chaingpt coin Explained: A Deep Dive into the Technology and Tokeno…

An Investor’s Introduction to chaingpt coin

ChainGPT Coin, commonly referred to as CGPT, is an innovative digital asset that merges the capabilities of artificial intelligence (AI) with blockchain technology, carving a niche for itself in the rapidly evolving cryptocurrency market. Positioned as a key player within the AI-driven Web3 landscape, ChainGPT is designed to enhance user experiences in the blockchain ecosystem by providing tools and applications that simplify complex processes. Its unique approach combines the power of AI with decentralized finance, making it an attractive option for both developers and everyday users.

At the heart of ChainGPT’s offerings is its AI Virtual Machine (AIVM), which serves as the backbone for a variety of services, including smart contract generation, NFT creation, and trading assistance. The CGPT token plays a crucial role in this ecosystem, granting holders access to premium features, staking opportunities, and governance rights through a decentralized autonomous organization (DAO). This multifaceted utility not only enhances the token’s appeal but also fosters a community-driven environment where users can influence the platform’s direction.

This guide aims to provide a comprehensive resource for investors looking to understand ChainGPT Coin and its potential in the cryptocurrency market. We will delve into the technology that powers ChainGPT, exploring its unique features and functionalities, as well as examining its tokenomics—how the CGPT token is structured, its supply dynamics, and its economic model.

Investment Potential and Risks

Investors will find a thorough analysis of the investment potential of ChainGPT Coin, highlighting its market performance, historical price trends, and factors that could influence its future valuation. Additionally, we will address the inherent risks associated with investing in cryptocurrencies, including market volatility, regulatory challenges, and technological risks, providing a balanced view to help investors make informed decisions.

How to Buy ChainGPT Coin

Lastly, the guide will offer practical information on how to purchase CGPT, detailing the various exchanges where it is listed, the steps involved in acquiring the token, and tips for securely storing it. By the end of this guide, readers will have a well-rounded understanding of ChainGPT Coin, equipping them with the knowledge needed to navigate their investment journey in this promising digital asset.

What is chaingpt coin? A Deep Dive into its Purpose

Understanding ChainGPT Coin

ChainGPT Coin (CGPT) is a revolutionary digital asset that operates within the ChainGPT ecosystem, a platform that integrates artificial intelligence (AI) with blockchain technology. Designed to simplify complex processes in the Web3, blockchain, and cryptocurrency landscapes, ChainGPT provides a suite of tools that cater to developers, businesses, and everyday users. This guide will delve into the core purpose of ChainGPT Coin, the problems it addresses, its unique selling propositions, and the team behind the project.

The Core Problem It Solves

The advent of blockchain technology and cryptocurrencies has transformed numerous industries, but it also presents several challenges. Many users find the complexity of blockchain technology daunting, particularly when it comes to tasks like smart contract creation, NFT minting, and market analysis. This complexity often leads to a barrier to entry for new users and hinders broader adoption of blockchain solutions.

ChainGPT addresses these challenges by providing an AI-driven platform that simplifies the interactions users have with blockchain technology. At its core, ChainGPT utilizes the AI Virtual Machine (AIVM) to streamline processes such as smart contract generation and auditing, NFT creation, and AI-driven market analysis. By harnessing the power of AI, ChainGPT makes these complex tasks more accessible and manageable for users, regardless of their technical expertise.

Moreover, the platform’s AI Trading Assistant offers valuable insights into market trends and technical analysis, empowering traders to make informed decisions. This feature is particularly beneficial in the highly volatile cryptocurrency market, where timely information can significantly impact investment outcomes. By democratizing access to sophisticated tools, ChainGPT helps to lower the entry barrier for users and fosters a more inclusive environment for cryptocurrency adoption.

Its Unique Selling Proposition

ChainGPT’s unique selling proposition lies in its innovative integration of AI with blockchain technology, which sets it apart from other projects in the cryptocurrency space. Here are some of the key features that contribute to its distinctiveness:

-

AI-Powered Tools: The ChainGPT ecosystem includes a variety of AI-driven tools such as an AI chatbot, smart contract generator, and NFT generator. These tools allow users to interact with blockchain technology using natural language, making it easier for those without technical backgrounds to engage with the ecosystem.

-

Decentralized Autonomous Organization (DAO): The CGPT token plays a crucial role in governance, allowing holders to participate in decision-making processes regarding the platform’s future. This democratic approach fosters a sense of community ownership and collaboration.

-

Sustainable Economy: ChainGPT incorporates a burn mechanism into its tokenomics, where a portion of transaction fees is used to buy and burn CGPT tokens. This deflationary model aims to increase the token’s value over time, benefiting long-term holders.

-

Comprehensive Ecosystem: Beyond just a token, ChainGPT offers a rich ecosystem that includes launchpads for token launches (ChainGPT Pad and DegenPad), incubation for AI startups through ChainGPT Labs, and a focus on real-world applications of AI in the blockchain space. This multifaceted approach enhances its utility and appeal.

-

Security Features: ChainGPT emphasizes security through tools like the CryptoGuard browser extension, which provides AI-powered protection for Web3 interactions. This focus on security ensures that users can engage confidently with the platform.

The Team and Backers

The driving force behind ChainGPT is its founder and CEO, Ilan Rakhmanov. Under his leadership, the project has developed a robust suite of AI tools and solutions that cater to the needs of users across the cryptocurrency landscape. While specific details about the broader team or additional founders may not be extensively documented, Rakhmanov’s vision and commitment to integrating AI with blockchain technology are evident in the platform’s innovative offerings.

The ChainGPT project has also garnered attention from various industry stakeholders and partners. Collaborations with over 100 leading Web3 companies have facilitated the integration of ChainGPT’s AI solutions into diverse platforms, enhancing their utility and accessibility. Furthermore, the project has received notable grants and awards, including recognition from Google Cloud and NVIDIA, underscoring its potential and impact in the field.

Fundamental Purpose in the Crypto Ecosystem

At its core, ChainGPT Coin serves as the lifeblood of the ChainGPT ecosystem, facilitating access to premium AI tools and enabling participation in governance through DAO voting. The token is integral to the platform’s functionality, serving as a marketplace currency and a means of incentivizing user engagement.

The fundamental purpose of CGPT extends beyond mere speculation; it aims to create a sustainable and thriving ecosystem where users can leverage AI to enhance their blockchain interactions. By simplifying complex processes, promoting security, and fostering community involvement, ChainGPT Coin positions itself as a vital component of the evolving cryptocurrency landscape.

In summary, ChainGPT Coin represents a forward-thinking approach to integrating AI with blockchain technology. Its commitment to user accessibility, community governance, and innovative solutions makes it a significant player in the Web3 space, paving the way for broader adoption and engagement in the cryptocurrency ecosystem.

The Technology Behind the Coin: How It Works

Overview of ChainGPT Technology

ChainGPT is an innovative platform that merges artificial intelligence (AI) with blockchain technology, creating a robust ecosystem designed to simplify and enhance the Web3 experience. At the core of ChainGPT is the AI Virtual Machine (AIVM), which powers a suite of AI-driven tools that cater to developers, businesses, and end-users. This guide will explore the key technological components that make ChainGPT unique, focusing on its blockchain architecture, consensus mechanism, and key innovations.

Blockchain Architecture

ChainGPT operates on a decentralized blockchain infrastructure that ensures security, transparency, and efficiency. The architecture is built using advanced cryptographic techniques that safeguard data integrity and privacy.

Structure of the Blockchain

The ChainGPT blockchain is structured as a series of interconnected blocks, each containing a list of transactions. These blocks are linked together in chronological order, forming a chain. Each block is secured through cryptographic hashing, which creates a unique fingerprint for the block and its contents. This ensures that any attempt to alter the information within a block would change its hash, alerting the network to potential tampering.

Decentralization

Decentralization is a fundamental principle of blockchain technology. In ChainGPT’s case, the network is maintained by a distributed set of nodes that validate transactions and maintain the ledger. This means that no single entity has control over the entire network, significantly reducing the risk of fraud or manipulation. The decentralized nature also enhances transparency, as all transactions can be publicly audited by anyone.

Consensus Mechanism

The consensus mechanism is a critical component of any blockchain, as it determines how transactions are verified and added to the blockchain. ChainGPT utilizes a consensus mechanism that promotes security and efficiency while minimizing the risk of centralization.

Proof of Stake (PoS)

ChainGPT employs a Proof of Stake (PoS) consensus mechanism, which is an energy-efficient alternative to the traditional Proof of Work (PoW) system. In PoS, validators are chosen to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral. This means that those who have a vested interest in the network’s success are responsible for validating transactions.

The benefits of PoS for ChainGPT include:

- Energy Efficiency: PoS consumes significantly less energy compared to PoW, making it more sustainable.

- Security: Validators have a financial incentive to act honestly; if they attempt to defraud the network, they risk losing their staked tokens.

- Scalability: PoS allows for faster transaction processing, enabling the ChainGPT platform to handle a larger volume of transactions without congestion.

Key Technological Innovations

ChainGPT distinguishes itself through several key innovations that enhance the user experience and provide unique functionalities.

AI Virtual Machine (AIVM)

The AIVM is the heart of the ChainGPT ecosystem, powering various AI-driven applications. It is designed to execute smart contracts, manage complex agent logic, and facilitate on-chain operations. The AIVM allows developers to create and deploy AI models that can interact seamlessly with the blockchain.

Features of AIVM:

- Smart Contract Automation: The AIVM enables users to generate smart contracts automatically, simplifying the process for those without programming expertise.

- Agent Logic Management: It supports the development of autonomous AI agents that can perform tasks such as trading, monitoring market trends, and providing real-time updates.

- Interoperability: The AIVM is designed to work across multiple blockchain networks, allowing users to leverage AI capabilities in a variety of ecosystems.

AI-Powered Tools

ChainGPT offers a suite of AI-powered tools that cater to different needs within the blockchain space:

- AI Chatbot: This tool serves as a crypto-native conversational assistant, providing users with research support, insights, and guidance on various blockchain-related topics.

- AI NFT Generator: Users can create and mint NFTs using simple text prompts, bridging the gap between creativity and blockchain technology.

- Smart Contract Auditor: This feature provides rapid security checks for Solidity contracts, ensuring that smart contracts are secure before deployment.

Decentralized Autonomous Organization (DAO)

ChainGPT integrates a decentralized governance model through its DAO, allowing $CGPT token holders to participate in decision-making processes. By holding tokens, users can vote on protocol changes, treasury allocations, and future developments. This democratic approach fosters community engagement and ensures that the platform evolves according to its users’ needs.

Security Features

Security is paramount in the blockchain space, and ChainGPT prioritizes user safety through various measures:

- CryptoGuard Browser Extension: This AI-powered tool provides security for Web3 interactions, protecting users from phishing attacks and other vulnerabilities.

- Multi-Factor Authentication (MFA): Users can enable MFA for added security when accessing their accounts, ensuring that only authorized individuals can perform transactions.

Integration with Existing Technologies

ChainGPT is committed to fostering innovation by providing developers and businesses with the tools they need to integrate AI capabilities into their systems. This is achieved through:

- APIs and SDKs: These development tools allow seamless integration of ChainGPT’s AI infrastructure into existing applications, enabling developers to build innovative solutions.

- White-Label Solutions: Businesses can rebrand and customize AI chatbots and launchpads, leveraging ChainGPT’s technology while maintaining their brand identity.

Future Developments

ChainGPT has a roadmap that outlines plans for continuous improvement and expansion of its technological offerings. Future developments may include:

- Enhanced AI Capabilities: Ongoing improvements to the AIVM and AI models to provide even more powerful tools for users.

- Broader Ecosystem Partnerships: Collaborations with more Web3 projects to enhance the utility and accessibility of ChainGPT’s offerings.

- Launch of New AI Applications: Introduction of additional AI-driven tools tailored to specific industry needs, further solidifying ChainGPT’s position in the market.

Conclusion

The technology behind ChainGPT is a compelling blend of AI and blockchain that aims to simplify complex processes and enhance user experiences in the Web3 landscape. With its decentralized architecture, efficient consensus mechanism, and innovative tools, ChainGPT is well-positioned to drive the future of AI-powered blockchain solutions. As the platform continues to evolve, it promises to deliver significant value to developers, businesses, and users alike, making it a noteworthy player in the cryptocurrency space.

Understanding chaingpt coin Tokenomics

ChainGPT Coin Tokenomics Overview

Understanding the tokenomics of ChainGPT Coin (CGPT) is crucial for both new and experienced investors as it provides insights into the underlying economic model of the token, its utility, and how it interacts within the broader ChainGPT ecosystem. The tokenomics of CGPT is designed to ensure sustainability, incentivize participation, and facilitate the growth of the platform.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 997.83 million CGPT |

| Max Supply | 1 billion CGPT |

| Circulating Supply | 857.07 million CGPT |

| Inflation/Deflation Model | Deflationary (with a burn mechanism) |

Token Utility (What is the coin used for?)

The $CGPT token serves multiple essential functions within the ChainGPT ecosystem. Its utility is primarily centered around the following key areas:

-

Access to Premium Features: CGPT tokens are required to access a range of premium AI tools and services offered on the ChainGPT platform. This includes advanced features in the AI Virtual Machine (AIVM) that powers smart contract generation, auditing, and NFT creation.

-

Governance Participation: Token holders can participate in governance through a decentralized autonomous organization (DAO). This allows them to vote on important protocol decisions, treasury allocations, and future development proposals, giving the community a voice in the platform’s evolution.

-

Staking and Farming: CGPT offers staking and farming opportunities for holders, allowing them to earn rewards. By locking up their tokens, users can participate in liquidity pools or yield farming, generating additional income while contributing to the platform’s stability.

-

Marketplace Currency: The CGPT token acts as the native currency within the ChainGPT ecosystem. It can be used for transactions within the platform, including paying for services, tools, and AI-generated content.

-

Burn Mechanism: To combat inflation and enhance the token’s long-term value, ChainGPT employs a burn mechanism. A portion of the fees collected from transactions and services is used to buy and burn CGPT tokens, reducing the total supply over time. This deflationary model aims to create scarcity, potentially increasing the token’s value as demand grows.

-

Gas Fees for AIVM Operations: CGPT tokens are also utilized as gas fees for deploying and running AI agents within the AIVM. This is essential for executing smart contracts and other operations on the platform, ensuring that users can interact with the technology efficiently.

Token Distribution

The distribution of CGPT tokens is structured to promote fairness, incentivize early adopters, and ensure the long-term sustainability of the ChainGPT ecosystem. Here’s how the token distribution is generally organized:

-

Team and Founders: A portion of the total supply is allocated to the founding team and developers. This allocation ensures that the creators are incentivized to contribute to the platform’s ongoing development and success. Typically, this portion is subject to a vesting period to align the team’s interests with those of the community.

-

Advisors and Partnerships: Tokens are also allocated to advisors and strategic partners who contribute to the project. This helps in forming valuable partnerships and securing expertise that can drive the platform’s growth.

-

Community Incentives: A significant portion of tokens is set aside for community incentives, including rewards for staking, liquidity mining, and participation in governance. This allocation is crucial for fostering a vibrant and engaged community around the ChainGPT platform.

-

Ecosystem Development: Tokens are reserved for ecosystem development initiatives, such as funding for new projects, grants for developers, and support for startups incubated within ChainGPT Labs. This ensures ongoing innovation and the expansion of the platform’s capabilities.

-

Public Sale: A portion of CGPT tokens is made available during public sales or initial coin offerings (ICOs). This allows investors to participate early in the project, providing the necessary capital for development and marketing efforts.

-

Reserve Fund: Finally, a reserve fund may be established to manage unexpected expenses, future development needs, or potential market fluctuations. This ensures that the project can remain agile and responsive to changing conditions.

Conclusion

The tokenomics of ChainGPT Coin (CGPT) plays a vital role in the platform’s functionality and sustainability. By providing a clear utility for the token, implementing a burn mechanism, and ensuring a fair distribution, ChainGPT aims to create a robust ecosystem that benefits all participants. Understanding these dynamics is essential for anyone looking to invest in or utilize CGPT, as they highlight the potential for growth and engagement within the ChainGPT community.

Price History and Market Performance

Key Historical Price Milestones

ChainGPT (CGPT) has experienced a notable price journey since its inception, reflecting the volatility and dynamics common in the cryptocurrency market.

The token debuted in April 2023, with an all-time low of approximately $0.008 recorded on April 10, 2023. This initial price point marked the beginning of its market presence, as it introduced investors to the potential of AI-driven blockchain solutions. Over the next several months, CGPT began to gain traction, influenced by growing interest in both the AI and cryptocurrency sectors.

A significant milestone occurred on March 12, 2024, when ChainGPT reached its all-time high of $0.5567. This peak was driven by a combination of factors, including the successful launch of key platform features, partnerships with over 100 Web3 companies, and the overall bullish sentiment in the crypto market at that time. The price surge represented an impressive increase of nearly 84.92% from its all-time low, showcasing the potential for growth within the ecosystem.

After reaching this peak, CGPT experienced a decline, which is common in the cryptocurrency space, where prices often fluctuate significantly. As of the latest available data, the token is trading at approximately $0.08394, reflecting a decrease of about 84.92% from its all-time high. Despite this downturn, the price is still significantly higher than its initial listing, indicating a sustained interest in the project and its underlying technology.

Factors Influencing the Price

Historically, the price of ChainGPT has been influenced by several key factors that are typical of the cryptocurrency market. Understanding these factors can provide insights into the price movements and overall market performance of CGPT.

Market Sentiment and Trends

Market sentiment plays a crucial role in the price of ChainGPT. Like many cryptocurrencies, CGPT’s value has been subject to the broader trends in the cryptocurrency market, which can be driven by investor sentiment, regulatory news, and technological advancements. Periods of bullish market trends often lead to increased buying activity, pushing prices higher, while bearish trends can result in sell-offs and price declines. For instance, during the bullish phase leading up to its all-time high, there was heightened interest in AI technologies and blockchain applications, which positively impacted CGPT’s price.

Project Developments and Innovations

The development and release of new features within the ChainGPT ecosystem have also significantly influenced its market performance. The launch of the AI Virtual Machine (AIVM) and various AI-powered tools, such as the AI Trading Assistant and Smart Contract Generator, generated excitement and increased utility for the CGPT token. As these tools became more integrated into the blockchain community, they attracted more users and investors, contributing to price increases.

Additionally, the establishment of partnerships with other Web3 companies has enhanced ChainGPT’s visibility and credibility in the market. These collaborations often lead to increased adoption and usage of the platform, which can drive demand for CGPT and positively affect its price.

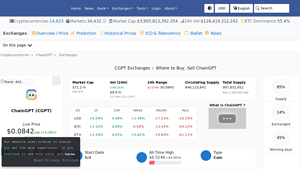

Market Capitalization and Trading Volume

The market capitalization and trading volume of ChainGPT are essential indicators of its market performance. As of the latest data, ChainGPT has a market capitalization of approximately $71.94 million, with a 24-hour trading volume of around $15.51 million. High trading volumes often indicate strong interest and liquidity, which can lead to more stable price movements. Conversely, low trading volumes can result in higher volatility and price swings.

The ratio of market cap to total value locked (TVL) is another critical metric. Currently, ChainGPT has a market cap/TVL ratio of 1870.1, suggesting that while the project has a solid market cap, the TVL is relatively low compared to it. This disparity could indicate that there is room for growth in terms of user engagement and investment in the platform’s offerings.

External Economic Factors

External economic factors, such as regulatory developments and macroeconomic trends, can also impact the price of ChainGPT. Regulatory news concerning cryptocurrencies can create uncertainty, leading to price fluctuations. For example, favorable regulations may lead to increased investment, while unfavorable news can cause panic selling.

Additionally, broader economic conditions, such as inflation rates and changes in fiat currency valuations, can affect investor behavior in the cryptocurrency market. Investors often turn to cryptocurrencies during times of economic uncertainty, which can lead to price increases, while in more stable economic periods, they may shift back to traditional assets.

Conclusion

In summary, the price history and market performance of ChainGPT (CGPT) illustrate a classic narrative of growth and volatility common in the cryptocurrency space. Key historical milestones, such as its all-time high and the factors influencing its price, highlight the interplay between market sentiment, project developments, trading dynamics, and external economic conditions. Understanding these elements can provide investors with a clearer picture of ChainGPT’s journey and its potential within the evolving landscape of digital assets.

Where to Buy chaingpt coin: Top Exchanges Reviewed

1. Changelly – Lowest Fees for ChainGPT (CGPT) Exchange!

Changelly stands out as a premier platform for exchanging ChainGPT (CGPT) due to its competitive rates and exceptionally low fees, making it an attractive option for both beginners and seasoned traders. With a user-friendly interface available on both its website and app, Changelly supports exchanges for over 700 cryptocurrencies and offers fast transaction processing. Additionally, the platform provides 24/7 live support, ensuring a seamless trading experience for its users.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

5. ChainGPT (CGPT) – Your Go-To for AI-Powered Trading!

ChainGPT (CGPT) is available for trading on over 32 cryptocurrency exchanges, with Binance, Gate, and HTX leading the pack. What sets these exchanges apart is their robust trading volumes, user-friendly interfaces, and advanced security features, making them ideal platforms for both novice and experienced traders. This accessibility across multiple exchanges enhances liquidity and provides users with various options to buy, sell, and trade CGPT efficiently.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

5. ChangeNOW – Effortless ChainGPT Trading Made Easy!

ChangeNOW stands out as a highly-rated exchange for buying and selling ChainGPT on the Binance Smart Chain, boasting an impressive rating of 4.8 from over 2,166 users. The platform offers free transactions and supports a range of top cryptocurrencies, including Bitcoin and Ethereum, making it a versatile choice for investors. Its user-friendly interface and efficient trading options enhance the overall experience for both beginners and seasoned traders alike.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

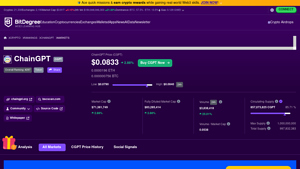

7. ChainGPT – Top Markets & CGPT Pairs Uncovered!

In the review article “Best ChainGPT Markets & CGPT Pairs – BitDegree,” readers will uncover the top exchanges for purchasing ChainGPT (CGPT), highlighting their unique features and trading capabilities. The article provides detailed insights into various CGPT trading pairs, ensuring users can make informed decisions. With a focus on accessibility and comprehensive market data, this guide stands out as an essential resource for both novice and experienced cryptocurrency investors looking to navigate the ChainGPT ecosystem effectively.

- Website: bitdegree.org

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy chaingpt coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

To buy ChainGPT coin (CGPT), the first step is selecting a suitable cryptocurrency exchange. Not all exchanges list every cryptocurrency, so it’s essential to find one that supports CGPT trading. Some popular exchanges where you can buy CGPT include:

- Binance: A leading global exchange offering a wide range of cryptocurrencies.

- KuCoin: Known for listing many altcoins, including CGPT.

- Gate.io: A platform that supports a variety of digital assets.

When choosing an exchange, consider factors such as:

- Reputation: Look for exchanges with positive user reviews and a solid track record in security.

- Fees: Check the trading fees, deposit fees, and withdrawal fees associated with the exchange.

- User Experience: Consider the ease of use of the platform, especially if you’re a beginner.

- Security Features: Ensure the exchange has robust security measures, such as two-factor authentication (2FA).

2. Create and Verify Your Account

Once you’ve selected an exchange, the next step is to create an account. Here’s how to do it:

- Visit the Exchange Website: Go to the official website of the exchange you’ve chosen.

- Sign Up: Click on the “Sign Up” or “Register” button. You will need to provide basic information, such as your email address and a secure password.

- Email Verification: After submitting your information, you will receive a verification email. Click on the link in the email to verify your account.

- Complete KYC (Know Your Customer): Most exchanges require you to complete a KYC process for security and regulatory compliance. This typically involves uploading identification documents (like a passport or driver’s license) and possibly a proof of address.

- Account Approval: Wait for the exchange to approve your KYC application. This can take from a few minutes to a few days, depending on the exchange.

3. Deposit Funds

With your account verified, you can now deposit funds to buy ChainGPT coin. Follow these steps:

- Log into Your Account: Access your account on the exchange.

- Navigate to the Deposit Section: Locate the “Deposit” or “Funds” section on the exchange.

- Select Your Deposit Method: Most exchanges offer multiple funding options, such as bank transfers, credit/debit cards, and cryptocurrency deposits. Choose the method that suits you best.

- Follow Instructions: If you’re depositing fiat currency (like USD), follow the instructions provided to complete the transfer. For crypto deposits, you’ll need to send the cryptocurrency to the address provided by the exchange.

- Confirm Deposit: After initiating the deposit, wait for it to be processed. This can take anywhere from a few minutes to several hours, depending on the method used.

4. Place an Order to Buy ChainGPT Coin

Now that your funds are in your exchange account, you can buy CGPT. Here’s how:

- Find the CGPT Trading Pair: Use the search function on the exchange to find the CGPT trading pair (for example, CGPT/USDT or CGPT/BTC).

- Select the Trading Pair: Click on the trading pair to access the trading interface.

- Choose Order Type: Most exchanges allow you to place different types of orders, including:

– Market Order: Buys CGPT at the current market price.

– Limit Order: Sets a specific price at which you want to buy CGPT. Your order will only execute if the market reaches that price. - Enter the Amount: Specify how much CGPT you want to buy.

- Review and Confirm: Double-check the details of your order, then click on the “Buy” button to execute the trade.

5. Secure Your Coins in a Wallet

After purchasing ChainGPT coin, it’s crucial to store your coins securely. While you can leave them on the exchange, it’s generally safer to transfer them to a personal wallet. Here’s how to do it:

- Choose a Wallet: Decide whether you want a hot wallet (online) or a cold wallet (offline). Examples include:

– Hot Wallets: MetaMask, Trust Wallet, or the exchange’s own wallet.

– Cold Wallets: Ledger, Trezor, or other hardware wallets. - Create Your Wallet: If you’re using a hot wallet, download the application and follow the setup instructions. For a cold wallet, follow the manufacturer’s setup guide.

- Transfer CGPT to Your Wallet: Go back to the exchange, navigate to the withdrawal section, and enter your wallet address. Specify the amount of CGPT you want to withdraw.

- Confirm Withdrawal: Follow the prompts to confirm the withdrawal. You may need to verify the transaction via email or 2FA.

- Check Your Wallet: After a short period, check your wallet to ensure your CGPT coins have arrived.

By following these steps, you can successfully purchase and secure ChainGPT coin, allowing you to participate in its ecosystem and take advantage of its offerings. Always remember to do your own research and stay informed about market trends and developments!

Investment Analysis: Potential and Risks

Understanding ChainGPT Coin: A Balanced Investment Analysis

ChainGPT Coin (CGPT) has emerged as a notable player in the intersection of artificial intelligence (AI) and blockchain technology. Its unique offerings and applications cater to a diverse audience, including developers, businesses, and individual users. However, as with any investment in the cryptocurrency space, potential investors should carefully evaluate both the strengths and risks associated with CGPT. Below is a balanced analysis highlighting the potential strengths and risks of investing in ChainGPT Coin.

Potential Strengths (The Bull Case)

1. Innovative Technology Integration

ChainGPT harnesses the power of AI through its AI Virtual Machine (AIVM), which streamlines various processes within the blockchain ecosystem. The platform offers tools like smart contract generation, auditing, NFT creation, and AI-driven market analysis, making blockchain technology more accessible to a broader audience. This innovative approach positions ChainGPT as a leader in the rapidly evolving Web3 landscape.

2. Strong Market Position and Use Cases

With its focus on real-world applications, ChainGPT addresses significant market needs. The platform’s AI Trading Assistant, for instance, equips traders with technical analysis and trend detection, while the AI NFT Generator allows for easy NFT creation. Such diverse use cases not only enhance user engagement but also contribute to the token’s utility, potentially driving demand for CGPT.

3. Community Governance and Engagement

The governance model of ChainGPT, facilitated by a decentralized autonomous organization (DAO), empowers CGPT holders to influence decisions regarding protocol development and treasury allocations. This participatory approach fosters a strong community, which can be a significant asset in driving the platform’s growth and sustainability.

4. Sustainable Economic Model

ChainGPT employs a burn mechanism where a portion of transaction fees is used to buy and burn CGPT tokens. This creates scarcity, potentially enhancing the value of remaining tokens over time. Additionally, the availability of staking and farming options provides holders with opportunities to earn rewards, further incentivizing long-term investment.

5. Collaborative Ecosystem and Partnerships

The platform’s collaborations with over 100 leading Web3 companies expand its reach and enhance its offerings. These partnerships facilitate the integration of ChainGPT’s AI solutions into various platforms, thereby increasing its utility and exposure within the blockchain community.

Potential Risks and Challenges (The Bear Case)

1. Market Volatility

The cryptocurrency market is known for its extreme volatility, which can significantly impact the price of digital assets, including CGPT. Price fluctuations can be driven by various factors, including market sentiment, regulatory news, technological developments, and macroeconomic trends. Such volatility can pose challenges for investors looking for stability and predictability in their investment.

2. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still developing, with various jurisdictions implementing differing regulations. Uncertainties regarding compliance can impact the operations of blockchain projects. If governments impose stricter regulations on cryptocurrencies or specifically target AI-driven projects, it could hinder ChainGPT’s growth and adoption, potentially leading to a decline in CGPT’s value.

3. Intense Competition

The integration of AI and blockchain has attracted numerous projects, leading to a highly competitive environment. ChainGPT faces competition from other blockchain platforms offering similar AI capabilities, such as Fetch.ai and SingularityNET. As new entrants continue to emerge, maintaining a competitive edge becomes crucial. Failure to differentiate its offerings or innovate could result in a loss of market share for ChainGPT.

4. Technological Risks

While ChainGPT’s technology is designed to enhance user experience and streamline processes, it is not without risks. Bugs, vulnerabilities, or failures in the AIVM or other critical components could expose users to security threats or operational inefficiencies. Additionally, rapid technological advancements may require constant updates and adaptations, which can strain resources and affect the platform’s stability.

5. Adoption Challenges

Despite its innovative features, widespread adoption of ChainGPT may face hurdles. Users accustomed to traditional blockchain solutions might be hesitant to embrace new technologies, particularly those involving AI. Building trust and demonstrating the practical benefits of its offerings will be essential for ChainGPT to achieve significant market penetration.

Conclusion

Investing in ChainGPT Coin presents a blend of opportunities and challenges. Its innovative technology, strong community engagement, and sustainable economic model serve as compelling reasons for potential investors to consider CGPT. However, investors must also remain vigilant about the inherent risks associated with market volatility, regulatory uncertainty, competition, technological vulnerabilities, and adoption challenges.

As with any investment in the cryptocurrency space, conducting thorough research, understanding personal risk tolerance, and staying informed about market developments are crucial steps for making educated investment decisions. While ChainGPT holds promise as a transformative force in the AI and blockchain sectors, it is essential to approach any investment with a balanced perspective.

Frequently Asked Questions (FAQs)

1. What is ChainGPT Coin (CGPT)?

ChainGPT Coin (CGPT) is the native utility token of the ChainGPT ecosystem, which integrates artificial intelligence (AI) with blockchain technology. The token is used to access various AI-driven tools and services within the ChainGPT platform, including smart contract generation, NFT creation, and trading assistance. It also plays a role in governance through decentralized autonomous organization (DAO) voting and supports staking and farming opportunities for token holders.

2. Who created ChainGPT Coin?

ChainGPT was founded by Ilan Rakhmanov, who serves as the CEO. Under his leadership, the project has developed a comprehensive suite of AI tools designed to simplify and enhance processes in the blockchain and cryptocurrency sectors. While specific details about other founding members are not publicly disclosed, Rakhmanov’s vision has been pivotal in shaping the direction of ChainGPT.

3. What makes ChainGPT Coin different from Bitcoin?

While Bitcoin is primarily a decentralized digital currency and store of value, ChainGPT Coin is designed to function within a specialized ecosystem that combines AI and blockchain technology. ChainGPT focuses on providing AI-powered tools and services that facilitate smart contract management, NFT creation, and data analysis, whereas Bitcoin’s primary use case revolves around peer-to-peer transactions. Additionally, ChainGPT employs a governance model through DAO voting, which is not a feature of Bitcoin.

4. Is ChainGPT Coin a good investment?

The potential of ChainGPT Coin as an investment depends on various factors, including market trends, technological advancements, and adoption within the blockchain community. As of now, CGPT has shown significant price fluctuations, with an all-time high of $0.5567 and a current market cap of approximately $71.94 million. Prospective investors should conduct thorough research, consider their risk tolerance, and stay informed about developments in the AI and blockchain sectors before making any investment decisions.

5. What are the real-world applications of ChainGPT?

ChainGPT offers a diverse range of real-world applications, leveraging AI to enhance blockchain interactions. Key applications include:

– AI Trading Assistant: Provides technical analysis and market insights for traders.

– Smart Contract Tools: Facilitates the generation and auditing of smart contracts using natural language.

– NFT Generator: Allows users to mint NFTs from text prompts.

– AI Chatbot: Serves as a conversational assistant for research and support within the crypto space.

These tools cater to developers, businesses, and everyday users, enhancing accessibility to blockchain technology.

6. How can I acquire ChainGPT Coin?

ChainGPT Coin can be acquired through various cryptocurrency exchanges that support CGPT trading. Users can purchase CGPT using other cryptocurrencies or fiat currencies, depending on the exchange’s offerings. It’s essential to choose reputable exchanges and ensure that you follow proper security measures when creating accounts and managing digital assets.

7. What is the total supply of ChainGPT Coin?

The total supply of ChainGPT Coin is capped at 1 billion CGPT tokens, with approximately 857.07 million tokens currently in circulation. The tokenomics of CGPT include a burn mechanism, where a portion of the fees collected is used to buy back and burn tokens, contributing to the sustainability and potential appreciation of the token’s value over time.

8. How does ChainGPT ensure the security of its platform?

ChainGPT employs a multi-faceted approach to ensure security within its ecosystem. This includes utilizing advanced cryptographic techniques for transaction validation and integrity, implementing decentralized consensus mechanisms to prevent data manipulation, and offering tools like the CryptoGuard browser extension for enhanced Web3 security. These measures help protect users’ assets and data while engaging with the platform.

Final Verdict on chaingpt coin

Overview of ChainGPT Coin (CGPT)

ChainGPT Coin (CGPT) is the native utility token of the ChainGPT ecosystem, which aims to revolutionize the intersection of artificial intelligence and blockchain technology. The primary purpose of CGPT is to facilitate access to a comprehensive suite of AI-driven tools designed for various applications, including smart contract generation, NFT creation, and market analysis. The platform leverages its proprietary AI Virtual Machine (AIVM) to power these functionalities, providing users with a simplified and efficient approach to engaging with blockchain technology.

Technological Innovations

At the core of ChainGPT’s offering is the AIVM, which enhances the functionality of the platform by enabling seamless interactions with smart contracts and on-chain operations. ChainGPT also emphasizes security through advanced cryptographic techniques and decentralized consensus mechanisms, ensuring that users can trust the integrity of their transactions. Moreover, the platform supports developers with APIs and SDKs, making it easier to integrate AI capabilities into existing systems.

Potential and Risks

As a high-risk, high-reward investment, CGPT presents significant opportunities for those looking to capitalize on the growing demand for AI solutions in the blockchain space. Its robust feature set, coupled with a sustainable burn mechanism and community governance through DAO voting, positions CGPT as a potentially valuable asset. However, potential investors should be aware of the inherent volatility of the cryptocurrency market and the specific risks associated with investing in emerging technologies.

Conclusion

In conclusion, ChainGPT Coin embodies a blend of innovative technology and practical applications, making it an intriguing option for both novice and seasoned investors. However, it is crucial to recognize the speculative nature of cryptocurrencies. Therefore, we strongly encourage you to conduct your own thorough research (DYOR) before making any investment decisions in CGPT or any other digital asset. Understanding the nuances of the project and the market will empower you to make informed choices that align with your investment goals.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.