robinhood coin Explained: A Deep Dive into the Technology and Token…

An Investor’s Introduction to robinhood coin

Robinhood Coin, often referred to by its ticker symbol $HOOD, has emerged as a notable player in the cryptocurrency landscape. Inspired by the legendary figure of Robin Hood, this digital asset aims to democratize finance by providing everyone with the opportunity to participate in the growing crypto economy. Unlike many other cryptocurrencies that serve specific technical purposes or act as utility tokens within platforms, Robinhood Coin positions itself as a symbol of financial freedom and social justice. It is designed to empower everyday investors by enabling them to harness the potential of blockchain technology and digital assets.

As the popularity of cryptocurrencies continues to rise, Robinhood Coin has garnered attention for its unique narrative and community-driven approach. The coin is built on the Ethereum blockchain, leveraging smart contract capabilities to ensure transparency and security for its users. The total supply of $HOOD is capped at 10 billion tokens, which adds a layer of scarcity that can potentially drive demand among investors. Its purpose transcends mere speculation; it seeks to create a movement that champions financial equity and opposes the manipulation often seen in traditional financial systems.

This guide aims to be a comprehensive resource for both beginner and intermediate investors interested in Robinhood Coin. It will cover several critical aspects:

Technology

We will delve into the underlying technology of Robinhood Coin, exploring its blockchain architecture, smart contract functionality, and how it differentiates itself from other digital currencies.

Tokenomics

Understanding the economic model behind Robinhood Coin is essential for evaluating its investment potential. This section will detail the coin’s supply dynamics, distribution methods, and incentives for holding and using the token.

Investment Potential

Investors are always on the lookout for assets that offer promising returns. This guide will analyze market trends, historical performance, and expert opinions on the future of Robinhood Coin, providing insights into its potential as a long-term investment.

Risks

Every investment carries inherent risks, and cryptocurrencies are no exception. We will outline the potential pitfalls associated with investing in Robinhood Coin, including market volatility, regulatory challenges, and technological vulnerabilities.

How to Buy

For those ready to invest, understanding the purchasing process is crucial. This guide will provide step-by-step instructions on how to buy Robinhood Coin, including the platforms where it is traded and tips for managing your investment securely.

By the end of this guide, readers will have a well-rounded understanding of Robinhood Coin, equipping them with the knowledge needed to make informed investment decisions in the ever-evolving world of cryptocurrency.

What is robinhood coin? A Deep Dive into its Purpose

Overview of Robinhood Coin

Robinhood Coin, often symbolized as $HOOD, is a cryptocurrency that aims to embody the principles of financial equity and accessibility inspired by the legendary figure of Robin Hood. This digital asset is designed to empower everyday investors and provide a platform for wealth generation that is fair and equitable. Unlike many cryptocurrencies that focus solely on speculation or utility within closed ecosystems, Robinhood Coin emphasizes a broader mission of financial inclusion.

The Core Problem It Solves

The primary challenge that Robinhood Coin seeks to address is the systemic financial inequality that exists within the current economic landscape. Traditional financial systems often favor the wealthy, leaving the average individual with limited opportunities to grow their wealth. This disparity can be exacerbated in the cryptocurrency space, where many newcomers may feel overwhelmed by the complexities of trading and investing.

Robinhood Coin aims to democratize access to financial opportunities by providing a straightforward and accessible platform for users. This means not only allowing individuals to invest with lower barriers to entry but also offering educational resources to help them navigate the crypto landscape. The vision is to create an environment where anyone, regardless of their financial background, can participate and benefit from the burgeoning digital economy.

Its Unique Selling Proposition

What sets Robinhood Coin apart in the crowded cryptocurrency market is its commitment to social justice and equitable wealth distribution. The project is not merely a speculative asset; it is positioned as a movement towards financial freedom for everyone. Here are some of its unique selling propositions (USPs):

-

Community-Focused Approach: Robinhood Coin is built around the idea of community participation. It encourages holders to engage in the governance of the project, allowing them to have a say in decisions that affect the ecosystem. This model fosters a sense of ownership and responsibility among users.

-

Educational Resources: Recognizing that knowledge is power, Robinhood Coin emphasizes the importance of financial literacy. The project aims to provide resources that educate users about cryptocurrency trading, investment strategies, and the underlying technology. This empowers individuals to make informed decisions and feel confident in their investments.

-

Low-Cost Transactions: In line with its mission of accessibility, Robinhood Coin promotes low-cost transactions, making it easier for users to buy, sell, and trade without incurring hefty fees. This is particularly advantageous for newcomers who may be hesitant to invest due to high transaction costs associated with other platforms.

-

Decentralized Finance (DeFi) Integration: Robinhood Coin aspires to integrate with decentralized finance solutions, allowing users to lend, borrow, and earn interest on their holdings. This feature not only enhances the utility of the coin but also aligns with the project’s goal of providing users with diverse financial opportunities.

-

Security and Trust: The project prioritizes the security of its users’ assets. With a focus on best practices in cybersecurity and compliance with regulatory standards, Robinhood Coin seeks to build trust and confidence in its platform.

The Team and Backers

The success of any cryptocurrency project heavily relies on the vision, expertise, and commitment of its team. Robinhood Coin is backed by a group of experienced professionals from diverse backgrounds, including finance, technology, and blockchain development. The team’s collective experience ensures that the project is grounded in both innovative technology and a thorough understanding of market dynamics.

Additionally, Robinhood Coin has garnered attention from various investors and crypto enthusiasts who share its vision of financial equity. These backers not only provide financial support but also contribute strategic insights that help shape the project’s roadmap and future developments.

Fundamental Purpose in the Crypto Ecosystem

In the broader context of the cryptocurrency ecosystem, Robinhood Coin serves several vital functions:

-

Promoting Financial Inclusion: By lowering barriers to entry and enhancing access to financial resources, Robinhood Coin contributes to a more inclusive financial system. This aligns with the ethos of many blockchain projects that seek to provide alternatives to traditional banking.

-

Encouraging Responsible Investing: Through its educational initiatives, Robinhood Coin encourages responsible investing practices. This focus on education helps mitigate the risks associated with speculative trading and fosters a more informed investor base.

-

Facilitating Community Engagement: The project’s governance model promotes community involvement, making it a participatory ecosystem. This engagement not only strengthens the community but also enhances the project’s resilience and adaptability to changing market conditions.

-

Driving Innovation: As Robinhood Coin integrates with DeFi solutions and explores new use cases, it contributes to the ongoing innovation within the cryptocurrency space. By experimenting with different financial models, it helps to expand the possibilities of what cryptocurrencies can achieve.

-

Fostering Trust and Transparency: In an industry often criticized for a lack of transparency, Robinhood Coin aims to lead by example. By prioritizing security and compliance, it helps build trust among users and sets a standard for other projects.

Conclusion

Robinhood Coin represents a significant step toward creating a more equitable financial landscape within the cryptocurrency space. By addressing systemic inequalities, promoting financial literacy, and fostering community engagement, it aims to empower individuals to take control of their financial futures. As the cryptocurrency ecosystem continues to evolve, Robinhood Coin’s commitment to its core principles may well play a crucial role in shaping the future of finance for everyone.

The Technology Behind the Coin: How It Works

Overview of Robinhood Coin

Robinhood Coin (HOOD) is a cryptocurrency that aims to empower users by facilitating financial freedom and access to digital assets. Built on the Ethereum blockchain, Robinhood Coin leverages the underlying technology of blockchain to create a decentralized and secure environment for its users. This guide will delve into the core components of Robinhood Coin, exploring its blockchain architecture, consensus mechanism, key technological innovations, and more.

Blockchain Architecture

At its core, Robinhood Coin is built on the Ethereum blockchain, which is one of the most widely used and robust blockchain platforms. Ethereum allows developers to create smart contracts and decentralized applications (dApps), providing a flexible environment for various use cases.

1. Ethereum Foundation

The Ethereum blockchain is maintained by a global network of nodes that validate transactions and execute smart contracts. This decentralized structure ensures that no single entity has control over the network, promoting transparency and security. Robinhood Coin benefits from this established infrastructure, allowing it to utilize Ethereum’s network for its operations.

2. Smart Contracts

Robinhood Coin utilizes smart contracts to automate transactions and enforce the rules of the network. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This means that transactions can occur automatically without the need for intermediaries, reducing costs and increasing efficiency. For Robinhood Coin, smart contracts help in managing token transfers, staking rewards, and other functionalities seamlessly.

3. Token Standards

Robinhood Coin adheres to the ERC-20 token standard, which is a widely accepted framework for creating tokens on the Ethereum blockchain. This standard provides a set of rules that all tokens must follow, ensuring compatibility with various wallets, exchanges, and other dApps. By using ERC-20, Robinhood Coin can be easily traded and integrated within the broader Ethereum ecosystem.

Consensus Mechanism

Consensus mechanisms are crucial for maintaining the integrity and security of blockchain networks. They are the protocols that nodes follow to agree on the validity of transactions. Robinhood Coin, being built on Ethereum, initially operated on a Proof-of-Work (PoW) mechanism but has transitioned to Proof-of-Stake (PoS) with Ethereum 2.0.

1. Proof-of-Work (PoW)

In the PoW system, miners compete to solve complex mathematical problems, and the first one to solve it gets the right to add a new block to the blockchain. This method, while secure, requires significant computational power and energy, making it less environmentally friendly. PoW was the original consensus mechanism used by Ethereum before the transition to PoS.

2. Proof-of-Stake (PoS)

Ethereum’s move to PoS represents a significant shift in how transactions are validated. In PoS, validators are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral. This method is more energy-efficient and allows for quicker transaction processing. For Robinhood Coin, this means lower transaction fees and faster confirmation times, enhancing the user experience.

Key Technological Innovations

Robinhood Coin stands out not only for its underlying blockchain technology but also for several innovative features that enhance its functionality and user engagement.

1. Staking Mechanism

Robinhood Coin allows users to stake their tokens, which means they can lock up their coins to support the network’s operations in exchange for rewards. This process not only secures the network but also incentivizes users to hold their tokens long-term, potentially increasing the token’s value. The staking rewards can vary based on the number of coins staked and the overall network participation.

2. Decentralized Finance (DeFi) Integration

Robinhood Coin aims to integrate with various DeFi platforms, enabling users to access lending, borrowing, and yield farming opportunities directly through the Robinhood ecosystem. This integration allows users to leverage their Robinhood Coin holdings to earn passive income or take out loans without the need for traditional financial institutions.

3. User-Friendly Interface

One of the key innovations of Robinhood Coin is its emphasis on user experience. The platform is designed to be intuitive and accessible, particularly for beginners in the cryptocurrency space. With features like one-click trading and simplified transaction processes, users can easily buy, sell, or trade Robinhood Coin and other cryptocurrencies.

Security Features

Security is a paramount concern in the cryptocurrency world, and Robinhood Coin incorporates several measures to protect users and their assets.

1. Cold Storage

The majority of Robinhood Coin assets are held in cold storage, which means they are kept offline and away from potential cyber threats. This practice significantly reduces the risk of hacking and theft, providing users with peace of mind regarding the safety of their investments.

2. Insurance Coverage

Robinhood Coin’s platform is backed by crime insurance that protects against losses from theft and cybersecurity breaches. This insurance is underwritten by reputable institutions, adding an additional layer of security for users.

3. Regular Audits

To ensure the integrity of its systems and processes, Robinhood Coin undergoes regular audits conducted by third-party security experts. These audits help identify potential vulnerabilities and ensure that the platform adheres to the highest security standards.

Community and Governance

Community involvement and governance are essential components of any successful cryptocurrency. Robinhood Coin encourages active participation from its users in decision-making processes.

1. Decentralized Governance

Robinhood Coin aims to implement a decentralized governance model, allowing token holders to propose and vote on changes to the protocol. This approach empowers the community and ensures that the development of the coin aligns with the interests of its users.

2. Community Engagement

The Robinhood Coin team actively engages with its community through various channels, including social media, forums, and community events. This engagement fosters a sense of belonging and encourages collaboration among users, developers, and stakeholders.

Conclusion

Robinhood Coin represents a unique blend of traditional financial principles and innovative blockchain technology. By leveraging the Ethereum blockchain, implementing a Proof-of-Stake consensus mechanism, and focusing on user experience and security, Robinhood Coin aims to democratize access to financial opportunities for all users. Its commitment to community governance and engagement further solidifies its position as a forward-thinking digital asset in the ever-evolving cryptocurrency landscape. Whether you are a beginner or an experienced investor, understanding the technology behind Robinhood Coin is crucial for making informed decisions in your cryptocurrency journey.

Understanding robinhood coin Tokenomics

Tokenomics Overview

The tokenomics of Robinhood Coin (HOOD) is a crucial aspect for investors and users to understand, as it provides insights into the structure, utility, and potential value of the coin. Tokenomics encompasses various metrics, including total supply, circulating supply, and the underlying economic model governing the token’s value. Understanding these elements can help investors make informed decisions regarding their investments in Robinhood Coin.

Key Metrics

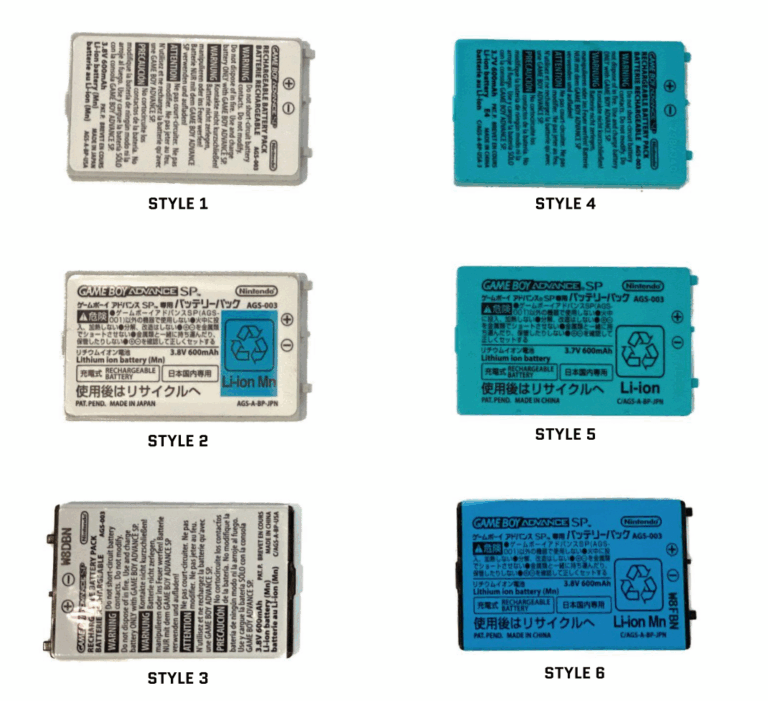

| Metric | Value |

|---|---|

| Total Supply | 10,000,000,000 HOOD |

| Max Supply | 10,000,000,000 HOOD |

| Circulating Supply | 10,000,000,000 HOOD |

| Inflation/Deflation Model | Deflationary |

Total Supply and Max Supply

The total supply of Robinhood Coin is set at 10 billion tokens, which also represents its maximum supply. This fixed supply model is intended to create scarcity, a fundamental principle in economics that can drive demand and, consequently, the value of the token. With a capped supply, the potential for inflation is minimized, making it an attractive option for those who are wary of inflationary currencies.

Circulating Supply

Currently, the circulating supply of Robinhood Coin is equal to its total supply, which means all tokens are available for trading and use in the market. This scenario can lead to higher liquidity, enabling easier buying and selling of the token on various exchanges.

Inflation/Deflation Model

Robinhood Coin operates on a deflationary model. This means that over time, the supply of coins may decrease through mechanisms such as token burns or buybacks, potentially increasing the value of the remaining tokens. A deflationary model can enhance investor sentiment, as it aligns with the principles of scarcity and demand.

Token Utility (What is the coin used for?)

Robinhood Coin serves multiple purposes within its ecosystem, enhancing its value proposition for users and investors alike. Here are some of the primary uses of the token:

-

Transaction Fees: Users can utilize Robinhood Coin to pay for transaction fees on the platform. By using the native token for these fees, users may benefit from reduced rates compared to using traditional currencies.

-

Staking: Holders of Robinhood Coin can stake their tokens to earn rewards. Staking helps secure the network and contributes to its overall stability while providing users with an opportunity to generate passive income.

-

Governance: Token holders may have governance rights that allow them to participate in decision-making processes regarding the future of the Robinhood Coin ecosystem. This could include voting on proposals, changes to the protocol, or even adjustments to the tokenomics itself.

-

Incentives and Rewards: The Robinhood Coin may also be used for various incentive programs, such as rewards for early adopters, participation in promotions, or loyalty programs. This can encourage more users to engage with the platform and hold the token long-term.

-

Integration with Other Services: As the Robinhood platform evolves, there may be additional integrations with other services or platforms that accept Robinhood Coin. This could expand its utility further, making it a more versatile asset for users.

Token Distribution

The distribution of Robinhood Coin plays a significant role in its adoption and long-term sustainability. Here’s a breakdown of the token distribution model:

-

Initial Distribution: The initial allocation of tokens is designed to ensure a wide distribution among users, preventing centralization of ownership. This approach helps build a strong community around the token, which is essential for its success.

-

Team and Advisors: A portion of the total supply is typically reserved for the team behind the project and advisors. This allocation incentivizes the team to work towards the long-term success of the coin, as they have a vested interest in its value.

-

Ecosystem Development: A significant share of tokens is often set aside for ecosystem development. This includes funding for marketing, partnerships, and further enhancements to the platform that supports Robinhood Coin. Such investments can lead to increased adoption and utility.

-

Community Incentives: To foster engagement and community growth, some tokens may be allocated for community incentives, such as airdrops, contests, or liquidity mining programs. These initiatives can attract new users and encourage existing holders to remain active in the ecosystem.

-

Reserve Fund: A reserve fund may be established to provide liquidity for future developments or unforeseen expenses. This fund acts as a buffer, ensuring that the project can navigate challenges without negatively impacting the token’s value.

In conclusion, the tokenomics of Robinhood Coin is structured to create a sustainable and engaging ecosystem for its users. With a fixed supply, multiple utilities, and a well-thought-out distribution model, Robinhood Coin aims to not only provide value to its holders but also to foster a thriving community around its platform. Understanding these elements can help investors navigate the evolving landscape of this digital asset effectively.

Price History and Market Performance

Key Historical Price Milestones

Robinhood Coin, often referred to as $HOOD, has had a dynamic and eventful price history since its inception. The coin was launched as part of a broader trend of meme and community-driven cryptocurrencies, drawing inspiration from the legendary figure of Robin Hood.

-

Launch and Initial Trading Phase: Upon its launch, Robinhood Coin experienced significant volatility, typical of new cryptocurrencies. Initial trading volumes were relatively low, resulting in price fluctuations that could be attributed to speculative trading and community interest. The price quickly rose from its initial listing, reaching a notable milestone of $0.01 within the first few weeks, spurred by social media buzz and the coin’s meme potential.

-

Peak Performance: The coin saw its all-time high in the summer of 2023, when it surged to approximately $0.50. This peak was largely driven by a combination of factors, including increased media coverage, endorsements from influential figures in the cryptocurrency community, and the general bullish sentiment in the broader crypto market. During this time, trading volumes spiked, indicating heightened investor interest.

-

Subsequent Corrections: Following its peak, Robinhood Coin underwent a significant correction, a common occurrence in the cryptocurrency market. By the end of 2023, the price had retraced to around $0.20. This decline was influenced by broader market trends, including regulatory scrutiny of cryptocurrencies and market corrections impacting many digital assets.

-

Resilience and Recovery Attempts: Entering 2024, Robinhood Coin attempted to recover some of its lost value, fluctuating between $0.15 and $0.30. This period was characterized by efforts from the development team to enhance the coin’s utility and community engagement through various initiatives, including partnerships and marketing campaigns.

-

Current Market Standing: As of October 2023, Robinhood Coin’s price has stabilized around $0.25, reflecting a moderate level of market interest. The coin remains in the top tier of meme tokens, with a dedicated community that continues to advocate for its use and growth.

Factors Influencing the Price

Historically, the price of Robinhood Coin has been influenced by a variety of factors, both internal and external to the cryptocurrency ecosystem.

-

Market Sentiment: Like many cryptocurrencies, Robinhood Coin’s price has been significantly affected by overall market sentiment. Bullish trends in the cryptocurrency market often lead to increased investment in altcoins, including $HOOD. Conversely, bearish trends can lead to rapid sell-offs, impacting the coin’s price negatively.

-

Social Media and Community Engagement: The role of social media cannot be overstated in the price movements of Robinhood Coin. Memes, viral trends, and endorsements from popular social media influencers have historically driven significant interest and investment in the coin. A notable example includes a viral TikTok campaign that led to a sudden influx of new investors, pushing the price upward.

-

Technological Developments: The development team behind Robinhood Coin has frequently announced upgrades and new features aimed at enhancing the coin’s utility. For example, the introduction of staking rewards and partnerships with decentralized finance (DeFi) platforms have positively influenced investor perception and price stability.

-

Regulatory Environment: The broader regulatory landscape for cryptocurrencies has also played a crucial role in shaping the market performance of Robinhood Coin. Regulatory news, whether positive or negative, can lead to immediate price reactions. For instance, announcements regarding increased scrutiny of meme tokens or proposals for stricter regulations often coincide with price dips.

-

Market Competition: The competitive landscape of the cryptocurrency market also affects Robinhood Coin’s price. The emergence of new meme coins and established cryptocurrencies vying for attention can dilute investor interest and impact trading volumes. As more projects enter the market, Robinhood Coin must continually innovate and maintain its relevance to attract and retain investors.

-

Investor Behavior: The behavior of retail investors, particularly those trading on platforms like Robinhood, has historically influenced the price of $HOOD. Investor psychology, driven by fear and greed, often leads to rapid price changes. Events like pump-and-dump schemes, where prices are artificially inflated before being sold off, have been observed in the past, contributing to the volatility of the coin.

In summary, Robinhood Coin has exhibited significant price volatility since its launch, characterized by dramatic peaks and corrections. Various factors, including market sentiment, community engagement, regulatory developments, and competitive dynamics, have influenced its price history. Understanding these elements is crucial for anyone looking to invest in or engage with this digital asset.

Where to Buy robinhood coin: Top Exchanges Reviewed

5 Reasons Robinhood Outshines Coinbase for Beginners

In the 2025 comparison of Robinhood and Coinbase, both platforms emerge as top contenders for novice crypto investors, each offering unique advantages. Robinhood stands out with its user-friendly interface and commission-free trading, making it accessible for those new to cryptocurrency. Conversely, Coinbase excels in providing a comprehensive suite of educational resources and a wider variety of cryptocurrencies, catering to users seeking to expand their knowledge and investment options.

- Website: coinledger.io

- Platform Age: Approx. 11 years (domain registered in 2014)

3. Robinhood – Trade Crypto with Minimal Costs!

Robinhood distinguishes itself in the cryptocurrency trading landscape by providing one of the lowest average trading costs, making it an attractive option for both novice and seasoned investors. Unlike competitors such as Coinbase, Kraken, and Crypto.com, which impose higher fees, Robinhood’s streamlined platform allows users to trade cryptocurrencies with minimal financial overhead. This cost efficiency, combined with its user-friendly interface, positions Robinhood as a compelling choice for cost-conscious crypto enthusiasts.

- Website: robinhood.com

- Platform Age: Approx. 30 years (domain registered in 1995)

3. Robinhood – Simplest Path to Crypto Wallets!

The Reddit discussion on transferring cryptocurrency from Robinhood to a wallet highlights the platform’s unique position in the crypto market, particularly for beginners. Users emphasize the importance of understanding wallet options like Trezor and Ledger while navigating the process of moving assets. Robinhood stands out for its user-friendly interface and commission-free trading, making it accessible for newcomers looking to dip their toes into cryptocurrency before managing their own wallets.

- Website: reddit.com

- Platform Age: Approx. 20 years (domain registered in 2005)

How to Buy robinhood coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Robinhood Coin is to select a cryptocurrency exchange that lists this asset. While Robinhood may offer the coin directly, other exchanges might also facilitate its purchase. Here are a few popular exchanges you can consider:

- Robinhood: Known for its user-friendly interface and no-commission trading, Robinhood allows you to buy and sell cryptocurrencies, including Robinhood Coin.

- Coinbase: Another popular option, Coinbase provides a secure platform with a variety of cryptocurrencies available for trading.

- Binance: One of the largest exchanges globally, Binance offers a wide range of cryptocurrencies and trading pairs.

Before you proceed, ensure that the exchange you choose is available in your region and supports Robinhood Coin.

2. Create and Verify Your Account

After selecting an exchange, you will need to create an account. Follow these steps:

- Sign Up: Visit the exchange’s website or download its app. Click on the “Sign Up” or “Create Account” button.

- Provide Information: Fill out the registration form with your email address, a secure password, and any other required details.

- Verify Your Identity: Most exchanges require identity verification to comply with regulations. You may need to upload a government-issued ID and provide personal information such as your Social Security Number (for U.S. residents). This process can take anywhere from a few minutes to a few days, depending on the exchange.

- Enable Two-Factor Authentication (2FA): For added security, enable 2FA. This typically involves linking your account to a mobile app like Google Authenticator or receiving SMS codes.

3. Deposit Funds

Once your account is verified, you need to deposit funds to buy Robinhood Coin. Here’s how:

- Choose Your Deposit Method: Most exchanges offer various methods to deposit funds, including bank transfers, credit/debit cards, and sometimes PayPal. Check the fees associated with each method, as they can vary.

- Deposit Funds: Follow the instructions provided by the exchange to complete your deposit. If you’re using a bank transfer, note that it may take a few days for the funds to appear in your account.

- Confirm Your Balance: Once the funds are deposited, check your account balance to ensure the funds are available for trading.

4. Place an Order to Buy Robinhood Coin

With your account funded, you can now place an order to buy Robinhood Coin. Here are the steps to do this:

- Navigate to the Market Section: Find the market or trading section of the exchange. Look for the search bar to locate Robinhood Coin.

- Select Robinhood Coin: Once you find Robinhood Coin, click on it to view its trading page.

- Choose Your Order Type: You can typically choose between a market order (buying at the current market price) or a limit order (setting a specific price at which you want to buy).

- Enter the Amount: Specify how much Robinhood Coin you want to purchase. Ensure that your order does not exceed your available balance.

- Confirm Your Purchase: Review the order details, including fees, and click on the “Buy” or “Place Order” button to finalize your purchase. You should receive a confirmation once the order is executed.

5. Secure Your Coins in a Wallet

After purchasing Robinhood Coin, it’s crucial to keep your investment safe. While you can store your coins on the exchange, a more secure option is to transfer them to a personal wallet. Here’s how:

- Choose a Wallet: You can opt for a software wallet (like Exodus or Atomic Wallet) for ease of use or a hardware wallet (like Ledger or Trezor) for maximum security.

- Set Up Your Wallet: If you’re using a software wallet, download the app and create a new wallet. Follow the instructions to secure it with a strong password and back up your recovery phrase.

- Transfer Your Coins: Go to your exchange account, find the option to withdraw or send coins, and enter your wallet address. Double-check the address to avoid mistakes.

- Confirm the Transfer: After submitting the transfer request, wait for the transaction to be confirmed on the blockchain. This can take anywhere from a few minutes to several hours, depending on network congestion.

By following these steps, you can successfully buy and secure Robinhood Coin, paving the way for your investment journey in the cryptocurrency space. Always remember to conduct thorough research and consider your risk tolerance before investing in any digital asset.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Unique Value Proposition

Robinhood Coin (HOOD) positions itself as a digital asset that embodies the ethos of financial empowerment, inspired by the legendary figure of Robin Hood. The project aims to democratize access to wealth and financial opportunities, appealing to a broad audience that resonates with its narrative of social justice and economic equality. This strong branding can attract users looking for a coin that represents more than just financial gain.

2. Low-Cost Trading Environment

Robinhood, as a platform, is known for its low-cost trading structure, often touted as having some of the lowest fees in the industry. This can be particularly advantageous for Robinhood Coin, as it allows investors to acquire and trade HOOD without incurring significant transaction costs. For beginners and casual investors, this could encourage participation and investment in the coin.

3. Accessibility and User Experience

The Robinhood platform is designed to be user-friendly, making it accessible for beginners who may be intimidated by more complex trading platforms. The ease of use, along with features like recurring buys and staking options, can promote ongoing engagement with Robinhood Coin. Additionally, the ability to start investing with as little as $1 lowers the barrier to entry for new investors.

4. Robust Security Measures

Security is a critical concern in the cryptocurrency space, and Robinhood addresses this with industry-leading security protocols. The majority of crypto assets are held in cold storage, which is disconnected from the internet, thereby reducing the risk of hacks and breaches. Furthermore, Robinhood provides crime insurance against theft and cybersecurity breaches, enhancing investor confidence in holding Robinhood Coin on the platform.

5. Strong Community Support

The narrative surrounding Robinhood Coin, which emphasizes social justice and financial inclusivity, can foster a strong community of supporters. A dedicated community can drive demand and interest in the coin, as members promote its values and vision. Community-driven initiatives, such as social media campaigns and educational resources, can further enhance its visibility and adoption.

6. Integration with Popular Cryptocurrencies

Robinhood supports a wide array of popular cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin, which can facilitate broader market acceptance of Robinhood Coin. The potential for cross-promotional opportunities and liquidity on the platform can enhance the visibility and trading volume of HOOD, contributing to its overall growth.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies are notoriously volatile, with prices subject to rapid and unpredictable fluctuations. Robinhood Coin is likely to experience similar market dynamics, which can pose significant risks for investors. Sudden price drops may lead to panic selling and significant losses for those who are not prepared for such volatility. This unpredictability can deter potential investors who prefer more stable investment options.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, with governments around the world grappling with how to classify and regulate digital assets. Robinhood Coin may face scrutiny from regulatory bodies, which could impact its operations and market adoption. Regulatory changes can lead to restrictions on trading, increased compliance costs, or even bans in certain jurisdictions, introducing additional risks for investors.

3. Competition from Established Players

The cryptocurrency market is highly competitive, with numerous established players and new entrants vying for market share. Robinhood Coin faces competition not only from other meme coins and tokens but also from well-established cryptocurrencies with strong ecosystems, such as Bitcoin and Ethereum. The presence of competing assets can dilute investor interest and hinder the growth of HOOD.

4. Technological Risks

As a blockchain-based asset, Robinhood Coin is susceptible to various technological risks, including vulnerabilities in smart contracts, network congestion, and issues related to scalability. Any technical failures or security breaches could undermine investor confidence and lead to significant losses. Additionally, the rapid pace of technological advancement in the blockchain space means that Robinhood Coin must continuously innovate to remain relevant.

5. Lack of Clear Utility

While Robinhood Coin markets itself as a revolutionary asset, its long-term viability hinges on the development of clear use cases and utility. If the coin fails to establish practical applications within the broader cryptocurrency ecosystem or does not gain traction as a medium of exchange, its value proposition may diminish. Investors may become disillusioned if the project does not deliver on its promises or if its real-world applications remain unclear.

6. Market Sentiment and Speculation

The success of Robinhood Coin may heavily rely on market sentiment and speculative trading behaviors. As a meme-inspired token, it may attract investors based more on trends and social media hype rather than intrinsic value or utility. This reliance on sentiment-driven trading can create a precarious situation where the coin’s value is susceptible to sudden swings based on public perception, news events, or social media trends.

Conclusion

Investing in Robinhood Coin presents both potential opportunities and inherent risks. While the coin’s unique narrative, low-cost trading environment, and robust security measures may attract investors, it is essential to consider the volatility, regulatory uncertainties, and competitive landscape within the cryptocurrency market. As with any investment, thorough research and an understanding of both the potential strengths and risks are crucial for making informed decisions.

Frequently Asked Questions (FAQs)

1. What is Robinhood Coin?

Robinhood Coin, also known as $HOOD, is a cryptocurrency that aims to embody the spirit of financial justice, inspired by the legendary figure Robin Hood. It seeks to provide financial opportunities to everyday investors, promoting the idea of wealth distribution and financial empowerment. The coin operates on the Ethereum blockchain and offers various utilities, distinguishing it from simple meme tokens.

2. Who created Robinhood Coin?

The exact identity of the creators behind Robinhood Coin is not publicly disclosed. However, the project aims to resonate with the ethos of financial justice and community empowerment. The development team likely includes individuals passionate about cryptocurrency and social equity, although specifics about their backgrounds or affiliations remain limited.

3. Is Robinhood Coin a good investment?

Whether Robinhood Coin is a good investment depends on individual financial goals, risk tolerance, and market conditions. As with any cryptocurrency, potential investors should conduct thorough research, considering factors like market trends, the coin’s utility, and community engagement. It is essential to remember that cryptocurrencies can be highly volatile, and investing in them carries inherent risks.

4. What makes Robinhood Coin different from Bitcoin?

While both Robinhood Coin and Bitcoin are cryptocurrencies, they serve different purposes. Bitcoin is primarily viewed as a store of value and a decentralized digital currency, often referred to as “digital gold.” In contrast, Robinhood Coin is positioned as a community-driven token aimed at promoting financial justice and accessibility. Additionally, Robinhood Coin operates on the Ethereum blockchain, allowing for smart contract functionality, whereas Bitcoin’s primary focus is as a currency.

5. How can I buy Robinhood Coin?

To purchase Robinhood Coin, you will need to find a cryptocurrency exchange that supports it. Once you’ve created an account on an exchange that lists $HOOD, you can deposit funds (usually in fiat currency or another cryptocurrency) and then trade for Robinhood Coin. Ensure you follow all necessary security protocols, such as enabling two-factor authentication on your account.

6. Can I store Robinhood Coin in a wallet?

Yes, Robinhood Coin can be stored in a cryptocurrency wallet that supports Ethereum-based tokens (ERC-20 tokens). Hardware wallets, software wallets, and mobile wallets are popular options for securely holding cryptocurrencies. Always ensure that you follow best practices for wallet security, such as keeping your private keys safe and using reputable wallet services.

7. What is the total supply of Robinhood Coin?

Robinhood Coin has a total supply of 10 billion $HOOD tokens. This fixed supply means that no additional coins will be minted beyond this amount, which can influence its scarcity and potential value over time. Understanding the supply dynamics is crucial for investors when evaluating the token’s long-term potential.

8. Is Robinhood Coin listed on major exchanges?

As of now, Robinhood Coin’s availability may vary across different exchanges. While it may be listed on some smaller or decentralized exchanges, it is essential to check its status on major platforms to ensure liquidity and ease of trading. Always verify the exchange’s reputation and security measures before trading.

Final Verdict on robinhood coin

Overview of Robinhood Coin

Robinhood Coin ($HOOD) aims to embody the spirit of financial justice by providing an accessible platform for individuals to invest and potentially improve their financial situations. Built on the Ethereum blockchain, this token integrates advanced technologies, including AI, to enhance its utility and appeal within the cryptocurrency landscape. The narrative surrounding Robinhood Coin draws inspiration from the legendary figure of Robin Hood, emphasizing a mission of redistributing wealth and providing opportunities for the common investor.

Purpose and Technology

The primary purpose of Robinhood Coin is to democratize access to cryptocurrency investments, positioning itself as more than just a meme token. It is framed as a tool for financial empowerment, targeting both new and seasoned investors who are looking for innovative ways to grow their assets. The technology behind Robinhood Coin leverages Ethereum’s robust infrastructure, which supports smart contracts and decentralized applications, ensuring that transactions are secure and efficient.

Potential and Risks

As with any cryptocurrency, investing in Robinhood Coin presents both opportunities and risks. The potential for significant returns exists, particularly in a market characterized by volatility and rapid growth. However, this asset class is also notorious for its price fluctuations and susceptibility to market sentiment. Therefore, investors should approach Robinhood Coin with caution, recognizing that while it could yield high rewards, it also poses substantial risks.

Conduct Your Own Research (DYOR)

In conclusion, Robinhood Coin represents an intriguing entry into the cryptocurrency world, particularly for those who resonate with its mission of financial equity. Nevertheless, it is crucial to understand that this is a high-risk investment. Prospective investors should conduct thorough research (DYOR) to evaluate their risk tolerance, understand the market dynamics, and make informed decisions before committing any capital to Robinhood Coin or similar digital assets. The crypto landscape is ever-evolving, and being well-informed is key to navigating its complexities.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.