Should You Invest in kaspa coin? A Full Analysis (2025)

An Investor’s Introduction to kaspa coin

Kaspa Coin, denoted as KAS, is an innovative digital asset that has garnered attention in the cryptocurrency market for its unique technological approach and scalability. As a Layer-1 cryptocurrency built on a proof-of-work (PoW) consensus mechanism, Kaspa utilizes a novel protocol known as GHOSTDAG, which allows for the coexistence of parallel blocks rather than discarding them. This capability not only enhances transaction throughput but also maintains the security and decentralization that are foundational to blockchain technology. With aspirations to achieve a block rate of up to 100 blocks per second, Kaspa aims to offer rapid confirmation times that are largely limited by internet latency, positioning it as a promising player in the evolving landscape of digital currencies.

The purpose of this guide is to serve as a comprehensive resource for both beginners and intermediate investors interested in understanding Kaspa Coin. Throughout this guide, we will delve into several key areas, including:

Technology

We will explore the underlying technology of Kaspa, including its GHOSTDAG consensus mechanism and its implications for scalability and security. Understanding the technical aspects will provide investors with insights into what differentiates Kaspa from other cryptocurrencies.

Tokenomics

This section will cover the economic structure of Kaspa, detailing its supply dynamics, monetary policy, and how these factors influence its value proposition. With a total supply capped at 28.7 billion KAS, we will analyze the implications of its unique emission schedule, which is inspired by musical scales.

Investment Potential

Kaspa’s market performance and historical price data will be examined to assess its investment potential. We will provide insights into recent trends, market capitalization, and trading volume to help investors gauge the asset’s viability.

Risks

Every investment carries risks, and cryptocurrency is no exception. This section will address potential challenges and risks associated with investing in Kaspa, such as market volatility, regulatory scrutiny, and technological developments that could impact its future.

How to Buy Kaspa

Finally, we will guide you on how to acquire Kaspa Coin, including the best exchanges for trading KAS and tips for safe transactions.

By the end of this guide, readers will have a well-rounded understanding of Kaspa Coin, equipping them to make informed decisions in their investment journey. Whether you are looking to add to your crypto portfolio or simply wish to learn more about this emerging digital asset, this guide aims to provide clarity and insight.

What is kaspa coin? A Deep Dive into its Purpose

Overview of Kaspa Coin

Kaspa Coin (KAS) is a Layer-1 cryptocurrency that leverages a novel consensus mechanism known as GHOSTDAG, which is a generalization of Nakamoto Consensus. Unlike traditional blockchains that discard competing blocks, GHOSTDAG allows multiple blocks to coexist, creating a Directed Acyclic Graph (DAG) structure. This innovative design enables Kaspa to achieve high throughput, low confirmation times, and a decentralized network that can be easily accessed by everyday users.

The Core Problem It Solves

In the cryptocurrency landscape, one of the primary challenges is achieving scalability without compromising security or decentralization. Traditional blockchains, like Bitcoin, face issues such as slow transaction speeds and high fees during peak network congestion. Kaspa addresses these problems through its unique blockDAG architecture, which allows it to process up to 10 blocks per second, with aspirations of scaling to 100 blocks per second in the future. This is a significant improvement over many existing blockchains, which can only handle a limited number of transactions per second.

The GHOSTDAG protocol effectively eliminates the issue of orphaned blocks, which are blocks that are created but not included in the main chain due to their timing. Instead, Kaspa’s network can recognize and utilize these parallel blocks, resulting in faster transaction confirmations that are largely dictated by internet latency rather than the limitations of the blockchain itself. This feature is particularly important for applications that require immediate finality and responsiveness, such as decentralized finance (DeFi) platforms and real-time payment systems.

Moreover, Kaspa is designed to be accessible. Its full node can run on standard consumer hardware, which lowers the barriers to entry for individuals wishing to participate in network security and governance. This aligns with the ethos of decentralization, allowing anyone with a computer to contribute to the network without needing specialized equipment.

Its Unique Selling Proposition

Kaspa’s standout feature is its combination of high throughput, low latency, and decentralized accessibility, all while maintaining the security of a proof-of-work (PoW) system. The implementation of GHOSTDAG enables Kaspa to maintain a high level of security while facilitating rapid transactions. This is particularly appealing for developers and users who require a reliable and efficient blockchain for their applications.

Additionally, Kaspa employs a unique monetary policy that decreases the emission of new coins geometrically over time, inspired by the principles of music theory, specifically the 12-note scale. This “chromatic phase” ensures that the block rewards are halved monthly rather than annually, providing a smooth transition in the issuance of new coins. This approach not only adds an interesting layer to its economic model but also helps to mitigate inflationary pressures that can be seen in other cryptocurrencies.

The network’s development is further enhanced by its ongoing focus on Layer-2 solutions. Kaspa is actively working on expanding its capabilities to support scalable applications, decentralized oracles, and secure sequencing, which will contribute to a more robust ecosystem. This forward-thinking approach positions Kaspa favorably against competitors that may struggle with similar scalability issues.

The Team and Backers

Kaspa was initiated by Dr. Yonatan Sompolinsky, a respected figure in the field of blockchain research, who has contributed significantly to the development of scalable proof-of-work protocols. Sompolinsky’s academic background, including his work at Harvard University, lends credibility to the project. His research, conducted under the guidance of Prof. Aviv Zohar at the Hebrew University, laid the groundwork for the GHOSTDAG protocol and its application in Kaspa.

The project originated from DAGLabs, a research company that Sompolinsky co-founded, which was initially funded by Polychain Capital. The transition from a centralized research entity to a decentralized community-driven model reflects the project’s commitment to its founding principles of transparency and inclusivity. As DAGLabs dissolved around the time of Kaspa’s fair launch in November 2021, the project has since been maintained and developed by a global community of contributors. This decentralized approach ensures that no single entity controls the direction of the project, aligning with the broader goals of the cryptocurrency movement.

Kaspa’s team also includes Elichai Turkel, a Bitcoin Core contributor who served as the applied cryptographer during its development phase. The involvement of such experienced individuals in the cryptocurrency space adds further legitimacy to the project and enhances its potential for long-term success.

Conclusion

Kaspa Coin represents a significant advancement in the quest for a scalable, secure, and decentralized cryptocurrency. By tackling the core issues of transaction speed and accessibility, Kaspa has positioned itself as a viable alternative to traditional blockchains. Its unique GHOSTDAG consensus mechanism, innovative monetary policy, and commitment to decentralization make it an attractive option for both users and developers looking to build on a reliable and efficient platform.

As the cryptocurrency ecosystem continues to evolve, Kaspa’s ongoing development and research efforts aim to expand its capabilities and foster a robust community. This positions Kaspa not only as a cryptocurrency but also as a platform for innovation in the blockchain space, reflecting the foundational principles laid out by its creators.

The Technology Behind the Coin: How It Works

Overview of Kaspa Coin Technology

Kaspa Coin (KAS) is a unique cryptocurrency that stands out due to its innovative technology, particularly its use of the GHOSTDAG protocol. This advanced structure allows for high transaction throughput and quick confirmation times while maintaining decentralization and security. In this section, we will explore the fundamental aspects of Kaspa’s technology, including its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

Unlike traditional blockchains, which follow a linear structure where blocks are added in a sequential manner, Kaspa utilizes a Directed Acyclic Graph (DAG) architecture known as blockDAG. In a blockDAG, multiple blocks can be created and confirmed simultaneously, allowing for a more scalable and efficient network.

How the BlockDAG Works

In a conventional blockchain, when miners create a new block, it is added to the chain, and any competing blocks that are created at the same time are discarded. This leads to the phenomenon known as “orphaned blocks,” where some blocks are not included in the main chain, wasting computational resources. Kaspa’s blockDAG structure, however, allows these competing blocks to coexist. Instead of discarding blocks, the GHOSTDAG protocol orders them based on their relationships and confirmations.

This design enables Kaspa to achieve a high block rate—currently around 10 blocks per second, with aspirations to scale up to 100 blocks per second. This high throughput is essential for supporting a growing number of transactions, making Kaspa suitable for modern applications that require rapid processing.

Scalability and Performance

The blockDAG architecture contributes significantly to Kaspa’s scalability. Because multiple blocks can be processed in parallel, the network can handle a larger volume of transactions without compromising speed. The confirmation times are primarily determined by internet latency, which means that as long as users have a reliable internet connection, they can expect swift transaction confirmations.

Consensus Mechanism: Proof-of-Work

Kaspa operates on a Proof-of-Work (PoW) consensus mechanism, which is the same foundational technology used by Bitcoin. However, Kaspa has made several enhancements to improve efficiency and scalability.

k-Heavyhash Algorithm

To secure the network, Kaspa employs an algorithm known as k-Heavyhash. This algorithm is designed for forward compatibility with future mining technologies, such as Photonic miners. The use of PoW ensures that miners must invest computational resources to validate transactions and secure the network, which helps maintain decentralization.

In a PoW system, miners compete to solve complex mathematical problems, and the first miner to solve the problem gets to add a block to the chain (or in this case, the DAG). This process is energy-intensive, but it provides a high level of security, making it difficult for any single entity to dominate the network.

Key Technological Innovations

Kaspa incorporates several key technological innovations that enhance its functionality and user experience. These innovations not only improve performance but also align with the original vision of decentralized cryptocurrency.

GHOSTDAG Protocol

The GHOSTDAG protocol is perhaps the most significant innovation behind Kaspa. By allowing multiple blocks to exist and be confirmed simultaneously, it eliminates the inefficiencies associated with traditional blockchains. This protocol ensures that all blocks are taken into account, leading to a more robust and secure network.

Crescendo Upgrade

One of the pivotal moments in Kaspa’s development was the Crescendo upgrade, which increased the block rate to 10 blocks per second. This hard fork was essential for achieving the desired performance while maintaining network stability. The upgrade illustrates Kaspa’s commitment to continuous improvement and adaptation in response to technological advancements and user needs.

Monetary Policy: Chromatic Phase

Kaspa’s monetary policy is another distinctive feature. The project employs a unique emission schedule known as the “chromatic phase,” which decreases the block reward geometrically over time. This policy is inspired by the 12-note musical scale, and it aims to create a more predictable and sustainable supply of KAS tokens. The initial block reward is set at 440 KAS, and it will halve annually, but with a smooth transition every month. This innovative approach to monetary policy is designed to maintain stability and encourage long-term investment.

Accessibility and Decentralization

Kaspa is engineered for accessibility, ensuring that anyone can run a full node on a standard PC without needing specialized hardware. This feature is crucial for maintaining decentralization, as it allows a broader range of users to participate in the network. The efficient multithreaded CPU usage and secure pruning mechanism help keep disk usage low while preserving cryptographic integrity.

Future Developments

Kaspa is not resting on its laurels; ongoing development includes the introduction of Layer-2 solutions. These solutions aim to expand the network’s capabilities further, leveraging Kaspa’s unique architecture to support scalable applications, decentralized oracles, and secure sequencing. The active development community is dedicated to pushing the boundaries of what is possible within the Kaspa ecosystem.

Conclusion

Kaspa Coin represents a significant advancement in the cryptocurrency landscape, offering a unique blend of high performance, security, and decentralization. Its innovative use of the blockDAG architecture and GHOSTDAG protocol sets it apart from traditional blockchain networks, making it a compelling option for users and investors alike. As the project continues to evolve, its focus on accessibility and scalability promises to keep Kaspa at the forefront of the cryptocurrency space, catering to the needs of modern applications and users. Whether you are a beginner or an experienced investor, understanding the technology behind Kaspa is essential for appreciating its potential and future growth.

Understanding kaspa coin Tokenomics

Kaspa Coin Tokenomics Overview

Kaspa (KAS) is a unique cryptocurrency that leverages a novel consensus mechanism known as GHOSTDAG, which allows for high throughput while maintaining decentralization and security. Understanding its tokenomics is crucial for investors and users to grasp how KAS operates within its ecosystem. This section will cover key metrics related to Kaspa’s token supply, inflation/deflation model, utility, and distribution.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 26.67 billion KAS |

| Max Supply | 28.70 billion KAS |

| Circulating Supply | 26.67 billion KAS |

| Inflation/Deflation Model | Geometric deflation based on a musical scale |

Total Supply, Max Supply, and Circulating Supply

Kaspa has a total supply of approximately 26.67 billion KAS, which is the amount of coins that currently exist in the network. The maximum supply is capped at 28.70 billion KAS, meaning that no more than this amount will ever be created. The circulating supply, which is the number of coins available for trading and use in the market, is also 26.67 billion KAS, indicating that all of the coins that have been minted so far are actively circulating.

Inflation/Deflation Model

Kaspa employs a unique geometric deflation model for its monetary policy. The block reward for miners started at 440 KAS and is halved annually. However, this halving occurs smoothly each month, reducing the block reward by a factor of ( (1/2)^{(1/12)} ). This approach is inspired by the 12-note scale of music, where each note represents a step in the scale. The initial block reward correlates to the frequency of the note A4, and each year is referred to as an “octave.” This design aims to control the inflation rate and maintain the value of KAS over time.

Token Utility (What is the coin used for?)

Kaspa serves multiple purposes within its ecosystem, primarily as a medium of exchange and a means to secure the network. Here are the main utilities of KAS:

-

Transaction Fees: KAS is used to pay for transaction fees on the network. Users must hold KAS to send transactions, which helps to incentivize miners to validate and confirm transactions on the blockchain.

-

Mining Rewards: Miners who contribute their computational power to secure the Kaspa network are rewarded with KAS. This creates an incentive for users to participate in the network and helps maintain its security and integrity.

-

Governance Participation: Although Kaspa is designed to be a decentralized network without a central governance model, KAS holders may have the opportunity to participate in decision-making processes regarding network upgrades and changes in the future.

-

Store of Value: Given its deflationary model and capped supply, KAS can also serve as a store of value. Investors may hold KAS in anticipation of its appreciation over time, similar to how traditional assets are viewed.

-

Layer-2 Solutions: With ongoing development efforts, Kaspa aims to support layer-2 solutions that will enable more complex applications and services to be built on its platform. KAS will likely play a crucial role in these developments, further expanding its utility.

Token Distribution

The distribution of KAS tokens is crucial for understanding the equity and fairness of the network. Kaspa was launched with a fair distribution model, meaning that there was no pre-mining or allocation for founders and insiders. Here’s a brief overview of how KAS is distributed:

-

Mining: The primary method of acquiring KAS is through mining. Miners validate transactions and secure the network, receiving KAS as a reward for their efforts. This approach ensures that KAS is distributed based on the contributions made to the network.

-

Public Participation: Since Kaspa is an open-source project, anyone can participate in mining and thus acquire KAS. This democratizes access to the cryptocurrency and aligns with the project’s goal of decentralization.

-

Community Initiatives: Kaspa has various community-driven initiatives aimed at promoting the adoption and use of KAS. These initiatives often distribute tokens to participants as rewards for contributions, which can include development work, marketing, and community engagement.

-

Future Developments: As Kaspa evolves, there may be new mechanisms for token distribution, particularly as layer-2 solutions and other applications are developed. This could potentially introduce new ways for users to earn KAS and engage with the ecosystem.

In summary, the tokenomics of Kaspa is designed to promote decentralization, security, and fair access. Its unique deflationary model, coupled with the active participation of the community and miners, positions KAS as a promising asset in the ever-evolving cryptocurrency landscape. Understanding these dynamics will help investors and users make informed decisions regarding their involvement with Kaspa.

Price History and Market Performance

Key Historical Price Milestones

Kaspa Coin (KAS) has experienced significant price fluctuations since its launch, reflecting both its unique technological advancements and the broader cryptocurrency market trends.

-

Launch and Initial Trading Phase

Kaspa was launched in November 2021, entering the market with a modest price point. Following its fair launch, the price began at a fraction of a cent, around $0.0001699, marking its all-time low on June 1, 2022. This initial price level provided early investors with an opportunity to acquire KAS at a very low cost. -

Early Growth and Market Recognition

As the cryptocurrency gained traction among developers and investors, Kaspa began to rise steadily. By mid-2022, interest in the project surged, leading to gradual price increases. This growth was partly fueled by the unique features of the GHOSTDAG protocol, which allowed for high transaction throughput without sacrificing decentralization. -

Significant Price Surge in 2023

The year 2023 marked a notable turning point for Kaspa as it began to attract more attention in the crypto community. The price escalated to approximately $0.07953 by late October 2023, showing a strong recovery from its previous lows. This surge can be attributed to a combination of increased trading volumes and heightened interest in Layer-1 solutions capable of handling high transaction speeds. -

All-Time High

Kaspa reached its all-time high of approximately $0.2075 on August 1, 2024. This peak reflected the growing recognition of its technological capabilities and the potential for real-world applications. At this price point, KAS was positioned among the top cryptocurrencies by market capitalization, reflecting its increasing prominence in the market. -

Recent Price Movements

As of late October 2023, KAS has shown resilience, trading around $0.07957 with a market cap exceeding $2 billion. The price has experienced fluctuations, with a 24-hour trading range of approximately $0.07752 to $0.08019. This stability in the face of market volatility is indicative of growing investor confidence.

Factors Influencing the Price

Historically, the price of Kaspa has been influenced by several key factors:

-

Technological Developments

The unique architecture of Kaspa, particularly its GHOSTDAG consensus mechanism, has played a critical role in its price dynamics. Innovations such as the Crescendo upgrade, which increased the block rate to 10 blocks per second, have attracted both developers and investors looking for scalable blockchain solutions. The ability to process transactions rapidly and efficiently has positioned Kaspa favorably against other cryptocurrencies, contributing to its price appreciation. -

Market Sentiment and Speculation

Like many cryptocurrencies, Kaspa’s price has been affected by overall market sentiment. Bullish trends in the broader cryptocurrency market often lead to increased trading volumes and speculative investments in KAS. Conversely, bearish trends can result in price declines as investors seek to mitigate losses. Media coverage, social media discussions, and community engagement have also significantly influenced investor sentiment. -

Regulatory Developments

The cryptocurrency landscape is heavily influenced by regulatory announcements and government policies. As governments around the world adapt to the growing presence of digital currencies, any regulatory news can impact investor confidence and market behavior. Kaspa, being a relatively new and innovative project, is particularly sensitive to such changes, which can result in swift price movements. -

Adoption and Use Cases

The practical applications of Kaspa’s technology play a crucial role in its price trajectory. Increased adoption in real-world scenarios, such as decentralized finance (DeFi) applications or partnerships with other blockchain projects, can enhance its visibility and utility. When users and developers demonstrate a growing interest in utilizing Kaspa’s capabilities, it can lead to upward pressure on the price. -

Market Liquidity and Trading Volume

The liquidity of KAS in the market is a significant factor influencing its price. Higher trading volumes generally indicate increased interest and can lead to more stable price movements. For example, a 24-hour trading volume of approximately $29.7 million suggests active market participation, which can help maintain price stability and attract further investment. -

Competition with Other Cryptocurrencies

The competitive landscape of cryptocurrencies also impacts Kaspa’s market performance. As new projects emerge and existing ones evolve, Kaspa must continuously demonstrate its advantages to maintain investor interest. Price movements can be influenced by the performance of similar cryptocurrencies, particularly those also focused on high throughput and scalability.

Conclusion

In summary, Kaspa Coin has shown a remarkable journey since its inception, characterized by significant price milestones and driven by various factors including technological advancements, market sentiment, regulatory developments, and competition. As the cryptocurrency landscape continues to evolve, monitoring these influences will be crucial for understanding Kaspa’s future market performance.

Where to Buy kaspa coin: Top Exchanges Reviewed

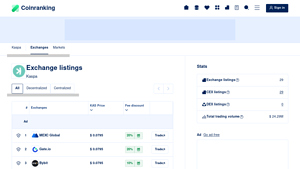

5. Kaspa (KAS) – A Rising Star in the Exchange Arena!

The exchange listings for Kaspa (KAS) on Coinranking provide a comprehensive overview of available trading platforms, allowing users to compare prices, trading volumes, and any applicable discounts. This feature stands out by empowering traders to make informed decisions based on real-time data, ensuring they select the most advantageous exchange for their transactions. The user-friendly interface simplifies the process, catering to both novice and experienced investors alike.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

3. Kaspa Exchange – A Rising Star in the US Crypto Scene!

Kaspa Exchange distinguishes itself in the US cryptocurrency landscape through its seamless integration with popular platforms like Coinbase and TradeOgre, allowing users to easily purchase Bitcoin or Litecoin and convert them to Kaspa. This streamlined process, coupled with weekly trading capabilities, appeals to both novice and experienced investors looking for a straightforward way to manage their digital assets efficiently. Its user-friendly approach makes it a noteworthy option for those interested in Kaspa trading.

- Website: reddit.com

- Platform Age: Approx. 20 years (domain registered in 2005)

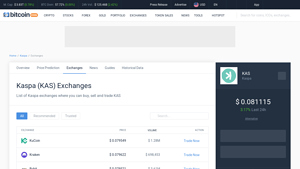

5. Kaspa Exchanges – Your Gateway to Effortless KAS Trading!

Kaspa exchanges, including prominent platforms like KuCoin, Kraken, Bybit, and Gate, offer a robust environment for buying, selling, and trading KAS. What sets these exchanges apart is their user-friendly interfaces, diverse trading pairs, and strong security measures, making them accessible for both novice and experienced traders. Additionally, their liquidity and trading volume enhance the overall trading experience for those looking to engage with the Kaspa ecosystem.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

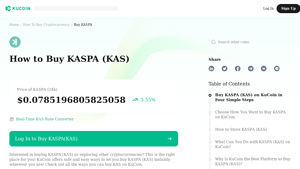

7. KuCoin – Your Gateway to KASPA (KAS) Trading!

KuCoin stands out as a premier exchange for purchasing KASPA (KAS) due to its user-friendly interface and robust security features, ensuring a seamless buying experience for users worldwide. With multiple payment options available, KuCoin simplifies the process of acquiring KAS, making it accessible for both novice and experienced investors. Its commitment to safety and ease of use positions KuCoin as a reliable platform for trading digital assets.

- Website: kucoin.com

- Platform Age: Approx. 12 years (domain registered in 2013)

How to Buy kaspa coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

Before you can purchase Kaspa (KAS), you need to select a cryptocurrency exchange that supports the trading of KAS. Some popular exchanges where you can buy Kaspa include:

- Gate.io: Known for its wide variety of cryptocurrencies and trading pairs.

- MEXC: Offers multiple trading options and a user-friendly interface.

- Bybit: A well-known platform for both spot and derivatives trading.

- Kraken: One of the longest-standing exchanges with a reputation for security.

When choosing an exchange, consider factors such as user experience, fees, trading volume, and security features. Make sure the exchange allows you to trade in your preferred fiat currency (e.g., USD, EUR).

2. Create and Verify Your Account

Once you’ve selected an exchange, you’ll need to create an account. Follow these steps:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. Provide your email address and create a secure password.

- Email Verification: Check your email for a verification link. Click on it to verify your email address.

- Complete KYC (Know Your Customer): Most exchanges require you to complete KYC verification to comply with regulations. This typically involves providing personal information, uploading identification documents (like a passport or driver’s license), and possibly a utility bill for address verification.

- Two-Factor Authentication (2FA): Enable 2FA for an added layer of security. This usually involves linking your account to a mobile app like Google Authenticator or receiving SMS codes.

3. Deposit Funds

After your account is verified, you can deposit funds to start buying Kaspa. Here’s how to do it:

- Go to the Deposit Section: Navigate to the “Wallet” or “Funds” section of the exchange and select “Deposit.”

- Choose a Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit card, or cryptocurrency. Choose the method that suits you best.

– Bank Transfer: This is usually the most economical option, but it may take several days to process.

– Credit/Debit Card: This method is faster but may incur higher fees.

– Cryptocurrency Transfer: If you already own other cryptocurrencies, you can deposit them and trade them for Kaspa. - Follow the Instructions: Depending on your chosen method, follow the on-screen instructions to complete the deposit. If you are depositing cryptocurrency, ensure you send it to the correct wallet address provided by the exchange.

4. Place an Order to Buy kaspa coin

Once your account is funded, you can buy Kaspa. Here’s how:

- Navigate to the Trading Section: Find the “Markets” or “Trade” section on the exchange.

- Select the KAS Trading Pair: Look for the KAS trading pair that matches your deposited currency (e.g., KAS/USD, KAS/USDT).

- Choose the Order Type: You can place different types of orders:

– Market Order: This will buy Kaspa at the current market price. It’s the easiest option for beginners.

– Limit Order: This allows you to set a specific price at which you want to buy Kaspa. The order will only execute if the price reaches your set level. - Enter the Amount: Specify how much Kaspa you want to purchase. Review the total cost and any fees before confirming.

- Confirm the Order: Click the “Buy” or “Place Order” button to finalize your transaction. You will receive a notification once the order is executed.

5. Secure Your Coins in a Wallet

After purchasing Kaspa, it’s crucial to secure your coins. While you can keep them on the exchange, it’s safer to transfer them to a personal wallet. Here’s how:

- Choose a Wallet: You can use a software wallet (like Exodus or Atomic Wallet) or a hardware wallet (like Ledger or Trezor) for better security.

- Set Up Your Wallet: If you choose a software wallet, download the app and create a new wallet. Follow the instructions to back up your recovery phrase securely.

- Transfer KAS to Your Wallet:

– Go to the wallet section of the exchange.

– Select “Withdraw” and enter your wallet’s KAS address.

– Specify the amount you wish to transfer and confirm the transaction. - Verify the Transfer: Check your wallet to ensure the KAS has been received. Always double-check the wallet address before making the transfer to avoid losing your funds.

By following these steps, you can successfully purchase and secure your Kaspa coins, allowing you to participate in this growing cryptocurrency ecosystem.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Innovative Technology

Kaspa is built on a unique consensus mechanism known as the GHOSTDAG protocol, which allows for the coexistence of multiple blocks within a Directed Acyclic Graph (DAG) structure. This design enables the network to achieve higher throughput and faster confirmation times compared to traditional blockchains. Currently, Kaspa processes approximately 10 blocks per second, with aspirations to scale this to 100 blocks per second in the future. This scalability could position Kaspa as a competitive player in the ever-evolving cryptocurrency space, especially for applications requiring high transaction speeds.

Strong Market Position

With a current market capitalization of around $2.12 billion and a rank of #46 among cryptocurrencies, Kaspa has established a significant presence in the market. Its trading volume, which fluctuates around $29.7 million in a 24-hour period, indicates active investor interest and liquidity, making it easier for new investors to enter and exit positions without significant price slippage.

Decentralization and Accessibility

Kaspa is designed to run efficiently on standard consumer hardware, which aligns with its goal of decentralization. This accessibility allows a broader range of individuals to participate in the network without the need for specialized mining equipment. By maintaining a low barrier to entry, Kaspa encourages community involvement and contributes to its security and resilience against centralized control.

Unique Monetary Policy

Kaspa’s monetary policy is characterized by a distinctive emission schedule, where block rewards decrease geometrically over time, akin to the structure of a musical scale. This innovative approach not only adds an interesting layer to its economic model but also aims to mitigate inflationary pressures as the network matures. Such a thoughtfully designed monetary policy may appeal to investors seeking a long-term value proposition.

Active Development Community

The project is supported by a global community of contributors dedicated to its ongoing development and research. This decentralized approach fosters innovation and adaptability, allowing Kaspa to evolve in response to market needs and technological advancements. The commitment of its developers to expand the network’s capabilities, including the development of layer-2 solutions, may further enhance its utility and appeal.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Like many cryptocurrencies, Kaspa is subject to significant market volatility. Price fluctuations can be abrupt and dramatic, influenced by broader market trends, investor sentiment, and speculative trading behaviors. Such volatility can lead to substantial financial losses for investors, particularly those who are unprepared for the risks associated with trading digital assets. Investors must approach with caution, understanding that prices can swing wildly over short periods.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain and varies significantly across jurisdictions. Governments worldwide are still grappling with how to classify, regulate, and tax digital assets. Potential regulatory crackdowns could impact the viability of Kaspa as an investment. For instance, if certain jurisdictions impose stringent regulations on proof-of-work cryptocurrencies, it could hinder Kaspa’s growth and adoption, affecting its market performance.

Competition

Kaspa operates in a highly competitive environment, where numerous cryptocurrencies vie for market share. Other Layer-1 solutions and blockchains with similar scalability and speed features may pose significant competition. Established projects like Ethereum, Solana, and newer entrants continually innovate and enhance their ecosystems, which could overshadow Kaspa if it fails to differentiate itself effectively. If Kaspa cannot maintain its unique value proposition or keep pace with technological advancements, it may struggle to attract and retain users and investors.

Technological Risks

While Kaspa’s GHOSTDAG protocol presents innovative advantages, it also faces inherent technological risks. The complexity of the DAG structure and the consensus mechanism could introduce vulnerabilities or bugs that may compromise network security or stability. Additionally, as the network scales, maintaining performance while ensuring security will be a critical challenge. Any failure to address these technological concerns could lead to a loss of confidence among users and investors, negatively impacting the network’s reputation and value.

Dependency on Mining

Kaspa relies on a proof-of-work consensus mechanism, which requires miners to validate transactions and secure the network. As the mining landscape evolves, factors such as rising energy costs, changes in mining hardware availability, and increased competition could affect the network’s security and operational efficiency. If mining becomes less profitable or more challenging, it could lead to decreased participation from miners, ultimately compromising network security.

Conclusion

In summary, while Kaspa presents a compelling case for investment through its innovative technology, strong market position, and unique monetary policy, potential investors must weigh these strengths against significant risks. Market volatility, regulatory uncertainty, competition, and technological vulnerabilities are critical factors that could impact Kaspa’s future performance. As with any investment in cryptocurrencies, thorough research, risk assessment, and a well-considered investment strategy are essential for navigating this dynamic and often unpredictable landscape.

Frequently Asked Questions (FAQs)

1. What is Kaspa Coin (KAS)?

Kaspa Coin (KAS) is a Layer-1 cryptocurrency that operates on a proof-of-work (PoW) consensus mechanism, utilizing a unique protocol known as GHOSTDAG. This protocol enables the coexistence of multiple parallel blocks, allowing for high throughput and rapid confirmation times, which are primarily limited by internet latency. Kaspa aims to provide a decentralized network that is accessible and efficient, processing approximately 10 blocks per second, with ambitions to scale up to 100 blocks per second.

2. Who created Kaspa Coin?

Kaspa was initiated by Dr. Yonatan Sompolinsky, a researcher affiliated with Harvard University. His work on scalable proof-of-work protocols laid the foundation for the GHOSTDAG consensus mechanism used in Kaspa. The project began under DAGLabs, a research company funded by Polychain Capital, and transitioned to a community-led model after its fair launch in November 2021. The development of Kaspa is maintained by a global group of contributors, reflecting its open-source and decentralized nature.

3. What makes Kaspa Coin different from Bitcoin?

Kaspa Coin differentiates itself from Bitcoin primarily through its consensus mechanism and block structure. While Bitcoin uses a traditional blockchain that discards competing blocks, Kaspa’s GHOSTDAG protocol allows for multiple blocks to exist simultaneously, enhancing scalability and transaction speed. Additionally, Kaspa aims for a much higher block generation rate, currently at 10 blocks per second compared to Bitcoin’s approximately 7 blocks per 10 minutes. This enables faster transaction confirmations and a more efficient network.

4. Is Kaspa Coin a good investment?

As with any investment in cryptocurrency, determining whether Kaspa Coin is a good investment depends on various factors, including market conditions, technological developments, and individual risk tolerance. Kaspa has shown significant price growth since its launch, reaching an all-time high of approximately $0.2075 in August 2024. However, potential investors should conduct thorough research, consider the volatility of the cryptocurrency market, and assess their investment strategy before investing in KAS.

5. How many Kaspa Coins are there?

As of now, there are approximately 26.67 billion Kaspa Coins in circulation, with a maximum supply capped at around 28.7 billion coins. The emission of new coins is governed by a unique monetary policy that reduces block rewards geometrically over time, based on musical intervals. This approach aims to control inflation and provide a predictable supply schedule.

6. How is the Kaspa network secured?

The Kaspa network is secured through a proof-of-work mechanism that employs the k-Heavyhash algorithm. This algorithm was specifically chosen to ensure forward compatibility with future mining technologies, such as photonic miners. Miners play a critical role in validating transactions and maintaining the integrity of the network, similar to other PoW cryptocurrencies.

7. Where can I buy Kaspa Coin?

Kaspa Coin can be purchased on various centralized exchanges, including popular platforms like Kraken, Bybit, Gate.io, and MEXC. Trading pairs typically include KAS/USDT or KAS/BTC. It is advisable to check the exchange’s trading volume and liquidity for KAS to ensure a smooth trading experience.

8. What are the future developments planned for Kaspa?

Kaspa has several future developments in the pipeline, including the introduction of layer-2 solutions that will enhance its capabilities. These developments aim to leverage Kaspa’s unique architecture to support scalable applications, decentralized oracles, and secure sequencing. The ongoing improvements reflect the project’s commitment to advancing its technology and expanding its ecosystem while maintaining decentralization and security.

Final Verdict on kaspa coin

Overview of Kaspa Coin

Kaspa Coin (KAS) is a cutting-edge Layer-1 cryptocurrency designed to achieve high scalability and fast transaction speeds through its innovative GHOSTDAG protocol. This unique consensus mechanism allows for parallel block processing, which significantly increases throughput while maintaining the security and decentralization characteristics expected of proof-of-work systems. Currently operating at a rate of 10 blocks per second, Kaspa aims to scale even further, with long-term goals of reaching up to 100 blocks per second, thereby ensuring quick confirmation times that are primarily limited by internet latency.

Technological Innovations

The architecture of Kaspa is noteworthy for its efficient use of resources, allowing full nodes to operate on standard personal computers without the need for specialized hardware. This design aligns with the original vision of Satoshi Nakamoto, promoting accessibility and decentralization in cryptocurrency participation. Additionally, the project incorporates a unique monetary policy that geometrically decreases emissions over time, mimicking the frequencies of musical notes, which adds a layer of intrigue to its economic model.

Investment Potential

While Kaspa Coin presents promising technological advancements and a solid foundation for future growth, it is essential to recognize that investing in cryptocurrencies remains a high-risk, high-reward endeavor. As with any digital asset, potential investors should be aware of the volatility in the market, regulatory uncertainties, and the rapid pace of technological changes that could impact Kaspa’s trajectory.

Final Thoughts

In conclusion, Kaspa Coin stands out as a unique and ambitious project within the cryptocurrency landscape. Its innovative approach to scalability and security presents exciting opportunities for both developers and investors. However, potential investors are strongly advised to conduct their own thorough research (DYOR) to understand the associated risks and to make informed decisions. By carefully analyzing the project’s fundamentals, market trends, and technological developments, investors can better position themselves in this dynamic digital asset class.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.