cosmos crypto Explained: A Deep Dive into the Technology and Tokeno…

An Investor’s Introduction to cosmos crypto

Introduction to Cosmos Crypto

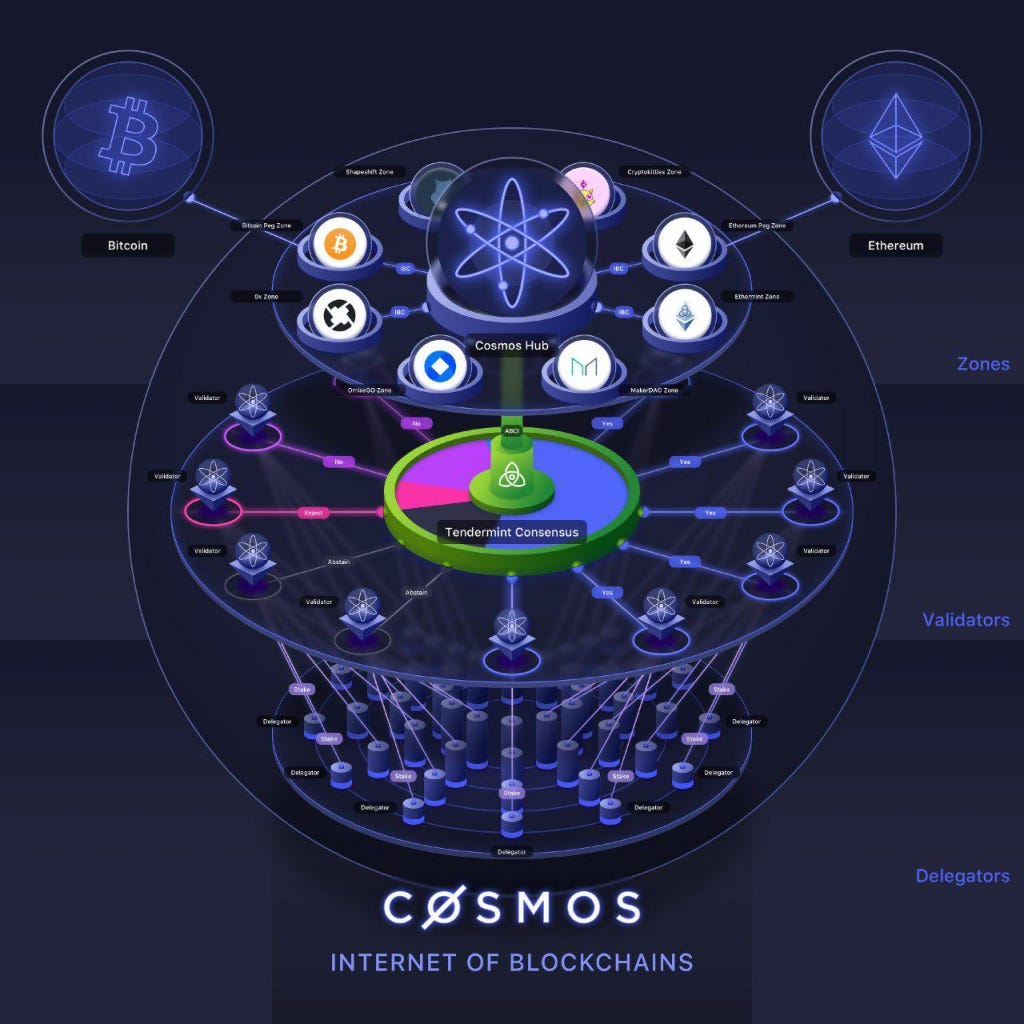

Cosmos (ATOM) is often heralded as a pioneering project in the realm of blockchain technology, frequently referred to as the “Internet of Blockchains.” Launched in 2014 and officially launched through a token sale in 2017, Cosmos aims to address some of the most pressing challenges in the cryptocurrency space, including scalability, interoperability, and the complexity of blockchain development. With the vision of creating a network of interconnected blockchains, Cosmos allows various blockchain applications to communicate and transact with one another seamlessly. This capability is increasingly important as the number of blockchain networks continues to grow, leading to potential fragmentation in the ecosystem.

One of the key features that sets Cosmos apart is its use of a modular architecture, which simplifies the process of building custom blockchains. Developers can leverage the Cosmos Software Development Kit (SDK) to create tailored solutions without needing to start from scratch. This modularity fosters innovation and enhances scalability, allowing blockchains to handle a larger volume of transactions compared to traditional networks like Bitcoin and Ethereum.

The significance of Cosmos in the crypto market is further underscored by its robust governance model and the proof-of-stake consensus mechanism, which incentivizes users to participate in network security and decision-making. With ATOM as its native token, users can stake their tokens to earn rewards while also having a say in the future direction of the network.

Purpose of This Guide

This guide serves as a comprehensive resource for both beginners and intermediate investors interested in Cosmos crypto. We aim to provide a well-rounded understanding of the technology underlying Cosmos, including its unique features and architecture. Additionally, we will delve into the tokenomics of ATOM, exploring its supply dynamics, utility, and potential for value appreciation.

Investing in cryptocurrencies involves inherent risks, and this guide will outline the potential risks associated with Cosmos as well as the broader market context. Lastly, we will provide practical information on how to buy ATOM, including the various exchanges where it is listed and the steps involved in making your first purchase.

By the end of this guide, readers will have a clearer understanding of Cosmos crypto, empowering them to make informed decisions about their investments in this innovative and rapidly evolving space.

What is cosmos crypto? A Deep Dive into its Purpose

Introduction to Cosmos Crypto

Cosmos, often referred to as the “Internet of Blockchains,” represents a significant evolution in the blockchain space, aimed at addressing critical challenges that have hindered the scalability and interoperability of decentralized networks. By creating a framework that allows multiple blockchains to communicate and operate seamlessly, Cosmos provides a robust solution to the fragmentation that currently characterizes the blockchain landscape.

The Core Problem It Solves

The primary problem that Cosmos aims to tackle is the fragmentation of blockchain networks. Currently, numerous blockchains exist independently, often unable to communicate with one another. This lack of interoperability limits the potential for decentralized applications (dApps) to leverage the full capabilities of different networks, stifling innovation and user adoption.

Traditional blockchain architectures, particularly those using proof-of-work (PoW) consensus mechanisms like Bitcoin, suffer from scalability issues, slow transaction times, and high fees. These challenges make it difficult for blockchains to handle the increasing demand for transactions and applications. Cosmos addresses these issues through its unique architecture, which allows for the creation of interconnected blockchains (referred to as “zones”) that can communicate via the Inter-Blockchain Communication (IBC) protocol.

The IBC protocol enables the transfer of data and value between different blockchains, allowing them to operate together in a cohesive ecosystem. This interoperability not only enhances scalability but also fosters a more inclusive environment for developers and users, as they can easily access a variety of services across multiple blockchains.

Its Unique Selling Proposition

Cosmos distinguishes itself from other blockchain projects through several key features:

-

Interoperability: The IBC protocol is the cornerstone of Cosmos’s architecture, enabling seamless communication between different blockchains. This allows developers to create applications that can interact with multiple networks, enhancing functionality and user experience.

-

Modularity: The Cosmos SDK (Software Development Kit) allows developers to build their own blockchains with ease. Its modular framework means developers can use pre-existing components rather than starting from scratch, significantly speeding up the development process and reducing complexity.

-

Scalability: By allowing multiple blockchains to operate in parallel, Cosmos can handle a much higher volume of transactions compared to traditional blockchains. Each zone can process transactions independently, alleviating congestion and improving overall performance.

-

Proof-of-Stake Consensus: Cosmos utilizes a hybrid proof-of-stake (PoS) model, where validators are chosen based on the amount of ATOM tokens they stake. This system is not only more energy-efficient than PoW but also incentivizes validators to act honestly, as they risk losing their staked tokens for dishonest behavior.

-

Governance: ATOM holders have governance rights within the Cosmos ecosystem, allowing them to propose and vote on changes to the network. This decentralized governance model empowers the community and ensures that the network evolves according to the needs of its users.

The Team and Backers

Cosmos was co-founded by Jae Kwon, Zarko Milosevic, and Ethan Buchman, who initially developed the Tendermint protocol, a crucial component of the Cosmos ecosystem. Tendermint provides a consensus engine that allows developers to build blockchains without starting from scratch, thus simplifying the process of blockchain development.

While Jae Kwon remains a principal architect of the project, he stepped down as CEO in 2020, passing the leadership to Peng Zhong. The team has since undergone significant restructuring to enhance development capabilities and community engagement. The Interchain Foundation, a non-profit organization, supports the Cosmos ecosystem, driving initiatives that promote the growth and adoption of Cosmos technology.

The backing of influential investors and partnerships with various blockchain projects further solidify Cosmos’s position in the industry. Notable collaborations include projects like Terra and Crypto.org, which utilize the IBC protocol, showcasing the practical applications and widespread adoption of Cosmos’s technology.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Cosmos is to create a more interconnected and efficient blockchain ecosystem. By addressing the issues of fragmentation and scalability, Cosmos enables a future where multiple blockchains can coexist, communicate, and collaborate effectively. This vision aligns with the broader goal of decentralized finance (DeFi) and the development of dApps that can provide users with diverse functionalities without the limitations imposed by isolated networks.

Cosmos aims to lower barriers to entry for developers, making it easier to build and deploy blockchain solutions tailored to specific needs. This democratization of blockchain technology is crucial for fostering innovation and attracting a wider range of participants to the ecosystem.

Furthermore, the Cosmos ecosystem is designed to be environmentally sustainable, promoting energy-efficient consensus mechanisms and practices. As the world increasingly focuses on sustainability, Cosmos’s commitment to reducing environmental impact positions it favorably in the evolving landscape of digital assets.

In conclusion, Cosmos represents a transformative approach to blockchain technology, aiming to create a future where interconnected networks enhance user experiences and developer opportunities. By solving critical challenges in scalability, interoperability, and usability, Cosmos stands out as a pioneering force in the cryptocurrency ecosystem, paving the way for the next generation of blockchain solutions.

The Technology Behind the Coin: How It Works

Overview of Cosmos Technology

Cosmos is often referred to as the “Internet of Blockchains” due to its innovative approach to blockchain interoperability. Its architecture aims to solve some of the fundamental challenges of the blockchain ecosystem, such as scalability, fragmentation, and developer complexity. This guide will explore the technology behind Cosmos, breaking down its architecture, consensus mechanisms, and key innovations in a straightforward manner.

Blockchain Architecture

Cosmos employs a unique multi-layered architecture that consists of three primary layers: the application layer, the networking layer, and the consensus layer. Each layer plays a vital role in the functioning of the Cosmos ecosystem.

Application Layer

The application layer is where the core functionalities of decentralized applications (dApps) reside. In Cosmos, this layer is designed to facilitate the processing of transactions and the updating of the state of the blockchain. Developers can build their own blockchains using the Cosmos SDK, which provides modular components that can be customized according to specific needs. This modularity allows developers to create tailored solutions without having to start from scratch, significantly reducing development time and effort.

Networking Layer

The networking layer is responsible for enabling communication between different blockchains (also referred to as “zones”) within the Cosmos ecosystem. This is crucial for interoperability, as it allows various independent blockchains to exchange data and value seamlessly. The Inter-Blockchain Communication (IBC) protocol is a key component of this layer, facilitating secure communication across different blockchain networks.

Consensus Layer

The consensus layer ensures that all nodes in the network agree on the current state of the blockchain. In Cosmos, this is achieved through the Tendermint Core, which combines a Byzantine Fault Tolerance (BFT) consensus algorithm with a Proof-of-Stake (PoS) mechanism. This enables validators to reach consensus quickly and efficiently, ensuring the integrity of the blockchain.

Consensus Mechanism: Proof-of-Stake

Overview of Proof-of-Stake

Unlike traditional Proof-of-Work (PoW) systems that rely on resource-intensive mining, Cosmos utilizes a hybrid Proof-of-Stake (PoS) mechanism. In PoS, validators are chosen to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. This not only makes the process more energy-efficient but also aligns the interests of validators with the overall health of the network.

How it Works in Cosmos

In the Cosmos network, validators are incentivized to act honestly, as they stand to lose their staked tokens if they are found to be acting maliciously. When a validator is selected to produce a block, they confirm transactions and add them to the blockchain. The more ATOM tokens a validator stakes, the higher their chances of being selected. This creates a system where validators are encouraged to maintain the security and integrity of the network.

Key Technological Innovations

Cosmos introduces several innovative technologies that set it apart from other blockchain networks. These innovations focus on enhancing interoperability, scalability, and developer experience.

Inter-Blockchain Communication (IBC)

The Inter-Blockchain Communication (IBC) protocol is one of Cosmos’s most significant innovations. It allows different blockchains within the Cosmos ecosystem to communicate and transact with each other seamlessly. By using IBC, developers can create applications that leverage the unique features of multiple blockchains, enhancing functionality and user experience.

For example, a decentralized finance (DeFi) application could use IBC to facilitate token swaps between different blockchains, enabling users to access a broader range of assets and services without needing to rely on centralized exchanges.

Cosmos SDK

The Cosmos SDK is a powerful tool that simplifies the process of building custom blockchains. It provides developers with a modular framework that allows them to select and combine various pre-built components, such as governance modules, staking modules, and token modules. This modularity enables developers to create tailored solutions that meet specific needs while ensuring that they can take advantage of the underlying security and scalability of the Cosmos network.

Tendermint BFT

At the core of Cosmos’s consensus mechanism is the Tendermint BFT engine. This technology allows for fast block confirmation times and high throughput, making it possible for the network to handle a large number of transactions simultaneously. Tendermint’s BFT algorithm ensures that the network can reach consensus even in the presence of faulty nodes, enhancing the overall reliability of the Cosmos ecosystem.

Scalability and Performance

One of the primary goals of Cosmos is to achieve high scalability without sacrificing security or decentralization. The architecture of Cosmos allows for the creation of multiple independent blockchains (zones) that can operate in parallel. Each zone can handle its own transactions and governance, leading to a more efficient use of resources.

Application-Specific Blockchains

Cosmos encourages the development of application-specific blockchains, or “appchains,” which are tailored for specific use cases. This approach allows each blockchain to optimize its performance for its intended purpose, whether it be DeFi, gaming, or supply chain management. By enabling multiple appchains to coexist, Cosmos significantly increases the overall capacity of the network.

Governance in Cosmos

Governance is a critical aspect of any blockchain ecosystem, and Cosmos incorporates a robust governance model. ATOM token holders have the ability to participate in governance decisions, such as proposing and voting on changes to the protocol. This decentralized approach ensures that the network evolves according to the needs and preferences of its community, fostering a sense of ownership and engagement among stakeholders.

Security Features

The security of the Cosmos network is bolstered by its unique consensus mechanism and validator structure. Validators are required to stake ATOM tokens, which not only incentivizes honest behavior but also serves as collateral that can be slashed (penalized) in cases of malicious activity. Additionally, the Tendermint BFT algorithm provides resilience against network failures and attacks, ensuring that the network remains secure even in challenging conditions.

Future Developments

The Cosmos ecosystem is continuously evolving, with ongoing upgrades and enhancements being made to its technology. Recent innovations, such as the Interchain Accounts upgrade, aim to further improve interoperability and user experience by allowing users to manage accounts across different blockchains seamlessly.

As the Cosmos network continues to grow, it is expected to attract more developers and projects, creating a vibrant ecosystem of interconnected blockchains that can work together to solve real-world problems.

Conclusion

The technology behind Cosmos represents a significant advancement in the blockchain space. By focusing on interoperability, scalability, and developer experience, Cosmos is paving the way for a more connected and efficient blockchain ecosystem. Whether you are a developer looking to build your own blockchain or an investor interested in the future of decentralized technology, understanding the core components of Cosmos will provide valuable insights into its potential and impact on the broader cryptocurrency landscape.

Understanding cosmos crypto Tokenomics

Cosmos Tokenomics Overview

Cosmos (ATOM) is designed to create an interconnected ecosystem of blockchains, often referred to as the “Internet of Blockchains.” Its tokenomics is a crucial aspect of its functionality, influencing not only the economic incentives for participants in the network but also its governance and security mechanisms. This section will delve into the key metrics and components of Cosmos’ tokenomics, offering insights into how ATOM functions within its ecosystem.

| Metric | Value |

|---|---|

| Total Supply | 467.04 million ATOM |

| Max Supply | Unlimited |

| Circulating Supply | 467.04 million ATOM |

| Inflation/Deflation Model | Inflationary (dynamic) |

Token Utility (What is the coin used for?)

ATOM plays several vital roles within the Cosmos ecosystem, primarily revolving around governance, security, and staking.

-

Governance: ATOM holders have the power to participate in the governance of the Cosmos Hub. They can propose changes to the protocol and vote on key decisions, such as upgrades and modifications to network parameters. This decentralized governance model is crucial for the evolution and adaptability of the Cosmos network.

-

Staking: Cosmos employs a Proof-of-Stake (PoS) consensus mechanism, where validators are required to stake ATOM tokens to participate in the network’s operations. Validators who stake more tokens have a higher probability of being selected to validate transactions and earn rewards. This staking model not only secures the network but also incentivizes users to hold and invest in ATOM, thereby contributing to its value.

-

Transaction Fees: ATOM is used to pay transaction fees within the Cosmos ecosystem. When users conduct transactions or utilize services on the network, they pay fees in ATOM, which are then distributed to validators as rewards for their services. This creates a direct economic incentive for validators to maintain the network and validate transactions accurately.

-

Interchain Operations: With the introduction of the Inter-Blockchain Communication (IBC) protocol, ATOM can also facilitate transactions and interactions between different blockchains within the Cosmos ecosystem. This interoperability enhances the utility of ATOM by allowing it to be used across multiple chains, thus broadening its applicability and value.

Token Distribution

The distribution of ATOM tokens is designed to ensure a fair and broad allocation, promoting decentralization and community involvement in the network.

-

Initial Distribution: During the initial token sale in April 2017, a total of 200 million ATOM were sold at an average price of $0.10 each, raising approximately $16 million. The funds raised were intended to support the development of the Cosmos network and its associated technologies.

-

Allocation: The token distribution is split as follows:

– Investors: Approximately 80% of the total supply was allocated to investors, including both private and public sale participants. This large allocation to investors is intended to foster a strong community and incentivize early adopters.

– Founders and Team: The remaining 20% was distributed between the development teams and the Interchain Foundation, which oversees the ongoing development and support of the Cosmos ecosystem. -

Inflation Mechanism: Unlike many cryptocurrencies with a fixed supply, Cosmos employs an inflationary model. The inflation rate is dynamically adjusted based on the percentage of ATOM that is staked in the network. If less than 66% of ATOM is staked, the inflation rate increases, encouraging more users to stake their tokens and participate in network security. Conversely, if more than 66% of ATOM is staked, the inflation rate decreases. This model helps to ensure that there are sufficient rewards to incentivize staking while maintaining network security.

-

Validator Rewards: Validators earn rewards for their services, which are paid in ATOM. These rewards come from transaction fees as well as newly minted ATOM from the inflation model. The distribution of rewards is proportional to the amount of ATOM staked by each validator, thereby incentivizing validators to maintain high performance and security standards.

-

Long-term Vision: The tokenomics of Cosmos is designed with a long-term vision of sustainability and growth. By promoting staking and ensuring that rewards are aligned with network security, Cosmos aims to create a robust ecosystem that encourages participation from both individual users and institutional investors.

In conclusion, the tokenomics of Cosmos (ATOM) is a well-structured system that supports its goals of interoperability and scalability within the blockchain industry. By understanding the utility of ATOM and its distribution mechanisms, investors and users can better appreciate the value and potential of the Cosmos ecosystem. As the network continues to evolve and expand, the role of ATOM will likely grow in importance, making it a critical asset for those interested in the future of blockchain technology.

Price History and Market Performance

Key Historical Price Milestones

Cosmos (ATOM) has experienced significant price fluctuations since its inception, reflecting both the broader cryptocurrency market dynamics and its unique position within the blockchain ecosystem. Launched in April 2017, the initial public sale of ATOM tokens saw them priced around $0.10. This early entry point laid the groundwork for what would become a volatile trading history.

The first major milestone in ATOM’s price history occurred in early 2021, when it achieved a remarkable all-time high (ATH) of $44.70 on September 20, 2021. This surge represented a staggering increase of approximately 44,600% from its initial sale price and was largely driven by the growing interest in decentralized finance (DeFi) and blockchain interoperability, which are core features of the Cosmos network.

Following this peak, the price of ATOM faced substantial corrections that are typical in the cryptocurrency market. By the end of 2021, the price had started to decline, reflecting a broader market trend where many cryptocurrencies experienced downturns. By March 2022, ATOM’s price had plummeted to around $10, a decrease of over 77% from its ATH.

In the subsequent months, ATOM experienced a series of ups and downs, influenced by both external market conditions and developments within the Cosmos ecosystem. As of October 2023, ATOM is priced at approximately $4.51, representing a decline of about 89.89% from its all-time high. However, it is essential to note that this price is still significantly higher than its all-time low of $1.13, recorded on March 13, 2020, which reflects a price increase of around 299.58% since that time.

The current market capitalization of Cosmos stands at approximately $2.11 billion, with a 24-hour trading volume of about $100.31 million. The circulating supply is reported to be around 467.04 million ATOM tokens, reflecting a healthy trading activity despite the price fluctuations.

Factors Influencing the Price

Historically, the price of Cosmos has been influenced by a variety of factors, including market trends, technological developments, regulatory news, and overall sentiment in the cryptocurrency space.

Market Trends

The broader cryptocurrency market often dictates the price movements of individual assets, including ATOM. For instance, during bull markets, where investor sentiment is optimistic and prices of major cryptocurrencies like Bitcoin and Ethereum are rising, ATOM typically sees increased buying activity as well. Conversely, during bear markets, ATOM tends to follow suit, with significant price corrections reflecting the overall downturn in the market.

Technological Developments

Technological advancements and updates within the Cosmos ecosystem have also played a crucial role in influencing ATOM’s price. The launch of the Inter-Blockchain Communication (IBC) protocol in April 2021 marked a significant milestone, enabling different blockchains to communicate and transact with one another. This enhancement positioned Cosmos as a leading player in the blockchain interoperability space, driving investor interest and positively impacting the price.

Moreover, the introduction of the Interchain Accounts upgrade in early 2022 further showcased Cosmos’s commitment to innovation and scalability. These developments not only enhance the utility of the Cosmos network but also attract developers and projects, which can lead to increased demand for ATOM tokens.

Regulatory News

Regulatory scrutiny has become increasingly prevalent in the cryptocurrency sector, and Cosmos is no exception. News related to regulations or legal challenges faced by the cryptocurrency industry can cause immediate reactions in the market, impacting ATOM’s price. For instance, discussions regarding the classification of cryptocurrencies as securities can lead to heightened volatility, as investors react to potential implications for projects like Cosmos.

Market Sentiment

Investor sentiment plays a significant role in price fluctuations. Social media trends, news coverage, and community engagement can create hype or fear around specific cryptocurrencies. For example, positive sentiment surrounding ecosystem upgrades or partnerships can lead to increased buying pressure, while negative news can trigger selling.

The Cosmos community has also shown resilience, often rallying around the project during downturns, which can help stabilize the price. The active engagement of the community through forums, social media, and events helps maintain interest and support for the project, which is crucial in a space as volatile as cryptocurrency.

Conclusion

In summary, Cosmos (ATOM) has demonstrated a dynamic price history characterized by significant highs and lows, influenced by market trends, technological advancements, regulatory developments, and market sentiment. Understanding these historical price movements and the factors that have influenced them can provide valuable insights for both new and experienced investors in the cryptocurrency space. As Cosmos continues to evolve and adapt to the changing landscape of blockchain technology, monitoring these influences will be essential for comprehending its market performance.

Where to Buy cosmos crypto: Top Exchanges Reviewed

5. Cosmos (ATOM) – Your Gateway to the Interconnected Blockchain Universe!

The guide from 99Bitcoins highlights the straightforward process of buying Cosmos (ATOM) through top exchanges like Binance, KuCoin, and MEXC. What sets these platforms apart is their user-friendly interfaces, robust security measures, and a wide range of trading options, making them ideal for both beginners and seasoned investors. The emphasis on necessary verification steps ensures a safe trading environment, enhancing the overall purchasing experience for new users.

- Website: 99bitcoins.com

- Platform Age: Approx. 12 years (domain registered in 2013)

5. Cosmos Exchanges – Your Gateway to Seamless ATOM Trading!

Cosmos exchanges, including renowned platforms like Huobi (HTX), Binance, KuCoin, and Kraken, offer robust trading options for ATOM, the native token of the Cosmos ecosystem. These exchanges stand out for their high liquidity, user-friendly interfaces, and a variety of trading pairs, making it easy for both novice and experienced traders to buy, sell, and trade ATOM efficiently. Additionally, their security measures and customer support enhance the overall trading experience.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Best Exchanges to Buy & Sell Cosmos (ATOM) at Top Prices!

ChangeNOW stands out as a premier platform for exchanging Cosmos (ATOM) due to its competitive pricing and user-friendly interface, boasting an impressive rating of 4.8 from over 2,100 users. With no fees for transactions, users can instantly trade ATOM at the best rates while accessing real-time price charts and educational resources to guide their buying and selling decisions. This combination of value and support makes ChangeNOW a top choice for both novice and experienced crypto traders.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

14. Kraken – Top Choice for Security and Reliability

In the competitive landscape of cryptocurrency exchanges, KuCoin stands out as a leading platform, ranking among the top ten globally. With the ability to buy, sell, and trade over 700 crypto assets, it offers a diverse range of options for investors. Its user-friendly interface, advanced trading features, and robust security measures make KuCoin an attractive choice for both beginners and experienced traders looking to invest in Cosmos and other digital assets.

- Website: cryptoradar.com

- Platform Age: Approx. 10 years (domain registered in 2015)

How to Buy cosmos crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Cosmos (ATOM) is to select a cryptocurrency exchange. A cryptocurrency exchange is a platform that allows you to buy, sell, and trade cryptocurrencies. Some popular exchanges that support ATOM include:

- Binance: Known for its extensive range of cryptocurrencies and low trading fees.

- Coinbase: User-friendly and ideal for beginners, offering a simple interface.

- OKEx: Offers various trading pairs and advanced trading options.

- Kraken: Provides strong security features and a wide range of fiat currency options.

When choosing an exchange, consider factors such as the fees, supported payment methods, security features, and user reviews.

2. Create and Verify Your Account

Once you’ve selected an exchange, you’ll need to create an account:

-

Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide some personal information, including your email address and a password.

-

Email Verification: After signing up, you’ll receive an email to verify your account. Click the link in the email to confirm your registration.

-

Identity Verification: Most exchanges require you to verify your identity to comply with regulations. This process typically involves submitting a government-issued ID (like a passport or driver’s license) and sometimes a proof of address (like a utility bill). Follow the exchange’s instructions to complete this step.

3. Deposit Funds

After your account is verified, you can deposit funds to buy Cosmos:

-

Choose a Deposit Method: Navigate to the “Deposit” section of the exchange. Most platforms allow deposits via bank transfer, credit/debit cards, and sometimes even PayPal. Choose the method that suits you best.

-

Select Currency: Choose the currency you want to deposit (e.g., USD, EUR) and follow the instructions to complete the deposit. Be aware of any fees associated with your chosen deposit method.

-

Confirm Deposit: After initiating the deposit, it may take some time for the funds to appear in your exchange account, depending on the payment method used. Ensure you check your account balance after a few hours to confirm the deposit.

4. Place an Order to Buy Cosmos Crypto

With funds in your account, you can now buy ATOM:

-

Navigate to the Trading Section: Find the trading section on the exchange. Look for “Markets” or “Trade” to view available cryptocurrencies.

-

Select ATOM: Search for Cosmos (ATOM) in the market pairs. You may find it listed as ATOM/USD, ATOM/EUR, or ATOM/BTC, depending on the currency you deposited.

-

Choose Order Type: You will typically have options for different types of orders:

– Market Order: Buy ATOM at the current market price. This is the simplest option and executes immediately.

– Limit Order: Set a specific price at which you want to buy ATOM. This order will only execute when the market reaches your specified price. -

Enter Amount: Specify how much ATOM you want to purchase. The exchange will display the estimated cost based on the current price.

-

Confirm Order: Review the order details and click the “Buy” button to complete the transaction. You should receive a confirmation once the order is executed.

5. Secure Your Coins in a Wallet

After purchasing ATOM, it’s crucial to secure your coins:

-

Choose a Wallet: While you can leave your ATOM on the exchange, it’s safer to transfer it to a personal wallet. There are different types of wallets:

– Hardware Wallets: Devices like Ledger or Trezor that offer high security for storing cryptocurrencies offline.

– Software Wallets: Applications like Exodus or Atomic Wallet that are user-friendly and convenient for daily transactions.

– Mobile Wallets: Wallet apps available on smartphones for easy access to your coins. -

Transfer ATOM to Your Wallet: If using a wallet, navigate to the “Withdraw” section of the exchange, enter your wallet address, specify the amount of ATOM to transfer, and confirm the transaction.

-

Backup Your Wallet: Make sure to back up your wallet and store the recovery phrase securely. This step is crucial for recovering your funds in case of device loss or failure.

By following these steps, you’ll be well on your way to buying and securely storing Cosmos (ATOM). Always stay informed about market trends and ensure you practice safe trading habits.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Interoperability

One of the standout features of Cosmos is its commitment to solving the problem of blockchain fragmentation. With its Inter-Blockchain Communication (IBC) protocol, Cosmos enables different blockchains to communicate and interact with one another seamlessly. This interoperability is essential as it allows for the transfer of data and assets across various networks, creating a more cohesive ecosystem. In a world where decentralized applications (dApps) are becoming more prevalent, the ability to connect multiple blockchains could position Cosmos as a vital infrastructure provider in the blockchain space.

2. Scalability

Cosmos is often referred to as “Blockchain 3.0” due to its emphasis on scalability. Its architecture allows for the creation of multiple “zones,” which can operate independently and handle their own transactions. This modular approach means that as demand for blockchain services grows, Cosmos can scale efficiently without experiencing the bottlenecks that often plague older blockchains like Bitcoin and Ethereum. The potential for high transaction throughput and low fees—estimated at around $0.01 per transaction—makes it an attractive option for developers and businesses looking to build scalable solutions.

3. Developer-Friendly Ecosystem

The Cosmos SDK (Software Development Kit) is designed to simplify the development process for new blockchains and decentralized applications. Its modular design allows developers to use pre-built components, which can significantly reduce the time and effort needed to launch new projects. This ease of use is expected to attract a broader range of developers, thereby increasing the number of projects and applications built on the Cosmos network. Additionally, the support for various programming languages enhances its accessibility, allowing developers from different backgrounds to participate.

4. Strong Community and Governance

Cosmos has cultivated a robust community of developers, validators, and enthusiasts who actively participate in the network’s governance. The ATOM token plays a crucial role in this governance model, allowing holders to vote on protocol upgrades and changes. A well-engaged community can contribute to the network’s resilience and adaptability, ensuring that it evolves in response to user needs and market conditions.

5. Unique Economic Model

The economic model of Cosmos, which operates on a hybrid proof-of-stake (PoS) mechanism, incentivizes users to stake their ATOM tokens. This not only secures the network but also allows stakers to earn rewards over time. The deflationary nature of the ATOM token, as more tokens are staked and locked up, can create upward pressure on the price. As adoption grows, the demand for ATOM could increase, benefiting early investors.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

The cryptocurrency market is notoriously volatile, and Cosmos is no exception. As of October 2023, ATOM has experienced significant price fluctuations, with its all-time high reaching $44.70 in September 2021, followed by a steep decline. Such volatility can deter potential investors and users, as they may be hesitant to engage with a platform where the value of their assets can drop dramatically in a short period. This market sentiment can be influenced by broader economic factors, regulatory changes, and market trends, making it challenging for investors to predict future performance.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, and this uncertainty poses a risk for projects like Cosmos. Governments around the world are working to establish frameworks that govern the use of cryptocurrencies, and these regulations can significantly impact the operations of blockchain networks. For instance, if ATOM is classified as a security, it may face stricter regulations that could hinder its adoption and usability. Furthermore, regulatory actions against other cryptocurrencies could create a ripple effect that affects the broader market, including Cosmos.

3. Competition

Cosmos operates in a highly competitive environment, with numerous other blockchain projects vying for attention and market share. Competitors like Polkadot, Ethereum 2.0, and others also focus on interoperability and scalability. As these projects develop and evolve, they may introduce features that could overshadow Cosmos or attract developers and users away from its ecosystem. The ability of Cosmos to maintain its competitive edge will depend on its ongoing development, community engagement, and the successful execution of its roadmap.

4. Technological Risks

While Cosmos’s architecture offers many advantages, it also comes with potential technological risks. The complexity of its multi-layered structure may introduce vulnerabilities or bugs that could compromise the network’s security and functionality. Additionally, as the ecosystem grows and more zones are created, the challenge of maintaining a secure and efficient communication protocol becomes more significant. Any major technological failure could erode trust in the Cosmos network and deter users and developers from engaging with it.

5. Adoption Challenges

Despite its innovative features, Cosmos may face challenges in achieving widespread adoption. Developers and businesses often prefer established platforms with large user bases and proven track records. Convincing them to build on a relatively newer ecosystem like Cosmos may require significant marketing efforts and incentives. Furthermore, the success of Cosmos relies on the successful deployment of various projects and applications, which may take time to materialize.

Conclusion

In summary, Cosmos presents a compelling case for investment with its focus on interoperability, scalability, and a developer-friendly ecosystem. However, potential investors should remain cautious and consider the inherent risks associated with market volatility, regulatory uncertainty, competition, technological challenges, and adoption hurdles. As with any investment in the cryptocurrency space, thorough research and a clear understanding of the project’s dynamics are essential for making informed decisions.

Frequently Asked Questions (FAQs)

1. What is Cosmos crypto (ATOM)?

Cosmos is a decentralized network of independent blockchains that communicate with each other through an Inter-Blockchain Communication (IBC) protocol. The native cryptocurrency of the Cosmos ecosystem is ATOM, which is used for staking and governance within the network. Cosmos aims to solve issues related to scalability, interoperability, and usability in blockchain technology by providing a modular framework that allows developers to build connected blockchains easily.

2. Who created Cosmos crypto?

Cosmos was co-founded by Jae Kwon, Zarko Milosevic, and Ethan Buchman, who were part of the Tendermint team. Tendermint, founded in 2014, is the core technology behind Cosmos. While Jae Kwon is still involved as a principal architect, he stepped down as CEO in 2020, with Peng Zhong taking over the leadership role.

3. What makes Cosmos crypto different from Bitcoin?

The primary difference between Cosmos and Bitcoin lies in their underlying technology and objectives. Bitcoin operates on a proof-of-work consensus mechanism, which is often criticized for being slow and energy-intensive. In contrast, Cosmos uses a proof-of-stake consensus algorithm, allowing for faster transactions and lower energy consumption. Moreover, Cosmos focuses on interoperability between different blockchains, while Bitcoin is primarily a standalone digital currency.

4. Is Cosmos crypto a good investment?

Whether Cosmos is a good investment depends on various factors, including market conditions, individual risk tolerance, and investment goals. As of October 2023, Cosmos has a market cap of approximately $2.11 billion, with ATOM trading around $4.51. Potential investors should conduct thorough research, consider the project’s long-term vision and utility, and assess market trends before making investment decisions.

5. How does Cosmos ensure security?

Cosmos employs a proof-of-stake consensus algorithm, which means that validators who stake ATOM tokens are responsible for verifying transactions and maintaining network security. Validators with a higher stake have a greater chance of being chosen to validate blocks. If a validator acts dishonestly, they risk losing their staked tokens, thus incentivizing honest behavior within the network.

6. How can I buy Cosmos (ATOM)?

Cosmos (ATOM) can be purchased on various cryptocurrency exchanges, including Binance, Coinbase, and OKEx. Users can trade ATOM against several fiat currencies and other cryptocurrencies. To buy ATOM, you typically need to create an account on an exchange, complete identity verification, deposit funds, and then place a buy order for ATOM.

7. What are the benefits of using Cosmos?

Cosmos offers several benefits, including:

– Interoperability: The IBC protocol allows different blockchains to communicate, reducing fragmentation in the blockchain space.

– Scalability: Cosmos can process significantly more transactions per second compared to older blockchains like Bitcoin and Ethereum.

– Modularity: Developers can use the Cosmos SDK to build custom blockchains easily, making it accessible for a wide range of applications.

8. What is the future of Cosmos crypto?

The future of Cosmos looks promising due to its focus on interoperability and scalability. As more projects adopt the IBC protocol and the demand for interconnected blockchain solutions grows, Cosmos is well-positioned to play a significant role in the evolution of the blockchain ecosystem. Ongoing developments, upgrades, and community engagement will be crucial in determining its long-term success and adoption.

Final Verdict on cosmos crypto

Overview of Cosmos (ATOM)

Cosmos, often referred to as the “Internet of Blockchains,” aims to tackle some of the most pressing issues in the blockchain space, such as scalability, interoperability, and complexity. By offering a modular framework, Cosmos enables developers to build interconnected blockchains, referred to as “zones,” that can communicate seamlessly through its Inter-Blockchain Communication (IBC) protocol. This architecture not only enhances scalability but also facilitates the creation of decentralized applications (dApps) with ease.

Technological Foundations

At the core of the Cosmos ecosystem lies the Tendermint consensus engine, which employs a proof-of-stake (PoS) mechanism. This allows validators to secure the network and earn rewards by staking ATOM tokens, the native cryptocurrency of the Cosmos Hub. The Cosmos SDK further empowers developers by providing tools to create customized blockchains tailored to specific needs, enhancing flexibility and reducing development time.

Potential and Risks

Cosmos has positioned itself as a leader in blockchain interoperability, offering a promising solution to the fragmentation seen across various networks. Its robust technology and growing ecosystem suggest significant potential for future adoption and growth. However, as with any cryptocurrency, investing in Cosmos carries inherent risks. The market remains volatile, and regulatory uncertainties can impact the value of digital assets.

Final Thoughts

In summary, Cosmos represents a high-risk, high-reward investment opportunity within the cryptocurrency landscape. Its innovative approach to blockchain connectivity and scalability makes it an attractive option for investors looking to diversify their portfolios. However, potential investors should approach with caution, ensuring they conduct thorough research (DYOR) to understand the intricacies of the Cosmos ecosystem and the broader market dynamics before committing their capital.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.