What is amp coin? A Complete Guide for Investors (2025)

An Investor’s Introduction to amp coin

Amp Coin, known by its ticker symbol AMP, is a digital collateral token that aims to enhance the efficiency and security of transactions within the cryptocurrency ecosystem. Launched in 2020 by the Flexa network, Amp has garnered attention for its innovative approach to collateralization, which provides instant and verifiable assurances for various forms of value transfers. As a decentralized and open-source protocol built on the Ethereum blockchain, Amp is designed to address the challenges of slow transaction confirmation times, price volatility, and the need for broader adoption in digital payments.

The Significance of Amp Coin in the Crypto Market

Amp Coin plays a pivotal role in the growing landscape of decentralized finance (DeFi) and payment solutions. By acting as collateral for transactions, it allows users and merchants to engage in instant and secure payments, effectively minimizing the risks associated with transaction failures. This unique proposition positions Amp as a vital component in the future of financial technology, particularly as more businesses seek to integrate cryptocurrency payments into their operations.

The Flexa network, which utilizes Amp, provides merchants with a way to accept payments in cryptocurrencies while being protected from potential losses due to transaction delays. If a payment fails, the collateral in Amp can be liquidated to cover the merchant’s losses, ensuring they receive the equivalent in fiat currency. This innovative mechanism not only enhances transaction security but also builds trust among users and merchants alike.

Purpose of This Guide

This guide serves as a comprehensive resource for both beginners and intermediate investors who are interested in understanding Amp Coin. It will cover various aspects of this digital asset, including its underlying technology, tokenomics, and investment potential. Additionally, we will explore the risks associated with investing in Amp and provide practical insights on how to buy and store it effectively.

Whether you are looking to invest in Amp Coin for its potential as a collateralization solution or simply want to learn more about its unique features and applications, this guide will equip you with the knowledge you need to navigate the world of Amp and make informed investment decisions. By the end of this guide, you will have a clearer understanding of how Amp fits into the broader cryptocurrency market and its potential for future growth.

What is amp coin? A Deep Dive into its Purpose

Understanding Amp Coin

Amp (AMP) is an innovative cryptocurrency designed to provide collateralization services, particularly for digital payments. Launched in 2020, Amp operates on the Ethereum blockchain as an ERC-20 token, and it aims to facilitate secure, instant, and verifiable transactions across various asset-related use cases. This unique approach positions Amp as a vital player in the evolving landscape of decentralized finance (DeFi) and blockchain-based payment solutions.

The Core Problem It Solves

In the rapidly growing world of digital finance, traditional payment methods often struggle with issues such as slow transaction confirmation times, price volatility, and fraud. These challenges can deter both merchants and consumers from fully embracing cryptocurrency as a viable payment method.

Amp addresses these problems by acting as a collateral token that can secure transactions in real-time. When a payment is initiated using a cryptocurrency like Bitcoin or Ethereum, there is a risk that the transaction could fail due to network congestion or unconfirmed transactions. In such cases, Amp allows for the collateralization of the payment, meaning that if the primary transaction does not go through, the value of the transaction can be covered by the Amp collateral. This mechanism ensures that merchants receive their payments quickly and with minimal risk, effectively bridging the gap between traditional finance and the crypto world.

Its Unique Selling Proposition

Amp’s unique selling proposition lies in its ability to provide a decentralized collateralization framework through a system of collateral partitions and collateral managers. Here are some key features that set Amp apart from other cryptocurrencies:

-

Decentralized and Open-Source: Amp is built on a decentralized protocol, allowing users to interact with the platform transparently. Its open-source nature encourages community involvement and continuous improvement.

-

Collateral Partitions: Amp utilizes collateral partitions that can be designated to secure specific accounts, applications, or transactions. These partitions carry balances that are verifiable on the Ethereum blockchain, ensuring transparency and security in collateralization.

-

Collateral Managers: Smart contracts known as collateral managers oversee the locking, releasing, and redirecting of collateral within these partitions. This allows for dynamic management of collateral, providing flexibility in value transfers.

-

Support for Multiple Assets: Amp is designed to work with various digital assets, making it a versatile tool for both merchants and consumers. This adaptability opens the door for broader adoption across different sectors of the financial ecosystem.

-

Passive Income Opportunities: Users can stake their Amp tokens to earn passive income, making it attractive for investors looking to generate returns while supporting the network’s security and functionality.

The Team and Backers

Amp is backed by Flexa, a blockchain payments company co-founded by Trevor Filter, Zachary Kilgore, and Tyler Spalding. Flexa is based in New York and specializes in creating more efficient and secure payment solutions for both merchants and consumers. The team behind Amp is highly experienced in the fields of technology and finance, with a strong emphasis on innovation and user experience.

Tyler Spalding, the CEO of Flexa, has an impressive academic background, holding degrees in Mechanical and Aerospace Engineering from the University of Illinois and an MBA from MIT. His expertise in blockchain technology and financial systems has been instrumental in shaping Amp’s vision and operational strategy. The involvement of seasoned professionals in both blockchain technology and traditional finance reinforces the credibility and potential of the Amp project.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Amp within the cryptocurrency ecosystem is to act as a reliable and efficient collateralization solution for digital payments. By providing a mechanism for instant, verifiable assurances, Amp enhances the security and speed of transactions, addressing some of the key pain points associated with cryptocurrency payments.

Amp’s integration with the Flexa network allows merchants to accept cryptocurrency payments seamlessly, knowing that they are protected against potential losses from transaction failures. This not only builds trust among merchants but also encourages consumers to use cryptocurrencies for everyday transactions, thereby driving broader adoption.

Furthermore, Amp’s capabilities extend beyond simple payment solutions. Its flexible collateralization framework can be applied to various use cases within the DeFi space, such as lending and borrowing protocols, asset exchanges, and even insurance products. As more financial platforms recognize the value of collateralization in reducing risk and increasing efficiency, Amp is well-positioned to play a crucial role in this transformation.

Conclusion

In summary, Amp coin is a groundbreaking digital asset that seeks to solve significant challenges within the cryptocurrency payment landscape. Its unique approach to collateralization, backed by an experienced team and a robust infrastructure, positions it as a vital component of the evolving DeFi ecosystem. As the demand for secure, fast, and reliable payment solutions continues to grow, Amp’s role in facilitating these transactions will likely expand, making it a noteworthy asset for both investors and users alike.

The Technology Behind the Coin: How It Works

Overview of Amp Coin Technology

Amp (AMP) is an innovative cryptocurrency designed to provide collateralization for digital asset transactions. By utilizing smart contracts and blockchain technology, Amp facilitates secure, fast, and reliable payments, making it an essential player in the decentralized finance (DeFi) ecosystem. This guide will explore the technology behind Amp, breaking down its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

Amp is built primarily on the Ethereum blockchain, which is known for its robust capabilities in executing smart contracts.

Ethereum Foundation

Ethereum, introduced in 2015, pioneered the concept of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This allows for trustless transactions without the need for intermediaries. Amp leverages Ethereum’s infrastructure, benefiting from its established network and security features.

Collateral Partitions

One of the unique features of Amp’s architecture is the concept of collateral partitions. These partitions are specific areas within the Amp protocol where collateral can be allocated to secure transactions. Each partition can be designated for different accounts, applications, or transactions, allowing for flexible and efficient collateral management.

- Verification: Collateral balances within these partitions are directly verifiable on the Ethereum blockchain, ensuring transparency and security.

- Flexibility: Users can create and manage multiple partitions, tailoring their collateralization needs based on specific transactions or applications.

Collateral Managers

Amp employs smart contracts known as collateral managers, which are responsible for overseeing the collateral within each partition. These contracts can lock, release, and redirect collateral as needed, ensuring that the necessary funds are always available to support transactions.

- Locking and Releasing Collateral: When a transaction is initiated, collateral managers can lock up a specified amount of AMP tokens to secure the transaction. Once the transaction is confirmed, the collateral can be released back to the user.

- Redirecting Collateral: If a transaction fails (for example, due to a long confirmation time), collateral managers can liquidate the AMP collateral to cover any losses incurred by the vendor, ensuring that they receive payment.

Consensus Mechanism

The security and integrity of the Amp protocol are underpinned by Ethereum’s consensus mechanism, which transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS) with the Ethereum 2.0 upgrade.

Proof-of-Stake (PoS)

Proof-of-Stake is a consensus mechanism that allows users to validate transactions and create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. This method contrasts with Proof-of-Work, which relies on computational power to solve complex mathematical problems.

- Energy Efficiency: PoS is significantly more energy-efficient than PoW, as it does not require extensive computational resources to validate transactions.

- Security: In PoS, validators have a vested interest in maintaining the network’s integrity. If they attempt to act dishonestly, they risk losing their staked tokens.

By utilizing PoS, Amp benefits from increased transaction speeds and reduced energy consumption, making it a more sustainable option within the cryptocurrency landscape.

Key Technological Innovations

Amp’s technology is characterized by several key innovations that set it apart from other cryptocurrencies.

Instant Collateralization

Amp’s primary function is to provide instant collateralization for digital asset transactions. This means that when a payment is made using cryptocurrencies like Bitcoin or Ethereum, Amp can immediately secure the transaction by locking up AMP tokens as collateral.

- Reducing Transaction Risks: By providing instant collateralization, Amp minimizes the risks associated with price volatility and slow transaction times. If a payment fails to confirm, the collateral can be liquidated to cover any losses.

- Enhanced User Experience: For merchants and consumers, this process ensures a smoother transaction experience, as they can confidently engage in cryptocurrency payments without worrying about delays or failed transactions.

Predefined Partition Strategies

Amp introduces the concept of predefined partition strategies, which enable unique collateral models. These strategies allow users to stake tokens without removing them from their original addresses, enhancing the flexibility of collateral management.

- Staking Flexibility: Users can stake their AMP tokens while maintaining ownership, allowing for greater liquidity and usability within the ecosystem.

- Tailored Solutions: Different applications can implement specific partition strategies that suit their operational needs, enhancing the overall versatility of the Amp platform.

Interoperability

Amp is designed to operate across multiple blockchain platforms, including Ethereum, Solana, and NEAR Protocol. This interoperability allows Amp to be integrated into various financial applications, expanding its use cases and user base.

- Cross-Chain Functionality: By supporting multiple blockchains, Amp can facilitate transactions across different ecosystems, making it a valuable asset in the growing DeFi space.

- Wider Adoption: The ability to operate on various platforms enhances Amp’s appeal to developers and users, promoting broader adoption and integration into payment solutions.

Use Cases for Amp

Amp’s technology enables a wide range of applications, making it a versatile asset in the cryptocurrency market.

- Payment Networks: Amp can secure transactions for digital payment networks, ensuring that merchants receive instant, fraud-resistant payments.

- Decentralized Finance (DeFi): As the DeFi space continues to grow, Amp’s ability to collateralize loans and other financial products makes it a critical component for securing value transfers.

- Asset Transfers: Individuals can use Amp to collateralize personal asset transfers, ensuring immediate settlement and reducing transaction risks associated with traditional finance.

Conclusion

Amp’s technology is designed to address some of the most pressing issues in the cryptocurrency space, such as transaction delays, price volatility, and security concerns. By leveraging the Ethereum blockchain, employing a proof-of-stake consensus mechanism, and introducing innovative features like collateral partitions and predefined strategies, Amp provides a robust solution for collateralizing digital asset transactions. Its versatility and interoperability position it as a key player in the evolving landscape of decentralized finance, paving the way for more secure and efficient value transfers in the digital economy.

Understanding amp coin Tokenomics

Amp Coin Tokenomics

Amp (AMP) is an innovative digital collateral token designed to provide instant and verifiable assurances for value transfers. Launched in 2020, it operates primarily on the Ethereum blockchain, although it is also available on other networks like Solana and NEAR Protocol. Understanding the tokenomics of Amp is crucial for investors and enthusiasts alike, as it provides insight into the economic model behind the token, its utility, and its overall sustainability.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 99.71 billion AMP |

| Max Supply | 100 billion AMP |

| Circulating Supply | 84.28 billion AMP |

| Inflation/Deflation Model | Deflationary |

Total Supply and Circulating Supply

The total supply of Amp is approximately 99.71 billion AMP tokens, with a maximum supply capped at 100 billion AMP. As of now, the circulating supply stands at about 84.28 billion AMP tokens, which accounts for approximately 84% of the total supply. This structured supply model is designed to mitigate the risks associated with inflation, as the fixed cap limits the number of tokens that can be created, ensuring that value is maintained over time.

Inflation/Deflation Model

Amp adopts a deflationary model, which means that the supply of AMP tokens is not designed to increase over time. This is an essential aspect of its tokenomics as it protects against the dilution of value that can occur in inflationary systems. The fixed supply model is intended to create scarcity, thereby potentially increasing the value of the token as demand grows. Furthermore, as tokens are used for collateralization in transactions, they may be locked or utilized in a way that reduces the available circulating supply, further enhancing scarcity.

Token Utility (What is the coin used for?)

Amp serves multiple functions within its ecosystem, primarily focusing on collateralizing payments and providing security for transactions on the Flexa network. Here are some key utilities of the AMP token:

-

Collateralization of Payments: Amp tokens act as collateral for transactions made on the Flexa network. If a payment fails due to unconfirmed transaction times or other issues, the collateralized AMP can be liquidated to cover losses, ensuring that the vendor receives their payment in fiat currency. This feature is particularly useful in reducing the risks associated with cryptocurrency volatility and transaction delays.

-

Staking for Passive Income: Investors can stake their AMP tokens to earn rewards. By locking their tokens in the network, users contribute to the overall security and functionality of the system, while also earning passive income in the form of additional AMP tokens.

-

Integration with Decentralized Finance (DeFi): Amp’s utility extends to various DeFi applications, where it can be used as collateral for lending and borrowing activities. This versatility enhances the token’s appeal to a broader audience within the cryptocurrency space.

-

Real-World Applications: Amp aims to facilitate faster and more secure transactions across a variety of asset-related use cases. It provides a straightforward interface for verifiable collateralization, helping merchants and consumers engage in seamless transactions without the fear of fraud.

Token Distribution

The distribution of Amp tokens is a critical component of its tokenomics, ensuring that the allocation aligns with the project’s goals and community involvement. While specific percentages of distribution may vary, the following categories typically outline how AMP tokens are allocated:

-

Founders and Team: A portion of the total supply is allocated to the founding team and early contributors. This allocation incentivizes the team to continue developing and improving the project.

-

Community Incentives: A significant amount of AMP is often reserved for community initiatives, such as rewards for staking, liquidity mining, and other programs designed to encourage user engagement and participation.

-

Partnerships and Ecosystem Development: Tokens may also be allocated for strategic partnerships and collaborations that can enhance the utility and adoption of the Amp protocol.

-

Reserves: A portion of the supply may be kept in reserve for future developments or unforeseen circumstances, ensuring the project has the necessary resources to adapt and grow.

Conclusion

Understanding the tokenomics of Amp is essential for anyone looking to invest or engage with this digital asset. With a fixed supply and deflationary model, Amp is designed to maintain its value over time while providing robust utility in collateralizing payments and integrating with DeFi applications. As the ecosystem continues to develop, the Amp token’s role in facilitating secure, instant transactions will likely become increasingly significant, making it an asset worth monitoring in the evolving cryptocurrency landscape.

Price History and Market Performance

Key Historical Price Milestones

Amp (AMP) was launched in September 2020, and since then, its price trajectory has seen significant fluctuations influenced by various market dynamics. Upon its release, AMP’s price started at a modest level, reflecting the nascent stage of the project and the overall market conditions at that time.

The token reached its all-time low of approximately $0.0007946 on November 17, 2020. This period was marked by a general downturn in the cryptocurrency market, with many altcoins facing pressure due to Bitcoin’s volatility and regulatory scrutiny.

In 2021, Amp experienced a substantial price surge, coinciding with the broader cryptocurrency market rally. The price peaked at an all-time high of $0.1211 on June 16, 2021. This remarkable increase was driven by a growing interest in decentralized finance (DeFi) and the increasing adoption of cryptocurrencies as payment solutions. The surge in price was also fueled by the rise of the Flexa network, which promoted the use of AMP as collateral for instant payment transactions, thereby enhancing its utility and market appeal.

Following its peak, AMP’s price experienced a significant correction, which is common in the cryptocurrency market. By the end of 2021, the price had retraced to around $0.05. The decline continued into 2022, with the price oscillating between $0.01 and $0.04 for much of the year, as market participants reacted to global economic conditions, including inflation concerns and regulatory developments.

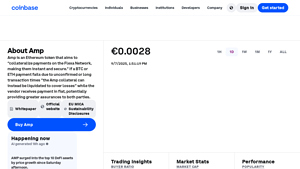

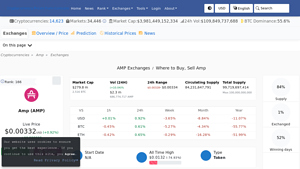

In 2023, AMP’s price has remained relatively stable, hovering around the $0.003 to $0.005 range. As of October 2023, AMP is trading at approximately $0.003321, reflecting a market capitalization of around $280 million. The circulating supply at this time is approximately 84.28 billion AMP tokens, which is about 84% of its maximum supply of 100 billion tokens.

Factors Influencing the Price

Historically, the price of Amp has been influenced by a variety of factors, both internal to the Amp project and external market conditions.

Market Sentiment and Speculation

Cryptocurrency prices are significantly impacted by market sentiment and speculative trading. The enthusiasm surrounding DeFi projects and their potential for disrupting traditional finance has played a crucial role in AMP’s price movements. Periods of heightened speculation, particularly during bull markets, have often led to sharp price increases, as seen in early 2021 when AMP reached its all-time high.

Conversely, negative sentiment, driven by regulatory news or broader economic concerns, can lead to rapid sell-offs. For instance, after reaching its peak, AMP faced downward pressure as the cryptocurrency market corrected, with many investors cashing out profits or reacting to bearish market signals.

Adoption and Use Cases

Amp’s value proposition as a collateral token for instant and secure transactions has attracted attention from merchants and payment platforms. The partnership with Flexa, which facilitates crypto payments at retail locations, has been a significant driver of demand for AMP. Increased adoption of the Flexa network and the use of AMP as collateral in various transactions can lead to higher demand and, consequently, price appreciation.

Regulatory Developments

The regulatory landscape surrounding cryptocurrencies has evolved rapidly, affecting investor confidence and market dynamics. News related to regulatory scrutiny, especially concerning tokens classified as securities, has historically impacted the price of AMP. The ongoing discussions and legal actions by authorities, particularly in the United States, can create uncertainty, leading to price volatility.

Technological Developments

Technological advancements and updates within the Amp ecosystem can also influence its price. Enhancements in the underlying protocol, such as improvements in transaction speed and security, can increase the attractiveness of the token. Additionally, the introduction of new features or partnerships that expand the use cases for AMP can generate positive momentum in the market.

Market Trends and Correlation with Major Cryptocurrencies

AMP’s price is often correlated with broader market trends, particularly those of major cryptocurrencies like Bitcoin and Ethereum. When Bitcoin experiences significant price movements, it often sets the tone for the rest of the market, including altcoins like AMP. A bullish trend in Bitcoin can lead to increased investor interest in altcoins, while a bearish trend may result in a flight to safety, causing altcoins to decline in value.

Conclusion

Understanding the price history and market performance of Amp is crucial for investors looking to navigate its complexities. The historical price milestones, coupled with the various factors influencing its price, provide a comprehensive view of how AMP has evolved since its inception. Investors should remain aware of the dynamic nature of the cryptocurrency market, where sentiment, adoption, regulatory changes, and technological advancements continually shape price movements.

Where to Buy amp coin: Top Exchanges Reviewed

3. Coinbase – Easiest Platform for AMP Beginners!

In the Reddit thread “Where to buy AMP?”, users highlight Coinbase and Gemini as the top exchanges for purchasing AMP in the United States, praising their user-friendly interfaces and robust security features. The discussion also emphasizes the availability of various reputable exchanges in other countries, making it easier for international users to access AMP. This variety ensures that both novice and experienced investors can find a suitable platform to trade AMP effectively.

- Website: reddit.com

- Platform Age: Approx. 20 years (domain registered in 2005)

5. Amp – Powering Instant Transactions with Style!

Coinbase stands out as a user-friendly centralized exchange for purchasing Amp (AMP), offering a seamless experience for both beginners and experienced investors. With detailed instructions available, users can easily navigate the platform to buy Amp, while live charts and market capitalization data provide valuable insights into the asset’s performance. Coinbase’s robust security measures and intuitive interface further enhance its appeal as a reliable choice for trading digital assets.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

3. Amp (AMP) – Your Gateway to Fast Transactions!

Amp (AMP) can be traded on over 22 exchanges, with Binance, MEXC Global, and Gate being the top choices for investors. These platforms stand out due to their high liquidity, user-friendly interfaces, and robust security measures, making them ideal for both novice and experienced traders. Additionally, these exchanges often offer competitive trading fees and a variety of trading pairs, enhancing the overall trading experience for Amp enthusiasts.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

How to Buy amp coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Amp (AMP) is to select a cryptocurrency exchange that supports the token. Some of the most popular exchanges where you can buy AMP include:

- Binance

- Coinbase

- KuCoin

- Gemini

- Bittrex

- SushiSwap (for decentralized trading)

When choosing an exchange, consider factors such as security, user experience, fees, and the availability of your preferred payment methods (credit card, bank transfer, etc.). It’s advisable to conduct some research on the exchanges and read reviews to ensure you are selecting a reputable platform.

2. Create and Verify Your Account

Once you’ve selected an exchange, you’ll need to create an account. Here’s how to do it:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button.

- Provide Information: Fill out the registration form with your email address, password, and any other required information.

- Verify Your Email: Check your email for a verification link from the exchange. Click on the link to confirm your email address.

- Complete KYC Verification: Most exchanges require you to complete a Know Your Customer (KYC) verification process. This typically involves uploading a government-issued ID and sometimes a proof of address. Follow the instructions provided by the exchange to complete this step.

3. Deposit Funds

After your account is verified, you will need to deposit funds to purchase AMP. Here’s how to do that:

- Log In: Access your account on the exchange.

- Go to the Deposit Section: Navigate to the “Wallet” or “Funds” section, and select “Deposit.”

- Choose Your Deposit Method: Select your preferred payment method (bank transfer, credit card, or cryptocurrency).

- Follow Instructions: If you’re using a bank transfer or credit card, follow the instructions provided by the exchange to complete the deposit. If you’re depositing cryptocurrency, send the funds to the specified wallet address.

4. Place an Order to Buy Amp Coin

With your account funded, you can now purchase AMP. Here’s how to place an order:

- Navigate to the Trading Section: Go to the exchange’s trading interface, usually labeled as “Markets” or “Trade.”

- Select AMP: Find AMP in the list of available cryptocurrencies. You may also search for AMP using the search bar.

- Choose Order Type: Decide whether you want to place a market order (buying at the current market price) or a limit order (setting a specific price at which you want to buy).

– Market Order: If you choose this, simply enter the amount of AMP you wish to buy and confirm the order.

– Limit Order: Enter the price you want to pay for AMP and the quantity. Your order will execute once the market price reaches your specified limit. - Review and Confirm: Double-check the details of your order before confirming. Ensure that you are comfortable with the fees associated with the transaction.

5. Secure Your Coins in a Wallet

After your purchase is complete, it’s crucial to secure your AMP tokens. While you can keep them on the exchange, it’s safer to transfer them to a personal wallet. Here’s how:

- Choose a Wallet: You can use a software wallet (like MetaMask or Trust Wallet) or a hardware wallet (like Ledger or Trezor) for enhanced security.

- Set Up Your Wallet: Follow the instructions to create your wallet and securely store your recovery phrases or private keys.

- Transfer AMP to Your Wallet:

– Go to your exchange account, navigate to the “Withdraw” or “Send” section.

– Enter your wallet address and the amount of AMP you wish to transfer.

– Confirm the transaction and wait for it to process. It may take some time depending on the network congestion.

Conclusion

Buying Amp (AMP) can be a straightforward process if you follow these steps carefully. Always ensure that you keep your account information secure and consider using two-factor authentication (2FA) on your exchange account for added security. By taking the necessary precautions and educating yourself about the cryptocurrency market, you can make informed decisions as you invest in digital assets.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Amp (AMP) has garnered attention as a unique digital asset within the cryptocurrency ecosystem, particularly due to its role as a collateral token designed to facilitate secure and instant transactions. Below are some of the potential strengths that may make Amp an attractive investment option for both beginners and intermediate investors.

1. Innovative Use Case

Amp’s primary function is to provide collateral for transactions on the Flexa network, which aims to enable instant payments across various platforms. By acting as a digital collateral token, Amp enhances transaction security and efficiency, making it particularly appealing in an era where speed and reliability are paramount in financial transactions. This innovative approach could lead to broader adoption, especially among merchants looking for secure payment solutions.

2. Decentralized and Open-Source Nature

The decentralized and open-source architecture of Amp contributes to its transparency and reliability. Being built on the Ethereum blockchain, it benefits from the security provided by Ethereum’s robust infrastructure and proof-of-stake consensus mechanism. The open-source nature allows for community involvement and scrutiny, fostering trust and encouraging further development and improvement of the protocol.

3. Strong Team and Backing

Amp is associated with Flexa, a well-established blockchain payments company founded by experienced professionals in the fintech space. The team behind Amp, including co-founder Tyler Spalding, has a strong background in technology and finance, which may bolster confidence in the project’s long-term viability. Having a reputable parent company could also facilitate partnerships and integrations that enhance the utility of Amp.

4. Versatile Applications

The potential applications for Amp extend beyond simple payment processing. Its collateralization capabilities can be leveraged in various sectors, including decentralized finance (DeFi) platforms, lending and borrowing protocols, and asset transfers. As the DeFi space continues to evolve, the demand for reliable collateral solutions like Amp may increase, potentially driving up its value.

5. Fixed Supply Model

Amp has a maximum supply cap of 100 billion tokens, which is a non-inflationary model. This fixed supply can contribute to scarcity over time, particularly if demand increases. A stable supply could help mitigate some of the volatility often seen in cryptocurrency markets, making Amp an appealing option for those wary of inflationary assets.

6. Growing Market Demand for Crypto Payments

As cryptocurrency adoption continues to rise, there is a growing demand for efficient and secure payment solutions. Amp’s role in facilitating instant, fraud-resistant transactions positions it well within this expanding market. Increased merchant acceptance of cryptocurrencies could lead to a higher demand for collateral solutions, potentially benefiting Amp.

Potential Risks and Challenges (The Bear Case)

While there are several potential strengths associated with Amp, there are also significant risks and challenges that investors should consider before investing in this digital asset.

1. Market Volatility

Cryptocurrencies are known for their price volatility, and Amp is no exception. Its current price of approximately $0.0033 reflects a drastic decline from its all-time high of $0.1211 in June 2021, representing a drop of over 97%. This volatility can pose significant risks for investors, as price fluctuations can lead to substantial losses. Investors should be prepared for potential downturns and market corrections.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, with various governments and regulatory bodies around the world implementing differing regulations. Amp has faced scrutiny, particularly given its classification as a potential security by the U.S. Securities and Exchange Commission (SEC). Regulatory actions or changes in the legal status of cryptocurrencies could have a profound impact on Amp’s viability and market performance.

3. Competition

Amp operates in a competitive landscape with numerous other collateral tokens and payment solutions. Projects such as Chainlink (LINK) and others in the DeFi space may pose a threat to Amp’s market share. If competitors offer superior features, better integration capabilities, or more robust use cases, Amp could struggle to maintain its relevance and user base.

4. Technological Risks

As a blockchain-based protocol, Amp is not immune to technological challenges. Smart contracts can be vulnerable to bugs, hacks, or exploits that could compromise the security of the platform. While Amp’s smart contracts have been audited, the risk of unforeseen vulnerabilities always exists. Additionally, reliance on the Ethereum network means that any issues affecting Ethereum—such as network congestion or scalability problems—could impact Amp’s performance.

5. Adoption and Integration Challenges

For Amp to realize its full potential, widespread adoption and integration into payment systems and platforms are essential. However, achieving significant traction can be challenging, especially in a market where many merchants and users are still hesitant to adopt cryptocurrency solutions. If Amp fails to secure key partnerships or integrations, it may struggle to gain the traction needed to increase its market presence.

6. Market Sentiment and Speculation

The cryptocurrency market is heavily influenced by sentiment and speculative trading. Price movements can often be driven by social media trends, news events, or market sentiment rather than underlying fundamentals. This speculative nature can lead to unpredictable price swings, making it difficult for investors to gauge the true value of Amp in the long term.

Conclusion

In summary, Amp presents a compelling case for consideration among cryptocurrency investors due to its innovative use case, strong backing, and potential for growth in a rapidly evolving market. However, investors must also be aware of the inherent risks associated with market volatility, regulatory uncertainty, competition, and technological challenges. Conducting thorough research and understanding both the potential strengths and weaknesses of Amp will be essential for making informed investment decisions. As always, it’s crucial to approach cryptocurrency investments with caution and a clear understanding of one’s risk tolerance.

Frequently Asked Questions (FAQs)

1. What is Amp (AMP) Coin?

Amp (AMP) is an open-source, decentralized digital collateral token designed to provide instant, verifiable assurances for value transfers. Launched in 2020, Amp facilitates quick and irreversible transactions across various asset-related use cases. It operates as collateral for securing payments and other forms of value exchange, ensuring transactions are completed without delays or risk of fraud. Amp’s architecture includes collateral partitions and collateral managers that allow specific accounts, applications, or transactions to be collateralized, with balances directly verifiable on the Ethereum blockchain.

2. Who created Amp Coin?

Amp was launched by Flexa, a blockchain payments company co-founded in 2018 by Trevor Filter, Zachary Kilgore, and Tyler Spalding. Tyler Spalding, who serves as the CEO of Flexa, has a strong background in engineering and business, having studied at prestigious institutions like MIT and Harvard Business School. The Flexa team developed Amp to enhance the efficiency and security of digital payments.

3. How does Amp work?

Amp operates through smart contracts known as collateral managers, which handle the locking, releasing, and redirecting of collateral within designated partitions. This setup supports value transfers by ensuring that collateral is available and verifiable in real-time. Amp introduces predefined partition strategies that enable unique collateral models, allowing tokens to be staked without leaving their original addresses. Built on the Ethereum blockchain, Amp utilizes Ethereum’s proof-of-stake (PoS) consensus mechanism for secure and efficient operations.

4. What makes Amp different from Bitcoin?

While Bitcoin is primarily a digital currency designed for peer-to-peer transactions and store of value, Amp serves as a collateral token specifically aimed at securing value transfers across different platforms. Amp focuses on providing instant and fraud-resistant transaction assurances, which allows it to function in various financial applications, including decentralized finance (DeFi) and payment networks. Bitcoin, on the other hand, does not offer built-in collateralization features.

5. Is Amp Coin a good investment?

The investment potential of Amp Coin depends on various factors, including market trends, technological advancements, and its adoption rate across payment platforms. As with any cryptocurrency, investing in Amp involves risks and volatility. Prospective investors should conduct thorough research, consider market conditions, and assess their risk tolerance before investing in Amp or any other digital asset.

6. What are the potential use cases for Amp?

Amp is designed to collateralize a broad range of value transfers, offering versatile applications in both traditional and decentralized finance. Key use cases include:

– Digital Payment Networks: Securing instant, fraud-resistant transactions for merchants and consumers.

– Asset Transfers: Collateralizing personal asset transfers to ensure immediate settlement and reduce transaction risks.

– DeFi Integration: Enhancing the security and efficiency of decentralized finance protocols by providing collateral for lending, borrowing, and staking activities.

7. How many Amp Coins are in circulation?

At present, there are approximately 84.28 billion Amp (AMP) coins in circulation, out of a maximum supply of 100 billion AMP. This fixed supply aims to reduce volatility and prevent inflation. The current market cap of Amp is around $279 million, reflecting its overall value in the cryptocurrency market.

8. Where can I buy Amp Coin?

Amp (AMP) is available on various cryptocurrency exchanges, including Binance, Coinbase, KuCoin, Uniswap, Gemini, and many others. Users can purchase Amp using fiat currencies or other cryptocurrencies, depending on the exchange’s supported trading pairs. It is advisable to use reputable exchanges and follow security best practices when trading digital assets.

Final Verdict on amp coin

Overview of Amp Coin

Amp (AMP) is an innovative cryptocurrency designed to serve as a digital collateral token, primarily facilitating secure and instantaneous value transfers on the Flexa Network. Launched in 2020, Amp aims to resolve common issues associated with traditional payment systems, such as slow transaction confirmations and price volatility. It employs a unique architecture consisting of collateral partitions and managers, enabling the efficient locking, releasing, and redirection of collateral to ensure that transactions are completed without delays or fraud.

Technology and Functionality

Built on the Ethereum blockchain, Amp leverages smart contracts to enhance security and transparency. Its proof-of-stake consensus mechanism bolsters the network’s reliability, while rigorous audits by respected firms like ConsenSys Diligence and Trail of Bits add an extra layer of trust. The token’s structure allows for various applications, including securing payments for digital and physical goods, and facilitating transactions in decentralized finance (DeFi) platforms. This versatility positions Amp as a valuable asset in the growing landscape of digital currencies.

Investment Considerations

As with any cryptocurrency, investing in Amp carries inherent risks and rewards. The current market cap of approximately $280 million and a circulating supply of over 84 billion AMP tokens highlight its presence in the competitive crypto space. However, Amp has seen significant volatility, with its all-time high of $0.1211 in June 2021 declining by over 97% to its current price of around $0.0033. This stark price fluctuation underscores Amp’s classification as a high-risk, high-reward asset.

Final Thoughts

In conclusion, while Amp presents exciting opportunities for those interested in digital collateralization and secure payment systems, potential investors should approach with caution. The combination of innovative technology and market volatility necessitates thorough research and a clear understanding of the risks involved. As always, it is crucial to conduct your own due diligence (DYOR) before making any investment decisions in the cryptocurrency space.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.