Should You Invest in biconomy coin? A Full Analysis (2025)

An Investor’s Introduction to biconomy coin

Biconomy Coin, known by its ticker symbol BICO, is a prominent digital asset within the cryptocurrency ecosystem, specifically designed to enhance the user experience of decentralized applications (DApps). As a multichain relayer protocol, Biconomy aims to bridge the gap between traditional Web2 applications and the evolving Web3 landscape, making interactions with blockchain technology more seamless and user-friendly. Its focus on transaction management and gas optimization positions it as a critical player in the decentralized finance (DeFi) sector, addressing common pain points that users encounter when engaging with blockchain technologies.

In an era where decentralized finance is gaining traction, Biconomy stands out by allowing users to conduct transactions without the burden of gas fees—a major hurdle that often deters new users from exploring DApps. By employing innovative solutions such as meta transactions, Biconomy enables users to submit transactions with zero gas costs, while a third party covers the fees. This unique approach not only simplifies the user onboarding process but also enhances the overall efficiency of transactions across multiple blockchains.

This guide aims to provide a comprehensive resource for both beginners and intermediate investors interested in Biconomy Coin. It will cover various aspects of the cryptocurrency, including its underlying technology, tokenomics, investment potential, risks associated with trading, and practical steps on how to purchase BICO. By delving into these topics, this guide seeks to equip readers with the knowledge necessary to make informed decisions regarding their investment in Biconomy Coin.

Understanding BICO’s role in the broader crypto market is essential for potential investors. With a total supply of 1 billion coins and a market cap of approximately $95 million, BICO’s value is influenced by its utility within the Biconomy ecosystem and its adoption by various DApps. As the cryptocurrency market continues to evolve, Biconomy’s innovative solutions may play a significant role in shaping the future of decentralized applications and finance.

In summary, Biconomy Coin is not just another digital asset; it represents a significant advancement in the quest for user-friendly blockchain solutions. Whether you are a seasoned investor or new to the world of cryptocurrencies, this guide will serve as your roadmap to understanding and engaging with Biconomy Coin effectively.

What is biconomy coin? A Deep Dive into its Purpose

Understanding Biconomy Coin (BICO)

Biconomy Coin (BICO) is the native utility token of the Biconomy protocol, a multichain relayer system designed to simplify and enhance the user experience on decentralized applications (DApps). In an ecosystem where user onboarding and transaction processes can often be cumbersome, Biconomy aims to bridge the gap between traditional web applications and the evolving world of web3.

The Core Problem It Solves

The primary challenge that Biconomy addresses is the complexity associated with using DApps. Unlike traditional web applications, which typically require no additional fees or extensive technical knowledge, DApps often involve intricate processes, including the payment of gas fees, the need for specific tokens, and understanding blockchain nuances. These barriers can deter new users from engaging with decentralized platforms.

Biconomy tackles these challenges through several innovative solutions:

-

Gas Fee Management: Biconomy allows users to pay gas fees in various ERC-20 tokens rather than being restricted to the native cryptocurrency of the blockchain (such as ETH on Ethereum). This flexibility significantly enhances user experience and removes the necessity to hold multiple tokens just for transaction fees.

-

Meta Transactions: The protocol utilizes meta transactions, which enable users to submit transactions without the need to pay gas fees upfront. In this scenario, a third party covers the transaction costs, allowing users to interact with DApps seamlessly. This model not only simplifies the process but also makes it more cost-effective.

-

Streamlined Onboarding: Biconomy provides infrastructure that allows protocols to onboard users without requiring them to navigate the complexities of blockchain technology. This includes avoiding network changes and transaction confirmations that can often be time-consuming.

Overall, Biconomy’s solutions aim to reduce gas costs by up to 40% and enhance transaction speeds, making it easier for users to engage with DApps.

Its Unique Selling Proposition

Biconomy’s unique selling proposition lies in its focus on user experience and the seamless integration of its solutions into existing platforms. The protocol’s capabilities can be broken down into several key features:

-

Multichain Compatibility: Biconomy is designed to work across various blockchains, allowing users to interact with multiple DApps without the need to switch networks or wallets. This interoperability is crucial for fostering a more connected and user-friendly web3 environment.

-

Non-Custodial and Trustless: The Biconomy protocol is built to be non-custodial, meaning users retain control of their private keys. This security measure is essential in the cryptocurrency space, where trust and security are paramount.

-

Developer-Friendly Infrastructure: Biconomy offers a simple software development kit (SDK) that developers can integrate into their DApps with minimal effort. This ease of integration encourages more projects to adopt Biconomy’s solutions, further enhancing its utility and reach within the ecosystem.

-

Governance and Staking Opportunities: As the native token of the Biconomy network, BICO enables holders to participate in governance decisions, such as protocol upgrades and the allocation of treasury funds. Additionally, BICO can be staked, providing users with rewards while contributing to the network’s security.

The Team and Backers

Biconomy was founded by a diverse team of blockchain entrepreneurs with extensive experience in the industry. The co-founders include:

-

Ahmed Al-Balaghi: An alumnus of Queen Mary University, Ahmed has a background in blockchain technology with experience in China, the UK, and the UAE. His previous work at Viewfin, a leading Chinese blockchain company, has equipped him with valuable insights into the market.

-

Sachin Tomar: With a strong foundation in software engineering, Sachin contributes his technical expertise to the project, ensuring that Biconomy’s solutions are both innovative and practical.

-

Aniket Jindal: Aniket has a history of working on various blockchain projects in the UAE, bringing a wealth of knowledge about the intricacies of the industry.

Biconomy has garnered support from notable blockchain venture capitalists, including Coinbase Ventures, Binance Launchpad, and Mechanism Capital. This backing not only provides financial resources but also lends credibility to the project, positioning it as a significant player in the evolving landscape of decentralized finance (DeFi) and web3 applications.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Biconomy and its native token, BICO, is to create a more accessible and user-friendly environment for interacting with DApps. By eliminating the complexities associated with blockchain transactions, Biconomy aims to drive mass adoption of decentralized technologies.

In a broader context, Biconomy contributes to the ongoing evolution of the crypto ecosystem by:

-

Promoting Decentralization: By enabling users to engage with DApps without the need for extensive knowledge of blockchain mechanics, Biconomy fosters a decentralized web that is more inclusive.

-

Enhancing User Engagement: With its solutions, Biconomy encourages more users to explore decentralized finance, gaming, and social platforms, thus increasing overall engagement in the crypto space.

-

Facilitating Innovation: By providing developers with a robust infrastructure, Biconomy encourages the creation of new and innovative DApps, further enriching the ecosystem.

In conclusion, Biconomy Coin (BICO) stands out as a vital asset in the cryptocurrency landscape. By addressing the fundamental pain points associated with using decentralized applications and fostering an inclusive environment, Biconomy plays a crucial role in shaping the future of web3 technology. As the project continues to evolve, its impact on user adoption and engagement in the crypto ecosystem is likely to grow, making it a noteworthy consideration for both beginners and experienced investors alike.

The Technology Behind the Coin: How It Works

Overview of Biconomy

Biconomy is designed as a multichain relayer protocol that aims to simplify the interaction between users and decentralized applications (DApps). By providing a seamless experience akin to traditional web applications, Biconomy addresses several challenges faced by users in the Web3 space. The core technology behind Biconomy revolves around transaction management and gas optimization, enabling users to engage with DApps without the complexities typically associated with blockchain technology.

Blockchain Architecture

Biconomy operates primarily on the Ethereum blockchain, but it is designed to be multichain compatible. This means that it can interact with various blockchain networks, allowing users to perform transactions across different platforms without needing to switch networks or wallets. Here are some key components of its architecture:

-

Relayer Infrastructure: At the heart of Biconomy’s architecture is its relayer network. This network acts as an intermediary that facilitates transactions on behalf of users. When a user initiates a transaction, instead of directly interacting with the blockchain, the transaction request is sent to a relayer. The relayer then processes the transaction and submits it to the blockchain, covering the gas fees in the process.

-

Meta Transactions: Biconomy employs a technology called meta transactions, which allows users to submit transactions without paying gas fees upfront. In a typical blockchain transaction, users need to hold the native cryptocurrency (like ETH for Ethereum) to pay for gas fees. However, with meta transactions, users can sign a transaction and send it to the relayer, which pays the gas fees on their behalf. This feature significantly lowers the barrier to entry for new users, who may not be familiar with holding or managing cryptocurrencies.

-

Cross-Chain Compatibility: Biconomy’s architecture supports multiple blockchain networks, enabling users to perform transactions across different ecosystems seamlessly. This is achieved through standardized interfaces and protocols that allow the Biconomy infrastructure to communicate with various blockchains.

Consensus Mechanism

Biconomy itself does not have a unique consensus mechanism as it primarily operates on existing blockchains like Ethereum. However, understanding the underlying consensus mechanisms of these blockchains is essential:

-

Ethereum’s Proof of Stake (PoS): As of Ethereum 2.0, the network transitioned from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism. In PoS, validators are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This reduces the energy consumption associated with mining and enhances the overall security of the network.

-

Benefits of PoS for Biconomy: By leveraging Ethereum’s PoS, Biconomy benefits from faster transaction confirmation times and lower fees compared to traditional PoW systems. This allows Biconomy to offer a more efficient and cost-effective service to its users.

Key Technological Innovations

Biconomy introduces several innovative technologies that significantly enhance the user experience in decentralized applications:

-

Gas Optimization: One of the primary focuses of Biconomy is to reduce gas costs for users. The protocol can reduce gas fees by up to 40% through its relayer infrastructure. By aggregating transactions and optimizing the gas fee structure, Biconomy ensures that users spend less on fees, making DApps more accessible.

-

User-Friendly Onboarding: Biconomy simplifies the onboarding process for new users. Traditional blockchain applications often require users to navigate complex wallet setups, gas management, and transaction signing. Biconomy’s solution allows users to interact with DApps without needing to understand these complexities, thereby lowering the learning curve for newcomers.

-

ERC-20 Gas Payments: Users can pay gas fees in any ERC-20 token of their choice, rather than being restricted to the native cryptocurrency of the blockchain (like ETH). This flexibility enables users to manage their assets more efficiently and avoid holding unnecessary amounts of ETH just for gas fees.

-

Non-Custodial Transactions: Biconomy emphasizes security by ensuring that all transactions are non-custodial. Users maintain control over their private keys, and the relayer only facilitates the submission of transactions. This architecture reduces the risks associated with centralized exchanges or custodial wallets, where users must trust a third party with their assets.

Use Cases and Applications

Biconomy’s technology has been adopted by various decentralized applications and protocols, showcasing its versatility and effectiveness:

-

Curve Finance: Biconomy enables gasless BTC deposits on Curve Finance, allowing users to provide liquidity without incurring gas fees. This functionality enhances user experience and encourages more users to participate in liquidity provisioning.

-

Perpetual Protocol: By utilizing Biconomy, Perpetual Protocol offers gasless trading on the xDAI chain. Users can execute trades without worrying about gas fees, making trading more accessible and user-friendly.

-

Decentral Games: In the gaming sector, Biconomy provides a seamless experience for players by removing gas fees. Players can engage in games without needing to hold MATIC or any other blockchain-specific tokens, simplifying the gaming experience.

-

Sapien Network: This social blogging platform leverages Biconomy to enable gasless transactions for new bloggers. Users can transact with SPN tokens without needing to manage gas fees, thereby fostering a more inclusive environment for content creators.

Future Developments and Vision

Biconomy aims to continue evolving its technology to address the growing needs of the decentralized ecosystem. Some of the future developments may include:

-

Decentralization: Biconomy plans to progressively decentralize its network to enhance security and trust. By distributing control among multiple nodes, Biconomy can reduce the risks associated with central points of failure.

-

Enhanced Interoperability: As the blockchain landscape continues to evolve, Biconomy aims to improve its cross-chain capabilities, allowing even more seamless interactions between different blockchain networks.

-

Developer Tools and SDKs: Biconomy is committed to providing robust tools for developers, enabling them to integrate the Biconomy infrastructure into their DApps easily. This will facilitate the adoption of Biconomy’s technology across a broader range of applications.

Conclusion

Biconomy represents a significant advancement in the blockchain space, focusing on enhancing user experience and accessibility for decentralized applications. By leveraging innovative technologies such as meta transactions, gas optimization, and a robust relayer infrastructure, Biconomy addresses many of the barriers that have hindered the widespread adoption of blockchain technology. As the ecosystem continues to evolve, Biconomy’s commitment to improving user interactions will play a crucial role in shaping the future of Web3.

Understanding biconomy coin Tokenomics

Biconomy Coin (BICO) is the native utility token of the Biconomy protocol, designed to facilitate and enhance the user experience in decentralized applications (DApps). The tokenomics of BICO plays a crucial role in its ecosystem, affecting everything from governance and transaction fees to staking and rewards. Understanding its tokenomics is essential for both beginners and intermediate investors looking to navigate this digital asset effectively.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 1,000,000,000 BICO |

| Max Supply | 1,000,000,000 BICO |

| Circulating Supply | 979,332,576 BICO |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The utility of BICO is multifaceted, contributing significantly to the functionality and governance of the Biconomy protocol. Here are the primary uses of BICO:

-

Transaction Fees: BICO is used to pay transaction fees on the Biconomy network. This is particularly important as the protocol aims to reduce gas costs for users interacting with DApps. By allowing users to pay gas fees in various ERC-20 tokens, Biconomy enhances flexibility and reduces the friction typically associated with gas fees on Ethereum.

-

Governance: BICO holders have the ability to participate in governance decisions affecting the Biconomy protocol. This includes voting on proposals related to protocol upgrades, changes in fee structures, and allocation of treasury funds. This governance model ensures that the community has a voice in the evolution of the network.

-

Staking: Users can stake BICO tokens to earn rewards and help secure the network. Staking not only incentivizes users to hold onto their tokens but also contributes to the overall stability and security of the Biconomy ecosystem. Rewards for staking are typically distributed in BICO, creating an additional incentive for token holders.

-

Incentives for Node Operators: Node operators on the Biconomy network are required to pay transaction fees in BICO when they add information to the blockchain. This creates a direct demand for the token and ensures that it is actively used within the ecosystem.

-

Access to Services: As Biconomy continues to expand its offerings, BICO may also be required for accessing new services and features on the platform, thereby increasing its utility over time.

Token Distribution

The distribution of BICO tokens is designed to align the interests of various stakeholders in the ecosystem, from the community to the founding team. Here’s a breakdown of the token distribution:

-

Community (38.12%): This portion is allocated to the community with a vesting schedule that includes 7.5% released at the token generation event (TGE) and a linear release over 47 months. This long-term distribution encourages community engagement and participation.

-

Foundation (10%): The foundation receives 10% at TGE, with a 12-month lockup followed by a 24-month linear release. This allocation supports the ongoing development and governance of the Biconomy protocol.

-

Team and Advisors (22%): This allocation includes a 12-month cliff followed by a 24-month linear release. This structure ensures that the team is incentivized to focus on the long-term success of the project.

-

Pre-seed Round (6%): Investors from the pre-seed round will see a 9-month lockup followed by a 27-month linear release, aligning their interests with the project’s growth.

-

Seed Round (6.38%): Similar to the pre-seed round, this allocation has a 9-month lockup followed by a 24-month linear release.

-

Private Round (12%): This allocation includes 10% at TGE, a 12-month lockup, and a 24-month linear release. Private investors play a crucial role in funding the project in its early stages.

-

Strategic Investors (0.5%): This small allocation is released with 10% at TGE and a 6-month lockup, followed by a 24-month linear release. These investors are typically key partners who can provide strategic advantages.

-

Public Sale (5%): This portion is allocated with 10% at TGE, a 6-month lockup, and a 3-month linear release. This ensures that early adopters and public investors have access to BICO while also aligning their incentives with the project’s long-term goals.

Conclusion

The tokenomics of Biconomy Coin (BICO) is structured to ensure a balanced and sustainable ecosystem. With a total supply of 1 billion tokens, the utility of BICO spans transaction fees, governance, staking, and incentivizing node operators, making it an integral part of the Biconomy protocol. The thoughtful distribution model not only fosters community engagement but also aligns the interests of all stakeholders, from the founding team to investors and users. Understanding these aspects will help investors make informed decisions about their involvement with Biconomy and its native token, BICO.

Price History and Market Performance

Key Historical Price Milestones

Biconomy (BICO) has experienced significant price fluctuations since its inception. Understanding these key historical price milestones can provide insight into the asset’s market behavior and investor sentiment.

-

Initial Launch and Early Trading: Biconomy was launched in October 2021. The initial trading price was relatively low, as is typical for many new cryptocurrencies. The token gained traction rapidly, reflecting growing interest in its utility as a multichain relayer protocol designed to enhance user experiences in decentralized applications.

-

All-Time High: The peak price for BICO occurred on December 2, 2021, when it reached an impressive $21.87. This spike can be attributed to a combination of factors including increased adoption of decentralized finance (DeFi) applications, strong market sentiment towards altcoins, and overall bullish trends in the broader cryptocurrency market at the time. The launch of new features and partnerships may have also contributed to the heightened interest and price surge.

-

Subsequent Declines: After reaching its all-time high, BICO saw a significant decline in value, as is common in the volatile cryptocurrency market. By early 2022, the price began to retract sharply, reflecting broader market corrections that affected numerous cryptocurrencies. This downward trend continued, with the price dropping to approximately $0.10 by late 2022, marking a decline of over 99% from its peak.

-

All-Time Low: The price of BICO reached its all-time low of $0.07712 on June 22, 2023. This period was characterized by a general downturn in the cryptocurrency market, with many projects experiencing similar declines. The low price point also highlighted investor caution amidst regulatory challenges and macroeconomic factors affecting the crypto ecosystem.

-

Recent Performance: As of October 2023, BICO is trading around $0.09724, with a market capitalization of approximately $95.23 million. The token has seen a slight recovery from its all-time low, with a 24-hour trading volume of around $5.06 million. The price has fluctuated between $0.09535 and $0.09838 over recent days, indicating a relatively stable trading range compared to its historical volatility.

Factors Influencing the Price

Historically, the price of Biconomy has been influenced by various factors that reflect both internal developments within the project and broader market trends.

-

Market Sentiment and Trends: Like many cryptocurrencies, BICO’s price has been heavily influenced by overall market sentiment. Periods of bullish sentiment, often driven by positive news in the cryptocurrency space or significant technological advancements, have led to price increases. Conversely, bearish trends, often spurred by negative news or macroeconomic factors, have resulted in price declines.

-

Adoption and Use Cases: The utility of Biconomy as a relayer protocol has directly impacted its price. The more decentralized applications (DApps) and protocols that adopt Biconomy’s technology, the greater the demand for BICO tokens, leading to potential price increases. Partnerships with well-known DeFi projects, such as Curve Finance and Perpetual Protocol, have historically boosted investor confidence and interest in BICO.

-

Market Dynamics: The cryptocurrency market is characterized by high volatility, and BICO is no exception. The price has been influenced by trading volumes, the number of active users, and liquidity on various exchanges. Higher trading volumes can lead to more significant price movements, while low liquidity can result in sharp price drops.

-

Regulatory Environment: Regulatory developments have also played a role in shaping investor sentiment towards BICO and the broader cryptocurrency market. News of impending regulations or government actions can lead to uncertainty, causing price fluctuations as investors react to potential risks.

-

Technological Developments: Biconomy’s ongoing improvements and updates to its platform can significantly influence its price. Announcements regarding upgrades, new features, or successful implementations of the protocol in various projects can drive interest and potentially lead to price increases.

-

Investor Behavior: The behavior of retail and institutional investors can also impact BICO’s price. As more investors become aware of the potential use cases for Biconomy, increased demand can drive the price up. Conversely, profit-taking or panic selling during market downturns can lead to rapid price declines.

Conclusion

Biconomy’s price history reflects a journey marked by significant highs and lows, influenced by various internal and external factors. Understanding these historical price milestones and the elements that have shaped market performance can provide valuable context for both new and seasoned investors. As the cryptocurrency market continues to evolve, Biconomy’s role in enhancing user experiences on decentralized applications will be a key area to watch for potential future developments.

Where to Buy biconomy coin: Top Exchanges Reviewed

5. ChangeNOW – Your Go-To for Biconomy at Unbeatable Prices!

ChangeNOW stands out as a premier platform for exchanging Biconomy (BICO) due to its competitive pricing, user-friendly interface, and commitment to transparency. With a high rating of 4.8 from over 2,100 users, it offers real-time market data, including live charts and market cap, ensuring that users can make informed trading decisions. Additionally, the platform’s fee-free transactions enhance its appeal for both novice and experienced investors looking to buy or sell BICO seamlessly.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Biconomy – Simplifying Transactions Made Easy!

Kraken stands out as a user-friendly exchange for purchasing Biconomy (BICO), allowing users to start investing with as little as $10. It offers multiple convenient payment options, including credit/debit cards, ACH deposits, and mobile payment methods like Apple and Google Pay, making the buying process accessible for both beginners and experienced investors. This flexibility, combined with Kraken’s robust security features, positions it as a reliable platform for acquiring digital assets.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

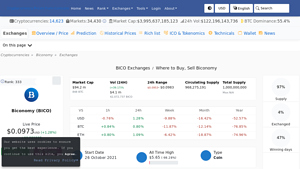

3. Biconomy (BICO) – Streamlining Your Crypto Transactions!

Biconomy (BICO) is gaining traction in the crypto market, with over 35 exchanges offering trading options, including prominent platforms like Binance, Gate, and HTX. What sets Biconomy apart is its focus on enhancing user experience through efficient transaction solutions and lower fees, making it an appealing choice for both novice and experienced traders. This accessibility across multiple exchanges further contributes to its growing popularity in the digital asset space.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

How to Buy biconomy coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

To buy Biconomy (BICO), the first step is selecting a reputable cryptocurrency exchange that supports the trading of BICO. Some popular exchanges where you can find Biconomy include:

- Coinbase: Known for its user-friendly interface, it’s suitable for beginners.

- Binance: Offers a wide variety of trading pairs and lower fees.

- Kraken: Provides a secure platform with various features for both beginners and advanced traders.

- KuCoin: Known for listing numerous altcoins, including BICO.

When choosing an exchange, consider factors such as security measures, transaction fees, supported payment methods, and user reviews.

2. Create and Verify Your Account

Once you have selected an exchange, you will need to create an account. Here’s how to do it:

- Visit the Exchange’s Website: Go to the official website of the exchange you chose.

- Sign Up: Look for the “Sign Up” or “Register” button and click on it.

- Provide Information: Fill in the required information, including your email address, password, and any other necessary details.

- Verify Your Email: Check your email for a verification link sent by the exchange. Click on this link to verify your account.

- Complete KYC (Know Your Customer): Most exchanges require you to complete KYC verification. This may involve uploading identification documents (like a passport or driver’s license) and providing personal information (like your address and date of birth). This process may take some time, depending on the exchange’s policies.

3. Deposit Funds

After your account is verified, you will need to deposit funds to purchase Biconomy. Here’s how to do it:

- Navigate to the Deposit Section: Log into your account and find the “Deposit” or “Funds” section on the exchange.

- Select Your Deposit Method: Choose how you want to deposit funds. Most exchanges offer several options, including bank transfers, credit/debit cards, and cryptocurrency deposits.

- Follow Instructions: If you choose a bank transfer or card payment, follow the instructions provided by the exchange. For cryptocurrency deposits, you will receive a wallet address to send your funds to.

- Confirm the Deposit: Once you have initiated the deposit, wait for the funds to appear in your exchange account. Depending on the method used, this may take a few minutes to several days.

4. Place an Order to Buy Biconomy Coin

With funds available in your account, you can now buy Biconomy. Follow these steps:

- Find Biconomy on the Exchange: Use the search function to locate the BICO trading pair (e.g., BICO/USD, BICO/ETH).

- Select the Trading Pair: Click on the BICO trading pair to open the trading interface.

- Choose Your Order Type: Decide whether you want to place a market order (buying BICO at the current market price) or a limit order (setting a specific price at which to buy).

– Market Order: Enter the amount of BICO you want to buy and confirm the order. This type of order is executed immediately at the best available price.

– Limit Order: Set the price at which you want to buy BICO, enter the amount, and submit the order. This order will execute only when the market price reaches your set price. - Review and Confirm: Double-check the details of your order before confirming the purchase.

5. Secure Your Coins in a Wallet

After purchasing Biconomy, it’s essential to secure your coins. Here’s how:

- Choose a Wallet: You can store your BICO in various types of wallets:

– Software Wallets: These are applications that can be installed on your computer or mobile device (e.g., MetaMask, Trust Wallet).

– Hardware Wallets: Physical devices that store your cryptocurrency offline (e.g., Ledger, Trezor). These are considered more secure.

– Exchange Wallets: While convenient, it is generally safer to transfer your BICO to a private wallet. - Transfer Your BICO: If you choose a wallet outside of the exchange, you will need to transfer your BICO:

– Navigate to the withdrawal section of the exchange.

– Enter your wallet address and the amount of BICO you want to transfer.

– Confirm the transaction. - Backup Your Wallet: Ensure you back up your wallet’s recovery phrase or private keys securely. This step is crucial to recovering your funds in case you lose access to your wallet.

By following these steps, you will be able to buy and securely hold Biconomy (BICO) coins, paving the way for your involvement in the world of decentralized finance and applications.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Biconomy Coin (BICO) has emerged as a notable player in the cryptocurrency space, primarily due to its focus on enhancing user experiences within decentralized applications (DApps). The following sections outline several potential strengths that may make BICO an attractive investment option for both beginners and intermediate investors.

Innovative Technology

Biconomy operates as a multichain relayer protocol, which allows users to interact with DApps without the usual complexities associated with blockchain transactions. By leveraging meta transactions, Biconomy enables users to pay gas fees with various ERC-20 tokens rather than being restricted to native tokens of the blockchain, such as Ethereum (ETH). This flexibility can significantly enhance user onboarding and retention, making the platform more appealing to a broader audience.

Additionally, the protocol’s ability to reduce gas costs by up to 40% is a compelling feature that may draw in users who have previously hesitated to engage with DApps due to high transaction fees. The promise of faster transaction confirmations further enhances user experience, positioning Biconomy as a viable solution to existing web3 bottlenecks.

Strong Market Position and Partnerships

Biconomy has garnered attention and support from reputable venture capital firms, including Coinbase Ventures and Binance Launchpad. Such backing not only provides financial stability but also enhances credibility within the cryptocurrency ecosystem. The partnerships with various projects, including Curve Finance and Perpetual Protocol, demonstrate the practical application of Biconomy’s technology and its growing acceptance among other platforms. This widespread adoption can help bolster BICO’s market position and create a network effect that benefits all stakeholders.

Governance and Utility

BICO serves as the native utility token for the Biconomy network, allowing holders to participate in governance decisions and earn rewards through staking. This dual utility can attract investors looking for not only potential price appreciation but also active participation in the platform’s future developments. Governance tokens are increasingly valued in the decentralized finance (DeFi) space, as they empower communities to shape the direction of projects.

Market Demand for Simplified User Experiences

As the cryptocurrency market matures, there is a growing demand for user-friendly solutions that simplify blockchain interactions. Biconomy’s focus on making web3 applications as intuitive as web2 applications aligns well with this trend. If the platform can effectively capture and retain users who are new to blockchain technology, it could experience substantial growth in user adoption, which may positively influence BICO’s value.

Potential Risks and Challenges (The Bear Case)

While Biconomy Coin presents numerous potential strengths, it is essential to consider the risks and challenges that could impact its future performance. Below are several factors that investors should be aware of.

Market Volatility

The cryptocurrency market is known for its extreme volatility, and BICO is no exception. Price fluctuations can be influenced by various factors, including market sentiment, macroeconomic conditions, and technological advancements. Investors should be prepared for the possibility of significant price swings, which can lead to both substantial gains and losses. This inherent volatility can make BICO a risky investment, especially for those who may not have the financial resilience to weather such fluctuations.

Regulatory Uncertainty

Regulatory frameworks surrounding cryptocurrencies are still evolving, and Biconomy is not insulated from these changes. Governments around the world are grappling with how to regulate digital assets, which could affect the operations and adoption of Biconomy’s platform. For instance, stricter regulations on DeFi platforms or the use of utility tokens could hinder BICO’s growth prospects. Investors should remain informed about potential regulatory developments that may impact Biconomy and the broader cryptocurrency market.

Competition

The blockchain space is highly competitive, with numerous projects vying for market share in the DeFi sector. Biconomy faces competition from other relayer protocols, layer-2 solutions, and existing DApps that aim to enhance user experiences. Some competitors may offer similar functionalities, potentially diluting Biconomy’s unique selling proposition. The ability of Biconomy to differentiate itself and maintain a competitive edge will be crucial for its long-term success and adoption.

Technological Risks

As a technology-driven platform, Biconomy is not immune to technological risks. Issues such as software bugs, security vulnerabilities, and scalability challenges can arise, potentially affecting the platform’s reliability and user experience. While Biconomy has undergone audits from reputable firms, the dynamic nature of blockchain technology means that new vulnerabilities can emerge over time. Investors should consider the potential implications of technological failures and the company’s ability to address them promptly.

Market Sentiment and Speculation

Cryptocurrency investments are often driven by market sentiment and speculation rather than fundamental value. The popularity of a project can wax and wane based on social media trends, news cycles, and general market enthusiasm. Biconomy’s price may be subject to irrational fluctuations driven by hype or fear, making it challenging to gauge its true value based on traditional investment metrics. Investors should be cautious of the speculative nature of the cryptocurrency market and be prepared for potential emotional and psychological impacts on their investment decisions.

Conclusion

Biconomy Coin presents a unique value proposition with its innovative technology aimed at simplifying the user experience within decentralized applications. While its strengths, including strong partnerships, governance utility, and market demand for user-friendly solutions, position it favorably, investors must also be mindful of the inherent risks associated with market volatility, regulatory uncertainty, competition, technological challenges, and speculative market behavior.

As with any investment, thorough research, a clear understanding of the associated risks, and a long-term perspective are crucial when considering an investment in Biconomy Coin. While the potential for growth exists, so too do the challenges that could impact its journey in the ever-evolving cryptocurrency landscape.

Frequently Asked Questions (FAQs)

1. What is Biconomy Coin (BICO)?

Biconomy Coin (BICO) is the native utility token of the Biconomy protocol, which is designed to enhance user interactions with decentralized applications (DApps) across multiple blockchains. Biconomy focuses on transaction management and gas optimization, allowing users to perform transactions without needing to pay gas fees in the traditional manner. Instead, users can pay gas fees in any ERC-20 token of their choice, making the process more user-friendly and accessible.

2. Who created Biconomy Coin?

Biconomy Coin was co-founded by an international team of blockchain entrepreneurs, including Ahmed Al-Balaghi, Sachin Tomar, and Aniket Jindal. This diverse team has experience across various global markets, including China, the UK, and the UAE. The project is also supported by prominent blockchain venture capitalists such as Coinbase Ventures and Binance Launchpad.

3. How does Biconomy work?

Biconomy utilizes a relayer infrastructure that addresses several challenges in the web3 ecosystem. By implementing meta transactions, users can submit transactions without paying gas fees upfront; instead, a third party covers these fees. This infrastructure allows for faster transaction confirmations and simplifies user onboarding by removing the complexities typically associated with blockchain interactions, such as network changes and gas payments.

4. What makes Biconomy different from Bitcoin?

While both Biconomy and Bitcoin operate on blockchain technology, their purposes and functionalities differ significantly. Bitcoin is primarily a digital currency used for peer-to-peer transactions and as a store of value. In contrast, Biconomy is a protocol aimed at enhancing the usability of DApps by providing a seamless transaction experience and enabling gasless transactions. Biconomy focuses on improving user experience in the web3 space rather than serving as a standalone currency.

5. Is Biconomy Coin a good investment?

As with any cryptocurrency, the potential for investment in Biconomy Coin (BICO) depends on various factors, including market trends, technological advancements, and the project’s adoption. BICO has experienced significant price fluctuations, including an all-time high of $23.80 in December 2021. Investors should conduct thorough research, consider their risk tolerance, and evaluate the project’s fundamentals before making investment decisions.

6. How many Biconomy Coins are in circulation?

The total supply of Biconomy Coins (BICO) is 1 billion. As of now, approximately 979.33 million BICO are in circulation, which represents about 98% of the total supply. This circulating supply plays a role in determining the token’s market cap and its availability for trading.

7. What are the use cases for Biconomy?

Biconomy has several practical use cases, particularly in enhancing the user experience on decentralized applications. For example, it enables gasless transactions on platforms like Curve Finance and Perpetual Protocol, allowing users to interact with these applications without worrying about gas fees. This technology can be applied across various sectors, including DeFi, gaming, and social platforms, making it versatile in the web3 ecosystem.

8. How is the Biconomy network secured?

The Biconomy network employs a non-custodial and trustless approach, where users retain control of their private keys. The smart contracts underlying the protocol have been audited by reputable firms such as Quantstamp and Certik, enhancing security. Additionally, Biconomy plans to progressively decentralize its operations to further bolster security and resilience against potential threats.

Final Verdict on biconomy coin

Overview of Biconomy Coin

Biconomy (BICO) is a multichain relayer protocol designed to simplify user interactions with decentralized applications (DApps). Its primary objective is to make Web3 products as user-friendly as traditional Web2 applications. Biconomy achieves this by addressing common bottlenecks in the blockchain space, such as high gas fees and complex onboarding processes. By utilizing meta transactions, Biconomy allows users to submit transactions without the need for gas fees, which can be paid in various ERC-20 tokens. This functionality is particularly beneficial for applications in decentralized finance (DeFi) and gaming, where user experience is crucial.

Technology and Functionality

The underlying technology of Biconomy focuses on transaction management and gas optimization, significantly reducing gas costs—by up to 40% in some cases. The protocol’s non-custodial infrastructure ensures that users retain control of their private keys while enabling seamless transactions across multiple blockchains. Additionally, Biconomy’s network has been audited by reputable firms, enhancing its security and reliability. With a total supply of 1 billion BICO tokens, these are used for transaction fees, staking, and governance, allowing token holders to participate in decision-making processes.

Investment Potential and Risks

As with any cryptocurrency, Biconomy presents both opportunities and risks. The asset has experienced significant volatility, with an all-time high of $23.80 in December 2021, dropping to around $0.097 today. This price fluctuation highlights the high-risk, high-reward nature of investing in BICO. While the project’s innovative approach to enhancing user experience in the blockchain ecosystem positions it well for future growth, potential investors should remain cautious.

Final Thoughts

In conclusion, Biconomy coin represents a promising investment opportunity within the cryptocurrency space, particularly for those interested in improving user interactions with DApps. However, due to its inherent volatility and the evolving nature of the blockchain industry, it is essential to approach this asset with due diligence. We strongly encourage you to conduct your own thorough research (DYOR) before making any investment decisions in Biconomy or any other cryptocurrency.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.