core crypto Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to core crypto

Core (CORE) is a cutting-edge layer-1 blockchain designed to bridge the gap between Bitcoin and decentralized finance (DeFi). Launched in January 2023, Core leverages the innovative “Satoshi Plus” consensus mechanism, which combines elements of Bitcoin’s Proof-of-Work and Ethereum’s Delegated Proof-of-Stake. This unique approach aims to tackle the blockchain trilemma—balancing decentralization, scalability, and security—while providing a robust platform for deploying Ethereum-compatible smart contracts and decentralized applications (dApps). As the first blockchain to effectively integrate Bitcoin into its operational framework, Core is gaining traction among investors and developers alike, establishing itself as a significant player in the evolving crypto landscape.

Purpose of This Guide

This guide serves as a comprehensive resource for both beginners and intermediate investors seeking to understand Core and its potential in the cryptocurrency market. We will explore several key areas:

-

Technology: A detailed examination of the Core blockchain’s architecture, including its consensus mechanism, smart contract capabilities, and unique features that differentiate it from other blockchain platforms.

-

Tokenomics: An analysis of the CORE token, including its supply dynamics, distribution model, and utility within the ecosystem. Understanding tokenomics is crucial for assessing the long-term viability and value of any cryptocurrency.

-

Investment Potential: Insights into the market performance of CORE, including historical price trends, current market capitalization, and trading volume. We will also discuss factors that could influence the future price trajectory of the token.

-

Risks: A balanced overview of the potential risks associated with investing in Core, including market volatility, regulatory challenges, and technological risks inherent in the blockchain space.

-

How to Buy CORE: Step-by-step instructions for purchasing CORE tokens on various exchanges, ensuring you have the necessary tools to enter the market confidently.

By the end of this guide, you will have a well-rounded understanding of Core, equipping you to make informed decisions about your investment strategy. Whether you’re intrigued by its innovative technology or considering adding it to your portfolio, this resource aims to clarify the intricacies of Core and its place in the broader cryptocurrency ecosystem.

What is core crypto? A Deep Dive into its Purpose

Introduction to Core Crypto

Core (CORE) is an innovative layer 1 blockchain designed to bridge the gap between Bitcoin and decentralized finance (DeFi). Launched in January 2023, Core aims to leverage the security of Bitcoin while enabling high throughput and low fees, making it an attractive platform for developers and users looking to engage with smart contracts and decentralized applications (dApps). Built on the Ethereum Virtual Machine (EVM), Core provides compatibility with existing Ethereum tools and protocols, allowing for seamless integration into the broader blockchain ecosystem.

The Core Problem It Solves

The primary challenge that Core addresses is the limitations of traditional DeFi platforms, particularly those built solely on Ethereum. While Ethereum has been the leading platform for DeFi, it suffers from high gas fees and scalability issues, especially during periods of high network congestion. In contrast, Core seeks to create a more efficient and cost-effective ecosystem by utilizing a unique consensus mechanism known as Satoshi Plus, which combines elements of Bitcoin’s Proof-of-Work (PoW) and Ethereum’s Delegated Proof-of-Stake (DPoS).

This innovative approach allows Core to achieve a balance between decentralization and scalability, effectively addressing what is known as the blockchain trilemma: the challenge of achieving decentralization, security, and scalability simultaneously. By providing lower transaction fees and higher throughput, Core enables users to interact with DeFi applications without the prohibitive costs associated with Ethereum.

Moreover, Core facilitates self-custodial Bitcoin staking, allowing users to earn rewards while retaining complete control over their assets. This feature transforms idle Bitcoin into a productive asset, enhancing its utility in the DeFi landscape.

Its Unique Selling Proposition

Core’s unique selling proposition lies in its ability to combine the security of Bitcoin with the flexibility of an EVM-compatible blockchain. The Satoshi Plus consensus mechanism is at the heart of this proposition, enabling users to stake Bitcoin and earn rewards in CORE tokens while maintaining custody of their Bitcoin. This is achieved through the use of Bitcoin’s native CheckLockTimeVerify (CLTV) feature, which allows users to timelock their Bitcoin for a specified period while participating in the Core network’s governance and security.

Additionally, Core introduces a dual staking mechanism that allows users to stake both Bitcoin and CORE tokens. This approach not only increases the potential yield for participants but also aligns their interests with the growth of the Core ecosystem. By staking both assets, users can access higher reward tiers, creating a sustainable incentive structure that drives engagement and liquidity.

Another distinguishing feature of Core is its governance model, which operates through a decentralized autonomous organization (DAO). This structure empowers the community to propose and vote on upgrades, making the network more adaptable and responsive to the needs of its users. The DAO manages transaction fees, governance parameters, and development proposals, ensuring that the ecosystem evolves in line with community interests.

The Team and Backers

The Core project is supported by a global team of contributors who are passionate about building a better web 3.0. While the identities of the founding team members remain undisclosed, the project has garnered significant attention and support, with a growing community of over 1.6 million followers on Twitter and more than 74,000 on Telegram. This large and engaged community reflects the project’s potential and the trust placed in its vision.

Core is backed by a network of strategic partners and advisors who bring expertise in blockchain technology, DeFi, and financial services. The project also benefits from collaborations with established entities in the cryptocurrency space, enhancing its credibility and reach. The involvement of a dedicated team focused on continuous development and community engagement is crucial for the long-term success of the Core ecosystem.

Fundamental Purpose in the Crypto Ecosystem

At its core, Core aims to redefine how Bitcoin can be utilized within the DeFi landscape. By providing a platform that supports smart contracts and dApps while leveraging Bitcoin’s security, Core creates new opportunities for developers and users alike. Its fundamental purpose is to transform Bitcoin from a static store of value into a dynamic, yield-generating asset that can actively participate in the DeFi ecosystem.

Core’s vision aligns with the broader goals of web 3.0, which seeks to create a decentralized internet where users have control over their data and assets. By enabling self-custodial staking and facilitating the creation of dApps, Core empowers individuals to engage with decentralized financial services while retaining ownership of their assets.

In conclusion, Core (CORE) represents a significant advancement in the cryptocurrency landscape by combining the security of Bitcoin with the flexibility of EVM-compatible smart contracts. Its innovative approach to consensus, staking, and governance positions it as a valuable player in the evolving DeFi ecosystem. As the project continues to develop, it has the potential to unlock new possibilities for users and developers, further bridging the gap between Bitcoin and the broader blockchain space.

The Technology Behind the Coin: How It Works

Introduction to Core Crypto Technology

Core (CORE) is an innovative cryptocurrency designed to bridge the gap between Bitcoin and the decentralized finance (DeFi) ecosystem. Built on a unique blockchain architecture and utilizing a novel consensus mechanism, Core aims to provide high throughput and real yield opportunities for users. In this guide, we will break down the fundamental technologies that power Core, making it easier for beginners and intermediate investors to understand how it works.

Blockchain Architecture

Core operates as a Layer 1 (L1) blockchain that is compatible with the Ethereum Virtual Machine (EVM). This compatibility allows developers to create decentralized applications (dApps) and smart contracts using familiar Ethereum tools and languages. The key features of Core’s blockchain architecture include:

-

EVM Compatibility: Core’s architecture allows it to run Ethereum-based applications seamlessly. This means that developers can port their existing Ethereum dApps to Core, benefiting from its unique features while maintaining the same programming environment.

-

High Throughput: The Core blockchain is designed for scalability, enabling it to handle a large number of transactions per second (TPS). This is crucial for supporting the growing demand in the DeFi space and ensuring that users can conduct transactions without experiencing delays.

-

Decentralized Autonomous Organization (DAO): Core is governed by the Core DAO, which plays a pivotal role in decision-making and the development of the ecosystem. This decentralized governance structure ensures that the community has a say in the direction of the project, promoting transparency and inclusivity.

Consensus Mechanism

The consensus mechanism is a fundamental component of any blockchain, as it determines how transactions are validated and how new blocks are added to the chain. Core employs a unique consensus mechanism called “Satoshi Plus,” which combines elements of Bitcoin’s Proof-of-Work (PoW) and Ethereum’s Delegated Proof-of-Stake (DPoS).

Proof-of-Work (PoW)

In a traditional PoW system, miners compete to solve complex mathematical problems to validate transactions and create new blocks. This process requires significant computational power and energy consumption. Core integrates this model by allowing Bitcoin miners to participate in its consensus process.

- Bitcoin Miners’ Role: Core leverages the existing Bitcoin mining infrastructure by allowing miners to direct their hash power towards electing validators for the Core network. This integration not only enhances Core’s security but also incentivizes Bitcoin miners to engage with the Core ecosystem, creating a symbiotic relationship.

Delegated Proof-of-Stake (DPoS)

In a DPoS system, token holders can vote for a group of validators who are responsible for validating transactions and maintaining the network. This system is more energy-efficient compared to PoW, as it does not require extensive computational resources.

- Validator Election: In Core, both CORE token holders and Bitcoin holders can participate in the election of validators. By timelocking their Bitcoin, users can vote for validators, thereby contributing to the network’s security and governance. This dual approach ensures that the network benefits from the strengths of both PoW and DPoS.

Key Technological Innovations

Core introduces several technological innovations that enhance its functionality and user experience. These innovations are crucial for attracting users and developers to the ecosystem.

Self-Custodial Bitcoin Staking

One of Core’s standout features is its Self-Custodial Bitcoin Staking mechanism. This allows users to stake their Bitcoin while retaining full custody of their assets.

-

Timelocking Mechanism: Users can lock their Bitcoin for a specified period (minimum 24 hours) using Bitcoin’s native CheckLockTimeVerify (CLTV) feature. During this period, they earn the right to vote for validators, thus participating in the consensus process without losing control of their funds.

-

Security: Because the Bitcoin remains in the user’s wallet and is only timelocked, there is no risk of slashing or losing funds to third parties. This innovative approach promotes user trust and encourages participation in the staking process.

Dual Staking

Core enhances the staking experience through a feature known as Dual Staking, which allows users to stake both Bitcoin and CORE tokens simultaneously.

-

Increased Yields: By participating in Dual Staking, users can significantly increase their rewards. The protocol recognizes this commitment with a multiplier effect on yields, which means that the more CORE tokens a user stakes alongside their Bitcoin, the greater their potential rewards.

-

Sustainable Rewards: The rewards generated from Dual Staking come from a combination of fixed block rewards and transaction fees. This sustainable model creates a flywheel effect, where increased DeFi activity attracts more Bitcoin to the network, further driving rewards.

Ecosystem and Community Engagement

Core is not just a blockchain; it is an entire ecosystem that supports a variety of decentralized applications and services. The platform encourages community engagement and development through several initiatives:

-

Decentralized Applications (dApps): Core’s high throughput and EVM compatibility enable developers to build a wide range of dApps, from DeFi protocols to gaming and NFTs. This diversity attracts users and fosters a vibrant ecosystem.

-

Community Governance: The Core DAO plays a crucial role in the governance of the network. Community members can propose upgrades, vote on governance parameters, and influence the direction of the project. This decentralized decision-making process empowers users and builds trust within the community.

Security Measures

Security is paramount in the cryptocurrency space, and Core takes this seriously. The network is regularly audited by CertiK, a well-known firm specializing in blockchain security. This ensures that vulnerabilities are identified and addressed promptly, providing users with peace of mind.

-

Validator Security: Validators on the Core network are elected through a combination of Bitcoin and CORE staking, ensuring that those responsible for maintaining the network have a vested interest in its success.

-

Audit and Compliance: The integration of auditing services helps to instill confidence among users and investors, as they can be assured that the network operates securely and efficiently.

Conclusion

Core’s innovative blend of Bitcoin’s security and the flexibility of a DeFi-centric blockchain positions it as a unique player in the cryptocurrency landscape. With its advanced consensus mechanism, dual staking capabilities, and commitment to community governance, Core is paving the way for a new era of decentralized finance. As the ecosystem continues to grow, both beginners and experienced investors will find exciting opportunities within the Core network. By understanding the technology behind Core, users can make informed decisions about their participation in this evolving digital asset space.

Understanding core crypto Tokenomics

Core Crypto Tokenomics Overview

Core (CORE) is a blockchain-based cryptocurrency that plays a pivotal role in the Core network, which is designed to integrate the benefits of Bitcoin with the flexibility of decentralized finance (DeFi) platforms. Understanding the tokenomics of Core is essential for investors and users interested in leveraging its capabilities within the expanding ecosystem of blockchain technologies.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 2.1 billion CORE |

| Max Supply | 2.1 billion CORE |

| Circulating Supply | 1.01 billion CORE |

| Inflation/Deflation Model | Deflationary (Burn model) |

Token Utility (What is the coin used for?)

The CORE token serves multiple essential functions within the Core ecosystem:

-

Governance: CORE holders have the right to participate in the governance of the Core network. This includes voting on proposals and protocol upgrades, which empowers the community to shape the future of the blockchain.

-

Transaction Fees: CORE is used to pay for transaction fees on the Core network. This helps maintain the network’s operations and incentivizes validators to secure the network.

-

Staking: CORE can be staked to secure the network through a delegated Proof-of-Stake (DPoS) mechanism. Users can lock their CORE tokens to elect validators, contributing to the overall security and efficiency of the blockchain.

-

Yield Generation: CORE is integral to the Dual Staking feature, where users can stake both Bitcoin and CORE. This combination significantly enhances the yield generated from staking Bitcoin, thus incentivizing users to hold and utilize CORE.

-

Incentives for Developers: The ecosystem rewards developers who create decentralized applications (dApps) and services on the Core blockchain with S-Prize tokens, promoting innovation and growth within the network.

-

Deflationary Mechanism: The Core ecosystem has a burn model similar to Ethereum’s “Ultra Sound Money.” A portion of transaction fees and rewards will be periodically burned, reducing the total supply of CORE over time. This deflationary approach is designed to increase the scarcity and potential value of the token.

Token Distribution

The distribution of CORE tokens is strategically designed to ensure the sustainability and growth of the Core ecosystem. The total supply of 2.1 billion CORE tokens is allocated across several categories:

-

Node Mining (39.995%): A significant portion of the total supply is reserved for node mining, incentivizing users to participate in network validation and security.

-

Core Users (25.029%): This allocation is aimed at the broader community of Core users, ensuring that a substantial amount of tokens is available for staking and participating in the ecosystem.

-

Contributors (15%): This allocation rewards developers and contributors who are instrumental in building and improving the Core ecosystem, aligning their interests with the long-term success of the project.

-

Reserves (10%): A portion of the total supply is set aside for reserves, providing a buffer for future development and unforeseen circumstances.

-

Relayer Rewards (0.476%): This small allocation incentivizes relayers who facilitate transactions and communications within the network.

-

Treasury (9.5%): The treasury allocation supports ongoing development and marketing efforts, ensuring that the Core network continues to grow and attract new users.

Conclusion

Understanding the tokenomics of Core is crucial for anyone looking to invest in or utilize this innovative cryptocurrency. With its unique combination of governance, staking, and deflationary mechanisms, CORE is designed to foster a robust and sustainable ecosystem that bridges Bitcoin’s security with the flexibility of DeFi. By participating in the Core network, users not only contribute to the network’s security and functionality but also stand to benefit from the various yield-generating opportunities available within the ecosystem. As the Core network evolves, its tokenomics will play a vital role in shaping the future of decentralized finance and blockchain technology.

Price History and Market Performance

Key Historical Price Milestones

Core (CORE) was launched in January 2023, marking the beginning of its journey in the cryptocurrency market. Since its inception, the token has experienced significant price fluctuations, reflecting the volatile nature of the crypto ecosystem.

One of the most notable milestones for Core occurred shortly after its launch. On February 8, 2023, CORE reached its all-time high (ATH) of $6.47. This peak represented a remarkable performance, fueled by the excitement surrounding its unique Satoshi Plus consensus mechanism and its promise of bridging Bitcoin with decentralized finance (DeFi). The initial surge in price was characteristic of many new projects that capture investor interest, particularly those associated with innovative technologies.

However, the price trajectory was not linear. Following the ATH, CORE faced a downward trend, typical in the crypto market, where many assets experience significant corrections after initial surges. By November 3, 2023, CORE had reached its all-time low of $0.3432, representing a decline of approximately 93.3% from its peak. This downturn was influenced by broader market conditions, including regulatory concerns and shifts in investor sentiment.

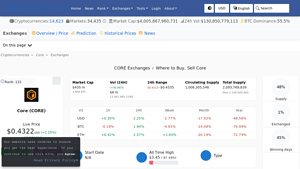

As of the latest data, the price of CORE is approximately $0.4331, with a market capitalization of around $437.78 million. The circulating supply is 1.01 billion CORE tokens, which constitutes about 48% of its maximum supply of 2.1 billion tokens. Over the past 24 hours, CORE has seen a trading volume of approximately $8.44 million, indicating a moderate level of market activity.

Factors Influencing the Price

Historically, the price of Core has been influenced by a variety of factors, both specific to the project and reflective of the broader cryptocurrency market.

Market Sentiment

Investor sentiment plays a crucial role in the price movements of any cryptocurrency. Core’s initial price surge in early 2023 was driven by positive sentiment surrounding its technological innovations and the potential for high yields through its staking mechanisms. As the project gained traction and more users engaged with its platform, the demand for CORE tokens increased, which in turn drove the price higher.

Conversely, negative market sentiment can lead to sharp declines. Following the ATH, a general downturn in the cryptocurrency market, exacerbated by negative news and regulatory scrutiny, contributed to Core’s significant price drop. Investors often react to market trends, leading to sell-offs during bearish phases, which can disproportionately affect newer tokens like CORE.

Technological Developments

The technological aspects of Core, particularly its Satoshi Plus consensus mechanism, have also impacted its market performance. This unique model combines elements of Bitcoin’s Proof-of-Work and Ethereum’s Delegated Proof-of-Stake, aiming to achieve a balance between security and scalability. Announcements regarding upgrades, partnerships, or enhancements to the Core network can influence investor confidence and, subsequently, the token’s price.

For instance, as the ecosystem expands with more decentralized applications (dApps) and partnerships, the perceived utility of the CORE token increases, which can create upward pressure on its price. The integration of innovative features, such as self-custodial Bitcoin staking, also positions Core as a viable option for investors looking for yield opportunities, enhancing its attractiveness.

Regulatory Environment

The regulatory landscape for cryptocurrencies has been a significant factor influencing the price of Core. As governments around the world grapple with how to regulate digital assets, announcements or policy changes can lead to rapid price fluctuations. For example, regulatory crackdowns or unfavorable legislation can instill fear among investors, causing them to sell off their holdings.

In contrast, positive regulatory developments—such as clearer guidelines for DeFi protocols—can lead to increased confidence in the market, potentially benefiting projects like Core that aim to integrate Bitcoin with DeFi solutions.

Market Competition

The competitive landscape of the cryptocurrency market is another critical factor influencing Core’s price. With numerous Layer 1 blockchains and DeFi platforms vying for attention, Core must continuously differentiate itself. The emergence of new projects offering similar or superior functionalities can divert investor interest and impact the demand for CORE tokens.

As the Core network develops and more dApps are launched, its ability to attract users and retain their interest will be pivotal. The success of its ecosystem in providing unique solutions and high yield opportunities can enhance its market position and influence its price trajectory.

Economic Conditions

Broader economic conditions, including inflation rates, interest rates, and macroeconomic trends, also play a role in the performance of cryptocurrencies, including Core. As global economic conditions fluctuate, they can affect investor behavior, leading to shifts in capital allocation between traditional assets and cryptocurrencies. For instance, a rising interest rate environment may lead investors to prefer assets that yield higher returns, influencing their decision to invest in yield-generating platforms like Core.

Conclusion

In summary, the price history and market performance of Core (CORE) reflect a complex interplay of various factors, including market sentiment, technological advancements, regulatory developments, competition, and broader economic conditions. Understanding these elements is crucial for investors looking to navigate the cryptocurrency landscape and make informed decisions regarding their investments in Core and similar digital assets.

Where to Buy core crypto: Top Exchanges Reviewed

5 Steps to Seamless CORE Acquisition!

In the article “How to Buy Core (CORE): A Step-by-Step Guide” on Bitcompare, readers are presented with a comprehensive overview of the best platforms for purchasing Core (CORE) cryptocurrency. The guide stands out by offering detailed instructions tailored for both beginners and experienced investors, while also highlighting essential considerations to ensure a smooth buying process. This resource empowers users to make informed decisions when entering the Core market.

- Website: bitcompare.net

- Platform Age: Approx. 6 years (domain registered in 2019)

5. Core (CORE) – Your Gateway to Seamless Trading!

Core (CORE) is accessible on over 23 cryptocurrency exchanges, with notable platforms such as Gate, OKEX, and Bitget leading the way. These exchanges stand out due to their robust trading features, high liquidity, and user-friendly interfaces, making them ideal for both novice and experienced investors looking to buy, sell, or trade CORE. Additionally, their competitive fee structures and diverse trading pairs enhance the overall trading experience.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

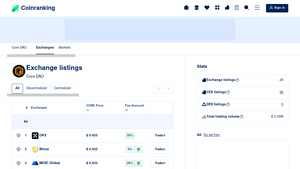

5. Core DAO (CORE) – Unlocking Diverse Exchange Opportunities!

The review article on ‘Exchange Listings of Core DAO (CORE)’ highlights the platform’s comprehensive comparison features, allowing users to easily assess various exchanges based on prices, trading volumes, and discounts. This functionality empowers traders to make informed decisions, ensuring they choose the best exchange for their CORE transactions. The focus on user-friendly navigation and detailed analytics sets this exchange apart in the competitive landscape of cryptocurrency trading.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

3. Swapzone – Your Go-To for Seamless CORE Trading!

Core Exchange on Swapzone stands out for its user-friendly platform, offering competitive rates for trading CORE against various cryptocurrencies. With a commendable rating of 4.7 based on 153 reviews, it emphasizes speed and security, ensuring a seamless trading experience. The combination of favorable pricing and reliable service makes Core Exchange an attractive option for both novice and experienced traders looking to swap digital assets efficiently.

- Website: swapzone.io

- Platform Age: Approx. 6 years (domain registered in 2019)

How to Buy core crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step to buying Core (CORE) is selecting a cryptocurrency exchange where it is listed. Several exchanges support CORE trading pairs, including:

- Huobi

- OKX

- Gate.io

- Bybit

- Poloniex

When choosing an exchange, consider the following factors:

- Reputation: Look for exchanges with a strong track record and positive user reviews.

- Fees: Check the trading fees, deposit and withdrawal fees, and any other costs associated with using the platform.

- User Experience: Ensure the platform is user-friendly, especially if you are a beginner.

- Security Features: Look for exchanges that offer two-factor authentication (2FA), cold storage, and other security measures.

2. Create and Verify Your Account

Once you have chosen an exchange, follow these steps to create your account:

- Sign Up: Navigate to the exchange’s website and click on the ‘Sign Up’ or ‘Register’ button. You will be prompted to provide your email address and create a password.

- Email Verification: After submitting your details, check your email for a verification link from the exchange. Click the link to verify your email address.

- Identity Verification: Most exchanges require you to verify your identity to comply with regulatory requirements. This typically involves submitting a government-issued ID and possibly a proof of address document (like a utility bill).

- Enable Two-Factor Authentication (2FA): To enhance the security of your account, enable 2FA. This adds an additional layer of protection by requiring a code sent to your mobile device each time you log in.

3. Deposit Funds

With your account set up and verified, the next step is to deposit funds into your exchange account. You can usually deposit through various methods:

- Bank Transfer: This is a common method, but it may take a few days for the funds to appear in your account.

- Credit/Debit Card: Some exchanges allow you to buy cryptocurrencies directly with a card, offering instant deposits.

- Cryptocurrency Transfer: If you already own other cryptocurrencies, you can transfer them to your exchange wallet and trade them for CORE.

To deposit funds:

- Navigate to the ‘Deposit’ section of your exchange account.

- Select your preferred deposit method and follow the instructions.

- Make sure to double-check any wallet addresses if you are transferring crypto to avoid loss of funds.

4. Place an Order to Buy Core Crypto

Now that you have funds in your account, you can place an order to buy CORE tokens. Here’s how:

- Find CORE: Use the search function on the exchange to locate the CORE trading pair (e.g., CORE/USDT or CORE/BTC).

- Select the Type of Order: You typically have several options:

- Market Order: This buys CORE at the current market price. It’s the simplest option for beginners.

- Limit Order: This allows you to set a specific price at which you want to buy CORE. Your order will only execute if the market reaches your specified price.

- Enter the Amount: Decide how much CORE you want to buy and enter the amount in the appropriate field.

- Review Your Order: Before finalizing, double-check the details of your order, including the total cost and any fees.

- Execute the Order: Click on the ‘Buy’ button to place your order. If you placed a market order, it should execute immediately. Limit orders may take longer, depending on market conditions.

5. Secure Your Coins in a Wallet

After successfully purchasing CORE, it’s crucial to secure your tokens. Leaving your assets on an exchange can be risky due to potential hacks. Instead, consider transferring your CORE to a secure wallet.

- Choose a Wallet Type: There are several types of wallets:

- Software Wallets: These are applications you can download on your computer or smartphone. Examples include MetaMask and Trust Wallet.

- Hardware Wallets: These are physical devices that store your cryptocurrencies offline, providing enhanced security. Examples include Ledger and Trezor.

-

Paper Wallets: A less common method, this involves printing your private keys on paper. It is secure if stored properly but can be lost or damaged easily.

-

Transfer Your CORE: Once you have chosen a wallet, find your wallet address and use the withdrawal function on your exchange to transfer your CORE tokens. Always double-check the wallet address to ensure accuracy.

By following these steps, you can successfully buy and secure your Core (CORE) tokens, setting yourself on the path to participating in the growing Core ecosystem.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

1. Unique Consensus Mechanism

Core operates on a novel consensus mechanism known as Satoshi Plus, which combines elements of Bitcoin’s Proof-of-Work (PoW) and Ethereum’s Delegated Proof-of-Stake (DPoS). This dual approach aims to enhance both security and scalability, addressing one of the most significant challenges in blockchain technology—often referred to as the blockchain trilemma. By leveraging the strengths of both PoW and DPoS, Core could potentially offer a more robust platform for decentralized applications (dApps) and smart contracts, attracting developers and users alike.

2. EVM Compatibility

The Core blockchain is compatible with the Ethereum Virtual Machine (EVM), which allows developers to easily migrate existing Ethereum dApps or create new ones without extensive reworking. This compatibility could lead to a faster adoption rate among developers familiar with Ethereum, thereby enriching the Core ecosystem with innovative applications and services.

3. Focus on Bitcoin Integration

Core positions itself as the “Bitcoin Everything Chain,” emphasizing the integration of Bitcoin into decentralized finance (DeFi) applications. By allowing Bitcoin holders to stake their assets while maintaining custody, Core taps into a significant market of Bitcoin investors who are looking for ways to generate yield without relinquishing control over their assets. This unique proposition could drive user engagement and transaction volume on the Core network.

4. Strong Community Support

Core has garnered a substantial following, with over 1.6 million followers on Twitter and more than 74,000 on Telegram. A strong community can play a vital role in the success of a cryptocurrency project, as engaged users are more likely to contribute to development, governance, and adoption. Community-driven initiatives can also enhance marketing efforts and drive organic growth.

5. Potential for High Yield Generation

With the introduction of Dual Staking, where users can stake both Bitcoin and CORE tokens, investors may benefit from significantly higher yield rates. This dual mechanism not only incentivizes users to engage with the platform but also creates a sustainable ecosystem where rewards can attract more Bitcoin and CORE tokens, thereby enhancing liquidity and overall market participation.

6. Governance and Decentralization

Core operates through a decentralized autonomous organization (DAO), which empowers token holders to participate in governance decisions. This decentralized structure can lead to more democratic decision-making and align the interests of users with the long-term vision of the platform. It may also foster a sense of ownership among the community, driving further engagement and commitment.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies are notoriously volatile, and Core is no exception. The price of CORE has fluctuated significantly, reaching an all-time high of $6.47 in February 2023 and dropping to around $0.43 in October 2023, representing a decline of over 93%. Such extreme price swings can deter potential investors and undermine confidence in the asset. Market volatility can also lead to liquidity challenges, making it difficult for investors to buy or sell their holdings without affecting the price.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, and Core is not immune to the potential impacts of new regulations. Governments worldwide are scrutinizing digital assets, and changes in policy could affect the operation of Core and its associated token. Regulatory challenges can lead to increased compliance costs, restrictions on trading, or even the prohibition of certain activities, which could hinder the growth of the Core ecosystem.

3. Intense Competition

Core operates in a highly competitive environment, with numerous Layer 1 blockchains vying for market share. Established platforms such as Ethereum, Solana, and Avalanche have already built substantial ecosystems and user bases. Core will need to differentiate itself significantly to attract developers and users away from these competitors. If it fails to do so, it may struggle to gain traction and achieve its growth objectives.

4. Technological Risks

As a relatively new blockchain, Core faces various technological risks. Issues such as network congestion, security vulnerabilities, or bugs in the code can undermine user confidence and disrupt operations. Additionally, the integration of Bitcoin staking adds complexity to the system, which may introduce unforeseen challenges. Should any significant technical issues arise, they could negatively impact the platform’s reputation and usability.

5. Centralization Concerns

While Core aims for decentralization through its DAO structure, concerns about centralization may arise if a small group of validators or stakeholders accumulate significant power. This could lead to governance issues and decisions that do not reflect the interests of the broader community. Ensuring that governance remains decentralized and truly representative of all stakeholders is crucial for maintaining trust in the platform.

6. Adoption Challenges

Even with its innovative features, Core may face challenges in achieving widespread adoption. Developers and users may be hesitant to switch from established platforms to a newer blockchain, especially if the perceived benefits do not outweigh the risks. Core must effectively communicate its advantages and provide robust support to encourage migration and engagement, which may prove to be a significant hurdle.

Conclusion

In summary, Core presents a compelling investment opportunity with its unique consensus mechanism, EVM compatibility, and focus on integrating Bitcoin into DeFi. However, potential investors should be aware of the inherent risks, including market volatility, regulatory uncertainties, and intense competition. As with any investment in cryptocurrency, a thorough understanding of both the potential rewards and the risks involved is essential for making informed decisions.

Frequently Asked Questions (FAQs)

1. What is Core (CORE) cryptocurrency?

Core (CORE) is a Layer 1 blockchain designed to operate within the Bitcoin ecosystem, combining features of both Bitcoin and Ethereum. It utilizes the Satoshi Plus consensus mechanism, which merges Bitcoin’s Proof-of-Work (PoW) with Delegated Proof-of-Stake (DPoS). This design aims to provide scalability and decentralization while enabling the execution of Ethereum-compatible smart contracts and decentralized applications (dApps). The Core network is governed by a decentralized autonomous organization (DAO), which allows users to participate in decision-making processes.

2. Who created Core (CORE)?

The Core project was developed by a global team known as CoreDAO. While the team comprises contributors passionate about building a better Web 3.0, the identities of the individual creators and developers are not publicly disclosed. The project has garnered significant community support, evident from its large following on social media platforms.

3. What makes Core (CORE) different from Bitcoin?

Core differs from Bitcoin in several ways:

– Consensus Mechanism: While Bitcoin relies solely on Proof-of-Work, Core employs a hybrid model (Satoshi Plus) that combines PoW and DPoS for enhanced scalability and decentralization.

– Smart Contracts: Core is EVM-compatible, enabling the creation and execution of smart contracts and dApps, which is not possible on the Bitcoin network.

– Utility Token: CORE serves as both a utility and governance token within the Core ecosystem, allowing users to pay transaction fees, participate in governance, and earn rewards through staking.

4. Is Core (CORE) a good investment?

As with any cryptocurrency investment, the potential for profit comes with risks. Core has shown growth since its launch, with a market capitalization of approximately $437.78 million and a price of around $0.43. However, it is essential to conduct thorough research, consider market trends, and assess personal risk tolerance before investing. Factors such as market volatility, competition, and regulatory changes can significantly impact the value of digital assets like Core.

5. How does staking work in Core (CORE)?

Staking in Core allows users to lock up their Bitcoin or CORE tokens to participate in network validation and earn rewards. Users can stake Bitcoin using a self-custodial method that maintains control over their assets while contributing to the network’s security. Additionally, Core offers dual staking, where users can stake both Bitcoin and CORE to increase their yields significantly. Rewards are derived from block rewards and transaction fees generated by the network.

6. What are the risks associated with Core (CORE)?

Investing in Core, like any cryptocurrency, carries inherent risks, including:

– Market Volatility: Prices can fluctuate dramatically due to market sentiment and external factors.

– Technological Risks: As a relatively new blockchain, potential vulnerabilities in the protocol or smart contracts could pose risks.

– Regulatory Risks: Changes in regulations regarding cryptocurrencies may affect Core’s operations and market viability.

7. Where can I buy Core (CORE)?

Core (CORE) is available on various cryptocurrency exchanges, including Huobi, OKX, Gate.io, Bybit, and Poloniex. Users can trade CORE for other cryptocurrencies, such as Tether (USDT). It is advisable to use reputable exchanges and ensure compliance with local regulations when trading cryptocurrencies.

8. How is the Core network secured?

The security of the Core network is achieved through its Satoshi Plus consensus mechanism, which integrates Bitcoin mining power with a delegated proof-of-stake model. This dual approach ensures robust security while maintaining decentralization. Additionally, the network undergoes regular audits by firms specializing in blockchain security, such as CertiK, to identify and mitigate potential vulnerabilities.

Final Verdict on core crypto

Overview of Core Crypto

Core (CORE) is an innovative Layer 1 blockchain designed to bridge the gap between Bitcoin and decentralized finance (DeFi). Utilizing the unique Satoshi Plus consensus mechanism, which combines Bitcoin’s Proof-of-Work (PoW) with Delegated Proof-of-Stake (DPoS), Core aims to deliver a scalable, secure, and efficient environment for running Ethereum-compatible smart contracts and decentralized applications (dApps). Launched in January 2023, Core is governed by a decentralized autonomous organization (DAO), ensuring community involvement in development and decision-making.

Key Features and Technology

One of the standout features of Core is its ability to facilitate self-custodial Bitcoin staking, allowing users to lock their Bitcoin while retaining control over their assets. This model not only enhances security but also generates yield through participation in the network’s consensus mechanism. Additionally, the Dual Staking option allows users to stake both Bitcoin and CORE tokens, significantly boosting potential rewards. With a capped supply of 2.1 billion CORE tokens, the project employs a burn model to promote scarcity and value appreciation.

Potential and Risks

While Core presents an exciting opportunity in the growing Bitcoin DeFi landscape, it is essential to recognize the inherent risks. The cryptocurrency market is known for its volatility, and investments in assets like CORE can lead to substantial gains or losses. As of now, CORE has seen a significant decline from its all-time high, emphasizing the importance of careful consideration before entering this asset class.

Final Thoughts

In conclusion, Core crypto represents a promising intersection of Bitcoin and DeFi, with advanced technology and a community-driven approach. However, it is crucial to remember that investing in cryptocurrencies carries risks. We strongly encourage all potential investors to conduct their own thorough research (DYOR) to understand the nuances of Core and the broader cryptocurrency market before making any financial commitments.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.