celsius coin Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to celsius coin

Celsius Coin (CEL) is the native cryptocurrency of the Celsius Network, a platform designed to revolutionize the way individuals interact with their digital assets. Launched in 2018, CEL aims to disrupt traditional financial systems by offering services such as high-yield savings accounts, low-interest loans, and a community-driven approach to lending and borrowing. The significance of Celsius Coin in the crypto market stems from its unique position as a decentralized finance (DeFi) solution, allowing users to earn interest on their cryptocurrency holdings while providing loans at competitive rates.

Celsius Network operates on the principle of putting its users first, often returning up to 80% of its revenue to the community through interest payments. This model has attracted a large user base, making CEL a noteworthy player in the DeFi space. The platform facilitates transactions without the typical penalties and fees associated with traditional banking, making it an appealing option for both new and experienced investors.

This guide aims to provide a comprehensive resource for understanding Celsius Coin, covering various aspects that potential investors should consider. We will delve into the following key topics:

Technology

We’ll explore the underlying technology of the Celsius Network, including its blockchain infrastructure and security measures. Understanding the technology can help investors gauge the platform’s reliability and scalability.

Tokenomics

An analysis of CEL’s economic model will be presented, detailing its supply, distribution, and utility within the Celsius ecosystem. This section will clarify how CEL functions as a medium of exchange and its role in enhancing user benefits.

Investment Potential

In this section, we will evaluate the historical performance of CEL, its current market position, and future prospects. We will discuss factors that could influence its price and adoption, helping investors make informed decisions.

Risks

Investing in cryptocurrency comes with inherent risks. We will outline potential challenges and market volatility that could affect CEL’s performance, allowing investors to better understand the risk-reward balance.

How to Buy

Finally, we will guide you through the process of acquiring Celsius Coin, detailing the exchanges where it is available and the steps involved in purchasing CEL.

By the end of this guide, readers will have a thorough understanding of Celsius Coin and the factors influencing its value, enabling them to make informed investment decisions in the evolving landscape of cryptocurrency.

What is celsius coin? A Deep Dive into its Purpose

Introduction to Celsius Coin (CEL)

Celsius Coin, commonly referred to as CEL, is the native cryptocurrency of the Celsius Network, a financial platform designed to offer a range of banking-like services to cryptocurrency users. Launched in June 2018, Celsius aims to disrupt traditional banking by providing users with higher interest rates on their deposits and more favorable loan terms. Through its innovative approach, Celsius seeks to create a community-driven financial ecosystem that prioritizes the interests of its users over profit maximization.

The Core Problem It Solves

The traditional banking system has long been criticized for its high fees, low interest rates on savings, and stringent loan requirements. Many individuals find it challenging to access credit due to these barriers, and when they do, the terms are often unfavorable. Celsius addresses these issues head-on by providing a platform where users can earn interest on their cryptocurrency holdings and borrow against them at more competitive rates.

-

High Yield on Savings: Celsius offers significantly higher interest rates on cryptocurrency deposits compared to traditional banks. Users can earn yields of up to 17% on their assets, attracting those who seek better returns on their investments.

-

Affordable Loans: The platform enables users to borrow against their crypto assets without the need to sell them. This feature is particularly valuable for individuals who want to access liquidity while maintaining their long-term investments. Borrowing rates can be as low as 1%, making it an attractive option compared to conventional financial institutions.

-

No Hidden Fees: Celsius operates on a model that eliminates many of the hidden fees associated with traditional banking, such as maintenance charges and withdrawal fees. This transparency fosters trust among users and encourages them to engage more fully with the platform.

-

Asset-Backed Loans: Loans provided through Celsius are asset-backed, meaning that borrowers must offer collateral that exceeds the amount they wish to borrow. This reduces the risk for the platform and its users, ensuring that loans are secure and well-managed.

Its Unique Selling Proposition

Celsius distinguishes itself from other cryptocurrency lending and borrowing platforms through several unique features:

-

Community-Centric Model: The Celsius Network operates with a strong community focus, where users are rewarded for their participation. By holding and using CEL tokens, users can boost their interest earnings and enjoy discounts on loan interest rates. This model creates a sense of belonging and incentivizes users to engage with the platform actively.

-

Algorithmic Interest Distribution: The platform employs an algorithm to calculate and distribute interest payouts to users. This ensures that returns are fair and reflective of market conditions, providing a level of financial transparency that is often lacking in traditional banking.

-

Institutional Lending: Celsius also lends to institutional entities, such as hedge funds, which allows the platform to generate revenue. The company returns a significant portion of this revenue—80%—back to its users, creating a mutually beneficial ecosystem.

-

Diverse Financial Products: Beyond lending and borrowing, Celsius aims to develop a suite of financial products that cater to various user needs, including payment solutions and investment opportunities. This versatility positions Celsius as a comprehensive financial solution for cryptocurrency users.

The Team and Backers

Celsius was co-founded by Alex Mashinsky and Daniel Leon, who bring a wealth of experience and expertise to the project.

-

Alex Mashinsky: Known for his contributions to internet technologies, including Voice Over Internet Protocol (VoIP), Mashinsky has a track record of successful startups and holds over 35 patents. His vision for Celsius is rooted in the belief that financial services should prioritize users’ interests.

-

Daniel Leon: As the co-founder and COO, Leon has a strong background in scaling early-stage startups. His leadership skills and focus on community building have been pivotal in Celsius’s growth and user engagement.

The Celsius Network has garnered support from a broad range of investors and advisors, further validating its potential in the cryptocurrency space. This backing has helped the platform to innovate and expand its offerings, creating a more robust and reliable service for its users.

Fundamental Purpose in the Crypto Ecosystem

Celsius Coin plays a crucial role in the broader cryptocurrency ecosystem by bridging the gap between traditional finance and decentralized finance (DeFi). Its primary purposes include:

-

Facilitating Transactions: CEL tokens can be used for various transactions within the Celsius Network, including paying interest on loans and earning rewards for holding the token. This functionality enhances the overall utility of CEL in the ecosystem.

-

Promoting Financial Inclusion: By offering accessible financial products to a global audience, Celsius aims to democratize access to financial services. This mission aligns with the core ethos of cryptocurrency—providing financial independence and empowerment to individuals around the world.

-

Enhancing User Experience: The incentives tied to CEL encourage users to engage more deeply with the platform. By rewarding users for their loyalty and participation, Celsius fosters a vibrant community that is essential for the platform’s long-term success.

-

Sustainability and Growth: As Celsius continues to innovate and expand its services, CEL serves as a critical component of its growth strategy. The token’s value is intrinsically linked to the platform’s success, making it an essential asset for investors and users alike.

Conclusion

Celsius Coin is more than just a cryptocurrency; it represents a shift in how financial services can be delivered in the digital age. By addressing the shortcomings of traditional banking, offering competitive rates, and fostering a community-driven ecosystem, Celsius has positioned itself as a leading player in the cryptocurrency space. Its innovative approach not only benefits individual users but also contributes to the broader goal of financial inclusion and empowerment in the crypto world.

The Technology Behind the Coin: How It Works

Understanding Celsius Coin (CEL)

Celsius Coin (CEL) is the native digital asset of the Celsius Network, a platform that aims to revolutionize the way users interact with cryptocurrencies by providing a range of financial services. This section delves into the technological underpinnings of Celsius Coin, explaining its blockchain architecture, consensus mechanism, and key innovations that set it apart in the decentralized finance (DeFi) landscape.

Blockchain Architecture

Celsius operates on the Ethereum blockchain, which is a decentralized platform that enables smart contracts and decentralized applications (dApps). Ethereum is known for its robust security, widespread adoption, and support for various tokens, including those adhering to the ERC-20 standard, which is the case for CEL.

ERC-20 Standard

The ERC-20 standard defines a common set of rules for tokens on the Ethereum blockchain. This standard ensures that all tokens can interact seamlessly with wallets, exchanges, and other smart contracts. By adhering to this standard, CEL can be easily traded on various cryptocurrency exchanges and integrated into different platforms.

Wallet Integration

Celsius provides its users with a wallet that facilitates the storage and management of CEL and other cryptocurrencies. The wallet is designed to be user-friendly, allowing both beginners and experienced users to manage their digital assets effortlessly. Security measures, such as two-factor authentication and encryption, are implemented to safeguard users’ funds.

Consensus Mechanism: Modified Proof-of-Stake

Celsius employs a modified proof-of-stake (PoS) consensus mechanism for its operations. In a traditional proof-of-stake system, validators are chosen to create new blocks and confirm transactions based on the number of coins they hold and are willing to “stake” as collateral.

How Modified PoS Works

In Celsius’s modified PoS system, users can earn rewards by staking their CEL tokens in the network. This staking mechanism not only incentivizes users to hold onto their tokens but also enhances the network’s security. The more tokens a user stakes, the greater their chances of being selected as a validator. This helps maintain a decentralized network while allowing users to earn passive income through interest on their staked assets.

Benefits of PoS

The modified PoS mechanism has several advantages over traditional proof-of-work (PoW) systems, such as Bitcoin:

- Energy Efficiency: PoS does not require the extensive computational power needed for mining in PoW systems, making it more environmentally friendly.

- Lower Barriers to Entry: Users can participate in the network by staking their tokens rather than investing in expensive mining equipment.

- Enhanced Security: The risk of a 51% attack is reduced since acquiring a majority of the staked tokens is significantly more challenging than controlling mining power.

Key Technological Innovations

Celsius distinguishes itself through several technological innovations that enhance user experience and broaden its service offerings.

Decentralized Finance (DeFi) Integration

Celsius integrates DeFi principles, allowing users to lend and borrow cryptocurrencies directly on the platform. Users can deposit their cryptocurrencies and earn interest, while borrowers can access loans using their crypto assets as collateral. This peer-to-peer lending model eliminates the need for traditional banks, enabling users to transact with lower fees and more favorable terms.

Automated Interest Calculation

One of the standout features of Celsius is its automated interest calculation system. The platform uses algorithms to determine the best possible interest rates for both lenders and borrowers. This system operates without the need for intermediaries, ensuring that users receive the best rates available based on market conditions.

CelPay Feature

Celsius includes a payment feature called CelPay, which allows users to send and receive cryptocurrency easily. This feature enhances the platform’s functionality by enabling users to transact seamlessly within the Celsius ecosystem, making it a versatile wallet solution for everyday crypto transactions.

Asset-Backed Loans

Celsius prioritizes user security by ensuring that all loans are asset-backed. Borrowers are required to provide collateral that exceeds the value of the loan they are taking out. This practice minimizes the risk for lenders and ensures that the platform can maintain liquidity.

Security Measures

Celsius employs multiple layers of security to protect its users’ assets. These include:

- Cold Storage: The majority of user funds are stored in cold wallets, which are not connected to the internet. This reduces the risk of hacks and unauthorized access.

- Two-Factor Authentication (2FA): Users are encouraged to enable 2FA to add an extra layer of security to their accounts.

- Regular Security Audits: The Celsius Network undergoes regular security audits to identify and rectify vulnerabilities, ensuring the platform remains secure against potential threats.

The Role of CEL Token

The CEL token plays a crucial role in the Celsius ecosystem. It serves multiple purposes, including:

- Interest Boosts: Users who choose to receive their interest payouts in CEL can earn higher returns compared to those who opt for other cryptocurrencies.

- Loan Discounts: Borrowers using CEL as collateral may receive discounted interest rates on their loans, making it an attractive option for those looking to leverage their crypto holdings.

- Community Engagement: CEL fosters a sense of community within the Celsius Network, as users who hold CEL tokens can participate in governance decisions and influence the platform’s future developments.

Conclusion

Celsius Coin (CEL) is more than just a cryptocurrency; it represents a comprehensive financial ecosystem designed to empower users in the evolving world of digital assets. Through its innovative use of blockchain technology, modified proof-of-stake consensus, and a suite of user-friendly features, Celsius is positioned to disrupt traditional financial services and offer a compelling alternative for both beginners and seasoned investors. As the cryptocurrency landscape continues to evolve, Celsius stands out as a platform that prioritizes the interests of its users while providing the tools necessary for financial independence.

Understanding celsius coin Tokenomics

Celsius Coin (CEL) is the native utility token of the Celsius Network, a platform designed to provide a range of financial services, including lending and borrowing of cryptocurrencies. Understanding the tokenomics of CEL is essential for both new and seasoned investors, as it sheds light on the economic model that underpins the token, its use cases, and its distribution.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 37,720,111 CEL |

| Max Supply | 695,658,161 CEL |

| Circulating Supply | 37,720,111 CEL |

| Inflation/Deflation Model | Deflationary Model |

Token Utility (What is the coin used for?)

The Celsius token (CEL) serves multiple purposes within the Celsius ecosystem, making it a versatile asset for users. Here are the primary utilities of CEL:

-

Interest Rate Discounts: CEL can be used to pay interest on loans taken out within the Celsius platform. Users who opt to pay their interest in CEL tokens can receive significant discounts, effectively lowering the cost of borrowing. This incentivizes users to hold and utilize CEL within the ecosystem.

-

Earning Interest: Users who deposit CEL into their Celsius wallets can earn interest on their holdings. The platform offers competitive interest rates, which are often higher than traditional banking institutions. This feature attracts users looking for better returns on their crypto assets.

-

Enhanced Rewards: Holding CEL tokens can boost the rewards users receive on their deposits. The Celsius platform rewards users with higher interest rates and additional incentives based on the amount of CEL they hold. This creates a direct correlation between token ownership and financial benefits.

-

Access to Premium Features: CEL holders may gain access to premium features and services within the Celsius Network. This includes exclusive financial products and services that may not be available to non-token holders.

-

Trading and Liquidity: CEL tokens can be traded on various exchanges, providing liquidity for users. The ability to buy and sell CEL contributes to its utility as a digital asset, allowing users to capitalize on price fluctuations.

-

Community Governance: In some cases, CEL holders may participate in governance decisions regarding the platform’s future developments and policies. This feature fosters a sense of community and empowers users to influence the direction of the Celsius Network.

Token Distribution

The distribution of CEL tokens plays a critical role in the overall tokenomics of the Celsius Network. Here’s a breakdown of how CEL tokens are allocated:

-

Initial Coin Offering (ICO): The CEL token had an ICO in May 2018, which accounted for a significant portion of the token supply. During the ICO, 50% of the total supply was made available to investors.

-

Treasury and Team Allocation:

– Treasury: 27% of the total supply is allocated to the treasury, which can be used for operational expenses, development, and future growth initiatives.

– Team and Advisors: 19% of the total supply is reserved for the founding team and advisors. This allocation is intended to incentivize early contributors and ensure that they remain committed to the project. -

Partners and Advertisers: 2% of the total supply is allocated to partners and advertisers. This allocation helps in promoting the Celsius Network and expanding its reach within the cryptocurrency community.

-

Locked Tokens: Approximately 24% of the total supply is locked according to a predefined schedule. This mechanism is designed to prevent market flooding and maintain price stability. As tokens are gradually unlocked, it allows for a controlled increase in circulating supply.

-

Incentives for Users: The Celsius Network has a strong focus on rewarding its users. As part of its business model, the platform returns 80% of its earnings from interest payments back to its users. This structure not only incentivizes user engagement but also fosters a loyal community.

Conclusion

The tokenomics of Celsius Coin (CEL) is designed to create a sustainable ecosystem that benefits users while promoting the growth of the Celsius Network. With a deflationary model, various utilities for the token, and a well-structured distribution plan, CEL serves as both a utility token and an investment asset. Understanding these elements can help investors make informed decisions regarding their participation in the Celsius ecosystem, whether they are looking to earn interest on their holdings, borrow against their crypto assets, or engage with the community. As the cryptocurrency market continues to evolve, the tokenomics of CEL will play a vital role in its future growth and utility.

Price History and Market Performance

Key Historical Price Milestones

Celsius (CEL), the native token of the Celsius Network, has experienced significant price fluctuations since its inception. Launched in June 2018, the token had an Initial Coin Offering (ICO) that attracted considerable interest, contributing to its initial market value.

-

Initial Launch and Early Days (2018-2020): Following its ICO, CEL traded at relatively low prices, primarily below $1. The token remained under the radar as the Celsius platform began to develop its user base and financial offerings.

-

All-Time High (June 2021): The price of CEL peaked at an astonishing $8.02 on June 3, 2021. This surge was attributed to the growing popularity of decentralized finance (DeFi) platforms, the bullish sentiment in the broader cryptocurrency market, and the increasing utility of the CEL token within the Celsius ecosystem, allowing users to earn interest and secure loans against their crypto holdings.

-

Post-Peak Decline (2021-2022): After reaching its all-time high, CEL’s price began a downward trajectory. By the end of 2021, the price had dropped significantly, reflective of the overall bearish trend in the cryptocurrency market. The decline continued into 2022, exacerbated by broader economic factors and market corrections.

-

All-Time Low (October 2018): Historically, CEL’s lowest price was recorded on October 16, 2018, at $0.02235. This period was marked by skepticism around the viability of crypto lending platforms and a general market downturn.

-

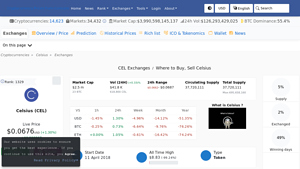

Current Performance (2023): As of October 2023, the price of CEL stands at approximately $0.06786, representing a recovery of over 200% from its all-time low. However, it remains down by around 99% from its all-time high, indicating a long road to recovery and the volatility inherent in cryptocurrency markets.

Factors Influencing the Price

Historically, the price of Celsius has been influenced by a variety of factors, both internal to the Celsius Network and external market conditions.

-

Market Sentiment and Trends: Like many cryptocurrencies, CEL’s price has been significantly impacted by the overall sentiment in the cryptocurrency market. Bullish trends, driven by positive news and adoption of DeFi protocols, have often led to price increases. Conversely, bearish trends resulting from regulatory news, security breaches in the crypto space, or broader economic downturns have negatively impacted CEL’s value.

-

Adoption and User Growth: The growth of the Celsius Network’s user base has directly correlated with the price of CEL. As more users joined the platform to earn interest on their crypto assets and take out loans, demand for the CEL token increased, driving up its price. The introduction of new features and partnerships also played a role in enhancing user engagement and, subsequently, the token’s value.

-

Regulatory Developments: Regulatory scrutiny of cryptocurrency platforms has been a double-edged sword for CEL. While certain regulations can provide legitimacy and attract institutional investors, negative regulatory news or actions (such as investigations or lawsuits) have historically led to sharp declines in CEL’s price.

-

Economic Conditions: Macroeconomic factors, including interest rates, inflation, and global economic stability, have also influenced CEL’s price. For instance, during times of economic uncertainty, investors may turn to cryptocurrencies as alternative assets, which can lead to price surges. Conversely, tightening monetary policies can lead to decreased investment in riskier assets like cryptocurrencies.

-

Technological Developments: Upgrades and improvements to the Celsius platform, including enhanced security measures, user experience improvements, and the introduction of new services, have historically contributed to price stability and growth. The perception of the platform’s reliability and its technological edge can boost user confidence, impacting CEL’s market performance positively.

-

Community Engagement and Transparency: The Celsius community’s engagement and the company’s transparency regarding operations and financial health have influenced investor sentiment. Positive community sentiment can lead to increased demand for CEL, while negative news or lack of communication can lead to sell-offs.

-

Competitor Landscape: The emergence of new competitors in the DeFi space can also impact the price of CEL. As more platforms offer similar services, user retention becomes crucial, and any loss of market share can negatively affect CEL’s value.

In summary, the price history and market performance of Celsius reflect a complex interplay of market dynamics, user adoption, regulatory changes, and technological advancements. Understanding these factors provides a clearer picture of CEL’s journey and its position within the broader cryptocurrency landscape.

Where to Buy celsius coin: Top Exchanges Reviewed

3. Celsius Coin – A Rising Star in Crypto Markets!

Celsius stands out in the cryptocurrency landscape with its user-friendly platform and competitive exchange rates, particularly for Celsius Coin (CEL). Rated 4.8 from over 2,165 reviews, it offers a seamless, free service for instant exchanges, allowing users to effortlessly trade CEL for various digital assets like Binance Coin (BNB) and XRP. Its commitment to providing an efficient trading experience makes Celsius an attractive option for both novice and seasoned investors.

- Website: changenow.io

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Celsius (CEL) – Your Gateway to Crypto Lending!

Celsius (CEL) is available on over eight cryptocurrency exchanges, with MEXC Global, Gate, and Coinex standing out as the top platforms for buying, selling, and trading this digital asset. These exchanges offer a user-friendly interface, competitive trading fees, and robust security features, making them ideal for both novice and experienced investors looking to engage with Celsius. The diverse options enhance accessibility and flexibility in trading CEL.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

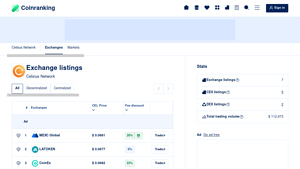

5. Celsius Network (CEL) – Top Choice for Earning Interest on Crypto

Celsius Network (CEL) is prominently listed on several reputable exchanges, including MEXC Global, LATOKEN, and CoinEx, as well as on decentralized platforms like Uniswap v3. This diverse range of listings enhances CEL’s accessibility and liquidity, catering to both centralized and decentralized finance users. The presence on multiple exchanges underscores Celsius Network’s commitment to providing users with flexible trading options and fostering a robust ecosystem for its digital asset.

- Website: coinranking.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Celsius (CEL) – Your Guide to Earning While You Hold!

The article “Buy Celsius (CEL) – Step by step guide for buying CEL – Ledger” highlights the unique requirement of having a Celsius wallet to purchase CEL, setting it apart from other exchanges like Coinbase and Coinmama. This necessity emphasizes Celsius’s commitment to user security and asset management. The guide provides a clear, streamlined process for acquiring CEL, making it accessible for both beginners and experienced investors looking to engage with this digital asset.

- Website: ledger.com

- Platform Age: Approx. 31 years (domain registered in 1994)

7. Celsius Network (CEL) – Your Gateway to Earning Crypto Interest!

The “How to Buy Celsius Network (CEL) Guide 2025” from CoinCodex provides a comprehensive overview of the best platforms for purchasing CEL, highlighting exchanges like CoinEx, Gate, and MEXC. What sets this guide apart is its emphasis on crucial factors such as fees, security features, and user experience, empowering both new and experienced investors to make informed decisions when navigating the Celsius Network ecosystem.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

How to Buy celsius coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

To buy Celsius Coin (CEL), the first step is to select a cryptocurrency exchange that supports the trading of CEL. Popular exchanges where you can purchase CEL include:

- Coinbase: A user-friendly platform ideal for beginners, offering a straightforward interface and a variety of cryptocurrencies.

- Binance: Known for its extensive range of digital assets and trading pairs, Binance is suitable for more experienced users.

- Kraken: Offers a secure trading environment with various cryptocurrencies available for trading, including CEL.

- KuCoin: This exchange often lists a variety of altcoins and can be a good option for CEL trading.

Before proceeding, ensure that the exchange you choose has a good reputation, strong security measures, and is available in your country.

2. Create and Verify Your Account

Once you have selected an exchange, the next step is to create an account:

- Sign Up: Visit the exchange’s website and click on the “Sign Up” or “Register” button.

- Provide Information: Fill out the required information, including your email address and a secure password. Make sure to use a strong password to enhance your account security.

- Email Verification: After submitting your registration, you will receive a verification email. Click on the link in the email to verify your account.

- Identity Verification: Most exchanges will require you to complete a Know Your Customer (KYC) process. This typically involves providing a government-issued ID (such as a passport or driver’s license) and possibly a proof of address. Follow the instructions provided by the exchange to complete this step.

3. Deposit Funds

After your account is verified, you need to deposit funds to start buying CEL:

- Choose a Deposit Method: Most exchanges accept deposits in fiat currency (like USD, EUR) or other cryptocurrencies. Choose your preferred method.

- Link Your Bank Account or Card: If you are depositing fiat currency, link your bank account or credit/debit card to your exchange account. This process may vary depending on the exchange.

- Make a Deposit: Follow the prompts to deposit funds into your account. If you are depositing cryptocurrency, navigate to the “Deposit” section, select the cryptocurrency, and copy the wallet address provided. Use this address to send your funds from your existing wallet.

4. Place an Order to Buy Celsius Coin

With funds in your account, you can now purchase Celsius Coin:

- Navigate to the Trading Section: Find the trading or market section on the exchange.

- Select CEL: Search for the CEL trading pair (e.g., CEL/USD, CEL/BTC) that you wish to trade.

- Choose Your Order Type: You can typically choose between different order types:

– Market Order: This type of order buys CEL at the current market price. It is quick and straightforward.

– Limit Order: This order allows you to set a specific price at which you want to buy CEL. The order will only execute when the market reaches that price. - Enter the Amount: Specify how much CEL you want to purchase. Review the total cost and any fees associated with the transaction.

- Confirm Your Order: Once you are satisfied with your order details, click on the “Buy” button to complete the transaction.

5. Secure Your Coins in a Wallet

After purchasing CEL, it is crucial to secure your coins:

- Choose a Wallet: While you can keep your CEL on the exchange, it is generally safer to transfer them to a personal wallet. Options include:

– Software Wallets: Applications like Exodus or Atomic Wallet that allow you to store your coins on your computer or mobile device.

– Hardware Wallets: Devices like Ledger or Trezor that provide an offline storage solution for enhanced security.

– Paper Wallets: A physical printout of your wallet’s private keys and public addresses, though this method requires careful handling to avoid loss. - Transfer CEL: Go to the “Withdraw” section of your exchange, enter your wallet address, and specify the amount of CEL you want to transfer. Double-check the address to avoid mistakes.

- Confirm the Transaction: Follow any additional security protocols (like two-factor authentication) to confirm the withdrawal. Once the transaction is complete, your CEL will be in your secure wallet.

By following these steps, you can successfully buy and securely store Celsius Coin (CEL), allowing you to participate in the broader cryptocurrency ecosystem. Always stay informed about market trends and security best practices to protect your investment.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Innovative Financial Model

Celsius Network (CEL) positions itself as a disruptive force in the traditional banking system by offering a peer-to-peer lending and borrowing platform that operates on blockchain technology. This model allows users to deposit their cryptocurrencies and earn interest, which is often higher than traditional savings accounts. The platform also enables users to borrow against their crypto assets without selling them, providing liquidity while retaining ownership of their investments. This innovative approach appeals to a growing number of users seeking alternatives to conventional financial institutions.

Strong Community and User Base

Celsius boasts a robust community of over 1 million users, which reflects a high level of engagement and trust in the platform. A strong community can lead to network effects, where the value of the platform increases as more users join and participate. This community-centric approach fosters loyalty and can drive the adoption of CEL as a utility token within the Celsius ecosystem, potentially increasing demand and supporting its value.

Attractive Yield Opportunities

The Celsius platform offers competitive yield rates for users who deposit their cryptocurrencies. Reports suggest that users can earn up to 17% on their assets, making it an attractive option for those looking to maximize returns on their holdings. This high yield potential can draw more users to the platform, enhancing liquidity and demand for CEL, especially in a market where traditional savings accounts offer minimal returns.

Asset-Backed Loans

Celsius emphasizes security by ensuring that all loans are asset-backed, meaning that borrowers must provide collateral exceeding the amount they wish to borrow. This practice reduces the risk of default and provides a level of assurance for lenders on the platform. The backing of loans with collateral can instill confidence in users and contribute to a more stable lending environment.

Experienced Leadership

Celsius was co-founded by Alex Mashinsky, a veteran in the tech industry with a proven track record in innovation. His extensive experience in developing internet technologies and startups can lend credibility to the project. The presence of a knowledgeable leadership team can enhance investor confidence and attract institutional interest, which is vital for the growth of any cryptocurrency.

Broad Market Appeal

Celsius aims to serve a diverse audience, from retail investors to institutional clients. Its services cater to individuals seeking better returns on their assets and institutions looking for crypto-backed lending solutions. This broad market appeal can help Celsius capture various segments of the cryptocurrency market, potentially driving growth and adoption.

Potential Risks and Challenges (The Bear Case)

Market Volatility

The cryptocurrency market is notoriously volatile, with prices capable of experiencing significant fluctuations within short periods. Celsius (CEL) has seen its price drop dramatically from an all-time high of $8.02 to around $0.06786, representing a staggering decline of over 99%. Such volatility can lead to unpredictable investment outcomes, making CEL a risky asset for investors, particularly those with a low risk tolerance. Additionally, market sentiment can be influenced by macroeconomic factors, regulatory news, and overall market trends, further complicating the investment landscape.

Regulatory Uncertainty

The regulatory environment surrounding cryptocurrencies is still evolving, and governments worldwide are grappling with how to approach digital assets. Celsius has previously faced scrutiny, and any future regulatory changes could impact its operations, user base, and overall market perception. Increased regulation could lead to compliance costs or even operational limitations, potentially hindering Celsius’s growth and affecting the value of CEL. Investors should be cautious of the potential for regulatory actions that could disrupt the platform’s services.

Competition

Celsius operates in a highly competitive space within the decentralized finance (DeFi) sector. Numerous platforms offer similar services, including lending, borrowing, and earning interest on crypto holdings. Competitors such as BlockFi, Aave, and Compound are continuously innovating and attracting users, which could dilute Celsius’s market share. If Celsius fails to differentiate itself or maintain its competitive advantages, it could struggle to retain existing users or attract new ones, negatively impacting CEL’s value.

Technological Risks

As with any blockchain-based platform, Celsius is subject to technological risks. Issues such as smart contract vulnerabilities, network congestion, and security breaches can pose significant threats to the platform’s integrity and user funds. While Celsius employs a modified proof-of-stake algorithm and has outlined security procedures, there is always a risk of cyberattacks or technical failures that could result in financial losses for users. Investors should be aware of the inherent risks associated with technology-driven platforms and the potential for unforeseen complications.

Bankruptcy and Operational Challenges

Celsius Network emerged from Chapter 11 bankruptcy in early 2024, which raises concerns about its operational stability and future viability. The shutdown of its mobile and web apps marks a significant turning point for the platform. While the reorganization plan aims to ensure distributions to creditors, the long-term implications for the platform’s operations and user trust remain uncertain. Investors may view the bankruptcy as a sign of underlying issues within the company, which could impact confidence in CEL and its future performance.

Dependence on Market Sentiment

The value of Celsius (CEL) and its adoption largely depend on market sentiment towards cryptocurrencies. Positive developments in the broader crypto market can boost interest in CEL, while negative sentiment can lead to rapid declines in value. This dependency on external factors makes CEL a speculative investment, and investors should be prepared for the possibility of significant price swings based on market trends and news events.

Conclusion

Celsius Network presents both compelling potential and notable risks for investors considering CEL. Its innovative financial model, strong community, and attractive yield opportunities position it as a noteworthy player in the DeFi space. However, challenges such as market volatility, regulatory uncertainty, competition, technological risks, and its recent bankruptcy may deter cautious investors. As always, individuals should conduct thorough research and consider their risk tolerance before making investment decisions in the cryptocurrency market.

Frequently Asked Questions (FAQs)

1. What is Celsius Coin (CEL)?

Celsius Coin (CEL) is the native cryptocurrency of the Celsius Network, a platform designed to provide financial services for cryptocurrency users. Launched in 2018, Celsius allows users to earn interest on their cryptocurrency deposits, borrow against their holdings, and utilize the CEL token to enhance their financial benefits on the platform. The CEL token serves various internal functions, including boosting user payouts and facilitating transactions within the Celsius ecosystem.

2. Who created Celsius Coin?

Celsius Coin was co-founded by Alex Mashinsky and Daniel Leon. Alex Mashinsky is known for his contributions to internet technologies, including Voice Over Internet Protocol (VoIP). Daniel Leon has experience in growing early-stage startups. Together, they aimed to create a platform that would offer better financial services compared to traditional banks, focusing on user-centric benefits.

3. What makes Celsius Coin different from Bitcoin?

While both Celsius Coin and Bitcoin are cryptocurrencies, they serve different purposes. Bitcoin is primarily a digital currency and a store of value, often referred to as “digital gold.” In contrast, Celsius Coin is part of a broader financial platform that offers lending, borrowing, and earning interest on cryptocurrency holdings. Celsius aims to provide higher interest rates on deposits and lower borrowing costs compared to traditional financial institutions, making it a more utility-focused cryptocurrency.

4. Is Celsius Coin a good investment?

Determining whether Celsius Coin is a good investment depends on individual risk tolerance, investment goals, and market conditions. As of now, CEL has seen significant price fluctuations and a decline from its all-time high of $8.02 in June 2021. Prospective investors should conduct thorough research, considering factors like the platform’s user base, services offered, and overall market trends before making investment decisions.

5. How can I buy Celsius Coin?

Celsius Coin (CEL) can be purchased on various cryptocurrency exchanges. Users can trade CEL against major cryptocurrencies like Bitcoin and Ethereum, as well as stablecoins. To buy CEL, you typically need to create an account on an exchange, complete the verification process, deposit funds, and then place an order for CEL. Popular exchanges include Coinbase, Binance, and others.

6. What is the current market cap and price of Celsius Coin?

As of the latest data, Celsius Coin has a market cap of approximately $2.55 million, with a circulating supply of around 37.72 million CEL tokens. The price of CEL is currently around $0.06786. However, prices and market caps can fluctuate rapidly, so it’s essential to check real-time data on cryptocurrency market tracking websites like CoinMarketCap or Coinbase.

7. How does Celsius Network ensure the security of its platform?

Celsius Network employs various security measures to protect users’ assets. It utilizes a modified proof-of-stake algorithm for its token and has implemented robust security protocols to safeguard user data and funds. However, users are also encouraged to take personal security measures, such as enabling two-factor authentication and using secure wallets, to prevent theft or unauthorized access.

8. What are the benefits of using Celsius Coin on the Celsius Network?

Using Celsius Coin on the Celsius Network offers several benefits, including:

– Higher Earnings: Users can earn interest on their cryptocurrency deposits, with rates often exceeding those offered by traditional banks.

– Lower Borrowing Costs: Users can borrow against their crypto holdings at competitive interest rates.

– Enhanced Rewards: Holding and using CEL tokens can increase interest payouts and provide discounts on loan rates.

– Community Incentives: The Celsius Network aims to create a community-driven platform where users benefit from shared growth and rewards.

Final Verdict on celsius coin

Overview of Celsius Coin (CEL)

Celsius Coin (CEL) serves as the native token of the Celsius Network, a platform designed to provide financial services tailored for cryptocurrency users. Launched in 2018, Celsius aims to disrupt traditional banking by offering higher interest rates on deposits, favorable loan terms, and a user-friendly interface. Its technology utilizes a modified proof-of-stake algorithm, which enhances security while facilitating efficient transactions. The CEL token plays a crucial role within the ecosystem, providing users with rewards, reduced fees, and enhanced access to services.

Market Position and Performance

Currently ranked #1731 in the cryptocurrency market, Celsius Coin has a market capitalization of approximately $2.55 million and a circulating supply of around 37.72 million CEL tokens. Despite reaching an all-time high of $8.02 in June 2021, CEL has seen significant declines, currently trading at about $0.06786. This drastic drop highlights the volatility inherent in this asset class, which can lead to both substantial gains and losses.

Risk and Reward Considerations

Investing in Celsius Coin presents a high-risk, high-reward scenario. The potential for significant returns exists, particularly if the Celsius platform can regain traction following its emergence from bankruptcy in early 2024. However, investors must remain cautious, as the cryptocurrency market is notoriously unpredictable, and Celsius has faced challenges in the past.

Conclusion: Conduct Your Own Research

In conclusion, while Celsius Coin offers intriguing opportunities within the decentralized finance (DeFi) space, it is essential to approach this asset with a well-informed mindset. Given its complex history and the current market dynamics, prospective investors should conduct thorough research (DYOR) before making any financial commitments. Understanding the underlying technology, market trends, and your own risk tolerance will be crucial for navigating the opportunities and challenges presented by Celsius Coin.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.