Should You Invest in stella crypto? A Full Analysis (2025)

An Investor’s Introduction to stella crypto

Stella crypto, officially known as Stellar Lumens (XLM), is a decentralized cryptocurrency that serves as the native digital asset for the Stellar network. Launched in 2014, Stellar aims to revolutionize the global financial system by providing a platform for fast, low-cost cross-border payments and financial services. It stands out in the cryptocurrency market as a leading player in the realm of decentralized finance (DeFi) and asset tokenization, enabling seamless transactions between different currencies and facilitating the issuance of digital assets.

The significance of Stella crypto lies in its unique approach to addressing the limitations of traditional financial systems. By leveraging blockchain technology, Stellar enables near-instantaneous transactions with minimal fees, making it an attractive solution for individuals and businesses looking to send money across borders efficiently. The network’s emphasis on accessibility and speed has garnered attention from financial institutions, non-profits, and developers, positioning it as a pivotal player in the future of global finance.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in understanding Stella crypto. We will delve into the technology that underpins the Stellar network, including its innovative consensus mechanism known as the Stellar Consensus Protocol (SCP). Additionally, we will explore the tokenomics of XLM, examining its supply, utility, and role within the ecosystem.

Investing in Stella crypto presents both opportunities and risks. This guide will outline the investment potential of XLM, discussing factors that may influence its price and market behavior. We will also address the inherent risks associated with investing in cryptocurrencies, including market volatility, regulatory changes, and technological challenges.

Finally, for those looking to enter the world of Stella crypto, we will provide a step-by-step guide on how to buy and store XLM securely. Whether you are a seasoned investor or just starting your journey into the cryptocurrency landscape, this guide will equip you with the knowledge needed to make informed decisions regarding Stella crypto and its place in your investment portfolio.

By the end of this guide, you will have a solid understanding of Stella crypto, its significance in the digital asset market, and the tools necessary to navigate your investment journey effectively.

What is stella crypto? A Deep Dive into its Purpose

Understanding Stella Crypto

Stella Crypto, often referred to simply as Stella, is a digital asset that operates on the Stellar blockchain network. The network itself is designed to facilitate cross-border payments and financial transactions at a speed and cost that is significantly more efficient than traditional banking systems. At the heart of Stella lies the need to improve financial access and connectivity across global markets, particularly for those who are unbanked or underbanked.

The Core Problem It Solves

One of the fundamental issues that Stella aims to address is the inefficiency of the current financial system, especially concerning cross-border transactions. Traditional banking methods can be slow, costly, and often exclude individuals and small businesses from participating in the global economy. High fees, long processing times, and limited access to banking services create significant barriers for many people, particularly in developing regions.

Stella leverages the Stellar network’s capabilities to enable near-instant global payments with low transaction costs. By utilizing the Stellar Consensus Protocol (SCP), which is fundamentally different from conventional Proof of Work or Proof of Stake mechanisms, Stella ensures that transactions are processed quickly and securely. SCP relies on a network of trusted validators, who do not require financial incentives to maintain the network, thereby fostering a more collaborative and accessible financial ecosystem.

Moreover, Stella’s functionality extends beyond simple payments. It supports the tokenization of real-world assets, allowing users to create and trade digital representations of physical assets, such as real estate or commodities. This tokenization not only enhances liquidity but also broadens the range of investment opportunities available to everyday users.

Its Unique Selling Proposition

Stella’s unique selling proposition lies in its blend of speed, cost-efficiency, and accessibility. The Stellar network can process thousands of transactions per second, with confirmation times often measured in just a few seconds. This level of efficiency is a game-changer for businesses and individuals who require rapid transactions, such as remittances or international trade payments.

Additionally, the low transaction fees associated with Stella make it an attractive option for users who may be deterred by the high costs of traditional banking. The Stellar network charges a fraction of a cent per transaction, making it feasible for small transactions that would otherwise be economically unviable in conventional systems.

Another distinguishing feature of Stella is its focus on real-world utility. The Stellar Development Foundation (SDF), which oversees the network, actively collaborates with various organizations and developers to create applications that solve real-world problems. For instance, partnerships with entities like MoneyGram enable users to convert cash to digital assets seamlessly, enhancing the accessibility of cryptocurrencies for individuals without banking services.

The Team and Backers

Stella is supported by the Stellar Development Foundation, a nonprofit organization established to promote financial inclusion and the adoption of the Stellar network. The foundation plays a crucial role in funding development projects, establishing partnerships, and providing resources for developers looking to build on the Stellar platform.

The team behind the Stellar Development Foundation includes experienced professionals from various fields, including finance, technology, and social impact. Notable figures include co-founder Jed McCaleb, who previously co-founded Ripple and is recognized for his significant contributions to the blockchain space. The diverse expertise of the team ensures that Stella is positioned to address the multifaceted challenges of global finance.

Moreover, the Stellar network has garnered backing from prominent investors and institutions, further validating its potential. The foundation has issued numerous grants to developers and organizations working on innovative solutions that utilize the Stellar network, fostering a vibrant ecosystem of applications and services.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Stella within the cryptocurrency ecosystem is to bridge the gap between traditional finance and blockchain technology. By focusing on enhancing financial access and efficiency, Stella aims to create a more inclusive global economy where individuals and businesses, regardless of their location or financial status, can participate in the financial system.

Stella also plays a crucial role in the growing decentralized finance (DeFi) landscape. With the introduction of smart contracts through the Soroban platform, Stella expands its capabilities to support a wide range of financial applications, including decentralized exchanges, lending protocols, and tokenized assets. This evolution aligns with the broader trend in the cryptocurrency space toward creating decentralized financial services that prioritize user control and accessibility.

In summary, Stella is not just another cryptocurrency; it represents a significant step toward reimagining how financial transactions can be conducted globally. By addressing the inefficiencies of traditional banking, promoting real-world asset tokenization, and empowering developers to create innovative solutions, Stella positions itself as a vital component of the future financial ecosystem. Its commitment to accessibility, speed, and cost-effectiveness underscores its potential to make a meaningful impact on the lives of millions around the world.

The Technology Behind the Coin: How It Works

Overview of Stellar

Stellar is a decentralized blockchain network designed to facilitate fast and low-cost cross-border payments. It was launched in 2014 with the mission to connect the world’s financial systems, enabling seamless transactions between different currencies. The network’s native cryptocurrency is Lumens (XLM), which is used primarily to pay transaction fees and as an intermediary currency for conversions. Stellar’s architecture and technology make it particularly suitable for various financial applications, including remittances, asset tokenization, and decentralized finance (DeFi).

Blockchain Architecture

Stellar operates on a decentralized, public blockchain that is designed to be scalable, efficient, and user-friendly. Unlike many other blockchain networks, Stellar aims to resemble cash transactions rather than typical cryptocurrency operations. This design philosophy is evident in its architecture, which includes the following components:

Nodes and Validators

The Stellar network consists of various nodes, each of which maintains a copy of the blockchain and participates in the consensus process. There are two main types of nodes in the Stellar network:

- Full Nodes: These nodes maintain a complete history of all transactions on the network and contribute to the validation process.

- Validator Nodes: These nodes play a crucial role in maintaining the network’s integrity. They participate in the consensus process, validating transactions and ensuring the network’s security.

Anchors

Anchors are trusted entities within the Stellar ecosystem that facilitate the exchange of currencies between the traditional financial system and the Stellar network. They serve as intermediaries that hold deposits in fiat currencies and issue corresponding digital tokens on the Stellar network. This setup enables users to convert their fiat currency into digital assets and vice versa, enhancing the accessibility of digital currencies.

Asset Issuance

One of the significant features of Stellar is its ability to issue various digital assets. This capability allows organizations and individuals to create tokens representing real-world assets, such as currencies, commodities, or even securities. The asset issuance framework is robust and compliant with regulatory standards, making Stellar a preferred choice for many institutions looking to tokenize their assets.

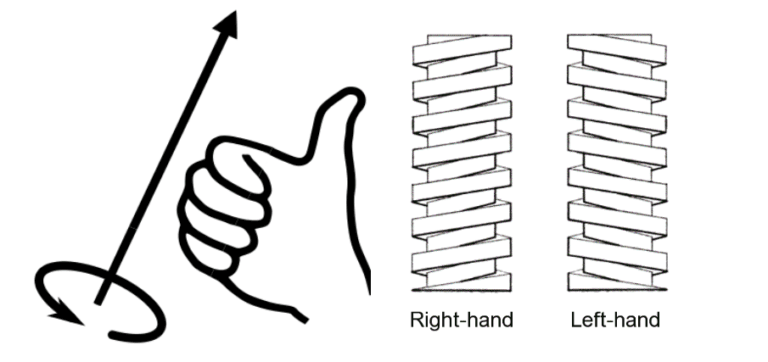

Consensus Mechanism

Stellar employs a unique consensus mechanism known as the Stellar Consensus Protocol (SCP). Unlike traditional consensus mechanisms like Proof-of-Work (PoW) or Proof-of-Stake (PoS), which rely on computational power or staked assets, SCP is designed to secure the network based on a system of trust and reputation.

How SCP Works

- Federated Byzantine Agreement (FBA): SCP is built on the principles of FBA, which allows nodes to reach consensus without relying on a single source of truth. Nodes can select a set of trusted validators (quorum slices) with whom they will agree on the validity of transactions.

- Reputation-Based Security: Validators are required to have publicly accessible and verifiable identities. This transparency builds trust within the network, as nodes can choose validators based on their reputation and reliability.

- No Financial Incentives: Unlike PoW and PoS, Stellar does not provide financial incentives to validators. Instead, they operate on the principle of network benefit, collaborating to reach consensus and ensure transaction validity.

This approach results in a fast and energy-efficient consensus process, with transaction finality achieved in just a few seconds.

Key Technological Innovations

Stellar has introduced several innovative technologies that enhance its functionality and usability. Some of the most notable innovations include:

Soroban Smart Contracts

Released in 2024, Soroban is Stellar’s smart contract platform designed specifically for financial applications. Built with Rust and WebAssembly, Soroban offers several advantages:

- Performance: Soroban prioritizes speed and efficiency, allowing complex operations to be executed quickly and predictably. It features deterministic concurrency, ensuring that operations are performed in a consistent manner without unexpected delays.

- Security: The platform benefits from Rust’s memory safety guarantees, reducing the risk of vulnerabilities. Soroban also employs a no-reentrancy design, which prevents certain types of attacks that could compromise the network’s integrity.

- Purpose-Built for Finance: Unlike general-purpose smart contract platforms, Soroban is tailored for financial applications, enabling the development of decentralized exchanges, lending protocols, and other financial services.

Cross-Border Payment Solutions

Stellar excels in facilitating cross-border payments by leveraging its unique transaction model. The network allows users to convert currencies quickly and efficiently. Here’s how it works:

- Currency Conversion: When a user wants to send money in one currency to a recipient in another currency, the Stellar protocol first converts the funds into XLM, its native cryptocurrency.

- Instant Transactions: The XLM is then instantly converted into the recipient’s desired currency. This two-step process enables transactions to be completed in just a few seconds, making Stellar an attractive option for remittances and international payments.

- Low Transaction Fees: Stellar’s transaction fees are minimal compared to traditional financial systems, making it a cost-effective solution for cross-border transactions.

Use Cases and Real-World Applications

Stellar’s technology has been adopted across various sectors, showcasing its versatility and real-world applicability. Here are a few notable use cases:

Remittances

Stellar is particularly well-suited for remittance services, allowing users to send money across borders quickly and affordably. This capability has attracted partnerships with companies like MoneyGram, enabling users to deposit and withdraw cash from their digital wallets at physical locations.

Asset Tokenization

Many institutions have turned to Stellar for asset tokenization, allowing them to bring real-world assets onto the blockchain. This process enhances liquidity, reduces transaction costs, and increases accessibility to a broader range of investors. For example, Franklin Templeton’s BENJI fund, the first U.S. registered money market fund on a public blockchain, is built on Stellar.

Decentralized Finance (DeFi)

With the introduction of Soroban, Stellar has expanded its capabilities to support a wide range of DeFi applications. Developers can now create platforms for decentralized exchanges, lending protocols, and other financial services that leverage Stellar’s efficiency and low transaction costs.

Conclusion

Stellar’s innovative technology and unique approach to blockchain make it a powerful player in the cryptocurrency landscape. Its focus on cross-border payments, asset tokenization, and decentralized finance positions it as a versatile solution for both individuals and institutions. By leveraging the Stellar Consensus Protocol and the Soroban smart contract platform, Stellar continues to enhance its capabilities and provide users with efficient, low-cost financial services. As the blockchain ecosystem evolves, Stellar’s commitment to connecting traditional finance with digital assets remains a key differentiator, driving its growth and adoption in the global market.

Understanding stella crypto Tokenomics

Tokenomics Overview

Tokenomics refers to the economic model and structure behind a cryptocurrency, detailing how tokens are created, distributed, and used within its ecosystem. For the Stellar network, which utilizes its native cryptocurrency, Lumens (XLM), understanding its tokenomics is crucial for both new and experienced investors. Stellar’s tokenomics is designed to facilitate low-cost, fast transactions, and enhance the accessibility of financial services worldwide.

| Metric | Value |

|---|---|

| Total Supply | 50 billion XLM |

| Max Supply | 50 billion XLM |

| Circulating Supply | 31.72 billion XLM |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The utility of XLM within the Stellar ecosystem is multi-faceted, serving both functional and economic purposes:

-

Transaction Fees: XLM is primarily used to pay for transaction fees on the Stellar network. This fee is minimal, usually just a fraction of a cent, which allows for efficient microtransactions—something that is essential for remittances and cross-border payments.

-

Cross-Border Transactions: One of Stellar’s core functionalities is facilitating cross-border payments. XLM acts as an intermediary currency, enabling the seamless exchange of different currencies. When a user sends money across borders, the transaction may first convert the funds into XLM and then to the recipient’s currency. This process not only accelerates transactions but also reduces costs compared to traditional banking methods.

-

Stability and Trust: By holding XLM, users can access more stable and predictable transaction costs. Given the fluctuating nature of cryptocurrency values, using XLM as a stable medium can help mitigate risks associated with price volatility during transactions.

-

Smart Contracts and DeFi: With the introduction of the Soroban smart contract platform, XLM can also be utilized in various decentralized finance (DeFi) applications. Users can engage in lending, borrowing, and trading activities that leverage the efficiency and security of Stellar’s blockchain.

-

Access to Financial Services: Stellar aims to enhance financial inclusion by providing users access to various financial services through its network. XLM facilitates this access by enabling users to convert their fiat currencies into digital assets and vice versa, thus connecting them to the global financial ecosystem.

Token Distribution

Understanding how XLM is distributed is critical for assessing its market dynamics and potential for future growth. Stellar’s distribution model aims for a fair and equitable allocation of tokens while maintaining network stability.

-

Initial Distribution: When Stellar launched in 2014, it initially issued 100 billion XLM. However, the Stellar Development Foundation (SDF) later decided to reduce the total supply to 50 billion XLM to enhance the token’s value and scarcity. This reduction was executed through a series of burns, where a portion of the tokens was permanently removed from circulation.

-

Distribution Strategy: The remaining 50 billion XLM is distributed with specific goals:

– Community and Ecosystem Development: A significant portion of XLM is allocated for community-building initiatives, partnerships, and grants to foster development on the Stellar network. This includes funding projects that increase the utility of Stellar and improve its ecosystem.

– Incentivizing Validators: While Stellar does not offer traditional financial incentives for validators, the network’s design encourages organizations to run nodes based on reputation and community benefit. This model helps maintain a decentralized network while promoting trust among participants. -

Market Dynamics: As of now, the circulating supply stands at approximately 31.72 billion XLM, accounting for around 63.4% of the total supply. This means that a significant portion of XLM is still held by the SDF and other stakeholders for future initiatives. The deflationary model, where new tokens are not being minted beyond the initial supply, suggests that the value of XLM could appreciate over time as demand grows and supply remains fixed.

-

Burn Mechanism: The SDF has committed to ongoing token burns as a way to manage inflation and maintain the token’s value. This strategy not only helps in reducing the circulating supply but also instills confidence among investors about the long-term viability of XLM as a digital asset.

-

Accessibility: Stellar’s anchor network provides on- and off-ramps for various fiat currencies, allowing users across the globe to easily access and use XLM. This accessibility is vital for the adoption of XLM in everyday transactions, particularly in developing regions where financial services are limited.

Conclusion

The tokenomics of Stellar’s XLM is thoughtfully designed to support its vision of connecting the world’s financial systems and promoting financial inclusion. By understanding its utility and distribution, investors can better navigate the opportunities and challenges presented by XLM. As the Stellar network continues to evolve with the integration of smart contracts and DeFi applications, the token’s role is likely to expand, offering new avenues for growth and utility within the broader digital asset ecosystem.

Price History and Market Performance

Key Historical Price Milestones

Stellar (XLM) has experienced significant price fluctuations since its inception in 2014. Understanding its historical price movements provides insights into the factors that have shaped its market performance over time.

-

Initial Launch and Early Years (2014-2017)

Stellar was launched in July 2014, initially priced at approximately $0.002. The cryptocurrency market was nascent, and XLM was relatively unknown. However, as the market began to gain traction, so did Stellar, reaching a price of around $0.01 by late 2015. The network’s focus on cross-border payments and partnerships with financial institutions started to draw attention. -

Bull Run of 2017

The year 2017 marked a significant turning point for Stellar. As Bitcoin and other cryptocurrencies entered a massive bull run, XLM followed suit. By January 2018, Stellar reached its all-time high of approximately $0.9381. This surge was fueled by increased interest in blockchain technology, initial coin offerings (ICOs), and a growing recognition of Stellar’s potential to facilitate cross-border transactions. -

Post-Bull Market Correction (2018-2019)

Following its all-time high, XLM, like many cryptocurrencies, faced a steep correction. By the end of 2018, the price had plummeted to around $0.12, marking a decline of over 87% from its peak. The market experienced a prolonged bear phase, and Stellar’s price remained relatively stagnant throughout 2019, fluctuating between $0.05 and $0.15. -

Gradual Recovery and Partnerships (2020-2021)

In 2020, the price began to recover, reaching around $0.16 by the end of the year. This recovery was partly driven by renewed interest in decentralized finance (DeFi) and the increasing adoption of blockchain technology. Stellar’s partnerships, particularly with companies like MoneyGram for cash-to-crypto services, contributed to its positive momentum. -

2021 Market Surge

The cryptocurrency market saw another bull run in 2021, with Stellar experiencing substantial growth. By May 2021, XLM reached prices of approximately $0.73. This period saw a surge in institutional interest and retail investments, contributing to the broader market’s bullish sentiment. -

Recent Trends (2022-2023)

The latter part of 2021 and into 2022 brought increased volatility. Prices fluctuated significantly, with XLM dropping to around $0.10 by early 2022 amidst a broader market correction and regulatory scrutiny of cryptocurrencies. As of October 2023, XLM is trading around $0.3582, with a market cap of approximately $11.36 billion. The price has seen a 1.32% increase over the past day, with a total supply of 50 billion XLM and a circulating supply of approximately 31.72 billion XLM.

Factors Influencing the Price

Historically, the price of Stellar has been influenced by a variety of factors, ranging from market trends to technological advancements and regulatory developments.

-

Market Sentiment and Trends

Like most cryptocurrencies, Stellar’s price is heavily influenced by overall market sentiment. Bull markets, characterized by rising prices and increased investor confidence, tend to lift XLM’s price along with other digital assets. Conversely, bear markets often lead to significant declines in price. Events such as Bitcoin’s price movements or regulatory news can trigger similar responses in the Stellar market. -

Technological Developments

The introduction of new features and upgrades to the Stellar network has also impacted its price. For instance, the launch of the Soroban smart contract platform in 2024 is expected to enhance Stellar’s functionality and attract new developers and projects. Such advancements can lead to increased demand for XLM as developers require the token for transaction fees. -

Partnerships and Use Cases

Strategic partnerships have played a critical role in Stellar’s adoption and price performance. Collaborations with financial institutions and companies like MoneyGram have expanded the network’s use cases, driving demand for XLM. The ability to facilitate low-cost, fast cross-border payments has positioned Stellar favorably in the competitive landscape of payment solutions. -

Regulatory Environment

Regulatory developments can significantly affect Stellar’s price. Positive regulatory news, such as the acceptance of cryptocurrencies by financial authorities, can lead to price surges. Conversely, negative news or crackdowns on crypto exchanges can result in sharp declines. As regulations evolve, they will continue to shape the landscape for Stellar and its market performance. -

Adoption of Real-World Assets

Stellar’s focus on tokenizing real-world assets (RWAs) has garnered interest from various sectors, including finance and logistics. The increased adoption of RWAs on the Stellar network can drive demand for XLM, as these assets often require the use of the native token for transactions and fees. -

Global Economic Conditions

Broader economic factors, such as inflation rates, currency devaluations, and economic crises, can also influence investor behavior towards cryptocurrencies. In times of economic uncertainty, cryptocurrencies, including Stellar, may be viewed as alternative stores of value or investment opportunities.

In conclusion, Stellar has experienced a dynamic price history influenced by market trends, technological advancements, partnerships, regulatory changes, adoption of real-world assets, and global economic conditions. Understanding these factors provides valuable insights for both beginner and intermediate investors looking to navigate the cryptocurrency landscape.

Where to Buy stella crypto: Top Exchanges Reviewed

15. Kraken – Ideal for Advanced Traders!

In this comprehensive review of the top 15 exchanges for purchasing Stellar Lumens, we provide an in-depth comparison of real-time prices, transaction fees, and available payment methods. Each exchange is evaluated based on user reviews, ensuring you can make an informed decision. This guide highlights standout features of each platform, helping both beginners and seasoned investors find the best option to acquire Stellar Lumens efficiently and securely.

- Website: cryptoradar.com

- Platform Age: Approx. 10 years (domain registered in 2015)

5. Stellar – The Future of Fast and Affordable Cross-Border Transactions!

Stellar for Exchanges offers a powerful blockchain infrastructure that distinguishes itself through its ability to facilitate fast, secure, and cost-effective transactions. By leveraging Stellar’s innovative technology, exchanges can enhance their operational efficiency and improve user experience, making it an appealing choice for digital asset trading. This platform not only supports a wide range of currencies but also enables seamless cross-border transactions, positioning Stellar as a leading solution in the competitive exchange landscape.

- Website: stellar.org

- Platform Age: Approx. 14 years (domain registered in 2011)

5. MoonPay – Easiest Way to Buy XLM!

MoonPay distinguishes itself as a user-friendly platform for purchasing Stellar (XLM) by providing multiple payment options, including credit/debit cards, bank transfers, Apple Pay, and Google Pay. This versatility enables users to quickly and conveniently acquire XLM, catering to both new and experienced investors. The streamlined process and diverse payment methods make MoonPay an attractive choice for those looking to enter the Stellar ecosystem.

- Website: moonpay.com

- Platform Age: Approx. 15 years (domain registered in 2010)

7. Stellar Exchange – Unlock the Best XLM Prices!

ChangeNOW stands out as a premier platform for exchanging Stellar (XLM) due to its competitive pricing, offering users the best exchange rates for XLM transactions. With a high rating of 4.8 from over 2,169 reviews, it provides a user-friendly experience with instant exchanges and no hidden fees. Additionally, ChangeNOW equips users with real-time Stellar price charts and educational resources, making it an excellent choice for both new and experienced investors looking to buy or sell XLM.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy stella crypto: A Step-by-Step Guide

Step 1: Choose a Cryptocurrency Exchange

The first step in purchasing Stella crypto (XLM) is to select a cryptocurrency exchange that supports it. There are many exchanges available, but it’s important to choose one that is reputable and user-friendly, especially if you are new to cryptocurrency. Here are a few popular options:

- Coinbase: Known for its user-friendly interface, Coinbase is a great option for beginners. It offers a simple way to buy, sell, and store cryptocurrencies.

- Binance: One of the largest exchanges in the world, Binance offers a wide variety of cryptocurrencies, including XLM. It has advanced trading features suitable for more experienced users as well.

- Kraken: Another reputable exchange, Kraken is known for its security features and wide range of available cryptocurrencies.

Before selecting an exchange, consider factors such as fees, supported payment methods, and geographical restrictions.

Step 2: Create and Verify Your Account

Once you have chosen an exchange, the next step is to create an account. Here’s how you can do that:

-

Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Create Account” button. You will need to provide your email address and create a password.

-

Verify Your Identity: Most exchanges require users to verify their identity to comply with regulations. You may need to provide personal information, including your name, address, and date of birth. Additionally, you may be asked to upload a government-issued ID (like a passport or driver’s license) and a proof of address (like a utility bill).

-

Enable Two-Factor Authentication (2FA): For added security, enable 2FA on your account. This typically involves linking your account to an authentication app on your smartphone, providing an extra layer of protection.

Step 3: Deposit Funds

After your account is verified, you will need to deposit funds to buy Stella crypto. Here’s how to do this:

-

Select Your Deposit Method: Most exchanges offer several deposit options, including bank transfers, credit/debit cards, and sometimes PayPal. Choose the method that suits you best.

-

Follow the Instructions: The exchange will provide instructions for making a deposit. If you’re using a bank transfer, it may take a few days for the funds to appear in your account. Credit/debit card deposits are usually instant.

-

Confirm Your Deposit: After initiating the deposit, check your account to ensure the funds have been credited.

Step 4: Place an Order to Buy Stella Crypto

Now that your account is funded, you can place an order to buy Stella crypto (XLM):

-

Navigate to the Trading Section: Look for the trading or market section on the exchange’s platform. You may find a search bar to look for XLM.

-

Choose Your Order Type: There are different types of orders you can place:

– Market Order: This order will buy XLM at the current market price. It is the simplest option for beginners.

– Limit Order: This allows you to set a specific price at which you want to buy XLM. Your order will only execute when the price reaches your specified limit. -

Enter the Amount: Specify how much XLM you want to buy. If you are using a market order, the exchange will show you the total cost based on the current market price.

-

Confirm Your Purchase: Review the details of your order and click “Buy” to complete the transaction. You should receive a confirmation once your order is executed.

Step 5: Secure Your Coins in a Wallet

After purchasing Stella crypto, it’s crucial to store your coins securely. While exchanges offer wallets, they are often less secure than personal wallets. Here are your options:

-

Use a Software Wallet: These are applications you can download on your computer or mobile device. Examples include Exodus and Atomic Wallet. They are user-friendly and suitable for beginners.

-

Use a Hardware Wallet: For maximum security, consider investing in a hardware wallet like Ledger or Trezor. These devices store your private keys offline, making it much harder for hackers to access your funds.

-

Transfer Your XLM: If you choose to use a software or hardware wallet, you will need to transfer your XLM from the exchange to your wallet. Find your wallet’s XLM address, go to the exchange, and select the option to withdraw or send funds. Enter your wallet address and the amount you want to transfer.

-

Confirm the Transfer: After initiating the transfer, check your wallet to ensure the coins have arrived. This may take a few minutes depending on network traffic.

By following these steps, you can successfully buy and secure Stella crypto (XLM). Always remember to do thorough research and consider the risks associated with cryptocurrency investments.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Innovative Technology and Use Cases

Stellar’s blockchain technology is designed for high efficiency and low transaction costs, making it particularly suitable for applications in cross-border payments and remittances. The network supports multi-currency transactions, allowing users to convert money almost instantly, which can significantly enhance financial accessibility for individuals and businesses in developing regions. This capability positions Stellar as a strong contender in the global payments landscape.

Moreover, the introduction of the Soroban smart contract platform enhances Stellar’s functionality, enabling developers to create sophisticated financial applications. This opens the door to decentralized finance (DeFi) solutions, further expanding its use cases beyond traditional payments. The emphasis on secure, efficient, and accessible financial services aligns with the growing demand for blockchain solutions in various industries.

2. Strong Partnerships and Institutional Adoption

Stellar has established notable partnerships, including collaborations with MoneyGram and the United Nations High Commissioner for Refugees (UNHCR). These partnerships highlight the network’s real-world applications and its potential to facilitate humanitarian efforts and improve financial inclusion. By enabling cash-to-crypto ramps, Stellar makes digital assets more accessible, potentially attracting a broader user base.

Additionally, the network has been selected by various institutions for asset tokenization and compliance, indicating trust and credibility within the financial sector. The ability to tokenize real-world assets (RWAs) positions Stellar as a vital player in the emerging market of digital assets, which is expected to grow significantly in the coming years.

3. Regulatory Compliance and Security

Stellar’s design emphasizes compliance and security, which are crucial factors for long-term success in the cryptocurrency space. The Stellar Consensus Protocol (SCP) employs a unique approach to network security that does not rely on financial incentives for validators, reducing the risk of malicious behavior. This consensus mechanism fosters a trustworthy environment, crucial for institutional adoption.

Furthermore, as regulatory scrutiny increases globally, Stellar’s focus on compliance could give it a competitive edge over other blockchain networks that may struggle to meet regulatory standards. This proactive stance towards regulation could attract institutions wary of potential legal ramifications associated with blockchain technology.

4. Market Position and Growth Potential

With a current market cap of approximately $11.36 billion and a circulating supply of 31.72 billion XLM, Stellar is well-positioned among the top cryptocurrencies. Its historical performance shows significant growth since its inception, with a peak price of $0.9381 in January 2018. While past performance is not indicative of future results, the potential for further adoption and increased use cases could drive future growth.

As the global economy continues to digitize, the demand for efficient payment solutions and DeFi applications is likely to increase. Stellar’s focus on facilitating these solutions positions it well to capitalize on this trend.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

The cryptocurrency market is notorious for its volatility, and Stellar is no exception. Price fluctuations can be dramatic, influenced by a variety of factors including market sentiment, macroeconomic events, and changes in regulatory environments. For investors, this volatility can pose significant risks, as rapid price declines can lead to substantial financial losses.

Moreover, the speculative nature of cryptocurrencies means that prices may not always reflect the underlying value of the technology or its potential applications. This can lead to exaggerated price swings that may deter conservative investors looking for stable investment opportunities.

2. Regulatory Uncertainty

While Stellar’s emphasis on compliance is a potential strength, the broader regulatory landscape for cryptocurrencies remains uncertain. Governments around the world are still developing frameworks to regulate digital assets, and changes in regulations can have profound impacts on the cryptocurrency market.

For instance, stricter regulations could limit the use of Stellar for certain applications or impose additional compliance costs on businesses operating within its ecosystem. Additionally, regulatory crackdowns on cryptocurrencies in major markets could diminish investor confidence, potentially impacting the price and adoption of XLM.

3. Competition

Stellar faces intense competition from other blockchain networks and financial technologies. Major players like Ripple, Ethereum, and newer entrants in the DeFi space are all vying for market share in cross-border payments and asset tokenization. Each of these platforms has its unique strengths and capabilities, which could attract users away from Stellar.

Furthermore, traditional financial institutions are increasingly exploring blockchain solutions, which could lead to the development of proprietary systems that compete directly with Stellar. The ability to differentiate itself and maintain a competitive edge will be critical for Stellar’s long-term success.

4. Technological Risks

While Stellar’s technology is designed for efficiency and security, it is not immune to potential technological risks. Issues such as network congestion, bugs in the code, or vulnerabilities in the consensus mechanism could lead to service disruptions or security breaches.

Additionally, as the network evolves and introduces new features like smart contracts, the complexity of the technology increases. This complexity may introduce unforeseen challenges or vulnerabilities that could affect user trust and adoption.

Moreover, the broader technological landscape is constantly evolving. New advancements in blockchain technology or shifts in consumer preferences could render Stellar’s current solutions less relevant, necessitating continuous innovation and adaptation to stay competitive.

Conclusion

Investing in Stellar (XLM) presents a mixed bag of potential opportunities and inherent risks. Its innovative technology, strong partnerships, and focus on compliance position it as a promising player in the evolving financial landscape. However, investors must also consider the volatility of the cryptocurrency market, regulatory uncertainties, competition from other blockchain networks, and the risks associated with technological changes.

As with any investment in cryptocurrency, it is crucial for investors to conduct thorough research, understand their risk tolerance, and stay informed about market developments. Engaging with the broader cryptocurrency community and utilizing educational resources can further aid in making informed investment decisions.

Frequently Asked Questions (FAQs)

1. What is Stellar (XLM) and how does it work?

Stellar (XLM) is a decentralized blockchain network designed to facilitate fast, low-cost international payments and currency exchanges. Launched in 2014, Stellar aims to connect financial systems globally, enabling users to send and receive money across borders efficiently. The network utilizes a unique consensus mechanism known as the Stellar Consensus Protocol (SCP), which allows for quick transaction validation without requiring extensive computational resources. Stellar’s native cryptocurrency, Lumens (XLM), is used to pay transaction fees and can also serve as an intermediary currency in transactions.

2. Who created Stellar (XLM)?

Stellar was founded by Jed McCaleb, who is also known for co-founding Ripple. The Stellar Development Foundation (SDF), a non-profit organization, was established to support the development and growth of the Stellar network. The SDF works to promote financial inclusion and accessibility, focusing on providing tools and resources to developers and organizations looking to leverage the Stellar blockchain.

3. What makes Stellar different from Bitcoin?

Stellar differs from Bitcoin in several key ways. Firstly, while Bitcoin is primarily a digital currency aimed at being a store of value and a means of peer-to-peer transactions, Stellar focuses on facilitating cross-border payments and connecting various financial systems. Stellar is designed for speed and low transaction costs, often completing transactions in seconds for a fraction of a cent. Additionally, Stellar uses the Stellar Consensus Protocol, which is based on a federated Byzantine agreement model, while Bitcoin relies on a Proof-of-Work consensus mechanism that requires significant energy consumption.

4. Is Stellar a good investment?

As with any investment, whether Stellar (XLM) is a good investment depends on individual financial goals, risk tolerance, and market conditions. While Stellar has shown promise due to its unique use case in facilitating international payments and its growing ecosystem of partnerships and applications, potential investors should conduct thorough research and consider market trends, historical performance, and the overall cryptocurrency landscape before making investment decisions.

5. How does Stellar support cross-border payments?

Stellar is particularly well-suited for cross-border payments due to its ability to handle multi-currency transactions efficiently. When a user sends money internationally, the Stellar network converts the funds into XLM, which acts as an intermediary, and then converts it into the desired currency. This process allows for near-instant transactions with low fees, making Stellar an attractive option for remittances and international financial services.

6. What are smart contracts on the Stellar network?

Smart contracts on the Stellar network are automated agreements that execute actions based on predefined conditions. Introduced with the Soroban platform in 2024, Stellar’s smart contracts are designed specifically for financial applications, enabling developers to build decentralized applications (dApps) that can handle complex financial operations. These smart contracts enhance the network’s capabilities by allowing for the creation of decentralized exchanges, lending protocols, and other financial services while maintaining Stellar’s core principles of efficiency and accessibility.

7. How is the Stellar network secured?

The Stellar network is secured through the Stellar Consensus Protocol (SCP), which relies on a reputation-based system rather than financial incentives. Unlike traditional Proof-of-Stake or Proof-of-Work systems, Stellar validators are not rewarded for their participation. Instead, they are trusted entities that work collaboratively to reach consensus on transaction validity. This design helps prevent double-spending and enhances overall network security, making it resilient against attacks.

8. Can Stellar (XLM) be used for tokenization of real-world assets?

Yes, Stellar is increasingly being used for the tokenization of real-world assets (RWAs). The network provides the necessary infrastructure for financial institutions to issue and manage digital representations of assets while maintaining regulatory compliance. Its low transaction costs and robust asset issuance framework have attracted significant interest from institutions looking to bring stablecoins, tokenized funds, and other financial products onto the blockchain, thus enabling innovative financial solutions that connect traditional finance with blockchain technology.

Final Verdict on stella crypto

Overview of Stellar Crypto

Stellar (XLM) is a decentralized blockchain network designed to enhance global financial access and streamline cross-border transactions. Launched in 2014, Stellar aims to connect diverse financial systems, making it easier for individuals and institutions to send and receive money across borders quickly and affordably. The network supports a variety of digital assets and facilitates near-instant transactions, positioning itself as a robust platform for remittances and international payments.

Technology and Features

At the heart of Stellar’s functionality is the Stellar Consensus Protocol (SCP), a unique consensus mechanism that relies on reputation rather than traditional mining or staking. This design enhances network security and efficiency, allowing for low-cost transactions with sub-five-second finality. With the introduction of Soroban, its smart contract platform, Stellar has expanded its capabilities to include decentralized finance (DeFi) applications, enabling developers to build a range of financial services that bridge traditional finance and blockchain technology.

Investment Potential

Stellar presents a promising opportunity for investors due to its real-world utility and partnerships with various institutions, including MoneyGram and the UNHCR. As the network continues to grow and adapt, it may play a significant role in the evolving landscape of digital finance. However, potential investors should be aware that investing in Stellar, like all cryptocurrencies, carries inherent risks. The cryptocurrency market is known for its volatility, and prices can fluctuate significantly based on market sentiment, regulatory changes, and technological developments.

Conclusion

In summary, Stellar crypto offers a compelling blend of innovative technology and real-world applications, making it an intriguing asset for those interested in the future of finance. However, it is crucial to recognize that investing in cryptocurrencies is a high-risk, high-reward endeavor. Therefore, we strongly encourage you to conduct your own thorough research (DYOR) before making any investment decisions. Understanding the fundamentals, market dynamics, and potential risks associated with Stellar will empower you to make informed choices in your investment journey.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.