Should You Invest in crow with knife crypto? A Full Analysis (2025)

An Investor’s Introduction to crow with knife crypto

Crow with Knife, abbreviated as CAW, has emerged as a notable player in the vibrant landscape of cryptocurrencies, particularly within the realm of meme coins. Launched by the Cro Crow community, it is recognized for its unique branding and strong community engagement. With a current market cap of approximately $21 million, CAW ranks at #865 in the cryptocurrency market, reflecting its growing popularity among investors and traders alike. This token operates primarily on the Cronos blockchain, a platform designed to facilitate fast and cost-effective transactions, which makes it an appealing choice for users looking to engage with decentralized finance (DeFi) and other blockchain applications.

Significance in the Crypto Market

As a decentralized memecoin, Crow with Knife aims to capture the whimsical spirit of meme culture while providing a serious investment vehicle for its community. Unlike traditional cryptocurrencies that may focus on utility or technological advancement, CAW leverages the power of community-driven marketing and social media engagement to drive interest and investment. This unique approach has led to a dedicated following, making it a noteworthy contender among other meme coins like Dogecoin and Shiba Inu. The token’s total supply is capped at 777.77 trillion CAW coins, with nearly 770 trillion already in circulation, highlighting its accessible nature for new investors.

Purpose of This Guide

This guide serves as a comprehensive resource for both beginners and intermediate investors interested in Crow with Knife. It will delve into various aspects of the token, including:

- Technology: An overview of the underlying blockchain and smart contract capabilities that support CAW.

- Tokenomics: A detailed analysis of the token’s supply, distribution, and economic model that influences its market behavior.

- Investment Potential: Insights into historical price movements, current market trends, and factors that could impact future valuation.

- Risks: An exploration of the potential risks associated with investing in meme coins, including market volatility and regulatory concerns.

- How to Buy CAW: Step-by-step instructions on acquiring Crow with Knife through various exchanges, ensuring investors can easily enter the market.

By the end of this guide, readers will have a thorough understanding of Crow with Knife, equipping them with the knowledge needed to make informed investment decisions in this exciting and rapidly evolving sector of the cryptocurrency market.

What is crow with knife crypto? A Deep Dive into its Purpose

Overview of Crow with Knife Crypto

Crow with Knife (CAW) is a decentralized memecoin operating on the Cronos blockchain, a prominent platform for DeFi applications and NFTs. Launched by the Cro Crow community, CAW aims to capitalize on the growing popularity of meme-based cryptocurrencies while providing a platform for community engagement and entertainment. With a total supply of 777.77 trillion tokens, all of which were in circulation from day one, CAW embodies the meme culture that has become a significant aspect of the cryptocurrency ecosystem.

The Core Problem It Solves

At its core, Crow with Knife addresses several issues prevalent in the crypto landscape, particularly within the realm of memecoins:

-

Community Engagement: Traditional cryptocurrencies often struggle with fostering a sense of community. By leveraging meme culture, Crow with Knife creates a fun and engaging environment for users. This engagement helps cultivate a loyal community that actively participates in the ecosystem, from social media discussions to governance decisions.

-

Accessibility: With a low entry price, CAW is accessible to a broad audience, including those who may be hesitant to invest in more established cryptocurrencies with higher price tags. This democratization of access encourages new investors to explore the world of crypto.

-

Entertainment Value: The memecoin phenomenon has transformed how people perceive and interact with cryptocurrencies. Crow with Knife adds an element of humor and entertainment, making the investment experience less intimidating and more enjoyable for newcomers.

-

Decentralization: Like many cryptocurrencies, CAW emphasizes decentralization. By ensuring that all tokens are in circulation from launch, it minimizes the risk of centralization that can occur when a significant portion of tokens is held by a small group of investors. This structure promotes a fairer distribution and encourages community-driven governance.

Its Unique Selling Proposition

Crow with Knife distinguishes itself from other memecoins through several unique features:

-

Community-Driven Development: The Cro Crow community is at the heart of the project. This decentralized approach allows community members to contribute ideas, participate in decision-making, and influence the project’s direction. The development team actively engages with the community, fostering transparency and trust.

-

Integration with the Cronos Ecosystem: By operating on the Cronos blockchain, Crow with Knife benefits from the platform’s scalability and low transaction costs. This integration allows for seamless transactions and interactions with other DeFi projects, enhancing user experience and accessibility.

-

Cultural Relevance: The project capitalizes on the meme culture, which resonates with younger audiences and internet users. By creating relatable and humorous content, Crow with Knife maintains cultural relevance and attracts a diverse user base.

-

Tokenomics: With a total supply of 777.77 trillion tokens, the design of CAW’s tokenomics ensures that there is enough liquidity for trading while maintaining an engaging price point for investors. The structure encourages trading and interaction, as users feel empowered by owning a portion of a widely circulated token.

The Team and Backers

The success of any cryptocurrency project often hinges on the strength of its team and the credibility of its backers. While specific information about the team behind Crow with Knife may not be extensively publicized, the project is rooted in the Cro Crow community. This community consists of passionate individuals who are invested in the project’s success and actively contribute to its development and marketing efforts.

-

Community Participation: The decentralized nature of Crow with Knife means that the project is supported by a collective of community members rather than a single entity. This structure promotes a sense of ownership among investors and encourages contributions from diverse backgrounds.

-

Transparency: The team behind Crow with Knife has made efforts to maintain transparency regarding project developments and community initiatives. Regular updates and engagement through social media platforms help build trust and keep investors informed.

-

Partnerships and Collaborations: While specific partnerships may not be publicly disclosed, the integration of Crow with Knife into the broader Cronos ecosystem signifies potential collaborations with other projects, enhancing its credibility and reach.

Fundamental Purpose in the Crypto Ecosystem

The primary purpose of Crow with Knife is to provide a fun and engaging platform for users while promoting community involvement in the cryptocurrency space. As a memecoin, it embraces the lighter side of crypto, allowing users to participate in a culture that prioritizes humor, relatability, and social engagement.

-

Encouraging New Investors: By lowering the barriers to entry and creating an inviting atmosphere, Crow with Knife aims to attract new investors into the cryptocurrency market. This influx of fresh capital can help sustain the broader ecosystem and promote further innovation.

-

Fostering Community: The success of Crow with Knife relies heavily on the strength of its community. By encouraging active participation and providing a platform for engagement, the project nurtures a supportive environment where users can share ideas, collaborate, and grow together.

-

Cultural Impact: Memecoins like Crow with Knife are reshaping the perception of cryptocurrencies, demonstrating that they can be both a serious investment and a source of entertainment. This duality contributes to the evolving narrative surrounding digital assets and broadens the appeal of cryptocurrencies to a wider audience.

In summary, Crow with Knife represents a unique blend of community engagement, cultural relevance, and accessible investment opportunities within the cryptocurrency landscape. By addressing key issues in the crypto space and fostering a fun and inclusive environment, CAW aims to carve out a significant niche in the ever-expanding world of digital assets.

The Technology Behind the Coin: How It Works

Introduction to Crow with Knife Crypto

Crow with Knife (CAW) is a decentralized memecoin that has gained popularity within the cryptocurrency community, particularly on the Cronos blockchain. This digital asset is designed to be community-driven, offering a playful yet serious approach to the world of cryptocurrencies. Understanding the technology behind CAW is crucial for investors and enthusiasts who wish to navigate its ecosystem effectively. This guide will break down the key technological components that underpin Crow with Knife.

Blockchain Architecture

The Crow with Knife token operates on the Cronos blockchain, which is part of the broader Cosmos ecosystem. Cronos is designed to provide high throughput and low transaction costs, making it an attractive platform for developers and users alike.

1. Layer 1 Blockchain

Cronos is a Layer 1 blockchain, meaning it has its own independent network and does not rely on other blockchains for its operations. This architecture allows for better scalability and performance. The Cronos blockchain is built using the Cosmos SDK, which enables developers to create custom blockchains with specific functionalities. This modular approach allows for flexibility in design and implementation.

2. Smart Contracts

Crow with Knife utilizes smart contracts to facilitate transactions and interactions within its ecosystem. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They run on the blockchain, ensuring transparency and security. The use of smart contracts allows Crow with Knife to automate various functions, such as token transfers and staking mechanisms, without the need for intermediaries.

Consensus Mechanism

The security and integrity of the Crow with Knife network are maintained through its consensus mechanism. Cronos employs a Proof-of-Stake (PoS) model, which is fundamentally different from the energy-intensive Proof-of-Work (PoW) mechanism used by Bitcoin.

1. Proof-of-Stake Explained

In a Proof-of-Stake system, validators are chosen to create new blocks and validate transactions based on the number of coins they hold and are willing to “stake” as collateral. This process is more energy-efficient than PoW because it does not require extensive computational power. Instead, it relies on the economic incentives of validators to maintain the network’s security.

2. Benefits of PoS for Crow with Knife

- Energy Efficiency: PoS significantly reduces energy consumption compared to PoW, making it more environmentally friendly.

- Incentivization: Validators earn rewards for their participation, encouraging them to act honestly and maintain the network’s integrity.

- Scalability: PoS allows for faster transaction processing, which is essential for a memecoin that aims to engage a large community.

Tokenomics of Crow with Knife

Tokenomics refers to the economic model behind a cryptocurrency, including supply, distribution, and incentives. Understanding the tokenomics of Crow with Knife is essential for grasping its potential value and utility.

1. Total and Circulating Supply

Crow with Knife has a total supply of 777.77 trillion tokens, with nearly all (approximately 769.86 trillion) already in circulation. This high supply is typical for memecoins, which often aim to engage users through low price points and high volume trading.

2. Distribution

Upon launch, 100% of the CAW supply was made available to the public. This immediate distribution fosters a sense of community ownership and engagement. The distribution model encourages users to participate actively in the ecosystem, whether through trading, holding, or utilizing the token in various applications.

3. Utility of CAW

While primarily a memecoin, CAW has potential utility beyond mere speculation. It can be used for various purposes within the Cronos ecosystem, including:

- Transaction Fees: Users can pay transaction fees using CAW, promoting its use as a medium of exchange.

- Staking: Token holders may have the opportunity to stake their CAW tokens to earn rewards, further incentivizing long-term holding.

Key Technological Innovations

Crow with Knife incorporates several innovative technologies that enhance its functionality and user experience.

1. Cross-Chain Compatibility

One of the standout features of the Cronos blockchain is its ability to support cross-chain transactions. This means that CAW can interact with various blockchains and ecosystems, allowing users to transfer value seamlessly between different platforms. Cross-chain compatibility enhances liquidity and opens up new avenues for CAW to gain traction within the broader cryptocurrency market.

2. Decentralized Finance (DeFi) Integration

Crow with Knife is positioned within the growing DeFi landscape, allowing users to access various financial services without intermediaries. This includes lending, borrowing, and yield farming opportunities, which can generate additional income for token holders. DeFi integration is a crucial aspect of modern cryptocurrencies, as it empowers users and enhances the overall utility of the token.

3. Community Governance

The Crow with Knife community plays a vital role in decision-making processes through governance mechanisms. Token holders may have the ability to propose and vote on changes to the protocol, fostering a sense of ownership and participation. This decentralized governance model aligns with the ethos of blockchain technology, where the community has a voice in the direction of the project.

Security Features

Security is paramount in the cryptocurrency space, and Crow with Knife implements several measures to safeguard its network and users.

1. Smart Contract Audits

To ensure the integrity of its smart contracts, Crow with Knife undergoes regular audits by third-party security firms. These audits identify potential vulnerabilities and ensure that the code operates as intended, minimizing the risk of exploits.

2. Community Reporting Mechanisms

The Crow with Knife community is encouraged to report any suspicious activities or vulnerabilities they encounter. This collaborative approach enhances the security of the ecosystem, as the community acts as an additional layer of oversight.

Conclusion

The technology behind Crow with Knife exemplifies the innovations and possibilities within the cryptocurrency space. By leveraging the strengths of the Cronos blockchain, employing an efficient Proof-of-Stake consensus mechanism, and integrating community-driven governance and DeFi capabilities, CAW positions itself as a unique player in the memecoin market.

As with any investment, understanding the underlying technology and its implications is crucial for making informed decisions. Whether you are a beginner or an experienced investor, a solid grasp of the technology behind Crow with Knife will empower you to navigate its ecosystem with confidence.

Understanding crow with knife crypto Tokenomics

Overview of Crow with Knife Tokenomics

The tokenomics of a cryptocurrency provides insights into its economic model, including supply dynamics, utility, and distribution methods. For the Crow with Knife crypto token (CAW), understanding these aspects is crucial for potential investors and users. This section will break down the key metrics and elaborate on the token’s utility and distribution.

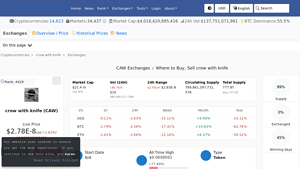

Key Metrics

The following table summarizes the essential metrics related to Crow with Knife (CAW):

| Metric | Value |

|---|---|

| Total Supply | 777.77 trillion CAW |

| Max Supply | 777.77 trillion CAW |

| Circulating Supply | 769.86 trillion CAW |

| Inflation/Deflation Model | Deflationary |

Total Supply and Max Supply

The total supply of Crow with Knife is set at 777.77 trillion CAW tokens, which is also the maximum supply. This means that there will never be more than 777.77 trillion tokens in existence. Such a fixed supply is characteristic of many cryptocurrencies, aiming to create scarcity and potentially increase value over time.

Circulating Supply

As of the latest updates, the circulating supply is approximately 769.86 trillion CAW. This figure represents the amount of CAW tokens that are actively available for trading and use in the market. The relatively high circulating supply compared to the total supply suggests that the project has made a significant portion of its tokens available for trading from its inception, which can be appealing for liquidity.

Inflation/Deflation Model

Crow with Knife adopts a deflationary model. In this context, deflationary tokens are those that may see a decrease in supply over time through mechanisms such as token burns or buybacks. While CAW’s initial supply is fully in circulation, future strategies may involve burning tokens to enhance value and reduce the overall supply, aligning with the principles of scarcity.

Token Utility (What is the coin used for?)

Crow with Knife serves several purposes within its ecosystem, particularly as a memecoin that has gained traction in the cryptocurrency community. Here are some key utilities of CAW:

-

Transactions: CAW can be used for peer-to-peer transactions within the crypto community. Users can send and receive CAW as a means of payment or value transfer, similar to other cryptocurrencies.

-

Trading: Given its presence on various exchanges, CAW can be traded against other cryptocurrencies. Investors may buy, sell, or hold CAW based on market conditions and personal investment strategies.

-

Community Engagement: As a memecoin, CAW fosters a sense of community among its holders. This engagement can include social media promotions, community events, and participation in various online forums. The Crow with Knife community, known as Cro Crow, plays a vital role in promoting the token and enhancing its visibility.

-

NFT Ecosystem: Crow with Knife has historical ties to the NFT space, being associated with the first NFT deployed on the Cronos chain. This connection may provide additional utility as the NFT market evolves, allowing CAW to be used for NFT purchases, trades, or rewards within NFT platforms.

-

Staking and Yield Farming: Although specific details regarding staking or yield farming mechanisms for CAW may vary, many tokens in the cryptocurrency space allow holders to earn rewards by locking up their assets. Future developments may introduce such features for CAW holders.

Token Distribution

The distribution of tokens is a critical aspect of any cryptocurrency, affecting its market dynamics and community engagement. For Crow with Knife, the distribution model has been designed to ensure that a significant portion of the supply is available for public trading from the outset.

-

Initial Distribution: From day one, 100% of the total supply was made available in circulation. This approach aims to provide immediate liquidity and encourage early adoption by investors.

-

Community Focus: The Crow with Knife project is community-driven, meaning that the governance and development of the token are influenced by its holders. This model fosters transparency and allows users to participate in decision-making processes regarding the future of the project.

-

No Pre-mining or Pre-sale: Unlike some cryptocurrencies that undergo pre-mining or pre-sale events, CAW was launched with all tokens available for trading. This can help build trust within the community, as early investors do not benefit disproportionately compared to later adopters.

-

Potential Future Burns: While the current supply is entirely in circulation, the deflationary model may include provisions for burning tokens in the future. This would reduce the circulating supply over time, which could enhance the value proposition for existing holders.

In conclusion, understanding the tokenomics of Crow with Knife (CAW) is essential for anyone looking to invest or engage with this digital asset. With a fixed supply, community-driven distribution, and various utilities, CAW presents an intriguing opportunity within the memecoin landscape. As always, potential investors should conduct thorough research and consider market conditions before making investment decisions.

Price History and Market Performance

Overview of Price Trends

The price of Crow with Knife (CAW) has experienced significant fluctuations since its inception as a memecoin within the Cronos ecosystem. With a total supply of 777.77 trillion CAW tokens and a current circulating supply of approximately 769.86 trillion, the token has seen various price milestones that reflect both market dynamics and community engagement.

Key Historical Price Milestones

-

Launch and Initial Trading: Crow with Knife was launched as a decentralized memecoin, and from day one, 100% of its total supply was in circulation. This unique feature set the stage for its initial trading behavior, as all tokens were available for trading, creating immediate market activity.

-

All-Time High: The token reached its all-time high of approximately $0.00000615 on April 30, 2024. This peak was marked by heightened community interest and broader market trends favoring meme cryptocurrencies. The surge in price was also fueled by social media promotions and community-driven initiatives that captured the attention of potential investors.

-

All-Time Low: Conversely, Crow with Knife recorded its all-time low of about $0.00000089647 on April 10, 2024. This decline can be attributed to various factors including market corrections, reduced trading volumes, and general bearish sentiments prevalent in the cryptocurrency market during that period.

-

Recent Price Performance: As of the latest data, the price of CAW is approximately $0.0000000278, reflecting a decrease of about 1.76% in the last 24 hours and a more pronounced decline of 10.3% over the past week. The current market capitalization stands at around $21.36 million, positioning CAW at rank #865 among cryptocurrencies.

Factors Influencing the Price

Historically, the price of Crow with Knife has been influenced by several factors that are common in the cryptocurrency market:

-

Market Sentiment: Like many memecoins, CAW’s price is significantly affected by market sentiment, particularly in the broader meme cryptocurrency space. Positive sentiment often leads to speculative buying, while negative sentiment can trigger sell-offs. Community engagement through social media platforms has proven to be a critical driver of sentiment.

-

Trading Volume and Liquidity: The trading volume for Crow with Knife has varied significantly, with 24-hour trading volumes reported at around $225,759 recently. Higher trading volumes typically correlate with increased liquidity, which can stabilize prices, while low trading volumes may lead to higher volatility and price swings.

-

Token Migration: The migration from an old contract to a new one also impacted CAW’s price dynamics. Such migrations can create uncertainty among investors, potentially leading to temporary price declines until the market adjusts to the new contract structure.

-

Market Conditions: CAW’s price movements have mirrored broader market trends. In periods of bullish market conditions, many cryptocurrencies, including CAW, tend to see price increases. Conversely, in bearish phases, CAW has often experienced sharp declines, as seen in its price performance following the all-time high.

-

Speculative Trading: As a memecoin, CAW is subject to speculative trading behavior. Investors often enter and exit positions based on trends and hype rather than underlying fundamentals. This behavior can lead to significant price fluctuations within short periods.

-

Community-Driven Initiatives: The Crow with Knife community plays a pivotal role in the price performance of the token. Initiatives such as contests, promotions, and collaborations with other projects can drive interest and engagement, leading to increased buying pressure and price appreciation.

Conclusion

The price history and market performance of Crow with Knife reflect the volatile nature of memecoins and the influence of community sentiment, market trends, and trading dynamics. Understanding these factors provides valuable insights for investors looking to navigate the complexities of the cryptocurrency landscape. As CAW continues to evolve, its historical performance offers a lens through which to analyze future developments within the token’s ecosystem.

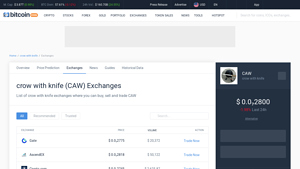

Where to Buy crow with knife crypto: Top Exchanges Reviewed

5 Reasons to Trade CAW on CoinCodex: Unlocking the Crow with Knife!

The “Crow with Knife” exchanges, including AscendEX, Crypto.com, Gate, and Raydium, offer a diverse and user-friendly platform for buying, selling, and trading CAW tokens. What sets these exchanges apart is their robust security features, a wide array of trading pairs, and competitive fees, making them accessible for both novice and experienced traders. Additionally, the integration of liquidity pools on platforms like Raydium enhances trading efficiency and user experience.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

3. CAW – A Rising Star in Niche Exchanges!

The article on “Exchange Listings of crow with knife (CAW)” provides a comprehensive overview of the various platforms where CAW is traded, highlighting key factors such as price comparisons, trading volumes, and available discounts. What sets this exchange apart is its user-friendly interface that allows traders to easily identify the most favorable conditions for their transactions, enabling them to make informed decisions while optimizing their trading strategies.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

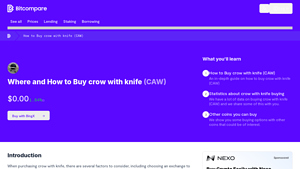

5. CAW Made Easy – Your Ultimate Guide to Buying Crow with Knife!

In the review article “How to Buy crow with knife (CAW): A Step-by-Step Guide – Bitcompare,” readers will discover a comprehensive overview of the top platforms for purchasing CAW tokens. The guide stands out by providing clear, step-by-step instructions tailored for both novice and experienced investors, along with crucial insights into potential pitfalls and considerations when engaging with this unique digital asset. This ensures a well-informed buying experience for users.

- Website: bitcompare.net

- Platform Age: Approx. 6 years (domain registered in 2019)

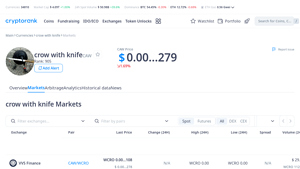

5. CAW Markets – Your Gateway to Trading Crow with Knife!

The “Crow with Knife Exchanges CAW Markets” review highlights the top four exchanges that facilitate the trading of the CAW token, emphasizing their competitive spreads and robust 24-hour trading volumes. Each platform is analyzed for its unique features, user experience, and liquidity, making it easier for traders to buy, sell, and trade CAW effectively. This comprehensive overview ensures that both novice and experienced investors can make informed decisions in the growing CAW market.

- Website: cryptorank.io

- Platform Age: Approx. 8 years (domain registered in 2017)

7. CAW Exchanges – Your Gateway to Crow with Knife Trading!

The “Crow with Knife (CAW)” cryptocurrency is primarily available on two exchanges: Gate and CoinW. What sets these platforms apart is their user-friendly interfaces and robust trading features, catering to both novice and experienced traders. With a focus on security and reliability, these exchanges offer a streamlined process for buying, selling, and trading CAW, making them ideal choices for those looking to engage with this unique digital asset.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

How to Buy crow with knife crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying Crow with Knife (CAW) is to select a cryptocurrency exchange where CAW is listed. Popular exchanges include:

- Centralized Exchanges (CEX): These platforms, such as Gate.io, Biconomy.com, and AscendEX, allow you to buy CAW with fiat or other cryptocurrencies. They often provide a user-friendly interface, making them ideal for beginners.

- Decentralized Exchanges (DEX): If you prefer more privacy and control over your funds, consider using a DEX like VVS Finance or MMFinance. Here, you can trade CAW directly from your wallet without the need for an intermediary.

Make sure to research the exchange’s reputation, supported payment methods, and trading fees before making your choice.

2. Create and Verify Your Account

Once you’ve selected an exchange, you’ll need to create an account. Here’s how:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You’ll be asked to provide your email address and create a password.

- Verification: Most exchanges require identity verification to comply with regulations. You may need to submit personal information and documents, such as a government-issued ID or proof of address. This process can take anywhere from a few minutes to several days, depending on the exchange’s policies.

- Enable Two-Factor Authentication (2FA): For added security, enable 2FA on your account. This typically involves linking your account to an authentication app (like Google Authenticator) or receiving SMS codes.

3. Deposit Funds

After your account is verified, you’ll need to deposit funds to buy CAW. Follow these steps:

- Select Deposit Method: Navigate to the “Deposit” section of your account. You can usually deposit funds via bank transfer, credit/debit card, or cryptocurrency transfer.

- Choose Currency: If you’re using fiat (like USD), select your currency and follow the prompts to complete the deposit. For cryptocurrency, choose the crypto you want to deposit (like Bitcoin or Ethereum) and copy the deposit address provided by the exchange.

- Complete the Deposit: If you’re depositing fiat, follow the instructions to transfer funds. If you’re transferring cryptocurrency, send it from your wallet to the deposit address. Wait for the funds to appear in your exchange account—this may take some time, especially for bank transfers.

4. Place an Order to Buy Crow with Knife Crypto

With funds in your account, you can now purchase CAW:

- Find CAW Trading Pair: Use the exchange’s search function to locate the CAW trading pair. For example, if you deposited USD, look for CAW/USD, or if you deposited a cryptocurrency like BTC, look for CAW/BTC.

- Choose Order Type: Decide whether you want to place a market order (buy CAW at the current market price) or a limit order (set a specific price at which you’re willing to buy). Market orders are generally executed immediately, while limit orders may take longer.

- Enter Order Details: Specify the amount of CAW you wish to buy. Review the transaction details, including fees, before finalizing your order.

- Confirm Purchase: Click the “Buy” button to execute your order. After the transaction is completed, you should see your CAW balance in your account.

5. Secure Your Coins in a Wallet

After purchasing CAW, it’s essential to store your coins securely:

- Choose a Wallet: You can store your CAW in a software wallet (like Trust Wallet or MetaMask) or a hardware wallet (like Ledger or Trezor) for enhanced security. Hardware wallets are recommended for long-term storage as they are less susceptible to hacking.

- Transfer CAW to Your Wallet: If you purchased CAW on an exchange, transfer your coins to your wallet by selecting the “Withdraw” or “Send” option on the exchange. Enter your wallet address carefully to avoid errors.

- Confirm Transfer: Double-check the wallet address and confirm the transfer. It may take some time for the transaction to be processed on the blockchain.

Conclusion

Buying Crow with Knife (CAW) can be a straightforward process if you follow these steps. By choosing a reliable exchange, verifying your account, depositing funds, placing an order, and securing your coins in a wallet, you’ll be well on your way to participating in the exciting world of cryptocurrency. Always remember to do your own research and consider the risks involved in trading digital assets.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Unique Market Positioning

Crow with Knife (CAW) is positioned within the memecoin category, which has gained significant traction in the cryptocurrency space. Memecoins often leverage community engagement and social media trends to gain popularity, attracting investors who are interested in speculative opportunities. The unique branding and thematic elements of CAW may resonate with specific audiences, providing a niche appeal that could drive demand.

2. Fully Circulated Supply

One of the notable aspects of CAW is that 100% of its total supply was in circulation from day one. This contrasts with many cryptocurrencies that have vesting schedules or locked tokens, which can lead to inflationary pressures as new tokens are released over time. With a fixed supply of 777.77 trillion tokens, CAW’s inflation dynamics are straightforward, potentially appealing to investors concerned about dilution.

3. Community-Driven Initiatives

The Crow with Knife project is built around a community that actively participates in its development and promotion. Community-driven projects often foster a sense of belonging among holders, which can lead to increased loyalty and engagement. This can translate to sustained interest and investment, especially if the community continues to innovate and create value around the token.

4. Market Cap and Trading Volume

As of now, CAW has a market capitalization of approximately $21.36 million, with a trading volume of around $225,000 over the last 24 hours. While this may appear modest compared to more established cryptocurrencies, it indicates a level of liquidity that is essential for investors looking to enter or exit positions. A healthy trading volume can also signal ongoing interest and activity in the market.

5. Accessibility Across Multiple Exchanges

CAW is available on various decentralized and centralized exchanges, which enhances its accessibility for investors. This availability can attract a broader base of users and traders, increasing the potential for price appreciation as demand grows. The ability to trade CAW across different platforms can also facilitate more dynamic price discovery.

6. Speculative Trading Opportunities

Given its memecoin status, CAW may present speculative trading opportunities for investors looking to capitalize on short-term price movements. The volatility often associated with memecoins can lead to significant price swings, offering potential rewards for those who can time their trades effectively. However, this speculative nature also requires a high risk tolerance.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Like many cryptocurrencies, CAW is subject to extreme price volatility. The price can be influenced by a range of factors, including market sentiment, trading volumes, and broader economic conditions. Such volatility can lead to significant losses for investors, particularly those who are not prepared for rapid price changes. For instance, CAW has experienced a decline of approximately 10.3% in the past week, illustrating the inherent risk of investing in this asset class.

2. Regulatory Uncertainty

The cryptocurrency market is under increasing scrutiny from regulatory bodies around the world. Changes in regulations can have profound impacts on the viability and legality of trading certain tokens, including CAW. For example, if regulators classify CAW as a security, this could restrict trading and lead to legal challenges. Investors must remain aware of the regulatory landscape and its potential impact on their investments.

3. Competition from Other Memecoins

CAW operates in a highly competitive space, with numerous other memecoins vying for investor attention and market share. Popular tokens like Dogecoin and Shiba Inu have established substantial communities and market positions. As new memecoins continue to emerge, CAW may struggle to maintain its relevance and attract new investors. The success of any memecoin often depends heavily on social media trends and community engagement, which can be fleeting.

4. Technological Risks

The underlying technology of CAW, including its blockchain and smart contracts, could present risks. Issues such as bugs, vulnerabilities, or network congestion can negatively affect the performance and security of the token. Additionally, the migration from an old contract to a new one, as noted in the project’s updates, introduces risks related to user adoption and the potential for technical errors. Investors should consider the technological robustness of the platform supporting CAW.

5. Lack of Fundamental Use Case

While some cryptocurrencies have clear use cases, such as smart contracts or decentralized finance (DeFi), CAW primarily exists as a memecoin without a well-defined utility. This lack of intrinsic value can make it more susceptible to speculative bubbles, where prices are driven by hype rather than fundamental use. Investors may face challenges justifying the long-term value of CAW without a solid foundation of utility or application.

6. Market Sentiment and Social Media Influence

The price of CAW is heavily influenced by market sentiment and social media trends. Memecoins often experience rapid price increases based on viral trends or endorsements from influential figures. Conversely, negative sentiment can lead to swift declines. This reliance on social media for price movement can create an unpredictable investment environment, and investors may find themselves at the mercy of external factors beyond their control.

Conclusion

Investing in Crow with Knife (CAW) presents both potential opportunities and significant risks. While the unique community-driven aspects and fixed supply may attract certain investors, the inherent volatility, regulatory uncertainties, and competitive pressures in the memecoin market warrant careful consideration. As always, it is essential for potential investors to conduct thorough research and assess their risk tolerance before engaging with any cryptocurrency.

Frequently Asked Questions (FAQs)

1. What is crow with knife crypto (CAW)?

Crow with Knife (CAW) is a decentralized memecoin that operates on the Cronos blockchain. It was launched by the Cro Crow community, which previously deployed the first NFT on the Cronos chain. With a total supply of 777.77 trillion tokens, CAW aims to engage the cryptocurrency community through humor and memes while offering a trading platform for users.

2. Who created crow with knife crypto?

Crow with Knife was initiated by the Cro Crow community. This community is known for its involvement in the Cronos ecosystem, including the deployment of the first NFT on the chain. The project reflects the collective effort of its community members, aiming to create a unique memecoin experience.

3. How is the price of crow with knife crypto determined?

The price of crow with knife (CAW) is calculated in real-time by aggregating data from various exchanges and markets. This uses a global volume-weighted average formula, which means that the price reflects the trading activity across multiple platforms, ensuring an accurate market representation.

4. Is crow with knife crypto a good investment?

Like many memecoins, crow with knife crypto’s value can be highly volatile and speculative. While it has a dedicated community and operates within the growing Cronos ecosystem, potential investors should conduct thorough research, consider market trends, and assess their risk tolerance before investing. It’s essential to remember that investing in cryptocurrencies can lead to significant financial risks.

5. What makes crow with knife crypto different from Bitcoin?

Crow with knife differs from Bitcoin in several key ways:

– Purpose: Bitcoin is primarily a digital currency and a store of value, while crow with knife is a memecoin that emphasizes community engagement and humor.

– Supply: Crow with knife has a significantly higher total supply (777.77 trillion) compared to Bitcoin’s capped supply of 21 million coins.

– Blockchain: Crow with knife operates on the Cronos chain, whereas Bitcoin operates on its own blockchain.

6. Where can I buy crow with knife crypto?

Crow with knife (CAW) can be purchased on various centralized and decentralized exchanges. Some of the most popular platforms include VVS Finance, Gate, and Biconomy. Users can trade CAW against other cryptocurrencies such as USDT and WCRO.

7. What is the current market cap of crow with knife crypto?

As of now, the market capitalization of crow with knife (CAW) is approximately $21.36 million. Market cap is calculated by multiplying the current price of the token by its circulating supply, which is around 769.86 trillion CAW tokens.

8. What are the risks associated with investing in crow with knife crypto?

Investing in crow with knife crypto, like other cryptocurrencies, carries inherent risks. These may include:

– Volatility: The price can fluctuate dramatically within short periods, leading to potential losses.

– Market Sentiment: Memecoins can be heavily influenced by social media trends and community sentiment, which may not always align with fundamental value.

– Regulatory Risks: Changes in cryptocurrency regulations could impact the trading and use of CAW.

Potential investors should carefully evaluate these risks and consider their investment strategy before participating in the market.

Final Verdict on crow with knife crypto

Overview of Crow with Knife Crypto

Crow with Knife (CAW) is a decentralized memecoin that operates on the Cronos blockchain, primarily driven by the Cro Crow community. Launched with a total supply of 777.77 trillion tokens, CAW is designed to be a community-centric asset, with 100% of its supply available from day one. This unique approach aims to foster an inclusive environment for holders while leveraging the popularity of meme culture within the cryptocurrency space.

Technology and Market Performance

As a token built on the Cronos ecosystem, CAW benefits from the underlying technology of the blockchain, which offers fast transaction speeds and low fees. The token recently underwent a contract migration, indicating active development and responsiveness to market needs. With a current market cap of approximately $21 million and a trading volume of around $225,000 in the last 24 hours, CAW has been experiencing fluctuations typical of memecoins. The price has seen significant highs and lows, with an all-time high of around $0.000006 and a notable decline from that peak.

Investment Potential and Risks

Investing in Crow with Knife crypto presents both opportunities and challenges. As a memecoin, it carries the potential for rapid price increases, often driven by community sentiment and social media trends. However, it is important to note that this asset class is characterized by high volatility, making it a high-risk investment. The price may fluctuate dramatically based on market trends, news, and investor sentiment, which can result in substantial gains or losses.

Final Thoughts

In conclusion, Crow with Knife crypto is an intriguing option for those interested in the memecoin sector, offering a blend of community engagement and potential for price action. However, due to its inherent risks and volatility, it is crucial for investors to conduct their own thorough research (DYOR) before making any investment decisions. Understanding the market dynamics, technology, and community sentiment surrounding CAW will be essential for making informed choices in this high-risk, high-reward asset class.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.