Should You Invest in clearpool crypto? A Full Analysis (2025)

An Investor’s Introduction to clearpool crypto

Introduction to Clearpool Crypto

Clearpool crypto, represented by the CPOOL token, is an innovative player in the decentralized finance (DeFi) space, focusing on creating a robust capital markets ecosystem. It distinguishes itself by allowing institutional borrowers to access unsecured loans directly from the DeFi ecosystem, bridging the gap between traditional finance and the burgeoning world of decentralized finance. This pioneering approach aims to address significant challenges faced by institutions, including limited access to financial services and inadequate risk management options.

The Clearpool protocol operates on both the Ethereum and Solana blockchains, utilizing smart contracts to facilitate transactions securely and transparently. Its dynamic interest model is driven by market supply and demand, allowing liquidity providers to earn attractive yields, while simultaneously offering borrowers a streamlined process for accessing capital. As institutions increasingly recognize the advantages of DeFi, Clearpool is positioned to play a crucial role in facilitating the flow of capital between the $120 trillion traditional financial markets and the decentralized landscape.

Purpose of This Guide

This guide aims to provide a comprehensive resource for both beginners and intermediate investors who are interested in Clearpool and its potential as a digital asset. It will delve into various aspects of the Clearpool ecosystem, including:

-

Technology: An overview of the underlying technology that powers Clearpool, focusing on its smart contracts and how they enhance security and efficiency in lending.

-

Tokenomics: A detailed analysis of the CPOOL token, including its supply, distribution, and the mechanics of staking and governance that empower holders to participate in the protocol’s decision-making processes.

-

Investment Potential: An assessment of Clearpool’s market position, historical performance, and potential for future growth, helping investors understand its value proposition in the competitive crypto landscape.

-

Risks: A candid discussion of the risks associated with investing in Clearpool, including market volatility, regulatory challenges, and technological risks inherent in DeFi platforms.

-

How to Buy: A step-by-step guide on how to acquire CPOOL tokens, including the platforms available for trading and best practices for securing your investment.

By the end of this guide, readers will have a well-rounded understanding of Clearpool crypto, enabling them to make informed decisions about their investments in this evolving digital asset space. Whether you are looking to diversify your portfolio or explore the DeFi sector, Clearpool offers a unique opportunity worth considering.

What is clearpool crypto? A Deep Dive into its Purpose

Overview of Clearpool Crypto

Clearpool is a decentralized capital markets ecosystem designed to bridge the gap between institutional borrowers and the decentralized finance (DeFi) space. It enables institutional players to access unsecured loans directly from the DeFi ecosystem, leveraging the advantages of blockchain technology. The protocol introduces a dynamic interest model that responds to market supply and demand, offering a more flexible and efficient way to manage capital flows.

The Core Problem It Solves

In the traditional financial system, institutional borrowers often face significant barriers when seeking unsecured loans. These barriers can include stringent requirements, high fees, and limited access to financial services. Clearpool addresses these challenges by creating a marketplace that allows borrowers to connect directly with liquidity providers (LPs) within the DeFi space.

The core problem Clearpool aims to solve is the inefficiency of capital allocation in traditional finance. By leveraging blockchain technology, Clearpool allows for the creation of liquidity pools that can be accessed by borrowers without the need for extensive credit checks or collateral. This not only simplifies the borrowing process but also enhances the overall efficiency of capital markets.

Moreover, Clearpool’s model addresses issues related to risk management and liquidity. Traditional finance often suffers from over-collateralization, where borrowers must lock up substantial assets to secure loans. Clearpool’s approach minimizes this requirement, allowing borrowers to access necessary funds more readily, thus promoting better capital utilization.

Its Unique Selling Proposition

Clearpool’s unique selling proposition lies in its combination of decentralized finance with institutional lending. The protocol introduces several innovative features that set it apart from traditional lending platforms:

-

Dynamic Interest Model: Clearpool employs a dynamic interest model that adjusts rates based on market conditions, providing more competitive and attractive yields for liquidity providers. This model contrasts with fixed interest rates commonly found in traditional finance.

-

Liquidity Provider Incentives: Liquidity providers earn attractive yields through Clearpool, with additional rewards paid in CPOOL, the protocol’s utility and governance token. This incentivizes more participants to provide liquidity, thus enhancing the overall liquidity of the platform.

-

Tokenized Credit System: Clearpool utilizes cpTokens, which are LP tokens representing a claim on the liquidity pool. This system allows LPs to manage their risk more effectively and hedge against potential losses, offering a sophisticated tool for financial management.

-

Governance and Community Involvement: CPOOL token holders participate in the governance of the protocol by voting on borrower whitelistings and other critical decisions. This decentralized governance model empowers the community and ensures that the platform evolves in a way that aligns with user interests.

-

Buyback Program: Clearpool has a planned buyback program that utilizes a portion of protocol revenue to purchase CPOOL tokens from the market, which helps sustain reward pools and supports the token’s price stability.

The Team and Backers

Clearpool is spearheaded by a team of experienced professionals from both traditional finance and the blockchain space. The founders, Robert Alcorn and Alessio Quaglini, have extensive backgrounds in capital markets and fintech, having worked together at a bank before venturing into the crypto space.

-

Robert Alcorn (CEO): With over 20 years of business experience, Alcorn has a deep understanding of global financial markets, liquidity, and collateral management. His expertise positions him well to lead Clearpool in its mission to innovate decentralized lending.

-

Jakob Kronbichler (CCO): Kronbichler brings significant experience in launching and scaling startups, particularly in alternative lending. His background in business development and go-to-market strategy is crucial for Clearpool’s growth and market penetration.

-

Pavel Ivanov (CTO): A blockchain developer with over a decade of experience, Ivanov has a strong track record in leading technology teams and has participated in multiple hackathons. His technical expertise is essential for the ongoing development and security of the Clearpool platform.

The team’s diverse skill set and industry connections enhance Clearpool’s credibility and ability to navigate the complex landscape of decentralized finance. Additionally, they are committed to building partnerships that can further integrate Clearpool into the broader financial ecosystem.

Fundamental Purpose in the Crypto Ecosystem

Clearpool’s fundamental purpose in the crypto ecosystem is to democratize access to capital for institutional borrowers while providing liquidity providers with attractive returns. By creating a decentralized marketplace that connects these two groups, Clearpool enhances the efficiency of capital allocation and promotes the growth of the DeFi sector.

As more institutions recognize the potential of decentralized finance, Clearpool aims to facilitate the transition of traditional capital markets into the DeFi space. The protocol serves as an essential infrastructure that enables institutions to leverage the benefits of blockchain technology, such as transparency, efficiency, and reduced costs.

Moreover, Clearpool contributes to the ongoing evolution of the DeFi ecosystem by introducing innovative financial products and services that address the needs of institutional players. As the landscape continues to mature, Clearpool’s role in bridging the gap between traditional finance and DeFi will be critical in shaping the future of capital markets.

In summary, Clearpool is not just another cryptocurrency; it represents a significant advancement in how financial services can operate in a decentralized world. By addressing core challenges in the lending market and providing a platform for innovation, Clearpool positions itself as a key player in the evolving landscape of decentralized finance.

The Technology Behind the Coin: How It Works

Overview of Clearpool

Clearpool is a decentralized capital markets ecosystem designed specifically for institutional borrowers seeking unsecured loans directly from the decentralized finance (DeFi) landscape. This innovative protocol leverages blockchain technology to create a more accessible, efficient, and transparent lending environment. By connecting traditional finance with DeFi, Clearpool enables institutions to tap into a broader range of financial services while offering liquidity providers the opportunity to earn attractive yields.

Blockchain Architecture

Clearpool operates on multiple blockchain networks, primarily Ethereum and Solana. These platforms are chosen for their robust infrastructure, security features, and the ability to facilitate smart contracts, which are essential for executing transactions without the need for intermediaries.

Ethereum

Ethereum is a well-established blockchain known for its smart contract functionality. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This allows Clearpool to automate various processes, such as loan disbursement and repayment, ensuring transparency and reducing the risk of fraud.

Solana

Solana, on the other hand, is recognized for its high throughput and low transaction fees, making it an attractive option for DeFi applications that require fast and cost-effective transactions. Clearpool leverages Solana’s capabilities to enhance user experience and scalability, allowing a larger number of transactions to be processed simultaneously.

Consensus Mechanism

Clearpool employs a combination of consensus mechanisms from the underlying blockchains it utilizes, primarily Ethereum’s Proof-of-Stake (PoS) and Solana’s Proof-of-History (PoH).

Proof-of-Stake (PoS)

In the PoS consensus mechanism, validators are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral. This approach not only enhances security but also reduces energy consumption compared to traditional Proof-of-Work (PoW) systems.

For Clearpool, PoS means that participants who stake their CPOOL tokens can earn rewards while contributing to the network’s security and functionality. This incentivizes users to hold onto their tokens, creating a more stable ecosystem.

Proof-of-History (PoH)

Solana’s PoH adds a unique layer to its consensus, allowing for the chronological ordering of transactions. This means that every transaction is timestamped, creating a verifiable order of events. For Clearpool, this ensures that loan requests and repayments are processed in a secure and transparent manner, reducing the potential for double-spending or fraud.

Key Technological Innovations

Clearpool introduces several innovative features that differentiate it from traditional lending platforms and other DeFi solutions.

Dynamic Interest Model

One of the standout features of Clearpool is its dynamic interest model, which adjusts interest rates based on market supply and demand. This flexibility allows the protocol to offer competitive rates for borrowers while also maximizing returns for liquidity providers.

When demand for loans increases, interest rates can rise, incentivizing more liquidity providers to contribute to the pools, thus ensuring that borrowers have access to the funds they need. Conversely, when demand decreases, rates can fall, making loans more affordable for borrowers.

Liquidity Pools and cpTokens

Clearpool utilizes liquidity pools, which are collections of funds locked in smart contracts. These pools provide the necessary capital for borrowers seeking loans. When liquidity providers contribute to these pools, they receive cpTokens, which represent their share in the pool.

These cpTokens not only serve as proof of ownership but also allow liquidity providers to earn rewards in the form of CPOOL tokens. This system creates a symbiotic relationship where borrowers gain access to funds while liquidity providers earn passive income.

Governance and Voting Mechanism

CPOOL is the utility and governance token of the Clearpool protocol. Holders of CPOOL tokens have the power to vote on critical aspects of the platform, including the whitelisting of new borrowers. This decentralized governance model ensures that the community has a voice in the decision-making process, promoting transparency and trust.

To participate in governance, CPOOL holders must stake their tokens, which also helps secure the network. This dual function of staking—earning rewards while participating in governance—encourages users to actively engage with the platform.

Risk Management Features

Clearpool incorporates several risk management tools to protect both borrowers and liquidity providers. By utilizing cpTokens, liquidity providers can gain insights into the risk profile of different loans, allowing them to make informed decisions about where to allocate their funds.

Moreover, the protocol plans to introduce sophisticated analytics tools that will assess borrower creditworthiness based on various data points. This will enable more informed lending decisions and help mitigate the risks associated with unsecured loans.

Security Measures

Security is paramount in any DeFi application, and Clearpool employs several measures to safeguard user funds and data.

Smart Contract Audits

Clearpool’s smart contracts undergo rigorous audits by reputable third-party firms. These audits are essential to identify and rectify vulnerabilities before the protocol goes live. Regular audits help maintain the integrity of the platform and reassure users that their funds are secure.

Multi-Signature Wallets

To enhance security, Clearpool utilizes multi-signature wallets for managing funds. This means that multiple private keys are required to authorize transactions, reducing the risk of unauthorized access and fraud.

Conclusion

Clearpool represents a significant advancement in the integration of decentralized finance with traditional capital markets. By providing a platform that allows institutional borrowers to access unsecured loans while offering liquidity providers attractive yields, Clearpool is carving out a unique niche in the DeFi space. Its innovative use of blockchain technology, dynamic interest models, and robust governance structure positions it as a forward-thinking solution in the evolving landscape of digital finance. Whether you are a beginner or an experienced investor, understanding the technology behind Clearpool can help you make informed decisions about your involvement in this promising ecosystem.

Understanding clearpool crypto Tokenomics

Clearpool’s tokenomics is an essential aspect of understanding its utility and governance within the decentralized capital markets ecosystem. The CPOOL token serves multiple roles, including incentivizing liquidity provision, enabling governance, and facilitating borrowing within the Clearpool protocol.

Key Metrics

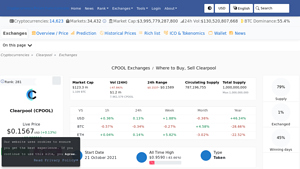

| Metric | Value |

|---|---|

| Total Supply | 1,000,000,000 CPOOL |

| Max Supply | 1,000,000,000 CPOOL |

| Circulating Supply | 808,946,755 CPOOL |

| Inflation/Deflation Model | Deflationary through buybacks and staking rewards |

Token Utility (What is the coin used for?)

The CPOOL token has several critical utilities within the Clearpool ecosystem:

-

Governance: CPOOL holders participate in the governance of the protocol. This includes voting on the whitelisting of new borrowers, which is essential for maintaining the quality and security of the lending process. By allowing the community to have a say, Clearpool decentralizes decision-making and aligns the interests of various stakeholders.

-

Staking: Borrowers are required to stake a certain amount of CPOOL to gain access to the borrowing feature of the protocol. This staking mechanism ensures that borrowers have a vested interest in maintaining the integrity of the platform, as they risk their staked tokens in the event of default.

-

Liquidity Provider Rewards: Liquidity providers earn rewards in CPOOL for supplying liquidity to the pools. This incentivization not only attracts capital into the ecosystem but also enhances the interest rates offered to borrowers, making Clearpool an attractive option for institutional lending.

-

Buyback Program: Clearpool has announced a buyback program wherein a portion of the protocol’s revenue will be used to buy CPOOL tokens from the market. This mechanism is designed to create a deflationary effect, potentially increasing the value of the token over time by reducing its circulating supply.

-

Earning Additional Rewards: CPOOL holders can earn additional CPOOL tokens through various incentive schemes, such as voting on proposals or participating in liquidity mining programs. This feature encourages active participation and helps to cultivate a vibrant community around the project.

Token Distribution

Understanding how CPOOL tokens are distributed is crucial for evaluating the long-term sustainability and potential appreciation of the asset. Here’s an overview of the distribution model:

-

Initial Distribution: When Clearpool launched, it created a total supply of 1 billion CPOOL tokens. At launch, only a small portion of these tokens was made available for circulation, with around 41.4 million CPOOL initially circulating.

-

Liquidity Providers: A significant portion of the tokens is allocated to liquidity providers. These tokens are distributed as rewards for providing liquidity to the pools, which is critical for the functioning of the Clearpool ecosystem. This allocation incentivizes users to contribute their assets and helps maintain liquidity in the market.

-

Team and Advisors: A portion of the total supply is allocated to the founding team and advisors. This allocation is typically locked for a predetermined period to ensure that the team remains committed to the project and its long-term success.

-

Community Incentives: A share of the tokens is reserved for community initiatives, including rewards for governance participation, staking rewards, and other incentive programs aimed at fostering community engagement.

-

Future Allocations: Clearpool may also reserve a percentage of tokens for future partnerships, ecosystem development, and strategic initiatives. This approach allows the protocol to remain flexible and adapt to changing market conditions.

Conclusion

The tokenomics of Clearpool (CPOOL) is designed to create a sustainable and engaging ecosystem for both borrowers and liquidity providers. By combining governance, staking, and liquidity incentives, Clearpool aligns the interests of all participants, promoting a robust decentralized capital market. As the protocol continues to evolve, the mechanisms in place for token utility and distribution will play a crucial role in its long-term success and adoption.

Investors and users should keep an eye on the development of these tokenomics features, as they could significantly influence the value and usability of CPOOL in the ever-changing landscape of decentralized finance (DeFi).

Price History and Market Performance

Overview of Clearpool’s Market Performance

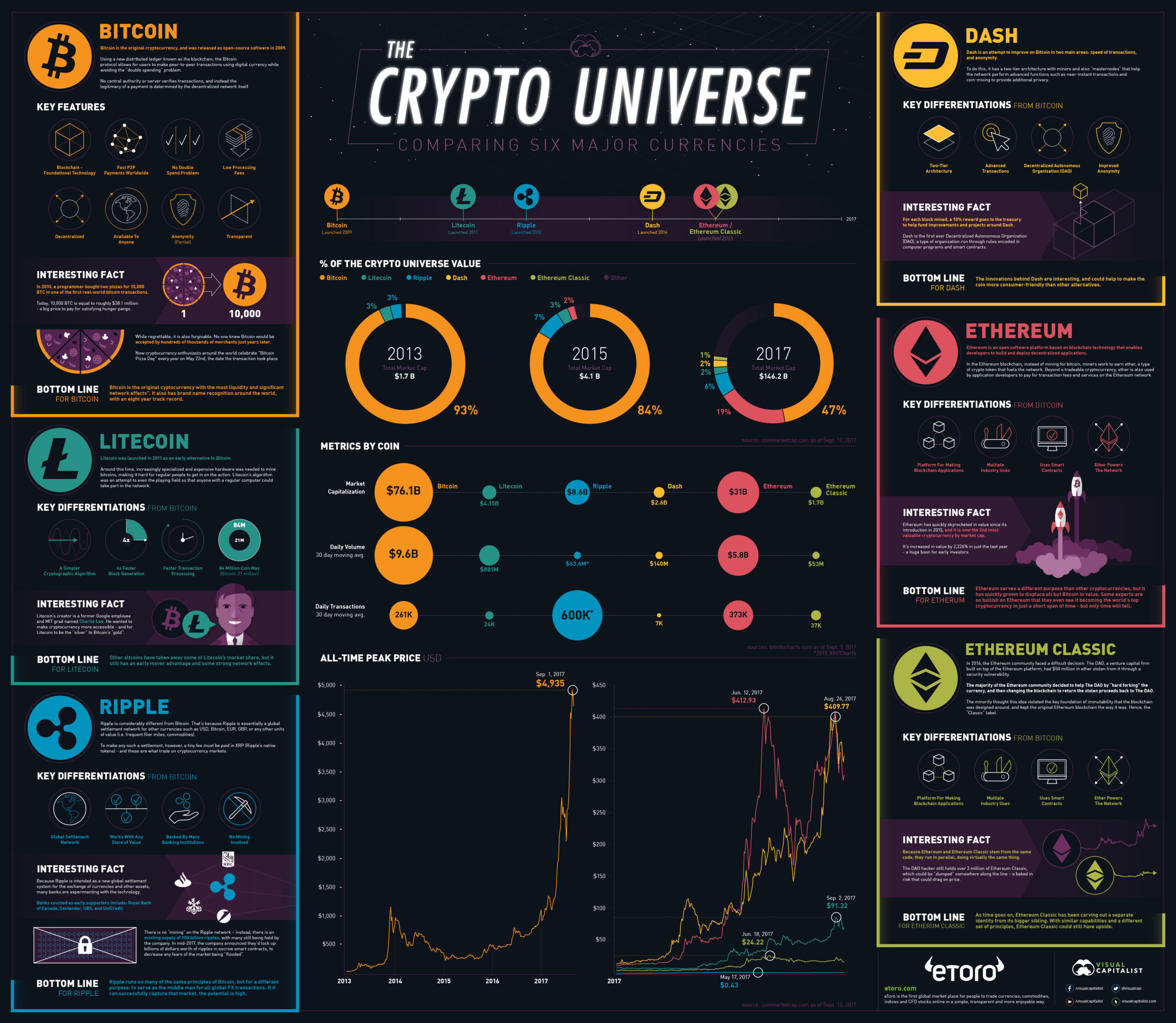

Clearpool (CPOOL) is a decentralized capital markets ecosystem designed to facilitate unsecured loans between institutional borrowers and the decentralized finance (DeFi) space. Since its inception, the price of CPOOL has experienced significant fluctuations, influenced by various market dynamics and broader economic factors. This section examines the key historical price milestones and the factors that have influenced the price of Clearpool.

Key Historical Price Milestones

Clearpool was launched on April 28, 2021, with an initial circulating supply of 41,375,000 CPOOL tokens. The token gained considerable attention shortly after its launch, reflecting the growing interest in DeFi protocols and their potential to disrupt traditional financial systems.

-

Initial Trading and Early Growth (2021):

– Following its launch, CPOOL’s price began to rise, reaching approximately $2.57 on November 16, 2021. This period marked an all-time high for the token, coinciding with a broader bullish trend across the cryptocurrency market as many DeFi projects gained traction. -

Market Correction and Decline (Late 2021 – 2022):

– Following its all-time high, Clearpool, like many cryptocurrencies, entered a phase of correction. By the end of 2021, CPOOL’s price began to decline, reflecting the overall bearish sentiment in the crypto market. Throughout 2022, the price fluctuated between $0.50 and $1.00, as the market grappled with regulatory concerns and macroeconomic factors. -

All-Time Low (October 2021):

– During this period, the price of CPOOL reached its all-time low, though specific data on the exact figure is not readily available. The lack of data points to the volatility and unpredictability characteristic of the cryptocurrency market. -

Recent Performance (2023):

– As of October 2023, CPOOL is trading at approximately $0.1565, with a market capitalization of around $126.66 million. The token has seen a slight increase of about 37% over the past year, indicating a potential stabilization and gradual recovery in price since the lows of 2022. The 24-hour trading volume has also shown fluctuations, typically hovering around $2 million, suggesting a moderate level of market activity.

Factors Influencing the Price

Historically, the price of Clearpool has been influenced by a combination of internal factors related to the protocol itself and external market conditions.

-

Market Sentiment and Overall Crypto Trends:

– The price of CPOOL has been closely tied to the general sentiment within the cryptocurrency market. Bullish trends in the larger market often lead to increased interest and investment in altcoins like Clearpool. Conversely, during bearish phases, CPOOL’s price tends to decline alongside other cryptocurrencies. -

Adoption and Use Case Development:

– Clearpool’s unique value proposition as a decentralized platform for institutional borrowers has played a crucial role in its price dynamics. As more institutions explore DeFi options, the demand for CPOOL may increase, positively impacting its price. The successful implementation of features like liquidity pools and the staking mechanism for CPOOL holders has also contributed to its perceived value. -

Regulatory Developments:

– Regulatory news and actions can significantly impact investor sentiment and market performance for cryptocurrencies. Clearpool, being part of the DeFi sector, is particularly sensitive to changes in regulations that could affect its operational capabilities or the broader DeFi landscape. -

Technological Developments and Partnerships:

– Partnerships with other blockchain projects and advancements in Clearpool’s technology can also influence its market performance. Successful integrations or collaborations can enhance the utility of CPOOL, leading to increased demand. -

Market Liquidity and Trading Volume:

– The liquidity of CPOOL in the market has affected its price stability. Higher trading volumes typically indicate greater interest and can lead to less price volatility. Conversely, low liquidity can exacerbate price swings, especially during market downturns. -

Investor Behavior and Speculation:

– The behavior of retail and institutional investors plays a pivotal role in the price movements of CPOOL. Speculative trading, often driven by news cycles and market trends, can lead to rapid price changes, reflecting the emotional and reactive nature of cryptocurrency trading.

Conclusion

Clearpool’s price history reflects the broader trends and challenges within the cryptocurrency market. From its significant highs to the lows experienced during market corrections, various factors have influenced its price trajectory. Understanding these dynamics is crucial for investors and enthusiasts looking to navigate the evolving landscape of digital assets. As Clearpool continues to develop its protocol and adapt to changing market conditions, its price performance will likely remain a focal point for both investors and analysts alike.

Where to Buy clearpool crypto: Top Exchanges Reviewed

1. Clearpool – Your Gateway to CPOOL Investment!

Kraken stands out as a user-friendly exchange for purchasing Clearpool (CPOOL), allowing users to start investing with as little as $10. Its diverse payment options, including credit/debit cards, ACH deposits, and mobile payment systems like Apple and Google Pay, enhance accessibility for both novice and experienced investors. The comprehensive guide simplifies the buying process, making it an excellent choice for those looking to enter the Clearpool market seamlessly.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

3. Clearpool (CPOOL) – Unlocking Liquidity with Diverse Exchange Listings!

Clearpool (CPOOL) is primarily listed on prominent decentralized and centralized exchanges, including Uniswap v3 and Gate.io, which enhances its accessibility for a wide range of investors. Notably, its presence on Uniswap v3 emphasizes the project’s commitment to decentralized finance, while listings on well-established platforms like Gate.io and Bybit offer additional liquidity and trading options. This diverse exchange representation positions CPOOL favorably within the competitive cryptocurrency market.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Clearpool (CPOOL) – Your Ultimate Guide to Seamless Buying!

The guide on purchasing Clearpool (CPOOL) from Bitcompare stands out by providing a clear, step-by-step approach tailored for both novice and experienced investors. It emphasizes the importance of selecting a suitable cryptocurrency exchange that operates within the user’s country and supports CPOOL trading, ensuring a seamless buying experience. This practical focus not only simplifies the acquisition process but also empowers users to make informed decisions in the evolving crypto market.

- Website: bitcompare.net

- Platform Age: Approx. 6 years (domain registered in 2019)

3. Clearpool – Unlock the Best CPOOL Exchange Rates!

Clearpool stands out as a premier exchange for trading CPOOL, offering competitive pricing and a user-friendly platform. With a stellar rating of 4.8 based on over 2,170 reviews, it ensures a seamless experience for both buying and selling. Users can easily access real-time market data, including live charts and market cap information, making it an ideal choice for investors looking to navigate the Clearpool ecosystem efficiently.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

3. Clearpool (CPOOL) – Your Gateway to Decentralized Finance!

Clearpool (CPOOL) is gaining traction across multiple cryptocurrency exchanges, with over 12 platforms available for trading. Notably, top exchanges like Gate, Bitget, and Coinex stand out for their robust trading features and liquidity. Clearpool’s unique decentralized finance (DeFi) model, which facilitates institutional borrowing and lending, makes it an attractive option for investors looking to engage in innovative financial solutions within the crypto ecosystem.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

How to Buy clearpool crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Clearpool (CPOOL) is to select a cryptocurrency exchange that supports CPOOL trading. Popular exchanges include:

- Coinbase: Known for its user-friendly interface, Coinbase allows you to buy, sell, and trade cryptocurrencies easily.

- Kucoin: Offers a wide variety of cryptocurrencies, including CPOOL, and has advanced trading features.

- Uniswap: A decentralized exchange (DEX) where you can swap Ethereum-based tokens directly from your wallet.

Make sure to check the trading fees, supported payment methods, and user reviews before making your choice.

2. Create and Verify Your Account

Once you have selected an exchange, you will need to create an account. Here’s how:

- Visit the Exchange’s Website: Go to the official website of the chosen exchange.

- Sign Up: Click on the “Sign Up” or “Register” button. You will be asked to provide your email address and create a secure password.

- Email Verification: After registering, check your email for a verification link. Click on it to verify your email address.

- Identity Verification: Most exchanges require you to verify your identity to comply with regulations. This process may involve uploading a government-issued ID and proof of address. Follow the instructions provided by the exchange to complete this step.

3. Deposit Funds

After your account is set up and verified, the next step is to deposit funds into your exchange account. Here’s how to do it:

- Log In: Access your account on the exchange.

- Navigate to the Deposit Section: Look for the “Deposit” option, usually found in the account settings or wallet section.

- Choose Your Payment Method: You can deposit funds using various methods, such as bank transfer, credit/debit card, or even other cryptocurrencies. Select your preferred option.

- Enter Deposit Amount: Specify how much you want to deposit and follow the prompts to complete the transaction. Keep in mind that different payment methods may have different processing times and fees.

4. Place an Order to Buy Clearpool Crypto

With funds in your account, you can now purchase CPOOL. Follow these steps:

- Navigate to the CPOOL Trading Pair: Search for CPOOL in the exchange’s market section. You may find it listed under trading pairs like CPOOL/USD or CPOOL/ETH.

- Select Order Type: Choose between a market order (buying at the current market price) or a limit order (setting a specific price at which you want to buy). For beginners, a market order is usually the simplest option.

- Enter the Amount: Specify how much CPOOL you wish to buy. The exchange will automatically calculate the total cost based on the current market price.

- Review and Confirm: Double-check the details of your order, including fees, before confirming the purchase. Click on the “Buy” button to execute your order.

5. Secure Your Coins in a Wallet

Once your order is executed, it’s essential to secure your CPOOL tokens. While you can store your CPOOL on the exchange, it is safer to transfer them to a personal wallet. Here’s how to do it:

- Choose a Wallet: You can choose between a software wallet (like MetaMask or Trust Wallet) or a hardware wallet (like Ledger or Trezor) for added security. Hardware wallets are generally recommended for long-term storage due to their offline nature.

- Set Up Your Wallet: Download the wallet app or set up your hardware wallet according to the manufacturer’s instructions. Make sure to keep your recovery phrase safe.

- Transfer CPOOL to Your Wallet:

– Find Your Wallet Address: Open your wallet and copy your CPOOL wallet address.

– Withdraw from Exchange: Go back to the exchange, navigate to your CPOOL holdings, and select the option to withdraw. Paste your wallet address and confirm the amount you wish to transfer.

– Confirm the Transaction: Review the withdrawal details and confirm. It may take some time for the transaction to be processed on the blockchain.

Conclusion

By following these steps, you can successfully buy and secure Clearpool (CPOOL) tokens. Always remember to conduct thorough research and stay informed about market trends to make educated decisions in your cryptocurrency journey.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Clearpool (CPOOL) is positioned within the decentralized finance (DeFi) sector as a platform that connects institutional borrowers with liquidity providers through unsecured loans. This innovative approach offers several potential strengths that may appeal to both investors and users.

1. Growing Demand for DeFi Solutions

The DeFi market has witnessed exponential growth over the past few years, driven by the increasing demand for decentralized financial services. Clearpool’s unique offering of unsecured loans positions it to capture a portion of this expanding market. As more institutions recognize the benefits of DeFi, Clearpool could become a preferred platform for accessing liquidity without the constraints of traditional finance.

2. Attractive Yield Opportunities

Clearpool provides liquidity providers (LPs) with the potential for attractive yields. By supplying liquidity to the platform, LPs can earn interest from borrowers, supplemented by additional rewards in CPOOL tokens. This dual incentive structure may attract more participants to the ecosystem, enhancing liquidity and driving demand for CPOOL.

3. Strong Governance Mechanisms

CPOOL serves as both a utility and governance token within the Clearpool ecosystem. Token holders have voting rights on critical decisions, such as whitelisting new borrowers. This decentralized governance model empowers the community and creates a sense of ownership among stakeholders, which can foster loyalty and long-term engagement.

4. Experienced Management Team

Clearpool’s management team boasts extensive experience in both traditional finance and the blockchain sector. With backgrounds in capital markets and fintech, the founders are well-equipped to navigate the complexities of the financial landscape. Their expertise could enhance the platform’s credibility and operational efficiency.

5. Robust Tokenomics

Clearpool has a capped supply of 1 billion CPOOL tokens, with a significant portion (approximately 81%) currently in circulation. The planned buyback program, which uses a share of the protocol’s revenue to purchase CPOOL tokens from the open market, may create upward pressure on the token price and sustain reward pools for liquidity providers. This mechanism can potentially enhance the long-term value of the token.

6. Integration with Traditional Finance

Clearpool aims to bridge the gap between traditional capital markets and DeFi. By offering a platform that facilitates unsecured loans, it could attract institutional capital that has traditionally shied away from the cryptocurrency space. This integration could lead to increased market activity and growth for both Clearpool and the broader DeFi ecosystem.

Potential Risks and Challenges (The Bear Case)

While Clearpool presents several strengths, potential investors should also consider the risks associated with this digital asset. Understanding these challenges is crucial for making informed investment decisions.

1. Market Volatility

Cryptocurrency markets are notoriously volatile, with prices often subject to rapid fluctuations based on market sentiment, regulatory news, and broader economic factors. CPOOL’s price history reflects this volatility, having reached an all-time high of $2.21 in November 2021, only to decline by over 90% since then. Investors should be prepared for significant price swings, which can impact their investment value and exit strategies.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies and DeFi is still evolving. Governments worldwide are increasingly scrutinizing digital assets, which could lead to new regulations that impact Clearpool’s operations. Uncertainty surrounding compliance requirements could hinder the platform’s growth and adoption, potentially affecting CPOOL’s market value.

3. Competitive Landscape

The DeFi sector is highly competitive, with numerous platforms offering similar services. Clearpool faces competition from established DeFi protocols and new entrants that may innovate more rapidly or offer better incentives. This competitive pressure could limit Clearpool’s market share and influence its ability to attract borrowers and liquidity providers.

4. Technological Risks

Clearpool’s reliance on blockchain technology introduces certain risks. Smart contracts, which underpin the platform’s operations, can be vulnerable to bugs or exploits. A successful attack on Clearpool’s smart contracts could lead to significant financial losses for users and undermine trust in the platform. Additionally, the ongoing development of blockchain technology means that Clearpool must continuously adapt to stay competitive and secure.

5. Adoption Challenges

Despite the growing interest in DeFi, mainstream adoption remains a challenge. Many institutional investors are still hesitant to engage with DeFi due to concerns about security, regulatory compliance, and the complexities of using decentralized platforms. Clearpool must overcome these hurdles to achieve widespread acceptance and utilization of its services.

6. Economic Factors

External economic factors, such as inflation, interest rates, and global economic conditions, can impact the demand for DeFi services. A downturn in the economy may lead to reduced borrowing activity, affecting Clearpool’s revenue and the demand for CPOOL tokens. Investors should consider the broader economic environment when evaluating the potential performance of Clearpool.

Conclusion

Clearpool offers a unique proposition within the DeFi landscape, targeting institutional borrowers with unsecured loan solutions. Its attractive yield opportunities, governance model, and experienced management team present compelling reasons for potential investors to consider CPOOL. However, the inherent risks associated with market volatility, regulatory uncertainty, competition, technological vulnerabilities, adoption challenges, and economic factors warrant careful consideration.

As with any investment, individuals should conduct thorough research and consider their risk tolerance before engaging with Clearpool or any other cryptocurrency. Understanding both the potential strengths and risks is essential for making informed decisions in the ever-evolving world of digital assets.

Frequently Asked Questions (FAQs)

1. What is Clearpool (CPOOL)?

Clearpool (CPOOL) is a decentralized capital markets ecosystem that facilitates unsecured loans for institutional borrowers directly from the decentralized finance (DeFi) ecosystem. The Clearpool protocol operates on both the Ethereum and Solana blockchains, providing a marketplace where borrowers can access liquidity while liquidity providers earn attractive yields through interest rates enhanced by additional rewards paid in CPOOL tokens.

2. Who created Clearpool?

Clearpool was co-founded by Robert Alcorn and Alessio Quaglini, both of whom have extensive backgrounds in traditional finance and cryptocurrency. The team includes professionals experienced in capital markets, fintech, and blockchain technology, aiming to bridge the gap between traditional finance and the DeFi landscape.

3. What makes Clearpool different from Bitcoin?

While Bitcoin is primarily a digital currency and a store of value, Clearpool is focused on providing decentralized capital markets. Clearpool enables institutional borrowers to access unsecured loans, whereas Bitcoin functions as a peer-to-peer payment system. Additionally, Clearpool utilizes a governance token (CPOOL) that allows holders to participate in protocol decisions, unlike Bitcoin, which does not have a formal governance structure.

4. Is Clearpool crypto a good investment?

As with any investment, the potential for profit or loss in Clearpool (CPOOL) depends on various factors, including market conditions, the project’s adoption, and its overall performance in the DeFi space. Prospective investors should conduct thorough research and consider their risk tolerance before investing in CPOOL or any cryptocurrency.

5. What is the current price of Clearpool?

As of the latest data, the price of Clearpool (CPOOL) is approximately $0.1565 USD. Prices can fluctuate frequently, so it’s advisable to check a reliable cryptocurrency exchange or market data platform for real-time pricing.

6. What is the market cap of Clearpool?

Clearpool currently has a market cap of around $126.68 million. Market capitalization is calculated by multiplying the current price of CPOOL by its circulating supply, which provides an indication of the asset’s overall value in the market.

7. How can I earn rewards with Clearpool?

Users can earn rewards in Clearpool by providing liquidity to the platform or participating in governance activities. Liquidity providers earn interest on their contributions and additional CPOOL tokens, while CPOOL holders can stake their tokens to participate in voting for borrower whitelisting, potentially earning more rewards in the process.

8. What is the all-time high price of Clearpool?

The all-time high price of Clearpool (CPOOL) was approximately $2.21, reached on November 16, 2021. Since then, the price has experienced significant fluctuations, reflecting the volatility commonly seen in the cryptocurrency market.

Final Verdict on clearpool crypto

Overview of Clearpool Crypto

Clearpool (CPOOL) is a decentralized capital markets ecosystem designed to facilitate unsecured loans for institutional borrowers directly from the decentralized finance (DeFi) space. By leveraging a dynamic interest model driven by market supply and demand, Clearpool aims to create an efficient marketplace that connects traditional finance with the rapidly evolving DeFi landscape. The platform allows liquidity providers to earn attractive yields, enhanced by additional rewards paid in CPOOL, its native utility and governance token.

Technology and Functionality

The Clearpool protocol operates on both the Ethereum and Solana blockchains, utilizing smart contracts to manage liquidity pools and borrower whitelisting. CPOOL holders play a crucial role in the governance of the protocol by voting on borrower proposals, which can unlock additional rewards. Furthermore, the introduction of cpTokens allows liquidity providers to manage risks and hedge against market fluctuations effectively. This innovative approach positions Clearpool as a vital player in bridging the $120 trillion traditional capital markets with the DeFi ecosystem.

Risk and Reward

Investing in Clearpool carries inherent risks, typical of high-volatility assets in the cryptocurrency space. With a current market cap of approximately $126.68 million and a price that has seen significant fluctuations—reaching an all-time high of $2.21—potential investors should be cautious. The asset’s performance is influenced by various factors, including market sentiment, regulatory developments, and the overall growth of the DeFi sector.

Final Thoughts

In conclusion, Clearpool presents an intriguing opportunity for those looking to explore the intersection of decentralized finance and traditional capital markets. However, as with any cryptocurrency investment, it is essential to recognize that while the potential for high returns exists, so do substantial risks. Therefore, it is crucial for investors—both beginners and intermediates—to conduct their own thorough research (DYOR) before making any investment decisions. Understanding the underlying technology, market dynamics, and the broader context of the DeFi space will empower you to make informed choices in your investment journey.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.