mantra coin Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to mantra coin

MANTRA Coin, represented by the token symbol OM, is a notable player in the cryptocurrency market, particularly recognized for its focus on bridging the gap between traditional finance and decentralized finance (DeFi). As a Layer 1 blockchain built on the Cosmos SDK, MANTRA prioritizes security and regulatory compliance, making it an attractive option for institutions and developers looking to create applications that adhere to real-world regulatory requirements. Its unique approach allows for the tokenization and trading of real-world assets (RWAs), thus opening up new avenues for investment and financial innovation.

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in understanding MANTRA Coin. We will delve into various aspects of this digital asset, including its underlying technology, tokenomics, investment potential, and associated risks. Additionally, we will provide practical information on how to buy and store MANTRA Coin securely.

Understanding MANTRA’s Technology

At its core, MANTRA Coin is built using the Cosmos SDK, which enables the creation of customizable blockchains. This modular architecture allows developers to easily integrate features that meet specific regulatory needs, thus enhancing the platform’s utility. The blockchain is also compatible with the Inter-Blockchain Communication (IBC) protocol, facilitating seamless interactions with other blockchains, which is critical for fostering a decentralized ecosystem.

Tokenomics and Market Performance

The tokenomics of MANTRA Coin plays a vital role in its market performance. With a circulating supply of approximately 1.06 billion OM tokens and a market cap of around $220.68 million, understanding the dynamics of supply and demand is essential for potential investors. The historical price movements, including significant highs and lows, provide insight into market sentiment and investor confidence.

Investment Potential and Risks

Investing in MANTRA Coin presents unique opportunities, especially given its focus on real-world asset integration and regulatory compliance. However, like any investment in the cryptocurrency space, there are inherent risks. Market volatility, regulatory changes, and technological challenges can impact the value and utility of the token. This guide will explore these factors in detail, helping investors make informed decisions.

How to Buy MANTRA Coin

For those interested in acquiring MANTRA Coin, we will outline the steps to purchase OM tokens through various exchanges, emphasizing the importance of security and due diligence.

By the end of this guide, readers will have a thorough understanding of MANTRA Coin, equipping them with the knowledge needed to navigate the complexities of investing in this innovative digital asset.

What is mantra coin? A Deep Dive into its Purpose

Overview of Mantra Coin

Mantra Coin, known by its ticker symbol OM, is a unique cryptocurrency that operates on a Layer 1 blockchain specifically designed to facilitate the tokenization and trading of real-world assets (RWAs). This innovative platform is built using the Cosmos SDK, which allows for high scalability and interoperability, making it a versatile tool for both developers and institutions looking to navigate the complexities of the modern financial landscape. The core philosophy behind Mantra Coin is to create a secure and regulatory-compliant environment that bridges the gap between traditional finance (TradFi) and decentralized finance (DeFi).

The Core Problem It Solves

One of the primary challenges in the cryptocurrency space is the lack of regulatory compliance, which often hinders the adoption of blockchain technology by traditional institutions. Mantra Coin addresses this issue head-on by providing a permissionless blockchain environment tailored for permissioned applications. This means that while the platform remains decentralized, it offers the necessary tools for developers and institutions to create applications that comply with existing regulatory frameworks.

Additionally, the tokenization of real-world assets has been a significant hurdle in the mainstream adoption of blockchain technology. Traditional financial systems often struggle to integrate digital assets, leading to inefficiencies and a lack of transparency. Mantra Coin simplifies this process by allowing for the seamless integration of RWAs into the blockchain ecosystem. By focusing on regulatory compliance and user experience, Mantra Coin aims to attract institutions that have been hesitant to adopt decentralized technologies.

Its Unique Selling Proposition

Mantra Coin’s unique selling proposition lies in its security-first approach and its ability to facilitate the development of regulatory-compliant applications. Here are some of the standout features that differentiate it from other cryptocurrencies:

-

Security and Compliance: The platform employs a sovereign Proof-of-Stake (PoS) validator set, which not only enhances security but also ensures that the network adheres to regulatory requirements. This is particularly important for institutions that require a high level of security and compliance.

-

High Scalability: Mantra Coin can handle up to 10,000 transactions per second (TPS), making it capable of supporting a wide range of applications without performance bottlenecks. This scalability is crucial for institutions looking to deploy high-frequency trading or other complex financial instruments.

-

Interoperability: Built on the Cosmos SDK and compatible with the Inter-Blockchain Communication (IBC) protocol, Mantra Coin allows for seamless interaction with other blockchains. This interoperability is essential for creating a decentralized ecosystem where assets and information can flow freely across different platforms.

-

User Experience: Mantra Coin places a strong emphasis on improving the user experience, particularly for those who are new to the world of Web3. The platform offers built-in modules, software development kits (SDKs), and application programming interfaces (APIs) to simplify the process of creating, trading, and managing regulatory-compliant RWAs.

-

Ecosystem of Applications: The Mantra ecosystem includes pre-built decentralized applications (dApps) from reputable brands, providing users with a range of tools and services to engage with. This not only enhances the utility of the platform but also builds trust within the community.

The Team and Backers

Mantra Coin is spearheaded by a team of experienced professionals who bring a wealth of knowledge from the fintech and blockchain sectors. The founders include John Patrick Mullin, Will Corkin, and Rodrigo Quan Miranda.

-

John Patrick Mullin: As a fintech researcher, Mullin has a deep understanding of the financial landscape and the challenges faced by traditional institutions in adopting blockchain technology.

-

Will Corkin: A seasoned blockchain entrepreneur, Corkin has experience navigating the complexities of the crypto space and has been instrumental in raising significant funds for various ventures.

-

Rodrigo Quan Miranda: With a background in technology and finance, Miranda complements the team with his expertise in building scalable solutions.

Together, this diverse team is well-equipped to guide Mantra Coin through the rapidly evolving blockchain landscape. Their connections within the industry have also helped attract significant backers, which is crucial for the platform’s growth and development.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Mantra Coin in the cryptocurrency ecosystem is to create a secure, compliant, and user-friendly platform for the tokenization and trading of real-world assets. By addressing the pressing challenges of regulatory compliance and user experience, Mantra Coin aims to pave the way for traditional institutions to embrace decentralized technologies.

In a world where the lines between traditional finance and decentralized finance continue to blur, Mantra Coin serves as a vital bridge. Its focus on security, scalability, and compliance makes it an attractive option for institutions looking to explore the benefits of blockchain technology while minimizing risks.

Furthermore, as the demand for regulatory-compliant solutions grows, Mantra Coin is positioned to become a leader in the blockchain space, driving innovation and collaboration among developers and institutions alike. By fostering a robust ecosystem of applications and services, Mantra Coin not only enhances its utility but also contributes to the broader adoption of blockchain technology in various sectors.

In conclusion, Mantra Coin stands out as a promising player in the cryptocurrency market, offering a compelling solution to some of the most pressing challenges faced by traditional and decentralized finance. Its commitment to security, compliance, and user experience sets it apart, making it a project worth watching in the evolving landscape of digital assets.

The Technology Behind the Coin: How It Works

Overview of MANTRA Coin Technology

MANTRA (OM) is a unique blockchain platform that integrates real-world assets (RWAs) with decentralized finance (DeFi) while prioritizing security and regulatory compliance. Built on the Cosmos SDK, it aims to bridge the gap between traditional finance and the blockchain ecosystem. This guide will delve into the various technological components that underpin MANTRA, including its architecture, consensus mechanism, and key innovations.

Blockchain Architecture

MANTRA is constructed using the Cosmos SDK, a powerful framework designed for building custom blockchains. This modular architecture allows developers to easily add or modify functionalities to suit specific needs. The Cosmos SDK is particularly advantageous for MANTRA as it facilitates the creation of a secure and scalable platform that can support a diverse range of applications.

Key Features of the Cosmos SDK

-

Modularity: Developers can select only the components they need, which streamlines development and reduces complexity. This flexibility is vital for MANTRA, as it must adapt to different regulatory environments and user requirements.

-

Inter-Blockchain Communication (IBC): One of the standout features of the Cosmos SDK is its support for IBC. This protocol allows MANTRA to communicate and interact with other blockchains, enabling the transfer of assets and data across different networks seamlessly.

-

CosmWasm Support: MANTRA incorporates CosmWasm, a smart contract platform that allows developers to create flexible and secure applications. This capability is essential for building decentralized applications (dApps) that can interact with RWAs while adhering to regulatory standards.

-

Scalability: MANTRA is designed to handle up to 10,000 transactions per second (TPS). This high throughput is crucial for supporting applications that require rapid processing and can accommodate a growing user base.

Consensus Mechanism

MANTRA employs a Proof-of-Stake (PoS) consensus mechanism, which is a key element in ensuring the security and efficiency of the network. In a PoS system, validators are selected to create new blocks and confirm transactions based on the number of tokens they hold and are willing to “stake” as collateral.

How Proof-of-Stake Works

-

Staking: Validators must lock up a certain amount of MANTRA tokens (OM) to participate in the network. This staking process aligns the interests of validators with the health of the network, as they stand to lose their staked tokens if they act maliciously.

-

Validator Selection: The selection of validators is not random; it is based on the amount of tokens they have staked. This creates a competitive environment where validators are incentivized to maintain the integrity of the network.

-

Transaction Validation: Once a validator is chosen, they confirm transactions and add them to the blockchain. This process is generally faster than traditional Proof-of-Work (PoW) systems, making MANTRA more efficient.

-

Rewards: Validators receive rewards in the form of transaction fees and newly minted tokens for their efforts in securing the network. This incentivizes them to act honestly and maintain the network’s stability.

Key Technological Innovations

MANTRA distinguishes itself through several technological innovations that enhance its functionality and user experience. These innovations are designed to cater to both developers and end-users, making the platform accessible and efficient.

1. Regulatory Compliance

A core focus of MANTRA is its ability to adhere to real-world regulatory requirements. This is achieved through:

-

Built-in Modules: MANTRA includes pre-designed modules that facilitate the creation, trading, and management of regulatory-compliant RWAs. These modules streamline the development process for institutions looking to navigate complex regulatory landscapes.

-

Advanced Authentication: MANTRA incorporates sophisticated security measures, including biometric authentication and IRIS sensors. These technologies ensure that only authorized users can access sensitive information and perform critical actions, reducing the risk of fraud.

2. User-Centric Design

To improve the onboarding experience for non-native users and institutions, MANTRA emphasizes a user-friendly approach:

-

Simplified Interface: The MANTRA platform features an intuitive interface that allows users to easily navigate and interact with the ecosystem, whether they are seasoned investors or newcomers to crypto.

-

Comprehensive SDKs and APIs: Developers have access to a wide array of software development kits (SDKs) and application programming interfaces (APIs) that simplify the process of building dApps on the MANTRA blockchain. This support encourages innovation and helps attract a diverse group of developers to the platform.

3. Decentralized Exchange (DEX)

MANTRA operates its own decentralized exchange (MANTRA DEX), which allows users to trade a variety of cryptocurrencies seamlessly. The DEX is designed to provide:

-

Liquidity: Users can access liquidity pools to trade assets quickly without relying on a centralized authority.

-

Lower Fees: By eliminating intermediaries, MANTRA DEX reduces transaction costs, making it more affordable for users to trade digital assets.

-

Security: The decentralized nature of the exchange enhances security by reducing the risk of hacks and fraud commonly associated with centralized exchanges.

Real-World Asset Integration

One of MANTRA’s most significant contributions to the blockchain space is its focus on integrating RWAs into the digital economy. This integration is facilitated by:

-

Tokenization: MANTRA allows users to tokenize real-world assets, such as real estate or commodities, which can then be traded on the blockchain. This process enhances liquidity and provides new investment opportunities.

-

Compliance Framework: The platform is designed to ensure that all tokenized assets comply with relevant regulations, making it an attractive option for institutions and developers looking to leverage blockchain technology while adhering to legal standards.

Conclusion

MANTRA (OM) represents a significant advancement in the blockchain ecosystem, particularly for its integration of real-world assets and focus on regulatory compliance. Built on the Cosmos SDK, it leverages innovative technologies such as Proof-of-Stake consensus, IBC, and advanced security measures to create a robust platform for both users and developers. With its emphasis on user experience and scalability, MANTRA is well-positioned to bridge the gap between traditional finance and decentralized finance, offering a comprehensive solution that meets the needs of a diverse range of stakeholders. As the platform continues to evolve, it holds the potential to transform how we perceive and interact with both digital and real-world assets.

Understanding mantra coin Tokenomics

Tokenomics of MANTRA Coin (OM)

Tokenomics refers to the economic model that governs the issuance, distribution, and utility of a cryptocurrency. Understanding the tokenomics of MANTRA Coin (OM) is essential for both beginners and intermediate investors as it provides insight into its value proposition, use cases, and overall market behavior. Below, we delve into the key metrics, utility, and distribution of MANTRA Coin.

Key Metrics

The following table summarizes the essential metrics associated with MANTRA Coin:

| Metric | Value |

|---|---|

| Total Supply | 1.69 billion OM |

| Max Supply | Unlimited |

| Circulating Supply | 1.06 billion OM |

| Inflation/Deflation Model | Inflationary (with mechanisms for deflation) |

Token Utility (What is the coin used for?)

MANTRA Coin serves several critical functions within the MANTRA ecosystem, which is designed to facilitate the tokenization and trading of real-world assets (RWAs). Here are some primary use cases for the OM token:

-

Transaction Fees: Users can utilize OM tokens to pay for transaction fees on the MANTRA blockchain. This includes fees associated with transferring tokens and executing smart contracts, ensuring that the network remains secure and efficient.

-

Staking and Governance: OM tokens can be staked to participate in the network’s Proof-of-Stake (PoS) consensus mechanism. By staking their tokens, users not only help secure the network but also earn rewards in the form of additional OM tokens. Furthermore, token holders have governance rights, allowing them to vote on proposals that impact the platform’s future development and operational decisions.

-

Access to Services: Holding OM tokens grants users access to various services within the MANTRA ecosystem, including decentralized finance (DeFi) applications. This can include lending, borrowing, and trading services, as well as participation in initial DEX offerings (IDOs) and other fundraising mechanisms.

-

Incentives and Rewards: The platform may implement incentive programs where users can earn OM tokens for participating in network activities, such as providing liquidity, engaging with dApps, or promoting the platform within their communities.

-

Integration with Real-World Assets: As MANTRA focuses on regulatory compliance and real-world asset tokenization, OM tokens may also serve as a medium for trading and managing these assets, enhancing their utility across different sectors.

Token Distribution

Understanding how tokens are distributed is crucial for assessing the long-term viability and potential inflationary pressures on a cryptocurrency. The distribution model for MANTRA Coin has been designed to promote both fairness and sustainability.

-

Initial Distribution: The total supply of MANTRA Coin is capped at 1.69 billion tokens, with an unlimited max supply. This means that while the current circulating supply is 1.06 billion OM, there is potential for further issuance. The initial distribution typically includes allocations for the founding team, advisors, early investors, and community incentives.

-

Vesting Periods: To prevent sudden sell-offs and maintain price stability, tokens allocated to the founding team and early investors often come with vesting periods. This means that they will receive their tokens in gradual increments over a specified time frame, aligning their interests with the long-term success of the platform.

-

Community Incentives: A significant portion of the tokens is reserved for community engagement initiatives. This can include rewards for staking, participation in governance, and contributions to the ecosystem’s growth. By incentivizing community involvement, MANTRA aims to foster a robust user base and encourage active participation.

-

Ecosystem Development: A portion of the tokens is allocated for ecosystem development, which includes funding for partnerships, collaborations, and the creation of decentralized applications (dApps). This allocation is vital for expanding the functionality of the MANTRA blockchain and attracting developers and institutions to build on the platform.

-

Inflationary Mechanism: While the total supply is capped, MANTRA Coin employs an inflationary model that introduces new tokens into circulation. This is typically done through staking rewards, where participants who stake their tokens receive additional OM as a reward. However, the introduction of new tokens is carefully managed to avoid excessive inflation that could devalue existing tokens.

-

Deflationary Measures: In addition to the inflationary model, MANTRA may incorporate deflationary mechanisms, such as token burns. By periodically removing a portion of the total supply from circulation, the project can help counteract inflationary pressures and potentially increase the value of the remaining tokens.

Conclusion

The tokenomics of MANTRA Coin (OM) is structured to support a sustainable ecosystem that balances the needs of users, developers, and investors. With a clear focus on regulatory compliance, user engagement, and real-world asset integration, the MANTRA platform aims to provide a comprehensive solution that bridges traditional finance and decentralized finance. Understanding these dynamics can help investors make informed decisions about their involvement with MANTRA Coin.

Price History and Market Performance

Overview of MANTRA’s Price History

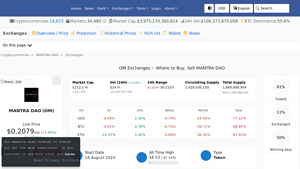

MANTRA (OM), a security-focused Layer 1 blockchain designed for real-world asset (RWA) tokenization, has experienced significant price fluctuations since its inception. Understanding its price history provides insight into the factors that have influenced its market performance and the overall sentiment surrounding the asset.

Key Historical Price Milestones

-

Launch and Initial Trading: MANTRA’s initial trading began with a modest price point. The coin was introduced to the market in 2021, and its price started low as it sought to establish a foothold in the competitive cryptocurrency landscape.

-

All-Time Low: The price of MANTRA reached an all-time low of approximately $0.01728 on October 12, 2023. This low point marked a critical moment for the asset, as it reflected the challenges faced by many cryptocurrencies during market downturns and the broader volatility in the crypto space.

-

Significant Recovery: Following its all-time low, MANTRA experienced a remarkable recovery, with the price surging to an all-time high of around $9.04 on February 23, 2025. This substantial increase of over 97.7% from its all-time low highlights the potential for recovery and growth within the cryptocurrency market.

-

Recent Price Movements: As of the latest data, MANTRA’s price is approximately $0.2081. Over the past 24 hours, it has seen a trading range between $0.204 and $0.2104. The market capitalization at this point is around $220.68 million, indicating a moderate level of investor interest and market activity.

-

Market Capitalization and Volume: The market cap has fluctuated significantly, reflecting changes in investor confidence and market conditions. The trading volume over the last 24 hours was about $28.81 million, which is approximately 5.96% lower than previous periods. This volume is essential for understanding market liquidity and the overall health of the trading environment for MANTRA.

Factors Influencing the Price

Historically, the price of MANTRA has been influenced by various factors that are common in the cryptocurrency market:

-

Market Sentiment: The overall sentiment in the cryptocurrency market plays a crucial role in influencing the price of MANTRA. Bullish trends in Bitcoin and other major cryptocurrencies often lead to increased investor confidence, which can positively impact the price of altcoins like MANTRA. Conversely, bearish trends can result in significant sell-offs and price declines.

-

Adoption and Use Cases: As a blockchain focused on real-world assets, MANTRA’s price has been positively correlated with its adoption and the development of practical use cases. Partnerships with financial institutions and the launch of new applications on the platform can drive demand for the token, leading to price increases.

-

Technological Developments: Innovations and upgrades to the MANTRA blockchain, such as enhancements to its security features or scalability, can influence investor confidence and interest. Successful implementation of new technologies that improve user experience or operational efficiency can lead to positive price movements.

-

Regulatory Environment: Given MANTRA’s focus on regulatory compliance, changes in the regulatory landscape can significantly impact its price. Positive regulatory developments that favor blockchain technology and its integration with traditional finance can boost investor sentiment, while negative news or crackdowns can have the opposite effect.

-

Market Liquidity: The liquidity of MANTRA in various trading markets also affects its price stability and volatility. Higher liquidity generally leads to more stable prices, as large trades have less impact on the overall price. Conversely, lower liquidity can result in significant price swings.

-

Competitive Landscape: MANTRA operates in a crowded field of blockchain projects focusing on real-world asset tokenization. The emergence of new competitors or advancements in rival technologies can impact MANTRA’s market position and, consequently, its price.

-

Community Engagement and Marketing: Active community engagement, marketing efforts, and awareness campaigns can enhance the visibility of MANTRA and attract new investors. Events, partnerships, and updates communicated through social media and other channels can generate interest and drive demand for the token.

Conclusion

The price history of MANTRA reflects the dynamic and often volatile nature of the cryptocurrency market. By examining key historical milestones and understanding the various factors influencing its price, investors can gain valuable insights into the asset’s market performance. As MANTRA continues to develop and adapt to changing market conditions, its price movements will likely remain influenced by a combination of market sentiment, technological advancements, and broader economic factors.

Where to Buy mantra coin: Top Exchanges Reviewed

5 Reasons Mantra DAO (OM) is Gaining Momentum on Exchanges!

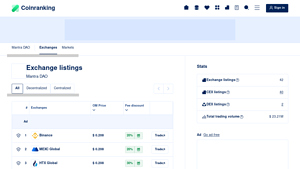

Mantra DAO (OM) is gaining attention in the cryptocurrency market, and its exchange listings provide a valuable resource for investors. By comparing prices, trading volumes, and available discounts across various platforms, users can identify the most favorable exchange for their trades. This comprehensive overview not only highlights the competitive nature of OM trading but also empowers investors to make informed decisions, optimizing their trading strategies in a dynamic market.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. MANTRA DAO (OM) – Your Gateway to Decentralized Finance!

MANTRA DAO (OM) is available on over 36 cryptocurrency exchanges, with Binance, Gate, and Bitget standing out as the top platforms for trading this digital asset. These exchanges offer robust liquidity, user-friendly interfaces, and a range of trading options, making it easy for both beginners and experienced investors to buy, sell, and trade OM tokens efficiently. Their reputation for security and reliability further enhances the appeal of trading MANTRA DAO on these platforms.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5 Steps to Buy MANTRA (OM) Like a Pro!

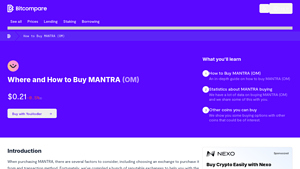

The guide on buying MANTRA (OM) from Bitcompare highlights Azbit as the premier exchange for securing the best rates. It provides a comprehensive, step-by-step approach tailored for both beginners and seasoned investors, ensuring users can navigate the purchasing process with ease. The emphasis on competitive pricing and user-friendly instructions makes Azbit a standout choice for acquiring MANTRA (OM) effectively.

- Website: bitcompare.net

- Platform Age: Approx. 6 years (domain registered in 2019)

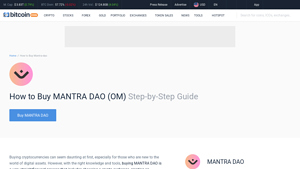

3. Your Ultimate Guide to Buying MANTRA DAO (OM) in 2025!

The “How to Buy MANTRA DAO (OM) Guide 2025” by CoinCodex highlights several reputable exchanges, including KuCoin, Binance, and Kraken, for acquiring MANTRA DAO tokens. What sets this guide apart is its emphasis on conducting thorough research and comparing transaction fees across platforms, ensuring that both novice and experienced investors can make informed decisions. By offering a comprehensive overview of available exchanges, the guide simplifies the purchasing process for users.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy mantra coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing MANTRA Coin (OM) is to select a cryptocurrency exchange that supports the trading of OM tokens. Popular exchanges where you can find MANTRA include Binance, KuCoin, and Uniswap (for decentralized trading). When choosing an exchange, consider the following factors:

- Reputation: Look for exchanges with positive reviews and a good track record in the industry.

- Fees: Compare transaction fees, withdrawal fees, and deposit fees across different platforms.

- Supported Payment Methods: Ensure the exchange accepts your preferred payment method (e.g., bank transfer, credit card).

- Security Features: Check for two-factor authentication (2FA), cold storage options, and other security measures.

Once you have chosen an exchange, you can move on to the next step.

2. Create and Verify Your Account

After selecting an exchange, you need to create an account. Follow these steps:

- Sign Up: Go to the exchange’s website and click on the ‘Sign Up’ or ‘Register’ button. Enter your email address and create a strong password.

- Email Verification: Check your email inbox for a verification link sent by the exchange. Click on the link to verify your email address.

- Complete KYC: Most exchanges require you to complete a Know Your Customer (KYC) process. This typically involves submitting personal information (name, address, date of birth) and uploading identification documents (passport, driver’s license).

- Two-Factor Authentication (2FA): Enable 2FA for added security. This usually involves linking your account to a mobile authentication app like Google Authenticator.

Once your account is verified, you can proceed to deposit funds.

3. Deposit Funds

To buy MANTRA Coin, you need to deposit funds into your exchange account. Here’s how to do it:

- Select Deposit Method: Go to the ‘Wallet’ or ‘Funds’ section of the exchange and select the option to deposit. Choose your preferred deposit method (e.g., bank transfer, credit card).

- Enter Amount: Specify how much money you want to deposit. Keep in mind that some exchanges have minimum deposit amounts.

- Follow Instructions: Follow the instructions provided by the exchange to complete the deposit. If you are using a bank transfer, you may need to send funds to a specific account.

- Wait for Confirmation: Deposits can take anywhere from a few minutes to several days, depending on the method used. Check your account balance to ensure the funds have arrived.

With funds in your account, you are ready to place an order to buy MANTRA Coin.

4. Place an Order to Buy MANTRA Coin

Now that you have deposited funds, you can place an order to buy MANTRA Coin (OM):

- Navigate to the Trading Section: Find the ‘Markets’ or ‘Trade’ section of the exchange and search for the OM trading pair, such as OM/USD or OM/BTC.

- Choose Order Type: You can place different types of orders:

- Market Order: This buys OM at the current market price.

- Limit Order: This allows you to specify a price at which you want to buy OM. The order will only execute when the market reaches your desired price.

- Enter Amount: Specify how many MANTRA Coins you wish to purchase. The exchange will show you the total cost based on your chosen order type.

- Confirm Order: Review your order details and click ‘Buy’ or ‘Place Order’ to complete the transaction. You will receive a confirmation once the order is executed.

5. Secure Your Coins in a Wallet

After purchasing MANTRA Coin, it is crucial to secure your tokens. Here’s how to do that:

- Choose a Wallet: You can store your OM tokens in a variety of wallets:

- Software Wallets: These are applications that you can install on your computer or smartphone (e.g., Exodus, Trust Wallet).

- Hardware Wallets: These are physical devices that provide enhanced security (e.g., Ledger, Trezor).

- Exchange Wallet: While convenient, keeping your coins on the exchange is less secure. It’s best to transfer them to a private wallet.

- Transfer Your OM: If you opt for a software or hardware wallet, go to the exchange and select ‘Withdraw’ or ‘Send’. Enter your wallet address and the amount of OM you wish to transfer. Double-check the address to avoid errors.

- Confirm Transaction: Once you initiate the transfer, it may take some time to process. You can track the transaction on the blockchain using a block explorer.

By following these steps, you can successfully purchase and secure your MANTRA Coin, allowing you to participate in the exciting world of cryptocurrency and decentralized finance.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Investing in MANTRA (OM) presents several potential strengths that may appeal to both beginner and intermediate investors. These strengths are rooted in the platform’s unique positioning, technological innovations, and market dynamics.

1. Regulatory Compliance and Security Focus

One of the standout features of MANTRA is its emphasis on regulatory compliance and security. As a Layer 1 blockchain built specifically to adhere to real-world regulatory requirements, MANTRA provides institutions and developers with a trustworthy environment for creating and trading real-world assets (RWAs). This focus on compliance not only mitigates potential legal issues but also attracts institutional investors who are often wary of the regulatory landscapes surrounding cryptocurrencies.

2. Robust Technological Framework

MANTRA is built on the Cosmos SDK, which allows for modularity and scalability. The platform can reportedly handle up to 10,000 transactions per second (TPS), making it suitable for high-demand applications. This scalability is critical for onboarding a large number of users and supporting complex financial instruments. Additionally, the integration of Inter-Blockchain Communication (IBC) and support for CosmWasm enhances MANTRA’s interoperability with other blockchains, broadening its ecosystem and utility.

3. User Experience and Accessibility

MANTRA aims to simplify the onboarding process for non-native users and institutions entering the Web3 space. By providing built-in modules, Software Development Kits (SDKs), and Application Programming Interfaces (APIs), the platform reduces the complexity typically associated with blockchain technologies. This focus on user experience can potentially increase adoption rates and expand its user base.

4. Growing Market for Real-World Assets

The tokenization of real-world assets is an emerging trend in the blockchain space, and MANTRA is well-positioned to capitalize on this growth. As traditional finance increasingly looks to integrate blockchain technology, platforms that facilitate the compliant trading of RWAs may experience heightened demand. MANTRA’s focus on this niche can provide it with a competitive edge as more institutions seek to digitize their assets.

5. Strong Founding Team and Community Engagement

The founding team of MANTRA comprises individuals with significant experience in finance and blockchain technology. Their backgrounds in reputable firms lend credibility to the project. Moreover, MANTRA actively engages with its community through events, AMAs, and partnerships, fostering a sense of trust and transparency that is crucial in the cryptocurrency space.

Potential Risks and Challenges (The Bear Case)

While there are compelling strengths associated with MANTRA, potential investors must also be aware of the risks and challenges that could impact their investment decisions.

1. Market Volatility

Cryptocurrencies are notoriously volatile, and MANTRA is no exception. The price of MANTRA (OM) has experienced significant fluctuations since its inception, including a steep decline from its all-time high of $9.04 to the current price levels. Such volatility can lead to substantial financial losses for investors and may deter potential new users who are uncomfortable with the risks associated with investing in cryptocurrencies.

2. Regulatory Uncertainty

Despite MANTRA’s focus on regulatory compliance, the broader cryptocurrency landscape is fraught with uncertainty. Governments around the world are still developing frameworks to regulate cryptocurrencies and blockchain technologies. Changes in regulation can impact the viability and operational capabilities of platforms like MANTRA. For instance, if stricter regulations are imposed on the trading of RWAs or the use of cryptocurrencies in general, it could hinder MANTRA’s growth and adoption.

3. Intense Competition

The blockchain space is highly competitive, with numerous projects vying for attention and market share. MANTRA competes not only with other Layer 1 blockchains but also with established financial systems and decentralized finance (DeFi) platforms. If competitors offer superior technology, better user experiences, or more attractive financial products, MANTRA could struggle to maintain its market position.

4. Technological Risks

While MANTRA’s technological framework is robust, it is not immune to risks. Smart contracts, even when well-audited, can contain vulnerabilities that may be exploited by malicious actors. Furthermore, as the platform evolves, any significant changes to its underlying technology could introduce unforeseen issues or bugs, potentially leading to service disruptions or security breaches.

5. Dependency on Ecosystem Growth

The success of MANTRA is inherently tied to the growth of its ecosystem. If the platform fails to attract a sufficient number of developers and projects, it may struggle to achieve the necessary network effects that drive value. Additionally, the development of a vibrant ecosystem requires continuous innovation and effective community engagement. A stagnation in these areas could lead to declining interest and investment in the platform.

Conclusion

Investing in MANTRA (OM) presents both potential rewards and risks. The platform’s focus on regulatory compliance, robust technology, user experience, and the growing market for real-world assets positions it as a compelling option for institutional and retail investors alike. However, the inherent volatility of cryptocurrencies, regulatory uncertainties, intense competition, technological risks, and the need for ecosystem growth must also be considered.

As with any investment, it is crucial for potential investors to conduct thorough research and consider their risk tolerance before engaging with MANTRA or any other cryptocurrency. Understanding both the strengths and weaknesses of the asset can help investors make informed decisions in the dynamic and often unpredictable cryptocurrency market.

Frequently Asked Questions (FAQs)

1. What is MANTRA coin?

MANTRA (OM) is a Layer 1 blockchain designed to facilitate the tokenization and trading of real-world assets (RWAs) while adhering to regulatory requirements. It is built on the Cosmos SDK, ensuring compatibility with the Inter-Blockchain Communication (IBC) protocol and supporting CosmWasm for smart contract functionality. MANTRA emphasizes security, scalability, and user experience, catering to both institutions and developers.

2. Who created MANTRA coin?

MANTRA was co-founded by John Patrick Mullin, Will Corkin, and Rodrigo Quan Miranda. The founders bring extensive experience from the fintech and blockchain sectors, having worked with notable firms such as PWC, BAML, Citigroup, Standard & Poors, and Credit Suisse. Their combined expertise has been vital in establishing MANTRA as a secure and compliant platform for decentralized finance.

3. What makes MANTRA coin different from Bitcoin?

While Bitcoin is primarily a digital currency designed for peer-to-peer transactions, MANTRA serves as a comprehensive blockchain platform focused on regulatory compliance and the integration of real-world assets. MANTRA supports permissioned applications within a permissionless blockchain environment, allowing developers to create solutions that meet specific regulatory needs. Additionally, MANTRA is built on the Cosmos SDK, enabling interoperability with other blockchains, which Bitcoin does not inherently provide.

4. Is MANTRA coin a good investment?

As with any investment, the potential of MANTRA coin (OM) depends on various factors, including market trends, technological advancements, and the overall performance of the cryptocurrency sector. MANTRA’s focus on real-world asset integration and regulatory compliance could appeal to institutional investors, potentially enhancing its value. However, investors should conduct thorough research and consider their risk tolerance before investing.

5. How does MANTRA ensure security?

MANTRA employs a sovereign Proof-of-Stake (PoS) validator set to secure its blockchain. This mechanism incentivizes validators to act honestly, as they risk losing their staked tokens if they compromise the network. Additionally, MANTRA incorporates advanced authentication technologies, such as biometric fingerprint scanners and IRIS sensors, to enhance platform security and ensure that only authorized users can access sensitive information.

6. What are the real-world applications of MANTRA?

MANTRA’s primary applications include facilitating the development of projects that require regulatory compliance, simplifying crypto investments through its decentralized exchange (MANTRA DEX), and supporting the tokenization of real-world assets. Its architecture allows developers to build and deploy a wide range of applications, including financial services and supply chain management solutions, bridging the gap between traditional finance and decentralized finance.

7. What is the current price of MANTRA coin?

As of the latest data, the price of MANTRA (OM) is approximately $0.2081, with a market cap of around $220.68 million. The price has seen significant fluctuations, including an all-time high of $9.04 in February 2025 and an all-time low of $0.01728 in October 2023. For the most up-to-date price and market information, it is advisable to check reliable cryptocurrency market platforms.

8. How does MANTRA support developers?

MANTRA provides a robust ecosystem for developers by offering built-in modules, software development kits (SDKs), and application programming interfaces (APIs). These tools simplify the process of creating, trading, and managing regulatory-compliant real-world assets. MANTRA’s focus on user experience and accessibility aims to onboard both seasoned developers and those new to blockchain technology, fostering innovation and collaboration in the Web3 space.

Final Verdict on mantra coin

Overview of MANTRA Coin

MANTRA Coin (OM) is positioned as a unique player in the cryptocurrency landscape, primarily focusing on bridging the gap between traditional finance and decentralized finance. Its architecture is built on the Cosmos SDK, which facilitates interoperability and scalability, allowing for up to 10,000 transactions per second. The platform is designed to tokenize and trade real-world assets (RWAs) while adhering to regulatory requirements, making it particularly appealing to institutions and developers seeking compliant solutions.

Key Features and Technology

The MANTRA blockchain employs a sovereign Proof-of-Stake (PoS) mechanism, ensuring robust security through a decentralized validator set. This setup incentivizes honest participation, safeguarding the network against malicious activities. With advanced features such as Inter-Blockchain Communication (IBC) compatibility and CosmWasm support, MANTRA enables developers to create complex applications while maintaining a user-friendly experience. The platform’s emphasis on regulatory compliance is highlighted by its built-in modules and APIs, streamlining the process of trading and managing RWAs.

Potential and Risks

While MANTRA offers promising technology and a compelling vision, it is essential to recognize that investing in cryptocurrencies, including MANTRA Coin, carries inherent risks. The price has demonstrated significant volatility, with historical highs and lows that underscore the unpredictable nature of the market. As a result, MANTRA Coin is classified as a high-risk, high-reward asset class, suitable for investors who are comfortable navigating the complexities of cryptocurrency investments.

Final Thoughts

In conclusion, MANTRA Coin represents an innovative approach to integrating real-world assets within the blockchain ecosystem. However, potential investors should proceed with caution. Conducting thorough research (DYOR) is vital before making any investment decisions in this dynamic and rapidly evolving space. Understanding the risks and potential rewards associated with MANTRA Coin will empower you to make informed choices in your cryptocurrency journey.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.