Cash Machine For Sale: The Ultimate B2B Sourcing Guide for Global Buyer

Introduction: Navigating the Global Market for cash machine for sale

In today’s rapidly evolving financial landscape, sourcing reliable cash machines for sale can pose significant challenges for international B2B buyers. With the demand for accessible cash solutions on the rise across regions such as Africa, South America, the Middle East, and Europe, businesses must navigate a complex market filled with various ATM models, suppliers, and compliance standards. This guide is designed to empower B2B decision-makers by providing a comprehensive overview of the cash machine market, including an in-depth examination of different types of ATMs, their applications, and critical factors to consider when selecting a supplier.

From understanding the nuances of new versus refurbished machines to exploring the latest technological advancements, this guide offers valuable insights that facilitate informed purchasing decisions. We will delve into essential aspects such as pricing structures, warranty options, and installation support, ensuring that businesses can maximize their investment. Additionally, we will highlight the importance of supplier vetting, helping buyers identify trustworthy partners that align with their operational needs and compliance requirements.

By leveraging the information presented in this guide, B2B buyers can confidently navigate the global market for cash machines, ensuring they select solutions that enhance their service offerings and contribute to their bottom line. Whether you’re a retailer in Brazil or a banking institution in Nigeria, this resource is tailored to meet your unique challenges and empower your purchasing strategy.

Understanding cash machine for sale Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Retail ATMs | Designed for high foot traffic; often equipped with user-friendly interfaces and security features. | Convenience stores, shopping malls | Pros: Attracts customers, generates transaction fees. Cons: Higher upfront costs. |

| Off-Premise ATMs | Compact, often weather-resistant; suitable for external locations like gas stations. | Gas stations, convenience stores | Pros: Expands service reach, minimal space requirements. Cons: Vulnerable to vandalism. |

| Through-the-Wall (TTW) ATMs | Installed through walls; ideal for secure environments. | Banks, credit unions | Pros: Enhanced security, high capacity for cash storage. Cons: Complex installation process. |

| Mobile ATMs | Portable units that can be relocated as needed; often used for events. | Festivals, outdoor events | Pros: Flexibility and adaptability, can serve temporary locations. Cons: Limited cash capacity. |

| High-End Retail ATMs | Advanced features like touchscreens, high-resolution displays, and enhanced security. | Luxury retail stores, hotels | Pros: Attractive design, improved customer experience. Cons: Higher investment required. |

What Are the Key Characteristics of Retail ATMs?

Retail ATMs are designed for locations with high foot traffic, such as convenience stores and shopping malls. They typically feature user-friendly interfaces and robust security measures, making them appealing to customers. B2B buyers should consider the potential for increased foot traffic and transaction fees generated by these machines. However, the initial investment can be significant, and ongoing maintenance costs must be factored into the overall budget.

How Do Off-Premise ATMs Differ from Other Types?

Off-premise ATMs are compact and often weather-resistant, making them ideal for external locations like gas stations and convenience stores. Their smaller footprint allows for installation in areas where space is limited, effectively expanding the reach of cash services. While they can generate revenue through transaction fees, buyers should be aware of potential vulnerabilities to vandalism and the need for regular cash replenishment.

What Are the Benefits of Through-the-Wall (TTW) ATMs?

Through-the-wall ATMs are installed directly into walls, typically found in banks and credit unions. Their design offers enhanced security and high cash storage capacity, making them suitable for environments where safety is a priority. B2B buyers should consider the complexity of installation and the need for professional support, but the long-term benefits of security and customer trust can justify the investment.

Why Choose Mobile ATMs for Temporary Locations?

Mobile ATMs provide flexibility and can be relocated as needed, making them ideal for temporary events such as festivals and outdoor gatherings. These units can quickly adapt to changing locations, offering cash access where it’s most needed. However, potential buyers should note that mobile ATMs generally have limited cash capacity, which may restrict their usability for larger events.

What Makes High-End Retail ATMs Stand Out?

High-end retail ATMs are equipped with advanced features such as touchscreens and high-resolution displays, enhancing the customer experience in luxury retail environments and hotels. They often come with enhanced security features to protect against fraud and theft. While the initial investment is higher, the potential for increased customer satisfaction and brand image can provide a strong return on investment for B2B buyers.

Key Industrial Applications of cash machine for sale

| Industry/Sector | Specific Application of cash machine for sale | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail | In-store ATMs for cash withdrawal | Increases foot traffic and customer satisfaction | Compliance with local regulations, ease of installation, and warranty options |

| Hospitality | ATMs in hotels and resorts | Provides convenience for guests, enhancing their experience | High uptime reliability, support for multiple currencies, and security features |

| Transportation | ATMs at airports and bus stations | Facilitates easy cash access for travelers | Compact design for space efficiency, robust security measures, and high transaction speed |

| Event Management | Temporary ATMs for festivals and events | Ensures cash availability in high-traffic areas | Portability, quick setup and takedown, and adaptable power sources |

| Financial Services | ATMs in banks and credit unions | Streamlines customer transactions, reduces wait times | Integration with existing banking systems, software compatibility, and service support |

How Are Cash Machines Utilized in the Retail Sector?

In the retail industry, cash machines are strategically placed within stores to facilitate cash withdrawals, encouraging customers to make purchases on-site. This not only increases foot traffic but also enhances customer satisfaction by providing immediate access to cash. Retailers need to consider compliance with local regulations, ease of installation, and warranty options when sourcing ATMs, particularly for international markets where standards may vary.

What Role Do Cash Machines Play in Hospitality?

Hotels and resorts benefit from having ATMs on-site as they provide guests with easy access to cash for various services, from dining to excursions. This convenience can significantly enhance the guest experience and encourage spending. For hospitality businesses, it is crucial to select ATMs that offer high uptime reliability, support for multiple currencies, and robust security features to safeguard transactions.

Why Are Cash Machines Essential for Transportation Hubs?

Airports and bus stations often deploy cash machines to ensure travelers have easy access to cash, which is vital for purchasing tickets or services. The design of these ATMs needs to be compact and user-friendly, as space can be limited in high-traffic areas. Buyers in this sector should prioritize security measures and high transaction speeds to accommodate the fast-paced environment.

How Do Temporary ATMs Benefit Event Management?

During festivals and large events, temporary ATMs are deployed to ensure cash availability in areas with heavy foot traffic. These ATMs must be portable and easy to set up and dismantle, often requiring adaptable power sources. Event organizers should focus on sourcing machines that can provide quick service to accommodate large crowds, ensuring that attendees have the cash they need to enjoy the event fully.

What Are the Key Considerations for Financial Services Using Cash Machines?

In the financial services sector, ATMs are integral for streamlining customer transactions and reducing wait times. Banks and credit unions should look for machines that can easily integrate with their existing banking systems and offer software compatibility. Additionally, service support is crucial to ensure that any issues are resolved quickly, maintaining high customer satisfaction and operational efficiency.

3 Common User Pain Points for ‘cash machine for sale’ & Their Solutions

Scenario 1: Uncertainty About Compliance Standards in ATM Purchases

The Problem: For B2B buyers, especially those in regions like Africa and South America, navigating the myriad compliance standards for ATMs can be daunting. Regulations such as PCI-DSS, ADA, and EMV can vary significantly by country, creating confusion about which standards apply to their specific context. This uncertainty may lead to purchasing machines that do not meet local compliance requirements, resulting in potential fines, operational delays, and increased costs for retrofitting or replacing non-compliant units.

The Solution: Buyers should conduct thorough research and seek expert advice on local compliance standards before making a purchase. Engaging with reputable suppliers who provide detailed specifications and certifications for their machines is crucial. For instance, look for ATMs that explicitly state they meet international compliance standards and inquire about any regional adaptations. Additionally, consider partnering with local legal or financial consultants specializing in ATM operations to ensure all regulations are addressed. This proactive approach can save time and money while ensuring seamless integration into existing financial infrastructures.

Scenario 2: Challenges in Sourcing Reliable ATM Suppliers

The Problem: Sourcing reliable ATM suppliers can be a significant challenge for B2B buyers, especially in emerging markets. Many buyers may encounter suppliers who over-promise on machine capabilities and support services, leading to frustrations with installation, maintenance, and transaction processing. This can result in equipment downtime, loss of revenue, and diminished customer trust.

The Solution: To overcome this issue, buyers should prioritize sourcing from established suppliers with a proven track record in the industry. Conducting due diligence through online reviews, case studies, and testimonials can provide insights into a supplier’s reliability. Furthermore, buyers should seek out suppliers who offer comprehensive support packages, including installation assistance, technical training, and ongoing maintenance services. Opting for vendors that provide a clear warranty policy can also mitigate risks associated with equipment failure. Engaging in direct discussions with potential suppliers about their service offerings and support response times can help establish a reliable partnership.

Scenario 3: High Initial Investment Costs Deterring ATM Purchases

The Problem: The high upfront costs associated with purchasing ATMs can deter many businesses, particularly small to medium enterprises in developing regions. While the potential for revenue generation through transaction fees exists, the initial investment can seem prohibitive, leading to missed opportunities for cash access in underserved markets.

The Solution: To address this financial barrier, buyers can explore various financing options such as leasing agreements or installment plans that spread the cost over time. Many suppliers offer flexible financing solutions tailored for businesses that may not have the capital for outright purchases. Additionally, buyers should consider purchasing refurbished ATMs, which can significantly reduce initial costs without sacrificing functionality. Engaging in discussions with suppliers about bulk purchase discounts or promotional offers can also yield financial benefits. By leveraging these financial strategies, businesses can gain access to ATM technology without overwhelming upfront expenses, allowing them to enhance their service offerings and improve cash accessibility for their customers.

Strategic Material Selection Guide for cash machine for sale

What Are the Common Materials Used in Cash Machines?

When selecting materials for cash machines, several factors come into play, including durability, cost, and compliance with international standards. Here, we analyze four common materials used in the construction of cash machines, focusing on their properties, advantages, disadvantages, and specific considerations for international B2B buyers.

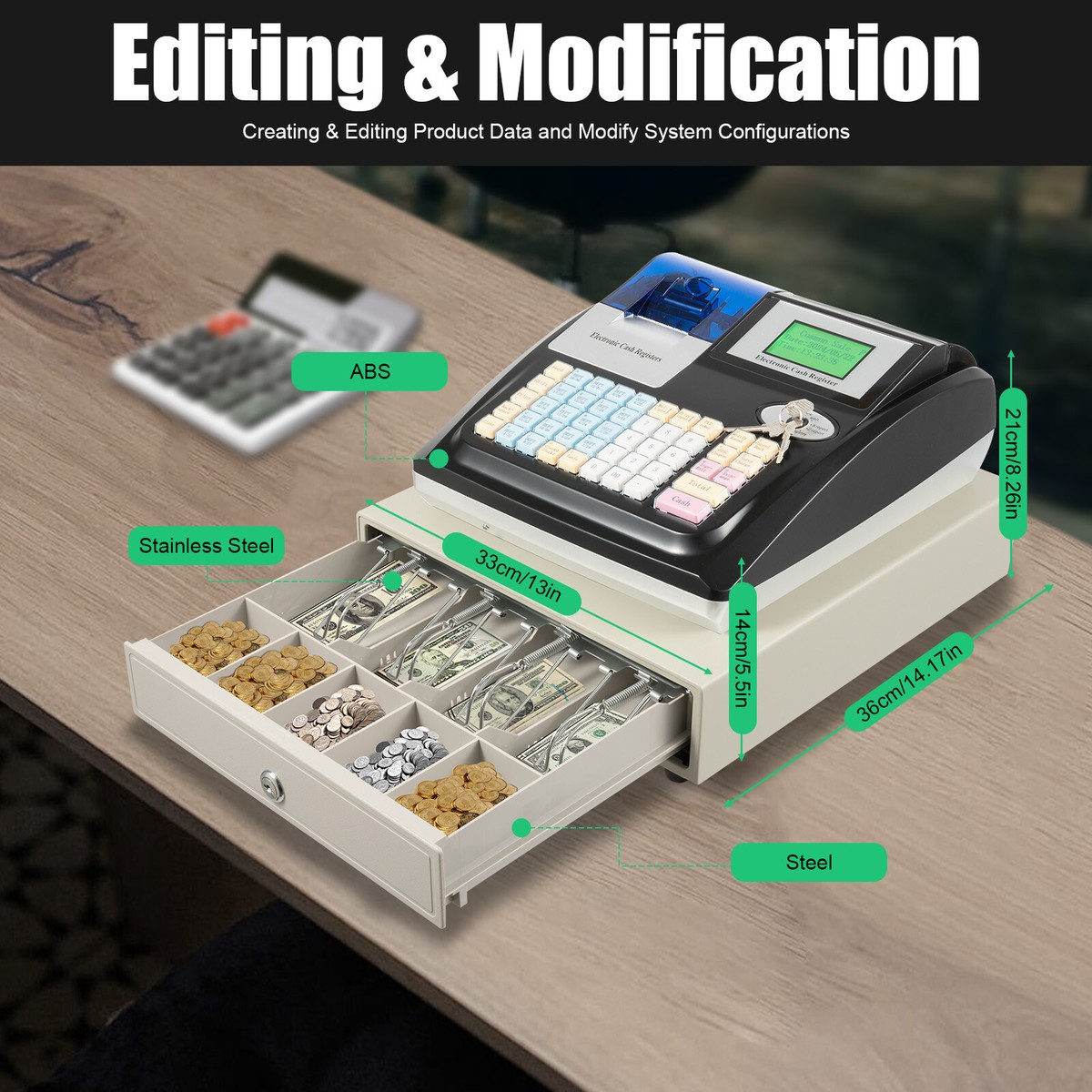

How Does Steel Perform as a Material for Cash Machines?

Key Properties: Steel is renowned for its high tensile strength and durability, making it an ideal choice for the outer casing of cash machines. It typically withstands high temperatures and pressures, while also offering resistance to corrosion when treated with protective coatings.

Pros & Cons: The primary advantage of steel is its robustness, which ensures long-term reliability and security against physical attacks. However, steel can be heavy and may increase shipping costs. Additionally, the manufacturing process can be complex, requiring specialized equipment for cutting and shaping.

Illustrative image related to cash machine for sale

Impact on Application: Steel’s strength makes it suitable for high-traffic environments, where durability is essential. However, its weight may limit installation options, particularly in locations with structural constraints.

Considerations for International Buyers: Compliance with international standards such as ASTM and ISO is crucial. Buyers from regions like Africa and South America should also consider local climate factors, as untreated steel may rust in humid environments.

What Role Does Aluminum Play in Cash Machine Construction?

Key Properties: Aluminum is lightweight and exhibits good corrosion resistance, particularly when anodized. It can withstand moderate temperatures and pressures, making it suitable for various environments.

Pros & Cons: The lightweight nature of aluminum allows for easier installation and lower shipping costs. However, it is less durable compared to steel, which may pose security risks in high-crime areas. Additionally, aluminum can be more expensive than steel, depending on the market.

Impact on Application: Aluminum is ideal for cash machines in retail locations where mobility and aesthetics are important. However, its lower strength may limit its use in high-security environments.

Considerations for International Buyers: Buyers should ensure that aluminum components meet local standards for corrosion resistance, particularly in coastal regions where salt exposure is a concern.

How Does Plastic Contribute to Cash Machine Design?

Key Properties: High-density polyethylene (HDPE) and polycarbonate are commonly used plastics in cash machines. These materials are lightweight, impact-resistant, and can endure a wide range of temperatures.

Pros & Cons: The primary advantage of plastic is its resistance to corrosion and its lightweight nature, which facilitates easier handling and installation. However, plastics may not provide the same level of security as metal materials, making them less suitable for high-risk locations.

Impact on Application: Plastic components are often used for internal parts or as protective casings in less vulnerable areas of the machine. Their flexibility allows for innovative designs, but they may not withstand extreme physical attacks.

Considerations for International Buyers: Compliance with environmental regulations regarding plastic waste is increasingly important. Buyers should also consider the long-term durability of plastic in various climates.

What About Glass in Cash Machine Design?

Key Properties: Tempered glass is often used for display screens and protective panels. It is designed to withstand high impact and is resistant to scratches, making it suitable for public use.

Pros & Cons: The main advantage of tempered glass is its aesthetic appeal and the ability to provide a clear display for users. However, it can shatter under extreme force, posing a security risk. The manufacturing process can also be more costly compared to other materials.

Impact on Application: Glass is ideal for enhancing user interaction and visibility, making it a popular choice for modern cash machines. However, its fragility may limit its use in high-risk environments.

Considerations for International Buyers: Buyers should ensure that the glass meets safety standards relevant to their region, particularly in areas prone to vandalism or extreme weather conditions.

Summary Table of Material Selection for Cash Machines

| Material | Typical Use Case for cash machine for sale | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Steel | Outer casing and structural components | High durability and security | Heavy and complex manufacturing | High |

| Aluminum | Lightweight casings and frames | Lightweight and corrosion-resistant | Less secure than steel | Medium |

| Plastic | Internal components and protective casings | Corrosion-resistant and flexible | Lower security against attacks | Low |

| Glass | Display screens and protective panels | Aesthetic appeal and visibility | Fragile and can shatter | Medium |

This comprehensive analysis provides B2B buyers with actionable insights into material selection for cash machines, ensuring informed decisions that align with their operational needs and regional standards.

In-depth Look: Manufacturing Processes and Quality Assurance for cash machine for sale

The manufacturing processes and quality assurance (QA) protocols for cash machines are critical for ensuring that these devices meet the operational and security needs of businesses, particularly in diverse markets across Africa, South America, the Middle East, and Europe. This section will outline the typical manufacturing stages, key techniques involved, and the quality control measures that buyers should consider when sourcing ATMs.

What Are the Main Stages of Manufacturing Cash Machines?

The manufacturing of cash machines involves several key stages, which can be categorized as follows:

Material Preparation

The process begins with sourcing high-quality materials that are critical for the durability and functionality of cash machines. This includes metals for the chassis, plastics for the casing, electronic components for the internal circuitry, and software systems. Suppliers often conduct rigorous assessments to ensure the materials meet industry standards.

Forming

After material preparation, the forming stage involves shaping the materials into the required components. This can include processes such as stamping for metal parts, injection molding for plastic casings, and printed circuit board (PCB) assembly for electronic components. Advanced techniques like CNC machining may also be used to achieve high precision in component creation.

Assembly

Once all parts are formed, they undergo assembly. This stage typically involves both manual and automated processes. Skilled technicians carefully assemble the components, ensuring that all connections are secure and functional. Each ATM is assembled in a controlled environment to minimize dust and contaminants, which could affect performance.

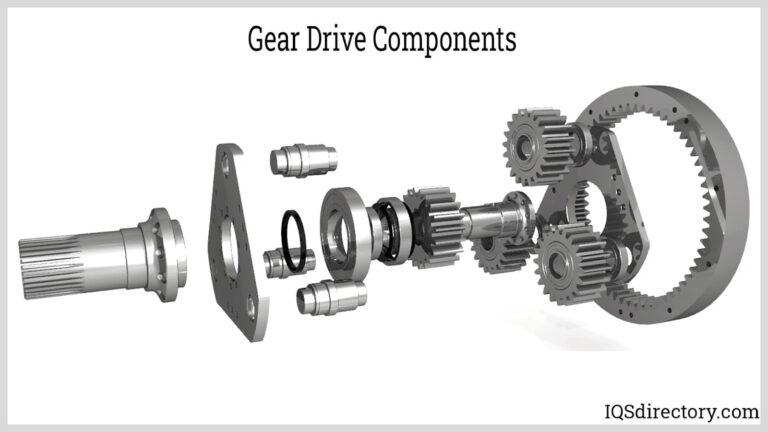

Illustrative image related to cash machine for sale

Finishing

The finishing stage includes aesthetic and functional enhancements. This may involve painting, applying protective coatings, and integrating security features like locks and alarms. Additionally, software installation is completed during this stage, ensuring the machine is ready for transactions.

How Is Quality Control Integrated into ATM Manufacturing?

Quality control is an integral part of the manufacturing process, ensuring that cash machines meet both international and industry-specific standards. Here’s how the QC process typically unfolds:

What Are the Relevant International Standards for Cash Machines?

To maintain a high level of quality, manufacturers often adhere to international standards such as ISO 9001, which focuses on quality management systems. Compliance with CE marking is also crucial, especially for machines sold in the European market, as it indicates conformity with health, safety, and environmental protection standards.

What Are the Industry-Specific Standards for ATMs?

In addition to general standards, cash machines may need to comply with specific regulations such as EMV (Europay, MasterCard, and Visa) for card transactions and PCI-DSS (Payment Card Industry Data Security Standard) for data protection. These standards ensure that ATMs are secure and reliable for handling sensitive financial transactions.

What Are the Key QC Checkpoints in ATM Manufacturing?

Quality control checkpoints typically include:

-

Incoming Quality Control (IQC): This step involves inspecting materials and components upon arrival to ensure they meet specified requirements before they are used in manufacturing.

-

In-Process Quality Control (IPQC): During the assembly process, QC personnel conduct checks to ensure that each stage of assembly adheres to quality standards and that any defects are addressed promptly.

-

Final Quality Control (FQC): Once assembly is complete, each ATM undergoes a thorough final inspection. This includes functionality tests, security feature checks, and performance evaluations to confirm that the machine operates as intended.

What Testing Methods Are Commonly Used in ATM Quality Control?

Several testing methods are employed to ensure the quality and reliability of cash machines:

-

Functional Testing: This involves verifying that all features of the ATM, including cash dispensing, card reading, and network connectivity, operate correctly.

-

Environmental Testing: Cash machines are subjected to various environmental conditions, such as temperature extremes and humidity, to ensure they can operate effectively in diverse climates.

-

Stress Testing: This method evaluates the ATM’s performance under heavy transaction loads to ensure it can handle peak usage without failure.

How Can B2B Buyers Verify Supplier Quality Control?

For international B2B buyers, particularly those from regions like Africa, South America, the Middle East, and Europe, verifying the quality control measures of ATM suppliers is crucial. Here are actionable steps to ensure compliance:

What Should Buyers Look for in Supplier Audits and Reports?

-

Third-Party Audits: Request documentation of third-party audits that verify compliance with international standards. This provides an unbiased perspective on the supplier’s quality processes.

-

Quality Assurance Reports: Suppliers should be able to provide comprehensive QA reports detailing their manufacturing processes, QC checkpoints, and testing outcomes.

-

Certifications: Ensure that the supplier holds necessary certifications such as ISO 9001, CE, and other relevant industry-specific certifications.

What Are the QC and Certification Nuances for International Buyers?

When purchasing ATMs from international suppliers, buyers should be aware of certain nuances:

-

Regulatory Compliance: Different regions have varying regulatory requirements for ATMs. Understanding these regulations is essential to ensure that the machines will be compliant upon arrival.

-

Import Standards: Countries may have specific import standards that must be met for electronic devices. Buyers should familiarize themselves with these standards to avoid potential issues during importation.

-

Local Support and Service: Consider suppliers who offer local support and service options, as this can significantly affect the maintenance and operation of ATMs in diverse environments.

By understanding these manufacturing processes and quality assurance protocols, B2B buyers can make informed decisions when purchasing cash machines, ensuring they select reliable, compliant, and high-quality products that meet their business needs.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘cash machine for sale’

Introduction

Purchasing a cash machine (ATM) for your business is a significant investment that requires careful consideration and planning. This step-by-step checklist is designed to guide B2B buyers through the sourcing process, ensuring that you make informed decisions that meet your operational needs and align with your financial objectives.

Step 1: Define Your Technical Specifications

Before you start searching for suppliers, outline the technical specifications that your cash machine must meet. Consider factors such as the machine’s size, processing speed, security features, and compliance with industry standards like PCI and EMV. By having clear specifications, you can streamline the selection process and ensure that the ATM meets your business requirements.

- Size and Capacity: Determine the number of transactions you expect and the note capacity needed.

- Security Features: Look for machines with advanced security options to safeguard against fraud.

Step 2: Research Potential Suppliers

Take the time to research various suppliers that offer cash machines for sale. Look for established companies with a solid reputation in the industry. Check online reviews, testimonials, and case studies to gauge their reliability and service quality.

- Industry Affiliations: Verify if the supplier is affiliated with reputable industry organizations, which can be an indicator of trustworthiness.

- Geographic Reach: Ensure the supplier can deliver to your location, particularly if you are operating in regions like Africa or South America.

Step 3: Evaluate Product Offerings

Once you have shortlisted potential suppliers, assess their product range. Ensure they offer a variety of models from reputable manufacturers such as Nautilus Hyosung and Genmega. Look for machines that align with your technical specifications and consider both new and refurbished options.

- Warranty and Support: Check if the machines come with warranties and what kind of post-purchase support is available.

- Custom Features: Investigate if the ATM can be customized to suit your specific business needs.

Step 4: Request Quotes and Compare Pricing

Contact your shortlisted suppliers to request detailed quotes. Pay attention to the pricing structure, including any hidden fees for shipping, installation, or maintenance. Comparing these quotes will help you identify the best value for your investment.

- Total Cost of Ownership: Consider not just the purchase price but also ongoing costs like maintenance and transaction fees.

- Volume Discounts: Inquire about discounts for bulk purchases if you plan to buy multiple machines.

Step 5: Check Supplier Certifications and Compliance

Verify that the suppliers adhere to necessary certifications and compliance requirements. This step is crucial to ensure that the ATM meets legal and operational standards in your region.

- Regulatory Compliance: Confirm that the ATM complies with local laws and international standards to avoid legal issues.

- Certification Verification: Ask for documentation that proves their compliance and quality assurance processes.

Step 6: Plan for Installation and Maintenance

Consider the logistics of installation and ongoing maintenance. A good supplier should offer installation support and maintenance services to ensure your ATM operates smoothly after purchase.

- Installation Services: Confirm whether the supplier provides installation services and the timeline involved.

- Maintenance Plans: Inquire about maintenance contracts to keep the ATM in optimal working condition.

Step 7: Finalize Your Purchase Agreement

Once you have completed the evaluation process and are satisfied with your chosen supplier, finalize the purchase agreement. Ensure that all terms, including delivery dates, warranties, and support services, are clearly outlined.

- Clear Terms: Review all terms and conditions thoroughly to avoid misunderstandings.

- Payment Options: Discuss payment methods that work best for your business, whether it’s upfront or financing options.

Following these steps will help you navigate the complexities of sourcing cash machines effectively, setting the foundation for a successful ATM operation that meets your business needs.

Comprehensive Cost and Pricing Analysis for cash machine for sale Sourcing

What Are the Key Cost Components in Cash Machine Pricing?

When sourcing cash machines for sale, understanding the cost structure is essential. The primary cost components include:

-

Materials: The cost of raw materials, such as metals, plastics, and electronic components, significantly influences pricing. High-quality materials can enhance durability and functionality, justifying a higher price point.

-

Labor: Labor costs encompass the wages for skilled workers involved in assembly, programming, and quality control. Countries with higher labor costs may see increased machine prices, while manufacturers in regions with lower labor costs can offer more competitive pricing.

-

Manufacturing Overhead: This includes utilities, rent, and other indirect costs associated with production. Efficient production processes can help reduce overhead, thus lowering overall costs.

-

Tooling: The investment in machinery and tools for production can impact pricing. Custom tooling for specific machine features may raise initial costs, but it can also lead to economies of scale for larger orders.

-

Quality Control (QC): Implementing robust QC processes ensures reliability and compliance with industry standards, which can add to manufacturing costs but ultimately leads to higher customer satisfaction and fewer returns.

-

Logistics: Shipping costs are a critical factor, especially for international buyers. Freight costs can vary significantly based on distance, shipping method, and destination regulations.

-

Margin: Manufacturers and distributors typically include a profit margin in their pricing, which can vary based on market competition and brand positioning.

How Do Price Influencers Affect the Cost of Cash Machines?

Several factors can influence the final pricing of cash machines:

-

Volume/MOQ (Minimum Order Quantity): Purchasing in bulk can lead to significant discounts. Suppliers often provide better pricing for larger orders, which is advantageous for businesses looking to deploy multiple machines.

-

Specifications and Customization: Tailoring a cash machine to meet specific needs (such as software integration or unique design features) can increase costs. Buyers should weigh the benefits of customization against the added expense.

-

Materials and Quality Certifications: Machines made with certified components, such as EMV compliance for card transactions, may carry higher prices. Certifications ensure that the machines meet safety and regulatory standards, which is crucial for operational reliability.

-

Supplier Factors: The reputation and reliability of the supplier can influence pricing. Established suppliers may charge a premium due to their proven track record and support services.

-

Incoterms: Understanding Incoterms (International Commercial Terms) is vital for international transactions. They define responsibilities for shipping, insurance, and tariffs, affecting the total landed cost of the machines.

What Are Effective Buyer Tips for Negotiating Cash Machine Prices?

International B2B buyers should consider several strategies to optimize their purchasing decisions:

-

Negotiate Volume Discounts: Leverage the power of bulk buying to negotiate lower prices. Discuss potential long-term partnerships to secure better terms.

-

Evaluate Total Cost of Ownership (TCO): Look beyond the initial purchase price. Consider long-term expenses such as maintenance, transaction fees, and potential downtime. A more expensive machine may offer lower TCO if it has higher reliability and lower operational costs.

-

Understand Pricing Nuances: Familiarize yourself with market prices in your region. Prices can vary based on local demand, currency fluctuations, and import duties. Use this knowledge to negotiate effectively.

-

Request Detailed Quotes: Obtain itemized quotes that break down costs. This transparency allows for better comparison between suppliers and aids in identifying areas for negotiation.

-

Consider Local Suppliers: Engaging with local suppliers can reduce shipping costs and simplify logistics. They may also provide better after-sales support, which is crucial for maintaining machine uptime.

In conclusion, a comprehensive understanding of the cost structure and pricing influencers for cash machines can significantly enhance your sourcing strategy. By applying these insights, B2B buyers can make informed decisions that align with their operational needs and financial goals.

Alternatives Analysis: Comparing cash machine for sale With Other Solutions

In the evolving landscape of financial transactions, businesses are increasingly exploring various solutions to enhance cash accessibility and streamline payments. While cash machines for sale represent a traditional and reliable option, alternatives exist that may better suit specific operational needs or market conditions. This section compares cash machines with two viable alternatives: mobile payment solutions and kiosk systems, highlighting their respective strengths and weaknesses.

| Comparison Aspect | Cash Machine For Sale | Mobile Payment Solutions | Kiosk Systems |

|---|---|---|---|

| Performance | High uptime, reliable cash dispensing | Instant transactions, user-friendly | Versatile services (e.g., tickets, info) |

| Cost | Initial investment + maintenance costs | Transaction fees, lower upfront costs | Moderate initial investment + service costs |

| Ease of Implementation | Requires installation and training | Quick setup, no physical installation | Requires space, but user-friendly setup |

| Maintenance | Regular cash replenishment and servicing | Minimal, mostly software updates | Regular maintenance, part replacements |

| Best Use Case | Retail locations, convenience stores | E-commerce, on-the-go payments | High foot traffic areas, informational needs |

What Are the Advantages and Disadvantages of Mobile Payment Solutions?

Mobile payment solutions, such as digital wallets and payment apps, have surged in popularity due to their convenience and speed. These platforms allow users to complete transactions via smartphones, facilitating cashless payments in various environments. One significant advantage is the lower upfront cost compared to cash machines, as businesses often pay transaction fees rather than investing in hardware. However, mobile payments can be limited by internet connectivity and may not be suitable in regions with low smartphone penetration. Additionally, businesses may need to educate customers on using these technologies, which can introduce a learning curve.

How Do Kiosk Systems Compare to Cash Machines?

Kiosk systems offer a flexible alternative, allowing businesses to provide a range of services beyond cash dispensing. These systems can be equipped to sell tickets, provide information, or even facilitate payments, making them highly versatile. Kiosks are particularly effective in high-foot-traffic areas, such as malls or airports, where they can serve multiple functions and enhance customer engagement. However, they require a moderate initial investment and ongoing maintenance, which can be a drawback for smaller businesses. Their effectiveness can also depend on the location and the specific services offered.

How Can B2B Buyers Choose the Right Solution?

Selecting the right solution depends on various factors, including business type, customer preferences, and operational capabilities. For businesses in retail or those requiring reliable cash access, cash machines may be the best choice due to their established reliability and customer familiarity. Conversely, businesses targeting tech-savvy customers or operating in urban areas may benefit from adopting mobile payment solutions for their speed and convenience. Kiosk systems serve as a compelling option for businesses looking to diversify their service offerings and engage customers in innovative ways. Ultimately, understanding the unique needs of the target market and evaluating each solution’s costs and benefits will guide B2B buyers in making an informed decision.

Essential Technical Properties and Trade Terminology for cash machine for sale

What Are the Key Technical Properties of Cash Machines for Sale?

When considering the purchase of cash machines, several critical technical properties must be evaluated to ensure the equipment meets the needs of your business. Here are some key specifications:

-

Compliance Standards

Cash machines must adhere to several industry regulations, including PCI (Payment Card Industry) standards, ADA (Americans with Disabilities Act) compliance, and EMV (Europay, MasterCard, and Visa) standards. Compliance ensures that machines are secure, accessible, and capable of processing chip-enabled cards, which is essential for safeguarding customer data and ensuring legal operation across different regions. -

Cassette Capacity

The cassette capacity refers to the amount of cash the machine can hold, typically measured in notes (e.g., 1K or 2K cassettes). A higher capacity means less frequent cash replenishment, which is crucial for high-traffic locations. Understanding cassette capacity helps in forecasting cash flow and operational efficiency. -

Display Type and Size

The display type (LCD or TFT) and size (e.g., 10.1″ or 15″) significantly affect user interaction. Larger, high-resolution screens enhance the customer experience by providing clear instructions and visually appealing interfaces, which can lead to increased transactions and customer satisfaction. -

Durability and Weather Resistance

The material and design of cash machines determine their durability and weather resistance, especially important in outdoor or harsh environments. Machines made from robust materials can withstand vandalism and adverse weather conditions, thereby reducing maintenance costs and downtime. -

Installation and Connectivity Options

Different cash machines may offer various installation configurations (e.g., wall-mounted or through-the-wall) and connectivity options (e.g., wired or wireless). The right configuration can maximize space utilization and ensure reliable internet connectivity for transaction processing.

Which Trade Terminology Should B2B Buyers Understand When Purchasing Cash Machines?

Familiarity with industry jargon is essential for effective communication and negotiation in the ATM market. Below are some common terms that buyers should know:

-

OEM (Original Equipment Manufacturer)

This term refers to the company that originally manufactures the ATM machines. Understanding OEM relationships is crucial for buyers as it affects warranty, service quality, and the availability of replacement parts. -

MOQ (Minimum Order Quantity)

MOQ indicates the minimum number of units a supplier requires for an order. For B2B buyers, being aware of MOQ can help in budgeting and inventory management, especially when considering bulk purchases. -

RFQ (Request for Quotation)

An RFQ is a document that buyers send to suppliers to request pricing for specific products or services. Including detailed specifications in the RFQ ensures that the quotes received are accurate and comparable, facilitating informed decision-making. -

Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers in international transactions, including who bears the shipping costs and risk during transit. Understanding these terms is vital for international buyers to negotiate favorable terms and minimize potential disputes. -

Turnkey Solutions

This term describes a complete ATM package that includes the machine, installation, and maintenance services. For B2B buyers, turnkey solutions can simplify the purchasing process, ensuring all components work seamlessly from day one. -

Field Service Technician

A field service technician is a trained professional responsible for the installation, maintenance, and repair of cash machines. Knowing about the availability and qualifications of technicians can influence purchasing decisions, as reliable service support is essential for minimizing downtime.

Understanding these technical specifications and trade terms can significantly enhance the purchasing experience for cash machines, leading to better-informed decisions and more successful business operations.

Navigating Market Dynamics and Sourcing Trends in the cash machine for sale Sector

What Are the Current Market Dynamics and Key Trends in the Cash Machine Sector?

The global cash machine market is experiencing significant growth, driven by increasing demand for automated cash access and the expansion of the banking infrastructure in emerging economies. International B2B buyers, especially from Africa, South America, the Middle East, and Europe, are witnessing a surge in the adoption of ATMs as financial institutions and retail businesses seek to enhance customer convenience and improve transaction efficiency. The rise of digital banking and contactless payments, however, presents a dual challenge and opportunity. While the need for cash machines remains robust, there is a growing expectation for ATMs to integrate advanced technologies such as biometric authentication and contactless transaction capabilities.

Emerging sourcing trends include a shift towards multi-functional ATMs that not only dispense cash but also offer additional services such as bill payments and mobile top-ups. International buyers should also consider the increasing importance of machine compatibility with various payment networks and the need for compliance with regional regulations, particularly in areas like PCI and EMV standards. Furthermore, the demand for used ATMs is on the rise, driven by cost-conscious buyers looking for reliable solutions without the premium price tag of new machines. This trend highlights the importance of sourcing from reputable suppliers who provide warranties and maintenance support.

How Is Sustainability and Ethical Sourcing Impacting the Cash Machine for Sale Sector?

Sustainability is becoming a crucial consideration in the cash machine sector, as B2B buyers increasingly prioritize environmentally friendly practices. The production and disposal of ATMs have significant environmental impacts, prompting manufacturers to adopt greener practices. This includes using recyclable materials, energy-efficient components, and eco-friendly packaging. Buyers are encouraged to seek out suppliers who prioritize sustainability, as this not only reflects corporate social responsibility but can also enhance brand reputation in a market that values ethical business practices.

Ethical sourcing extends beyond the materials used; it encompasses the entire supply chain. Buyers should inquire about the manufacturing processes of cash machines, ensuring that they are produced under fair labor conditions and that suppliers adhere to ethical standards. Certifications such as ISO 14001 for environmental management and Fair Trade can serve as indicators of a supplier’s commitment to sustainable and ethical practices. As more businesses recognize the importance of sustainability, aligning with suppliers who share these values can foster long-term partnerships and customer loyalty.

What Is the Brief Evolution and History of ATMs Relevant to B2B Buyers?

The evolution of ATMs dates back to the late 1960s when the first cash machine was introduced, revolutionizing the way consumers accessed cash. Initially, these machines were rudimentary, offering basic cash withdrawal services. Over the decades, advancements in technology transformed ATMs into sophisticated financial terminals capable of handling various transactions, including deposits, transfers, and bill payments.

For B2B buyers, understanding the historical context of ATMs is essential. It highlights the rapid technological advancements that have shaped the market, emphasizing the importance of sourcing machines that are not only compliant with current standards but are also adaptable to future innovations. As the industry continues to evolve, staying informed about the historical developments can provide valuable insights into the reliability and longevity of different ATM models, guiding buyers in their purchasing decisions.

Frequently Asked Questions (FAQs) for B2B Buyers of cash machine for sale

-

How do I ensure the reliability of an ATM supplier?

To ensure the reliability of an ATM supplier, conduct thorough research on their reputation in the industry. Look for reviews, testimonials, and case studies from existing clients. Verify their experience in international shipping and support, especially in your region. Additionally, check if they offer warranties and after-sales support, which can be crucial for maintenance and troubleshooting. Engaging in direct communication can also help gauge their responsiveness and professionalism. -

What is the best ATM machine for retail environments?

The best ATM machine for retail environments typically includes features such as a user-friendly interface, high uptime reliability, and compliance with industry standards like PCI and EMV. Models such as the Nautilus Hyosung HALO II and Genmega G2500 are popular choices, offering robust security features, customizable options, and attractive designs that enhance customer experience. Assess your specific business needs, including transaction volume and location, to make an informed decision. -

What payment terms should I expect when purchasing ATMs?

Payment terms for purchasing ATMs can vary significantly among suppliers. Most offer options such as upfront payments, financing plans, or leasing arrangements. It’s essential to clarify these terms before finalizing a purchase. Look for suppliers who provide transparent pricing, including shipping and installation costs, and inquire about any potential discounts for bulk purchases. Establishing clear payment terms can help manage cash flow effectively. -

Are there minimum order quantities (MOQ) for cash machines?

Many ATM suppliers set a minimum order quantity (MOQ) to streamline their operations and reduce shipping costs. This can vary widely, with some suppliers offering individual units while others may require bulk purchases. For international buyers, understanding the MOQ is crucial as it affects shipping logistics and total costs. Always confirm the MOQ with your supplier before proceeding to ensure it aligns with your business needs. -

How can I customize an ATM for my business needs?

Customization options for ATMs often include branding, software configurations, and hardware modifications. Suppliers may offer personalized wraps or skins to align the ATM with your brand identity. Additionally, software can be tailored to include specific transaction options or languages to cater to your customer base. Discuss your specific requirements with potential suppliers to understand the extent of customization they can provide. -

What logistics considerations should I be aware of when importing ATMs?

When importing ATMs, consider factors such as shipping costs, import duties, and compliance with local regulations. Ensure the supplier can handle international shipping and provide necessary documentation for customs clearance. Additionally, factor in the time required for shipping and installation to avoid disruption in your operations. Collaborating with a logistics partner familiar with importing electronic equipment can simplify this process. -

How do I assess the quality assurance (QA) processes of an ATM supplier?

Assessing the QA processes of an ATM supplier involves examining their testing and certification procedures. Inquire if they perform rigorous testing on their machines, especially used units, to ensure functionality and compliance with industry standards. Additionally, ask about warranties and support services that reflect their commitment to quality. A reputable supplier should provide transparency regarding their QA protocols. -

What are the common maintenance requirements for ATMs?

Regular maintenance for ATMs includes software updates, cash replenishment, and routine inspections to ensure optimal functionality. Most suppliers offer maintenance packages that cover these services, which can be beneficial for B2B buyers. Establish a maintenance schedule with your supplier to minimize downtime and ensure compliance with security standards. Understanding the maintenance requirements upfront can help you plan for ongoing operational costs effectively.

Top 5 Cash Machine For Sale Manufacturers & Suppliers List

1. ATM Machines – Hyosung 2700CE & Genmega G2500

Domain: nasatm.com

Registered: 2010 (15 years)

Introduction: New ATM Machines for Sale starting at $2420 with a 2-year warranty. Used ATM Machines for Sale starting at $1795 with a 90-day warranty. Key models include: 1. Hyosung 2700CE – $1,795, known for reliability and meets industry standards. 2. Genmega G2500 – $2,420, designed for retail with 8″ display and EMV compliance. 3. Genmega Onyx-Series – $2,580, upgraded appearance and features. 4. Nautilus H…

2. Nautilus Hyosung – Halo II ATM Machine

Domain: ebay.com

Registered: 1995 (30 years)

Introduction: ATM Machines for sale on eBay include various brands such as Nautilus Hyosung, Diebold, Triton, and Wincor Nixdorf. A notable listing is the Nautilus Hyosung Halo II ATM Machine priced at $2,825.00. Other items include components like the AUO G057QN01V2 LCD Panel Driver Board for $80.10. The listings feature both new and used machines, with options to filter by price, condition, and shipping prefe…

3. Hyosung – Halo II

Domain: atmbrokerage.com

Registered: 2013 (12 years)

Introduction: ATM Machines for Sale:

– Brands: Hyosung, Genmega, Triton, Puloon

– Features: Plug-and-play, fully compliant, high uptime, easy setup, fast shipping

– Warranty: 2-year warranty, free installation support, lifetime technical programming

– Pricing:

– Hyosung Halo II: $3,050

– Genmega 2500: $2,689

– Genmega GT 3000: $4,774

– Genmega Onyx: $2,849

– Hyosung Force: $3,312

– Genmega…

4. ATM Money Machine – New and Used ATMs

Domain: atmmoneymachine.com

Registered: 2009 (16 years)

Introduction: ATM Money Machine offers new and used ATMs from leading brands like Hyosung, Genmega, and Triton. Their ATMs are plug-and-play, preprogrammed, fully compliant, and shipped quickly for immediate use. They provide nationwide ATM processing, technical support, and detailed transaction reporting. Customers keep 100% of the surcharge revenue from transactions, with potential earnings depending on locat…

5. Genmega – G2500 ATM Machine

Domain: atmdepot.com

Registered: 2003 (22 years)

Introduction: {‘new_atm_machines’: [{‘model’: ‘Genmega G2500’, ‘features’: [‘8″ TFT High-resolution 32-Bit Color LCD Screen’, ‘1,000 Note Removable Cassette’, ‘GenCam Camera System’, ‘Electronic Lock’, ‘EMV Card Reader’, ’24 Month Warranty’, ‘2″ Wide Printer (Upgradable to 3″)’, ‘Integrated ATM Sign Topper’, ‘ADA Compliant Voice Guided Transactions’, ‘Communications: Dial Up, TCP/IP Internet, or Wireless’, ‘One…

Strategic Sourcing Conclusion and Outlook for cash machine for sale

In the competitive landscape of cash machines, strategic sourcing emerges as a pivotal factor for B2B buyers looking to maximize profitability and operational efficiency. By selecting reputable suppliers and leveraging the latest ATM technologies, businesses can enhance customer satisfaction and ensure compliance with industry standards. Key considerations include evaluating the total cost of ownership, warranty offerings, and the availability of after-sales support.

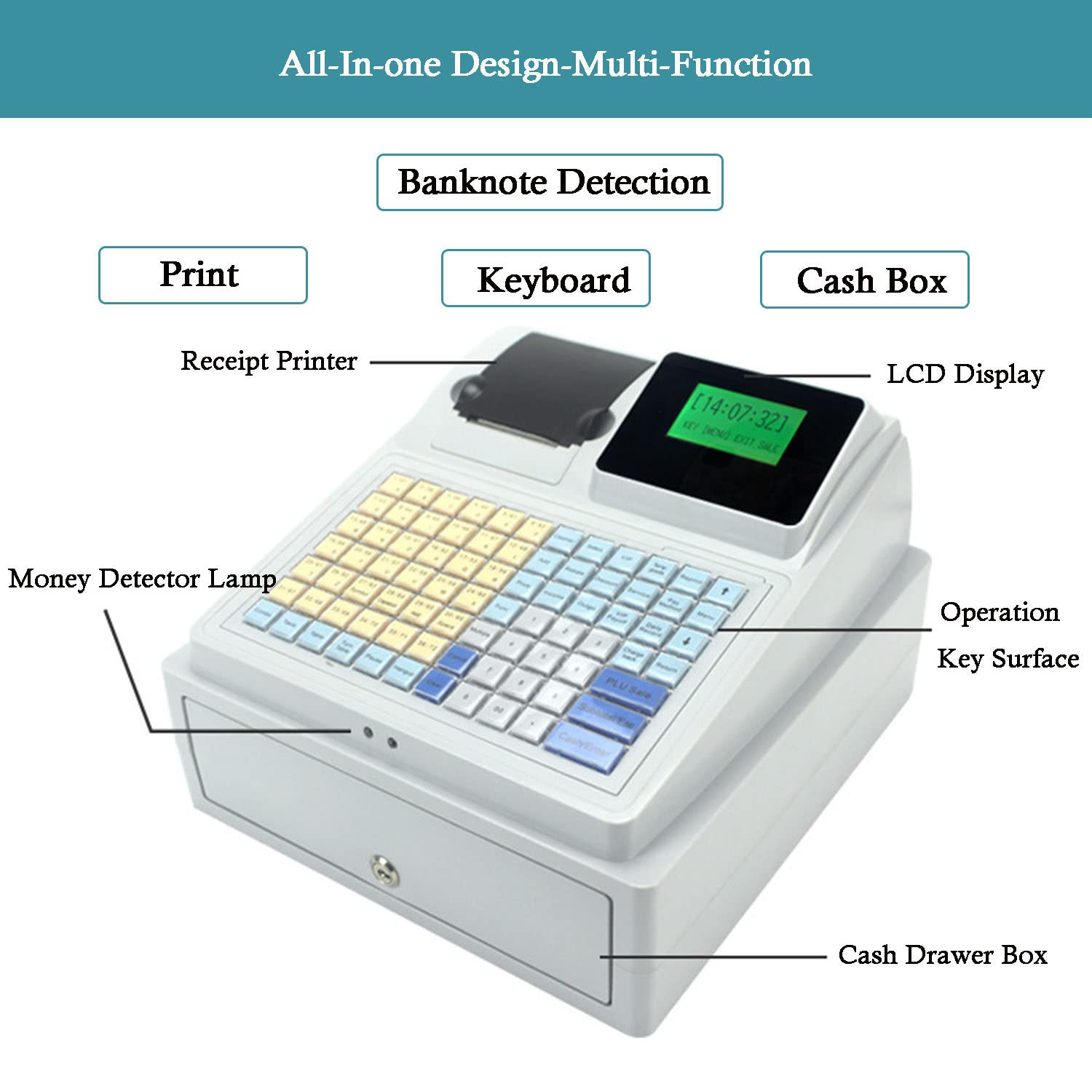

Illustrative image related to cash machine for sale

For international buyers, particularly in regions like Africa, South America, the Middle East, and Europe, the opportunity to invest in reliable and innovative ATM solutions is ripe. As markets evolve and the demand for accessible cash grows, aligning your sourcing strategy with trusted manufacturers such as Nautilus Hyosung and Genmega can provide a competitive edge.

Now is the time to take action. Explore diverse options, whether new or refurbished ATMs, to find solutions that meet your business needs. Investing in the right cash machines not only positions your business for immediate success but also sets the stage for long-term growth in an increasingly cash-dependent world. Embrace the future of cash accessibility and enhance your operational capabilities today.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.