Oil Packing Machine: The Ultimate 2025 Sourcing Guide

Introduction: Navigating the Global Market for Oil Packing Machines

In the competitive landscape of the food and beverage industry, efficient oil packaging is a cornerstone for maintaining product quality, ensuring compliance, and scaling operations. As demand for edible oils surges globally—driven by consumer trends in health-conscious cooking and industrial applications—businesses in the USA and Europe face mounting pressure to optimize their packaging processes. Imagine streamlining your production line with machines that handle everything from viscous oils to precise pouch filling, reducing waste and boosting throughput. This guide equips B2B buyers with the insights needed to make informed decisions in sourcing oil packing machines.

The core challenge lies in navigating a fragmented global market. Suppliers vary widely in quality, from basic vertical form fill seal (VFFS) systems to advanced rotary premade pouch machines. Regulatory hurdles, such as FDA and EU standards for food safety and labeling, complicate imports. Pricing fluctuations, supply chain disruptions, and the need for customization—whether for oil pouch packing, bottle filling, or automated lines—can overwhelm procurement teams. Without a strategic approach, businesses risk downtime, compliance issues, or suboptimal ROI.

This comprehensive B2B guide addresses these pain points head-on. We’ll explore:

- Key Machine Types: From liquid filling machines for oils to specialized systems like spout pouch and sachet packers.

- Market Trends and Suppliers: Insights into top global providers, including pricing benchmarks and case studies from USA and European clients.

- Selection Criteria: Factors like capacity, automation levels, and integration with existing lines.

- Best Practices: Tips for procurement, installation, and maintenance to ensure long-term efficiency.

By the end, you’ll be positioned to select machines that align with your operational goals, enhancing competitiveness in a dynamic market.

(Word count: 248)

Top 10 Oil Packing Machine Manufacturers & Suppliers List

1. Top 10 Packing Machine Manufacturers in the world – Landpack

Domain: landpack.com

Registered: 2009 (16 years)

Introduction: 1. Landpack-China · 2. Tetra Pak- Switzerland · 3. Krones-Germany · 4. KHS GmbH-Germany · 5. Sidel-France · 6. Syntegon-Germany · 7. MULTIVAC-Germany….

2. Edible Oil Filling Machine – Spheretech Packaging

Domain: spheretechpackaging.com

Registered: 2018 (7 years)

Introduction: Spheretech Packaging, a trusted manufacturer of Liquid Filling, Capping, Sealing, and Packaging Machines for multiple industries….

3. Top 10 Packaging and Filling Machine Manufacturers in China

Domain: qualipakmachines.com

Registered: 2023 (2 years)

Introduction: ECHO Machinery is recognized as the largest premade pouch packing machine manufacturer in China and has developed over 90 patents. The company ……

4. Bottling & Filling Equipment Manufacturer | E-PAK Machinery

Domain: epakmachinery.com

Registered: 2001 (24 years)

Introduction: E-PAK Machinery manufactures quality liquid filling machines, including cappers and labelers, for the bottling industry. Buy equipment and parts online….

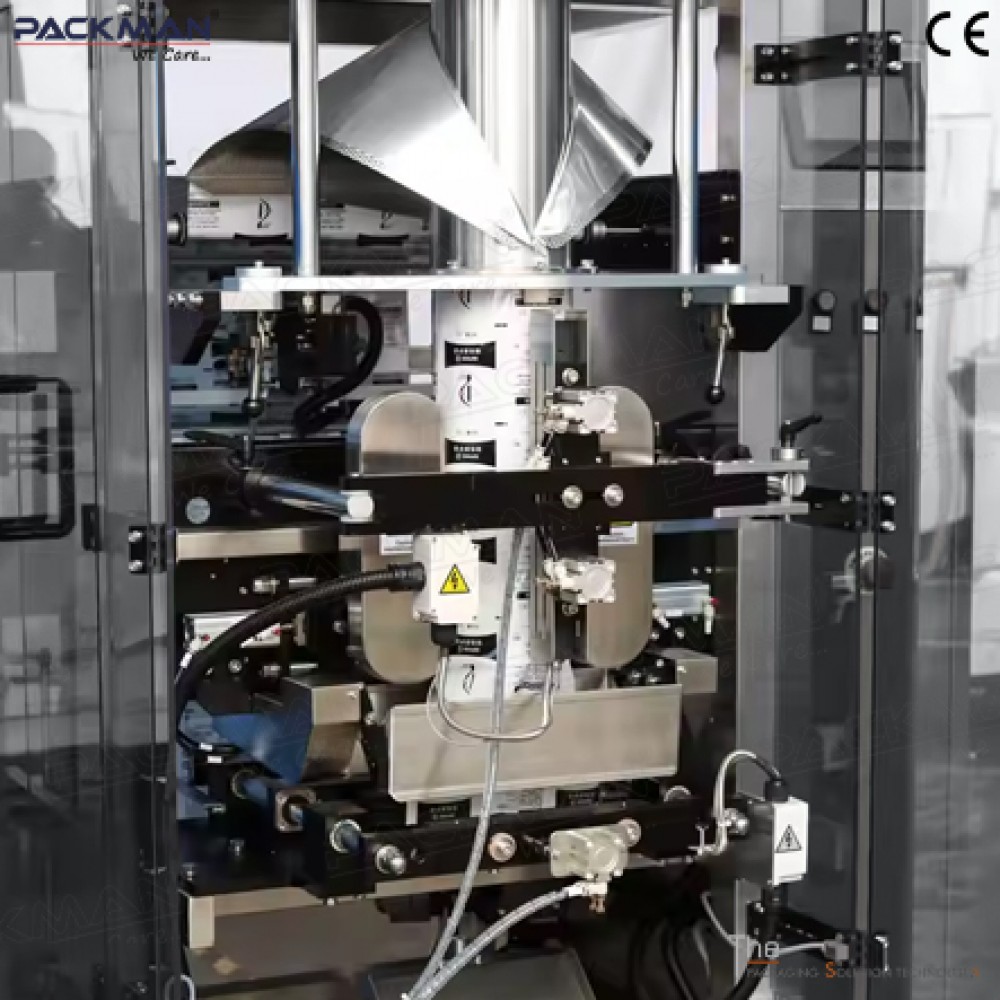

Illustrative Image (Source: Google Search)

5. Edible Oil Packing Machine – Gtech Packaging India Private Limited

Domain: gtechpackaging.com

Registered: 2014 (11 years)

Introduction: We are a manufacturer and exporter of Oil Packaging Machine and our product is made up of good quality. know more. 25475114348. Get Best Price ……

6. Pouch Packaging Machine Supplier in Bengaluru and Counting and …

Domain: unitekpackagingsystems.com

Registered: 2016 (9 years)

Introduction: Pouch Packaging Machine Supplier in Bengaluru. Oil Packing Machines · Rs 1,69,999 / Piece. Capacity: 25 -30 pouch per minutes; Power: 6.5 kW. Get Best Price….

Understanding oil packing machine Types and Variations

Understanding Oil Packing Machine Types and Variations

Oil packing machines are essential for efficient, hygienic packaging in industries like food, cosmetics, and chemicals. This section outlines key types, focusing on variations suitable for B2B operations in the USA and Europe. We identify four primary types based on packaging format and functionality: Vertical Form Fill Seal (VFFS) Machines, Doypack Machines, Bottle Filling Machines, and Sachet Packing Machines.

| Type | Features | Applications | Pros/Cons |

|---|---|---|---|

| Vertical Form Fill Seal (VFFS) Machines | Automated forming of pouches from film rolls, filling with oil, and sealing; supports high-speed operations; integrates weighing and labeling. | Bulk packaging of edible oils, lubricants, and industrial oils in flexible pouches. | Pros: High efficiency, cost-effective for large volumes; Cons: Higher initial setup cost, less suitable for rigid containers. |

| Doypack Machines | Handles pre-made or formed stand-up pouches with spouts or zippers; includes filling, capping, and sealing; supports vacuum or modified atmosphere packaging. | Premium oil products like olive oil or essential oils in resealable pouches for retail and export. | Pros: Versatile for various pouch styles, enhances product shelf life; Cons: Slower for very high volumes, requires pouch pre-preparation. |

| Bottle Filling Machines | Inline or rotary systems for filling glass/plastic bottles; includes capping, labeling, and cartoning; precise volumetric or gravimetric filling. | Bottled cooking oils, motor oils, and pharmaceuticals in rigid containers. | Pros: Accurate dosing, easy integration with existing lines; Cons: Limited to bottle formats, higher maintenance for viscous oils. |

| Sachet Packing Machines | Forms and fills small single-serve sachets or sticks; multi-lane capabilities for high output; suitable for liquid dosing. | Sample packets or travel-sized oils like cooking oil sachets or lubricants. | Pros: Ideal for portion control, low material waste; Cons: Not suited for large volumes, potential for seal failures with thin films. |

Vertical Form Fill Seal (VFFS) Machines

VFFS machines streamline oil packaging by converting flat film rolls into sealed pouches in a continuous process. They are ideal for medium to high-volume production, handling viscosities from thin lubricants to thicker edible oils. Key components include film unwinding, forming tubes, oil filling via pumps, and heat sealing. In the USA and Europe, these comply with FDA and EU food safety standards, often integrating multihead weighers for precise measurement. Businesses benefit from reduced labor costs and scalability, with models supporting nitrogen flushing to extend shelf life.

Illustrative Image (Source: Google Search)

Doypack Machines

Doypack machines specialize in stand-up pouches, offering flexibility for spouted or zippered designs that improve user convenience. They operate by feeding pre-made pouches into rotary or horizontal systems for filling and sealing, accommodating oils with additives or flavors. Common in European markets for premium products like extra virgin olive oil, these machines ensure leak-proof packaging and can include spout insertion for easy dispensing. Advantages include branding opportunities through custom pouch shapes, though operators must monitor for consistent fill levels to avoid overflows.

Bottle Filling Machines

These machines focus on rigid containers, using piston or peristaltic pumps for accurate oil dispensing into bottles. Inline models suit smaller operations, while rotary versions handle high-speed lines in large facilities. They are prevalent in the USA for automotive oils and in Europe for bottled vinegars or specialty oils, with features like automatic capping and labeling for compliance with traceability regulations. Maintenance involves regular cleaning to prevent residue buildup, making them reliable for consistent batch production.

Sachet Packing Machines

Sachet machines produce compact, single-use packets, forming them from film rolls and filling via timed pumps. They excel in multi-lane configurations for high throughput, suitable for promotional samples or portion-controlled oils. In B2B contexts across the USA and Europe, they support applications like hotel amenities or industrial lubricants, ensuring hygienic seals. While efficient for low-volume packaging, they require precise film tensioning to maintain integrity, offering cost savings through minimal material use.

Key Industrial Applications of oil packing machine

Key Industrial Applications of Oil Packing Machines

Oil packing machines, such as pouch and bottle fillers, are essential for efficient, automated packaging in various sectors. Below is a summary of key industries and applications, along with detailed benefits.

Illustrative Image (Source: Google Search)

| Industry/Application | Detailed Benefits |

|---|---|

| Food and Beverage (e.g., edible oils like vegetable, olive, and cooking oils) | Ensures hygienic filling to prevent contamination; provides precise volume control for consistent portioning; extends shelf life through airtight sealing; supports high-speed production lines to meet demand in large-scale manufacturing; complies with FDA and EU food safety regulations for traceability and quality assurance. |

| Automotive and Lubricants (e.g., motor oils, hydraulic fluids, and industrial lubricants) | Delivers accurate dispensing to avoid overfills or shortages; offers robust, leak-proof packaging for safe transport and storage; integrates with labeling systems for regulatory compliance (e.g., SAE standards); reduces material waste and operational costs through automation; enhances product integrity in harsh environments. |

| Cosmetics and Personal Care (e.g., essential oils, massage oils, and beauty serums) | Maintains product purity with sterile filling processes; enables customizable pouch or bottle formats for retail appeal; preserves volatile compounds through vacuum or inert gas sealing; supports small-batch flexibility for diverse SKUs; meets EU cosmetic regulations (e.g., REACH) for safety and labeling. |

| Pharmaceuticals and Healthcare (e.g., medicinal oils and pharmaceutical-grade liquids) | Provides sterile, tamper-evident packaging to ensure patient safety; allows precise dosing for accurate medication delivery; integrates with capping and labeling for GMP compliance; minimizes cross-contamination risks in cleanroom environments; facilitates traceability with batch coding and serialization. |

| Chemicals and Industrial (e.g., chemical oils, solvents, and specialty fluids) | Handles viscous or hazardous materials with corrosion-resistant components; ensures secure sealing to prevent leaks and spills; supports bulk packaging options for B2B supply chains; reduces labor costs via automated lines; adheres to OSHA and EU chemical safety standards for handling and storage. |

3 Common User Pain Points for ‘oil packing machine’ & Their Solutions

3 Common User Pain Points for Oil Packing Machines & Their Solutions

In the B2B sector, oil packing machines are essential for efficient packaging of products like edible oils, lubricants, and industrial fluids. Below, we outline three prevalent pain points faced by manufacturers and distributors in the USA and Europe, presented in a Scenario/Problem/Solution format.

Pain Point 1: Leakage and Spillage During Filling

- Scenario: A food processing company in the USA experiences frequent leaks while packing cooking oil into pouches, resulting in product waste and cleanup delays.

- Problem: Inadequate sealing mechanisms or incompatible materials lead to spillage, increasing material costs, risking contamination, and non-compliance with FDA hygiene standards.

- Solution: Invest in advanced oil packing machines with precision drip-free nozzles and automated sealing systems, such as those integrated with vertical form fill seal (VFFS) technology. Regular calibration and using food-grade, anti-corrosive components can reduce waste by up to 20% and ensure regulatory adherence.

Pain Point 2: Inconsistent Filling Accuracy

- Scenario: A European lubricant manufacturer struggles with varying fill volumes in bottles, leading to customer complaints and returns.

- Problem: Manual or outdated filling systems cause over- or under-filling, affecting product consistency, inventory management, and compliance with EU measurement regulations like the Measuring Instruments Directive.

- Solution: Adopt automated liquid filling lines with servo-driven pumps and inline weighers for precise volume control. Implementing real-time monitoring software can achieve accuracy within ±1% tolerances, minimizing rework and enhancing supply chain reliability.

Pain Point 3: High Downtime Due to Maintenance Issues

- Scenario: An industrial oil supplier in Europe faces prolonged machine breakdowns, halting production lines and delaying shipments.

- Problem: Frequent clogs from viscous oils or wear on components result in unplanned downtime, escalating operational costs and disrupting B2B contracts.

- Solution: Select robust oil packing machines with modular designs for quick part replacement and predictive maintenance features, such as IoT sensors for early fault detection. Scheduled servicing and operator training can cut downtime by 30%, improving overall equipment effectiveness (OEE) and production throughput.

In-depth Look: Manufacturing Processes and Quality Assurance for oil packing machine

In-depth Look: Manufacturing Processes and Quality Assurance for Oil Packing Machines

Oil packing machines, such as those used for pouch, bottle, or sachet filling in liquid packaging lines, are engineered for precision and efficiency. This section examines the core manufacturing processes and quality assurance protocols, drawing from established practices in the industry. These insights are particularly relevant for B2B buyers in the USA and Europe, where compliance with international standards ensures reliability in food, chemical, and pharmaceutical applications.

Manufacturing Processes

The production of oil packing machines involves a systematic workflow to achieve durability, accuracy, and compliance. Key stages include preparation, forming, assembly, and quality control (QC).

Preparation

This initial phase focuses on material selection and design optimization:

– Material Sourcing: High-grade stainless steel (e.g., 304 or 316) is procured for corrosion resistance, essential for oil-handling components. Suppliers are vetted for certifications like RoHS and REACH to meet EU and US regulations.

– Design and Prototyping: CAD software is used to create blueprints tailored for oil-specific features, such as anti-drip nozzles and volumetric fillers. Prototypes are tested for flow rates and viscosity handling (e.g., for edible oils or lubricants).

– Component Fabrication Planning: Precision parts like pumps, sensors, and conveyors are planned, ensuring compatibility with automated lines.

Forming

Shaping and machining raw materials into functional components:

– CNC Machining: Computer numerical control (CNC) tools form frames, hoppers, and filling heads with tolerances under 0.01 mm for leak-proof performance.

– Welding and Fabrication: TIG welding secures joints in the machine body, followed by surface treatments like passivation to enhance hygiene and prevent oil contamination.

– Electrical Integration Prep: Wiring harnesses and control panels are formed, incorporating PLC systems for programmable logic in oil pouch or bottle packing.

Assembly

Integration of components into a complete system:

– Modular Assembly: Sub-assemblies (e.g., filling stations, capping units) are built on production lines and combined. For oil packing machines, this includes installing peristaltic pumps for accurate dosing.

– Testing Integration: Initial functional tests verify mechanics, such as servo motors for high-speed operation (up to 100 pouches/minute).

– Customization: Machines are adapted for specific needs, like integrating labeling or capping lines for comprehensive oil packaging solutions.

Quality Control (QC)

Rigorous checks at every stage ensure defect-free output:

– In-Process Inspections: Dimensional accuracy and material integrity are verified using tools like calipers and ultrasonic testers.

– Final Testing: Machines undergo simulated runs with oil substitutes to assess speed, accuracy (e.g., ±1% fill variance), and safety features like emergency stops.

– Documentation: Each unit receives a traceability report, including serial numbers and test data, for post-sale support.

| Stage | Key Activities | Tools/Methods |

|---|---|---|

| Preparation | Material sourcing, design | CAD, supplier audits |

| Forming | Machining, welding | CNC, TIG welding |

| Assembly | Integration, initial tests | Modular lines, PLC programming |

| QC | Inspections, final testing | Calipers, simulation runs |

Quality Assurance and Standards

Quality assurance in oil packing machine manufacturing adheres to international benchmarks to guarantee performance and regulatory compliance. Leading manufacturers, such as those with ISO certifications, implement robust systems.

- ISO 9001 Compliance: Establishes a quality management system (QMS) for consistent production, risk assessment, and continuous improvement. This ensures machines meet FDA (USA) and EU food contact material standards for oil packaging.

- Additional Standards: ISO 14001 for environmental management minimizes waste in production, while CE marking confirms safety for European markets. HACCP principles are integrated for food-grade machines to prevent contamination.

- Audits and Certifications: Third-party audits verify processes, with certificates available for client review. This supports B2B procurement by reducing downtime risks and ensuring scalability for high-volume oil packing operations.

By prioritizing these processes and standards, oil packing machines deliver reliable, efficient solutions for global supply chains. For pricing or customization details, consult certified suppliers like Landpack.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘oil packing machine’

Practical Sourcing Guide: A Step-by-Step Checklist for Oil Packing Machine

This checklist provides a structured approach to sourcing oil packing machines (e.g., pouch, bottle, or liquid filling systems) for B2B operations in the USA and Europe. Focus on compliance with regional standards such as FDA, CE marking, and ISO certifications.

Step 1: Define Requirements

- Identify production needs: Determine throughput (e.g., packs per minute), oil types (e.g., edible, industrial), and packaging formats (e.g., pouches, bottles, sachets).

- Specify technical features: Include filling accuracy, material compatibility (e.g., stainless steel for corrosion resistance), automation level (e.g., VFFS or rotary systems), and integration with existing lines.

- Set budget and timeline: Factor in initial costs, shipping, customs duties (e.g., EU tariffs), and lead times (typically 4-12 weeks from Asian suppliers).

Step 2: Research Suppliers

- Source from verified directories: Use platforms like ThomasNet (USA), Alibaba (with verified badges), or EU-based portals like Europages.

- Evaluate global options: Prioritize manufacturers like Landpack for oil-specific machines (e.g., oil pouch or bottle packing systems); check for USA/Europe distributors to minimize import risks.

- Review certifications: Ensure suppliers meet regional regulations (e.g., CE for Europe, UL for USA) and have client references in food/pharma sectors.

Step 3: Request Quotes and Samples

- Submit RFQs: Provide detailed specs to 3-5 suppliers, including volume requirements and customization needs (e.g., spout pouch filling for oils).

- Analyze pricing: Compare machine costs (e.g., $10,000-$50,000 for entry-level models), plus extras like installation, training, and spare parts.

- Request demos: Ask for virtual tours, video demos, or sample runs to verify performance on oil viscosity and hygiene standards.

Step 4: Evaluate and Select

- Assess quality and reliability: Review warranties (e.g., 1-2 years), after-sales support (e.g., remote diagnostics), and uptime guarantees.

- Conduct due diligence: Check supplier ratings, financial stability, and past delivery records; consider site visits if feasible.

- Use a decision matrix:

| Criteria | Weight | Supplier A Score | Supplier B Score | Supplier C Score |

|---|---|---|---|---|

| Price | 30% | |||

| Compliance/Quality | 25% | |||

| Features/Tech | 20% | |||

| Support/Services | 15% | |||

| Lead Time | 10% | |||

| Total | 100% |

Step 5: Negotiate and Procure

- Negotiate terms: Secure favorable payment structures (e.g., 30% deposit, balance on delivery), bulk discounts, and service contracts.

- Finalize contracts: Include clauses for IP protection, dispute resolution (e.g., under USA/EU law), and penalties for delays.

- Arrange logistics: Coordinate shipping (e.g., via sea freight for cost efficiency) and import compliance (e.g., HTS codes for machinery).

Step 6: Installation and Optimization

- Plan setup: Schedule professional installation and operator training to ensure seamless integration.

- Test and validate: Run trials to confirm output quality, efficiency, and compliance with safety standards (e.g., OSHA in USA).

- Monitor performance: Establish KPIs (e.g., downtime <5%) and maintain a spares inventory for ongoing operations.

Comprehensive Cost and Pricing Analysis for oil packing machine Sourcing

Comprehensive Cost and Pricing Analysis for Oil Packing Machine Sourcing

Sourcing oil packing machines, such as oil pouch packing machines or oil bottle filling lines, involves evaluating multiple cost factors. This analysis focuses on key components—materials, labor, and logistics—based on typical industry benchmarks for machines from suppliers like Landpack. Prices can vary by machine type (e.g., vertical form fill seal for liquids or spout pouch fillers), capacity, and customization. Expect base prices ranging from $5,000–$15,000 for entry-level models to $50,000+ for automated lines, excluding additional fees. For USA and European buyers, factor in import duties (e.g., 2–5% tariffs) and compliance with standards like FDA or CE certification.

Cost Breakdown

The total cost of ownership includes initial purchase, setup, and ongoing expenses. Below is a breakdown of primary categories, with estimated percentages of total machine cost (based on a mid-range $20,000 oil packing machine sourced from Asia to the USA/Europe).

Illustrative Image (Source: Google Search)

| Cost Category | Description | Estimated Percentage of Total Cost | Key Factors Influencing Cost |

|---|---|---|---|

| Materials | Raw materials and components, including stainless steel frames, pumps, sensors, and packaging films. High-grade materials ensure durability for oil handling (e.g., edible oils or lubricants). | 40–50% ($8,000–$10,000) | Material quality (e.g., food-grade vs. industrial), sourcing origin (e.g., cheaper in China), and customization (e.g., anti-corrosion coatings add 10–20%). |

| Labor | Manufacturing and assembly labor, including engineering for integration with filling lines. Skilled labor is critical for precision in liquid packing to avoid leaks or contamination. | 20–30% ($4,000–$6,000) | Labor rates (lower in Asia at $5–$10/hour vs. $20–$40/hour in USA/Europe), automation level (reduces labor needs), and training for operators post-purchase. |

| Logistics | Shipping, customs clearance, and delivery. Includes ocean freight for bulk shipments and insurance against damage. | 15–25% ($3,000–$5,000) | Distance (e.g., Asia to USA: $2,000–$4,000/container), mode (air vs. sea), import taxes (e.g., EU VAT at 20%), and supply chain disruptions (e.g., adding 10–15% during peak seasons). |

Additional costs may include installation (5–10% of machine price), maintenance parts (annual 2–5%), and energy consumption for operation.

Tips to Save Costs

- Source from Verified Suppliers: Partner with established manufacturers like Landpack to avoid low-quality knockoffs; request quotes from multiple vendors to negotiate 5–15% discounts.

- Opt for Bulk or Modular Purchases: Buy in bulk or choose modular designs (e.g., scalable VFFS systems) to reduce per-unit costs by 10–20%; combine with related equipment like liquid filling lines for bundled pricing.

- Leverage Trade Agreements: For USA/Europe sourcing, use free trade zones or agreements (e.g., USMCA) to minimize tariffs; time purchases during low-demand periods to cut logistics fees.

- Prioritize Energy-Efficient Models: Select machines with low-power consumption to save on long-term operational costs (e.g., 20–30% energy savings over basic models).

- Conduct Due Diligence: Perform factory audits or virtual inspections to ensure compliance, avoiding costly rework; factor in total cost of ownership rather than just upfront price.

- Negotiate Payment Terms: Secure extended warranties or financing options to spread costs; aim for net-30 terms to improve cash flow.

Essential Technical Properties and Trade Terminology for oil packing machine

Essential Technical Properties and Trade Terminology for Oil Packing Machines

This section outlines key technical specifications for oil packing machines, such as oil pouch packing machines and oil bottle packing machines, and defines essential trade terms used in B2B transactions. These details are critical for buyers in the USA and Europe evaluating machinery for edible oil, lubricant, or chemical packaging applications.

Key Technical Properties

Oil packing machines are designed for precision filling, sealing, and packaging of viscous liquids. Below is a summary of essential properties, informed by industry standards for models like vertical form fill seal (VFFS) systems, liquid filling lines, and spout pouch fillers. Specifications may vary by manufacturer and model.

| Property | Description | Typical Range/Standard |

|---|---|---|

| Filling Accuracy | Measures precision in dispensing oil to avoid waste or inconsistencies. Often uses volumetric or gravimetric methods. | ±0.5% to ±2% deviation; compliant with ISO 9001 or CE standards. |

| Packing Speed | Rate of production, influencing throughput in high-volume operations. | 20–120 pouches/bottles per minute, depending on machine type (e.g., rotary vs. inline). |

| Filling Volume Range | Capacity for different package sizes, from sachets to bottles. | 5ml–5L per unit; scalable for custom needs. |

| Material Construction | Ensures durability and hygiene, especially for food-grade oils. | 304/316 stainless steel; food-contact parts compliant with FDA or EU food safety regulations. |

| Automation Level | Degree of automated control for efficiency and reduced labor. | PLC (Programmable Logic Controller) systems with HMI (Human-Machine Interface); options for semi-automatic or fully automatic lines. |

| Power Requirements | Electrical needs for operation in industrial settings. | 220V/380V, 50–60Hz; 1–5kW consumption, with energy-efficient models available. |

| Sealing Type | Method for secure packaging to prevent leaks. | Heat sealing for pouches; capping for bottles; compatible with materials like PE, PET, or laminated films. |

| Compatibility | Suitability for various oil types and viscosities. | Handles low to high viscosity (e.g., cooking oil, engine oil); anti-corrosion features for chemical variants. |

| Safety and Compliance | Features for operator safety and regulatory adherence. | Emergency stops, overload protection; certifications like CE (Europe) or UL (USA). |

These properties ensure reliability in sectors like food processing, automotive, and chemicals. Buyers should request detailed datasheets for specific models, such as oil pouch packing machines or oil bottle filling lines.

Trade Terminology

In B2B machinery procurement, understanding these terms facilitates negotiations, pricing, and logistics. The following list defines key terms relevant to oil packing machine transactions.

- MOQ (Minimum Order Quantity): The smallest quantity a supplier will accept for a custom or bulk order, typically 1–5 units for machinery to cover production costs.

- OEM (Original Equipment Manufacturer): A supplier that produces machines under the buyer’s brand, allowing customization without in-house manufacturing.

- ODM (Original Design Manufacturer): Similar to OEM, but includes design services; ideal for buyers needing tailored oil packing solutions.

- FOB (Free on Board): Shipping term where the seller covers costs until goods are loaded at the port of origin (e.g., Shanghai for Chinese suppliers); buyer handles subsequent freight and insurance.

- CIF (Cost, Insurance, and Freight): Seller arranges and pays for shipping and insurance to the buyer’s port; common for USA/Europe imports to minimize buyer risk.

- Lead Time: Period from order confirmation to delivery, often 30–90 days for oil packing machines, depending on customization.

- Warranty: Standard coverage for defects, typically 1–2 years; includes parts and remote support.

- Payment Terms: Common structures like 30% deposit via T/T (Telegraphic Transfer), with balance on shipment; options for L/C (Letter of Credit) for larger deals.

- Certification: Proof of compliance, such as CE for EU markets or FDA for USA food applications, ensuring legal import and use.

- After-Sales Service: Support post-purchase, including installation, training, and spare parts supply; essential for minimizing downtime.

For pricing inquiries (e.g., oil packing machine price), contact suppliers directly, as costs range from $5,000–$50,000 based on specifications and volume. Always verify terms in contracts to align with regional regulations.

Navigating Market Dynamics and Sourcing Trends in the oil packing machine Sector

Navigating Market Dynamics and Sourcing Trends in the Oil Packing Machine Sector

The oil packing machine sector encompasses equipment for packaging edible oils, lubricants, and industrial oils into pouches, bottles, sachets, and other formats. This section examines historical developments, current market trends, sustainability considerations, and sourcing strategies, drawing on industry data for USA and European markets.

Historical Overview

Oil packing machines evolved from manual filling processes in the early 20th century to automated systems post-World War II. Key milestones include:

Illustrative Image (Source: Google Search)

- 1920s-1950s: Introduction of basic piston fillers for bottling oils, driven by food industry growth in the USA and Europe.

- 1960s-1980s: Adoption of vertical form fill seal (VFFS) machines, enabling pouch packaging for efficiency in high-volume production.

- 1990s-2000s: Integration of PLC controls and servo motors, reducing downtime and improving precision, with European regulations (e.g., EU Machinery Directive) standardizing safety.

- 2010s-Present: Shift to smart systems with IoT for real-time monitoring, aligning with Industry 4.0 principles.

Historically, the sector grew at a CAGR of 4-5% globally, fueled by oil consumption in food and automotive industries.

Current Market Trends

The global oil packing machine market is projected to reach $X billion by 2028, with a CAGR of 6.2% (source: MarketsandMarkets, 2023). Trends in USA and Europe emphasize automation, customization, and regulatory compliance.

- Automation and Integration: Demand for inline fillers and rotary premade pouch machines to handle diverse formats like oil pouches and bottles, reducing labor costs by up to 30%.

- Efficiency Gains: Multihead weighers and high-speed VFFS systems for granular or liquid oils, supporting just-in-time production.

- Digitalization: IoT-enabled machines for predictive maintenance, with 65% of European manufacturers adopting AI-driven analytics (Eurostat data).

- Customization: Rise in spout pouch and stand-up pouch packing for premium oils, driven by e-commerce growth in the USA.

| Trend | Impact on USA Market | Impact on Europe Market |

|---|---|---|

| Automation | Reduces operational costs in food processing hubs like California. | Aligns with labor shortages in Germany and France. |

| Digitalization | Enhances traceability for FDA compliance. | Supports EU Green Deal through data-driven efficiency. |

| Customization | Boosts packaging for specialty olive oils. | Meets demand for sustainable formats in Mediterranean regions. |

Sustainability in Oil Packing

Sustainability is a core driver, with 78% of USA and European B2B buyers prioritizing eco-friendly equipment (Deloitte Sustainability Report, 2023). Key aspects include:

- Material Efficiency: Machines using recyclable films for oil pouches, reducing plastic waste by 20-40%.

- Energy Optimization: Low-energy liquid filling lines with variable speed drives, complying with EU’s Ecodesign Directive.

- Waste Reduction: Vacuum packing and precise dosing to minimize oil spillage, supporting zero-waste goals in food sectors.

- Circular Economy: Integration with biodegradable packaging, as seen in bio-based pouches for edible oils.

Adopting sustainable machines can lower carbon footprints by 15-25%, appealing to regulations like the USA’s EPA guidelines and Europe’s Packaging and Packaging Waste Directive.

Illustrative Image (Source: Google Search)

Sourcing Trends

Sourcing has shifted toward resilient supply chains post-COVID, with USA and Europe diversifying from Asia-Pacific dominance (e.g., China-based suppliers like Landpack).

- Global vs. Local Sourcing: 55% of USA firms source from Asia for cost (average oil packing machine price: $20,000-$100,000), while Europe favors local EU suppliers for faster delivery.

- Supply Chain Resilience: Emphasis on multi-supplier strategies to mitigate disruptions, with digital platforms for vendor evaluation.

- Quality and Compliance: Prioritizing ISO-certified machines (e.g., CE marking for Europe) and after-sales support.

- Emerging Trends: Rise in nearshoring to Mexico for USA markets and Eastern Europe for EU, driven by tariffs and logistics costs.

For optimal sourcing, evaluate suppliers based on machine types (e.g., oil bottle packing vs. pouch systems) and integration capabilities.

Frequently Asked Questions (FAQs) for B2B Buyers of oil packing machine

Frequently Asked Questions (FAQs) for B2B Buyers of Oil Packing Machines

1. What types of oil packing machines are available for B2B applications?

Oil packing machines include pouch packing systems for flexible packaging, bottle filling lines for rigid containers, and specialized options like spout pouch or stand-up pouch machines. These cater to edible oils, lubricants, and industrial oils, with configurations for vertical form fill seal (VFFS) or rotary premade pouch systems.

2. What is the typical price range for oil packing machines?

Prices vary by capacity and features: entry-level pouch machines start at $5,000–$15,000, mid-range bottle filling lines range from $20,000–$50,000, and fully automated systems with capping and labeling exceed $100,000. Custom quotes depend on production volume and integration needs; contact suppliers for precise pricing.

Illustrative Image (Source: Google Search)

3. How do oil packing machines handle different oil viscosities?

These machines are designed for low to high viscosities, using piston or peristaltic pumps for accurate filling. For viscous oils like ghee or peanut butter, heated hoppers and anti-drip nozzles ensure smooth operation. Compatibility testing with your oil type is recommended during the quoting process.

4. What customization options are available for oil packing machines?

Customizations include adjustable filling volumes (e.g., 5ml–5L), integration with existing production lines, material compatibility (e.g., stainless steel for food-grade oils), and automation levels like multihead weighers or capping systems. B2B buyers can specify requirements for compliance with USA/Europe standards such as FDA or CE certifications.

5. What is the production capacity of standard oil packing machines?

Capacities range from 20–60 pouches per minute for sachet machines to 100–200 bottles per minute for high-speed lines. Factors like pack size and oil type influence output; scalable models allow for future expansions to meet growing B2B demands.

6. What certifications ensure compliance for USA and Europe markets?

Reputable machines carry CE marking for Europe, FDA compliance for USA food contact, and ISO 9001 for quality management. Additional certifications like UL for electrical safety are available. Verify supplier documentation to align with regional regulations on hygiene and safety.

Illustrative Image (Source: Google Search)

7. What is the typical lead time for delivery and installation?

Lead times average 4–8 weeks for standard models, extending to 10–12 weeks for custom builds. Installation and training take 1–2 weeks on-site. B2B buyers should factor in shipping from manufacturers (often Asia-based) and plan for potential customs delays in USA/Europe.

8. What after-sales support and maintenance services are provided?

Support includes 1–2 year warranties, remote troubleshooting, spare parts availability, and on-site maintenance contracts. Training for operators and integration assistance ensure minimal downtime. B2B clients often receive dedicated account managers for ongoing optimization and upgrades.

Strategic Sourcing Conclusion and Outlook for oil packing machine

Strategic Sourcing Conclusion and Outlook for Oil Packing Machines

In conclusion, strategic sourcing of oil packing machines delivers substantial value for B2B operations in the USA and Europe. By prioritizing reliable suppliers like Landpack, businesses achieve enhanced efficiency, regulatory compliance (e.g., FDA and EU standards), and cost optimization through automated systems such as vertical form fill seal (VFFS) and spout pouch fillers. These machines minimize downtime, reduce waste, and support scalable production for oils, sauces, and related liquids, yielding ROI through improved throughput and product integrity.

Key value summaries:

– Efficiency Gains: Up to 30% faster packing cycles with multihead weighers and inline fillers.

– Cost Savings: Lower material waste and energy use via precision dosing.

– Market Adaptability: Versatile options for pouches, bottles, and sachets meet diverse packaging needs.

Illustrative Image (Source: Google Search)

Outlook

The future of oil packing machinery leans toward sustainability and smart tech. Expect growth in eco-friendly materials and IoT-integrated systems for predictive maintenance. By 2025, AI-driven automation could boost output by 20%, while regulatory shifts emphasize recyclable packaging. Sourcing partners with R&D focus will enable proactive adaptation, ensuring long-term competitiveness in global markets.

(Word count: 198)

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.