Should You Invest in reef coin? A Full Analysis (2025)

An Investor’s Introduction to reef coin

Reef Coin, represented by the ticker symbol REEF, is an innovative cryptocurrency that aims to simplify access to blockchain technology for users of all levels of experience. Launched as part of the Reef ecosystem, it serves as the native token for the Reef Chain—a Layer 1 blockchain built on the Substrate framework. Reef Chain is designed to facilitate the deployment of decentralized applications (dApps) and is particularly focused on the decentralized finance (DeFi) space, gaming, and NFTs. Its unique approach combines low transaction fees, fast processing times, and user-friendly interfaces, making it an attractive option for both newcomers and seasoned investors.

The significance of Reef Coin in the cryptocurrency market is underscored by its vision of democratizing access to blockchain technology. With a current market cap of approximately $6.32 million and a circulating supply of over 21 billion REEF tokens, the coin aims to provide a cost-effective solution for users looking to engage in the DeFi space without the high fees typically associated with Ethereum-based applications. The Reef ecosystem includes essential tools such as ReefSwap (a decentralized exchange), ReefScan (a blockchain explorer), and the Reef Chain Wallet, which together create a comprehensive environment for managing digital assets.

This guide serves as a comprehensive resource for understanding Reef Coin, covering various aspects crucial for investors. We will delve into the underlying technology of the Reef blockchain, exploring its unique features and advantages over other platforms. Additionally, we will examine the tokenomics of REEF, including its supply dynamics and utility within the ecosystem.

Investors will also benefit from insights into the potential investment opportunities that Reef Coin presents, alongside an analysis of the associated risks. The guide will provide practical information on how to buy REEF tokens through various exchanges, ensuring that readers are equipped with the knowledge needed to make informed decisions.

Whether you are a beginner taking your first steps into the cryptocurrency world or an intermediate investor looking to diversify your portfolio, this guide aims to empower you with the information necessary to navigate the exciting landscape of Reef Coin and its broader ecosystem.

What is reef coin? A Deep Dive into its Purpose

Understanding Reef Coin (REEF)

Reef Coin (REEF) is the native cryptocurrency of the Reef ecosystem, designed to facilitate transactions and governance within the Reef blockchain. Launched with the goal of simplifying access to decentralized finance (DeFi) and blockchain technology, Reef Coin aims to bridge the gap between traditional finance and the burgeoning world of cryptocurrencies. This section will delve into the core problem Reef Coin addresses, its unique selling propositions, and the team and backers behind the project.

The Core Problem It Solves

The rise of blockchain technology and cryptocurrencies has introduced significant opportunities for innovation and investment. However, many individuals, especially newcomers, face challenges when trying to navigate this complex landscape. The core problem that Reef Coin seeks to address is the accessibility and usability of blockchain technology.

-

High Transaction Fees: Many popular blockchains, like Ethereum, often encounter high gas fees, making it financially unviable for small transactions. Reef aims to tackle this issue by providing low transaction costs, averaging around 5 REEF per transaction. This affordability allows users to engage with DeFi applications without incurring prohibitive fees.

-

Complexity of Blockchain Interactions: Understanding blockchain concepts like decentralized applications (dApps), yield farming, and staking can be overwhelming for newcomers. Reef simplifies these concepts by analogizing Web3 terms to familiar Web 2.0 equivalents, enhancing user experience. For instance, the Reef Name Service acts as a username, making it easier for users to manage their identities on the blockchain.

-

Fragmented Ecosystem: Investors and users often find themselves managing assets across multiple blockchains, leading to a fragmented experience. Reef addresses this by enabling users to port assets seamlessly between different networks, thanks to its liquidity bridges and compatibility with Ethereum and other EVM-compatible networks. This interoperability fosters a more cohesive and user-friendly environment for managing assets.

Its Unique Selling Proposition

Reef Coin distinguishes itself through several unique features that cater to both newcomers and experienced crypto users:

-

Built on Substrate: Reef Chain, the underlying blockchain for Reef Coin, is built on the Substrate framework, allowing for rapid development and scalability. This architecture supports almost instant transactions and enables developers to deploy existing Ethereum dApps on Reef with minimal modifications, significantly lowering the barrier to entry for projects looking to migrate.

-

Nominated Proof of Stake (NPoS): The Reef network utilizes a Nominated Proof of Stake system for securing its blockchain. This approach allows users to stake REEF tokens to nominate validators, who are then responsible for maintaining network security. NPoS not only incentivizes participation but also enhances the overall decentralization of the network.

-

User-Friendly Interfaces: Reef has developed a suite of core applications, including the Reef Chain Wallet, ReefSwap, and ReefScan, all designed with user experience in mind. These applications provide intuitive interfaces that make it easy for users to interact with the blockchain, swap tokens, and monitor their assets without requiring extensive technical knowledge.

-

Community Governance: Reef Coin holders have a say in the governance of the network. By staking their REEF tokens, users can participate in decision-making processes regarding network upgrades and development, ensuring that the platform evolves in a way that aligns with community interests.

-

Ecosystem Growth: Reef actively fosters an ecosystem that includes decentralized finance applications, gaming, and NFTs. By providing tools for developers, such as integrated development environments and blockchain explorers, Reef encourages innovation and the creation of new applications that can thrive on its platform.

The Team and Backers

Reef was founded by Denko Mancheski, who has a background in fintech and a passion for making blockchain technology accessible to a wider audience. His vision for Reef was to create a blockchain that empowers retail investors to engage with DeFi, NFTs, and gaming without the steep learning curve typically associated with these technologies.

The team behind Reef includes a diverse group of professionals, including developers, marketers, and community managers, all working together to ensure the project’s success. Currently, Derek E. Silva operates as a key figure in managing the Reef ecosystem, further bolstered by a dedicated team committed to expanding its reach and functionality.

Reef has also attracted backing from several prominent venture capital firms and funds, including NGC, QCP, and Bitcoin.com, among others. This financial support not only validates the project but also provides the necessary resources for ongoing development and marketing efforts.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Reef Coin and the Reef ecosystem is to lower barriers to entry for users wanting to participate in the decentralized finance space. By providing a user-friendly interface, low transaction fees, and a robust platform for developers, Reef aims to democratize access to blockchain technology.

In essence, Reef Coin serves as a bridge for traditional finance users who may be hesitant to engage with cryptocurrencies due to perceived complexities. By addressing the core problems of accessibility, usability, and cost, Reef Coin positions itself as a viable option for both newcomers and seasoned investors looking to navigate the evolving landscape of digital assets.

In conclusion, Reef Coin not only provides a means of transaction within its ecosystem but also embodies a broader vision of inclusivity and innovation in the cryptocurrency space, making it an essential player in the ongoing evolution of blockchain technology.

The Technology Behind the Coin: How It Works

Overview of Reef Coin Technology

Reef Coin (REEF) operates on the Reef Chain, a blockchain designed to facilitate decentralized applications (dApps) with a focus on accessibility, scalability, and affordability. This section will delve into the core technological aspects of Reef Coin, including its architecture, consensus mechanism, and key innovations that set it apart in the cryptocurrency landscape.

Blockchain Architecture

Layer 1 Blockchain

Reef Chain is a Layer 1 blockchain, meaning it operates independently as a foundational layer for dApps. Built using the Substrate framework, which is a development framework for building blockchains, Reef Chain is designed to be fast, scalable, and easy to use. This architecture allows for almost instant transaction finality, typically within 10 seconds, which is essential for applications requiring quick interactions, such as gaming and decentralized finance (DeFi).

Compatibility with Ethereum

One of the standout features of Reef Chain is its compatibility with the Ethereum Virtual Machine (EVM). This means that developers can port their existing Ethereum dApps to Reef Chain with minimal modifications. This compatibility allows for a seamless transition for projects looking to benefit from Reef’s lower fees and faster transaction times, making it an attractive option for developers and users alike.

User-Friendly Interface

Reef Chain emphasizes user experience, aiming to simplify blockchain interactions for both new and experienced users. The platform offers a suite of core applications, including the Reef Chain Wallet, ReefSwap, and ReefScan, designed with intuitive interfaces that mimic familiar Web 2.0 experiences. This focus on accessibility is crucial for onboarding new users who may find traditional blockchain interfaces daunting.

Consensus Mechanism

Nominated Proof of Stake (NPoS)

Reef Chain employs a Nominated Proof of Stake (NPoS) consensus mechanism to secure its network. In this system, users can either run validator nodes or become nominators. Validators are responsible for producing new blocks and confirming transactions, while nominators select trustworthy validators to support. This dual role structure encourages community participation and enhances network security.

-

Validators: To become a validator, individuals must have technical expertise, stake REEF tokens, and maintain a node that operates continuously. Validators are incentivized through transaction fees and rewards for their contributions to the network. However, if they fail to meet performance standards or maintain uptime, their stakes—and those of their nominators—can be penalized, ensuring that only reliable validators remain active.

-

Nominators: Users who lack the technical skills to run a validator node can still participate in securing the network by nominating validators. This allows them to earn rewards without the need for complex setups. However, when REEF tokens are staked as nominations, they are locked for a set period, typically 28 days, before they can be moved or transferred again.

Key Technological Innovations

Low Transaction Fees

One of the primary goals of Reef Chain is to reduce the high transaction fees often associated with other blockchains, particularly Ethereum. Reef Chain achieves this through its efficient architecture and the use of NPoS, which minimizes the costs associated with transaction validation. Users can expect to pay an average of only 5 REEF for transaction fees, making it much more accessible for everyday users and small-scale transactions.

On-Chain Governance

Reef Chain incorporates a robust on-chain governance model, allowing the community to participate in decision-making processes regarding protocol upgrades and changes. This governance structure is facilitated by a Technical Council elected by the community, which can implement upgrades without the need for hard forks. This flexibility ensures that the Reef ecosystem can evolve in response to user needs and technological advancements.

Interoperability with Other Blockchains

Reef Chain is designed with interoperability in mind, allowing it to connect seamlessly with other blockchains. This is achieved through liquidity bridges that enable the transfer of assets between Reef and other networks, such as Ethereum and Binance Smart Chain. This capability is particularly beneficial for users looking to leverage liquidity across multiple platforms and enhances the overall utility of the Reef ecosystem.

Support for Multiple Virtual Machines

Another innovative feature of Reef Chain is its support for multiple virtual machines. While it is primarily compatible with the EVM, Reef Chain can also accommodate other virtual machines, allowing developers to build and deploy applications in various programming environments. This extensibility is crucial for fostering a diverse ecosystem of dApps and attracting a wide range of developers.

Security Features

Validator Selection and Performance Monitoring

The NPoS system not only encourages community engagement but also enhances the security of the Reef network. Validators are selected based on their reputation and performance, and their activities are continuously monitored. This ensures that only capable validators can participate in block production, reducing the risk of malicious actors compromising the network.

Slashing Mechanism

To maintain high performance standards, Reef Chain implements a slashing mechanism for validators who fail to perform adequately. If a validator does not meet uptime requirements or engages in dishonest behavior, a portion of their staked REEF can be slashed, penalizing them and protecting the network’s integrity. This mechanism also extends to nominators, who share the risk associated with their chosen validators.

Conclusion

Reef Coin represents a significant advancement in blockchain technology, particularly for users and developers seeking a more accessible and efficient platform for decentralized applications. With its Layer 1 architecture, Nominated Proof of Stake consensus mechanism, and innovative features such as low transaction fees and on-chain governance, Reef Chain is poised to attract a wide user base. Its emphasis on user experience, interoperability, and security further solidifies its position as a promising player in the evolving landscape of cryptocurrencies. Whether you’re a beginner or an experienced investor, understanding the technology behind Reef Coin will help you appreciate its potential and the opportunities it offers within the blockchain ecosystem.

Understanding reef coin Tokenomics

Key Metrics of Reef Coin Tokenomics

To understand the tokenomics of Reef Coin (REEF), we first need to examine its core metrics. The following table summarizes the key statistics related to the REEF token:

| Metric | Value |

|---|---|

| Total Supply | 21.01 billion REEF |

| Max Supply | Not specified |

| Circulating Supply | 21.01 billion REEF |

| Inflation/Deflation Model | Deflationary with fee burns |

Token Utility (What is the coin used for?)

REEF serves several critical functions within the Reef ecosystem, primarily designed to enhance user experience and promote engagement with the platform. Here are the primary utilities of the REEF token:

-

Transaction Fees: REEF tokens are used to pay for transaction fees on the Reef Chain. With an average fee of just 5 REEF per transaction, the platform aims to provide an affordable alternative to existing blockchains, particularly Ethereum, which is often criticized for its high gas fees.

-

Staking and Network Security: REEF operates on a Nominated Proof of Stake (NPoS) consensus mechanism. Users can stake their REEF tokens to secure the network and participate in its governance. By nominating validators, stakers help maintain the integrity and security of the Reef Chain while earning rewards in the form of additional REEF tokens.

-

Governance Participation: Token holders have the opportunity to participate in governance decisions, influencing the future direction of the Reef ecosystem. This participatory model allows users to vote on proposals, upgrades, and changes to the network, ensuring that the community has a say in its development.

-

Liquidity Provision: Users can utilize REEF tokens to provide liquidity on decentralized exchanges like ReefSwap. By supplying liquidity, users can earn fees and rewards, making it an attractive option for those looking to generate passive income.

-

Access to DApps and Services: As a native utility token, REEF enables users to access various decentralized applications (DApps) built on the Reef Chain. This includes DeFi protocols, NFT marketplaces, and gaming applications, all of which contribute to the overall utility of the token within the ecosystem.

-

Fee Burn Mechanism: Reef has implemented a fee burn mechanism aimed at reducing the total supply over time. A portion of the transaction fees collected is burned, contributing to a deflationary model that could potentially increase the token’s value as supply diminishes.

Token Distribution

Understanding how REEF tokens are distributed is vital for assessing the token’s long-term sustainability and potential for growth. The distribution model is designed to create a balanced ecosystem that encourages participation, rewards early investors, and supports the development of the platform.

-

Initial Distribution: The initial distribution of REEF tokens was allocated to various stakeholders, including the development team, advisors, investors, and community initiatives. The exact percentages of these allocations are typically outlined in the project’s whitepaper or official documentation.

-

Team and Advisors: A portion of the total supply is allocated to the development team and advisors, usually with a vesting period to ensure long-term commitment to the project. This helps align the interests of the team with those of the community and investors.

-

Investors and Partnerships: Early investors and strategic partners often receive a share of the tokens as part of fundraising efforts. These allocations are crucial for securing necessary funding and building a strong network of partnerships to support the platform’s growth.

-

Community Incentives: Reef emphasizes community engagement and user participation. Therefore, a significant portion of tokens may be reserved for community incentives, including rewards for staking, liquidity provision, and participation in governance.

-

Ecosystem Development: To ensure continuous growth, a portion of the token supply is often allocated for ecosystem development, including funding for new projects, marketing initiatives, and educational programs aimed at onboarding new users.

-

Burn Mechanism: As mentioned earlier, the fee burn mechanism contributes to the deflationary nature of the REEF token. By periodically burning a portion of the transaction fees, the total supply decreases over time, potentially increasing the value of the remaining tokens.

Conclusion

In summary, Reef Coin (REEF) is designed to provide a comprehensive and user-friendly experience in the decentralized finance (DeFi) space. Its tokenomics reflects a commitment to affordability, community engagement, and long-term sustainability. By understanding its utility, distribution, and the mechanics behind its deflationary model, investors can make informed decisions regarding their participation in the Reef ecosystem. As the platform continues to evolve, the REEF token will play a pivotal role in facilitating access to blockchain technology and enabling innovative decentralized applications.

Price History and Market Performance

Key Historical Price Milestones

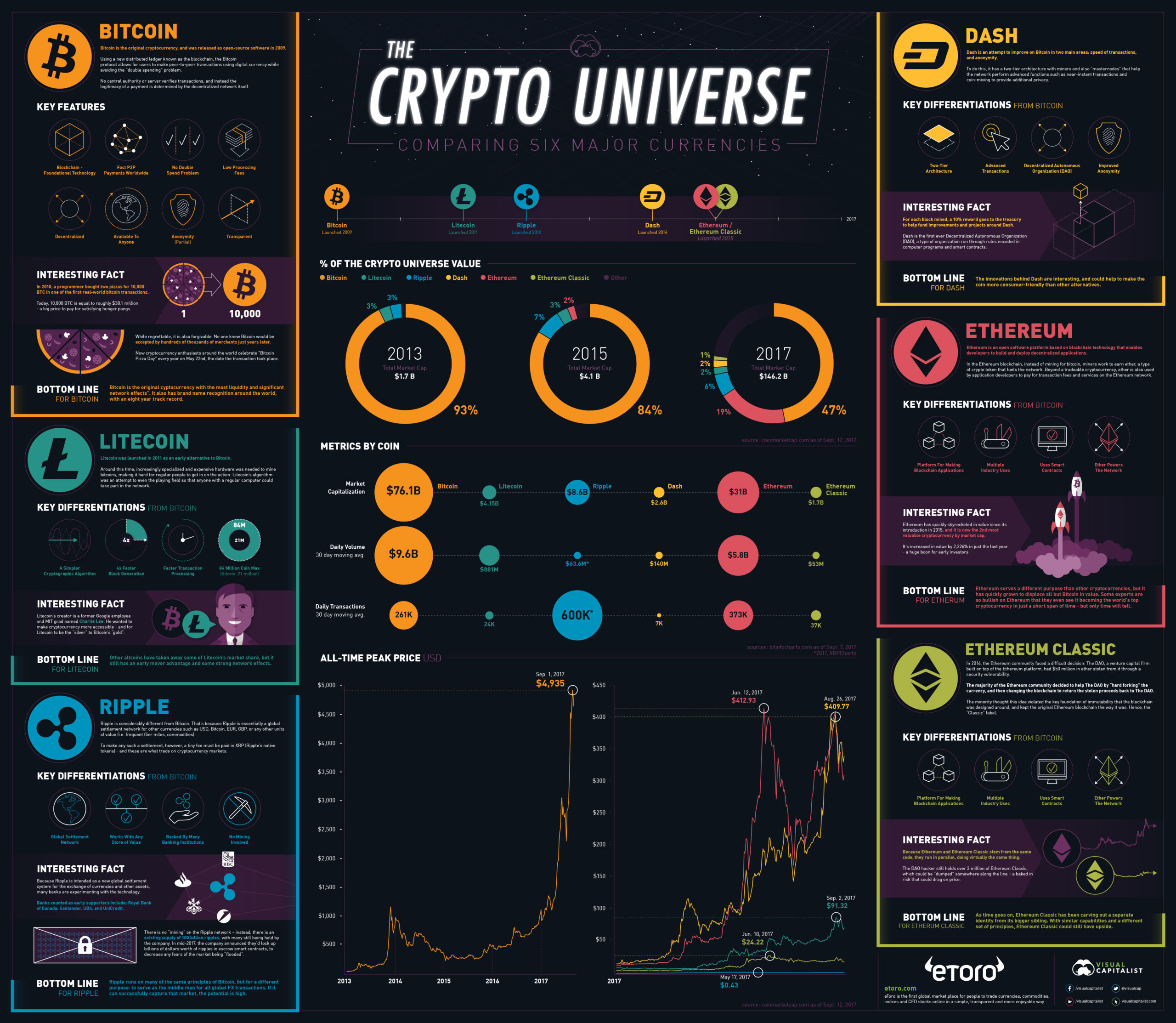

Reef Coin (REEF) has experienced significant fluctuations since its inception, reflecting the volatile nature of the cryptocurrency market.

-

Launch and Initial Performance: Reef Coin was launched in December 2020, and it quickly garnered attention in the market. In the early days, REEF’s price remained relatively low, as is common with many new cryptocurrencies. The initial trading price was around $0.005, which attracted early investors looking for potential growth opportunities.

-

All-Time High: One of the most notable milestones for Reef was its all-time high, reached on March 15, 2021, when REEF traded at approximately $0.05841. This surge can be attributed to the broader market rally in cryptocurrencies, driven by increasing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs). The high liquidity and community engagement around the Reef ecosystem contributed to this price spike.

-

Subsequent Decline: Following its peak, REEF experienced a significant decline in price, which is a common trend in the cryptocurrency market following all-time highs. By the end of 2021, the price had dropped to around $0.02, marking a decrease of over 65% from its peak. This decline continued into 2022, influenced by various market factors including regulatory scrutiny and macroeconomic conditions affecting the broader financial markets.

-

All-Time Low: The lowest recorded price for REEF occurred on June 26, 2023, when it fell to approximately $0.0001739. This represented a staggering decline of 99.70% from its all-time high, reflecting the intense volatility and challenges faced by many cryptocurrencies during market downturns.

-

Recent Performance: As of October 2023, REEF is trading at around $0.0003011, with a market cap of approximately $6.32 million. Over the past 24 hours, the price has fluctuated between $0.0002887 and $0.0003252. This indicates that while REEF has not returned to its previous highs, it has shown some resilience in a challenging market environment.

Factors Influencing the Price

Historically, the price of Reef Coin has been influenced by a variety of factors, both internal to the Reef ecosystem and external to the cryptocurrency market as a whole.

-

Market Sentiment: Like many cryptocurrencies, REEF’s price is heavily influenced by market sentiment. Periods of bullish sentiment in the cryptocurrency market often lead to price increases, while bearish sentiment can trigger sharp declines. For example, the broader adoption of DeFi platforms in early 2021 contributed to a bullish phase, positively impacting REEF’s price.

-

Technological Developments: The development and enhancements within the Reef ecosystem play a critical role in influencing its price. Innovations such as the introduction of new features, partnerships, and integrations can lead to increased interest and investment in REEF. For instance, the launch of the Reef Chain, designed to facilitate easier access to DeFi applications, likely contributed to initial price increases and investor enthusiasm.

-

Competition: The competitive landscape within the cryptocurrency space also affects REEF’s market performance. The emergence of new DeFi platforms and blockchains that offer similar or improved functionalities can divert attention and investment away from REEF, impacting its price negatively. As new players enter the market, REEF must continue to innovate to maintain its relevance.

-

Regulatory Environment: Changes in the regulatory landscape surrounding cryptocurrencies can have immediate effects on price. Increased scrutiny or regulation can create uncertainty among investors, leading to price declines. Conversely, positive regulatory developments can boost confidence and lead to price increases.

-

Market Liquidity and Trading Volume: The liquidity of REEF and its trading volume are also significant factors in its price performance. Higher trading volumes generally indicate greater interest and can lead to price stability or increases. Conversely, low trading volumes can result in higher volatility and price swings.

-

Investor Behavior: The actions of large holders or “whales” in the market can significantly influence REEF’s price. Large buy or sell orders can create substantial price movements, particularly in a market with lower liquidity. Additionally, retail investor sentiment, often driven by social media trends and community engagement, can lead to rapid price changes.

-

Economic Factors: Broader economic conditions, such as inflation rates, interest rates, and global financial stability, also impact cryptocurrency prices, including REEF. During economic uncertainty, investors may move to safer assets, leading to declines in cryptocurrency prices.

Conclusion

The price history and market performance of Reef Coin illustrate the complexities and volatility inherent in the cryptocurrency market. Understanding these historical trends and the factors influencing price movements can provide valuable insights for both new and experienced investors. As the cryptocurrency landscape continues to evolve, the future performance of REEF will likely be shaped by its ability to adapt to market changes, technological advancements, and shifts in investor sentiment.

Where to Buy reef coin: Top Exchanges Reviewed

1. ChangeNOW – Top Choice for Seamless REEF Trading!

ChangeNOW stands out as a premier platform for exchanging REEF, offering competitive pricing and a user-friendly interface. With an impressive rating of 4.8 based on over 2,100 reviews, it provides real-time market data, including live charts and market cap details, ensuring users have the information they need to make informed trading decisions. Additionally, the platform’s commitment to zero fees enhances its appeal for both novice and experienced investors looking to buy or sell REEF efficiently.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

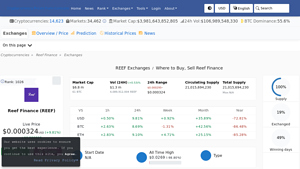

3. Reef Finance (REEF) – Your Gateway to DeFi Opportunities!

Reef Finance (REEF) stands out in the cryptocurrency market by offering versatile trading options across multiple reputable exchanges, including Binance, MEXC Global, and Gate. This accessibility allows users to easily buy, sell, and trade REEF tokens while benefiting from competitive trading fees and liquidity. The presence of these exchanges enhances the overall trading experience for both novice and experienced investors, making it an attractive option for those looking to engage with the Reef ecosystem.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

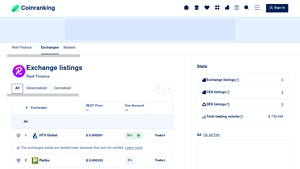

5. Reef Finance – Your Gateway to Diverse Crypto Opportunities!

Reef Finance (REEF) stands out in the cryptocurrency market due to its comprehensive exchange listings that allow users to easily compare prices, trading volumes, and available discounts across various platforms. This feature empowers traders to make informed decisions, ensuring they select the most advantageous exchange for their transactions. By providing a user-friendly interface and real-time data, Reef Finance enhances the trading experience for both novice and experienced investors.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

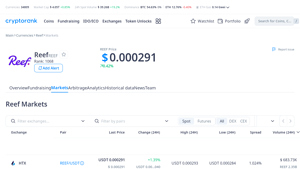

5. Reef – Your Gateway to Seamless Crypto Trading!

Reef Exchanges stands out as a versatile platform for trading REEF, featuring five active markets across 11 top exchanges. It offers valuable insights into trading spreads and 24-hour volume data, enabling users to make informed decisions. With its user-friendly interface and comprehensive market analysis, Reef Exchanges caters to both novice and experienced traders, making it a compelling choice for those looking to buy, sell, or trade REEF tokens efficiently.

- Website: cryptorank.io

- Platform Age: Approx. 8 years (domain registered in 2017)

7. MEXC – Your Gateway to REEF with Seamless Transactions!

MEXC Exchange stands out as a top choice for purchasing REEF (REEF) due to its impressive reliability, deep liquidity, and extensive selection of tokens. With a high user rating of 4.7 from over 166,000 reviews, MEXC provides a secure and efficient trading environment, making it an ideal platform for both beginners and experienced investors looking to acquire REEF and explore other digital assets.

- Website: mexc.com

- Platform Age: Approx. 25 years (domain registered in 2000)

How to Buy reef coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Reef Coin (REEF) is to choose a cryptocurrency exchange that supports it. Popular exchanges where you can buy REEF include:

- Gate.io

- MEXC

- CoinEx

These exchanges allow you to trade REEF against various cryptocurrencies and fiat currencies. When selecting an exchange, consider the following factors:

- Security: Ensure the exchange has a strong security track record.

- Fees: Check the trading and withdrawal fees, as these can vary significantly.

- User Experience: A user-friendly interface can help make your trading experience smoother.

- Payment Methods: Look for exchanges that support your preferred payment method, whether it’s bank transfer, credit card, or other cryptocurrencies.

2. Create and Verify Your Account

Once you have chosen an exchange, you will need to create an account:

-

Sign Up: Go to the exchange’s website and click on the ‘Sign Up’ or ‘Register’ button. Fill out the required information, including your email address and a strong password.

-

Email Verification: After signing up, you will typically receive a verification email. Click the link in the email to verify your account.

-

Identity Verification: Many exchanges require you to complete a Know Your Customer (KYC) process to comply with regulations. This may involve uploading a government-issued ID and a proof of residence (like a utility bill). Follow the instructions provided by the exchange to complete this step.

3. Deposit Funds

Once your account is verified, you need to deposit funds to buy Reef Coin:

-

Choose a Deposit Method: Navigate to the ‘Deposit’ section of the exchange. Select your preferred deposit method (e.g., bank transfer, credit card, or cryptocurrency).

-

Deposit Currency: If you are depositing fiat currency (like USD or EUR), enter the amount you wish to deposit. If you are depositing another cryptocurrency, ensure you select the correct coin.

-

Follow Instructions: Follow the on-screen instructions to complete your deposit. If you are depositing fiat, you may need to provide banking details or use a third-party payment processor. For cryptocurrency deposits, you will receive a wallet address to send your funds.

-

Confirmation: Wait for the deposit to be confirmed. This may take anywhere from a few minutes to several hours, depending on the method used.

4. Place an Order to Buy Reef Coin

Now that your account is funded, you can buy Reef Coin:

-

Navigate to the Trading Section: Go to the trading section of the exchange and search for the REEF trading pair (for example, REEF/USD or REEF/BTC).

-

Select Order Type: Choose the type of order you wish to place:

- Market Order: This order buys REEF at the current market price. It’s the simplest option for beginners.

-

Limit Order: This order allows you to specify the price at which you want to buy REEF. It will only execute when the market reaches that price.

-

Enter Amount: Input the amount of REEF you want to purchase. The exchange will show you the total cost, including any fees.

-

Review and Confirm: Review your order details, and if everything looks correct, click the ‘Buy’ button to execute your order.

5. Secure Your Coins in a Wallet

After purchasing Reef Coin, it’s important to secure your investment:

- Choose a Wallet: There are several types of wallets available:

- Hardware Wallets: These are physical devices that store your cryptocurrency offline and are considered very secure (e.g., Ledger, Trezor).

- Software Wallets: These are applications you can install on your computer or mobile device. They are convenient but less secure than hardware wallets (e.g., Trust Wallet, MetaMask).

-

Exchange Wallets: While you can leave your REEF on the exchange, it’s safer to transfer them to a personal wallet.

-

Transfer Your REEF: If you choose a software or hardware wallet, navigate to the withdrawal section of the exchange and enter your wallet address. Confirm the transaction.

-

Backup Your Wallet: Ensure you back up your wallet’s recovery phrase and keep it in a safe place. This is crucial for recovering your funds if you lose access to your wallet.

By following these steps, you will successfully purchase and secure Reef Coin. Always remember to stay informed about market trends and security practices to protect your investments.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. User-Friendly Design and Accessibility

Reef aims to democratize access to blockchain technology by creating an ecosystem that is easy to use for both newcomers and experienced users. Its design philosophy incorporates familiar Web 2.0 concepts, which helps reduce the learning curve associated with blockchain technology. With applications like the Reef Chain Wallet, ReefSwap, and ReefScan, users can easily interact with the blockchain without needing extensive technical knowledge.

2. Fast and Affordable Transactions

Built on the Substrate framework, Reef Chain offers low transaction fees and fast processing times. Users can expect average fees of just 5 REEF, making it an attractive option compared to Ethereum, where high gas fees can deter participation in decentralized finance (DeFi) activities. The ability to conduct nearly instant transactions with finality achieved in approximately 10 seconds positions Reef as a competitive alternative for users seeking efficiency.

3. Strong Ecosystem and Community Support

Reef has garnered attention and support from various venture capitalists and funds, which adds credibility to its project. The backing from notable investors helps ensure that the project has the resources necessary for development and marketing. Additionally, the growing user base of over 106,000 holders indicates a solid community foundation, which is vital for the success of any cryptocurrency.

4. Cross-Chain Compatibility

Reef’s architecture allows it to bridge assets from other blockchains, including Ethereum and BNB Chain, facilitating liquidity and user engagement across multiple platforms. This cross-chain functionality enhances its appeal as it can attract users from various ecosystems and allows for the easy transfer of assets, which is critical in the increasingly interconnected world of blockchain.

5. Nominated Proof of Stake (NPoS) Security

Reef uses a Nominated Proof of Stake consensus mechanism that allows users to participate in network security by nominating validators. This approach not only helps secure the network but also incentivizes community participation. By staking REEF tokens, users can earn rewards, thus fostering a sense of ownership and alignment with the network’s success.

6. Governance and Upgradability

Reef Chain incorporates on-chain governance, allowing token holders to participate in decision-making processes regarding protocol upgrades and changes. This democratic approach ensures that the platform can adapt to user needs and market conditions, which is essential for long-term sustainability. The self-upgradable nature of the chain also means that it can evolve without requiring extensive hard forks, further enhancing its resilience.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Like most cryptocurrencies, REEF is subject to significant price volatility. The live price of REEF as of now is $0.000301, with an all-time high of $0.05841 and an all-time low of $0.0001739. Such fluctuations can lead to rapid changes in market sentiment, which may result in substantial financial losses for investors. Market volatility is exacerbated by external factors, including macroeconomic conditions and shifts in investor sentiment towards digital assets.

2. Regulatory Uncertainty

The regulatory environment surrounding cryptocurrencies is evolving, with governments around the world implementing new regulations that can affect the operations of blockchain projects. Uncertainty regarding legal compliance, taxation, and potential restrictions can pose risks to the Reef ecosystem. If governments impose stringent regulations, it could hinder the adoption of Reef and similar projects, limiting their growth potential.

3. Competition

The blockchain and cryptocurrency landscape is highly competitive, with numerous projects vying for market share. Reef faces competition not only from established platforms like Ethereum but also from emerging blockchains that offer similar functionalities. As new projects continue to enter the market with innovative features, Reef must continuously evolve to maintain its relevance and attract users. Failure to differentiate itself effectively could lead to a loss of market position.

4. Technological Risks

While Reef Chain is built on the robust Substrate framework, there are inherent technological risks associated with any blockchain project. Issues such as network congestion, bugs in smart contracts, or vulnerabilities in the code can lead to significant operational challenges. Additionally, the reliance on third-party bridges for cross-chain functionality introduces potential points of failure that could compromise the security and efficiency of the ecosystem.

5. Adoption and Use Case Viability

For Reef to succeed, it must achieve widespread adoption and demonstrate practical use cases that attract users. While the project has a user-friendly interface and accessibility features, the actual utility of the REEF token and the associated applications must be compelling enough to drive user engagement. If the project fails to deliver on its promise or faces challenges in user acquisition, it may struggle to maintain its market position.

6. Dependence on Developer Community

The success of Reef heavily relies on the developer community to create and maintain decentralized applications (dApps) on its platform. A lack of interest or engagement from developers could limit the growth of the ecosystem, resulting in fewer applications and services available for users. Encouraging developers to build on Reef Chain is crucial, and any decline in developer activity could adversely impact the project’s viability.

Conclusion

Investing in Reef (REEF) presents both potential opportunities and significant risks. The project’s focus on user accessibility, low transaction costs, and community governance creates a compelling narrative for potential investors. However, the inherent volatility of the cryptocurrency market, regulatory uncertainties, and competition from other platforms necessitate careful consideration. As with any investment in digital assets, it is essential for investors to conduct thorough research and evaluate their risk tolerance before making decisions.

Frequently Asked Questions (FAQs)

1. What is Reef Coin (REEF)?

Reef Coin (REEF) is the native cryptocurrency of the Reef ecosystem, which operates on the Reef Chain—a Layer 1 blockchain built with the Substrate framework. The Reef ecosystem aims to provide an easy-to-use platform for decentralized applications (dApps), focusing on accessibility for both novice and experienced users. REEF tokens are used for transaction fees, staking, and governance within the Reef network.

2. Who created Reef Coin?

Reef Coin was founded by Denko Mancheski, who aimed to build a blockchain that would simplify access to decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain applications for retail investors. The development team behind Reef includes experts in blockchain technology, marketing, and community management.

3. How does Reef Coin differ from Bitcoin?

Reef Coin differs from Bitcoin in several key aspects:

– Purpose: While Bitcoin primarily serves as a digital currency and store of value, Reef Coin is designed specifically for facilitating transactions on the Reef Chain and supporting dApps.

– Technology: Reef operates on a Layer 1 blockchain built on Substrate, allowing for faster and cheaper transactions, whereas Bitcoin uses its own blockchain with slower transaction speeds and higher fees.

– Consensus Mechanism: Reef utilizes a Nominated Proof of Stake (NPoS) mechanism, which allows users to nominate validators to secure the network, while Bitcoin relies on Proof of Work (PoW), which requires significant computational power.

4. Is Reef Coin a good investment?

As with any cryptocurrency, the potential for investment in Reef Coin depends on various factors including market trends, technology adoption, and overall market sentiment. While Reef Coin has shown promise with its unique features and community support, it’s essential for investors to conduct thorough research, consider their risk tolerance, and stay updated on market developments before making investment decisions.

5. Where can I buy Reef Coin?

Reef Coin (REEF) can be purchased on various centralized exchanges such as Gate.io, MEXC, and CoinEx. It is also available on decentralized exchanges like Uniswap and 1inch. Ensure to choose a platform that suits your trading needs and offers adequate security measures.

6. How can I stake Reef Coin?

To stake Reef Coin, users need to nominate a validator on the Reef Chain. This involves bonding (locking) a certain amount of REEF tokens to participate in the network’s security and validation process. Nominators can earn rewards in the form of additional REEF tokens, although they must remain aware of the unbonding period, which lasts 28 days if they decide to un-nominate.

7. What are the main features of Reef Chain?

Reef Chain offers several features that set it apart:

– Low Fees: Transactions on Reef Chain typically cost around 5 REEF, making it an affordable option compared to other blockchains.

– Scalability: Built on the Substrate framework, Reef Chain supports high transaction throughput and low latency.

– Ease of Use: The Reef ecosystem is designed with user-friendly interfaces that simplify interactions with blockchain technology for all users, regardless of their technical expertise.

– Cross-Chain Compatibility: Reef Chain allows for easy porting of existing Ethereum-based applications and assets, enhancing liquidity and usability.

8. What is the current price of Reef Coin?

As of now, the live price of Reef Coin (REEF) is approximately $0.000301 USD. The cryptocurrency has a market capitalization of around $6.32 million, with a circulating supply of 21.01 billion REEF tokens. Prices fluctuate regularly, so it is advisable to check a reliable cryptocurrency market data provider for real-time updates.

Final Verdict on reef coin

Overview of Reef Coin

Reef Coin (REEF) serves as the native token of the Reef blockchain, designed to facilitate easy access to decentralized finance (DeFi) and blockchain applications. Built on the Substrate framework, Reef aims to provide a fast, affordable, and user-friendly experience, making it particularly appealing for newcomers to the cryptocurrency space. Reef’s core applications, such as the Reef Chain Wallet and ReefSwap, allow users to engage with DeFi protocols and decentralized applications (dApps) seamlessly.

Technology and Features

The Reef blockchain employs a Nominated Proof of Stake (NPoS) consensus mechanism, enabling quick transaction finality—averaging around 10 seconds—and low fees, which average around 5 REEF per transaction. This efficiency is complemented by the blockchain’s ability to support existing Ethereum-based applications with minimal code changes, thereby attracting developers looking to migrate their projects. Additionally, Reef boasts features like on-chain governance and liquidity bridges, further enhancing its ecosystem.

Investment Potential

Despite its innovative technology and community-driven approach, investing in Reef Coin comes with inherent risks. The cryptocurrency market is known for its volatility, and REEF has seen significant price fluctuations, including a dramatic decline from its all-time high of $0.05841 in March 2021. As of now, it is trading at approximately $0.000301, reflecting a substantial drop and highlighting the asset’s speculative nature.

Conclusion

In conclusion, Reef Coin presents an intriguing opportunity for both new and experienced investors interested in the DeFi space. Its user-centric design, low transaction costs, and compatibility with existing Ethereum applications position it as a promising platform within the blockchain ecosystem. However, potential investors should approach this asset class with caution, recognizing it as a high-risk, high-reward investment. As always, it is crucial to conduct thorough research (DYOR) before making any investment decisions, ensuring that you fully understand the risks and potential rewards associated with Reef Coin.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.