vana coin Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to vana coin

Vana Coin, denoted by the ticker symbol VANA, is an innovative digital asset that operates on its own EVM-compatible Layer 1 blockchain. It stands out in the cryptocurrency landscape by enabling users to transform personal data into financial assets. This is achieved through the aggregation of private datasets for artificial intelligence (AI) model training, allowing individuals to tokenize and monetize their data. This unique approach not only empowers users with ownership and control over their digital footprints but also fosters a decentralized economy centered around data.

Significance in the Crypto Market

Vana Coin’s significance lies in its pioneering role in merging data ownership with blockchain technology. As the demand for data privacy and monetization grows, VANA positions itself as a key player in this niche. Unlike traditional cryptocurrencies that primarily focus on financial transactions, Vana emphasizes the value of data as an asset, creating a new frontier for both individual users and businesses alike. This innovative concept places Vana Coin among the notable projects in the blockchain ecosystem, appealing to both tech-savvy investors and those concerned about data privacy.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for beginners and intermediate investors who wish to understand Vana Coin in depth. It will cover essential aspects of the cryptocurrency, including:

-

Technology: An exploration of Vana’s blockchain infrastructure, its unique features such as Data Liquidity Pools (DLPs), and the Proof of Contribution mechanism that ensures data quality.

-

Tokenomics: A breakdown of VANA’s economic model, including its total supply, circulating supply, market cap, and how these factors influence its value.

-

Investment Potential: An analysis of VANA’s market performance, historical price trends, and its positioning within the broader cryptocurrency market.

-

Risks: A discussion of the potential risks associated with investing in Vana Coin, including market volatility, regulatory challenges, and technological risks.

-

How to Buy: A step-by-step guide on acquiring VANA, including information on supported exchanges and wallets.

By the end of this guide, readers will be equipped with the knowledge necessary to make informed investment decisions regarding Vana Coin, understand its place in the cryptocurrency ecosystem, and navigate the opportunities and challenges it presents. Whether you are looking to invest or simply curious about this emerging digital asset, this resource will provide you with the insights needed to engage with Vana Coin effectively.

What is vana coin? A Deep Dive into its Purpose

Understanding Vana Coin

Vana Coin (VANA) is a cryptocurrency that operates on an EVM-compatible Layer 1 blockchain. It aims to empower users by transforming their personal data into financial assets. This innovative approach allows individuals to aggregate private datasets for artificial intelligence (AI) model training, effectively enabling them to tokenize and monetize their data. The fundamental purpose of Vana Coin lies in its unique ability to grant users ownership and control over their digital footprints, thus addressing critical issues surrounding data privacy and monetization in the digital age.

The Core Problem It Solves

In today’s digital landscape, data is often viewed as the new oil, with companies profiting from the collection and utilization of user data without proper compensation or acknowledgment to the individuals contributing it. This has led to growing concerns about data privacy, ownership, and the lack of transparency in how personal information is used.

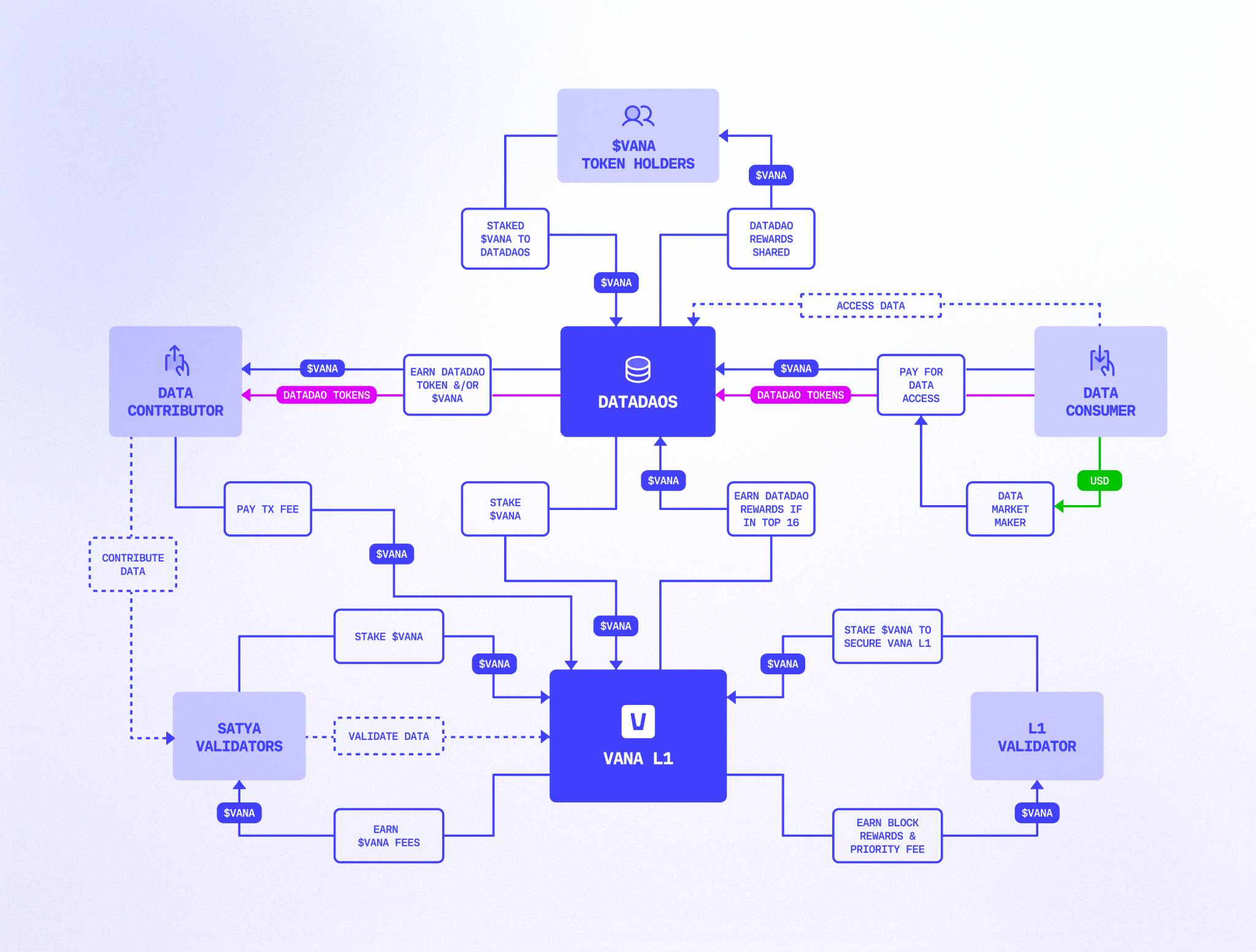

Vana Coin addresses these issues by introducing a decentralized model where users can manage their data through Data Decentralized Autonomous Organizations (Data DAOs). This allows individuals to retain ownership of their data while having the ability to monetize it. By participating in the Vana ecosystem, users can contribute their data to Data Liquidity Pools (DLPs), where it is validated and tokenized. This process not only empowers users but also enhances data quality for AI applications, creating a win-win scenario for both data contributors and developers.

Its Unique Selling Proposition

Vana’s unique selling proposition lies in its innovative approach to data monetization and ownership. Here are some of the key features that set Vana apart from other cryptocurrencies and platforms:

-

Data Liquidity Pools (DLPs): Vana introduces DLPs where users can contribute their data. This data is then validated and tokenized, creating data tokens that represent ownership and value. By facilitating the creation of these tokens, Vana allows users to trade their data as a financial asset.

-

Proof of Contribution: To ensure that the data submitted meets the network’s standards, Vana employs a Proof of Contribution system. This mechanism validates submissions, ensuring data quality and integrity, which is critical for AI model training.

-

Incentive Structures: Vana actively incentivizes participation within its ecosystem. Data contributors, validators, and DLP creators are rewarded with VANA tokens, encouraging users to provide high-quality data. This not only fosters a vibrant community but also promotes a self-sustaining economic model.

-

Focus on Privacy: Unlike traditional data platforms that often exploit user information, Vana emphasizes user privacy and control. Users can choose what data to share, how it is used, and the terms of its monetization, thus creating a more ethical approach to data management.

-

AI and Big Data Integration: By aggregating datasets specifically for AI model training, Vana positions itself at the intersection of blockchain and artificial intelligence. This dual focus enhances the value of the data being contributed while also improving AI algorithms with more diverse and high-quality datasets.

The Team and Backers

The success of any cryptocurrency project heavily relies on its team and the support it receives from backers. While specific details about the Vana team may not be widely publicized, it is essential to note that projects like Vana typically attract talent from various sectors, including technology, finance, and AI.

The team behind Vana is likely composed of experts in blockchain development, data science, and AI, all working collaboratively to drive the project’s vision. Additionally, partnerships and collaborations with established organizations in the tech and finance sectors can further validate Vana’s credibility. The backing of venture capital firms or crypto-focused investment groups can also provide necessary financial support, helping to ensure the project’s longevity and stability.

The Fundamental Purpose in the Crypto Ecosystem

Vana Coin’s fundamental purpose within the crypto ecosystem is to redefine the way personal data is handled and monetized. By leveraging blockchain technology, Vana seeks to empower individuals, giving them the tools to control and profit from their own data. This shift not only promotes user autonomy but also fosters a more equitable digital economy.

As the demand for data-driven solutions continues to grow, Vana’s focus on data liquidity and user empowerment positions it as a key player in the evolving landscape of digital assets. By creating a marketplace for personal data that respects user privacy and ownership, Vana could pave the way for a new era of data management that benefits all stakeholders involved.

In summary, Vana Coin represents a significant step forward in addressing the challenges associated with data privacy and ownership in the digital age. Through its innovative features and commitment to user empowerment, Vana aims to create a more ethical and sustainable model for data monetization, making it a noteworthy addition to the cryptocurrency landscape.

The Technology Behind the Coin: How It Works

Blockchain Architecture

Vana Coin operates on a Layer 1 blockchain, which means it is built as a standalone blockchain network rather than relying on another blockchain like Ethereum. This architecture allows Vana to process transactions and execute smart contracts independently.

One of the key features of Vana’s architecture is its compatibility with the Ethereum Virtual Machine (EVM). This compatibility enables developers familiar with Ethereum’s ecosystem to create decentralized applications (dApps) on Vana without needing to learn a new programming language or framework. By supporting EVM, Vana aims to attract developers and users looking for a platform that combines the benefits of a dedicated blockchain with the familiarity of the Ethereum ecosystem.

Consensus Mechanism

The consensus mechanism is a crucial component of any blockchain, as it determines how transactions are validated and added to the blockchain. Vana utilizes a unique variation of the Proof-of-Stake (PoS) consensus mechanism called Proof of Contribution.

In traditional PoS systems, validators are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. In Vana’s Proof of Contribution model, the focus shifts to the quality and relevance of the data contributed by users. Here’s how it works:

- Data Contribution: Users can contribute their personal data to the network. This data is then validated based on predetermined criteria.

- Validation: Validators assess the quality of the submitted data. If the data meets the network’s standards, it is accepted, and contributors are rewarded with VANA tokens.

- Incentives: By rewarding users for high-quality data contributions, Vana ensures that the data liquidity pools remain rich and valuable for AI model training, which is a core function of the platform.

This mechanism not only promotes active participation but also enhances the integrity and reliability of the data on the network.

Key Technological Innovations

Vana Coin integrates several innovative technologies that set it apart from other blockchain projects. Here are some of the most notable:

Data Liquidity Pools (DLPs)

One of Vana’s standout features is its Data Liquidity Pools. These are specialized pools where users can aggregate their data for monetization. Here’s how they work:

- Tokenization: When users contribute data to a DLP, that data is tokenized, meaning it is converted into digital tokens that represent ownership and value. This process allows users to retain control over their data while still being able to monetize it.

- Access for AI Training: The tokenized data can be used for training AI models, which is a significant draw for companies looking to leverage high-quality datasets. By aggregating data, Vana creates a rich resource that can be utilized across various sectors.

Proof of Contribution

As previously mentioned, Vana employs a Proof of Contribution mechanism to validate data submissions. This method not only ensures data quality but also incentivizes users to contribute valuable information.

- Quality Assurance: The validation process involves a thorough review of the data against established criteria. This ensures that only high-quality data is included in the network, enhancing its overall value.

- Token Rewards: Contributors of validated data are rewarded with VANA tokens, creating a financial incentive for users to share their data responsibly and ethically.

Decentralized Autonomous Organizations (DAOs)

Vana’s architecture allows for the creation of Data DAOs, which are organizations that operate autonomously based on smart contracts. These DAOs play a critical role in managing the data liquidity pools and ensuring fair governance.

- User Governance: Data DAOs enable contributors to have a say in how their data is used and managed. This participatory approach fosters a sense of ownership among users, aligning their interests with the success of the platform.

- Flexible Management: DAOs can adapt to the evolving needs of the ecosystem, allowing for dynamic governance that can respond to new challenges and opportunities.

Interoperability and Integration

Vana is designed with interoperability in mind, allowing it to connect and communicate with other blockchains and systems. This is crucial for creating a holistic ecosystem where different platforms can collaborate and share data.

- Cross-Chain Compatibility: By being EVM-compatible, Vana can interact with Ethereum-based projects, facilitating the transfer of assets and data across networks. This opens up opportunities for partnerships and integrations that can enhance the overall utility of Vana.

- APIs and SDKs: Vana provides developers with APIs (Application Programming Interfaces) and SDKs (Software Development Kits) to build and integrate applications seamlessly. This encourages innovation and the development of new use cases within the Vana ecosystem.

Security Features

Security is paramount in any blockchain project, and Vana employs multiple layers of protection to safeguard its network and users.

- Encryption: All data transactions within the Vana network are encrypted, ensuring that sensitive information remains confidential and secure from unauthorized access.

- Smart Contract Audits: Vana conducts regular audits of its smart contracts to identify and rectify potential vulnerabilities. This proactive approach helps to prevent exploits and maintain trust within the ecosystem.

- Community Vigilance: The decentralized nature of Vana means that the community plays an active role in monitoring the network for suspicious activities. This collective vigilance enhances overall security and fosters a sense of shared responsibility among users.

Conclusion

Vana Coin represents a significant advancement in the blockchain space, particularly in how it addresses personal data ownership and monetization. Through its innovative use of Data Liquidity Pools, a unique Proof of Contribution consensus mechanism, and a commitment to interoperability, Vana is positioning itself as a leader in the emerging field of data-driven decentralized applications.

As the world increasingly values data as an asset, Vana’s technology not only empowers individuals but also paves the way for a more equitable digital economy. Whether you are a beginner or an experienced investor, understanding the technology behind Vana Coin is essential for recognizing its potential and future impact on the blockchain landscape.

Understanding vana coin Tokenomics

Vana Coin (VANA) is a cryptocurrency designed to facilitate the transformation of personal data into financial assets. Its tokenomics is integral to understanding how it operates within its ecosystem, the incentives it provides, and the overall value proposition for users and investors. This section will explore the critical aspects of Vana Coin’s tokenomics, including supply metrics, utility, and distribution.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 120,000,000 VANA |

| Max Supply | 120,000,000 VANA |

| Circulating Supply | 30,084,000 VANA |

| Inflation/Deflation Model | Deflationary (limited supply) |

Total Supply, Max Supply, and Circulating Supply

-

Total Supply: The total supply of Vana Coin is capped at 120 million tokens. This fixed supply model is designed to create scarcity, which can enhance value over time as demand increases.

-

Max Supply: The maximum supply is also 120 million tokens, indicating that no additional VANA tokens will be created beyond this limit. This aspect is crucial for investors as it ensures that the token retains its value by preventing inflation due to oversupply.

-

Circulating Supply: As of now, approximately 30,084,000 VANA tokens are in circulation. This represents about 25% of the total supply, which is a significant factor in determining market cap and liquidity.

-

Inflation/Deflation Model: Vana Coin operates on a deflationary model due to its capped supply. This means that as the circulating supply increases (through mechanisms like staking or token unlocks), the total supply remains fixed, potentially increasing the value of existing tokens as demand grows.

Token Utility (What is the coin used for?)

Vana Coin serves multiple purposes within its ecosystem:

-

Data Tokenization: One of the primary utilities of VANA tokens is to facilitate the tokenization of personal data. Users can aggregate their private datasets and submit them to the Vana network. In return, they receive VANA tokens as compensation for their contributions. This process allows users to monetize their data, transforming it into a financial asset.

-

Incentives for Participation: VANA tokens are used to incentivize various participants within the ecosystem. This includes data contributors, validators who ensure data quality, and those who create Data Liquidity Pools (DLPs). By rewarding participants with VANA tokens, the network encourages the submission of high-quality data, which is essential for the overall functionality and success of the platform.

-

Governance: Token holders may have governance rights, enabling them to participate in decision-making processes regarding protocol updates, changes in incentive structures, and other critical aspects of the Vana ecosystem. This democratic approach helps align the interests of the community with the long-term goals of the project.

-

Transaction Fees: VANA tokens can also be used to pay for transaction fees within the network. This creates a demand for the tokens, as users need them to interact with various services and features on the platform.

-

Staking: Users may have the option to stake their VANA tokens, which can generate additional rewards over time. Staking not only incentivizes holding the tokens but also contributes to the network’s security and stability.

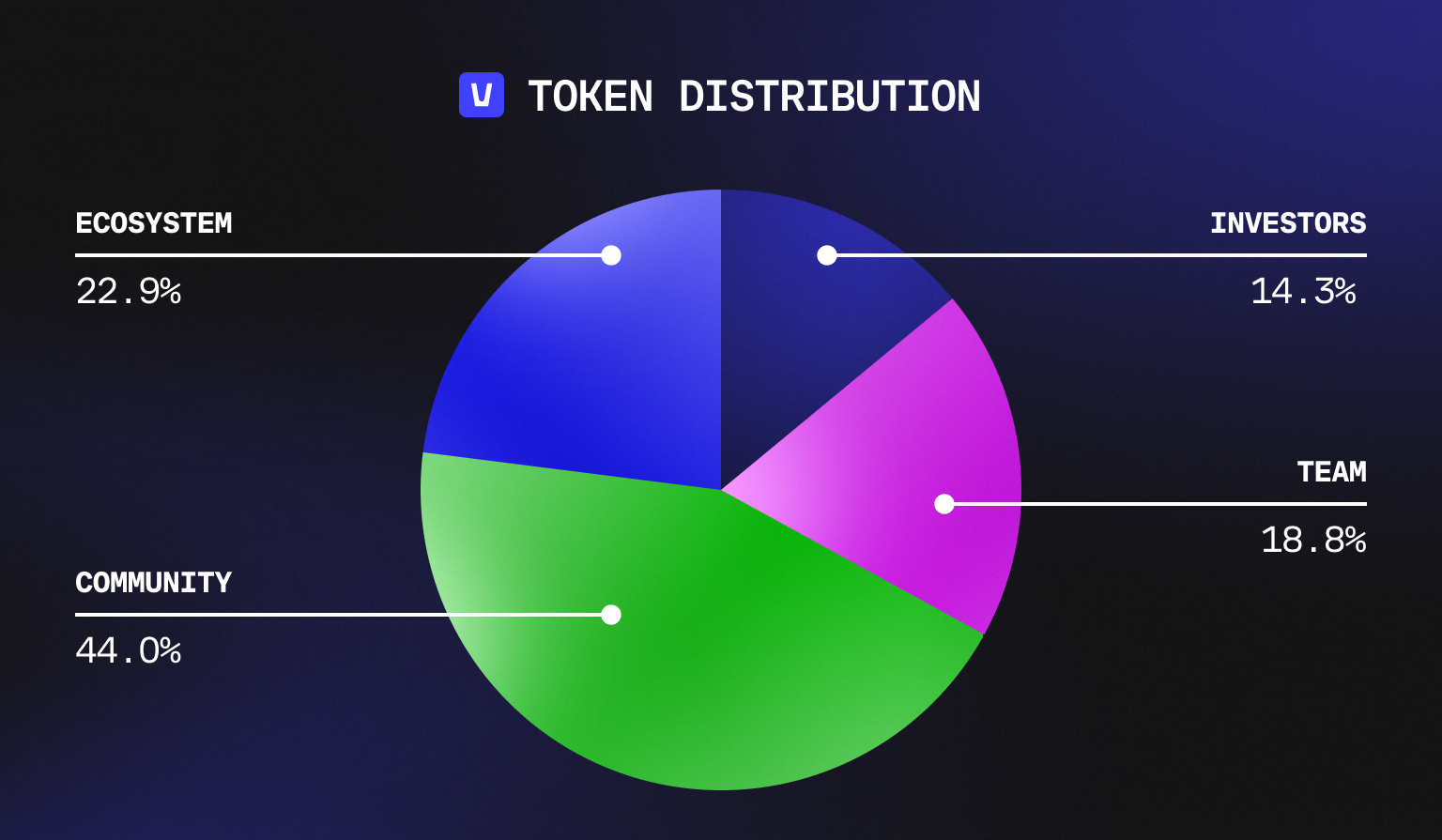

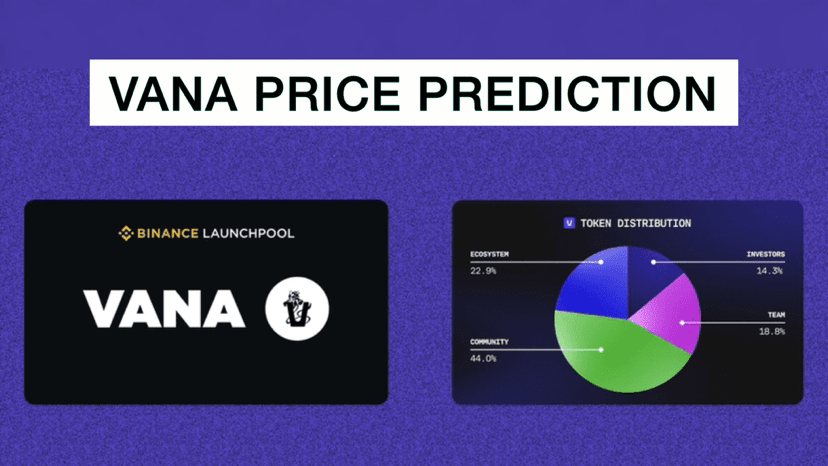

Token Distribution

Understanding how VANA tokens are distributed is crucial for evaluating the project’s long-term viability and community engagement. The distribution model typically includes several key components:

-

Initial Token Allocation: A portion of the total supply is allocated to the team, advisors, and early investors. This allocation is often subject to vesting periods to ensure that early stakeholders remain committed to the project’s success.

-

Community Incentives: A significant percentage of tokens is typically reserved for community incentives, including rewards for data contributions, participation in governance, and staking. This allocation helps to build a vibrant ecosystem by encouraging user engagement and support.

-

Liquidity Pools: To facilitate trading and ensure liquidity in the market, a portion of VANA tokens may be allocated to liquidity pools. This helps maintain a healthy trading environment and allows users to easily buy or sell their tokens.

-

Development Fund: A fraction of the total supply may be set aside for ongoing development and operational expenses. This fund is crucial for sustaining the project, funding new features, and ensuring the platform’s growth.

-

Marketing and Partnerships: Some tokens may be allocated for marketing efforts and establishing partnerships with other projects or companies. This strategy can enhance visibility and adoption, driving demand for the token.

In conclusion, the tokenomics of Vana Coin is structured to create a balanced and sustainable ecosystem. With a fixed supply and diverse utility, VANA tokens are positioned to play a pivotal role in the monetization of personal data while incentivizing participation and governance. As the project continues to evolve, understanding these dynamics will be essential for both new and experienced investors looking to navigate the Vana ecosystem.

Price History and Market Performance

Key Historical Price Milestones

Vana Coin (VANA) has experienced a range of price movements since its inception, reflecting both the broader cryptocurrency market dynamics and specific developments within its ecosystem.

-

Initial Launch and Early Trading: Vana was launched in 2023, with its initial trading price set around $5.00. Early adoption was driven by interest in its unique proposition as a Layer 1 blockchain focused on transforming personal data into financial assets.

-

First Major Surge: The coin saw significant price appreciation, reaching an all-time high of $35.53 on December 17, 2024. This surge was largely attributed to the growing interest in data monetization and decentralized finance (DeFi) solutions, as well as the overall bullish sentiment in the cryptocurrency market during that period.

-

Subsequent Decline: Following its peak, VANA experienced a sharp decline, with prices dropping to around $4.00 by mid-2025. This decline can be linked to a broader market correction that affected many cryptocurrencies, as well as increasing competition in the data-focused blockchain sector.

-

Recent Performance: As of late September 2025, VANA has fluctuated between $3.74 (its all-time low recorded on September 4, 2025) and a recent high of $4.29. The current trading price is approximately $4.20, showing a recovery of about 11.5% from its all-time low. The recent price fluctuations can be attributed to various factors, including market sentiment and developments within the Vana ecosystem.

Factors Influencing the Price

Historically, the price of Vana Coin has been influenced by a variety of factors, which can be broadly categorized into market sentiment, technological developments, and regulatory considerations.

-

Market Sentiment: Like many cryptocurrencies, VANA’s price is heavily influenced by the overall sentiment in the cryptocurrency market. Periods of bullish sentiment have typically led to price surges, while bearish trends have resulted in declines. For example, the all-time high in December 2024 coincided with a period of widespread optimism across the crypto market, driven by institutional investments and increased public interest in blockchain technology.

-

Technological Developments: Vana’s unique features, such as Data Liquidity Pools and Proof of Contribution, play a significant role in shaping its value proposition. Announcements related to upgrades, partnerships, or new functionalities can lead to increased investor interest and price volatility. For instance, the introduction of new incentive structures for data contributors has often been met with positive market reactions, boosting the price in the short term.

-

Competition and Market Positioning: The competitive landscape within the blockchain sector can also impact Vana’s price. As more projects emerge that focus on data monetization and DeFi, Vana must continually prove its unique value proposition to maintain investor interest. Price fluctuations can occur when competitors announce similar features or gain significant market traction.

-

Regulatory Environment: Regulatory developments can significantly impact the price of cryptocurrencies, including Vana. Increased scrutiny or favorable regulations can lead to price increases, while negative regulatory news can result in price drops. For example, discussions around data privacy laws and their implications for blockchain technology can create uncertainty, affecting investor confidence.

-

Trading Volume and Liquidity: VANA’s trading volume has shown considerable variability, often correlating with price movements. High trading volumes typically indicate strong market interest and can lead to price increases, while low volumes may result in increased volatility and price drops. As of the latest data, Vana’s trading volume has surged to around $27.58 million in the last 24 hours, reflecting increased market activity and potential upward pressure on price.

-

Market Capitalization Trends: Vana’s market cap has also played a role in its price performance. As of now, the market cap stands at approximately $125.94 million, which places it within a competitive range among other cryptocurrencies. The relationship between market cap and price can be indicative of investor confidence and perceived value.

Conclusion

In summary, Vana Coin’s price history reflects a complex interplay of market dynamics, technological advancements, and external factors. Understanding these historical price movements and the influencing factors can provide valuable insights for both new and experienced investors looking to navigate the evolving landscape of cryptocurrencies. As Vana continues to develop its platform and respond to market trends, its price performance will likely remain a topic of interest and analysis within the broader cryptocurrency community.

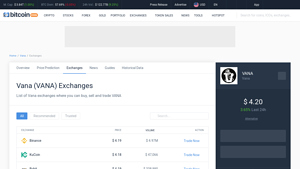

Where to Buy vana coin: Top Exchanges Reviewed

5 Reasons to Choose Vana Exchanges for Trading VANA!

Vana Exchanges offers a robust platform for buying, selling, and trading VANA across 27 different exchanges, including prominent names like Binance and Bilaxy. What sets Vana apart is its extensive trading options and liquidity, which cater to both novice and experienced traders. With various features and competitive trading pairs, Vana provides a user-friendly experience that enhances accessibility in the cryptocurrency market.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

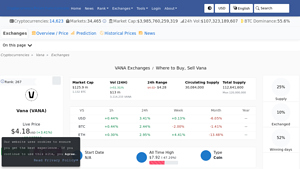

5. Vana (VANA) – Your Gateway to Seamless Crypto Trading!

Vana (VANA) stands out in the cryptocurrency market due to its availability on major exchanges like Binance, MEXC Global, and Gate, providing users with ample opportunities to buy, sell, and trade. The comprehensive table on CoinLore highlights these platforms, showcasing their trading depth and liquidity, which are crucial for both novice and experienced investors looking for reliable options to engage with VANA. This accessibility enhances Vana’s appeal in the competitive crypto landscape.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5 Reasons to Try NIRVANA (VANA) on SwapSpace Today!

NIRVANA (VANA) on SwapSpace distinguishes itself by offering users a versatile platform with a high rating of 4.6 from 856 reviews, highlighting its reliability and user satisfaction. The exchange provides multiple options for trading NIRVANA, allowing users to select the most favorable rates and minimize transaction fees, making it an appealing choice for both novice and experienced cryptocurrency traders seeking cost-effective solutions.

- Website: swapspace.co

- Platform Age: Approx. 6 years (domain registered in 2019)

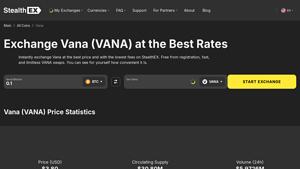

5. Vana Exchange – Your Gateway to Seamless Crypto Trading!

Vana Exchange, featured on StealthEX, distinguishes itself by offering instant VANA swaps without the need for registration, allowing users to trade seamlessly and efficiently. With a focus on providing competitive pricing and minimal transaction fees, it caters to both novice and experienced traders seeking a hassle-free exchange experience. The platform’s commitment to speed and convenience makes it an attractive option for those looking to engage with Vana quickly and effectively.

- Website: stealthex.io

- Platform Age: Approx. 7 years (domain registered in 2018)

How to Buy vana coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying Vana Coin (VANA) is selecting a cryptocurrency exchange where you can trade it. VANA is available on several exchanges, including:

- Binance: One of the largest and most popular exchanges, offering a wide range of cryptocurrencies.

- CoinUp.io: A user-friendly exchange with a focus on altcoins.

- Upbit: A well-known exchange in South Korea that supports various trading pairs.

When choosing an exchange, consider factors such as security, fees, user interface, and supported payment methods. Make sure the exchange allows trading pairs with VANA, such as VANA/USDT or VANA/KRW.

2. Create and Verify Your Account

Once you have selected an exchange, follow these steps to create your account:

-

Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide your email address and create a secure password.

-

Email Verification: After signing up, check your email for a verification link. Click on this link to confirm your email address.

-

Identity Verification: Many exchanges require you to complete identity verification (KYC) to comply with regulations. This usually involves providing personal information such as your name, address, and a government-issued ID. Follow the instructions provided by the exchange to complete this process.

3. Deposit Funds

With your account verified, the next step is to deposit funds. Here’s how to do it:

-

Log In to Your Account: Use your credentials to access your exchange account.

-

Navigate to the Deposit Section: Look for a “Funds” or “Wallet” section, and select “Deposit.”

-

Select Your Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit cards, or cryptocurrency. Choose the method that suits you best. If you are using fiat currency (like USD), select the corresponding option.

-

Follow Instructions: Depending on your selected method, follow the instructions provided to complete the deposit. Ensure that you check any fees associated with your chosen method.

4. Place an Order to Buy Vana Coin

After funding your account, you can proceed to buy Vana Coin:

-

Navigate to the Trading Section: Find the section for trading or markets on the exchange.

-

Select VANA: Search for Vana Coin using its ticker symbol (VANA). Choose the trading pair that matches your deposited currency (e.g., VANA/USDT).

-

Choose Order Type: You can typically place different types of orders:

– Market Order: This order buys VANA at the current market price.

– Limit Order: This order allows you to set a specific price at which you want to buy VANA. The order will execute only when the market reaches your set price. -

Enter the Amount: Specify how much VANA you want to purchase and review the total cost, including any trading fees.

-

Confirm the Order: Once you’re satisfied with the details, click the “Buy” button to execute your order. You should receive a confirmation of your transaction.

5. Secure Your Coins in a Wallet

After purchasing Vana Coin, it’s essential to secure your investment:

-

Choose a Wallet: Decide whether you want to store your VANA in a hot wallet (online) or a cold wallet (offline). Hot wallets are convenient for trading, while cold wallets offer enhanced security.

-

Create a Wallet: If you don’t have a wallet, create one. Popular wallet options include:

– Software Wallets: Such as Exodus or Atomic Wallet for easy access.

– Hardware Wallets: Like Ledger or Trezor for higher security. -

Transfer Your VANA: Go to your exchange account, navigate to the withdrawal section, and select VANA. Enter the address of your wallet and confirm the transfer.

-

Confirm Receipt: After a few minutes, check your wallet to ensure that your VANA has been successfully transferred.

Conclusion

By following these steps, you can successfully buy and secure Vana Coin. Remember to conduct thorough research and consider market conditions before making any investment. Always prioritize security when dealing with cryptocurrencies, and never invest more than you can afford to lose. Happy trading!

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Innovative Data Monetization Model

Vana Coin (VANA) operates within a unique framework that allows users to tokenize their personal data. By utilizing Data Decentralized Autonomous Organizations (Data DAOs), individuals gain the ability to aggregate and monetize their private datasets. This innovative approach not only empowers users by giving them ownership over their data but also taps into a growing market for data monetization. As concerns about data privacy and ownership escalate, Vana’s model may attract users seeking to regain control over their digital footprints.

Strong Market Demand for Data Solutions

The demand for data-driven solutions is on the rise, especially in sectors like artificial intelligence (AI) and big data analytics. Vana’s architecture, which is built on an EVM-compatible Layer 1 blockchain, positions it well within this expanding market. Companies are increasingly looking for high-quality datasets to train their AI models, and Vana’s platform offers a potential solution by providing access to validated and tokenized data. This could lead to increased adoption and a growing user base.

Incentive Structures to Foster Participation

The ecosystem is designed with various incentive mechanisms to encourage participation. Users contributing data, validators ensuring data quality, and creators of Data Liquidity Pools (DLPs) all receive rewards in the form of VANA tokens. Such incentives are crucial for fostering a vibrant community and promoting active engagement within the platform. A strong community can enhance the network effect, leading to further adoption and increased value for VANA.

Market Performance and Growth Potential

As of the latest data, Vana has demonstrated a significant market capitalization of approximately $125 million, with a trading volume that indicates active market engagement. The token has shown resilience, with recent price increases suggesting a growing interest from investors. With a fully diluted valuation (FDV) of around $503 million, there remains substantial room for growth, particularly if the demand for Vana’s services increases.

Scalability and Technological Robustness

Vana’s underlying technology is built on a Layer 1 blockchain, which allows for scalability and efficient transaction processing. This is particularly important as the user base grows and the demand for data transactions increases. The Proof of Contribution mechanism enhances data integrity and quality, which is essential for attracting users looking for reliable data monetization solutions.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Cryptocurrencies are notorious for their price volatility, and Vana is no exception. The price of VANA can experience significant fluctuations over short periods, influenced by broader market trends, investor sentiment, and speculative trading. Such volatility can lead to substantial financial risk for investors. It is essential for potential investors to be aware of this inherent risk and to consider their risk tolerance before investing in VANA.

Regulatory Uncertainty

The cryptocurrency landscape is evolving, with regulations varying significantly across different jurisdictions. Vana operates in a space that intersects with data privacy, which is subject to stringent regulations in many regions. The potential for future regulatory changes poses a risk to Vana’s operations and could impact its ability to function effectively. Investors should closely monitor regulatory developments that could affect the cryptocurrency market and Vana’s specific model.

Intense Competition

Vana is entering a competitive market where various projects aim to leverage blockchain technology for data monetization and AI applications. Competitors may offer similar or improved solutions, making it challenging for Vana to differentiate itself and maintain market share. The presence of established players and emerging startups could impact Vana’s growth trajectory and user acquisition strategies.

Technological Risks

While Vana’s technology promises scalability and efficiency, it is not without potential pitfalls. Technical failures, such as network outages or security breaches, could undermine user trust and confidence in the platform. Additionally, the reliance on smart contracts introduces risks associated with coding errors or vulnerabilities that could be exploited. Continuous development, rigorous testing, and security audits are essential to mitigate these risks, and failure to address them could have severe consequences for the network’s reputation and usability.

Market Adoption Challenges

Despite its innovative approach, Vana may face challenges in achieving widespread adoption. Convincing users to transition from traditional data management solutions to a decentralized model can be a significant hurdle. Additionally, the education of potential users about the benefits and functionalities of the Vana platform is crucial. Without effective marketing and user onboarding strategies, Vana might struggle to grow its user base and realize its full potential.

Conclusion

Investing in Vana Coin offers a compelling opportunity to participate in the evolving landscape of data monetization and blockchain technology. Its innovative model, strong market demand, and effective incentive structures present a robust case for potential growth. However, investors must also weigh the inherent risks associated with market volatility, regulatory challenges, competition, and technological vulnerabilities. As with any investment, thorough research and a clear understanding of both the potential and the risks are crucial for making informed decisions in the cryptocurrency space.

Frequently Asked Questions (FAQs)

1. What is Vana Coin (VANA)?

Vana Coin (VANA) is a cryptocurrency that operates on the Vana blockchain, which is an EVM-compatible Layer 1 network. It allows users to tokenize and monetize their personal data through Data Decentralized Autonomous Organizations (Data DAOs). VANA facilitates the creation of Data Liquidity Pools (DLPs), where users can contribute their data, ensuring they maintain ownership and control over their digital footprints.

2. Who created Vana Coin?

Vana Coin was developed by a team of blockchain and data science experts with a vision to empower individuals by giving them control over their personal data. The specific identities of the creators may not be publicly disclosed, as is common with many cryptocurrencies. However, they aim to create a decentralized platform that prioritizes user privacy and data ownership.

3. What makes Vana Coin different from Bitcoin?

While Bitcoin primarily serves as a digital currency and a store of value, Vana Coin focuses on the monetization and tokenization of personal data. Vana utilizes a Proof-of-Contribution system to ensure data quality and integrity, which is not a feature of Bitcoin. Additionally, Vana’s ecosystem incentivizes participation through rewards in the form of VANA tokens, targeting users who contribute high-quality data.

4. Is Vana Coin a good investment?

As with any cryptocurrency, whether Vana Coin is a good investment depends on various factors, including market conditions, technological developments, and individual risk tolerance. As of now, Vana has shown significant price fluctuations, with an all-time high of approximately $35.53 and a current price around $4.20. Potential investors should conduct thorough research and consider the project’s fundamentals, use cases, and market trends before making investment decisions.

5. How can I buy Vana Coin?

Vana Coin can be purchased on various centralized exchanges, with Binance being the most popular platform for trading VANA. Other exchanges include CoinUp.io and Upbit. Users can buy VANA using trading pairs such as VANA/USDT or VANA/KRW, depending on their preferred currency.

6. What is the current market cap of Vana Coin?

As of now, Vana Coin has a market capitalization of approximately $125.94 million. This figure is calculated by multiplying the current price of VANA by its circulating supply, which stands at around 30.08 million VANA tokens.

7. What is the total supply and maximum supply of Vana Coin?

Vana Coin has a total supply of 120 million VANA tokens, of which approximately 30.08 million are currently in circulation. The maximum supply indicates the total number of tokens that will ever be created, ensuring that there is a cap on the number of VANA tokens available in the market.

8. What are the key features of Vana Coin?

Vana Coin offers several unique features, including:

– Data Liquidity Pools (DLPs): Users can contribute data that is validated and tokenized, allowing them to create data tokens representing ownership and value.

– Proof of Contribution: This mechanism ensures that only high-quality data submissions are rewarded, maintaining the integrity of the ecosystem.

– Incentive Structures: Participants, including data contributors and validators, are rewarded with VANA tokens, promoting active engagement in the network.

These features position Vana as a forward-thinking project in the blockchain space, particularly in the realm of personal data monetization.

Final Verdict on vana coin

Overview of Vana Coin

Vana Coin (VANA) is an innovative digital asset operating on an EVM-compatible Layer 1 blockchain. Its primary purpose is to empower individuals by allowing them to transform their personal data into financial assets. This is achieved through a unique mechanism where users can aggregate private datasets for AI model training, subsequently tokenizing and monetizing their data via Data Decentralized Autonomous Organizations (Data DAOs). This not only grants users ownership and control over their digital footprints but also creates new avenues for income generation.

Technological Framework

Vana employs several key technologies that enhance its functionality. The introduction of Data Liquidity Pools (DLPs) allows users to contribute their data, which is then validated and tokenized to create data tokens. This process is supported by a Proof of Contribution system that ensures the quality and integrity of the submitted data. Participants in the ecosystem, including data contributors and validators, are incentivized through rewards in the form of $VANA tokens, fostering an active and engaged community.

Investment Potential and Risks

Currently ranked around #307 by market capitalization, Vana Coin has shown significant price fluctuations, with an all-time high of approximately $35.53 in December 2024, and a recent low of $3.74 just days ago. Its market cap stands at approximately $125 million, with a circulating supply of about 30 million VANA tokens. The asset has experienced a 3.51% increase in the last 24 hours, indicating some positive market sentiment.

However, it is crucial to note that investing in Vana Coin, like many cryptocurrencies, carries inherent risks. The cryptocurrency market is known for its volatility, and VANA’s performance may be influenced by various factors, including regulatory developments and market trends.

Final Thoughts

In conclusion, Vana Coin presents a compelling proposition for those interested in the intersection of personal data ownership and blockchain technology. While it offers promising potential for high rewards, it also comes with high risks typical of the cryptocurrency space. As always, it is imperative for potential investors to conduct their own thorough research (DYOR) before making any investment decisions, ensuring that they understand the intricacies of the asset and the broader market environment.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.