Should You Invest in api3 coin? A Full Analysis (2025)

An Investor’s Introduction to api3 coin

API3 Coin is an innovative digital asset that plays a crucial role in the rapidly evolving landscape of decentralized finance (DeFi) and blockchain technology. As a native token of the API3 platform, it addresses a significant challenge faced by smart contracts: the need for reliable and timely access to off-chain data. By enabling decentralized application programming interfaces (APIs), API3 aims to provide a seamless connection between smart contracts and real-world data sources, thereby enhancing the functionality and trustworthiness of blockchain applications.

The significance of API3 Coin lies in its ability to bridge the gap between on-chain and off-chain ecosystems. Traditional oracles, which serve as intermediaries for data retrieval, often introduce issues such as centralization and increased costs. API3’s approach eliminates these problems by allowing API providers to operate their own nodes, thereby ensuring greater data transparency and reducing the potential for manipulation. This not only enhances the efficiency of smart contracts but also contributes to the broader adoption of blockchain technology across various sectors, including finance, supply chain management, and more.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in API3 Coin. It will cover several essential aspects, including:

Technology Overview

We will delve into the underlying technology of API3, particularly its unique Airnode middleware, which allows for the rapid deployment of decentralized APIs. Understanding this technology is crucial for grasping how API3 differentiates itself from traditional oracle solutions.

Tokenomics

An exploration of API3’s economic model will be provided, detailing its supply structure, distribution, and any potential inflation or deflation mechanisms. This section will help investors assess the long-term viability of the token.

Investment Potential

This guide will analyze API3’s market performance, recent price movements, and potential future trends. We will look at factors influencing its price and market cap, providing insights into its investment potential.

Risks

Investing in cryptocurrencies carries inherent risks, and API3 Coin is no exception. This section will outline the key risks associated with API3, including market volatility, regulatory challenges, and technological risks.

How to Buy API3

Finally, we will provide step-by-step instructions on how to purchase API3 Coin, including the best exchanges to use and tips for securely storing your tokens.

By the end of this guide, readers will have a well-rounded understanding of API3 Coin, equipping them with the knowledge needed to make informed investment decisions in this dynamic market.

What is api3 coin? A Deep Dive into its Purpose

Understanding API3 Coin

API3 is a decentralized oracle network designed to enable smart contracts to access real-world data in a reliable and secure manner. The cryptocurrency associated with this network, API3 Coin (API3), serves as the native token that facilitates various operations within the API3 ecosystem. With the rapid evolution of blockchain technology, the demand for trustworthy data sources has become increasingly vital, and API3 aims to address this need.

The Core Problem It Solves

In the blockchain space, smart contracts require access to external data to function effectively. This external data is often provided through application programming interfaces (APIs). However, traditional APIs are not inherently compatible with blockchain technology, creating a significant challenge known as the “Oracle Problem.”

The Oracle Problem arises because smart contracts cannot directly connect to external data sources. Instead, they rely on oracles—third-party services that fetch data from APIs and relay it to the smart contracts. While oracles provide a temporary solution, they introduce issues of trust, centralization, and increased costs. This is where API3 comes into play.

API3 aims to decentralize the process of data acquisition by allowing API providers to run their own oracles, known as Airnodes. This innovative approach eliminates the need for intermediary oracles, thereby reducing costs and increasing the reliability of data. By enabling direct access to APIs, API3 ensures that smart contracts can retrieve timely and accurate real-world data without the drawbacks associated with traditional oracles.

Its Unique Selling Proposition

API3’s unique selling proposition lies in its ability to bridge the gap between traditional APIs and blockchain technology. Here are some key features that set API3 apart:

-

Decentralized Data Access: API3 allows API providers to operate their own nodes, creating a decentralized network of data sources. This reduces reliance on centralized oracles and enhances the overall security and integrity of the data.

-

Airnode Technology: The backbone of API3 is its middleware solution called Airnode. Airnode can be deployed in minutes and is designed to provide seamless integration between APIs and smart contracts. This technology not only enhances transparency but also significantly reduces transaction fees, making it more economical for developers and businesses.

-

Focus on Transparency: API3 emphasizes data transparency by allowing users to trace the data back to its source. This contrasts with traditional oracles, which often obscure the source of the data, leading to potential trust issues.

-

Community-Driven Governance: API3 incorporates a governance model that allows API3 token holders to participate in decision-making processes within the network. This community-driven approach fosters a sense of ownership and accountability among users.

-

Interoperability: API3 is built on the Ethereum blockchain, which allows it to interact with various decentralized applications (dApps) and protocols. This interoperability enhances its utility and makes it a versatile asset in the broader cryptocurrency ecosystem.

The Team and Backers

API3 was co-founded by a team of experienced professionals with diverse backgrounds in blockchain technology, software development, and academia. The key figures behind API3 include:

-

Heikki Vanttinen: Heikki is the co-founder and has a rich history in blockchain development. He previously served as the founder and CEO of CLC Group, a blockchain lab focused on developing smart contract solutions. His vision for API3 is rooted in creating efficient and secure systems that leverage real-world data.

-

Burak Benligiray: As a co-founder and the Chief Technology Officer (CTO), Burak has played a pivotal role in the technical development of API3. His experience with ChainAPI and previous roles in blockchain projects contribute to the robustness of the API3 ecosystem.

-

Saša Milić: Saša brings a wealth of knowledge from her academic background as a lecturer and her professional experience as a software engineer at Facebook. Her insights into data science and software development are invaluable to the API3 project.

In addition to its core team, API3 has garnered support from various backers and investors, which has helped propel the project forward. The initial token sale raised substantial funds, demonstrating strong interest and belief in the project’s potential.

Conclusion: The Fundamental Purpose in the Crypto Ecosystem

API3 serves a critical role in the cryptocurrency ecosystem by addressing the fundamental need for reliable data access in smart contracts. By decentralizing data acquisition and providing a transparent, efficient, and cost-effective solution, API3 enhances the functionality of decentralized applications.

As blockchain technology continues to evolve, the demand for trustworthy, real-world data will only grow. API3’s innovative approach positions it as a key player in the oracle space, contributing to the broader goal of creating a more interconnected and trustworthy digital economy. Whether for developers, businesses, or investors, understanding API3 and its potential impact is essential for anyone looking to navigate the future of blockchain technology.

The Technology Behind the Coin: How It Works

Introduction to API3

API3 is a decentralized oracle solution designed to connect smart contracts with real-world data through application programming interfaces (APIs). As the cryptocurrency and blockchain landscape evolves, the need for reliable data feeds has become increasingly important, particularly for decentralized applications (dApps) in sectors like finance, supply chain, and beyond. This guide will provide an in-depth understanding of the technology behind API3, focusing on its architecture, consensus mechanism, and key innovations.

Blockchain Architecture

API3 operates on the Ethereum blockchain, which is known for its robust smart contract capabilities. Here’s a breakdown of its architectural components:

Ethereum as the Foundation

Ethereum is a decentralized platform that enables developers to build and deploy smart contracts—self-executing contracts with the terms of the agreement directly written into code. API3 leverages this technology to facilitate interactions between smart contracts and external data sources through oracles.

Decentralized APIs

The core innovation of API3 is the concept of decentralized APIs. Traditional APIs are centralized and often controlled by a single entity, which poses risks such as data manipulation or downtime. API3 aims to decentralize this model by allowing API providers to run their own nodes. This not only enhances reliability but also ensures that the data fed to smart contracts is trustworthy and tamper-proof.

Airnode: The Middleware

Airnode is the key middleware component of API3’s architecture. It acts as a bridge between the smart contracts and the APIs, enabling seamless data transmission. Here’s how it works:

- Deployment: API providers can deploy their own Airnode in minutes, making it accessible for a wide range of developers and businesses.

- Data Fetching: Once deployed, the Airnode can fetch data from any API endpoint, making it incredibly versatile.

- Request Handling: Smart contracts can send requests to the Airnode, which then retrieves the required data and sends it back to the contract.

- Transaction Efficiency: Airnode reduces transaction costs by streamlining the data-fetching process, allowing smart contracts to operate more efficiently.

Consensus Mechanism

While API3 itself does not have a unique consensus mechanism, it operates within the Ethereum ecosystem, which predominantly uses the Proof-of-Stake (PoS) model following its transition from Proof-of-Work (PoW) in the Ethereum 2.0 upgrade.

Understanding Proof-of-Stake

In a PoS system, validators are chosen to create new blocks and verify transactions based on the number of coins they hold and are willing to “stake” as collateral. This model offers several advantages:

- Energy Efficiency: PoS is significantly less energy-intensive compared to PoW, making it more sustainable for the environment.

- Security: Validators have a financial incentive to act honestly since they risk losing their staked coins if they behave maliciously.

- Scalability: PoS allows for greater transaction throughput, which is essential for supporting dApps that require high-speed data processing.

Key Technological Innovations

API3 introduces several innovative features that set it apart from traditional oracle solutions:

Direct API Access

One of the main challenges with existing oracle solutions is the “Oracle Problem,” which refers to the difficulty of securely connecting smart contracts with off-chain data sources. API3 addresses this by enabling direct access to APIs without the need for intermediary oracles. This reduces costs and enhances transparency, as users can verify the data source directly.

Decentralized Governance

API3 incorporates a decentralized governance model, allowing stakeholders to participate in decision-making processes. Token holders can propose and vote on changes to the protocol, ensuring that the platform evolves in a way that reflects the community’s needs and interests. This governance structure fosters a sense of ownership among users and helps maintain the integrity of the network.

Flexible Data Sources

API3’s design allows for integration with a wide range of data sources, including financial market data, weather data, IoT device data, and more. This flexibility enables developers to create diverse dApps that can respond to real-world events in real-time.

Enhanced Data Transparency

With API3, users can trace the data back to its original source, providing a higher level of transparency compared to traditional oracles. This transparency is crucial for applications in sectors such as finance, where trust in data accuracy is paramount.

Use Cases of API3

The technology behind API3 enables a variety of use cases across different sectors:

Decentralized Finance (DeFi)

In the DeFi sector, accurate and timely data is critical for functions such as pricing assets, executing trades, and managing collateral. API3 can provide reliable price feeds and other essential data, enhancing the functionality of DeFi platforms.

Supply Chain Management

API3 can be used to track real-time data in supply chains, such as inventory levels, shipment statuses, and environmental conditions. This data can be fed into smart contracts to automate processes and improve transparency across the supply chain.

Insurance

In the insurance industry, API3 can facilitate parametric insurance contracts that automatically trigger payouts based on real-world events, such as weather conditions. This use of reliable data sources enhances the efficiency and trustworthiness of insurance processes.

Conclusion

API3 represents a significant advancement in the way decentralized applications can access and utilize real-world data. By leveraging the Ethereum blockchain, employing decentralized APIs, and introducing innovative solutions like Airnode, API3 addresses critical challenges faced by traditional oracle systems. Its focus on transparency, flexibility, and community governance positions it as a valuable tool for developers looking to build robust dApps across various industries. As the demand for reliable data continues to grow, API3 is well-positioned to play a pivotal role in the evolving blockchain ecosystem.

Understanding api3 coin Tokenomics

Token Metrics

To understand the tokenomics of API3, it is essential to analyze its key metrics. Below is a table summarizing the critical aspects of the API3 token:

| Metric | Value |

|---|---|

| Total Supply | 151,526,604 API3 |

| Max Supply | 151,526,604 API3 |

| Circulating Supply | 86,421,978 API3 |

| Inflation/Deflation Model | Deflationary (No inflation scheduled) |

Token Utility (What is the coin used for?)

API3 serves multiple purposes within its ecosystem, primarily revolving around the functionality of decentralized oracles and API services. Here are the main utilities of the API3 token:

-

Governance: API3 token holders have the right to participate in the governance of the API3 protocol. This means they can vote on critical decisions affecting the protocol’s future, including upgrades, changes to the network, and how funds from the ecosystem treasury are allocated.

-

Staking: Token holders can stake their API3 tokens to secure the network. By doing so, they help ensure the reliability of the oracles and APIs, contributing to the overall security and integrity of the data being provided to smart contracts.

-

Access to Services: API3 tokens can be used to pay for accessing various decentralized APIs. This utility allows developers and businesses to leverage API3’s services for integrating off-chain data into their decentralized applications (dApps) and smart contracts.

-

Incentives for Node Operators: Those who run nodes in the API3 network can earn API3 tokens as rewards for providing accurate and reliable data. This incentivization mechanism helps maintain the quality and dependability of the APIs within the ecosystem.

-

Payment for Services: API3 tokens can also be used to pay for API access, which allows developers and businesses to retrieve data from the decentralized API services offered by API3.

Token Distribution

The distribution of API3 tokens is designed to promote decentralization and ensure that various stakeholders within the ecosystem have a vested interest. Here’s a breakdown of the token distribution:

-

Initial Allocation: During the token sale, a significant number of tokens were allocated to various stakeholders:

– Founding Team: 30 million tokens were reserved for the founding team, reflecting their commitment to the project.

– Pre-seed and Seed Investors: 15 million tokens were distributed among early investors who contributed to the project’s initial funding.

– Public Token Distribution: 20 million tokens were made available during the public token distribution event held in December 2020.

– Partners and Contributors: 10 million tokens were allocated to partners and contributors who assist in the project’s development and growth.

– Ecosystem Fund: 25 million tokens were set aside for an ecosystem fund, which is intended to support the growth and sustainability of the API3 ecosystem. -

Vesting Period: To prevent market manipulation and ensure long-term commitment, the tokens allocated to seed investors and the founding team are subject to a vesting period of two to three years. This means that these tokens are gradually released over time rather than being available all at once, which helps maintain price stability.

-

Circulating vs. Total Supply: As of the latest data, there are approximately 86.42 million API3 tokens in circulation, out of a total supply of 151.53 million. The remaining tokens are either locked up due to the vesting schedule or reserved for future use in the ecosystem.

-

No Maximum Supply Limit: While the total supply is capped at approximately 151.53 million tokens, there is no maximum supply limit beyond this. This means that the issuance of new tokens is not planned, contributing to a deflationary model. This aspect is critical in maintaining the value of the API3 token as demand grows.

Conclusion

Understanding the tokenomics of API3 is vital for both new and experienced investors. The structured distribution, coupled with its utility in governance, staking, and payment for services, positions API3 as a promising player in the decentralized oracle space. As the demand for reliable off-chain data continues to rise, the API3 token’s role in facilitating this access will likely become increasingly significant. With a focus on decentralization and community governance, API3 aims to create a sustainable ecosystem that benefits all stakeholders involved.

Price History and Market Performance

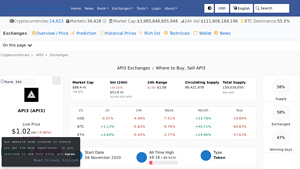

Overview of API3 Price History

API3 (API3) is a decentralized oracle solution designed to connect smart contracts with off-chain data, and its price history reflects various market dynamics and events in the broader cryptocurrency ecosystem. Launched in December 2020, API3 has experienced significant price fluctuations, which can be attributed to factors such as market sentiment, technological advancements, and broader economic trends.

Key Historical Price Milestones

Initial Launch and Early Performance

API3’s initial launch in December 2020 saw its token priced at approximately $1.00. The project aimed to address the “Blockchain Oracle Problem,” which has become increasingly relevant as decentralized finance (DeFi) and other blockchain applications gained traction. In the early weeks following its launch, API3 experienced moderate trading volume and price stability, typical of new cryptocurrencies entering the market.

All-Time High

On April 7, 2021, API3 reached its all-time high of approximately $10.31. This surge can be attributed to a combination of factors, including the overall bullish sentiment in the cryptocurrency market, heightened interest in DeFi projects, and positive reception from investors and developers alike. The broader market was experiencing a significant rally at this time, with many altcoins benefiting from the momentum driven by Bitcoin and Ethereum.

Market Correction

Following its peak in April 2021, API3, like many cryptocurrencies, faced a substantial market correction. By mid-2022, the price had dropped significantly, reflecting the broader downturn in the cryptocurrency market. The price fluctuated around the $2-$3 range for several months during this period, as investors reassessed their positions amid increased regulatory scrutiny and market volatility.

Recent Developments

In early 2023, API3’s price saw another wave of fluctuations, largely influenced by macroeconomic factors such as inflation rates, interest rates, and the performance of traditional financial markets. The price dipped to around $0.50 in March 2023, marking a significant decline from its all-time high. However, it experienced a recovery phase in the latter half of 2023, trading between $0.90 and $1.08, as the project continued to develop its technology and expand its partnerships within the blockchain ecosystem.

Current Market Performance

As of October 2023, API3 is trading at approximately $1.02, with a market capitalization of around $88.33 million. The circulating supply of API3 is approximately 86.42 million tokens, out of a total supply of 151.52 million. The trading volume over the past 24 hours has shown significant activity, indicating ongoing investor interest and market participation.

Factors Influencing the Price

Historically, the price of API3 has been influenced by several key factors:

Market Sentiment

The sentiment in the cryptocurrency market plays a crucial role in the price movements of API3. Bullish trends often lead to increased investment and speculative trading, driving prices higher. Conversely, bearish trends can lead to rapid sell-offs and declining prices. For instance, the significant price increase in early 2021 coincided with a general market rally, while the downturn later that year reflected a broader market correction.

Technological Developments

API3’s price has also been affected by technological advancements and updates within the project. The introduction of its decentralized oracle solution, Airnode, aimed to enhance the efficiency and transparency of API integrations with blockchain applications. Positive developments in the project, such as partnerships with other blockchain platforms or successful implementations of their technology, can lead to increased investor confidence and price appreciation.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies has a substantial impact on the price of API3. News regarding regulations, government policies, or legal challenges can lead to increased volatility. For example, during periods of heightened regulatory scrutiny, investors may become more cautious, leading to sell-offs and price declines.

Broader Economic Factors

Macroeconomic conditions, such as inflation, interest rates, and global economic stability, can also influence the price of API3. In times of economic uncertainty, investors may seek safer assets, which can lead to decreased demand for cryptocurrencies. Conversely, favorable economic conditions can boost investor confidence and lead to increased demand for digital assets.

Conclusion

In summary, API3’s price history reflects a dynamic interplay of market sentiment, technological advancements, regulatory developments, and broader economic conditions. As the project continues to evolve and the cryptocurrency landscape matures, the price of API3 will likely remain influenced by these factors, making it essential for investors to stay informed about both the project and the wider market environment. Understanding these historical trends and influences can provide valuable insights for those looking to navigate the complexities of investing in API3 and similar digital assets.

Where to Buy api3 coin: Top Exchanges Reviewed

5. API3 – Your Gateway to Decentralized Oracles!

API3 (API3) stands out in the cryptocurrency market with its availability on over 45 exchanges, including top platforms like Binance, Gate, and HTX. This broad accessibility allows users to easily buy, sell, and trade API3 with various trading pairs, such as USDT, BUSD, and TRY on Binance. The diverse options enhance liquidity and trading flexibility, making API3 an attractive choice for both novice and seasoned investors.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. Top Exchanges to Buy Api3 (API3) – Compare and Save!

In the review article “Buy Api3 (API3) on these exchanges – comparison – Blockchaincenter,” readers will find a comprehensive analysis of various cryptocurrency exchanges that offer Api3 (API3) trading. The standout feature of this comparison is the detailed price analysis across dozens of platforms, enabling users to identify the most cost-effective options for purchasing API3. This resource is invaluable for both novice and experienced investors looking to maximize their investment efficiency.

- Website: blockchaincenter.net

- Platform Age: Approx. 8 years (domain registered in 2017)

5. API3 – Unlocking Seamless Data for DeFi Success!

Kraken’s guide to purchasing API3 highlights its user-friendly platform, allowing users to buy the digital asset with as little as $10. The exchange stands out for its diverse payment options, including credit/debit cards, ACH deposits, and mobile payment services like Apple and Google Pay, making it accessible for both novice and experienced investors. Kraken’s robust security measures and comprehensive resources further enhance its appeal as a reliable choice for cryptocurrency transactions.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. API3 Token – Your Gateway to Decentralized Oracle Solutions!

The “How to Buy API3 Token (API3) Guide 2025” by CoinCodex provides a comprehensive overview of various exchanges where users can purchase API3 tokens, highlighting popular platforms such as KuCoin, Binance, and Kraken. What sets this guide apart is its emphasis on the importance of researching and comparing transaction fees, ensuring that both novice and experienced investors make informed decisions while navigating the diverse cryptocurrency landscape.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

7. MEXC – Your Go-To Exchange for API3 Token Purchases!

MEXC Exchange distinguishes itself by offering over 100 payment options, ensuring that users can effortlessly purchase API3 Token (API3) from virtually any location worldwide. This flexibility caters to a diverse range of preferences, whether users opt for traditional payment methods or local alternatives, enhancing the accessibility and convenience of trading on the platform. MEXC’s commitment to user-friendly transactions makes it a standout choice for both novice and experienced investors.

- Website: mexc.com

- Platform Age: Approx. 25 years (domain registered in 2000)

How to Buy api3 coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to buying API3 coin is to select a cryptocurrency exchange that supports it. Popular exchanges where you can buy API3 include:

- Uniswap (a decentralized exchange where you can trade directly from your wallet)

- Huobi Global (a centralized exchange that offers various trading pairs)

- KuCoin (another centralized exchange with a wide range of cryptocurrencies)

- OKEx (which offers API3 paired with Ethereum)

When choosing an exchange, consider factors such as trading fees, security features, user interface, and the availability of trading pairs (e.g., API3/USDT, API3/ETH). Make sure the exchange is reputable and has good reviews from other users.

2. Create and Verify Your Account

Once you have chosen an exchange, you will need to create an account. Here’s how:

- Visit the Exchange Website: Go to the official website of the exchange you selected.

- Sign Up: Click on the “Sign Up” or “Register” button. You will be prompted to provide your email address and create a password.

- Email Verification: After registering, check your email for a verification link. Click on it to verify your email address.

- Identity Verification: Many exchanges require identity verification (KYC – Know Your Customer) for security reasons. You may need to provide personal information such as your name, address, and date of birth. Additionally, you may be required to upload a government-issued ID (passport, driver’s license, etc.) and a selfie.

- Set Up Two-Factor Authentication (2FA): For added security, enable 2FA on your account. This typically involves linking your account to an authentication app like Google Authenticator or receiving SMS codes.

3. Deposit Funds

After your account is verified, you will need to deposit funds to buy API3. Here’s how:

- Navigate to the Deposit Section: Log in to your account and find the “Deposit” option, usually located in your account dashboard.

- Choose a Deposit Method: Most exchanges accept deposits in fiat currencies (like USD, EUR) or cryptocurrencies (like Bitcoin or Ethereum). Choose the method that suits you best.

- Follow Instructions: If you are depositing fiat, you may need to link your bank account or use a credit/debit card. If you are depositing crypto, copy the provided wallet address and send the funds from your external wallet.

- Confirm the Deposit: Wait for your deposit to be confirmed. This may take a few minutes to several hours, depending on the method used.

4. Place an Order to Buy API3 Coin

With funds in your exchange account, you can now buy API3. Here’s how to place an order:

- Find API3 on the Exchange: Use the search bar on the exchange to find API3. You can search for the trading pair you wish to use (e.g., API3/USDT).

- Select the Trading Pair: Click on the trading pair to access the trading interface.

- Choose the Order Type: You can typically choose between a market order (buy at the current market price) or a limit order (set a specific price at which you want to buy). For beginners, a market order is usually simpler.

- Enter the Amount: Specify how much API3 you want to buy or how much fiat/crypto you want to spend.

- Review and Confirm: Double-check the details of your order, including fees. Once everything looks good, click the “Buy” button to execute your order.

5. Secure Your Coins in a Wallet

After purchasing API3, it’s essential to secure your coins. While you can keep them on the exchange, using a wallet is safer. Here’s how to do it:

- Choose a Wallet: There are various types of wallets, including:

– Hardware Wallets (like Ledger or Trezor) for maximum security.

– Software Wallets (like MetaMask or Trust Wallet) for convenience.

– Paper Wallets for offline storage. - Transfer API3 to Your Wallet:

– If using a software wallet, download and set it up.

– Generate a receiving address in your wallet for API3.

– Go to your exchange account, navigate to the “Withdraw” section, and enter your wallet address along with the amount of API3 you want to transfer. - Confirm the Transfer: Review the withdrawal details and confirm the transaction. It may take some time for the transaction to be processed on the blockchain.

By following these steps, you can successfully buy and secure your API3 coins, setting you on the path to exploring the world of decentralized APIs!

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Unique Value Proposition

API3 aims to bridge the gap between decentralized applications (dApps) and real-world data through decentralized APIs. Traditional oracles often serve as intermediaries, which can introduce inefficiencies and vulnerabilities. API3’s approach allows API providers to run their own nodes, thereby improving data transparency and reliability. This unique selling point can position API3 favorably in the growing decentralized finance (DeFi) sector, where accurate data is crucial for the functionality of smart contracts.

2. Growing Demand for Decentralized Oracles

As the blockchain ecosystem expands, the demand for reliable data feeds continues to grow. Various sectors, including finance, supply chain, and gaming, are increasingly leveraging smart contracts that require real-time data access. API3’s decentralized oracle solutions can cater to this demand, potentially leading to increased adoption and usage of the token.

3. Strong Team and Backing

API3 is supported by a team of experienced professionals in both blockchain technology and software development. With founders like Heikki Vanttinen, who has a background in creating real-world connected smart contract solutions, and Saša Milić, who has experience in software engineering at major tech firms, the project boasts a solid foundation. The team’s expertise can help navigate challenges and drive the project forward.

4. Market Position and Liquidity

As of the latest data, API3 has a market capitalization of approximately $88 million, ranking it within the top 400 cryptocurrencies. The token is actively traded on several exchanges, including Uniswap and Huobi Global, which enhances its liquidity and accessibility for investors. This liquidity can be attractive for both traders and long-term holders, enabling easier entry and exit points in the market.

5. Potential for Significant Growth

Historically, API3 has shown strong price movement, with an all-time high of over $10 in April 2021. Despite recent fluctuations, the token has demonstrated resilience, with a recovery of over 100% from its all-time low. If the project successfully scales its operations and captures more market share in the oracle space, the potential for price appreciation could be significant.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrency markets are notorious for their volatility. The price of API3, like many other digital assets, can experience dramatic fluctuations within short periods. This volatility can be driven by market sentiment, regulatory news, or macroeconomic factors. Investors should be prepared for the possibility of substantial price declines, which may not reflect the underlying fundamentals of the project.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving. Governments worldwide are working to develop frameworks that govern the use of digital assets, and these regulations can vary significantly from one jurisdiction to another. API3, being an ERC-20 token, is subject to regulations affecting Ethereum-based tokens. Any adverse regulatory developments could negatively impact the project’s operations, adoption, and, consequently, its token value.

3. Competition

API3 operates in a competitive space with other established oracle solutions like Chainlink and Band Protocol. These projects have already built substantial ecosystems and partnerships, making it challenging for newer entrants like API3 to gain traction. If API3 cannot differentiate itself effectively or capture a significant market share, its growth potential could be limited.

4. Technological Risks

As a blockchain-based project, API3 faces inherent technological risks. The reliance on decentralized APIs and smart contracts means that any vulnerabilities in the underlying code or the Airnode middleware could lead to security breaches or data inaccuracies. These issues could undermine user trust and adoption. Furthermore, the complexity of integrating APIs with blockchain technology could present ongoing technical challenges.

5. Adoption and Network Effects

The success of API3 hinges on widespread adoption of its technology. If developers and businesses do not embrace decentralized APIs or prefer traditional solutions, the project may struggle to achieve its growth targets. Network effects play a crucial role in the success of any technology platform, and if API3 fails to attract a sufficient number of users or developers, it could find itself isolated in a crowded market.

6. Dependency on the Ethereum Network

API3 is built on the Ethereum blockchain, which means it is subject to the network’s performance and scalability issues. High transaction fees and slow confirmation times during peak usage can hinder the functionality of API3’s services. As Ethereum continues to evolve with upgrades like Ethereum 2.0, the impacts of these changes will be critical for API3’s operational efficiency.

Conclusion

In summary, API3 presents a compelling case for investment with its innovative approach to decentralized APIs and the growing need for reliable data in the blockchain ecosystem. However, potential investors must weigh these strengths against the inherent risks associated with market volatility, regulatory uncertainty, competition, and technological challenges. Conducting thorough research and considering one’s risk tolerance is essential before making any investment decisions in the cryptocurrency space.

Frequently Asked Questions (FAQs)

1. What is API3 Coin?

API3 Coin (API3) is the native cryptocurrency of the API3 platform, which aims to create decentralized APIs for smart contracts. Traditional APIs often struggle to provide reliable data to blockchain applications, leading to issues in connectivity and data transparency. API3 seeks to solve these problems by allowing API providers to run their own nodes, effectively creating a decentralized network of APIs that can be accessed by smart contracts.

2. Who created API3 Coin?

API3 was co-founded by Heikki Vanttinen, Burak Benligiray, and Saša Milić. Heikki Vanttinen has a background in developing blockchain solutions and previously served as CEO of CLC Group. Burak Benligiray also worked at CLC Group as CTO and has experience with API integration platforms. Saša Milić has a robust academic background, having lectured at the University of Toronto and worked as a software engineer for Facebook.

3. How does API3 differ from other oracle solutions?

API3 distinguishes itself from traditional oracle solutions by allowing API providers to operate their own nodes directly, which helps to eliminate the middleware layer that often leads to increased costs and centralization. This direct connection enhances transparency and reduces transaction fees, making it a more efficient solution for accessing real-world data for smart contracts.

4. Is API3 Coin a good investment?

As with any cryptocurrency investment, whether API3 Coin is a good investment depends on various factors, including market conditions, the project’s utility, and your own financial goals. It’s important to conduct thorough research, analyze market trends, and consider the project’s potential for growth. As of now, API3 has a market cap of approximately $88 million and has seen significant price fluctuations in its history.

5. Where can I buy API3 Coin?

API3 can be purchased on several cryptocurrency exchanges. Some of the most popular platforms include Uniswap (for trading against Wrapped ETH), Huobi Global, and KuCoin (trading against USDT). It is also available on OKEx and 1inch, paired with ETH. Always ensure to use reputable exchanges and consider the fees associated with trading.

6. What is the total supply of API3 Coin?

The total supply of API3 Coin is approximately 151.52 million tokens. As of now, around 86.42 million API3 tokens are in circulation. The tokenomics involve a vesting period for seed investors and the founding team, ensuring that not all tokens are released into circulation at once, which helps to stabilize the market.

7. How is the API3 network secured?

API3 operates as an ERC-20 token on the Ethereum blockchain, which means it inherits the security features of the Ethereum network. The decentralized nature of API3’s architecture allows it to leverage the consensus mechanisms of Ethereum, making it secure against attacks while facilitating smart contract interactions.

8. What are the potential use cases for API3 Coin?

API3 Coin has several potential use cases, particularly in decentralized finance (DeFi) and various blockchain applications that require real-time, reliable data. By enabling decentralized APIs, API3 can support applications ranging from supply chain management to financial services, where accurate data is crucial for decision-making. Additionally, it could be used to incentivize API providers to contribute to the network, promoting a robust ecosystem of data sources.

Final Verdict on api3 coin

Overview of API3 Coin

API3 Coin (API3) is a unique digital asset designed to bridge the gap between traditional APIs and decentralized blockchain technology. Its primary goal is to enable decentralized versions of APIs that can be built, managed, and monetized, allowing smart contracts to access reliable real-world data. This capability is essential for the growing decentralized finance (DeFi) ecosystem and other blockchain applications that require timely and accurate data inputs.

Technology and Innovation

The backbone of API3 is its innovative middleware solution known as Airnode. This technology allows API providers to operate their own nodes, thereby reducing reliance on traditional oracles that can introduce centralization and increased costs. By facilitating a direct connection between APIs and smart contracts, API3 enhances data transparency and reduces transaction fees, making it an appealing option for developers looking to integrate real-world data into their blockchain applications.

Market Position and Potential

As of now, API3 holds a market capitalization of approximately $88 million, with a current price around $1.02. Despite its all-time high of over $10 in April 2021, the coin has shown significant volatility, reflecting the broader trends in the cryptocurrency market. The potential for API3 lies in its ability to solve critical challenges in the blockchain space, particularly as demand for reliable data continues to grow. However, investors should be aware that the project is still relatively young and navigating a competitive landscape filled with established players like Chainlink.

Investment Considerations

Investing in API3 Coin comes with inherent risks and rewards. While its innovative approach to data connectivity presents exciting opportunities, the volatility of cryptocurrency markets means that prices can fluctuate dramatically. Therefore, it is crucial for potential investors to conduct their own thorough research (DYOR) before making any investment decisions. Understanding the technology, the market dynamics, and the risks involved will help ensure that your investment aligns with your financial goals and risk tolerance.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.