Should You Invest in dextools crypto? A Full Analysis (2025)

An Investor’s Introduction to dextools crypto

DEXTools, commonly referred to by its token symbol DEXT, is a significant player in the decentralized finance (DeFi) ecosystem. Launched in June 2020, DEXTools has rapidly established itself as a vital tool for traders and investors looking to navigate the complexities of decentralized markets. It provides a suite of analytical tools and resources that empower users to make informed trading decisions, thereby enhancing their overall trading experience. The platform integrates real-time blockchain data into a user-friendly interface, making it easier for individuals to track liquidity movements, monitor large transactions, and evaluate the performance of various tokens.

The DEXT token serves as the native utility token within the DEXTools ecosystem. It provides holders with access to premium features, subscription tiers, and exclusive trading groups, fostering a vibrant community of engaged traders. As the DeFi landscape continues to grow, DEXTools is increasingly seen as an essential resource for anyone looking to capitalize on the opportunities presented by decentralized exchanges (DEXs).

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in DEXTools crypto. Throughout this guide, we will delve into several key areas:

Technology Overview

We will explore the underlying technology that powers DEXTools, including its unique features such as Pool Explorer, Pair Explorer, and Wallet Info. Understanding these tools is crucial for maximizing your trading strategies and gaining insights into market dynamics.

Tokenomics

An in-depth examination of DEXT’s tokenomics will be provided, including its supply dynamics, deflationary mechanisms, and market performance. This section will help investors understand the value proposition of holding DEXT tokens.

Investment Potential

We will analyze the investment potential of DEXTools by reviewing historical price trends, market capitalization, and its competitive position within the DeFi sector. This will include a discussion of its all-time highs and lows, as well as recent performance metrics.

Risks and Considerations

Investing in cryptocurrencies comes with inherent risks. We will outline the potential risks associated with investing in DEXTools, including market volatility, regulatory challenges, and the competitive landscape.

How to Buy DEXT

Finally, we will provide a step-by-step guide on how to purchase DEXT tokens, including the exchanges where they can be traded and the necessary steps for new investors.

By the end of this guide, readers will have a well-rounded understanding of DEXTools crypto, empowering them to make informed decisions in their investment journey.

What is dextools crypto? A Deep Dive into its Purpose

Understanding DEXTools Crypto

DEXTools is an innovative platform designed specifically for traders in the decentralized finance (DeFi) ecosystem. It aggregates blockchain data into a user-friendly interface, allowing users to make informed decisions while trading on decentralized exchanges (DEXs). The platform’s native utility token, DEXT, plays a crucial role in accessing various features and functionalities of the DEXTools ecosystem.

The Core Problem It Solves

In the rapidly evolving world of cryptocurrency trading, particularly within the DeFi space, traders face several challenges. These include:

-

Data Overload: The sheer volume of data generated by various DeFi protocols can be overwhelming. Traders need access to accurate, real-time information to make informed decisions. DEXTools addresses this by consolidating critical trading data into a single platform.

-

Lack of Transparency: Many new tokens and projects lack reliable information about their trustworthiness and performance. DEXTools provides tools like the Pair Explorer, which enables users to analyze charts, transaction histories, and project metrics, helping them assess the legitimacy of tokens before investing.

-

Monitoring Liquidity Movements: Understanding liquidity is essential for traders looking to enter or exit positions efficiently. DEXTools’ Pool Explorer allows users to track liquidity movements and the formation of new pools on DEXs, giving them insights into market trends and potential trading opportunities.

-

Tracking Whale Activity: Large transactions can significantly impact market prices, and knowing when and where these transactions occur can give traders an edge. The Big Swap Explorer tool enables users to monitor significant trades and the behavior of major holders (often referred to as “whales”).

-

Complex Trading Processes: Navigating multiple DEXs can be cumbersome and time-consuming. DEXTools offers a Multiswap feature that simplifies the trading process by allowing users to engage with multiple DEX portals simultaneously, thus enhancing trading efficiency.

Its Unique Selling Proposition

What sets DEXTools apart from other trading platforms is its comprehensive suite of tools tailored specifically for DeFi traders. Here are some of its unique features:

-

Integrated Analytics: DEXTools provides in-depth analytics, allowing traders to view real-time data about token performance, liquidity, and historical price movements. This level of insight is crucial for making strategic trading decisions.

-

Community Engagement: The DEXTools platform fosters a strong community through initiatives like DEXT Force Ventures, where users can collaborate and share insights. This community-driven approach enhances user engagement and fosters trust among traders.

-

Deflationary Tokenomics: DEXT is designed to be deflationary, with 10% of the subscription tokens used for DEXTools features burned each month. This mechanism helps to reduce the overall supply of DEXT over time, potentially increasing its value as demand grows.

-

User-Centric Design: The platform’s user interface is designed to be intuitive, making it accessible for both novice and experienced traders. The easy navigation and clear presentation of data allow users to focus on trading rather than deciphering complex information.

The Team and Backers

DEXTools was founded in June 2020 by Frederic and Javier, two seasoned traders and developers who recognized the need for a dedicated platform to support DeFi trading. They were later joined by Pablo, the current CTO, who played a pivotal role in the platform’s early development and growth.

The founders’ background in trading and technology has equipped them with the skills necessary to create a robust platform that addresses the specific needs of DeFi traders. Their commitment to the project is reflected in the platform’s continuous evolution based on community feedback and emerging trends in the crypto market.

Fundamental Purpose in the Crypto Ecosystem

The primary purpose of DEXTools is to enhance the trading experience in the decentralized finance landscape. By providing traders with comprehensive data and tools, DEXTools empowers users to make well-informed decisions and navigate the complexities of the DeFi market more effectively.

In addition to its trading tools, DEXTools serves as a bridge between various decentralized exchanges, facilitating smoother transactions and better liquidity management. The platform’s focus on community initiatives and transparency fosters a sense of trust and collaboration among users, essential in the often volatile world of cryptocurrency trading.

Moreover, DEXTools contributes to the overall growth of the DeFi ecosystem by promoting informed trading practices and supporting the development of new projects. By offering tools that enhance transparency and accessibility, DEXTools plays a vital role in shaping a more efficient and user-friendly DeFi landscape.

Conclusion

In summary, DEXTools crypto represents a significant advancement in the trading experience within the decentralized finance ecosystem. By addressing key challenges faced by traders and offering a suite of unique tools, DEXTools positions itself as an essential resource for anyone looking to navigate the complexities of DeFi trading effectively. With a strong team at the helm and a community-driven approach, DEXTools is poised to continue its growth and impact in the ever-evolving world of cryptocurrency.

The Technology Behind the Coin: How It Works

Introduction to DEXTools Technology

DEXTools operates in the decentralized finance (DeFi) ecosystem, providing traders with a comprehensive suite of tools to enhance their trading experience on decentralized exchanges (DEXs). The technology behind DEXTools is built on blockchain principles, which ensures transparency, security, and efficiency in trading activities. This guide will delve into the core technological aspects of DEXTools, covering its blockchain architecture, consensus mechanisms, and key innovations that distinguish it in the crowded crypto space.

Blockchain Architecture

At its core, DEXTools leverages the Ethereum blockchain, which is known for its smart contract capabilities. Smart contracts are self-executing contracts with the agreement directly written into code. They facilitate, verify, and enforce the negotiation of a contract, making transactions trustworthy without the need for a third party.

Ethereum as the Foundation

-

Decentralization: The Ethereum blockchain operates on a decentralized network of nodes, ensuring that no single entity controls the entire network. This decentralization is crucial for maintaining the integrity of trading activities on DEXTools, as it reduces the risk of manipulation or downtime.

-

Smart Contracts: DEXTools utilizes smart contracts to automate various functionalities within its platform. For example, the Pool Explorer and Pair Explorer tools use smart contracts to track liquidity pools and token transactions. This automation not only speeds up processes but also minimizes human error.

-

Interoperability: DEXTools is designed to work seamlessly with multiple decentralized exchanges, allowing users to access various trading pairs and liquidity pools without being confined to a single platform. This interoperability is achieved through the Ethereum network’s robust infrastructure, which supports the integration of different DeFi applications.

Consensus Mechanism

The Ethereum blockchain employs a consensus mechanism known as Proof of Stake (PoS), which is crucial for maintaining the network’s security and functionality.

Understanding Proof of Stake

-

Energy Efficiency: Unlike Proof of Work (PoW), which requires extensive computational power and energy consumption to validate transactions, PoS allows validators to create new blocks based on the number of coins they hold and are willing to “stake” as collateral. This makes PoS a more environmentally friendly option.

-

Security and Rewards: In a PoS system, validators are incentivized to act honestly. If they validate fraudulent transactions, they risk losing their staked assets. Conversely, honest validators earn rewards in the form of transaction fees and newly minted tokens. This alignment of incentives helps secure the network.

-

Scalability: PoS is designed to support a higher transaction throughput compared to PoW. This scalability is essential for DEXTools, especially during periods of high trading volume, ensuring that users experience minimal delays in transaction confirmations.

Key Technological Innovations

DEXTools incorporates several innovative features that enhance the trading experience and provide valuable insights for users.

1. Pool Explorer

The Pool Explorer tool allows users to monitor liquidity movements and the formation of new pools on decentralized exchanges. This feature is essential for traders looking to identify emerging opportunities and assess market sentiment.

- Liquidity Tracking: Users can see real-time data on liquidity providers, helping them make informed decisions about where to invest.

- Trend Analysis: By analyzing liquidity trends, traders can anticipate price movements and adjust their strategies accordingly.

2. Pair Explorer

The Pair Explorer tool provides detailed information about specific trading pairs, including charts, transaction history, and trust metrics.

- Comprehensive Analytics: Users can analyze price trends, volume changes, and historical performance, allowing them to make data-driven decisions.

- Trust Metrics: By evaluating the trustworthiness of a token based on various parameters, traders can avoid scams and high-risk investments.

3. Wallet Info

This feature enables users to track and follow the wallets of successful traders.

- Transparency: By observing the trading patterns of experienced investors, users can glean insights into effective trading strategies.

- Community Engagement: This feature fosters a sense of community among users, as they can share tips and strategies based on observed behaviors.

4. Big Swap Explorer

The Big Swap Explorer tool helps users track large transactions, often referred to as “whale” movements.

- Market Sentiment Indicator: Significant trades can indicate shifts in market sentiment, allowing users to react promptly to potential price changes.

- Risk Management: By understanding where large trades are occurring, traders can adjust their positions to mitigate risks associated with sudden market shifts.

5. Multiswap

The Multiswap feature allows users to interact with multiple decentralized exchanges simultaneously, facilitating faster trading.

- Efficiency: Users can execute trades across various platforms in one go, reducing the time spent navigating between different exchanges.

- Price Optimization: By accessing multiple DEXs, users can take advantage of the best available prices for their trades, maximizing potential profits.

Security Measures

In addition to its innovative features, DEXTools implements several security measures to protect users and their assets.

1. Smart Contract Audits

DEXTools ensures that its smart contracts are regularly audited by reputable third-party firms. These audits help identify vulnerabilities and enhance the overall security of the platform.

2. User Privacy

DEXTools prioritizes user privacy by allowing traders to operate anonymously. Users can track transactions and liquidity movements without revealing their identities, which is a critical aspect of maintaining privacy in the crypto space.

3. Community-Driven Development

The DEXTools platform is built with community feedback in mind. By engaging with its user base, DEXTools can continuously improve its features and security measures, fostering a collaborative environment.

Conclusion

In summary, DEXTools is a cutting-edge platform that leverages the Ethereum blockchain and innovative technologies to enhance the trading experience in decentralized finance. By utilizing a robust architecture, a secure consensus mechanism, and a suite of advanced trading tools, DEXTools empowers traders to navigate the complexities of the crypto market effectively. As the DeFi ecosystem continues to evolve, DEXTools remains at the forefront, providing valuable insights and tools to help users maximize their trading potential. Whether you are a beginner or an experienced investor, understanding the technology behind DEXTools will enable you to make more informed decisions in your trading journey.

Understanding dextools crypto Tokenomics

Tokenomics Overview

In the rapidly evolving world of cryptocurrencies, understanding the tokenomics of a digital asset is crucial for both beginner and intermediate investors. DEXTools (DEXT) is a utility token associated with the DEXTools platform, which provides traders with comprehensive data and tools for navigating decentralized markets. This section delves into the key aspects of DEXTools’ tokenomics, including supply metrics, utility, and distribution strategies.

| Metric | Value |

|---|---|

| Total Supply | 112,551,255 DEXT |

| Max Supply | 200,000,000 DEXT |

| Circulating Supply | 70,029,672 DEXT |

| Inflation/Deflation Model | Deflationary (10% monthly burn) |

Token Utility (What is the coin used for?)

The DEXT token serves multiple purposes within the DEXTools ecosystem, providing users with access to various features and services. Here are the primary utilities of DEXT:

-

Access to Premium Features: Users can unlock advanced functionalities of the DEXTools application by holding DEXT tokens or subscribing to a monthly plan. These premium features enhance the trading experience, offering tools that help traders make informed decisions.

-

Participation in Community Initiatives: DEXT holders gain access to exclusive trading groups and community-driven projects such as DEXT Force Ventures. This participation fosters a collaborative environment where traders can share insights and strategies.

-

Transaction Fees: DEXT tokens can be used to pay for transaction fees within the DEXTools platform, creating a seamless experience for users engaging in various trading activities.

-

Incentives and Rewards: The DEXTools ecosystem often rewards users for their engagement and participation. Holding DEXT can lead to potential rewards, such as bonuses or early access to new features.

-

Access to Analytics Tools: DEXTools provides a suite of analytics tools, including Pool Explorer, Pair Explorer, Wallet Info, and Big Swap Explorer. These tools help users track liquidity movements, monitor significant transactions, and analyze market trends, all of which are essential for successful trading.

Token Distribution

The distribution of DEXT tokens is designed to ensure a balanced and fair allocation among users while promoting long-term value retention. Here’s a breakdown of the distribution model:

-

Initial Token Launch: DEXTools was launched in June 2020 with an initial total supply of 200 million tokens. However, to enhance scarcity and maintain value, 50% of the tokens allocated to the team (50 million DEXT) were burned right at the outset, leaving a total supply of 150 million DEXT.

-

Monthly Token Burns: The DEXTools team employs a deflationary model, where 10% of the subscription tokens used for accessing features are burned each month. This model is designed to gradually reduce the circulating supply of DEXT, increasing scarcity and potentially enhancing the token’s value over time.

-

Circulating Supply: As of now, the circulating supply of DEXT stands at approximately 70 million tokens, which is about 35% of the maximum supply of 200 million. This limited circulation is a strategic move to create demand while ensuring that enough tokens remain available for users to engage with the platform.

-

Market Dynamics: The allocation strategy and the deflationary model are essential for maintaining a healthy market for DEXT. The current market cap of around $42.33 million reflects the ongoing interest in DEXTools as a utility platform for decentralized trading.

-

Community Involvement: DEXTools emphasizes community feedback and participation in its development process. This approach not only fosters a sense of ownership among users but also ensures that the platform evolves according to the needs of its community.

Conclusion

The tokenomics of DEXTools (DEXT) is intricately designed to support its utility as a vital component of the decentralized trading ecosystem. With a clear inflationary model, a defined purpose for the token, and a commitment to community involvement, DEXT aims to create a sustainable and valuable asset for its users. For investors, understanding these dynamics is essential for making informed decisions about their engagement with DEXTools and the broader cryptocurrency market.

Price History and Market Performance

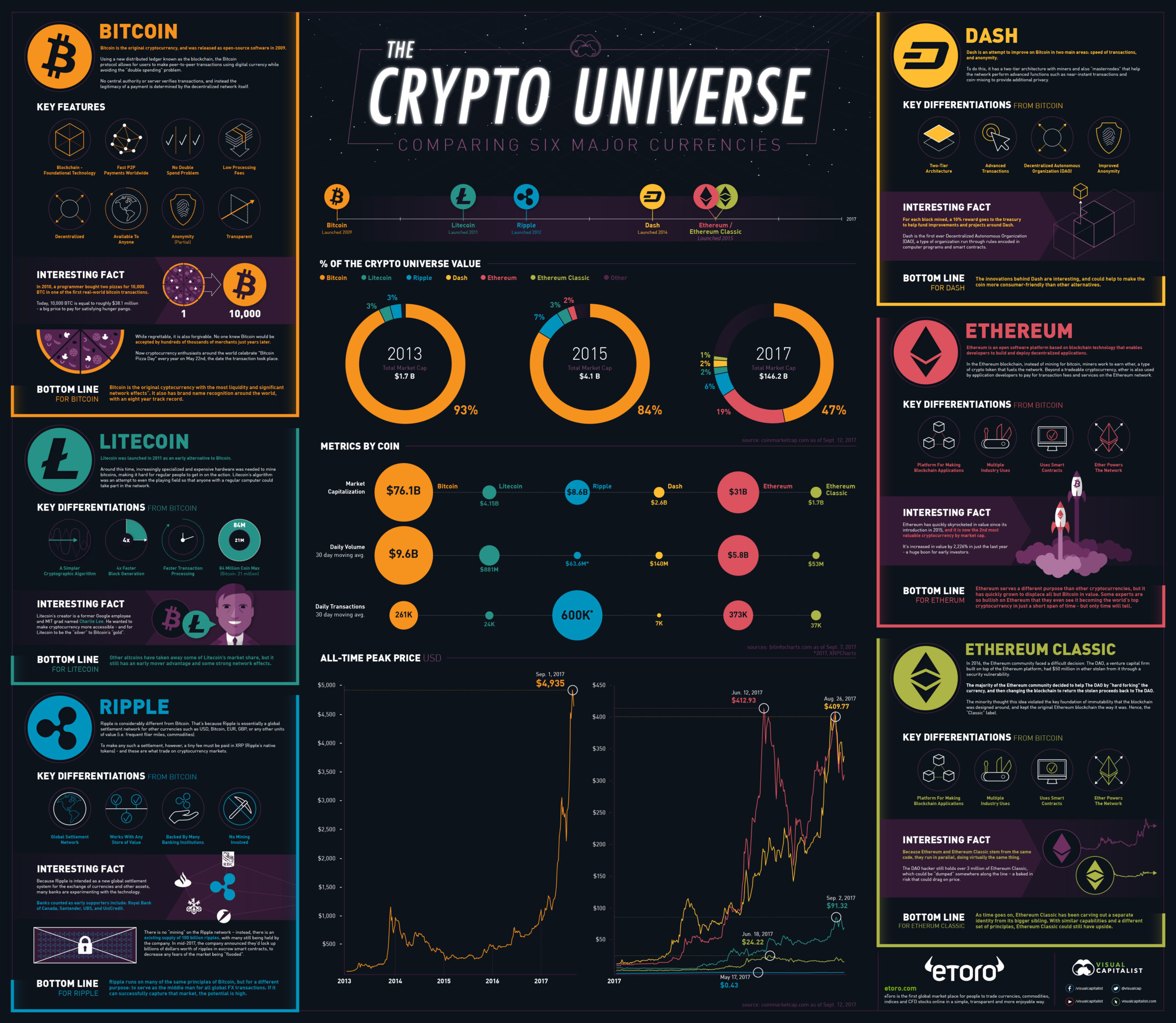

Key Historical Price Milestones

DEXTools (DEXT) has experienced a volatile price history since its inception in June 2020. Initially launched with a total supply of 200 million tokens, DEXT underwent significant changes, including a token burn event that reduced the supply and aimed to create a deflationary model. The price of DEXT has seen substantial fluctuations, reflecting the typical volatility associated with cryptocurrency markets.

-

Launch and Early Trading: DEXT launched in June 2020, and during its early days, it was traded at relatively low prices. The token was primarily used to access features of the DEXTools platform and gradually gained traction within the DeFi community.

-

All-Time Low: The price of DEXT hit its all-time low on July 3, 2021, when it was valued at approximately $0.0044. This period coincided with a broader market downturn in the cryptocurrency space, which affected many digital assets.

-

All-Time High: DEXT reached its all-time high on November 16, 2021, with a price of $4.35. This surge was largely attributed to the increasing popularity of decentralized finance (DeFi) tools and platforms, as traders sought better analytics and trading options. During this time, DEXTools became a central hub for DeFi traders, significantly boosting demand for its native token.

-

Post-All-Time High Decline: Following the peak in November 2021, the price of DEXT experienced a sharp decline, reflecting the broader bearish trends in the cryptocurrency market. By the end of 2022, the price had dropped significantly, and by early 2023, it was trading around $0.40.

-

Recent Performance: As of October 2023, the price of DEXT is approximately $0.6045, showing a modest recovery from its previous lows. The market cap is around $42.33 million, with a circulating supply of approximately 70 million DEXT tokens. The token has experienced a 1.37% increase in the last 24 hours, indicating a potential stabilization in its price.

Factors Influencing the Price

Historically, the price of DEXT has been influenced by several key factors, including market trends, technological developments, and community engagement.

-

Market Trends: DEXT’s price has mirrored the overall trends in the cryptocurrency market. Bullish sentiment in the crypto space often leads to increased trading volumes and price surges for DEXT. Conversely, bearish market conditions have resulted in sharp declines in its price, as seen in the aftermath of the 2021 crypto boom.

-

Utility and Adoption: The utility of DEXT within the DEXTools ecosystem has played a significant role in its price dynamics. As more traders adopted DEXTools for its analytics and trading features, demand for DEXT increased. This was particularly evident during periods of heightened activity in the DeFi sector, where traders sought tools to enhance their trading strategies.

-

Token Burns and Supply Dynamics: The deflationary model implemented by DEXTools, which includes monthly token burns, has had a direct impact on the available supply of DEXT. As the circulating supply decreases, the potential for price appreciation increases, provided that demand remains steady or grows. This has historically led to price spikes during periods of increased interest in the platform.

-

Community Engagement and Governance: The DEXTools community has been instrumental in shaping the platform’s direction and feature set. Active community participation in governance and initiatives has often led to increased engagement with the platform, subsequently influencing the price of DEXT. Positive sentiment and engagement can lead to increased trading activity, while negative developments or community disputes can have the opposite effect.

-

Technological Developments: Innovations and upgrades within the DEXTools platform have also influenced DEXT’s price. New features that enhance user experience, such as the introduction of advanced analytics tools or improved user interfaces, can attract more users and traders, thus driving demand for DEXT. Conversely, any technical issues or failures to meet community expectations can negatively impact the token’s price.

-

Competition: The competitive landscape of DeFi analytics tools and platforms also affects DEXT’s market performance. As new players enter the space, existing platforms must continually innovate and offer unique value propositions to maintain their user base and token value. Competition can lead to price volatility as traders shift their preferences based on perceived utility and effectiveness.

In conclusion, DEXT has demonstrated significant price movements since its launch, influenced by a variety of market dynamics, technological advancements, and community involvement. Understanding these historical patterns and factors is crucial for investors and traders looking to navigate the evolving landscape of DEXTools and its native token.

Where to Buy dextools crypto: Top Exchanges Reviewed

3 Simple Steps to Buy DexTools (DEXT) Like a Pro!

In the review article “How to Buy DexTools (DEXT): A Step-by-Step Guide – Bitcompare,” readers will discover the unique advantages of DexTools, a platform that stands out for its user-friendly interface and comprehensive tools for tracking decentralized finance (DeFi) assets. The guide offers a clear, step-by-step approach to purchasing DEXT, ensuring that both novice and experienced investors can navigate the process seamlessly while understanding key considerations for a successful transaction.

- Website: bitcompare.net

- Platform Age: Approx. 6 years (domain registered in 2019)

5 Reasons Dextools is Essential for Every Crypto Trader!

Dextools is a powerful platform that stands out for its comprehensive suite of tools designed to enhance the trading experience for cryptocurrency investors. It integrates seamlessly with popular exchanges like Uniswap, providing real-time analytics and insights into token performance, liquidity, and market trends. By combining Dextools with Etherscan, users gain a deeper understanding of their investments, making it an essential resource for both novice and experienced traders navigating the decentralized finance landscape.

- Website: reddit.com

- Platform Age: Approx. 20 years (domain registered in 2005)

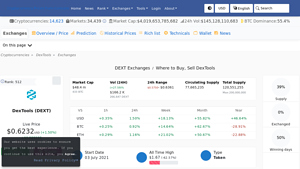

5. DexTools (DEXT) – Your Ultimate Trading Companion!

DexTools (DEXT) stands out in the crypto landscape due to its versatile trading options across multiple exchanges, including prominent platforms like Coinex, Uniswap V2, and Coinbase Pro. With a user-friendly interface and a focus on decentralized trading, DexTools offers investors a seamless experience for buying, selling, and trading DEXT. Additionally, its robust analytics tools empower traders to make informed decisions, enhancing its appeal to both novice and experienced users.

- Website: coinlore.com

64. DEXTools Alternatives – Explore the Future of Trading!

In the review article “Find 64 DEXTools Alternatives (2025) – Alchemy,” readers will discover a comprehensive selection of 64 alternatives to DEXTools, highlighting various analytics tools available in the Alchemy Dapp Store. Notably, the article emphasizes Alchemy’s robust Transfers API, which allows users to efficiently track wallet activity, providing a valuable resource for both novice and experienced cryptocurrency investors seeking enhanced tracking and analytical capabilities.

- Website: alchemy.com

- Platform Age: Approx. 32 years (domain registered in 1993)

3. Binance – Your Gateway to DEXTools (DEXT) Mastery!

The “How to Buy DEXTools (DEXT) Guide – Binance” offers a comprehensive walkthrough for purchasing DEXTools by integrating a crypto wallet with a decentralized exchange. What sets this guide apart is its emphasis on utilizing a trusted platform like Binance, ensuring a seamless transaction process while tapping into the benefits of decentralized trading. This combination of centralized security and decentralized flexibility makes it an attractive option for both novice and experienced investors.

- Website: binance.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy dextools crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying DEXTools (DEXT) is selecting a cryptocurrency exchange where the token is listed. DEXT is primarily traded on decentralized exchanges (DEX) like Uniswap, but it can also be found on some centralized exchanges (CEX) such as Bilaxy, Hoo, Hotbit, and BKEX. When choosing an exchange, consider factors like:

- Reputation: Look for exchanges with a solid track record and positive user reviews.

- Liquidity: Higher liquidity means easier transactions without significant price changes.

- Supported Payment Methods: Ensure the exchange supports your preferred payment method (bank transfer, credit card, etc.).

- Security Features: Check for two-factor authentication (2FA) and other security measures.

Once you’ve chosen an exchange, navigate to its website to begin the registration process.

2. Create and Verify Your Account

After selecting an exchange, you need to create an account. This process typically involves:

- Registration: Provide your email address, create a password, and agree to the exchange’s terms and conditions.

- Email Verification: Check your email for a verification link and click on it to confirm your account.

- Identity Verification: Most exchanges require identity verification (KYC) to comply with regulations. You may need to provide personal information, such as your full name, address, date of birth, and upload a government-issued ID. This process can take anywhere from a few minutes to a couple of days.

3. Deposit Funds

Once your account is verified, you can deposit funds to buy DEXTools. Here’s how to do it:

- Log into Your Account: Access your exchange account using your credentials.

- Go to the Deposit Section: Navigate to the section where you can add funds. This is often labeled “Deposit” or “Funds.”

- Select Your Payment Method: Choose your preferred method of deposit. Common options include bank transfers, credit/debit cards, or cryptocurrency deposits.

- Follow Instructions: Each method will have specific instructions. For bank transfers, you may need to provide your bank details. For credit/debit cards, simply enter your card information.

- Confirm the Deposit: After entering the required information, confirm the deposit. The funds may take some time to appear in your exchange account, depending on the method used.

4. Place an Order to Buy DEXTools Crypto

With funds in your account, you can now place an order to buy DEXTools. Follow these steps:

- Find the DEXTools Trading Pair: Search for DEXTools using its ticker symbol (DEXT) and select the trading pair (e.g., DEXT/ETH or DEXT/USDT) based on the cryptocurrency you deposited.

- Choose Order Type: Decide whether you want to place a market order (buy immediately at the current market price) or a limit order (set a specific price at which you want to buy).

- Market Order: If you select this option, enter the amount of DEXT you wish to purchase and confirm the order.

- Limit Order: If you opt for a limit order, specify the price and amount, then confirm the order. The order will execute once the market reaches your specified price.

- Review and Confirm: Double-check the details of your order (amount, price, fees) before confirming the transaction.

5. Secure Your Coins in a Wallet

After successfully purchasing DEXTools, it’s crucial to secure your coins. Here are the steps to do so:

- Choose a Wallet: You can store your DEXT tokens in a software wallet (like MetaMask or Trust Wallet) or a hardware wallet (like Ledger or Trezor) for enhanced security.

- Create a Wallet: If you don’t already have a wallet, download the wallet app or set up a hardware wallet following the manufacturer’s instructions.

- Transfer DEXT to Your Wallet:

- Get Your Wallet Address: Open your wallet and find your DEXT wallet address. This is a long string of letters and numbers.

- Go to the Exchange: Log back into your exchange account and navigate to the withdrawal section.

- Enter Wallet Address: Input your DEXT wallet address and specify the amount of DEXT you want to transfer.

- Confirm Withdrawal: Review the transaction details and confirm the withdrawal. Depending on network congestion, the transfer may take some time.

Conclusion

By following these steps, you can successfully buy DEXTools (DEXT) and securely store your tokens. Always remember to conduct thorough research and practice safe trading habits when dealing with cryptocurrencies.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Utility and Functionality

DEXTools (DEXT) provides a comprehensive suite of tools for traders in the decentralized finance (DeFi) ecosystem. Its features, such as the Pool Explorer, Pair Explorer, and Wallet Info, empower users to make informed trading decisions by offering insights into liquidity movements, token transactions, and market metrics. By holding or subscribing to DEXT, users gain access to premium features that enhance their trading experience. This utility can drive demand for the token, particularly as more traders seek efficient tools to navigate the complexities of decentralized markets.

2. Growing Adoption and Community Support

Since its launch in June 2020, DEXTools has seen significant adoption within the DeFi community. With over 5 million unique users in the last month, the platform has established itself as a central hub for DeFi trading. The founders’ commitment to community engagement, including initiatives like DEXT Force Ventures, fosters a loyal user base that can contribute to the token’s long-term viability. A strong community can enhance the platform’s credibility and encourage more users to adopt DEXT for their trading needs.

3. Deflationary Tokenomics

DEXTools has implemented a deflationary model where 10% of subscription tokens used to pay for DEXT features are burned monthly. This mechanism decreases the total supply over time, potentially increasing the value of the remaining tokens. As the circulating supply diminishes, the scarcity may attract investors looking for assets with deflationary characteristics, thereby driving up demand and price.

4. Market Position and Growth Potential

Currently ranked #623 in the cryptocurrency market, DEXTools has significant growth potential. Its market capitalization of approximately $42.33 million and a fully diluted valuation of $120.90 million indicate that there is room for expansion, especially if the DeFi sector continues to grow. With a focus on providing high-quality, real-time data and analytics, DEXTools can position itself to capture a larger market share as more traders enter the DeFi space.

5. Strategic Partnerships and Ecosystem Integration

DEXTools operates within the Ethereum ecosystem and has also expanded its presence on the BNB Chain. This multi-chain approach allows DEXT to tap into different user bases and liquidity pools, increasing its exposure and potential for growth. Strategic partnerships with other DeFi projects can further enhance its utility and attract more users to its platform.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

The cryptocurrency market is known for its extreme volatility, and DEXTools is no exception. The price of DEXT has experienced significant fluctuations, from an all-time high of $4.35 to its current price around $0.60, reflecting an 86% decline. Such volatility can deter potential investors who may be wary of investing in an asset that can drastically change in value over short periods. This unpredictability can also impact the platform’s user base, as traders may be hesitant to rely on DEXT during turbulent market conditions.

2. Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies and DeFi is still evolving. Governments around the world are implementing various regulations that could affect the operations of platforms like DEXTools. Uncertainty about how these regulations will impact the use of DEXT for trading, as well as the broader DeFi market, poses a risk to investors. Stricter regulations could limit the functionalities of DEXTools or lead to increased compliance costs, potentially diminishing its attractiveness to users.

3. Competition in the DeFi Space

The DeFi sector is highly competitive, with numerous platforms offering similar tools and services. New entrants continuously emerge, and established players are constantly innovating to capture market share. DEXTools faces competition from other analytics platforms and trading tools that may offer enhanced features or lower fees. If DEXTools cannot differentiate itself effectively or keep pace with competitors, it may struggle to maintain or grow its user base.

4. Technological Risks

As a platform built on blockchain technology, DEXTools is susceptible to technological risks. Issues such as network congestion, smart contract vulnerabilities, or bugs in the application could lead to significant problems for users. Any major technical failures could erode trust in the platform, prompting users to seek alternatives. Furthermore, the rapid pace of technological advancement in the blockchain space means that DEXTools must continuously innovate to stay relevant and secure.

5. Dependency on Ethereum and Market Trends

DEXTools primarily operates within the Ethereum ecosystem, which is subject to its own set of challenges, including high transaction fees and scalability issues. Any negative developments affecting Ethereum, such as network congestion or unfavorable upgrades, could have direct repercussions on DEXTools’ functionality and user experience. Additionally, the overall performance of the cryptocurrency market impacts DEXT’s value; a downturn in the market could lead to decreased interest in DeFi and, consequently, DEXTools.

Conclusion

Investing in DEXTools (DEXT) presents both potential strengths and risks that investors should carefully consider. The platform’s utility, growing adoption, deflationary tokenomics, and strategic partnerships could position it well for future growth. However, market volatility, regulatory uncertainty, competition, technological risks, and dependency on the Ethereum network pose significant challenges that could affect its performance.

As with any investment in cryptocurrency, potential investors should conduct thorough research and consider their risk tolerance before engaging with DEXT. Understanding the nuances of the DeFi ecosystem and the specific factors influencing DEXTools will be crucial for making informed investment decisions.

Frequently Asked Questions (FAQs)

1. What is DEXTools crypto?

DEXTools is an application and ecosystem designed for traders in the decentralized finance (DeFi) space. It aggregates blockchain data into a unified user interface, providing insights into decentralized markets. The native utility token of DEXTools, known as DEXT, allows users to access premium features of the app, participate in trading groups, and engage in community initiatives like DEXT Force Ventures.

2. How does DEXTools work?

DEXTools operates by offering a suite of tools tailored for decentralized trading. Key features include:

- Pool Explorer: Monitors liquidity movements and the formation of new liquidity pools on decentralized exchanges.

- Pair Explorer: Provides charts and transaction data for specific tokens, including trust metrics and project assessments.

- Wallet Info: Enables users to track and follow the wallets of their favorite traders.

- Big Swap Explorer: Tracks significant transactions to give insights into market movements.

- Multiswap: Allows users to access multiple decentralized exchange portals simultaneously for faster trading.

3. Who created DEXTools crypto?

DEXTools was founded by Frederic and Javier, experienced traders and developers, who launched the project in June 2020 using their own funding. Pablo, the current Chief Technology Officer (CTO), joined shortly after the launch and contributed to the platform’s early growth and development. The platform has gained significant traction within the DeFi community since its inception.

4. What makes DEXTools crypto different from Bitcoin?

While Bitcoin is primarily a digital currency designed as a store of value and medium of exchange, DEXTools serves as a trading tool and ecosystem for decentralized markets. DEXTools focuses on providing data analytics and insights for trading, whereas Bitcoin operates as a decentralized currency. Additionally, DEXTools utilizes its utility token, DEXT, for accessing features and functionalities within its platform, which is not a function of Bitcoin.

5. Is DEXTools crypto a good investment?

Investing in DEXTools (DEXT) depends on various factors, including your investment strategy, market conditions, and risk tolerance. As with any cryptocurrency, potential investors should conduct thorough research and consider the project’s utility, market trends, and the overall crypto landscape before making investment decisions. It’s advisable to consult financial professionals if you’re unsure.

6. What is the current price and market cap of DEXTools?

As of the latest data, DEXTools (DEXT) is priced at approximately $0.6045, with a market capitalization of around $42.33 million. Prices can fluctuate rapidly, so it’s essential to check real-time data on cryptocurrency exchanges or financial platforms.

7. What is the all-time high of DEXTools?

The all-time high price for DEXTools (DEXT) was approximately $1.08, reached on February 23, 2024. This reflects the highest price that DEXT has attained since its launch, illustrating the potential volatility and growth of the asset over time.

8. How many DEXTools tokens are there in circulation?

Currently, there are approximately 70 million DEXTools (DEXT) tokens in circulation out of a maximum supply of 200 million tokens. The DEXTools ecosystem has a deflationary mechanism, as 10% of subscription tokens used for features are burned each month, which can influence the supply and potential value of the token over time.

Final Verdict on dextools crypto

Summary of DEXTools (DEXT)

DEXTools is a platform designed to provide traders with essential insights into decentralized markets, integrating blockchain data into a user-friendly interface. The native utility token, DEXT, plays a crucial role in accessing various features of the DEXTools ecosystem, including premium trading groups and specialized tools for monitoring market activities. With functionalities such as Pool Explorer, Pair Explorer, and Wallet Info, DEXTools enhances the trading experience by enabling users to track liquidity movements, analyze token metrics, and follow notable traders.

Technology and Community Engagement

Since its launch in June 2020, DEXTools has positioned itself as a central hub for decentralized finance (DeFi) traders. The platform’s strong focus on community feedback has led to continuous improvements and the development of initiatives like DEXT Force Ventures. The app has amassed a significant user base, indicating its value within the crypto community. The deflationary model of DEXT, which involves the monthly burning of a percentage of tokens used for subscriptions, adds an interesting dynamic that could potentially influence its value over time.

Investment Considerations

While DEXTools offers numerous benefits and tools for traders, it is essential to recognize that investing in DEXT is not without risks. The cryptocurrency market is inherently volatile, and the value of DEXT has seen significant fluctuations, including a stark decline from its all-time high. As such, potential investors should approach DEXTools as a high-risk, high-reward asset class.

Call to Action

Before making any investment decisions, it is imperative to conduct thorough research and due diligence (DYOR). Understanding the intricacies of DEXTools and the broader crypto market will empower you to make informed choices. Always consider your financial situation and risk tolerance before investing in digital assets like DEXT.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.