Unlocking Value: A Strategic Analysis of the Titanium Etf Market

Introduction: Navigating the Global Market for titanium etf

In today’s rapidly evolving industrial landscape, B2B buyers face the challenge of effectively navigating the global market for titanium ETFs. Sourcing the right titanium ETF can be daunting, particularly when considering the diverse applications of titanium—from aerospace components to innovative consumer products. This guide serves as a comprehensive resource, shedding light on various types of titanium ETFs, their applications across industries, and critical factors such as supplier vetting and cost analysis.

Understanding the nuances of titanium investments is essential for international buyers, especially those operating in regions like Africa, South America, the Middle East, and Europe, including countries like Nigeria and Brazil. As demand for titanium continues to rise due to its unique properties and versatility, making informed purchasing decisions becomes paramount. This guide empowers you with actionable insights, enabling you to identify reputable suppliers and select the right ETFs that align with your business objectives.

With a focus on strategic investment choices and market trends, our aim is to equip you with the knowledge needed to capitalize on the opportunities presented by titanium ETFs. Whether you’re looking to diversify your portfolio or enhance your operational capabilities, this guide is your key to unlocking the potential of titanium in the global market.

Understanding titanium etf Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| First Trust Indxx Global Natural Resources Income ETF | Broad exposure to natural resources, including a significant allocation to titanium stocks | Aerospace, construction, chemicals | Pros: Diversification, moderate expense ratio. Cons: Limited direct titanium focus. |

| iShares MSCI Global Metals & Mining Producers ETF | Focus on diversified metals, with major holdings in companies producing titanium alloys | Aerospace, defense, automotive | Pros: Strong exposure to titanium producers. Cons: Potential volatility in metal markets. |

| SPDR S&P Metals & Mining ETF | Concentrated on metals and mining companies, includes a variety of industries | Manufacturing, aerospace, energy | Pros: Diversified metal exposure, reasonable fees. Cons: Limited number of holdings. |

| VanEck Rare Earth/Strategic Metals ETF | Includes rare earth and strategic metals, with titanium as a critical component | Technology, renewable energy, defense | Pros: Focus on strategic metals, growing demand. Cons: Less liquidity compared to larger ETFs. |

What Are the Key Characteristics of the First Trust Indxx Global Natural Resources Income ETF?

The First Trust Indxx Global Natural Resources Income ETF offers investors broad exposure to a variety of natural resource sectors, including significant investments in companies involved in titanium production. This ETF is particularly suitable for B2B buyers looking for stability through diversified holdings. Key purchasing considerations include its moderate expense ratio and a quarterly distribution yield, which makes it attractive for companies that prioritize income alongside capital appreciation.

Illustrative image related to titanium etf

How Does the iShares MSCI Global Metals & Mining Producers ETF Stand Out?

The iShares MSCI Global Metals & Mining Producers ETF distinguishes itself by focusing on companies that produce diversified metals, including significant holdings in titanium alloy producers. This ETF is ideal for B2B buyers in industries such as aerospace and defense, where titanium is critical. Buyers should consider its reasonable expense ratio and the potential for volatility in metal prices, which could impact returns but also offer opportunities during market fluctuations.

Why Choose the SPDR S&P Metals & Mining ETF for B2B Investments?

The SPDR S&P Metals & Mining ETF is characterized by its focus on a concentrated selection of metals and mining stocks, offering exposure to a variety of sectors, including titanium. This ETF is particularly suitable for manufacturers and companies in the aerospace industry. While it has a modest expense ratio, buyers should be aware of the limited number of holdings, which may increase risk if specific sectors underperform.

What Are the Advantages of the VanEck Rare Earth/Strategic Metals ETF?

The VanEck Rare Earth/Strategic Metals ETF is notable for its inclusion of rare earth and strategic metals, making it a compelling choice for B2B buyers in technology and renewable energy sectors. The ETF’s focus on companies involved in titanium production aligns well with industries that rely on advanced materials. Buyers should evaluate its less liquid nature compared to larger ETFs, alongside its potential for capital growth as demand for strategic metals continues to rise.

Key Industrial Applications of titanium etf

| Industry/Sector | Specific Application of titanium etf | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Aerospace | Investment in titanium alloy producers | Enhanced material strength and weight reduction | Regulatory compliance, supply chain reliability |

| Medical Devices | Funding for titanium-based implants | Biocompatibility and durability in medical applications | Quality certifications, sourcing from reputable suppliers |

| Automotive | Support for titanium in lightweight vehicles | Improved fuel efficiency and performance | Availability of raw materials, market trends |

| Electronics | Investment in titanium components for devices | Increased device longevity and reliability | Technological compatibility, sourcing logistics |

| Construction | Financing titanium-based materials for structures | Enhanced corrosion resistance and longevity | Project specifications, local regulations |

How is Titanium ETF Used in Aerospace Applications?

Titanium ETFs provide exposure to companies that produce titanium alloys, which are critical in the aerospace industry due to their high strength-to-weight ratio. Investors in this sector support businesses that manufacture components for aircraft and spacecraft, effectively enhancing performance while reducing fuel consumption. For international buyers in regions such as Africa and South America, understanding the regulatory landscape and ensuring compliance with international standards is vital to sourcing these materials effectively.

Illustrative image related to titanium etf

What Role Does Titanium ETF Play in Medical Device Manufacturing?

In the medical device sector, titanium ETFs facilitate investments in manufacturers of titanium implants and surgical instruments. Titanium’s biocompatibility makes it an ideal choice for medical applications, providing durability and resistance to corrosion. Buyers in the Middle East and Europe must prioritize suppliers that meet stringent quality certifications to ensure the safety and efficacy of medical devices, thus navigating complex regulatory frameworks for importing these materials.

How Can Automotive Companies Benefit from Titanium ETF Investments?

Automotive manufacturers leverage titanium ETFs to invest in suppliers of titanium components that contribute to lightweight vehicle designs. This results in enhanced fuel efficiency and overall vehicle performance. B2B buyers from regions like Nigeria and Brazil should consider the availability of raw materials and market trends, as well as partnerships with suppliers who can provide innovative solutions in line with evolving automotive regulations.

What is the Significance of Titanium ETF in Electronics?

Titanium ETFs enable investments in companies that produce titanium components for electronic devices, enhancing their longevity and reliability. The electronics sector benefits from the durability and lightweight properties of titanium, which are essential for modern devices. Buyers must ensure technological compatibility and efficient sourcing logistics, especially in regions with developing markets, to maintain a competitive edge in the rapidly evolving electronics landscape.

Illustrative image related to titanium etf

How Does Titanium ETF Support Construction Projects?

In construction, titanium ETFs can finance the use of titanium-based materials in infrastructure projects, providing enhanced corrosion resistance and durability. This is particularly beneficial in challenging environments, such as coastal areas or regions with extreme weather conditions. B2B buyers need to be aware of project specifications and local regulations, ensuring that sourced materials comply with safety and quality standards while also considering the environmental impact of their projects.

3 Common User Pain Points for ‘titanium etf’ & Their Solutions

Scenario 1: Navigating Market Volatility in Titanium ETFs

The Problem: B2B buyers often grapple with the inherent volatility in the commodities market, particularly concerning titanium. Fluctuations in supply and demand can lead to erratic pricing of titanium ETFs, making it difficult for businesses to project costs accurately. This unpredictability can hinder budgeting processes and impact decision-making for large-scale projects that require titanium-based materials. Buyers may feel overwhelmed, especially if they lack the analytical tools to assess market trends effectively.

The Solution: To mitigate the risks associated with market volatility, B2B buyers should develop a robust market analysis strategy. This includes subscribing to financial news platforms that specialize in metals and commodities, using analytical tools to track historical price movements, and employing predictive analytics software that can forecast future trends based on current data. Additionally, forming partnerships with financial advisors who specialize in commodities can provide tailored insights into when to buy or sell titanium ETFs. By staying informed and utilizing sophisticated analysis techniques, buyers can make more confident investment decisions that align with their financial goals.

Scenario 2: Difficulty in Identifying Reliable Titanium ETF Options

The Problem: With a multitude of titanium ETFs available in the market, B2B buyers often find it challenging to identify which funds provide the best exposure and value for their investment. The lack of clarity regarding fund holdings, performance history, and expense ratios can lead to confusion and potential misallocation of resources. This uncertainty is particularly pronounced for businesses in emerging markets, where access to comprehensive financial data may be limited.

Illustrative image related to titanium etf

The Solution: To navigate the landscape of titanium ETFs effectively, buyers should conduct thorough due diligence on potential investments. Start by analyzing the top-performing ETFs that include titanium holdings, such as the First Trust Indxx Global Natural Resources Income ETF and the iShares MSCI Global Metals & Mining Producers ETF. Utilize resources like Morningstar and Yahoo! Finance to compare key metrics such as assets under management, historical performance, and expense ratios. Additionally, buyers can attend webinars and industry conferences focused on commodities investing, where they can gain insights from experts and network with other investors. By equipping themselves with knowledge and resources, buyers can make informed choices that align with their investment strategies.

Scenario 3: Understanding Regulatory Impacts on Titanium ETFs

The Problem: B2B buyers, especially those operating in international markets, often face challenges related to regulatory changes that can affect the performance of titanium ETFs. For example, new tariffs or environmental regulations in key producing countries can impact the supply chain and, consequently, the pricing and availability of titanium. Buyers may struggle to keep abreast of these changes, which can lead to unexpected costs and investment risks.

The Solution: To stay ahead of regulatory impacts, B2B buyers should establish a proactive compliance and risk management framework. This involves regularly monitoring regulatory news from reliable sources such as government publications and industry associations. Buyers should also consider joining professional networks that provide updates on international trade policies and market regulations affecting the metals sector. Furthermore, integrating risk assessment tools into their investment strategy can help identify potential vulnerabilities in their portfolio related to regulatory changes. By fostering a culture of compliance and vigilance, buyers can better navigate the complexities of investing in titanium ETFs and protect their investments from unforeseen regulatory impacts.

Strategic Material Selection Guide for titanium etf

What Are the Key Materials Relevant to Titanium ETFs?

When considering titanium ETFs, it is essential to analyze the underlying materials that influence performance and investment potential. Here, we explore four common materials associated with titanium ETFs, focusing on their properties, advantages, disadvantages, and specific considerations for international B2B buyers.

What Are the Key Properties of Titanium Alloys?

Titanium alloys, primarily composed of titanium and other metals such as aluminum and vanadium, are known for their exceptional strength-to-weight ratio and corrosion resistance. These properties make them suitable for high-stress applications, particularly in the aerospace and automotive industries. Titanium alloys can withstand extreme temperatures, often rated for use in environments exceeding 600°C (1112°F).

Illustrative image related to titanium etf

Pros: Their durability and lightweight nature make them ideal for applications where performance is critical, such as aircraft components and medical implants.

Cons: The manufacturing complexity of titanium alloys can lead to higher production costs. Additionally, their machinability is lower compared to other metals, which can complicate fabrication processes.

For B2B buyers in regions like Africa and South America, understanding the compliance with international standards such as ASTM and ISO is crucial, especially when sourcing titanium alloys for aerospace applications.

How Does Titanium Dioxide Impact Product Applications?

Titanium dioxide (TiO2) is a white pigment widely used in coatings, plastics, and cosmetics. Its high refractive index and opacity make it a preferred choice for applications requiring brightness and durability.

Pros: TiO2 is non-toxic and offers excellent UV resistance, making it suitable for outdoor applications. It enhances the durability of products, particularly in harsh environments.

Illustrative image related to titanium etf

Cons: The extraction and processing of titanium dioxide can be environmentally intensive, raising sustainability concerns. Furthermore, fluctuations in supply can affect pricing, impacting overall costs.

International buyers, particularly in Europe, are increasingly focused on sustainability and compliance with environmental regulations. Understanding local regulations regarding TiO2 use is vital for manufacturers in these markets.

What Are the Benefits of Rare Earth Metals in Titanium ETFs?

Rare earth metals, often included in titanium ETFs, play a significant role in the production of high-performance alloys and catalysts. They are essential for various applications, including electronics and renewable energy technologies.

Pros: Rare earth metals enhance the performance characteristics of titanium alloys, improving their strength and thermal stability. They are critical for advancing technologies, particularly in the electric vehicle sector.

Cons: The mining and processing of rare earth metals can be environmentally damaging, and geopolitical factors can influence their availability. This can lead to price volatility and supply chain risks.

For B2B buyers in the Middle East, understanding the geopolitical landscape and supply chain dynamics is crucial when investing in titanium ETFs that include rare earth metals.

How Do Steel Alloys Complement Titanium Applications?

Steel alloys, particularly those containing titanium, are used in various industrial applications due to their enhanced mechanical properties. These alloys benefit from titanium’s strength and corrosion resistance.

Pros: The combination of steel and titanium results in materials that are both strong and lightweight, making them suitable for high-performance applications in construction and automotive sectors.

Cons: The cost of producing titanium steel alloys can be high, and the complexity of manufacturing processes may deter some manufacturers. Additionally, the properties of these alloys can vary significantly based on the composition and processing methods.

Illustrative image related to titanium etf

B2B buyers in Brazil and Nigeria should be aware of local manufacturing capabilities and standards when considering investments in titanium steel alloys, ensuring compliance with relevant industry regulations.

Summary Table of Key Materials for Titanium ETFs

| Material | Typical Use Case for titanium etf | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Titanium Alloys | Aerospace components, medical implants | Exceptional strength-to-weight ratio | High manufacturing complexity | High |

| Titanium Dioxide | Coatings, plastics, cosmetics | Non-toxic, excellent UV resistance | Environmentally intensive extraction | Medium |

| Rare Earth Metals | Electronics, renewable energy technologies | Enhances performance characteristics | Environmental impact and price volatility | High |

| Steel Alloys | Construction, automotive applications | Strong and lightweight | High production cost and variable properties | Medium |

This analysis provides B2B buyers with insights into the materials associated with titanium ETFs, highlighting their properties, advantages, limitations, and considerations for international markets. Understanding these factors is essential for making informed investment decisions in the titanium sector.

In-depth Look: Manufacturing Processes and Quality Assurance for titanium etf

What Are the Main Stages of the Manufacturing Process for Titanium ETFs?

The manufacturing process for titanium products that may underlie ETFs involves several critical stages, each crucial for ensuring the integrity and quality of the final product. These stages include material preparation, forming, assembly, and finishing.

How Is Material Prepared for Titanium Production?

Material preparation begins with the sourcing of high-grade titanium ore, primarily ilmenite or rutile. The ore undergoes initial processing to extract titanium dioxide (TiO2), which is then refined into titanium metal through the Kroll process or the Hunter process. In the Kroll process, titanium tetrachloride (TiCl4) is produced and subsequently reduced with magnesium, resulting in titanium sponge. This sponge is then crushed and melted in a vacuum arc furnace to produce titanium ingots, which serve as the primary raw material for manufacturing.

Illustrative image related to titanium etf

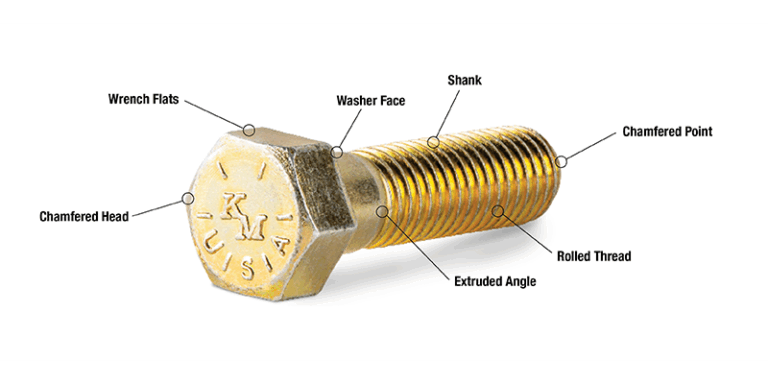

What Forming Techniques Are Used in Titanium Manufacturing?

Once the titanium ingots are ready, they undergo various forming techniques to achieve the desired shapes and sizes. Common techniques include:

- Forging: This method involves shaping the titanium by applying compressive forces, which enhances its mechanical properties.

- Rolling: In this process, titanium is passed through rollers to produce sheets or plates, which are often used in aerospace and industrial applications.

- Extrusion: Titanium is forced through a die to create long shapes like bars or tubes, commonly used in structural applications.

These forming techniques must be meticulously controlled to ensure that the titanium maintains its strength and fatigue resistance, which are essential for high-performance applications.

How Is Assembly Done in Titanium Manufacturing?

The assembly stage involves joining different titanium components to create final products. Various methods are employed, including welding, riveting, and adhesive bonding.

- Welding: Titanium can be welded using techniques such as Gas Tungsten Arc Welding (GTAW) or Electron Beam Welding (EBW). These methods require a controlled environment to prevent contamination and ensure joint integrity.

- Riveting: Often used in aerospace applications, riveting provides a strong mechanical connection between parts without compromising the material’s integrity.

- Adhesive Bonding: This technique is increasingly used in industries where weight reduction is critical, allowing for the joining of titanium to other materials effectively.

Each assembly method must be tailored to the specific application, taking into consideration the mechanical loads and environmental conditions the final product will encounter.

What Finishing Processes Are Commonly Applied to Titanium Products?

Finishing processes are essential to enhance the surface properties of titanium products, contributing to their corrosion resistance and aesthetic appeal. Common finishing techniques include:

- Surface Treatment: Processes such as anodizing or passivation can be applied to improve corrosion resistance.

- Polishing: This is often used for aesthetic reasons, providing a smooth surface finish that is critical for consumer-facing products.

- Coating: Titanium can be coated with various materials to enhance its properties, such as biocompatibility in medical applications or wear resistance in industrial uses.

The choice of finishing process depends on the intended use of the titanium product and the specific performance characteristics required.

Illustrative image related to titanium etf

What Quality Assurance Standards Are Relevant for Titanium Manufacturing?

Quality assurance (QA) is vital in titanium manufacturing, particularly for B2B transactions involving international buyers. Compliance with international standards such as ISO 9001 is essential, as it ensures a systematic approach to quality management and continuous improvement.

How Do Industry-Specific Standards Impact Quality Assurance?

In addition to general standards, industry-specific certifications can significantly influence quality assurance processes. For example:

- CE Marking: Required for products sold within the European Economic Area, indicating compliance with health, safety, and environmental protection standards.

- API Standards: For products used in the oil and gas industry, adherence to American Petroleum Institute (API) standards ensures that materials meet rigorous performance criteria.

What Are the Key Quality Control Checkpoints in Titanium Manufacturing?

Quality control (QC) is integrated throughout the manufacturing process, with specific checkpoints established to monitor and verify quality at various stages:

- Incoming Quality Control (IQC): This initial stage involves inspecting raw materials and components before they enter the manufacturing process. It ensures that only materials meeting specified standards are used.

- In-Process Quality Control (IPQC): During manufacturing, continuous monitoring is conducted to detect defects early. This includes real-time inspections and process adjustments to maintain quality standards.

- Final Quality Control (FQC): At the end of the production process, finished products undergo thorough testing and inspection before shipment. This may include dimensional checks, mechanical testing, and surface inspections.

How Can B2B Buyers Verify Supplier Quality Control?

B2B buyers looking to ensure quality in titanium products can take several actions to verify supplier quality control:

- Conduct Audits: Regular audits of suppliers can reveal their adherence to quality standards and operational practices. This can be done through on-site inspections or third-party audits.

- Request Quality Reports: Suppliers should provide documentation detailing their quality control processes, including test results and compliance with relevant standards.

- Engage Third-Party Inspectors: Utilizing independent inspection services can provide an unbiased assessment of the supplier’s operations and product quality.

What Are the Nuances of Quality Control for International B2B Buyers?

For international buyers, particularly from regions such as Africa, South America, the Middle East, and Europe, understanding the nuances of quality control is essential. Different countries may have varying regulations and standards, and aligning these with the supplier’s practices can be challenging.

- Cultural Differences: Communication styles and business practices can vary significantly across regions, impacting how quality assurance is perceived and implemented.

- Regulatory Compliance: Buyers must ensure that suppliers comply not only with local regulations but also with international standards applicable to their industry. This is particularly important for sectors like aerospace and medical devices.

By understanding these complexities and actively engaging in the quality assurance process, B2B buyers can build reliable partnerships with titanium suppliers, ensuring that they receive high-quality products that meet their specific needs.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘titanium etf’

Introduction

This practical sourcing guide serves as a comprehensive checklist for B2B buyers interested in procuring titanium ETFs. With the growing demand for titanium across various industries, understanding how to effectively source and evaluate ETFs that include titanium exposure is crucial. This guide will walk you through essential steps to ensure informed investment decisions.

Step 1: Identify Your Investment Objectives

Before diving into specific ETFs, clearly define your investment goals. Consider factors such as risk tolerance, expected returns, and investment horizon. Understanding your objectives will guide you in selecting an ETF that aligns with your financial strategy.

- Risk Tolerance: Are you looking for high-risk, high-reward options, or do you prefer a more stable, conservative investment?

- Investment Horizon: Will you need access to this capital in the short term, or are you prepared for a long-term investment?

Step 2: Research ETF Options

Explore various ETFs that provide exposure to titanium-related stocks. Look for funds that feature a diversified portfolio, including major players in the titanium market.

Illustrative image related to titanium etf

- Key ETFs to Consider: Familiarize yourself with ETFs like the First Trust Indxx Global Natural Resources Income ETF and the iShares MSCI Global Metals & Mining Producers ETF.

- Performance Metrics: Analyze historical performance data and expense ratios to assess how well the ETF has performed relative to its peers.

Step 3: Evaluate the Underlying Holdings

Examine the components of the ETFs you are considering. Understanding which companies and industries are included in the ETF can provide insights into potential risks and rewards.

- Titanium Exposure: Look for ETFs with significant holdings in companies like Rio Tinto or ATI, which are key players in titanium production.

- Diversification Benefits: Ensure the ETF holds a mix of assets to mitigate risks associated with market volatility in the titanium sector.

Step 4: Assess Liquidity and Trading Volume

Liquidity is vital for any investment, especially for ETFs. Check the average trading volume and the bid-ask spread to gauge how easily you can enter or exit positions.

- Trading Volume: Higher trading volumes generally indicate better liquidity, which can lead to lower transaction costs.

- Bid-Ask Spread: A narrower spread suggests that the ETF is actively traded, making it easier to buy and sell without significant price impact.

Step 5: Review Fund Management and Fees

Investigate the management team behind the ETF and their investment strategy. Understanding their approach can help you assess the ETF’s potential performance.

- Expense Ratios: Consider the cost of investing in the ETF, as lower fees can significantly impact long-term returns.

- Management Experience: Research the fund manager’s track record and expertise in managing similar funds.

Step 6: Consider Regulatory Compliance and Tax Implications

Ensure that the ETF complies with relevant regulatory standards. Additionally, understand the tax implications of investing in ETFs, especially if you are operating in different jurisdictions.

- Regulatory Standards: Verify that the ETF adheres to the regulations of the markets in which it operates.

- Tax Considerations: Be aware of capital gains taxes and any withholding taxes that may apply based on your location.

Step 7: Finalize Your Investment Strategy

After gathering all necessary information, create a comprehensive investment strategy. This should include how much capital you intend to allocate to titanium ETFs and the timeframe for your investments.

Illustrative image related to titanium etf

- Allocation Strategy: Determine what percentage of your overall investment portfolio will be dedicated to titanium ETFs.

- Monitoring Plan: Establish a schedule for reviewing your investments to ensure they continue to align with your goals and market conditions.

By following this checklist, B2B buyers can navigate the complexities of sourcing titanium ETFs effectively, ensuring a well-informed investment decision that aligns with their business objectives.

Comprehensive Cost and Pricing Analysis for titanium etf Sourcing

What Are the Key Cost Components in Titanium ETF Sourcing?

When sourcing titanium ETFs, understanding the cost structure is crucial for international B2B buyers. The primary cost components include:

-

Materials: The underlying assets in a titanium ETF often consist of stocks from mining companies and producers of titanium alloys. The price of titanium can fluctuate significantly based on global supply and demand dynamics, impacting ETF pricing.

-

Labor: The management fees associated with ETFs are influenced by the operational costs of the fund managers. These fees can vary depending on the complexity of the fund’s strategy and the expertise of the team managing it.

-

Manufacturing Overhead: While ETFs do not involve traditional manufacturing, the cost of maintaining the fund, including compliance and regulatory expenses, is a key overhead component. Funds that focus on niche markets like titanium may incur higher overhead due to specialized knowledge requirements.

-

Tooling: Though not applicable in a conventional sense, the ‘tooling’ in ETFs refers to the technological platforms and systems used for trading and managing the fund. More sophisticated platforms may lead to higher costs, which could be passed on to investors.

-

Quality Control (QC): Ensuring that the ETF meets regulatory standards and maintains investment quality is vital. QC costs might involve audits, performance assessments, and compliance checks.

-

Logistics: For ETFs, logistics can relate to how assets are acquired and managed. This may include transaction costs associated with buying and selling underlying stocks.

-

Margin: Fund managers typically add a margin to cover risks and ensure profitability. This margin influences the overall expense ratio of the ETF.

How Do Pricing Influencers Affect Titanium ETF Costs?

Several factors influence the pricing of titanium ETFs, which B2B buyers should consider:

-

Volume and Minimum Order Quantity (MOQ): Larger investments may lead to lower expense ratios due to economies of scale. Understanding the fund’s structure and the minimum investment required can help buyers optimize their entry point.

-

Specifications and Customization: While ETFs are standardized products, some funds may offer tailored exposure to specific sectors or geographies. Customized ETFs may carry higher fees due to additional management complexity.

-

Materials and Quality Certifications: ETFs that invest in companies with high-quality certifications and sustainable practices may come with a premium. Buyers should weigh the cost against potential long-term benefits and market demand.

-

Supplier Factors: The reputation and performance history of the fund manager can impact costs. Established managers may charge higher fees due to perceived reliability and expertise.

-

Incoterms: While typically associated with physical goods, understanding the implications of Incoterms in a financial context can be valuable. Buyers should be aware of how transaction costs may vary based on where the ETF is domiciled and the regulatory environment.

What Are the Best Buyer Tips for Sourcing Titanium ETFs Internationally?

Navigating the complexities of titanium ETF sourcing, especially for international buyers from regions like Africa, South America, the Middle East, and Europe, requires strategic insights:

-

Negotiation: Engage in discussions with fund managers to understand fee structures better. Some funds may be open to negotiating lower fees for larger investments.

-

Cost-Efficiency: Analyze the Total Cost of Ownership (TCO) rather than just the initial investment. Consider management fees, transaction costs, and potential capital gains taxes when evaluating the overall cost-effectiveness of an ETF.

-

Pricing Nuances: Be mindful of currency fluctuations and geopolitical factors that may influence ETF pricing. Buyers should also consider local regulations that might affect investment returns.

-

Research and Due Diligence: Conduct thorough research on the fund’s historical performance, management team, and investment strategy. This diligence can provide insights into potential risks and rewards.

Disclaimer on Indicative Prices

The pricing discussed herein is indicative and subject to market fluctuations. It is essential for buyers to conduct their own research and consult financial advisors before making investment decisions.

Illustrative image related to titanium etf

Alternatives Analysis: Comparing titanium etf With Other Solutions

Introduction: Understanding Alternative Solutions to Titanium ETFs

As B2B buyers explore investment opportunities in titanium and related industries, it’s essential to consider various solutions beyond titanium exchange-traded funds (ETFs). While titanium ETFs provide exposure to the metal and its applications, other alternatives may better align with specific business goals, risk tolerance, or investment strategies. This section presents a comparative analysis of titanium ETFs against two viable alternatives: direct investment in titanium stocks and investing in commodity futures contracts for titanium.

Comparison Table

| Comparison Aspect | Titanium ETF | Direct Investment in Titanium Stocks | Commodity Futures Contracts for Titanium |

|---|---|---|---|

| Performance | Moderate; diversified exposure | High potential; dependent on stock performance | Variable; influenced by market speculation |

| Cost | Management fees (0.35% – 0.7%) | Brokerage fees; potential high volatility | Transaction fees; margin requirements |

| Ease of Implementation | Simple; bought like any stock | Requires market research and analysis | Complex; requires understanding of futures market |

| Maintenance | Minimal; managed by ETF provider | Active monitoring of stock performance | Requires active management and monitoring |

| Best Use Case | Diversification for conservative investors | High-risk, high-reward for aggressive investors | Hedging against price fluctuations or speculation |

Detailed Breakdown of Alternatives

Direct Investment in Titanium Stocks

Investing directly in titanium stocks can provide higher returns compared to ETFs, as the performance is directly tied to the success of individual companies. Companies like Rio Tinto and ATI are leading players in the titanium market, and owning their stocks can yield significant gains during market upswings. However, direct investments also come with higher risks due to market volatility and the performance of specific firms. Additionally, this approach demands thorough market research and ongoing monitoring to adapt to fluctuating conditions.

Commodity Futures Contracts for Titanium

Commodity futures contracts allow investors to speculate on the future price of titanium, offering a unique avenue for profit. This method can be beneficial for those looking to hedge against price volatility in the titanium market. However, futures contracts require a deep understanding of the commodities market and entail higher complexity. Investors must be prepared to manage margin requirements and potential losses, making this option less suitable for conservative investors. The speculative nature of futures can lead to significant risks, especially in uncertain market conditions.

Conclusion: Choosing the Right Investment Solution

When deciding between titanium ETFs and alternative investment methods, B2B buyers should assess their specific needs and risk tolerance. Titanium ETFs provide a relatively low-risk, diversified approach suitable for conservative investors looking for exposure to the titanium market without the complexities of individual stock selection or futures trading. On the other hand, direct investments in titanium stocks may appeal to those with a higher risk appetite seeking substantial returns. Meanwhile, futures contracts offer a hedging strategy for those familiar with market dynamics but require active management and expertise. Ultimately, understanding the unique features and risks associated with each option will empower buyers to make informed investment decisions aligned with their strategic objectives.

Illustrative image related to titanium etf

Essential Technical Properties and Trade Terminology for titanium etf

What Are the Key Technical Properties of Titanium ETFs?

When considering investments in titanium exchange-traded funds (ETFs), understanding the technical properties associated with titanium and the ETFs themselves is crucial. Here are several critical specifications:

-

Material Grade

Material grade indicates the quality and composition of titanium used in various applications. Titanium is often classified by its grade, such as Grade 1 (pure titanium) to Grade 5 (titanium alloy). For B2B buyers, knowing the material grade helps determine the suitability of titanium for specific applications, impacting product performance and lifecycle costs. -

Tolerance

Tolerance refers to the allowable deviation from a specified dimension in manufacturing processes. In titanium applications, tight tolerances are essential, especially in aerospace and medical fields. A clear understanding of tolerances ensures that products meet safety and performance standards, minimizing risks associated with product failure. -

Yield Strength

Yield strength is the stress at which a material begins to deform plastically. For titanium, high yield strength makes it ideal for applications requiring durability and lightweight properties, such as aerospace components. Recognizing yield strength helps buyers assess the performance capabilities of titanium stocks within an ETF. -

Corrosion Resistance

Titanium is known for its exceptional corrosion resistance, especially in harsh environments. This property is critical for industries such as oil and gas, where materials are exposed to corrosive substances. B2B buyers should evaluate the corrosion resistance of the titanium stocks within an ETF to ensure long-term reliability. -

Thermal Stability

Thermal stability refers to the ability of titanium to maintain its properties under varying temperatures. This is particularly important in high-temperature applications like aerospace engines. Understanding thermal stability helps businesses select appropriate titanium products for their specific operational environments.

What Trade Terminology Should B2B Buyers Know When Investing in Titanium ETFs?

Familiarity with industry-specific jargon can significantly enhance decision-making. Here are some common terms relevant to titanium ETFs:

-

OEM (Original Equipment Manufacturer)

An OEM is a company that produces parts and equipment that may be marketed by another manufacturer. In the context of titanium, OEMs often require high-quality materials for manufacturing components. B2B buyers should consider the OEMs involved in the titanium ETFs to gauge product reliability. -

MOQ (Minimum Order Quantity)

MOQ is the smallest amount of a product that a supplier is willing to sell. In titanium procurement, understanding MOQ is essential for businesses to manage inventory costs effectively. This term is particularly relevant when investing in titanium stocks that support bulk manufacturing. -

RFQ (Request for Quotation)

An RFQ is a document that a buyer sends to suppliers to request pricing information for specific products or services. For B2B buyers in the titanium market, issuing RFQs can help ensure competitive pricing and favorable contract terms. This process is integral to making informed investment decisions in ETFs. -

Incoterms (International Commercial Terms)

Incoterms are a set of international rules that define the responsibilities of buyers and sellers in international transactions. Understanding these terms is crucial for B2B buyers dealing with titanium ETFs that involve cross-border transactions. Familiarity with Incoterms can help mitigate risks and clarify shipping responsibilities. -

Diversification

Diversification in investment refers to spreading capital across various assets to reduce risk. For titanium ETFs, diversification means investing in a mix of titanium-related stocks to buffer against market volatility. B2B investors should prioritize ETFs that offer a well-diversified portfolio to safeguard their investments.

By understanding these technical properties and trade terminology, B2B buyers can navigate the titanium ETF landscape more effectively, making informed decisions that align with their business goals.

Navigating Market Dynamics and Sourcing Trends in the titanium etf Sector

What are the Key Market Dynamics and Trends in the Titanium ETF Sector for International B2B Buyers?

The titanium ETF market is increasingly shaped by global trends such as the rising demand for sustainable materials and the growth of industries like aerospace, automotive, and renewable energy. International B2B buyers, particularly in regions like Africa, South America, the Middle East, and Europe, are noticing a significant uptick in the utilization of titanium due to its unique properties, such as lightweight strength and corrosion resistance. The compound titanium dioxide, commonly used in paints, cosmetics, and food products, also contributes to this heightened interest.

Emerging technologies in mining and materials processing are revolutionizing sourcing strategies, making it easier for buyers to access titanium-related products through ETFs. For instance, enhanced data analytics and blockchain technology are being leveraged to improve supply chain transparency and efficiency, which is particularly valuable for B2B buyers seeking reliable sourcing partners. Additionally, the increasing focus on ethical sourcing is compelling companies to align with suppliers who prioritize responsible mining practices, thereby influencing investment decisions.

As international markets fluctuate, B2B buyers must also be cognizant of geopolitical factors that can impact supply chains. For instance, trade policies and tariffs can significantly affect the pricing and availability of titanium products. Thus, understanding local regulations and international trade agreements becomes crucial for buyers looking to navigate this dynamic market landscape effectively.

How is Sustainability and Ethical Sourcing Influencing Titanium ETFs in B2B Transactions?

Sustainability has become a cornerstone in the decision-making process for B2B buyers in the titanium ETF sector. As industries increasingly adopt environmentally friendly practices, the demand for ethically sourced materials is on the rise. Buyers are looking for titanium products that are not only high-quality but also sourced responsibly, minimizing environmental degradation and supporting local communities.

The titanium mining industry has faced scrutiny over its environmental impact, particularly regarding land degradation and resource depletion. As a result, several companies are adopting ‘green’ certifications and sustainable mining practices. B2B buyers should prioritize suppliers with credible certifications that demonstrate a commitment to environmental stewardship. These certifications can include ISO 14001 for environmental management systems and other industry-specific standards that validate sustainable practices.

Furthermore, the increasing regulatory focus on sustainability, especially in regions like Europe, is driving the need for ethical sourcing. Compliance with these regulations can enhance a company’s reputation and open up new markets. For B2B buyers, aligning with suppliers who prioritize sustainability not only mitigates risks but also creates a competitive advantage in an increasingly eco-conscious marketplace.

What is the Historical Context of Titanium ETFs and Their Relevance to B2B Buyers?

The evolution of titanium ETFs has been influenced by the growing recognition of titanium’s applications across various industries, particularly in aerospace, defense, and medical devices. Initially, titanium was primarily sourced through traditional mining and production methods, which were often associated with high costs and significant environmental impacts.

Over the past two decades, advancements in extraction and processing technologies have made titanium more accessible and economically viable. This has led to the establishment of ETFs that offer diversified exposure to titanium-related assets, allowing B2B buyers to invest in a broader portfolio of companies engaged in titanium production and processing without the need to select individual stocks.

As the market for titanium continues to expand, understanding its historical context helps B2B buyers appreciate the dynamics at play. By investing in titanium ETFs, companies can benefit from the metal’s long-term growth potential while also adhering to contemporary demands for sustainability and ethical sourcing. This historical perspective underscores the strategic importance of titanium in modern supply chains and investment portfolios.

Frequently Asked Questions (FAQs) for B2B Buyers of titanium etf

-

1. How do I evaluate the best titanium ETFs for my business needs?

To evaluate the best titanium ETFs, consider factors such as the fund’s assets under management, historical performance, and the diversity of its holdings. Look for ETFs that include major titanium producers like Rio Tinto and ATI, which provide stability and growth potential. Additionally, assess the expense ratio and distribution frequency, as these will affect your overall returns. It’s also wise to review market trends and forecasts for titanium demand, especially in industries pertinent to your business, such as aerospace or manufacturing. -

2. What are the key benefits of investing in titanium ETFs?

Investing in titanium ETFs offers several advantages, including diversification and reduced risk compared to individual stock investments. Titanium is a crucial material in numerous industries, including aerospace, automotive, and consumer goods, which supports its demand. ETFs that include titanium stocks allow for exposure to broader market movements while mitigating the volatility associated with single stocks. Furthermore, many ETFs offer regular distributions, which can provide a steady income stream for businesses looking to reinvest or manage cash flow. -

3. How can I ensure compliance with international trade regulations when investing in titanium ETFs?

To ensure compliance with international trade regulations, familiarize yourself with the specific laws governing securities trading in your country and the countries where the ETFs are based. Consult with legal experts or compliance officers who specialize in international investments. Additionally, stay updated on trade agreements and tariffs that may affect the cost of titanium products. It’s also important to understand reporting requirements for foreign investments to avoid any legal complications. -

4. What is the minimum order quantity (MOQ) for purchasing titanium ETFs?

While ETFs do not have a traditional minimum order quantity like physical goods, the minimum investment is often determined by the price per share of the ETF. Many brokerage platforms allow you to purchase fractional shares, which can lower the barrier to entry. However, consider your investment strategy and the overall portfolio size, as it’s advisable to have a diversified approach to minimize risk. Consult with your financial advisor to determine the best investment size for your business goals. -

5. How should I vet suppliers of titanium ETFs to ensure quality?

When vetting suppliers of titanium ETFs, look for reputable financial institutions or asset management firms with a strong track record in fund management. Check for regulatory compliance and transparent reporting practices. Review the ETF’s performance history, expense ratios, and management fees. Additionally, assess customer reviews and ratings to gauge the experiences of other investors. Engaging with a financial advisor can also provide insights into the credibility and reliability of the ETF providers. -

6. What payment terms should I expect when investing in titanium ETFs?

Payment terms for investing in titanium ETFs typically depend on the brokerage or financial institution you choose. Most platforms operate on a cash basis, requiring payment at the time of purchase. Some may offer margin accounts that allow for leveraged investments, but this comes with additional risks. Ensure you understand any fees associated with transactions, such as brokerage fees or commissions, which can impact your overall investment returns. Always clarify payment terms with your broker before proceeding. -

7. What quality assurance measures are in place for titanium ETFs?

Quality assurance for titanium ETFs is generally reflected in the fund’s management practices and regulatory compliance. Most ETFs are required to follow strict guidelines set by financial authorities, ensuring transparency and accountability. Look for ETFs that provide regular performance reports and disclosures about their holdings. Additionally, consider funds managed by well-established financial institutions with a history of strong performance and ethical management. Engaging with investor relations can also provide clarity on quality assurance practices. -

8. How can I manage logistics when investing in titanium ETFs across different regions?

Managing logistics for investing in titanium ETFs across different regions involves understanding the operational capabilities of your brokerage and any international trading fees. Choose a brokerage that offers access to global markets and is familiar with the specific regulations in your region. Additionally, consider the time zones and trading hours of the markets where the ETFs are listed. Stay informed about any geopolitical factors that might impact market performance, and ensure you have a clear strategy for currency exchange if applicable.

Top 7 Titanium Etf Manufacturers & Suppliers List

1. Fool – First Trust Indxx Global Natural Resources Income ETF

Domain: fool.com

Registered: 1995 (30 years)

Introduction: This company, Fool – First Trust Indxx Global Natural Resources Income ETF, is a notable entity in the market. For specific product details, it is recommended to visit their website directly.

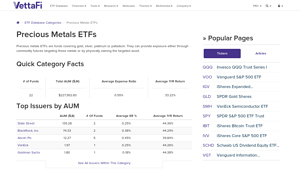

2. ETFDB – Precious Metals ETFs Overview

Domain: etfdb.com

Registered: 2009 (16 years)

Introduction: {“category”:”Precious Metals ETFs”,”number_of_funds”:22,”total_AUM”:”$227,952.83 million”,”average_expense_ratio”:”0.55%”,”average_1YR_return”:”33.22%”,”top_issuers”:[{“name”:”State Street”,”AUM”:”$135.28 billion”,”number_of_funds”:2,”average_ER”:”0.25%”,”average_1YR_return”:”44.36%”},{“name”:”BlackRock, Inc.”,”AUM”:”$74.33 billion”,”number_of_funds”:2,”average_ER”:”0.38%”,”average_1YR_return”:”44…

3. ATI Inc – Titanium-Based Products

Domain: bullishbears.com

Registered: 2016 (9 years)

Introduction: 1. ATI Inc (NYSE: ATI) – Leading producer of titanium-based products, especially for aerospace and defense. Produces titanium sponge, alloys, castings, forgings, and machined components. $325M investment in new melting capabilities. Improved financial performance.

2. Chemours Company (NYSE: CC) – Leader in titanium technologies, particularly titanium dioxide. Plans to build a chlor-alkali facili…

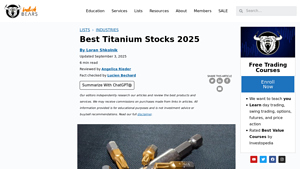

4. VanEck – Rare Earth/Strategic Metals ETF

Domain: vaneck.com

Registered: 1995 (30 years)

Introduction: VanEck Rare Earth/Strategic Metals ETF (REMX) seeks to provide investment results that correspond generally to the price and yield performance of the MVIS Global Rare Earth/Strategic Metals Index. The ETF invests in companies involved in the production, refining, and recycling of rare earth and strategic metals. Key features include a focus on companies that derive at least 50% of their revenue fr…

5. Titanium Metals Corp – Titanium Melted and Mill Products

Domain: etfchannel.com

Registered: 2009 (16 years)

Introduction: Company Name: Titanium Metals Corp.

Website: www.timet.com

Sector: Non-Precious Metals & Non-Metallic Mining

Description: Titanium Metals produces titanium melted and mill products for commercial aerospace, military, industrial and other applications. Products include titanium sponge, melted products (ingot, electrode, slab), mill products (forged and rolled from ingot or slab including long produ…

6. justETF – Precious Metals ETFs

Domain: justetf.com

Registered: 2011 (14 years)

Introduction: Annual total expense ratio (TER): 0.00% p.a. – 1.00% p.a.\nNumber of indices on precious metals: 16\nNumber of ETFs on precious metals: 50\nKey ETFs/ETCs details:\n1. iShares Physical Gold ETC – ISIN: IE00B4ND3602, Fund size: 23,522 m EUR, TER: 0.12% p.a., Use of profits: Accumulating, Domicile: Ireland, Replication method: Physically backed\n2. Invesco Physical Gold A – ISIN: IE00B579F325, Fund s…

7. Titanium Sands Ltd – Heavy Mineral Sands Exploration

Domain: morningstar.com.au

Introduction: Titanium Sands Ltd (ASX:TSL) is an Australian-based company focused on exploring mineral properties in Australia and Sri Lanka, specifically high-grade, high-value, and easily minable heavy mineral sands deposits. The company operates in one reportable segment, which is mineral exploration in Sri Lanka. The fiscal year ends on June 30, 2026, and the company is categorized under the Basic Materials…

Strategic Sourcing Conclusion and Outlook for titanium etf

In conclusion, the landscape of titanium ETFs presents a promising opportunity for international B2B buyers, particularly in regions like Africa, South America, the Middle East, and Europe. The strategic sourcing of titanium through ETFs allows businesses to diversify their investments while mitigating risks associated with individual stocks. As the demand for titanium continues to rise across various sectors—including aerospace, cosmetics, and food products—investors can benefit from ETFs that encompass a broader range of metals, thereby enhancing portfolio resilience.

By leveraging the insights gained from understanding the key players and dynamics in the titanium market, B2B buyers can make informed decisions that align with their operational needs and growth strategies. The combination of exposure to major producers, such as Rio Tinto and Tronox, along with the stability provided by diversified holdings, positions titanium ETFs as a smart choice for forward-thinking investors.

As we look ahead, the growing emphasis on sustainable practices and technological advancements will likely amplify the relevance of titanium and its associated markets. B2B buyers are encouraged to explore these avenues actively, ensuring they remain at the forefront of industry developments while capitalizing on the myriad benefits that titanium ETFs offer.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Illustrative image related to titanium etf