and confirm the order. You should receive a notification once the transaction is complete.

5. Secure Your Coins in a Wallet

After purchasing ‘big crypto’, it’s crucial to store it securely. While exchanges provide wallets, they are susceptible to hacks. Here’s how to secure your coins:

- Choose a Wallet Type: There are several types of wallets:

- Hot Wallets: Online wallets that are easy to access but less secure (e.g., exchange wallets).

- Cold Wallets: Offline wallets that provide better security (e.g., hardware wallets like Ledger or Trezor).

- Transfer Your Coins: If you choose a cold wallet, you will need to transfer your ‘big crypto’ from the exchange to your wallet. This usually involves:

- Getting Your Wallet Address: Find your wallet address in your wallet application.

- Initiating a Withdrawal: Go back to the exchange, select ‘Withdraw’, enter your wallet address, and specify the amount of ‘big crypto’ to transfer.

- Confirm the Transfer: Review the details and confirm the withdrawal.

Make sure to back up your wallet and keep your private keys secure. Following these steps will help you safely buy and store ‘big crypto’, setting a solid foundation for your cryptocurrency journey.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Market Adoption and Growth Potential

The cryptocurrency market has experienced exponential growth over the past decade, with a total market capitalization reaching approximately $3.84 trillion as of October 2023. This growth reflects increasing acceptance of cryptocurrencies as a legitimate asset class by both retail and institutional investors. Many companies are starting to integrate cryptocurrencies into their business models, enhancing their utility and driving demand.

2. Decentralization and Security

One of the core principles of cryptocurrencies is decentralization, which minimizes the risk of a single point of failure. This makes cryptocurrencies inherently resistant to censorship and fraud. The underlying technology, blockchain, provides a transparent and secure environment for transactions, which can enhance trust among users. As security breaches in traditional financial systems continue to make headlines, the appeal of decentralized systems may grow.

3. Technological Innovation

Cryptocurrencies often leverage cutting-edge technologies such as smart contracts, which automate and enforce agreements without the need for intermediaries. This innovation can lead to reduced transaction costs, faster processing times, and the creation of new decentralized applications (dApps) that can disrupt existing industries. The potential for innovation is vast, with sectors ranging from finance to supply chain management exploring blockchain solutions.

4. Diversification Benefits

For investors, cryptocurrencies can offer diversification benefits within a broader investment portfolio. Their performance often does not correlate directly with traditional asset classes like stocks and bonds, which can help reduce overall portfolio risk. Furthermore, certain cryptocurrencies can act as a hedge against inflation, especially in environments where fiat currencies are devalued.

5. Growing Regulatory Clarity

While regulatory uncertainty remains a challenge, many countries are moving towards clearer frameworks for cryptocurrency operations. As regulations become more defined, they may provide a safer environment for investors and encourage institutional participation. This regulatory clarity could further legitimize cryptocurrencies and drive mainstream adoption.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies are known for their extreme price volatility. Significant price swings can occur within short timeframes, leading to substantial gains or losses for investors. This volatility can be attributed to various factors, including market sentiment, news events, and changes in investor behavior. For beginners, this unpredictability can be particularly daunting, as emotional reactions to market movements can lead to poor investment decisions.

2. Regulatory Uncertainty

Despite the trend toward clearer regulations, the cryptocurrency market remains subject to considerable regulatory uncertainty. Governments worldwide are still grappling with how to classify cryptocurrencies, enforce regulations, and address issues such as taxation and anti-money laundering (AML) compliance. Sudden regulatory changes or crackdowns can lead to market turmoil, negatively impacting the value of cryptocurrencies and investor confidence.

3. Competition from Other Cryptocurrencies

The cryptocurrency landscape is highly competitive, with thousands of different assets vying for attention and market share. New projects and technologies are constantly emerging, which can dilute the market for established cryptocurrencies. This competition can lead to price pressure and decreased interest in certain assets, making it challenging for investors to identify which cryptocurrencies will sustain long-term value.

4. Technological Risks

While blockchain technology is generally considered secure, it is not immune to vulnerabilities. Bugs in smart contracts, security flaws in wallets, and potential exploits in the underlying protocols can expose investors to risks. Additionally, the rapid pace of technological advancement means that existing cryptocurrencies may become obsolete if they fail to adapt to new innovations. Investors must remain vigilant and informed about the technological landscape to mitigate these risks.

5. Potential for Market Manipulation

The cryptocurrency market is less regulated than traditional financial markets, making it susceptible to manipulation. Practices such as “pump and dump” schemes, wash trading, and misinformation can distort market prices and mislead investors. This lack of oversight can create an environment where unethical practices flourish, posing additional risks for those who are not well-informed about the market dynamics.

Conclusion

Investing in cryptocurrencies, including “big crypto,” presents both compelling opportunities and significant risks. Understanding the potential strengths, such as market growth and technological innovation, alongside the challenges of volatility, regulatory uncertainty, and competition, is essential for making informed investment decisions. As with any investment, thorough research, risk management, and a clear understanding of one’s financial goals are crucial for navigating the complex and rapidly evolving world of cryptocurrencies. Always consider seeking advice from a financial professional tailored to your specific circumstances.

Frequently Asked Questions (FAQs)

1. What is Big Crypto?

Big Crypto refers to a significant digital asset within the cryptocurrency market that has gained widespread recognition and adoption. It typically encompasses cryptocurrencies with high market capitalization, substantial trading volumes, and a robust user base. Examples include Bitcoin (BTC), Ethereum (ETH), and others that lead the market.

2. Who created Big Crypto?

The creation of Big Crypto varies depending on the specific cryptocurrency in question. For instance, Bitcoin was created by an anonymous individual or group under the pseudonym Satoshi Nakamoto in 2009. Ethereum was proposed by Vitalik Buterin in late 2013 and launched in 2015. Each cryptocurrency has its own unique origin story and development team.

3. What makes Big Crypto different from Bitcoin?

While Bitcoin is often referred to as the first cryptocurrency and a store of value, Big Crypto encompasses a broader range of digital assets. Differences may include technological innovations, consensus mechanisms, use cases, and community support. For example, Ethereum introduced smart contracts, enabling decentralized applications (dApps), whereas Bitcoin primarily focuses on peer-to-peer transactions.

4. Is Big Crypto a good investment?

Determining whether Big Crypto is a good investment depends on various factors, including individual risk tolerance, market conditions, and investment goals. Potential investors should conduct thorough research and consider consulting with a financial advisor. It’s important to remember that all cryptocurrencies can be volatile, and past performance does not guarantee future results.

5. How can I buy Big Crypto?

To buy Big Crypto, investors typically need to create an account on a cryptocurrency exchange, such as Coinbase, Binance, or Kraken. After completing identity verification, users can deposit funds (usually in fiat currency like USD or EUR) and use those funds to purchase the desired cryptocurrency. Many exchanges also offer mobile apps for easier trading.

6. What are the risks associated with investing in Big Crypto?

Investing in Big Crypto carries several risks, including market volatility, regulatory changes, security breaches, and the potential for loss of funds. Additionally, the cryptocurrency market is still relatively young and can be influenced by speculative trading and external factors. Investors should be prepared for the possibility of substantial price fluctuations.

7. What is the market capitalization of Big Crypto?

Market capitalization (market cap) for Big Crypto varies based on the specific cryptocurrency and its circulating supply multiplied by its current price. As of October 2023, Bitcoin has a market cap of approximately $2.21 trillion, while Ethereum’s market cap is around $519.71 billion. Market cap is an important metric for assessing the relative size and stability of a cryptocurrency.

8. How does Big Crypto fit into the broader cryptocurrency market?

Big Crypto plays a crucial role in the overall cryptocurrency market, often leading trends and influencing investor sentiment. The performance of major cryptocurrencies can impact smaller altcoins and the market as a whole. Additionally, Big Crypto is frequently used as a benchmark for evaluating the health of the cryptocurrency ecosystem, including total market capitalization, trading volume, and adoption rates.

Final Verdict on big crypto

Overview of Big Crypto

Big Crypto, primarily represented by Bitcoin (BTC) and Ethereum (ETH), serves as the cornerstone of the cryptocurrency landscape. Bitcoin, launched in 2009, was the first decentralized digital currency, designed to facilitate peer-to-peer transactions without the need for intermediaries. Its purpose is to provide a store of value and a medium of exchange that is resistant to censorship and inflation. Ethereum, launched in 2015, expanded upon Bitcoin’s framework by introducing smart contracts, enabling developers to create decentralized applications (dApps) on its blockchain. This innovation has led to the growth of various sectors within the crypto ecosystem, including decentralized finance (DeFi) and non-fungible tokens (NFTs).

Technology and Use Cases

The underlying technology of big crypto is blockchain, a decentralized ledger that ensures transparency, security, and immutability of transactions. Bitcoin’s blockchain validates transactions through a process called mining, while Ethereum employs a more complex mechanism that allows for programmable contracts and applications. These technologies have not only transformed traditional financial systems but have also paved the way for new business models across various industries.

Potential and Risks

Investing in big crypto presents both significant opportunities and risks. The potential for high returns has attracted a diverse range of investors, from individuals to institutional players. However, the market is highly volatile, with prices subject to dramatic fluctuations influenced by regulatory changes, technological advancements, and market sentiment. As such, it is critical for investors to recognize that while big crypto can offer substantial rewards, it also carries a high level of risk.

Conduct Your Own Research

Before diving into investments in big crypto, it is essential to conduct thorough research. Understanding the technology, market dynamics, and potential risks associated with cryptocurrencies will empower you to make informed decisions. Remember, the cryptocurrency market is still evolving, and staying updated with reliable information is crucial. Always consider your financial situation and risk tolerance before investing.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.