Should You Invest in compound coin? A Full Analysis (2025)

An Investor’s Introduction to compound coin

Compound coin, known by its ticker symbol COMP, is a prominent player in the decentralized finance (DeFi) landscape, recognized for its innovative approach to lending and borrowing within the blockchain ecosystem. Launched in 2018, Compound operates on the Ethereum blockchain and has gained significant traction among investors and users alike. The protocol enables individuals to lend their cryptocurrencies to others in exchange for interest, while also allowing borrowers to secure loans against their crypto holdings. With its unique model of incentivizing users through the issuance of cTokens and the governance token COMP, Compound has established itself as a cornerstone of the DeFi movement.

The significance of Compound in the crypto market lies not only in its functionality but also in its community-driven governance model. Holders of COMP tokens have the power to propose and vote on changes to the protocol, making it a truly decentralized platform. This governance aspect enhances user engagement and aligns the interests of the community with the platform’s development, fostering a sense of ownership among its participants. As one of the first protocols to successfully implement a decentralized lending model, Compound has set a precedent for other projects in the space, contributing to the overall growth and evolution of decentralized finance.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in Compound coin. It will cover various aspects of the asset, including:

Technology Overview

Understanding the underlying technology that powers Compound, including its smart contracts and how it facilitates lending and borrowing.

Tokenomics

An in-depth look at the supply and distribution of COMP tokens, as well as the economic incentives that drive user participation in the protocol.

Investment Potential

An analysis of the historical price trends, current market position, and potential future growth of Compound coin, helping investors make informed decisions.

Risks

A candid discussion of the risks associated with investing in Compound, including market volatility, smart contract vulnerabilities, and regulatory concerns.

How to Buy

A step-by-step guide on purchasing COMP tokens, including an overview of the exchanges where it is available and the different trading pairs offered.

By exploring these facets, this guide aims to equip readers with the knowledge necessary to navigate the Compound ecosystem effectively and to understand its potential as an investment opportunity in the rapidly evolving world of cryptocurrency.

What is compound coin? A Deep Dive into its Purpose

Overview of Compound Coin

Compound Coin, represented by the token COMP, is a pivotal player in the decentralized finance (DeFi) ecosystem. It is an Ethereum-based token that underpins the Compound protocol, which allows users to lend and borrow cryptocurrencies in a decentralized manner. This protocol aims to create a more efficient and user-friendly financial ecosystem by enabling users to earn interest on their crypto holdings while also facilitating loans for those in need of liquidity.

The Core Problem It Solves

In traditional finance, individuals often find themselves with idle assets that yield little to no returns. This scenario is prevalent in the cryptocurrency space as well, where many users hold digital assets without leveraging their potential. The Compound protocol addresses this inefficiency by allowing users to earn interest on their idle cryptocurrencies.

By depositing their assets into Compound’s liquidity pools, users receive cTokens in return, which represent their stake in the pool. The beauty of this system is that as interest accumulates, the value of these cTokens increases, enabling users to redeem them for more of the underlying asset than they initially deposited. This mechanism not only provides a way for holders to earn passive income but also enhances the overall liquidity in the crypto market.

Moreover, the Compound protocol allows users to borrow against their crypto assets. Borrowers can take out loans by providing collateral, typically in the form of cryptocurrencies, which are overcollateralized to mitigate risks. This system ensures that lenders are protected, as the protocol enforces strict collateralization ratios. If a borrower’s collateral falls below a certain threshold, it can be liquidated to repay the loan. Thus, Compound addresses both the need for earning interest on idle assets and the demand for liquidity through borrowing.

Its Unique Selling Proposition

Compound’s unique selling proposition lies in its decentralized governance model and user-centric approach. Unlike traditional financial institutions that operate with centralized control, Compound allows token holders to participate in the governance of the protocol. This is facilitated through the COMP token, which enables users to propose changes, vote on protocol updates, and influence decisions about the future of the platform. This governance model fosters a sense of community ownership and ensures that the protocol evolves according to the users’ needs.

Additionally, Compound offers a transparent and automated system governed by smart contracts. These smart contracts handle all transactions, ensuring that the process is trustless and secure. Users can deposit and withdraw their assets at any time, and the entire process is designed to minimize counterparty risk.

The ability to earn interest on multiple cryptocurrencies is another significant advantage of Compound. Users can deposit a variety of Ethereum-based tokens and earn interest simultaneously, diversifying their earning potential without needing to manage multiple platforms. This flexibility attracts a broad user base, from individual investors to institutional participants.

The Team and Backers

Compound was founded in 2017 by Robert Leshner and Geoffrey Hayes, who both previously held significant roles at Postmates. Leshner currently serves as the CEO, while Hayes is the CTO of Compound Labs, Inc., the organization behind the protocol. Both founders have extensive experience in technology and finance, making them well-suited to navigate the complexities of the blockchain space.

The Compound team has grown to include a diverse group of engineers and professionals dedicated to enhancing the protocol. Their combined expertise has been pivotal in developing a robust and scalable platform that can handle the increasing demand for DeFi services.

The project has garnered significant backing from various venture capital firms and investors. Notably, Compound has attracted investments from prominent names in the crypto space, including Andreessen Horowitz and Paradigm. These partnerships not only provide financial support but also lend credibility to the project, further solidifying its position within the DeFi landscape.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Compound Coin and the Compound protocol extends beyond mere financial transactions. It represents a shift towards a more inclusive and efficient financial system, where users have control over their assets and can participate in a decentralized economy. By enabling users to earn interest on their digital assets and providing access to loans without the need for intermediaries, Compound democratizes finance.

In the broader context of the cryptocurrency ecosystem, Compound plays a crucial role in enhancing liquidity and capital efficiency. It encourages users to actively engage with their crypto holdings, fostering a culture of participation rather than passive investment. This active engagement is vital for the growth of the DeFi space, as it drives innovation and attracts new users.

Furthermore, the governance model of Compound sets a precedent for other DeFi projects. By allowing users to influence the protocol’s future, Compound showcases the potential for decentralized governance in shaping the evolution of financial systems. This model can inspire other projects to adopt similar approaches, promoting a more community-driven ecosystem.

Conclusion

In summary, Compound Coin (COMP) is a significant player in the DeFi ecosystem, addressing the challenges of idle assets and liquidity through its innovative lending and borrowing protocol. With a strong focus on user governance, transparency, and security, Compound not only empowers individuals to earn interest on their cryptocurrencies but also fosters a community-driven financial landscape. As the DeFi space continues to evolve, Compound’s foundational role in enhancing capital efficiency and promoting decentralized governance will likely influence the future of finance.

The Technology Behind the Coin: How It Works

Introduction to Compound and Its Technology

Compound (COMP) is a decentralized finance (DeFi) protocol built on the Ethereum blockchain that allows users to lend and borrow cryptocurrencies in a trustless manner. The technology behind Compound not only facilitates lending and borrowing but also empowers users through community governance. In this guide, we will explore the foundational technology of Compound, including its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

Compound operates on the Ethereum blockchain, which is known for its robust smart contract capabilities. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This allows for automated and trustless transactions without the need for intermediaries. Here’s how Compound’s architecture is structured:

-

Smart Contracts: The core of the Compound protocol is a set of smart contracts that manage the lending and borrowing processes. When users deposit assets into Compound, they interact with these smart contracts, which handle the issuance of cTokens and the calculation of interest.

-

cTokens: When users deposit cryptocurrencies (like ETH or USDC) into Compound, they receive cTokens in return. For example, depositing ETH will yield cETH. These cTokens represent the user’s stake in the liquidity pool and can be redeemed for the underlying asset at any time. The value of cTokens increases over time as interest accrues, allowing users to earn passive income on their deposits.

-

Liquidity Pools: Compound consists of multiple liquidity pools where users can deposit their assets. Each pool is associated with a specific cryptocurrency, and the smart contracts ensure that these pools are over-collateralized to mitigate risks associated with lending.

-

User Interface: Compound also features a user-friendly interface that interacts with the underlying smart contracts. Users can easily deposit, withdraw, and manage their assets through the Compound web application.

Consensus Mechanism

Compound utilizes the Ethereum blockchain, which employs a Proof-of-Stake (PoS) consensus mechanism as of its transition to Ethereum 2.0. Here’s a breakdown of how this consensus mechanism works:

-

Proof of Stake Basics: In a PoS system, validators are chosen to create new blocks and confirm transactions based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This contrasts with Proof of Work (PoW), where miners compete to solve complex mathematical problems.

-

Security and Efficiency: PoS is generally considered more energy-efficient than PoW because it eliminates the need for resource-intensive mining. Validators are incentivized to act honestly because they risk losing their staked assets if they attempt to cheat the system.

-

Scalability: The transition to PoS aims to improve Ethereum’s scalability, enabling it to process more transactions per second. This is crucial for DeFi protocols like Compound, which rely on the underlying blockchain to manage numerous transactions in real-time.

Key Technological Innovations

Compound has introduced several technological innovations that set it apart from traditional lending platforms and other DeFi protocols:

-

Algorithmic Interest Rates: One of the unique features of Compound is its algorithmic interest rate model. Interest rates for both lenders and borrowers are dynamically adjusted based on supply and demand. When the demand for borrowing increases, interest rates rise, incentivizing more lenders to provide liquidity. Conversely, when borrowing demand decreases, interest rates fall.

-

Community Governance: The governance of the Compound protocol is decentralized and governed by COMP token holders. Users can propose changes to the protocol, vote on proposals, and influence decisions regarding the protocol’s future. This governance structure empowers the community and ensures that the protocol evolves according to the needs of its users.

-

Collateralization Mechanism: Compound requires borrowers to provide collateral that exceeds the value of the loan they wish to take. This over-collateralization protects lenders by ensuring that the protocol remains solvent. If the value of the collateral falls below a certain threshold, the collateral is liquidated to cover the loan, ensuring that lenders are repaid.

-

Liquidation Mechanism: The liquidation process is automated and occurs if a borrower’s collateral falls below the maintenance threshold. Liquidators can purchase this collateral at a discount, providing a financial incentive for them to act quickly. This mechanism helps maintain the overall health of the lending pools and protects the interests of lenders.

-

Integration with Other DeFi Protocols: Compound is designed to be composable, meaning it can integrate seamlessly with other DeFi protocols and services. For example, users can leverage their cTokens in other applications, such as yield farming or trading, further enhancing the utility of their assets.

Security Measures

Security is paramount in the DeFi space, and Compound employs various measures to protect its users:

-

Audits: Compound’s smart contracts undergo regular audits by third-party firms to identify and rectify vulnerabilities. These audits help ensure that the protocol operates as intended and safeguards users’ funds.

-

Transparency: All transactions on Compound are recorded on the Ethereum blockchain, providing transparency and verifiability. Users can track their transactions and the state of the protocol at any time.

-

Over-Collateralization: As mentioned earlier, the requirement for borrowers to over-collateralize their loans serves as a safety net for lenders, reducing the risk of default.

User Experience and Accessibility

Compound aims to provide a seamless user experience, making it accessible to both novice and experienced users. Here are some features that enhance user experience:

-

Simple Interface: The Compound app is designed to be intuitive, allowing users to easily navigate through deposit and borrowing options. Users can quickly see their balances, interest rates, and available liquidity.

-

Educational Resources: Compound offers a range of educational materials to help users understand how the protocol works and how to maximize their earnings. This is particularly beneficial for newcomers to the DeFi space.

-

Cross-Platform Availability: Users can access Compound through various wallets and platforms that support Ethereum-based assets, further enhancing accessibility.

Conclusion

The technology behind Compound is a blend of advanced blockchain architecture, innovative economic models, and community governance. By leveraging smart contracts on the Ethereum blockchain, Compound provides a decentralized platform for lending and borrowing that empowers users to earn interest on their digital assets. With its algorithmic interest rates, over-collateralization mechanisms, and commitment to security, Compound represents a significant advancement in the DeFi landscape. As the DeFi ecosystem continues to evolve, Compound’s technology will likely play a pivotal role in shaping the future of finance.

Understanding compound coin Tokenomics

Overview of Compound Coin Tokenomics

Compound (COMP) is a decentralized finance (DeFi) protocol that allows users to lend and borrow cryptocurrencies in a trustless manner. The tokenomics of Compound is essential to understand how the COMP token functions within this ecosystem, influencing governance, incentives, and user engagement. Below is a detailed breakdown of key metrics and concepts related to COMP’s tokenomics.

| Metric | Value |

|---|---|

| Total Supply | 10,000,000 COMP |

| Max Supply | 10,000,000 COMP |

| Circulating Supply | 9,457,168 COMP |

| Inflation/Deflation Model | Deflationary (fixed supply) |

Token Utility (What is the coin used for?)

The COMP token serves multiple purposes within the Compound ecosystem, primarily revolving around governance and incentivization:

-

Governance:

– COMP token holders can participate in the governance of the Compound protocol. They have the authority to propose changes, vote on proposals, and influence the future development of the platform. This decentralized governance model ensures that decisions reflect the interests of the community rather than a centralized authority. -

Incentives for Participation:

– Users can earn COMP tokens by interacting with the Compound protocol. This includes lending assets to the platform or borrowing against collateral. By incentivizing users to engage with the protocol, Compound promotes liquidity and active participation in its ecosystem. -

cTokens:

– When users deposit cryptocurrencies into Compound, they receive cTokens (such as cETH or cDAI) in return. These cTokens represent a user’s stake in the lending pool and accrue interest over time. Although cTokens are distinct from COMP tokens, the ability to earn COMP through participation encourages users to deposit their assets into the platform. -

Earning Yield:

– The COMP token can also be used to earn yield. As users deposit their cryptocurrencies, the interest generated from borrowers is shared among depositors. The accrued cTokens can be redeemed for the underlying assets, which have appreciated in value due to the interest earned, incentivizing long-term holding and participation.

Token Distribution

The distribution of COMP tokens is designed to ensure a balanced allocation among various stakeholders, which fosters community engagement and supports the protocol’s growth. Here’s how the COMP tokens are distributed:

-

User Incentives:

– Approximately 4.2 million COMP tokens are earmarked for distribution to users over a four-year period. This allocation is intended to reward active participants who lend or borrow assets on the platform. The specific amount distributed daily is subject to change based on governance decisions. -

Founders and Team:

– The Compound team and its founders are allocated about 2.2 million tokens, which are subject to a four-year vesting schedule. This vesting period aligns the interests of the team with the long-term success of the protocol. -

Shareholders:

– Around 2.4 million COMP tokens are designated for shareholders of Compound Labs, Inc. This allocation aims to reward early investors and contributors who have supported the development of the platform. -

Community Governance Incentives:

– To further encourage community involvement, 775,000 COMP tokens are reserved for governance incentives. This allocation is aimed at stimulating active participation in the governance process, such as voting on proposals and participating in discussions. -

Future Team Members:

– An additional 332,000 COMP tokens are allocated for future team members, ensuring that new hires are incentivized to contribute to the growth and stability of the protocol.

Conclusion

The tokenomics of Compound (COMP) is a crucial component of its decentralized finance ecosystem. By providing a fixed supply of 10 million tokens and structuring their distribution to promote governance and user engagement, Compound aims to foster a robust community. The utility of COMP tokens in governance and incentives helps create a self-sustaining ecosystem that encourages users to lend, borrow, and actively participate in the protocol’s development.

Understanding these elements is vital for both new and experienced investors looking to navigate the Compound platform and leverage its features effectively. As the DeFi landscape continues to evolve, the role of COMP within the Compound protocol will likely adapt, reflecting the dynamic nature of decentralized finance.

Price History and Market Performance

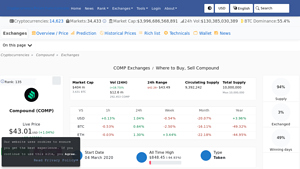

Key Historical Price Milestones

Compound (COMP) has experienced a rollercoaster of price movements since its inception. The token was launched in September 2018, and its initial trading price was relatively modest. Over the years, it has seen significant highs and lows, reflecting the volatile nature of the cryptocurrency market.

One of the most notable milestones in the price history of Compound occurred on May 12, 2021, when the token reached its all-time high of approximately $911.20. This peak coincided with a broader market rally, driven by increased interest in decentralized finance (DeFi) platforms and significant inflows of capital into the crypto space. During this period, Compound was one of the leading DeFi protocols, facilitating substantial lending and borrowing activities, which contributed to the heightened demand for its native token.

Following this peak, COMP experienced a sharp decline, typical of the volatility seen in the cryptocurrency market. By June 10, 2023, the price had plummeted to an all-time low of about $25.55, representing a staggering decrease of over 95% from its peak. This decline was influenced by a combination of factors, including regulatory concerns surrounding DeFi projects, overall bearish market sentiment, and increased competition from other lending protocols.

As of October 2023, the price of Compound stands at approximately $42.93, showcasing a recovery of about 68.07% from its all-time low. This recovery reflects a renewed interest in DeFi, driven by market stabilization and the introduction of innovative features by the Compound protocol to enhance user engagement and liquidity.

Factors Influencing the Price

Historically, the price of Compound has been influenced by a multitude of factors, which can be broadly categorized into market trends, regulatory developments, and technological advancements.

Market Trends

The price of COMP has been closely tied to the overall sentiment in the cryptocurrency market. Bull markets tend to drive up the prices of most cryptocurrencies, including COMP, as investors seek to capitalize on rising asset values. Conversely, bear markets often result in significant sell-offs, leading to price declines. For instance, the dramatic rise in COMP’s price in 2021 can be attributed to the bullish market conditions prevalent at that time, where many DeFi projects gained traction and saw substantial investment.

Additionally, trends in the broader financial markets also impact COMP’s price. For example, during periods of economic uncertainty or inflationary pressures, investors may flock to cryptocurrencies as alternative assets, influencing demand and price positively. Similarly, macroeconomic factors, such as interest rates and monetary policy, can affect investor sentiment towards crypto assets.

Regulatory Developments

Regulatory scrutiny has played a pivotal role in shaping the price trajectory of Compound. As governments around the world continue to grapple with how to regulate the rapidly evolving DeFi space, news regarding potential regulations can lead to swift price fluctuations. For instance, announcements of proposed regulations or enforcement actions against DeFi protocols can instill fear and uncertainty in the market, resulting in price declines.

Conversely, positive regulatory developments, such as the establishment of clearer guidelines for DeFi projects, can bolster investor confidence and lead to price appreciation. The price drop in mid-2023, when COMP reached its all-time low, coincided with heightened regulatory concerns in the DeFi sector, further illustrating the impact of regulatory factors on COMP’s price.

Technological Advancements

Technological developments within the Compound protocol itself have also influenced its price. Innovations that improve the user experience, increase the efficiency of the lending and borrowing processes, or expand the range of supported assets can enhance user engagement and drive demand for COMP tokens. For example, the introduction of new features or partnerships with other platforms can attract more users to the Compound ecosystem, potentially leading to increased trading volume and, subsequently, price appreciation.

Additionally, the governance model of Compound, where COMP token holders can propose and vote on changes to the protocol, fosters a sense of community and involvement among users. This decentralized governance model can enhance the overall value proposition of the token and influence its market performance.

Competition

The DeFi space is highly competitive, with numerous protocols vying for market share. The emergence of new lending platforms or enhancements to existing competitors can impact the price of COMP. For instance, if a competing protocol offers more attractive interest rates or innovative features, it may draw users away from Compound, negatively affecting its trading volume and price.

In summary, the price history of Compound is a reflection of the dynamic nature of the cryptocurrency market, influenced by a variety of factors including market trends, regulatory developments, technological advancements, and competitive pressures. Understanding these historical price movements and their underlying causes can provide valuable insights for both new and experienced investors looking to navigate the evolving landscape of digital assets.

Where to Buy compound coin: Top Exchanges Reviewed

5. Uniswap – Top Choice for DeFi Trading!

In the review of ‘Compound (COMP) Exchanges’ on CoinLore, the focus is on the extensive availability of platforms for trading COMP, with over 57 exchanges listed. Notably, Binance, Gate, and HTX emerge as the top choices, offering robust liquidity and user-friendly interfaces. These exchanges stand out for their security features, trading volume, and comprehensive support for various trading pairs, making them ideal for both novice and experienced investors looking to engage with Compound.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. Easy Steps to Buy Compound (COMP) Like a Pro!

This guide on buying Compound (COMP) highlights the seamless and efficient process offered by exchanges like Coinbase and Coinmama, which facilitate quick transactions for users. Notably, the requirement for a dedicated Compound wallet emphasizes security and ownership of assets, setting these platforms apart by prioritizing user safety while simplifying the purchasing experience. This combination of convenience and security makes them standout options for acquiring COMP.

- Website: ledger.com

- Platform Age: Approx. 31 years (domain registered in 1994)

3. ChangeNOW – Effortless Compound (COMP) Swaps!

ChangeNOW stands out as a premier platform for exchanging Compound (COMP) due to its user-friendly interface and competitive rates, boasting an impressive rating of 4.8 from over 2,100 users. The exchange offers instant transactions without hidden fees, making it accessible for both beginners and seasoned investors. Additionally, ChangeNOW provides comprehensive resources, including real-time price charts and guides, to facilitate seamless buying and selling of COMP and other cryptocurrencies.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy compound coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying Compound (COMP) is selecting a reputable cryptocurrency exchange. Some popular options include:

- Coinbase: User-friendly interface, ideal for beginners.

- Binance: Offers a wide range of cryptocurrencies and trading pairs.

- Huobi Global: Known for its extensive trading options and security features.

- Kraken: Offers both crypto-to-crypto and fiat-to-crypto trading.

Before making your decision, consider factors such as:

- Fees: Look for exchanges with competitive trading fees.

- Supported Payment Methods: Ensure the exchange supports your preferred payment method (e.g., bank transfer, credit card).

- Security Features: Choose exchanges with robust security measures, including two-factor authentication (2FA) and cold storage options.

2. Create and Verify Your Account

Once you’ve chosen an exchange, the next step is to create an account:

-

Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. Provide the required information, such as your email address and a secure password.

-

Email Verification: Check your email for a verification link from the exchange. Click the link to verify your email address.

-

Complete KYC: Most exchanges require you to complete a Know Your Customer (KYC) process to comply with regulations. This typically involves uploading identification documents (e.g., a passport or driver’s license) and possibly a proof of address (e.g., a utility bill).

-

Set Up Security Features: Enable two-factor authentication (2FA) to enhance the security of your account. This will require you to enter a code sent to your mobile device whenever you log in or make transactions.

3. Deposit Funds

After your account is verified, you need to deposit funds to purchase Compound:

-

Choose Your Deposit Method: Go to the “Deposit” or “Funds” section of the exchange. Select your preferred deposit method (bank transfer, credit card, etc.).

-

Enter Deposit Amount: Specify how much you want to deposit. Make sure to check any minimum deposit requirements.

-

Complete the Deposit: Follow the instructions provided by the exchange to complete your deposit. Note that bank transfers may take a few days, while credit card transactions are usually instant.

-

Check Your Balance: Once the funds are deposited, verify that your account balance reflects the new funds.

4. Place an Order to Buy Compound Coin

With funds in your account, you can now buy Compound:

-

Navigate to the Trading Section: Go to the “Markets” or “Trade” section of the exchange. Look for the trading pair that includes COMP, such as COMP/USD or COMP/BTC.

-

Choose Your Order Type: There are typically two main types of orders:

– Market Order: Buys COMP at the current market price. This is the simplest option for beginners.

– Limit Order: Sets a specific price at which you want to buy COMP. The order will only execute if the market reaches that price. -

Enter the Amount: Specify how much COMP you want to purchase. If using a market order, the exchange will automatically calculate the total cost based on the current price.

-

Review and Confirm Your Order: Double-check all details, including the amount and total cost. Once confirmed, submit your order.

-

Monitor Your Order: If you placed a limit order, you may need to wait for it to be filled. You can check the status in the “Open Orders” section of your account.

5. Secure Your Coins in a Wallet

After purchasing Compound, it’s essential to secure your coins:

-

Choose a Wallet: While you can store your COMP on the exchange, it’s safer to transfer it to a personal wallet. Options include:

– Software Wallets: Easy to use (e.g., MetaMask, Exodus).

– Hardware Wallets: More secure, ideal for long-term storage (e.g., Ledger, Trezor). -

Create Your Wallet: If you choose a software wallet, download the application or create an account on the wallet’s website. Follow the instructions to set up your wallet.

-

Transfer Your COMP: Go to your exchange account, find the option to withdraw funds, and enter your wallet address. Specify how much COMP you want to transfer and confirm the transaction.

-

Verify the Transfer: After a short period, check your wallet to ensure the COMP has arrived. Always double-check the wallet address before sending to avoid losing your funds.

By following these steps, you can successfully purchase and secure Compound (COMP), allowing you to participate in the DeFi ecosystem and potentially earn interest on your investment.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Strong DeFi Use Case

Compound (COMP) operates as a decentralized finance (DeFi) lending protocol, allowing users to earn interest on their cryptocurrencies by depositing them into liquidity pools. This model addresses a fundamental need in the crypto ecosystem: generating yield from otherwise idle digital assets. By facilitating lending and borrowing in a trustless manner, Compound enhances liquidity and promotes efficient capital allocation.

2. Community Governance

One of the unique aspects of Compound is its community governance model. COMP token holders can propose and vote on protocol changes, allowing for a democratic approach to decision-making. This decentralization fosters community engagement and can lead to more innovative and responsive development, as it allows users to influence the protocol’s direction based on their needs and preferences.

3. Proven Track Record

Since its launch in September 2018, Compound has gained significant traction, with total locked value (TVL) surpassing $800 million. Its established presence in the DeFi sector enhances its credibility and signals a level of trust among users and investors. The protocol has consistently evolved, introducing new features and supporting a variety of Ethereum-based tokens, which further diversifies its offerings.

4. Market Position and Recognition

As a leading DeFi protocol, Compound is recognized among the top projects within the cryptocurrency space. Its brand recognition can attract new users and investors, potentially driving demand for COMP tokens. Furthermore, the protocol’s integration with various wallets and exchanges increases its accessibility, further solidifying its market position.

5. Potential for Yield Generation

The mechanism through which Compound allows users to earn interest—via cTokens—enables users to benefit from variable interest rates based on supply and demand dynamics. As DeFi continues to grow, the demand for yield-generating platforms is likely to increase, which could enhance Compound’s user base and, by extension, the value of COMP tokens.

6. Limited Supply of COMP Tokens

Compound has a capped supply of 10 million COMP tokens, with approximately 9.45 million currently in circulation. This scarcity may positively impact the token’s value over time, especially if demand increases as the DeFi market expands. The fixed supply also creates a potential incentive for holders to retain their tokens, anticipating future value appreciation.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrency markets are notoriously volatile, with prices often experiencing significant fluctuations within short periods. For Compound, the price of COMP tokens can be influenced by broader market trends, speculation, and investor sentiment. This volatility poses risks for investors, as sudden price drops can lead to substantial losses. Additionally, the overall market environment for cryptocurrencies can impact the adoption and use of DeFi protocols like Compound.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies and DeFi is still evolving. Governments and regulatory bodies around the world are increasingly scrutinizing the crypto space, which may lead to new regulations affecting how platforms like Compound operate. Potential regulations could include restrictions on lending practices, compliance requirements, or even outright bans in certain jurisdictions. Such changes could limit Compound’s functionality, deter users, and negatively impact the value of COMP tokens.

3. Competition

The DeFi space is highly competitive, with numerous protocols offering similar services. Competitors such as Aave, MakerDAO, and others are continually innovating and attracting users. If Compound fails to differentiate itself or keep pace with advancements made by competitors, it could lose market share and relevance. The introduction of new features or more attractive yield rates by competitors could further challenge Compound’s position in the market.

4. Technological Risks

As a blockchain-based protocol, Compound is reliant on smart contracts and the underlying technology of the Ethereum network. While the protocol has undergone audits, the risk of bugs or vulnerabilities in the code remains a concern. Exploits could lead to the loss of user funds or a breach of trust in the platform. Additionally, if the Ethereum network faces congestion or high transaction fees, it may hinder user experience and deter participation in Compound’s lending and borrowing activities.

5. User Adoption and Engagement

The success of Compound largely depends on user adoption and ongoing engagement. If interest in DeFi wanes or if users find the platform too complex to navigate, it could lead to decreased usage. Furthermore, if the user experience does not improve or if the protocol fails to attract new users, the long-term sustainability of Compound could be jeopardized.

6. Economic and Market Conditions

External economic factors, such as inflation, interest rates, and macroeconomic trends, can affect investor behavior in the cryptocurrency space. A downturn in traditional financial markets or an economic recession could lead to reduced interest in speculative assets like cryptocurrencies, impacting the overall demand for DeFi services. Additionally, if traditional financial institutions begin offering competitive yield-generating products, this could divert potential users away from DeFi protocols like Compound.

Conclusion

In summary, investing in Compound (COMP) presents both potential opportunities and risks. Its robust DeFi model, community governance, and established market presence provide a solid foundation for growth. However, investors must also consider the inherent market volatility, regulatory uncertainties, competition, technological risks, user adoption, and external economic factors. As with any investment, conducting thorough research and understanding the dynamics at play is crucial before making decisions regarding Compound or any other cryptocurrency.

Frequently Asked Questions (FAQs)

1. What is Compound Coin (COMP)?

Compound Coin, or COMP, is the native governance token of the Compound protocol, a decentralized finance (DeFi) platform built on the Ethereum blockchain. Compound allows users to lend and borrow cryptocurrencies through a system of smart contracts. By depositing assets into the platform, users can earn interest on their holdings, while borrowers can secure loans by providing collateral. COMP token holders have the ability to propose and vote on changes to the protocol, making it a community-driven platform.

2. Who created Compound Coin?

Compound was founded in 2017 by Robert Leshner and Geoffrey Hayes, both of whom have backgrounds in technology and entrepreneurship. They previously worked at Postmates, an online food delivery service. Leshner currently serves as the CEO, while Hayes is the CTO of Compound Labs, Inc., the company behind the Compound protocol.

3. How does Compound Coin work?

Compound operates as a lending and borrowing platform where users can deposit cryptocurrencies into liquidity pools. In exchange, they receive cTokens, which represent their stake in the pool. The value of cTokens increases over time, allowing users to redeem them for more of the underlying asset than they initially deposited. Borrowers can take loans by providing collateral, with the interest rates dynamically adjusted based on supply and demand within the platform.

4. Is Compound Coin a good investment?

As with any investment, whether Compound Coin is a good investment depends on various factors, including market conditions, individual financial goals, and risk tolerance. COMP has experienced significant price fluctuations, including an all-time high of $915.60 in May 2021. Potential investors should conduct thorough research, consider the fundamentals of the Compound protocol, and stay updated on market trends before making any investment decisions.

5. What makes Compound Coin different from Bitcoin?

While both Compound and Bitcoin are built on blockchain technology, they serve different purposes. Bitcoin is primarily a digital currency designed for peer-to-peer transactions and as a store of value. In contrast, Compound is a DeFi platform that enables users to lend and borrow cryptocurrencies, earning interest on their deposits. Additionally, Compound has a governance model that allows COMP token holders to influence protocol changes, whereas Bitcoin operates on a more decentralized basis without a centralized governance structure.

6. How can I buy Compound Coin (COMP)?

Compound Coin (COMP) can be purchased on various cryptocurrency exchanges, including Coinbase, Binance, and Huobi Global. Users can trade COMP against other cryptocurrencies or fiat currencies such as the US Dollar (USD). Before buying, ensure that you have a cryptocurrency wallet to securely store your COMP tokens.

7. What are the risks associated with using Compound?

While Compound offers opportunities for earning interest and borrowing, it also comes with risks. The primary risks include smart contract vulnerabilities, market volatility, and liquidation risks for borrowers. If the value of a borrower’s collateral drops below a certain threshold, it may be liquidated to cover the loan. Users should carefully assess their risk tolerance and consider using additional security measures, such as diversifying their investments.

8. How is the Compound network secured?

The Compound protocol is secured through smart contracts on the Ethereum blockchain. These contracts automatically handle deposits, withdrawals, and interest calculations. Additionally, the protocol enforces a collateralization requirement for loans to ensure that each pool is overcollateralized. If a borrower’s collateral value falls below the required maintenance level, it is sold to liquidators at a discount, helping to protect lenders and maintain the integrity of the platform.

Final Verdict on compound coin

Overview of Compound Coin

Compound (COMP) is a decentralized finance (DeFi) protocol built on the Ethereum blockchain that allows users to lend and borrow cryptocurrencies. By depositing assets into Compound’s liquidity pools, users earn interest in the form of cTokens, which represent their stake in the pool. The protocol operates through smart contracts, ensuring trustless transactions and automatic management of funds. Users can also take out secured loans by providing collateral, with varying loan-to-value ratios depending on the asset used as collateral.

Key Features and Technology

One of the standout features of Compound is its community governance model. COMP token holders can propose and vote on changes to the protocol, ensuring that the platform evolves according to the needs of its users. This decentralized governance structure enhances user engagement and aligns the interests of the community with the long-term success of the protocol. With a total supply capped at 10 million COMP tokens, the asset has a scarcity that can potentially drive value as demand increases.

Investment Considerations

However, investing in Compound coin comes with inherent risks. The cryptocurrency market is known for its volatility, and while COMP has seen significant growth, it also faced a drastic decline from its all-time high of over $900 in May 2021 to current levels around $42.94. This fluctuation underscores the high-risk, high-reward nature of digital assets. Investors should be aware of market trends, the competitive landscape, and regulatory developments that could impact the DeFi sector.

Final Thoughts

Before making any investment in Compound or any cryptocurrency, it is crucial to conduct thorough research. Understanding the underlying technology, market dynamics, and your risk tolerance will equip you to make informed decisions. Always remember the adage: Do Your Own Research (DYOR). The world of digital assets is exciting but requires careful navigation to maximize potential gains while minimizing risks.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.