Should You Invest in arc crypto? A Full Analysis (2025)

An Investor’s Introduction to arc crypto

ARC is a unique cryptocurrency positioned as the infrastructure layer for high-performance, privacy-focused artificial intelligence (AI) models. With the rapid advancement of AI technologies, ARC aims to address the growing need for speed, privacy, and sustainability in AI operations. By leveraging its proprietary Efficiency AI technology, ARC empowers both businesses and individuals to utilize AI in a more effective manner, making it a noteworthy player in the evolving cryptocurrency landscape.

In the context of the broader crypto market, ARC stands out for its integration of blockchain technology with AI capabilities. The platform features core products, such as Reactor and Matrix, designed to facilitate streamlined AI operations while ensuring the privacy of sensitive data. As a utility token, the $ARC token serves multiple purposes within this ecosystem, providing access to governance, staking, and participation in various AI-driven applications.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors who are interested in understanding ARC. It will delve into several key areas:

Technology

We will explore the underlying technology that powers ARC, including its use of Ethereum’s blockchain, the functionality of Reactor and Matrix, and how these components work together to create a robust AI ecosystem.

Tokenomics

Understanding the economic model behind ARC is crucial for evaluating its investment potential. This section will cover the total supply, distribution of tokens, and the mechanisms that influence its market dynamics.

Investment Potential

Investors will benefit from insights into ARC’s historical performance, market cap, and trading volume. We will analyze factors that could affect its price trajectory and the overall sentiment surrounding the token.

Risks

Like any investment, there are inherent risks associated with investing in ARC. This guide will outline potential challenges, including market volatility, regulatory considerations, and technological risks.

How to Buy ARC

For those interested in acquiring ARC tokens, we will provide step-by-step instructions on how to purchase them on various exchanges, including tips for setting up wallets and securing your investment.

By the end of this guide, readers will have a well-rounded understanding of ARC, equipping them to make informed decisions regarding their investment in this innovative cryptocurrency. Whether you are looking to diversify your portfolio or explore new technologies, ARC presents an intriguing opportunity in the ever-evolving digital asset landscape.

What is arc crypto? A Deep Dive into its Purpose

Overview of ARC Crypto

ARC (ARC) is a utility token designed as the backbone of an innovative ecosystem that combines artificial intelligence (AI) and blockchain technology. Deployed on the Ethereum blockchain, ARC aims to provide an infrastructure layer for high-performance, privacy-centric AI models. This project is particularly focused on enhancing the efficiency, privacy, and sustainability of AI operations, making it a unique player in the rapidly evolving cryptocurrency landscape.

The Core Problem It Solves

The main challenges faced by AI development today are performance bottlenecks, privacy concerns, and sustainability issues. Traditional AI systems often struggle with the following problems:

-

Performance Efficiency: Many AI models require significant computational resources, leading to high costs and time delays in deployment. This can deter businesses from leveraging AI technologies effectively.

-

Data Privacy: With growing concerns about data breaches and privacy violations, organizations need solutions that ensure sensitive information remains protected during AI processing. Existing models often lack the necessary privacy features, which can result in misuse or unauthorized access to data.

-

Sustainability: The environmental impact of high-energy-consuming AI models is a pressing concern. The crypto industry itself has faced scrutiny for its energy consumption, and AI systems that rely on traditional computation methods exacerbate this issue.

ARC addresses these challenges through its proprietary technology and product offerings. By utilizing Efficiency AI, ARC optimizes AI processes, reducing computational needs and costs while improving speed. Furthermore, the integration of blockchain technology ensures that data remains private and secure, allowing users to maintain control over their sensitive information. Lastly, ARC emphasizes sustainability by creating solutions that require less energy, thereby contributing to a greener future for AI technology.

Its Unique Selling Proposition

ARC’s distinctiveness lies in its innovative approach to merging AI with blockchain. Here are some key features that set it apart:

-

Efficiency AI Technology: ARC leverages Efficiency AI to streamline AI operations. This technology minimizes resource consumption while maximizing performance, making AI more accessible and affordable for businesses and individuals alike.

-

Privacy-Focused Solutions: Through its Matrix product, ARC combines AI with blockchain to ensure that operations remain private. Sensitive data is protected, which is crucial in industries where confidentiality is paramount. By returning control of data to users, ARC builds trust and security in AI applications.

-

Reactor Platform: The Reactor serves as an advanced development tool for AI applications. It includes a built-in ARC Virtual Machine (AVM) and a proprietary programming language that allows users to create, edit, and deploy smart contracts across various blockchain networks. This versatility enables developers to work efficiently without the usual hurdles associated with traditional coding environments.

-

Smart Order Routing (SOR): ARC employs SOR technology to optimize trading activities. By routing orders across multiple exchanges, users can obtain the best possible prices for their transactions, thereby enhancing liquidity and trading efficiency.

-

Decentralized and Non-Custodial: ARC operates as a non-custodial platform, meaning users retain full control over their funds without the limitations often imposed by centralized financial institutions. This feature enhances user autonomy and aligns with the core principles of blockchain technology.

The Team and Backers

The success of any cryptocurrency project hinges significantly on the expertise and vision of its team. ARC is supported by a diverse group of professionals with backgrounds in technology, finance, and AI. The team comprises experienced developers, data scientists, and blockchain experts who are committed to driving the project forward.

While specific names and detailed profiles of the team members are often kept under wraps for privacy reasons, it is crucial to consider the experience and track record of those involved. A strong team typically has a history of successful projects and a clear understanding of market dynamics, which is essential for navigating the complexities of both the AI and cryptocurrency sectors.

In addition to the core team, ARC has garnered interest from various backers and investors who recognize the potential of integrating AI with blockchain. Support from reputable investors can provide not only financial backing but also valuable connections and insights that can aid in the project’s growth and development.

Fundamental Purpose in the Crypto Ecosystem

ARC’s fundamental purpose within the crypto ecosystem is to facilitate the intersection of artificial intelligence and blockchain technology, creating a framework that prioritizes performance, privacy, and sustainability. As AI continues to permeate various sectors, the demand for solutions that can handle data securely and efficiently will only grow.

By positioning itself as a leader in this niche, ARC not only aims to capture market share but also to drive the evolution of AI applications in a manner that respects user privacy and minimizes environmental impact. The project’s emphasis on user control, decentralized finance, and innovative technology aligns perfectly with the overarching goals of the cryptocurrency movement—empowering individuals and providing alternatives to traditional systems.

In summary, ARC is more than just a cryptocurrency; it is a transformative platform that seeks to reshape how businesses and individuals approach AI technology. By solving critical problems and offering unique solutions, ARC has the potential to make a significant impact in both the AI and blockchain spheres, paving the way for a new era of privacy-first, sustainable AI applications.

The Technology Behind the Coin: How It Works

Overview of ARC Crypto Technology

ARC (ARC) is an innovative cryptocurrency designed to serve as the infrastructure layer for high-performance, privacy-first artificial intelligence (AI) models. By leveraging blockchain technology, ARC aims to make AI operations faster, more private, and sustainable. This section will delve into the key technological components that power ARC, including its blockchain architecture, consensus mechanism, and notable innovations that distinguish it within the cryptocurrency landscape.

Blockchain Architecture

ARC operates primarily on the Ethereum blockchain as an ERC-20 token, which means it benefits from the established security and functionality of the Ethereum network. Ethereum is renowned for its smart contract capabilities, enabling developers to create decentralized applications (dApps) that run on its blockchain.

Key Features of ARC’s Blockchain Architecture:

-

Smart Contracts: ARC utilizes Ethereum’s smart contracts to facilitate transactions and interactions within its ecosystem. These self-executing contracts are coded with specific conditions, ensuring trust and transparency in operations without the need for intermediaries.

-

Scalability: While ARC starts on Ethereum, there are plans to expand to Layer-2 solutions. Layer-2 protocols help improve scalability by processing transactions off the main Ethereum chain and then settling them back on it. This results in faster transaction speeds and reduced costs, which are essential for an AI-focused platform.

-

Interoperability: Future updates include the development of a multi-chain bridge, allowing ARC to interact with other blockchain networks. This feature will enhance the usability and reach of ARC, enabling users to access a broader range of services and assets.

Consensus Mechanism

ARC is built on the Ethereum blockchain, which currently employs a Proof-of-Stake (PoS) consensus mechanism following its transition from Proof-of-Work (PoW) with the Ethereum 2.0 upgrade. Understanding how this consensus mechanism works is crucial for grasping the security and efficiency of ARC.

Proof-of-Stake Explained:

-

How It Works: In a PoS system, validators are chosen to create new blocks and confirm transactions based on the number of tokens they hold and are willing to “stake” as collateral. This approach significantly reduces the energy consumption associated with PoW, where miners compete to solve complex mathematical problems.

-

Benefits for ARC: By utilizing PoS, ARC benefits from enhanced security and lower environmental impact. Stakers are incentivized to act honestly because any malicious activity could result in the loss of their staked tokens.

-

Decentralization: PoS also supports a more decentralized network as it lowers the barrier to entry for validators compared to PoW, which requires substantial computational power. This decentralization is vital for maintaining the integrity and resilience of the ARC network.

Key Technological Innovations

ARC incorporates several technological innovations that enhance its functionality and user experience, particularly in the realm of AI integration.

1. Efficiency AI Technology

One of the standout features of ARC is its proprietary Efficiency AI technology, which is designed to optimize AI operations. This technology focuses on three main areas:

- Speed: ARC aims to accelerate the processing of AI models, allowing businesses and developers to deploy AI solutions more quickly.

- Privacy: By combining Efficiency AI with blockchain, ARC ensures that sensitive data remains private. This is particularly important in sectors like finance and healthcare, where data security is paramount.

- Sustainability: The architecture of ARC is built to support sustainable AI practices, reducing the carbon footprint associated with traditional AI computing methods.

2. Reactor and Matrix

ARC’s ecosystem is powered by two core products: Reactor and Matrix.

-

Reactor: This component serves as a software package that simplifies the development of AI applications. It includes features such as a built-in ARC Virtual Machine (AVM) and a proprietary programming language. Reactor aims to streamline the coding process, reduce errors, and improve efficiency by enabling users to deploy smart contracts across multiple blockchain networks seamlessly.

-

Matrix: Matrix integrates Efficiency AI with blockchain technology to facilitate private AI operations. By ensuring that data remains secure and under user control, Matrix empowers individuals and businesses to utilize AI without compromising their privacy.

3. Smart Order Routing (SOR)

ARC employs Smart Order Routing technology to optimize trading on its platform. This innovative approach involves:

-

Best Execution: SOR algorithms analyze multiple centralized and decentralized exchanges to find the best possible prices for trading assets. By routing orders through various platforms, users can achieve optimal trade execution and liquidity.

-

User Experience: For both institutional and retail investors, SOR enhances the trading experience by ensuring that users receive the best available market prices, thereby maximizing their investment potential.

User Empowerment and Control

ARC’s architecture emphasizes user empowerment by providing full control over funds and eliminating the limitations often associated with centralized financial institutions. This is achieved through:

-

Non-Custodial Solutions: ARC is designed to be non-custodial, meaning users retain full ownership of their assets without relying on third-party services. This approach mitigates risks related to hacks and mismanagement that can occur in centralized platforms.

-

No KYC Requirements: ARC does not impose Know Your Customer (KYC) requirements, allowing users to interact with the platform anonymously. This feature appeals to privacy-conscious individuals and enhances the platform’s accessibility.

Conclusion

ARC represents a significant advancement in the intersection of blockchain technology and artificial intelligence. With its robust architecture, efficient consensus mechanism, and innovative features, ARC is poised to empower users in a secure and sustainable manner. As the platform continues to evolve, it aims to bridge the gap between AI and blockchain, offering a unique solution that prioritizes privacy, efficiency, and user control. By understanding the technology behind ARC, investors and users can better appreciate its potential impact on the digital asset landscape and the future of AI applications.

Understanding arc crypto Tokenomics

Key Metrics of ARC Tokenomics

To understand the tokenomics of ARC, it is essential to look at its key metrics, which provide insights into its supply dynamics and overall market behavior.

| Metric | Value |

|---|---|

| Total Supply | 1,030,000,000 ARC |

| Max Supply | 1,030,000,000 ARC |

| Circulating Supply | 922,619,290 ARC |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The ARC token serves multiple purposes within the ARC ecosystem, which is designed to provide a high-performance, privacy-first environment for artificial intelligence (AI) models. Here are the primary utilities of the ARC token:

-

Governance: Holders of the ARC token can participate in the governance of the platform. This includes voting on proposals that affect the ecosystem’s development and operational parameters. This democratic process allows the community to have a say in the future direction of the project.

-

Staking: Users can stake their ARC tokens to earn rewards. Staking not only provides passive income opportunities for token holders but also enhances the network’s security and stability. By locking up their tokens, participants contribute to the overall health of the ecosystem.

-

Access to Services: The ARC token is required to access various services and functionalities within the ecosystem, such as utilizing the Reactor and Matrix products. These products are designed to streamline AI model development and deployment, making it easier for users to harness the power of artificial intelligence.

-

Transaction Fees: Users can use ARC tokens to pay for transaction fees on the platform. This creates a demand for the token as users engage with the ecosystem, thus potentially driving up its value.

-

Incentives and Rewards: The ARC token is also used for providing rewards and incentives to users who contribute to the ecosystem, whether through providing liquidity, participating in governance, or using the platform’s services.

Token Distribution

The distribution of ARC tokens is crucial for understanding the project’s long-term sustainability and market dynamics. The token allocation is designed to balance the interests of various stakeholders, ensuring that there is enough supply for development while also rewarding early investors and community participants. Below is a breakdown of the token distribution:

-

Investors (Seed, Private, and Public): 33% of the total token supply is allocated to investors. This allocation includes early backers and public investors who believed in the project’s vision. Such a significant portion reflects the project’s reliance on initial funding to kickstart its operations and development.

-

Team: The team behind ARC holds 12% of the total token supply. This allocation is typical in blockchain projects and serves as an incentive for the team to work diligently towards the project’s success.

-

Rewards and Incentives: 20% of the tokens are set aside for rewards and incentives. This ensures that active participants, such as stakers and liquidity providers, are rewarded for their engagement with the ecosystem.

-

CEX, Market Makers, and Partners: 15% of the total supply is allocated to centralized exchanges (CEX), market makers, and partners. This allocation is essential for facilitating liquidity and enabling trading on various platforms, which is crucial for the token’s market presence.

-

Ecosystem Development: 20% of the tokens are dedicated to funding the ecosystem’s future development. This shows a long-term commitment to growth and innovation, ensuring that the ARC ecosystem continues to evolve.

-

Locked Tokens: 50% of the tokens are locked in Unicrypt for a period of 12-24 months. This demonstrates the team’s commitment to the project and helps to mitigate the risk of sudden sell-offs that could negatively impact the token’s price.

Conclusion

The tokenomics of ARC are structured to promote a sustainable and thriving ecosystem centered around AI technologies. By ensuring a balanced distribution of tokens among investors, the development team, and community participants, ARC aims to create an environment where all stakeholders can benefit from the growth and success of the project.

Understanding the utility and distribution of the ARC token is crucial for both current and potential investors, as it provides insight into the project’s long-term viability and the mechanisms in place to drive engagement and value within the ecosystem. As the ARC ecosystem continues to develop, the effective management of its tokenomics will play a pivotal role in shaping its future.

Price History and Market Performance

Key Historical Price Milestones

The price history of ARC ($ARC) reflects the cryptocurrency’s journey since its launch in March 2022. Upon its debut, the token was priced at approximately $0.004. Notably, the price experienced a significant surge shortly after the launch, peaking at $0.1289 by mid-March 2022. This initial spike was largely attributed to the release of the ARC mobile application, which generated heightened interest and trading activity within the crypto community.

However, like many cryptocurrencies, ARC faced volatility in the following months. The price trend showed a gradual decline, and by January 2023, it had dropped significantly, reaching lows around $0.004. This period marked a challenging phase for many digital assets, as the overall cryptocurrency market was experiencing a downturn due to various macroeconomic factors, including regulatory scrutiny and shifts in investor sentiment.

A notable milestone for ARC occurred in January 2022 when it achieved its all-time high of $0.308. This peak represented a remarkable 98.8% decline from its all-time high as of October 2023, which stood at $0.003696. The drastic decline can be attributed to a combination of market corrections and the fading hype surrounding its initial launch.

The token underwent a 1:1 swap from an old contract to a new one, which also had implications for its price and market cap. As of now, the market capitalization of ARC is around $3.41 million, with a circulating supply of approximately 922.61 million tokens out of a total supply of 1.03 billion. This limited supply plays a role in the token’s price dynamics, as scarcity can influence trading behavior and valuation.

Factors Influencing the Price

Historically, the price of ARC has been influenced by several key factors that are common in the cryptocurrency market:

-

Market Sentiment: The overall sentiment within the cryptocurrency market has a profound impact on ARC’s price. During bullish trends, investor enthusiasm can lead to increased buying pressure, driving prices higher. Conversely, bearish sentiment often results in selling pressure, causing declines in price. For instance, the surge to $0.1289 in March 2022 coincided with a generally positive market atmosphere for cryptocurrencies.

-

Technological Developments: ARC’s unique offerings, including its proprietary Efficiency AI technology and tools like Reactor and Matrix, significantly affect its price. Announcements regarding technological advancements or partnerships can lead to price spikes, as investors often respond positively to innovations that enhance utility and adoption.

-

Trading Volume: The volume of trading activity can also influence price movements. For example, during periods of higher trading volume, typically associated with increased interest or announcements, prices may experience more volatility. The 24-hour trading volume for ARC has varied, and spikes in volume often correlate with price fluctuations.

-

Market Conditions: Broader market conditions, including regulatory developments, macroeconomic factors, and trends in major cryptocurrencies like Bitcoin and Ethereum, influence ARC’s price. For example, regulatory news affecting the cryptocurrency space can lead to uncertainty, impacting investor confidence and consequently, the price of ARC.

-

Supply Dynamics: The fixed supply of ARC tokens plays a crucial role in its price formation. With a maximum supply capped at 1.03 billion tokens, any changes in the circulating supply due to token burns, lock-ups, or other mechanisms can affect scarcity and, thus, the price. The current circulating supply is approximately 922.61 million tokens, which means over 89% of the total supply is already in circulation.

-

Community Engagement: The level of community involvement and engagement with the ARC project can also impact its price. A strong community can drive awareness, adoption, and usage of the token, which may lead to positive price action. Conversely, if community interest wanes, it may lead to decreased demand and lower prices.

-

Competitive Landscape: The performance of ARC can also be influenced by the competitive landscape within the cryptocurrency market, particularly in the AI and blockchain sectors. The emergence of new projects with similar or improved functionalities can divert attention and investment away from ARC, affecting its market performance.

In summary, the price history of ARC reflects a complex interplay of market dynamics, technological developments, and broader economic factors. Understanding these elements is crucial for investors looking to navigate the evolving landscape of this digital asset. As the cryptocurrency market continues to develop, historical performance and the factors influencing it will remain critical for assessing ARC’s potential trajectory.

Where to Buy arc crypto: Top Exchanges Reviewed

1. ChangeNOW – Top Choice for Competitive ARC Rates!

ChangeNOW stands out as a premier platform for exchanging ARC, boasting a high rating of 4.8 based on over 2,166 user reviews. It offers competitive pricing, a user-friendly interface, and real-time market data, including live charts and market capitalization. With no hidden fees and a commitment to transparency, ChangeNOW provides a seamless experience for both buying and selling ARC, making it a top choice for cryptocurrency enthusiasts.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

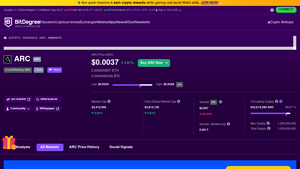

5. Top Exchanges for Buying ARC: Unlock Your Investment Potential!

In the review article “Where to Buy ARC: Best ARC Markets & ARC Pairs,” BitDegree highlights the top crypto exchanges for purchasing ARC, emphasizing their user-friendly interfaces and diverse trading pairs. The article provides a comprehensive analysis of each market, enabling both novice and experienced traders to make informed decisions. By offering detailed insights into ARC trading opportunities, it stands out as a valuable resource for anyone looking to engage with this digital asset.

- Website: bitdegree.org

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Trade AI Rig Complex – Revolutionizing Real-Time ARC Trading!

The Trade AI Rig Complex on Kraken distinguishes itself with its advanced charting tools and deep liquidity, catering to traders of all experience levels. Its secure ARC markets provide a robust trading environment, complemented by a variety of powerful order types that enhance trading strategies. This combination of features not only promotes effective decision-making but also ensures a seamless trading experience, making it a standout choice for cryptocurrency enthusiasts.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. ARC Crypto Token – Your Gateway to Innovative Blockchain Solutions!

In the review article “How to Buy ARC Crypto Token? – LCX,” readers will discover a straightforward, step-by-step guide for purchasing the Arc AI Token on the LCX Exchange. What sets LCX apart is its user-friendly interface and emphasis on security, making it an ideal platform for both novice and experienced traders. The article highlights the efficient trading process, ensuring a seamless experience for users looking to invest in ARC tokens.

- Website: lcx.com

3. ARC (ARC) – Your Gateway to Seamless Trading!

ARC (ARC) exchanges offer a comprehensive platform for users to buy, sell, and trade ARC tokens across multiple markets. What sets these exchanges apart is their user-friendly interface, real-time price updates, and detailed trading volume statistics, making it easy for both beginners and experienced traders to navigate the ARC ecosystem. Additionally, the availability of clear buying instructions enhances accessibility, ensuring that users can efficiently engage with the ARC cryptocurrency.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

How to Buy arc crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing ARC crypto is to select a cryptocurrency exchange that supports it. Currently, ARC can be traded on decentralized exchanges like Uniswap (V2). Here are a few factors to consider when choosing an exchange:

- Reputation: Ensure the exchange is well-reviewed and has a solid track record of security.

- User Interface: Look for an exchange with a user-friendly interface, especially if you are new to cryptocurrency trading.

- Fees: Compare transaction and withdrawal fees across different exchanges to find the most cost-effective option.

- Trading Pairs: Confirm that the exchange offers trading pairs for ARC, such as ARC/ETH or ARC/USDT.

2. Create and Verify Your Account

Once you’ve selected an exchange, you need to create an account. Here’s how to do it:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Create Account” button. You will be asked to provide an email address and create a password.

- Email Verification: After signing up, you’ll receive a confirmation email. Click the link in the email to verify your account.

- Identity Verification (KYC): Some exchanges require you to complete a Know Your Customer (KYC) process. This may involve uploading identification documents (like a passport or driver’s license) and a proof of address (like a utility bill). This step may not be necessary for decentralized exchanges.

- Two-Factor Authentication (2FA): To enhance security, enable 2FA on your account. This typically involves linking your account to an authentication app like Google Authenticator or receiving SMS codes.

3. Deposit Funds

With your account set up and verified, you’ll need to deposit funds to buy ARC. Here’s how:

- Choose Deposit Method: Most exchanges allow deposits through bank transfers, credit/debit cards, or other cryptocurrencies. Choose the method that suits you best.

- Deposit Amount: Specify the amount you wish to deposit. Be mindful of any minimum deposit requirements.

- Complete Deposit: Follow the instructions to complete the deposit. For bank transfers, this may take several days, while credit card transactions are usually instant.

4. Place an Order to Buy ARC Crypto

After funding your account, you can place an order to buy ARC. Here’s how:

- Navigate to the Trading Section: Find the trading section of the exchange, typically labeled as “Markets” or “Trade.”

- Select ARC: Search for ARC in the list of available cryptocurrencies. Select the trading pair you want to use (for example, ARC/ETH).

- Choose Order Type: You can usually select from different order types:

- Market Order: This order buys ARC at the current market price.

- Limit Order: This order sets a specific price at which you want to buy ARC. Your order will only execute when the market price reaches your specified price.

- Enter Amount: Specify how much ARC you wish to purchase.

- Confirm Order: Review your order details and confirm the transaction. You should receive a notification once your order is executed.

5. Secure Your Coins in a Wallet

After purchasing ARC, it’s essential to secure your coins in a wallet. This step is crucial for protecting your investment from potential hacks or exchange failures. Here’s how to do it:

- Choose a Wallet Type:

- Software Wallets: These can be desktop or mobile wallets. They are convenient but less secure than hardware wallets.

- Hardware Wallets: These are physical devices that store your cryptocurrencies offline, providing a higher level of security.

- Set Up Your Wallet: Follow the instructions provided by the wallet service to create a new wallet. Make sure to write down and securely store your recovery seed phrase.

- Transfer ARC to Your Wallet: Go to the exchange where you purchased ARC and navigate to the withdrawal section. Enter your wallet address and the amount of ARC you wish to transfer. Confirm the transaction.

Conclusion

Buying ARC crypto is a straightforward process, but it requires careful attention to detail at each step. By following this guide, you can navigate the purchasing process with confidence, ensuring that your investment in ARC is secure and well-managed. Always conduct thorough research and stay informed about market trends to make the most of your cryptocurrency investment.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Innovative Technology and Unique Value Proposition

ARC crypto is positioned as an infrastructure layer for high-performance, privacy-first artificial intelligence (AI) models. Its proprietary Efficiency AI technology aims to enhance the speed, privacy, and sustainability of AI operations. This focus on privacy and efficiency addresses growing concerns about data security in the digital age, making ARC a potentially attractive option for businesses looking to adopt AI solutions while maintaining control over sensitive information.

Strong Utility in a Growing Market

The $ARC token serves multiple functions within the ARC ecosystem, including governance, staking, and access to various AI services. As the demand for AI technologies continues to grow across industries, ARC’s ability to integrate blockchain technology with AI could result in increased adoption and utility of its token. This dual focus on AI and blockchain positions ARC in a rapidly expanding market, potentially driving demand for its services and, by extension, its token.

Non-Custodial and Decentralized Model

ARC’s non-custodial framework eliminates the limitations often found in centralized financial systems, such as Know Your Customer (KYC) requirements and restrictions on fund access. This model appeals to users who prioritize privacy and control over their assets. By offering a decentralized platform, ARC may attract a diverse user base, from retail investors to institutional participants, thereby enhancing liquidity and market stability.

Market Position and Growth Potential

With a current market cap of approximately $3.41 million and a circulating supply of 922.61 million ARC tokens, the project has room for growth. Historical price movements indicate that ARC reached an all-time high of $0.308 in January 2022. While it has since declined significantly, the potential for future growth remains, particularly if the project successfully expands its user base and enhances its technological offerings. The development of a multi-chain bridge in future updates could further enhance its reach and usability.

Potential Risks and Challenges (The Bear Case)

Market Volatility

The cryptocurrency market is notoriously volatile, with prices often subject to rapid fluctuations based on market sentiment, news, and broader economic trends. As of the latest data, ARC is priced at approximately $0.0037, a significant drop from its all-time high. This volatility poses a risk for investors, as sudden price swings can lead to substantial losses. Potential investors should be prepared for the possibility that market conditions could adversely impact the value of ARC tokens.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain, with many jurisdictions still developing frameworks to govern digital assets. Increased scrutiny from regulatory bodies could lead to restrictions on the use and trading of cryptocurrencies, including ARC. This uncertainty could affect investor confidence and market participation, potentially leading to reduced liquidity and lower token prices. Investors should stay informed about regulatory developments that could impact the cryptocurrency market as a whole.

Intense Competition

The space in which ARC operates is highly competitive, with numerous projects vying for market share in the AI and blockchain sectors. Established players with significant resources could overshadow ARC, making it challenging for the project to gain traction. Furthermore, the success of ARC will depend on its ability to differentiate itself from competitors and deliver on its promises of performance and privacy. If it fails to do so, it may struggle to attract users and investors.

Technological Risks

As an ERC-20 token on the Ethereum blockchain, ARC relies on the underlying technology of Ethereum, which is itself subject to potential issues such as network congestion, high gas fees, and security vulnerabilities. Additionally, the project’s proprietary technologies, such as the Reactor and Matrix, may face challenges during development or deployment, which could hinder the overall success of the platform. Any significant technological setbacks could impact user trust and adoption, ultimately affecting the token’s value.

Tokenomics and Supply Concerns

With a total supply capped at one billion tokens, the distribution and allocation of ARC tokens can impact market dynamics. Currently, a significant portion of the tokens is locked for 12-24 months, which may limit immediate liquidity. However, once these tokens are released, they could flood the market, potentially driving prices down if demand does not keep pace with supply. Understanding the tokenomics and potential future supply changes is crucial for investors.

Conclusion

In summary, ARC crypto presents a compelling case for investment due to its innovative technology, utility in a growing market, and non-custodial model. However, potential investors must also weigh the risks, including market volatility, regulatory uncertainty, competition, technological challenges, and supply dynamics. As with any investment in the cryptocurrency space, thorough research and a cautious approach are essential. Investors should remain aware of both the opportunities and challenges that ARC presents, keeping a close watch on market trends and project developments.

Frequently Asked Questions (FAQs)

1. What is ARC Crypto?

ARC is a cryptocurrency that serves as the utility token for the ARC ecosystem, which is designed to support high-performance, privacy-first artificial intelligence (AI) models. Built on the Ethereum blockchain, ARC aims to enhance the speed, privacy, and sustainability of AI operations. It features two core products: Reactor, which streamlines the development of smart contracts, and Matrix, which integrates AI with blockchain technology to protect sensitive data.

2. Who created ARC Crypto?

ARC was developed by a team of engineers and blockchain experts focused on creating solutions that leverage artificial intelligence in a decentralized manner. The specific identities of the team members are often not publicly disclosed in the crypto space, but the project emphasizes a commitment to transparency and community engagement.

3. What makes ARC Crypto different from Bitcoin?

While Bitcoin is primarily a digital currency designed for peer-to-peer transactions, ARC focuses on providing infrastructure for AI applications. ARC aims to combine blockchain technology with AI to enhance performance and privacy, offering tools that allow developers and businesses to build and deploy AI models in a secure environment. Additionally, ARC operates within a specific niche, targeting the AI industry, whereas Bitcoin serves as a general-purpose cryptocurrency.

4. Is ARC Crypto a good investment?

Determining whether ARC is a good investment depends on various factors, including market trends, the project’s development progress, and your investment goals. As of now, ARC’s price is significantly lower than its all-time high, and it operates in a competitive space with many emerging projects. Potential investors should conduct thorough research and consider the project’s fundamentals, including its technology, use cases, and market demand before making investment decisions.

5. Where can I buy ARC Crypto?

ARC can be purchased on various cryptocurrency exchanges, most notably Uniswap (V2). To buy ARC, you’ll need to set up a cryptocurrency wallet, acquire Ethereum (ETH) or another supported cryptocurrency, and then swap it for ARC on the exchange. For detailed guidance on how to buy ARC, you can refer to educational resources available on platforms like CoinMarketCap.

6. How many ARC coins are there in circulation?

ARC has a fixed total supply of 1 billion tokens. As of the latest data, the circulating supply is approximately 922.61 million ARC coins. The token distribution includes allocations for investors, the development team, rewards, and future ecosystem development, with a portion locked to demonstrate the project’s long-term commitment.

7. How is the ARC network secured?

ARC operates as an ERC-20 token on the Ethereum blockchain, benefiting from the security and decentralization that Ethereum provides. The network is designed to be non-custodial, meaning users retain full control over their funds without the need for traditional KYC (Know Your Customer) requirements. Future plans may include building a multi-chain bridge to enhance security and interoperability.

8. What are the future prospects for ARC Crypto?

The future prospects for ARC depend on its ability to effectively execute its roadmap, develop its AI capabilities, and attract users to its ecosystem. Given the increasing demand for AI solutions and the growing interest in decentralized technologies, ARC has potential for growth. However, like all cryptocurrencies, it is subject to market volatility, competition, and regulatory changes, so investors should stay informed about developments in the space.

Final Verdict on arc crypto

Overview of ARC Crypto

ARC is designed as an infrastructure layer for high-performance, privacy-first artificial intelligence (AI) models. Utilizing its proprietary Efficiency AI technology, ARC aims to enhance the speed, privacy, and sustainability of AI operations. Its core products, Reactor and Matrix, facilitate a robust ecosystem where users can engage in governance, staking, and various applications within the AI landscape. The ARC token, built on the Ethereum blockchain, allows users to access these services while promoting decentralized control over their data.

Unique Features and Potential

What sets ARC apart is its commitment to privacy and user control. By integrating blockchain technology with AI, ARC ensures that sensitive data remains protected, allowing users to leverage AI capabilities without compromising their information. The Reactor platform streamlines development processes, enhancing efficiency and reducing costs, which can attract both institutional and retail investors. The tokenomics of ARC, with a fixed supply of 1 billion tokens and a clear allocation strategy, supports a sustainable growth model.

Investment Considerations

Despite its promising technology and unique market positioning, investing in ARC carries inherent risks. The cryptocurrency market is notoriously volatile, and while the potential for high rewards exists, so do significant risks. The current market cap of approximately $3.4 million and trading volume indicate that ARC is still in the early stages of adoption, which may lead to price fluctuations.

Final Thoughts

In conclusion, ARC presents an intriguing opportunity for investors interested in the convergence of AI and blockchain technology. Its focus on privacy and efficiency positions it well within a rapidly evolving sector. However, as with any investment in the cryptocurrency space, it is crucial to approach ARC with caution. Conducting thorough research (DYOR) and understanding the risks involved will be essential for anyone considering an investment in this high-risk, high-reward asset class.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.