What is aurora coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to aurora coin

Aurora Coin, represented by the ticker AURORA, is a unique digital asset that operates within the burgeoning ecosystems of the NEAR Protocol and Ethereum. As a decentralized application platform, Aurora enables developers to build and deploy Ethereum-compatible applications (dApps) with enhanced scalability and lower transaction costs. This innovative framework is particularly significant in the current crypto market, where the demand for efficient, cost-effective smart contract solutions continues to grow. Aurora’s ability to facilitate seamless interactions between Ethereum and NEAR through its Rainbow Bridge makes it a vital player in the evolving landscape of blockchain technology.

This guide aims to serve as a comprehensive resource for both beginner and intermediate investors interested in Aurora Coin. It will delve into several crucial aspects of the asset, including its underlying technology, tokenomics, investment potential, associated risks, and practical steps for purchasing AURORA tokens. By providing detailed insights, the guide seeks to empower readers with the knowledge necessary to make informed decisions regarding their involvement in this digital asset.

Understanding the Technology

At the heart of Aurora’s functionality is its Ethereum Virtual Machine (EVM) compatibility, which allows developers to run Solidity smart contracts on the NEAR blockchain. This capability not only enhances the performance of dApps but also opens up new avenues for innovation within the blockchain space. The integration of the Rainbow Bridge facilitates the transfer of assets between Ethereum and NEAR, providing users with a versatile platform for managing their digital assets.

Tokenomics Overview

The AURORA token serves as the governance token for the Aurora ecosystem, enabling holders to participate in decision-making processes related to protocol upgrades and development. With a total supply capped at 1 billion tokens, the distribution and allocation of AURORA are designed to incentivize both developers and the community, ensuring a robust and engaged ecosystem.

Investment Potential and Risks

While Aurora Coin presents significant investment potential, it is essential to consider the inherent risks associated with cryptocurrency investments. Market volatility, regulatory changes, and technological challenges can all impact the price and usability of AURORA tokens. This guide will explore these factors in detail, helping investors understand both the opportunities and the risks involved.

How to Buy Aurora Coin

For those looking to invest in AURORA, this guide will provide a step-by-step process on how to purchase the token. From setting up a cryptocurrency wallet to selecting an exchange, readers will find practical advice to navigate the purchasing process effectively.

In summary, Aurora Coin stands as a promising asset within the cryptocurrency market, offering unique technological advantages and opportunities for investors. This guide aims to equip readers with the knowledge and resources necessary to engage with Aurora Coin confidently.

What is aurora coin? A Deep Dive into its Purpose

Understanding Aurora Coin

Aurora Coin, represented by the ticker AURORA, is a cryptocurrency that operates on the NEAR Protocol, a high-performance blockchain designed to facilitate the development and deployment of decentralized applications (dApps). Aurora serves as a bridge between the Ethereum and NEAR ecosystems, allowing developers and users to take advantage of the unique features of both platforms. It primarily aims to provide a seamless experience for Ethereum developers and users while leveraging the scalability and low transaction costs of the NEAR blockchain.

The Core Problem It Solves

One of the main challenges in the cryptocurrency space is the issue of interoperability between different blockchain networks. Developers often face hurdles when trying to move their applications or assets from one blockchain to another, especially from Ethereum, which is known for its robust ecosystem but also its high transaction fees and congestion issues.

Aurora addresses this problem by offering a platform that enables Ethereum-compatible dApps to run on the NEAR Protocol. This interoperability is achieved through the use of the Rainbow Bridge, which facilitates the transfer of assets, including ERC-20 tokens, between Ethereum and NEAR. By allowing Ethereum developers to deploy their Solidity smart contracts on NEAR, Aurora effectively lowers the barriers for entry, enabling them to take advantage of NEAR’s higher throughput and lower transaction costs.

Moreover, as the demand for decentralized applications continues to grow, the need for scalable solutions becomes increasingly critical. Aurora’s architecture supports high throughput and low latency, making it an attractive option for developers looking to scale their applications without being hindered by the limitations of the Ethereum network.

Its Unique Selling Proposition

Aurora’s unique selling proposition lies in its ability to provide a turn-key solution for developers transitioning from Ethereum to NEAR. The following are key features that distinguish Aurora from other blockchain solutions:

-

EVM Compatibility: Aurora is designed to be fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to easily port their existing Ethereum dApps to the NEAR blockchain without needing to rewrite their codebase. This compatibility reduces the time and resources needed for migration, encouraging more developers to explore the NEAR ecosystem.

-

Low Transaction Costs: One of the significant drawbacks of the Ethereum network is its often exorbitant gas fees, particularly during periods of high demand. Aurora leverages NEAR’s architecture to provide significantly lower transaction fees, making it economically viable for users to interact with dApps.

-

Scalability: The NEAR Protocol is built to handle a large number of transactions per second, which means that dApps running on Aurora can scale efficiently as user demand grows. This feature is particularly appealing for applications that anticipate high user engagement or require rapid transactions.

-

Governance through AuroraDAO: The governance of the Aurora ecosystem is managed by AuroraDAO, which comprises representatives from various sectors of the blockchain industry. This decentralized governance model ensures that the project evolves in a manner that aligns with the interests of its community, fostering trust and engagement among users.

-

Strong Development Team: Aurora’s development team is composed of experienced professionals with backgrounds in physics, mathematics, software engineering, and blockchain technology. This expertise underpins the platform’s reliability and innovation.

The Team and Backers

Aurora is developed by Aurora Labs, a team committed to creating a seamless and efficient experience for developers and users. The leadership team includes notable figures in the blockchain space:

-

Dr. Alex Shevchenko, CEO: With a Ph.D. in physics and mathematics, Dr. Shevchenko has been an active entrepreneur in the blockchain industry since 2015. He is also known for his work on Bitfury’s Exonum, which showcases his extensive experience in blockchain scalability solutions.

-

Arto Bendiken, CTO: An autodidact and cypherpunk with over 20 years of experience in software engineering, Bendiken has worked with prestigious organizations such as the European Space Agency and the U.S. Navy. His expertise is invaluable in building robust and secure blockchain systems.

-

Frank Braun, Head of Security & Infrastructure: With a Ph.D. in computer science, Braun brings over two decades of experience in developing complex software systems. His focus on security is critical in ensuring that the Aurora platform remains safe for users.

-

Joshua J. Bouw, Engine Team Lead: Known as ‘The Godfather of Proof of Stake,’ Bouw has made significant contributions to the design of crypto-economic systems and has extensive experience in software development.

-

Kirill Abramov, Bridge Team Lead: With a rich background in high-performance software development, Abramov is instrumental in creating the cross-chain solutions that Aurora offers.

Additionally, Aurora has garnered support from notable investors and backers in the blockchain ecosystem, which enhances its credibility and provides the necessary resources for growth and development.

Conclusion

In summary, Aurora Coin (AURORA) represents a critical innovation in the blockchain space, addressing the pressing need for interoperability between Ethereum and NEAR. By facilitating the seamless transition of Ethereum dApps to a more scalable and cost-effective platform, Aurora enhances the overall user experience and encourages further development within the blockchain ecosystem. With a strong team and a clear mission, Aurora is well-positioned to contribute significantly to the future of decentralized applications and blockchain technology.

The Technology Behind the Coin: How It Works

Overview of Aurora Coin

Aurora Coin (AURORA) is a unique cryptocurrency that operates as an Ethereum Virtual Machine (EVM) on the NEAR Protocol. Designed to facilitate seamless interaction between Ethereum-based applications and the NEAR blockchain, Aurora enables developers to build decentralized applications (dApps) that leverage the scalability, speed, and low costs associated with NEAR, while maintaining compatibility with Ethereum smart contracts.

Blockchain Architecture

Aurora’s architecture is built on two primary layers: the NEAR Protocol layer and the Aurora layer itself.

-

NEAR Protocol: NEAR is a highly scalable blockchain that uses a unique sharding mechanism to improve transaction speeds and reduce costs. Sharding allows the network to split into smaller, more manageable pieces (shards), which can process transactions simultaneously. This architecture significantly enhances throughput, making it capable of handling thousands of transactions per second.

-

Aurora Layer: The Aurora layer acts as a bridge between the Ethereum ecosystem and the NEAR Protocol. It allows developers to deploy Solidity smart contracts on the NEAR blockchain without having to rewrite their code. This compatibility is crucial for developers who want to take advantage of NEAR’s benefits without losing the investments made in Ethereum-based applications.

Consensus Mechanism

Aurora operates on the NEAR Protocol, which employs a consensus mechanism known as Nightshade. Nightshade is a variant of Proof-of-Stake (PoS) designed to enhance security and scalability.

-

Proof-of-Stake (PoS): In PoS, validators are chosen to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. This method reduces the energy consumption associated with mining seen in Proof-of-Work (PoW) systems, like Bitcoin.

-

Nightshade: This innovative consensus mechanism allows NEAR to process multiple transactions in parallel by dividing the blockchain into shards. Each shard can validate transactions independently, which increases the overall throughput of the network. Nightshade’s design ensures that even if one shard experiences congestion, the others can continue processing transactions, thus maintaining network efficiency.

Key Technological Innovations

Aurora introduces several technological innovations that set it apart from other blockchain solutions:

1. Rainbow Bridge

The Rainbow Bridge is a critical component of the Aurora ecosystem. It enables the transfer of assets and data between Ethereum and NEAR seamlessly. Users can move ERC-20 tokens and other assets across the two blockchains without the need for centralized exchanges. The bridge operates using smart contracts that lock assets on one chain and mint equivalent assets on the other, ensuring a secure and efficient transfer process.

2. EVM Compatibility

Aurora supports Ethereum’s Virtual Machine (EVM), allowing developers to deploy existing Ethereum smart contracts on the NEAR blockchain without modification. This feature is particularly beneficial for developers looking to migrate or expand their applications, as it reduces the need for extensive re-coding and testing.

3. Low Transaction Costs

One of Aurora’s standout features is its low transaction fees compared to Ethereum. The NEAR Protocol’s sharding mechanism and efficient consensus algorithm result in significantly lower costs for users. This affordability makes it attractive for developers and users who want to interact with dApps without incurring prohibitive costs.

4. Scalability

Aurora leverages the NEAR Protocol’s sharding technology to provide a highly scalable environment for dApps. As the number of users and transactions grows, Aurora can accommodate increased demand without compromising performance. This scalability is crucial in today’s fast-paced digital landscape, where user engagement and transaction volume can fluctuate significantly.

5. Governance through AuroraDAO

Aurora is governed by a decentralized autonomous organization (DAO) known as AuroraDAO. This governance model allows token holders to participate in decision-making processes regarding protocol upgrades, feature implementations, and overall project direction. This democratic approach ensures that the community’s voice is heard and that the platform evolves in line with user needs.

Smart Contracts and Developer Experience

Aurora provides a robust environment for developers to create and deploy smart contracts. By utilizing familiar tools and frameworks from the Ethereum ecosystem, developers can quickly transition to building on Aurora.

-

Development Tools: Aurora supports popular development tools such as Truffle and Hardhat, which streamline the smart contract development process. These tools offer testing frameworks, deployment scripts, and debugging capabilities, making it easier for developers to ensure the reliability of their applications.

-

User-Friendly Interfaces: The platform also emphasizes user experience, providing intuitive interfaces for both developers and end-users. This focus on usability helps to attract a broader audience and encourages more developers to build on the platform.

Security Features

Security is paramount in the blockchain space, and Aurora employs various measures to protect user assets and data:

-

Smart Contract Audits: To enhance security, Aurora encourages developers to conduct thorough audits of their smart contracts before deployment. This practice minimizes the risk of vulnerabilities and exploits.

-

Multi-Signature Wallets: Aurora supports multi-signature wallets for enhanced security. This feature requires multiple private keys to authorize a transaction, reducing the risk of unauthorized access.

-

Regular Updates and Bug Bounties: The Aurora team actively works on maintaining the platform’s security through regular updates and improvements. They also implement bug bounty programs to incentivize white-hat hackers to find and report vulnerabilities.

Conclusion

Aurora Coin represents a significant advancement in the blockchain ecosystem, providing a solution that bridges the gap between Ethereum and NEAR Protocol. Its innovative architecture, low transaction costs, scalability, and strong governance through AuroraDAO make it an appealing choice for developers and users alike. By harnessing the power of the NEAR Protocol and offering EVM compatibility, Aurora is well-positioned to thrive in the rapidly evolving world of decentralized finance and blockchain applications. As the ecosystem continues to grow, Aurora’s commitment to security, usability, and community governance will play a crucial role in its long-term success.

Understanding aurora coin Tokenomics

Aurora Coin (AURORA) operates within the NEAR Protocol ecosystem, providing Ethereum-compatible solutions for developers and users. Understanding the tokenomics of AURORA is crucial for potential investors and users who wish to grasp how this digital asset functions within its ecosystem. This section will break down the key metrics, utility, and distribution of the AURORA token, helping you make informed decisions.

| Metric | Value |

|---|---|

| Total Supply | 999,855,344 AURORA |

| Max Supply | 1,000,000,000 AURORA |

| Circulating Supply | 635,549,970 AURORA |

| Inflation/Deflation Model | Deflationary (linear unlocks) |

Token Utility (What is the coin used for?)

The AURORA token serves multiple essential functions within the Aurora ecosystem:

-

Governance: AURORA is primarily a governance token, enabling holders to participate in decision-making processes regarding protocol upgrades and changes. Governance tokens empower the community by allowing them to vote on proposals that affect the platform’s future, ensuring that the interests of the stakeholders are considered.

-

Incentives and Rewards: The token is used to incentivize various activities within the ecosystem, such as participation in liquidity pools and staking. By holding and using AURORA tokens, users can earn rewards, which contributes to the overall growth and engagement of the platform.

-

Cross-Chain Interoperability: AURORA facilitates the movement of assets between Ethereum and NEAR blockchain, allowing users to seamlessly interact with decentralized applications (dApps) across different platforms. This interoperability is made possible through the Rainbow Bridge, which supports the transfer of ERC-20 tokens and other assets.

-

Access to Services: Users may require AURORA tokens to access specific services within the ecosystem, such as transaction fees for deploying smart contracts or utilizing various dApps. This creates a demand for the token as users engage with the platform’s offerings.

Token Distribution

The distribution of AURORA tokens is structured to foster long-term growth and stability within the ecosystem. Here’s a breakdown of the allocation:

- Unlocked Tokens (Total: 48% + 24% = 72%):

- AuroraDAO: 48% of the total supply is allocated to AuroraDAO, which is responsible for managing future projects and community initiatives. This significant allocation demonstrates the project’s commitment to decentralization and community involvement.

- Community Treasury: 20% is set aside for community treasury purposes, which can be used for various community-driven projects and initiatives.

- Incentives for Early Partnerships: 1% is allocated for initial partnerships and market-making activities to support the growth of the ecosystem.

- Aurora Labs: 1% is reserved for project advisors to incentivize their contributions to the platform.

-

Validator Delegators: 3% will be distributed linearly to delegators of Aurora validators on the NEAR protocol.

-

Locked Tokens (Total: 27%):

- Long-Term Incentives for Aurora Labs: 16% is reserved for long-term incentives, which may be subject to a vesting scheme to align the interests of the team with the project’s success over time.

- Early Contributors: 2% is allocated to early contributors, with similar vesting conditions to ensure their continued support and commitment to the project.

- Private Round Investors: 9% is allocated to private round investors, providing them with a stake in the project’s success.

The locked tokens are subjected to a two-year unlocking scheme with a linear unlock every three months, starting with a 6-month cliff. This means that after six months, 25% of the locked tokens will be unlocked, followed by additional 12.5% releases every three months until the full amount is available.

Conclusion

Understanding the tokenomics of AURORA is vital for anyone interested in participating in the Aurora ecosystem. The structured token distribution and diverse utility of the AURORA token highlight its role in promoting a decentralized governance model, incentivizing community engagement, and facilitating cross-chain interactions. By grasping these concepts, investors and users can better navigate the evolving landscape of this digital asset and make informed decisions about their participation in the Aurora ecosystem.

Price History and Market Performance

Overview of Aurora Coin’s Price History

Aurora (AURORA) is a cryptocurrency that operates on the NEAR Protocol, providing a platform for Ethereum-compatible applications. Since its inception, Aurora has experienced significant price fluctuations influenced by various factors, including market trends, technological developments, and broader economic conditions.

Key Historical Price Milestones

Aurora’s price history can be characterized by several key milestones that highlight its market performance:

-

Token Generation Event (TGE): Aurora launched its token generation event on November 18, 2021. At this stage, the price began at a relatively low level as it entered the market, marking the starting point for investors.

-

All-Time High (ATH): The price of Aurora reached its all-time high of approximately $35.43 on January 16, 2022. This surge was primarily driven by the overall bullish sentiment in the cryptocurrency market, particularly during the early months of 2022, when many digital assets were reaching new peaks.

-

Decline and Market Correction: Following its ATH, Aurora experienced a significant decline, which is a common trend in the cryptocurrency market. By October 19, 2023, the price had plummeted to an all-time low of approximately $0.04756, representing a staggering decrease of about 99.75% from its ATH. This drop can be attributed to a combination of market correction, decreased investor confidence, and broader economic challenges affecting the crypto space.

-

Recent Price Recovery: As of the latest data, Aurora’s price has shown signs of recovery. Trading at around $0.08708, the coin has increased by approximately 15.86% in the last 24 hours, indicating a potential resurgence in market interest. This price movement reflects a broader trend of increasing trading volume and activity surrounding the token.

-

Market Capitalization: At its peak, Aurora’s market capitalization reached over $1 billion during the ATH phase. Currently, it has a market cap of approximately $55.34 million, suggesting a substantial contraction in its market value compared to its peak.

Factors Influencing the Price

Historically, the price of Aurora has been influenced by a multitude of factors that are common in the cryptocurrency market:

-

Market Sentiment: The overall sentiment in the cryptocurrency market plays a crucial role in determining the price of Aurora. Periods of bullish sentiment often lead to price surges, while bearish phases can result in sharp declines. For instance, the price spike to its ATH was largely fueled by a general market euphoria surrounding cryptocurrencies at that time.

-

Technological Developments: As a product built on the NEAR Protocol, advancements in technology and updates within the Aurora ecosystem can directly impact its price. The introduction of new features, partnerships, or improvements in the underlying technology can enhance investor confidence and drive demand.

-

Regulatory Environment: Changes in the regulatory landscape can significantly influence investor sentiment and market activity. Increased scrutiny or favorable regulations can lead to either a surge in interest or a decline in market participation, thus affecting the price of Aurora.

-

Trading Volume and Liquidity: The trading volume and liquidity of Aurora also affect its price dynamics. Higher trading volumes often correlate with increased price stability and can signal heightened interest from investors. The recent spike in trading volume by over 600% indicates a renewed interest in the token, which may contribute to its recent price recovery.

-

Market Correlations: Aurora’s performance is also influenced by its correlations with other major cryptocurrencies, particularly Ethereum, given its compatibility with the Ethereum ecosystem. Fluctuations in Ethereum’s price often have a ripple effect on tokens like Aurora.

-

Investor Behavior: The behavior of retail and institutional investors can drive price changes. For instance, large buy orders can push prices up, while sell-offs can lead to rapid declines. The community sentiment, as observed through social media and forums, often reflects investor confidence or fear, impacting trading decisions.

Conclusion

Aurora’s price history showcases a volatile journey typical of many cryptocurrencies. From its initial launch and subsequent ATH to its current recovery phase, the price of Aurora has been shaped by a variety of internal and external factors. Understanding these dynamics is crucial for both new and experienced investors looking to navigate the complexities of the cryptocurrency market. As Aurora continues to evolve, keeping an eye on market trends, technological advancements, and regulatory developments will be essential for anyone interested in this digital asset.

Where to Buy aurora coin: Top Exchanges Reviewed

5. Auroracoin Exchanges – Your Gateway to AUR Trading!

FreiExchange stands out as the leading platform for trading Auroracoin (AUR), boasting a notable trading volume of $207.89 in the past 24 hours. This exchange is particularly appealing for users seeking a reliable venue to buy, sell, and trade AUR, offering a user-friendly interface and efficient transaction processes. Additionally, its focus on niche cryptocurrencies makes it a go-to choice for those interested in the Auroracoin market.

- Website: coincodex.com

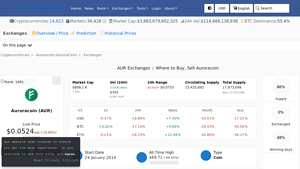

5. Auroracoin (AUR) – Your Gateway to Icelandic Crypto Trading!

Auroracoin (AUR) is primarily traded on two exchanges: FreiExchange and YoBit, making it relatively niche in the cryptocurrency market. FreiExchange is noted for its user-friendly interface and robust security features, while YoBit offers a wider array of trading pairs and additional functionalities. The limited number of exchanges may enhance the exclusivity of AUR, but it also means that liquidity and trading volume can be lower compared to more widely adopted cryptocurrencies.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. Aurora (AOA) – Your Ultimate Step-by-Step Buying Guide!

This guide provides a comprehensive, step-by-step approach to purchasing Aurora (AOA), highlighting the convenience of using a credit or debit card through popular exchanges like Coinbase and Coinmama. What sets this exchange apart is its user-friendly interface, making it accessible for both beginners and experienced investors, alongside the essential requirement of setting up an Aurora wallet to securely store your assets.

- Website: ledger.com

- Platform Age: Approx. 31 years (domain registered in 1994)

3. Changelly – Lowest Fees for Exchanging Aurora (AURORA)!

Changelly stands out as a premier exchange for trading Aurora (AURORA) due to its exceptionally low fees and user-friendly interface, earning a commendable rating of 4.7 from over 5,000 users. The platform offers fast exchanges and supports a diverse selection of over 700 cryptocurrencies, making it a versatile choice for traders. Additionally, Changelly provides 24/7 live support, ensuring a seamless trading experience for both beginners and experienced investors.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

How to Buy aurora coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Aurora Coin (AURORA) is to select a reliable cryptocurrency exchange. Some of the most popular exchanges where you can buy AURORA include:

- Gate.io: Known for a wide variety of cryptocurrencies and trading pairs.

- Bybit: Offers a user-friendly interface and competitive trading fees.

- Coinbase Exchange: Great for beginners due to its intuitive platform.

When choosing an exchange, consider the following factors:

- User Experience: Ensure the platform is easy to navigate.

- Security Features: Look for exchanges that implement strong security measures, such as two-factor authentication (2FA).

- Fees: Review trading fees, withdrawal fees, and deposit fees to avoid unexpected costs.

- Supported Payment Methods: Confirm that the exchange accepts your preferred payment method, such as bank transfers or credit cards.

2. Create and Verify Your Account

Once you’ve selected an exchange, you’ll need to create an account:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You’ll typically be required to provide your email address and create a password.

- Email Verification: After signing up, check your email for a verification link from the exchange. Click the link to verify your email address.

- Identity Verification: Most exchanges require you to complete Know Your Customer (KYC) verification. This process may involve submitting personal identification documents (such as a passport or driver’s license) and a proof of address (like a utility bill). Follow the exchange’s instructions carefully.

3. Deposit Funds

With your account verified, the next step is to deposit funds to purchase AURORA:

- Choose a Payment Method: Navigate to the “Funds” or “Wallet” section of the exchange and select “Deposit”. Most exchanges offer various options, including bank transfers, credit/debit cards, and sometimes even PayPal.

- Select Your Currency: Choose the currency you wish to deposit (e.g., USD, EUR). If you plan to buy AURORA directly with fiat currency, ensure the exchange supports that option.

- Complete the Deposit: Follow the on-screen instructions to complete your deposit. This may take some time to process, especially for bank transfers. Check the transaction status in your account.

4. Place an Order to Buy Aurora Coin

After your funds have been deposited, you can place an order to buy AURORA:

- Locate AURORA Trading Pair: Go to the trading section of the exchange and find the AURORA trading pair that corresponds to your deposited currency (e.g., AURORA/USD or AURORA/USDT).

- Select Order Type: Choose the type of order you wish to place. Common types include:

- Market Order: Buy AURORA at the current market price. This is the quickest way to make a purchase.

- Limit Order: Set a specific price at which you want to buy AURORA. Your order will only be executed if the market reaches that price.

- Enter Amount: Specify how much AURORA you want to purchase. The exchange will typically display the total cost based on the current price.

- Confirm Order: Review your order details and click “Buy” or “Place Order” to finalize your purchase.

5. Secure Your Coins in a Wallet

Once your purchase is complete, it’s essential to secure your AURORA tokens:

- Choose a Wallet: While you can store AURORA on the exchange, it’s safer to transfer your coins to a personal wallet. Options include:

- Software Wallets: Such as MetaMask, which allows you to manage your tokens easily.

- Hardware Wallets: Physical devices like Ledger or Trezor that offer enhanced security.

- Transfer AURORA: If you choose a personal wallet, copy your wallet address and go to the exchange’s withdrawal section. Enter your wallet address, specify the amount of AURORA to transfer, and confirm the transaction.

- Verify Transfer: After a few minutes, check your wallet to ensure the AURORA tokens have arrived. Always double-check your wallet address before transferring to avoid loss of funds.

By following these steps, you can successfully purchase and secure Aurora Coin (AURORA), positioning yourself in the evolving landscape of cryptocurrency investments. Remember to stay informed about market trends and practice safe trading habits.

Investment Analysis: Potential and Risks

Overview of Aurora Coin

Aurora Coin (AURORA) is a cryptocurrency that serves as a governance token for the Aurora ecosystem, which is built on the NEAR Protocol. It enables Ethereum developers to deploy dApps (decentralized applications) on a scalable and low-cost platform, while also allowing for seamless asset transfers between Ethereum and NEAR via the Rainbow Bridge. As of today, the price of AURORA is approximately $0.087, with a market cap of around $55 million. This section aims to provide a balanced analysis of the potential strengths and risks associated with investing in Aurora Coin.

Potential Strengths (The Bull Case)

1. Strong Technological Foundation

Aurora is built on the NEAR Protocol, which is known for its high throughput and scalability. This technology allows developers to create dApps that can handle a large volume of transactions without compromising speed or performance. Furthermore, Aurora offers compatibility with Ethereum’s EVM (Ethereum Virtual Machine), enabling developers to easily migrate their existing Ethereum-based applications to the NEAR ecosystem. This dual compatibility could attract a broad range of developers and projects, thereby increasing the utility and adoption of AURORA.

2. Governance and Community Involvement

The AURORA token plays a crucial role in the governance of the Aurora ecosystem. Holders of AURORA tokens can participate in decision-making processes regarding upgrades and changes to the protocol, fostering a sense of community and encouraging long-term commitment from users. This decentralized governance model can lead to a more resilient ecosystem, as it allows for community-driven improvements and adaptability.

3. Growing Ecosystem and Partnerships

Aurora has established a growing ecosystem with various partnerships and integrations. As the DeFi (Decentralized Finance) sector continues to expand, Aurora’s ability to facilitate interactions between Ethereum and NEAR could position it favorably within the broader crypto landscape. The potential for collaborations with other projects and platforms can further enhance its visibility and adoption.

4. Market Potential in Cross-Chain Solutions

As the demand for cross-chain solutions increases, Aurora’s ability to facilitate seamless asset transfers between different blockchain networks positions it well within this emerging market. The Rainbow Bridge feature allows users to transfer ERC-20 tokens and other assets between Ethereum and NEAR, which could attract users looking for interoperability among various blockchain ecosystems.

5. Robust Development Team

Aurora Labs boasts a team of experienced professionals with backgrounds in physics, software engineering, and blockchain technology. The expertise of the team members can instill confidence in investors regarding the project’s long-term viability and innovation. A strong development team is critical for navigating the rapidly evolving landscape of blockchain technology and addressing challenges as they arise.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies are notoriously volatile, and AURORA is no exception. The price of Aurora Coin has experienced significant fluctuations, including a dramatic drop from its all-time high of around $35.43 to current levels. Such volatility can deter potential investors and users who may be hesitant to engage with a digital asset that is subject to unpredictable price swings. This inherent risk is amplified by the overall sentiment in the cryptocurrency market, which can be influenced by external factors such as macroeconomic trends, regulatory news, and market speculation.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, and Aurora is not immune to these uncertainties. Regulatory actions can impact the development and usage of blockchain projects, potentially leading to restrictions or outright bans in certain jurisdictions. The lack of clear regulatory frameworks can pose challenges for Aurora’s adoption and growth, as developers and users may be hesitant to engage with a platform that could be subject to sudden regulatory changes.

3. Intense Competition

The blockchain and cryptocurrency space is highly competitive, with numerous projects vying for market share in the DeFi and cross-chain solutions sectors. Aurora faces competition not only from established platforms like Ethereum but also from other emerging projects that offer similar functionalities. The ability of Aurora to differentiate itself and maintain a competitive edge will be crucial for its long-term success. If competitors offer better solutions or capture a larger market share, AURORA could struggle to gain traction.

4. Technological Risks

Despite its robust technological foundation, Aurora is still susceptible to various technological risks. Issues such as smart contract vulnerabilities, network congestion, or security breaches could undermine user confidence and hinder the platform’s growth. Moreover, as a relatively new project, Aurora must continuously innovate and adapt to keep pace with technological advancements and user expectations in the rapidly changing blockchain landscape.

5. Dependence on NEAR Protocol

Aurora’s operations are closely tied to the NEAR Protocol. Any significant issues or setbacks experienced by NEAR could directly impact Aurora’s performance and user adoption. If NEAR fails to achieve its scalability and performance goals, or if it faces its own set of challenges, Aurora may find itself affected by these developments. This dependence could be seen as a risk, particularly if NEAR’s trajectory does not align with the expectations of the market and its users.

Conclusion

Investing in Aurora Coin presents a range of potential opportunities and risks. Its strong technological foundation, community governance, and growing ecosystem provide a compelling case for its future growth. However, investors should remain aware of the inherent market volatility, regulatory uncertainties, competition, and technological risks that could impact the project’s success. As with any investment in cryptocurrency, it is essential to conduct thorough research and consider personal risk tolerance before engaging with AURORA.

Frequently Asked Questions (FAQs)

1. What is Aurora Coin (AURORA)?

Aurora Coin, often referred to by its ticker symbol AURORA, is a cryptocurrency that operates on the NEAR Protocol. It serves as a bridge for Ethereum users and decentralized applications (dApps) to easily transition to the NEAR blockchain. Aurora allows developers to deploy Solidity smart contracts on the NEAR platform and facilitates the transfer of assets, including ERC-20 tokens, between Ethereum, NEAR, and Aurora through the Rainbow Bridge. AURORA also functions as a governance token, enabling holders to vote on protocol upgrades and developments.

2. Who created Aurora Coin?

Aurora Coin was developed by Aurora Labs, a team led by CEO Dr. Alex Shevchenko, who has a background in physics and mathematics, and has been involved in blockchain technology since 2015. The team includes experts with extensive experience in software engineering, security, and blockchain development, ensuring a robust foundation for the project. Aurora Labs aims to provide a scalable and user-friendly platform for developers and users alike.

3. What makes Aurora Coin different from Bitcoin?

Aurora Coin differs from Bitcoin primarily in its functionality and purpose. While Bitcoin is primarily a digital currency designed for peer-to-peer transactions and a store of value, Aurora Coin is designed to enhance interoperability between Ethereum and NEAR Protocol. Aurora focuses on enabling developers to create decentralized applications and smart contracts in a more efficient manner while also providing lower transaction costs. Furthermore, Aurora operates within a more complex ecosystem that includes governance features through its AURORA token.

4. Is Aurora Coin a good investment?

Determining whether Aurora Coin is a good investment depends on various factors, including market conditions, individual investment strategies, and risk tolerance. As of now, AURORA has shown significant volatility, with an all-time high of approximately $35.43 and a recent price around $0.087. Investors should conduct thorough research, consider the project’s fundamentals, market trends, and their financial goals before making any investment decisions. Consulting with a financial advisor is also advisable.

5. Where can I buy Aurora Coin?

Aurora Coin can be purchased on several centralized exchanges, with the most popular being Gate, Bybit, and Coinbase. Users can trade AURORA against stablecoins like USDT or fiat currencies. It’s important to check the trading volumes and fees on each platform to choose the best option for your trading needs.

6. What is the current market cap of Aurora Coin?

As of the latest data, Aurora Coin has a market capitalization of approximately $55.34 million, with a circulating supply of around 635.54 million AURORA tokens. Market capitalization is calculated by multiplying the current price of the token by its circulating supply. This metric helps investors gauge the overall size and stability of the cryptocurrency.

7. What is the total supply and allocation of Aurora Coin?

The total supply of Aurora Coin is capped at 1 billion tokens (1,000,000,000 AURORA). The token allocation is structured as follows:

– 1% for initial DEX offering and market-making,

– 1% for project advisors,

– 48% reserved for future projects by AuroraDAO,

– 20% allocated to a community treasury,

– 3% for incentives to Aurora validators on NEAR.

Additionally, there are locked tokens (16% for long-term incentives, 2% for early contributors, and 9% for private round investors) that will be unlocked gradually over a two-year period.

8. How does Aurora Coin perform compared to other cryptocurrencies?

Aurora Coin’s performance can be assessed by comparing its price movements and market behavior to other cryptocurrencies, especially those in the Ethereum ecosystem. As of the latest updates, AURORA has experienced a price increase of approximately 15% in the last 24 hours, indicating heightened trading activity. However, it is crucial to keep in mind that cryptocurrency markets are highly volatile, and past performance does not guarantee future results. Analyzing trends and market sentiment can provide insights into its performance relative to peers.

Final Verdict on aurora coin

Overview of Aurora Coin

Aurora Coin (AURORA) serves as a pivotal bridge between the Ethereum and NEAR Protocol ecosystems, allowing developers to deploy Ethereum-compatible decentralized applications (dApps) on the NEAR blockchain. This interoperability is facilitated by the Rainbow Bridge, which enables seamless asset transfers, including ERC-20 tokens, between these two networks. This unique positioning not only enhances user experience with low transaction fees but also opens up new avenues for developers to innovate in a scalable environment.

Technology and Governance

The Aurora platform is built on a robust Ethereum Virtual Machine (EVM) framework, ensuring that developers can leverage familiar tools while benefiting from NEAR’s high throughput and efficiency. The AURORA token acts as a governance token, empowering the AuroraDAO to manage protocol upgrades and future initiatives. This decentralized governance model is crucial for maintaining community engagement and aligning the interests of various stakeholders within the ecosystem.

Market Performance and Potential

As of now, Aurora Coin is ranked #539 in the cryptocurrency market, with a circulating supply of approximately 635 million tokens and a market cap of around $55 million. The asset has experienced significant volatility, with an all-time high of $35.43 and a recent low of $0.04756. Despite its current price of around $0.087, the historical performance indicates a high-risk, high-reward investment profile.

Conclusion

Investing in Aurora Coin presents both opportunities and risks. Its innovative technology and strategic positioning within the blockchain landscape suggest potential for growth, especially as demand for cross-chain interoperability increases. However, prospective investors should be aware of the inherent volatility and risks associated with cryptocurrencies. Thoroughly understanding the asset, its market dynamics, and the broader economic context is crucial.

In conclusion, we strongly encourage you to conduct your own thorough research (DYOR) before making any investment decisions in Aurora Coin or any other cryptocurrency. Understanding the fundamentals, market trends, and potential risks will empower you to make informed choices in this rapidly evolving digital asset space.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.