jupiter crypto Explained: A Deep Dive into the Technology and Token…

An Investor’s Introduction to jupiter crypto

Introduction to Jupiter Crypto

Jupiter (JUP) is a prominent player in the decentralized finance (DeFi) landscape, primarily operating within the Solana blockchain ecosystem. Recognized for its advanced swap aggregation engine, Jupiter facilitates efficient trading and liquidity provisioning, making it a cornerstone of the Solana network. As a decentralized exchange (DEX) aggregator, Jupiter empowers users to seamlessly swap tokens while minimizing slippage and optimizing trade execution. Its robust set of features, including limit orders, dollar-cost averaging (DCA), and perpetual trading, cater to both novice and experienced traders, solidifying its position as a comprehensive DeFi superapp.

The significance of Jupiter in the cryptocurrency market extends beyond its technical functionalities. With a market capitalization of approximately $1.55 billion and a circulating supply of 3.11 billion JUP tokens, it ranks among the top cryptocurrencies by market cap. Jupiter’s innovative approach to liquidity aggregation and its commitment to democratizing access to advanced financial tools make it an attractive option for investors seeking to engage with the DeFi space. Furthermore, its recent initiatives, such as partnerships to introduce a SOL-based debit card, aim to bridge traditional finance with the burgeoning world of cryptocurrencies, enhancing the practical utility of digital assets.

This guide serves as a comprehensive resource for investors looking to understand Jupiter crypto in depth. We will explore various facets of this digital asset, including its underlying technology, tokenomics, and investment potential. Additionally, we will discuss the risks associated with investing in Jupiter and provide insights on how to buy and store JUP tokens securely.

Whether you are a beginner eager to learn about the DeFi ecosystem or an intermediate investor seeking to refine your trading strategies, this guide will equip you with the knowledge necessary to navigate the complexities of Jupiter crypto. By delving into its features and applications, you will gain a clearer understanding of how Jupiter operates within the broader cryptocurrency market and its potential for future growth.

What is jupiter crypto? A Deep Dive into its Purpose

Understanding Jupiter Crypto

Jupiter (JUP) is a decentralized cryptocurrency and exchange platform that operates on the Solana blockchain. Known primarily for its advanced swap aggregation engine, Jupiter serves as a critical infrastructure for the decentralized finance (DeFi) ecosystem, facilitating seamless and efficient trading of digital assets. This platform aims to optimize the trading experience for both novice and experienced users, providing a suite of tools designed to enhance liquidity and accessibility in the ever-evolving world of cryptocurrency.

The Core Problem It Solves

In the rapidly expanding DeFi space, one of the fundamental challenges is ensuring sufficient liquidity for trading. Many decentralized exchanges (DEXs) struggle with fragmented liquidity, leading to inefficiencies and increased slippage during trades. Slippage occurs when the execution price of a trade differs from the expected price, which can significantly impact profitability, especially in a volatile market.

Jupiter addresses this issue through its sophisticated swap aggregation engine. By aggregating liquidity from various sources, it allows users to execute trades at the best available prices, minimizing slippage and enhancing the overall trading experience. This capability is particularly crucial for traders who require quick execution and reliable pricing to optimize their strategies.

Additionally, Jupiter offers a range of financial products that cater to diverse trading needs. Features such as limit orders, dollar-cost averaging (DCA), and time-weighted average price (TWAP) empower users to implement advanced trading strategies without the need for constant market monitoring. These tools help mitigate the risks associated with market volatility and provide users with greater control over their investments.

Its Unique Selling Proposition

What sets Jupiter apart in the crowded DeFi landscape is its comprehensive approach to trading and liquidity. Here are some key aspects of its unique selling proposition:

-

Decentralized Exchange Aggregation: As a DEX aggregator, Jupiter connects users to multiple liquidity pools, ensuring that they can access the best prices across various platforms. This not only enhances trading efficiency but also democratizes access to liquidity for all users.

-

User-Friendly Interface: Jupiter is designed with user experience in mind. Its intuitive interface makes it accessible for beginners while still offering the advanced tools that seasoned traders need. This focus on usability is essential for fostering broader adoption of DeFi technologies.

-

Innovative Financial Tools: The platform’s suite of tools, including limit orders, DCA, TWAP, and perpetual trading, enables users to implement sophisticated trading strategies. These features are particularly appealing to users looking to optimize their trading performance in a fast-paced environment.

-

Interoperability: Jupiter facilitates cross-chain asset transfers, enhancing interoperability between different blockchain networks. This capability allows users to move assets seamlessly across platforms, thereby increasing liquidity and expanding trading opportunities.

-

Security and Reliability: Built on the Solana blockchain, Jupiter benefits from a high-performance infrastructure characterized by low transaction costs and fast processing times. The security protocols inherent in Solana’s architecture, including its unique consensus mechanism, provide users with confidence in the platform’s reliability.

The Team and Backers

The success of any cryptocurrency project often hinges on the strength and expertise of its team. Jupiter is supported by a group of experienced professionals with backgrounds in blockchain technology, finance, and software development. The team is dedicated to advancing the platform and expanding its capabilities, ensuring that it remains competitive in the rapidly changing DeFi landscape.

While specific details about the team members and backers may not be publicly available, the project’s commitment to transparency and community engagement is evident through its governance model. Jupiter token holders have a voice in decision-making processes, allowing the community to influence the platform’s future direction. This democratic approach not only fosters trust but also ensures that the platform evolves in a manner that aligns with user needs and preferences.

Fundamental Purpose in the Crypto Ecosystem

Jupiter’s primary purpose is to serve as a decentralized liquidity infrastructure within the Solana blockchain ecosystem. By providing essential tools for efficient trading and liquidity aggregation, Jupiter aims to enhance the overall user experience in the DeFi space. Its commitment to accessibility and innovation positions it as a vital component of the growing blockchain ecosystem.

Moreover, Jupiter’s efforts to bridge the gap between traditional finance and DeFi, as demonstrated by its partnership with Sanctum to introduce a SOL-based debit card, reflect its ambition to make cryptocurrencies more usable in everyday transactions. This initiative not only expands the utility of digital assets but also encourages mainstream adoption of blockchain technology.

In summary, Jupiter is more than just a cryptocurrency; it is a comprehensive platform designed to address the challenges of liquidity, trading efficiency, and user accessibility in the decentralized finance space. With its innovative features, strong community engagement, and commitment to interoperability, Jupiter stands out as a key player in the evolving world of digital assets. As the DeFi landscape continues to grow, Jupiter’s role in facilitating seamless trading and enhancing user experience will be instrumental in shaping the future of cryptocurrency.

The Technology Behind the Coin: How It Works

Overview of Jupiter Crypto

Jupiter (JUP) is a decentralized exchange aggregator built on the Solana blockchain, designed to enhance liquidity and facilitate efficient trading within the decentralized finance (DeFi) ecosystem. By leveraging advanced technologies and mechanisms, Jupiter aims to provide users with a seamless trading experience while ensuring security and low costs.

Blockchain Architecture

At the core of Jupiter’s technology is the Solana blockchain, known for its high throughput and low transaction fees. Solana employs a unique architecture that distinguishes it from other blockchains, making it particularly well-suited for DeFi applications like Jupiter.

-

Layered Architecture:

– Solana’s architecture is structured in layers, which helps to manage the execution of smart contracts and transaction processing efficiently. This layered approach allows for parallel processing of transactions, meaning multiple transactions can be executed simultaneously. This significantly increases the overall throughput of the network, enabling it to handle thousands of transactions per second. -

Smart Contracts:

– Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Jupiter utilizes smart contracts to automate trading processes, manage liquidity, and ensure that trades are executed exactly as programmed. This minimizes the risk of human error and enhances the trustworthiness of the platform. -

Decentralized Exchange Aggregation:

– As a decentralized exchange aggregator, Jupiter collects liquidity from various decentralized exchanges (DEXs) and presents users with the best available trading options. This aggregation process is critical in ensuring users can execute trades at optimal prices, reducing slippage and improving their trading outcomes.

Consensus Mechanism

Jupiter operates on the Solana blockchain, which employs a unique consensus mechanism that combines Proof of History (PoH) and Proof of Stake (PoS).

-

Proof of History (PoH):

– PoH is a novel consensus mechanism that creates a historical record of events on the blockchain, proving that a transaction occurred at a specific point in time. This is achieved through cryptographic proofs that establish a verifiable sequence of events. By using PoH, Solana can order transactions efficiently without requiring extensive communication between nodes, leading to faster processing times. -

Proof of Stake (PoS):

– In addition to PoH, Solana employs PoS to secure the network. In this system, validators are required to stake their tokens as collateral. This incentivizes honest behavior, as validators stand to lose their staked tokens if they act maliciously. The combination of PoH and PoS allows Solana to maintain high security while achieving rapid transaction speeds.

Key Technological Innovations

Jupiter integrates several innovative features that enhance its functionality and user experience. These innovations are designed to provide users with advanced tools for trading, liquidity management, and cross-chain asset transfers.

-

Swap Aggregation Engine:

– The swap aggregation engine is one of Jupiter’s standout features. It aggregates liquidity from multiple DEXs, allowing users to swap tokens efficiently. This engine minimizes slippage by routing trades through the most liquid sources, ensuring that users receive the best possible prices for their trades. -

Limit Orders:

– Jupiter allows users to set limit orders, enabling them to specify the price at which they want to buy or sell an asset. This feature empowers traders to implement more sophisticated trading strategies without the need for constant market monitoring. Users can place orders that will execute automatically when market conditions meet their specified criteria.

-

Dollar-Cost Averaging (DCA) and Time-Weighted Average Price (TWAP):

– Jupiter offers advanced trading strategies such as DCA and TWAP. DCA allows users to invest a fixed amount of money at regular intervals, reducing the impact of market volatility. TWAP, on the other hand, helps users execute large trades over a specified period, minimizing market impact and achieving an average price over time. -

Bridge Comparator:

– The Bridge Comparator feature facilitates cross-chain transactions by identifying the most efficient routes for transferring assets between different blockchains. This capability enhances interoperability and allows users to take advantage of opportunities across multiple platforms, which is crucial in the rapidly evolving crypto landscape. -

Perpetual Trading:

– Jupiter’s perpetual trading feature allows users to engage in futures trading with leverage. This provides traders with the opportunity to profit from market movements without needing to hold the underlying assets. This innovation attracts more sophisticated traders looking for increased exposure to market fluctuations.

Security Measures

Security is paramount in the cryptocurrency space, and Jupiter leverages the inherent security features of the Solana blockchain to protect its users.

-

Decentralization:

– Jupiter operates in a decentralized manner, meaning there is no single point of failure. This structure enhances security by distributing control across numerous nodes, making it difficult for malicious actors to compromise the network. -

Smart Contract Audits:

– To further enhance security, Jupiter’s smart contracts undergo rigorous audits. These audits help identify potential vulnerabilities and ensure that the contracts function as intended, reducing the risk of exploits or hacks. -

User-Controlled Funds:

– Users retain control over their funds at all times. Unlike centralized exchanges where users deposit their assets into the exchange’s custody, Jupiter allows users to trade directly from their wallets. This reduces the risk associated with centralized management of funds.

User-Centric Design

Jupiter’s technology is designed with the user in mind, emphasizing accessibility and ease of use.

-

Intuitive Interface:

– The platform features a user-friendly interface that simplifies the trading process. Whether a novice or an experienced trader, users can navigate the platform with ease, making it accessible to a broader audience. -

Low Fees:

– One of Jupiter’s significant advantages is its low transaction fees. By utilizing the Solana blockchain’s efficiency, Jupiter keeps costs minimal, allowing users to engage with the platform without incurring high expenses. -

Community Governance:

– Jupiter incorporates community governance, allowing token holders to participate in decision-making processes. This democratic approach fosters a sense of ownership and involvement among users, encouraging them to contribute to the platform’s development and evolution.

Conclusion

Jupiter (JUP) stands as a robust player in the decentralized finance landscape, underpinned by the advanced technologies of the Solana blockchain. With its innovative features such as swap aggregation, limit orders, and cross-chain capabilities, Jupiter not only enhances the trading experience for users but also promotes a more inclusive and accessible DeFi ecosystem. Its commitment to security, user-centric design, and community governance positions it as a significant component of the evolving cryptocurrency landscape, appealing to both novice and experienced investors. As the DeFi space continues to grow, Jupiter’s technological advancements will likely play a crucial role in shaping the future of decentralized trading.

Understanding jupiter crypto Tokenomics

| Metric | Value |

|---|---|

| Total Supply | 6.99 Billion JUP |

| Max Supply | 7 Billion JUP |

| Circulating Supply | 3.11 Billion JUP |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The Jupiter (JUP) token serves multiple essential functions within the Jupiter ecosystem and the broader decentralized finance (DeFi) landscape. Primarily, it acts as the native utility token for the Jupiter platform, enabling users to access various features and participate in the governance of the protocol.

-

Transaction Fees: One of the primary uses of JUP tokens is to pay for transaction fees incurred when users engage in trading or swapping tokens on the Jupiter platform. This fee structure incentivizes the use of JUP, as users can save on costs by utilizing the platform’s native currency.

-

Governance Participation: JUP token holders are granted the ability to participate in governance decisions concerning the future development and direction of the Jupiter platform. This decentralized approach to governance ensures that the community has a voice in critical decisions, such as updates to protocol features, fee structures, and tokenomics adjustments.

-

Liquidity Provisioning: JUP tokens can also be used to provide liquidity within the Jupiter ecosystem. Users can stake their tokens in liquidity pools to earn rewards, thereby enhancing the overall liquidity available on the platform. This function is crucial for maintaining efficient trading and minimizing slippage during transactions.

-

Access to Advanced Features: The JUP token unlocks access to various advanced trading features and financial tools offered by the platform. Features such as limit orders, dollar-cost averaging, and perpetual trading are designed to cater to both novice and experienced traders, and having JUP tokens can provide users with enhanced access to these functionalities.

-

Incentives and Rewards: Jupiter employs JUP tokens as part of its incentive mechanisms. Users can earn rewards through various activities, such as participating in trading competitions or completing specific tasks. This token-based incentive structure fosters user engagement and encourages active participation in the ecosystem.

Token Distribution

Understanding how JUP tokens are distributed is vital for evaluating their potential impact on the market and the overall health of the ecosystem. The distribution of JUP tokens is typically structured to ensure a fair allocation among various stakeholders, including the development team, early investors, and the broader community. Here are some key aspects of Jupiter’s token distribution:

-

Initial Distribution: At launch, a portion of the total supply was allocated to the development team, advisors, and early investors to fund the initial growth and development of the platform. This allocation is essential for ensuring that the project has the resources needed to build and expand its services.

-

Community Incentives: A significant portion of JUP tokens is set aside for community incentives. This may include tokens reserved for airdrops, liquidity mining, and other promotional activities designed to attract users to the platform. By distributing tokens to the community, Jupiter aims to foster a loyal user base and encourage widespread adoption of its services.

-

Vesting Schedules: To prevent sudden sell-offs that could adversely affect the market, JUP tokens allocated to the development team and early investors typically come with vesting schedules. These schedules ensure that tokens are released gradually over time, aligning the interests of the team with the long-term success of the project.

-

Burn Mechanism: Jupiter has introduced a deflationary model to enhance the token’s value over time. This model may involve periodic token burns, where a certain number of JUP tokens are permanently removed from circulation. By reducing the total supply, the burn mechanism can potentially increase the scarcity of the token, thereby driving up its value.

-

Ecosystem Growth: As the Jupiter platform continues to evolve, new tokens may be allocated to support the introduction of innovative features and partnerships. The ongoing development of the ecosystem will likely require additional funding, and token distribution strategies will adapt accordingly to ensure the platform’s sustainability and growth.

In conclusion, the tokenomics of Jupiter (JUP) is designed to create a robust and sustainable ecosystem that incentivizes user participation while promoting long-term value appreciation. By understanding the utility and distribution of JUP tokens, investors and users can make more informed decisions about their involvement in the Jupiter platform and the broader DeFi landscape. The combination of strategic token allocation, governance participation, and a deflationary model positions Jupiter as a significant player within the Solana ecosystem and the evolving world of decentralized finance.

Price History and Market Performance

Key Historical Price Milestones

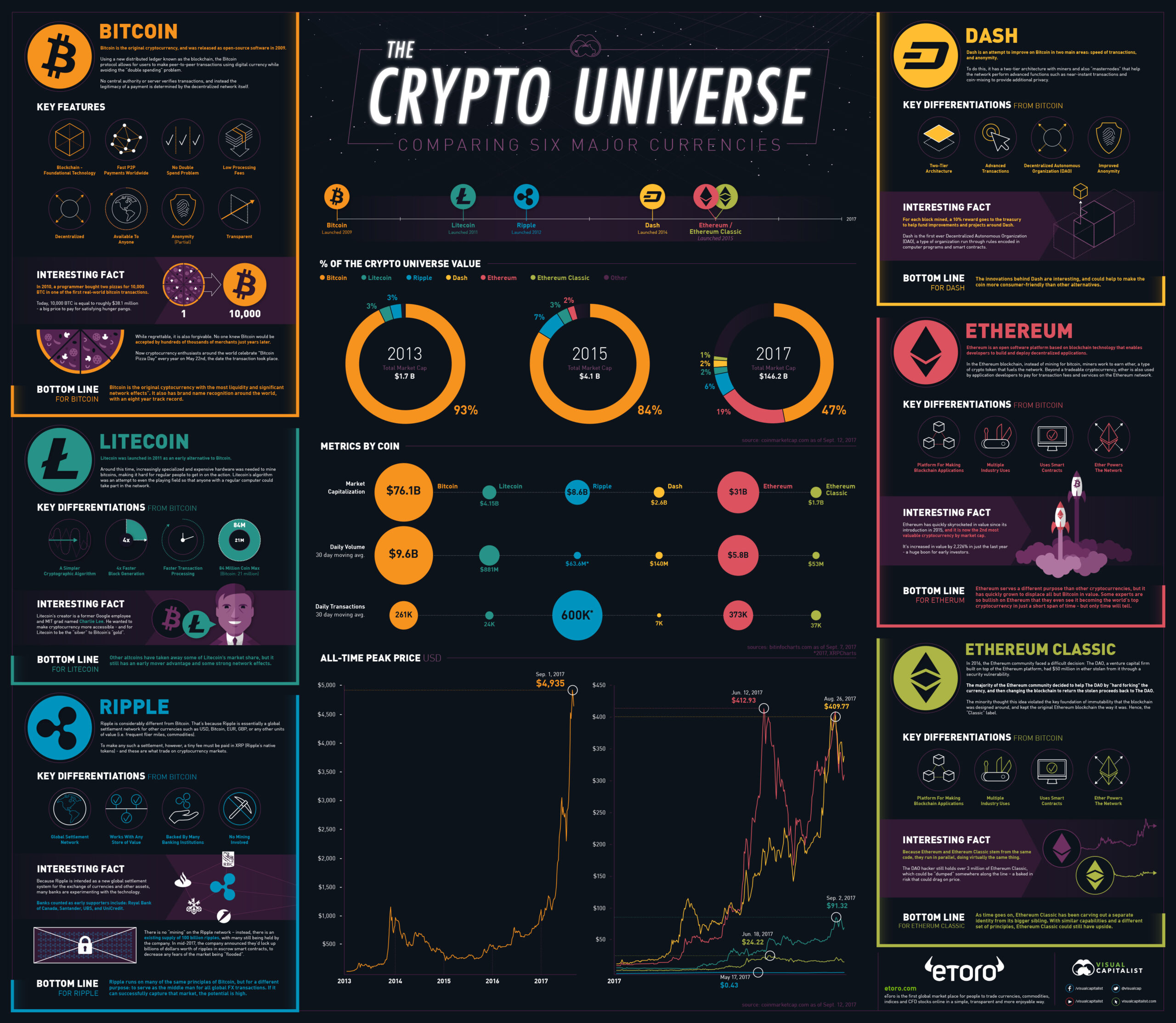

Jupiter (JUP) has experienced a range of price fluctuations since its inception, reflecting the volatility typical of many cryptocurrencies. Launched on the Solana blockchain, Jupiter positioned itself as a significant player in the decentralized finance (DeFi) space, leveraging the network’s high throughput and low transaction costs.

One of the most notable milestones in Jupiter’s price history occurred when it reached its all-time high of $2.04 on January 31, 2024. This peak illustrated strong market interest and investor confidence, attributed to Jupiter’s robust platform features and partnerships that enhanced its utility within the DeFi ecosystem. Following this high, the price experienced a substantial decline, dropping approximately 75.61% from its peak value.

On the opposite end of the spectrum, Jupiter recorded its all-time low of $0.3064 on April 7, 2025. This low point was significant as it marked a critical recovery phase for the asset, leading to a rebound of about 62.7% in subsequent trading periods. Such fluctuations are indicative of broader market trends, investor sentiment, and the evolving nature of the cryptocurrency landscape.

Throughout its trading history, Jupiter has maintained a circulating supply of 3.11 billion JUP out of a total supply of 6.99 billion JUP. The market capitalization has varied, with Jupiter reaching a peak market cap of $1.55 billion, showcasing its position within the top cryptocurrencies by market cap. These figures reflect not only Jupiter’s performance but also its acceptance and integration within the Solana ecosystem.

Factors Influencing the Price

Historically, the price of Jupiter has been influenced by several critical factors, including market trends, technological advancements, and broader economic conditions. Understanding these influences can provide valuable insights into the dynamics shaping JUP’s market performance.

Market Sentiment and Trends

Market sentiment plays a pivotal role in the price movements of cryptocurrencies, including Jupiter. Periods of bullish sentiment often correlate with price increases as investors are more willing to buy into the asset. Conversely, bearish sentiment can lead to significant sell-offs. For instance, during market rallies, Jupiter’s price surged as traders sought to capitalize on its potential, particularly during the height of interest in DeFi solutions.

Additionally, the overall performance of the cryptocurrency market, especially major players like Bitcoin and Ethereum, tends to impact JUP’s price. When Bitcoin experiences substantial price changes, it often triggers similar reactions in altcoins, including Jupiter. Thus, Jupiter’s performance is not solely isolated but is part of a larger market context.

Technological Developments

Technological advancements within the Jupiter platform have also been significant price drivers. The introduction of innovative features such as limit orders, dollar-cost averaging (DCA), and perpetual trading capabilities have attracted traders seeking more sophisticated tools for managing their investments. Each new feature not only enhances the platform’s usability but also contributes to increased trading volume, which can positively affect the price.

Moreover, Jupiter’s partnership with Sanctum to release a SOL-based debit card represents a strategic move to integrate traditional finance with the DeFi space, further boosting its appeal. Such partnerships can lead to increased adoption and usage, which in turn can positively influence the token’s market price.

Regulatory Environment

The evolving regulatory landscape surrounding cryptocurrencies has also had a notable impact on Jupiter’s price. Regulatory news, whether positive or negative, can lead to immediate market reactions. For instance, favorable regulations can lead to increased investor confidence, while stringent regulations may create uncertainty and lead to price declines. Jupiter, being part of the DeFi sector, is particularly sensitive to regulatory developments, as these can directly affect its operational model and user engagement.

Economic Factors

Broader economic conditions, including inflation rates, interest rates, and global economic stability, also influence the cryptocurrency market. During times of economic uncertainty, investors may turn to cryptocurrencies as alternative assets, thereby driving demand and prices up. Conversely, in a stable economic environment, traditional investments may take precedence, leading to reduced interest in speculative assets like Jupiter.

Market Liquidity

Market liquidity, which refers to how easily an asset can be bought or sold without causing significant price changes, has also played a crucial role in Jupiter’s price history. High liquidity typically correlates with more stable prices, while lower liquidity can lead to higher volatility. Jupiter’s position as a decentralized exchange aggregator has enhanced its liquidity, allowing for smoother trading experiences and potentially stabilizing price movements.

Conclusion

In summary, Jupiter’s price history is marked by significant fluctuations influenced by a variety of factors, including market sentiment, technological advancements, regulatory developments, economic conditions, and market liquidity. Understanding these historical price milestones and influencing factors provides valuable context for both new and experienced investors navigating the ever-evolving landscape of cryptocurrency. As Jupiter continues to innovate and adapt within the Solana ecosystem, its price dynamics will likely remain a focal point for market participants.

Where to Buy jupiter crypto: Top Exchanges Reviewed

5 Reasons to Buy Jupiter on Kraken Today!

Kraken’s guide to buying Jupiter (JUP) stands out for its user-friendly approach, allowing investors to start with as little as $10. The exchange supports multiple payment methods, including credit/debit cards, ACH deposits, and mobile payment options like Apple and Google Pay, enhancing accessibility for both beginners and seasoned traders. With its robust security measures and a reputation for reliability, Kraken provides a solid platform for acquiring JUP.

- Website: kraken.com

5. Jupiter Exchanges – Your Gateway to Effortless JUP Trading!

Jupiter Exchanges stand out for their accessibility and robust trading options, allowing users to buy, sell, and trade JUP across major platforms like HTX (Huobi), Binance, KuCoin, and Kraken. These exchanges offer a user-friendly interface, competitive trading fees, and a diverse range of trading pairs, making them ideal for both novice and experienced investors looking to engage with Jupiter’s ecosystem effectively.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Buy Jupiter – Your Gateway to Seamless Crypto Transactions!

MoonPay stands out as a user-friendly platform for purchasing Jupiter (JUP), the native token of the Solana decentralized exchange. Its streamlined process allows users to buy JUP quickly using various payment methods, including credit and debit cards, as well as bank transfers. This accessibility, combined with its commitment to security and efficiency, makes MoonPay an attractive option for both novice and experienced cryptocurrency investors looking to engage with the Solana ecosystem.

- Website: moonpay.com

- Platform Age: Approx. 15 years (domain registered in 2010)

7. Top Exchanges to Buy Jupiter: Uncovering the Best JUP Markets!

In the review article “Where to Buy Jupiter: Best Jupiter Markets & JUP Pairs,” BitDegree highlights the top cryptocurrency exchanges for purchasing Jupiter (JUP), emphasizing their competitive trading pairs and user-friendly interfaces. The guide provides detailed insights into market dynamics, enabling both novice and seasoned investors to make informed decisions while exploring the best platforms for trading Jupiter, ensuring a seamless buying experience.

- Website: bitdegree.org

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy jupiter crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to buying Jupiter (JUP) is selecting a reliable cryptocurrency exchange. Several exchanges support JUP trading, including popular platforms such as Binance, Coinbase, and Kraken. When choosing an exchange, consider the following factors:

- Reputation: Look for exchanges with a strong track record and positive user reviews.

- Supported Pairs: Ensure the exchange supports trading pairs for JUP, such as JUP/USD or JUP/USDT.

- Fees: Compare transaction and withdrawal fees across different exchanges to find the most cost-effective option.

- Security: Choose an exchange that employs robust security measures, including two-factor authentication (2FA) and cold storage for funds.

2. Create and Verify Your Account

Once you have selected an exchange, the next step is to create an account:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide your email address and create a password.

- Verification: Most exchanges require identity verification to comply with regulations. You may need to provide personal information such as your name, address, and date of birth. Be prepared to upload a government-issued ID and possibly a proof of address (e.g., utility bill).

- Security Setup: After verification, set up additional security measures, such as enabling 2FA, to protect your account from unauthorized access.

3. Deposit Funds

With your account set up and verified, you can now deposit funds to purchase JUP:

- Select Deposit Method: Navigate to the “Deposit” section of your account. Most exchanges allow deposits via bank transfers, credit/debit cards, or other cryptocurrencies.

- Choose Currency: If you plan to buy JUP directly with fiat currency, select the currency you want to deposit (e.g., USD, EUR).

- Complete the Deposit: Follow the instructions provided by the exchange to complete your deposit. For bank transfers, this might involve transferring funds to a specified bank account. For card payments, you may need to input your card details.

4. Place an Order to Buy Jupiter Crypto

Now that your account is funded, you can place an order to buy JUP:

- Navigate to the Trading Section: Find the trading section on the exchange platform. Look for the trading pair for JUP (e.g., JUP/USD).

- Choose Order Type: Select the type of order you want to place:

- Market Order: This order buys JUP at the current market price. It is the quickest way to purchase but may result in slight price fluctuations.

- Limit Order: This order allows you to set a specific price at which you want to buy JUP. The order will execute only when the market reaches your specified price.

- Enter Amount: Specify how much JUP you want to purchase. Review the total cost and any applicable fees before confirming.

- Confirm the Order: Once you are satisfied with the details, confirm your order. You will receive a notification once your order is executed.

5. Secure Your Coins in a Wallet

After purchasing JUP, it’s essential to secure your coins:

- Choose a Wallet: While exchanges provide wallets for storing cryptocurrencies, it’s safer to transfer your JUP to a personal wallet. You can choose from:

- Hardware Wallets: These are physical devices that store your cryptocurrencies offline, offering the highest security.

- Software Wallets: These are applications (desktop or mobile) that store your coins. They are more convenient but less secure than hardware wallets.

- Web Wallets: These wallets are hosted online and are easy to access, but they carry higher risks of hacks.

- Transfer JUP: If you decide to use a personal wallet, find your wallet’s JUP address and transfer your coins from the exchange to your wallet. Be sure to double-check the address before sending to avoid losing your funds.

- Backup Your Wallet: Ensure you have a backup of your wallet’s recovery phrase or private keys, as this is essential for recovering your funds in case of loss or theft.

Conclusion

Buying Jupiter (JUP) is a straightforward process that involves selecting a suitable exchange, creating and verifying your account, depositing funds, placing an order, and securing your coins in a wallet. By following these steps, you can confidently navigate the process and participate in the growing decentralized finance ecosystem.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Strong Market Position within DeFi

Jupiter (JUP) operates as a decentralized exchange aggregator on the Solana blockchain, positioning itself as a vital player within the decentralized finance (DeFi) ecosystem. The platform’s core functionality—facilitating efficient token swaps through its advanced liquidity aggregation engine—enables it to cater to both novice and experienced traders. As DeFi continues to gain traction, Jupiter’s established market presence and user-friendly design may contribute to sustained growth and adoption.

2. Robust Technological Foundation

Built on the Solana blockchain, Jupiter benefits from the network’s high throughput and low transaction costs. Solana’s unique consensus mechanism, combining Proof of History (PoH) and Proof of Stake (PoS), ensures that transactions are processed quickly and securely. This technological advantage allows Jupiter to minimize slippage during trades and optimize the user experience, making it a compelling choice for traders who prioritize efficiency.

3. Diverse Product Offerings

Jupiter’s suite of DeFi products, including Limit Orders, Dollar-Cost Averaging (DCA), Time-Weighted Average Price (TWAP), and Perpetual Trading, provides users with various trading strategies and options. By catering to different trading styles and preferences, Jupiter enhances its appeal to a broad audience, potentially attracting more users and increasing transaction volumes on its platform.

4. Community Governance

Jupiter’s emphasis on community engagement and governance is another strength. Token holders can participate in decision-making processes regarding the platform’s future direction, fostering a sense of ownership among users. This decentralized approach not only enhances transparency but also aligns the interests of the community with the platform’s success, potentially leading to greater user loyalty.

5. Real-World Applications

The partnership with Sanctum to introduce a SOL-based debit card exemplifies Jupiter’s commitment to bridging the gap between traditional finance and the crypto space. This initiative allows users to utilize their digital assets in everyday transactions, thereby enhancing the practical utility of JUP. As adoption of cryptocurrencies in real-world applications increases, Jupiter’s role in this ecosystem could become increasingly significant.

6. Low Transaction Fees

One of the critical advantages of utilizing Jupiter is the low transaction fees associated with trading on the platform. By leveraging Solana’s efficient architecture, Jupiter reduces barriers to entry for users, encouraging more frequent trading and engagement. This affordability can be particularly appealing in a market where high transaction costs can deter participation.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies, including Jupiter, are known for their price volatility. JUP’s price can fluctuate significantly due to various factors, including market sentiment, investor behavior, and macroeconomic events. Such volatility poses risks for investors, particularly those looking for stable returns. Sudden price swings can lead to substantial losses, especially for those using leveraged trading options available on the platform.

2. Regulatory Uncertainty

The evolving regulatory landscape surrounding cryptocurrencies presents a significant challenge for platforms like Jupiter. Governments worldwide are increasingly scrutinizing digital assets, and regulatory changes could impact the operations of decentralized exchanges and DeFi platforms. Uncertainty regarding compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations could hinder user adoption and create operational challenges.

3. Competition in the DeFi Space

The DeFi sector is highly competitive, with numerous platforms vying for market share. Jupiter faces competition not only from other decentralized exchange aggregators but also from centralized exchanges and emerging DeFi projects. As new players enter the market with innovative features and services, Jupiter must continuously evolve and improve its offerings to maintain its competitive edge.

4. Technological Risks

While Jupiter benefits from the robust technology of the Solana blockchain, it is not immune to technological risks. Bugs, vulnerabilities, or exploits within smart contracts can lead to significant financial losses for users. Additionally, the reliance on the Solana network means that any issues affecting the blockchain’s performance—such as network outages or security breaches—could directly impact Jupiter’s functionality and user experience.

5. Dependency on Liquidity

As a decentralized exchange aggregator, Jupiter relies heavily on liquidity from various sources to facilitate trades efficiently. A decrease in available liquidity, whether due to market conditions or changes in user behavior, could adversely affect the platform’s ability to execute trades at optimal prices. Low liquidity can lead to increased slippage and a poorer trading experience for users, potentially driving them to alternative platforms.

6. Historical Performance and Price Trends

Jupiter’s historical price performance indicates that it has experienced significant price fluctuations, including a notable drop from its all-time high. This trend raises questions about its long-term viability and the potential for future price recoveries. Investors should consider these historical trends and assess their risk tolerance when evaluating Jupiter as part of their investment portfolio.

Conclusion

Investing in Jupiter presents a unique set of potential strengths and risks. Its strong position within the DeFi ecosystem, robust technological foundation, diverse product offerings, and commitment to community governance highlight its attractiveness as a digital asset. However, investors must remain vigilant about the inherent risks, including market volatility, regulatory uncertainty, competition, technological challenges, and liquidity dependencies.

Understanding these factors can aid investors—both beginners and intermediates—in making informed decisions about their involvement with Jupiter. As with any investment, conducting thorough research and considering one’s risk tolerance is paramount in navigating the dynamic landscape of cryptocurrency investments.

Frequently Asked Questions (FAQs)

1. What is Jupiter crypto (JUP)?

Jupiter (JUP) is a decentralized exchange aggregator built on the Solana blockchain. It serves as a pivotal liquidity infrastructure within the decentralized finance (DeFi) landscape, enabling users to execute efficient token swaps and access various financial tools, such as limit orders and dollar-cost averaging (DCA). Jupiter aims to enhance trading experiences by minimizing slippage and providing advanced features for both novice and experienced traders.

2. Who created Jupiter crypto?

Jupiter was developed by a team of engineers and blockchain enthusiasts who recognized the need for a robust liquidity solution within the Solana ecosystem. The project is community-driven, with governance mechanisms allowing token holders to influence its development and direction. This decentralized approach emphasizes transparency and user involvement.

3. What makes Jupiter crypto different from Bitcoin?

While Bitcoin is primarily a digital currency designed as a store of value and medium of exchange, Jupiter focuses on providing a platform for decentralized trading and liquidity aggregation. Jupiter operates within the DeFi space, offering advanced trading functionalities and tools that cater to a diverse range of trading strategies, whereas Bitcoin’s primary use case revolves around being a decentralized currency.

4. Is Jupiter crypto a good investment?

As with any cryptocurrency investment, the potential for profit or loss exists. Jupiter’s strong market position within the Solana ecosystem, innovative DeFi features, and community-driven governance model may appeal to investors. However, investors should conduct thorough research, assess their risk tolerance, and consider market conditions before making any investment decisions.

5. How does Jupiter’s technology work?

Jupiter utilizes a swap aggregation engine that aggregates liquidity from multiple sources to facilitate efficient token swaps. This technology minimizes slippage and enhances the trading experience. Built on the Solana blockchain, Jupiter benefits from high transaction speeds and low costs, making it a suitable platform for decentralized trading activities.

6. What are the real-world applications of Jupiter?

Jupiter’s applications extend to decentralized trading, governance participation, and cross-chain asset transfers. Its liquidity aggregation capabilities ensure efficient trading, while its DeFi products enable users to engage in diverse trading strategies. Additionally, partnerships, such as the one with Sanctum for a Solana-based debit card, aim to bridge traditional finance and the crypto space, increasing Jupiter’s utility in everyday transactions.

7. What are the risks associated with investing in Jupiter?

Investing in Jupiter carries several risks, including market volatility, regulatory changes, and the inherent risks of the DeFi space. As a relatively new project, potential vulnerabilities in its technology or governance model may also pose risks. Investors should remain vigilant and consider these factors when evaluating their investment strategies.

8. How can I buy and store Jupiter (JUP)?

Jupiter can be purchased on various centralized and decentralized exchanges that support trading pairs with cryptocurrencies like USDT or SOL. Once acquired, it’s essential to store JUP securely in a compatible wallet. Hardware wallets or reputable software wallets that support Solana-based tokens are recommended to ensure the safety of your assets.

Final Verdict on jupiter crypto

Summary of Jupiter Crypto

Jupiter (JUP) is a significant player in the decentralized finance (DeFi) ecosystem, particularly within the Solana blockchain. As a decentralized exchange aggregator, Jupiter facilitates efficient token swaps by aggregating liquidity from various sources, allowing users to trade assets with minimal slippage and at optimal prices. The platform is designed for both novice and experienced traders, offering advanced tools such as limit orders, dollar-cost averaging (DCA), and perpetual trading. These features enhance the trading experience and provide users with greater flexibility in managing their investments.

Technological Foundation

Built on the high-performance Solana blockchain, Jupiter benefits from rapid transaction speeds and low fees, making it a cost-effective solution for users. Its innovative swap aggregation engine is a cornerstone of its technology, ensuring users have access to the best liquidity. Additionally, Jupiter’s commitment to security is reinforced by Solana’s unique consensus mechanisms—Proof of History (PoH) and Proof of Stake (PoS)—which help maintain the integrity of transactions and protect against potential vulnerabilities.

Potential and Risks

While Jupiter presents exciting opportunities for users looking to engage with DeFi and capitalize on the evolving cryptocurrency market, it is essential to recognize that it is part of a high-risk, high-reward asset class. The volatility inherent in cryptocurrency markets can lead to significant price fluctuations, which can impact investment outcomes. Moreover, the overall health of the Solana ecosystem and the broader DeFi landscape will play crucial roles in Jupiter’s future performance.

Final Thoughts

As with any investment, it is imperative for potential investors to conduct their own thorough research (DYOR) before committing funds to Jupiter or any cryptocurrency. Understanding the project’s fundamentals, technology, and market dynamics will empower you to make informed decisions tailored to your financial goals and risk tolerance.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.