What is api3 crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to api3 crypto

API3 is an innovative cryptocurrency that aims to bridge the gap between decentralized applications (dApps) and real-world data through its decentralized oracle network. As smart contracts become increasingly prevalent in various sectors, the need for reliable and timely off-chain data has never been more crucial. API3 seeks to solve this problem by allowing API providers to create and manage their own decentralized oracles, thus ensuring that smart contracts can access accurate data without the risks associated with traditional oracles.

Significance in the Crypto Market

API3 is positioned within the broader decentralized finance (DeFi) ecosystem as a significant player in the oracle space. While other oracle solutions, such as Chainlink, have gained popularity, API3 differentiates itself by focusing on enabling direct connections between APIs and smart contracts. This unique approach not only enhances data transparency but also reduces costs associated with data retrieval, making it an attractive option for developers looking to build robust and efficient dApps.

Purpose of This Guide

This guide aims to provide a comprehensive resource for both beginners and intermediate investors who are interested in understanding API3 crypto. It will cover various aspects of the project, including its underlying technology, tokenomics, investment potential, associated risks, and practical steps on how to buy API3 tokens.

Overview of Technology

API3 utilizes a lightweight middleware called Airnode, which allows API providers to quickly deploy their own oracles without requiring extensive blockchain knowledge. This capability streamlines the process of integrating real-world data into blockchain applications and enhances the overall efficiency of data delivery.

Tokenomics and Investment Potential

API3 is an ERC-20 token based on the Ethereum blockchain. As of now, the circulating supply is approximately 86.42 million tokens, contributing to a market capitalization of around $87.69 million. The token’s utility extends beyond mere transactions; it is also used for governance and incentivizing API providers within the network.

Risks and Considerations

As with any cryptocurrency investment, potential investors should be aware of the inherent risks, including market volatility, regulatory changes, and technological challenges. Understanding these factors is vital for making informed investment decisions.

Buying API3

For those looking to invest in API3, the token is available on several popular exchanges, including Uniswap, Huobi Global, and KuCoin. This guide will outline the steps to purchase API3 tokens, ensuring a smooth entry into this promising crypto asset.

In summary, API3 represents a significant advancement in the oracle landscape, and this guide will equip you with the knowledge needed to navigate this exciting project in the cryptocurrency market.

What is api3 crypto? A Deep Dive into its Purpose

Overview of API3

API3 is a decentralized oracle network designed to bridge the gap between traditional application programming interfaces (APIs) and blockchain technology. It aims to provide smart contracts with reliable, real-time data from the outside world, addressing a significant challenge in the blockchain ecosystem—how to access off-chain data securely and efficiently. By enabling API providers to operate their own oracles, API3 seeks to enhance the reliability and transparency of data feeds that are essential for decentralized applications (dApps) and smart contracts.

The Core Problem It Solves

In the realm of decentralized finance (DeFi) and blockchain applications, the reliance on accurate and timely data is paramount. Smart contracts, which are self-executing contracts with the terms directly written into code, often require real-world data to function correctly. However, traditional APIs do not have a direct connection to blockchain networks, leading to what is known as the “Blockchain Oracle Problem.” This issue arises because oracles, which serve as intermediaries between external data sources and smart contracts, can introduce vulnerabilities, increase costs, and lead to centralization.

API3 addresses this problem by allowing API providers to create and operate their own decentralized oracles, known as Airnode. This innovative approach eliminates the need for third-party intermediaries, thereby reducing the potential for manipulation and improving data accuracy. With Airnode, API providers can directly connect their APIs to smart contracts, ensuring that the data remains reliable and transparent throughout the entire process.

Its Unique Selling Proposition

API3’s unique selling proposition lies in its ability to offer a decentralized solution that prioritizes transparency and cost-efficiency. Here are some key features that set API3 apart from traditional oracle solutions:

-

Decentralized API Management: API3 empowers API providers to manage their own oracles, which means they have full control over the data being fed into the blockchain. This decentralization mitigates the risks associated with single points of failure and centralization prevalent in conventional oracle systems.

-

Airnode: This lightweight middleware allows API providers to deploy oracles in minutes. By streamlining the integration process, Airnode lowers the barriers for API providers to enter the blockchain space, facilitating a broader range of data sources for smart contracts.

-

Cost Reduction: By eliminating intermediaries, API3 significantly reduces transaction fees associated with data retrieval. This makes it economically viable for various applications, from DeFi protocols to supply chain management systems.

-

Data Transparency: API3 offers enhanced data transparency by allowing users to trace the data source back to the original API. This feature is crucial for maintaining trust in the data being utilized by smart contracts, as it allows users to verify the authenticity of the information.

-

OEV Rewards: API3 incentivizes participation in its ecosystem through the Oracle Earnings Vault (OEV), where users can earn rewards for providing data feeds. This creates a sustainable model for data provision and encourages more API providers to join the network.

The Team and Backers

API3 was co-founded by a team of experienced professionals with backgrounds in blockchain technology, software engineering, and marketing. The core team includes:

-

Heikki Vanttinen: A blockchain expert and former CEO of CLC Group, Heikki has been instrumental in developing solutions for real-world connected smart contracts. His extensive knowledge of the blockchain ecosystem informs the strategic direction of API3.

-

Burak Benligiray: Serving as the CTO, Burak has a strong technical background and has previously developed integration platforms for blockchain applications. His experience in software engineering is vital for the technical development of API3 and its components.

-

Saša Milić: With experience as a lecturer at the University of Toronto and roles in major tech companies like Facebook, Saša brings a wealth of knowledge in computer science and data management to the team.

API3 has also garnered support from notable backers and investors, which enhances its credibility and resources for development. The project has successfully raised significant funds through token sales, which are being utilized to expand the ecosystem and improve its offerings.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of API3 is to create a seamless connection between off-chain data sources and on-chain smart contracts, addressing one of the most pressing challenges in the blockchain industry. As decentralized applications continue to evolve, the demand for reliable data feeds will only grow. API3 positions itself as a critical player in this space by providing a decentralized, cost-effective, and transparent solution.

In conclusion, API3 is an innovative project that seeks to redefine how data is accessed and utilized within the blockchain ecosystem. By enabling API providers to create their own decentralized oracles, API3 not only enhances data accuracy and transparency but also empowers the broader adoption of blockchain technology across various industries. As the importance of reliable data continues to rise, API3 is poised to play a vital role in the future of decentralized finance and beyond.

The Technology Behind the Coin: How It Works

Understanding API3: The Technology Behind the Coin

API3 is a decentralized oracle network that connects smart contracts with real-world data through application programming interfaces (APIs). As the demand for reliable data in decentralized finance (DeFi) and other blockchain applications grows, understanding the technology behind API3 is essential for investors and enthusiasts alike. This guide will explore API3’s blockchain architecture, consensus mechanism, and key technological innovations, providing a comprehensive overview of how this cryptocurrency operates.

Blockchain Architecture

API3 is built on the Ethereum blockchain, which is known for its smart contract capabilities. This choice of architecture enables API3 to leverage the strengths of Ethereum while addressing some of its limitations.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They run on the blockchain and are immutable, meaning once deployed, they cannot be altered. API3 utilizes smart contracts to facilitate interactions between decentralized applications (dApps) and APIs. By integrating APIs directly into smart contracts, API3 allows for seamless access to off-chain data, which is crucial for the functionality of many blockchain applications.

Decentralized Oracles

Traditional APIs serve as a bridge between applications and external data sources. However, they often rely on centralized systems, which can lead to issues such as downtime, data manipulation, and increased costs. API3 addresses these challenges by introducing decentralized oracles. These oracles are responsible for fetching real-world data and delivering it to smart contracts in a secure and reliable manner.

Consensus Mechanism

API3 does not have its own consensus mechanism, as it operates on the Ethereum blockchain, which uses a Proof-of-Stake (PoS) model following the Ethereum 2.0 upgrade. However, API3 incorporates its own governance and operational mechanics through its native token, API3.

Ethereum’s Proof-of-Stake

In a PoS system, validators are chosen to create new blocks and verify transactions based on the number of tokens they hold and are willing to “stake” as collateral. This mechanism encourages good behavior among validators, as their financial investment is at stake. By operating on Ethereum, API3 benefits from this robust and secure consensus mechanism, ensuring the integrity of data being processed through its decentralized oracle network.

Key Technological Innovations

API3 introduces several key innovations that differentiate it from other oracle solutions. These innovations enhance the reliability, transparency, and efficiency of data provision for smart contracts.

Airnode

Airnode is a lightweight middleware solution developed by API3. It allows API providers to create their own oracles without needing extensive blockchain knowledge. This tool simplifies the process of integrating APIs with smart contracts, making it accessible to a broader range of developers.

- Easy Deployment: Airnode can be deployed in minutes, reducing the technical barriers for API providers. This rapid deployment allows for a more extensive network of data providers, enhancing the overall reliability of the API3 ecosystem.

- Cost-Effectiveness: By eliminating the need for third-party oracles, Airnode significantly reduces transaction fees associated with data requests. This cost efficiency is crucial for projects operating on tight budgets.

Decentralized Governance

API3 utilizes a decentralized governance model, allowing token holders to participate in decision-making processes. This model ensures that the community has a say in the development and direction of the API3 network.

- Token-Based Voting: API3 token holders can propose and vote on changes to the protocol, including updates to Airnode and other system parameters. This democratic approach fosters a sense of ownership among participants and aligns the project’s development with the community’s needs.

- Incentives for Participation: By rewarding active participants in the governance process, API3 encourages a vibrant community that is invested in the project’s success.

OEV Rewards

API3 introduces a unique reward system called OEV (Oracle Ecosystem Value) rewards. This initiative incentivizes API providers and developers to contribute data feeds to the network.

- Earnings for API Providers: API providers can earn OEV rewards for their contributions, creating a financial incentive to participate actively in the ecosystem. This model not only enriches the data available to smart contracts but also fosters a sustainable network of reliable data providers.

- Encouraging Quality Data: By rewarding providers based on the quality and reliability of their data, API3 ensures that smart contracts receive accurate and timely information, enhancing the overall functionality of decentralized applications.

The Importance of Decentralization

Decentralization is a core principle of blockchain technology, and API3 embodies this principle by allowing API providers to operate their own nodes. This approach mitigates the risks associated with centralization, such as single points of failure and data manipulation.

Trustlessness

By enabling direct connections between smart contracts and APIs without intermediaries, API3 fosters a trustless environment. Smart contracts can access real-time data without relying on a central entity, reducing the risk of fraud and enhancing security.

Transparency

API3 enhances data transparency by providing users with the ability to trace the origin of the data used in smart contracts. This feature is particularly important in industries where data integrity is crucial, such as finance and supply chain management.

Conclusion

API3 represents a significant advancement in the integration of real-world data into blockchain applications. By combining the strengths of Ethereum’s blockchain architecture with innovative solutions like Airnode and decentralized governance, API3 addresses many challenges faced by traditional APIs and oracles. As the demand for reliable data continues to grow in the DeFi space and beyond, understanding the technology behind API3 will be essential for investors and developers looking to leverage its capabilities.

In summary, API3 not only simplifies the connection between smart contracts and APIs but also enhances the security, transparency, and efficiency of data provision in the blockchain ecosystem. By fostering a decentralized, community-driven environment, API3 is poised to play a vital role in the future of decentralized applications.

Understanding api3 crypto Tokenomics

API3 is a decentralized oracle platform that aims to connect smart contracts with real-world data through decentralized APIs. Understanding the tokenomics of API3 is crucial for investors and users alike as it provides insights into its economic model, utility, and distribution. Below, we will explore the key metrics of API3’s tokenomics, followed by discussions on token utility and distribution.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 151,526,604 API3 |

| Max Supply | 151,526,604 API3 |

| Circulating Supply | 86,421,978 API3 |

| Inflation/Deflation Model | Deflationary due to token burns and limited supply |

Token Utility (What is the coin used for?)

API3 tokens serve several key functions within the API3 ecosystem:

-

Governance: API3 holders have the ability to participate in the governance of the platform. They can vote on proposals that affect the ecosystem, including protocol upgrades, fee structures, and the allocation of resources. This decentralized governance model ensures that the community has a say in the project’s direction.

-

Staking: Users can stake their API3 tokens to earn rewards. Staking involves locking up tokens to support the network’s operations, such as validating transactions or providing liquidity. In return for their participation, stakers receive rewards, which can be in the form of additional API3 tokens or other incentives.

-

Payment for Services: API3 tokens are used to pay for access to decentralized API services. When developers need to integrate data into their smart contracts, they can use API3 tokens to compensate data providers for their services. This creates a direct economic incentive for data providers to maintain and offer high-quality APIs.

-

Participation in the OEV Rewards Program: API3 has introduced the Oracle Enabled Validation (OEV) Rewards program, which incentivizes developers and projects to utilize its decentralized oracles. Participants can earn rewards for their contributions to the ecosystem, further increasing the utility of the API3 token.

-

Deflationary Mechanisms: API3 incorporates deflationary mechanisms, such as token burns, which reduce the total supply over time. This can potentially increase the value of the remaining tokens as demand grows while supply decreases.

Token Distribution

Understanding how API3 tokens are distributed is essential for evaluating its long-term viability and the interests of various stakeholders:

-

Initial Distribution: The initial distribution of API3 tokens took place during a public sale and through allocations to various stakeholders. The distribution was designed to incentivize early investors, the development team, and strategic partners.

-

Allocation Breakdown:

– Founders and Team: A significant portion of tokens was allocated to the founding team and early contributors. This allocation often comes with a vesting period to align the team’s interests with the project’s long-term success.

– Investors: Early investors, including seed and private investors, received a share of the total supply. Their allocations are also subject to vesting schedules to prevent immediate sell-offs that could negatively impact the token price.

– Ecosystem Fund: A portion of the tokens is reserved for an ecosystem fund aimed at supporting projects that build on API3 and its services. This fund is essential for fostering innovation and growth within the ecosystem. -

Vesting Periods: To promote stability, a vesting period is applied to the tokens allocated to founders and early investors. This ensures that these stakeholders do not sell their tokens immediately after the launch, which could lead to volatility and undermine market confidence.

-

Ongoing Distribution: API3 tokens are continually distributed through staking rewards and participation in the OEV Rewards program. This ongoing distribution mechanism encourages community involvement and supports the network’s growth.

-

Market Liquidity: The circulating supply of API3 tokens is crucial for market liquidity. As of now, approximately 86.4 million API3 tokens are in circulation, with a market cap of around $87.7 million. This liquidity allows for easier trading and price discovery on various exchanges.

Conclusion

The tokenomics of API3 provide a comprehensive view of its economic model, utility, and distribution. By leveraging governance, staking, and payment mechanisms, API3 aims to create a sustainable ecosystem that supports decentralized APIs and smart contracts. The careful distribution of tokens and the incorporation of deflationary mechanisms position API3 as a potentially valuable asset for both investors and users in the growing decentralized finance landscape. Understanding these aspects will help you make informed decisions regarding your involvement with API3.

Price History and Market Performance

Overview of API3’s Price History

API3 (API3) is a decentralized oracle network designed to connect smart contracts with real-world data through application programming interfaces (APIs). Since its inception, API3 has experienced notable price fluctuations influenced by various market dynamics and broader cryptocurrency trends. Understanding its price history can provide valuable insights into the asset’s performance and the factors that have driven its valuation.

Key Historical Price Milestones

-

Launch and Initial Trading (December 2020): API3 was launched in December 2020 following a successful token sale that raised significant capital. Upon its introduction, the token price started at around $1.00, establishing a base for future trading.

-

Early Growth (January – March 2021): In early 2021, API3 saw a gradual increase in price, peaking at approximately $5.00 by mid-March. This surge was largely attributed to the overall bullish sentiment in the cryptocurrency market, particularly for projects focusing on decentralized finance (DeFi) and oracles.

-

All-Time High (April 2021): API3 reached its all-time high of approximately $10.31 on April 7, 2021. This peak was part of a broader market rally that saw many cryptocurrencies achieving record valuations. The growing interest in DeFi and the need for reliable data oracles significantly contributed to this spike in value.

-

Market Correction (Mid-2021): Following the April high, API3, like many other cryptocurrencies, experienced a significant correction. By mid-July 2021, the price had fallen to around $2.00. This correction was influenced by a general downturn in the cryptocurrency market, coupled with regulatory concerns and profit-taking by investors.

-

Continued Volatility (2021 – 2022): Throughout the latter half of 2021 and into early 2022, API3’s price remained volatile, fluctuating between $1.50 and $4.00. Factors such as market sentiment, competition from other oracle solutions like Chainlink, and the overall state of the DeFi sector played a role in this volatility.

-

Recent Performance (2023): As of October 2023, API3 is trading at around $1.01, with a market capitalization of approximately $87.69 million. The price has seen a decrease of about 90% from its all-time high, reflecting the challenges faced by the broader cryptocurrency market and the specific issues within the oracle sector.

Factors Influencing the Price

Historically, the price of API3 has been influenced by several key factors:

1. Market Sentiment

Market sentiment plays a crucial role in the valuation of cryptocurrencies, including API3. Bullish market conditions often lead to increased investment in DeFi projects, driving up prices. Conversely, bearish trends can lead to significant sell-offs and price drops. The overall sentiment in the cryptocurrency market, often driven by Bitcoin’s price movements, has had a direct impact on API3’s performance.

2. Technological Developments

API3’s price has also been influenced by advancements in its technology and offerings. The introduction of Airnode, a lightweight oracle solution, aimed at improving data transparency and reducing costs, has been a significant development. Such technological advancements can generate renewed interest and investment in the project, leading to price increases.

3. Competition

The presence of other oracle solutions, particularly Chainlink, has affected API3’s market positioning. Chainlink’s established presence and market dominance can overshadow newer projects like API3. The competitive landscape can lead to fluctuations in API3’s price as investors evaluate the relative strengths and weaknesses of these technologies.

4. Regulatory Environment

Regulatory developments surrounding cryptocurrencies can significantly influence market behavior. News of regulatory scrutiny or favorable legislation can lead to rapid price changes. API3’s performance has been impacted by broader regulatory news affecting the cryptocurrency market, as investors often react to potential risks.

5. Market Liquidity and Trading Volume

The trading volume and liquidity of API3 can also affect its price. High trading volume typically indicates strong investor interest and can lead to price stability or growth. Conversely, low liquidity can result in increased volatility and price fluctuations. As of the latest data, API3 has a 24-hour trading volume of approximately $76 million, indicating a reasonable level of market activity.

6. Adoption and Use Cases

The adoption of API3’s technology by developers and projects within the DeFi ecosystem has a direct correlation with its price. As more projects utilize API3 for reliable data feeds, demand for the token may increase, positively influencing its price. Conversely, a lack of adoption or usage can lead to stagnation or declines in price.

Conclusion

API3’s price history reflects the inherent volatility of the cryptocurrency market, shaped by various external and internal factors. From its all-time high in April 2021 to its current trading levels, API3’s performance has been a testament to the challenges and opportunities present in the evolving landscape of decentralized oracles and the broader blockchain ecosystem. Understanding these historical price movements and the factors that influenced them can provide investors with a comprehensive view of API3 as they navigate their investment strategies.

Where to Buy api3 crypto: Top Exchanges Reviewed

3. Kraken – Your Gateway to Seamless API3 Purchases!

Kraken stands out as a user-friendly exchange for purchasing API3, allowing users to start investing with as little as $10. The platform offers a variety of payment options, including credit/debit cards, ACH deposits, and mobile payment solutions like Apple and Google Pay, making it accessible for both beginners and experienced investors. With its robust security features and comprehensive educational resources, Kraken is a reliable choice for those looking to enter the cryptocurrency market.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. API3 – Your Gateway to Decentralized Oracles!

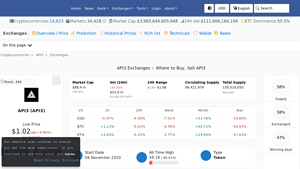

API3 (API3) can be traded on over 45 crypto exchanges, with Binance, Gate, and HTX leading the pack. What sets these exchanges apart is their diverse range of supported trading pairs, particularly on Binance, which includes popular options like USDT, BUSD, and TRY. This variety provides flexibility for traders and investors, making it easier to access API3 and engage in liquidity management across different markets.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. ChangeNOW – Top Choice for API3 Trading!

ChangeNOW stands out as a premier platform for exchanging API3, offering competitive rates and a user-friendly experience. With a high rating of 4.8 from over 2,000 users, it provides instant transactions without fees, making it an attractive choice for both novice and experienced traders. Users can easily access real-time API3 pricing in USD, detailed charts, and educational resources, enhancing their trading experience significantly.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Top Exchanges to Buy Api3 (API3) – Find Your Perfect Match!

In the Blockchaincenter review article, various cryptocurrency exchanges are compared for purchasing Api3 (API3), highlighting key features such as price competitiveness and payment options like PayPal. Notably, the exchange’s commitment to transparency is underscored through its proof of reserves, which enhances user trust. This comprehensive analysis allows investors to make informed decisions by weighing factors like fees, available coins, and the unique offerings of each platform.

- Website: blockchaincenter.net

- Platform Age: Approx. 8 years (domain registered in 2017)

3. API3 – Elevate Your DeFi Experience!

The exchange listings for API3 on Coinranking provide a comprehensive overview of available trading platforms, allowing users to compare prices, trading volumes, and potential discounts. This feature stands out by empowering traders to make informed decisions, ensuring they select the most favorable exchange for their transactions. With real-time data at their fingertips, users can optimize their trading strategies and enhance their overall trading experience.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy api3 crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing API3 is selecting a suitable cryptocurrency exchange. Some popular exchanges where you can buy API3 include:

- Centralized Exchanges (CEX): These are traditional platforms where users can buy, sell, and trade cryptocurrencies. Notable exchanges for API3 include:

- Huobi Global

- KuCoin

-

OKEx

-

Decentralized Exchanges (DEX): These allow users to trade directly with one another without a central authority. A well-known DEX for API3 is:

- Uniswap (where it is paired with Wrapped ETH)

When choosing an exchange, consider factors like user experience, transaction fees, security measures, and the availability of trading pairs.

2. Create and Verify Your Account

Once you’ve chosen an exchange, you need to create an account. Here’s how to do it:

- Visit the Exchange Website: Go to the official website of the chosen exchange.

- Sign Up: Click on the “Sign Up” or “Register” button. You will typically need to provide your email address and create a password.

- Verification: Most exchanges require users to verify their identity. This may involve providing personal information, such as:

– Full name

– Date of birth

– Address

– A government-issued ID (passport, driver’s license, etc.)

Complete the verification process as instructed. This step is crucial for ensuring the security and legitimacy of your account.

3. Deposit Funds

With your account set up and verified, you can deposit funds to purchase API3. There are typically two main methods to deposit:

- Fiat Deposit: If you want to buy API3 using traditional currency (like USD, EUR, etc.), you can deposit fiat through:

- Bank transfer

- Credit or debit card

Check the exchange for accepted fiat currencies and the associated fees.

- Cryptocurrency Deposit: If you already own cryptocurrencies, you can deposit them into your exchange account. To do this:

1. Go to the “Wallet” or “Funds” section of the exchange.

2. Select the cryptocurrency you wish to deposit.

3. Copy the wallet address provided by the exchange.

4. Send your cryptocurrency from your personal wallet to the exchange’s wallet address.

Make sure to double-check the wallet address and the network you are using to avoid any loss of funds.

4. Place an Order to Buy API3 Crypto

After funding your account, you can proceed to buy API3. Here’s how to do it:

- Navigate to the Trading Section: Go to the trading or markets section of the exchange.

- Select API3: Look for API3 in the list of cryptocurrencies. You may find it under the trading pairs like API3/USDT, API3/ETH, etc.

- Choose Order Type: Decide whether you want to place a market order (buy at the current price) or a limit order (set a specific price at which you want to buy).

– Market Order: This executes immediately at the best available price.

– Limit Order: This allows you to specify a price, and the order will execute only when the market reaches that price. - Enter Amount: Specify how much API3 you want to purchase.

- Review and Confirm: Double-check the details of your order, including fees, and click “Buy” to complete the transaction.

5. Secure Your Coins in a Wallet

After purchasing API3, it’s crucial to secure your investment. While you can leave your coins on the exchange, it’s generally safer to transfer them to a personal wallet. Here are the types of wallets you can use:

- Software Wallets: Applications for your computer or mobile device. Examples include MetaMask and Trust Wallet.

- Hardware Wallets: Physical devices that store your cryptocurrencies offline, such as Ledger or Trezor, providing enhanced security against hacks.

To transfer your API3 to your wallet:

- Get Your Wallet Address: Open your wallet and copy your API3 wallet address.

- Go to the Exchange: Navigate back to the exchange where you purchased API3.

- Withdraw Funds: Select the option to withdraw API3, paste your wallet address, and specify the amount to send.

- Confirm Transaction: Follow any prompts to confirm the withdrawal.

Always double-check the wallet address and ensure you are sending the correct cryptocurrency to avoid loss of funds.

By following these steps, you can successfully buy API3 and take a significant step into the world of cryptocurrency.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Unique Value Proposition

API3 aims to address the “Blockchain Oracle Problem” by allowing API providers to operate their own nodes. This approach eliminates the reliance on third-party oracles, which can introduce inefficiencies and centralization risks. By creating decentralized APIs, API3 enhances data transparency and reliability for smart contracts, potentially making it a vital resource in the growing decentralized finance (DeFi) ecosystem.

2. Strong Market Demand

As blockchain technology becomes more integrated into various industries, the need for reliable real-world data is growing. API3’s model of enabling decentralized APIs can fill a significant gap in the market, especially for applications requiring timely and trustworthy data feeds. The demand for oracles is likely to increase, providing a favorable environment for API3’s adoption.

3. Experienced Team

The founders of API3 bring a wealth of experience from their backgrounds in blockchain and software engineering. This expertise can be a crucial factor in navigating the complexities of developing and scaling the API3 platform. A strong team can also enhance investor confidence and attract partnerships within the industry.

4. Integration with Existing Ecosystems

API3 is built on the Ethereum blockchain, which is one of the most widely used platforms for decentralized applications. This integration allows API3 to leverage Ethereum’s existing user base and infrastructure. Additionally, as API3 continues to expand its network of data feeds across various chains, it can further enhance its utility and attract a broader audience.

5. Incentive Structures

API3 has introduced incentive mechanisms, such as the OEV (Oracle Earnings Vault) rewards, to encourage participation and engagement within its ecosystem. These rewards can drive user acquisition and retention, fostering a vibrant community around the API3 project.

6. Growth Potential

The overall growth of the DeFi sector and increasing interest in blockchain technology suggest that API3 has substantial room for growth. As more developers and businesses recognize the importance of reliable data in their applications, API3’s adoption could increase, potentially leading to a higher valuation.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Like many cryptocurrencies, API3 is subject to significant market volatility. Price fluctuations can be dramatic and are often driven by external factors, including market sentiment, regulatory news, and macroeconomic trends. This volatility can pose risks for investors, particularly those who may not be prepared for sudden downturns or price corrections.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies and blockchain technology is still evolving. Changes in regulations can significantly impact the operation and adoption of projects like API3. For instance, stricter regulations on data privacy or cryptocurrency transactions could hinder API3’s ability to function effectively. Investors should remain aware of potential regulatory changes that could affect API3’s business model.

3. Competition

API3 operates in a competitive environment, with several established players in the oracle space, such as Chainlink and Band Protocol. These competitors have already secured significant market share and partnerships, which could make it challenging for API3 to gain traction. Additionally, new entrants into the market could further intensify competition, potentially impacting API3’s growth prospects.

4. Technological Risks

As a blockchain-based project, API3 relies heavily on the underlying technology to function correctly. Potential technological risks include smart contract vulnerabilities, network congestion, and scalability issues. Any significant technical failure could damage API3’s reputation and deter users from adopting the platform.

5. Adoption Challenges

While API3 has a promising value proposition, actual adoption by developers and businesses is not guaranteed. The process of integrating decentralized APIs into existing systems can be complex and may require significant time and resources. If API3 fails to achieve widespread adoption, its utility and value could be adversely affected.

6. Tokenomics and Supply Dynamics

API3 has a circulating supply of approximately 86.42 million tokens, with a total supply of around 151.52 million. The tokenomics structure, including vesting periods for early investors and the potential for future token unlocks, could impact the market dynamics. If a large number of tokens are released into circulation, it could lead to price pressure, particularly if demand does not keep pace.

Conclusion

In summary, API3 presents a compelling case for investment with its unique approach to decentralized APIs, growing market demand, and experienced team. However, potential investors should also consider the inherent risks, including market volatility, regulatory uncertainty, and competition. As with any investment, thorough research and an understanding of the broader market context are essential for making informed decisions. Always remember that investing in cryptocurrencies carries inherent risks, and it is crucial to assess your risk tolerance before proceeding.

Frequently Asked Questions (FAQs)

1. What is API3 crypto?

API3 is a cryptocurrency that focuses on providing decentralized application programming interfaces (APIs) for smart contracts. It aims to address the challenges associated with traditional APIs by creating a framework where API providers can operate their own nodes, thus improving data transparency and reliability for decentralized applications. The project utilizes a middleware solution called Airnode, which allows for seamless integration of real-world data into smart contracts without relying on third-party oracles.

2. Who created API3 crypto?

API3 was co-founded by Heikki Vanttinen, Burak Benligiray, and Saša Milić. Heikki Vanttinen has a background in developing blockchain solutions and previously worked as the CEO of CLC Group. Burak Benligiray served as the Chief Technology Officer (CTO) at CLC Group and has a history of contributing to API technologies. Saša Milić is a software engineer with experience at Facebook and academia, specifically in teaching computer science.

3. What makes API3 crypto different from Bitcoin?

API3 and Bitcoin serve different purposes within the cryptocurrency ecosystem. Bitcoin is primarily a digital currency designed for peer-to-peer transactions and store of value. In contrast, API3 focuses on providing a decentralized infrastructure for smart contracts to access real-world data through APIs. While Bitcoin is a standalone cryptocurrency, API3 operates within the decentralized finance (DeFi) space and enhances the functionality of smart contracts on platforms like Ethereum.

4. Is API3 crypto a good investment?

Determining whether API3 is a good investment depends on various factors, including market conditions, the project’s development, and individual risk tolerance. As of now, API3 has shown significant volatility, with an all-time high of $10.31 and a current price around $1.01. Investors should conduct thorough research, consider the project’s fundamentals, and evaluate their investment strategy before making a decision.

5. How is the API3 network secured?

API3 operates on the Ethereum blockchain as an ERC-20 token. The security of the network relies on Ethereum’s robust consensus mechanism and decentralized nature. Additionally, the use of Airnode allows API providers to manage their own nodes, which adds a layer of security and reliability to the data being provided to smart contracts.

6. Where can I buy API3 crypto?

API3 can be purchased on various cryptocurrency exchanges. Popular platforms include Uniswap (paired with Wrapped ETH), Huobi Global (paired with USDT), KuCoin, OKEx, and 1inch. Before buying, ensure that you have a compatible wallet to store your API3 tokens and understand the trading pairs available on each exchange.

7. What are the current statistics for API3 crypto?

As of now, API3 has a circulating supply of approximately 86.42 million tokens, with a market cap of around $87.69 million. The token’s current price is approximately $1.01, with a 24-hour trading volume of around $76.17 million. API3’s all-time high was $10.31, and it has experienced significant fluctuations since its launch.

8. What are the use cases of API3 crypto?

API3 has several use cases, primarily centered around improving the accessibility of real-world data for decentralized applications. It enables developers to create decentralized APIs that can be integrated into smart contracts, thus facilitating various applications in sectors like finance, supply chain management, and gaming. By providing reliable data feeds, API3 enhances the functionality of DeFi projects and helps create more robust and transparent decentralized applications.

Final Verdict on api3 crypto

Overview of API3

API3 is a decentralized oracle network designed to connect smart contracts with real-world data via application programming interfaces (APIs). It aims to solve the “Blockchain Oracle Problem” by allowing API providers to run their own nodes, thereby reducing reliance on centralized oracles and enhancing data transparency. The project utilizes a lightweight middleware known as Airnode, which can be deployed quickly and efficiently, minimizing transaction costs and improving the overall reliability of data feeds.

Market Position and Performance

As of October 2023, API3 is ranked #393 in the cryptocurrency market with a price hovering around $1.01 and a market cap of approximately $87.7 million. The token has a circulating supply of about 86.4 million API3 coins, with a total supply of 151.5 million. Although API3 reached an all-time high of $10.31 in April 2021, it has since experienced significant volatility, illustrating the high-risk nature of this digital asset.

Potential and Risks

The potential for API3 lies in its ability to address critical data accessibility issues in decentralized finance (DeFi) and other blockchain applications. By providing reliable and transparent data feeds, API3 could play a pivotal role in the broader adoption of smart contracts and decentralized applications. However, like any cryptocurrency, investing in API3 comes with risks. Its price can be highly volatile, and the project is still navigating a competitive landscape filled with established players like Chainlink.

Conclusion

In summary, API3 presents an innovative solution to the challenges faced by smart contracts in accessing real-world data. Its unique technology and potential applications make it an intriguing option for investors looking to diversify their portfolios in the cryptocurrency space. However, as with any investment in digital assets, it is essential to recognize that this asset class carries significant risks, and API3 is no exception. Therefore, we strongly encourage readers to conduct their own thorough research (DYOR) before making any investment decisions.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.