Should You Invest in coq inu coin? A Full Analysis (2025)

An Investor’s Introduction to coq inu coin

Coq Inu Coin, often abbreviated as COQ, is a notable player in the ever-evolving cryptocurrency market, particularly recognized as a meme coin on the Avalanche C-Chain. Launched by a group of respected community members, Coq Inu aims to blend humor with the power of blockchain technology, tapping into the growing trend of meme-based cryptocurrencies that have captured the imagination of investors and the general public alike. With a current market cap of approximately $30.57 million and a circulating supply of 69.42 trillion COQ tokens, the coin has garnered attention for its unique branding and community-driven approach.

Significance in the Crypto Market

Meme coins, including Coq Inu, have emerged as a significant segment within the broader cryptocurrency landscape. While often criticized for their speculative nature, these tokens have nonetheless succeeded in building vibrant communities and creating substantial market movements. Coq Inu, in particular, differentiates itself by being positioned on the Avalanche blockchain, which is known for its speed and low transaction fees. This strategic choice enhances its usability and accessibility, potentially attracting a diverse range of users from casual investors to crypto enthusiasts.

Purpose of This Guide

The purpose of this guide is to serve as a comprehensive resource for both beginner and intermediate investors looking to understand Coq Inu Coin in depth. We will explore various facets of the cryptocurrency, including its underlying technology, tokenomics, and investment potential. Additionally, we will outline the risks associated with investing in meme coins, which can often be volatile and subject to rapid price fluctuations.

Investors will also learn how to purchase Coq Inu, including the platforms where it is available and the steps necessary to navigate the buying process safely. By providing a detailed overview, this guide aims to equip readers with the knowledge they need to make informed decisions regarding their investment in Coq Inu Coin.

What to Expect

Throughout this guide, we will delve into the mechanics of how Coq Inu operates, its historical price movements, and community engagement strategies that contribute to its appeal. By understanding these elements, investors can better assess whether Coq Inu aligns with their investment goals and risk tolerance. Whether you are drawn to the humor of meme coins or intrigued by the technology behind them, this guide will provide the insights necessary to navigate the exciting world of Coq Inu Coin.

What is coq inu coin? A Deep Dive into its Purpose

Understanding Coq Inu Coin

Coq Inu Coin (COQ) is a meme-based cryptocurrency that operates on the Avalanche C-Chain, which is known for its high throughput and low transaction fees. As a relatively new entrant in the cryptocurrency market, Coq Inu aims to carve out a niche for itself by leveraging the popularity of meme coins while establishing a community-driven project that emphasizes transparency and user engagement.

The Core Problem It Solves

In the evolving landscape of cryptocurrencies, many investors are drawn to meme coins due to their community-centric nature and potential for rapid price appreciation. However, the market is often flooded with projects that lack genuine utility or a clear vision. Coq Inu addresses this issue by providing a platform that not only embraces the fun and engaging aspects of meme culture but also focuses on building a sustainable community.

One of the primary challenges in the meme coin sector is the prevalence of scams and poorly executed projects. Coq Inu seeks to mitigate these risks by ensuring that its contract has been fully renounced, meaning the developers cannot make changes to the contract post-launch. Additionally, the initial liquidity was established using a modest amount of AVAX (the native token of the Avalanche network), and all tokens were allocated to the liquidity pool, demonstrating a commitment to the project’s integrity and reducing the likelihood of pump-and-dump schemes.

Its Unique Selling Proposition

Coq Inu distinguishes itself from other meme coins through several key features:

-

Community Focus: The project is built around a strong community ethos, encouraging users to engage with one another and participate in the project’s growth. This is facilitated through social media channels, community events, and regular updates from the team.

-

Transparent Mechanics: By burning liquidity and renouncing the contract, Coq Inu aims to foster trust among its users. This transparency is crucial in attracting investors who are wary of the high-risk environment typical of meme coins.

-

Low Transaction Costs: Operating on the Avalanche network allows Coq Inu to offer low transaction fees, making it more accessible for users to buy, sell, and trade COQ tokens without incurring significant costs.

-

Potential for Growth: While the current market cap of Coq Inu is modest, its total supply of 69.42 trillion COQ tokens presents a unique opportunity for investors. With effective marketing and community engagement, there is potential for significant price appreciation, similar to other successful meme coins like Dogecoin and Shiba Inu.

-

Engaging Marketing Strategy: Coq Inu employs a playful and humorous marketing approach that resonates with the meme coin community. This strategy not only attracts attention but also encourages users to share the project within their networks, further enhancing its visibility.

The Team and Backers

Coq Inu is developed by a team of individuals who are well-respected within the cryptocurrency community. The project’s creators have backgrounds in technology and finance, which lends credibility to their efforts. Importantly, the team has chosen to remain anonymous, a common practice in the meme coin space. This anonymity can be a double-edged sword; while it allows for a degree of privacy, it may also raise concerns among potential investors about accountability.

Despite the anonymity of the team, the project has gained traction through its community-driven initiatives and social media presence. The lack of a formal backing from large investors or venture capital firms is compensated by the organic growth of its community. This grassroots approach is characteristic of successful meme coins and can lead to sustainable long-term growth as the community continues to rally around the project.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Coq Inu Coin extends beyond mere speculation and trading. It aims to foster a vibrant community of cryptocurrency enthusiasts who share a passion for memes and digital assets. By creating a platform where users can engage, share, and collaborate, Coq Inu hopes to contribute to the broader cryptocurrency ecosystem by:

-

Promoting User Engagement: Through community-driven initiatives and events, Coq Inu encourages users to actively participate in the project, fostering a sense of belonging and shared purpose.

-

Educating New Investors: As a meme coin, Coq Inu has the potential to attract newcomers to the cryptocurrency space. By providing educational resources and engaging content, the project aims to help users navigate the complexities of crypto investing.

-

Supporting the Avalanche Ecosystem: By building on the Avalanche C-Chain, Coq Inu contributes to the growth of this blockchain ecosystem. As more users engage with Coq Inu, they also become familiar with the benefits of Avalanche, which may lead to increased adoption of the platform.

-

Encouraging Fun and Creativity: At its core, Coq Inu embodies the lighthearted nature of meme culture. By encouraging creativity and fun, the project seeks to make cryptocurrency accessible and enjoyable for everyone, regardless of their level of expertise.

Conclusion

In summary, Coq Inu Coin represents a unique blend of community engagement, transparency, and meme culture within the cryptocurrency landscape. While it faces the inherent challenges of being a meme coin, its commitment to fostering a trustworthy environment and engaging its users sets it apart. For beginners and intermediate investors alike, understanding the dynamics of Coq Inu can provide valuable insights into the evolving world of digital assets and the role of community-driven projects in shaping the future of cryptocurrency.

The Technology Behind the Coin: How It Works

Overview of Coq Inu Coin

Coq Inu Coin (COQ) is a meme-based cryptocurrency that operates on the Avalanche blockchain, known for its speed and efficiency. Launched with a total supply of 69.42 trillion tokens, Coq Inu aims to capture the playful spirit of meme coins while providing a robust framework for community engagement and trading. This guide will explore the underlying technology of Coq Inu, including its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

Coq Inu is built on the Avalanche platform, a decentralized blockchain network designed to facilitate high-speed transactions and smart contract capabilities. The Avalanche architecture consists of three primary components:

-

Platform Chain (P-Chain): The P-Chain coordinates the network, handles the staking mechanism, and manages the creation of subnets. It ensures that validators can communicate effectively and maintain consensus across the network.

-

Exchange Chain (X-Chain): This chain is designed for asset transfers and is responsible for the creation and management of digital assets. It uses a unique Avalanche consensus protocol, allowing for near-instant transactions and scalability.

-

Contract Chain (C-Chain): The C-Chain is where smart contracts are deployed. It is fully compatible with Ethereum’s smart contract functionality, enabling developers to create decentralized applications (dApps) that can interact with Coq Inu and other tokens on the Avalanche network.

This architecture allows Coq Inu to benefit from the Avalanche network’s high throughput and low latency, making transactions faster and cheaper compared to many other blockchains.

Consensus Mechanism

Coq Inu utilizes the Avalanche consensus protocol, which combines elements of both classical consensus and Nakamoto consensus (used in Bitcoin). Here’s how it works:

-

Directed Acyclic Graph (DAG): The Avalanche consensus is based on a DAG structure, allowing for multiple transactions to be processed simultaneously. This leads to increased throughput and reduced confirmation times.

-

Gossip Protocol: Validators communicate using a gossip protocol, where they share information about transactions with a subset of other validators. This decentralized communication helps to quickly propagate transaction information across the network.

-

Random Sampling: Instead of requiring all validators to agree on a transaction (as in traditional proof-of-stake systems), the Avalanche protocol uses random sampling. Validators randomly sample a small number of other validators to gauge their opinion on a transaction. If enough validators agree on a transaction, it is considered confirmed.

-

Finality: Once a transaction is confirmed, it achieves finality almost instantly, meaning it cannot be reversed or altered. This is a significant advantage over other systems that may take longer to confirm transactions.

This consensus mechanism allows Coq Inu to achieve high levels of security and efficiency while maintaining low transaction fees, making it attractive to users and investors.

Key Technological Innovations

Coq Inu incorporates several innovative technologies that enhance its functionality and user experience:

1. Decentralized Governance

Coq Inu employs a decentralized governance model that allows the community to participate in decision-making processes. Token holders can propose and vote on changes to the protocol, ensuring that the project evolves according to the community’s needs and desires. This approach fosters a sense of ownership and engagement among users.

2. Liquidity Pools and Yield Farming

Liquidity pools are essential for the trading of Coq Inu on decentralized exchanges (DEXs). Users can provide liquidity by depositing COQ tokens into these pools, earning rewards in the form of transaction fees or additional tokens. Yield farming allows users to maximize their returns by strategically moving their assets across different liquidity pools, providing incentives for long-term holding and participation in the ecosystem.

3. Tokenomics

Coq Inu’s tokenomics is designed to promote sustainability and growth. With a fixed supply of 69.42 trillion COQ tokens, the project has implemented mechanisms to prevent inflation and ensure value retention. The team behind Coq Inu has burned a significant portion of the initial supply, which reduces the circulating supply and potentially increases the token’s value over time.

4. Interoperability

One of the standout features of Coq Inu is its compatibility with Ethereum-based dApps. By utilizing the C-Chain, developers can easily create and deploy smart contracts that interact with both the Avalanche and Ethereum ecosystems. This interoperability broadens the potential user base and enhances the token’s utility.

5. Community Engagement and Marketing

Coq Inu leverages social media and community-driven marketing strategies to promote its project. The team focuses on building a strong online presence through platforms like Twitter, Reddit, and Telegram. Engaging with the community helps to drive awareness and adoption, which is crucial for the success of any meme coin.

Security Features

Security is a paramount concern in the cryptocurrency space, and Coq Inu employs several features to protect its users and network:

-

Smart Contract Audits: To ensure the safety of funds, Coq Inu’s smart contracts undergo rigorous audits by third-party security firms. This process helps identify and rectify vulnerabilities before they can be exploited.

-

Validator Incentives: Validators play a crucial role in maintaining the network’s integrity. They are incentivized to act honestly through the potential for rewards, creating a strong disincentive against malicious behavior.

-

Community Reporting: The decentralized governance model allows the community to report suspicious activities or vulnerabilities. This collaborative approach enhances the overall security of the network.

Conclusion

Coq Inu Coin represents a unique blend of meme culture and robust blockchain technology. By leveraging the strengths of the Avalanche platform, Coq Inu aims to provide a fun yet functional cryptocurrency experience for its users. With its decentralized governance, innovative tokenomics, and commitment to security, Coq Inu positions itself as a noteworthy player in the meme coin space. Whether you are a beginner or an experienced investor, understanding the technology behind Coq Inu can provide valuable insights into its potential and future growth.

Understanding coq inu coin Tokenomics

Coq Inu Coin (COQ) is a meme coin that operates on the Avalanche C-Chain. As a meme coin, it is primarily designed to engage the community and capitalize on the viral nature of internet culture. Understanding the tokenomics of Coq Inu is essential for both new and experienced investors, as it reveals the underlying economic principles that govern the token’s value, utility, and distribution.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 69.42 trillion COQ |

| Max Supply | 69.42 trillion COQ |

| Circulating Supply | 69.42 trillion COQ |

| Inflation/Deflation Model | Deflationary |

The total supply, max supply, and circulating supply of Coq Inu Coin are all set at 69.42 trillion COQ. This significant supply level is typical for meme coins, which often aim for broad accessibility and engagement among users. The inflation/deflation model of Coq Inu is deflationary, meaning that mechanisms may exist to reduce the total supply over time, potentially increasing scarcity and value for holders.

Token Utility (What is the coin used for?)

Coq Inu Coin primarily serves as a medium of exchange within its ecosystem, but its utility extends beyond mere transactions. Here are some of the key functions of COQ:

-

Community Engagement: As a meme coin, COQ is intended to foster community participation and engagement. This includes social media campaigns, contests, and events that leverage the humor and cultural references associated with the Coq Inu brand.

-

Liquidity Provision: The initial liquidity for COQ was provided by the founding team, who renounced their ownership of the contract. This means that the liquidity is locked, creating a more stable trading environment. Users can trade COQ on various decentralized exchanges (DEXs) within the Avalanche ecosystem, contributing to its liquidity and overall market dynamics.

-

Staking Rewards: Some platforms may offer staking options for COQ holders, allowing them to earn rewards by locking up their tokens. This not only incentivizes holding but also reduces the circulating supply, aligning with the token’s deflationary model.

-

Integration with Other Projects: As COQ gains popularity, there may be opportunities for partnerships and integrations with other projects within the Avalanche ecosystem, enhancing its utility and use cases.

-

Charitable Contributions: Some meme coins have been known to engage in charitable activities, and while this may not be a primary focus of Coq Inu, community-driven initiatives could arise that leverage COQ for social good.

Token Distribution

The distribution of Coq Inu Coin is crucial in understanding its market dynamics and potential for value appreciation. Here’s a breakdown of how the tokens are typically allocated:

-

Initial Liquidity: The founders provided the entire supply of COQ with an initial liquidity of 150 AVAX. This liquidity was locked, ensuring that the market has enough COQ for trading without the risk of a rug pull.

-

Community Rewards: A portion of the tokens is often set aside for community rewards and initiatives. This can include airdrops, contests, and other promotional activities that aim to increase user engagement and market presence.

-

Development Fund: While specific allocations for a development fund were not detailed in available sources, many projects allocate a percentage of tokens for ongoing development, marketing, and operational expenses. This ensures that the project can sustain itself and continue to grow.

-

Burn Mechanisms: To support the deflationary model, some tokens may be burned over time, reducing the overall supply. While specific burn mechanisms for COQ were not mentioned, community-driven initiatives may arise to implement such strategies.

-

Market Liquidity: Maintaining adequate liquidity in decentralized exchanges is essential for a healthy trading environment. The locked liquidity provided by the founders plays a pivotal role in this aspect, allowing users to buy and sell COQ with minimal price slippage.

In summary, the tokenomics of Coq Inu Coin is structured to promote community engagement, ensure liquidity, and potentially create value through deflationary mechanisms. Understanding these aspects is vital for investors looking to navigate the meme coin landscape, especially in a market that can be highly volatile and speculative. By leveraging its unique position within the Avalanche ecosystem, Coq Inu aims to carve out a niche for itself in the ever-evolving world of cryptocurrency.

Price History and Market Performance

Overview of Coq Inu Coin

Coq Inu (COQ) is a meme coin operating on the Avalanche C-Chain, gaining popularity among enthusiasts for its community-driven approach and humorous branding. Like many meme-based cryptocurrencies, its price movements can be quite volatile and are often influenced by market sentiment, community engagement, and broader trends within the cryptocurrency ecosystem.

Key Historical Price Milestones

Historically, Coq Inu has experienced significant fluctuations in its market price. Here are some notable milestones:

-

All-Time High: Coq Inu reached its all-time high of approximately $0.0000065 on March 9, 2024. This peak occurred during a period when many meme coins saw a surge in popularity, driven by social media trends and the overall bullish sentiment in the cryptocurrency market.

-

All-Time Low: The coin hit its all-time low of around $0.000000093201 on December 7, 2023. This low point was reflective of a broader market downturn that affected many cryptocurrencies, particularly those classified as meme coins, which are often more susceptible to market sentiment.

-

Recent Performance: As of the latest data, Coq Inu’s price stands at approximately $0.00000044, with a market capitalization of around $30.57 million. Over the past 24 hours, the price has seen a minor decline of about 1.01%, indicating a relatively stable trading environment compared to its historical volatility.

-

Volume and Market Cap: The trading volume over the last 24 hours has been approximately $2.92 million, showcasing active trading interest. The circulating supply of Coq Inu is about 69.42 trillion COQ tokens, which is also the maximum supply, indicating that there is no inflationary pressure from additional token issuance.

Factors Influencing the Price

Historically, the price of Coq Inu has been influenced by a variety of factors:

1. Market Sentiment and Social Media Trends

As a meme coin, Coq Inu’s price is heavily influenced by social media trends and community sentiment. The rise and fall of meme coins are often tied to viral moments on platforms like Twitter, Reddit, and TikTok. For instance, spikes in engagement or mentions can lead to increased buying pressure, driving prices higher. Conversely, negative sentiment or lack of engagement can result in price declines.

2. Broader Cryptocurrency Market Trends

The overall performance of the cryptocurrency market plays a critical role in the price movements of Coq Inu. For example, during bull markets, meme coins often experience heightened interest and investment as traders look for high-risk, high-reward opportunities. Conversely, in bear markets, these coins typically see sharper declines due to their speculative nature.

3. Community Development and Engagement

The strength and activity of the Coq Inu community significantly impact its price. Initiatives such as community events, contests, and partnerships can enhance visibility and attract new investors. A well-engaged community can create a sense of ownership and loyalty among holders, which may help stabilize prices during market fluctuations.

4. Liquidity and Trading Volume

Liquidity is a crucial factor for any cryptocurrency, including Coq Inu. The ability to buy and sell the coin without causing significant price changes is essential for maintaining a healthy market. High trading volume often correlates with price stability, as it allows for more transactions without drastically impacting the price. Conversely, low liquidity can lead to increased volatility.

5. Technological Developments and Upgrades

While Coq Inu is primarily a meme coin, any technological advancements or upgrades to its underlying blockchain (Avalanche C-Chain) can influence its price. Improvements in transaction speed, security, or usability can enhance the overall ecosystem, potentially attracting more users and investors.

6. Market Regulation and News

Regulatory developments can have a significant impact on the price of cryptocurrencies. News regarding government regulations, security breaches, or legal issues involving other cryptocurrencies can affect investor confidence and market sentiment, thereby influencing the price of Coq Inu.

Conclusion

In summary, Coq Inu has experienced a tumultuous price history marked by significant highs and lows. Its market performance is heavily influenced by community engagement, market sentiment, and broader trends within the cryptocurrency landscape. As a meme coin, it embodies the volatile nature of this sector, where social media and community dynamics play pivotal roles in price movements. Investors should be aware of these factors when considering their involvement with Coq Inu, as historical performance can provide insights into potential future dynamics.

Where to Buy coq inu coin: Top Exchanges Reviewed

1. Coq Inu – Your Next Memecoin Investment Awaits!

Kraken stands out as a user-friendly exchange for purchasing Coq Inu, offering flexible payment options starting from just $10. Users can conveniently buy COQ through credit/debit cards, ACH deposits, or mobile payment methods like Apple and Google Pay, depending on availability. This accessibility, combined with Kraken’s robust security measures and a reputation for reliability, makes it an attractive choice for both novice and experienced cryptocurrency investors looking to enter the Coq Inu market.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. Coq Inu (COQ) – Your Ultimate Guide to Smart Investing!

The guide “How to Buy Coq Inu (COQ): A Step-by-Step Guide” by Bitcompare emphasizes the importance of selecting the right cryptocurrency exchange for purchasing Coq Inu. It stands out by providing detailed criteria for evaluating exchanges, including their operational regions, supported trading pairs, and user-friendly features. This comprehensive approach ensures that both beginners and experienced investors can make informed decisions, enhancing their trading experience while navigating the Coq Inu market.

- Website: bitcompare.net

- Platform Age: Approx. 6 years (domain registered in 2019)

5. KuCoin – Your Gateway to Coq Inu (COQ)!

KuCoin stands out as a user-friendly exchange for purchasing Coq Inu (COQ), providing a secure and efficient platform for instant transactions. With a variety of payment options and a straightforward buying process, KuCoin caters to both novice and experienced investors. Its global accessibility further enhances its appeal, making it a preferred choice for those looking to invest in COQ seamlessly from anywhere in the world.

- Website: kucoin.com

- Platform Age: Approx. 12 years (domain registered in 2013)

5. Changelly – Top Choice for Minimal Exchange Fees on Coq Inu!

Changelly stands out as an exceptional platform for exchanging Coq Inu (COQ) due to its competitive rates and low transaction fees, making it an attractive option for both new and seasoned investors. With a user-friendly website and app, Changelly facilitates fast exchanges across over 700 cryptocurrencies, complemented by 24/7 live support. Its high user rating of 4.7 from over 5,000 reviews further underscores its reliability and efficiency in the crypto exchange space.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

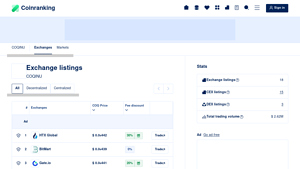

3. COQINU (COQ) – Rising Star with Diverse Exchange Options!

COQINU (COQ) has garnered attention through its strategic listings on notable exchanges such as HTX Global, Gate.io, BitMart, and XT.COM. These platforms not only enhance COQ’s accessibility to a broader audience but also signify its growing credibility within the cryptocurrency market. The diverse range of exchanges allows for increased trading volume and liquidity, making COQ an attractive option for both new and experienced investors seeking opportunities in emerging digital assets.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy coq inu coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

To buy Coq Inu Coin (COQ), the first step is to select a reliable cryptocurrency exchange. Some popular exchanges that support Coq Inu include:

- Kraken

- PancakeSwap (for decentralized trading)

- Uniswap (if you prefer a decentralized option on the Ethereum network)

When choosing an exchange, consider factors such as:

- Reputation and Security: Look for exchanges with a good track record for security and customer service.

- Fees: Check the trading and withdrawal fees, as these can vary significantly between platforms.

- User Interface: A user-friendly interface can make your trading experience smoother, especially if you are a beginner.

2. Create and Verify Your Account

Once you’ve chosen an exchange, the next step is to create an account. Here’s how to do it:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button.

- Enter Your Information: Fill in the required information, such as your email address, password, and any other personal details.

- Verify Your Email: After submitting your information, you’ll receive a verification email. Click on the link in the email to verify your account.

- Complete KYC (Know Your Customer): Most exchanges require you to complete KYC. This process may involve uploading identification documents and proof of address. Follow the instructions provided by the exchange to complete this step.

3. Deposit Funds

After your account is verified, you need to deposit funds to buy Coq Inu. Here’s how to do it:

- Log in to Your Account: Use your credentials to log in to the exchange.

- Navigate to the Deposit Section: Look for a “Funds” or “Wallet” section, and then select “Deposit.”

- Choose Your Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit card, or cryptocurrency. Select your preferred method.

– If using fiat currency (like USD), follow the prompts to link your bank account or card.

– If depositing cryptocurrency, you’ll need to send the crypto to the wallet address provided by the exchange. - Confirm the Deposit: Once you’ve initiated the deposit, confirm the transaction. Be aware that it may take some time for the funds to appear in your account, depending on the method used.

4. Place an Order to Buy Coq Inu Coin

Now that you have funds in your account, you can buy Coq Inu. Here’s how to place an order:

- Find the COQ Trading Pair: In the exchange’s trading interface, search for the Coq Inu trading pair, such as COQ/USD or COQ/ETH.

- Select the Type of Order: You can typically choose between different order types:

– Market Order: Buys COQ at the current market price.

– Limit Order: Sets a specific price at which you want to buy COQ. - Enter the Amount: Specify how much COQ you wish to purchase.

- Review Your Order: Double-check the details of your order, including the total cost and any fees.

- Submit Your Order: Click the “Buy” button to execute your order. If you placed a limit order, it will only execute when the market reaches your specified price.

5. Secure Your Coins in a Wallet

After purchasing Coq Inu, it’s essential to secure your coins properly. Here’s how to do that:

- Choose a Wallet: You can use a software wallet (like Trust Wallet or MetaMask) or a hardware wallet (like Ledger or Trezor) for enhanced security.

- Create Your Wallet: If you choose a software wallet, download the app and follow the instructions to create a new wallet. Make sure to write down your recovery phrase and store it securely.

- Transfer COQ to Your Wallet:

– Go to the “Withdraw” or “Send” section of the exchange.

– Enter your wallet address (make sure it’s correct) and the amount of COQ you want to transfer.

– Confirm the transaction. It may take some time for the transfer to complete. - Verify the Transfer: Check your wallet to ensure the COQ has arrived.

Conclusion

Buying Coq Inu Coin involves a few straightforward steps: selecting an exchange, creating an account, depositing funds, placing an order, and securing your coins. By following this guide, you can navigate the process confidently, ensuring your investment is both safe and successful. Always remember to do your research and only invest what you can afford to lose. Happy trading!

Investment Analysis: Potential and Risks

Understanding Coq Inu Coin: A Balanced Investment Analysis

Coq Inu Coin (COQ) is a meme cryptocurrency that has garnered attention within the Avalanche ecosystem. As with any digital asset, potential investors should thoroughly analyze both the strengths and risks associated with investing in Coq Inu. This section aims to provide a balanced overview of these factors to aid informed decision-making.

Potential Strengths (The Bull Case)

1. Community-Driven Project

Coq Inu was founded by respected members of the community who have committed to transparency and integrity. The project has no initial distribution, as the entire supply was allocated with liquidity, and the smart contract has been fully renounced. This aspect can foster trust and a sense of belonging among its holders, potentially leading to a loyal community that supports the token’s growth.

2. Market Position

As of now, Coq Inu ranks around #745 in market capitalization with approximately $30.57 million. While this may seem modest compared to established cryptocurrencies, the meme coin space often sees rapid shifts in sentiment and price, especially during bullish market conditions. The asset’s current price, around $0.00000044, allows for low-entry points, making it appealing to speculative investors looking for high-risk, high-reward opportunities.

3. Meme Coin Popularity

Meme coins like Dogecoin and Shiba Inu have demonstrated significant price appreciation based on community engagement and social media influence. Coq Inu, being a meme coin, can potentially leverage similar patterns of growth if it manages to capture the community’s attention effectively. Its presence on social media platforms and meme culture can be a catalyst for price movements.

4. Liquidity and Trading Volume

Coq Inu has a trading volume of approximately $2.92 million over the last 24 hours, indicating decent liquidity. Higher liquidity can facilitate smoother transactions and reduce the impact of large trades on the token’s price. This is an essential factor for investors considering entering or exiting positions.

5. Technological Underpinnings

Built on the Avalanche blockchain, Coq Inu benefits from the underlying technology that offers high throughput and low transaction fees. The Avalanche ecosystem is known for its scalability and efficiency, which can enhance the usability of Coq Inu and support its growth as a digital asset.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies are notoriously volatile, and Coq Inu is no exception. The price can fluctuate dramatically over short periods, influenced by market sentiment, trading volume, and broader economic conditions. Investors must be prepared for potential losses as the price can drop significantly, as evidenced by Coq Inu’s all-time high of $0.0000065 compared to its current price, representing a decline of over 90%.

2. Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies is continuously evolving. Governments worldwide are increasingly scrutinizing digital assets, which can lead to potential restrictions or bans. Regulatory changes can adversely affect market sentiment and the operational capabilities of cryptocurrencies like Coq Inu, creating an unpredictable investment environment.

3. Intense Competition

The cryptocurrency market is saturated with thousands of tokens, many of which are meme coins vying for attention and market share. Coq Inu competes not only with established coins like Dogecoin and Shiba Inu but also with numerous other emerging meme projects. This competition can dilute market interest and hinder the growth potential of Coq Inu, especially if it fails to differentiate itself or maintain community engagement.

4. Technological Risks

While Coq Inu benefits from being built on the Avalanche blockchain, it is not immune to technological risks. Smart contract vulnerabilities, network congestion, or issues related to interoperability can pose threats to the token’s stability and security. Furthermore, if the Avalanche network experiences problems, it could directly impact Coq Inu’s performance.

5. Market Sentiment and Speculation

Meme coins often depend heavily on market sentiment and speculative trading, which can lead to irrational price movements. Sudden changes in social media trends or community interest can result in rapid price increases or crashes. This speculative nature makes it challenging to predict long-term value, and investors may find themselves exposed to significant risks based on fickle market dynamics.

Conclusion

Investing in Coq Inu Coin presents a mix of potential benefits and significant risks. Its community-driven approach, market positioning, and technological advantages are compelling factors for consideration. However, investors must remain vigilant regarding the inherent volatility, regulatory uncertainties, and competitive pressures that characterize the cryptocurrency landscape.

As with any investment, particularly in the highly speculative world of cryptocurrencies, it is crucial to conduct thorough research and assess personal risk tolerance. Investors should be prepared for fluctuations in value and stay informed about market trends and developments within the Coq Inu community and the broader cryptocurrency ecosystem.

Frequently Asked Questions (FAQs)

1. What is Coq Inu Coin (COQ)?

Coq Inu Coin (COQ) is a meme cryptocurrency built on the Avalanche blockchain. It was created as part of the growing trend of meme coins, similar to Dogecoin and Shiba Inu. Coq Inu aims to provide a fun and engaging experience for its community while leveraging the technological advantages of the Avalanche ecosystem.

2. Who created Coq Inu Coin?

Coq Inu was founded by a group of respected members within the cryptocurrency community. They launched the project with a focus on transparency and community engagement. Notably, the entire supply of COQ was allocated with an initial liquidity of 150 AVAX, and the contract has been fully renounced, meaning that the creators no longer have control over the token’s supply or distribution.

3. Is Coq Inu Coin a good investment?

The potential of Coq Inu as an investment depends on various factors, including market trends, community engagement, and overall sentiment in the cryptocurrency space. As a meme coin, it may experience high volatility and speculative trading. It is essential for investors to conduct thorough research and consider their risk tolerance before investing in Coq Inu or any other cryptocurrency.

4. What makes Coq Inu Coin different from Bitcoin?

Coq Inu Coin differs from Bitcoin in several key ways:

– Purpose: Bitcoin was designed as a decentralized digital currency and store of value, while Coq Inu is primarily a meme coin created for entertainment and community engagement.

– Technology: Bitcoin operates on its own blockchain, whereas Coq Inu is built on the Avalanche blockchain, which offers faster transaction speeds and lower fees.

– Supply: Bitcoin has a capped supply of 21 million coins, while Coq Inu has a total supply of 69.42 trillion coins, making it much more abundant.

5. What is the current price and market cap of Coq Inu Coin?

As of now, Coq Inu Coin has a price of approximately $0.00000044 USD and a market cap of around $30.57 million. The price can be highly volatile, so it’s advisable to check real-time data on cryptocurrency exchanges or financial news platforms for the latest updates.

6. How can I buy Coq Inu Coin?

You can purchase Coq Inu Coin on various cryptocurrency exchanges that support it, including decentralized exchanges (DEX) on the Avalanche network. To buy COQ, you typically need to create an account on an exchange, deposit funds (like AVAX or USDT), and then trade for Coq Inu Coin. Always ensure to use secure wallets for storing your cryptocurrencies.

7. What are the risks associated with investing in Coq Inu Coin?

Investing in Coq Inu Coin, like any other cryptocurrency, comes with inherent risks. These include:

– Market Volatility: Meme coins can be subject to rapid price fluctuations based on market sentiment and trends.

– Lack of Fundamental Value: As a meme coin, COQ may not have the same level of utility or adoption as more established cryptocurrencies.

– Regulatory Risks: The cryptocurrency market is still evolving, and regulatory changes can impact the value and trading of coins like Coq Inu.

8. How does the community influence Coq Inu Coin?

The community plays a crucial role in the success of Coq Inu Coin. Since it is a meme coin, community engagement and social media presence can significantly affect its popularity and market performance. Active participation in discussions, promotions, and events can enhance visibility and contribute to a more robust ecosystem around the coin.

Final Verdict on coq inu coin

Overview of Coq Inu Coin

Coq Inu Coin (COQ) is a meme cryptocurrency built on the Avalanche blockchain. Positioned as a playful and community-driven asset, it capitalizes on the popularity of meme coins, leveraging the vibrant culture around such tokens. With a total supply of 69.42 trillion coins and a market cap of approximately $30.57 million, Coq Inu aims to engage a wide audience by combining humor with crypto investments.

Technology and Ecosystem

The Coq Inu project benefits from the Avalanche ecosystem’s fast transaction speeds and low fees, making it an attractive option for users seeking efficient trading experiences. The coin has a fully renounced contract, meaning that the developers have relinquished control over the token’s supply, which can instill confidence in the community. This transparency is crucial for meme coins, where trust can significantly influence market dynamics.

Potential and Risks

As a meme coin, Coq Inu presents both opportunities and challenges. Its playful branding and community-focused approach may attract speculative investors looking for quick returns. However, like many cryptocurrencies in this category, COQ is subject to high volatility and can experience significant price fluctuations. While the coin has seen a remarkable return from its all-time low, it remains down substantially from its peak, highlighting the unpredictable nature of meme coins.

Conclusion

In summary, Coq Inu Coin represents a high-risk, high-reward investment opportunity within the cryptocurrency landscape. Its unique positioning as a meme coin on a robust blockchain offers potential for community engagement and speculative trading. However, the inherent volatility and risks associated with such assets cannot be overlooked.

As always, it is imperative for potential investors to conduct thorough research (DYOR) before committing any funds to Coq Inu or similar cryptocurrencies. Understanding the market dynamics, the project’s fundamentals, and your own risk tolerance will empower you to make informed investment decisions.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.