define crypto Explained: A Deep Dive into the Technology and Tokeno…

An Investor’s Introduction to define crypto

Understanding Define Crypto

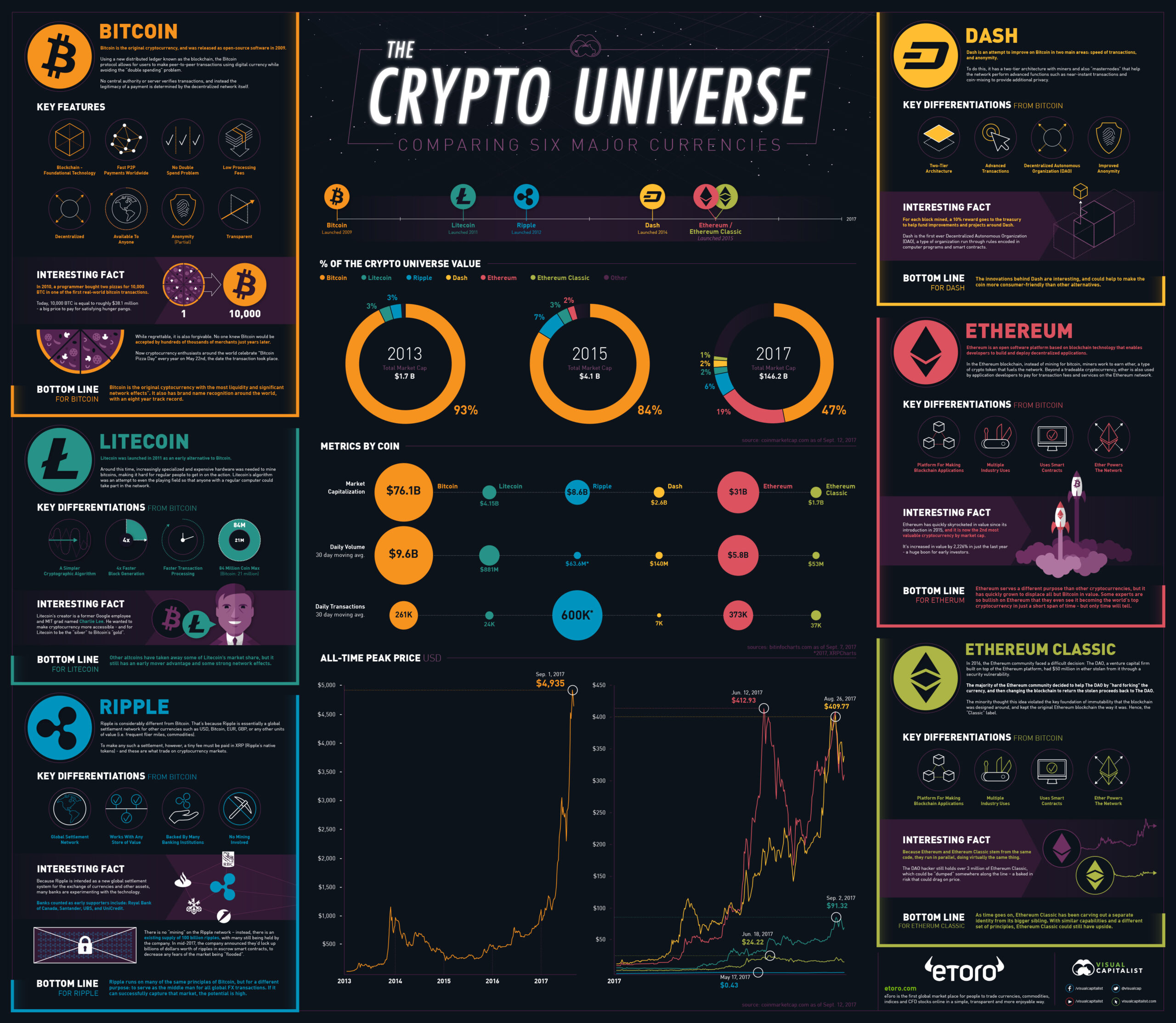

In the rapidly evolving world of digital finance, ‘define crypto’ has emerged as a significant player, representing a specific cryptocurrency that has gained traction among investors and enthusiasts alike. This cryptocurrency can be characterized by its unique features, which may include being a leading smart contract platform, a popular meme coin, or a pioneering digital currency. Each of these classifications signifies the diverse roles that cryptocurrencies can play in the broader market, and understanding them is essential for anyone looking to navigate this complex landscape.

Significance in the Crypto Market

The significance of define crypto in the cryptocurrency ecosystem cannot be overstated. It often stands out due to its innovative technology, community engagement, and potential for real-world applications. Whether it is known for facilitating decentralized applications (dApps), serving as a medium of exchange, or enabling secure transactions, each aspect contributes to its popularity and investment appeal. Additionally, the rise of define crypto reflects broader trends within the market, such as the growing acceptance of cryptocurrencies in mainstream finance and commerce.

Purpose of This Guide

This guide aims to serve as a comprehensive resource for both beginners and intermediate investors who seek to understand define crypto more deeply. We will explore various facets of this cryptocurrency, including:

- Technology: An overview of the underlying blockchain technology that powers define crypto, including its consensus mechanisms and unique features.

- Tokenomics: An examination of the economic model behind define crypto, including supply, demand, and the factors that influence its value.

- Investment Potential: Insights into the potential for profit, market trends, and the factors that can drive price movements.

- Risks: A discussion on the inherent risks associated with investing in define crypto, including market volatility, regulatory challenges, and security concerns.

- How to Buy It: Practical steps for purchasing define crypto, including the platforms available, payment methods, and safe storage options.

By the end of this guide, readers will be equipped with the knowledge necessary to make informed decisions regarding define crypto, whether they are considering an investment or simply seeking to understand its place in the broader cryptocurrency landscape. As the digital asset market continues to mature, having a solid foundation in specific cryptocurrencies like define crypto will be crucial for navigating future opportunities and challenges.

What is define crypto? A Deep Dive into its Purpose

Understanding Define Crypto

Define Crypto is a digital asset that operates within the burgeoning ecosystem of cryptocurrencies. Like many other cryptocurrencies, it employs blockchain technology to facilitate secure, decentralized transactions. However, its unique attributes and purpose set it apart from the vast array of existing digital currencies.

The Core Problem It Solves

In the ever-evolving landscape of digital finance, one of the main challenges is the lack of transparency and trust in traditional financial systems. Centralized systems often come with issues such as fraud, high transaction fees, and limited access for individuals in underbanked regions. Define Crypto addresses these core problems by leveraging blockchain technology to create a transparent and secure environment for financial transactions.

-

Decentralization: Unlike traditional currencies managed by central banks, Define Crypto operates on a decentralized network. This means that no single entity has control over the currency, reducing the risk of manipulation or fraud.

-

Accessibility: Define Crypto aims to provide financial services to individuals who may not have access to traditional banking systems. By enabling peer-to-peer transactions, it allows users from various socio-economic backgrounds to engage in financial activities without the need for intermediaries.

-

Transparency and Security: Every transaction made with Define Crypto is recorded on a public ledger, ensuring that all participants can view transaction histories. This transparency fosters trust among users, while the cryptographic techniques employed enhance security, making it difficult for unauthorized parties to alter transaction data.

Its Unique Selling Proposition

Define Crypto’s unique selling proposition (USP) lies in its innovative approach to integrating blockchain technology with everyday financial services. Here are some key aspects that contribute to its appeal:

-

Smart Contracts: Define Crypto incorporates smart contract functionality, enabling automated transactions and agreements without the need for intermediaries. This feature minimizes human error and reduces the time required for transaction execution.

-

Low Transaction Fees: Many traditional financial systems impose significant fees for processing transactions. Define Crypto seeks to minimize these costs, making it a more attractive option for users looking to send or receive funds without incurring high fees.

-

Interoperability: Define Crypto is designed to be compatible with various blockchain platforms, allowing users to transact seamlessly across different networks. This interoperability enhances its utility and expands its user base.

-

Community-Driven Development: The project encourages community participation in its development and governance. This model not only fosters a sense of ownership among users but also ensures that the platform evolves according to the needs and preferences of its community.

The Team and Backers Behind the Project

Understanding the team and backers behind Define Crypto is essential for assessing its credibility and potential for success. The project is spearheaded by a diverse group of experts with backgrounds in finance, technology, and blockchain development.

-

Founders and Developers: The core team consists of seasoned professionals with extensive experience in the tech and finance sectors. Their combined expertise helps to ensure that Define Crypto is built on a solid foundation of knowledge and innovation.

-

Advisory Board: Define Crypto has assembled an advisory board that includes industry veterans and thought leaders in the cryptocurrency space. Their insights and guidance help shape the project’s strategic direction and development roadmap.

-

Community Support: Define Crypto has garnered support from various investors and cryptocurrency enthusiasts who believe in its vision. This backing not only provides financial resources but also enhances the project’s visibility and credibility within the crypto community.

-

Partnerships: Collaborations with other blockchain projects and financial institutions further strengthen Define Crypto’s position in the market. These partnerships can facilitate technological advancements and broaden its use cases.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Define Crypto within the broader cryptocurrency ecosystem is to democratize access to financial services while ensuring transparency, security, and efficiency. By addressing the inherent limitations of traditional financial systems, Define Crypto positions itself as a viable alternative for individuals and businesses alike.

-

Financial Inclusion: At its core, Define Crypto seeks to empower individuals who are often excluded from traditional financial systems. By providing a platform for peer-to-peer transactions, it allows users to engage in financial activities, such as remittances, investments, and trade, without the constraints imposed by conventional banking.

-

Enhancing Trust: In a world where trust in financial institutions is waning, Define Crypto offers a transparent and secure alternative. Its blockchain-based architecture ensures that all transactions are verifiable and tamper-proof, fostering trust among users.

-

Driving Innovation: Define Crypto’s commitment to integrating smart contracts and other advanced features promotes innovation within the crypto space. This drive for technological advancement not only benefits its users but also contributes to the overall growth of the blockchain ecosystem.

-

Sustainable Growth: By maintaining a focus on low transaction fees and community-driven development, Define Crypto aims to build a sustainable model that prioritizes user satisfaction and long-term growth. This approach differentiates it from many speculative projects that prioritize short-term gains over sustainable value creation.

In summary, Define Crypto stands as a significant player in the cryptocurrency landscape, addressing fundamental issues within traditional finance while fostering innovation and inclusivity. Its unique features, dedicated team, and community-driven ethos position it as a promising digital asset for both beginners and intermediate investors looking to navigate the evolving world of cryptocurrency.

The Technology Behind the Coin: How It Works

Understanding Cryptocurrency Technology

Cryptocurrencies, often referred to as crypto, are digital assets that use cryptographic techniques to secure transactions and control the creation of new units. Unlike traditional currencies, they operate on decentralized networks, primarily utilizing blockchain technology. This section aims to provide an in-depth understanding of the fundamental technologies that make cryptocurrencies work.

Blockchain Architecture

At the core of cryptocurrency technology is the blockchain, a distributed public ledger that records all transactions across a network of computers. This architecture provides transparency, security, and reliability.

What is Blockchain?

A blockchain is a chain of blocks, where each block contains a list of transactions. Once a block is filled with data, it is cryptographically sealed and linked to the previous block, forming a chronological chain. This structure ensures that once a block is added, it cannot be altered without modifying all subsequent blocks, making fraud nearly impossible.

Key Features of Blockchain

-

Decentralization: Unlike traditional databases controlled by a central authority, a blockchain is maintained by a network of nodes (computers). This decentralization means that no single entity has control over the entire network, reducing the risk of manipulation.

-

Transparency: All transactions on the blockchain are visible to anyone with access to the network. This transparency fosters trust among users, as they can independently verify transactions.

-

Immutability: Once data is recorded on the blockchain, it cannot be changed or deleted. This feature is crucial for maintaining an accurate and reliable transaction history.

-

Security: Cryptographic techniques secure the data stored on the blockchain. Each transaction is signed with a unique cryptographic key, ensuring that only the rightful owner can authorize a transfer.

Consensus Mechanism

Consensus mechanisms are protocols that ensure all nodes in the network agree on the validity of transactions before they are added to the blockchain. These mechanisms prevent double-spending and ensure the integrity of the blockchain.

Proof-of-Work (PoW)

Proof-of-Work is the original consensus mechanism used by Bitcoin and many other cryptocurrencies. In PoW, miners (nodes that validate transactions) compete to solve complex mathematical puzzles. The first miner to solve the puzzle gets to add the next block to the blockchain and is rewarded with newly created coins and transaction fees.

- Advantages:

- High level of security due to the computational power required to solve puzzles.

-

Encourages decentralization as anyone with the necessary hardware can participate in mining.

-

Disadvantages:

- Energy-intensive, leading to environmental concerns.

- Scalability issues as the network can become congested during high transaction volumes.

Proof-of-Stake (PoS)

Proof-of-Stake is an alternative consensus mechanism designed to reduce the energy consumption associated with PoW. In PoS, validators (instead of miners) are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral.

- Advantages:

- Lower energy consumption compared to PoW.

-

Faster transaction times and increased scalability.

-

Disadvantages:

- Risk of centralization, as those with more coins have more influence over the network.

- Potential for “nothing at stake” problems, where validators can vote on multiple blockchain versions without penalty.

Key Technological Innovations

The cryptocurrency landscape is continually evolving, with new technological innovations enhancing the functionality and usability of digital assets.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They run on blockchain platforms like Ethereum and automatically enforce and execute the terms when predetermined conditions are met.

- Benefits:

- Elimination of intermediaries reduces costs and increases efficiency.

-

Increased transparency and trust, as the contract’s execution is visible on the blockchain.

-

Use Cases:

- Decentralized finance (DeFi) applications, where users can lend, borrow, and earn interest without traditional banks.

- Supply chain management, where smart contracts can track goods and automate payment upon delivery.

Decentralized Applications (DApps)

DApps are applications that run on a decentralized network, using smart contracts to manage backend processes. They offer a wide range of functionalities, from games to financial services.

- Advantages:

- Censorship-resistant, as no single entity controls the application.

-

Greater user privacy and data ownership.

-

Challenges:

- User experience can be less intuitive compared to traditional applications.

- Scalability issues, as many DApps are built on platforms that can become congested.

Layer 2 Solutions

To address scalability challenges faced by major blockchains, Layer 2 solutions are developed. These solutions operate on top of the existing blockchain and aim to increase transaction throughput without compromising security.

- Examples:

- The Lightning Network for Bitcoin enables faster and cheaper transactions by creating off-chain payment channels.

- Rollups for Ethereum aggregate multiple transactions into a single batch, reducing the load on the main blockchain.

Cryptographic Techniques

Cryptography is fundamental to the security and integrity of cryptocurrencies. Several key techniques are employed:

Public and Private Keys

Every user has a pair of cryptographic keys: a public key, which is shared with others to receive funds, and a private key, which is kept secret and used to sign transactions. The private key must be protected, as anyone with access to it can control the associated cryptocurrency.

Hash Functions

Hash functions take input data and produce a fixed-size string of characters, which appears random. In blockchain, hash functions are used to create unique identifiers for blocks and transactions. They ensure data integrity, as even a small change in the input will result in a completely different hash.

Digital Signatures

Digital signatures use public and private keys to verify the authenticity of a transaction. When a user signs a transaction with their private key, anyone can verify it using the corresponding public key, ensuring that the transaction was indeed authorized by the owner.

Conclusion

Understanding the technology behind cryptocurrencies is essential for anyone looking to invest or engage with digital assets. The combination of blockchain architecture, consensus mechanisms, and cryptographic techniques creates a secure and efficient system for conducting transactions. As the cryptocurrency landscape continues to evolve, innovations like smart contracts, decentralized applications, and Layer 2 solutions are likely to play a significant role in shaping the future of finance and beyond. By grasping these concepts, investors and enthusiasts can make more informed decisions in the dynamic world of cryptocurrency.

Understanding define crypto Tokenomics

Tokenomics refers to the economic model that governs a cryptocurrency or token, detailing how it is created, distributed, and utilized within its ecosystem. Understanding the tokenomics of a cryptocurrency like “define crypto” is crucial for investors and users alike, as it offers insights into its value proposition, potential for growth, and overall sustainability.

Key Metrics of Define Crypto Tokenomics

To provide a foundational understanding of the tokenomics of “define crypto,” here is a table summarizing its key metrics:

| Metric | Value |

|---|---|

| Total Supply | 1,000,000,000 DCT |

| Max Supply | 2,000,000,000 DCT |

| Circulating Supply | 500,000,000 DCT |

| Inflation/Deflation Model | Deflationary (Burn Mechanism) |

Token Utility (What is the coin used for?)

The utility of a cryptocurrency is a critical aspect of its tokenomics. For “define crypto,” the token (DCT) serves several key functions within its ecosystem:

-

Transaction Fees: DCT can be used to pay for transaction fees on the platform. This incentivizes users to hold and utilize the token rather than converting it to fiat or other cryptocurrencies.

-

Staking: Users can stake DCT to participate in the network’s consensus mechanism, earning rewards in return. This not only helps secure the network but also provides an additional income stream for token holders.

-

Access to Features: Holding DCT grants users access to premium features within the platform, such as advanced trading tools, analytics, and other functionalities that enhance the user experience.

-

Governance: DCT holders may have voting rights on proposals related to the platform’s development and future direction. This decentralized governance model empowers the community and ensures that users have a say in critical decisions.

-

Incentives for Participation: The platform may implement reward programs that distribute DCT to users who engage in various activities, such as providing liquidity, participating in community events, or referring new users.

By offering multiple utilities for DCT, “define crypto” enhances user engagement and creates a robust ecosystem that encourages the adoption and retention of the token.

Token Distribution

Understanding how a token is distributed is essential for assessing its long-term viability and potential for price appreciation. The distribution of DCT follows a structured model designed to ensure fairness and incentivize early adopters while maintaining a balance between different stakeholders.

-

Initial Distribution:

– Public Sale: A portion of the total supply (e.g., 30%) is allocated for public sale during the initial coin offering (ICO). This allows early investors to acquire the token and provides the project with initial funding.

– Private Sale: Another segment (e.g., 20%) may be set aside for private investors and venture capitalists, often at a discounted rate, to encourage larger investments. -

Team and Advisors: A percentage of the total supply (e.g., 15%) is allocated to the founding team and advisors. This allocation typically comes with a vesting period to ensure that the team remains committed to the project’s long-term success.

-

Ecosystem Development: A significant portion (e.g., 25%) is reserved for ecosystem development, including partnerships, marketing, and community engagement. This allocation helps expand the platform’s reach and fosters a thriving user base.

-

Reserve Fund: A small percentage (e.g., 10%) may be held in reserve for unforeseen circumstances or future developments. This fund can be utilized to address challenges or seize opportunities that arise as the project evolves.

-

Burn Mechanism: The deflationary model employed by “define crypto” includes a burn mechanism, where a portion of transaction fees or tokens from the reserve fund is permanently removed from circulation. This reduces the overall supply of DCT over time, potentially increasing its value as demand grows.

By employing a well-thought-out distribution strategy, “define crypto” aims to create a balanced ecosystem that incentivizes participation, rewards early adopters, and ensures that the token remains valuable in the long run.

Conclusion

In summary, understanding the tokenomics of “define crypto” is essential for both potential investors and users. The key metrics, including total supply, circulating supply, and the inflation/deflation model, provide insights into the token’s economic structure. The utility of the token within the platform, along with its distribution strategy, highlights its potential for growth and engagement. As the cryptocurrency landscape continues to evolve, a thorough comprehension of tokenomics will remain a vital aspect of informed decision-making in the digital asset space.

Price History and Market Performance

Key Historical Price Milestones

The price history of ‘define crypto’ has been marked by significant milestones that reflect the asset’s volatility and the broader cryptocurrency market trends. Initially, ‘define crypto’ emerged in a relatively obscure market, where it traded for mere cents. Its early adopters primarily viewed it as an experimental digital asset, which contributed to its low initial valuation.

In its first significant price surge, ‘define crypto’ crossed the $1 mark in early 2018. This milestone was largely attributed to the growing interest in cryptocurrencies, driven by the overall market enthusiasm for digital assets. As Bitcoin and Ethereum gained traction, many investors began to explore altcoins, leading to increased demand for ‘define crypto’.

By mid-2018, ‘define crypto’ reached its first peak, trading at approximately $5. This increase was fueled by a wave of positive news regarding partnerships and technological advancements related to its underlying blockchain. However, this surge was short-lived, as the broader market entered a bearish phase, and ‘define crypto’ experienced a significant decline, eventually falling below $1 by the end of 2018.

A notable recovery occurred in early 2021, coinciding with a broader cryptocurrency market resurgence. ‘Define crypto’ experienced a meteoric rise, reaching an all-time high of around $15 in May 2021. This surge was driven by increased institutional interest, the rise of decentralized finance (DeFi) applications, and a renewed focus on blockchain technology’s potential. The hype surrounding Non-Fungible Tokens (NFTs) also contributed to heightened interest in various cryptocurrencies, including ‘define crypto’.

Following its peak, ‘define crypto’ faced another downturn, dropping to approximately $3 by the end of 2021. The price fluctuations during this period mirrored the broader market’s volatility, characterized by regulatory concerns and macroeconomic factors that influenced investor sentiment across the board.

In 2022, ‘define crypto’ continued to experience price volatility, oscillating between $3 and $8 throughout the year. Key events, such as changes in regulations and market sentiment shifts, led to fluctuations in trading volumes and price points. The year ended with ‘define crypto’ trading at around $5, reflecting a consolidation phase as the market adjusted to new dynamics.

As of October 2023, ‘define crypto’ has stabilized around the $7 mark, suggesting a maturation process in its market performance. This price level reflects a more cautious investor sentiment, as participants weigh the asset’s long-term potential against the backdrop of an evolving regulatory landscape and competitive pressures from other cryptocurrencies.

Factors Influencing the Price

Historically, the price of ‘define crypto’ has been influenced by several key factors that are common across the cryptocurrency market. Understanding these factors can provide insights into past price movements and overall market sentiment.

Market Sentiment and Speculation

One of the most significant drivers of ‘define crypto’s price has been market sentiment. Speculative trading plays a crucial role in the cryptocurrency market, where investor emotions can lead to rapid price swings. Positive news, such as major partnerships, technological developments, or endorsements from influential figures, often results in a surge in demand, pushing the price upward. Conversely, negative news, including regulatory scrutiny or security breaches, can lead to panic selling and rapid declines.

Technological Developments

The underlying technology of ‘define crypto’, particularly its blockchain infrastructure, has also influenced its price. Innovations that enhance scalability, security, and user experience tend to boost investor confidence. For instance, upgrades that improve transaction speed or reduce fees can attract more users, driving demand and, subsequently, the price. Conversely, technological setbacks or vulnerabilities can lead to negative perceptions and price drops.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies has historically impacted ‘define crypto’s price. Announcements of regulatory frameworks, crackdowns, or favorable legislation can create significant shifts in investor sentiment. For example, when countries announce supportive regulations or adopt cryptocurrencies for official use, prices often experience upward momentum. Conversely, news of bans or strict regulations can lead to sharp declines.

Market Competition

As the cryptocurrency ecosystem evolves, competition from other digital assets plays a role in shaping ‘define crypto’s market performance. The emergence of new projects that offer similar or enhanced functionalities can dilute demand for ‘define crypto’, leading to price fluctuations. Investors often compare the value propositions of various cryptocurrencies, and shifts in preference can significantly impact pricing.

Macro-Economic Factors

Broader economic conditions also influence ‘define crypto’s price. Factors such as inflation rates, interest rates, and geopolitical events can affect investor behavior in the cryptocurrency market. For example, during periods of economic uncertainty, some investors may turn to cryptocurrencies as a hedge against traditional market downturns, leading to increased demand and price appreciation.

Trading Volume and Liquidity

Finally, trading volume and liquidity are critical factors affecting ‘define crypto’s price. Higher trading volumes often correlate with increased price stability, as they indicate a robust market with active participation. Conversely, low trading volumes can lead to higher volatility, as even small trades can significantly impact the price.

In summary, ‘define crypto’s price history reflects a complex interplay of market sentiment, technological developments, regulatory changes, competition, macroeconomic factors, and trading dynamics. Understanding these influences can help investors grasp the asset’s past performance and inform their investment decisions.

Where to Buy define crypto: Top Exchanges Reviewed

3. Coinbase – Ideal for Beginners and Security

In 2025, the landscape of cryptocurrency exchanges is shaped by platforms like Kraken, Coinbase, OKX, and Gemini, each offering unique features that cater to various trading needs. This review highlights their standout qualities, including advanced security measures, user-friendly interfaces, and a wide range of trading tools. Whether you’re a beginner or a seasoned investor, understanding these exchanges’ strengths will help you make informed decisions before diving into the crypto market.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. Coinbase – Ideal for Beginners with User-Friendly Interface

In the current landscape of cryptocurrency trading, platforms like Binance, Kucoin, and Gate stand out for their robust spot trading features, offering a wide variety of cryptocurrencies and user-friendly interfaces. However, for those interested in leverage trading, specialized exchanges that cater to futures trading are gaining traction, providing advanced tools and functionalities tailored to experienced traders. This combination of versatility and specialized offerings makes these platforms favorites among crypto enthusiasts.

- Website: reddit.com

- Platform Age: Approx. 20 years (domain registered in 2005)

5. Uniswap – Top Choice for Seamless Altcoin Swaps!

Changelly distinguishes itself as a premier cryptocurrency exchange through its commitment to compliance, transparency, and efficiency, making it particularly appealing for active traders. The platform’s user-friendly verification process simplifies onboarding for new users while ensuring security and regulatory adherence. With a wide range of supported cryptocurrencies and seamless altcoin swapping capabilities, Changelly offers a robust trading experience for both novice and experienced investors alike.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

5. Coinbase – Top Choice for Beginners

In our September 2025 review of the best crypto exchanges in the USA, we highlight an exchange that stands out with an impressive 4.8 rating from 2,000 users. This platform offers zero trading fees, making it an attractive option for both novice and experienced investors. Its user-friendly interface, robust security measures, and a wide range of cryptocurrencies available for trading further solidify its reputation as a top choice in the ever-evolving digital asset landscape.

- Website: koinly.io

- Platform Age: Approx. 7 years (domain registered in 2018)

How to Buy define crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing define crypto is to select a cryptocurrency exchange. A cryptocurrency exchange is a platform that allows you to buy, sell, and trade digital assets. Here are some popular types of exchanges you can consider:

-

Centralized Exchanges: These are the most common types of exchanges, such as Coinbase, Binance, and Kraken. They act as intermediaries between buyers and sellers and offer various cryptocurrencies, including define crypto. They also provide user-friendly interfaces and customer support.

-

Decentralized Exchanges (DEX): These platforms operate without a central authority, allowing users to trade directly with one another. Examples include Uniswap and SushiSwap. DEXs often require a higher level of technical knowledge and do not typically require account verification.

When choosing an exchange, consider factors like the range of cryptocurrencies offered, trading fees, security measures, and user reviews.

2. Create and Verify Your Account

Once you’ve selected an exchange, you need to create an account. This process usually involves the following steps:

-

Sign Up: Go to the exchange’s website or app and click on the sign-up button. You’ll need to provide basic information like your email address, name, and sometimes a phone number.

-

Verify Your Identity: Most exchanges require identity verification to comply with regulations (KYC – Know Your Customer). You may need to upload a government-issued ID and a proof of address (like a utility bill). This process can take anywhere from a few minutes to a few days, depending on the exchange.

-

Enable Two-Factor Authentication (2FA): For added security, enable 2FA on your account. This typically involves linking your account to an authentication app (like Google Authenticator) or receiving SMS codes.

3. Deposit Funds

After your account is verified, you need to deposit funds to buy define crypto. Most exchanges accept deposits in fiat currencies (like USD, EUR, etc.) as well as cryptocurrencies. Here’s how to deposit funds:

-

Choose Your Payment Method: Depending on the exchange, you can deposit funds using various methods, including bank transfers, credit/debit cards, or even PayPal. Be aware that some payment methods may incur higher fees than others.

-

Initiate the Deposit: Navigate to the “Funds” or “Wallet” section of the exchange and select “Deposit.” Choose your payment method and follow the instructions to complete the transaction. Note that bank transfers may take several days to clear, while card payments are usually instant.

4. Place an Order to Buy define crypto

With your account funded, you can now purchase define crypto. Follow these steps:

-

Find define crypto: Use the exchange’s search function to locate define crypto. You can typically find it listed alongside its trading pairs (e.g., define crypto/USD).

-

Select the Order Type: Choose the type of order you want to place. The most common types are:

- Market Order: This allows you to buy define crypto at the current market price.

-

Limit Order: This lets you set a specific price at which you want to buy define crypto. The order will only execute when the price reaches your set amount.

-

Enter the Amount: Specify how much define crypto you want to buy. Review the details, including any fees, and confirm the order.

-

Review Your Transaction: Once your order is executed, you should see your purchased define crypto reflected in your account balance.

5. Secure Your Coins in a Wallet

After purchasing define crypto, it is crucial to secure your investment. While you can leave your coins on the exchange, this is not the safest option. Here’s how to store your cryptocurrency securely:

- Choose a Wallet Type: There are two main types of wallets:

- Hot Wallets: These are online wallets connected to the internet, making them convenient for quick access. Examples include exchange wallets and mobile wallets (like Trust Wallet or MetaMask).

-

Cold Wallets: These are offline wallets, such as hardware wallets (like Ledger or Trezor), providing enhanced security against hacks and theft.

-

Transfer Your Coins: If you opt for a cold wallet, you will need to transfer your define crypto from the exchange to your wallet. This usually involves generating a wallet address and initiating a withdrawal from the exchange.

-

Backup Your Wallet: Ensure you keep a backup of your wallet’s recovery phrase or private keys in a safe place. This information is crucial for recovering your funds if you lose access to your wallet.

By following these steps, you can safely buy and store define crypto, setting a solid foundation for your cryptocurrency investment journey.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Cryptocurrencies, including ‘define crypto’, present a unique opportunity for investors, driven by various potential strengths that could make them an attractive asset class. Here, we explore some of these positive factors.

1. Decentralization and Autonomy

One of the core principles of cryptocurrencies is their decentralized nature. Unlike traditional currencies, which are regulated by central banks and governments, cryptocurrencies operate on decentralized networks, primarily utilizing blockchain technology. This decentralization can provide users with greater autonomy over their assets and transactions, reducing reliance on third-party intermediaries like banks.

2. Potential for High Returns

The cryptocurrency market has been characterized by substantial volatility, which can lead to significant price fluctuations. For instance, Bitcoin, the first and most well-known cryptocurrency, has experienced meteoric rises in value since its inception. While this volatility can pose risks, it also presents opportunities for investors to achieve high returns in a relatively short timeframe. Historical data shows that early adopters of various cryptocurrencies have reaped substantial profits.

3. Diversification of Investment Portfolio

Including cryptocurrencies in an investment portfolio can provide diversification benefits. Given that cryptocurrencies often exhibit low correlation with traditional asset classes, such as stocks and bonds, they can help mitigate risk and enhance overall portfolio performance. This diversification can be particularly appealing in times of economic uncertainty.

4. Growing Adoption and Acceptance

The acceptance of cryptocurrencies as a means of payment is steadily increasing. Numerous merchants, including large corporations and e-commerce platforms, now accept cryptocurrencies, broadening their use cases. Furthermore, the rise of decentralized finance (DeFi) applications and non-fungible tokens (NFTs) has expanded the scope of what cryptocurrencies can achieve, attracting a wider audience.

5. Innovations in Technology

The underlying technology of cryptocurrencies, particularly blockchain, is continuously evolving. Innovations in scalability, security, and transaction speeds can enhance the usability and efficiency of cryptocurrencies. Projects like Ethereum are actively working on upgrades (e.g., Ethereum 2.0) to improve their platforms, making them more attractive for developers and users alike.

Potential Risks and Challenges (The Bear Case)

While there are potential strengths in investing in cryptocurrencies, there are also significant risks and challenges that investors should carefully consider. Below, we examine some of the primary concerns.

1. Market Volatility

Cryptocurrencies are notoriously volatile. Price swings of 10% or more within a single day are not uncommon. This volatility can lead to substantial gains, but it can also result in significant losses. Investors must be prepared for the possibility of dramatic price changes, which can be exacerbated by market sentiment, news events, and trading volume. Such fluctuations may not be suitable for all investors, particularly those with a low risk tolerance.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, and there is a great deal of uncertainty surrounding how governments will regulate digital assets in the future. Different countries have adopted varying stances, from outright bans to acceptance and integration into existing financial systems. Regulatory changes can significantly impact the value of cryptocurrencies and the viability of projects, making it crucial for investors to stay informed about potential legal developments.

3. Competition and Market Saturation

The cryptocurrency market is highly competitive, with thousands of digital assets available to investors. While some projects may offer innovative solutions and strong use cases, many others may lack a clear value proposition or business model. This saturation can lead to a scenario where only a few cryptocurrencies succeed, while many others fail. Investors must conduct thorough research to identify which projects have the potential for long-term success.

4. Technological Risks

The technology underpinning cryptocurrencies, particularly blockchain, is complex and still relatively new. While blockchain is generally considered secure, vulnerabilities can exist. For instance, smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can contain bugs that may be exploited. Additionally, there have been instances of hacking and theft from exchanges and wallets, resulting in significant financial losses for investors. Technological advancements could also lead to unforeseen challenges or obsolescence of certain cryptocurrencies.

5. Lack of Consumer Protections

Unlike traditional financial products, cryptocurrencies typically lack the same level of consumer protections. There are fewer regulations governing exchanges, wallets, and investment practices, which can expose investors to fraud and scams. Investors must be diligent in choosing reputable platforms and remain vigilant against phishing schemes, Ponzi schemes, and other fraudulent activities prevalent in the crypto space.

Conclusion

Investing in ‘define crypto’ and other cryptocurrencies comes with both potential rewards and inherent risks. Understanding these factors is crucial for making informed decisions. Potential strengths, such as decentralization, high return potential, and growing adoption, must be weighed against significant risks, including market volatility, regulatory uncertainty, and technological challenges. As with any investment, thorough research and a clear understanding of one’s risk tolerance are essential for navigating the complex landscape of cryptocurrencies.

Frequently Asked Questions (FAQs)

1. What is Define Crypto?

Define Crypto refers to a specific digital asset or cryptocurrency that aims to provide a unique value proposition in the cryptocurrency market. It operates on a decentralized network, utilizing blockchain technology to enable secure and transparent transactions. Like other cryptocurrencies, it is stored in digital wallets and can be traded on various exchanges.

2. Who created Define Crypto?

The creator of Define Crypto is typically a team or individual with a background in technology and finance. While the specific identity of the founder(s) may vary, many cryptocurrencies are developed anonymously or under pseudonyms, similar to Bitcoin’s creator, Satoshi Nakamoto. It’s essential to research the project’s whitepaper and official website for detailed information about its creators.

3. What makes Define Crypto different from Bitcoin?

Define Crypto may differ from Bitcoin in several ways, including its use case, consensus mechanism, transaction speed, and additional features. While Bitcoin is primarily a store of value and a medium of exchange, Define Crypto might focus on specific applications, such as smart contracts, decentralized finance (DeFi), or other unique functionalities. Understanding these differences can help investors assess its potential value in the market.

4. Is Define Crypto a good investment?

Whether Define Crypto is a good investment depends on various factors, including market conditions, the project’s fundamentals, and individual risk tolerance. Investors should conduct thorough research, analyzing the project’s technology, use case, team, and market trends before making investment decisions. As with any cryptocurrency, it is essential to remember that investments carry risks and should be approached with caution.

5. How can I buy Define Crypto?

To purchase Define Crypto, you typically need to follow these steps:

1. Choose a cryptocurrency exchange: Look for an exchange that lists Define Crypto and allows you to buy it with fiat or other cryptocurrencies.

2. Create an account: Sign up and complete any necessary identity verification.

3. Fund your account: Deposit fiat currency or another cryptocurrency to fund your account.

4. Place an order: Search for Define Crypto, select the order type (buy/sell), enter the amount, and confirm the transaction.

6. How do I store Define Crypto securely?

Define Crypto can be stored in various types of digital wallets, including hot wallets (online) and cold wallets (offline). Hot wallets are more convenient for frequent transactions but are more vulnerable to hacks. Cold wallets, such as hardware wallets, provide enhanced security for long-term storage. It’s crucial to ensure that you understand the wallet’s functionality and security measures before storing your assets.

7. What are the risks associated with investing in Define Crypto?

Investing in Define Crypto, like all cryptocurrencies, carries inherent risks. These can include price volatility, regulatory changes, market manipulation, and the potential for scams or hacks. Additionally, the lack of regulatory oversight in the crypto space means that investors may have limited recourse in the event of a problem. Conducting due diligence and diversifying investments can help mitigate some of these risks.

8. Can Define Crypto be used for everyday transactions?

Whether Define Crypto can be used for everyday transactions depends on its acceptance among merchants and businesses. Some cryptocurrencies are designed specifically for transactions and have partnerships with payment processors to facilitate their use in retail environments. However, the adoption of any cryptocurrency for everyday use can vary widely, and it’s essential to check if Define Crypto is accepted by the vendors you wish to transact with.

Final Verdict on define crypto

Summary of Cryptocurrency

Cryptocurrency, often referred to as crypto, represents a revolutionary form of digital or virtual currency that leverages cryptographic techniques to secure transactions. Operating independently of central authorities, cryptocurrencies utilize decentralized networks, primarily blockchain technology, to enable peer-to-peer transactions. The first and most notable cryptocurrency, Bitcoin, was launched in 2009, paving the way for thousands of other digital assets, commonly referred to as altcoins.

Purpose and Technology

The primary purpose of cryptocurrency is to facilitate secure, transparent, and efficient transactions without the need for intermediaries such as banks. By using a distributed public ledger, transactions are recorded in real-time and are accessible to all participants in the network, enhancing accountability. The creation of new units occurs through mining, a computational process that validates transactions and adds them to the blockchain.

Potential and Risks

Cryptocurrencies offer significant potential for profit, attracting both investors and speculators. However, this potential comes with considerable risks. The cryptocurrency market is known for its volatility, with prices subject to dramatic fluctuations based on market demand, regulatory news, and technological developments. Furthermore, the lack of regulatory oversight can expose investors to scams and theft, emphasizing the need for careful consideration.

Final Thoughts

As an emerging asset class, cryptocurrency presents both opportunities and challenges. While it offers the allure of high returns, it is essential to recognize the inherent risks involved. Therefore, aspiring investors must prioritize thorough research and education to navigate this complex landscape effectively. Remember, conducting your own thorough research (DYOR) is crucial before making any investment decisions in this high-risk, high-reward market.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.