clv coin Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to clv coin

Clover Finance, represented by the CLV token, is an innovative blockchain operating system that aims to bridge the compatibility gap among various blockchains, particularly within the decentralized finance (DeFi) ecosystem. Launched in July 2021, Clover Finance was developed with the vision of providing a seamless platform for developers and users to interact with decentralized applications (DApps) across multiple blockchain networks. As the cryptocurrency landscape continues to evolve, CLV has emerged as a noteworthy player, reflecting the growing demand for cross-chain compatibility and DeFi solutions.

Significance in the Crypto Market

Clover Finance’s CLV token is integral to its operations, serving not only as a medium for transaction fees but also as a governance token that allows holders to participate in decision-making processes regarding system upgrades and network enhancements. This dual functionality positions CLV as a vital component within the broader DeFi landscape, enabling users to engage in staking and governance activities while benefiting from the platform’s unique features.

The significance of CLV in the cryptocurrency market is underscored by its innovative approach to blockchain interoperability. By facilitating interactions between different blockchain ecosystems, Clover Finance aims to simplify the development and deployment of DApps, thereby attracting a diverse range of developers and users. This focus on cross-chain functionality and usability is particularly relevant as the demand for decentralized solutions continues to rise.

Purpose of This Guide

This guide serves as a comprehensive resource for both novice and intermediate investors interested in understanding CLV and its potential within the cryptocurrency space. It will cover various aspects of Clover Finance, including:

- Technology: An overview of the underlying technology that powers Clover Finance, detailing its multi-layered architecture designed for efficient cross-chain operations.

- Tokenomics: Insights into the economic model of the CLV token, including its supply dynamics, distribution, and utility within the Clover ecosystem.

- Investment Potential: Analysis of the factors that may influence the price and market performance of CLV, helping investors make informed decisions.

- Risks: A balanced view of the potential risks associated with investing in CLV, including market volatility and technological challenges.

- How to Buy: Step-by-step instructions on acquiring CLV tokens through various exchanges, ensuring that investors can easily participate in the market.

By the end of this guide, readers will have a well-rounded understanding of Clover Finance and the CLV token, equipping them with the knowledge needed to navigate this exciting segment of the cryptocurrency market.

What is clv coin? A Deep Dive into its Purpose

Introduction to CLV Coin

CLV Coin, the native token of Clover Finance, operates within a unique blockchain infrastructure designed to enhance the interoperability of decentralized finance (DeFi) applications. Launched in 2021, Clover Finance aims to bridge the compatibility gap between different blockchain ecosystems, facilitating a more integrated and user-friendly experience for developers and users alike.

The Core Problem It Solves

One of the primary challenges facing the blockchain industry is the issue of interoperability. Many blockchain networks operate in isolation, which can hinder the transfer of assets and data across different platforms. This fragmentation creates inefficiencies and limits the potential of decentralized applications (dApps) to function seamlessly across various ecosystems.

Clover Finance addresses this problem by offering a robust infrastructure that supports cross-chain compatibility. By enabling different blockchain networks to communicate with one another, Clover allows developers to create dApps that can operate across multiple platforms without the need for extensive modifications. This solution not only enhances the functionality of dApps but also opens up new avenues for innovation within the DeFi space.

Clover Finance also simplifies the user experience for those new to DeFi. With its one-stop platform, users can access various financial services, such as lending, borrowing, and trading, all from a single interface. This accessibility is crucial for attracting a broader audience to the DeFi landscape, which has historically been complex and intimidating for newcomers.

Its Unique Selling Proposition

Clover Finance’s unique selling proposition lies in its multi-layered architecture and its commitment to cross-chain compatibility. The platform comprises several layers:

-

Storage Layer: This layer ensures that data is securely stored and can be accessed efficiently across different applications and blockchains.

-

Smart Contract Layer: By allowing developers to create and deploy smart contracts, Clover makes it easier to automate processes and enhance the functionality of dApps.

-

DeFi Protocol Layer: This layer facilitates various DeFi services, such as liquidity provision and yield farming, enabling users to maximize their returns on investments.

-

eApp Layer: The external application layer allows developers to deploy applications without relying on other virtual machines or consuming additional network bandwidth. This feature significantly streamlines the development process and reduces the barriers to entry for new developers.

Additionally, Clover Finance introduces an innovative gas fee structure that adjusts based on user activity. Frequent users can benefit from lower transaction fees, making the platform more economical for active participants.

Moreover, the CLV token serves multiple purposes within the Clover ecosystem. It is used for governance, allowing holders to vote on important decisions regarding network upgrades and changes. Additionally, CLV tokens can be staked to validate transactions on the network, providing an opportunity for users to earn rewards while contributing to the security and efficiency of the platform.

The Team and Backers

The success of any blockchain project heavily relies on the competence and vision of its founding team. Clover Finance was founded by a trio of experienced professionals: Viven Kirby, Norelle Ng, and Burak Keçeli.

-

Viven Kirby, the project lead, brings a wealth of experience in enterprise resource planning. His background includes significant roles in technology companies, where he honed his skills in system architecture and project management.

-

Norelle Ng, the operations lead, is a seasoned blockchain expert with a strong foundation in human-computer interaction. Her previous advisory roles with various blockchain companies showcase her expertise in navigating the complexities of the cryptocurrency landscape.

-

Burak Keçeli, the tech lead, is a highly skilled programmer with a history of developing innovative software solutions. His early start in programming has equipped him with the knowledge and experience necessary to tackle the technical challenges faced by Clover Finance.

The team is complemented by a diverse group of advisors and backers who provide strategic insights and support. The project’s early funding came from a seed program, which allowed Clover Finance to develop its technology and launch its mainnet successfully in July 2021.

Fundamental Purpose in the Crypto Ecosystem

Clover Finance, through its CLV token, aims to serve as a cornerstone for cross-chain DeFi applications. Its fundamental purpose is to create a more interconnected blockchain ecosystem where users can easily access and utilize a variety of financial services without being limited by the constraints of individual networks.

By fostering interoperability, Clover Finance not only enhances the functionality of dApps but also democratizes access to DeFi services. This aligns with the broader vision of the cryptocurrency industry, which seeks to create a more inclusive financial system that empowers individuals and reduces reliance on traditional financial institutions.

In conclusion, CLV Coin represents a significant innovation in the cryptocurrency space, addressing critical challenges related to interoperability and user accessibility. With its unique infrastructure and experienced team, Clover Finance is well-positioned to drive the next wave of growth in the DeFi sector, making it an essential player in the ongoing evolution of blockchain technology.

The Technology Behind the Coin: How It Works

Introduction to Clover Finance (CLV)

Clover Finance, commonly referred to as CLV, is an innovative blockchain operating system designed to facilitate seamless cross-chain interactions and decentralized finance (DeFi) applications. Launched in July 2021, Clover aims to bridge the compatibility gap that exists in the blockchain ecosystem, enabling developers and users to interact with various blockchain networks effortlessly. This section delves into the core technological components that underpin Clover Finance, providing a clear understanding of how it works.

Blockchain Architecture

Clover Finance employs a multi-layered architecture that enhances its functionality and interoperability. This architecture consists of several key layers:

-

Storage Layer: This foundational layer is responsible for data storage, ensuring that all transactions and smart contracts are securely stored on the blockchain. It allows for efficient retrieval and management of data, which is crucial for the overall performance of the network.

-

Smart Contract Layer: At this layer, developers can create and deploy smart contracts—self-executing contracts with the terms of the agreement directly written into code. Clover’s smart contract layer is compatible with the Ethereum Virtual Machine (EVM), enabling developers familiar with Ethereum to easily transition to Clover and build decentralized applications (DApps).

-

DeFi Protocol Layer: This layer focuses on decentralized finance applications, allowing users to engage in various financial services without intermediaries. It supports features like lending, borrowing, and yield farming, providing users with opportunities to earn rewards and manage their assets efficiently.

-

eApp Layer: Short for external applications, the eApp layer represents an evolution of traditional DApps. It allows developers to deploy applications without relying on other virtual machines or consuming excessive network bandwidth. This layer enhances user experience by ensuring that applications run smoothly and efficiently.

This multi-layered structure not only enhances the performance and scalability of Clover Finance but also allows for the seamless integration of various functionalities within the ecosystem.

Consensus Mechanism: Proof-of-Stake (PoS)

Clover Finance utilizes a Proof-of-Stake (PoS) consensus mechanism to secure its network. Unlike traditional Proof-of-Work (PoW) systems, which require significant computational power to validate transactions, PoS relies on validators who are chosen based on the number of tokens they hold and are willing to “stake” as collateral.

How Proof-of-Stake Works

-

Staking: Users who hold CLV tokens can stake them to participate in the validation process. By locking up their tokens, they contribute to the network’s security and are incentivized to act honestly, as dishonest behavior could lead to losing their staked tokens.

-

Validator Selection: Validators are selected to create new blocks and confirm transactions based on the amount of CLV they have staked. The more tokens a user stakes, the higher the chances of being chosen as a validator.

-

Transaction Validation: When a validator is selected, they confirm transactions and add them to the blockchain. This process is energy-efficient compared to PoW, making Clover Finance more environmentally friendly.

-

Rewards: Validators earn rewards in the form of transaction fees and newly minted CLV tokens for their efforts in maintaining the network. This incentivizes users to stake their tokens and participate actively in the ecosystem.

Key Technological Innovations

Clover Finance incorporates several technological innovations that enhance its functionality and user experience. These innovations include:

Cross-Chain Compatibility

Clover Finance is designed to facilitate interoperability between different blockchain networks. This means that users can seamlessly interact with various blockchains, such as Bitcoin and Ethereum, without the need for complex bridges or intermediaries. This cross-chain compatibility opens up a world of possibilities for users and developers, allowing them to leverage the strengths of multiple blockchains within a single ecosystem.

Identity-Based Gas Fee Schedule

One of the unique features of Clover Finance is its identity-based gas fee schedule. This system allows frequent users of the network to benefit from lower transaction fees based on their usage patterns. By adjusting fees according to user activity, Clover incentivizes regular interaction with the network while making it more affordable for users to participate in DeFi activities.

Relayer Functionality

Clover Finance introduces a relayer mechanism that allows transaction relayers to act on behalf of senders. This feature is particularly beneficial for users who may not have enough native tokens to cover gas fees. In this case, relayers can cover the gas fees in the base currency while receiving compensation in the denominated asset. This innovative approach simplifies the transaction process and enhances user accessibility.

Governance and Community Involvement

Clover Finance emphasizes community governance through the use of the CLV token. Token holders have the ability to vote on system upgrades, proposals, and changes to the network. This decentralized governance model ensures that the community has a say in the direction of the project, fostering a sense of ownership and engagement among users.

Security Features

Clover Finance employs multiple security measures to protect its network and users. These include:

-

Decentralization: By utilizing a PoS consensus mechanism and allowing community governance, Clover reduces the risk of centralization and single points of failure.

-

Multi-Signature Wallets: Clover supports multi-signature wallets, which require multiple private keys to authorize a transaction. This adds an extra layer of security for users and organizations managing significant funds.

-

Regular Audits: The Clover team conducts regular security audits of its smart contracts and infrastructure to identify vulnerabilities and ensure the network remains secure against potential attacks.

Conclusion

Clover Finance (CLV) represents a significant advancement in the blockchain ecosystem, providing a comprehensive infrastructure for cross-chain compatibility and decentralized finance applications. Through its innovative multi-layered architecture, efficient Proof-of-Stake consensus mechanism, and user-friendly features, Clover aims to empower developers and users alike. As the blockchain landscape continues to evolve, Clover Finance positions itself as a critical player in bridging the gaps between various blockchain networks, ultimately fostering a more interconnected and accessible financial ecosystem. By understanding the technology behind Clover Finance, investors and users can better appreciate its potential in the rapidly changing world of digital assets.

Understanding clv coin Tokenomics

Clover Finance (CLV) operates within a unique ecosystem designed for cross-chain compatibility and decentralized finance (DeFi) applications. The tokenomics of CLV plays a crucial role in defining its utility, distribution, and overall functionality within the network. This section delves into the key aspects of CLV’s tokenomics, providing beginners and intermediate investors with a clear understanding of how CLV functions as a digital asset.

| Metric | Value |

|---|---|

| Total Supply | 2,000,000,000 CLV |

| Max Supply | Not capped |

| Circulating Supply | 1,224,140,929 CLV |

| Inflation/Deflation Model | Deflationary |

Token Utility (What is the coin used for?)

The CLV token is the native utility token of the Clover Finance ecosystem and serves multiple purposes that enhance its functionality and user engagement within the network:

-

Transaction Fees: CLV tokens are used to pay for transaction fees within the Clover network. This includes fees for transferring assets, interacting with decentralized applications (DApps), and executing smart contracts.

-

Governance: Holders of CLV tokens have governance rights, allowing them to participate in decision-making processes regarding protocol upgrades and changes. This decentralized governance model ensures that the community has a say in the evolution of the platform.

-

Staking: The CLV token can be staked to nominate node validators within the network. By participating in staking, users contribute to the security and stability of the Clover ecosystem while earning rewards in return.

-

Incentives and Rewards: The CLV token is also used to incentivize ecosystem participants, including developers and users. This includes rewards for liquidity providers and other participants who contribute to the network’s growth.

-

Interoperability: Clover Finance aims to bridge various blockchains, and CLV plays a pivotal role in facilitating seamless interactions between them. This cross-chain functionality enhances the versatility and usability of the token across different platforms.

Token Distribution

Understanding the distribution of CLV tokens is essential to grasping its economic model. The total supply of CLV is set at 2 billion tokens, with the following allocation breakdown:

-

Ecosystem Incentives (40%): A significant portion of the tokens is reserved for ecosystem incentives, which will be distributed over a vesting period of 36 months. This allocation is designed to encourage participation in the Clover ecosystem and foster its growth.

-

Coinlist Sale (15%): A portion of the tokens was sold during the Coinlist sale, providing early investors with an opportunity to acquire CLV tokens.

-

Foundation (12%): The foundation retains 12% of the total supply, which will be used to support the long-term development and sustainability of the Clover Finance project. This allocation will also be vested over a 36-month period.

-

Team (10%): The development team is allocated 10% of the total supply, which is also subject to a 36-month vesting period. This ensures that the team’s interests are aligned with the long-term success of the project.

-

Early Backers (10%): Early supporters of Clover Finance are rewarded with 10% of the total supply, vested over 36 months. This incentivizes early investment and loyalty to the project.

-

Marketing (7.5%): A portion of the tokens (7.5%) is allocated for marketing efforts to promote Clover Finance and expand its user base. This allocation will also be vested over 36 months.

-

Contributors Grant (3%): To encourage contributions from the community, 3% of the total supply is reserved for grants to contributors, ensuring that the community remains engaged and motivated.

-

Private Sale (2.5%): A small portion (2.5%) of the tokens was sold in a private sale to qualified investors, with an 18-month vesting period in place.

Conclusion

Clover Finance’s tokenomics is strategically designed to promote the growth and sustainability of the ecosystem. With a total supply of 2 billion CLV tokens, the distribution model ensures that various stakeholders, including users, developers, and early investors, are incentivized to participate in the network. The utility of the CLV token extends beyond mere transactions, encompassing governance, staking, and cross-chain interoperability, thereby enhancing its value proposition. Understanding these elements is crucial for anyone looking to invest in or utilize Clover Finance’s offerings effectively.

Price History and Market Performance

Key Historical Price Milestones

Clover Finance (CLV) has experienced a notable price trajectory since its inception. The project was launched in May 2020, and its token, CLV, was made available to the public shortly thereafter. Here are some key historical price milestones that highlight the significant fluctuations in CLV’s market performance:

-

Initial Launch and Early Trading: After its launch, CLV saw initial trading at relatively low prices, typical for new projects. In the months following its release, the price hovered around $0.10 to $0.30, reflecting early investor sentiment and the gradual adoption of the platform.

-

All-Time High (ATH): The most significant milestone for CLV occurred on April 27, 2021, when it reached an all-time high (ATH) of approximately $42.21. This peak was driven by a combination of factors, including increased interest in decentralized finance (DeFi) platforms, the broader cryptocurrency market rally, and the unique selling points of Clover Finance, such as cross-chain compatibility and a robust infrastructure for DApps.

-

Subsequent Decline: Following its ATH, CLV experienced a sharp decline, consistent with market corrections that affected many cryptocurrencies. By the end of 2021, the price had plummeted significantly, reflecting the volatility inherent in the crypto market.

-

Recent Price Performance: As of October 2023, the price of CLV has settled around $0.01792, representing a decline of over 99% from its all-time high. This downturn can be attributed to various market dynamics, including changing investor sentiment and broader economic factors affecting the cryptocurrency landscape.

Factors Influencing the Price

Historically, the price of CLV has been influenced by a range of factors, both intrinsic to the project and external to the cryptocurrency ecosystem. Understanding these factors can provide insights into the market dynamics that have shaped CLV’s price over time.

Market Sentiment and Speculation

Market sentiment plays a crucial role in determining the price of cryptocurrencies, including CLV. During periods of bullish sentiment in the broader crypto market, CLV often experienced price surges as investors sought exposure to emerging projects. Conversely, bearish sentiment typically led to sharp declines, as seen after the ATH in April 2021. The speculative nature of cryptocurrency investment often amplifies these price movements, as traders react to news, trends, and social media buzz.

Technological Developments and Upgrades

Clover Finance’s development and technological advancements have significantly impacted its price. Announcements regarding upgrades, new partnerships, or features have historically led to positive price movements. For instance, the launch of the Clover mainnet in July 2021 was a pivotal moment that attracted attention and investment, contributing to the initial price rise. Conversely, delays or setbacks in development can lead to negative sentiment and price declines.

Market Conditions and Economic Factors

The broader economic landscape also influences the price of CLV. Factors such as regulatory developments, macroeconomic trends, and shifts in investor behavior towards risk assets can have a pronounced effect. For example, the tightening of monetary policy or adverse regulatory news can lead to market-wide sell-offs, impacting CLV alongside other cryptocurrencies.

Competition and Market Position

Clover Finance operates in a competitive environment with various other DeFi platforms and blockchain solutions. The emergence of new competitors or significant advancements by existing ones can affect CLV’s market position and, consequently, its price. If investors perceive that Clover is falling behind in technological innovation or market adoption, this can lead to reduced interest and lower prices.

Trading Volume and Liquidity

Trading volume is another critical factor influencing CLV’s price. Higher trading volumes typically correlate with increased price stability and can indicate robust investor interest. Conversely, low trading volumes can lead to higher volatility and price swings, as even small buy or sell orders can disproportionately impact the price. Historical data shows that CLV has experienced fluctuations in trading volume, which has directly affected its market performance.

Conclusion

In summary, the price history and market performance of Clover Finance (CLV) reflect a complex interplay of market sentiment, technological advancements, economic conditions, competition, and trading dynamics. From its initial launch to its all-time high and subsequent decline, CLV’s price has been shaped by both internal developments and external market forces. Understanding these factors provides a clearer picture of how CLV has performed historically and highlights the inherent volatility and unpredictability of the cryptocurrency market.

Where to Buy clv coin: Top Exchanges Reviewed

5. Clover Finance – Your Gateway to Seamless CLV Trading!

Clover Finance stands out for its seamless trading experience, particularly on platforms like Kucoin, which currently leads in CLV trading volume with nearly $946 in the past 24 hours. This exchange not only facilitates the buying, selling, and trading of CLV tokens efficiently but also offers users robust liquidity and a user-friendly interface, making it an ideal choice for both new and seasoned investors in the Clover Finance ecosystem.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Top Exchanges for Clover Finance: Your Ultimate Trading Guide!

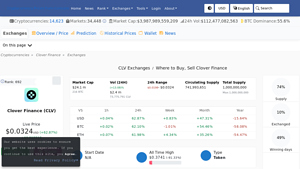

Clover Finance (CLV) is available on over 14 crypto exchanges, with Binance, Gate, and HTX standing out as the top platforms for trading. Binance offers a wide range of supported trading pairs, including BTC and BUSD, making it a preferred choice for liquidity and trading volume. The user-friendly interfaces and robust security measures of these exchanges enhance the trading experience, appealing to both novice and experienced investors looking to buy or sell CLV.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. Clover Finance – Your Gateway to DeFi on Coinbase!

Coinbase stands out as a premier platform for purchasing Clover Finance in the United States due to its user-friendly interface, robust security measures, and strong reputation in the cryptocurrency community. As a centralized exchange, Coinbase offers a seamless buying experience, making it accessible for both beginners and experienced investors. Its commitment to regulatory compliance and customer support further enhances its appeal, positioning it as a trusted choice for managing digital assets like Clover Finance.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

5 Steps to Effortlessly Buy Clover Finance (CLV) Today!

The guide on Bitcompare for purchasing Clover Finance (CLV) highlights the standout features of various exchanges, including Kraken, OKX, Uphold, and BingX, which offer competitive pricing for CLV. With a focus on user-friendly steps for both beginners and experienced traders, the article emphasizes the importance of choosing the right exchange based on transaction fees and security, making it a valuable resource for anyone looking to invest in Clover Finance.

- Website: bitcompare.net

- Platform Age: Approx. 6 years (domain registered in 2019)

7. Clover Finance – Your Gateway to DeFi Success!

Kraken stands out as a user-friendly exchange for purchasing Clover Finance (CLV), allowing users to start investing with as little as $10. The platform supports multiple payment options, including credit/debit cards, ACH deposits, and mobile payments via Apple and Google Pay, making it accessible for both beginners and experienced investors. With its robust security measures and intuitive interface, Kraken is an excellent choice for acquiring CLV seamlessly.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

How to Buy clv coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing CLV coin is to select a reliable cryptocurrency exchange. There are several platforms where you can buy CLV, including:

- Centralized Exchanges (CEX): Popular exchanges like Binance, Coinbase, OKEx, and KuCoin allow you to buy CLV using fiat currencies or other cryptocurrencies. These exchanges are user-friendly and suitable for beginners.

- Decentralized Exchanges (DEX): If you prefer trading directly from your crypto wallet without intermediaries, consider platforms like Uniswap or PancakeSwap. However, be aware that DEXs may require a bit more technical knowledge.

Before choosing an exchange, check the following:

- Supported Payment Methods: Ensure the exchange allows deposits in your preferred currency.

- Fees: Look into trading fees, deposit fees, and withdrawal fees.

- Security: Research the exchange’s security measures and user reviews.

2. Create and Verify Your Account

Once you have chosen an exchange, the next step is to create an account. Here’s how to do it:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will be prompted to enter your email address and create a password.

- Email Verification: After signing up, check your email for a verification link. Click on it to verify your email address.

- Identity Verification: Most exchanges require identity verification for compliance with regulations. Prepare to provide personal information such as your name, address, date of birth, and possibly a government-issued ID. Follow the instructions provided by the exchange to complete this process.

- Two-Factor Authentication (2FA): Enable 2FA for added security. This usually involves linking your account to a mobile authentication app like Google Authenticator.

3. Deposit Funds

Now that your account is set up and verified, you can deposit funds:

- Go to the Deposit Section: Log into your exchange account and navigate to the “Wallet” or “Funds” section. Look for the option to deposit.

- Choose Your Deposit Method: Select your preferred deposit method. Most exchanges allow you to deposit via bank transfer, credit/debit card, or by transferring cryptocurrency from another wallet.

- Follow the Instructions: If depositing fiat currency, follow the instructions to link your bank account or input your card details. For cryptocurrency deposits, copy the wallet address provided by the exchange and use it to send your crypto from another wallet.

- Confirm Your Deposit: Depending on the method chosen, it may take some time for the funds to reflect in your account. Ensure you check your account balance after the deposit is processed.

4. Place an Order to Buy CLV Coin

With funds in your account, you can now purchase CLV coins:

- Navigate to the Trading Section: Find the trading section of the exchange, often labeled as “Markets” or “Trade.”

- Select CLV: Search for the CLV coin in the list of available cryptocurrencies. You may need to search for “Clover Finance” or use the CLV trading pair, such as CLV/USD or CLV/BTC.

- Choose the Type of Order: You can place different types of orders:

– Market Order: Buy at the current market price. This is the simplest option for beginners.

– Limit Order: Set a specific price at which you want to buy CLV. This order will only execute when the market reaches your specified price. - Enter the Amount: Specify how much CLV you want to buy. Review the total cost and any fees before confirming your order.

- Confirm the Purchase: Once satisfied, click the “Buy” button to complete the transaction.

5. Secure Your Coins in a Wallet

After purchasing CLV coins, it’s essential to secure them properly:

- Choose a Wallet: You can store your CLV coins in various wallets, such as:

– Exchange Wallet: Convenient but less secure. Consider this only for short-term storage.

– Software Wallet: Applications like Trust Wallet or MetaMask provide more control and security.

– Hardware Wallet: Devices like Ledger or Trezor offer the highest security for long-term storage. - Transfer Your CLV Coins: If you decide to use a personal wallet, navigate to the withdrawal section of the exchange. Enter your wallet address and the amount of CLV you wish to transfer. Double-check the address to avoid losing your funds.

- Confirm the Transfer: Follow any additional steps required by the exchange to complete the withdrawal. Check your wallet to ensure the CLV coins have arrived.

By following these steps, you can successfully purchase and secure your CLV coins, allowing you to participate in the Clover Finance ecosystem. Always stay informed about market trends and security practices to protect your investment.

Investment Analysis: Potential and Risks

Overview of CLV Coin

Clover Finance (CLV) is a blockchain operating system designed to facilitate cross-chain compatibility for decentralized finance (DeFi) applications. It offers a multi-layered infrastructure that includes various components such as a storage layer, a smart contract layer, and a DeFi protocol layer. The CLV token serves multiple purposes within the Clover ecosystem, including governance, transaction payments, and incentivizing participation. As of now, CLV is ranked #849 in the cryptocurrency market, with a market cap of approximately $21.93 million and a trading price around $0.01792.

Investors considering CLV should weigh the potential strengths against the risks associated with this digital asset.

Potential Strengths (The Bull Case)

1. Unique Technological Infrastructure

Clover Finance has developed a unique technological framework that bridges the gap between different blockchain ecosystems. By leveraging the Substrate framework and Polkadot parachain technology, Clover offers enhanced security and transaction speed. This multi-layered approach allows developers to build decentralized applications (DApps) that can operate across multiple blockchains, significantly increasing the utility of the platform.

2. Growing Demand for Cross-Chain Solutions

The demand for cross-chain solutions is rising as the cryptocurrency ecosystem matures. Users and developers are increasingly looking for ways to interact seamlessly across different blockchain networks. Clover’s focus on interoperability positions it well to capture a share of this growing market. As DeFi continues to expand, platforms that facilitate cross-chain interactions will likely see increased adoption.

3. Governance and Community Involvement

The CLV token offers governance capabilities, allowing holders to vote on network upgrades and participate in decision-making processes. This decentralized governance model fosters a sense of community and can lead to more user-driven developments. Engaged communities can enhance the resilience and adaptability of a project, which is crucial in the fast-evolving crypto landscape.

4. Experienced Team

The founding team of Clover Finance has a diverse background in enterprise resource planning, blockchain technology, and human-computer interaction. Their combined expertise provides a strong foundation for the project, as experienced teams are often better equipped to navigate challenges and drive innovation. The credibility of the team can also instill confidence among potential investors.

5. Incentive Structures

Clover Finance employs various incentive mechanisms to encourage user participation and engagement. For instance, the identity-based gas fee schedule allows frequent users to benefit from reduced fees, which could enhance user retention and attract new participants. Furthermore, the ecosystem incentives tied to the distribution of CLV tokens can stimulate network growth.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

Cryptocurrencies, including CLV, are known for their price volatility. The price of CLV has seen significant fluctuations, with an all-time high of $2.17 in August 2021, marking a decline of over 99% to its current price. This volatility can lead to substantial losses for investors, particularly those with a short-term investment horizon. Such market dynamics can be influenced by broader market trends, investor sentiment, and macroeconomic factors.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is continuously evolving, and Clover Finance is not immune to these changes. Governments worldwide are increasingly scrutinizing digital assets, which could lead to new regulations that impact the operation and adoption of platforms like Clover. Regulatory actions can create uncertainty, potentially affecting CLV’s market performance and its long-term viability. Investors should remain informed about regulatory developments and consider their potential implications on the project.

3. Competition

The DeFi space is highly competitive, with numerous projects vying for attention and market share. Clover Finance faces competition from established platforms and emerging projects that offer similar services. This competitive pressure may limit CLV’s growth potential and market penetration. Investors should analyze the competitive landscape to understand Clover’s positioning and differentiation strategies.

4. Technological Risks

While Clover Finance offers a robust technological framework, it is not without risks. As with any blockchain-based project, there are potential vulnerabilities related to smart contracts, security breaches, and network scalability. If the Clover platform experiences technical failures, it could undermine user confidence and lead to a decline in adoption. Additionally, the complexity of the technology may pose challenges for developers, potentially slowing down the pace of innovation.

5. Dependence on Market Sentiment

The success of CLV is closely tied to market sentiment and the overall health of the cryptocurrency ecosystem. Negative market conditions, such as downturns in major cryptocurrencies like Bitcoin and Ethereum, can adversely affect investor interest and liquidity for CLV. This dependence on broader market trends means that CLV could suffer even if the underlying technology and fundamentals are sound.

Conclusion

Investing in CLV coin presents a range of opportunities and challenges. On one hand, Clover Finance’s innovative technology, focus on cross-chain interoperability, and engaged community offer a compelling case for potential growth. On the other hand, investors must navigate market volatility, regulatory uncertainties, and competitive pressures that could impact the project’s success.

As with any investment, it’s crucial for potential investors to conduct thorough research and consider their risk tolerance before engaging with CLV or any other cryptocurrency. Understanding both the potential and the risks can help investors make informed decisions and navigate the complexities of the crypto market effectively.

Frequently Asked Questions (FAQs)

1. What is CLV Coin?

Clover Finance, commonly known as CLV, is a blockchain operating system designed to provide a comprehensive infrastructure for decentralized applications (DApps) and decentralized finance (DeFi) solutions. It aims to bridge the compatibility gap between different blockchains, allowing developers and users to interact seamlessly across multiple networks. The CLV token serves multiple purposes within the ecosystem, including transaction fees, governance, and voting on network upgrades.

2. Who created CLV Coin?

CLV was founded by a team of experienced professionals in the blockchain space: Viven Kirby, Norelle Ng, and Burak Keçeli. Viven Kirby serves as the project lead with a background in enterprise resource planning, while Norelle Ng brings expertise in human-computer interaction and blockchain technology. Burak Keçeli, the tech lead, has a strong programming background and has previously developed various applications and platforms.

3. How does CLV Coin work?

CLV operates on a multi-layered structure that includes a storage layer, a smart contract layer, a DeFi protocol layer, and an eApp layer. This architecture allows developers to create and deploy DApps and eApps that function across various blockchains. The network utilizes a proof-of-stake (PoS) consensus mechanism, enabling CLV holders to stake their tokens to help validate transactions and participate in governance.

4. What makes CLV Coin different from Bitcoin?

While Bitcoin is primarily a digital currency focused on peer-to-peer transactions, CLV is designed as a blockchain operating system facilitating cross-chain compatibility and decentralized applications. CLV aims to enhance interoperability among different blockchains and offers a broader range of functionalities, including governance, staking, and multi-chain support, making it more versatile for developers and users in the DeFi space.

5. Is CLV Coin a good investment?

As with any cryptocurrency, whether CLV is a good investment depends on various factors, including market conditions, the project’s development, and individual financial goals. While CLV has shown potential in the DeFi space and has a dedicated team behind it, investors should conduct thorough research and consider their risk tolerance before investing. It’s also crucial to keep an eye on market trends and the overall performance of the cryptocurrency.

6. Where can I buy CLV Coin?

You can purchase CLV Coin on various centralized and decentralized exchanges, including Binance, Coinbase, KuCoin, and OKEx. Some platforms allow direct fiat purchases, while others require trading against other cryptocurrencies. Before buying, ensure that you are using a reputable exchange and understand the associated fees.

7. What are the potential use cases for CLV Coin?

CLV Coin is designed for a variety of use cases within the Clover Finance ecosystem, including:

– Transaction Fees: Users can pay for transaction fees using CLV tokens.

– Governance: CLV holders can vote on important network decisions and upgrades.

– Staking: Users can stake their CLV tokens to help secure the network and earn rewards.

– DApp Development: Developers can utilize CLV to create cross-chain decentralized applications.

8. What is the market performance of CLV Coin?

As of now, CLV Coin has a market capitalization of approximately $21.93 million, with a circulating supply of about 1.22 billion tokens. Its price fluctuates based on market conditions, with an all-time high of approximately $2.17 reached in August 2021. Like other cryptocurrencies, the price of CLV can be highly volatile, and it’s essential for investors to monitor its performance regularly.

Final Verdict on clv coin

Overview of CLV Coin

Clover Finance, represented by the CLV token, aims to provide a robust blockchain infrastructure that enhances cross-chain compatibility for decentralized finance (DeFi) applications. By leveraging the Substrate framework and Polkadot’s parachain technology, Clover offers a multi-layered platform that includes a storage layer, smart contract layer, DeFi protocol layer, and an eApp layer. This architecture allows developers to build and deploy applications that can operate seamlessly across various blockchains, thereby bridging the existing compatibility gaps in the blockchain ecosystem.

Key Features and Technology

The CLV token serves multiple purposes within the Clover ecosystem. It is primarily used for transaction fees and governance, allowing holders to vote on system upgrades and nominate validators within a proof-of-stake consensus mechanism. Additionally, Clover’s unique identity-based gas fee structure rewards frequent users with reduced fees, promoting user engagement and network activity. The project is designed to cater to both novice and experienced users, making DeFi more accessible to a wider audience.

Investment Considerations

Despite its innovative features and potential for growth, investing in CLV coin carries inherent risks. The cryptocurrency market is notoriously volatile, and CLV has experienced significant price fluctuations, including a steep decline from its all-time high of $42.21. As of now, it trades at approximately $0.01792, indicating a high-risk, high-reward investment profile.

Conclusion

In conclusion, CLV coin offers a compelling proposition for those interested in the evolving landscape of blockchain technology and DeFi applications. However, potential investors should exercise caution and perform thorough due diligence. The dynamic nature of the cryptocurrency market necessitates that you conduct your own research (DYOR) to make informed decisions tailored to your financial goals and risk tolerance.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.