Should You Invest in sei coin? A Full Analysis (2025)

An Investor’s Introduction to sei coin

Sei coin, represented by the ticker SEI, is a pioneering digital asset that has carved out a unique niche within the cryptocurrency landscape as the first sector-specific Layer 1 blockchain tailored for decentralized exchanges (DEXes). Launched with the goal of addressing the specific needs of trading platforms, Sei coin aims to enhance the efficiency, speed, and reliability of transactions, making it an attractive option for both developers and investors. Its architecture supports a high-performance environment, allowing for rapid transaction processing and low fees, which are essential for the fast-paced world of crypto trading.

As the cryptocurrency market continues to evolve, Sei coin has gained recognition for its innovative approach to tackling the inherent limitations faced by traditional blockchains. By employing parallelized execution, Sei can process transactions significantly faster than many existing networks, thus removing bottlenecks that often hinder performance. This capability is particularly vital in the context of DEXes, where even minor delays can result in substantial financial losses. Furthermore, Sei coin is compatible with Ethereum, allowing developers to seamlessly deploy smart contracts while enjoying enhanced performance.

This guide serves as a comprehensive resource for investors at all levels, from beginners to those with more experience in the cryptocurrency space. It aims to provide an in-depth understanding of Sei coin, covering various aspects such as its underlying technology, tokenomics, investment potential, associated risks, and practical steps for purchasing the asset.

Purpose of This Guide

The primary objective of this guide is to empower potential investors with the knowledge necessary to make informed decisions regarding Sei coin. We will explore the intricacies of Sei’s blockchain technology, including its security features and governance model. Additionally, we will analyze its market performance, providing insights into its price trends and future outlook.

Investing in cryptocurrencies involves risks, and Sei coin is no exception. Therefore, this guide will also address the potential risks associated with investing in Sei and offer strategies for mitigating those risks. Finally, we will provide a step-by-step process for buying Sei coin, ensuring that readers can navigate the investment landscape with confidence.

In summary, Sei coin represents a significant advancement in the blockchain space, particularly for decentralized trading platforms. This guide will equip you with the essential knowledge to understand and engage with this innovative digital asset effectively.

What is sei coin? A Deep Dive into its Purpose

Introduction to Sei Coin

Sei Coin (SEI) is a cryptocurrency that operates on the Sei blockchain, recognized as the first sector-specific Layer 1 blockchain designed explicitly for decentralized exchanges (DEXes). It aims to optimize the trading experience by addressing the unique challenges that DEXes face, such as speed, reliability, and scalability. Sei Coin is not only a native asset of the Sei blockchain but also plays a crucial role in facilitating transactions, governance, and participation within the Sei ecosystem.

The Core Problem It Solves

The rise of decentralized exchanges has transformed the cryptocurrency landscape, providing users with the ability to trade assets directly without intermediaries. However, DEXes have encountered significant hurdles due to the limitations of existing blockchain technologies. These challenges include:

-

Scalability: Most traditional blockchains struggle to handle the high transaction volumes generated by DEXes, leading to delays and increased costs.

-

Speed: In trading environments, transaction speed is critical. Any lag can result in financial losses for traders, making it essential for DEXes to operate with minimal latency.

-

Reliability: Unlike other blockchain applications, DEXes require continuous uptime. Even short downtimes can have catastrophic impacts on trading operations.

Sei addresses these challenges by providing a specialized infrastructure tailored to the needs of DEXes. The Sei blockchain is engineered to facilitate high-speed transactions, allowing for settlement times as quick as 400 milliseconds. This makes it particularly suitable for high-frequency trading applications, which are increasingly common in the cryptocurrency market.

Its Unique Selling Proposition

Sei’s unique selling proposition lies in its commitment to delivering a high-performance blockchain environment optimized for trading. Some of the standout features include:

-

Parallelized Execution: Sei employs a parallelized execution model, allowing it to process multiple transactions simultaneously. This significantly enhances throughput and reduces congestion, ensuring that trades are executed promptly.

-

Ethereum Compatibility: Sei maintains full compatibility with the Ethereum Virtual Machine (EVM), enabling developers to deploy existing Ethereum-based applications with minimal modifications. This compatibility opens the door for a wider range of projects and developers to leverage Sei’s capabilities.

-

Giga Upgrade: The upcoming Giga upgrade promises to enhance the blockchain’s throughput by 50 times, further optimizing execution, consensus, and storage. This upgrade is expected to elevate Sei’s performance to levels comparable to traditional web applications, making it a formidable competitor in the blockchain space.

-

Sustainability Focus: Sei is also committed to sustainability, aiming for carbon neutrality in its operations. This focus on environmental responsibility is becoming increasingly important in the crypto industry, and Sei’s initiative reflects a broader trend toward sustainable blockchain practices.

-

Community-Driven Governance: Sei empowers its community through its native governance token. Token holders can participate in governance decisions, shaping the future direction of the network. This approach fosters a sense of ownership and accountability among users.

The Team and Backers

Sei was co-founded by Dan Edlebeck and Jayendra Jog, both of whom possess extensive experience in the blockchain and cryptocurrency space. They recognized the pressing need for a blockchain that could cater specifically to the demands of decentralized exchanges. Their vision was to create a platform that not only solves existing issues but also propels the DEX ecosystem forward.

The Sei team has also garnered support from notable investors and partners, including Coinbase Ventures and Multicoin Capital. Such backing not only lends credibility to the project but also provides the necessary resources for development and growth. These partnerships are vital for Sei’s strategic expansion and innovation, allowing it to tap into broader networks and expertise within the blockchain community.

Fundamental Purpose in the Crypto Ecosystem

Sei’s fundamental purpose is to serve as a robust foundation for decentralized finance (DeFi) applications, particularly those centered around trading. By addressing the specific needs of DEXes, Sei aims to enhance the overall efficiency and reliability of trading activities within the cryptocurrency ecosystem. Its design not only facilitates the trading of cryptocurrencies but also supports various financial products, such as derivatives and asset management solutions.

The blockchain’s architecture is tailored to accommodate a wide range of financial applications, making it attractive to both developers and financial institutions. By focusing on the trading sector, Sei positions itself as a critical player in the DeFi landscape, fostering innovation and driving adoption.

Moreover, Sei’s commitment to community involvement through governance and its transparent operations ensures that it remains aligned with the needs and interests of its users. This community-driven approach is essential in the rapidly evolving crypto space, where user engagement and feedback can significantly impact a project’s success.

Conclusion

In summary, Sei Coin represents a significant advancement in blockchain technology tailored specifically for decentralized exchanges. By solving core problems related to scalability, speed, and reliability, Sei positions itself as a vital infrastructure for the future of trading in the cryptocurrency ecosystem. With a strong team, strategic partnerships, and a commitment to community governance and sustainability, Sei Coin is poised to make a lasting impact on the DeFi landscape. As the cryptocurrency market continues to evolve, Sei’s focus on optimizing trading processes will play a crucial role in enhancing user experience and driving broader adoption of decentralized finance.

The Technology Behind the Coin: How It Works

Understanding Sei Coin’s Technology

Sei Coin is a cutting-edge Layer 1 blockchain specifically designed to optimize decentralized exchanges (DEXes). Its architecture and technological innovations address the unique challenges faced by trading platforms, such as speed, scalability, and reliability. In this guide, we will delve into the key components that make Sei Coin a powerful tool for developers and traders alike.

Blockchain Architecture

Sei operates on a Layer 1 blockchain architecture, which means it is built as an independent blockchain rather than relying on another chain (like Ethereum). This architecture is tailored to meet the demands of high-frequency trading applications, particularly DEXes. Here are some of the key aspects of Sei’s blockchain architecture:

1. Parallelized Execution

One of the standout features of Sei is its parallelized execution capability. Traditional blockchains process transactions in a sequential manner, which can lead to bottlenecks and slower transaction speeds. In contrast, Sei allows multiple transactions to be processed simultaneously. This significantly increases throughput and reduces transaction times, making it ideal for environments where speed is crucial.

2. Ethereum Compatibility

Sei is fully compatible with the Ethereum Virtual Machine (EVM), which means that developers can easily deploy existing Ethereum-based smart contracts on the Sei platform. This compatibility facilitates a smoother transition for developers looking to take advantage of Sei’s superior performance without having to rewrite their code.

3. Sector-Specific Design

Sei is the first sector-specific Layer 1 blockchain aimed at optimizing trading processes. By focusing on the unique requirements of DEXes, Sei eliminates inefficiencies and enhances performance metrics that are vital for trading applications. This specialization allows Sei to deliver unparalleled reliability and speed, setting it apart from more general-purpose blockchains.

Consensus Mechanism

Sei uses a consensus mechanism designed to enhance security and performance. While the specifics of Sei’s consensus model may evolve, understanding its general principles is essential.

1. Proof-of-Stake (PoS)

Sei utilizes a Proof-of-Stake (PoS) consensus mechanism, which is more energy-efficient than traditional Proof-of-Work (PoW) systems. In PoS, validators are chosen to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. This model encourages participants to act honestly, as malicious behavior can lead to the loss of their staked tokens.

2. Transaction Finality

Sei’s consensus mechanism provides fast transaction finality, meaning that once a transaction is confirmed, it cannot be reversed. This is particularly important for trading platforms, where the risk of double-spending or transaction reversal can have significant financial implications. Fast finality ensures that trades are executed reliably and without the risk of disputes.

Key Technological Innovations

Sei is not just about being fast; it also introduces several technological innovations that enhance its functionality and user experience.

1. Giga Upgrade

The upcoming Giga upgrade is a major enhancement planned for Sei. This upgrade aims to deliver a 50x improvement in EVM throughput, optimizing the execution of smart contracts, consensus processes, and storage capabilities. Such enhancements will push Sei’s performance closer to traditional web applications, making it capable of handling high-frequency trading scenarios with ease.

2. Customizable Order Types

Sei allows developers to create and implement customizable order types within their DEXes. This flexibility enables trading platforms to offer innovative features such as limit orders, market orders, and stop-loss orders, enhancing the overall trading experience for users. By providing these options, Sei empowers developers to cater to the diverse needs of traders.

3. On-Chain Order Matching

Unlike many existing DEXes that rely on off-chain solutions for order matching, Sei offers on-chain order matching capabilities. This means that orders are matched directly on the blockchain, reducing latency and increasing the speed at which trades can be executed. This feature is particularly beneficial for high-frequency trading, where every millisecond counts.

4. Low Transaction Fees

Sei’s efficient architecture allows for lower transaction fees compared to many other blockchains. This is crucial for traders who often execute multiple transactions in quick succession. By minimizing costs, Sei makes trading more accessible and appealing, especially for retail investors.

Security Features

Security is a paramount concern for any blockchain, especially one focused on financial applications. Sei incorporates several features to ensure the integrity and safety of its network.

1. Robust Validator Network

Sei’s PoS mechanism relies on a network of validators who are incentivized to maintain the integrity of the blockchain. The more reputable validators there are, the more secure the network becomes. This decentralization reduces the risk of a single point of failure and enhances overall security.

2. Transparent Governance

Sei employs a transparent governance model that allows token holders to participate in decision-making processes. This community-driven approach ensures that the network evolves according to the needs and desires of its users, fostering a sense of ownership and responsibility among stakeholders.

3. Continuous Auditing and Monitoring

To maintain a secure environment, Sei conducts continuous auditing and monitoring of its protocols and smart contracts. This proactive approach helps identify and mitigate potential vulnerabilities before they can be exploited, ensuring that the network remains robust against attacks.

Use Cases

Sei’s technology opens up a wide range of use cases that extend beyond traditional trading platforms. Here are a few examples:

1. Decentralized Exchanges (DEXes)

As the primary focus of Sei, DEXes benefit immensely from its high throughput, low fees, and customizable order types. This makes Sei an attractive option for developers looking to launch or enhance their trading platforms.

2. Financial Instruments

Sei’s architecture is well-suited for the creation of complex financial instruments, such as derivatives and synthetic assets. By providing a secure and efficient environment for these products, Sei can facilitate more sophisticated trading strategies.

3. NFT Marketplaces

The scalability and speed of Sei also make it a viable choice for NFT marketplaces, where rapid transactions and low fees are essential for user satisfaction. Developers can leverage Sei’s capabilities to create engaging and efficient platforms for buying, selling, and trading NFTs.

Conclusion

Sei Coin stands out in the cryptocurrency landscape due to its innovative technology and focus on the unique needs of decentralized exchanges. Its parallelized execution, PoS consensus mechanism, and sector-specific design create an environment optimized for high-frequency trading and financial applications. As Sei continues to evolve and implement upgrades, it promises to be a pivotal player in the future of decentralized finance (DeFi). Whether you’re a developer looking to build on its platform or an investor interested in its potential, understanding the technology behind Sei is essential for navigating the rapidly changing world of cryptocurrency.

Understanding sei coin Tokenomics

Sei Coin Tokenomics

Tokenomics refers to the economic model behind a cryptocurrency, detailing how the tokens are distributed, their utility, and the mechanisms that govern their supply and demand. In the case of Sei Coin (SEI), understanding its tokenomics is crucial for both potential investors and users of the Sei network. Below, we will explore key metrics related to Sei Coin’s tokenomics, its utility, and the distribution of its tokens.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 10 billion SEI |

| Max Supply | Not specified |

| Circulating Supply | 6 billion SEI |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

Sei Coin serves multiple purposes within its ecosystem, primarily designed to enhance the functionality of decentralized exchanges (DEXes). Here are the main utilities of SEI:

-

Transaction Fees: SEI tokens are used to pay for transaction fees on the Sei network. This includes fees for executing trades on DEXes built on the platform. By using SEI for transaction fees, users help maintain the network’s functionality and security.

-

Staking: SEI tokens can be staked by holders to earn rewards. Staking not only allows users to generate passive income but also contributes to the network’s security and consensus mechanism. When users stake their SEI, they participate in the network’s operations, which enhances the overall reliability of the platform.

-

Governance: SEI token holders have a voice in the governance of the Sei network. This includes participating in decision-making processes regarding upgrades, changes to the protocol, and other critical governance issues. This feature promotes a community-driven approach, ensuring that the network evolves in alignment with the interests of its users.

-

Incentives for Developers: Sei aims to foster a robust ecosystem of decentralized applications (dApps) and services. Developers can utilize SEI tokens as incentives for building and deploying applications on the Sei network. This encourages innovation and enhances the overall utility of the Sei platform.

-

Access to Financial Products: As a foundational layer for various financial applications, SEI tokens can be used to access a range of financial products, including derivatives and asset management solutions. This broad utility positions SEI as a crucial element in the growing decentralized finance (DeFi) landscape.

Token Distribution

The distribution of SEI tokens is designed to ensure a balanced allocation that promotes long-term growth and sustainability of the Sei network. Here are some key aspects of token distribution:

-

Initial Distribution: A portion of the total supply was allocated to early investors and partners to incentivize their support and involvement in the network’s development. This initial distribution is often crucial for establishing a strong foundation for the project.

-

Community Incentives: Sei has initiatives in place to distribute tokens to the community, such as airdrops and rewards for participation in network activities. These distributions are aimed at fostering community engagement and ensuring that a significant portion of the token supply is in the hands of active users.

-

Ecosystem Growth: A portion of the total supply is reserved for ecosystem development. This includes funding for developers, partnerships, and marketing initiatives. By allocating tokens for ecosystem growth, Sei aims to create a vibrant environment that attracts new users and projects to the platform.

-

Team and Advisors: A part of the token supply is allocated to the founding team and advisors. This allocation is typically subject to a vesting schedule to ensure that the team remains committed to the project’s long-term success.

-

Treasury and Reserves: Sei maintains a treasury that can be used for various purposes, including future developments, operational costs, and unforeseen challenges. This reserve plays a crucial role in ensuring the network’s sustainability and ability to adapt to changing market conditions.

Conclusion

Understanding the tokenomics of Sei Coin is essential for anyone looking to engage with the Sei network, whether as an investor or a user. With a clear utility model, diverse applications, and a structured distribution strategy, Sei Coin is positioned to play a significant role in the evolving landscape of decentralized finance. As always, potential investors should conduct thorough research and consider the inherent risks associated with cryptocurrency investments.

Price History and Market Performance

Overview of Sei Coin’s Market Performance

Sei Coin (SEI) is a high-performance Layer 1 blockchain designed specifically for decentralized exchanges (DEXes). Since its launch, it has gained attention for its unique approach to solving scalability and speed issues in the cryptocurrency space. Understanding its price history and market performance provides valuable insights for both new and experienced investors.

Key Historical Price Milestones

Sei Coin was launched in August 2023, during which it reached an all-time low of approximately $0.007989 on August 15, 2023. This low price point was common for newly launched cryptocurrencies, as they often experience volatility as they establish their market presence.

Following its initial launch, Sei Coin demonstrated remarkable growth. By March 16, 2024, it reached its all-time high of $1.14. This surge in price can be attributed to several factors, including increased adoption of the Sei platform, positive community engagement, and significant technological advancements, such as the Sei v2 upgrade. This upgrade aimed to enhance the platform’s scalability and transaction speed, making it more appealing to developers and users alike.

As of now, Sei Coin’s price is approximately $0.2954, reflecting a 74.12% decline from its all-time high. Despite this decrease, it has shown substantial growth from its initial price, illustrating the volatile yet potentially rewarding nature of investing in cryptocurrencies.

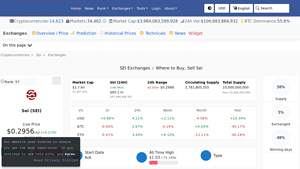

Price Fluctuations and Market Capitalization

Sei Coin’s market capitalization has experienced notable fluctuations over time. At its peak, the market cap reached around $1.77 billion, positioning it among the top cryptocurrencies by market cap, currently ranked at #56 on CoinMarketCap. The trading volume has also varied, with recent data indicating a 24-hour trading volume of approximately $122.07 million. This level of trading activity demonstrates ongoing interest from traders and investors.

The circulating supply of Sei Coin is currently 6 billion SEI tokens, out of a total supply of 10 billion. This limited supply can impact price dynamics, particularly during periods of high demand or significant news related to the project.

Factors Influencing the Price

Historically, the price of Sei Coin has been influenced by several key factors:

1. Technological Developments

Sei Coin’s unique selling proposition lies in its architecture tailored for DEXes. The platform’s upgrades, including the anticipated Giga upgrade, have played a crucial role in price movements. Improvements in transaction speed and scalability directly enhance user experience, attracting more developers and traders to the platform.

2. Market Sentiment

The overall sentiment in the cryptocurrency market significantly impacts Sei Coin’s price. During bullish phases in the broader market, Sei has often seen substantial price increases, reflecting investor enthusiasm for blockchain technologies. Conversely, during bearish trends, Sei’s price has also suffered, indicative of the correlation between its performance and the overall crypto market.

3. Community Engagement

The establishment of the Sei Marines community has been pivotal in driving engagement and awareness. Community-led initiatives, such as educational programs and promotional events, have helped solidify a loyal user base, fostering a positive perception of the project and contributing to price stability and growth.

4. Partnerships and Collaborations

Strategic partnerships have also influenced Sei’s market performance. Collaborations with well-known entities in the crypto space, such as Coinbase Ventures and Multicoin, have bolstered confidence in Sei’s potential. Such endorsements can lead to increased visibility and investment, impacting the price positively.

5. Regulatory Developments

As with any cryptocurrency, regulatory news can significantly affect Sei Coin’s price. Announcements regarding changes in regulations, especially those concerning decentralized finance (DeFi) and DEXes, can lead to price volatility. Positive regulatory developments tend to boost investor confidence, whereas negative news can trigger sell-offs.

6. Market Events

Significant market events, such as major crypto conferences or technological showcases, can lead to spikes in interest and investment in Sei Coin. Events that highlight Sei’s unique features or advancements can result in increased trading volumes and price appreciation.

Conclusion

In summary, Sei Coin has experienced a dynamic price history characterized by significant milestones and fluctuations. Its performance has been shaped by technological advancements, community engagement, market sentiment, and broader regulatory landscapes. As Sei continues to evolve, its historical price trends provide a foundation for understanding its potential within the competitive cryptocurrency market. Investors are encouraged to conduct thorough research and consider these historical factors when evaluating Sei Coin as a potential investment.

Where to Buy sei coin: Top Exchanges Reviewed

5. Kraken – Your Easy Gateway to Buying SEI Today!

Kraken’s guide to buying SEI highlights the exchange’s user-friendly approach, allowing users to start investing with as little as $10. It supports various payment methods, including credit/debit cards, ACH deposits, and mobile payment options like Apple and Google Pay, enhancing accessibility for both beginners and experienced investors. Kraken’s commitment to security and regulatory compliance further distinguishes it as a trusted platform for purchasing digital assets.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. Sei (SEI) – Your Gateway to Fast and Efficient Trading!

Sei (SEI) is gaining traction in the cryptocurrency market, with over 41 exchanges facilitating its trading. Notably, leading platforms like Binance, Gate, and Phemex stand out for their robust trading features and liquidity, making them ideal choices for buying, selling, and trading Sei. These exchanges offer a seamless experience for users, ensuring access to the latest market trends and competitive pricing for this emerging digital asset.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. ChangeNOW – Best for Seamless SEI Swaps!

ChangeNOW stands out as a premier platform for exchanging SEI, boasting an impressive 4.8 rating from over 2,166 users. It offers competitive pricing and a user-friendly interface, making it easy for both beginners and experienced traders to buy and sell SEI. With real-time market data, including live charts and market cap information, ChangeNOW ensures that users are well-informed throughout their trading experience, all without any fees.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

7. Sei (SEI) – Your Ultimate Guide to Seamless Buying!

The guide on Bitcompare offers a comprehensive overview of purchasing Sei (SEI), highlighting key exchanges like Bake, BingX, Bitfinex, and Bitget, all featuring the same competitive price of $0.28. What sets this guide apart is its step-by-step approach, making it accessible for both beginners and experienced investors. Additionally, it emphasizes the importance of selecting the right exchange, ensuring users can navigate the buying process with confidence and ease.

- Website: bitcompare.net

- Platform Age: Approx. 6 years (domain registered in 2019)

How to Buy sei coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Sei Coin (SEI) is selecting a cryptocurrency exchange that supports SEI trading. Some popular exchanges that list Sei Coin include Binance, KuCoin, and Bybit. When choosing an exchange, consider the following factors:

- Reputation: Look for exchanges with a strong reputation for security and customer service.

- Fees: Compare transaction and withdrawal fees across different platforms.

- Liquidity: Higher liquidity means you can buy and sell more easily without affecting the price.

- User Experience: Consider the interface and usability of the exchange, especially if you’re a beginner.

Once you’ve selected an exchange, you can proceed to create your account.

2. Create and Verify Your Account

After selecting an exchange, you will need to create an account:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button.

- Enter Information: Fill in the required personal information, such as your email address, password, and any other necessary details.

- Email Verification: Most exchanges will send a verification email. Click on the link in the email to verify your account.

- Identity Verification: To comply with regulations, exchanges often require you to complete KYC (Know Your Customer) verification. This may involve uploading identification documents such as a passport or driver’s license and possibly a proof of address (like a utility bill).

- Two-Factor Authentication (2FA): For added security, enable 2FA. This typically involves linking your account to an app like Google Authenticator, which generates a unique code for logging in.

3. Deposit Funds

Once your account is verified, you need to deposit funds to buy Sei Coin:

- Log In: Sign into your account on the exchange.

- Navigate to the Deposit Section: Look for a “Deposit” or “Funds” section in your account dashboard.

- Choose a Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit card, or cryptocurrency transfer. Choose the method that suits you best.

- Follow Instructions: Follow the specific instructions provided by the exchange for your chosen deposit method. If you are using a bank transfer or card payment, you may need to enter your banking details or card information.

- Confirm Deposit: After completing the deposit, check your account balance to ensure the funds have been credited. This may take some time depending on the method used.

4. Place an Order to Buy Sei Coin

Now that you have funds in your account, you can buy Sei Coin:

- Navigate to the SEI Trading Pair: Go to the trading section of the exchange and find the SEI trading pair (e.g., SEI/USD, SEI/USDT).

- Select the Type of Order: You can usually choose between different types of orders:

– Market Order: Buy Sei Coin at the current market price.

– Limit Order: Set a specific price at which you want to buy Sei Coin. The order will only execute if the market reaches that price. - Enter the Amount: Specify how much Sei Coin you want to buy. If you are using a market order, the exchange will show you how much you will spend.

- Review and Confirm: Double-check the details of your order (amount, price, total cost) before confirming.

- Complete the Purchase: Click on the “Buy” button to execute your order. You should see the Sei Coin in your account shortly after.

5. Secure Your Coins in a Wallet

After purchasing Sei Coin, it’s crucial to secure your investment:

- Choose a Wallet: Decide whether you want to use a hot wallet (online) or a cold wallet (offline). A cold wallet, such as a hardware wallet, is generally more secure.

- Create Your Wallet: If you choose a hot wallet, sign up for a wallet service. For cold wallets, purchase and set up the device according to the manufacturer’s instructions.

- Transfer Your SEI: Go to the exchange and navigate to the withdrawal section. Enter your wallet address and the amount of Sei Coin you want to transfer.

- Confirm the Transfer: Review the withdrawal details and confirm the transaction. Always double-check the wallet address to avoid errors.

- Monitor Your Wallet: After the transfer, monitor your wallet to ensure that the Sei Coin has arrived safely.

By following these steps, you can successfully buy and secure Sei Coin, setting the foundation for your cryptocurrency investment journey. Always remember to conduct thorough research and stay informed about market trends as you navigate the world of digital assets.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Sei Coin (SEI) is positioned as a high-performance Layer 1 blockchain specifically designed to enhance decentralized exchanges (DEXes). Its unique architecture and capabilities present several potential strengths that could attract investors and users alike.

1. Specialized Blockchain for DEXes

Sei is the first sector-specific Layer 1 blockchain, tailored to meet the unique demands of decentralized exchanges. Unlike general-purpose blockchains, Sei’s design focuses on optimizing trading processes, which could provide a significant competitive advantage in the rapidly evolving DeFi landscape. By addressing the specific needs of DEXes, Sei aims to enhance transaction speeds, reduce latency, and improve overall reliability.

2. High Transaction Speed and Low Fees

One of Sei’s standout features is its ability to process transactions at remarkable speeds, reportedly settling in as little as 400 milliseconds. This rapid transaction capability is crucial for DEXes, where timing can significantly affect trading outcomes. Additionally, Sei aims to maintain low transaction fees, making it an attractive option for traders and developers looking to minimize costs.

3. Upcoming Technological Upgrades

The anticipated Giga upgrade promises to enhance Sei’s performance by increasing EVM throughput by up to 50 times. This upgrade is expected to optimize execution, consensus, and storage, pushing the platform’s performance closer to that of traditional Web2 applications. Such advancements could attract more developers and users, thereby increasing the utility and adoption of Sei.

4. Strong Community Engagement

Sei’s founders have emphasized building a robust community through initiatives like the Sei Marines community. Engaging users and fostering a sense of belonging can lead to a loyal user base, which is essential for the long-term success of any blockchain project. A strong community can also drive grassroots marketing and adoption, further enhancing Sei’s visibility in the market.

5. Commitment to Sustainability

Sei’s focus on sustainability and carbon neutrality aligns with the growing trend in the crypto space towards environmental responsibility. This commitment can appeal to environmentally conscious investors and users, potentially increasing the platform’s attractiveness in a market that is increasingly scrutinizing the environmental impact of blockchain technologies.

6. Strategic Partnerships and Institutional Support

Sei has garnered attention and support from notable entities within the cryptocurrency space, including endorsements from Coinbase Ventures and Multicoin. Such backing can provide additional credibility, attract further investment, and facilitate strategic partnerships that can enhance Sei’s ecosystem.

7. Diverse Use Cases

Beyond facilitating trading, Sei aims to support a wide range of financial applications, including derivatives and asset management solutions. This versatility could broaden the appeal of Sei to institutional investors and developers seeking a robust platform for various financial activities.

Potential Risks and Challenges (The Bear Case)

While Sei Coin presents several strengths, potential investors must also consider the associated risks and challenges that could impact its success and market performance.

1. Market Volatility

The cryptocurrency market is notorious for its volatility, which can affect the price and adoption of Sei. Sudden price fluctuations can lead to investor panic, resulting in rapid sell-offs and decreased market confidence. Such volatility can be exacerbated by external factors, including macroeconomic trends, regulatory news, or changes in market sentiment.

2. Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies is still evolving, with governments worldwide grappling with how to regulate digital assets. Increased scrutiny and potential regulations could pose significant risks to Sei and other cryptocurrencies. For instance, unfavorable regulatory changes could hinder Sei’s operations, limit its user base, or impose additional compliance costs.

3. Competition from Other Blockchains

Sei operates in a highly competitive environment, with numerous Layer 1 and Layer 2 solutions vying for dominance in the DeFi space. Established platforms like Ethereum, Binance Smart Chain, and newer entrants may pose significant competition. The ability of Sei to attract developers and users away from these platforms will be critical for its growth and long-term viability.

4. Technological Risks

Sei’s reliance on advanced technology, including its unique parallelized execution model, introduces inherent risks. Any bugs, vulnerabilities, or failures in the underlying technology could lead to severe consequences, including loss of funds or operational downtime. Moreover, as Sei continues to develop and implement upgrades, the potential for unforeseen technical challenges increases.

5. Dependence on DEX Market Dynamics

Sei’s success is closely tied to the performance and adoption of decentralized exchanges. If the DEX market experiences downturns or fails to grow as anticipated, Sei could face significant challenges. Factors such as user preference for centralized exchanges, security concerns, or market saturation could impede Sei’s growth prospects.

6. Limited Historical Data

As a relatively new player in the cryptocurrency space, Sei has limited historical data regarding its price performance and market behavior. This lack of a track record can make it difficult for potential investors to gauge future performance and assess the risks accurately. Investors may find it challenging to make informed decisions without established benchmarks for comparison.

7. Governance and Decision-Making Risks

Sei’s governance structure, which allows token holders to participate in decision-making, can introduce risks related to community dynamics and decision-making efficiency. Disagreements within the community or a lack of active participation could hinder the platform’s development and responsiveness to market needs.

Conclusion

Sei Coin offers a compelling proposition as a specialized Layer 1 blockchain designed for decentralized exchanges, boasting high performance, low fees, and a commitment to sustainability. However, potential investors should remain aware of the inherent risks associated with market volatility, regulatory uncertainty, competition, and technological challenges. A balanced understanding of these factors is essential for making informed investment decisions in the dynamic and rapidly evolving cryptocurrency landscape. As always, thorough research and due diligence are paramount before engaging with any digital asset.

Frequently Asked Questions (FAQs)

1. What is Sei Coin?

Sei Coin (SEI) is the native cryptocurrency of the Sei blockchain, a high-performance Layer 1 blockchain specifically designed for decentralized exchanges (DEXes). It aims to enhance the efficiency and reliability of trading platforms by providing a sector-specific solution that addresses the unique demands of DEXes, such as speed, scalability, and low transaction fees. Sei utilizes parallelized execution to enable faster transactions and seamless smart contract deployment, making it suitable for high-frequency trading applications.

2. Who created Sei Coin?

Sei Coin was co-founded by Dan Edlebeck and Jayendra Jog. They recognized the challenges that decentralized exchanges face in terms of reliability and performance. Their goal was to create a blockchain infrastructure that specifically caters to the needs of trading platforms, thus empowering DEXes and improving the overall cryptocurrency trading experience.

3. What makes Sei Coin different from Bitcoin?

Sei Coin and Bitcoin serve very different purposes within the cryptocurrency ecosystem. Bitcoin is primarily a store of value and a digital currency, designed for peer-to-peer transactions and as a hedge against inflation. In contrast, Sei Coin is a specialized Layer 1 blockchain focused on facilitating high-speed trading and supporting decentralized applications, particularly DEXes. Sei is designed to handle a high volume of transactions quickly, which is essential for trading, while Bitcoin prioritizes security and decentralization.

4. Is Sei Coin a good investment?

As with any cryptocurrency investment, the potential for profit comes with inherent risks. Sei Coin has gained attention due to its innovative approach to optimizing decentralized exchanges, which could position it well within the growing DeFi (Decentralized Finance) landscape. Investors should consider factors such as market demand, technological advancements, and the overall performance of the Sei ecosystem. It’s crucial to conduct thorough research and assess your risk tolerance before investing in Sei Coin or any other digital asset.

5. How does Sei Coin enhance decentralized exchanges?

Sei Coin enhances decentralized exchanges by providing a specialized blockchain infrastructure that addresses the unique challenges faced by DEXes. Its parallelized execution allows for faster transaction processing and reduced latency, which is critical for trading activities. Additionally, Sei’s architecture supports seamless smart contract deployment, enabling developers to create innovative financial products and services that can operate efficiently on the platform.

6. What is the current market performance of Sei Coin?

As of now, Sei Coin (SEI) is trading at approximately $0.2954, with a market capitalization of around $1.77 billion. The circulating supply stands at about 6 billion SEI tokens, with a total supply of 10 billion. Sei Coin has experienced significant price fluctuations, having reached an all-time high of $1.14 and an all-time low of $0.007989. Investors should monitor market trends and trading volumes to make informed decisions.

7. How is Sei Coin secured?

Sei Coin’s security is built on a robust Layer 1 blockchain architecture that is specifically tailored for trading applications. It employs advanced security protocols and governance models that emphasize transparency and community involvement. The platform’s design focuses on enhancing transaction reliability and speed, which are crucial for DEX operations. By integrating battle-tested components and fostering a strong developer community, Sei aims to create a secure environment for all participants.

8. What are the future developments planned for Sei Coin?

Sei Coin has several upcoming developments aimed at enhancing its ecosystem. One notable event is the Giga upgrade, which is expected to deliver significant improvements in transaction throughput and overall performance. This upgrade aims to optimize execution, consensus, and storage, pushing Sei’s capabilities closer to those of traditional web applications. Additionally, Sei continues to foster community engagement and strategic partnerships, which are essential for driving innovation and growth within the platform.

Final Verdict on sei coin

Overview of Sei Coin

Sei coin (SEI) is a native digital asset of the Sei blockchain, a high-performance Layer 1 platform specifically designed to optimize decentralized exchanges (DEXes). With its innovative architecture, Sei aims to address the common bottlenecks faced by existing blockchains, such as transaction speed and scalability. The platform utilizes a parallelized execution model, enabling faster transaction processing and lower fees, which are essential for high-frequency trading environments. Additionally, Sei is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to seamlessly deploy smart contracts.

Technological Advancements

Sei’s upcoming Giga upgrade is a significant milestone, promising to enhance EVM throughput by up to 50 times. This improvement will further solidify Sei’s position as a go-to solution for DEXes and high-frequency applications, catering to the growing demand for efficient trading platforms. The commitment to carbon neutrality and community engagement reflects Sei’s dedication to sustainability and responsible development in the crypto space.

Investment Potential

As a relatively new entrant in the cryptocurrency market, Sei coin presents both opportunities and risks. Its current market cap of approximately $1.77 billion and a trading volume of around $122 million indicate a growing interest among investors. However, like all cryptocurrencies, investing in Sei coin carries inherent risks, including market volatility and technological challenges. Its price has seen significant fluctuations since its launch, highlighting the unpredictable nature of the crypto landscape.

Conclusion

In conclusion, Sei coin stands out for its targeted approach to enhancing DEX performance and its focus on high-frequency trading applications. While its innovative technology and growing ecosystem present compelling investment opportunities, potential investors should remember that the cryptocurrency market is high-risk and high-reward. It is crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Always remember to DYOR (Do Your Own Research) to make informed choices in this dynamic and rapidly evolving market.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.