Unlocking Value: A Strategic Analysis of the Sensor Diagram Market

Introduction: Navigating the Global Market for sensor diagram

In the rapidly evolving landscape of global commerce, sourcing the right sensor diagram can be a daunting challenge for international B2B buyers. As industries increasingly integrate automation and smart technologies, understanding the intricacies of sensor diagrams becomes essential for optimizing operations and ensuring product efficacy. This comprehensive guide is designed to empower decision-makers by providing insights into various types of sensor diagrams, their applications across different sectors, and best practices for supplier vetting.

From the agricultural fields of Africa to the advanced manufacturing hubs in Germany, the demand for reliable and efficient sensors is universal. This guide will delve into the key aspects of sensor diagrams, including wiring configurations, pinouts, and circuit representations, ensuring that buyers can navigate through technical specifications with ease. Furthermore, it addresses critical factors such as cost implications, regulatory compliance, and market trends that influence purchasing decisions in diverse regions, including South America and the Middle East.

By equipping B2B buyers with actionable insights and practical knowledge, this guide aims to facilitate informed purchasing decisions, enabling businesses to enhance their operational efficiency and stay competitive in the global market. Whether you are a seasoned professional or new to the field, understanding sensor diagrams is crucial for leveraging technology to drive growth and innovation.

Understanding sensor diagram Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Wiring Diagrams | Illustrates electrical connections and component layout. | Industrial automation, building management. | Pros: Clear visualization; aids troubleshooting. Cons: Can be complex for non-technical staff. |

| Pin Out Diagrams | Details pin configurations for connectors and sensors. | Robotics, automotive, and manufacturing sectors. | Pros: Essential for compatibility; simplifies integration. Cons: May require technical knowledge to interpret. |

| Circuit Diagrams | Shows the electrical circuit and functional flow of sensors. | Electronics design, prototyping, education. | Pros: Comprehensive overview; aids in design verification. Cons: Can be overwhelming for beginners. |

| Block Diagrams | Simplified representation of system components and interactions. | System integration, project planning. | Pros: Easy to understand; useful for presentations. Cons: Lacks detail on specific connections. |

| Functional Diagrams | Focuses on the operational aspects of sensor systems. | IoT applications, smart building technologies. | Pros: Highlights system functionality; aids in requirements gathering. Cons: May overlook detailed wiring information. |

What are Wiring Diagrams and Their Importance for B2B Buyers?

Wiring diagrams are crucial for visualizing the electrical connections and layout of various components within a sensor system. They are particularly beneficial in industrial automation and building management, where clear and concise illustrations can aid in troubleshooting and maintenance. B2B buyers should consider the complexity of these diagrams, as they may require a certain level of technical expertise to interpret effectively. Investing in high-quality wiring diagrams can enhance operational efficiency and reduce downtime.

Why are Pin Out Diagrams Essential for Compatibility?

Pin out diagrams provide detailed information on the pin configurations of connectors and sensors, making them indispensable in sectors such as robotics and automotive manufacturing. These diagrams ensure that components are compatible, facilitating smoother integration into existing systems. For B2B buyers, understanding pin configurations is vital when selecting sensors to avoid costly mismatches. While these diagrams are critical for successful implementation, they may necessitate some technical background for proper interpretation.

How Do Circuit Diagrams Aid in Electronics Design?

Circuit diagrams illustrate the electrical circuit and functional flow of sensors, serving as a roadmap for electronics design and prototyping. They are widely used in educational settings and by engineers to verify design specifications. For B2B buyers, having access to clear circuit diagrams can significantly reduce errors during the design phase. However, the complexity of these diagrams can be daunting for those without a strong background in electronics, making it essential to ensure that the team has the necessary skills to utilize them effectively.

What are the Benefits of Using Block Diagrams?

Block diagrams offer a simplified representation of system components and their interactions, making them particularly useful for system integration and project planning. They help stakeholders visualize the overall architecture of a sensor system without delving into intricate details. For B2B buyers, block diagrams can facilitate effective communication among team members and stakeholders, aiding in project alignment. However, the lack of detailed wiring information can be a drawback for those needing comprehensive technical insights.

How Do Functional Diagrams Support IoT and Smart Building Technologies?

Functional diagrams focus on the operational aspects of sensor systems, highlighting how components interact to achieve desired functionalities. They are especially relevant in IoT applications and smart building technologies, where understanding system requirements is critical. B2B buyers should consider how functional diagrams can assist in gathering and defining project requirements. While they provide valuable insights into system operation, these diagrams may overlook detailed wiring and connection specifics, necessitating supplementary documentation for complete understanding.

Key Industrial Applications of sensor diagram

| Industry/Sector | Specific Application of sensor diagram | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing | Automation of production lines using proximity sensors | Increased efficiency and reduced downtime in operations | Compatibility with existing systems and durability |

| Agriculture | Soil moisture sensing for irrigation management | Optimized water usage and improved crop yield | Environmental resilience and accuracy of readings |

| Oil & Gas | Leak detection systems utilizing temperature sensors | Enhanced safety and reduced risk of environmental damage | Compliance with safety regulations and response time |

| Automotive | Collision detection systems in vehicles | Improved safety and reduced insurance costs | Reliability and integration with existing vehicle systems |

| Smart Buildings | Energy management through occupancy sensors | Lower operational costs and improved energy efficiency | Scalability and ease of integration with smart systems |

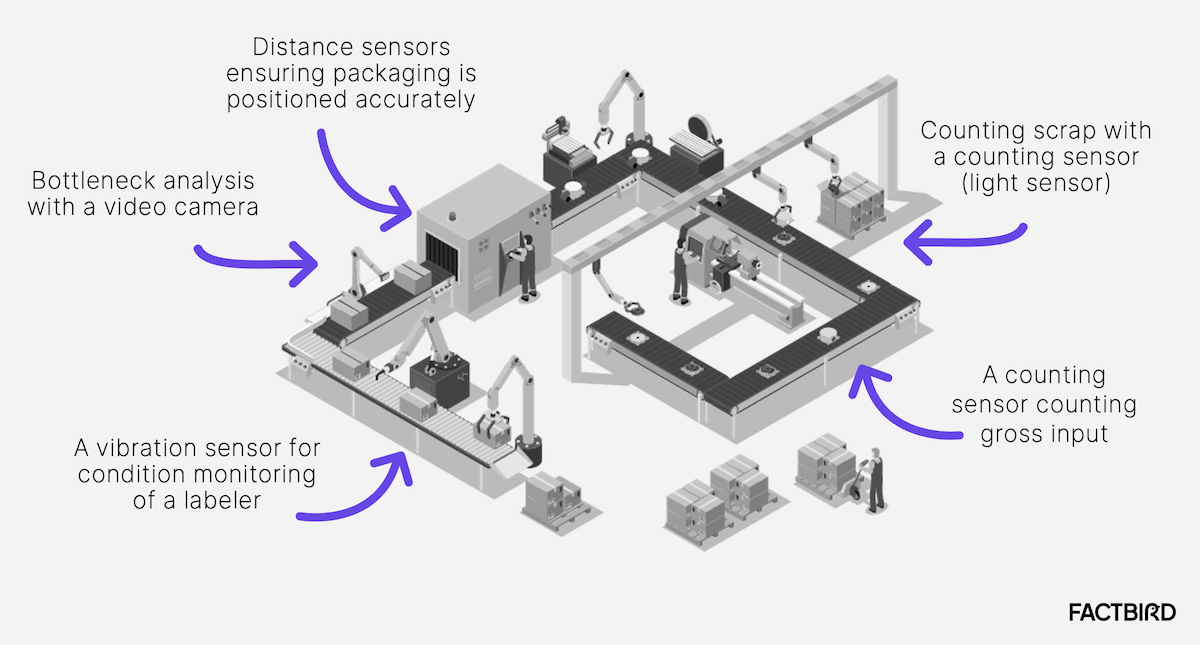

How is ‘Sensor Diagram’ Used in Manufacturing Automation?

In manufacturing, sensor diagrams are essential for automating production lines. They illustrate the wiring and connections of various sensors, such as proximity sensors, which detect the presence of objects on the assembly line. This automation minimizes human error, enhances efficiency, and significantly reduces downtime. For international buyers, especially in regions like Germany and Saudi Arabia, sourcing sensors that are compatible with existing machinery and can withstand harsh industrial environments is crucial.

What Role Does ‘Sensor Diagram’ Play in Agriculture?

In agriculture, sensor diagrams are used to design and implement soil moisture sensing systems that facilitate precise irrigation management. These sensors provide real-time data on soil conditions, enabling farmers to optimize water usage and enhance crop yields. For buyers in South America and Africa, it’s vital to consider sensors that are resilient to various climatic conditions and can deliver accurate readings to ensure effective irrigation strategies.

How Are Sensor Diagrams Critical in Oil & Gas?

In the oil and gas sector, sensor diagrams are integral to developing leak detection systems that utilize temperature sensors. These diagrams help in establishing effective monitoring systems that can identify leaks early, thereby enhancing safety and mitigating environmental risks. Buyers in the Middle East must prioritize sourcing sensors that comply with stringent safety regulations and can operate reliably under extreme conditions.

How Do Sensor Diagrams Enhance Automotive Safety?

In the automotive industry, sensor diagrams are used to create collision detection systems that utilize various sensors to monitor the vehicle’s surroundings. These systems are designed to improve safety and reduce insurance costs by alerting drivers to potential hazards. International buyers, particularly from Europe, should focus on sourcing high-reliability sensors that can seamlessly integrate with existing vehicle technologies to enhance safety features.

What Benefits Do Sensor Diagrams Offer for Smart Buildings?

For smart buildings, sensor diagrams are crucial in implementing energy management systems that use occupancy sensors. These diagrams guide the installation of sensors that monitor room occupancy, allowing for more efficient energy usage. Buyers in Europe and the Middle East should seek scalable solutions that easily integrate with existing smart technologies to maximize energy efficiency and reduce operational costs.

3 Common User Pain Points for ‘sensor diagram’ & Their Solutions

Scenario 1: Difficulty in Interpreting Complex Sensor Diagrams

The Problem: Many B2B buyers, especially those new to sensor technology or those in less technologically advanced regions, often struggle to interpret complex sensor diagrams. This can lead to miscommunication between teams and delays in project timelines. For instance, a buyer in Saudi Arabia trying to implement a new automation system may find the provided diagrams too intricate, lacking clarity on wiring and connections, which can hinder effective installation and maintenance.

The Solution: To alleviate this issue, buyers should seek sensor diagrams that incorporate clear labeling, step-by-step instructions, and simplified visuals. When sourcing sensors, look for manufacturers that provide comprehensive documentation, including visual guides that break down the components and wiring in an easy-to-understand manner. Additionally, consider investing in training sessions for your team, either through online courses or workshops led by experienced professionals. This investment will not only enhance understanding but also foster a culture of continuous learning, ultimately leading to smoother project execution.

Scenario 2: Inconsistencies in Wiring Standards Across Different Regions

The Problem: B2B buyers operating in diverse markets such as South America and Europe often encounter inconsistencies in wiring standards and pin configurations among sensors. This can create confusion and increase the risk of errors during installation. For example, a company in Germany might import sensors designed for the American market, leading to mismatched wiring diagrams that complicate integration into existing systems.

The Solution: To navigate these challenges, buyers should prioritize sourcing from suppliers that provide adaptable wiring diagrams specific to the local standards of the regions where they operate. When purchasing sensors, request detailed wiring and pinout diagrams tailored to your specific application. Additionally, engaging with local distributors who understand regional standards can help ensure compliance and reduce errors. Implementing a thorough checklist for wiring compatibility before installation can further mitigate risks, ensuring that all components will function seamlessly together.

Scenario 3: Lack of Technical Support for Sensor Installation

The Problem: Many B2B buyers find themselves without adequate technical support when attempting to install sensors based on the provided diagrams. This is particularly true for organizations in emerging markets where access to technical expertise is limited. For instance, a manufacturing plant in Africa may receive a set of sensor diagrams but lacks the in-house capability to troubleshoot issues that arise during installation, leading to costly downtime.

The Solution: To address this gap, buyers should look for suppliers that offer robust technical support services, including direct access to engineers or technical representatives. Ensure that the manufacturer provides not only diagrams but also a support hotline or chat service for real-time troubleshooting. Prioritize suppliers that conduct virtual training or provide on-site installation assistance, which can empower your team to handle installations confidently. Additionally, consider forming partnerships with local technical consultants who can offer ongoing support and maintenance services, ensuring that your systems remain operational and efficient over time.

Strategic Material Selection Guide for sensor diagram

What Are the Common Materials Used in Sensor Diagrams?

When selecting materials for sensor diagrams, it is essential to consider the properties and suitability of each material for specific applications. Here, we analyze four common materials used in sensor diagrams, focusing on their key properties, advantages and disadvantages, and their impact on applications. This analysis also includes considerations for international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe.

1. Polycarbonate

Key Properties: Polycarbonate is known for its high impact resistance and optical clarity. It can withstand temperatures ranging from -40°C to 120°C, making it suitable for various environments. Its excellent dimensional stability also ensures that it maintains its shape under stress.

Pros & Cons: The primary advantage of polycarbonate is its durability and lightweight nature, which reduces shipping costs. However, it is susceptible to scratching and UV degradation unless treated, which can affect long-term performance. The manufacturing complexity is moderate, but costs can be higher than other plastics.

Impact on Application: Polycarbonate is ideal for applications requiring transparency and strength, such as protective covers for sensors. However, its susceptibility to UV light may limit its use in outdoor applications unless properly coated.

Considerations for International Buyers: Buyers should ensure compliance with international standards such as ISO and ASTM for safety and performance. In regions with high UV exposure, additional treatments may be necessary to enhance durability.

2. Stainless Steel

Key Properties: Stainless steel offers excellent corrosion resistance and can withstand high temperatures and pressures. It is available in various grades, each with specific properties suited for different environments.

Pros & Cons: The key advantage of stainless steel is its durability and resistance to harsh chemicals, making it suitable for industrial applications. However, it is heavier and more expensive than other materials, which can increase shipping costs. Manufacturing processes can also be complex, requiring specialized equipment.

Impact on Application: Stainless steel is commonly used in sensors exposed to corrosive environments, such as food processing or chemical industries. Its robustness ensures long-term reliability, but its weight may be a concern for portable applications.

Considerations for International Buyers: Buyers must consider the specific grade of stainless steel to ensure compatibility with local regulations and standards, such as DIN in Germany or ASTM in the U.S.

3. PVC (Polyvinyl Chloride)

Key Properties: PVC is a versatile thermoplastic known for its chemical resistance and low cost. It can operate effectively within a temperature range of -15°C to 60°C.

Pros & Cons: The primary advantage of PVC is its affordability and ease of manufacturing, making it a popular choice for various applications. However, it has lower mechanical strength compared to metals and is not suitable for high-temperature applications.

Impact on Application: PVC is commonly used in sensor housings and insulations where cost-effectiveness is critical. However, its limited temperature range may restrict its use in extreme conditions.

Considerations for International Buyers: Buyers should be aware of environmental regulations regarding PVC, particularly in Europe, where restrictions on certain additives may apply.

4. Silicone

Key Properties: Silicone is a flexible material that can endure extreme temperatures, from -60°C to 200°C. It is also resistant to moisture and many chemicals, making it suitable for diverse applications.

Pros & Cons: The flexibility and high-temperature resistance of silicone are its main advantages, allowing it to be used in a variety of sensor applications. However, it can be more expensive than other plastics and may require specialized manufacturing processes.

Impact on Application: Silicone is ideal for applications requiring a flexible seal or insulation, particularly in harsh environments. Its durability ensures long-lasting performance, but cost considerations may limit its use in budget-sensitive projects.

Considerations for International Buyers: Compliance with international standards for food safety and chemical resistance is crucial, especially in regions with strict regulations like Europe and North America.

Summary Table of Material Selection for Sensor Diagrams

| Material | Typical Use Case for sensor diagram | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polycarbonate | Protective covers for sensors | High impact resistance | Susceptible to UV degradation | Medium |

| Stainless Steel | Industrial sensors in corrosive environments | Excellent corrosion resistance | Heavier and more expensive | High |

| PVC | Sensor housings and insulation | Cost-effective and easy to manufacture | Lower mechanical strength | Low |

| Silicone | Flexible seals for harsh environments | High-temperature resistance | More expensive and specialized mfg | Medium |

This strategic material selection guide provides valuable insights for B2B buyers, enabling informed decisions tailored to their specific operational needs and regional compliance requirements.

In-depth Look: Manufacturing Processes and Quality Assurance for sensor diagram

What Are the Key Stages in the Manufacturing Process of Sensor Diagrams?

The manufacturing process of sensors involves several critical stages, each contributing to the overall quality and functionality of the final product. Understanding these stages is essential for B2B buyers looking to source high-quality sensors for their applications.

Material Preparation: How Are Raw Materials Selected for Sensor Manufacturing?

The first step in the manufacturing process involves sourcing and preparing raw materials. This can include metals, plastics, ceramics, and semiconductors, depending on the type of sensor being produced. Suppliers often prioritize materials that meet specific industry standards, ensuring durability and reliability. For instance, sensors used in harsh environments might require corrosion-resistant materials or specialized coatings.

Before production, these materials undergo rigorous testing to verify their properties and ensure they align with the intended sensor specifications. This may involve evaluating electrical conductivity, thermal resistance, and mechanical strength.

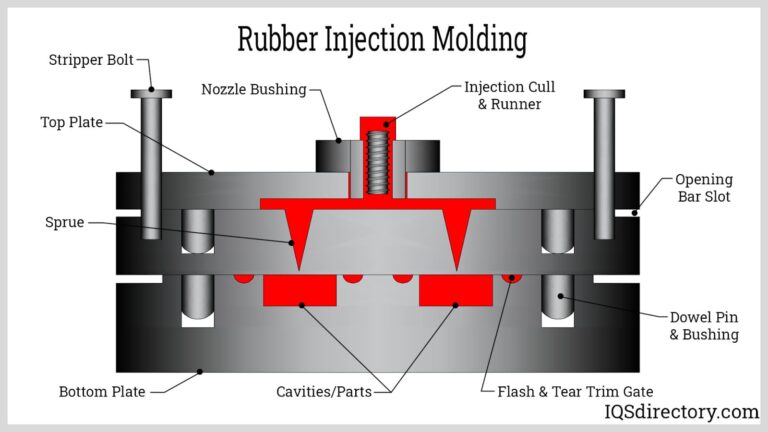

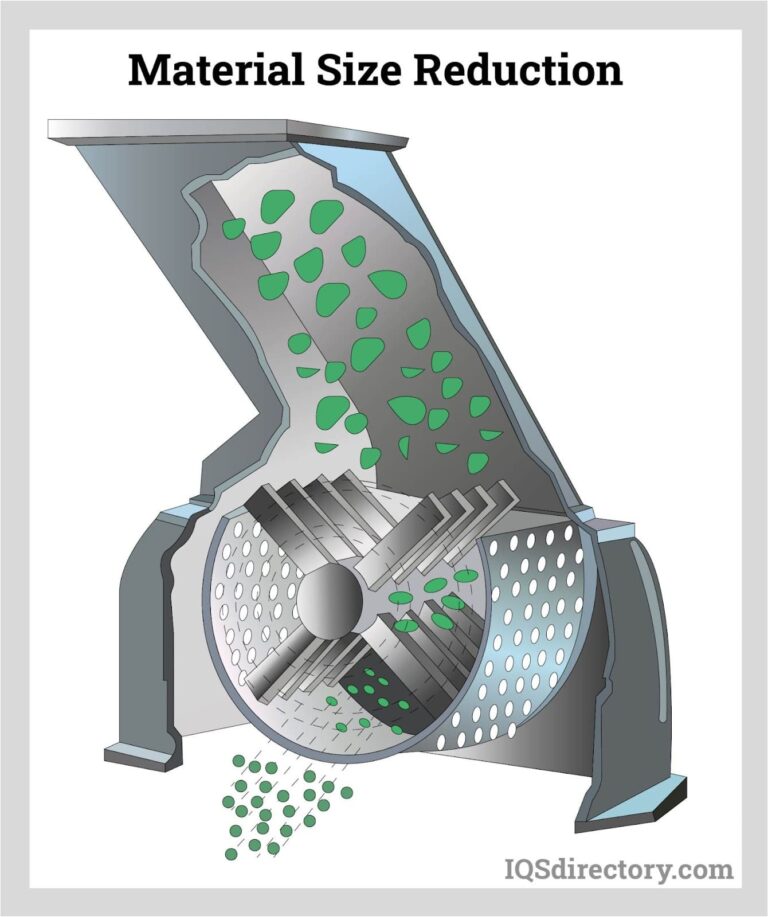

Forming: What Techniques Are Used to Shape Sensor Components?

Once the materials are prepared, the next phase is forming, where raw materials are shaped into specific components. Techniques such as injection molding, stamping, and machining are commonly used. For instance, injection molding is often employed for plastic sensor housings, while metal components might be produced through stamping or CNC machining.

The choice of forming technique can significantly impact the sensor’s performance and cost. High-precision machining may be necessary for applications requiring tight tolerances, while more cost-effective methods might be suitable for mass production of standard sensors.

Assembly: How Are Sensor Components Assembled for Optimal Performance?

After forming, the various components undergo assembly. This stage typically involves integrating electronic circuits, sensors, and other parts into a final product. Automated assembly lines are frequently utilized to enhance efficiency and consistency, particularly in high-volume production scenarios.

Quality control during assembly is crucial. Manufacturers often implement checks at various stages to ensure that components fit correctly and function as intended. This might include verifying the alignment of optical sensors or ensuring that electrical connections are secure.

Finishing: What Finishing Processes Enhance the Quality of Sensors?

The finishing stage involves applying surface treatments and coatings to enhance performance and durability. This can include processes such as anodizing for aluminum components, applying protective coatings to prevent corrosion, or adding labels and markings.

Finishing not only improves the aesthetic appeal of sensors but also plays a vital role in their longevity. For example, sensors exposed to moisture or chemicals may require specialized coatings to ensure they function reliably over time.

What Quality Assurance Practices Are Essential for Sensor Manufacturing?

Quality assurance (QA) in sensor manufacturing is vital for ensuring that products meet international standards and customer expectations. The following practices are commonly employed:

Which International Standards Should B2B Buyers Consider?

Many manufacturers adhere to international standards such as ISO 9001, which outlines the requirements for a quality management system. Compliance with these standards demonstrates a commitment to quality and continuous improvement. Additionally, industry-specific certifications like CE marking for products sold in Europe or API standards for oil and gas applications may be relevant.

These certifications assure buyers that the sensors meet rigorous safety and performance criteria, which is particularly important in regulated industries.

What Are the Key Quality Control Checkpoints in Sensor Manufacturing?

Quality control is typically structured around several checkpoints throughout the manufacturing process, including:

-

Incoming Quality Control (IQC): This initial checkpoint involves inspecting raw materials before they enter the production line. Ensuring that materials meet specifications can prevent defects later in the manufacturing process.

-

In-Process Quality Control (IPQC): During manufacturing, continuous monitoring is essential. This may involve testing components at various stages to identify issues early and minimize waste.

-

Final Quality Control (FQC): The final inspection ensures that the completed sensors meet all specifications and performance standards. This might include functional testing, visual inspections, and environmental testing.

How Can B2B Buyers Verify Supplier Quality Control Processes?

B2B buyers can take several steps to verify the quality control processes of potential suppliers:

-

Audits: Conducting on-site audits can provide insights into the supplier’s manufacturing practices, quality control measures, and adherence to international standards.

-

Quality Reports: Requesting detailed quality reports can help buyers understand the supplier’s performance history, including defect rates and compliance with standards.

-

Third-Party Inspections: Engaging independent inspection services can provide an unbiased assessment of the supplier’s quality control measures and product reliability.

What Nuances Should International B2B Buyers Be Aware of When Sourcing Sensors?

When sourcing sensors internationally, particularly from regions such as Africa, South America, the Middle East, and Europe, buyers should be aware of several nuances:

-

Regulatory Compliance: Different regions may have specific regulatory requirements that impact sensor design and manufacturing. Understanding these regulations can help avoid compliance issues and ensure smooth market entry.

-

Cultural Considerations: Communication styles and business practices can vary significantly across cultures. Buyers should be prepared to navigate these differences to build successful partnerships.

-

Logistics and Supply Chain Challenges: International sourcing often involves complex logistics. Buyers should consider lead times, shipping methods, and potential tariffs that could affect overall costs.

Conclusion: How Can B2B Buyers Ensure They Source High-Quality Sensors?

By understanding the manufacturing processes and quality assurance practices involved in sensor production, B2B buyers can make informed decisions. Prioritizing suppliers who adhere to international standards and demonstrate robust quality control measures will help ensure that the sensors sourced will meet the necessary performance and reliability criteria. Engaging in thorough due diligence, including audits and inspections, can further mitigate risks and enhance supplier relationships in the global marketplace.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘sensor diagram’

To effectively procure sensor diagrams that meet your business needs, following a structured approach will streamline the sourcing process. This guide provides a checklist that helps B2B buyers make informed decisions, ensuring that the selected diagrams align with technical requirements and industry standards.

Step 1: Define Your Technical Specifications

Before starting your search, clearly outline the technical specifications required for your sensor diagrams. This includes the types of sensors you need (e.g., proximity, photoelectric, capacitive) and their specific applications. Consider the environmental conditions they will operate in, such as temperature ranges and exposure to chemicals, to ensure compatibility.

- Identify operational parameters like voltage, current ratings, and response times.

- Document any industry standards or certifications that your sensors must comply with.

Step 2: Research Potential Suppliers

Investigate various suppliers to find those that specialize in the specific types of sensor diagrams you require. Look for suppliers with a strong reputation in your industry and regions of interest, such as Africa, South America, the Middle East, and Europe.

- Utilize online directories and trade platforms to compile a list of potential suppliers.

- Check for reviews and testimonials to gauge the experiences of other buyers.

Step 3: Evaluate Supplier Capabilities

Once you have a list of potential suppliers, assess their capabilities in providing the necessary sensor diagrams. This evaluation should include their technical expertise and experience in your specific sector.

- Request detailed company profiles, including their history, product range, and any relevant case studies.

- Verify their ability to provide customized solutions if your requirements are unique.

Step 4: Request Sample Diagrams

Before finalizing any agreements, ask suppliers for sample diagrams that illustrate their work. This will help you evaluate the clarity, accuracy, and quality of their diagrams.

- Ensure that the sample diagrams are relevant to your specifications and applications.

- Review the diagrams for completeness, including all necessary annotations and wiring details.

Step 5: Verify Compliance with Standards

Check that the sensor diagrams comply with international standards relevant to your industry. This is crucial for ensuring safety, reliability, and interoperability with existing systems.

- Look for certifications such as ISO, CE, or UL that indicate compliance.

- Confirm that the diagrams adhere to local regulations specific to your operational region.

Step 6: Assess Pricing and Terms

Review the pricing structures and payment terms offered by potential suppliers. Ensure that the costs align with your budget while considering the quality of the diagrams provided.

- Ask for detailed quotations that break down costs for different types of diagrams and any additional services.

- Clarify payment terms, including any upfront costs and timelines for delivery.

Step 7: Finalize Contracts and Agreements

Once you have selected a supplier, proceed to finalize contracts. This should include clear terms regarding the scope of work, deliverables, timelines, and warranties.

- Ensure that the contract specifies the quality assurance processes to be followed.

- Include clauses that protect your interests, such as non-disclosure agreements if necessary.

Following this checklist will help you navigate the complexities of sourcing sensor diagrams effectively, ensuring that you make informed decisions that support your business objectives.

Comprehensive Cost and Pricing Analysis for sensor diagram Sourcing

When sourcing sensor diagrams, understanding the comprehensive cost structure and pricing dynamics is crucial for international B2B buyers. This section delves into the essential cost components, influential pricing factors, and strategic buyer tips, particularly for those operating in regions such as Africa, South America, the Middle East, and Europe.

What are the Key Cost Components for Sensor Diagram Sourcing?

The cost structure for sensor diagrams can be broken down into several critical components:

-

Materials: The choice of materials significantly impacts the overall cost. High-quality components such as specialized sensors or durable wiring can drive prices up, while more generic materials may lower costs. It’s essential to balance quality and cost to ensure reliability.

-

Labor: Labor costs vary by region and can be influenced by local wage standards and expertise levels. Skilled technicians who can accurately produce and assemble sensor diagrams often command higher wages, but their expertise can result in better quality and fewer errors.

-

Manufacturing Overhead: This includes costs related to facilities, utilities, and indirect labor. Efficient manufacturing processes can help keep overhead low, which is critical for competitive pricing.

-

Tooling: The initial investment in tooling is necessary for creating specific sensor diagram configurations. Custom tooling can lead to higher upfront costs, but it may be justified by the long-term savings on mass production.

-

Quality Control (QC): Implementing stringent QC processes ensures the reliability of the sensor diagrams. While this adds to costs, it can prevent costly recalls and enhance customer satisfaction.

-

Logistics: Shipping and handling costs depend on the distance, mode of transport, and weight of the materials. Understanding Incoterms is crucial to determine responsibilities and potential additional costs during shipping.

-

Margin: Suppliers typically include a profit margin in their pricing. Understanding the typical margins within your sector can help in negotiating better terms.

How Do Pricing Influencers Affect Sensor Diagrams?

Several factors can influence the pricing of sensor diagrams:

-

Volume/MOQ: Minimum order quantities (MOQ) can lead to economies of scale. Larger orders often result in lower per-unit costs, making it advantageous for buyers with significant needs.

-

Specifications and Customization: Custom sensor diagrams tailored to specific applications can increase costs. Buyers should weigh the benefits of customization against their budget constraints.

-

Quality and Certifications: High-quality sensors that meet international standards or specific certifications (like ISO or CE) may come at a premium. However, investing in certified products can reduce risks associated with compliance and reliability.

-

Supplier Factors: The reputation, reliability, and location of suppliers can affect pricing. Established suppliers with a track record of quality may command higher prices, but their reliability can justify the cost.

-

Incoterms: Understanding Incoterms can help buyers manage logistics costs effectively. Terms like FOB (Free on Board) or CIF (Cost, Insurance, and Freight) determine who bears the costs at various stages of the shipping process.

What Buyer Tips Can Enhance Cost-Efficiency in Sensor Diagram Sourcing?

To maximize cost-efficiency when sourcing sensor diagrams, buyers should consider the following strategies:

-

Negotiate Terms: Always negotiate pricing and payment terms. Suppliers may have room to adjust prices based on volume or long-term partnerships.

-

Evaluate Total Cost of Ownership (TCO): Focus not only on the initial purchase price but also on the TCO, which includes maintenance, operational costs, and potential downtime. A slightly higher initial investment in quality can yield long-term savings.

-

Understand Pricing Nuances in International Markets: Be aware of currency fluctuations, tariffs, and local regulations that can affect pricing. Building relationships with local suppliers can help mitigate some of these risks.

-

Leverage Local Knowledge: In regions like Africa or South America, local suppliers may offer better pricing due to reduced shipping costs and local market understanding.

-

Conduct Market Research: Regularly assess market prices and industry trends to ensure you are getting competitive quotes. This knowledge can empower negotiations and sourcing decisions.

In conclusion, a thorough understanding of cost components and pricing influencers, combined with strategic buying practices, can enhance the sourcing process for sensor diagrams. Buyers who adopt these insights will be better equipped to secure advantageous deals while ensuring product quality and reliability.

Alternatives Analysis: Comparing sensor diagram With Other Solutions

Understanding Alternatives to Sensor Diagrams for Industrial Applications

When evaluating sensor diagrams, it’s essential to consider various alternative solutions that can achieve similar outcomes in automation and control processes. Each alternative presents its own unique advantages and challenges, influencing the decision-making process for B2B buyers in diverse markets such as Africa, South America, the Middle East, and Europe.

Comparison Table of Sensor Diagram and Alternatives

| Comparison Aspect | Sensor Diagram | PLC (Programmable Logic Controller) | HMI (Human-Machine Interface) |

|---|---|---|---|

| Performance | High accuracy in sensor integration | High versatility and programmability | Enhanced user interaction and control |

| Cost | Moderate initial setup cost | High upfront investment, lower long-term | Moderate, depending on complexity |

| Ease of Implementation | Requires technical expertise | Complex programming required | User-friendly, but setup can be intricate |

| Maintenance | Moderate, depending on system complexity | High, requires specialized knowledge | Low to moderate, depending on software updates |

| Best Use Case | Specific sensor applications | Complex automation systems | User-centered control environments |

What Are the Pros and Cons of PLCs as an Alternative to Sensor Diagrams?

Programmable Logic Controllers (PLCs) are a robust alternative to sensor diagrams, particularly for complex industrial automation. They offer high versatility and can be programmed to handle a wide range of tasks beyond simple sensor integration. However, the initial investment in PLCs can be substantial, and the programming complexity may require specialized personnel. For businesses focusing on large-scale automation with diverse inputs, PLCs can be an excellent fit, although they may not be the most cost-effective solution for smaller operations.

How Do HMIs Offer a Different Approach Compared to Sensor Diagrams?

Human-Machine Interfaces (HMIs) provide an interactive platform for operators to control and monitor industrial processes. Unlike sensor diagrams, which focus on the technical aspects of sensor integration, HMIs enhance user experience by offering visual representations of data and control options. While they can be easier to use, setting up an HMI can be intricate, especially if it needs to interface with multiple systems. HMIs are best suited for environments where operator interaction is critical, although they may not provide the same level of detailed technical insight as sensor diagrams.

Conclusion: How Should B2B Buyers Choose the Right Solution?

For B2B buyers, selecting the right solution hinges on specific operational needs and budget constraints. If the primary requirement is high accuracy in sensor integration, sensor diagrams may be the optimal choice. For businesses seeking versatility and scalability, PLCs could prove more advantageous despite their higher upfront costs. Conversely, if user interaction and ease of monitoring are paramount, HMIs can provide significant value. Ultimately, careful consideration of each alternative’s strengths and limitations will guide buyers toward the most suitable solution for their unique contexts.

Essential Technical Properties and Trade Terminology for sensor diagram

What Are the Key Technical Properties of Sensor Diagrams That B2B Buyers Should Know?

When evaluating sensor diagrams, understanding specific technical properties is crucial for making informed purchasing decisions. Here are some essential specifications that buyers should consider:

-

Material Grade

The material grade of sensors determines their durability and performance under various environmental conditions. Common materials include stainless steel for corrosion resistance and plastic for lightweight applications. For B2B buyers, selecting the appropriate material ensures longevity and reliability, which can significantly reduce maintenance costs and downtime. -

Tolerance

Tolerance refers to the permissible limit or limits of variation in a physical dimension. In sensor manufacturing, tight tolerances are critical for ensuring accuracy and consistency in measurements. For businesses, understanding tolerance levels can help in selecting sensors that meet specific operational requirements, thus preventing costly errors in automation processes. -

Operating Temperature Range

This specification indicates the temperature limits within which the sensor can function effectively. Different applications may require sensors to operate under extreme temperatures. B2B buyers need to match the sensor’s operating range with their operational environment to ensure optimal performance and avoid sensor failure. -

Response Time

The response time of a sensor is the time taken to detect a change and output a signal. In applications where quick reactions are essential, such as safety systems, a shorter response time is crucial. Buyers should consider this property to ensure that the sensors can keep up with the speed of their operational processes. -

Output Type

Sensors can provide different types of outputs, including analog and digital signals. Understanding the output type is essential for compatibility with existing systems and ensuring seamless integration. For B2B operations, selecting the correct output type can facilitate better data management and analysis. -

Ingress Protection (IP) Rating

The IP rating indicates the sensor’s resistance to dust and water. A higher rating signifies better protection, which is particularly important in harsh industrial environments. B2B buyers should assess the IP rating to ensure that the sensors will withstand their specific operating conditions, thereby enhancing reliability.

What Are Common Trade Terms Related to Sensor Diagrams That Buyers Should Understand?

Familiarizing oneself with trade terminology is vital for navigating the procurement process effectively. Here are some key terms that B2B buyers should know:

-

OEM (Original Equipment Manufacturer)

An OEM is a company that produces parts and equipment that may be marketed by another manufacturer. Understanding OEM relationships can help buyers identify high-quality components that are compatible with their existing systems. -

MOQ (Minimum Order Quantity)

MOQ refers to the smallest number of units that a supplier is willing to sell. This term is crucial for budgeting and inventory management, as it can affect overall procurement costs. Buyers should negotiate MOQs to align with their operational needs while minimizing excess inventory. -

RFQ (Request for Quotation)

An RFQ is a document sent to suppliers requesting pricing information for specific products or services. It is an essential tool for comparing supplier offers and ensuring competitive pricing. B2B buyers should utilize RFQs to streamline the procurement process and gather accurate cost estimates. -

Incoterms (International Commercial Terms)

These are standardized terms used in international trade to define the responsibilities of buyers and sellers. Familiarity with Incoterms helps buyers understand shipping costs, insurance responsibilities, and delivery obligations, which are crucial for smooth cross-border transactions. -

Lead Time

Lead time is the time it takes from placing an order to receiving the product. It is vital for planning and managing production schedules. B2B buyers should consider lead times when placing orders to ensure timely availability of sensors for their projects. -

Certification Standards

Certification standards indicate that a product meets specific regulatory or industry requirements. Common standards include ISO, CE, and RoHS. For B2B buyers, ensuring that sensors comply with relevant certifications can minimize liability and enhance product quality assurance.

By understanding these technical properties and trade terms, B2B buyers can make more informed decisions regarding sensor diagrams, ultimately enhancing operational efficiency and competitiveness in their respective markets.

Navigating Market Dynamics and Sourcing Trends in the sensor diagram Sector

Market Overview & Key Trends

The sensor diagram sector is witnessing transformative growth driven by the increasing demand for automation and smart technologies across various industries. Global drivers include the rise of the Internet of Things (IoT), advancements in artificial intelligence (AI), and the need for enhanced data collection and analysis. These factors have led to a surge in the adoption of sensor technology, particularly in manufacturing, automotive, and healthcare sectors. For international B2B buyers from regions like Africa, South America, the Middle East, and Europe, this presents an opportunity to source innovative solutions that can streamline operations and enhance productivity.

Emerging trends indicate a shift towards more integrated sensor systems that provide real-time data analytics. The use of wireless sensors is becoming prevalent, allowing for greater flexibility in installations and reducing the need for extensive wiring, which can be a barrier in developing regions. Additionally, there is a growing emphasis on customization, enabling businesses to tailor sensor solutions to their specific operational needs. This trend is particularly significant in regions like Saudi Arabia and Germany, where industries are rapidly evolving to meet modern challenges.

Furthermore, the market is becoming increasingly competitive, with numerous players entering the landscape. Buyers must navigate this dynamic environment by focusing on suppliers that offer not only quality products but also robust support and training. Building relationships with manufacturers who prioritize innovation and customer service will be key to ensuring successful sourcing in this sector.

How is Sustainability Influencing Sourcing Decisions in the Sensor Diagram Sector?

Sustainability is becoming a crucial factor for B2B buyers in the sensor diagram sector. As environmental concerns gain prominence globally, companies are increasingly prioritizing sustainable practices in their supply chains. The environmental impact of sensor production, including resource extraction, manufacturing processes, and waste management, is under scrutiny. B2B buyers must consider these factors when selecting suppliers, opting for those who demonstrate a commitment to minimizing their ecological footprint.

Ethical sourcing is also gaining traction, with businesses seeking partners who uphold fair labor practices and transparency in their operations. Certifications such as ISO 14001 for environmental management and ISO 26000 for social responsibility are becoming benchmarks for evaluating potential suppliers. Buyers should actively seek vendors who utilize sustainable materials and processes, such as recyclable components and energy-efficient manufacturing techniques.

Incorporating ‘green’ certifications into sourcing strategies not only aligns with corporate social responsibility goals but can also enhance brand reputation and customer loyalty. As consumers increasingly favor environmentally responsible companies, B2B buyers who prioritize sustainability in their sourcing decisions will be better positioned to meet market demands and regulatory requirements.

What is the Evolution of the Sensor Diagram Sector?

The sensor diagram sector has evolved significantly over the decades, transitioning from simple mechanical switches to complex electronic systems capable of advanced data processing. Initially, sensors were primarily analog devices used in basic applications. However, the advent of digital technology and microelectronics has revolutionized the field, allowing for the development of sophisticated sensors that integrate seamlessly with automation systems.

The introduction of IoT has further accelerated this evolution, enabling sensors to communicate wirelessly and provide real-time data analytics. As industries have embraced automation and digital transformation, the demand for high-performance sensor solutions has surged. This shift has compelled manufacturers to innovate continuously, leading to the development of smart sensors equipped with AI capabilities for predictive maintenance and enhanced operational efficiency.

In summary, the sensor diagram sector’s evolution reflects a broader trend towards automation and data-driven decision-making, which is crucial for B2B buyers looking to leverage technology for competitive advantage. Understanding this historical context can guide purchasing decisions and foster strategic partnerships in the sensor landscape.

Frequently Asked Questions (FAQs) for B2B Buyers of sensor diagram

-

How do I solve compatibility issues with sensor diagrams?

To address compatibility issues with sensor diagrams, ensure that you are using the correct wiring standards and specifications for your specific application. Research the voltage and current requirements of the sensors you intend to use, as well as any protocol specifics if using smart sensors. Collaborate with your supplier to obtain detailed wiring diagrams and pin-out specifications. Additionally, testing the sensors in a controlled environment before full deployment can help identify and resolve potential issues early on. -

What is the best type of sensor for industrial automation applications?

The best type of sensor for industrial automation largely depends on the specific application and environment. Proximity sensors are commonly used for detecting the presence or absence of objects without physical contact, while temperature sensors are crucial for monitoring thermal conditions. For high-precision applications, consider using capacitive or inductive sensors. Evaluate factors such as operating range, environmental conditions, and the type of output signal required (analog or digital) when selecting the most suitable sensor. -

How can I verify the reliability of a sensor supplier?

To verify the reliability of a sensor supplier, check for industry certifications and compliance with international standards such as ISO 9001. Request references from previous clients and evaluate their feedback on product quality and service. Conduct an audit of the supplier’s manufacturing processes and quality assurance protocols. Additionally, consider their experience in your specific industry and their ability to provide technical support and after-sales service. -

What customization options are available for sensor diagrams?

Customization options for sensor diagrams can include alterations in wiring configurations, output types, and even sensor specifications to suit your operational needs. Many suppliers offer tailored solutions based on your project requirements. It is essential to communicate your specific needs clearly during the design phase and collaborate with engineers to develop diagrams that integrate seamlessly with your existing systems. Always request a prototype or sample to validate the design before full-scale production. -

What are the minimum order quantities (MOQs) for sensor products?

Minimum order quantities (MOQs) for sensor products can vary significantly among suppliers. Some manufacturers may offer flexible MOQs for standard products, while custom solutions typically require larger orders. It is advisable to discuss MOQs upfront with potential suppliers and consider negotiating terms based on your projected needs and budget. Smaller businesses may benefit from suppliers that offer tiered pricing based on order volume, allowing for more manageable initial investments. -

What payment terms should I expect when sourcing sensors internationally?

Payment terms when sourcing sensors internationally can vary based on the supplier’s policies and your negotiation capabilities. Common terms include advance payments, letters of credit, or net payment terms (e.g., net 30, net 60). Be prepared to discuss and agree upon terms that align with your cash flow and purchasing strategy. It is also wise to inquire about currency exchange rates and any additional fees that may apply to international transactions. -

How do I ensure quality assurance for sensor products?

To ensure quality assurance for sensor products, request documentation on the supplier’s quality control processes, including testing protocols and certifications. Consider implementing a third-party inspection service to verify product quality before shipment. Establish clear quality criteria and performance benchmarks during the negotiation phase, and ensure that the supplier is committed to continuous improvement through regular audits and feedback loops. -

What logistics considerations should I keep in mind when importing sensors?

When importing sensors, consider logistics aspects such as shipping methods, lead times, customs regulations, and duties applicable to your region. Choose a reliable freight forwarder experienced in handling electronic components to mitigate risks. Ensure that your supplier provides all necessary documentation, including invoices and certificates of conformity, to facilitate smooth customs clearance. Additionally, factor in potential delays and plan accordingly to avoid disruptions in your supply chain.

Top 4 Sensor Diagram Manufacturers & Suppliers List

1. Pinterest – Proximity Sensor Wiring Guide

Domain: pinterest.com

Registered: 2009 (16 years)

Introduction: Proximity Sensor Wiring Diagram and Connection Procedure, Three(3) Wire PNP Type Proximity Sensor, NPN Type Proximity Sensor

2. HTM Sensors – Wiring & Pin Out Diagrams

Domain: htmsensors.com

Registered: 2005 (20 years)

Introduction: Wiring & Pin Out Diagrams for various sensor types including Proximity Sensors, Capacitive Sensors, Photoelectric Sensors, Pneumatic Cylinder Sensors, Cables and Connectors, LED Indicators, Safety Light Curtains, Ultrasonic Sensors, Thermo Sensors, and Sensor Protection. Product categories include Long Range MetalHead AMS Sensors, Proximity Sensors for Welding, Ceramic Coated MetalHead, Automotive…

3. Elprocus – Types of Sensors

Domain: elprocus.com

Registered: 2013 (12 years)

Introduction: Types of Sensors: Temperature Sensor, IR Sensor, Ultrasonic Sensor, Touch Sensor, Proximity Sensors, Pressure Sensor, Level Sensors, Smoke and Gas Sensors. Temperature Sensor Details: Types include thermocouples, thermistors, semiconductor temperature sensors, and resistance temperature detectors (RTDs). Example Circuit: Simple temperature sensor circuit using a thermistor, battery, transistors, a…

4. OurPCB – Sensor Circuit PCBA

Domain: ourpcb.com

Registered: 2005 (20 years)

Introduction: Sensor circuits play a vital role in various applications, including home security systems and consumer electronics. OurPCB specializes in Printed Circuit Board Assembly (PCBA) for sensor circuits, ensuring precision in assembly. Key types of sensors include: 1. Temperature Sensors – use a small transistor circuit to switch loads ON or OFF. 2. IR Sensors – utilize photovoltaic cells to detect and …

Strategic Sourcing Conclusion and Outlook for sensor diagram

In the rapidly evolving landscape of sensor technology, strategic sourcing is critical for international B2B buyers aiming to enhance operational efficiency and drive innovation. By leveraging comprehensive sensor diagrams, businesses can ensure proper integration and functionality of sensor systems across diverse applications—from industrial automation to home automation. Understanding the intricacies of wiring and pinout diagrams enables buyers to make informed decisions, minimizing downtime and optimizing resource allocation.

Investing in high-quality sensors not only improves performance but also fosters long-term partnerships with suppliers who can provide ongoing support and innovation. For companies in Africa, South America, the Middle East, and Europe, particularly in regions like Saudi Arabia and Germany, this approach can lead to competitive advantages in both local and global markets.

As we look to the future, the demand for advanced sensing solutions will only grow. We encourage B2B buyers to actively engage with suppliers, explore cutting-edge technologies, and incorporate strategic sourcing practices that align with their business goals. Embrace the opportunity to enhance your operational capabilities and position your organization for success in an increasingly automated world.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.