Should You Invest in tron crypto? A Full Analysis (2025)

An Investor’s Introduction to tron crypto

TRON (TRX) has emerged as one of the most significant players in the cryptocurrency market since its launch in 2017. As a decentralized blockchain-based operating system, TRON aims to revolutionize the way digital content is created and shared, enabling content creators to connect directly with their audiences without the interference of centralized platforms like YouTube or Facebook. This ambitious vision positions TRON not just as a cryptocurrency but as a comprehensive ecosystem that supports decentralized applications (dApps), smart contracts, and content sharing.

Significance in the Crypto Market

TRON has garnered substantial attention and a strong user base, often ranking among the top cryptocurrencies by market capitalization. As of now, TRON holds a market cap of approximately $31.19 billion, securing its place as the ninth-largest cryptocurrency globally. Its unique approach to empowering content creators and enhancing user engagement has made it a popular choice among developers and investors alike. The TRON network boasts impressive scalability, claiming to handle up to 2,000 transactions per second without fees, which is significantly higher than many other blockchain platforms, including Bitcoin and Ethereum.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in TRON and its native token, TRX. We will delve into various aspects of the TRON ecosystem, including:

- Technology: An overview of the underlying blockchain technology, consensus mechanism, and how the TRON network operates.

- Tokenomics: A detailed look at TRX’s supply, distribution, and how it is utilized within the TRON ecosystem.

- Investment Potential: An analysis of TRON’s historical performance, current market trends, and future outlook.

- Risks: A candid discussion of the potential risks associated with investing in TRON, including market volatility and regulatory challenges.

- How to Buy: A step-by-step guide on how to purchase TRX, including exchanges where it is available and tips for secure transactions.

By the end of this guide, readers will have a well-rounded understanding of TRON, equipping them with the knowledge to make informed investment decisions in this dynamic and rapidly evolving cryptocurrency space. Whether you are looking to invest in TRX or simply want to understand its technology and ecosystem better, this guide is designed to provide valuable insights and practical information.

What is tron crypto? A Deep Dive into its Purpose

Overview of TRON (TRX)

TRON (TRX) is a decentralized blockchain-based operating system launched in 2017 by the Tron Foundation, founded by Justin Sun. Initially, TRX tokens were ERC-20 tokens on the Ethereum network, but they transitioned to their own blockchain a year later. The platform aims to provide a decentralized ecosystem for content creators, enabling them to directly connect with consumers without the need for intermediaries like streaming services or app stores. By leveraging blockchain technology, TRON seeks to empower creators and offer a more equitable distribution of revenue.

The Core Problem It Solves

The digital content landscape today is dominated by centralized platforms that often exploit content creators by taking a significant portion of the revenue generated from their work. Services like YouTube, Spotify, and Apple impose high fees and strict control over how creators distribute their content, resulting in creators receiving only a fraction of the profits.

TRON addresses this problem by creating a decentralized platform where content creators can share their work directly with their audience. This eliminates the need for intermediaries, allowing creators to retain a larger share of the revenue. By using TRON’s blockchain, creators can receive direct compensation in the form of TRX tokens for their contributions, thus ensuring that they are rewarded fairly for their intellectual labor.

Its Unique Selling Proposition

One of TRON’s primary differentiators is its focus on content sharing and entertainment, making it a compelling alternative to existing centralized platforms. Here are some key features that enhance TRON’s unique selling proposition:

-

Decentralization: TRON’s architecture allows for a decentralized Internet where users control their data and content. This contrasts with traditional platforms where user data is often monetized without consent.

-

High Throughput: TRON claims to process up to 2,000 transactions per second (TPS), significantly more than Bitcoin (6 TPS) and Ethereum (25 TPS). This high throughput is achieved through its Delegated Proof-of-Stake (dPoS) consensus mechanism, which enhances transaction speed and efficiency.

-

Feeless Transactions: Users can engage in transactions on the TRON network without incurring fees, which is particularly appealing for content creators who often operate on thin margins. This lack of transaction fees enables creators to earn more from their work.

-

Robust Ecosystem for dApps: TRON supports the development of decentralized applications (dApps), providing a platform for developers to create a variety of applications ranging from games to social media. This flexibility attracts a diverse range of developers and users to the ecosystem.

-

Community Engagement: TRON allows users to participate in the governance of the network by voting for “super representatives,” who are responsible for validating transactions and maintaining the network. This participatory approach fosters community involvement and trust.

-

Acquisition of BitTorrent: In 2018, TRON acquired BitTorrent, a well-known file-sharing service. This acquisition not only expanded TRON’s user base but also integrated its technology with a platform that has millions of active users, enhancing its value proposition.

The Team and Backers Behind the Project

TRON was founded by Justin Sun, a prominent figure in the cryptocurrency space, who has a background in economics and business from Peking University and the University of Pennsylvania. Sun has previously worked with Ripple, where he served as the chief representative in Greater China. His vision for TRON is to create a decentralized content ecosystem that empowers creators and consumers alike.

The Tron Foundation, which oversees the development of TRON, is backed by a talented team of developers and advisors from various tech backgrounds. The foundation is known for its transparent roadmap and commitment to ongoing development, which has helped to build trust within the community.

In addition to its founder, TRON has attracted support from notable investors and partners within the cryptocurrency and tech industries. This backing not only lends credibility to the project but also provides it with the resources needed for continued growth and innovation.

Fundamental Purpose in the Crypto Ecosystem

TRON’s fundamental purpose is to revolutionize the way digital content is created, distributed, and monetized. By leveraging blockchain technology, TRON aims to create a more equitable system for content creators, enabling them to monetize their work without the interference of centralized entities. This vision aligns with the broader goals of the cryptocurrency ecosystem, which seeks to decentralize power and provide individuals with greater control over their assets and data.

Furthermore, TRON contributes to the growing landscape of decentralized finance (DeFi) and non-fungible tokens (NFTs) by offering tools and platforms for developers to create innovative applications. The ability to build dApps on TRON not only enhances its utility but also fosters a vibrant ecosystem where users can engage in various activities, from gaming to content sharing.

In conclusion, TRON represents a significant step toward a decentralized Internet, addressing critical issues faced by content creators and consumers. Its focus on high throughput, feeless transactions, and community engagement positions it as a compelling player in the cryptocurrency landscape, with the potential to reshape the future of digital content.

The Technology Behind the Coin: How It Works

Understanding TRON: An Overview

TRON (TRX) is a decentralized blockchain-based operating system designed to provide a platform for content creators to connect directly with consumers. Launched in 2017 by the Tron Foundation, TRON aims to eliminate intermediaries in the content distribution process, allowing creators to retain more of their earnings while providing consumers with access to content at lower costs. The TRON network supports decentralized applications (dApps) and utilizes blockchain technology to ensure transparency, security, and efficiency.

Blockchain Architecture

TRON’s architecture is built on a three-layer system that enhances its functionality and scalability:

-

Storage Layer:

– This layer is responsible for securely storing data on the TRON network, including the blockchain state and historical transaction data. It segments various types of data related to the ecosystem, ensuring that information is organized and accessible.

– The storage layer is crucial for maintaining the integrity of the network, as it allows users to verify the history of transactions and data interactions. -

Core Layer:

– The core layer processes various instructions and executes smart contracts. It is where the logic of the TRON network is executed.

– Developers can write smart contracts using programming languages such as Solidity and Java. The processed instructions are then sent to the TRON Virtual Machine (TVM), which ensures that the dApps function as intended. -

Application Layer:

– This layer is where developers create and deploy dApps. It is the interface through which users interact with the TRON network.

– TRX tokens are utilized within this layer, allowing developers to create wallets and applications that can interact with the TRON ecosystem.

The layered architecture of TRON allows it to achieve high throughput, processing up to 2,000 transactions per second (TPS) without incurring transaction fees. This scalability is one of TRON’s key advantages over other blockchain networks.

Consensus Mechanism

TRON employs a unique consensus mechanism known as Delegated Proof-of-Stake (dPoS), which differs from traditional consensus methods like Proof-of-Work (PoW) and standard Proof-of-Stake (PoS). Here’s how it works:

- Delegated Proof-of-Stake (dPoS):

- In a dPoS system, TRX holders can freeze their tokens to gain voting power, referred to as Tron Power. This voting power allows them to elect “Super Representatives” (SRs) who are responsible for validating transactions and producing new blocks.

- The SRs are incentivized to act in the best interests of the network, as they receive TRX rewards for their contributions. These rewards are then distributed to the users who voted for them, creating a community-driven approach to network security and governance.

- This system enhances the network’s efficiency and reduces energy consumption compared to PoW systems, which require extensive computational power and energy to validate transactions.

Key Technological Innovations

TRON has introduced several technological innovations that enhance its functionality and user experience:

-

Smart Contracts:

– TRON supports smart contracts, self-executing contracts with the terms of the agreement directly written into code. Smart contracts on TRON facilitate the automation of various processes, reducing the need for intermediaries and increasing efficiency.

– This capability allows developers to create a wide range of dApps, from games to financial services, that can operate autonomously on the blockchain. -

Decentralized Applications (dApps):

– The TRON network is one of the most popular platforms for building dApps. These applications run on the TRON blockchain, offering users a decentralized alternative to traditional applications.

– dApps on TRON can cover various sectors, including gaming, social media, and finance, providing users with more control over their data and interactions. -

Feeless Transactions:

– One of TRON’s standout features is its ability to facilitate transactions without fees. This is made possible through its high throughput and efficient consensus mechanism.

– Users can send and receive TRX without worrying about transaction costs, making TRON an attractive option for microtransactions and frequent trading. -

TRON Virtual Machine (TVM):

– The TVM is a key component of the TRON ecosystem that enables the execution of smart contracts. It is compatible with the Ethereum Virtual Machine (EVM), allowing developers to easily migrate their dApps from Ethereum to TRON.

– The TVM enhances the performance of dApps by providing a fast and reliable environment for executing smart contracts, which is critical for applications requiring real-time interactions. -

Token Standards:

– TRON has introduced its own token standards, including TRC-10 and TRC-20. These standards allow developers to create their own tokens on the TRON blockchain with ease.

– TRC-10 tokens do not require the use of smart contracts, making them simpler and faster to create. In contrast, TRC-20 tokens are built using smart contracts, providing greater flexibility and functionality. -

Decentralized File Storage:

– TRON aims to create a decentralized content distribution network, and as part of this vision, it acquired BitTorrent in 2018. This acquisition enables TRON to leverage BitTorrent’s infrastructure to facilitate decentralized file sharing and storage.

– Users can share files directly with each other, reducing reliance on centralized servers and enhancing data privacy.

Ecosystem and Community Involvement

TRON emphasizes community involvement and transparency in its development process. The project has a clear roadmap that outlines its goals and milestones, allowing users and investors to understand its long-term vision.

- Community Governance:

-

The dPoS system not only secures the network but also empowers TRX holders to participate in governance decisions. This community-driven approach fosters a sense of ownership among users and encourages active participation in the ecosystem.

-

Development Support:

- TRON provides developers with extensive resources and documentation to facilitate dApp development. This support helps to grow the TRON ecosystem, attracting more developers and projects to the platform.

Conclusion

TRON’s technology is designed to create a decentralized platform for content sharing and entertainment, offering numerous advantages over traditional systems. With its innovative architecture, efficient consensus mechanism, and robust support for dApps and smart contracts, TRON is well-positioned to play a significant role in the future of blockchain technology. By prioritizing user engagement and community governance, TRON aims to empower creators and consumers alike, paving the way for a more equitable digital content landscape. As the cryptocurrency and blockchain space continues to evolve, TRON’s unique approach and technological innovations will likely keep it at the forefront of the industry.

Understanding tron crypto Tokenomics

| Metric | Value |

|---|---|

| Total Supply | 94.66 billion TRX |

| Max Supply | Unlimited |

| Circulating Supply | 94.66 billion TRX |

| Inflation/Deflation Model | Deflationary (TRX burns for USDD) |

Token Utility (What is the coin used for?)

TRON (TRX) serves multiple functions within the TRON ecosystem, primarily revolving around content creation, distribution, and community interaction. Here are some key utilities of TRX:

-

Transaction Fees: TRX is used to pay for transaction fees within the TRON network. Unlike many other blockchain networks, TRON allows users to conduct transactions without incurring fees in the traditional sense. Instead, users can freeze their TRX to obtain Tron Power (TP), which grants them the ability to vote and participate in the governance of the network.

-

Incentives for Content Creators: One of the primary goals of TRON is to empower content creators by enabling them to earn directly from their work. Users can reward creators with TRX tokens, thereby creating a direct economic incentive for content production. This model eliminates the need for intermediaries, allowing creators to retain a larger share of the revenue generated from their content.

-

Smart Contracts and DApps: TRX is integral to the execution of smart contracts and decentralized applications (DApps) built on the TRON blockchain. Developers utilize TRX to create and deploy their applications, thus making it a vital asset in the TRON ecosystem.

-

USDD Stablecoin: TRX plays a crucial role in the operation of the Decentralized USD (USDD) stablecoin. The protocol requires burning a certain amount of TRX to mint USDD, which helps stabilize the value of the stablecoin. This burning mechanism introduces a deflationary aspect to TRX, as it reduces the circulating supply when USDD is created.

-

Participation in Governance: TRX holders can freeze their tokens to gain voting rights in the TRON network. This process allows them to vote for “super representatives,” who play a critical role in block production and network governance. This voting system ensures that TRX holders have a say in the development and direction of the TRON ecosystem.

Token Distribution

The distribution of TRX tokens is a significant aspect of its tokenomics and is designed to foster community engagement while providing resources for the development of the TRON network. The initial allocation of TRX tokens at the time of the project’s launch in 2017 was as follows:

-

Initial Coin Offering (ICO): 40 billion TRX tokens were allocated to participants in the ICO, allowing early investors to acquire a substantial share of the token supply. This was aimed at generating funds for the project’s development.

-

Private Investors: 15.75 billion TRX were designated for private investors, which included venture capitalists and strategic partners. This allocation was intended to ensure that the project had sufficient backing from experienced investors.

-

Tron Foundation: 34 billion TRX tokens were allocated to the Tron Foundation, which plays a crucial role in the development and governance of the TRON network. This allocation is meant to fund ongoing development efforts, community initiatives, and partnerships.

-

Justin Sun’s Company: 10 billion TRX were allocated to a company owned by Justin Sun, the founder of TRON. This allocation was likely intended to incentivize Sun and his team to remain committed to the project and drive its success.

The total supply of TRX is capped at 100 billion tokens, but there is no maximum supply limit, allowing for potential future adjustments in response to network needs and market conditions. Critics have pointed out that the distribution model leans heavily in favor of the foundation and early investors, which can raise concerns about centralization and the potential for market manipulation.

The TRON ecosystem is designed to support a decentralized content sharing and entertainment platform, where users can directly interact with creators and reward them for their contributions. By allowing creators to issue their tokens and facilitating a wide range of decentralized applications, TRON aims to create a vibrant and self-sustaining economy.

In summary, TRON’s tokenomics is characterized by its extensive use cases within the ecosystem, a significant focus on empowering content creators, and a distribution model that seeks to balance development funding with community engagement. The combination of these elements positions TRX as a key player in the burgeoning world of decentralized content and blockchain technology.

Price History and Market Performance

Key Historical Price Milestones

TRON (TRX) was launched in September 2017, and its price history has seen significant fluctuations since its inception. Initially, TRX was an ERC-20 token on the Ethereum blockchain, and its price was relatively low, starting at approximately $0.0011 during its initial coin offering (ICO). Over the years, TRON transitioned to its own blockchain, which has played a crucial role in its price trajectory.

Early Growth and Speculation (2017-2018)

In late 2017, TRON began gaining traction, largely driven by the cryptocurrency market’s overall bullish sentiment. By December 2017, TRX reached its first notable milestone, soaring to around $0.25. This surge was part of a broader altcoin rally, where many cryptocurrencies experienced dramatic price increases. The excitement surrounding TRON’s ambitious plans to decentralize content sharing and its charismatic founder, Justin Sun, contributed to this rapid price increase.

Major Price Peaks and Market Corrections (2018-2019)

In early 2018, TRX reached its all-time high of approximately $0.30, fueled by significant speculation and investor interest. However, this peak was short-lived, as the overall cryptocurrency market began to correct itself. By the end of 2018, TRX had fallen sharply, dropping to around $0.01. This decline reflected a broader market downturn, where many cryptocurrencies experienced substantial losses.

Stabilization and Gradual Recovery (2019-2020)

Following the 2018 crash, TRX’s price stabilized, hovering between $0.01 and $0.03 for much of 2019. The project continued to develop its platform, focusing on enhancing its ecosystem and attracting developers to build decentralized applications (dApps). In 2020, TRX saw a resurgence, partly due to increased interest in DeFi (decentralized finance) and the broader cryptocurrency market’s recovery. By mid-2020, the price had climbed to around $0.03-$0.04, reflecting renewed investor confidence.

All-Time High and Subsequent Volatility (2021-2022)

The year 2021 marked a significant turning point for TRON. The cryptocurrency market experienced another explosive rally, with TRX reaching a new high of approximately $0.16 in April 2021. The rise was driven by various factors, including the increasing popularity of dApps on the TRON network and the platform’s growing ecosystem. However, the price was again met with volatility, and by the end of 2021, TRX had retraced to around $0.07.

In 2022, the market faced various challenges, including regulatory scrutiny and macroeconomic factors affecting investor sentiment. TRX’s price fluctuated, dropping to around $0.05 before recovering slightly towards the end of the year.

Recent Performance and Current Price (2023)

As of October 2023, TRON’s price stands at approximately $0.33, with a market capitalization of around $31 billion. The price has shown resilience amid a mixed market environment, maintaining a position within the top ten cryptocurrencies by market capitalization. The trading volume has also been significant, indicating a healthy level of investor interest and activity.

Factors Influencing the Price

Historically, the price of TRON has been influenced by a combination of market sentiment, technological developments, and regulatory factors.

Market Sentiment and Speculation

The cryptocurrency market is notoriously volatile, and TRON is no exception. Price movements are often driven by investor sentiment and speculation. Major announcements, partnerships, or developments within the TRON ecosystem can lead to rapid price changes. For example, the acquisition of BitTorrent in 2018 generated significant buzz and positively impacted TRX’s price. Conversely, negative news or market corrections can lead to sharp declines.

Technological Developments

TRON’s ongoing development and upgrades to its platform have also played a crucial role in influencing its price. The introduction of new features, such as enhanced smart contract capabilities and support for dApps, can attract developers and users to the platform, boosting demand for TRX. Additionally, the launch of initiatives like the USDD stablecoin in 2022 aimed to enhance the TRON ecosystem’s functionality and stability, which can positively impact TRX’s price.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies has been a significant factor in TRON’s price movements. As governments worldwide continue to scrutinize digital assets, regulatory news can create uncertainty among investors. For instance, any indications of increased regulation or legal challenges can lead to price declines, while positive regulatory developments can spur investor confidence and price appreciation.

Overall Market Trends

TRON’s price is also affected by broader market trends in the cryptocurrency space. Correlations with Bitcoin and Ethereum, the two largest cryptocurrencies, often influence TRX’s price movements. When Bitcoin experiences a significant price increase or decrease, other cryptocurrencies, including TRON, typically follow suit.

In summary, TRON’s price history is characterized by notable milestones marked by periods of rapid growth followed by corrections. The cryptocurrency’s performance has been shaped by a complex interplay of market sentiment, technological advancements, and regulatory considerations, creating a dynamic environment for investors and users alike.

Where to Buy tron crypto: Top Exchanges Reviewed

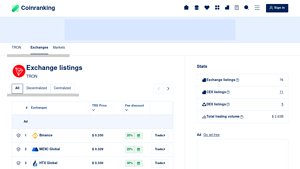

5. TRON (TRX) – A Must-Have on Top Exchanges!

The article “Exchange Listings of TRON (TRX) – Coinranking” provides a comprehensive overview of various platforms where TRX is traded, enabling users to compare prices, trading volumes, and available discounts. This resource stands out for its user-friendly interface and detailed analytics, allowing both novice and experienced traders to make informed decisions about where to buy or sell TRON, ensuring optimal trading outcomes.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Kraken – Your Go-To for Easy TRX Purchases!

Kraken stands out as a premier exchange for purchasing Tron (TRX) due to its user-friendly interface and multiple payment options, including credit/debit cards, ACH deposits, and mobile payment methods like Apple and Google Pay. With a low starting investment of just $10, Kraken caters to both novice and experienced investors, making it an accessible platform for those looking to dive into the world of cryptocurrencies.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

3. Coinbase – Ideal for Beginners!

In the article “How to Buy Tron in 2025 – Best Exchanges” from Webopedia, readers will discover top-rated cryptocurrency exchanges specifically tailored for purchasing Tron. The review highlights key features of each platform, including user experience, security measures, and transaction fees, ensuring investors can make informed decisions. With a focus on the evolving crypto landscape, the article emphasizes exchanges that stand out for their reliability and ease of use in 2025.

- Website: webopedia.com

- Platform Age: Approx. 27 years (domain registered in 1998)

How to Buy tron crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying TRON (TRX) is selecting a cryptocurrency exchange where you can purchase it. There are many exchanges available, but some of the most popular and reputable ones include:

- Binance

- KuCoin

- Bittrex

- Bitfinex

- Poloniex

When choosing an exchange, consider factors such as security, trading fees, user interface, and the availability of TRX. For beginners, platforms with a user-friendly interface and good customer support are often recommended.

2. Create and Verify Your Account

Once you have chosen an exchange, you will need to create an account. This process generally involves the following steps:

-

Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will typically need to provide your email address and create a password.

-

Email Verification: After signing up, you will receive a verification email. Click the link in the email to verify your account.

-

Complete KYC (Know Your Customer): Most exchanges require you to complete a KYC process to comply with regulations. This usually involves providing personal information such as your full name, address, and date of birth, along with identification documents (like a passport or driver’s license).

-

Two-Factor Authentication (2FA): To enhance security, it’s advisable to enable 2FA on your account. This usually involves linking your account to a mobile app like Google Authenticator or receiving SMS codes.

3. Deposit Funds

After your account is set up and verified, the next step is to deposit funds. Here’s how to do it:

-

Log In: Access your account on the exchange.

-

Navigate to Deposit Section: Find the “Deposit” or “Funds” tab on the exchange dashboard.

-

Choose Your Deposit Method: Most exchanges allow you to deposit fiat currencies (like USD, EUR, etc.) or cryptocurrencies (like Bitcoin or Ethereum). Select your preferred method.

-

Fiat Deposit: If you’re depositing fiat, you might have options like bank transfer, credit/debit card, or other payment methods. Follow the instructions for your chosen method to complete the deposit.

-

Crypto Deposit: If you are depositing cryptocurrency, select the cryptocurrency you want to deposit (e.g., Bitcoin), and the exchange will provide you with a wallet address. Send your cryptocurrency to this address.

- Confirm Deposit: Wait for your deposit to be confirmed. The time it takes for funds to appear in your exchange account will vary based on the method used.

4. Place an Order to Buy TRON Crypto

With funds in your account, you can now place an order to buy TRX. Here’s how:

-

Go to the Trading Section: Navigate to the “Markets” or “Trade” section of the exchange.

-

Select TRON (TRX): Find TRX in the list of available cryptocurrencies. You can usually search for it by entering “TRX” in the search bar.

-

Choose Order Type: Most exchanges offer different order types, such as:

– Market Order: Buy TRX at the current market price.

– Limit Order: Set a specific price at which you want to buy TRX. Your order will only execute if the market reaches that price. -

Enter Amount: Specify how much TRX you wish to purchase, then review the order details.

-

Confirm the Order: Click “Buy” or “Place Order” to execute your trade. Once completed, TRX will be credited to your exchange account.

5. Secure Your Coins in a Wallet

After purchasing TRX, it’s essential to secure your coins. Keeping your cryptocurrency on an exchange can be risky due to potential hacks or outages. Here’s how to store your TRX safely:

-

Choose a Wallet Type: There are several types of wallets available:

– Software Wallets: Applications that can be installed on your computer or smartphone (e.g., TronLink, Atomic Wallet).

– Hardware Wallets: Physical devices that store your cryptocurrency offline (e.g., Ledger, Trezor).

– Paper Wallets: Printed QR codes that represent your TRX holdings. -

Transfer TRX to Your Wallet:

– If you choose a software or hardware wallet, create a wallet and obtain your wallet address.

– Go to the “Withdraw” section of the exchange, enter your wallet address, and specify how much TRX you want to transfer.

– Confirm the withdrawal. -

Backup Your Wallet: Ensure you create a backup of your wallet’s recovery phrase or private key. This is crucial for recovering your funds in case you lose access to your wallet.

By following these steps, you can successfully buy and secure your TRON (TRX) cryptocurrency. Always remember to do your own research and stay updated on best practices for cryptocurrency security.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Strong Market Position

TRON (TRX) has established itself as one of the top 10 cryptocurrencies by market capitalization, currently ranked #9 with a market cap exceeding $31 billion. This solid market position suggests a level of investor confidence and a growing user base. With a circulating supply of approximately 94.66 billion TRX, the token is actively traded, ensuring liquidity for investors.

Vision and Use Case

TRON’s primary goal is to create a decentralized content sharing ecosystem, aiming to empower content creators by eliminating intermediaries. By allowing creators to interact directly with their audience, TRON could potentially disrupt established models in the entertainment and content industries, such as those used by YouTube and Spotify. This vision aligns well with the increasing demand for decentralized solutions and could attract more users and developers to the TRON platform.

High Throughput and Scalability

TRON boasts a high transaction throughput, claiming to handle up to 2,000 transactions per second (TPS) without fees. This is a significant advantage over other blockchain networks, such as Bitcoin and Ethereum, which have much lower transaction capacities. The network’s Delegated Proof-of-Stake (dPoS) consensus mechanism enhances efficiency and encourages community participation, allowing TRON to scale effectively as its user base grows.

Ecosystem and Development Activity

TRON’s ecosystem supports a variety of decentralized applications (dApps), with an extensive developer community actively building on the platform. The acquisition of BitTorrent further strengthens TRON’s position in the file-sharing and content distribution space, providing a ready user base and an established infrastructure. The ongoing development of new features and applications could enhance TRON’s functionality and attract more users.

Yield Generation through Staking

TRON offers users the ability to stake their TRX tokens to earn rewards, which can be an attractive feature for investors looking for passive income. With the introduction of the USDD stablecoin, TRON provides additional opportunities for yield generation, as users can stake USDD for potentially high returns. This aspect may enhance investor interest and contribute to the token’s value.

Potential Risks and Challenges (The Bear Case)

Market Volatility

The cryptocurrency market is known for its extreme volatility, and TRON is no exception. The price of TRX can fluctuate dramatically within short periods, influenced by market sentiment, news events, and broader economic factors. Such volatility can pose risks for investors, as it may lead to significant gains or losses in a short timeframe. Potential investors should be prepared for this inherent risk when considering TRON as part of their portfolio.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain in many jurisdictions, including the United States. TRON, like other cryptocurrencies, faces potential scrutiny from regulators, especially concerning its classification as a security. The ongoing legal challenges faced by various cryptocurrency projects could impact TRON’s operations and market perception. Any unfavorable regulatory developments could lead to a decrease in investor confidence and impact the token’s value.

Competition

The blockchain space is highly competitive, with numerous projects vying for dominance in the decentralized application sector. TRON faces competition from established platforms like Ethereum and emerging protocols such as Solana and Cardano. These competitors may offer similar or superior features, potentially attracting developers and users away from TRON. If TRON fails to innovate or differentiate itself effectively, it may struggle to maintain its market position.

Technological Risks

As with any technology-based platform, TRON is subject to technological risks, including potential vulnerabilities in its codebase, network security, and scalability issues. While the dPoS consensus mechanism provides efficiency, it also raises concerns regarding centralization, as a small number of super representatives could exert significant control over the network. Any security breaches, such as hacks or exploits, could undermine user trust and lead to financial losses for investors.

Tokenomics and Supply Concerns

TRON’s tokenomics also raise questions among critics. A significant portion of the initial supply was allocated to the Tron Foundation and its founder, Justin Sun, which some argue creates a potential conflict of interest. Additionally, the lack of a capped maximum supply for TRX may lead to inflationary pressures in the long term, affecting the token’s value. Investors should consider these factors when evaluating the potential for long-term growth.

Conclusion

In summary, TRON presents a compelling case for investment, driven by its strong market position, innovative vision, and robust technological infrastructure. However, potential investors should remain vigilant regarding the inherent risks, including market volatility, regulatory uncertainty, and intense competition. A balanced approach that considers both the strengths and weaknesses of TRON can help investors make informed decisions about their involvement in this digital asset. As always, thorough research and a cautious approach are advisable when investing in cryptocurrencies.

Frequently Asked Questions (FAQs)

1. What is TRON (TRX)?

TRON (TRX) is a decentralized blockchain-based operating system launched in 2017 by the Tron Foundation. Initially an ERC-20 token on Ethereum, TRX transitioned to its own blockchain to facilitate a decentralized content sharing ecosystem. TRON aims to empower content creators by allowing them to directly connect with consumers without intermediaries, thus maximizing their earnings. The platform supports smart contracts and decentralized applications (dApps), making it a competitive alternative to Ethereum.

2. Who created TRON crypto?

TRON was founded by Justin Sun, an entrepreneur recognized for his contributions to the cryptocurrency space. Sun has a background in economics from Peking University and a master’s degree from the University of Pennsylvania. Before launching TRON, he worked with Ripple as its chief representative in Greater China. Under his leadership, TRON has grown significantly, acquiring the file-sharing service BitTorrent in 2018.

3. What makes TRON different from Bitcoin?

While both TRON and Bitcoin utilize blockchain technology, they serve different purposes. Bitcoin is primarily a digital currency designed for peer-to-peer transactions, whereas TRON focuses on creating a decentralized content sharing platform. TRON supports smart contracts and dApps, allowing developers to build applications on its blockchain. Additionally, TRON uses a Delegated Proof-of-Stake (dPoS) consensus mechanism, which is more energy-efficient and allows for faster transaction processing compared to Bitcoin’s Proof-of-Work (PoW) model.

4. Is TRON crypto a good investment?

Whether TRON is a good investment depends on various factors, including market conditions, your investment goals, and risk tolerance. As of October 2023, TRON has a market capitalization of around $31.19 billion and a circulating supply of approximately 94.66 billion TRX. It has shown significant growth since its inception, but like all cryptocurrencies, it is subject to volatility. Potential investors should conduct thorough research and consider diversifying their portfolios to mitigate risks.

5. How many TRON coins are in circulation?

TRON has a total supply of approximately 100 billion TRX tokens, with around 94.66 billion of these currently in circulation. The distribution of TRX tokens during the initial coin offering (ICO) allocated 45% to the project founders and the Tron Foundation, which has drawn some criticism regarding centralization.

6. How is the TRON network secured?

TRON utilizes a Delegated Proof-of-Stake (dPoS) consensus mechanism for network security. TRX holders can freeze their tokens to gain Tron Power, which allows them to vote for “super representatives” that produce blocks and verify transactions. This system not only enhances security but also improves transaction throughput, enabling TRON to process up to 2,000 transactions per second without fees.

7. Where can I buy TRON (TRX)?

TRON can be purchased on various cryptocurrency exchanges, including Binance, KuCoin, Bitfinex, and Poloniex. However, it is not available on Coinbase. To acquire TRX, users typically first convert fiat currency to Bitcoin or Ethereum and then trade those for TRX on supported exchanges.

8. What are the use cases for TRON (TRX)?

TRON’s primary use cases revolve around content sharing and entertainment. The platform enables content creators to publish their work and receive direct compensation in TRX tokens, reducing reliance on traditional intermediaries like streaming services. Additionally, TRON supports the creation of dApps, decentralized games, and the issuance of personal tokens by creators. The introduction of the USDD stablecoin also expands TRON’s functionality within the DeFi space, allowing users to earn yields on their holdings.

Final Verdict on tron crypto

Summary of TRON (TRX)

TRON is a decentralized blockchain-based operating system that aims to revolutionize the content-sharing landscape by empowering creators and eliminating intermediaries. Launched in 2017 by Justin Sun, TRON allows users to publish, store, and own data freely, facilitating direct interaction between content creators and consumers. The platform supports smart contracts and decentralized applications (dApps), making it a robust alternative to Ethereum.

Technology Behind TRON

TRON employs a delegated proof-of-stake (dPoS) consensus mechanism, allowing TRX holders to vote for block producers known as “super representatives.” This structure not only enhances transaction throughput—capable of processing up to 2,000 transactions per second—but also promotes energy efficiency compared to traditional proof-of-work systems. The architecture of TRON is divided into three layers: the storage layer, application layer, and core layer, ensuring organized data management and efficient execution of dApps.

Potential and Risks

While TRON presents a compelling proposition for content creators and users seeking a decentralized alternative to traditional platforms, it is essential to recognize the inherent risks associated with investing in cryptocurrencies. The market is highly volatile, with TRX experiencing significant price fluctuations since its inception. As of now, TRON holds a strong market position, ranking within the top ten cryptocurrencies by market capitalization, but potential investors should remain cautious.

Conduct Your Own Research

Given the complexities and risks involved in the cryptocurrency space, it is crucial for investors—especially beginners and intermediates—to conduct their own thorough research (DYOR) before making any investment decisions. Understanding the underlying technology, market dynamics, and the project’s roadmap will empower you to make informed choices in this high-risk, high-reward asset class.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.