berachain coin Explained: A Deep Dive into the Technology and Token…

An Investor’s Introduction to berachain coin

Berachain Coin (BERA) has emerged as a significant player in the ever-evolving cryptocurrency landscape, primarily recognized for its innovative approach to blockchain technology. Positioned as an EVM-identical Layer 1 blockchain, Berachain combines the benefits of modular design with a unique consensus mechanism known as Proof of Liquidity (PoL). This pioneering framework aligns the security of the network with liquidity provision, making it a compelling option for developers and investors alike.

The significance of Berachain Coin in the crypto market lies in its ability to tackle some of the most pressing challenges faced by traditional blockchain networks, such as liquidity fragmentation and scalability. By offering a platform that facilitates seamless interaction between decentralized applications (dApps), Berachain aims to create a more interconnected ecosystem where assets can flow freely across various networks. This functionality not only enhances the overall user experience but also opens up new avenues for innovation within the decentralized finance (DeFi) sector.

This guide is crafted as a comprehensive resource for both beginners and intermediate investors who are looking to understand Berachain Coin in depth. It will cover several critical aspects of the digital asset, including:

Technology

We will explore the underlying technology that powers Berachain, including its EVM compatibility and modular design. Understanding these elements is essential for grasping how Berachain aims to improve upon existing blockchain solutions.

Tokenomics

An overview of the economic model behind Berachain Coin will be provided, detailing its tri-token structure and the roles of BERA and BGT within the ecosystem. This section will help investors understand how the tokenomics influence the value and utility of the coins.

Investment Potential

We will assess the investment potential of Berachain Coin by analyzing its market performance, historical price trends, and future growth prospects. This analysis will include considerations of market cap, trading volume, and other relevant metrics.

Risks

No investment comes without risks. This guide will highlight the potential risks associated with investing in Berachain Coin, including market volatility, regulatory challenges, and technological vulnerabilities.

How to Buy

Finally, we will provide step-by-step instructions on how to purchase Berachain Coin, including recommended exchanges and wallets, ensuring that newcomers can easily navigate the process.

By the end of this guide, readers will have a solid understanding of Berachain Coin, its market significance, and the factors that may influence their investment decisions. Whether you are a curious newcomer or a seasoned investor, this resource aims to equip you with the knowledge necessary to engage with Berachain Coin confidently.

What is berachain coin? A Deep Dive into its Purpose

Overview of Berachain Coin

Berachain Coin, commonly referred to as BERA, is the native cryptocurrency of the Berachain network, a Layer 1 blockchain that is fully compatible with the Ethereum Virtual Machine (EVM). This innovative blockchain leverages a unique consensus mechanism known as Proof of Liquidity (PoL) to align network security with liquidity provision. The platform’s architecture and tokenomics are designed to facilitate the development of decentralized applications (dApps) while addressing key challenges in the current blockchain ecosystem, such as liquidity fragmentation and scalability.

The Core Problem It Solves

One of the primary issues that Berachain aims to tackle is liquidity fragmentation, which has been a significant barrier to the seamless exchange of assets across different blockchain networks. In traditional blockchain environments, liquidity is often trapped within individual ecosystems, making it difficult for users to transfer assets or utilize services across platforms. This fragmentation can hinder the growth of decentralized finance (DeFi) applications and limit the overall efficiency of the blockchain ecosystem.

Berachain seeks to solve this problem by creating a modular design that enables the development of Layer 1 blockchains tailored to specific needs without sacrificing interoperability. By focusing on modularity, Berachain allows developers to create solutions that can easily interact with other blockchain networks, facilitating smoother asset transfers and interactions.

Additionally, the Proof of Liquidity mechanism implemented by Berachain aligns the economic incentives of network participants. This approach ensures that validators and users are rewarded for providing liquidity, thereby enhancing the overall functionality and scalability of dApps built on the platform. The dual-token model, which includes BERA as the gas and staking token and BGT as the governance token, further incentivizes participation and engagement within the ecosystem.

Its Unique Selling Proposition

Berachain’s unique selling proposition lies in its innovative combination of technology and tokenomics. The platform’s Proof of Liquidity consensus mechanism is a groundbreaking approach that not only secures the network but also incentivizes the efficient allocation of liquidity. This mechanism allows for a more responsive and adaptable blockchain, where economic rewards are closely tied to the actual demand for liquidity and security.

Moreover, Berachain is fully EVM-compatible, allowing developers to easily migrate existing Ethereum-based applications to the Berachain platform without extensive modifications. This compatibility opens up a vast array of possibilities for developers, as they can leverage the extensive ecosystem of tools and services available within the Ethereum space.

The tri-token model further enhances Berachain’s appeal. While BERA serves as the primary gas and staking token, BGT (the governance token) allows holders to participate in decision-making processes regarding protocol changes and economic incentives. This structure empowers the community and ensures that the platform evolves in a manner that reflects the interests of its users.

Additionally, Berachain’s commitment to education and community development through initiatives like Beracademy showcases its dedication to increasing blockchain literacy and fostering active participation among users. Events such as the “Hot Bera Summer” and the launch of the public testnet, bArtio B2, are essential for building a vibrant ecosystem and engaging the community.

The Team and Backers Behind the Project

The success of any blockchain project heavily relies on the expertise and vision of its team. Berachain boasts a diverse and experienced team of developers, blockchain enthusiasts, and industry veterans who are committed to realizing the platform’s vision. Their combined expertise in blockchain technology, finance, and software development positions Berachain to tackle the challenges of the modern blockchain landscape effectively.

In addition to a strong internal team, Berachain has garnered attention from venture capitalists and institutional investors, reflecting confidence in the project’s potential. This backing not only provides the necessary financial resources to support development and marketing efforts but also adds credibility to the project within the competitive cryptocurrency space.

The involvement of strategic partners, such as Union and BeraLand, further strengthens Berachain’s ecosystem. These partnerships facilitate collaboration and innovation, helping to broaden the platform’s capabilities and reach.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of Berachain Coin (BERA) is to serve as a utility token within the Berachain network, enabling various functions that are crucial for the platform’s operation. As the gas token, BERA is used to pay for transaction fees, which are essential for maintaining the network’s functionality. Additionally, users can stake BERA to participate in the network’s security and governance processes, aligning their interests with the platform’s success.

The introduction of the BGT token for governance further enhances user participation, allowing the community to have a voice in the platform’s future. This democratic approach ensures that decisions are made in the best interest of the network and its participants.

Ultimately, Berachain aims to create a scalable, interoperable, and developer-friendly environment that can support a wide range of decentralized applications. By addressing key challenges such as liquidity fragmentation and providing robust economic incentives, Berachain is poised to play a significant role in the evolving blockchain ecosystem.

In summary, Berachain Coin is not just a digital asset; it represents a comprehensive solution to some of the most pressing issues in the blockchain space. With its innovative technology, strong community focus, and experienced team, Berachain is well-positioned to make a lasting impact on the future of decentralized finance and blockchain technology as a whole.

The Technology Behind the Coin: How It Works

Overview of Berachain

Berachain is an innovative Layer 1 blockchain that is fully compatible with the Ethereum Virtual Machine (EVM). This compatibility allows developers to create and migrate decentralized applications (dApps) seamlessly from Ethereum to Berachain without extensive modifications to their code. The platform focuses on enhancing liquidity and scalability in the blockchain ecosystem, making it particularly appealing for decentralized finance (DeFi) applications.

Blockchain Architecture

Berachain’s architecture is designed to be modular, allowing for flexibility and customization in developing blockchain solutions tailored to specific needs. Here are the key components of its architecture:

-

EVM Compatibility: Being EVM-identical means that Berachain can leverage the vast array of tools, libraries, and services available in the Ethereum ecosystem. This compatibility ensures that developers can utilize existing Ethereum-based applications and infrastructure, making it easier to build and deploy new solutions.

-

Modular Design: The modular architecture allows Berachain to facilitate the development of various Layer 1 blockchains without compromising interoperability. This design helps mitigate liquidity fragmentation by enabling seamless asset transfers and interactions between different blockchain networks.

-

Tri-Token Model: Berachain employs a tri-token model that includes BERA, BGT, and a third token, which serves distinct purposes. BERA is used for gas fees and staking, while BGT is utilized for governance and rewards. This model enhances the economic stability of the network by providing clear roles for each token.

Consensus Mechanism: Proof of Liquidity (PoL)

One of the standout features of Berachain is its unique Proof of Liquidity (PoL) consensus mechanism. Here’s how it works:

-

Alignment with Liquidity Needs: Unlike traditional consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS), PoL directly ties the network’s security to the liquidity provided by participants. This means that validators must stake BERA tokens, which helps secure the network while also incentivizing liquidity provision.

-

Dynamic Rewards: Validators who stake BERA receive BGT rewards based on the liquidity they provide. This reward system is designed to scale with actual demand for economic security and chain liquidity, ensuring that validators are incentivized to participate actively in the network.

-

Decentralized Governance: The PoL mechanism also facilitates decentralized governance, allowing BGT holders to participate in decision-making processes. This ensures that the community has a say in the network’s development and economic incentives, fostering a collaborative environment.

Key Technological Innovations

Berachain incorporates several technological innovations that enhance its functionality and appeal:

1. Delegated Proof of Stake (dPoS)

In addition to PoL, Berachain utilizes a Delegated Proof of Stake (dPoS) mechanism. This hybrid model enhances security and scalability by allowing BERA token holders to vote for a set of validators. Here’s how dPoS works:

-

Validator Selection: Token holders can delegate their voting power to trusted validators, who are responsible for confirming transactions and maintaining the integrity of the blockchain. This system not only improves network security but also ensures that validators are motivated to act in the best interest of the community.

-

Scalability and Efficiency: dPoS enhances the network’s scalability by reducing the number of nodes required for transaction validation, which can lead to faster transaction times and lower fees.

2. BeaconKit Infrastructure

Berachain is built using BeaconKit, a robust framework that allows for full EVM compatibility. This infrastructure provides several benefits:

-

Standardization: By adhering to standard Ethereum execution clients, Berachain ensures that developers can easily transition their applications to its platform. This standardization reduces the friction typically associated with migrating dApps between different blockchains.

-

Security Features: BeaconKit includes built-in safeguards against centralization, such as stake caps and concave emission scaling. These features promote a more decentralized and secure network by preventing any single entity from gaining too much control.

3. Cross-Chain Interoperability

Berachain places a strong emphasis on cross-chain interoperability, enabling seamless asset transfers and interactions between different blockchain networks. This capability is crucial for enhancing liquidity and allowing users to access a wider range of services and applications. Here’s how it works:

-

Interconnected Ecosystem: By supporting cross-chain interactions, Berachain facilitates a more interconnected blockchain ecosystem. This means that users can easily move assets across different platforms, enhancing the overall user experience.

-

DeFi Integration: The focus on interoperability is particularly beneficial for decentralized finance applications, which often require seamless access to liquidity from multiple sources. Berachain’s architecture allows DeFi projects to leverage liquidity from other blockchains, fostering a more robust financial ecosystem.

Security Measures

Security is a critical aspect of any blockchain, and Berachain employs multiple layers of protection to safeguard its network:

-

Multi-Signature Wallets: Berachain supports the use of hardware wallets and multi-signature transactions, which require multiple approvals for transaction execution. This significantly reduces the risk of unauthorized access and enhances the security of user assets.

-

Regular Protocol Updates: The team behind Berachain is committed to maintaining the network’s security by regularly updating its protocols and software. These updates address potential vulnerabilities and adapt to evolving security threats, ensuring that the network remains resilient against attacks.

Community and Governance

Community engagement is vital for the success of any blockchain project, and Berachain has implemented several mechanisms to foster community participation:

-

Governance Participation: BGT holders can influence protocol decisions and economic incentives by participating in governance proposals. This decentralized governance model ensures that the community has a voice in shaping the platform’s future.

-

Educational Initiatives: Berachain has launched initiatives such as Beracademy, which aims to educate users and developers about blockchain technology and its applications. This focus on education helps increase blockchain literacy and encourages more people to participate in the ecosystem.

Conclusion

Berachain represents a significant advancement in blockchain technology, with its modular architecture, unique Proof of Liquidity consensus mechanism, and strong emphasis on cross-chain interoperability. By combining these elements, Berachain aims to create a scalable, efficient, and user-friendly platform for decentralized applications. As the blockchain landscape continues to evolve, Berachain’s innovative approach positions it as a promising solution for developers and investors alike. Whether you are a beginner or an experienced investor, understanding the technology behind Berachain is essential for navigating this exciting new frontier in the cryptocurrency world.

Understanding berachain coin Tokenomics

Berachain coin (BERA) is an essential component of the Berachain blockchain ecosystem, which operates on a unique two-token model designed to optimize both utility and governance within its network. Understanding the tokenomics of BERA is crucial for investors and users who wish to grasp how this digital asset functions, its potential value, and its role in the broader Berachain ecosystem.

Key Metrics

| Metric | Value |

|---|---|

| Total Supply | 508.08 million BERA |

| Max Supply | ∞ (Infinite) |

| Circulating Supply | 125.56 million BERA |

| Inflation/Deflation Model | Deflationary model based on demand |

Token Utility (What is the coin used for?)

Berachain’s tokenomics is structured around two primary tokens: BERA and BGT. Each token serves distinct purposes that cater to different aspects of the network’s functionality.

BERA (Gas and Staking Token)

BERA is the primary token used for transaction fees and securing the network through staking. Its utility can be categorized as follows:

-

Transaction Fees: BERA acts as the gas token for the Berachain network, meaning that users must pay transaction fees in BERA to process their transactions. This is a common feature in many blockchain ecosystems, where gas fees help maintain the network’s efficiency and incentivize validators.

-

Staking: Token holders can stake BERA to participate in network security. By locking their tokens, users help validate transactions and maintain the integrity of the blockchain. In return, they receive rewards in the form of BGT tokens, which can be used for governance and other purposes.

-

Participation in Governance: While BERA itself is primarily a utility token, its role in staking allows users to indirectly participate in governance through the BGT rewards they earn. This creates a synergy between the two tokens, enhancing user engagement and investment in the network’s future.

BGT (Governance and Rewards Token)

BGT is designed for governance participation and incentivizing specific user actions within the Berachain ecosystem. Its primary functions include:

-

Governance: BGT holders can participate in the decision-making processes of the Berachain protocol. This includes voting on proposals that affect the network’s development, economic incentives, and other critical aspects. The governance model aims to ensure that the community has a significant say in the direction of the project.

-

Rewards: Users can earn BGT through staking BERA or providing liquidity to the network. This incentivizes active participation in the ecosystem and encourages users to contribute to its growth.

-

Liquidity Provision: Protocols within the Berachain ecosystem can utilize BGT to bootstrap liquidity and incentivize user actions, such as liquidity mining or other DeFi activities. This creates a dynamic environment where users are rewarded for their participation, ultimately enhancing the network’s overall liquidity.

Token Distribution

The distribution of BERA is crucial to understanding its long-term viability and potential for value appreciation. The initial allocation of BERA tokens is designed to promote community engagement and ensure a balanced ecosystem.

-

Community Initiatives: A significant portion of the total supply, approximately 48.9%, is allocated to community initiatives. This allocation is intended to incentivize user participation, foster a loyal user base, and support projects that benefit the Berachain ecosystem.

-

Team and Development: A portion of the total supply is reserved for the core development team and early investors. This allocation ensures that the team has the necessary resources to continue developing the platform and addressing any challenges that arise.

-

Ecosystem Growth: Berachain plans to allocate tokens for strategic partnerships, marketing efforts, and ecosystem development. This approach aims to expand the network’s reach and attract more users and developers.

-

Phased Governance Approach: The governance model for Berachain will transition from an initial centralized structure to a fully decentralized model over time. This phased approach allows for stability during the early stages of the project while gradually empowering the community to take control of governance decisions.

Conclusion

Understanding the tokenomics of Berachain coin (BERA) is essential for both potential investors and users of the platform. With a well-structured utility model and a focus on community engagement, Berachain aims to create a sustainable ecosystem that benefits all participants. The dual-token system, with BERA serving as the gas and staking token while BGT facilitates governance and rewards, reflects a thoughtful approach to aligning user incentives with network security and growth.

As the Berachain ecosystem continues to evolve, staying informed about the tokenomics and how they may change in response to market dynamics and community input will be crucial for anyone looking to engage with this innovative blockchain project.

Price History and Market Performance

Key Historical Price Milestones

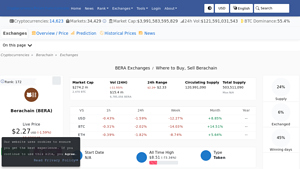

Berachain Coin (BERA) has experienced a notable price trajectory since its inception, reflecting both the broader cryptocurrency market dynamics and the unique developments within the Berachain ecosystem. As of October 2023, the price of BERA stands at approximately $2.27, with a market capitalization of around $285.42 million. This positions Berachain as the 164th largest cryptocurrency by market cap.

All-Time High and Low

One of the most significant milestones in Berachain’s price history occurred on February 6, 2025, when BERA reached its all-time high of $14.99. This peak represented a substantial increase from its initial trading values, showcasing the coin’s potential and the growing interest in the platform. However, it is essential to note that the price subsequently experienced a decline of about 84.84%, illustrating the volatility often associated with cryptocurrencies.

Conversely, the all-time low for BERA was also recorded on February 6, 2025, at $1.00. This low point marked a critical juncture for the coin, reflecting the inherent risks and fluctuations that can occur in the cryptocurrency market. The subsequent recovery from this low, with an increase of approximately 127.32%, highlights the potential for rebounds in price, driven by market sentiment and project developments.

Price Fluctuations

Historically, BERA has demonstrated notable price fluctuations within shorter time frames as well. For instance, in the 24 hours leading up to the current price point, BERA traded between a low of $2.24 and a high of $2.33, indicating a daily volatility of about 4%. Such fluctuations are typical in the crypto space, where market sentiment, trading volume, and external factors can rapidly influence prices.

Factors Influencing the Price

The price of Berachain Coin has been influenced by a variety of factors, both internal to the Berachain ecosystem and external market conditions.

Market Sentiment and Trends

Like many cryptocurrencies, the price of BERA is significantly affected by overall market sentiment. Bullish trends in the broader cryptocurrency market can lead to increased interest and investment in BERA, pushing its price upward. Conversely, bearish market conditions often result in decreased trading activity and price declines. Historical data indicates that Berachain’s price movements often correlate with major market events, such as Bitcoin’s price fluctuations and regulatory developments affecting the crypto landscape.

Project Developments and Milestones

The Berachain ecosystem’s developments play a crucial role in shaping investor sentiment and, consequently, the price of BERA. Key milestones, such as the launch of the public testnet and significant partnerships, have historically led to price surges as they signal progress and potential for future growth. For instance, the announcement of community initiatives or educational programs, like Beracademy, tends to generate positive sentiment, driving up demand for BERA as investors become more optimistic about the project’s long-term viability.

Trading Volume and Liquidity

The trading volume of Berachain Coin is another critical factor influencing its price. A higher trading volume often correlates with greater liquidity, making it easier for investors to buy and sell BERA without significantly impacting its price. In the last 24 hours, BERA has recorded a trading volume of approximately $31.11 million, representing about 10.9% of its market cap. Such liquidity is essential for price stability and can attract more investors, further influencing price movements.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies can also impact the price of BERA. Positive regulatory news or clarity can lead to increased investor confidence, driving prices higher. Conversely, negative regulatory developments, such as crackdowns on exchanges or increased scrutiny on crypto projects, can have an adverse effect. Historically, Berachain’s price has reacted to such external pressures, reflecting the broader sentiment in the crypto market regarding regulatory risks.

Innovations and Technological Advancements

Berachain’s unique technological features, such as its Proof of Liquidity consensus mechanism and EVM-identical Layer 1 blockchain, have positioned it as a significant player in the blockchain ecosystem. Innovations that enhance the platform’s usability or expand its capabilities tend to create excitement among investors, often leading to price increases. Historical performance shows that announcements related to technological advancements or new partnerships have frequently resulted in positive price movements for BERA.

Conclusion

In summary, the price history and market performance of Berachain Coin illustrate the dynamic and often volatile nature of cryptocurrency investments. Key milestones, market sentiment, project developments, trading volume, regulatory factors, and technological innovations all contribute to shaping the price trajectory of BERA. As the Berachain ecosystem continues to evolve, understanding these factors can help investors navigate the complexities of the cryptocurrency market while making informed decisions regarding their investments in Berachain Coin.

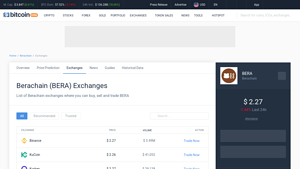

Where to Buy berachain coin: Top Exchanges Reviewed

5 Reasons to Trade BERA on Berachain Exchanges!

Berachain stands out in the cryptocurrency market through its availability on prominent exchanges like HTX (Huobi), Binance, KuCoin, and Kraken, which enhances its accessibility for traders. These platforms offer robust trading features, liquidity, and security, making it easy for users to buy, sell, and trade BERA. Additionally, the diverse range of exchanges supports a vibrant trading ecosystem, contributing to Berachain’s growing popularity among investors.

- Website: coincodex.com

- Platform Age: Approx. 8 years (domain registered in 2017)

5. Berachain (BERA) – Your Gateway to Decentralized Trading!

Berachain (BERA) is available on over 32 cryptocurrency exchanges, with leading platforms like Binance, MEXC Global, and Gate offering robust trading options. What sets these exchanges apart is their high liquidity, user-friendly interfaces, and comprehensive trading tools, making it easy for both novice and experienced traders to buy, sell, and trade BERA efficiently. This broad availability across major exchanges enhances accessibility and fosters a vibrant trading environment for the token.

- Website: coinlore.com

- Platform Age: Approx. 9 years (domain registered in 2016)

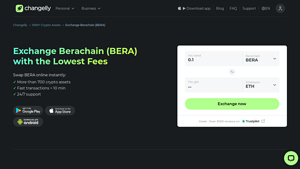

5. Changelly – The Cheapest Way to Exchange Berachain (BERA)!

Changelly stands out as a premier exchange for Berachain (BERA), offering users the opportunity to trade at some of the lowest fees in the market. With a high rating of 4.7 from over 5,000 users, it facilitates fast exchanges across more than 700 cryptocurrencies. The platform’s user-friendly interface, available on both web and iOS, along with 24/7 live support, ensures a seamless trading experience for both novice and experienced investors.

- Website: changelly.com

- Platform Age: Approx. 12 years (domain registered in 2013)

3. Nexo – Effortless Berachain Purchases with Credit or Debit!

Nexo stands out as a convenient platform for purchasing Berachain (BERA) with credit or debit cards, offering a seamless user experience. Its flexible payment options cater to both novice and experienced investors, making it easy to acquire BERA directly. The intuitive interface simplifies the buying process, ensuring that users can efficiently navigate their transactions while accessing a growing selection of cryptocurrencies.

- Website: nexo.com

- Platform Age: Approx. 27 years (domain registered in 1998)

How to Buy berachain coin: A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in purchasing Berachain Coin (BERA) is to select a cryptocurrency exchange where it is listed. Popular exchanges that typically list various digital assets include:

- Binance

- Coinbase

- Kraken

- KuCoin

- Gate.io

When choosing an exchange, consider factors such as:

- Reputation and Security: Look for exchanges with a solid track record and robust security measures to protect your funds.

- Fees: Check the trading fees, withdrawal fees, and any other costs associated with the exchange.

- Availability in Your Region: Ensure the exchange operates in your country and supports your local currency.

- User Interface: A user-friendly interface can make the buying process easier, especially for beginners.

2. Create and Verify Your Account

Once you’ve selected an exchange, the next step is to create an account. Here’s how:

- Sign Up: Go to the exchange’s website and click on the “Sign Up” or “Register” button. You will need to provide your email address and create a password.

- Verification: Most exchanges require identity verification to comply with regulations. You may need to submit personal information, including your name, address, and date of birth. Additionally, you might be required to upload identification documents like a passport or driver’s license.

- Two-Factor Authentication (2FA): Enable 2FA for added security. This typically involves linking your account to an authentication app on your smartphone, providing an extra layer of protection.

3. Deposit Funds

After your account is verified, you will need to deposit funds to buy Berachain Coin. Follow these steps:

- Navigate to the Deposit Section: Go to the wallet or funds section of your account.

- Select Your Deposit Method: Most exchanges allow deposits via bank transfer, credit/debit card, or cryptocurrency transfer. Choose the method that suits you best.

- Follow the Instructions: If you choose bank transfer or card, follow the on-screen instructions to complete the deposit. For cryptocurrency deposits, you will receive a wallet address to send funds to.

- Wait for Confirmation: Depending on your deposit method, it may take some time for the funds to appear in your exchange account.

4. Place an Order to Buy Berachain Coin

With funds in your account, you can now place an order to buy BERA. Here’s how:

- Find Berachain Coin (BERA): Use the search bar on the exchange to locate Berachain Coin. You may also find it listed under the trading pairs section.

- Select the Trading Pair: Choose the appropriate trading pair, such as BERA/USD or BERA/BTC, depending on the currency you deposited.

- Choose Order Type: You can typically place a market order (buying at the current market price) or a limit order (setting a specific price to buy). For beginners, a market order is often simpler.

- Enter the Amount: Specify how much Berachain Coin you want to purchase.

- Review and Confirm: Double-check the details of your order before confirming the transaction. Once satisfied, click the “Buy” button to complete the purchase.

5. Secure Your Coins in a Wallet

After purchasing Berachain Coin, it is crucial to secure your assets properly. While you can leave them on the exchange, it is safer to transfer them to a personal wallet. Here’s how to do it:

- Choose a Wallet: You can use a software wallet (like MetaMask or Trust Wallet) or a hardware wallet (like Ledger or Trezor) for enhanced security. Hardware wallets are generally considered more secure as they store your private keys offline.

- Set Up Your Wallet: If you’re using a software wallet, download the app and create a new wallet. Be sure to back up your recovery phrase in a safe place.

- Transfer Your BERA: Go to the exchange where you purchased Berachain Coin, navigate to the withdrawal section, and enter your wallet address. Specify the amount of BERA you want to transfer and confirm the transaction.

- Confirm the Transfer: Check your wallet to ensure the coins have arrived. It may take some time for the transaction to be confirmed on the blockchain.

By following these steps, you can successfully purchase and secure Berachain Coin, positioning yourself to participate in its ecosystem and potential future developments. Always remember to do your own research and consider the risks involved in cryptocurrency investments.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Investing in Berachain Coin (BERA) presents several potential strengths that could make it an attractive option for both beginners and intermediate investors. Below are some of the key factors that contribute to its bullish outlook:

Innovative Consensus Mechanism

Berachain introduces a novel Proof of Liquidity (PoL) consensus mechanism, which aligns network security with liquidity provision. This innovation not only improves the efficiency of transaction processing but also incentivizes users to contribute liquidity to the network. The dual-token model of BERA and BGT allows for a more dynamic economic structure, catering to both transaction fees and governance participation. This unique approach could enhance user engagement and drive demand for BERA, potentially increasing its value over time.

Strong Community Support

Community involvement is crucial for the success of any cryptocurrency project. Berachain has demonstrated strong community alignment, with a significant portion of its genesis supply allocated to community initiatives. This encourages active participation in governance and decision-making, fostering a loyal user base. Additionally, the phased governance approach through the BGT Foundation allows for a gradual transition to full community control, which could enhance trust and long-term commitment among users.

EVM Compatibility

Being EVM-identical allows Berachain to leverage the existing Ethereum ecosystem, making it easier for developers to migrate dApps and services without extensive modifications. This compatibility not only broadens the potential user base but also facilitates the integration of various DeFi applications, enhancing the overall utility of the platform. Developers may find it attractive to build on Berachain, given the ease of access to Ethereum’s extensive tools and services.

Growing Ecosystem and Use Cases

Berachain is designed to support a wide range of applications, particularly within decentralized finance (DeFi). Its architecture enables the development of modular Layer 1 blockchains, which can cater to specific needs while maintaining interoperability. This flexibility opens up possibilities for various use cases, such as automated market makers (AMMs), real-world asset tokenization, and cross-chain interactions. A robust ecosystem can attract more users and investors, potentially driving demand for BERA.

Institutional Interest

The growing interest from institutional investors and venture capitalists in Berachain signals confidence in the platform’s technology and its potential for scalability and interoperability. Such backing can provide the necessary resources for further development and marketing efforts, enhancing the project’s credibility and visibility in the competitive cryptocurrency landscape.

Potential Risks and Challenges (The Bear Case)

While Berachain shows promise, there are several risks and challenges that investors should consider before committing capital. Below are some of the primary concerns:

Market Volatility

Cryptocurrencies are known for their inherent volatility, and Berachain is no exception. The price of BERA can experience significant fluctuations due to market sentiment, trading volume, and macroeconomic factors. For new investors, this volatility can lead to substantial gains or losses in a short period. It’s essential to understand that such market dynamics can make cryptocurrencies a risky investment, especially for those with a low-risk tolerance.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving. As governments around the world develop frameworks to govern digital assets, Berachain could face challenges related to compliance and legal scrutiny. Regulatory changes can impact the usability and trading of cryptocurrencies, leading to potential restrictions or bans that could adversely affect BERA’s value. Investors should remain aware of the evolving regulatory environment and its implications for their investments.

Competition

The blockchain space is highly competitive, with numerous projects vying for market share in the DeFi sector and beyond. Berachain faces competition from established platforms and emerging projects that offer similar functionalities and use cases. This competition could lead to market fragmentation and may affect Berachain’s ability to attract users and developers. Investors should consider how Berachain differentiates itself from its competitors and whether it can maintain its unique value proposition.

Technological Risks

As a blockchain project, Berachain is susceptible to various technological risks, including security vulnerabilities, bugs, and potential exploits. The introduction of new technologies, such as the Proof of Liquidity mechanism, may also present unforeseen challenges that could impact the network’s stability and security. Additionally, the reliance on smart contracts poses risks if not properly audited, as vulnerabilities can lead to significant financial losses. Investors should assess the robustness of Berachain’s technology and its capacity to address potential issues.

Execution Risk

The success of Berachain relies heavily on the team’s ability to execute their vision and roadmap effectively. Delays in development, failure to achieve key milestones, or mismanagement of resources could hinder the project’s growth and adoption. Investors should evaluate the project’s track record, the team’s experience, and their ability to adapt to changing market conditions.

Conclusion

In summary, Berachain Coin presents a unique investment opportunity with several potential strengths, including its innovative consensus mechanism, community support, EVM compatibility, and growing ecosystem. However, investors should also be mindful of the associated risks, such as market volatility, regulatory uncertainty, competition, technological challenges, and execution risk.

As with any investment, thorough research and a clear understanding of the risks involved are essential. While Berachain may offer promising prospects, individuals should approach their investment decisions with caution and consider their risk tolerance and investment goals.

Frequently Asked Questions (FAQs)

1. What is Berachain Coin (BERA)?

Berachain Coin (BERA) is the native cryptocurrency of the Berachain blockchain, which operates as an EVM-identical Layer 1 blockchain. BERA serves multiple purposes within the Berachain ecosystem, including acting as the gas and staking token for transaction fees and validator security. It plays a crucial role in the network’s operations, facilitating transactions and incentivizing validators to maintain network integrity.

2. Who created Berachain Coin?

Berachain Coin was developed by a team of blockchain enthusiasts and professionals who initially launched the project as an NFT initiative. As the project evolved, the team pivoted to focus on creating a robust Layer 1 blockchain infrastructure. While specific individuals may not be publicly disclosed, the project is backed by partnerships and a community-driven approach, emphasizing collective development and governance.

3. What makes Berachain Coin different from Bitcoin?

Berachain Coin differs from Bitcoin primarily in its underlying technology and purpose. While Bitcoin is a decentralized digital currency primarily used for peer-to-peer transactions, Berachain is designed to support decentralized applications (dApps) and smart contracts through its EVM-identical Layer 1 blockchain. Additionally, Berachain utilizes a unique Proof of Liquidity (PoL) consensus mechanism, which focuses on aligning network security with liquidity provision, contrasting with Bitcoin’s Proof of Work (PoW) model.

4. Is Berachain Coin a good investment?

As with any cryptocurrency investment, the potential for profit comes with inherent risks. Berachain Coin has shown promising growth, evidenced by its market cap and unique features such as its dual-token model and PoL consensus. However, investors should conduct thorough research, assess market trends, and consider their risk tolerance before investing. It is advisable to stay updated on developments within the Berachain ecosystem and broader market conditions.

5. How can I buy Berachain Coin?

Berachain Coin can typically be purchased on various cryptocurrency exchanges. To buy BERA, you will need to create an account on a supported exchange, deposit funds (usually in Bitcoin or Ethereum), and then trade those funds for BERA. Always ensure that you use reputable exchanges and consider security measures, such as enabling two-factor authentication.

6. What are the main use cases for Berachain Coin?

The primary use cases for Berachain Coin include:

– Transaction Fees: BERA is used to pay for transaction fees on the Berachain network.

– Staking: Users can stake BERA to secure the network and earn rewards.

– Governance Participation: Through the BGT token, holders can influence protocol decisions and economic incentives, thus participating in the governance of the Berachain ecosystem.

7. How is Berachain secured?

Berachain employs a multi-layered security framework that includes its Proof of Liquidity consensus mechanism, which aligns liquidity provision with network security. Additionally, it utilizes a Delegated Proof of Stake (dPoS) model, allowing token holders to vote for validators who confirm transactions. This enhances both security and scalability. Regular protocol updates and the use of hardware wallets further bolster the network’s security.

8. What is the future of Berachain Coin?

The future of Berachain Coin appears promising, with plans for further development and expansion of its ecosystem. Upcoming events, such as the anticipated main launch in 2024, and ongoing initiatives like Beracademy for community education, suggest a commitment to fostering a vibrant user base. As Berachain continues to enhance its platform and attract institutional interest, the potential for growth and adoption may increase, making it an asset to watch in the evolving blockchain landscape.

Final Verdict on berachain coin

Overview of Berachain Coin

Berachain Coin (BERA) is a pivotal digital asset within the Berachain ecosystem, a high-performance, EVM-identical Layer 1 blockchain designed to enhance the development and deployment of decentralized applications (dApps). The unique Proof of Liquidity (PoL) consensus mechanism employed by Berachain aligns network security with liquidity provision, making it a promising choice for developers and investors alike. BERA serves dual purposes as both a gas and staking token, allowing users to pay transaction fees and secure the network while participating in governance through its companion token, BGT.

Technological Innovation

The architecture of Berachain is characterized by its modular design, enabling tailored solutions without compromising interoperability. This modularity aims to alleviate liquidity fragmentation, a common challenge in the blockchain space, thereby enhancing asset exchange across various platforms. Additionally, Berachain’s compatibility with Ethereum ensures that developers can leverage existing tools and services, facilitating easier transitions and application development.

Potential and Risks

While Berachain presents significant potential for growth, particularly in the decentralized finance (DeFi) sector, it is crucial to recognize that investing in cryptocurrencies, including BERA, comes with inherent risks. The cryptocurrency market is known for its volatility, and Berachain is no exception. With a market cap of approximately $285.42 million and a fluctuating price history, BERA represents a high-risk, high-reward asset class that may appeal to both beginners and seasoned investors.

Final Thoughts

In conclusion, Berachain Coin embodies a blend of innovative technology and strategic community engagement that positions it as a noteworthy player in the evolving blockchain landscape. However, potential investors should approach this asset with caution. Always prioritize conducting thorough research (DYOR) to understand the implications of investing in Berachain and to make informed decisions tailored to your financial goals.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.