Should You Invest in cortex crypto? A Full Analysis (2025)

An Investor’s Introduction to cortex crypto

Cortex crypto, represented by the token CTXC, is a pioneering decentralized platform that integrates artificial intelligence (AI) with blockchain technology. As a unique player in the cryptocurrency market, Cortex aims to democratize AI by enabling the execution and uploading of AI models on a distributed network. This innovative approach not only enhances the capabilities of smart contracts but also opens up numerous possibilities for decentralized applications (DApps) that leverage AI technologies. With the ongoing evolution of blockchain and AI, Cortex stands out as a notable contender in the rapidly growing landscape of digital assets.

Significance in the Crypto Market

Cortex occupies a distinctive niche within the cryptocurrency ecosystem, often categorized under AI and big data applications. Its focus on AI integration allows developers to build applications that can utilize complex AI models while benefiting from the security and transparency of blockchain technology. This dual functionality positions Cortex as a valuable asset for developers and businesses looking to harness AI’s power within decentralized frameworks. Despite its potential, Cortex has faced challenges in market performance, with its all-time high reaching $2.41 in April 2018, which illustrates the volatility and risk associated with investing in cryptocurrencies.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in Cortex crypto. It will cover key aspects of the Cortex platform, including:

-

Technology: An in-depth exploration of the underlying technology that powers Cortex, including its unique architecture and the Cortex Virtual Machine (CVM) designed for efficient AI model execution.

-

Tokenomics: A detailed analysis of the CTXC token, including its supply dynamics, market capitalization, and the role it plays within the Cortex ecosystem.

-

Investment Potential: Insights into the current market trends, historical performance, and future outlook for CTXC, helping investors make informed decisions.

-

Risks: A balanced discussion of the potential risks associated with investing in Cortex, including market volatility, technological challenges, and regulatory considerations.

-

How to Buy: Step-by-step guidance on purchasing CTXC, including the various exchanges where it is available and the process involved.

By providing this detailed overview, the guide aims to equip investors with the knowledge necessary to navigate the complexities of Cortex crypto, ultimately aiding in their investment decisions. Whether you are looking to understand the technical intricacies or explore the investment landscape, this guide will be an invaluable tool in your cryptocurrency journey.

What is cortex crypto? A Deep Dive into its Purpose

Introduction to Cortex Crypto

Cortex (CTXC) is an innovative cryptocurrency designed to bridge the gap between blockchain technology and artificial intelligence (AI). As a decentralized platform, Cortex enables users to upload and execute AI models on a distributed network, fundamentally transforming how AI is integrated and utilized within the blockchain ecosystem. The platform’s primary goal is to democratize access to AI technologies, allowing developers to create AI-enabled decentralized applications (DApps) that leverage the power of smart contracts.

The Core Problem It Solves

One of the critical challenges in the blockchain space has been the limited ability to execute machine learning models on-chain. Traditional smart contracts often rely on off-chain processing, which can lead to inefficiencies and undermine the trustless nature of blockchain technology. This disconnect prevents the full potential of smart contracts from being realized, as they cannot independently verify or execute complex AI tasks.

Cortex addresses this issue by introducing the Cortex Virtual Machine (CVM), which allows for the efficient execution of machine learning models directly on the blockchain. By utilizing GPU rather than CPU resources, the CVM enables faster and more effective processing of AI algorithms. This innovation not only enhances the functionality of smart contracts but also ensures that AI models can operate in a secure and decentralized manner.

Furthermore, Cortex’s approach fosters the development of a marketplace for AI models. Developers can upload their models to the Cortex network, where they can be accessed and utilized by others. This creates a competitive environment that encourages continuous improvement and innovation in AI technologies, ultimately benefiting all participants in the ecosystem.

Its Unique Selling Proposition

Cortex’s unique selling proposition lies in its ability to combine AI with blockchain technology in a way that is both practical and accessible. Several features set Cortex apart from other blockchain projects:

-

AI Democratization: Cortex aims to make AI technologies available to a broader audience by allowing anyone to upload and execute AI models. This democratization empowers developers and users alike, enabling them to leverage cutting-edge AI tools without the need for extensive resources or expertise.

-

Integration with Smart Contracts: The ability to integrate AI models into smart contracts opens up a myriad of possibilities for DApps. Developers can create sophisticated applications that utilize AI for automation, analytics, and decision-making, enhancing the overall utility of the blockchain.

-

Marketplace for AI Models: Cortex facilitates a marketplace where AI developers can share their models. This not only provides access to high-quality AI solutions but also encourages competition among model creators, driving innovation and improvement.

-

Robust Security Measures: Security is paramount in the cryptocurrency space, and Cortex employs various strategies to ensure the safety of its platform. This includes encryption, smart contract audits, and data privacy measures designed to protect user information and maintain the integrity of the network.

-

Community-Driven Ecosystem: Cortex emphasizes a decentralized approach that empowers its community. By not taking a percentage of earnings from contributors, the platform fosters a sustainable environment that encourages participation and collaboration.

The Team and Backers

Cortex was co-founded by Ziqi Chen and Jia Tian, both of whom bring significant expertise in AI and blockchain technology. Ziqi Chen has a background as a principal research scientist at SFTC, where he developed various innovative technologies. Jia Tian has experience working at major tech companies like Baidu and Alibaba, where he was involved in architecting large-scale recommender systems.

The team’s diverse skill set combines deep technical knowledge with practical experience in AI development and blockchain implementation. Their vision for Cortex is to create a platform that not only supports AI models but also enhances the overall blockchain ecosystem through innovative applications and services.

In addition to the founding team, Cortex has garnered support from various investors and partners in the blockchain space. This backing provides additional credibility and resources to help the project grow and achieve its goals.

Fundamental Purpose in the Crypto Ecosystem

Cortex’s fundamental purpose is to redefine the intersection of AI and blockchain technology. By enabling the execution of AI models on-chain, Cortex not only enhances the capabilities of smart contracts but also opens new avenues for DApp development. The project seeks to establish itself as a leading platform for AI integration within the blockchain ecosystem, ultimately contributing to the broader goal of making advanced technologies accessible to everyone.

The potential use cases for Cortex are vast. From enhancing security protocols through AI-driven threat detection to automating complex processes in various industries, the integration of AI into decentralized applications can lead to significant advancements in efficiency and innovation.

In summary, Cortex stands out as a pioneering project that addresses a critical gap in the blockchain landscape. By merging AI with blockchain technology, it empowers developers and users, fostering an ecosystem of innovation that can drive the next wave of technological advancement. As the demand for AI solutions continues to grow, Cortex positions itself as a key player in this evolving landscape, making it an essential project for those interested in the future of cryptocurrency and decentralized technologies.

The Technology Behind the Coin: How It Works

Overview of Cortex

Cortex is a decentralized blockchain platform that uniquely integrates artificial intelligence (AI) into its architecture. It allows AI models to be uploaded and executed on the blockchain, enabling the creation of AI-enhanced decentralized applications (DApps) and smart contracts. This innovative approach aims to democratize AI, making powerful machine learning tools accessible to developers and users alike.

In this section, we will explore the core technology behind Cortex, including its blockchain architecture, consensus mechanism, and key technological innovations. This knowledge will help you understand how Cortex operates and its potential impact on the future of AI and blockchain technology.

Blockchain Architecture

Cortex is built on a Layer 1 blockchain, which means it operates independently and does not rely on another blockchain for its functionality. Its architecture is designed specifically to support AI models and smart contracts. Here are the key components of Cortex’s architecture:

-

Cortex Virtual Machine (CVM):

– The Cortex Virtual Machine is a crucial part of the platform. Unlike traditional virtual machines that rely on the Central Processing Unit (CPU) for computations, the CVM utilizes Graphics Processing Units (GPUs). This is significant because GPUs are better suited for handling the complex calculations required for AI and machine learning tasks.

– The CVM enables efficient execution of machine learning models directly on the blockchain, allowing DApps to use AI models without needing to reference off-chain data or external services. This capability ensures that smart contracts can function autonomously, maintaining the integrity and reliability of the blockchain. -

Smart Contracts:

– Cortex supports smart contracts written in Solidity, a popular programming language in the Ethereum ecosystem. This compatibility makes it easier for developers familiar with Ethereum to create AI-enabled DApps on the Cortex platform.

– Smart contracts on Cortex can call AI models stored on the blockchain, allowing for a wide range of applications, from automated trading systems to personalized recommendation engines.

-

Decentralized Model Repository:

– Cortex provides a decentralized marketplace where developers can upload and share their AI models. This repository encourages collaboration and competition among AI developers, leading to higher-quality models over time.

– Users can access a variety of AI models, making it easier to integrate advanced functionalities into their applications. This collaborative environment fosters innovation and drives the development of new use cases for AI in blockchain.

Consensus Mechanism

Cortex employs a unique consensus mechanism to secure its network and validate transactions. Understanding this mechanism is essential for grasping how the platform maintains trust and security.

-

Proof of Work (PoW):

– Initially, Cortex utilized a Proof of Work (PoW) consensus mechanism similar to Bitcoin. In PoW, miners compete to solve complex mathematical problems to validate transactions and add them to the blockchain. This process consumes significant computational power and energy.

– While PoW provides security, it can be slow and inefficient, particularly for applications requiring real-time processing, such as AI models. -

Transition to Proof of Stake (PoS):

– As the platform evolved, Cortex began transitioning to a Proof of Stake (PoS) consensus mechanism. In PoS, validators are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral.

– This shift offers several advantages:- Energy Efficiency: PoS consumes significantly less energy than PoW, making it more sustainable and environmentally friendly.

- Faster Transactions: PoS can facilitate quicker transaction confirmations, which is crucial for applications that rely on real-time data processing, such as AI.

- Enhanced Security: With PoS, the risk of centralization is reduced, as validators are incentivized to act honestly to protect their staked assets.

Key Technological Innovations

Cortex is not just another blockchain; it is a platform that integrates cutting-edge technologies to advance the capabilities of decentralized applications. Here are some of the key innovations that set Cortex apart:

-

On-Chain AI Model Execution:

– One of the most significant innovations of Cortex is its ability to execute AI models directly on the blockchain. This capability allows DApps to perform complex computations without relying on off-chain data, ensuring transparency and security.

– By enabling on-chain AI execution, Cortex opens the door to numerous applications, including automated decision-making systems, fraud detection, and predictive analytics. -

Cortex 2.0 Upgrade:

– Cortex is continuously evolving, with the upcoming Cortex 2.0 upgrade aimed at enhancing the platform’s functionality. This upgrade focuses on improving the core technical architecture for on-chain AI integration, ensuring better security and performance.

– Key features of Cortex 2.0 include:

- Formal Verification: This process involves mathematically proving the correctness of algorithms and smart contracts, reducing the likelihood of errors and vulnerabilities.

- Trusted Execution Environments (TEEs): These secure areas within a processor allow sensitive computations to be performed while protecting the data from unauthorized access, enhancing privacy and security for AI models.

-

ZkMatrix Layer 2 Rollup:

– Cortex is also launching ZkMatrix, a Layer 2 solution that utilizes zkRollup technology. This approach allows for scaling the network by bundling multiple transactions into a single proof, significantly improving transaction throughput while maintaining security and decentralization.

– ZkMatrix is designed to enhance user experience by reducing transaction fees and confirmation times, making the platform more accessible for developers and users. -

Community-Driven Ecosystem:

– Cortex emphasizes community involvement and collaboration. By allowing developers to contribute to the platform without taking a percentage of their earnings, Cortex fosters a sustainable ecosystem where talent and innovation can flourish.

– This model encourages a diverse range of applications and services, making the platform more versatile and appealing to various industries.

Conclusion

Cortex represents a pioneering effort to merge blockchain technology with artificial intelligence, providing a robust platform for developers to create innovative applications. Its unique architecture, transitioning consensus mechanism, and key technological advancements position it at the forefront of the decentralized AI landscape.

As the platform continues to evolve, Cortex aims to become a leader in democratizing AI access, enabling a new generation of decentralized applications that leverage the power of artificial intelligence. Understanding the technology behind Cortex is essential for anyone interested in the future of blockchain and AI, as it holds the potential to transform numerous industries and enhance the way we interact with technology.

Understanding cortex crypto Tokenomics

Cortex (CTXC) is a cryptocurrency designed to bridge the gap between artificial intelligence (AI) and blockchain technology. Understanding its tokenomics is essential for both new and experienced investors who are exploring the potential of this unique digital asset. This section delves into the key metrics, utility, and distribution of the CTXC token, providing a comprehensive overview of its economic framework.

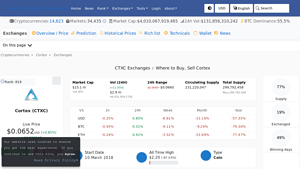

| Metric | Value |

|---|---|

| Total Supply | 299,792,458 CTXC |

| Max Supply | 299,792,458 CTXC |

| Circulating Supply | 232,322,436 CTXC |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The CTXC token serves multiple purposes within the Cortex ecosystem, providing essential functions that drive the platform’s operations and incentivize participation. Here are the primary utilities of the CTXC token:

-

Transaction Fees: CTXC is used to pay transaction fees on the Cortex network. Whenever users execute smart contracts or interact with AI models, they must pay these fees in CTXC. This mechanism ensures that the network can operate smoothly and incentivizes miners and validators who maintain the blockchain’s integrity.

-

Reward System: Contributors who upload AI models to the Cortex blockchain are rewarded with CTXC tokens. This creates an incentive for developers and data scientists to share their AI models, enhancing the overall quality and variety of available models on the platform. It fosters a collaborative environment where the best AI solutions can be accessed and utilized by developers creating decentralized applications (DApps).

-

Staking and Governance: As the Cortex platform evolves, CTXC holders may be given the opportunity to participate in governance decisions. By staking their tokens, users can have a say in protocol upgrades, changes to the ecosystem, and other critical decisions affecting the network’s future. This aspect of token utility promotes community engagement and decentralization.

-

Access to AI Services: Developers looking to integrate AI capabilities into their DApps can use CTXC to access various AI services available on the Cortex network. This includes executing AI models and leveraging the power of machine learning in their applications, thus broadening the potential use cases for the token.

-

Marketplace Participation: Cortex aims to create a decentralized marketplace for AI models, where users can buy and sell AI services and models using CTXC. This marketplace not only encourages innovation but also creates an ecosystem where AI solutions can be monetized effectively.

Token Distribution

The distribution of CTXC tokens is a crucial aspect of its tokenomics. Understanding how tokens are allocated can provide insights into the project’s sustainability, governance, and potential for growth. Here’s a breakdown of the token distribution:

-

Initial Token Allocation: Upon launch, a significant portion of CTXC tokens was allocated to the development team, early investors, and community incentives. This initial distribution is vital for ensuring that the project has enough resources for development and marketing while also rewarding early adopters.

-

Ecosystem Incentives: A portion of the total supply is reserved for community incentives, including rewards for AI model contributions and staking rewards. This strategy aims to foster a strong community of developers and users who are actively engaged in the ecosystem.

-

Mining Rewards: The Cortex platform employs a mining mechanism, allowing users to generate CTXC through the mining process. This not only helps secure the network but also introduces new tokens into circulation. As miners validate transactions and execute smart contracts, they are rewarded with CTXC, contributing to the overall supply of the token.

-

Vesting Periods: To ensure stability and prevent market manipulation, certain allocations, particularly those for team members and early investors, may have vesting periods. This means that tokens are locked for a specific duration and are gradually released over time, which helps to align the interests of the team with those of the community.

-

Burn Mechanisms: Some tokens may be burned as part of the platform’s deflationary model. By reducing the total supply over time, this mechanism can potentially increase the value of remaining tokens, benefiting long-term holders. The specifics of any burn program would be detailed in official communications from the Cortex team.

Conclusion

Cortex (CTXC) presents a compelling case for investors looking to explore the intersection of blockchain and artificial intelligence. Its tokenomics, characterized by a fixed supply, multiple utility functions, and a thoughtful distribution model, positions it as a unique player in the cryptocurrency landscape. Understanding these elements is crucial for potential investors, as they provide insights into the asset’s value proposition, sustainability, and future growth potential. As the Cortex ecosystem continues to develop, the role of CTXC will likely evolve, further enhancing its importance within the decentralized AI landscape.

Price History and Market Performance

Key Historical Price Milestones

Cortex (CTXC) has experienced a dynamic price history since its inception, reflecting both the volatility of the cryptocurrency market and the unique features of the Cortex platform. The cryptocurrency was launched in 2018, and its journey has been marked by several significant milestones.

-

Initial Launch and Early Performance: Upon its launch, CTXC quickly gained traction among investors, primarily due to its innovative approach to integrating artificial intelligence (AI) with blockchain technology. The token reached an all-time high of $2.41 on April 30, 2018. This peak was largely driven by the initial excitement surrounding blockchain projects that incorporated AI, positioning Cortex as a pioneer in this niche.

-

Post-Launch Decline: Following the 2018 peak, CTXC experienced a sharp decline, which is a common trend in the cryptocurrency market following initial hype. By the end of 2018, the price had dropped significantly, reflecting broader market trends where many cryptocurrencies lost substantial value.

-

All-Time Low: The price hit an all-time low of $0.03413 on March 16, 2020. This period coincided with the broader market downturn due to the global economic impact of the COVID-19 pandemic, which affected investor sentiment across all asset classes, including cryptocurrencies.

-

Recovery and Stability: In the subsequent years, CTXC exhibited periods of recovery. By mid-2021, the price had risen to around $0.16, reflecting renewed interest in cryptocurrencies and blockchain projects as the market began to recover from the pandemic-induced lows.

-

Recent Performance: As of October 2023, the price of Cortex is approximately $0.06544, with a market capitalization of about $15.2 million. Over the past year, CTXC has seen a decline of approximately 59.68% from its price of $0.16 a year ago. The trading volume over the last 24 hours has been reported at $2.18 million, indicating ongoing trading activity despite the price fluctuations.

Factors Influencing the Price

Historically, the price of Cortex has been influenced by various factors, ranging from market trends to technological developments and regulatory news.

-

Market Sentiment and Trends: Like many cryptocurrencies, CTXC’s price is sensitive to market sentiment. Bullish trends in the overall cryptocurrency market often lead to increased investment in altcoins, including Cortex. Conversely, during bear markets, CTXC has experienced significant sell-offs, reflecting broader market dynamics. For instance, the 2018 bull run that led to CTXC’s all-time high was followed by a prolonged bear market, which resulted in substantial price corrections.

-

Technological Developments: Cortex’s focus on integrating AI with blockchain technology is a unique selling point that has attracted attention. Announcements regarding technological upgrades, partnerships, or enhancements to the Cortex platform have historically had a positive impact on the price. For example, the introduction of features like the Cortex Virtual Machine (CVM) aimed at improving the execution of AI models on the blockchain has contributed to investor interest.

-

Competition and Market Position: The competitive landscape within the cryptocurrency space also plays a role in CTXC’s price movements. As new projects emerge that offer similar functionalities, investor interest can shift, impacting the demand for CTXC. The ongoing development of AI-focused blockchain projects has created a competitive environment that can influence the market performance of Cortex.

-

Regulatory Environment: Regulatory news can have a significant impact on the cryptocurrency market as a whole. Changes in regulations affecting cryptocurrencies or blockchain technologies can lead to increased volatility in CTXC’s price. For instance, news of stricter regulations in major markets can lead to declines across the board, including for Cortex.

-

Community Engagement and Adoption: The level of community engagement and adoption of the Cortex platform can also influence its market performance. As more developers create decentralized applications (DApps) using Cortex’s AI capabilities, this can enhance demand for CTXC, positively affecting its price. Conversely, a lack of adoption or development activity can lead to stagnation in price growth.

-

Market Capitalization and Trading Volume: The relatively low market capitalization of Cortex, approximately $15.2 million, means that it can be more susceptible to price swings due to lower liquidity. High trading volumes, as seen recently with $2.18 million in 24-hour trading, indicate active trading and can provide stability to the price, while low trading volumes may lead to increased volatility.

In summary, the price history and market performance of Cortex (CTXC) reflect a complex interplay of market dynamics, technological advancements, and external factors. Understanding these historical trends and influences can provide valuable insights for both new and experienced investors looking to navigate the cryptocurrency landscape.

Where to Buy cortex crypto: Top Exchanges Reviewed

5. Top Exchanges for Trading Cortex (CTXC) – Your Guide to Profitable Moves!

Cortex (CTXC) stands out in the cryptocurrency market due to its accessibility across multiple exchanges, including prominent platforms like Binance, HTX, and Coinex. These exchanges offer a variety of trading options and liquidity, making it easier for both novice and experienced investors to buy, sell, and trade CTXC. The diverse selection of trading venues enhances user flexibility and fosters a competitive environment, benefiting traders with better rates and services.

- Website: coinlore.com

1. Changelly – Top Choice for Low-Cost Cortex (CTXC) Trading!

Changelly stands out as an exceptional platform for exchanging Cortex (CTXC) due to its competitive rates and low transaction fees. With a high rating of 4.7 from over 5,000 users, it offers a seamless experience for trading more than 700 cryptocurrencies. The platform is accessible via both website and mobile app, ensuring fast exchanges and 24/7 live support, making it a top choice for both novice and experienced traders.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

3. KuCoin – Your Gateway to Cortex (CTXC) Buying!

KuCoin stands out as a user-friendly centralized exchange for purchasing Cortex (CTXC), offering a seamless platform for both novice and experienced traders. With a wide range of cryptocurrencies available and competitive trading fees, KuCoin provides robust security features and a comprehensive suite of tools for market analysis. Its intuitive interface and efficient transaction processes make it an ideal choice for anyone looking to invest in CTXC effortlessly.

- Website: kucoin.com

3. Cortex Exchange – Your Gateway to CTXC Trading!

Cortex Exchange, featured on Swapzone, offers an impressive user rating of 4.7 based on 153 reviews, highlighting its reliability and efficiency. What sets this exchange apart is its ability to provide fast and secure trading of CTXC to various cryptocurrencies at competitive rates. With a focus on user experience and seamless transactions, Cortex Exchange is an attractive option for both novice and seasoned traders looking to exchange digital assets efficiently.

- Website: swapzone.io

- Platform Age: Approx. 6 years (domain registered in 2019)

How to Buy cortex crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Cortex (CTXC) is to select a cryptocurrency exchange that supports the trading of CTXC. Here are some popular exchanges where you can buy Cortex:

- Coinbase: Known for its user-friendly interface, Coinbase is suitable for beginners.

- Binance: Offers a wide range of cryptocurrencies and trading pairs, including CTXC.

- Kraken: Known for its security features and competitive fees.

- Huobi: A well-established exchange that supports a variety of altcoins.

Before choosing an exchange, consider factors such as security, fees, user experience, and whether the exchange is available in your country.

2. Create and Verify Your Account

Once you have selected an exchange, the next step is to create an account. Follow these steps:

- Sign Up: Visit the exchange’s website and click on the ‘Sign Up’ or ‘Create Account’ button.

- Provide Information: Fill out the registration form with your email address and create a strong password.

- Verify Your Email: Check your email inbox for a verification link sent by the exchange and click on it to verify your account.

- Complete KYC Verification: Most exchanges require you to complete Know Your Customer (KYC) verification. This usually involves:

– Uploading a government-issued ID (like a passport or driver’s license).

– Providing personal information such as your name, address, and date of birth.

– Sometimes, you may need to upload a selfie or a document proving your address (like a utility bill). - Wait for Approval: The verification process can take anywhere from a few minutes to a few days, depending on the exchange.

3. Deposit Funds

After your account is verified, you’ll need to deposit funds to buy Cortex. Follow these steps:

- Choose a Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit card, or cryptocurrency transfer. Select the method that suits you best.

- Follow Instructions: If you’re depositing via bank transfer or card, follow the exchange’s instructions to complete the deposit. If you’re transferring cryptocurrency, ensure you send it to the correct wallet address provided by the exchange.

- Confirm the Deposit: Depending on the method used, it may take a few minutes to several days for the funds to appear in your account. Check your account balance to confirm the deposit.

4. Place an Order to Buy Cortex Crypto

Now that your account is funded, you can place an order to buy Cortex. Here’s how:

- Navigate to the Trading Section: Go to the trading or markets section of the exchange.

- Select the CTXC Trading Pair: Look for the trading pair that matches the currency you deposited (e.g., CTXC/USD or CTXC/BTC).

- Choose Order Type: Decide whether you want to place a market order (buy CTXC at the current market price) or a limit order (set a specific price at which you want to buy CTXC).

- Enter the Amount: Specify how much CTXC you want to purchase.

- Review and Confirm: Double-check the details of your order, including the total cost and fees, then click on the ‘Buy’ or ‘Place Order’ button.

5. Secure Your Coins in a Wallet

After purchasing Cortex, it’s crucial to store your coins securely. Here are steps to secure your CTXC:

- Choose a Wallet: You can use a software wallet (like Exodus or Trust Wallet) or a hardware wallet (like Ledger or Trezor) for enhanced security.

- Set Up Your Wallet: If you choose a software wallet, download the application and follow the instructions to create a new wallet. For hardware wallets, follow the manufacturer’s setup guide.

- Transfer CTXC to Your Wallet: Go to your exchange account, navigate to the withdrawal section, and enter your wallet address. Specify the amount of CTXC you want to transfer.

- Confirm the Transfer: Review the transaction details and confirm the withdrawal. The transfer may take a few minutes to complete.

- Backup Your Wallet: Make sure to back up your wallet’s recovery phrase and store it in a safe place. This is critical for recovering your funds if you lose access to your wallet.

Conclusion

By following these steps, you will successfully purchase and secure your Cortex cryptocurrency. Always remember to conduct thorough research and stay updated on market trends to make informed investment decisions. Happy investing!

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Cortex (CTXC) is positioned at the intersection of two rapidly evolving fields: blockchain technology and artificial intelligence (AI). This unique positioning offers several potential strengths for investors considering this digital asset.

1. Innovative Technology Integration

Cortex aims to democratize access to AI by allowing developers to upload and execute AI models on a decentralized blockchain. This integration of AI into smart contracts opens up a range of possibilities for innovative applications, such as automated decision-making processes and enhanced data analytics. As the demand for AI solutions continues to rise across various industries, Cortex’s ability to provide a platform for AI integration could enhance its value proposition significantly.

2. Growing Market for AI and Blockchain

Both AI and blockchain are experiencing substantial growth, with increasing interest from businesses and consumers alike. The demand for AI-driven solutions is projected to continue its upward trajectory, particularly in sectors such as finance, healthcare, and supply chain management. By leveraging blockchain technology, Cortex can offer transparency, security, and efficiency in deploying AI models, making it attractive to developers and businesses looking to capitalize on these trends.

3. Community-Driven Development

Cortex promotes a decentralized model that encourages community participation and contribution. By allowing AI developers to store their models on the platform without taking a percentage of their earnings, Cortex fosters an ecosystem that prioritizes fair compensation and sustainability. This community-driven approach can lead to a rich library of AI models, enhancing the platform’s overall utility and appeal.

4. Security Measures

Cortex employs robust security protocols, including encryption and thorough smart contract audits, to protect its platform and users. By prioritizing security, Cortex aims to build trust among users and investors, which is essential in the volatile cryptocurrency landscape. The focus on data privacy and threat detection also positions Cortex as a responsible player in the blockchain space.

5. Experienced Founders

Cortex was co-founded by Ziqi Chen and Jia Tian, both of whom have extensive experience in AI and technology. Their backgrounds and expertise lend credibility to the project and may inspire confidence among potential investors. A strong leadership team can be instrumental in navigating the challenges that come with developing and scaling a new technology.

Potential Risks and Challenges (The Bear Case)

While Cortex offers several potential strengths, it is essential to consider the risks and challenges that could impact its performance as an investment.

1. Market Volatility

Cryptocurrency markets are notoriously volatile, with price fluctuations that can occur rapidly and unpredictably. The current price of Cortex (CTXC) is significantly lower than its all-time high of $2.41, reflecting a decline of over 97%. Such volatility can deter potential investors and complicate long-term investment strategies. Investors should be prepared for the possibility of significant price swings, which could affect their investment returns.

2. Regulatory Uncertainty

The regulatory environment for cryptocurrencies remains uncertain and varies significantly by jurisdiction. Governments around the world are still in the process of establishing frameworks for the use and trading of digital assets. Any adverse regulatory changes could impact Cortex’s operations, leading to restrictions on its use or potential penalties. Furthermore, regulations surrounding AI technologies are also evolving, which could introduce additional complexities for Cortex’s business model.

3. Competition

Cortex operates in a competitive landscape where numerous projects are exploring the integration of AI and blockchain. Other platforms may offer similar functionalities, potentially attracting developers and users away from Cortex. The success of Cortex will depend on its ability to differentiate itself from competitors and attract a loyal user base. If Cortex cannot establish itself as a leader in this niche, it may struggle to gain traction in the market.

4. Technological Risks

The integration of AI and blockchain technology presents unique technological challenges. Cortex must ensure that its platform can efficiently handle the execution of AI models while maintaining the security and integrity of the blockchain. Any technical failures or vulnerabilities could undermine user confidence and deter developers from utilizing the platform. Additionally, as the technology landscape evolves, Cortex will need to keep pace with advancements to remain relevant.

5. Dependence on Community Engagement

Cortex’s community-driven model is both a strength and a potential vulnerability. While community contributions can enhance the platform’s offerings, a lack of engagement or participation from developers could hinder its growth. If the ecosystem fails to attract a sufficient number of quality AI models, the platform’s utility and attractiveness to users may diminish. This dependence on community engagement means that the success of Cortex is not solely in its hands but also relies on the broader developer community.

Conclusion

Investing in Cortex (CTXC) presents a blend of opportunities and risks. On one hand, its innovative approach to integrating AI with blockchain technology, coupled with a community-driven development model, positions it well for potential growth in a rapidly expanding market. On the other hand, investors must remain cautious of the inherent market volatility, regulatory uncertainties, competitive pressures, and technological challenges that could impact its performance.

As with any investment in cryptocurrency, it is crucial to conduct thorough research and consider both the potential rewards and risks. Investors should approach Cortex with a well-informed perspective, recognizing that while it offers unique opportunities, it also comes with significant uncertainties typical of the cryptocurrency space.

Frequently Asked Questions (FAQs)

1. What is Cortex (CTXC)?

Cortex is an open-source, decentralized blockchain platform designed to support artificial intelligence (AI) models. It allows users to upload and execute AI models on a distributed network, facilitating the integration of AI technologies into smart contracts and decentralized applications (DApps). By doing so, Cortex aims to democratize access to AI, enabling developers to utilize advanced models in various applications.

2. Who created Cortex crypto?

Cortex was co-founded by Ziqi Chen and Jia Tian. Ziqi Chen has a background in developing innovative technologies as a principal research scientist, while Jia Tian has experience as an architect for large recommender systems at major companies like Baidu and Alibaba. Their vision was to create a platform that merges blockchain technology with AI to enhance accessibility and usability.

3. What makes Cortex crypto different from Bitcoin?

Cortex differs from Bitcoin primarily in its purpose and functionality. While Bitcoin is a decentralized digital currency primarily designed for peer-to-peer transactions and a store of value, Cortex focuses on integrating AI models into its blockchain. This allows Cortex to support complex applications that utilize machine learning and AI, enabling features that Bitcoin does not offer.

4. Is Cortex crypto a good investment?

As with any investment, the potential for profit or loss with Cortex (CTXC) depends on various factors, including market conditions, technological advancements, and overall adoption of the platform. Investors should conduct thorough research, consider their risk tolerance, and evaluate Cortex’s use case in the AI and blockchain space before making investment decisions.

5. What is the current price of Cortex (CTXC)?

As of the latest data, the price of Cortex (CTXC) is approximately $0.06544 USD. Prices are subject to fluctuation due to market dynamics, so it is advisable to check real-time prices on cryptocurrency exchanges or financial news platforms for the most current information.

6. What is the market cap of Cortex?

Cortex has a market capitalization of approximately $15.20 million. Market cap is calculated by multiplying the current price of the cryptocurrency by its circulating supply. A higher market cap typically indicates a higher valuation and may suggest stability within the market.

7. What is the all-time high of Cortex?

The all-time high price of Cortex (CTXC) was $2.41, reached on April 30, 2018. This represents a significant decline from its peak, highlighting the volatility often seen in cryptocurrency markets. Investors should be aware of such fluctuations when considering investments.

8. How does Cortex ensure security?

Cortex employs several measures to secure its platform, including data encryption, smart contract audits, and privacy measures to protect user information. The platform also incorporates threat detection and response capabilities to address potential risks associated with decentralized networks. These strategies collectively aim to provide a secure environment for executing AI models and transactions on the Cortex blockchain.

Final Verdict on cortex crypto

Overview of Cortex Crypto

Cortex (CTXC) is an innovative cryptocurrency designed to bridge the gap between blockchain technology and artificial intelligence (AI). Its core purpose is to democratize access to AI by allowing users to upload and execute AI models on a decentralized platform. This integration facilitates the development of AI-enabled decentralized applications (DApps) and smart contracts, offering a unique utility within the blockchain ecosystem. The platform’s architecture includes a specialized Cortex Virtual Machine (CVM) that optimizes the execution of machine learning models, enhancing performance and security.

Technology and Use Cases

Cortex operates on a peer-to-peer, open-source blockchain, leveraging Ethereum’s capabilities while introducing its own innovative features. The platform incentivizes AI developers to contribute high-quality models, fostering a competitive environment that improves the overall quality of AI applications. Cortex is also launching ZkMatrix, a Layer 2 solution utilizing zkRollup technology, which aims to enhance scalability and efficiency. As a result, Cortex not only serves as a medium for transactions but also as a foundation for various applications in sectors like threat detection, automation, and data analytics.

Investment Considerations

As with any cryptocurrency investment, it is essential to recognize that Cortex is classified as a high-risk, high-reward asset. Its current market cap stands at approximately $15.2 million, with a circulating supply of 232.3 million CTXC coins. Despite its potential, investors should be aware of the volatility associated with cryptocurrencies and the challenges faced by projects in the competitive AI and blockchain sectors.

Final Thoughts

Before considering an investment in Cortex, it is crucial to conduct thorough research (DYOR). Understand the technology, assess the market trends, and evaluate how Cortex fits into your overall investment strategy. The integration of AI and blockchain offers exciting possibilities, but as with any investment, due diligence is key to making informed decisions.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.