chia crypto Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to chia crypto

Chia Network, often referred to as “Chia crypto” or simply “Chia,” represents a unique evolution in the cryptocurrency landscape. Founded by Bram Cohen, the inventor of the BitTorrent protocol, Chia aims to create a more sustainable and efficient blockchain ecosystem. Unlike many other cryptocurrencies that rely on energy-intensive consensus mechanisms, Chia utilizes a novel consensus algorithm known as Proof of Space and Time (PoST). This approach allows users to “farm” Chia by allocating unused disk space, making it a more environmentally friendly option compared to traditional mining methods.

Chia’s significance in the crypto market extends beyond its innovative consensus mechanism. It is positioned as a layer-1 blockchain designed for a wide range of applications, particularly in the enterprise sector. With its custom programming language, Chialisp, Chia facilitates the development of smart contracts and decentralized applications, providing developers with the tools to create scalable and secure solutions. This versatility has garnered interest from businesses and institutions looking to leverage blockchain technology for various use cases, including data integrity, asset tokenization, and carbon market infrastructure.

The purpose of this guide is to serve as a comprehensive resource for both beginners and intermediate investors interested in Chia crypto. We will delve into the underlying technology that powers Chia, exploring its consensus mechanism and programming language. Understanding the technical aspects is crucial for assessing its potential impact on the broader cryptocurrency ecosystem.

In addition to technology, we will examine the tokenomics of Chia (XCH), including its supply dynamics, market performance, and historical price trends. This analysis will help investors gauge the asset’s investment potential and understand the factors that may influence its value over time.

Moreover, we will discuss the associated risks of investing in Chia, including market volatility and regulatory considerations. A balanced view of the risks and rewards will enable investors to make informed decisions.

Lastly, we will provide practical guidance on how to buy and store Chia, ensuring that readers have the necessary information to navigate the acquisition process confidently. Whether you are looking to invest in Chia for the long term or explore its technological innovations, this guide will equip you with the knowledge needed to engage with this pioneering digital asset effectively.

What is chia crypto? A Deep Dive into its Purpose

Understanding Chia Crypto

Chia Network, often referred to as Chia crypto or XCH, is a layer-1 blockchain platform that aims to create a more sustainable and efficient framework for digital transactions. Founded by Bram Cohen, the creator of the BitTorrent protocol, Chia seeks to address the inherent inefficiencies and environmental concerns associated with traditional blockchain technologies, particularly those using proof-of-work (PoW) consensus mechanisms.

The Core Problem It Solves

The primary issue that Chia addresses is the excessive energy consumption and environmental impact associated with conventional cryptocurrency mining methods, particularly those that rely on proof-of-work. Bitcoin, for example, requires massive amounts of computational power and energy, leading to significant carbon footprints and concerns about sustainability.

Chia introduces a novel consensus mechanism known as Proof of Space and Time (PoST). This mechanism leverages unused disk space on hard drives instead of consuming vast amounts of electrical energy. In PoST, miners (or “farmers,” as they are referred to in the Chia ecosystem) allocate storage space to create “plots” of data. These plots are then used to solve cryptographic challenges, allowing farmers to earn rewards in the form of XCH, Chia’s native cryptocurrency. This method not only reduces energy consumption but also makes it possible for more individuals to participate in the network without needing specialized, energy-intensive hardware.

Its Unique Selling Proposition

Chia’s unique selling proposition lies in its innovative consensus mechanism and its focus on sustainability and accessibility. Here are some key aspects that set Chia apart from other cryptocurrencies:

-

Energy Efficiency: By utilizing available disk space instead of energy-intensive computations, Chia significantly lowers its environmental impact. This positions Chia as a more sustainable alternative to traditional cryptocurrencies.

-

Decentralization and Accessibility: Chia’s farming process can be done using common consumer hardware, making it more accessible to a broader audience. This contrasts sharply with Bitcoin mining, which often requires expensive, specialized equipment.

-

Smart Contracts with Chialisp: Chia features its own programming language, Chialisp, designed specifically for creating smart contracts. Chialisp is built to be powerful yet easy to audit, enhancing security and transparency in transactions.

-

Enterprise Applications: Chia is tailored not only for individual users but also for enterprise solutions. Its blockchain technology is designed to support various applications, including supply chain management, digital asset tokenization, and carbon market infrastructure. This focus on enterprise use cases differentiates Chia from many other cryptocurrencies that primarily target retail investors.

-

Regulatory Compliance: Chia Network aims to align itself with regulatory frameworks, making it appealing to traditional financial institutions. This compliance-oriented approach can facilitate broader adoption and integration into existing financial systems.

The Team and Backers Behind the Project

Chia Network is backed by an experienced team of professionals from various sectors, which enhances its credibility and potential for success. The project was co-founded by Bram Cohen, who is best known for creating the BitTorrent protocol. His experience in peer-to-peer technology provides a strong foundation for Chia’s decentralized objectives.

Other notable members of the Chia team include:

-

Gene Hoffman: Former CEO of NASDAQ and currently the Chief Operating Officer (COO) at Chia Network. His extensive background in finance and technology brings valuable insights into the project’s strategic direction.

-

Mitch Edwards: Former CEO of Overstock.com, who serves as the Chief Financial Officer (CFO) at Chia Network. His experience in e-commerce and finance is instrumental in guiding Chia’s growth and market positioning.

The support from these experienced professionals, along with a dedicated development team, positions Chia to tackle challenges effectively and innovate within the blockchain space.

Fundamental Purpose in the Crypto Ecosystem

Chia’s fundamental purpose is to create a more sustainable, efficient, and inclusive blockchain ecosystem. By addressing the energy consumption issues associated with traditional mining and introducing a more accessible farming model, Chia aims to broaden the base of participation in cryptocurrency networks.

Additionally, Chia’s focus on enterprise solutions and regulatory compliance provides a pathway for integrating blockchain technology into existing financial frameworks. This could lead to increased adoption of digital assets by institutional players and traditional financial entities, ultimately contributing to the maturation of the cryptocurrency market.

Moreover, Chia’s commitment to sustainability aligns with the growing awareness and demand for environmentally friendly technologies. As the world increasingly recognizes the need for sustainable practices, Chia’s model could serve as a blueprint for future blockchain projects, encouraging others to adopt similar approaches.

In summary, Chia Network represents a significant evolution in the cryptocurrency landscape, prioritizing sustainability, accessibility, and regulatory compliance. Its unique consensus mechanism, combined with a robust development team, positions it as a promising player in the quest for a more efficient and equitable blockchain ecosystem.

The Technology Behind the Coin: How It Works

Overview of Chia Network

Chia Network, founded by Bram Cohen, the inventor of BitTorrent, aims to create a more efficient and sustainable blockchain platform. Unlike traditional cryptocurrencies that rely on energy-intensive methods, Chia introduces innovative concepts to enhance decentralization, security, and energy efficiency. This guide explores the technology that powers Chia, focusing on its blockchain architecture, consensus mechanism, and key innovations.

Blockchain Architecture

Chia Network operates as a Layer 1 blockchain, meaning it functions independently and doesn’t require another blockchain to operate. Its architecture is designed to support a wide range of applications, making it suitable for both individual users and enterprises.

Data Layer

At its core, Chia’s blockchain is structured around a data layer that allows for the secure storage and management of digital assets. This layer is built to ensure high throughput and low latency, enabling quick transactions and smart contract execution. The data layer employs a unique approach to data management, which facilitates efficient asset tracking and auditing.

Smart Contracts with Chialisp

Chia introduces a new programming language called Chialisp. This language is specifically designed for creating smart contracts on the Chia blockchain. Chialisp is powerful yet easy to audit, making it secure and accessible for developers. Its design allows for complex logic to be implemented while ensuring that the contracts remain transparent and verifiable. This is essential for building trust in decentralized applications (dApps) that operate on the Chia Network.

Consensus Mechanism

Chia’s consensus mechanism is a significant departure from traditional models like Proof-of-Work (PoW) and Proof-of-Stake (PoS). Instead, it employs a dual mechanism called Proof of Space and Time (PoST), which enhances energy efficiency and security.

Proof of Space

In the PoST model, miners (referred to as “farmers” in Chia) allocate unused storage space on their hard drives to participate in the network. This approach leverages existing hardware, allowing users to contribute to the network without the need for specialized, energy-consuming equipment like ASIC miners used in PoW systems. The more storage space a farmer dedicates, the higher their chances of being selected to create new blocks and earn rewards.

Proof of Time

Alongside Proof of Space, Chia incorporates Proof of Time to ensure that the network maintains a consistent pace. This aspect of the consensus mechanism uses Verifiable Delay Functions (VDFs), which require a certain amount of time to compute. This method prevents manipulation and ensures that the passage of time is verifiable, adding an additional layer of security to the blockchain.

Key Technological Innovations

Chia Network incorporates several technological innovations that differentiate it from other blockchain platforms. Here are some of the most notable features:

Energy Efficiency

One of the primary goals of Chia is to reduce the environmental impact associated with cryptocurrency mining. By utilizing hard drive space instead of computational power, Chia significantly lowers energy consumption. This shift towards sustainability is becoming increasingly important as the crypto industry faces scrutiny over its carbon footprint.

Dynamic Block Sizes

Chia supports dynamic block sizes, which allow the network to adjust to varying transaction volumes. This flexibility ensures that the blockchain can handle spikes in activity without congestion, making it more robust and efficient for users.

Advanced Asset Management

The Chia Network is designed for advanced asset management, enabling users to tokenize real-world assets and manage them on the blockchain. This feature opens up possibilities for various applications, including supply chain management, real estate, and carbon credits. The ability to maintain an immutable record of asset provenance is crucial for industries that require transparency and trust.

Interoperability

Chia is built with interoperability in mind, allowing it to connect with other blockchains and traditional financial systems. This capability is essential for enabling broader adoption and integration of blockchain technology into existing infrastructures. By facilitating seamless interactions between different systems, Chia aims to create a more inclusive financial ecosystem.

Use Cases for Chia

The unique technology behind Chia enables a wide range of use cases, particularly in enterprise settings. Here are a few potential applications:

Carbon Market Infrastructure

Chia’s blockchain technology can enhance carbon market infrastructure by providing transparent and auditable records of carbon credits. This application is particularly relevant as businesses and governments seek to address climate change and track their emissions accurately.

Luxury Goods Authentication

Chia can be utilized to authenticate luxury products, providing a verifiable record of provenance. This application helps combat counterfeiting and ensures that consumers can trust the authenticity of high-value items.

Decentralized Finance (DeFi)

With its smart contract capabilities, Chia opens up opportunities for decentralized finance applications. Developers can create financial products and services that operate without intermediaries, providing users with greater control over their assets.

Conclusion

Chia Network represents a significant advancement in blockchain technology, focusing on sustainability, efficiency, and security. By leveraging innovative concepts like Proof of Space and Time, dynamic block sizes, and a powerful programming language, Chia aims to create a more inclusive and environmentally friendly financial ecosystem. Whether for individual users or enterprises, Chia’s technological foundation offers a compelling alternative to traditional blockchain platforms, positioning it well for the future of digital assets. As the cryptocurrency landscape continues to evolve, Chia’s unique approach may play a vital role in shaping the next generation of blockchain technology.

Understanding chia crypto Tokenomics

Chia Network (XCH) is a cryptocurrency that introduces a unique approach to blockchain technology and tokenomics. Founded by Bram Cohen, the creator of BitTorrent, Chia aims to provide a more efficient and eco-friendly alternative to traditional proof-of-work systems. This section delves into the tokenomics of Chia, covering key metrics, token utility, and distribution.

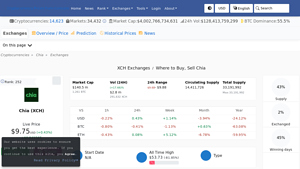

| Metric | Value |

|---|---|

| Total Supply | 33 million XCH |

| Max Supply | Not enough data |

| Circulating Supply | 14 million XCH |

| Inflation/Deflation Model | Deflationary with gradual reduction in rewards |

Token Utility (What is the coin used for?)

Chia’s native token, XCH, serves multiple purposes within the Chia ecosystem:

-

Transaction Fees: XCH is used to pay for transaction fees on the Chia network. As transactions are processed, a small amount of XCH is deducted as a fee, which incentivizes validators (referred to as “farmers” in the Chia ecosystem) to maintain the network.

-

Farming Rewards: Unlike traditional mining, Chia employs a “farming” model where users allocate unused storage space on their hard drives to secure the network. In return, they receive XCH as rewards. This model promotes energy efficiency, as it requires significantly less power compared to proof-of-work mining.

-

Smart Contracts: Chia supports smart contracts through its programming language, Chialisp. Users can utilize XCH to execute smart contracts, enabling a range of decentralized applications (dApps) on the Chia blockchain. This functionality opens up opportunities for various use cases, including decentralized finance (DeFi), asset tokenization, and supply chain management.

-

Governance: Although still evolving, XCH may play a role in governance decisions within the Chia ecosystem. This could involve voting on protocol upgrades or changes, aligning the interests of the community with the direction of the project.

-

Staking and Lending: As the ecosystem matures, XCH may also be used for staking or lending within DeFi applications, allowing holders to earn additional returns on their assets.

Token Distribution

The distribution of XCH is designed to ensure a fair and equitable launch while maintaining incentives for long-term participation in the network.

-

Initial Distribution: Upon launch, Chia distributed a portion of XCH to early investors and contributors, including the development team and advisors. This initial allocation was aimed at fostering development and adoption of the platform.

-

Farming Rewards: The majority of XCH is allocated for farming rewards. As users dedicate their storage capacity to the network, they earn XCH over time. This process is designed to create a decentralized network of farmers, reducing reliance on a small number of large players.

-

Community Incentives: A portion of XCH is set aside for community initiatives, including grants for developers, marketing efforts, and partnerships. This allocation encourages community engagement and supports the growth of the ecosystem.

-

Future Allocations: Chia has plans for future allocations that may include partnerships with enterprises and other blockchain projects. This approach aims to expand the utility and adoption of XCH beyond individual users to institutional players as well.

Conclusion

Chia’s tokenomics reflect a thoughtful approach to creating a sustainable and user-friendly blockchain ecosystem. By leveraging a unique farming mechanism and a focus on smart contracts, Chia aims to stand out in the crowded cryptocurrency landscape. As the network evolves, understanding the tokenomics of XCH will be essential for both new and experienced investors looking to participate in this innovative project. With its deflationary model and diverse utility, XCH has the potential to play a significant role in the future of decentralized finance and blockchain applications.

Price History and Market Performance

Key Historical Price Milestones

Chia Network (XCH) has experienced a noteworthy price journey since its inception. Founded in 2017 by Bram Cohen, the creator of BitTorrent, Chia officially launched its mainnet in March 2021. The token quickly garnered attention for its unique consensus mechanism, known as Proof of Space and Time (PoST), which aims to provide a more energy-efficient alternative to traditional Proof of Work (PoW) systems.

Initial Launch and Early Performance

Upon its launch, Chia’s price was approximately $0.25. The cryptocurrency market was already witnessing a bullish trend, and within weeks, XCH saw substantial increases. By May 2021, Chia reached an all-time high of approximately $1,934.51. This surge was attributed to a combination of factors, including increased interest in environmentally friendly blockchain solutions and a broader market rally in the cryptocurrency space.

Post-Launch Volatility

After hitting its peak in May 2021, Chia’s price underwent significant volatility. The broader cryptocurrency market faced corrections, which also impacted XCH. By the end of 2021, the price had dropped to around $300, showcasing a typical post-rally decline seen in many cryptocurrencies.

2022 and Beyond

As 2022 unfolded, Chia continued to experience fluctuations in its market value. By mid-2022, the price had stabilized around the $50 mark, reflecting a more mature trading environment. However, challenges such as regulatory scrutiny and competition from other blockchain projects began to influence investor sentiment and market dynamics.

As of October 2023, Chia’s price has seen further declines, with current trading values hovering around $9.73, marking a significant decrease from its all-time high and illustrating the ongoing volatility inherent in the cryptocurrency market.

Factors Influencing the Price

Historically, the price of Chia has been influenced by several key factors:

1. Market Sentiment and Broader Cryptocurrency Trends

The overall sentiment in the cryptocurrency market plays a significant role in determining Chia’s price. Periods of bullish sentiment, characterized by widespread investor enthusiasm, often lead to price surges. Conversely, bearish trends, often triggered by negative news or regulatory developments, can lead to sharp declines. For example, the dramatic price drop from its all-time high in 2021 coincided with a broader market correction affecting numerous digital assets.

2. Adoption of Chia’s Technology

Chia’s unique consensus mechanism, which relies on unused disk space rather than energy-intensive mining, has attracted attention from environmentally conscious investors and developers. As enterprises and developers adopt Chia’s technology for applications such as carbon accounting and asset tokenization, this can positively influence demand for XCH, subsequently affecting its price.

3. Regulatory Developments

Regulatory scrutiny has a profound impact on the cryptocurrency market, and Chia is no exception. News related to regulations, particularly those that affect the use and trading of cryptocurrencies, can result in price fluctuations. For instance, increased regulatory clarity may instill confidence in investors, leading to price increases, while stringent regulations could lead to declines.

4. Technological Developments and Updates

Chia Network continually evolves its technology, and updates to its platform can impact investor confidence and market performance. For instance, the introduction of new features, enhancements to the Chialisp programming language, or improvements in the network’s efficiency can generate positive sentiment and lead to price increases. Conversely, technical issues or delays in development can negatively affect market confidence.

5. Market Competition

The cryptocurrency landscape is highly competitive, with numerous projects vying for attention and market share. Chia faces competition from other blockchain platforms offering similar functionalities, including Ethereum, Solana, and other Layer-1 solutions. The success of these competitors can influence investor perception of Chia’s potential, impacting its price.

6. Trading Volume and Market Capitalization

The trading volume of Chia also serves as an indicator of market interest and liquidity. High trading volumes often correlate with price increases, as they indicate strong investor interest and activity. Conversely, low trading volumes may lead to increased price volatility and potential declines. As of October 2023, Chia has a market capitalization of approximately $140.15 million, which reflects its position within the broader cryptocurrency market.

Conclusion

In summary, the price history and market performance of Chia (XCH) have been shaped by a multitude of factors ranging from market sentiment and technological advancements to regulatory developments and competitive pressures. Understanding these influences is crucial for both novice and experienced investors as they navigate the complexities of investing in cryptocurrencies. By examining historical price milestones and the underlying factors that drive price changes, investors can gain valuable insights into Chia’s market dynamics and its potential role within the evolving landscape of digital assets.

Where to Buy chia crypto: Top Exchanges Reviewed

5. Chia (XCH) – Your Ultimate Guide to Eco-Friendly Investing!

The “How to Buy Chia (XCH) Guide 2025” on CoinCodex highlights key platforms like KuCoin, CoinEx, and OKX for purchasing Chia, emphasizing the importance of thorough research. What sets this guide apart is its comprehensive comparison of fees, security features, and supported payment methods across these exchanges, empowering users to make informed decisions tailored to their specific needs in the evolving cryptocurrency landscape.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Chia (XCH) – Your Green Investment in Sustainable Crypto!

Chia (XCH) can be traded on over 13 cryptocurrency exchanges, with MEXC Global, Gate, and HTX emerging as the top platforms for buying, selling, and trading this unique asset. MEXC Global stands out for its user-friendly interface and diverse trading pairs, while Gate offers robust liquidity and advanced trading features. HTX also provides competitive options, making these exchanges ideal for both novice and experienced investors looking to engage with Chia’s innovative blockchain technology.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

7. Chia Crypto – The Future of Sustainable Trading!

The article “Chia Crypto Trading 2025 | How To Buy And Sell XCH” highlights the unique position of Chia (XCH) in the cryptocurrency market, emphasizing its availability on notable exchanges like OKEx and Gate.io. It addresses the necessity of trading other cryptocurrencies to acquire XCH, which may appeal to seasoned investors seeking diversification. The guide provides essential insights for both newcomers and experienced traders looking to navigate the Chia ecosystem effectively.

- Website: daytrading.com

- Platform Age: Approx. 29 years (domain registered in 1996)

How to Buy chia crypto: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying Chia (XCH) is to select a cryptocurrency exchange that supports trading for this digital asset. Here are a few popular options:

- Coinbase: A user-friendly platform that is ideal for beginners. It provides a secure environment and a straightforward process for buying cryptocurrencies.

- Binance: One of the largest exchanges in terms of trading volume, offering a wide variety of cryptocurrencies, including Chia.

- Kraken: Known for its strong security measures and a solid selection of cryptocurrencies, including XCH.

- Chia Network Wallet: The Chia Cloud Wallet is a new option that allows users to buy XCH directly using ACH from any U.S. bank account.

Before making a choice, consider factors such as the exchange’s fees, user interface, security features, and customer support.

2. Create and Verify Your Account

Once you have selected an exchange, you will need to create an account. Here’s how to do it:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Create Account” button. You will be prompted to enter your email address and create a password.

- Email Verification: After signing up, check your email for a verification link. Click on the link to verify your email address.

- Identity Verification: Most exchanges require identity verification to comply with regulations. This usually involves submitting a government-issued ID and possibly a proof of address (like a utility bill). Follow the instructions provided by the exchange to complete this process.

- Two-Factor Authentication (2FA): For added security, enable two-factor authentication. This typically involves linking your account to a mobile app (like Google Authenticator) to generate a code for logging in.

3. Deposit Funds

With your account verified, the next step is to deposit funds. Most exchanges allow you to deposit in fiat currencies (like USD) or cryptocurrencies. Here’s how to deposit funds:

- Navigate to the Deposit Section: Go to your account dashboard and find the “Deposit” or “Funds” section.

- Choose Your Deposit Method: Select how you want to deposit funds. Common methods include bank transfer (ACH), credit/debit card, or cryptocurrency deposit.

- Enter Deposit Amount: If you’re depositing fiat, enter the amount you wish to deposit. If you’re transferring cryptocurrency, ensure you are sending the correct type to the provided wallet address.

- Confirm Deposit: Follow the prompts to confirm your deposit. If you’re using a bank transfer, it may take a few days for the funds to appear in your account.

4. Place an Order to Buy Chia Crypto

Once your funds are available in your account, you can purchase Chia (XCH):

- Find Chia on the Exchange: Use the search function on the exchange to locate Chia (XCH).

- Select the Trading Pair: Choose the trading pair that matches your deposited currency (e.g., XCH/USD).

- Choose Your Order Type: You can place a market order (buying at the current market price) or a limit order (specifying the price you’re willing to pay).

– Market Order: This will execute immediately at the current market price.

– Limit Order: This will only execute when the price reaches your specified limit. - Enter the Amount: Specify how much Chia you want to buy.

- Review and Confirm: Check the details of your order and confirm the transaction. Your purchased XCH will be credited to your exchange wallet.

5. Secure Your Coins in a Wallet

After purchasing Chia, it’s essential to secure your coins in a wallet. Leaving your assets on an exchange can be risky due to potential hacks or exchange failures. Here’s how to secure your XCH:

- Choose a Wallet: You can select from various wallet types:

– Hardware Wallets: Physical devices like Ledger or Trezor provide high security.

– Software Wallets: Applications or desktop wallets that you can download to your device (e.g., Chia Wallet).

– Paper Wallets: A physical printout of your public and private keys. - Transfer Your XCH: Go to your exchange account, find the “Withdraw” option, and enter your wallet address. Specify the amount of XCH you want to transfer.

- Confirm the Transfer: Double-check the wallet address to avoid mistakes, then confirm the transaction. Depending on network traffic, it may take some time for the transfer to complete.

By following these steps, you can successfully buy and secure Chia (XCH), setting the stage for your journey into cryptocurrency investment. Always remember to stay informed about market conditions and best practices for securing your digital assets.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Chia Network, founded by Bram Cohen, the inventor of BitTorrent, presents a compelling case for investment due to several inherent strengths. Below, we explore the potential benefits and strengths of investing in Chia (XCH).

Innovative Consensus Mechanism

Chia employs a novel consensus mechanism known as Proof of Space and Time (PoST), which distinguishes it from traditional Proof of Work (PoW) and Proof of Stake (PoS) systems. This approach allows users to utilize unused disk space for mining, thus significantly reducing energy consumption compared to PoW systems. This innovation addresses growing concerns about the environmental impact of cryptocurrency mining, potentially attracting more environmentally conscious investors and enterprises.

Smart Contract Capabilities

Chia introduces Chialisp, a unique programming language designed for smart contracts. This language is not only powerful and easy to audit but also enables simultaneous transactions, which can enhance the overall efficiency of blockchain applications. The ability to create complex financial instruments and automated contracts could open up new avenues for developers and businesses, making Chia a more attractive option for enterprise-level applications.

Focus on Real-World Use Cases

Chia’s platform is designed with real-world applications in mind. The network aims to provide solutions for various sectors, including finance, supply chain management, and carbon markets. For instance, partnerships like the Climate Action Data Trust (CADT) demonstrate Chia’s commitment to creating transparent and efficient carbon accounting systems. This focus on practical use cases may enhance its adoption and utility, potentially driving demand for XCH.

Market Position and Future Growth

Despite the challenges faced by the cryptocurrency market, Chia has managed to establish a foothold with a market cap of approximately $140 million as of October 2023. With a total supply of 33 million XCH, the asset has room for growth, especially if it gains traction among institutional investors and enterprises. The broader acceptance of blockchain technology could provide a significant boost to Chia’s market position.

Strong Leadership and Vision

Chia Network is backed by an experienced management team, including former executives from major companies like NASDAQ and Overstock.com. Their expertise and vision for the future of blockchain technology can instill confidence in potential investors. The company’s commitment to compliance and regulatory recognition further demonstrates its seriousness in becoming a mainstream financial technology player.

Potential Risks and Challenges (The Bear Case)

While Chia presents several strengths, potential investors should also consider various risks and challenges that could impact the asset’s performance. Below are key factors to be aware of.

Market Volatility

The cryptocurrency market is notorious for its volatility. XCH, like many other digital assets, can experience significant price fluctuations within short periods. As of October 2023, Chia’s price is around $9.73, down approximately 99% from its all-time high of $1,934.51 in May 2021. Such volatility can lead to substantial financial losses for investors who may enter the market at unfavorable times. This unpredictability can deter risk-averse investors and may lead to speculative trading rather than long-term investment.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving. Governments worldwide are grappling with how to regulate digital assets, and this uncertainty can create risks for projects like Chia. If regulations become overly restrictive or if certain functionalities of Chia’s network are deemed non-compliant, it could hinder its growth and adoption. Furthermore, regulatory scrutiny can lead to reputational damage, which may affect investor confidence.

Competition

Chia faces stiff competition from other blockchain projects that also aim to provide energy-efficient solutions and smart contract capabilities. Established players like Ethereum, which is transitioning to a Proof of Stake model, and newer entrants may attract developers and users away from Chia. The competitive landscape can limit Chia’s market share and hinder its ability to grow, particularly if it cannot differentiate itself effectively from other platforms.

Technological Risks

While Chia’s innovative technology offers distinct advantages, it is not without its risks. The reliance on a unique consensus mechanism could pose challenges in terms of scalability and security. As the network grows, it may face technical hurdles that could lead to vulnerabilities or inefficiencies. Additionally, any unforeseen bugs or flaws in the Chialisp programming language could have significant implications for the smart contracts deployed on the Chia network, potentially leading to financial losses or loss of user trust.

Adoption and Ecosystem Development

Chia’s success largely depends on its adoption by developers and enterprises. While the platform has the potential for real-world applications, the rate at which these use cases are developed and adopted is uncertain. If the Chia ecosystem fails to attract enough developers or if projects on the platform do not gain traction, the overall utility of XCH may diminish, adversely affecting its value.

Conclusion

Investing in Chia (XCH) presents both potential rewards and significant risks. Its innovative consensus mechanism, smart contract capabilities, focus on real-world applications, and strong leadership create a compelling case for investment. However, market volatility, regulatory uncertainties, competition, technological challenges, and the need for ecosystem development are critical factors that potential investors must consider.

As with any investment, thorough research and a clear understanding of one’s risk tolerance are essential. Chia’s future will depend on its ability to navigate these challenges while capitalizing on its strengths to establish itself as a leading player in the evolving landscape of blockchain technology.

Frequently Asked Questions (FAQs)

1. What is Chia Network (XCH)?

Chia Network, denoted by its token XCH, is a layer 1 blockchain platform that utilizes a unique consensus mechanism called Proof of Space and Time (PoST). Unlike traditional blockchains that rely on energy-intensive Proof of Work (PoW) or Proof of Stake (PoS) mechanisms, Chia allows users to mine or “farm” the cryptocurrency by allocating unused disk space on their hard drives. This method is designed to be more energy-efficient while maintaining security and decentralization.

2. Who created Chia Network?

Chia Network was founded in 2017 by Bram Cohen, the inventor of the BitTorrent file-sharing protocol. The team includes experienced professionals, such as former NASDAQ CEO Gene Hoffman and former Overstock.com CEO Mitch Edwards, who bring a wealth of knowledge from the tech and finance sectors to the project.

3. What makes Chia different from Bitcoin?

Chia differentiates itself from Bitcoin primarily through its consensus mechanism. While Bitcoin employs Proof of Work, which requires significant computational power and energy consumption, Chia uses Proof of Space and Time. This allows users to farm XCH by utilizing spare hard drive space, making it a more eco-friendly alternative. Additionally, Chia’s programming language, Chialisp, is designed to facilitate secure and efficient smart contracts, enhancing its functionality beyond that of Bitcoin.

4. Is Chia crypto a good investment?

As with any cryptocurrency, whether Chia is a good investment depends on various factors, including market conditions, individual financial goals, and risk tolerance. Chia has seen significant price fluctuations, reaching an all-time high of $1,934.51 in May 2021 but currently trades at approximately $9.73. Potential investors should conduct thorough research and consider both the technology behind Chia and broader market trends before investing.

5. What are the potential use cases for Chia?

Chia Network is designed for a variety of applications, particularly in the enterprise sector. Its unique technology can support decentralized finance (DeFi), carbon credit trading, and digital asset management. One notable use case is the Climate Action Data Trust (CADT), which leverages Chia’s blockchain for efficient carbon accounting. Developers can also build applications using Chia’s smart contract capabilities, potentially transforming various industries.

6. How does Chia farming work?

Farming Chia involves allocating unused storage space on a hard drive to create “plots.” These plots are then used to participate in the network’s consensus process. When a block is created, farmers with plots are randomly selected to receive rewards in XCH. The process is designed to be more environmentally friendly than traditional mining, as it consumes significantly less energy.

7. What is the current market cap of Chia?

As of the latest data, Chia Network has a market cap of approximately $140.15 million. Market capitalization is an important metric that reflects the total value of a cryptocurrency, calculated by multiplying the current price by the circulating supply of tokens. For Chia, the circulating supply is around 14 million XCH.

8. How can I buy Chia (XCH)?

Chia can be purchased through various cryptocurrency exchanges, including Coinbase. Users can buy XCH using traditional payment methods like bank transfers or credit cards, depending on the exchange’s policies. Additionally, the Chia Cloud Wallet is expected to facilitate purchasing XCH using Automated Clearing House (ACH) transfers from U.S. bank accounts, making it more accessible for users.

Final Verdict on chia crypto

Overview of Chia Crypto

Chia Network (XCH) presents a unique approach to blockchain technology by utilizing a consensus mechanism known as Proof of Space and Time (PoST). This innovative method distinguishes it from traditional Proof of Work (PoW) and Proof of Stake (PoS) systems, as it relies on unused disk space rather than energy-intensive computations. Founded by Bram Cohen, the creator of BitTorrent, Chia aims to provide a more energy-efficient and secure platform for decentralized applications and smart contracts. Its programming language, Chialisp, enhances the platform’s capabilities, making it accessible for developers while ensuring robust security and ease of auditing.

Purpose and Potential

Chia’s primary goal is to improve the efficiency and sustainability of blockchain technology. It is designed for various applications, particularly in enterprise settings, where it can enhance data management and infrastructure. Chia Network seeks to facilitate tokenization, custody, and trading of digital assets, paving the way for new financial products and services. The potential use cases are broad, ranging from carbon market infrastructure to luxury goods authentication, showcasing its versatility.

Investment Considerations

While Chia presents exciting opportunities, it is essential to recognize that it operates within a volatile market. As of now, Chia’s market capitalization stands at approximately $140 million, with a significant drop from its all-time high of nearly $1,935. This fluctuation highlights the risks associated with investing in cryptocurrencies. Investors should approach Chia with caution, understanding that, like many digital assets, it is a high-risk, high-reward asset class.

Final Thoughts

In conclusion, while Chia Network offers innovative technology and potential applications, it is crucial for investors—especially beginners and intermediate users—to conduct thorough research (DYOR) before diving into this asset. Understanding the underlying technology, market dynamics, and your own investment strategy will be key to making informed decisions in the rapidly evolving cryptocurrency landscape.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.