Should You Invest in blast crypto? A Full Analysis (2025)

An Investor’s Introduction to blast crypto

Blast (BLAST) is an innovative cryptocurrency that operates as an Ethereum Layer 2 (L2) solution, setting itself apart by offering native yield for both Ethereum (ETH) and stablecoins. As the digital asset landscape continues to evolve, Blast emerges as a significant player, providing unique financial mechanisms that cater to both investors and developers. By leveraging Ethereum’s robust security while enhancing transaction efficiency, Blast addresses some of the pressing scalability issues faced by the Ethereum network. This positions it as a promising alternative for those looking to engage with decentralized finance (DeFi) applications and other blockchain innovations.

In the crowded market of digital assets, Blast’s standout feature is its ability to generate yield from ETH staking and Real-World Asset (RWA) protocols. With an attractive yield of 3.4% for ETH and 8% for stablecoins, Blast offers investors an opportunity to earn passive income on their holdings, which is a compelling proposition in the current financial landscape. This functionality not only benefits individual investors but also incentivizes developers to build decentralized applications (Dapps) on the platform, fostering a vibrant ecosystem that encourages innovation.

This guide aims to provide a comprehensive resource for both beginners and intermediate investors looking to understand Blast crypto. We will explore various aspects of Blast, including its underlying technology, tokenomics, investment potential, associated risks, and the process of acquiring BLAST tokens. Understanding these components is crucial for making informed investment decisions and navigating the complexities of the cryptocurrency market.

As we delve into the technology behind Blast, we will examine how it utilizes optimistic rollup technology to improve transaction speeds and reduce costs while ensuring security. Furthermore, we will discuss the tokenomics of BLAST, including its market cap, circulating supply, and governance features that empower token holders to participate in the protocol’s development.

Additionally, we will analyze the investment potential of Blast, exploring historical price performance, market trends, and future projections. While the opportunities presented by Blast are compelling, we will also address the risks inherent in investing in cryptocurrencies, including market volatility and regulatory challenges.

Finally, we will guide you through the process of purchasing BLAST tokens, providing insights on various exchanges and wallets, ensuring that you are well-equipped to navigate your investment journey in this dynamic cryptocurrency landscape.

What is blast crypto? A Deep Dive into its Purpose

Overview of Blast Crypto

Blast (BLAST) is an innovative cryptocurrency operating as an Ethereum Layer 2 (L2) solution. It is designed to enhance the Ethereum blockchain’s capabilities by providing unique yield-generating features for both Ethereum (ETH) and stablecoins. This project aims to address several challenges faced by existing blockchain solutions while fostering a robust ecosystem for developers and users alike.

The Core Problem It Solves

The primary challenge that Blast aims to address is the lack of yield opportunities in many existing Layer 2 solutions. Most L2 protocols do not offer any interest or yield on the assets staked within their ecosystems, leaving users without the ability to earn passive income on their holdings. This limitation can deter potential investors and developers who seek more lucrative opportunities within the decentralized finance (DeFi) space.

Additionally, transaction costs and speeds on the Ethereum mainnet can hinder the usability of decentralized applications (Dapps). By leveraging optimistic rollup technology, Blast enhances transaction efficiency while maintaining the security of the Ethereum blockchain. This allows for faster processing times and lower fees, which are crucial for the scalability of DeFi applications and other blockchain services.

Moreover, the integration of Real-World Assets (RWA) into the blockchain ecosystem is another challenge that Blast seeks to overcome. By tokenizing real-world assets and providing mechanisms for their trading, Blast bridges the gap between traditional finance and blockchain technology. This not only enhances the utility of the platform but also opens up new avenues for investment and revenue generation.

Its Unique Selling Proposition

Blast’s unique selling proposition lies in its ability to offer native yield on assets, which is a rarity among Layer 2 solutions. Specifically, Blast provides a 3.4% yield for ETH and an impressive 8% yield for stablecoins. This yield is generated through ETH staking and RWA protocols, with the returns automatically distributed to users. This feature positions Blast as an attractive option for users looking to earn passive income while participating in the crypto ecosystem.

Another compelling aspect of Blast is its focus on developer incentives. The platform offers innovative building blocks, such as gas revenue sharing, which allows developers to earn a portion of transaction fees generated by their Dapps. This model encourages the creation of competitive products and services, fostering a vibrant ecosystem that benefits both users and builders.

Governance is also a key feature of Blast. Token holders have a say in the protocol’s future developments, aligning the interests of the community and developers. This decentralized governance structure empowers users, allowing them to participate in decision-making processes that shape the platform’s trajectory.

Blast’s commitment to community engagement is further exemplified by its Airdrop program, which rewards early access members and developers. This initiative not only incentivizes participation but also helps build a strong and active community around the Blast ecosystem.

The Team and Backers

The driving force behind Blast is its founder, Tieshun Roquerre, also known as Pacman. Roquerre’s vision for the project has been instrumental in its development, focusing on creating a platform that seamlessly integrates yield generation with blockchain technology. His leadership and expertise in the crypto space have guided Blast toward becoming a competitive player in the Layer 2 landscape.

The team behind Blast is comprised of experienced professionals from various sectors, including blockchain technology, finance, and software development. Their combined expertise allows for a comprehensive approach to building and scaling the platform, ensuring that it meets the needs of both developers and users.

While specific backers or investors have not been prominently disclosed, the project’s innovative features and strong community engagement have attracted attention within the crypto ecosystem. The support from the community, coupled with the team’s expertise, positions Blast for sustained growth and success.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Blast in the crypto ecosystem is to provide a scalable, efficient, and rewarding platform for both users and developers. By addressing the lack of yield opportunities in existing L2 solutions, Blast enhances the attractiveness of decentralized finance for investors looking to earn returns on their crypto holdings.

Furthermore, Blast serves as a decentralized launchpad for new blockchain projects, offering funding and support for initiatives at various stages of development. This approach encourages innovation and helps foster a diverse array of Dapps, which ultimately enhances the utility of the Blast platform.

In summary, Blast is not just another Layer 2 solution; it is a comprehensive platform that combines yield generation, developer incentives, and community engagement to create a vibrant ecosystem. By bridging the gap between traditional finance and the blockchain world, Blast is poised to make a significant impact on the future of decentralized finance and the broader cryptocurrency landscape. Its unique offerings make it a compelling choice for both investors and developers, reinforcing its position as a promising player in the rapidly evolving crypto space.

The Technology Behind the Coin: How It Works

Overview of Blast Technology

Blast (BLAST) is an innovative cryptocurrency that operates as an Ethereum Layer 2 (L2) solution. It is designed to enhance the functionality of the Ethereum blockchain by improving transaction speeds, reducing costs, and providing unique yield opportunities for users. This guide delves into the technical aspects of Blast, exploring its architecture, consensus mechanisms, and key innovations.

Blockchain Architecture

At its core, Blast is built on the Ethereum blockchain, leveraging its security while enhancing its scalability. As an Ethereum Layer 2 solution, it utilizes a technology known as optimistic rollups, which allows it to bundle multiple transactions together and process them off the main Ethereum chain. This architecture helps to alleviate congestion on the Ethereum network, leading to faster transaction times and lower fees.

Optimistic Rollups

Optimistic rollups are a scaling solution that assumes transactions are valid by default. This means that when users make transactions on Blast, they are processed quickly without extensive verification. However, if a dispute arises regarding the validity of a transaction, it can be challenged, and the system will then perform the necessary checks.

This approach significantly speeds up transaction processing while maintaining a high level of security. Since Blast operates on top of Ethereum, it inherits the robust security features of the Ethereum mainnet. As a result, users can confidently engage with the platform, knowing their transactions are protected from potential attacks.

Consensus Mechanism

Blast utilizes Ethereum’s consensus mechanism, which is currently transitioning from Proof of Work (PoW) to Proof of Stake (PoS). While Blast itself does not introduce a new consensus mechanism, it benefits from Ethereum’s evolving architecture.

Proof of Stake (PoS)

In a Proof of Stake system, validators are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This transition to PoS is designed to make the network more energy-efficient and secure, as it requires significantly less computational power compared to PoW.

For Blast users, this means that the underlying security of the platform is strengthened, as PoS helps prevent malicious activities such as double-spending. Additionally, PoS allows for faster transaction confirmations, contributing to Blast’s overall efficiency.

Key Technological Innovations

Blast introduces several innovative features that set it apart from other Layer 2 solutions. These innovations not only enhance user experience but also provide developers with new tools for building decentralized applications (Dapps).

Native Yield for ETH and Stablecoins

One of the standout features of Blast is its ability to offer native yield on both Ethereum (ETH) and stablecoins. Unlike other L2 solutions that typically provide a default interest rate of 0%, Blast offers an attractive yield of 3.4% for ETH and 8% for stablecoins. This yield is generated through two primary mechanisms:

-

ETH Staking: Users can stake their ETH on the Layer 1 Ethereum network, earning rewards that are then transferred to Blast’s Layer 2. This process allows users to benefit from staking rewards without needing to navigate the complexities of Ethereum’s staking infrastructure.

-

Real-World Asset (RWA) Protocols: Blast integrates RWA protocols that connect blockchain technology with tangible assets. For instance, the yield generated from synthetic assets or tokenized real-world assets can be passed back to users, creating a seamless earning opportunity. This innovative approach broadens the scope of what users can earn, significantly enhancing the utility of their holdings.

Gas Revenue Sharing

Another key technological innovation is Blast’s gas revenue sharing model. Typically, developers on blockchain platforms do not receive a share of transaction fees, which can limit their incentives to build on the network. However, Blast introduces a new paradigm by sharing gas fee revenue with Dapp developers.

This model allows developers to earn a portion of the transaction fees generated by their applications, providing a direct financial incentive to create competitive products and services. This approach not only fosters innovation but also encourages a more diverse ecosystem of applications built on the Blast platform.

Developer Incentives and Airdrops

Blast actively engages with its developer community through initiatives like the Blast Airdrop program. This program rewards early access members and developers, encouraging participation and fostering a vibrant ecosystem. By incentivizing developers to build on the platform, Blast aims to attract innovative projects that can leverage its unique features.

Additionally, the Big Bang program offers funding and support for mobile Dapp development, further enhancing the platform’s appeal to developers. By providing resources and opportunities, Blast positions itself as an attractive option for those looking to innovate within the blockchain space.

Security Features

Security is a critical concern for any blockchain platform, and Blast prioritizes this aspect by leveraging the security of the Ethereum mainnet. By operating as a Layer 2 solution, Blast benefits from Ethereum’s well-established security protocols, ensuring that user transactions are protected from potential threats.

Dispute Resolution Mechanism

The optimistic rollup technology employed by Blast includes a robust dispute resolution mechanism. If a transaction is challenged, it triggers a verification process to confirm its validity. This ensures that any fraudulent activity can be addressed promptly, maintaining the integrity of the platform.

Real-World Asset Integration

Blast’s ability to integrate real-world assets into its blockchain ecosystem opens up a plethora of opportunities for users and developers alike. By allowing the tokenization of tangible assets, Blast bridges the gap between traditional finance and decentralized technology.

This integration not only enhances the utility of the platform but also enables the trading of synthetic assets based on real-world market indices. As a result, users can engage with a broader range of financial instruments, expanding their investment options and opportunities.

Conclusion

The technology behind Blast (BLAST) represents a significant advancement in the cryptocurrency landscape. By leveraging Ethereum’s security, employing optimistic rollups for scalability, and introducing innovative features like native yield and gas revenue sharing, Blast positions itself as a compelling option for both users and developers.

With its focus on enhancing user experience and fostering innovation, Blast is poised to make a lasting impact on the blockchain ecosystem. As more developers and users engage with the platform, the potential for growth and transformation within the decentralized finance space continues to expand.

Understanding blast crypto Tokenomics

Tokenomics of Blast Crypto (BLAST)

Tokenomics refers to the economic model of a cryptocurrency, detailing how the token operates within its ecosystem, its supply dynamics, and its utility. For Blast (BLAST), a Layer 2 solution built on Ethereum, the tokenomics are designed to foster a vibrant ecosystem that benefits both users and developers. Below, we will explore the essential metrics and components of Blast’s tokenomics.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 100,000,000,000 BLAST |

| Max Supply | 100,000,000,000 BLAST |

| Circulating Supply | 45,405,864,328 BLAST |

| Inflation/Deflation Model | Deflationary (with mechanisms to manage supply) |

Token Utility (What is the coin used for?)

The utility of the BLAST token is multifaceted, serving various purposes within the Blast ecosystem:

-

Governance: Holders of BLAST tokens have the ability to participate in the governance of the Blast protocol. This includes voting on proposals related to protocol upgrades, changes in yield rates, and other critical decisions that affect the ecosystem. This democratic approach aligns the interests of both developers and users, ensuring that the community has a voice in the project’s direction.

-

Yield Generation: One of the standout features of Blast is its native yield capabilities. BLAST tokens allow users to earn interest on their holdings. For example, users can earn a 3.4% yield on ETH and an 8% yield on stablecoins through the platform’s staking and Real-World Asset (RWA) protocols. This yield is automatically passed back to users, creating an attractive incentive for holding and using BLAST.

-

Transaction Fees: BLAST tokens may also be used to pay for transaction fees within the Blast ecosystem. Utilizing BLAST for gas fees can create demand for the token, as users may prefer to hold BLAST for its utility rather than converting it to ETH or another cryptocurrency for transactions.

-

Incentives for Developers: Blast aims to attract developers to build decentralized applications (Dapps) on its platform. By sharing gas fee revenue with developers and offering a unique airdrop program, BLAST incentivizes innovation within the ecosystem. This creates a more competitive environment for Dapps, which can lead to a richer array of services for users.

-

Participation in Ecosystem Events: The BLAST token allows holders to participate in various events and promotions within the Blast ecosystem. This includes airdrops, rewards programs, and other community-driven initiatives that encourage active participation and engagement.

Token Distribution

The distribution model of BLAST is crucial for understanding its long-term sustainability and market dynamics. Here are some key points regarding the distribution of BLAST tokens:

-

Initial Distribution: Upon launch, a portion of the total supply of BLAST tokens is allocated to various stakeholders, including the development team, early investors, and community incentives. This initial distribution is essential for kickstarting the ecosystem and ensuring that there are sufficient tokens in circulation for trading and utility.

-

Airdrop Programs: To foster community engagement, Blast has implemented a community airdrop strategy. This program is designed to reward early adopters and developers, creating a sense of ownership among participants. The distribution of airdrop tokens is typically based on specific criteria, such as activity within the ecosystem or holding certain amounts of tokens.

-

Staking Rewards: As part of its yield-generation mechanism, Blast distributes a portion of the rewards generated from ETH staking and RWA protocols back to BLAST holders. This not only incentivizes users to hold their tokens but also helps maintain a healthy circulating supply.

-

Developer Incentives: A significant portion of the BLAST tokens is reserved for incentivizing developers to build on the platform. This can include direct rewards for creating successful Dapps or sharing in the revenue generated from transaction fees.

-

Buyback and Burn Mechanisms: To manage inflation and create scarcity, Blast may implement buyback and burn strategies. In this model, a portion of the transaction fees or profits generated by the ecosystem is used to buy back BLAST tokens from the market, which are then burned, reducing the total supply over time. This deflationary model can help increase the token’s value by decreasing supply while demand remains constant or increases.

Conclusion

The tokenomics of Blast (BLAST) are designed to create a sustainable and engaging ecosystem for both users and developers. With a focus on governance, yield generation, and developer incentives, Blast positions itself as a unique Layer 2 solution on Ethereum. By implementing a thoughtful distribution model and exploring innovative economic mechanisms, Blast aims to foster a thriving community that actively participates in the growth and development of the platform. As the cryptocurrency landscape continues to evolve, understanding the tokenomics of projects like Blast will be essential for making informed investment decisions.

Price History and Market Performance

Key Historical Price Milestones

Blast (BLAST) has experienced significant fluctuations since its inception as an Ethereum Layer 2 (L2) solution. The price history is marked by several key milestones that reflect both the asset’s growth and the broader trends within the cryptocurrency market.

Initially, upon its launch, BLAST began trading at a modest price, influenced by the overall market sentiment surrounding new projects in the Layer 2 space. Over time, interest in Blast’s unique offerings—such as its ability to provide native yield for both ETH and stablecoins—drove its value upward.

One of the most notable peaks occurred on June 26, 2024, when BLAST reached its all-time high of approximately $0.5223. This surge can be attributed to a combination of factors including increased adoption of the platform, positive community engagement, and a growing recognition of its innovative features in the decentralized finance (DeFi) ecosystem. However, following this peak, the price saw a significant decline, reflecting the volatile nature of cryptocurrency markets.

In the months following its all-time high, BLAST faced downward pressure, with prices dropping to as low as $0.001877 by July 1, 2025. This marked the all-time low for the asset, illustrating the challenges faced by many cryptocurrencies during bearish market conditions. As of the latest data, BLAST is trading around $0.002378, showing a modest recovery from its lows but remaining significantly below its peak value.

Factors Influencing the Price

Historically, the price of Blast has been influenced by a variety of factors, both internal to the project and external market conditions.

Market Sentiment and Cryptocurrency Trends

The overall sentiment in the cryptocurrency market plays a crucial role in the price movements of BLAST. During bullish phases, positive sentiment and increased investment in digital assets often lead to higher prices. Conversely, during bearish markets, negative sentiment can result in sharp declines. For instance, the significant drop in price following its all-time high in mid-2024 can be linked to a broader market correction that affected many cryptocurrencies.

Adoption and Use Cases

The rate of adoption of the Blast platform directly impacts its price. As more users engage with Blast’s features—such as its yield-generating capabilities—demand for BLAST tokens can increase, leading to upward price pressure. The introduction of innovative applications, such as the Blast Airdrop and the Big Bang program aimed at supporting developers, has also contributed positively to market perception and user engagement.

Technological Developments

Technological advancements and updates within the Blast ecosystem can significantly influence investor confidence and, consequently, the price of BLAST. For example, improvements in the platform’s efficiency, security, and user experience can attract more users and developers, creating a positive feedback loop that drives demand for the token.

Competition and Market Position

Blast operates in a competitive landscape of Layer 2 solutions, where it must continuously differentiate itself from other platforms. Competitive pressures from other Ethereum L2 solutions can influence its market position and, thus, its price. Projects that offer similar or superior features may divert potential users and investors, leading to fluctuations in BLAST’s value.

Regulatory Environment

The evolving regulatory landscape surrounding cryptocurrencies can also impact the price of Blast. Regulatory news can create uncertainty or confidence in the market, affecting overall investment flows. For instance, favorable regulations may lead to increased institutional interest in Blast, while stringent regulations could deter potential investors.

Community Engagement

Lastly, the strength and engagement of the Blast community have historically played a significant role in the token’s performance. Community initiatives, social media presence, and user advocacy can enhance the visibility of the project and promote a positive narrative, which can drive price appreciation. The effectiveness of community-driven events, such as the Blast Community Airdrop, can further bolster interest and participation in the ecosystem.

Conclusion

In summary, the price history of Blast (BLAST) reflects a journey marked by significant milestones and influenced by various factors. From its initial launch to its all-time high and subsequent fluctuations, the performance of BLAST is a testament to the dynamic nature of the cryptocurrency market. Understanding these historical price movements and the factors that influence them is essential for investors looking to navigate the complexities of this digital asset. As the cryptocurrency landscape continues to evolve, so too will the narrative surrounding Blast and its potential within the broader market.

Where to Buy blast crypto: Top Exchanges Reviewed

3. Blast Exchanges – Your Gateway to Seamless BLAST Trading!

Blast Exchanges offers a dynamic platform for trading the BLAST cryptocurrency, with notable support from popular exchanges such as HTX (Huobi), KuCoin, Bybit, and Gate. What sets Blast Exchanges apart is its user-friendly interface, competitive trading fees, and a robust selection of trading pairs, making it accessible for both novice and seasoned traders. Additionally, the emphasis on security and customer support enhances the overall trading experience for users.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Coinbase – Easiest Way to Buy Blast in the US!

Coinbase stands out as a premier platform for purchasing Blast in the United States due to its reputation for security and user-friendly interface. As a centralized exchange, Coinbase offers a reliable environment for both individuals and businesses to buy, sell, and manage their Blast assets. Its strong emphasis on regulatory compliance and customer support further enhances its appeal, making it a top choice for cryptocurrency transactions.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

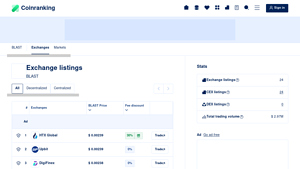

7. Blast – Your Gateway to Diverse Exchange Listings!

The Coinranking platform offers a comprehensive overview of BLAST (BLAST) exchange listings, enabling users to compare prices, trading volumes, and available discounts across various exchanges. This feature empowers traders to make informed decisions by identifying the best platforms for their transactions. The user-friendly interface and detailed analytics make Coinranking a standout resource for those looking to maximize their trading efficiency in the dynamic cryptocurrency market.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy blast crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Blast (BLAST) is to select a cryptocurrency exchange that supports trading for this asset. Some popular exchanges where BLAST is listed include:

- KuCoin: Known for a wide range of altcoins and user-friendly interface.

- Coinbase: A reputable platform, particularly for beginners, though it may have fewer altcoins available compared to others.

- Binance: One of the largest exchanges globally, offering extensive trading pairs and features.

When choosing an exchange, consider factors such as:

- Fees: Each exchange has its own fee structure for trading and withdrawals.

- Security: Look for exchanges with strong security measures, including two-factor authentication (2FA).

- User Experience: A platform that is easy to navigate will enhance your buying experience.

2. Create and Verify Your Account

Once you’ve selected an exchange, the next step is to create an account. Here’s how to do it:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will typically need to provide your email address and create a password.

- Verify Your Email: Check your email for a verification link from the exchange. Click on it to confirm your email address.

- Complete KYC (Know Your Customer): Most exchanges will require you to complete a KYC process for security and regulatory compliance. This may involve submitting personal identification documents (like a passport or driver’s license) and sometimes proof of address (like a utility bill).

- Enable 2FA: For added security, enable two-factor authentication (2FA) on your account. This typically involves linking your account to an authentication app like Google Authenticator.

3. Deposit Funds

After successfully creating and verifying your account, you need to deposit funds to purchase Blast. Follow these steps:

- Navigate to the Deposit Section: Find the “Funds” or “Wallet” section on the exchange and select “Deposit.”

- Choose Your Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit card, or cryptocurrency. Choose the method that suits you best.

– Bank Transfer: This is often the cheapest option, but it can take a few days to process.

– Credit/Debit Card: This is faster but may incur higher fees.

– Crypto Deposit: If you already own cryptocurrencies, you can deposit them directly into your exchange wallet. - Follow Instructions: If depositing fiat currency, follow the instructions provided by the exchange to complete your deposit.

4. Place an Order to Buy blast crypto

With your account funded, you can now place an order to buy Blast. Here’s how:

- Go to the Trading Section: Navigate to the trading interface of the exchange, usually found under “Markets” or “Trade.”

- Select the Trading Pair: Look for the BLAST trading pair (e.g., BLAST/USD or BLAST/USDT) and select it. This will bring up the trading options for Blast.

- Choose Your Order Type: There are typically two types of orders:

– Market Order: This buys Blast at the current market price. It’s quick and straightforward but may lead to slippage if the market is volatile.

– Limit Order: This allows you to specify the price at which you want to buy Blast. The order will only execute if the market reaches your specified price. - Enter the Amount: Input how much BLAST you wish to purchase. The exchange will calculate the total cost based on your order type.

- Confirm the Order: Review the details of your order and confirm the purchase. Once executed, the BLAST will appear in your exchange wallet.

5. Secure Your Coins in a Wallet

After purchasing Blast, it’s crucial to store your coins securely. While exchanges are convenient for trading, they are also potential targets for hackers. Here’s how to secure your BLAST:

- Choose a Wallet: There are several types of wallets to consider:

– Software Wallets: These are apps or programs on your computer or mobile device. Examples include MetaMask or Trust Wallet.

– Hardware Wallets: These are physical devices that store your crypto offline, offering a higher level of security. Examples include Ledger and Trezor.

– Paper Wallets: A less common method where you generate and print your keys offline. - Transfer Your BLAST: After setting up your wallet, go back to the exchange and navigate to the withdrawal section. Enter your wallet address (make sure it’s the correct one for BLAST) and confirm the transfer.

- Backup Your Wallet: If using a software or hardware wallet, ensure you back up your recovery phrase securely. This will allow you to recover your funds if you lose access to your wallet.

By following these steps, you can successfully buy and secure your Blast (BLAST) cryptocurrency, paving the way for your entry into the world of digital assets.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Unique Yield Generation

One of the standout features of Blast (BLAST) is its ability to generate native yields for both Ethereum (ETH) and stablecoins. Unlike many other Layer 2 (L2) solutions, which typically offer no interest, Blast provides an attractive yield of 3.4% for ETH and 8% for stablecoins. This yield is generated through ETH staking and Real-World Asset (RWA) protocols, which not only incentivizes users to hold their assets on the platform but also makes it a more appealing option for investors seeking passive income.

Robust Ecosystem for Developers

Blast positions itself as a developer-friendly platform with several innovative features. The introduction of gas revenue sharing and native yield allows decentralized application (Dapp) developers to create more competitive products and business models. This creates an attractive environment for builders, potentially leading to a richer ecosystem of applications that can drive user engagement and adoption.

Strong Community Engagement

Blast has initiated various programs aimed at community engagement, including an airdrop for early access members and developers. These strategies not only reward initial supporters but also foster a sense of community ownership and participation in the platform’s future. Such community-driven initiatives can lead to increased loyalty and long-term growth, as users feel invested in the success of the project.

Scalability and Cost Efficiency

As an Ethereum Layer 2 solution utilizing optimistic rollup technology, Blast aims to improve transaction speed and reduce costs on the Ethereum network. This scalability is crucial for attracting users and developers, as it allows for a smoother experience when interacting with Dapps. The potential for lower transaction fees can also make Blast an appealing choice for users, especially in a market where transaction costs can be a significant barrier to entry.

Integration with Real-World Assets

Blast’s focus on Real-World Assets (RWA) opens up new avenues for investment and application within the blockchain space. By connecting blockchain technology with tangible assets, Blast creates opportunities for tokenization and synthetic asset trading. This integration can bridge the gap between traditional finance and the decentralized world, attracting a broader audience and increasing the utility of the platform.

Potential Risks and Challenges (The Bear Case)

Market Volatility

The cryptocurrency market is notoriously volatile, and Blast is no exception. Prices can fluctuate dramatically due to various factors, including market sentiment, macroeconomic conditions, and regulatory news. Such volatility can pose significant risks for investors, particularly those who may be new to the cryptocurrency space. It’s essential to consider that the value of BLAST could decrease rapidly, leading to potential losses for holders.

Regulatory Uncertainty

As with many cryptocurrencies, regulatory uncertainty looms over Blast. Different countries have varying approaches to cryptocurrency regulation, which can affect the project’s operations and user adoption. Stricter regulations could hinder growth or lead to increased compliance costs. Moreover, regulatory scrutiny could impact the platform’s ability to offer yield-generating products, particularly those linked to traditional financial instruments.

Intense Competition

Blast operates in a crowded space, competing with other Ethereum Layer 2 solutions and DeFi platforms. Many of these competitors offer similar services, which could dilute Blast’s market share. The success of Blast will depend on its ability to differentiate itself from rivals and attract both users and developers. If it fails to establish a unique value proposition or keep pace with advancements made by competitors, its growth potential could be stunted.

Technological Risks

While optimistic rollup technology offers scalability advantages, it is not without its risks. The reliance on this technology requires robust security measures to prevent vulnerabilities that could be exploited by malicious actors. Any technical flaws or security breaches could undermine user confidence and lead to significant financial losses. Furthermore, the complexity of integrating RWAs into the blockchain could present additional challenges, potentially delaying development or leading to unforeseen issues.

Market Adoption and User Retention

The long-term success of Blast depends on its ability to attract and retain users. While the current yield offerings and developer incentives may be appealing, they do not guarantee sustained interest or engagement. User adoption can be influenced by many factors, including market trends, the emergence of new technologies, and overall market conditions. If Blast fails to maintain a strong user base or adapt to changing market dynamics, its growth trajectory could be negatively impacted.

Conclusion

In summary, Blast (BLAST) presents a compelling case for investment with its unique yield generation, developer incentives, and innovative approach to real-world asset integration. However, potential investors must also consider the inherent risks associated with market volatility, regulatory uncertainty, competition, and technological challenges. As with any investment, thorough research and a balanced perspective are essential when evaluating the potential of Blast in the evolving cryptocurrency landscape.

Frequently Asked Questions (FAQs)

1. What is Blast crypto?

Blast (BLAST) is an Ethereum Layer 2 (L2) scaling solution that offers unique features such as native yield for both Ethereum (ETH) and stablecoins. Unlike many other L2 platforms that do not provide any yield, Blast offers a 3.4% yield on ETH and an 8% yield on stablecoins. This yield is generated through ETH staking and Real-World Asset (RWA) protocols, automatically distributed back to users. Blast also enables developers to create competitive decentralized applications (Dapps) by providing them with innovative building blocks, including gas revenue sharing.

2. Who created Blast crypto?

Blast was founded by Tieshun Roquerre, also known as Pacman. His vision has been pivotal in shaping Blast into a platform that not only offers yield generation but also empowers developers through unique incentives and governance opportunities. Roquerre’s leadership has helped position Blast as a distinctive player within the crowded cryptocurrency landscape.

3. What makes Blast crypto different from Bitcoin?

While both Blast and Bitcoin operate on blockchain technology, they serve different purposes and utilize different mechanisms. Bitcoin is primarily a decentralized digital currency designed for peer-to-peer transactions and store of value. In contrast, Blast is an Ethereum Layer 2 solution that enhances the functionality of the Ethereum blockchain by offering yield on holdings and facilitating the development of decentralized applications. Additionally, Blast provides features like gas revenue sharing and native yield, which Bitcoin does not offer.

4. Is Blast crypto a good investment?

As with any investment, determining whether Blast is a good choice depends on individual financial goals, risk tolerance, and market conditions. Blast’s unique features, such as the ability to earn yield on both ETH and stablecoins, may appeal to investors looking for passive income opportunities. However, potential investors should conduct thorough research, consider market volatility, and evaluate Blast’s long-term viability before making any investment decisions.

5. How can I buy Blast crypto?

Blast can be purchased on several cryptocurrency exchanges. To buy Blast, you typically need to create an account on a supported exchange, complete any necessary identity verification, deposit funds, and then place an order for BLAST tokens. It’s important to ensure that you are using a reputable exchange and to consider transferring your tokens to a secure wallet for safekeeping after purchase.

6. What are the key features of Blast?

Blast offers several key features that set it apart from other Layer 2 solutions:

– Native Yield: Users can earn a 3.4% yield on ETH and 8% on stablecoins.

– Optimistic Rollup Technology: This enhances transaction speed and reduces costs while maintaining security through the Ethereum mainnet.

– Developer Incentives: Blast shares gas fee revenue with developers, encouraging innovation and competitive Dapp development.

– Governance Opportunities: Token holders can participate in the governance of the protocol, influencing its future direction.

7. What are the real-world applications of Blast?

Blast has various real-world applications, primarily in the decentralized finance (DeFi) space. It enables the creation of consumer-focused Dapps, NFT collections, and community tokens. Additionally, Blast serves as a decentralized launchpad for new blockchain projects, supports the tokenization of real-world assets, and aims to bridge traditional finance with blockchain technology. These applications contribute to its growing ecosystem and utility.

8. What is the current market status of Blast?

As of now, Blast (BLAST) has a market capitalization of approximately $107.99 million, with a circulating supply of about 45.4 billion BLAST tokens out of a total supply of 100 billion. The price of BLAST is around $0.002378, reflecting a slight decrease of 0.09% over the last 24 hours. Market conditions can fluctuate, so it’s advisable to monitor real-time data and trends when considering engagement with the asset.

Final Verdict on blast crypto

Overview of Blast Crypto

Blast (BLAST) is an innovative Ethereum Layer 2 (L2) solution that stands out by providing native yield for both Ethereum (ETH) and stablecoins. This yield is generated through ETH staking and Real-World Asset (RWA) protocols, allowing users to earn an attractive 3.4% on ETH and 8% on stablecoins. By leveraging optimistic rollup technology, Blast enhances the transaction speed and reduces costs while ensuring the security of the Ethereum mainnet. This unique combination of features positions Blast as a compelling option for both users seeking passive income and developers looking to create competitive decentralized applications (Dapps).

Potential and Risks

The Blast ecosystem offers significant potential for growth, particularly in the decentralized finance (DeFi) sector. Its approach to yield generation, governance opportunities for token holders, and revenue-sharing model for developers create a vibrant environment for innovation. Additionally, initiatives like the Blast Community Airdrop and the Big Bang program aim to further engage and expand its user base, fostering a strong community around the platform.

However, it is important to note that investing in Blast, like any cryptocurrency, carries inherent risks. The market is highly volatile, and while the potential for high returns exists, so does the possibility of substantial losses. Investors should be aware that the cryptocurrency landscape is characterized by rapid changes and regulatory uncertainties that may impact the performance of assets like Blast.

Final Thoughts

In conclusion, Blast represents a unique entry in the Layer 2 ecosystem, offering innovative features and potential for both users and developers. However, it is crucial to approach this high-risk, high-reward asset class with caution. We encourage you to conduct your own thorough research (DYOR) before making any investment decisions. Understanding the underlying technology, market dynamics, and your own risk tolerance will be key to navigating the exciting yet unpredictable world of cryptocurrencies.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.