dodo coin Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to dodo coin

Dodo Coin is a notable player in the decentralized finance (DeFi) landscape, specifically designed to enhance liquidity provision on decentralized exchanges (DEX). Launched in August 2020, Dodo Coin operates on the Ethereum blockchain and utilizes a unique Proactive Market Maker (PMM) algorithm. This innovative approach aims to provide better liquidity and price stability compared to traditional automated market makers (AMMs) like Uniswap. By mimicking human trading behaviors and leveraging oracles for accurate market pricing, Dodo Coin has positioned itself as a competitive alternative for liquidity providers and traders alike.

Significance in the Crypto Market

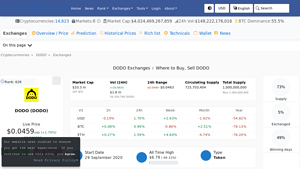

As the DeFi sector continues to grow, Dodo Coin stands out due to its focus on reducing price slippage and impermanent loss, common challenges faced by liquidity providers. With a current market cap of approximately $33.35 million and a circulating supply of around 725.7 million DODO tokens, Dodo Coin has garnered attention from investors and traders. Its ability to offer low transaction fees and flexible liquidity options makes it an attractive choice for those looking to engage in decentralized trading.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors interested in Dodo Coin. It will cover various aspects of the cryptocurrency, including:

-

Technology: An overview of the underlying technology that powers Dodo Coin, including its PMM algorithm and how it enhances liquidity in the DeFi ecosystem.

-

Tokenomics: Detailed insights into the supply, distribution, and economic model of Dodo Coin, helping investors understand its potential for growth and sustainability.

-

Investment Potential: Analysis of Dodo Coin’s historical price performance, market trends, and future outlook, enabling investors to make informed decisions.

-

Risks: A candid discussion of the risks associated with investing in Dodo Coin, including market volatility and potential security issues inherent in DeFi protocols.

-

How to Buy: Step-by-step instructions on acquiring Dodo Coin, whether through centralized or decentralized exchanges, along with tips for safely managing your investment.

By the end of this guide, readers will have a well-rounded understanding of Dodo Coin, empowering them to navigate the complexities of this unique cryptocurrency with confidence. Whether you are a seasoned investor or just starting your journey into the world of digital assets, this resource will provide valuable insights to enhance your investment strategy.

What is dodo coin? A Deep Dive into its Purpose

Introduction to DODO Coin

DODO Coin, or simply DODO, is the native cryptocurrency of the DODO decentralized finance (DeFi) protocol, which aims to enhance liquidity provision in the crypto ecosystem. Launched in August 2020, DODO operates on the Ethereum blockchain and utilizes a unique Proactive Market Maker (PMM) algorithm designed to offer better liquidity and price stability compared to traditional automated market makers (AMMs).

The Core Problem It Solves

One of the primary challenges in the decentralized finance space is the issue of liquidity. Traditional AMMs, such as Uniswap, often suffer from high slippage and impermanent loss, which can deter users from providing liquidity or trading. Slippage refers to the difference between the expected price of a trade and the actual price, often exacerbated in volatile markets. Impermanent loss is the temporary loss of funds experienced by liquidity providers due to price fluctuations between deposited tokens.

DODO addresses these issues through its PMM algorithm, which mimics human trading behavior and uses oracles to gather accurate market prices. This proactive approach allows DODO to provide sufficient liquidity closer to market prices, thereby reducing slippage and the risk of impermanent loss. Moreover, DODO allows liquidity providers (LPs) to create their own trading pairs and deposit tokens without any minimum requirements, which further enhances the protocol’s liquidity.

Its Unique Selling Proposition

DODO’s unique selling proposition lies in its innovative PMM algorithm, which sets it apart from traditional AMMs. Here are some key features that contribute to its competitive edge:

-

Proactive Market Making: Unlike passive liquidity provision, DODO’s PMM actively adjusts market prices to attract arbitrage trading. This mechanism helps stabilize the portfolios of liquidity providers and ensures better pricing for traders.

-

Low Transaction Fees: DODO aims to keep transaction costs lower than those of its competitors, making it more appealing for users looking to maximize their trading efficiency.

-

Flexible Liquidity Provision: Liquidity providers can create custom trading pairs and deposit various tokens without restrictions. This flexibility allows for a more diverse range of liquidity options compared to other platforms.

-

Initial DODO Offering (IDO): DODO supports new crypto projects by allowing them to list their tokens through IDOs without requiring quote tokens. This streamlined process enables projects to access liquidity more easily and promotes innovation within the crypto ecosystem.

-

High Capital Efficiency: The PMM algorithm allows for higher capital utilization, meaning that liquidity providers can achieve better returns on their investments without needing to lock up large amounts of capital.

-

Resistance to Impermanent Loss: By using oracles to maintain stable market prices, DODO mitigates the risks associated with impermanent loss, making it a more attractive option for liquidity providers.

The Team and Backers

DODO was founded by a team of experienced professionals in the blockchain space, including Diane Dai and Radar Bear, along with an anonymous development team. The project initially attracted significant attention and funding, successfully raising $600,000 in a seed round led by Framework Ventures. In September 2020, DODO completed a $5 million private sale funding round, with participation from notable investors such as Pantera Capital, Binance Labs, and Three Arrows Capital.

The backing by reputable venture capital firms and cryptocurrency exchanges has provided DODO with the resources necessary to develop and enhance its protocol. The team’s commitment to innovation and user-centric design has positioned DODO as a promising player in the DeFi space.

Fundamental Purpose in the Crypto Ecosystem

DODO’s fundamental purpose is to provide a robust and efficient liquidity solution for traders and liquidity providers in the decentralized finance ecosystem. By addressing the issues of slippage and impermanent loss, DODO enables a smoother trading experience and encourages more users to participate in liquidity provision.

The platform’s focus on innovation, such as the PMM algorithm and the IDO process, fosters an environment where new projects can thrive. This not only benefits individual investors but also contributes to the overall growth of the DeFi sector by facilitating the launch of new tokens and projects.

Moreover, DODO’s approach to liquidity provision aligns with the broader goals of decentralization and democratization within the cryptocurrency space. By empowering users to create their own trading pairs and manage their liquidity without the constraints typically imposed by centralized exchanges, DODO promotes a more inclusive and accessible financial ecosystem.

Conclusion

In summary, DODO Coin stands out in the crowded DeFi landscape due to its innovative approach to liquidity provision through the PMM algorithm. By solving critical issues related to slippage and impermanent loss, DODO creates a more favorable environment for both traders and liquidity providers. With strong backing from reputable investors and a dedicated team, DODO is well-positioned to continue its growth and impact on the cryptocurrency ecosystem. As DeFi evolves, DODO’s contributions may play a pivotal role in shaping the future of decentralized trading and liquidity solutions.

The Technology Behind the Coin: How It Works

Overview of DODO Coin Technology

DODO Coin is part of the DODO decentralized finance (DeFi) ecosystem, which primarily functions as a liquidity provider and decentralized exchange (DEX). DODO leverages a unique Proactive Market Maker (PMM) algorithm designed to improve liquidity and reduce slippage compared to traditional automated market makers (AMMs). This section will break down the technology behind DODO, including its blockchain architecture, consensus mechanism, and key technological innovations.

Blockchain Architecture

DODO operates primarily on the Ethereum blockchain, which is one of the most widely used platforms for decentralized applications (dApps). Ethereum’s blockchain architecture is built on a decentralized network of nodes that validate transactions and maintain a shared ledger. Here’s a closer look at the components involved:

-

Smart Contracts: DODO utilizes Ethereum’s smart contracts to automate processes such as trading, liquidity provision, and the management of token listings. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This ensures transparency and trust among users, as the contract executes automatically when conditions are met.

-

ERC20 Token Standard: DODO is an ERC20 token, which means it follows a standard protocol for tokens on the Ethereum blockchain. This ensures compatibility with various wallets and exchanges. The ERC20 standard defines a set of rules that govern how tokens can be transferred, how transactions are approved, and how users can access data about the tokens.

-

Interoperability: While DODO primarily operates on Ethereum, it is designed to be interoperable with other blockchain networks. This is essential for expanding its user base and providing liquidity across different platforms. DODO is also integrated with Binance Smart Chain and other ecosystems, allowing for cross-chain trading.

Consensus Mechanism

The Ethereum blockchain, where DODO is deployed, utilizes the Proof-of-Work (PoW) consensus mechanism, although it is in the process of transitioning to Proof-of-Stake (PoS) with Ethereum 2.0. Understanding these mechanisms is crucial as they affect transaction validation, security, and energy consumption.

-

Proof-of-Work (PoW): In PoW, miners solve complex mathematical problems to validate transactions and create new blocks. This process requires significant computational power and energy. The first miner to solve the problem gets rewarded with cryptocurrency. While PoW has been effective in securing the network, it has faced criticism for its environmental impact.

-

Proof-of-Stake (PoS): Ethereum’s transition to PoS aims to address the issues associated with PoW. In PoS, validators are chosen to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. This method is more energy-efficient and allows for faster transaction validation. DODO’s operations will benefit from Ethereum’s shift to PoS, as it will likely lead to reduced transaction costs and improved scalability.

Key Technological Innovations

DODO differentiates itself from traditional AMMs through several innovative technologies and methodologies that enhance liquidity provision and trading efficiency:

Proactive Market Maker (PMM) Algorithm

The PMM algorithm is the cornerstone of DODO’s liquidity provision. Unlike traditional AMMs that use a constant product formula, PMM mimics human trading behavior to provide liquidity more effectively. Here’s how it works:

-

Dynamic Pricing: PMM adjusts prices based on real-time market conditions. It uses oracles to fetch accurate price data from various exchanges, allowing it to offer competitive rates close to market prices. This reduces price slippage for traders and improves the overall trading experience.

-

Arbitrage Opportunities: The PMM algorithm encourages arbitrage trading by creating liquidity near market prices. When discrepancies arise between DODO and other exchanges, arbitrageurs can exploit these differences, which in turn stabilizes prices on the DODO platform.

-

Liquidity Stability: By focusing liquidity near the market price, PMM minimizes impermanent loss, a common risk faced by liquidity providers in traditional AMMs. This is achieved by allowing liquidity providers to deposit their tokens without a minimum requirement and to create their own trading pairs.

Initial DODO Offering (IDO)

DODO introduces a unique fundraising mechanism called Initial DODO Offering (IDO). This allows new projects to list their tokens on DODO without the need for quote tokens, simplifying the listing process. Here’s how IDOs work:

-

Simplified Token Listing: Projects only need to deposit their tokens into the liquidity pool, and the PMM algorithm automatically generates the necessary market depth. This reduces barriers to entry for new projects and encourages innovation in the DeFi space.

-

Constant Price Setting: To initiate an IDO, a project sets a constant price for its token, which helps in stabilizing the token’s value during its initial launch phase.

Low Transaction Fees and High Liquidity

DODO aims to provide a trading experience comparable to centralized exchanges (CEX) while maintaining the benefits of a decentralized platform. Key features include:

-

Low Fees: DODO’s PMM algorithm allows for lower transaction fees compared to traditional AMMs, making it an attractive option for traders looking to minimize costs.

-

High Liquidity: By leveraging its unique pricing mechanism and encouraging liquidity provision, DODO can offer high liquidity levels, ensuring that traders can execute large orders with minimal price impact.

Security Measures

Security is a paramount concern in the DeFi space, and DODO has implemented several measures to protect its users and their funds:

-

Smart Contract Audits: DODO’s smart contracts have undergone audits by reputable security firms like PeckShield. These audits are crucial for identifying vulnerabilities and ensuring the integrity of the protocol.

-

Decentralization: Being a decentralized protocol, DODO is resistant to single points of failure, which enhances its security. The distributed nature of the blockchain ensures that no single entity controls the network.

Conclusion

DODO Coin embodies the innovative spirit of the DeFi movement, utilizing advanced technologies to enhance liquidity and trading efficiency. Through its Proactive Market Maker algorithm, low transaction fees, and unique IDO mechanism, DODO offers a compelling alternative to traditional AMMs. As the Ethereum ecosystem transitions to Proof-of-Stake and continues to develop, DODO is well-positioned to benefit from increased scalability and reduced costs. Understanding these technological foundations is essential for both new and experienced investors looking to navigate the ever-evolving landscape of cryptocurrency.

Understanding dodo coin Tokenomics

| Metric | Value |

|---|---|

| Total Supply | 1,000,000,000 DODO |

| Max Supply | 1,000,000,000 DODO |

| Circulating Supply | 725,703,404 DODO |

| Inflation/Deflation Model | Deflationary (no inflation mechanism) |

Overview of DODO Tokenomics

DODO, a decentralized finance (DeFi) protocol and on-chain liquidity provider, operates on a unique tokenomics model that is designed to incentivize participation, promote stability, and support its liquidity provision functionalities. Understanding DODO’s tokenomics is crucial for both potential investors and users, as it provides insight into the value proposition of the DODO token within its ecosystem.

Total Supply, Circulating Supply, and Max Supply

DODO has a total supply of 1 billion tokens (1,000,000,000 DODO). This total supply is fixed, meaning there will never be more than this number of DODO tokens in circulation. The circulating supply, which is the number of tokens currently available for trading and use, stands at approximately 725.7 million DODO tokens. This indicates that a significant portion of the total supply is already in circulation, with about 27.3% of the total supply yet to be distributed or unlocked.

The maximum supply of DODO is also capped at 1 billion tokens, which plays a role in the token’s deflationary model. With no mechanisms in place to inflate the supply, the value of the DODO token could increase over time due to scarcity, assuming demand remains constant or increases.

Token Utility (What is the coin used for?)

The DODO token serves several important functions within the DODO ecosystem, which are crucial for its operation and user engagement:

-

Liquidity Provision: DODO tokens can be used to provide liquidity on the DODO platform. Liquidity providers deposit DODO tokens along with other assets into liquidity pools. In return, they earn transaction fees, which are distributed proportionally based on the amount of liquidity they provide.

-

Governance: DODO token holders have governance rights, allowing them to participate in decision-making processes regarding the protocol’s future developments and changes. This democratic approach ensures that the interests of the community are represented.

-

Incentives for Users: Users who engage with the DODO platform can earn rewards in the form of DODO tokens. This includes participating in liquidity mining programs, where users are incentivized to provide liquidity by receiving DODO tokens as rewards.

-

Access to Initial DODO Offerings (IDOs): DODO tokens can be utilized for participating in IDOs, a fundraising mechanism that allows new projects to launch their tokens on the DODO platform. This offers new projects a way to gain visibility and liquidity without the traditional barriers associated with launching tokens.

-

Transaction Fees: The DODO token is also utilized to pay transaction fees on the platform. Users are required to use DODO tokens to cover fees associated with trades and liquidity provision, creating a consistent demand for the token.

Token Distribution

The distribution of DODO tokens is designed to ensure that various stakeholders in the ecosystem are incentivized to support and grow the platform. The allocation of the total supply is as follows:

-

Core Team and Advisors (15%): A portion of the tokens is allocated to the core team, future hires, and advisors. This allocation rewards those who have contributed to the development of the DODO protocol and aligns their interests with the success of the platform.

-

Investors (16%): Early investors who supported the project during its funding rounds receive a share of the token supply. This allocation helps to foster long-term partnerships and ensures that investors have a vested interest in the protocol’s success.

-

Initial Liquidity Provision (1%): A small percentage of tokens is reserved for initial liquidity provision during the launch of the protocol. This allocation helps to establish liquidity from the outset, ensuring that users can trade DODO tokens with minimal slippage.

-

Operations, Marketing, and Partnerships (8%): Tokens are allocated for operational expenses, marketing initiatives, and establishing partnerships. This allocation is crucial for promoting the DODO platform and attracting new users.

-

Community Incentives (60%): The largest portion of the total supply is allocated for community incentives, including liquidity mining rewards and other user engagement initiatives. This allocation is designed to foster a vibrant community of users who actively participate in the ecosystem.

Conclusion

In summary, DODO’s tokenomics is structured to support its decentralized exchange model and incentivize user participation. With a fixed total supply, a variety of use cases for the DODO token, and a strategic distribution plan, DODO aims to create a sustainable and engaging ecosystem. Understanding these elements can help potential investors and users grasp the value of the DODO token in the rapidly evolving DeFi landscape.

Price History and Market Performance

Overview of DODO’s Price History

DODO Coin, the native token of the DODO decentralized exchange, has experienced a dynamic price journey since its inception. Launched in August 2020, DODO’s price history reflects a blend of market sentiment, technological developments, and broader trends in the cryptocurrency space. The token is primarily utilized for governance and as a means to facilitate transactions within the DODO ecosystem.

Key Historical Price Milestones

-

Initial Launch and Early Performance (2020)

Upon its launch in August 2020, DODO started trading at a relatively low price, reflecting the nascent stage of the project. The coin’s price gradually increased as it gained traction among users and liquidity providers. -

All-Time High (February 2021)

DODO reached its all-time high of approximately $8.51 on February 20, 2021. This peak was largely attributed to the booming decentralized finance (DeFi) sector at the time, which saw increased interest and investment in DeFi protocols. The unique Proactive Market Maker (PMM) algorithm of DODO attracted significant attention, enabling better liquidity and lower price slippage compared to other Automated Market Makers (AMMs). -

Subsequent Decline (2021-2022)

Following its all-time high, DODO’s price faced a significant decline, common in the volatile cryptocurrency market. By mid-2022, the price had dropped to around $1.00, reflecting broader market corrections and investor sentiment shifting towards more established cryptocurrencies. -

Recent Price Movements (2023)

In 2023, DODO’s price fluctuated within a range, with a notable low of approximately $0.03191 recorded on June 22, 2023, and a high of around $0.04634. As of late October 2023, the price stabilized around $0.04595, indicating a gradual recovery phase. The market cap during this period has hovered around $33 million, with a circulating supply of approximately 725 million DODO tokens.

Factors Influencing the Price

Historically, the price of DODO has been influenced by a variety of factors:

-

Market Sentiment and Trends

DODO’s price movements closely mirror the overall sentiment in the cryptocurrency market. Bullish trends in the broader market tend to bolster prices across altcoins, including DODO. Conversely, during bearish phases, DODO has experienced sharp declines, reflecting the high volatility inherent in the crypto space. -

Technological Developments

Innovations and upgrades to the DODO platform have also played a crucial role in shaping the price of its token. For instance, enhancements to the PMM algorithm and the introduction of new features, such as multi-chain trading capabilities, have attracted more liquidity and traders to the platform. Positive news about technological advancements can lead to increased demand for DODO, thereby influencing its price positively. -

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies significantly impacts investor confidence and market dynamics. Any news regarding potential regulations or legal challenges faced by DeFi protocols can lead to price fluctuations. DODO, like other DeFi tokens, is sensitive to such developments, which can affect its market performance. -

Liquidity and Trading Volume

The trading volume and liquidity available on exchanges where DODO is listed directly correlate with its price stability. Higher liquidity often results in lower price slippage, making it more attractive for traders. Conversely, periods of low trading volume can lead to increased volatility and price swings. -

Competition and Market Position

DODO operates in a competitive landscape dominated by other DeFi protocols and decentralized exchanges. The emergence of new competitors offering similar or improved features can impact DODO’s market share and, subsequently, its price. The protocol’s ability to differentiate itself through unique offerings and maintain user engagement is crucial for its price performance. -

Community Engagement and Governance

As a decentralized platform, community engagement plays a vital role in the success of DODO. The level of participation in governance decisions can influence the token’s price, as a strong and engaged community typically reflects a healthier ecosystem. Initiatives that foster community involvement can drive demand for DODO tokens.

Conclusion

In summary, DODO Coin has traversed a volatile price path since its launch, characterized by significant highs and lows. The price history of DODO is shaped by a confluence of market sentiment, technological advancements, regulatory dynamics, and competitive pressures. For both beginners and intermediate investors, understanding these historical trends and factors is essential for making informed decisions regarding DODO and its potential role in their cryptocurrency portfolios.

Where to Buy dodo coin: Top Exchanges Reviewed

5. DODO – Your Gateway to Decentralized Trading!

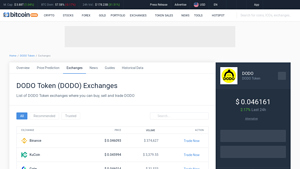

DODO (DODO) stands out in the cryptocurrency market due to its availability on over 30 exchanges, including major platforms like Binance, Gate, and Bitget. This extensive accessibility allows investors to buy, sell, and trade DODO with ease. Additionally, DODO’s innovative liquidity provision model enhances trading efficiency and minimizes slippage, making it an attractive option for both novice and experienced traders looking to engage with this digital asset.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

3. DODO Token – Seamless Trading Experience Awaits!

DODO Token exchanges, including prominent platforms like HTX (Huobi), Binance, KuCoin, and Gate, offer users a robust environment for buying, selling, and trading DODO. What sets these exchanges apart is their high liquidity, diverse trading pairs, and user-friendly interfaces, making it easy for both novice and experienced traders to access DODO Token. Additionally, their commitment to security and innovative trading features enhances the overall trading experience.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5 Reasons to Buy DODO (DODO) on Coin Insider!

In the Coin Insider review article on where to buy DODO (DODO), the exchange stands out for its comprehensive ranking system that emphasizes liquidity and the variety of DODO trading markets available. By providing a curated list of exchanges tailored for DODO transactions, the article assists both novice and experienced investors in identifying the most reliable platforms, ensuring optimal trading conditions and enhanced user experience.

- Website: crypto.coininsider.com

3. DODO – Top Choice for Minimal Exchange Fees!

Changelly stands out as a premier platform for exchanging DODO (DODO) due to its competitive rates and minimal fees, making it an attractive choice for both novice and experienced traders. With a user-friendly interface accessible via web or mobile app, Changelly supports over 700 cryptocurrencies and offers fast transactions. Additionally, the platform provides 24/7 live support, ensuring users receive assistance whenever needed, enhancing the overall trading experience.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

3. DODO Exchange – Your Gateway to Efficient Token Swaps!

DODO Exchange stands out for its user-friendly interface and competitive rates, allowing traders to seamlessly exchange DODOERC20 and other cryptocurrencies with speed and security. With a commendable rating of 4.7 from 153 users on Swapzone, it emphasizes efficiency and reliability, making it an attractive choice for both novice and experienced traders looking to optimize their cryptocurrency transactions.

- Website: swapzone.io

- Platform Age: Approx. 6 years (domain registered in 2019)

How to Buy dodo coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing DODO coin is to select a cryptocurrency exchange where you can buy it. DODO is available on both centralized exchanges (CEX) and decentralized exchanges (DEX). Some popular options include:

- Centralized Exchanges (CEX):

- MXC.com

- L Bank

-

BiKi

-

Decentralized Exchanges (DEX):

- Uniswap V2

- Dodo DEX

- Mooniswap

When choosing an exchange, consider factors such as fees, ease of use, security features, and the trading pairs available. If you’re new to cryptocurrency, a centralized exchange may offer a more user-friendly experience.

2. Create and Verify Your Account

Once you have selected an exchange, the next step is to create an account. Here’s how to do it:

- Visit the Exchange Website: Navigate to the official website of the exchange you chose.

- Sign Up: Look for a “Sign Up” or “Register” button, and click it. You will typically need to provide your email address and create a password.

- Verify Your Email: After registration, you will receive a verification email. Click the link in the email to confirm your account.

- Complete KYC (Know Your Customer): Most exchanges require identity verification to comply with regulations. You may need to provide personal information, including your name, address, and a government-issued ID. Follow the instructions provided by the exchange to complete this process.

3. Deposit Funds

With your account set up and verified, you can now deposit funds to buy DODO coin. Here’s how to do it:

- Log In to Your Account: Use your credentials to log in to the exchange.

- Navigate to the Deposit Section: Look for a section labeled “Deposit” or “Funds.”

- Choose Your Deposit Method: Most exchanges allow you to deposit funds via bank transfer, credit card, or other cryptocurrencies. Select your preferred method.

- Follow the Instructions: If you are depositing fiat currency (like USD), you may need to link your bank account or credit card. For cryptocurrency deposits, you will receive a wallet address to send your funds to.

- Confirm the Deposit: After initiating the deposit, wait for it to be confirmed. This may take a few minutes to several days, depending on the method used.

4. Place an Order to Buy DODO Coin

After your funds are successfully deposited, you are ready to purchase DODO coin. Here’s how to place an order:

- Find the DODO Trading Pair: Search for DODO on the exchange and select the trading pair that matches the currency you deposited (e.g., DODO/USD or DODO/ETH).

- Choose Order Type: Decide whether you want to place a market order (buy at current market price) or a limit order (set a specific price at which you want to buy).

– Market Order: This order will execute immediately at the current market price.

– Limit Order: This order will only execute when the price reaches your specified limit. - Enter the Amount: Specify how much DODO coin you want to buy.

- Review and Confirm: Double-check your order details, including the amount and total cost. If everything looks good, confirm the order.

5. Secure Your Coins in a Wallet

Once your purchase is complete, it’s essential to secure your DODO coins. While you can leave them on the exchange, a wallet provides better security. Here’s how to store your coins safely:

- Choose a Wallet Type: There are various types of wallets to choose from:

– Hardware Wallets: Physical devices that store your coins offline (e.g., Ledger, Trezor). Highly secure against online threats.

– Software Wallets: Applications or software that can be installed on your computer or mobile device (e.g., Trust Wallet, MetaMask). More convenient for frequent transactions. - Create a Wallet: If you choose a software wallet, download the application and follow the setup instructions. Make sure to back up your recovery phrase securely.

- Transfer DODO to Your Wallet: To move your DODO coins from the exchange to your wallet:

– Go to the “Withdraw” section of the exchange.

– Enter your wallet address and the amount of DODO you want to transfer.

– Confirm the transaction and wait for it to be processed.

By following these steps, you’ll have successfully purchased and secured your DODO coin, positioning yourself to explore the world of decentralized finance and trading.

Investment Analysis: Potential and Risks

Overview of DODO Coin

DODO is a decentralized finance (DeFi) protocol designed to provide liquidity through its unique Proactive Market Maker (PMM) algorithm. This algorithm aims to enhance liquidity and price stability compared to traditional automated market makers (AMMs). As a relatively newer player in the DeFi space, DODO has attracted interest due to its innovative features and potential for growth. However, like any cryptocurrency, investing in DODO Coin comes with both opportunities and risks. Below, we will explore the potential strengths and risks associated with this digital asset.

Potential Strengths (The Bull Case)

Innovative Liquidity Model

One of the standout features of DODO is its PMM algorithm, which allows for better liquidity provision and reduced price slippage. This innovative model collects liquidity near market prices, making it easier for traders to execute transactions with minimal impact on price. This can be particularly appealing for larger trades that may otherwise incur significant slippage on traditional AMM platforms like Uniswap.

Low Transaction Fees

DODO aims to offer low transaction fees compared to its competitors. Lower fees can attract a larger user base and increase trading volume, which is critical for the platform’s success and the long-term value of DODO tokens. This cost advantage can also encourage more liquidity providers to contribute to DODO’s liquidity pools.

Strong Backing and Development Team

DODO has gained credibility through significant funding rounds from reputable investors, including Binance Labs, Pantera Capital, and others. This backing not only provides financial resources for development but also enhances the project’s visibility and reputation within the cryptocurrency community. The founders, Diane Dai and Radar Bear, have a track record in the blockchain space, which may instill confidence in potential investors.

Diverse Use Cases

The DODO platform supports a variety of use cases, including Initial DODO Offerings (IDOs) for new crypto projects. This feature allows new projects to launch their tokens without needing a separate quote token, streamlining the process and potentially attracting more projects to the platform. Furthermore, DODO’s support for multiple chains enhances its utility and accessibility.

Market Demand for DeFi Solutions

As the DeFi space continues to grow, the demand for innovative solutions like DODO is likely to increase. The decentralized finance ecosystem is expanding rapidly, with more users seeking alternatives to traditional financial systems. DODO’s unique approach to liquidity provision and trading could position it well to capitalize on this trend.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Cryptocurrencies are notorious for their price volatility, and DODO is no exception. The price of DODO has experienced significant fluctuations, including a dramatic decline from its all-time high of approximately $8.51 in February 2021 to its current price around $0.045. Such volatility can lead to substantial financial losses for investors and may deter potential users from engaging with the platform.

Regulatory Uncertainty

The regulatory environment surrounding cryptocurrencies and DeFi platforms is still evolving. Governments worldwide are increasingly scrutinizing the crypto space, which could lead to stricter regulations. Regulatory changes can impact DODO’s operations, token utility, and overall market sentiment. Investors should remain aware of the potential for regulatory hurdles that could affect DODO’s growth and viability.

Intense Competition

The DeFi landscape is highly competitive, with numerous platforms vying for market share. DODO faces competition from established players like Uniswap, SushiSwap, and others that have a more extensive user base and liquidity. New entrants are continually emerging, introducing innovative features and competing for liquidity providers and traders. DODO will need to continually innovate and improve its offerings to maintain its competitive edge.

Technological Risks

As a decentralized protocol, DODO relies heavily on smart contracts and blockchain technology. While these technologies offer many advantages, they also come with inherent risks, including coding bugs, security vulnerabilities, and potential exploits. Even though DODO’s smart contracts have undergone audits, the risk of hacks and other security incidents remains a concern in the DeFi space. Any significant breaches could undermine trust in the platform and lead to financial losses for users.

Dependence on Ethereum Network

DODO operates on the Ethereum network, which has its own set of challenges, including high transaction fees during peak usage times and network congestion. While DODO’s PMM algorithm aims to mitigate some of these issues, any significant problems on the Ethereum network could directly affect DODO’s performance and user experience.

Conclusion

Investing in DODO Coin presents both potential rewards and risks. The innovative liquidity model, low transaction fees, and strong backing from reputable investors contribute to its appeal as a DeFi solution. However, investors must also consider the volatility, regulatory uncertainties, competition, and technological risks that accompany any cryptocurrency investment.

As always, thorough research and a clear understanding of the risks involved are essential before making investment decisions. DODO Coin’s future will depend on its ability to navigate these challenges while continuing to innovate in the rapidly evolving DeFi landscape.

Frequently Asked Questions (FAQs)

1. What is Dodo Coin (DODO)?

Dodo Coin, often referred to simply as DODO, is the native token of the DODO decentralized finance (DeFi) protocol. It operates on the Ethereum blockchain and utilizes a unique Proactive Market Maker (PMM) algorithm to provide liquidity and facilitate trading. Unlike traditional automated market makers (AMMs), DODO aims to offer better price stability and lower slippage for traders. The protocol also supports Initial DODO Offerings (IDOs), allowing new crypto projects to list their tokens without requiring quote tokens.

2. Who created Dodo Coin?

Dodo Coin was founded by Diane Dai and Radar Bear, along with an anonymous development team. The project was officially launched in August 2020. It initially attracted significant investment through a $600,000 seed round led by Framework Ventures, followed by a $5 million private sale that included contributions from notable firms like Pantera Capital and Binance Labs.

3. What makes Dodo Coin different from Bitcoin?

Dodo Coin differs from Bitcoin in several ways:

- Purpose: Bitcoin is primarily a digital currency designed as a store of value and medium of exchange. DODO, on the other hand, is a DeFi token focused on providing liquidity and facilitating trades on decentralized exchanges.

- Mechanism: Bitcoin uses a proof-of-work consensus mechanism, whereas DODO operates on a PMM algorithm that aims to provide liquidity and minimize price slippage.

- Supply: Bitcoin has a capped supply of 21 million coins, while DODO has a total supply of 1 billion tokens, with a significant portion allocated for community incentives and liquidity provision.

4. Is Dodo Coin a good investment?

As with any cryptocurrency investment, the potential for profit or loss with Dodo Coin depends on various factors, including market trends, the development of the DODO protocol, and broader economic conditions. While DODO has shown growth since its inception, it is essential to conduct thorough research, consider your risk tolerance, and possibly consult a financial advisor before investing. Past performance does not guarantee future results.

5. Where can I buy Dodo Coin?

Dodo Coin can be purchased on various centralized and decentralized exchanges. Some popular platforms include:

- Centralized Exchanges (CEX): MXC.com, L Bank, and BiKi.

- Decentralized Exchanges (DEX): Uniswap V2, Mooniswap, and the DODO exchange itself.

Always ensure you are using reputable exchanges and be aware of the potential risks associated with trading on these platforms.

6. How does the DODO protocol ensure liquidity?

DODO uses its PMM algorithm to ensure liquidity by mimicking human trading behaviors and utilizing oracles to provide accurate market prices. This approach allows DODO to maintain sufficient liquidity close to market prices, reducing price slippage and impermanent loss for liquidity providers. The protocol also incentivizes arbitrage trading, which helps stabilize liquidity.

7. What are the risks associated with investing in Dodo Coin?

Investing in Dodo Coin, like any cryptocurrency, carries inherent risks. These include:

- Market Volatility: Cryptocurrency prices can fluctuate significantly over short periods.

- Smart Contract Vulnerabilities: As a DeFi protocol, DODO relies on smart contracts, which may be susceptible to coding bugs or exploits.

- Regulatory Risks: Changes in regulations regarding cryptocurrencies can impact the market and specific projects like DODO.

Investors should be aware of these risks and consider diversifying their portfolios to mitigate potential losses.

8. How is Dodo Coin secured?

Dodo Coin is secured through the decentralized nature of its protocol, which eliminates a single point of failure. The smart contracts governing DODO were audited by PeckShield, a recognized blockchain security firm, to identify and address vulnerabilities. However, users should remain cautious, as DeFi protocols can still be exposed to risks from coding errors and potential security breaches. Always ensure to use secure wallets and practices when holding cryptocurrencies.

Final Verdict on dodo coin

Overview of DODO Coin

DODO Coin is the native token of the DODO decentralized exchange (DEX), which operates on a unique Proactive Market Maker (PMM) algorithm. Launched in August 2020, DODO aims to enhance liquidity and reduce price slippage compared to traditional Automated Market Makers (AMMs) like Uniswap. This technology allows DODO to provide better pricing for traders by leveraging on-chain liquidity and oracle data to stabilize market prices. With a total supply capped at 1 billion tokens, DODO has attracted significant interest from both liquidity providers and new cryptocurrency projects through its Initial DODO Offering (IDO) feature.

Market Position and Performance

As of October 2023, DODO’s market capitalization stands at approximately $33 million, with a current trading price of around $0.04595. Although the token experienced a remarkable peak of $8.51 in February 2021, it has faced significant volatility, reflecting the broader trends in the cryptocurrency market. The total value locked (TVL) in the DODO protocol is around $21 million, indicating a relatively healthy level of liquidity within its ecosystem.

Risk and Potential

Investing in DODO Coin comes with inherent risks typical of the cryptocurrency market. The DEX space is competitive, and while DODO’s innovative PMM model offers distinct advantages, it is still subject to market fluctuations, regulatory changes, and technological challenges. Consequently, DODO Coin is considered a high-risk, high-reward investment.

Conclusion: Do Your Own Research

Before considering an investment in DODO Coin, it is crucial to conduct thorough research. Understand the technology behind the PMM model, evaluate market trends, and assess your risk tolerance. The cryptocurrency landscape is rapidly evolving, and informed decision-making is essential for navigating this dynamic environment. Always remember to “Do Your Own Research” (DYOR) before making any investment decisions.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.