Should You Invest in gala crypto? A Full Analysis (2025)

An Investor’s Introduction to gala crypto

Gala is a prominent player in the rapidly evolving landscape of blockchain technology, particularly focusing on the intersection of gaming, music, and film within the Web3 ecosystem. Established in 2019 by Eric Schiermeyer, co-founder of the well-known gaming company Zynga, Gala aims to empower users and creators across multiple industries. The project is built on its proprietary layer-1 blockchain, known as GalaChain, which facilitates a decentralized environment where developers can create and deploy applications with ease. This innovative approach positions Gala as a potential leader in the burgeoning field of decentralized entertainment.

Significance in the Crypto Market

Gala has garnered attention for its unique ecosystem that combines gaming, music, and film, creating a multifaceted platform that appeals to a wide range of users. The GALA token serves as the official utility and gas token within this ecosystem, enabling transactions and incentivizing participation. With a current market cap of approximately $745 million and a circulating supply of nearly 46 billion tokens, GALA ranks within the top 100 cryptocurrencies by market capitalization. Its innovative model of rewarding node operators with newly minted tokens further distinguishes it from many other projects that rely on initial coin offerings (ICOs) for funding.

Purpose of This Guide

This guide aims to be a comprehensive resource for beginners and intermediate investors interested in understanding GALA and its broader ecosystem. We will delve into several key areas:

- Technology: Explore the underlying blockchain technology of GalaChain, its features, and its potential for scalability and security.

- Tokenomics: Analyze the economic model of the GALA token, including its supply dynamics, utility, and reward mechanisms.

- Investment Potential: Evaluate the factors influencing GALA’s market performance, historical price trends, and future growth prospects.

- Risks: Discuss the potential risks associated with investing in GALA, including market volatility, regulatory challenges, and technological vulnerabilities.

- How to Buy: Provide step-by-step instructions on acquiring GALA through various exchanges and wallets.

By the end of this guide, you will have a well-rounded understanding of GALA, equipping you with the knowledge needed to make informed investment decisions in this exciting digital asset. Whether you are drawn to the gaming aspect, the decentralized nature of the project, or the innovative approach to user empowerment, Gala presents a compelling opportunity in the cryptocurrency market.

What is gala crypto? A Deep Dive into its Purpose

Overview of Gala Crypto

Gala is a prominent player in the Web3 ecosystem, specifically designed to integrate decentralized applications (dApps) across various entertainment sectors, including gaming, music, and film. The project primarily utilizes its native token, $GALA, which acts as a utility and gas token within its blockchain environment, known as GalaChain. This layer-1 blockchain is crafted to support a diverse range of applications and is geared towards empowering creators and users alike.

The Core Problem It Solves

One of the fundamental issues that Gala aims to address is the lack of true ownership and control that users face in traditional digital entertainment ecosystems. In conventional models, users often invest time and money into games, music, and films without any real stake or ownership in the assets they consume. Gala seeks to change this by providing a decentralized platform where users can genuinely own their digital assets through blockchain technology.

Empowering Creators

Gala also addresses the challenges faced by creators and developers in the entertainment industry. Many creators struggle with high fees, restrictive platforms, and limited revenue-sharing models. GalaChain offers an open-source environment where developers can create and monetize their content without the constraints imposed by centralized entities. By allowing creators to launch custom tokens and smart contracts, Gala enables a more equitable distribution of revenue and recognition.

Building a Decentralized Infrastructure

Gala’s infrastructure is built around a decentralized network of nodes, primarily consisting of Founder’s Nodes. These nodes are crucial for maintaining the network’s functionality and security. By incentivizing node operators with $GALA rewards, Gala ensures that the ecosystem remains robust and resilient. This decentralized approach mitigates risks associated with centralization, such as censorship and single points of failure, thus fostering a more democratic digital landscape.

Its Unique Selling Proposition

Gala distinguishes itself in the crowded crypto space through several key features that enhance its appeal to both users and developers.

Layer-1 Blockchain (GalaChain)

At the heart of Gala’s offering is GalaChain, a layer-1 blockchain specifically designed to support a variety of entertainment applications. This blockchain provides the scalability and flexibility needed to accommodate a growing number of decentralized applications. Unlike many other projects that rely on existing blockchains, GalaChain is purpose-built for its ecosystem, enabling faster transactions and lower fees.

Developer-Friendly Ecosystem

Gala places a strong emphasis on creating a developer-friendly environment. Tools like the GalaChain SDK and the Creator Portal simplify the process of building on the platform. These resources are designed to reduce the barriers to entry for developers, allowing them to focus on innovation rather than technical hurdles. This commitment to accessibility can attract a broader range of developers, fostering a diverse array of applications.

No Initial Coin Offering (ICO)

Another significant aspect of Gala’s uniqueness is its decision not to conduct an ICO. Instead of relying on speculative investments, Gala was funded through the sale of products like Founder’s Node licenses and NFTs associated with its games. This approach aligns with the project’s ethos of decentralization and community empowerment, as it prioritizes user involvement over investor speculation.

Tokenomics and Sustainability

The $GALA token employs a dynamic emission model that adjusts based on the circulating supply and usage within the ecosystem. Tokens are burned when used as gas for transactions, thereby reducing the overall supply over time. This mechanism not only incentivizes usage but also aims to create scarcity, potentially enhancing the token’s value. Moreover, the system encourages long-term engagement from node operators, who play a vital role in maintaining the ecosystem’s integrity.

The Team and Backers

Gala was co-founded in 2019 by Eric Schiermeyer, who is also a co-founder of Zynga, a leading social gaming company. Schiermeyer’s extensive experience in both gaming and blockchain positions him as a visionary leader in the space. Under his guidance, Gala has assembled a talented team of over 350 employees, including experts in game development, blockchain technology, and decentralized finance.

Strategic Partnerships

Gala has formed strategic partnerships with various blockchain and entertainment entities, enhancing its credibility and reach. Collaborations with established platforms and developers not only bring additional resources but also foster innovation within the ecosystem. These partnerships are crucial for expanding the use cases of $GALA and reinforcing Gala’s position in the competitive landscape.

Conclusion: Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Gala in the crypto ecosystem is to create a decentralized, user-centric platform that empowers creators and users alike. By leveraging blockchain technology, Gala aims to redefine the relationship between users and digital assets, ensuring true ownership and control. Through its unique infrastructure, developer-friendly tools, and commitment to decentralization, Gala strives to build a sustainable ecosystem that can accommodate a billion users.

In summary, Gala is not just another blockchain project; it is a comprehensive ecosystem that seeks to disrupt traditional entertainment models by offering a decentralized alternative that prioritizes user empowerment and creator rights. As the world continues to shift towards Web3, Gala is well-positioned to be a leader in this transformative landscape, making it an essential project for anyone interested in the future of digital entertainment and decentralized applications.

The Technology Behind the Coin: How It Works

Introduction to Gala Crypto Technology

Gala is a web3 ecosystem designed to revolutionize the way users interact with digital entertainment. At its core lies GalaChain, a layer-1 blockchain that powers various platforms, including Gala Games, Gala Music, and Gala Film. This section delves into the technology behind Gala, explaining its architecture, consensus mechanisms, and key innovations in a way that’s accessible to both beginners and intermediate investors.

Blockchain Architecture

GalaChain is the backbone of the Gala ecosystem, providing a decentralized platform that supports a variety of applications, ranging from games to music and film. Here’s a closer look at its architecture:

-

Layer-1 Blockchain: GalaChain is a layer-1 blockchain, meaning it operates independently without relying on another blockchain for its security or transactions. This design allows for greater flexibility and scalability, making it capable of handling a large volume of transactions efficiently.

-

Modular Design: The architecture of GalaChain is modular, allowing developers to build and deploy their projects with ease. This means that different components of the blockchain can be updated or replaced without affecting the entire system. This modularity fosters innovation and adaptability within the ecosystem.

-

Interoperability: GalaChain is designed to be interoperable, allowing assets and tokens to be easily transferred between different blockchains, such as Ethereum and Binance Smart Chain. This feature enhances the usability of Gala’s ecosystem, enabling developers to tap into a broader market.

-

Decentralized Physical Infrastructure Network (DePIN): GalaChain utilizes a DePIN model, which relies on independent nodes (specifically Founder’s Nodes) to secure the network and validate transactions. This decentralized approach not only enhances security but also incentivizes community participation.

Consensus Mechanism

Understanding how GalaChain reaches consensus is crucial for grasping its functionality and security. Here’s how it works:

-

Founder’s Nodes: At the heart of GalaChain’s consensus mechanism are Founder’s Nodes, which play a critical role in maintaining the network. There are 50,000 Founder’s Nodes, and they are responsible for validating transactions and creating new blocks. Node operators are incentivized with daily $GALA rewards for their contributions, aligning their interests with the network’s security.

-

Proof-of-Stake-Like Model: While GalaChain doesn’t strictly adhere to traditional proof-of-stake (PoS) or proof-of-work (PoW) models, it incorporates elements from these systems. The node operators essentially stake their resources (computing power) to validate transactions, which is akin to PoS. This approach reduces energy consumption compared to PoW models and enhances the network’s overall efficiency.

-

Governance Rights: Node operators also enjoy governance rights, allowing them to participate in decision-making processes concerning the network. This democratic approach ensures that the community has a voice in the development and evolution of GalaChain.

Key Technological Innovations

Gala incorporates several innovative technologies that differentiate it from other blockchain projects. Here are some of the standout features:

1. GalaChain SDK

The GalaChain Software Development Kit (SDK) is a powerful tool designed to simplify the process for developers looking to build on the Gala platform. Key aspects include:

-

User-Friendly Tools: The SDK provides a set of easy-to-use tools that enable developers to create custom tokens, smart contracts, and decentralized applications (dApps) without needing extensive blockchain knowledge.

-

Open Source Resources: By offering open-source resources, Gala encourages collaboration and innovation within the developer community. This transparency fosters trust and allows for rapid iteration of ideas.

2. Creator Portal

The Creator Portal is another significant innovation within the Gala ecosystem, aimed at empowering creators and developers:

-

Simplified Access: The portal allows creators to easily access GalaChain’s functionalities, enabling them to launch their projects quickly and efficiently.

-

Community Engagement: Through the Creator Portal, developers can engage with the Gala community, receive feedback, and collaborate with other creators. This community-driven approach enhances the ecosystem’s vibrancy and diversity.

3. Node Networks

Beyond the Founder’s Nodes, GalaChain supports various specialized node networks, each tailored for specific applications:

-

Game-Specific Nodes: These nodes are designed to support the computational needs of individual games within the Gala ecosystem. By creating dedicated nodes, Gala ensures that each game can operate smoothly and efficiently.

-

Gala Music’s Jukebox Nodes and Gala Film’s Theater Nodes: Similar to game nodes, these specialized nodes cater to the unique requirements of music and film projects. This specialization allows for optimized performance and enhanced user experiences.

Emission and Supply Dynamics

Understanding how $GALA tokens are distributed and how their supply is managed is crucial for investors. Here’s a breakdown:

-

No ICO: Unlike many cryptocurrencies, Gala did not conduct an initial coin offering (ICO) to raise funds. Instead, it generates $GALA tokens through the operation of Founder’s Nodes. This unique approach emphasizes decentralization and community involvement from the outset.

-

Dynamic Emission Rate: The daily emission rate of $GALA is dynamically adjusted based on the circulating supply. This means that as more tokens are burned (used for transactions or other ecosystem activities), the emission rate decreases, creating a responsive supply system.

-

Token Burning: When $GALA is used as gas for transactions within the Gala ecosystem, it is burned. This burning mechanism not only reduces the circulating supply but also adds a deflationary aspect to the tokenomics, potentially increasing the token’s value over time.

Security Measures

Security is a paramount concern in the blockchain space, and Gala takes several measures to ensure the safety of its ecosystem:

-

Multisig Wallet: Gala employs a Gnosis multisig wallet to manage funds, ensuring that no single person has unilateral access. This collective oversight enhances security and minimizes the risk of malicious activities.

-

Audits and Ratings: Gala has undergone extensive audits, receiving a Gold badge and AAA rating from Certik, a leading blockchain security firm. This commitment to security reinforces user confidence in the platform.

-

Regulatory Compliance: Gala actively collaborates with international accounting and regulatory agencies to ensure compliance with best practices. This proactive approach helps mitigate risks associated with regulatory changes in the crypto landscape.

Conclusion

Gala’s innovative technology, characterized by its modular architecture, unique consensus mechanism, and community-driven approach, sets it apart in the rapidly evolving blockchain space. With a focus on empowering creators and fostering engagement, GalaChain is positioned as a versatile platform capable of supporting a diverse range of applications in the digital entertainment sector. As the ecosystem continues to grow, understanding its technological foundations will be essential for anyone interested in the future of Gala crypto and the broader web3 landscape.

Understanding gala crypto Tokenomics

Key Metrics of GALA Tokenomics

To better understand the tokenomics of the Gala cryptocurrency, it is essential to look at key metrics that define its economic structure. Below is a table summarizing these metrics:

| Metric | Value |

|---|---|

| Total Supply | 45.9 billion GALA |

| Max Supply | 50 billion GALA |

| Circulating Supply | 45.9 billion GALA |

| Inflation/Deflation Model | Dynamic emission based on total supply, with a portion burned during transactions |

Token Utility (What is the coin used for?)

The GALA token serves multiple purposes within the Gala ecosystem, which encompasses gaming, music, and film. Here are the primary utilities of the GALA token:

-

Transaction Fees: GALA is used as a gas token on the GalaChain. Whenever users engage in transactions, such as trading NFTs or interacting with decentralized applications (dApps) within the Gala ecosystem, GALA is required to facilitate these transactions. This provides a fundamental utility that ensures the smooth operation of the platform.

-

Rewards for Node Operators: A unique aspect of GALA is its issuance mechanism. The majority of new GALA tokens are distributed as rewards to Founder’s Node operators. These operators provide essential computing resources to the Gala ecosystem, and in return, they receive GALA tokens daily. This incentivizes community participation and helps maintain the network’s decentralized nature.

-

Governance Participation: GALA token holders are given governance rights, allowing them to vote on key decisions affecting the Gala ecosystem. This participatory model empowers the community and aligns the interests of token holders with the development and future direction of the platform.

-

Purchasing Power: GALA can be used to purchase in-game assets, music, and film-related content within the Gala ecosystem. This utility extends to enabling users to buy NFTs that represent ownership of digital goods, artwork, and more within the Gala universe.

-

Burn Mechanism: A portion of GALA is burned whenever it is used in transactions, reducing the overall supply over time. This deflationary aspect helps maintain the value of the token by limiting its availability, which is particularly important in a market where inflation can devalue digital assets.

Token Distribution

The distribution of GALA tokens is structured to promote decentralization, community engagement, and sustainable growth. Here’s how the distribution works:

-

Founder’s Nodes: The primary mechanism for GALA distribution is through the operation of Founder’s Nodes. These nodes are essential for powering the Gala ecosystem, and operators earn GALA tokens as rewards. The current distribution model allocates approximately 50% of the daily issuance to the node operators, while the remaining 50% is directed to the Gala Conservatorial Entity, which plays a crucial role in maintaining and curating the platform.

-

Dynamic Emission Rate: The emission rate of GALA tokens is not fixed; it is dynamically adjusted based on the total supply of GALA in circulation. This model ensures that the issuance of new tokens can respond to market conditions. For instance, if the total supply increases due to more tokens being emitted than burned, the emission rate will decrease to maintain balance.

-

Halving Events: The Gala tokenomics also includes halving events that trigger when certain milestones in total supply are reached. This mechanism reduces the daily issuance of GALA tokens, thereby exerting downward pressure on the circulating supply. For example, as the total supply approaches certain thresholds, the amount of GALA distributed daily to node operators is halved, encouraging scarcity.

-

No Initial Coin Offering (ICO): Unlike many projects in the cryptocurrency space, Gala did not conduct an ICO or any initial fundraising round. Instead, the project was funded through the sale of Founder’s Node licenses and NFTs. This approach aligns with Gala’s vision of decentralization and community empowerment.

-

Burning Tokens: As mentioned earlier, GALA tokens are burned when used as gas fees in the ecosystem. This burning mechanism helps reduce the circulating supply over time, contributing to a deflationary model that can positively impact the token’s value.

In summary, the tokenomics of GALA is designed to promote a sustainable ecosystem that rewards community involvement and supports the growth of its decentralized applications across gaming, music, and film. By leveraging a dynamic emission model, effective token utility, and a unique distribution strategy, Gala aims to create a thriving environment for users and developers alike. Understanding these elements is crucial for anyone looking to engage with the GALA token and its associated platforms.

Price History and Market Performance

Key Historical Price Milestones

The price history of Gala (GALA) has witnessed significant fluctuations since its inception, reflecting both the volatile nature of the cryptocurrency market and the project’s evolving ecosystem.

-

Initial Launch and Early Days (2020)

Gala was launched in 2020, and its early trading price was notably low, starting around $0.000151 in December 2020. This period marked the coin’s all-time low, providing a foundation for potential future growth. -

Initial Growth and Market Interest (2021)

As the project gained traction and visibility, the price began to rise in 2021. Gala’s price saw a remarkable increase, culminating in an all-time high of $0.8367 on November 26, 2021. This surge was primarily fueled by growing interest in blockchain gaming and the broader adoption of NFTs, which aligned with Gala’s gaming focus. The price increase during this period was over 550,000% compared to its all-time low, showcasing the volatility and potential for explosive growth within the cryptocurrency space. -

Market Correction and Consolidation (2022)

Following the all-time high, GALA, like many cryptocurrencies, experienced a significant market correction in 2022. The price retraced sharply, reflecting broader trends in the cryptocurrency market, including regulatory concerns and the bursting of speculative bubbles. Throughout 2022, GALA fluctuated between $0.05 and $0.20, as investors reevaluated the project’s fundamentals amidst a challenging market environment. -

Recent Performance (2023)

As of October 2023, GALA is trading around $0.01625, with a market capitalization of approximately $745.71 million. The token has demonstrated some resilience, managing to recover slightly from its lows while remaining a popular choice among gamers and NFT enthusiasts. The circulating supply of GALA is 45.9 billion, out of a maximum supply of 50 billion, indicating a substantial portion of tokens is already in circulation.

Factors Influencing the Price

Historically, the price of GALA has been influenced by a combination of market sentiment, project developments, and broader economic trends. Below are some of the key factors that have played a role in determining GALA’s market performance:

-

Market Sentiment and Speculation

Like many cryptocurrencies, GALA’s price is heavily influenced by market sentiment. Bullish sentiment, often driven by positive news about the Gala ecosystem or the broader blockchain gaming sector, has led to price spikes. Conversely, bearish sentiment, often triggered by negative news or broader market downturns, has resulted in price drops. The speculative nature of cryptocurrencies means that even small announcements can lead to significant price movements. -

Adoption of Gala Ecosystem

The adoption and success of the Gala ecosystem, which includes Gala Games, Gala Music, and Gala Film, have directly impacted GALA’s price. As more users engage with the platform and its offerings, demand for GALA increases, potentially driving up the price. The launch of new games and partnerships within the Gala ecosystem has historically correlated with positive price movements. -

Technological Developments

Innovations and upgrades within the Gala ecosystem, such as the introduction of GalaChain, have also influenced GALA’s price. The migration to a new contract address and enhancements to the underlying technology can boost investor confidence, leading to increased buying activity. Developers and investors closely monitor technological advancements, and positive developments can create a favorable environment for price appreciation. -

Market Conditions and Economic Factors

GALA’s price is not immune to macroeconomic conditions affecting the broader cryptocurrency market. Factors such as regulatory developments, changes in monetary policy, and the overall economic climate can impact investor behavior and sentiment. During times of economic uncertainty, investors may retreat from riskier assets, including cryptocurrencies, leading to price declines. -

Tokenomics and Supply Dynamics

The tokenomics of GALA, including its total supply and distribution model, play a crucial role in its market performance. The daily issuance of new tokens to Founder’s Node operators creates a supply dynamic that can influence price levels. Additionally, the mechanisms for burning tokens during transactions add a deflationary aspect that can support price stability over time. -

Community Engagement and Governance

The active involvement of the Gala community, particularly through the Founder’s Node network, has contributed to the project’s resilience. Community-driven governance and decision-making processes can enhance trust and loyalty among users, which in turn can positively influence GALA’s price.

Conclusion

In summary, the price history and market performance of GALA reflect a journey marked by significant milestones, influenced by various factors including market sentiment, adoption rates, technological advancements, and broader economic conditions. As the Gala ecosystem continues to develop and expand, it remains essential for investors to stay informed about these dynamics to understand potential future price movements.

Where to Buy gala crypto: Top Exchanges Reviewed

1. Changelly – Swap GALA with the Lowest Fees!

GALA Exchange, powered by Changelly, stands out for its competitive rates and low transaction fees, making it an attractive option for users looking to swap GALA (GALA) efficiently. With a high rating of 4.7 from over 5,000 reviews, it offers a user-friendly platform accessible via both website and app, supporting over 700 cryptocurrencies. Additionally, its 24/7 live support ensures that users receive assistance whenever needed, enhancing the overall trading experience.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

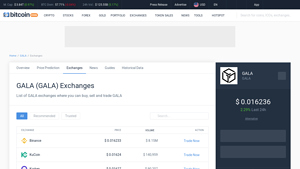

5. GALA Exchanges – Your Gateway to Seamless Trading!

GALA can be traded on several prominent exchanges, including HTX (Huobi), Binance, KuCoin, and Kraken, each offering unique features that enhance the trading experience. These platforms stand out due to their high liquidity, user-friendly interfaces, and robust security measures. Additionally, they provide various trading pairs and competitive fees, making it easier for users to buy, sell, and trade GALA efficiently in the ever-evolving cryptocurrency market.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

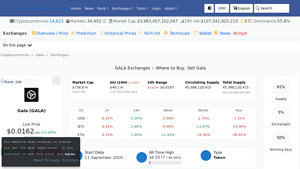

5. Gala (GALA) – Your Gateway to Exciting GameFi Trading!

Gala (GALA) can be traded on more than 50 cryptocurrency exchanges, with Binance, MEXC Global, and Gate leading the pack. What sets these exchanges apart is their high liquidity, extensive trading pairs, and user-friendly interfaces, making it easy for both beginners and experienced traders to buy, sell, and trade GALA. Additionally, Binance’s robust security measures and MEXC Global’s competitive fees enhance the trading experience for users looking to engage with this digital asset.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

3. KuCoin – Top Choice for GALA Traders!

In the Reddit discussion on purchasing GALA, users highlight the challenge of locating GALA V2 on exchanges, as most platforms still list the older version. The conversation points to decentralized exchanges like PancakeSwap on Binance Smart Chain and Uniswap on Ethereum as viable options for acquiring GALA V2. This emphasis on decentralized platforms reflects the growing preference for user-controlled transactions and access to newer token versions, enhancing the appeal of these exchanges for GALA investors.

- Website: reddit.com

- Platform Age: Approx. 20 years (domain registered in 2005)

How to Buy gala crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to buying Gala (GALA) is selecting a suitable cryptocurrency exchange. There are numerous exchanges available, each offering different features, security measures, and trading pairs. Some popular exchanges where you can buy GALA include:

- Binance: Known for its low trading fees and a wide variety of cryptocurrencies.

- Coinbase: A user-friendly platform ideal for beginners, although it may have higher fees.

- Kraken: Offers a robust security framework and a variety of fiat-to-crypto options.

- KuCoin: A popular choice for trading altcoins, including GALA.

When selecting an exchange, consider the following factors:

- Security: Look for exchanges with strong security protocols, such as two-factor authentication (2FA) and cold storage.

- Fees: Compare transaction and withdrawal fees among different exchanges.

- Liquidity: Choose an exchange with high trading volume for better price execution.

2. Create and Verify Your Account

Once you have chosen an exchange, the next step is to create an account. Follow these steps:

- Visit the Exchange Website: Go to the official website of the chosen exchange.

- Sign Up: Click on the “Sign Up” or “Register” button, usually found at the top right corner of the homepage.

- Enter Your Details: Provide your email address, create a strong password, and complete any additional required fields.

- Email Verification: Check your email for a verification link and click on it to confirm your email address.

- Identity Verification: Most exchanges require identity verification to comply with regulations. You may need to upload a government-issued ID and possibly a proof of address (like a utility bill). This process can take anywhere from a few minutes to a few days.

3. Deposit Funds

After your account is verified, you need to deposit funds to buy GALA. Here’s how:

- Log In to Your Account: Access your account on the exchange.

- Navigate to the Deposit Section: Look for a “Deposit” or “Funds” tab in your account dashboard.

- Select Your Deposit Method: Choose how you want to deposit funds. Common methods include:

– Bank Transfer: Usually free but can take a few days to process.

– Credit/Debit Card: Instant deposits but may incur higher fees.

– Cryptocurrency Transfer: If you already own cryptocurrencies, you can deposit them directly into your exchange wallet. - Follow the Instructions: Depending on your chosen method, follow the prompts to complete the deposit.

4. Place an Order to Buy Gala Crypto

Now that you have funded your account, it’s time to buy GALA. Follow these steps:

- Find GALA on the Exchange: Use the search bar to locate the GALA trading pair (e.g., GALA/USD or GALA/BTC).

- Select the Trading Pair: Click on the GALA trading pair to access the trading interface.

- Choose the Order Type: Decide whether you want to place a market order (buying at the current price) or a limit order (buying at a specific price).

– Market Order: Enter the amount of GALA you wish to buy and confirm the transaction. Your order will be executed immediately at the current market price.

– Limit Order: Enter the price at which you want to buy GALA and the amount. Your order will be executed when the market reaches your specified price. - Confirm the Purchase: Review your order details and confirm the purchase.

5. Secure Your Coins in a Wallet

After purchasing GALA, it’s essential to store your coins securely. While you can leave them on the exchange, it is safer to transfer them to a personal wallet. Here’s how to do it:

- Choose a Wallet: There are various types of wallets available:

– Software Wallets: Easy to use and accessible on mobile or desktop (e.g., MetaMask, Trust Wallet).

– Hardware Wallets: Physical devices offering enhanced security (e.g., Ledger, Trezor).

– Paper Wallets: A printed QR code for offline storage, though less user-friendly. - Create Your Wallet: Follow the wallet provider’s instructions to create your wallet and securely store your recovery phrase.

- Transfer Your GALA: Go to the exchange, navigate to the “Withdraw” section, and enter your wallet address and the amount of GALA you want to transfer. Confirm the withdrawal.

By following these steps, you can successfully purchase and secure your GALA tokens, paving the way for your investment in the Gala ecosystem. Always remember to conduct thorough research and consider your investment strategy before purchasing any cryptocurrency.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Strong Foundational Ecosystem

Gala operates within a multifaceted ecosystem that includes Gala Games, Gala Music, and Gala Film, all powered by its proprietary layer-1 blockchain, GalaChain. This diversification not only mitigates risks associated with reliance on a single industry but also positions Gala to capitalize on multiple growth sectors within the booming Web3 space. The focus on entertainment and digital assets is particularly appealing given the increasing popularity of play-to-earn gaming and digital content creation.

2. Innovative Tokenomics

The $GALA token exhibits a unique economic model. Unlike many cryptocurrencies, $GALA did not undergo an Initial Coin Offering (ICO); instead, it is primarily distributed as rewards to operators of Founder’s Nodes. This structure promotes decentralization and community involvement, aligning the interests of node operators with the health of the ecosystem. Additionally, the burning mechanism for $GALA when used as gas in transactions helps to create scarcity, potentially driving up value over time as the circulating supply decreases.

3. Developer-Friendly Environment

Gala has made significant strides to ensure that its platform is accessible to developers. With resources like the GalaChain SDK and the Gala Creator Portal, developers can easily build and deploy their projects on GalaChain. This could lead to a robust influx of innovative applications and games, further enhancing the utility and demand for $GALA.

4. Strong Leadership and Team

Founded by Eric Schiermeyer, a co-founder of Zynga, Gala benefits from experienced leadership with a proven track record in gaming and technology. The team comprises over 350 full-time employees and numerous external contributors, suggesting a solid foundation for growth and development. The leadership’s commitment to decentralization and user empowerment can also attract a dedicated community and long-term investors.

5. Security and Compliance

Security is paramount in the cryptocurrency space, and Gala has made substantial investments in ensuring the safety of its ecosystem. With a Gold badge and AAA rating from Certik, Gala is recognized as one of the most secure altcoins. The use of a Gnosis multisig safe for the $GALA token management further enhances security, ensuring that no single individual has unilateral access. This focus on security can foster trust among users and investors alike.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies are notorious for their price volatility. The price of $GALA has experienced significant fluctuations, including a peak all-time high of $0.8367 in November 2021, followed by a steep decline, bringing it down over 98% from its peak. Such volatility can deter potential investors who are risk-averse and may impact the long-term stability of the token’s value. The cryptocurrency market is highly speculative, and investors should be prepared for the possibility of rapid price swings.

2. Regulatory Uncertainty

The regulatory environment surrounding cryptocurrencies remains uncertain and can vary significantly across jurisdictions. As governments worldwide continue to grapple with how to regulate digital assets, Gala may face legal challenges that could impact its operations. Regulatory actions could potentially limit the functionality of the Gala ecosystem or impose compliance costs that affect its profitability. Investors should remain aware of potential changes in the regulatory landscape that could influence the value and usability of $GALA.

3. Intense Competition

The gaming and entertainment sectors in the blockchain space are becoming increasingly crowded. Numerous projects are vying for attention and market share, including established platforms and emerging startups. Gala must continuously innovate and differentiate itself to stay competitive. Failure to attract developers and users could hinder its growth potential and affect the demand for $GALA. The competitive landscape necessitates ongoing marketing and development efforts, which could strain resources.

4. Technological Risks

While GalaChain is designed to be a robust and user-friendly platform, it is not immune to technological risks. Potential issues such as bugs, vulnerabilities, or performance bottlenecks could hinder the user experience and the overall functionality of the ecosystem. Moreover, as the platform scales, it may encounter challenges related to transaction speeds, network congestion, and interoperability with other blockchains. The reliance on the success of GalaChain means that any technological setbacks could have a direct impact on the value of $GALA.

5. Dependence on Node Operators

The sustainability of the Gala ecosystem is heavily reliant on the active participation of Founder’s Node operators. If interest in operating nodes wanes, or if the rewards structure fails to incentivize continued participation, the ecosystem may suffer from reduced computational power and governance participation. This decline could impact the overall health and growth of the Gala ecosystem, leading to diminished utility for $GALA.

Conclusion

Investing in $GALA presents both promising opportunities and significant risks. The unique structure of Gala’s ecosystem, combined with its innovative tokenomics and strong leadership, positions it as a potentially valuable player in the Web3 space. However, potential investors must remain cognizant of the inherent volatility of the cryptocurrency market, regulatory uncertainties, and the competitive landscape that could affect Gala’s growth trajectory. As with any investment, conducting thorough research and understanding both the potential strengths and risks is crucial for making informed decisions in the cryptocurrency space.

Frequently Asked Questions (FAQs)

1. What is Gala Crypto (GALA)?

Gala Crypto, represented by the token GALA, is the official utility and gas token of the Gala ecosystem, which encompasses various entertainment platforms such as Gala Games, Gala Music, and Gala Film. Gala operates on a layer-1 blockchain called GalaChain, which allows developers to create decentralized applications (dApps) and custom tokens. The GALA token is primarily used for transactions within the Gala ecosystem, and its distribution is tied to the operation of Founder’s Nodes, which are essential for maintaining the network.

2. Who created Gala Crypto?

Gala was founded in 2019 by Eric Schiermeyer, who is also a co-founder of the well-known gaming company Zynga. Schiermeyer’s experience in social and blockchain gaming has been pivotal in shaping Gala’s vision to empower users and creators in the web3 space. Since its inception, Gala has grown significantly, employing over 350 individuals and collaborating with various developers to expand its decentralized ecosystem.

3. What makes Gala Crypto different from Bitcoin?

While both Gala and Bitcoin are cryptocurrencies, they serve different purposes and operate on distinct networks. Bitcoin is primarily a digital currency designed for peer-to-peer transactions, acting as a store of value and medium of exchange. In contrast, Gala is focused on creating an ecosystem for gaming and entertainment, enabling developers to build decentralized applications and utilize the GALA token for various services within the GalaChain. Additionally, Gala operates on a layer-1 blockchain with unique governance and tokenomics features, which differ significantly from Bitcoin’s proof-of-work mechanism.

4. Is Gala Crypto a good investment?

Determining whether Gala is a good investment depends on various factors, including market conditions, individual risk tolerance, and investment goals. As of now, GALA has experienced significant volatility, with an all-time high of approximately $0.8367 in November 2021 and a current price around $0.01625. Investors should conduct thorough research, assess the project’s fundamentals, and consider consulting financial advisors before making investment decisions.

5. How is the GALA token distributed?

GALA tokens are primarily distributed as rewards to operators of Founder’s Nodes, which are integral to the Gala ecosystem. The distribution is designed to incentivize node operators for providing resources to the network. No initial coin offering (ICO) was conducted for GALA; instead, the project sold products, such as Founder’s Node licenses and NFTs, to fund its development. The total supply of GALA is capped at 50 billion tokens, with daily emissions adjusted based on the circulating supply.

6. Where can I buy GALA tokens?

GALA tokens can be purchased on various centralized and decentralized exchanges, including major platforms that support Ethereum-based tokens. Users can trade GALA using its Ethereum contract or utilize the GalaSwap decentralized exchange within the Gala ecosystem. A comprehensive list of exchanges offering GALA is available on cryptocurrency data platforms like CoinMarketCap and CoinGecko.

7. How does Gala ensure network security?

Gala employs a Gnosis multisig safe to enhance security, ensuring that no single individual has unilateral control over the assets. This approach promotes collective oversight and governance. Additionally, Gala has received a Gold badge and AAA rating from CertiK, a leading security auditing firm, indicating a high level of security and compliance within its blockchain protocols.

8. What are the future prospects for Gala Crypto?

The future prospects for Gala depend on several factors, including the growth of the web3 ecosystem, adoption of GalaChain by developers, and the overall market dynamics of cryptocurrencies. Gala aims to become the first billion-user blockchain, focusing on expanding its entertainment offerings and attracting more creators and users. As the project continues to evolve and adapt to industry trends, it may present opportunities for growth and innovation in the gaming and entertainment sectors.

Final Verdict on gala crypto

Overview of Gala Crypto

Gala is an innovative cryptocurrency that serves as the native utility token for the Gala ecosystem, which encompasses gaming, music, and film. The project aims to empower creators and users by facilitating a decentralized environment through its own layer-1 blockchain, GalaChain. This blockchain supports a variety of applications and projects, providing developers with the tools they need to build and grow within the Web3 landscape.

Key Features and Technology

One of the standout features of Gala is its unique node system, which incentivizes users to participate in the ecosystem by running Founder’s Nodes. These nodes not only secure the network but also earn rewards in $GALA tokens, creating a community-driven infrastructure. The GalaChain is designed to be developer-friendly, allowing easy integration and the creation of custom tokens and smart contracts, which can be bridged to other blockchains like Ethereum and Binance Smart Chain.

Market Position and Potential

Currently ranked within the top 100 cryptocurrencies by market cap, Gala has a market capitalization of approximately $745 million and a circulating supply of nearly 46 billion tokens. With a maximum supply capped at 50 billion, the tokenomics are structured to encourage usage while also implementing a burning mechanism that reduces the supply over time. This dynamic can create scarcity, potentially benefiting long-term holders as demand increases.

Final Thoughts

Investing in Gala crypto is inherently a high-risk, high-reward proposition. The project operates in the rapidly evolving space of blockchain gaming and entertainment, which can lead to significant volatility in its token price. While the potential for growth is substantial, it is crucial for investors to approach with caution.

As with any investment in the cryptocurrency market, we strongly encourage you to conduct your own thorough research (DYOR) before making any financial commitments. Understanding the underlying technology, market dynamics, and your own risk tolerance will help you make informed decisions in this exciting yet unpredictable landscape.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.