Should You Invest in axelar crypto? A Full Analysis (2025)

An Investor’s Introduction to axelar crypto

Axelar is an innovative blockchain protocol designed to facilitate secure and efficient cross-chain communication within the decentralized finance (DeFi) ecosystem. As a key player in the growing landscape of interoperability solutions, Axelar aims to address one of the most significant challenges in the cryptocurrency space: enabling seamless interactions between various blockchain networks. This functionality is crucial as it allows decentralized applications (dApps) to leverage the unique features and capabilities of multiple blockchains without being confined to a single network.

The Axelar network operates on a decentralized infrastructure, utilizing a proof-of-stake (PoS) consensus mechanism that enhances security and scalability. This unique architecture allows developers to create dApps that can interact with over 80 different blockchains, making it a versatile tool for those looking to build and deploy multi-chain solutions. With the rise of decentralized finance and the increasing demand for interoperability, Axelar’s role is becoming increasingly significant, providing a vital link between disparate blockchain ecosystems.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in Axelar crypto. Here, you will find detailed information covering various aspects of the Axelar ecosystem, including:

Technology Overview

Understanding the underlying technology of Axelar is essential for grasping its potential. This section will delve into the network’s architecture, its decentralized validator system, and the APIs that facilitate cross-chain communication.

Tokenomics

Axelar operates with its native token, AXL, which plays a crucial role in the ecosystem. This section will cover the token’s supply dynamics, distribution, and its utility within the Axelar network.

Investment Potential

Investing in Axelar offers unique opportunities and challenges. In this section, we will analyze the market performance of AXL, its historical price trends, and factors that could influence its future valuation.

Risks and Considerations

Every investment comes with its risks, and Axelar is no exception. This section will explore potential risks associated with investing in AXL, including market volatility, regulatory challenges, and technological vulnerabilities.

How to Buy Axelar

For those interested in investing in Axelar, this guide will provide a step-by-step overview of how to purchase AXL tokens, including where to buy them and tips for securing your investment.

By the end of this guide, you will have a well-rounded understanding of Axelar crypto, empowering you to make informed decisions regarding your investment in this promising blockchain project.

What is axelar crypto? A Deep Dive into its Purpose

Introduction to Axelar Crypto

Axelar is an innovative blockchain project that focuses on enabling seamless and secure cross-chain communication within the decentralized finance (DeFi) ecosystem. As the demand for interoperability among various blockchain networks continues to grow, Axelar provides a crucial infrastructure layer that facilitates interactions between decentralized applications (dApps) across multiple chains. This capability is essential for developers and users who wish to leverage the unique advantages of different blockchains without being confined to a single ecosystem.

The Core Problem It Solves

The primary challenge that Axelar addresses is the lack of interoperability between disparate blockchain networks. As the blockchain landscape expands, each network tends to develop its own protocols, standards, and governance mechanisms, making it increasingly difficult for dApps and users to interact across different chains. This fragmentation can lead to inefficiencies, increased costs, and a poor user experience.

For example, if a user wants to transfer assets from Ethereum to Solana, they often face hurdles such as high transaction fees, long confirmation times, and the need to use complex bridging solutions. These issues can deter both developers and users from fully embracing the decentralized web.

Axelar’s solution lies in its decentralized network, which provides a suite of tools, protocols, and Application Programming Interfaces (APIs) designed to facilitate secure cross-chain communication. By enabling seamless asset transfers and interactions across various blockchains, Axelar helps to eliminate the barriers that currently hinder the growth and adoption of DeFi applications.

Its Unique Selling Proposition

What sets Axelar apart from other interoperability solutions is its robust infrastructure that combines a decentralized network of validators, a software development kit (SDK) of protocols, and gateway smart contracts.

-

Decentralized Network: Axelar operates on a proof-of-stake (PoS) consensus mechanism, relying on a network of validators to secure transactions and communicate across chains. This decentralized approach enhances security and mitigates the risks associated with central points of failure.

-

Developer-Friendly Tools: Axelar provides a comprehensive SDK that allows developers to build cross-chain applications without the need to learn new programming languages or frameworks. This ease of use is a significant advantage, as it enables developers to focus on their core business logic rather than wrestling with complex interoperability issues.

-

Dynamic Validator Infrastructure: Unlike many existing solutions that rely on optimistic setups or federated multi-signature schemes, Axelar employs a dynamic validator model. This design not only enhances security but also improves scalability, making it easier for the network to handle a growing number of transactions and interactions.

-

Programmable Controls and Compliance: Axelar’s Interchain Token Service (ITS) allows for instant deployment of tokens across more than 80 blockchains, complete with programmable controls and built-in compliance measures. This feature is particularly appealing to institutional players who require high levels of regulatory compliance and security.

The Team and Backers

Axelar was founded in 2020 by Georgios Vlachos and Sergey Gorbunov, both of whom have extensive backgrounds in blockchain technology. Georgios was instrumental in designing the consensus protocol for Algorand, while Sergey has contributed to the standardization of BLS signatures, which are crucial for secure communications in blockchain networks. Their expertise and vision have been pivotal in shaping Axelar’s mission and capabilities.

In addition to the founding team, Axelar has attracted significant backing from top-tier investors, including Binance, Coinbase Ventures, Dragonfly Capital, and Polychain Capital. This strong financial support not only validates Axelar’s potential but also provides the necessary resources to accelerate its development and expand its ecosystem.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Axelar is to serve as a bridge between different blockchain networks, enabling a unified experience for users and developers. By simplifying the process of cross-chain interactions, Axelar plays a vital role in promoting the growth of decentralized applications and the broader DeFi ecosystem.

With Axelar, developers can build applications that tap into the unique features of various blockchains, such as speed, security, and smart contract capabilities, without being restricted to a single platform. This flexibility is crucial for fostering innovation and ensuring that developers can create the best solutions for their users.

Moreover, Axelar’s focus on institutional-grade security and compliance opens the door for traditional financial institutions and enterprises to participate in the blockchain space. By providing a secure and compliant entry point to the decentralized ecosystem, Axelar can help bridge the gap between traditional finance and the burgeoning world of DeFi.

Conclusion

In summary, Axelar stands out as a key player in the quest for interoperability within the blockchain ecosystem. By addressing the challenges of cross-chain communication, providing developer-friendly tools, and ensuring robust security, Axelar is well-positioned to facilitate the growth of decentralized applications and promote the widespread adoption of blockchain technology. With a talented founding team and strong backing from prominent investors, Axelar is poised to make a significant impact on the future of decentralized finance and the broader crypto landscape.

The Technology Behind the Coin: How It Works

Overview of Axelar’s Technology

Axelar is a decentralized network that facilitates secure cross-chain communication, allowing different blockchain ecosystems to interact seamlessly. This innovative approach addresses a critical challenge in the blockchain space: interoperability. In simpler terms, Axelar enables various blockchains to “speak” to one another, making it easier for developers to create decentralized applications (dApps) that can operate across multiple networks.

This guide will explore the key components of Axelar’s technology, including its blockchain architecture, consensus mechanism, and several technological innovations that set it apart in the crowded field of cryptocurrencies.

Blockchain Architecture

At its core, Axelar operates on a decentralized network of validators. This architecture is essential for ensuring security, scalability, and efficiency in cross-chain communication. Here’s how it works:

Decentralized Network of Validators

Axelar’s network consists of over 75 validators who are responsible for verifying transactions and maintaining the integrity of the network. Validators are nodes that confirm the validity of transactions, ensuring that only legitimate transactions are added to the blockchain.

The decentralized nature of the validator network means that there is no single point of failure, making it more resilient against attacks. In addition, the presence of multiple validators enhances the network’s overall security, as it would require a malicious actor to compromise a significant number of validators to alter any data.

Interchain Token Service (ITS)

One of the standout features of Axelar is its Interchain Token Service (ITS). This service allows developers to deploy tokens across 80+ blockchains instantly. Instead of launching a new token for each blockchain, developers can tokenize their assets once and distribute them across multiple chains. This significantly reduces operational complexity and speeds up the time to market for new projects.

The ITS also incorporates programmable controls, compliance features, and liquidity routing, making it easier for developers to manage their tokens efficiently while adhering to regulatory standards.

Consensus Mechanism

Axelar employs a Proof-of-Stake (PoS) consensus mechanism, which is a more energy-efficient alternative to traditional Proof-of-Work (PoW) systems. Understanding PoS is crucial for grasping how Axelar maintains security and performance.

How Proof-of-Stake Works

In a PoS system, validators are chosen to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. This means that the more tokens a validator stakes, the higher their chances of being selected to validate transactions and earn rewards.

The benefits of PoS include:

- Energy Efficiency: PoS does not require the extensive computational power that PoW systems do, making it more environmentally friendly.

- Incentives for Honesty: Validators have a financial stake in the network; if they act maliciously, they risk losing their staked tokens.

- Scalability: PoS networks can process transactions more quickly than PoW networks, which is essential for supporting high-demand applications.

Axelar’s PoS mechanism ensures that only trustworthy validators participate in the network, enhancing security while facilitating fast and efficient transaction processing.

Key Technological Innovations

Axelar introduces several technological innovations that distinguish it from other blockchain projects. These innovations contribute to its mission of enabling seamless cross-chain communication.

Gateway Smart Contracts

Gateway smart contracts are a crucial component of Axelar’s infrastructure. They act as bridges between different blockchains, facilitating the transfer of assets and data across chains. Here’s how they work:

-

Asset Transfer: When a user wants to transfer an asset from one blockchain to another, the gateway smart contract locks the asset on the source chain and issues a corresponding wrapped token on the destination chain. This process ensures that the original asset cannot be double-spent.

-

Secure Communication: The smart contracts ensure that messages and data can be securely transmitted between different blockchains, allowing dApps to operate seamlessly across various ecosystems.

-

Interoperability: By using gateway smart contracts, developers can create applications that leverage functionalities from multiple blockchains without needing to build complex integrations manually.

API Integration

Axelar provides a suite of APIs that simplify the development of cross-chain applications. These APIs allow developers to interact with the network easily, making it accessible to those who may not be blockchain experts. The key features of these APIs include:

-

Ease of Use: Developers can build applications on the blockchain of their choice while still accessing resources across different chains, all without needing to learn new programming languages.

-

Standardized Functions: The APIs provide standardized functions for executing cross-chain operations, reducing the complexity involved in building and deploying dApps.

Dynamic Validator Set

Unlike static validator sets used in many blockchain networks, Axelar employs a dynamic validator mechanism. This means that validators can join or leave the network based on performance and reliability. The benefits of this approach include:

-

Flexibility: A dynamic validator set can adapt to changing network conditions, ensuring that the most reliable validators are always participating in the consensus process.

-

Enhanced Security: By allowing for the continuous evaluation of validators, Axelar can remove underperforming or malicious validators more quickly, thereby maintaining the integrity of the network.

Use Cases and Real-World Applications

Axelar’s technology is designed to cater to a wide range of use cases across various sectors, including finance, decentralized finance (DeFi), and real-world asset tokenization. Here are some examples:

Decentralized Finance (DeFi)

Axelar’s cross-chain capabilities are particularly beneficial for DeFi applications that require liquidity from multiple sources. By using Axelar, developers can build DeFi platforms that allow users to trade assets across different blockchains, enhancing liquidity and user experience.

Real-World Assets (RWAs)

The ability to tokenize real-world assets and distribute them across multiple blockchains opens up new opportunities for asset management and investment. For instance, a company could tokenize its equity and allow investors to buy shares across different blockchain networks, increasing accessibility and market reach.

Institutional Use Cases

Axelar’s robust security and compliance features make it an attractive option for institutional investors looking to engage with the blockchain ecosystem. For example, J.P. Morgan’s Onyx platform utilizes Axelar for rebalancing large portfolios of tokenized assets across various chains, demonstrating the network’s capacity to meet institutional-grade requirements.

Conclusion

Axelar is at the forefront of blockchain innovation, providing the tools and infrastructure necessary for secure cross-chain communication. Its decentralized network of validators, PoS consensus mechanism, and advanced technological features like gateway smart contracts and API integration make it a compelling option for developers and investors alike.

As the demand for interoperability in the blockchain space continues to grow, Axelar is well-positioned to play a pivotal role in shaping the future of decentralized applications and services. Whether you are a developer looking to build the next big dApp or an investor exploring new opportunities, understanding the technology behind Axelar is crucial for navigating the evolving landscape of cryptocurrencies.

Understanding axelar crypto Tokenomics

Overview of Axelar Tokenomics

Axelar (AXL) is a native cryptocurrency that powers the Axelar network, a decentralized platform designed to facilitate secure cross-chain communication for Web3 applications. The Axelar network aims to simplify the development and deployment of decentralized applications (dApps) across multiple blockchain ecosystems. Understanding the tokenomics of AXL is crucial for potential investors and users as it provides insights into its value proposition, utility, and the underlying economic model that supports its operations.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 1.21 billion AXL |

| Max Supply | Not explicitly defined |

| Circulating Supply | 1.03 billion AXL |

| Inflation/Deflation Model | Deflationary through usage |

Token Utility (What is the coin used for?)

The AXL token serves multiple purposes within the Axelar ecosystem, enhancing its utility and value:

-

Transaction Fees: AXL is used to pay transaction fees for operations conducted on the Axelar network. This includes fees associated with cross-chain messaging and data transfers, which are critical for the secure and efficient functioning of dApps that rely on multi-chain interactions.

-

Staking: AXL holders can participate in the network’s security through staking. By locking up their tokens, they help maintain the decentralized validator network, which is crucial for the proof-of-stake consensus mechanism employed by Axelar. In return for staking, users may earn rewards, thus incentivizing participation in the network’s security.

-

Governance: Token holders may have the right to participate in governance decisions that affect the development and future direction of the Axelar network. This can include voting on protocol upgrades, changes to fee structures, and other critical decisions that shape the ecosystem.

-

Access to Services: The AXL token may also be required for accessing certain services and features within the Axelar ecosystem, such as the Interchain Token Service (ITS), which enables the deployment of tokens across multiple blockchains seamlessly.

-

Incentives for Developers: Axelar has initiated funding programs to encourage developers to build on its platform. AXL tokens may be used to incentivize developers through grants or rewards for creating innovative applications that leverage Axelar’s capabilities.

Token Distribution

The distribution of AXL tokens is designed to ensure a balanced approach that supports the growth of the Axelar ecosystem while rewarding early supporters and contributors. The allocations are as follows:

-

Backers (29.5%): A significant portion of the tokens is allocated to early investors and backers who have contributed to the project’s development and funding. This allocation helps to secure financial resources for the platform’s growth.

-

Team (17%): A portion of the tokens is reserved for the founding team and key contributors. This allocation aligns their interests with the long-term success of the network, as their holdings will incentivize them to continue enhancing the platform.

-

Company Operations (12.5%): These tokens are designated for operational needs, including development, marketing, and other business activities necessary for sustaining and growing the Axelar network.

-

Community Sale (5%): A small percentage of tokens is allocated for community sales, allowing broader participation from the community and potential users, which helps to decentralize token ownership.

-

Community Programs (36%): This large allocation is focused on community engagement initiatives, including insurance funds and rewards for users who contribute to the ecosystem, ensuring that the community remains engaged and incentivized to use the platform.

Inflation/Deflation Model

Axelar’s tokenomics is characterized by a deflationary model. As the network grows and more transactions are conducted, the demand for AXL tokens is expected to increase, primarily due to their utility in paying transaction fees and staking. The deflationary aspect is further supported by the fact that as AXL is used for transaction fees, a portion of these tokens may be burned or removed from circulation, thus reducing the overall supply over time.

In summary, the tokenomics of Axelar (AXL) is structured to support a robust and growing ecosystem. With a clear utility for transaction fees, staking, governance, and developer incentives, AXL is positioned to play a critical role in the success of the Axelar network. The thoughtful distribution of tokens, along with a deflationary model, aims to foster a sustainable and engaged community while ensuring that the network can thrive in the competitive landscape of decentralized finance (DeFi) and cross-chain interoperability.

Price History and Market Performance

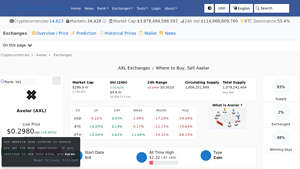

Key Historical Price Milestones

Axelar (AXL) has experienced notable fluctuations in its price since its inception. Understanding these price movements is essential for investors looking to grasp the asset’s market performance.

-

Launch and Initial Trading: Axelar’s native token, AXL, was launched in 2020. At the time of its debut, the token began trading at a relatively low price point, reflecting the initial market reception and investor interest.

-

All-Time High: A significant milestone occurred on March 1, 2024, when AXL reached its all-time high of $2.66. This peak can be attributed to growing interest in cross-chain technologies and the increasing adoption of decentralized applications (dApps) that leverage Axelar’s infrastructure. The all-time high highlighted the market’s optimism regarding the project’s potential.

-

Subsequent Decline: Following the peak, AXL faced a notable price decline, which is common in the cryptocurrency market where volatility is prevalent. As of October 2023, AXL’s price has dropped significantly, trading around $0.30. This decline represents an approximate 88.78% decrease from its all-time high, illustrating the challenges that digital assets face in maintaining momentum post-peak.

-

Recent Price Movements: In the weeks leading up to October 2023, AXL traded within a range of $0.2944 to $0.301, reflecting a relatively stable price environment compared to its historical volatility. The market cap during this period has hovered around $307 million, indicating a substantial level of investor interest despite the price drop.

Factors Influencing the Price

Historically, the price of Axelar has been influenced by a variety of factors, both internal and external to the cryptocurrency market.

-

Market Sentiment and Broader Trends: Like most cryptocurrencies, AXL’s price is sensitive to overall market sentiment. Bullish trends in the broader cryptocurrency market can lead to increased demand for AXL, while bearish trends can have the opposite effect. For instance, the general enthusiasm surrounding decentralized finance (DeFi) and cross-chain solutions has periodically driven interest in AXL.

-

Technological Developments: Axelar’s ability to innovate and expand its technological offerings has a direct impact on its price. Announcements regarding new features, partnerships, or improvements to the platform can lead to increased investor confidence and, subsequently, price increases. For example, the introduction of the Interchain Token Service (ITS) aimed at simplifying multichain distribution is likely to attract more developers and projects to the Axelar ecosystem, which could positively influence the token’s value.

-

Regulatory Environment: Regulatory news and developments can significantly impact the price of cryptocurrencies, including Axelar. Positive regulatory advancements that support blockchain technology and decentralized applications can lead to price rallies, while negative news can instigate sell-offs. For instance, regulatory clarity regarding the use of stablecoins and DeFi platforms can enhance investor confidence in projects like Axelar that operate within these domains.

-

Market Competition: The competitive landscape of interoperability solutions also plays a role in AXL’s price dynamics. As more projects emerge that offer similar functionalities, the pressure to innovate and maintain market share intensifies. Investors often evaluate AXL against its competitors, and shifts in market leadership can lead to price adjustments.

-

Adoption Rates: The extent to which institutions and developers adopt Axelar’s technology directly affects its market performance. Partnerships with major financial institutions and successful use cases can enhance AXL’s reputation and desirability, thereby driving its price upward. For instance, collaborations with entities like J.P. Morgan’s Onyx for tokenized asset management have showcased Axelar’s potential, positively impacting market sentiment.

-

Supply Dynamics: The mechanics of AXL’s supply can also influence its price. The circulating supply of AXL tokens is currently around 1.03 billion, with a total supply of 1.21 billion. Changes in the distribution of tokens, such as token unlocks or changes in staking rewards, can affect the available supply in the market, impacting price dynamics.

-

Trading Volume: The volume of AXL traded on various exchanges can indicate the level of interest and liquidity in the market. For instance, a trading volume of approximately $6.79 million over 24 hours reflects active trading and interest from investors. Higher volumes often correlate with increased price stability, while lower volumes can lead to more volatile price movements.

In conclusion, Axelar’s price history and market performance are shaped by a complex interplay of technological advancements, market sentiment, regulatory developments, and competitive dynamics. Investors should consider these factors when analyzing AXL’s market behavior and making investment decisions.

Where to Buy axelar crypto: Top Exchanges Reviewed

5. Axelar – Your Gateway to Seamless AXL Trading!

Axelar exchanges, including renowned platforms like HTX (Huobi), Binance, KuCoin, and Kraken, offer users a robust environment for buying, selling, and trading AXL tokens. What sets these exchanges apart is their high liquidity, user-friendly interfaces, and extensive security measures, making them ideal for both novice and experienced traders. Additionally, the availability of AXL across multiple reputable exchanges ensures competitive pricing and easy accessibility for investors.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Axelar (AXL) – Your Gateway to Cross-Chain Trading!

Axelar (AXL) is accessible on more than 27 cryptocurrency exchanges, with Binance, Gate, and Bitget leading the way. What sets Axelar apart is its robust cross-chain communication capabilities, allowing seamless transactions across different blockchain networks. This interoperability not only enhances user experience but also positions Axelar as a vital player in the evolving landscape of decentralized finance, making it an attractive asset for both new and seasoned investors.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5 Steps to Seamlessly Buy Axelar (AXL) Today!

The guide “How to Buy Axelar (AXL)” from Bitcompare provides a comprehensive overview of the best exchanges for purchasing Axelar, highlighting their unique features and competitive trading fees. With options like Bake, Bitmart, and Crypto.com offering low fees around 0.3%, this guide empowers both new and experienced investors to navigate the buying process efficiently while emphasizing the advantages of each platform for acquiring AXL tokens.

- Website: bitcompare.net

- Platform Age: Approx. 6 years (domain registered in 2019)

3. Changelly – Top Choice for Low-Axelar Fees!

Changelly stands out as a premier platform for exchanging Axelar (AXL) due to its competitive rates and low transaction fees, making it an attractive option for both novice and experienced traders. With a user-friendly website and mobile app, Changelly offers fast exchanges among over 700 cryptocurrencies. Additionally, the platform provides 24/7 live support, ensuring that users receive assistance whenever needed, further enhancing the overall trading experience.

- Website: changelly.com

3. Axelar Network – Seamless Cross-Chain Connectivity

Axelar Network’s ecosystem features Pangolin, a decentralized exchange that uniquely supports both Avalanche and Ethereum assets, offering users rapid settlement times and minimal transaction fees. Its emphasis on democratic distribution ensures a fair and inclusive trading environment, making it an attractive option for both novice and experienced investors. This combination of efficiency and accessibility sets Pangolin apart in the competitive landscape of decentralized finance.

- Website: axelar.network

How to Buy axelar crypto: A Step-by-Step Guide

Step 1: Choose a Cryptocurrency Exchange

The first step to purchasing Axelar (AXL) is to select a cryptocurrency exchange where you can buy it. Some of the popular exchanges that list AXL include:

- Coinbase: A user-friendly platform suitable for beginners.

- Kraken: Known for its security features and variety of trading options.

- Uniswap: A decentralized exchange (DEX) where you can trade directly from your wallet.

- Huobi: Offers a wide range of cryptocurrencies and trading pairs.

- KuCoin: Provides various altcoins and trading features.

When choosing an exchange, consider factors such as:

- User Experience: Is the platform easy to navigate?

- Fees: What are the trading and withdrawal fees?

- Security: Does the exchange have a good reputation for security?

- Supported Payment Methods: Can you deposit funds easily?

Step 2: Create and Verify Your Account

Once you have selected an exchange, the next step is to create an account. Here’s how to do that:

-

Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide your email address and create a password.

-

Verification: Most exchanges require you to verify your identity to comply with regulations. This process usually involves:

- Providing Personal Information: You may need to enter your full name, address, and date of birth.

- Submitting Identification: Upload a government-issued ID (like a passport or driver’s license) and possibly a selfie for verification.

- Email Confirmation: After submitting your information, check your email for a verification link. Click on it to confirm your account.

Step 3: Deposit Funds

With your account verified, you need to deposit funds to purchase Axelar. Here’s how to do it:

-

Navigate to the Deposit Section: Log in to your account and go to the “Wallet” or “Funds” section, then select “Deposit.”

-

Choose Your Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit card, or cryptocurrency. Select the method that suits you best.

-

Follow Instructions: If you choose bank transfer, you’ll receive the necessary bank details to complete the transaction. For credit cards, you can enter your card information directly.

-

Complete the Deposit: Confirm the amount you want to deposit and finalize the transaction. Note that bank transfers may take longer than credit card deposits.

Step 4: Place an Order to Buy Axelar Crypto

Now that your account is funded, you can buy Axelar. Follow these steps:

-

Go to the Trading Section: Navigate to the exchange’s trading interface, which is often labeled “Markets” or “Trade.”

-

Select AXL: In the search bar, type “AXL” or “Axelar” to find the trading pair you want (e.g., AXL/USD, AXL/BTC).

-

Choose Order Type: Decide whether you want to place a market order (buy at the current market price) or a limit order (set a specific price at which to buy).

-

Enter the Amount: Specify how much AXL you want to purchase.

-

Review and Confirm: Double-check your order details, including the total cost, and click “Buy” or “Place Order.” Your AXL tokens will be credited to your exchange wallet once the order is executed.

Step 5: Secure Your Coins in a Wallet

After purchasing Axelar, it’s crucial to secure your assets. Here’s how:

- Choose a Wallet: You can use a hot wallet (online, like a wallet provided by the exchange) for convenience or a cold wallet (offline, like a hardware wallet) for enhanced security. Recommended wallets include:

- Hot Wallets: MetaMask, Trust Wallet, or the wallet service provided by your exchange.

- Cold Wallets: Ledger Nano S, Ledger Nano X, or Trezor.

- Transfer Your AXL: If you are using a hot wallet, you can keep your AXL tokens there. However, for better security, consider transferring them to a cold wallet:

- Go to Your Exchange Wallet: Navigate to your AXL balance and select “Withdraw” or “Send.”

- Enter Your Wallet Address: Provide the address of your chosen wallet, double-checking for accuracy.

- Confirm the Transfer: Specify the amount you want to transfer and complete the withdrawal process.

- Backup Your Wallet: If you are using a software wallet, ensure you backup your recovery phrases or private keys in a safe place. This will allow you to recover your funds if needed.

By following these steps, you can successfully buy and secure Axelar (AXL) tokens. Always remember to do your own research and ensure that you are comfortable with the risks associated with cryptocurrency investments.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Strong Market Demand for Interoperability

The cryptocurrency landscape is increasingly becoming fragmented, with numerous blockchains operating in silos. Axelar addresses this issue by providing a secure and efficient interoperability solution that enables seamless cross-chain communication. As decentralized applications (dApps) proliferate, the demand for infrastructure that allows these applications to interact across various blockchains is expected to grow. Axelar’s approach simplifies the development process, making it attractive for developers looking to build applications that can leverage multiple blockchain ecosystems.

2. Institutional-Grade Security

Axelar boasts a decentralized network of over 75 validators, which contributes to its robust security framework. The platform’s emphasis on security is underscored by its claim of zero exploits to date. For institutional investors and developers, the assurance of a secure environment is crucial, particularly when handling significant amounts of digital assets. This level of security can enhance trust among potential users and partners, positioning Axelar as a reliable choice in the growing DeFi space.

3. Comprehensive Ecosystem Support

Axelar’s integration with over 80 blockchains through its Interchain Token Service (ITS) enables developers to deploy their tokens quickly and efficiently. This multi-chain capability allows for greater scalability and access to liquidity across various platforms. The potential to connect with established networks can attract more users and projects to the Axelar ecosystem, fostering growth and innovation.

4. Backing from Prominent Investors

Axelar has secured funding from notable investors, including Binance, Coinbase Ventures, and Polychain Capital. This backing not only provides financial stability but also lends credibility to the project. Such investor confidence can lead to increased visibility and partnerships, further propelling the platform’s growth and adoption.

5. Growing Interest in Decentralized Finance (DeFi) and Real-World Assets (RWAs)

As the DeFi sector continues to expand, Axelar’s capabilities can facilitate the seamless integration of real-world assets into the blockchain ecosystem. By enabling the tokenization of assets across multiple blockchains, Axelar positions itself as a key player in the evolving landscape of decentralized finance, where the demand for innovative financial solutions is ever-increasing.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

The cryptocurrency market is notoriously volatile, with prices capable of experiencing drastic fluctuations in short periods. As of the latest data, Axelar’s price has seen a significant decrease from its all-time high of $2.66 to around $0.30. Such volatility can deter potential investors and users, especially institutional players who may prioritize stability and predictability in their investments. The potential for large price swings can also impact the overall adoption of Axelar, as users may be hesitant to engage with a platform that is subject to such unpredictable movements.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain and varies significantly across different jurisdictions. As governments and regulatory bodies continue to evaluate how to classify and regulate digital assets, Axelar may face challenges in compliance. Any adverse regulatory decisions could restrict its operations or limit its ability to onboard new users and partners. Additionally, if regulations around cross-chain interoperability tighten, it could hinder Axelar’s growth potential.

3. Competition in the Interoperability Space

Axelar operates in a competitive environment, with several projects vying for dominance in the interoperability sector. Competitors such as Polkadot, Cosmos, and LayerZero offer similar solutions, each with unique features and benefits. The presence of established players can create a challenging landscape for Axelar, as it must continually innovate and differentiate itself to capture market share. Failure to do so could result in a decline in user interest and adoption.

4. Technological Risks

As a technology-driven platform, Axelar is not immune to potential technological risks. Issues such as network congestion, bugs in smart contracts, or vulnerabilities in the underlying code can pose significant challenges. Additionally, the reliance on a decentralized network of validators, while enhancing security, also introduces complexities in governance and consensus. Any technical failures or security breaches could undermine user trust and negatively impact the platform’s reputation.

5. Dependency on Developer Adoption

Axelar’s success is heavily dependent on its ability to attract developers to build on its platform. If developers perceive the platform as complex or lacking in sufficient resources and documentation, they may choose to utilize alternative solutions. The long-term viability of Axelar hinges on its ability to foster a vibrant developer community that continually creates innovative applications. Without consistent developer engagement, the platform may struggle to maintain its relevance in an ever-evolving market.

Conclusion

In summary, Axelar presents a compelling case as an interoperability solution in the cryptocurrency ecosystem, bolstered by its strong security measures, institutional backing, and a growing demand for cross-chain communication. However, potential investors and users should remain cognizant of the inherent risks, including market volatility, regulatory uncertainties, competition, technological challenges, and the necessity of ongoing developer engagement. As with any investment in the cryptocurrency space, thorough research and careful consideration of these factors are essential for making informed decisions.

Frequently Asked Questions (FAQs)

1. What is Axelar Crypto?

Axelar is a decentralized network designed to facilitate secure cross-chain communication for Web3 applications. It provides a suite of tools and APIs that assist developers in creating decentralized applications (dApps) that can interact across multiple blockchain networks. The Axelar network consists of three core components: a decentralized validator network, a software development kit (SDK) of protocols and APIs, and a set of gateway smart contracts that enable cross-chain connectivity. Its native token, AXL, plays a crucial role in the network’s ecosystem.

2. How does Axelar work?

Axelar operates through a decentralized network of validators that use a proof-of-stake consensus mechanism to ensure security and reliability. Developers can interact with the network via a simple API, which allows them to build applications without needing to learn new programming languages. This approach simplifies the process of creating cross-chain applications, as Axelar routes messages and maintains network security through its dynamic validator structure.

3. Who created Axelar Crypto?

Axelar was co-founded by Georgios Vlachos and Sergey Gorbunov, both of whom were part of the founding team at Algorand. Georgios designed the Algorand consensus protocol, while Sergey has contributed to standardizing BLS signatures, which are utilized in various blockchain implementations. Their expertise in blockchain technology has been instrumental in the development of Axelar.

4. What makes Axelar different from Bitcoin?

While Bitcoin primarily serves as a digital currency and store of value, Axelar focuses on enabling interoperability among different blockchain networks. Axelar provides infrastructure for cross-chain communication, allowing developers to build dApps that can function seamlessly across multiple blockchains. This unique focus on interoperability sets Axelar apart from Bitcoin’s more singular purpose.

5. Is Axelar Crypto a good investment?

As with any cryptocurrency investment, the potential for returns comes with inherent risks. Axelar’s market cap and trading volume indicate a level of interest, but potential investors should conduct thorough research, consider market trends, and evaluate their risk tolerance before investing in AXL. Additionally, Axelar’s focus on cross-chain communication may present growth opportunities in the evolving DeFi landscape.

6. What are the potential use cases for Axelar?

Axelar aims to provide developers with a robust platform for creating cross-chain applications. Potential use cases include decentralized finance (DeFi) solutions that require interoperability between different blockchains, tokenization of real-world assets (RWAs) across multiple networks, and portfolio management tools that can aggregate assets from various chains. Axelar’s infrastructure allows applications to operate smoothly in a multi-chain environment.

7. Where can I buy Axelar (AXL) tokens?

AXL tokens can be purchased on several cryptocurrency exchanges, including Coinbase, Kraken, Uniswap v3, Huobi, and KuCoin. Users can trade AXL for various cryptocurrencies or fiat currencies depending on the exchange’s offerings. Always ensure you are using reputable exchanges and consider security measures when trading cryptocurrencies.

8. What is the current market performance of Axelar?

As of the latest data, Axelar (AXL) has a market cap of approximately $307.64 million and a circulating supply of around 1.03 billion AXL tokens. The price of AXL fluctuates, so investors should monitor real-time data from reliable cryptocurrency market platforms to make informed decisions. The token has experienced significant price movements, with an all-time high of approximately $2.66 and current trading around $0.298.

Final Verdict on axelar crypto

Overview of Axelar Crypto

Axelar is an innovative project designed to facilitate seamless cross-chain communication within the decentralized finance (DeFi) ecosystem. Its primary purpose is to simplify the development of decentralized applications (dApps) by providing a secure and user-friendly framework for tokenization, trading, and yield generation across multiple blockchains. By leveraging a decentralized network of validators and a proof-of-stake consensus mechanism, Axelar ensures both security and scalability, making it a compelling option for developers and institutions looking to operate in the increasingly interconnected world of blockchain.

Key Technological Features

At the heart of Axelar’s technology is its Interchain Token Service (ITS), which allows for the instant deployment of tokens across over 80 blockchains, significantly reducing operational complexities for developers. Additionally, Axelar’s Fullport trading access connects users to leading on-chain trading venues, offering deep liquidity and a streamlined trading experience. The platform’s focus on compliance and programmable controls further enhances its appeal to institutional players, ensuring that it meets regulatory standards while maximizing operational efficiency.

Investment Considerations

While Axelar presents exciting opportunities in the realm of cross-chain interoperability, it is essential to acknowledge that investing in cryptocurrencies, including Axelar, carries inherent risks. The market is known for its volatility, and Axelar’s current price reflects a significant decline from its all-time high, indicating potential price fluctuations in the future. As a high-risk, high-reward asset class, potential investors should approach Axelar with caution, weighing the benefits of its technological advancements against the risks associated with cryptocurrency investments.

Final Thoughts

In conclusion, Axelar stands out as a promising player in the blockchain space, offering unique solutions for cross-chain communication that could significantly enhance the functionality of decentralized applications. However, due to the volatile nature of cryptocurrencies, it is vital for anyone considering an investment in Axelar to conduct their own thorough research (DYOR). Understanding the project’s fundamentals, market dynamics, and potential risks will empower investors to make informed decisions in this rapidly evolving landscape.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.