What is 1inch crypto? A Complete Guide for Investors (2025)

An Investor’s Introduction to 1inch crypto

1inch Network, commonly referred to as 1inch crypto, is a prominent player in the decentralized finance (DeFi) ecosystem, primarily recognized for its innovative approach as a decentralized exchange (DEX) aggregator. Founded in 2019 by Sergej Kunz and Anton Bukov, 1inch has rapidly evolved into a crucial tool for traders seeking optimal prices across multiple DEXs. Its significance lies in its ability to pool liquidity from various exchanges, allowing users to execute trades at the best possible rates without the need for manual comparisons. This feature has made it particularly appealing to both novice and experienced traders alike.

The primary function of 1inch is to enhance the trading experience by minimizing slippage and ensuring that users can access competitive pricing across a vast array of liquidity sources. This capability is especially important in a market characterized by volatility and rapid price fluctuations, making 1inch an essential resource for maximizing returns on trades. Moreover, the platform’s commitment to security and compliance has positioned it as a reliable option for users navigating the complexities of DeFi.

This guide aims to serve as a comprehensive resource for understanding 1inch crypto, covering essential aspects that potential investors should consider. We will delve into the underlying technology that powers the 1inch Network, exploring its advanced algorithms and cross-chain capabilities that set it apart from other platforms. Additionally, we will examine the tokenomics of 1INCH, the native cryptocurrency of the network, including its supply dynamics, market performance, and governance model.

Investing in 1inch also involves understanding the potential risks associated with the cryptocurrency market. This guide will outline the volatility, regulatory concerns, and security challenges that investors may face, enabling you to make informed decisions. Finally, we will provide practical information on how to acquire 1INCH tokens, including exchanges and wallets that support the cryptocurrency.

Whether you are a beginner looking to dip your toes into the world of DeFi or an intermediate investor seeking to enhance your portfolio, this guide will equip you with the knowledge necessary to navigate the landscape of 1inch crypto effectively. By understanding its significance, technology, and investment potential, you can make well-informed choices in your cryptocurrency journey.

What is 1inch crypto? A Deep Dive into its Purpose

Understanding 1inch Crypto

1inch Network (1INCH) is a decentralized finance (DeFi) platform that primarily functions as a decentralized exchange (DEX) aggregator. Its primary goal is to optimize cryptocurrency trading by offering users the best possible prices across multiple DEXes. By doing so, it addresses several significant challenges in the DeFi space, making it an essential player in the evolving landscape of digital assets.

The Core Problem It Solves

In the world of decentralized finance, traders often face the challenge of finding the best prices for their trades. With countless decentralized exchanges available, each with varying liquidity levels and fees, manually comparing prices can be both tedious and inefficient. This is where 1inch Network comes into play.

1inch aggregates liquidity from various DEXes, allowing users to execute trades that are split across multiple platforms. This aggregation ensures that traders receive optimal rates while minimizing slippage—the difference between the expected price and the actual price of a trade. By utilizing sophisticated algorithms, 1inch continuously analyzes and compares prices across numerous exchanges in real-time, guaranteeing users that they are getting the best possible deal for their transactions.

Moreover, the platform facilitates gasless transactions, which significantly reduces the cost of trading. Users can execute trades without incurring gas fees, thus making the trading experience more affordable. This feature is particularly appealing to both novice and experienced traders who may be deterred by high transaction costs on other platforms.

Its Unique Selling Proposition

1inch Network’s unique selling proposition (USP) lies in its comprehensive suite of features designed to enhance the user experience in the DeFi ecosystem.

-

DEX Aggregation: The primary feature of 1inch is its ability to aggregate liquidity from various DEXes. This ensures that users receive the best possible rates without needing to manually compare prices across different platforms.

-

Pathfinder Algorithm: The introduction of the Pathfinder algorithm marks a significant technological advancement for 1inch. This algorithm optimizes trade routes across multiple liquidity sources, effectively reducing transaction costs and improving the overall trading experience for users. The algorithm is designed to find the most efficient paths for trades, ensuring maximum profitability.

-

Cross-Chain Swaps: 1inch allows users to swap tokens across different blockchain networks seamlessly. This feature eliminates the need for bridges and the associated gas fees, making cross-chain transactions more accessible and cost-effective.

-

User-Friendly Wallet: The 1inch Wallet is a powerful mobile application that facilitates secure asset management and interaction with the Web3 ecosystem. Users can easily track their digital assets and execute trades through an intuitive interface.

-

Portfolio Tracking: The platform includes a cutting-edge portfolio tracker that offers detailed insights into users’ crypto holdings. This feature allows users to monitor their investments and make informed decisions based on real-time data.

-

Community Governance: The governance model of 1inch is built around its native token, 1INCH. Token holders can participate in decision-making processes, voting on proposals that shape the future development of the platform. This decentralized governance approach empowers the community and fosters a sense of ownership among users.

The Team and Backers

1inch Network was co-founded by Sergej Kunz and Anton Bukov, both of whom bring extensive experience in software development and blockchain technology. Before founding 1inch, Kunz worked as a software engineer and security specialist, gaining valuable insights from his tenure at prestigious companies like Porsche. Bukov has been involved in various blockchain projects, contributing significantly to the growth of decentralized finance solutions.

The 1inch team is complemented by a diverse group of developers, researchers, and community advocates, all dedicated to enhancing the platform and expanding its reach. Their collective expertise positions 1inch as a leader in the DeFi space, capable of addressing the challenges faced by traders and investors.

In addition to its talented team, 1inch has garnered support from notable backers in the cryptocurrency industry. The platform has received funding from prominent venture capital firms and angel investors, which has facilitated its growth and development. This backing not only provides financial resources but also lends credibility to the project, helping to attract more users and liquidity to the platform.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of 1inch Network is to streamline and enhance the trading experience for users within the decentralized finance ecosystem. By providing a platform that aggregates liquidity from multiple DEXes, 1inch ensures that users can execute trades at the best possible rates, thus maximizing their returns and minimizing costs.

Furthermore, 1inch plays a crucial role in promoting the adoption of decentralized finance by making it more accessible to a broader audience. Its user-friendly interface, low fees, and advanced features cater to both novice and experienced traders, helping to bridge the gap between traditional finance and the burgeoning world of digital assets.

In summary, 1inch Network stands out in the cryptocurrency landscape as a vital tool for traders seeking efficiency, cost-effectiveness, and security in their DeFi interactions. Its innovative solutions and commitment to community governance position it as a key player in the ongoing evolution of decentralized finance, paving the way for a more inclusive and user-centric financial ecosystem.

The Technology Behind the Coin: How It Works

Introduction to 1inch Network

1inch Network is a decentralized exchange (DEX) aggregator that optimizes trades across various decentralized finance (DeFi) platforms. It operates on the Ethereum blockchain, known for its robust smart contract capabilities. By pooling liquidity from multiple exchanges, 1inch ensures users can access the best possible rates, making it a valuable tool for traders in the cryptocurrency space. This guide delves into the underlying technology that makes 1inch Network a standout player in the DeFi ecosystem.

Blockchain Architecture

1inch Network primarily operates on the Ethereum blockchain, which is a decentralized platform that enables developers to create and deploy smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This architecture allows for transparency, security, and immutability in transactions, as once a contract is deployed, it cannot be altered.

-

Ethereum’s Role: Ethereum’s blockchain provides the foundational infrastructure for 1inch, allowing it to leverage the extensive network of nodes that validate transactions. This decentralized nature ensures that no single entity controls the network, enhancing security and trust among users.

-

Interoperability: Besides Ethereum, 1inch has expanded its operations to other blockchains like Binance Smart Chain (BSC) and Polygon. This multi-chain approach allows users to swap tokens across different networks without needing centralized exchanges, thereby increasing flexibility and reducing costs associated with transactions.

Consensus Mechanism

The consensus mechanism is a critical component of blockchain technology that ensures all participants in the network agree on the state of the blockchain. Ethereum, as of October 2023, uses a Proof of Stake (PoS) consensus mechanism.

-

Proof of Stake (PoS): In PoS, validators are chosen to create new blocks and confirm transactions based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This method contrasts with Proof of Work (PoW), where miners solve complex mathematical problems to validate transactions. PoS is more energy-efficient and scalable, making it suitable for high-volume networks like Ethereum.

-

Security through Staking: Validators in a PoS system are incentivized to act honestly because if they attempt to manipulate the system, they risk losing their staked assets. This economic incentive aligns the interests of validators with the overall health of the network, thus enhancing security.

Key Technological Innovations

1inch Network incorporates several advanced technologies that differentiate it from other DeFi platforms. Here are some of the key innovations:

Liquidity Aggregation

1inch’s primary function as a DEX aggregator allows it to source liquidity from numerous decentralized exchanges. This is vital for users looking for the best trading rates.

-

Real-time Price Analysis: The platform employs sophisticated algorithms that analyze prices across various exchanges in real-time. This process enables 1inch to split a single trade across multiple platforms, ensuring users receive optimal prices and minimizing slippage.

-

Slippage Minimization: Slippage occurs when the actual execution price of a trade differs from the expected price. By aggregating liquidity, 1inch reduces the likelihood of slippage, which is particularly important for larger trades where price impact can be significant.

Pathfinder Algorithm

The Pathfinder algorithm is a cornerstone of 1inch’s trading infrastructure. It optimizes the trading process by identifying the most efficient routes for executing trades.

-

Efficient Trade Execution: Pathfinder analyzes multiple liquidity sources to determine the best route for a trade, minimizing costs and maximizing returns. This algorithm is crucial for traders who want to ensure they get the best value for their transactions.

-

Cross-Chain Swaps: The algorithm also facilitates seamless token swaps across different blockchains without the need for traditional bridges, which often incur high fees and long wait times. This feature enhances the user experience by making it easier to navigate the complex landscape of DeFi.

Gasless Transactions

One of the significant pain points in using blockchain networks is the cost of transaction fees, commonly known as gas fees. 1inch addresses this issue through gasless transactions.

-

User-Friendly Experience: By allowing users to execute trades without incurring gas fees, 1inch enhances accessibility, particularly for new users who may be deterred by high transaction costs. This feature is made possible through the use of meta-transactions, where third parties can cover the gas fees on behalf of users.

-

Increased Engagement: By reducing the cost barrier associated with trading, 1inch fosters greater engagement within the DeFi space, attracting users who might otherwise hesitate to participate due to transaction costs.

Governance and Community Engagement

1inch Network employs a decentralized governance model through its native token, 1INCH. This model empowers the community to participate in the decision-making process regarding the network’s future development.

-

Decentralized Autonomous Organization (DAO): Token holders can vote on proposals that affect the platform, such as changes to the protocol or new feature implementations. This democratic approach ensures that the network evolves in a way that aligns with the interests of its users.

-

Community Support and Education: 1inch is committed to fostering a vibrant community by providing educational resources and support. This focus on user engagement not only enhances the user experience but also contributes to the network’s sustainability and growth.

Security Features

Security is a paramount concern in the world of cryptocurrency. 1inch Network employs several measures to protect users’ assets and ensure secure transactions.

-

Smart Contract Audits: The platform undergoes regular security audits conducted by third-party firms to identify and mitigate potential vulnerabilities in its smart contracts. This proactive approach helps ensure the integrity of the platform.

-

MEV Protection: 1inch offers protection against Miner Extractable Value (MEV) attacks, where miners could potentially manipulate transaction orders to their advantage. By implementing fair transaction ordering, 1inch enhances user trust and security.

Conclusion

The technology behind 1inch Network exemplifies the innovative spirit of the DeFi space. By leveraging Ethereum’s blockchain, employing advanced algorithms for liquidity aggregation, and focusing on user-friendly features like gasless transactions, 1inch has positioned itself as a critical player in the decentralized finance ecosystem. Its commitment to security, community engagement, and continuous innovation ensures that it remains at the forefront of the evolving cryptocurrency landscape. Whether you are a beginner or an experienced investor, understanding the technology behind 1inch Network can enhance your engagement with the DeFi world and empower your trading strategies.

Understanding 1inch crypto Tokenomics

1inch Network has established itself as a significant player in the decentralized finance (DeFi) space, primarily through its innovative approach to liquidity aggregation and trading optimization. Understanding the tokenomics of the 1inch crypto (1INCH) token is essential for both beginners and intermediate investors looking to grasp how this digital asset operates within the broader DeFi ecosystem.

Key Metrics of 1INCH Tokenomics

| Metric | Value |

|---|---|

| Total Supply | 1.5 billion 1INCH |

| Max Supply | 1.5 billion 1INCH |

| Circulating Supply | 1.39 billion 1INCH |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The 1INCH token serves multiple purposes within the 1inch Network, enhancing the overall functionality and user experience of the platform. Here are the primary uses of the 1INCH token:

-

Governance: One of the most significant roles of the 1INCH token is in governance. Token holders can participate in the decision-making processes of the network by voting on various proposals that affect the platform’s future. This decentralized governance model ensures that the community has a say in the development and direction of the 1inch Network.

-

Liquidity Provisioning: 1INCH tokens can be used to provide liquidity to various liquidity pools within the network. Users who contribute their assets to these pools earn rewards in the form of trading fees, thus incentivizing participation. This mechanism not only enhances liquidity but also allows users to earn passive income from their holdings.

-

Transaction Fee Discounts: Holding 1INCH tokens can provide users with discounts on transaction fees when using the platform. This benefit can be particularly appealing for frequent traders, as it reduces their overall trading costs.

-

Staking: The 1INCH token can also be staked, allowing users to lock up their tokens to earn rewards. Staking contributes to the network’s security and stability while providing token holders with an opportunity to increase their returns.

-

Access to Exclusive Features: As the platform evolves, there may be additional functionalities or features that are accessible only to 1INCH token holders. This creates an incentive for users to hold and utilize the token actively.

Token Distribution

The distribution of the 1INCH token is designed to encourage community involvement and ensure a fair allocation of tokens among various stakeholders. Here’s a breakdown of how the tokens are distributed:

-

Airdrop: Upon the launch of the 1INCH token in December 2020, a significant portion of tokens was distributed through an airdrop to early users of the platform. This strategic move not only rewarded existing users but also fostered a sense of community and ownership.

-

Team and Advisors: A portion of the total supply is allocated to the founding team and advisors. This allocation is typically vested over a period to ensure that the interests of the team align with those of the community.

-

Liquidity Mining: A significant amount of 1INCH tokens is reserved for liquidity mining programs. These programs incentivize users to provide liquidity to the platform by rewarding them with 1INCH tokens based on their contribution.

-

Ecosystem Growth: Tokens are also allocated for various initiatives aimed at expanding the 1inch ecosystem. This includes partnerships, integrations, and marketing efforts that contribute to the growth of the platform.

-

Reserve Funds: A portion of the total supply is held in reserve for future developments and unforeseen needs. This ensures that the network has the necessary resources to adapt to changes in the market and continue its growth trajectory.

Economic Model

The economic model of 1INCH is characterized by its deflationary nature. As the platform grows and more users engage with it, the demand for the token may increase. Additionally, mechanisms such as token buybacks or burns can be implemented to reduce the circulating supply over time, potentially increasing the token’s value.

This deflationary model, combined with the utility of the 1INCH token across various aspects of the platform, creates a strong foundation for its long-term viability. The emphasis on community governance also aligns the interests of token holders with the overall success of the 1inch Network.

Conclusion

Understanding the tokenomics of 1inch crypto is crucial for anyone looking to invest or engage with the platform. The 1INCH token plays a vital role in governance, liquidity provisioning, and user engagement, making it an integral part of the 1inch ecosystem. With a well-structured distribution model and a deflationary economic framework, the 1INCH token not only serves immediate utility but also positions itself for potential long-term growth within the rapidly evolving DeFi landscape.

Price History and Market Performance

Key Historical Price Milestones

1inch Network (1INCH) has experienced significant price fluctuations since its inception, reflecting both the volatility inherent in the cryptocurrency market and the dynamics of the decentralized finance (DeFi) sector.

-

Launch and Initial Trading: The 1INCH token was launched in December 2020, following the platform’s emergence as a prominent DEX aggregator. Initially, the token’s price was relatively low, as it was still establishing its presence in the crowded DeFi landscape.

-

All-Time High: The token reached its all-time high of approximately $7.87 on May 8, 2021. This peak coincided with a broader surge in interest and investment in DeFi projects, as well as the overall bullish trend in the cryptocurrency market during that period. The rise in price was fueled by increased user adoption of the platform and the growing demand for efficient trading solutions across decentralized exchanges.

-

Post-Peak Correction: Following this peak, 1INCH, like many cryptocurrencies, experienced a substantial correction. The price began to decline in the months following the all-time high, influenced by a combination of market corrections and changes in investor sentiment towards DeFi tokens. By late 2021 and into early 2022, 1INCH saw its price drop significantly, reflecting a trend that affected many digital assets during this period.

-

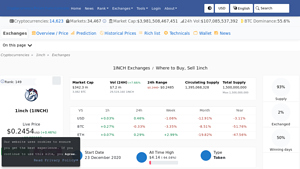

Recent Price Trends: As of October 2023, 1INCH is trading around $0.2450, with a market capitalization of approximately $342.06 million. The token’s price has seen fluctuations, with a 24-hour trading volume of about $12.52 million. The price has ranged between a low of $0.2436 and a high of $0.2484 over the past 24 hours, indicating ongoing trading activity and interest in the asset.

-

All-Time Low: The lowest recorded price of 1INCH occurred on April 7, 2025, at approximately $0.1495. This price point exemplifies the extreme volatility typical of cryptocurrencies, where prices can rapidly decline due to market dynamics.

Factors Influencing the Price

Historically, the price of 1INCH has been influenced by several key factors that are common in the cryptocurrency market, particularly within the DeFi sector.

-

Market Sentiment: The overall sentiment in the cryptocurrency market has a significant impact on the price of 1INCH. Bullish trends in the market can lead to increased buying activity, while bearish trends may result in selling pressure. For instance, the surge to an all-time high in May 2021 coincided with a generally optimistic outlook towards DeFi and cryptocurrencies as a whole.

-

Adoption and Usage: The level of adoption of the 1inch platform has directly influenced its token’s price. Increased user engagement, such as higher trading volumes and more users utilizing the platform’s services, tends to correlate with price increases. The introduction of new features, like the Pathfinder algorithm for optimized trading, has also contributed to enhanced user experience and increased demand for the token.

-

Competition and Market Dynamics: The competitive landscape of decentralized exchanges and aggregators also plays a role in the price of 1INCH. As new DEX platforms emerge and existing ones evolve, 1inch must continuously innovate to retain its user base. Changes in the competitive environment can affect market share and, consequently, the price of its token.

-

Regulatory Developments: Regulatory news can have immediate effects on the price of cryptocurrencies, including 1INCH. For example, announcements regarding regulations affecting DeFi platforms can lead to fluctuations in investor confidence and trading volumes. The DeFi sector has faced scrutiny from regulators, and any significant developments in this area can impact market performance.

-

Technological Developments: Upgrades and improvements to the 1inch platform itself have historically influenced its token’s price. For example, the transition to 1inch V2 introduced significant enhancements that improved the user interface and trading efficiency, which can lead to increased usage and, in turn, a potential rise in the token’s price.

-

Market Trends in DeFi: Broader trends within the DeFi ecosystem also impact 1INCH’s price. For instance, the rise of yield farming and liquidity provision has driven interest in DeFi tokens. Conversely, a downturn in DeFi activity can lead to decreased interest in tokens like 1INCH, resulting in price declines.

-

Liquidity and Trading Volume: The liquidity available on the 1inch platform and the overall trading volume of the token in various markets directly affect its price stability. Higher liquidity generally leads to lower volatility and more stable prices, while low liquidity can cause larger price swings.

Conclusion

The price history and market performance of 1INCH reflect the inherent volatility and complexity of the cryptocurrency landscape, particularly within the DeFi sector. Understanding the key historical milestones and the factors influencing its price can provide valuable insights for both beginner and intermediate investors. As the DeFi space continues to evolve, keeping an eye on these dynamics will be essential for making informed investment decisions regarding 1INCH and similar digital assets.

Where to Buy 1inch crypto: Top Exchanges Reviewed

1. 1inch – Your Gateway to Decentralized Trading!

1inch (1INCH) stands out in the cryptocurrency market by offering its users access to over 55 exchanges, ensuring liquidity and competitive trading options. Notably, top platforms like Binance, MEXC Global, and Gate facilitate seamless buying, selling, and trading of 1INCH, with various supported trading pairs including USDT and BUSD. This extensive availability across reputable exchanges enhances user experience and provides opportunities for efficient transactions.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5 Steps to Seamlessly Buy 1inch Network Token (1INCH) in 2025!

The “How to Buy 1inch Network Token (1INCH) Guide 2025” on CoinCodex highlights various reputable exchanges such as KuCoin, Binance, and Kraken, making it easy for users to acquire 1INCH tokens. What sets this guide apart is its emphasis on thorough research before purchasing, ensuring that both beginners and experienced investors can make informed decisions in a rapidly evolving cryptocurrency landscape.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Kraken – Your Go-To for Seamless 1INCH Purchases!

Kraken stands out as a user-friendly exchange for purchasing 1INCH, allowing users to start with as little as $10. The platform supports multiple payment options, including credit and debit cards, ACH deposits, and mobile payment methods like Apple and Google Pay, making the buying process accessible and convenient for both beginners and experienced investors. With its robust security features and comprehensive educational resources, Kraken enhances the overall trading experience.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. 1inch – Ultimate DeFi Solutions for Seamless Web3 Trading!

1inch Network distinguishes itself in the DeFi landscape by providing a comprehensive suite of products designed for seamless Web3 interactions. Its offerings, including the 1inch dApp, Wallet, Developer Portal, Portfolio, and Fusion, empower users with enhanced security and efficiency in decentralized trading and asset management. This holistic approach not only facilitates optimal token swaps but also supports developers in building robust DeFi applications, making 1inch a pivotal player in the evolving blockchain ecosystem.

- Website: 1inch.io

- Platform Age: Approx. 6 years (domain registered in 2019)

1. 1inch Exchange – Your Gateway to Efficient DeFi Trading!

1inch Exchange is a decentralized trading platform that aggregates liquidity from various sources, enabling users to find the best prices for their trades. What sets it apart is its unique routing technology, which optimizes transactions by splitting orders across multiple decentralized exchanges to minimize slippage and maximize returns. Additionally, the platform supports a wide range of cryptocurrencies, including its native 1INCH token, which can be easily purchased on major exchanges like Binance.

- Website: zenledger.io

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy 1inch crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing 1inch (1INCH) crypto is to select a cryptocurrency exchange. A cryptocurrency exchange is a platform where you can buy, sell, and trade digital assets. Here are some popular exchanges where 1INCH is available:

- Binance: One of the largest exchanges globally, offering a wide range of cryptocurrencies, including 1INCH.

- Coinbase: A user-friendly platform suitable for beginners, though it may have fewer options for trading pairs.

- Kraken: Known for its security and a variety of available cryptocurrencies.

- Uniswap: A decentralized exchange (DEX) where you can trade directly from your wallet without an intermediary.

When choosing an exchange, consider factors such as fees, available payment methods, security measures, and user interface. Ensure that the exchange supports your country and complies with local regulations.

2. Create and Verify Your Account

Once you have selected an exchange, the next step is to create an account. Here’s how to do that:

- Visit the Exchange Website: Navigate to the official website of the chosen exchange.

- Sign Up: Click on the “Sign Up” or “Register” button. You will need to provide basic information, including your email address and a secure password.

- Email Verification: After signing up, check your email for a verification link. Click the link to verify your email address.

- Complete KYC (Know Your Customer): Most exchanges require you to complete a KYC process. This typically involves submitting identification documents such as a government-issued ID and proof of address. Follow the instructions provided by the exchange to complete this step.

Verification times can vary, so be patient as your documents are reviewed.

3. Deposit Funds

With your account verified, you can now deposit funds to buy 1INCH. Here’s how:

- Log In: Sign in to your exchange account.

- Navigate to the Deposit Section: Find the deposit option in the menu. This could be labeled as “Funds,” “Wallet,” or “Deposit.”

- Select Your Deposit Method: Choose how you want to fund your account. Common methods include bank transfer, credit/debit card, or other cryptocurrencies.

- Follow the Instructions: If using a bank transfer, you may need to follow specific instructions to complete the transaction. For credit/debit cards, you’ll enter your card details.

- Confirm Deposit: Once you’ve initiated the deposit, confirm the transaction. Be aware that deposits can take time to process, depending on the method used.

4. Place an Order to Buy 1inch Crypto

After your funds have been deposited and are available in your exchange account, you can place an order to buy 1INCH. Here’s how:

- Go to the Trading Section: Navigate to the trading or markets page on the exchange.

- Search for 1INCH: Use the search function to find 1inch (1INCH) or locate it within the list of available cryptocurrencies.

- Select Your Trading Pair: Choose the trading pair that matches your deposited currency (e.g., 1INCH/USD or 1INCH/ETH).

- Choose Order Type: Decide on the type of order you want to place:

– Market Order: Buy 1INCH at the current market price. This is the simplest option for beginners.

– Limit Order: Set a specific price at which you want to buy 1INCH. This order will only execute if the price reaches your specified level. - Enter Amount: Specify how much 1INCH you want to buy.

- Review and Confirm: Double-check the details of your order, including fees, before clicking the “Buy” button.

5. Secure Your Coins in a Wallet

After successfully purchasing 1INCH, it’s crucial to secure your coins. While you can store them on the exchange, it’s generally safer to transfer them to a personal wallet. Here’s how:

- Choose a Wallet: Options include:

– Software Wallets: Apps like MetaMask or Trust Wallet that allow easy access to your coins.

– Hardware Wallets: Physical devices like Ledger or Trezor that provide enhanced security for long-term storage. - Set Up Your Wallet: Download and install your chosen wallet, following the setup instructions. Ensure you back up your recovery phrase securely.

- Transfer Your 1INCH:

– Log in to your exchange account.

– Navigate to the withdrawal section.

– Enter your wallet address and the amount of 1INCH you want to transfer.

– Confirm the transaction.

By following these steps, you will have successfully purchased and secured your 1inch crypto. Always remember to keep your wallet credentials safe and stay informed about best practices for cryptocurrency security.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Innovative Technology and Unique Value Proposition

1inch Network operates as a decentralized exchange (DEX) aggregator, allowing users to access liquidity from multiple exchanges simultaneously. This ensures that users can secure the best possible trading rates by splitting their trades across various platforms. The implementation of the Pathfinder algorithm enhances this capability, optimizing trading routes to minimize slippage and transaction costs. Such technological innovation positions 1inch as a valuable tool for traders seeking efficiency and cost-effectiveness in their transactions.

2. Expanding Ecosystem and Cross-Chain Capabilities

The 1inch Network has successfully expanded its ecosystem beyond Ethereum, integrating with other blockchain networks like Binance Smart Chain and Polygon. This cross-chain capability broadens the user base and addresses scalability issues by offering lower transaction fees and faster processing times. As the DeFi space continues to evolve, the ability to operate across multiple blockchains will likely enhance the platform’s relevance and usability.

3. Strong Community and Governance Model

The launch of the 1inch decentralized autonomous organization (DAO) has empowered token holders to participate in governance decisions. This community-driven approach fosters a sense of ownership and loyalty among users, which can be crucial for long-term sustainability. Engaging the community in decision-making not only strengthens the platform’s development but also aligns it with the interests of its users.

4. Proven Market Demand

With over 24.6 million trades and 3.2 million users, 1inch has demonstrated significant market adoption. The total trading volume exceeding $707 billion indicates a robust demand for its services. As decentralized finance continues to gain traction, 1inch’s established user base and trading volume position it favorably in a growing market.

5. Commitment to Security and Compliance

1inch Network emphasizes security and compliance, working with security specialists to create a safe environment for its users. The platform’s commitment to maintaining high-security standards is essential in the DeFi space, where vulnerabilities can lead to significant losses. By prioritizing security, 1inch can build trust among users and enhance its reputation in the market.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

The cryptocurrency market is known for its high volatility, which can significantly impact the value of digital assets, including 1INCH. Prices can fluctuate dramatically in short periods due to market sentiment, news events, or changes in trading volume. For investors, this volatility poses a risk as it can lead to substantial financial losses. Moreover, the broader market trends, including Bitcoin’s price movements, often influence altcoins, making them susceptible to sudden downturns.

2. Regulatory Uncertainty

As governments worldwide continue to develop regulatory frameworks for cryptocurrencies and decentralized finance, regulatory uncertainty remains a significant risk for projects like 1inch. Changes in regulations can affect the operational capabilities of DeFi platforms, leading to compliance challenges or even restrictions on certain activities. For instance, stricter regulations could limit the ability of 1inch to function as a DEX aggregator or impact its liquidity sources. This uncertainty could deter new users and investors, affecting growth prospects.

3. Intense Competition

The DeFi landscape is highly competitive, with numerous DEX aggregators and trading platforms vying for market share. Projects such as Uniswap, SushiSwap, and others offer similar functionalities, creating a crowded marketplace. This competition can lead to pricing pressures, reduced market share, and the need for continuous innovation to retain users. If 1inch fails to differentiate itself effectively or keep pace with competitors, it could struggle to maintain its position in the market.

4. Technological Risks

While the technology behind 1inch is innovative, it is not immune to risks. Smart contracts, while designed to be secure, can contain vulnerabilities that malicious actors may exploit. Any security breach or exploit could lead to significant financial losses for users and damage the platform’s reputation. Additionally, as 1inch continues to expand its technological capabilities, the complexity of its systems may introduce new risks, including bugs or operational failures. Ensuring robust security measures and regular audits will be essential to mitigate these risks.

5. Dependence on Ethereum Network

1inch Network primarily operates on the Ethereum blockchain, which, despite its popularity, faces scalability issues and high transaction fees during peak usage. Although 1inch has expanded to other blockchains, its dependence on Ethereum’s infrastructure means that any significant issues with the Ethereum network could adversely affect its operations. Users may experience delays or increased costs, leading to dissatisfaction and potential migration to other platforms.

6. Market Maturity and Adoption Challenges

As the DeFi market matures, user acquisition and retention may become more challenging. While 1inch has a solid user base, attracting new users in a saturated market may require substantial marketing efforts and innovative offerings. Moreover, the general public’s understanding and acceptance of DeFi technologies can vary, potentially limiting widespread adoption. If 1inch cannot effectively communicate its value proposition or if the broader adoption of DeFi stalls, it may face growth challenges.

Conclusion

Investing in 1inch presents both potential strengths and significant risks. Its innovative technology, expanding ecosystem, and strong community support highlight its potential as a leading player in the DeFi space. However, investors must also consider the challenges posed by market volatility, regulatory uncertainty, and intense competition. As with any investment, it is crucial to conduct thorough research and consider both the bullish and bearish aspects before making decisions. The evolving landscape of cryptocurrency requires investors to stay informed and adaptable to navigate the potential opportunities and risks effectively.

Frequently Asked Questions (FAQs)

1. What is 1inch crypto?

1inch is a decentralized exchange (DEX) aggregator that allows users to optimize their cryptocurrency trades across multiple decentralized exchanges. By pooling liquidity from various sources, 1inch ensures that users receive the best possible rates for their trades. It operates on Ethereum and other blockchains, offering features such as gasless transactions, cross-chain swaps, and a user-friendly wallet for managing digital assets.

2. Who created 1inch crypto?

1inch was co-founded by Sergej Kunz and Anton Bukov in 2019 during the ETHGlobal hackathon. Both founders have extensive backgrounds in software development and blockchain technology, which helped them design a platform that enhances trading efficiency and accessibility in the decentralized finance (DeFi) space.

3. What makes 1inch crypto different from Bitcoin?

While Bitcoin is primarily a digital currency aimed at being a store of value and medium of exchange, 1inch functions as a DEX aggregator within the DeFi ecosystem. Bitcoin operates on its own blockchain with a focus on peer-to-peer transactions, while 1inch leverages multiple decentralized exchanges to optimize trades, reduce costs, and enhance user experience in trading various cryptocurrencies.

4. Is 1inch crypto a good investment?

As with any cryptocurrency, the potential for investment in 1inch depends on various factors, including market conditions, user adoption, and the platform’s ongoing development. Investors should conduct thorough research and consider their risk tolerance before investing in 1inch or any other digital asset. Historically, the value of 1INCH has experienced significant fluctuations, reflecting the volatile nature of the cryptocurrency market.

5. How does 1inch ensure the best trading rates?

1inch utilizes advanced algorithms, particularly its Pathfinder algorithm, to analyze prices across numerous decentralized exchanges in real-time. This technology allows 1inch to split trades across multiple platforms, ensuring that users receive the best possible rates while minimizing slippage, which is the difference between the expected price and the actual execution price.

6. What features does the 1inch wallet offer?

The 1inch wallet is designed for managing digital assets within the Web3 ecosystem. It offers a secure and user-friendly interface for storing and transacting cryptocurrencies. Key features include support for multiple tokens, seamless integration with 1inch’s DEX aggregation service, and tools for tracking portfolio performance. The wallet also emphasizes security, ensuring that users’ private keys and assets are well protected.

7. Can I trade on 1inch without paying gas fees?

1inch offers a feature called gasless execution, which allows users to perform certain transactions without incurring gas fees. This is achieved by utilizing meta-transactions, where a third party pays the gas fees on behalf of the user. However, users should be aware that while some transactions may be gasless, others may still require gas fees, especially when interacting with the Ethereum blockchain.

8. What role does the 1INCH token play in the ecosystem?

The 1INCH token serves multiple purposes within the 1inch Network. It functions as a governance token, allowing holders to vote on proposals that shape the future of the platform. Additionally, the token can be used to access various features within the ecosystem, such as participating in liquidity pools and earning rewards. The token’s utility and governance functions empower the community and promote decentralization within the network.

Final Verdict on 1inch crypto

Overview of 1inch Crypto

1inch Network (1INCH) serves as a decentralized exchange (DEX) aggregator, offering users the ability to optimize their trades by sourcing liquidity from a multitude of DEXs. This unique approach ensures that traders can access the best possible rates while minimizing slippage, which is crucial for maximizing returns in the volatile cryptocurrency market. The platform’s advanced Pathfinder algorithm plays a significant role in achieving these efficiencies, making it a preferred choice among traders.

Technological Foundation

Built on the Ethereum blockchain, 1inch leverages the robust capabilities of smart contracts to ensure secure, transparent, and efficient transactions. The platform also supports cross-chain swaps, enabling users to transfer assets seamlessly across various blockchains without incurring gas fees. With features like a user-friendly wallet and portfolio tracker, 1inch enhances the overall trading experience and provides tools for effective asset management.

Potential and Risks

While 1inch Network has made significant strides in the DeFi space, it is essential to acknowledge that investing in cryptocurrencies, including 1INCH, is inherently risky. The digital asset market is characterized by volatility, and prices can fluctuate dramatically. As of now, 1INCH is trading around $0.2450, down significantly from its all-time high of $7.87 in May 2021, highlighting the risks associated with investing in this asset.

Final Thoughts

In conclusion, 1inch Network presents a compelling offering within the DeFi ecosystem, combining innovative technology with practical applications. However, as with any investment in cryptocurrencies, potential investors should be aware of the high-risk, high-reward nature of this asset class. It is crucial to conduct thorough research and due diligence before making any investment decisions. Always remember to DYOR (Do Your Own Research) to ensure that you are well-informed and prepared for the market’s inherent uncertainties.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.