chia coin Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to chia coin

Chia Network (XCH) is a unique cryptocurrency that has garnered attention for its innovative approach to blockchain technology. Founded by Bram Cohen, the creator of the widely used BitTorrent protocol, Chia aims to provide a more sustainable and efficient alternative to traditional cryptocurrencies like Bitcoin. It stands out in the crypto market as a pioneering project that employs a novel consensus mechanism known as Proof of Space and Time (PoST). This mechanism allows Chia to utilize unused disk space for mining, significantly reducing energy consumption compared to conventional Proof of Work (PoW) systems.

Chia Network’s vision extends beyond just being a cryptocurrency; it aspires to be a robust platform for smart contracts and decentralized applications. By employing a custom programming language called Chialisp, Chia facilitates the development of complex smart contracts while ensuring security and ease of auditing. This positions Chia as a competitor to established platforms like Ethereum, but with a focus on energy efficiency and lower barriers to entry for developers.

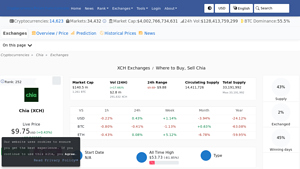

The significance of Chia in the cryptocurrency landscape lies not only in its technological advancements but also in its market potential. As of now, Chia ranks #285 on major cryptocurrency exchanges, with a market capitalization of approximately $140 million and a circulating supply of around 14.41 million XCH. Despite its relatively modest market cap, Chia has shown resilience and adaptability, making it an intriguing option for investors.

Purpose of This Guide

This guide aims to be a comprehensive resource for both beginners and intermediate investors interested in Chia Coin. It will cover several key aspects:

-

Technology: We will delve into the underlying blockchain technology, exploring how Chia’s Proof of Space and Time works and the advantages it offers over traditional mining methods.

-

Tokenomics: Understanding the economic model of Chia is crucial for evaluating its investment potential. This section will provide insights into the supply dynamics, reward distribution, and how these factors can affect the price of XCH.

-

Investment Potential: We will analyze the current market trends, historical price movements, and expert opinions to help you assess whether investing in Chia aligns with your financial goals.

-

Risks: Like any investment, Chia carries certain risks. We will discuss potential challenges, including market volatility, regulatory scrutiny, and technological hurdles that could impact its adoption and value.

-

How to Buy: Finally, we will provide step-by-step instructions on how to purchase Chia Coin, including the exchanges where it is listed and the best practices for securing your investment.

With this guide, you will gain a well-rounded understanding of Chia Coin, enabling you to make informed decisions in your investment journey.

What is chia coin? A Deep Dive into its Purpose

Understanding Chia Coin (XCH)

Chia Coin (XCH) is the native cryptocurrency of the Chia Network, a blockchain platform that aims to revolutionize the way digital assets are created, managed, and transacted. Founded by Bram Cohen, the inventor of the peer-to-peer file-sharing system BitTorrent, Chia Network was established in 2017 and launched its mainnet in 2021. Chia Coin operates on a unique consensus mechanism called Proof of Space and Time (PoST), designed to be energy-efficient compared to traditional models like Proof of Work (PoW) and Proof of Stake (PoS).

The Core Problem It Solves

The cryptocurrency landscape has been increasingly scrutinized for its environmental impact, particularly due to the energy consumption associated with Proof of Work systems, such as Bitcoin. Chia Network addresses this issue by utilizing unused storage space on hard drives rather than requiring extensive computational power.

By implementing the Proof of Space and Time model, Chia enables users—referred to as “farmers”—to allocate spare disk space to contribute to network security and transaction validation. This not only reduces energy consumption significantly but also democratizes the process, allowing anyone with a computer and spare storage to participate in the network. The environmental benefits of Chia’s approach are particularly appealing to eco-conscious investors and developers.

Its Unique Selling Proposition

Chia’s unique selling proposition lies in its innovative consensus mechanism and its ability to facilitate smart transactions through its proprietary programming language, Chialisp. Here are some key features that distinguish Chia Network from its competitors:

-

Proof of Space and Time (PoST): This novel consensus mechanism requires participants to prove they are using disk space and that a certain amount of time has elapsed. The process is less resource-intensive than traditional mining, making it more sustainable.

-

Chialisp: Chia’s on-chain programming language allows for the creation of complex smart contracts. It is designed to be powerful yet easy to audit, enhancing security and usability. Chialisp incorporates elements from Bitcoin’s UTXO model and Ethereum’s Solidity, allowing for more efficient transaction processing.

-

Corporate Structure: Unlike many cryptocurrencies that operate under decentralized autonomous organizations (DAOs), Chia Network is structured as a traditional joint-stock corporation. This allows for more straightforward governance and aligns the incentives of the team and investors.

-

Focus on Real-World Applications: Chia Network aims to enable new asset classes and improve existing financial systems, such as carbon markets and luxury goods authentication. This focus on practical applications enhances its appeal to businesses and institutional investors.

-

Community and Ecosystem Development: Chia Network actively supports its developer community and enterprise use cases, fostering an ecosystem that encourages the growth and adoption of its technology.

The Team and Backers

Chia Network was co-founded by Bram Cohen, whose experience in creating a widely-used decentralized application provides him with unique insights into building a scalable and efficient blockchain. The leadership team includes Gene Hoffman, a former public company CEO, who serves as the Chief Executive Officer. This blend of technical expertise and business acumen positions Chia Network for long-term success.

The project has attracted significant investment from reputable venture capital firms, including Andreessen Horowitz, Slow Ventures, and Galaxy Digital, raising $61 million in funding in May 2021. This backing not only provides the necessary capital for development but also lends credibility to the project, further encouraging adoption.

Fundamental Purpose in the Crypto Ecosystem

Chia Coin serves several essential purposes within the broader cryptocurrency ecosystem:

-

Sustainable Mining: By promoting an energy-efficient method of network participation, Chia Coin aims to set a precedent for other cryptocurrencies, encouraging a shift towards more environmentally friendly practices.

-

Smart Transactions: With the ability to create complex smart contracts through Chialisp, Chia Network enables a wide range of applications, from decentralized finance (DeFi) to supply chain management, making it a versatile tool for developers.

-

Asset Tokenization: Chia Network is focused on facilitating the tokenization of real-world assets, which could lead to increased liquidity and accessibility in various markets. This could revolutionize how assets are managed, traded, and transferred across borders.

-

Financial Infrastructure: As Chia Network aims to build the next generation of financial rails, it is positioned to support new asset classes and improve existing financial systems, making it a critical player in the evolution of blockchain technology.

-

Community Engagement: Chia’s corporate structure allows for more direct engagement with its user base, enabling the project to adapt and evolve based on community feedback and needs.

Conclusion

Chia Coin represents a significant step forward in the cryptocurrency space, combining energy efficiency with innovative technology. Its unique consensus mechanism, focus on real-world applications, and strong backing from industry leaders make it a noteworthy project for both beginners and experienced investors. As the demand for sustainable and efficient blockchain solutions continues to grow, Chia Network is well-positioned to play a pivotal role in shaping the future of digital assets.

The Technology Behind the Coin: How It Works

Introduction to Chia Network

Chia Network, the brainchild of Bram Cohen, the inventor of BitTorrent, aims to create a more sustainable and efficient blockchain ecosystem. Unlike many cryptocurrencies that rely on energy-intensive mining processes, Chia uses a novel approach that focuses on utilizing unused storage space. This guide will delve into the technological underpinnings of Chia Coin (XCH), exploring its blockchain architecture, consensus mechanism, and key innovations.

Blockchain Architecture

Chia operates on a layer-1 blockchain, which means it is a standalone blockchain that does not rely on another network for its operations. The architecture is designed to facilitate various functionalities, including smart contracts, transactions, and asset tokenization.

-

Layer-1 Structure:

– Chia’s blockchain is built from the ground up to support a wide array of applications, particularly in enterprise settings. This design allows it to handle high transaction volumes while maintaining security and decentralization.

– The blockchain employs a unique data structure that allows for efficient storage and retrieval of information. This structure helps in reducing the overall storage requirements compared to traditional blockchains. -

Chialisp Programming Language:

– Chia features its own smart contract language called Chialisp, which is designed to be powerful yet easy to audit. It draws inspiration from Ethereum’s Solidity but incorporates Bitcoin’s Unspent Transaction Output (UTXO) model.

– Chialisp allows for the creation of complex smart contracts and financial applications while ensuring that they are secure and efficient. This language facilitates simultaneous transaction processing, improving the overall speed of the blockchain.

Consensus Mechanism: Proof-of-Space-and-Time

One of the standout features of Chia Network is its consensus mechanism known as Proof-of-Space-and-Time (PoST). This approach is significantly different from the traditional Proof-of-Work (PoW) and Proof-of-Stake (PoS) mechanisms employed by other cryptocurrencies.

-

Proof-of-Space (PoS):

– In Chia, miners utilize their unused hard drive space to participate in the network. This process is referred to as “farming” rather than mining. To farm Chia, users must allocate free disk space, where the Chia software stores cryptographic numbers.

– When a new block is created, the software generates a challenge number based on the previous block. Miners then scan their stored numbers to find a match close to the challenge number. The first miner to find a suitable number gets to create the new block and is rewarded with XCH.

– This method significantly reduces energy consumption compared to traditional mining, which relies on computational power and energy-intensive hardware. -

Proof-of-Time (PoT):

– The second component of Chia’s consensus is Proof-of-Time, which ensures that the passage of time is verifiable within the network. This is achieved through a mechanism called Verifiable Delay Functions (VDFs).

– Timelords are specialized nodes that help validate the passage of time, thereby ensuring that the PoS function operates correctly. They contribute to the overall security of the network by ensuring that the challenges presented in the PoS are time-locked, making it difficult to manipulate the system. -

Combination of PoS and PoT:

– By combining Proof-of-Space with Proof-of-Time, Chia Network achieves a unique form of Nakamoto consensus that is both energy-efficient and secure. This hybrid model allows for faster block generation and transaction confirmation while reducing the environmental impact associated with traditional mining methods.

Key Technological Innovations

Chia Network introduces several technological innovations that enhance its functionality and efficiency:

-

Eco-Friendly Farming:

– Chia’s farming process is designed to be environmentally friendly. Unlike PoW, which requires significant energy consumption, PoST minimizes the ecological footprint by utilizing existing storage resources.

– Users can farm Chia using standard hard drives, making it accessible to a broader audience without the need for specialized and expensive mining rigs. -

Dynamic Block Rewards:

– Chia employs a dynamic block reward system that adjusts the rewards based on the network’s growth and the overall supply of XCH. Initially, 64 XCH are created every 10 minutes for the first three years, which decreases over time. This gradual reduction helps to control inflation and encourages long-term holding of the asset. -

Security Model:

– Chia Network opts for a traditional corporate structure rather than a decentralized autonomous organization (DAO). This choice aligns incentives more closely with business practices, facilitating easier governance and regulatory compliance.

– Ownership of coins does not influence governance, which contrasts with many other public blockchains where coin ownership can grant voting power. This model is designed to attract institutional investors and enterprise clients. -

Tokenization and Asset Management:

– The Chia blockchain supports the tokenization of real-world assets, enabling users to create digital representations of physical items. This feature can revolutionize industries such as real estate, art, and luxury goods by providing immutable proof of ownership and transaction history.

– With its focus on enterprise use, Chia aims to facilitate the development of new asset classes and enhance financial infrastructures, including carbon market solutions.

Conclusion

Chia Network represents a significant advancement in blockchain technology, prioritizing sustainability and efficiency through its innovative consensus mechanism and unique architecture. By utilizing unused storage space and implementing a hybrid PoST consensus, Chia aims to create a more eco-friendly and accessible blockchain ecosystem.

For beginners and intermediate investors, understanding the technology behind Chia is crucial as it not only highlights the project’s commitment to sustainability but also its potential to disrupt traditional financial systems. As the blockchain landscape continues to evolve, Chia Network’s approach may pave the way for a new era of digital assets and decentralized finance.

Understanding chia coin Tokenomics

Chia Network (XCH) presents a unique approach to tokenomics, driven by its innovative consensus mechanism and a commitment to sustainability. In this section, we will explore the essential aspects of Chia’s tokenomics, including key metrics, token utility, and token distribution.

| Metric | Value |

|---|---|

| Total Supply | 33.19 million XCH |

| Max Supply | Not specified |

| Circulating Supply | 14.41 million XCH |

| Inflation/Deflation Model | Controlled Inflation |

Token Utility (What is the coin used for?)

Chia’s native token, XCH, serves multiple purposes within the Chia Network ecosystem:

-

Transaction Fees: XCH is used to pay transaction fees on the Chia blockchain. As users conduct transactions, they must include a fee paid in XCH, which incentivizes miners to process and validate those transactions.

-

Farming Rewards: Chia employs a novel consensus mechanism known as Proof of Space and Time (PoST). Participants in the network can “farm” XCH by dedicating unused disk space to the network. Farmers are rewarded with XCH based on their contributions to the network, and these rewards are distributed every 10 minutes.

-

Governance Participation: While Chia Network operates as a traditional corporation rather than a decentralized autonomous organization (DAO), XCH holders may have opportunities to participate in governance discussions related to the platform’s future developments and strategic direction.

-

Asset Tokenization: Chia Network aims to facilitate the tokenization of real-world assets, enabling users to create and trade digital representations of physical items. XCH serves as the underlying currency for these transactions.

-

Investment: Like many cryptocurrencies, XCH can be held as an investment asset. Investors may buy and hold XCH in anticipation of price appreciation, driven by the network’s growth and adoption.

Token Distribution

Understanding the distribution model of Chia is crucial for assessing its long-term sustainability and potential impact on the market. Here are the main components of Chia’s token distribution:

-

Pre-farming: A significant portion of XCH was pre-farmed before the network’s official launch. Specifically, approximately 21 million XCH were allocated to support the development and administration of Chia Network. This pre-farming strategy is designed to provide initial funding for the project.

-

Farming Rewards Schedule: As mentioned earlier, Chia follows a controlled inflation model for its farming rewards. The distribution schedule is as follows:

– Years 1-3: 64 XCH are created every 10 minutes.

– Years 4-6: 32 XCH are created every 10 minutes.

– Years 7-9: 16 XCH are created every 10 minutes.

– Years 10-12: 8 XCH are created every 10 minutes.

– Post-Year 12: 4 XCH are created every 10 minutes indefinitely.

This schedule ensures that the inflation rate decreases over time, providing a more predictable supply model.

-

Strategic Reserve: Chia Network retains a strategic reserve of XCH, which can be utilized for various purposes, including funding future developments and managing the network’s liquidity. This reserve will play a crucial role in maintaining the stability and sustainability of the ecosystem.

-

Sales and Market Dynamics: Since October 2023, Chia Network has begun selling XCH, which could influence market dynamics and the distribution of tokens among investors. If the network continues to sell XCH without repurchasing, it could lead to a situation where the majority of XCH is owned by the company itself.

-

Circulating Supply: As of the latest data, the circulating supply of XCH stands at approximately 14.41 million. This figure is important for investors to consider, as it indicates the number of tokens actively available for trading in the market.

Conclusion

Chia Network’s tokenomics is characterized by a unique farming model and a commitment to sustainability through its Proof of Space and Time consensus mechanism. With a well-defined inflation model and a clear utility for its token, XCH is positioned to support various functions within the ecosystem, from transaction fees to asset tokenization. Understanding the distribution model and the implications of pre-farming will help investors assess the potential for XCH’s growth and its long-term viability in the ever-evolving cryptocurrency landscape.

Price History and Market Performance

Key Historical Price Milestones

Chia Network (XCH) has experienced notable price fluctuations since its inception, reflecting a mix of investor sentiment, market dynamics, and broader economic conditions. The following are some key historical price milestones for Chia:

-

Initial Launch and Early Performance (2021): Chia Network officially launched its mainnet in May 2021, and the price of XCH quickly surged. Within days, it reached an all-time high of approximately $1,934.51 on May 3, 2021. This rapid increase was largely driven by the novelty of its proof-of-space-and-time consensus mechanism, which attracted considerable attention from both investors and the media.

-

Post-Launch Decline (Mid to Late 2021): Following its initial spike, the price began to decline, reflecting a broader trend in the cryptocurrency market. By the end of 2021, Chia’s price had fallen significantly, hovering around $200 to $300 for much of the latter part of the year.

-

Continued Volatility (2022): Throughout 2022, Chia’s price continued to experience volatility, fluctuating between $50 and $100. Factors such as regulatory developments, changes in market sentiment towards cryptocurrencies, and shifts in investor interest in alternative blockchain technologies contributed to this volatility.

-

2023 Trends: In 2023, Chia’s price saw further downward pressure, particularly in the wake of broader market corrections affecting many cryptocurrencies. By October 2023, the price had stabilized around $9.71, reflecting a significant decrease of over 99.5% from its all-time high. The market cap during this period hovered around $140 million, with a 24-hour trading volume of approximately $2.94 million.

-

Recent Performance: As of October 2023, XCH has shown some resilience with a slight uptick of 0.19% in the last 24 hours. The price has fluctuated within a range of approximately $8.61 (its all-time low on February 3, 2025) to highs around $9.86 during recent trading sessions.

Factors Influencing the Price

Historically, the price of Chia has been influenced by a variety of factors, ranging from technological developments to market trends. Understanding these influences can provide insights into the cryptocurrency’s price behavior:

-

Technological Innovations: The unique consensus mechanism of Chia, which employs proof-of-space and proof-of-time, has been a significant draw for investors. As the network continues to evolve and innovate, any advancements or enhancements can impact its price. For example, the introduction of Chialisp, Chia’s smart transaction programming language, attracted developers and investors alike, contributing to initial price surges.

-

Market Sentiment: The broader cryptocurrency market’s sentiment plays a crucial role in Chia’s price movements. Periods of bullish sentiment across the market often lead to increased investments in altcoins, including Chia. Conversely, bearish trends can have a detrimental effect on its price. For instance, during market corrections, Chia’s price reflected the general downturn, showcasing its correlation with larger market trends.

-

Regulatory Environment: Regulatory developments regarding cryptocurrencies can significantly influence investor confidence and market behavior. Chia’s approach to compliance and its corporate structure (as opposed to a decentralized autonomous organization) positions it uniquely in the market. Any news regarding regulatory changes or potential listings on stock exchanges could lead to fluctuations in its price.

-

Supply Dynamics: The supply of XCH also plays a critical role in its price determination. With a total supply capped at approximately 33.19 million XCH, the circulating supply of 14.41 million XCH creates a scarcity effect that can drive prices up if demand increases. Additionally, the network’s decision to sell XCH starting in October 2023 has implications for its market performance and investor sentiment.

-

Investor Behavior: The actions of significant stakeholders, including venture capitalists and early investors, can also affect Chia’s price. The backing of prominent investors can instill confidence among retail investors, while any signs of selling pressure from major holders can lead to price declines.

-

Competition and Market Positioning: Chia operates in a competitive landscape of blockchain technologies. Its ability to differentiate itself from competitors, such as Ethereum and other layer-1 solutions, impacts its market share and pricing. As investors evaluate the potential of various blockchain projects, shifts in competitive positioning can lead to price adjustments.

Conclusion

In summary, Chia’s price history is marked by significant volatility and key milestones that reflect broader market trends and technological developments. The interplay of factors such as technological innovation, market sentiment, regulatory changes, supply dynamics, and competitive positioning continues to shape Chia’s market performance. Understanding these elements is crucial for both new and seasoned investors looking to navigate the complexities of Chia Network and its digital asset, XCH.

Where to Buy chia coin: Top Exchanges Reviewed

5. Chia (XCH) – Ideal for Eco-Conscious Traders

Chia (XCH) is available on over 13 cryptocurrency exchanges, with MEXC Global, Gate, and HTX leading the pack. These platforms distinguish themselves through user-friendly interfaces, robust security measures, and a variety of trading pairs that cater to both novice and experienced investors. Additionally, they offer competitive fees and liquidity, making it easier for users to buy, sell, and trade Chia efficiently.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. Chia (XCH) – Your Ultimate Guide to Sustainable Investing

The “How to Buy Chia (XCH) Guide 2025” by CoinCodex highlights the standout features of platforms like KuCoin, CoinEx, and OKX for purchasing Chia. It emphasizes the importance of conducting thorough research on each exchange, particularly focusing on their fees, security measures, and the variety of supported cryptocurrencies. This guide aims to equip both novice and seasoned investors with the necessary insights to make informed decisions when buying Chia.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

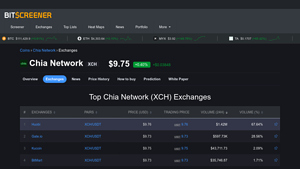

5. Huobi – Top Choice for Chia Network Trading!

In 2025, Gate.io and Huobi emerge as the top exchanges for trading Chia Network (XCH), boasting impressive 24-hour trading volumes of $2.53 million and $2.05 million, respectively. Gate.io stands out with its user-friendly interface and a wide array of trading pairs, while Huobi is recognized for its robust security features and liquidity. Both platforms provide a reliable environment for investors looking to engage with Chia Network’s unique blockchain ecosystem.

- Website: bitscreener.com

- Platform Age: Approx. 8 years (domain registered in 2017)

3. Gate.com – Your Go-To for Seamless Chia (XCH) Purchases!

Gate.com stands out as a user-friendly cryptocurrency exchange, particularly for those looking to purchase Chia (XCH). Its streamlined four-step guide simplifies the buying process, making it accessible for both beginners and experienced investors. Additionally, Gate’s extensive selection of cryptocurrencies enhances its appeal, providing users with a comprehensive platform to explore various digital assets beyond Chia.

- Website: gate.com

- Platform Age: Approx. 29 years (domain registered in 1996)

How to Buy chia coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Chia coin (XCH) is selecting a suitable cryptocurrency exchange. Chia is available on several platforms, including:

- Huobi

- Gate.io

- KuCoin

- OKEx

- Uniswap (V2)

When choosing an exchange, consider factors such as user experience, trading fees, security features, and the availability of XCH trading pairs. If you’re new to cryptocurrency, a user-friendly interface and reliable customer support may be particularly important.

2. Create and Verify Your Account

Once you’ve chosen an exchange, you will need to create an account. This typically involves the following steps:

-

Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button. You will be prompted to provide your email address and create a password.

-

Verify Your Email: After registering, the exchange will send a verification email. Click the link in the email to verify your account.

-

Complete KYC (Know Your Customer) Process: Most exchanges require you to complete a KYC process to comply with regulations. This usually involves submitting personal information, such as your name, address, and date of birth, and uploading identification documents (like a driver’s license or passport).

-

Enable Two-Factor Authentication (2FA): For added security, enable 2FA. This typically involves linking your account to an authentication app, like Google Authenticator, which will provide a time-sensitive code each time you log in.

3. Deposit Funds

After your account is verified, you will need to deposit funds to purchase Chia coin. Here’s how:

-

Navigate to the Deposit Section: Find the “Deposit” or “Funds” tab on the exchange.

-

Select Your Deposit Method: Most exchanges allow you to deposit using various methods, including bank transfers, credit/debit cards, or other cryptocurrencies. Choose the method that suits you best.

-

Follow the Instructions: If you choose to deposit via bank transfer, you may need to provide your bank details. For card payments, simply enter your card information. If you are depositing cryptocurrency, you will be given a wallet address to send the funds to.

-

Confirm the Deposit: Depending on the method chosen, your deposit may take some time to reflect in your account. Most deposits will appear quickly, but bank transfers can take longer due to processing times.

4. Place an Order to Buy Chia Coin

With funds in your exchange account, you are ready to purchase Chia coin. Here’s how to place an order:

-

Go to the Trading Section: Navigate to the trading page of the exchange. Look for the XCH trading pair (for example, XCH/USD or XCH/BTC).

-

Choose Your Order Type: Most exchanges offer various order types, including:

– Market Order: This order buys XCH at the current market price.

– Limit Order: This order allows you to set a specific price at which you want to buy XCH. -

Enter the Amount: Specify how much XCH you want to purchase.

-

Review Your Order: Double-check the details of your order, including the price and amount.

-

Place the Order: Click the “Buy” or “Place Order” button to execute your transaction. Once completed, you will receive a confirmation of your purchase.

5. Secure Your Coins in a Wallet

After purchasing Chia coin, it’s crucial to secure your investment. While exchanges offer wallets, they are not the safest option for long-term storage. Here’s how to secure your coins:

-

Choose a Wallet Type:

– Software Wallets: These are applications you can install on your computer or smartphone. Examples include the official Chia wallet and other third-party wallets that support XCH.

– Hardware Wallets: These are physical devices that store your coins offline, providing enhanced security. Popular hardware wallets include Ledger and Trezor. -

Transfer Your XCH: If you choose to use a wallet, go to the exchange where you bought your XCH, navigate to the withdrawal section, and enter your wallet address. Specify how much you want to transfer and confirm the transaction.

-

Backup Your Wallet: Ensure you have backup methods for your wallet, such as recovery phrases or backup files, to safeguard against loss.

-

Stay Updated: Keep your wallet software updated to protect against security vulnerabilities.

By following these steps, you can confidently buy and secure your Chia coin investment. Always remember to conduct your research and consider the risks involved in cryptocurrency trading.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Innovative Consensus Mechanism

Chia Network employs a unique consensus mechanism known as Proof of Space and Time (PoST). This approach significantly reduces energy consumption compared to traditional Proof of Work (PoW) systems. In an era where environmental concerns are paramount, Chia’s eco-friendly model may attract a segment of investors and users prioritizing sustainability. This innovative consensus mechanism not only enhances energy efficiency but also positions Chia as a more environmentally responsible choice among blockchain projects.

Strong Foundational Leadership

Founded by Bram Cohen, the inventor of the BitTorrent protocol, Chia Network benefits from strong leadership and a team with substantial experience in technology and blockchain. The presence of experienced executives, such as Gene Hoffman, adds credibility to the project. The backing of reputable venture capital firms, including Andreessen Horowitz and Galaxy Digital, further strengthens investor confidence in Chia’s long-term viability and growth prospects.

Strategic Enterprise Focus

Chia Network aims to cater primarily to enterprise-level applications, focusing on creating new asset classes and improving financial infrastructure. By targeting businesses and institutional investors, Chia is positioning itself for potential mass adoption in sectors that require robust blockchain solutions, such as finance, supply chain, and real estate. This enterprise focus could lead to significant partnerships and collaborations, enhancing the utility and value of the Chia token (XCH).

Unique Programming Language

Chia’s custom programming language, Chialisp, is designed to facilitate smart contracts and decentralized applications (dApps). By drawing from the best features of established languages like Solidity while maintaining compatibility with Bitcoin’s UTXO model, Chialisp offers developers a powerful yet user-friendly toolset. This could lead to increased developer interest and a vibrant ecosystem of applications built on Chia, potentially driving demand for XCH.

Potential for Listing on Stock Exchanges

Chia Network’s ambition to become a publicly traded entity on major stock exchanges such as NYSE or NASDAQ could significantly enhance its visibility and credibility in the financial markets. If successful, this move would not only provide a new avenue for raising capital but could also attract traditional investors who may be hesitant to invest in cryptocurrencies directly. A stock listing could facilitate broader acceptance and integration of Chia’s technology within mainstream finance.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Like all cryptocurrencies, Chia (XCH) is subject to market volatility. Prices can experience significant fluctuations due to factors such as market sentiment, macroeconomic conditions, and speculative trading. This volatility can pose risks for investors, especially those seeking stable returns. Additionally, the relatively low market capitalization of Chia, currently around $140 million, may lead to more pronounced price swings compared to larger, more established cryptocurrencies.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, and Chia Network is not exempt from potential scrutiny. Governments worldwide are increasingly focusing on regulating digital assets, which could impact how Chia operates. Regulatory changes could affect everything from how Chia can market its services to how it interacts with users and investors. This uncertainty may deter some investors, particularly institutional players who prioritize compliance and regulatory clarity.

Intense Competition

Chia Network faces fierce competition from both established blockchain platforms and emerging projects. Major players like Ethereum, Solana, and Cardano have already garnered substantial market share and developer interest. Additionally, newer blockchains are continually emerging, each promising unique features and benefits. As a result, Chia must consistently innovate and demonstrate its value proposition to attract and retain users and developers in a crowded market.

Technological Risks

While Chia’s Proof of Space and Time consensus mechanism is innovative, it is still relatively untested compared to more established systems like PoW and PoS. The long-term security and scalability of Chia’s technology remain to be seen. As the network grows, it may encounter unforeseen technical challenges that could affect performance, security, and user experience. Additionally, any significant bugs or vulnerabilities could undermine trust in the platform, leading to potential losses for investors.

Dependence on Farming Economics

Chia’s unique farming model, which rewards users for providing unused storage space, introduces a different set of economic dynamics. The initial pre-farming of 21 million XCH could lead to concerns about centralization and distribution. As the network matures, the economics of farming may shift, potentially affecting the incentives for users to participate. If farming rewards are perceived as insufficient or if competition among farmers increases, it could lead to decreased interest in the network.

Conclusion

Chia Network (XCH) presents a compelling case for investment with its innovative technology, strong leadership, and strategic focus on enterprise applications. However, potential investors must carefully consider the inherent risks associated with market volatility, regulatory uncertainty, competition, and technological challenges. As with any investment in cryptocurrency, it is essential to conduct thorough research and consider personal risk tolerance before making any financial commitments.

Frequently Asked Questions (FAQs)

1. What is Chia Coin (XCH)?

Chia Coin, also known as XCH, is the native cryptocurrency of the Chia Network, a layer 1 blockchain founded by Bram Cohen, the creator of BitTorrent. Chia employs a unique consensus mechanism called Proof of Space and Time (PoST), which allows users to “farm” Chia by utilizing unused storage space on their hard drives. This approach aims to reduce energy consumption compared to traditional Proof of Work (PoW) systems like Bitcoin.

2. Who created Chia Coin?

Chia Coin was created by Bram Cohen, who is also known for developing the popular peer-to-peer file-sharing protocol BitTorrent. The Chia Network was established in 2017 and has since attracted significant venture capital investment, including contributions from well-known firms like Andreessen Horowitz and Galaxy Digital.

3. What makes Chia Coin different from Bitcoin?

Chia Coin differs from Bitcoin primarily in its consensus mechanism. While Bitcoin relies on Proof of Work, which requires substantial energy and computational power, Chia uses Proof of Space and Time. This method involves utilizing free disk space to secure the network, making it more energy-efficient. Additionally, Chia’s smart contract programming language, Chialisp, enables faster and more efficient transactions compared to Bitcoin.

4. Is Chia Coin a good investment?

As with any investment in cryptocurrency, the potential for profit comes with risks. Chia Coin has seen significant price fluctuations, with its all-time high reaching $1,934.51 in May 2021, followed by a notable decline. Prospective investors should conduct thorough research, consider market trends, and evaluate their risk tolerance before investing in Chia or any other cryptocurrency.

5. How can I buy Chia Coin?

Chia Coin can be purchased on several cryptocurrency exchanges, including Huobi, Gate.io, Uniswap (V2), KuCoin, and OKEx. In the near future, the Chia Cloud Wallet is expected to allow users to buy XCH directly using ACH transfers from U.S. bank accounts, simplifying the purchasing process.

6. How does Chia’s farming mechanism work?

Chia’s farming mechanism involves users allocating unused disk space on their hard drives. Farmers install special software that creates cryptographic numbers stored on their disks. When a new block is created, the software checks for numbers that match a challenge, similar to solving a puzzle in traditional mining. Successful farmers are rewarded with XCH for their contributions to the network.

7. What is Chialisp?

Chialisp is Chia Network’s custom programming language designed for creating smart contracts on the blockchain. It combines elements from Bitcoin’s UTXO model and Ethereum’s Solidity language, allowing for simultaneous transactions and increased efficiency. Chialisp aims to make smart contracts easier to audit and secure, providing developers with powerful tools for building decentralized applications.

8. How is Chia Network secured?

Chia Network employs a unique hybrid consensus mechanism that combines Proof of Space and Proof of Time. This approach not only enhances security and reduces energy consumption but also operates under a traditional corporate structure rather than a decentralized autonomous organization (DAO). This model allows for centralized governance and corporate accountability, which Chia Network believes aligns incentives better than other blockchain models.

Final Verdict on chia coin

Overview of Chia Coin

Chia Network (XCH) offers a unique approach to blockchain technology, distinguishing itself with its innovative consensus mechanism known as Proof of Space and Time (PoST). This system allows the network to achieve greater energy efficiency compared to traditional Proof of Work (PoW) models, making it an appealing option for environmentally-conscious investors. Founded by Bram Cohen, the creator of BitTorrent, Chia aims to provide a decentralized platform that supports smart contracts through its proprietary programming language, Chialisp. This language is designed to be secure, easy to audit, and powerful, facilitating the development of decentralized applications.

Market Position and Potential

As of now, Chia is ranked #285 in terms of market capitalization, with a current price around $9.71 and a market cap of approximately $140 million. Despite experiencing a drastic decline from its all-time high of $1,934.51 in May 2021, Chia presents an intriguing investment opportunity, particularly for those interested in the evolution of blockchain technology and its applications in real-world scenarios. The project is geared towards enterprise use, which may enhance its adoption in the future, particularly as the demand for energy-efficient blockchain solutions increases.

Investment Considerations

However, it is crucial to recognize that investing in Chia Coin is not without risks. The cryptocurrency market is highly volatile, and Chia is no exception. The asset class carries the potential for significant rewards but also poses substantial risks, including market fluctuations, regulatory uncertainties, and the overall performance of the cryptocurrency sector.

Final Thoughts

In conclusion, while Chia Coin offers a compelling blend of innovative technology and a vision for sustainable blockchain solutions, it remains a high-risk, high-reward investment. Prospective investors should approach Chia with caution, ensuring they conduct thorough research and consider their risk tolerance. As always, remember the mantra: Do Your Own Research (DYOR) before making any investment decisions in the cryptocurrency space.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.